2020 Second Quarter Update Strategic Storage Trust IV, Inc. This property is not owned by Strategic Storage Trust IV, Inc. This property is owned by our sponsor. H. Michael Schwartz – Founder & Chairman Exhibit 99.1

Risk Factors & Other Information This investor presentation may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our real estate investment strategy; uncertainties relating to financing availability and capital proceeds; uncertainties relating to the closing of property acquisitions; uncertainties related to the timing and availability of distributions; uncertainties related to the impact of the outbreak of the novel coronavirus (COVID-19); and other risk factors as outlined in the Company’s public filings with the Securities and Exchange Commission. This is neither an offer nor a solicitation to purchase securities. As of June 30, 2020, our accumulated deficit was approximately $22.0 million, and we anticipate that our operations will not be profitable in 2020. We have paid, and may continue to pay, distributions from sources other than our cash flows from operations, including from the net proceeds of our public offering and the private offering transaction. We are not prohibited from undertaking such activities by our charter, bylaws, or investment policies, and we may use an unlimited amount from any source to pay our distributions. For the years ended December 31, 2017, 2018 and 2019, and for the six months ended June 30, 2020, we have funded substantially all of our distributions using proceeds from our private offering transaction and our public offering. Payment of distributions in excess of earnings may have a dilutive effect on the value of your shares. If we pay distributions from sources other than cash flow from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns. Additionally, to the extent distributions exceed cash flow from operations, a stockholder’s basis in our stock may be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain. No public market currently exists for shares of our common stock and we may not list our shares on a national securities exchange before three to five years after completion of this offering, if at all; therefore, it may be difficult to sell your shares. If you sell your shares, it will likely be at a substantial discount. Our charter does not require us to pursue a liquidity transaction at any time. We may only calculate the value per share for our shares annually and, therefore, you may not be able to determine the net asset value of your shares on an ongoing basis We have limited operating history, and the prior performance of real estate programs sponsored by affiliates of our sponsor may not be indicative of our future results. We are a “blind pool.” As a result, you will not be able to evaluate the economic merits of our future investments prior to their purchase. We may be unable to invest the net proceeds from this offering on acceptable terms to investors, or at all. There are substantial conflicts of interest among us and our sponsor, advisor, property manager and transfer agent. Our advisor will face conflicts of interest relating to the purchase of properties, including conflicts with SmartStop Self Storage REIT, Inc. and the advisors other private programs sponsored by our sponsor, and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities. We have no employees and must depend on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources to us. We will pay substantial fees and expenses to our advisor, its affiliates and participating broker-dealers, which will reduce cash available for investment and distribution. We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment. We may fail to qualify as a REIT, which could adversely affect our operations and our ability to make distributions. Our board of directors may change any of our investment objectives without your consent.

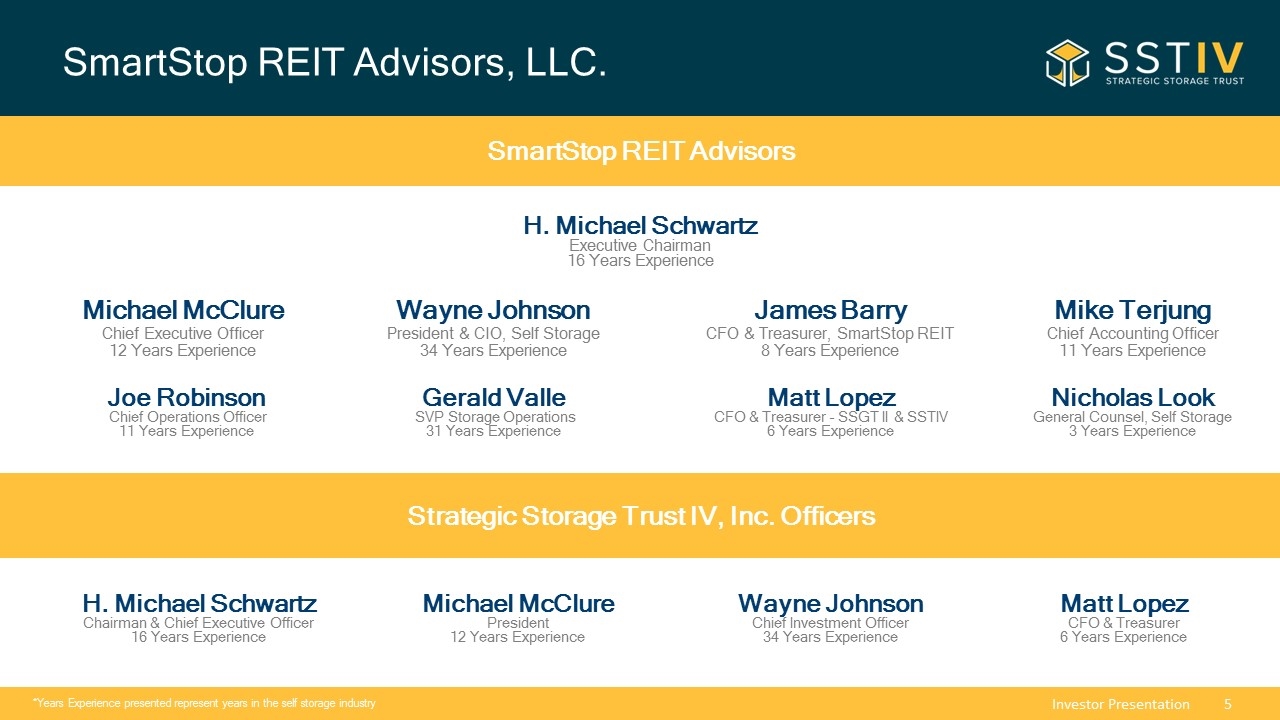

SmartStop REIT Advisors, LLC.

SmartStop REIT Advisors, LLC. SmartStop REIT Advisors, LLC. (“SmartStop”) and its affiliates are fully-integrated self storage companies with a combined portfolio of over $1.6 billion of self storage assets. SmartStop is the 10th largest self storage company in the U.S. with an owned and managed portfolio of 10.9 million rentable square feet across 144 facilities throughout the U.S. & Toronto, Canada Growing portfolio of properties in the greater Toronto area, comprising approx. 1.2 million net rentable square feet Management team is experienced in the development, redevelopment, lease up, and acquisition of self storage properties in the U.S. and Toronto. More than 380 employees, including 36 in Toronto, Canada Transacted over $4.0 billion in self storage properties in the past 15 years

