2020 Third Quarter Update Strategic Storage Trust IV, Inc. This property is not owned by Strategic Storage Trust IV, Inc. This property is owned by our sponsor. H. Michael Schwartz – Founder & Chairman Exhibit 99.1

Risk Factors & Other Information Certain of the matters discussed in this investor presentation, other than historical facts, constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements and any such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. All forward-looking statements speak only as of the date hereof and are based on current expectations and involve a number of assumptions, risks and uncertainties that could cause the actual results to differ materially from such forward-looking statements. Such forward-looking statements include, but are not limited to, statements about the expected effects and benefits of the potential merger with SmartStop Self Storage REIT, Inc. There are several factors which could cause actual plans and results to differ materially from those expressed or implied in forward-looking statements, including, without limitation, the following: (i) uncertainties relating to changes in general economic and real estate conditions; (ii) uncertainties relating to the implementation of our real estate investment strategy; (iii) uncertainties relating to financing availability and capital proceeds; (iv) uncertainties relating to the closing of property acquisitions; (v) uncertainties related to the timing and availability of distributions; (vi) uncertainties related to the impact of the outbreak of the novel coronavirus (COVID-19); (vii) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (viii) the failure to obtain the approval of SST IV’s stockholders or the failure to satisfy the other closing conditions to the merger; (ix) risks related to disruption of management’s attention from SST IV’s and SmartStop’s ongoing business operations due to the transaction; and (x) the effect of the announcement of the merger on the ability of the parties to retain and hire key personnel, maintain relationships with their customers and suppliers, and maintain their operating results and business generally. Actual results may differ materially from those indicated by such forward-looking statements. In addition, the forward-looking statements represent SST IV’s views as of the date on which such statements were made. SST IV anticipates that subsequent events and developments may cause its views to change. These forward-looking statements should not be relied upon as representing SST IV’s views as of any date subsequent to the date hereof. Additional factors that may affect the business or financial results of SST IV are described in the risk factors included in SST IV’s filings with the SEC, including SST IV’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, copies of which are available on the SEC’s website, www.sec.gov. SST IV expressly disclaims a duty to provide updates to forward-looking statements, whether as a result of new information, future events or other occurrences. As of September 30, 2020, our accumulated deficit was approximately $24.9 million, and we anticipate that our operations will not be profitable in 2020. We have paid, and may continue to pay, distributions from sources other than our cash flows from operations, including from the net proceeds of our public offering and the private offering transaction. We are not prohibited from undertaking such activities by our charter, bylaws, or investment policies, and we may use an unlimited amount from any source to pay our distributions. For the years ended December 31, 2017, 2018 and 2019, and for the nine months ended September 30, 2020, we have funded substantially all of our distributions using proceeds from our private offering transaction and our public offering. Payment of distributions in excess of earnings may have a dilutive effect on the value of your shares. If we pay distributions from sources other than cash flow from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns. Additionally, to the extent distributions exceed cash flow from operations, a stockholder’s basis in our stock may be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain. No public market currently exists for shares of our common stock and we may not list our shares on a national securities exchange before three to five years after completion of our offering, if at all; therefore, it may be difficult to sell your shares. If you sell your shares, it will likely be at a substantial discount. Our charter does not require us to pursue a liquidity transaction at any time. We may only calculate the value per share for our shares annually and, therefore, you may not be able to determine the net asset value of your shares on an ongoing basis We have limited operating history, and the prior performance of real estate programs sponsored by affiliates of our sponsor may not be indicative of our future results. We are a “blind pool.” As a result, you will not be able to evaluate the economic merits of our future investments prior to their purchase. We may be unable to invest the net proceeds from our offering on acceptable terms to investors, or at all. There are substantial conflicts of interest among us and our sponsor, advisor, property manager and transfer agent. Our advisor will face conflicts of interest relating to the purchase of properties, including conflicts with SmartStop Self Storage REIT, Inc. and the advisors other private programs sponsored by our sponsor, and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities. We have no employees and must depend on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources to us. We will pay substantial fees and expenses to our advisor, its affiliates and participating broker-dealers, which will reduce cash available for investment and distribution. We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment. We may fail to qualify as a REIT, which could adversely affect our operations and our ability to make distributions. Our board of directors may change any of our investment objectives without your consent.