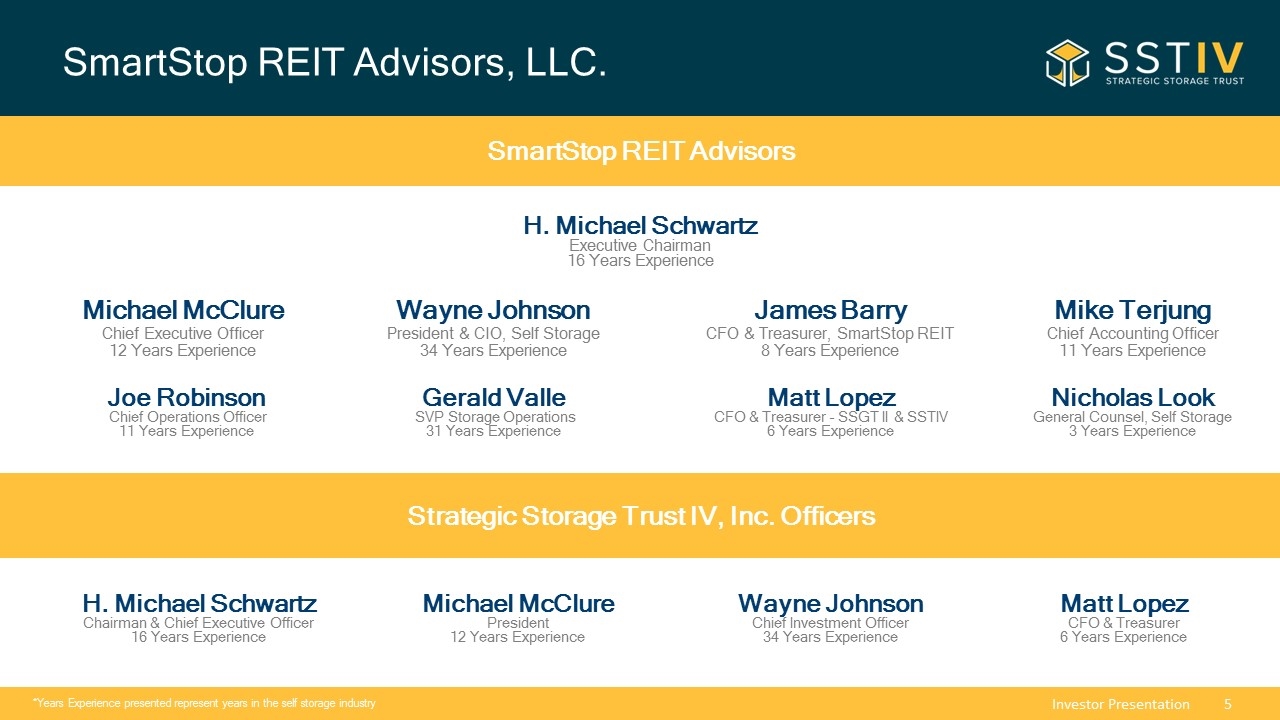

SmartStop REIT Advisors, LLC. H. Michael Schwartz Executive Chairman 16 Years Experience Wayne Johnson President & CIO, Self Storage 34 Years Experience Gerald Valle SVP Storage Operations 31 Years Experience Mike Terjung Chief Accounting Officer 11 Years Experience Michael McClure Chief Executive Officer 12 Years Experience Michael McClure President 12 Years Experience Wayne Johnson Chief Investment Officer 34 Years Experience Matt Lopez CFO & Treasurer – SSGT II & SSTIV 6 Years Experience H. Michael Schwartz Chairman & Chief Executive Officer 16 Years Experience James Barry CFO & Treasurer, SmartStop REIT 8 Years Experience Nicholas Look General Counsel, Self Storage 3 Years Experience SmartStop REIT Advisors Matt Lopez CFO & Treasurer 6 Years Experience Strategic Storage Trust IV, Inc. Officers Joe Robinson Chief Operations Officer 11 Years Experience *Years Experience presented represent years in the self storage industry

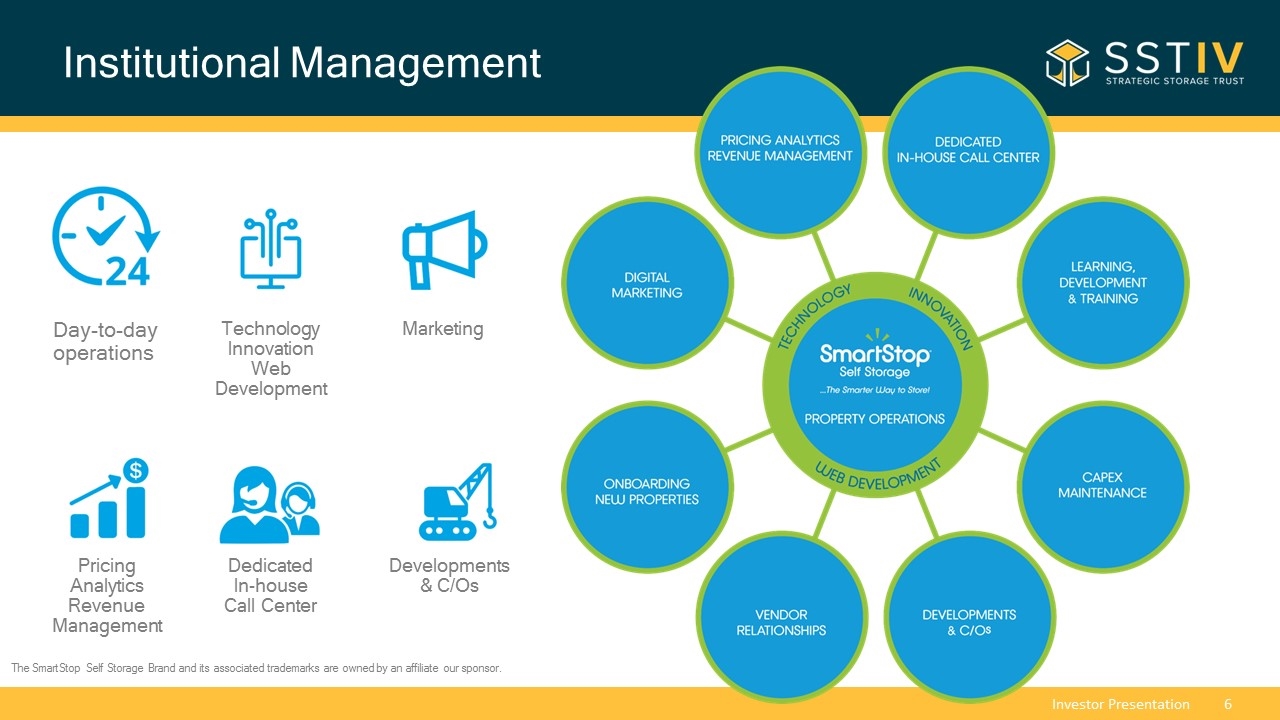

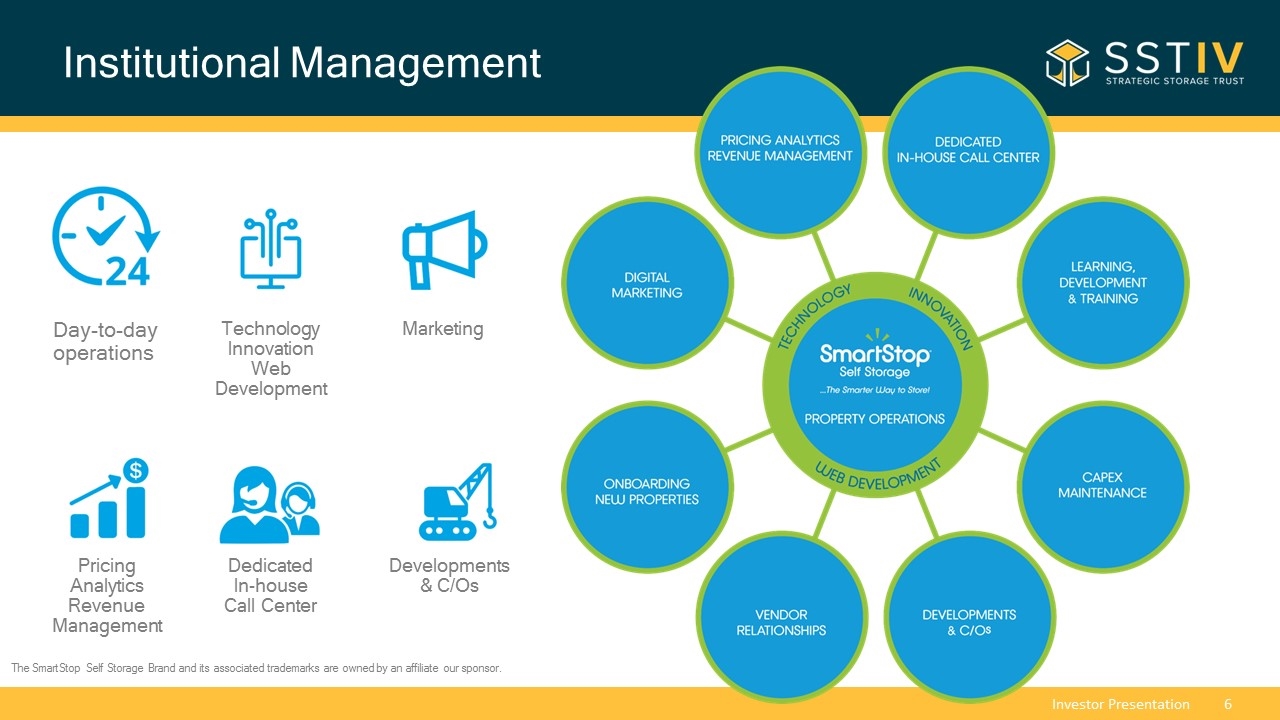

Institutional Management Day-to-day operations Technology Innovation Web Development Marketing Pricing Analytics Revenue Management Dedicated In-house Call Center Developments & C/Os The SmartStop Self Storage Brand and its associated trademarks are owned by an affiliate our sponsor.