Additional Disclaimer & Risk Factors Additional Information and Where to Find It In connection with the proposed merger, SST IV intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”) that will include a proxy statement of SST IV and will also constitute a prospectus of SmartStop. SST IV intends to mail or otherwise provide to its stockholders the proxy statement/prospectus and other relevant materials, and hold a meeting of its stockholders to obtain the requisite stockholder approval of the merger and an amendment to SST IV’s charter to remove the limitations on “roll-up transactions,” which is necessary to consummate the merger. BEFORE MAKING ANY VOTING DECISION, SST IV’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER AND THE PARTIES TO THE PROPOSED MERGER. Investors and security holders may obtain a free copy of the proxy statement/prospectus and other documents that SST IV and SmartStop file with the SEC (when available) from the SEC’s website at www.sec.gov, SST IV’s website at https://strategicreit.com/site/sst4, and SmartStop’s website at https://strategicreit.com/site/sst2. In addition, the proxy statement/prospectus and other documents filed by SST IV and SmartStop with the SEC (when available) may be obtained from SST IV free of charge by directing a request to the following address: Strategic Storage Trust IV, Inc., Attention: Nicholas M. Look, 10 Terrace Road, Ladera Ranch, California 92694, or by calling (877) 327-3485. . No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy or sell any securities or a solicitation of a proxy or of any vote or approval. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication may be deemed to be solicitation material in respect of the proposed merger. Participants in Solicitation Relating to the Merger SST IV and SmartStop and their respective directors and executive officers, as well as SST IV’s external investment advisor, may be deemed, under SEC rules, to be participants in the solicitation of proxies from SST IV’s stockholders with respect to the proposed merger. Security holders can obtain information regarding the names, affiliations and interests of such persons in SST IV’s proxy statement filed with the SEC on April 9, 2020, and SmartStop’s proxy statement filed with the SEC on April 24, 2020. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement/prospectus regarding the proposed merger when it becomes available.

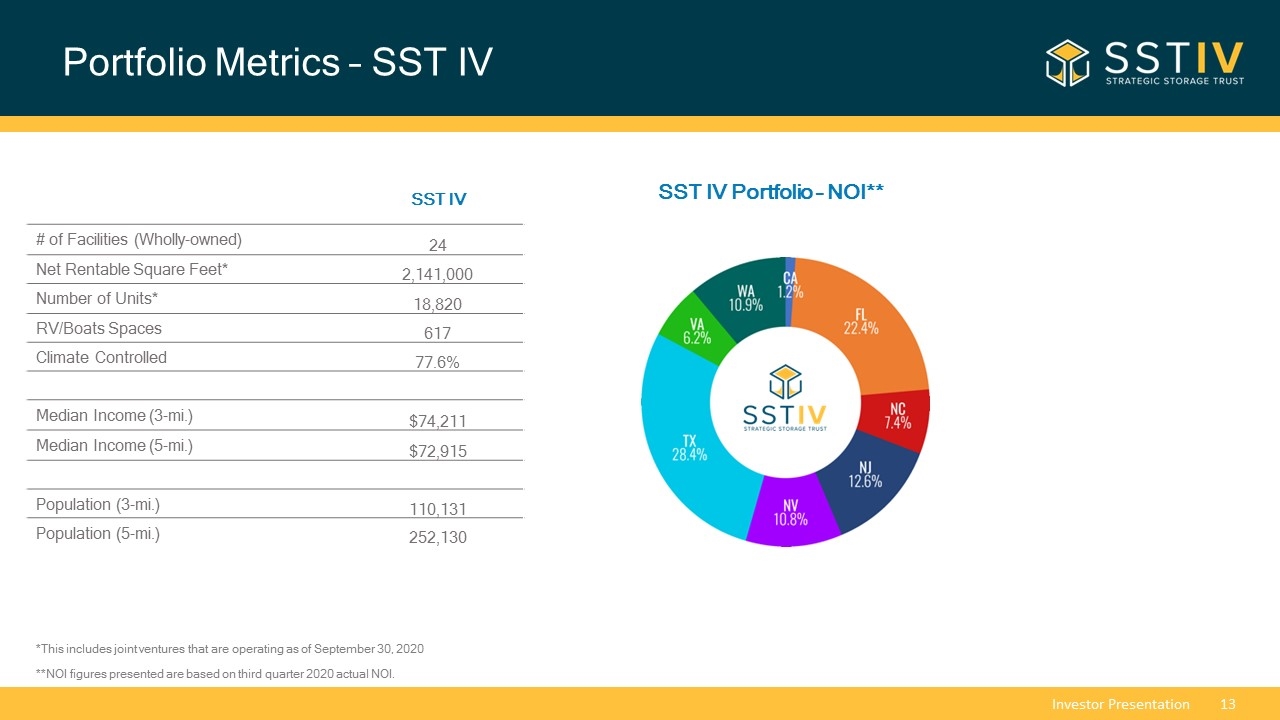

Additional Information Regarding NOI Net Operating Income or (“NOI”) NOI is a non-GAAP measure that SmartStop defines as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization, acquisition expenses and other non-property related expenses. SST IV believes that NOI is useful for investors as it provides a measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with the ongoing operation of the properties. Additionally, SST IV believes that NOI (also referred to as property operating income) is a widely accepted measure of comparative operating performance in the real estate community. However, SST IV’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount.

SmartStop REIT Advisors, LLC

SmartStop REIT Advisors, LLC. SmartStop REIT Advisors, LLC (“SmartStop”) and its affiliates are fully-integrated self storage companies with a combined portfolio of over $1.7 billion of self storage assets. SmartStop is the 10th largest self storage company in the U.S. with an owned and managed portfolio of 11.3 million rentable square feet across 149 facilities throughout the U.S. & Toronto, Canada Growing portfolio of properties in the greater Toronto area, comprising approx. 1.3 million net rentable square feet Management team is experienced in the development, redevelopment, lease up, and acquisition of self storage properties in the U.S. and Toronto. Approximately 390 employees, including 36 in Toronto, Canada Transacted over $4.0 billion in self storage properties in the past 15 years

SmartStop REIT Advisors, LLC H. Michael Schwartz Executive Chairman 16 Years Experience Wayne Johnson President & CIO, Self Storage 34 Years Experience Gerald Valle SVP Storage Operations 31 Years Experience Mike Terjung Chief Accounting Officer 11 Years Experience Michael McClure Chief Executive Officer 12 Years Experience Michael McClure President 12 Years Experience Wayne Johnson Chief Investment Officer 34 Years Experience H. Michael Schwartz Chairman & Chief Executive Officer 16 Years Experience James Barry CFO & Treasurer, SmartStop REIT 8 Years Experience Nicholas Look General Counsel, Self Storage 3 Years Experience SmartStop REIT Advisors Matt Lopez CFO & Treasurer 6 Years Experience Strategic Storage Trust IV, Inc. Officers Joe Robinson Chief Operations Officer 11 Years Experience *Years Experience presented represent years in the self storage industry Nicholas Look Secretary 3 Years Experience