Novel Coronavirus (COVID-19) Update

Protecting Our Customers & Employees Social Distancing: Allowing only one customer in our office at a time and enforcing stay-at-home when sick procedures for employees Cleanliness: Thorough cleaning at each of our facilities and installation of plastic dividers. Employees are required to wear masks, and ill customers are asked to call us or visit us online Security: Security systems remain online, and staff are performing routine inspections Communication: Call center remains open, and customers can access accounts and pay bills online Prioritizing the health and safety of customers and employees, while ensuring locations continue to stay open

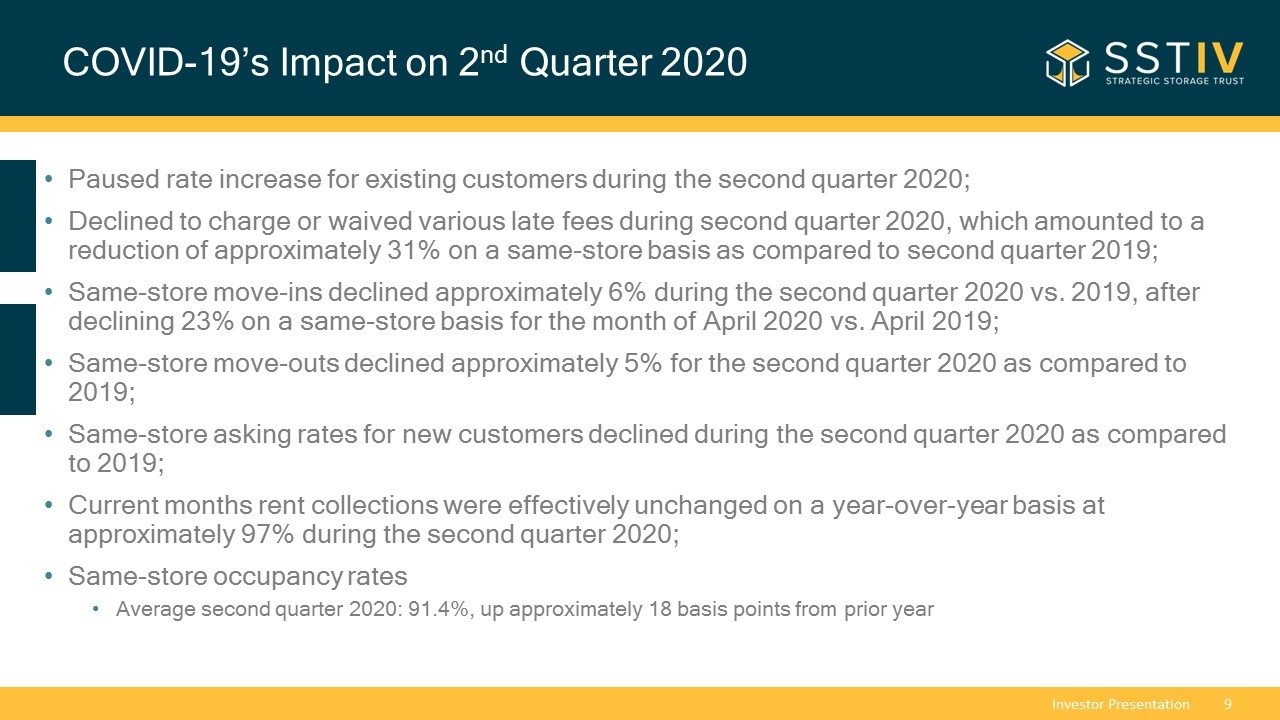

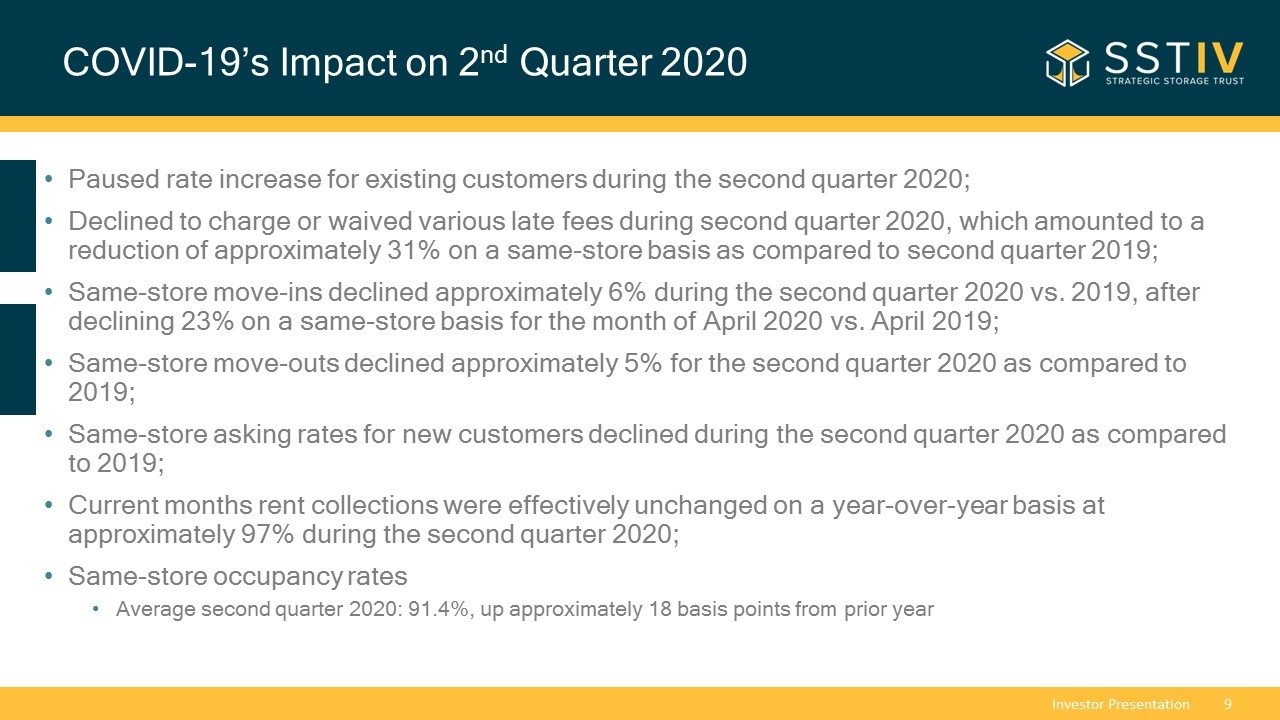

COVID-19’s Impact on 2nd Quarter 2020 Royal Palm Beach, Florida Paused rate increase for existing customers during the second quarter 2020; Declined to charge or waived various late fees during second quarter 2020, which amounted to a reduction of approximately 31% on a same-store basis as compared to second quarter 2019; Same-store move-ins declined approximately 6% during the second quarter 2020 vs. 2019, after declining 23% on a same-store basis for the month of April 2020 vs. April 2019; Same-store move-outs declined approximately 5% for the second quarter 2020 as compared to 2019; Same-store asking rates for new customers declined during the second quarter 2020 as compared to 2019; Current months rent collections were effectively unchanged on a year-over-year basis at approximately 97% during the second quarter 2020; Same-store occupancy rates Average second quarter 2020: 91.4%, up approximately 18 basis points from prior year

Business Continuity and Positioning Continue to rent units through the call center and via the online leasing capabilities of the SmartStop website As of March 13 (~6 months), the majority of our corporate employees were working remotely with no interruption of key business functions Significant liquidity across our storage programs, both in cash and availability Continuing to pay stockholder distributions and are confident that self storage is well suited to weather all economic environments Updated distributions to a monthly practice, providing board of directors the flexibility to evaluate any potential financial impact of COVID-19 on our business and to respond effectively, if needed Well positioned with the SmartStop Self Storage platform to grow in the future Royal Palm Beach, Florida

Strategic Storage Trust IV, Inc.

Strategic Storage Trust IV, Inc. Stabilized + Growth Self Storage Properties NO Acquisition Fees* NO Financing Fees* NO Disposition Fees* *Although there are no acquisition fees, disposition fees or financing fees, there are significant fees including, but not limited to, asset management fees, property management fees, construction fees and related expenses. These fees could be greater overall than another REIT’s total fees, regardless of the types of fees charged.

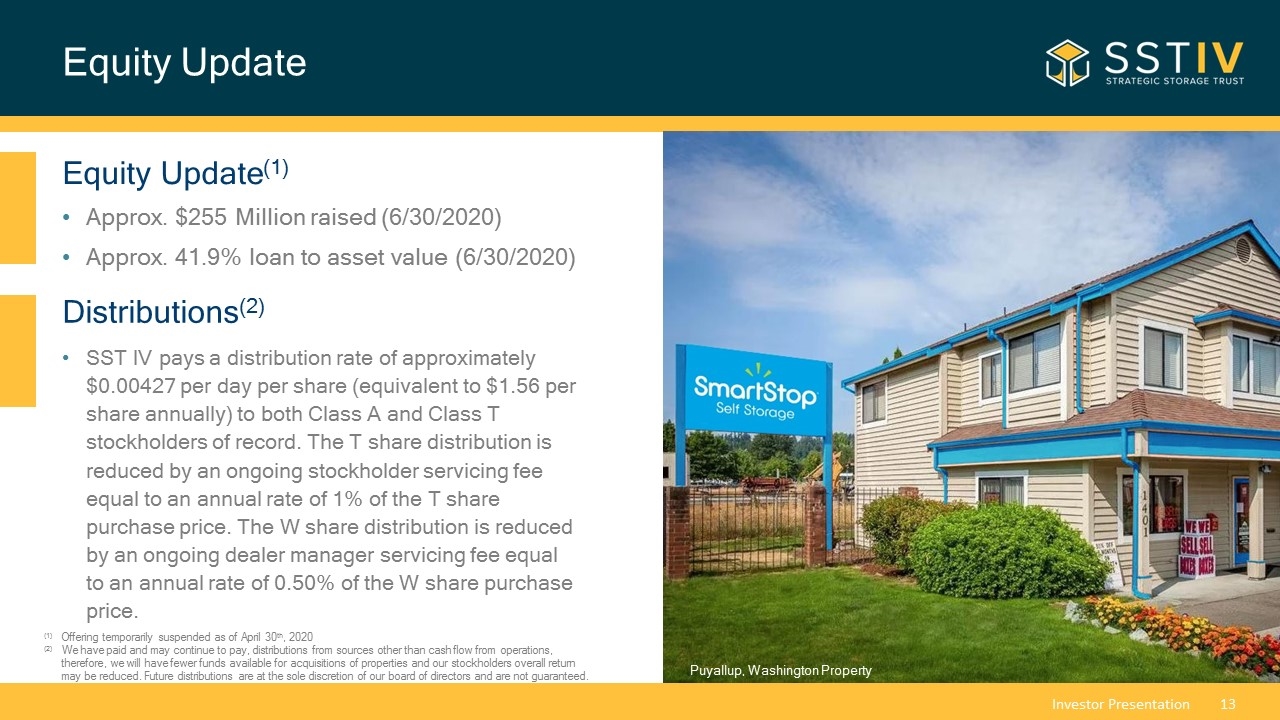

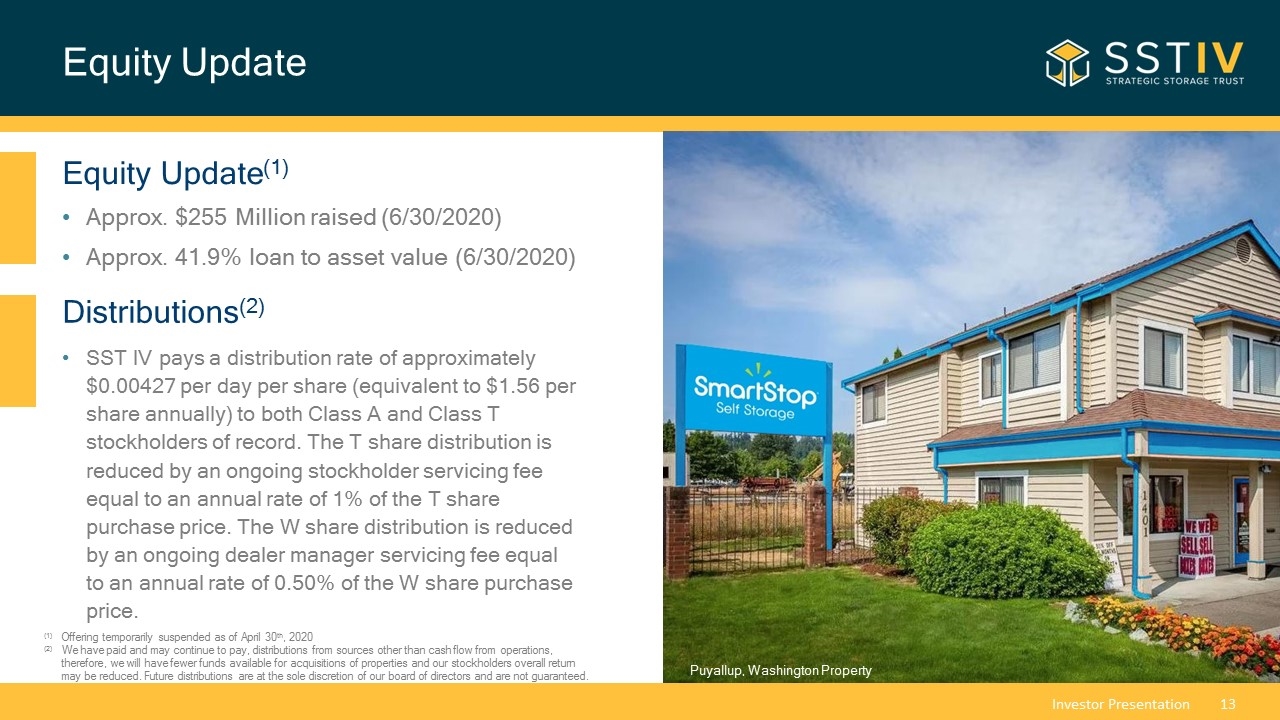

Equity Update Royal Palm Beach, Florida Equity Update(1) Approx. $255 Million raised (6/30/2020) Approx. 41.9% loan to asset value (6/30/2020) Distributions(2) SST IV pays a distribution rate of approximately $0.00427 per day per share (equivalent to $1.56 per share annually) to both Class A and Class T stockholders of record. The T share distribution is reduced by an ongoing stockholder servicing fee equal to an annual rate of 1% of the T share purchase price. The W share distribution is reduced by an ongoing dealer manager servicing fee equal to an annual rate of 0.50% of the W share purchase price. (1) Offering temporarily suspended as of April 30th, 2020 (2) We have paid and may continue to pay, distributions from sources other than cash flow from operations, therefore, we will have fewer funds available for acquisitions of properties and our stockholders overall return may be reduced. Future distributions are at the sole discretion of our board of directors and are not guaranteed. Puyallup, Washington Property