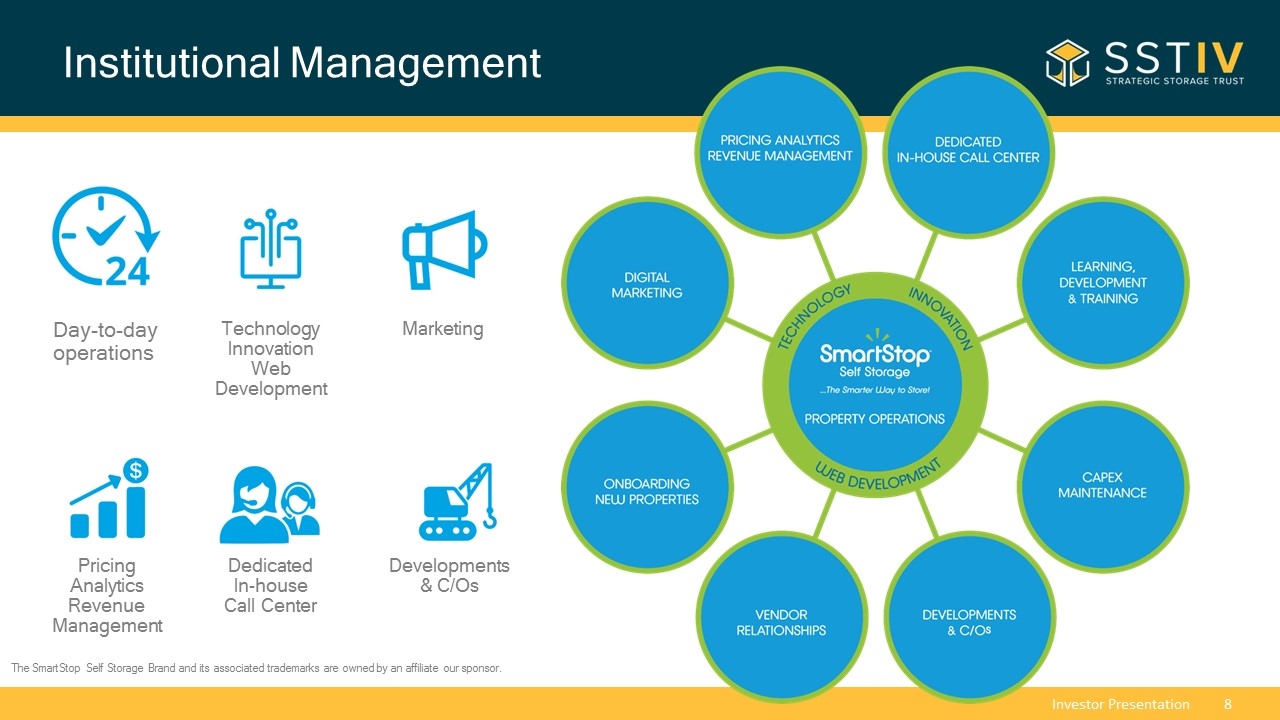

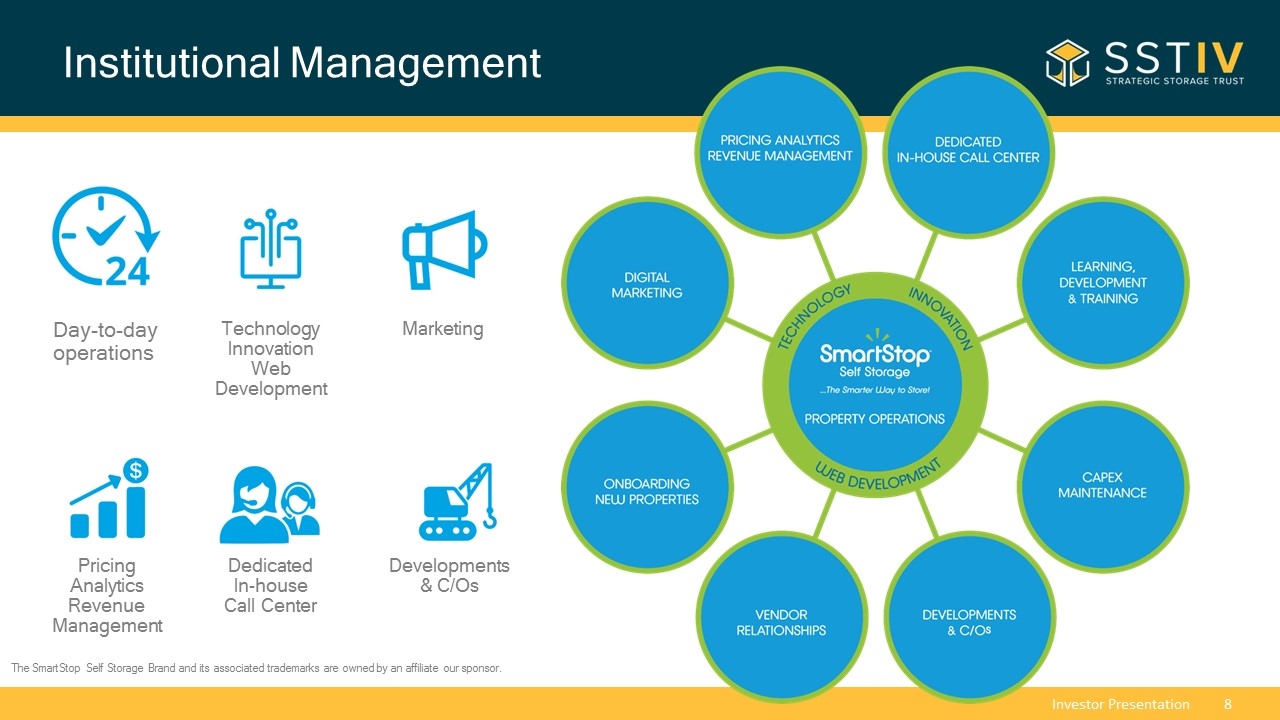

Institutional Management Day-to-day operations Technology Innovation Web Development Marketing Pricing Analytics Revenue Management Dedicated In-house Call Center Developments & C/Os The SmartStop Self Storage Brand and its associated trademarks are owned by an affiliate our sponsor.

Strategic Storage Trust IV, Inc. Merger with SmartStop Self Storage REIT, Inc.