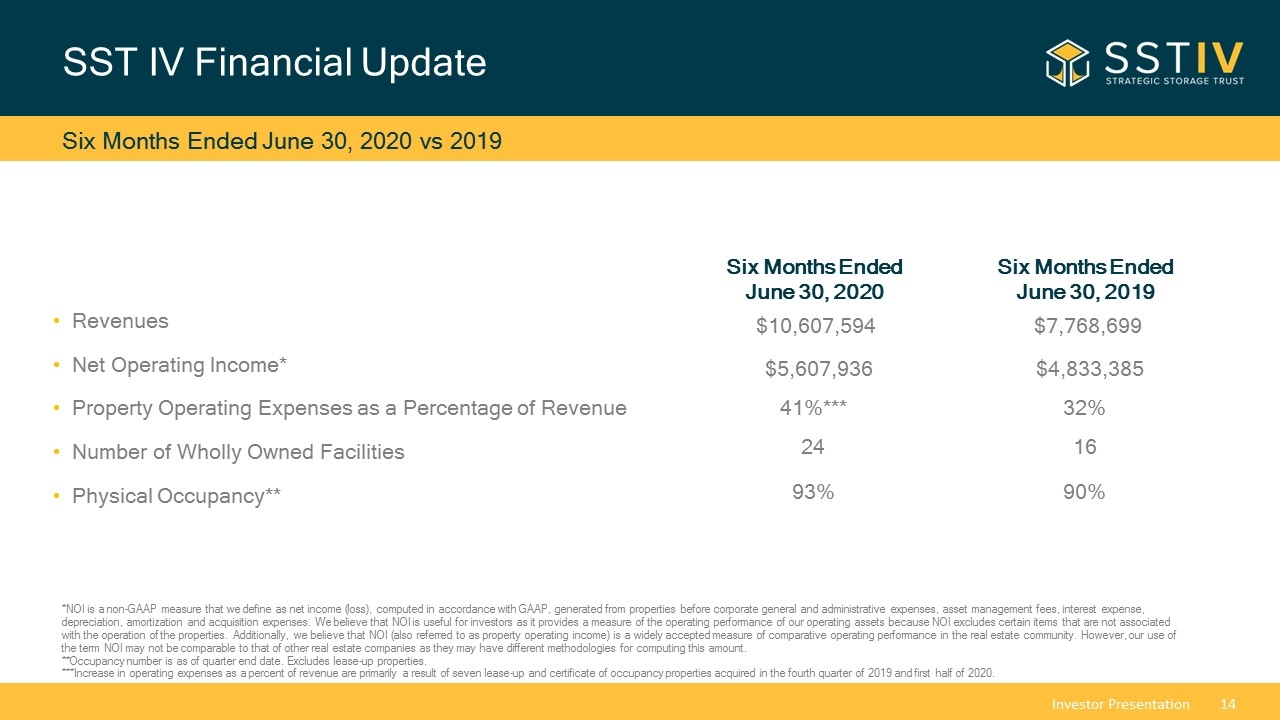

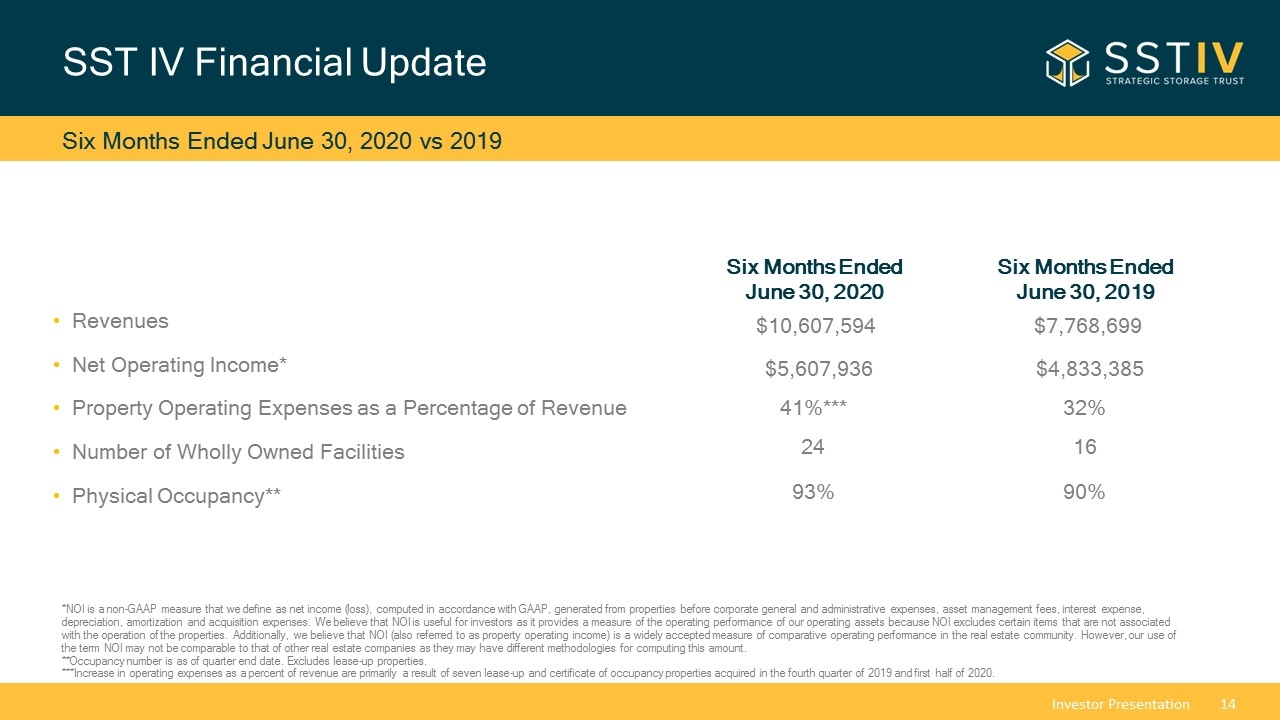

SST IV Financial Update Six Months Ended June 30, 2020 vs 2019 Modified FFO Revenues Net Operating Income* Property Operating Expenses as a Percentage of Revenue Number of Wholly Owned Facilities Physical Occupancy** Six Months Ended June 30, 2020 $10,607,594 $5,607,936 41%*** 24 93% Six Months Ended June 30, 2019 $7,768,699 $4,833,385 32% 16 90% *NOI is a non-GAAP measure that we define as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization and acquisition expenses. We believe that NOI is useful for investors as it provides a measure of the operating performance of our operating assets because NOI excludes certain items that are not associated with the operation of the properties. Additionally, we believe that NOI (also referred to as property operating income) is a widely accepted measure of comparative operating performance in the real estate community. However, our use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. **Occupancy number is as of quarter end date. Excludes lease-up properties. ***Increase in operating expenses as a percent of revenue are primarily a result of seven lease-up and certificate of occupancy properties acquired in the fourth quarter of 2019 and first half of 2020.

SST IV Financial Update SST IV Net Asset Value Independent, 3rd Party Valuation Engaged Duff & Phelps Asset-by-Asset valuation of Real Estate (no portfolio premium) In accordance with IPA NAV Guideline See our Current Report on Form 8-K filed with the SEC on June 30, 2020 for a description of the methodologies and assumptions used to determine, and limitations of, the estimated value per share. NAV VALUE = $22.65

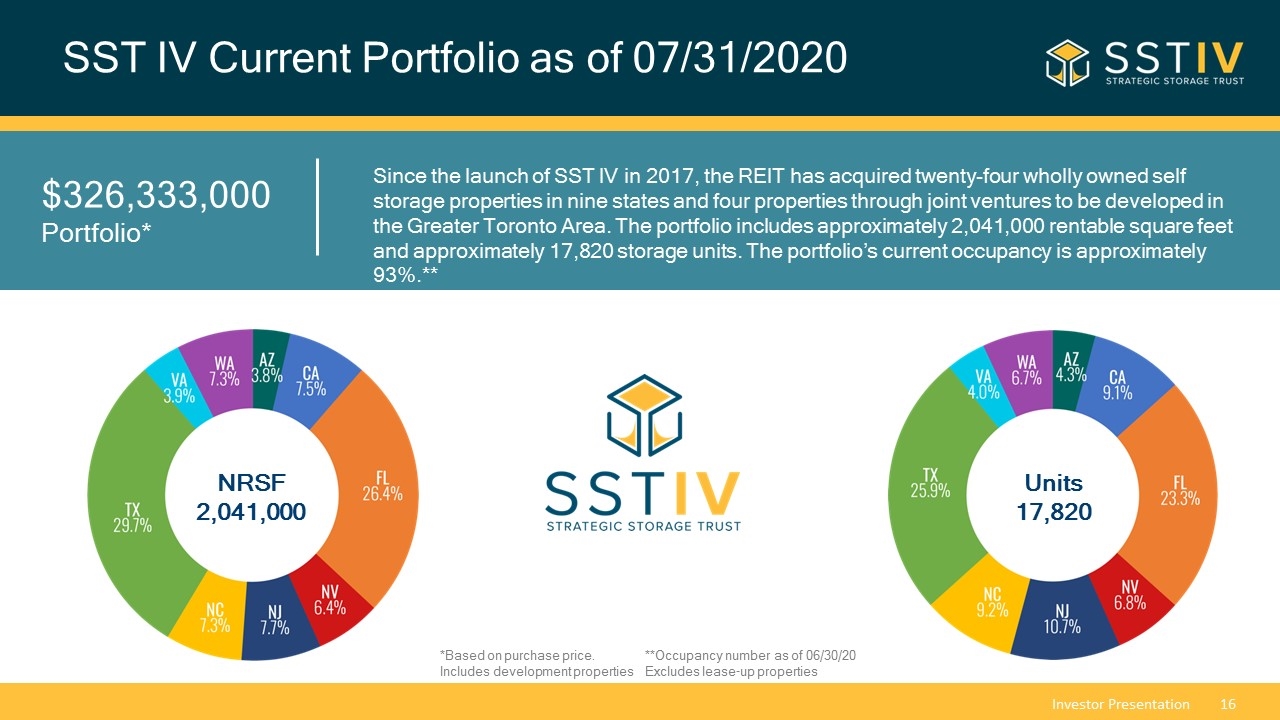

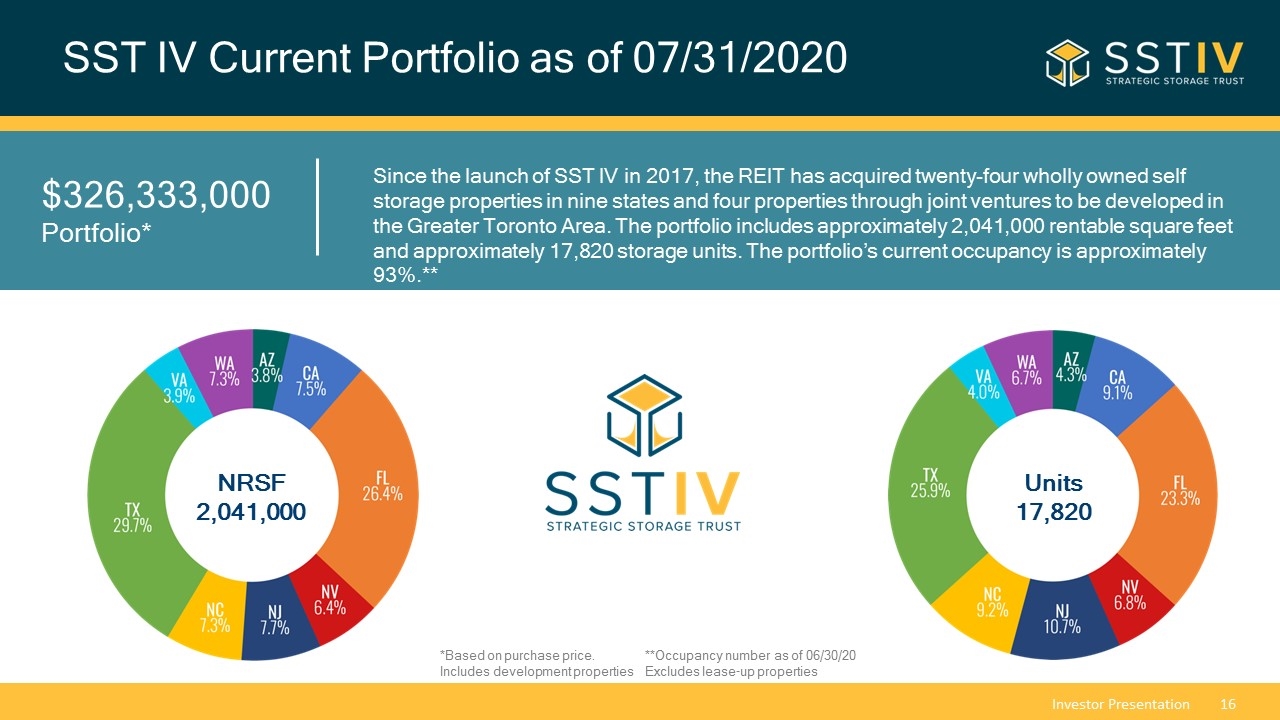

SST IV Current Portfolio as of 07/31/2020 $326,333,000 Portfolio* Since the launch of SST IV in 2017, the REIT has acquired twenty-four wholly owned self storage properties in nine states and four properties through joint ventures to be developed in the Greater Toronto Area. The portfolio includes approximately 2,041,000 rentable square feet and approximately 17,820 storage units. The portfolio’s current occupancy is approximately 93%.** NRSF 2,041,000 Units 17,820 **Occupancy number as of 06/30/20 Excludes lease-up properties *Based on purchase price. Includes development properties