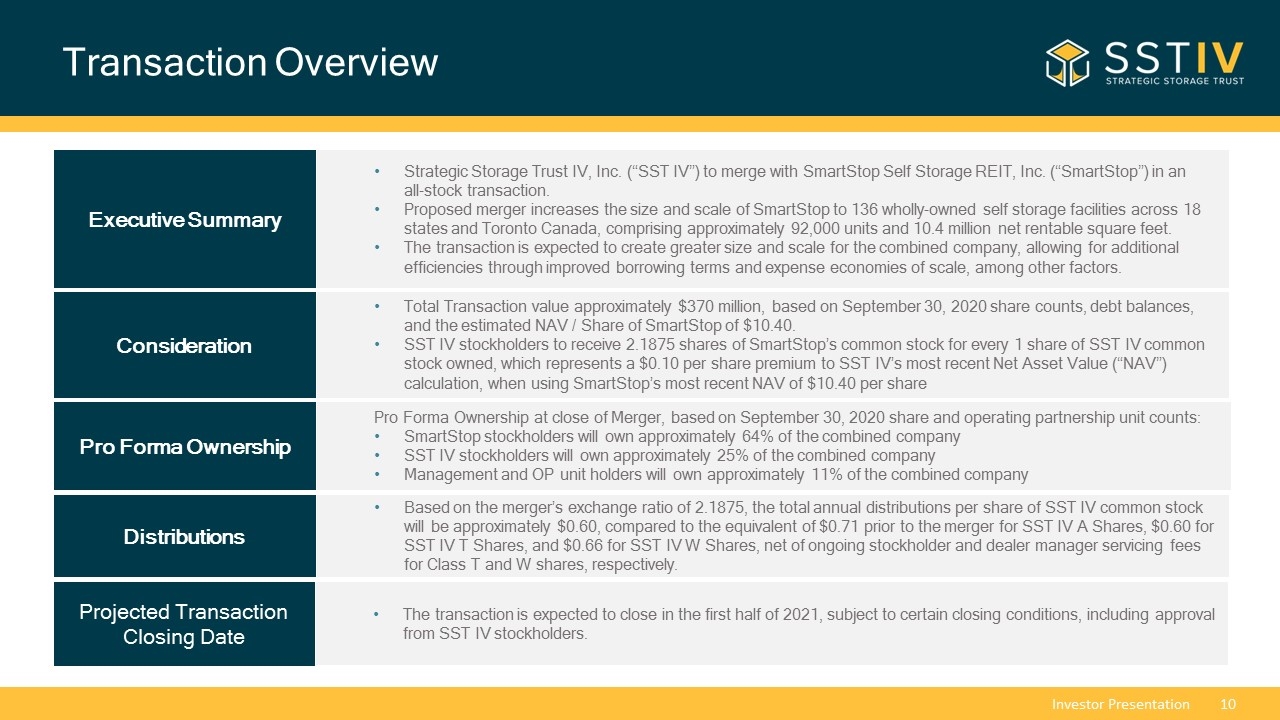

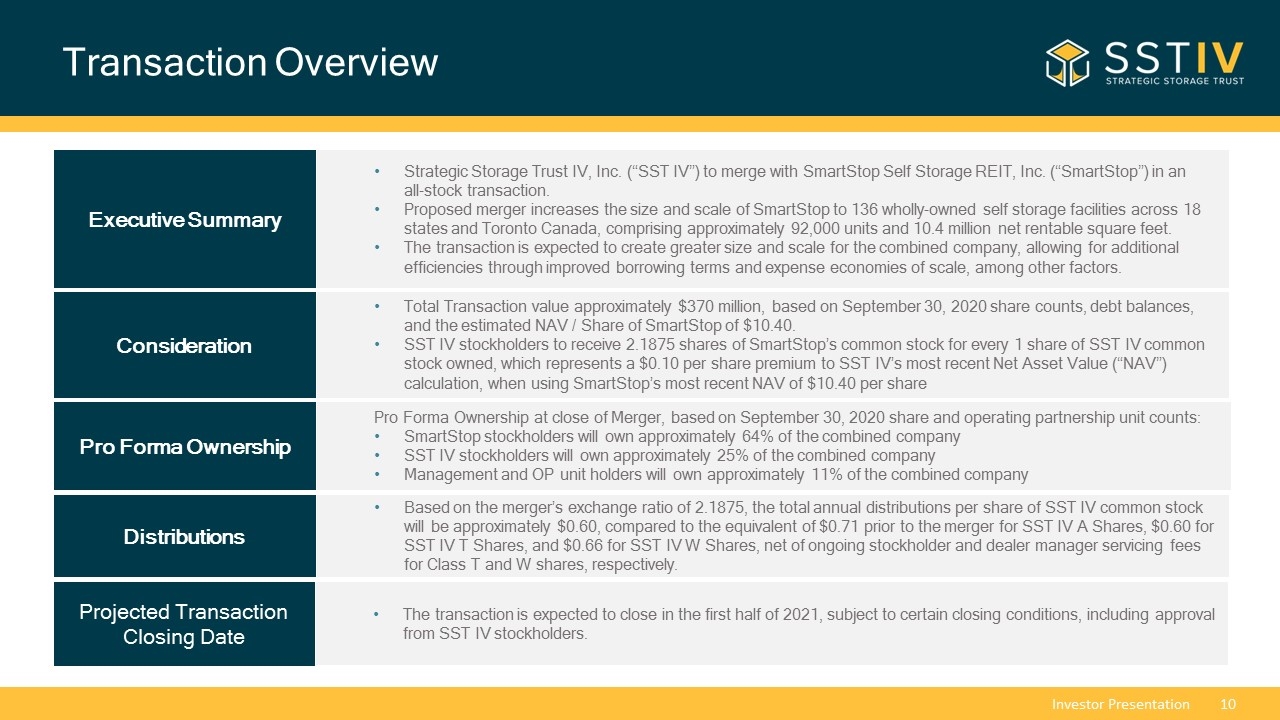

Transaction Overview Executive Summary Consideration Pro Forma Ownership Distributions Projected Transaction Closing Date Strategic Storage Trust IV, Inc. (“SST IV”) to merge with SmartStop Self Storage REIT, Inc. (“SmartStop”) in an all-stock transaction. Proposed merger increases the size and scale of SmartStop to 136 wholly-owned self storage facilities across 18 states and Toronto Canada, comprising approximately 92,000 units and 10.4 million net rentable square feet. The transaction is expected to create greater size and scale for the combined company, allowing for additional efficiencies through improved borrowing