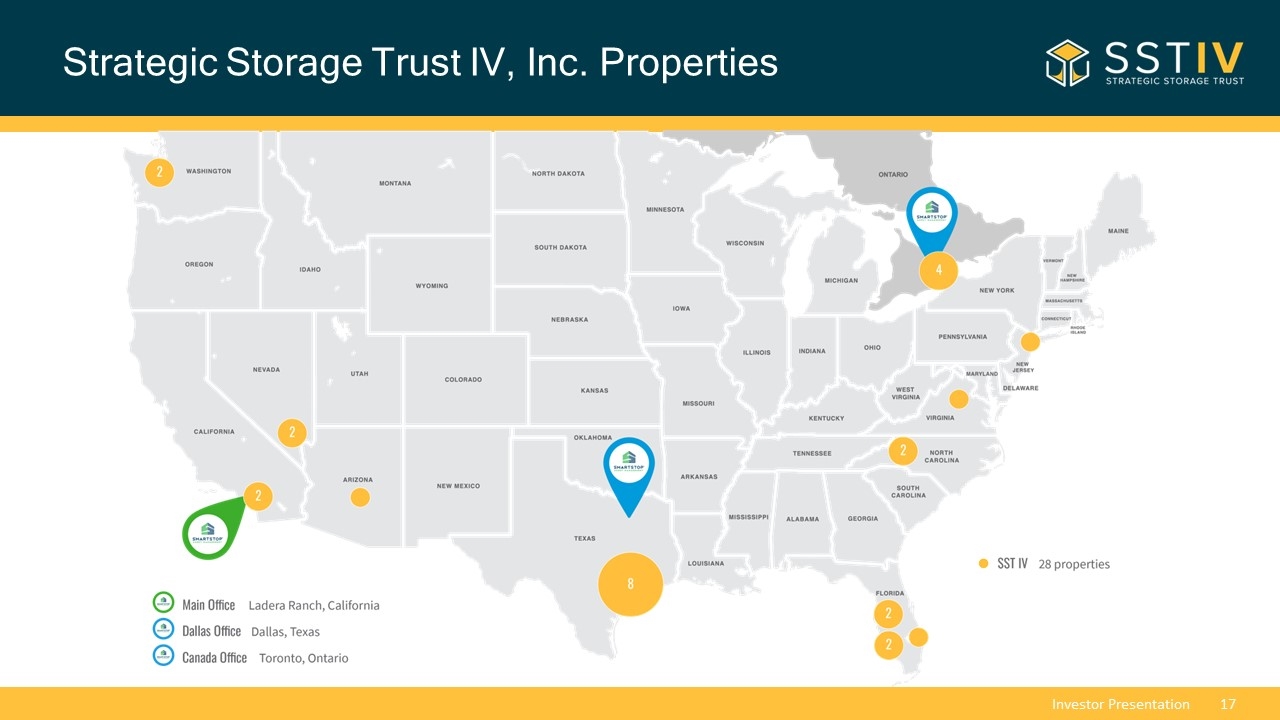

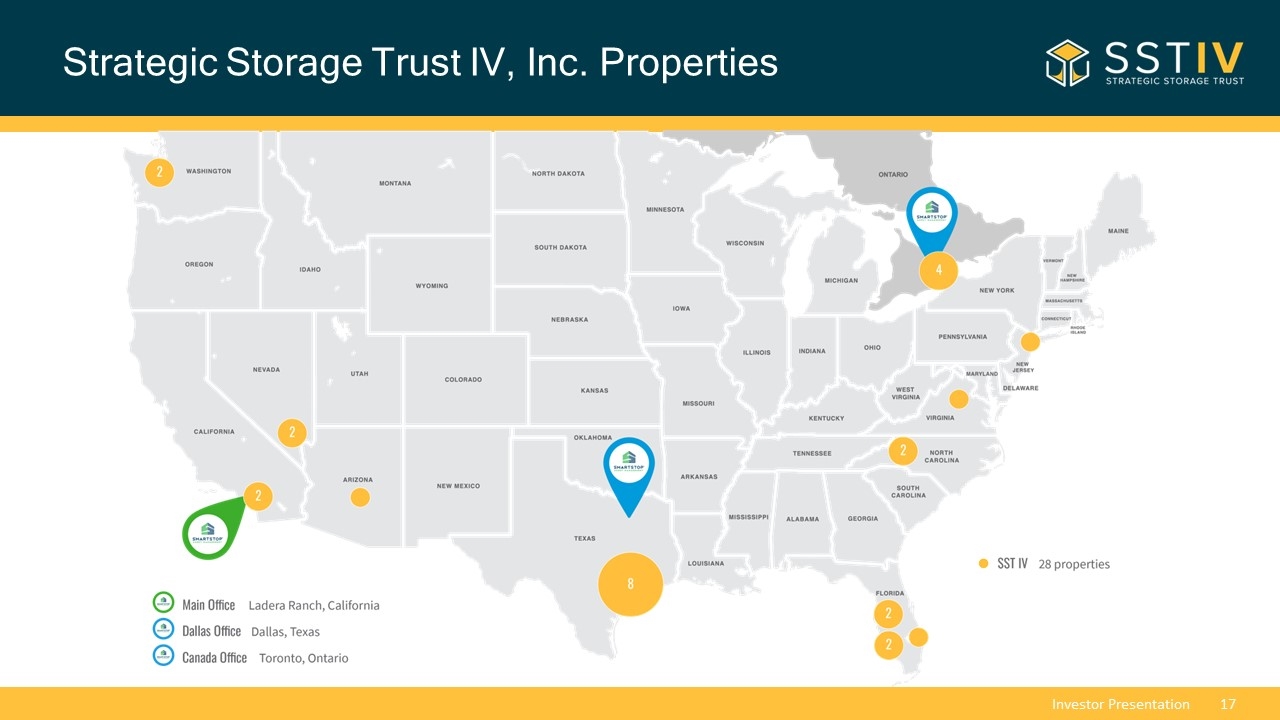

Strategic Storage Trust IV, Inc. Properties

Recent Acquisitions Taylor Theus Portfolio 3,510 Units 325,700 NRSF Approx. 87% Occupancy* Purchase Price: $64.5M Ocoee, Florida Charlotte, North Carolina Charlotte, North Carolina Charlottesville, Virginia *Occupancy number as of 07/31/2020 4 properties currently in lease up

Recent Acquisition 13788 W. Greenway Rd Surprise, Arizona 716 Units 78,775 NRSF Approx. 62% Occupancy* Purchase Price: $7,825,000 *Occupancy number as of 07/31/2020 Acquired at C of O 12/17/2019

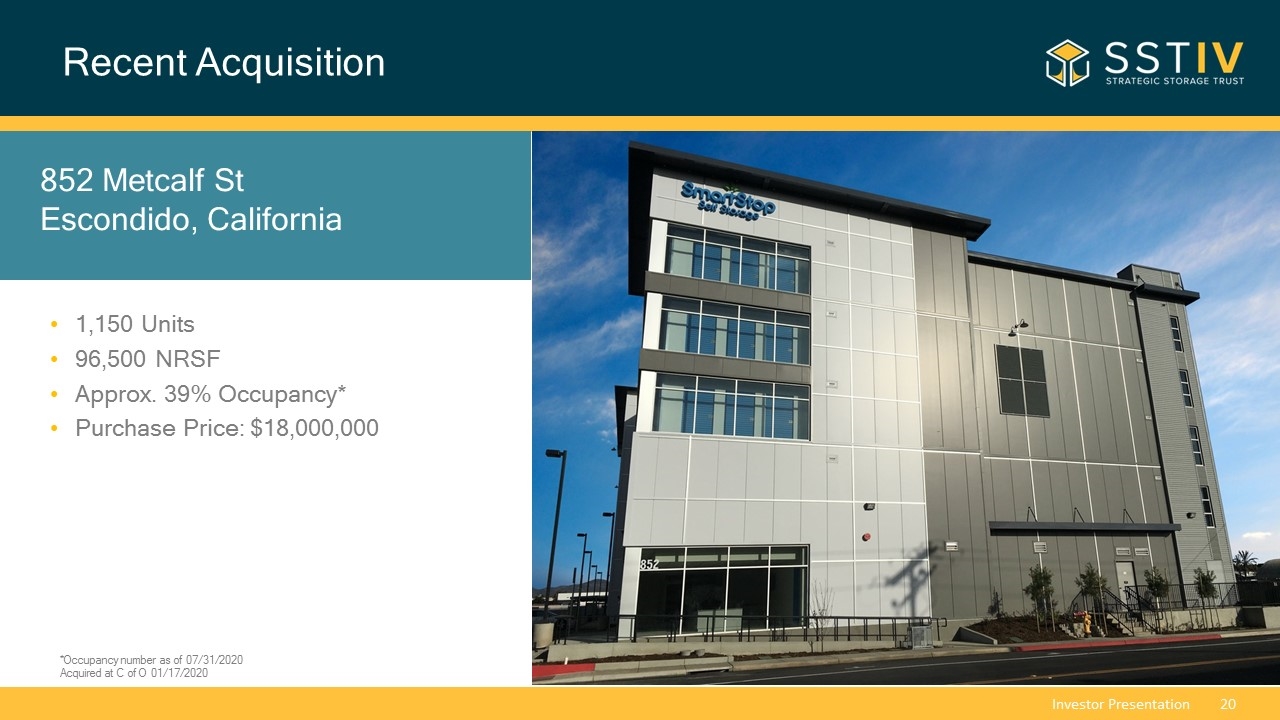

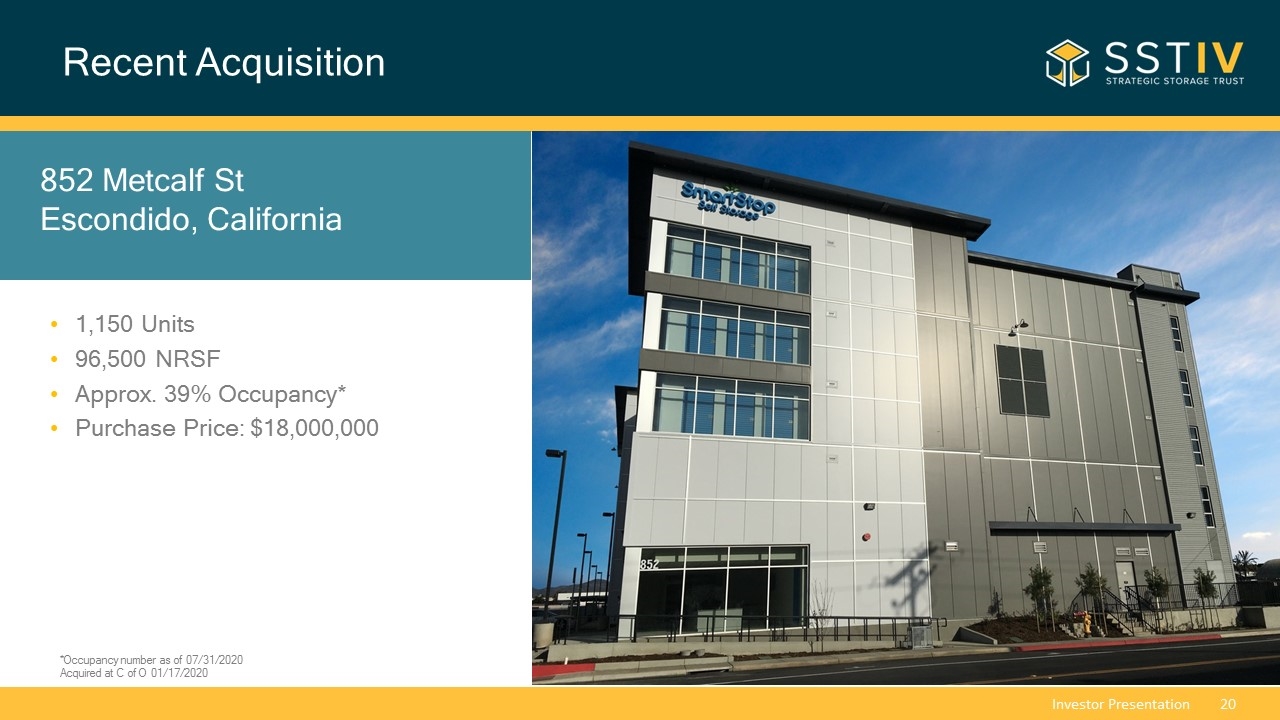

Recent Acquisition 852 Metcalf St Escondido, California 1,150 Units 96,500 NRSF Approx. 39% Occupancy* Purchase Price: $18,000,000 *Occupancy number as of 07/31/2020 Acquired at C of O 01/17/2020

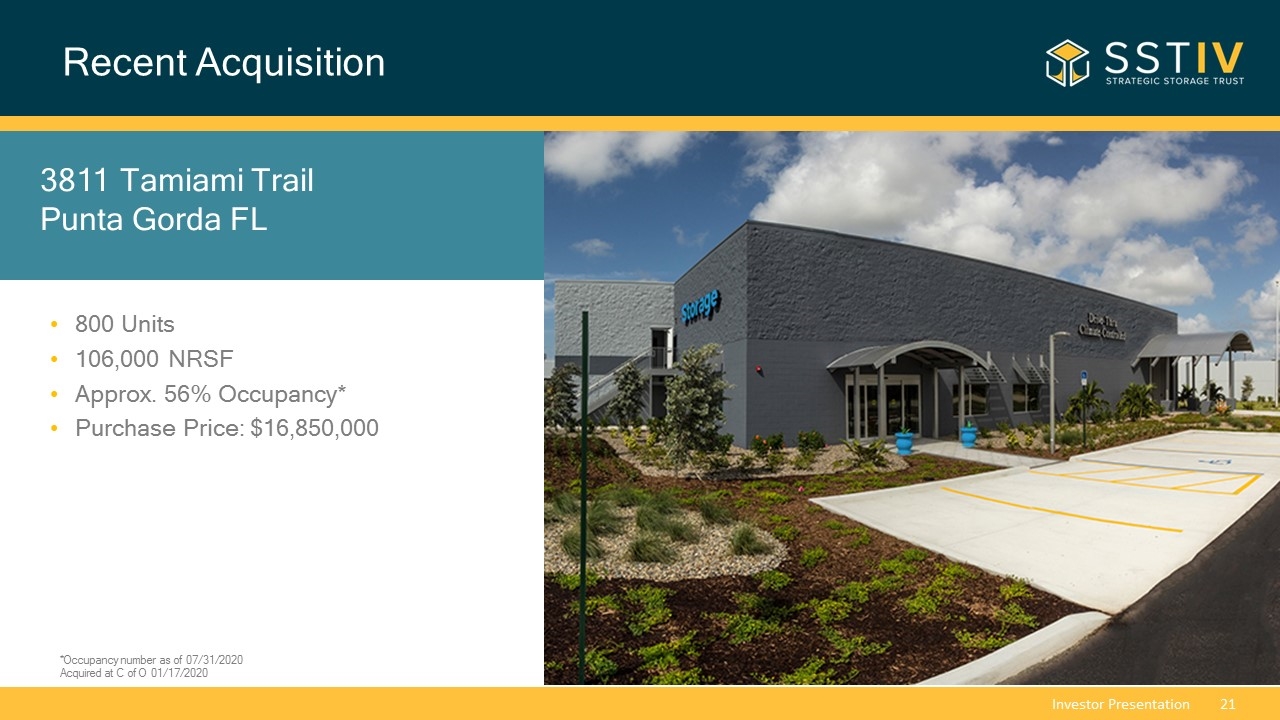

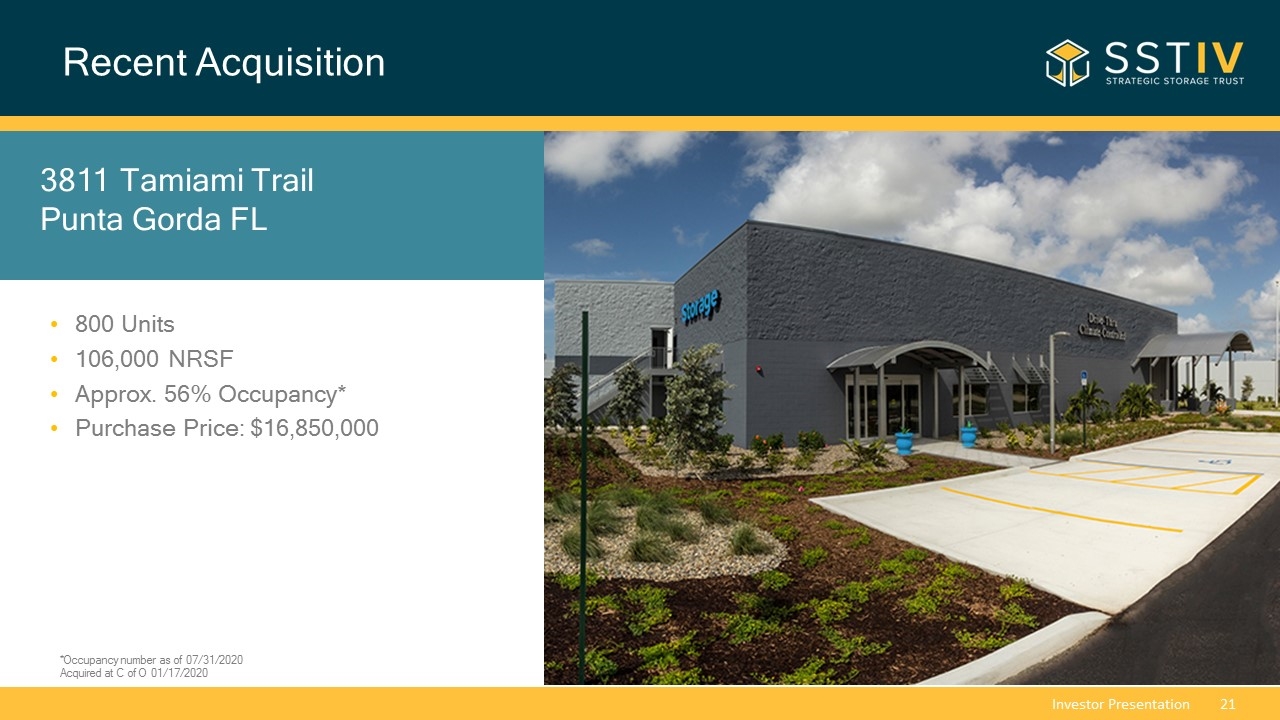

Recent Acquisition 3811 Tamiami Trail Punta Gorda FL 800 Units 106,000 NRSF Approx. 56% Occupancy* Purchase Price: $16,850,000 *Occupancy number as of 07/31/2020 Acquired at C of O 01/17/2020

Recent Development Opening 145 Wicksteed Ave North York, ONT* 1,000 Units 100,000 NRSF Approx. 5% Occupancy** Developed Property *Property owned through a Joint Venture with SmartCentres REIT **Occupancy number as of 07/31/2020 Operational as of 6/18/2020

Strategic Storage Trust IV, Inc. Goals Monthly Distributions(1) Capital Appreciation Recession Resistant(2) Hedge Against Inflation & Increasing Interest Rates (Due to month to month rents) No Tenant Improvements / Leasing Commissions(3) Goal of Meeting Current & Future Income Needs 3-5 Year Anticipated Hold After Completion of Offerings(4) (1)Distributions are at the sole discretion of the Board of Directors and are not guaranteed. Demand for storage is driven by major demographic trends which are going to happen regardless of GDP growth rates, unemployment or what the S&P 500 is doing accordingly, [self] storage is recession resistant.” Source: “Gates: Recession-resistant property is best for investors” - Austin Business Journal by Cody Lyon, Staff Writer, September 2011. Past performance is no indication of future results. It is possible to lose money on this investment. While the self storage industry may be resistant to recessions, there is no guarantee that a related investment will realize a profit or prevent against loss. We will not pay commissions in connection with the leasing of our self storage units; however, we will pay certain fees associated with the day–to-day management and operations of our self storage facilities. The timing of our exit strategy is subject to market conditions and the discretion of our Board of Directors. There is no assurance that we will achieve one or more of the liquidity events we intend to seek within this time frame or at all. Our offering may last up to 3.5 years and our Board of Directors may determine that it is in the best interest of our stockholders to conduct a follow-on offering, in which case offerings of our common stock could be conducted for 6 years or more.

Self Storage Companies Publicly Traded Self Storage Companies NYSE: EXR NYSE: PSA NYSE: CUBE NYSE: LSI NYSE: UHAL NYSE: JCAP NYSE: NSA Public Non-Traded Self Storage REITs Merger Pending

Next Steps Main Office 10 Terrace Road Ladera Ranch, CA 92694 877.32.REIT5 (877.327.3485) info@strategicREIT.com Company Info: StrategicREIT.com Storage Rentals: SmartStopSelfStorage.com Investor Services 866.418.5144

Questions?