terms and expense economies of scale, among other factors. Total Transaction value approximately $370 million, based on September 30, 2020 share counts, debt balances, and the estimated NAV / Share of SmartStop of $10.40. SST IV stockholders to receive 2.1875 shares of SmartStop’s common stock for every 1 share of SST IV common stock owned, which represents a $0.10 per share premium to SST IV’s most recent Net Asset Value (“NAV”) calculation, when using SmartStop’s most recent NAV of $10.40 per share Pro Forma Ownership at close of Merger, based on September 30, 2020 share and operating partnership unit counts: SmartStop stockholders will own approximately 64% of the combined company SST IV stockholders will own approximately 25% of the combined company Management and OP unit holders will own approximately 11% of the combined company Based on the merger’s exchange ratio of 2.1875, the total annual distributions per share of SST IV common stock will be approximately $0.60, compared to the equivalent of $0.71 prior to the merger for SST IV A Shares, $0.60 for SST IV T Shares, and $0.66 for SST IV W Shares, net of ongoing stockholder and dealer manager servicing fees for Class T and W shares, respectively. The transaction is expected to close in the first half of 2021, subject to certain closing conditions, including approval from SST IV stockholders.

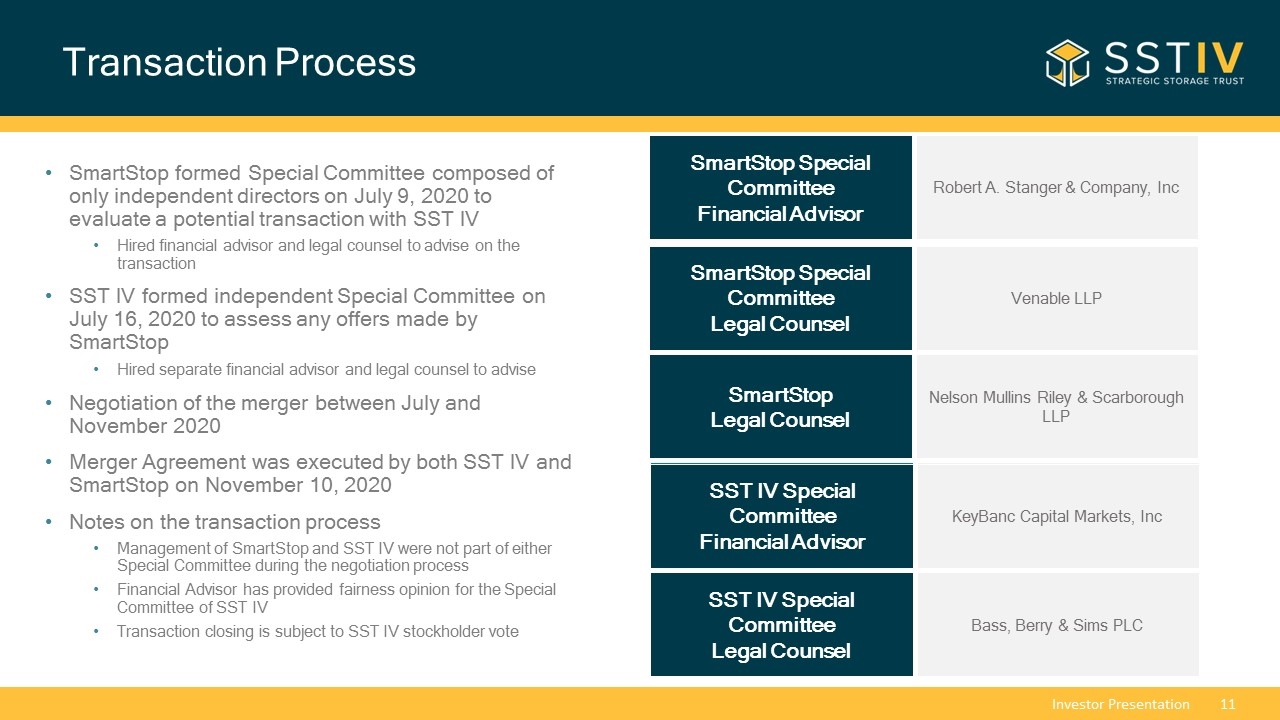

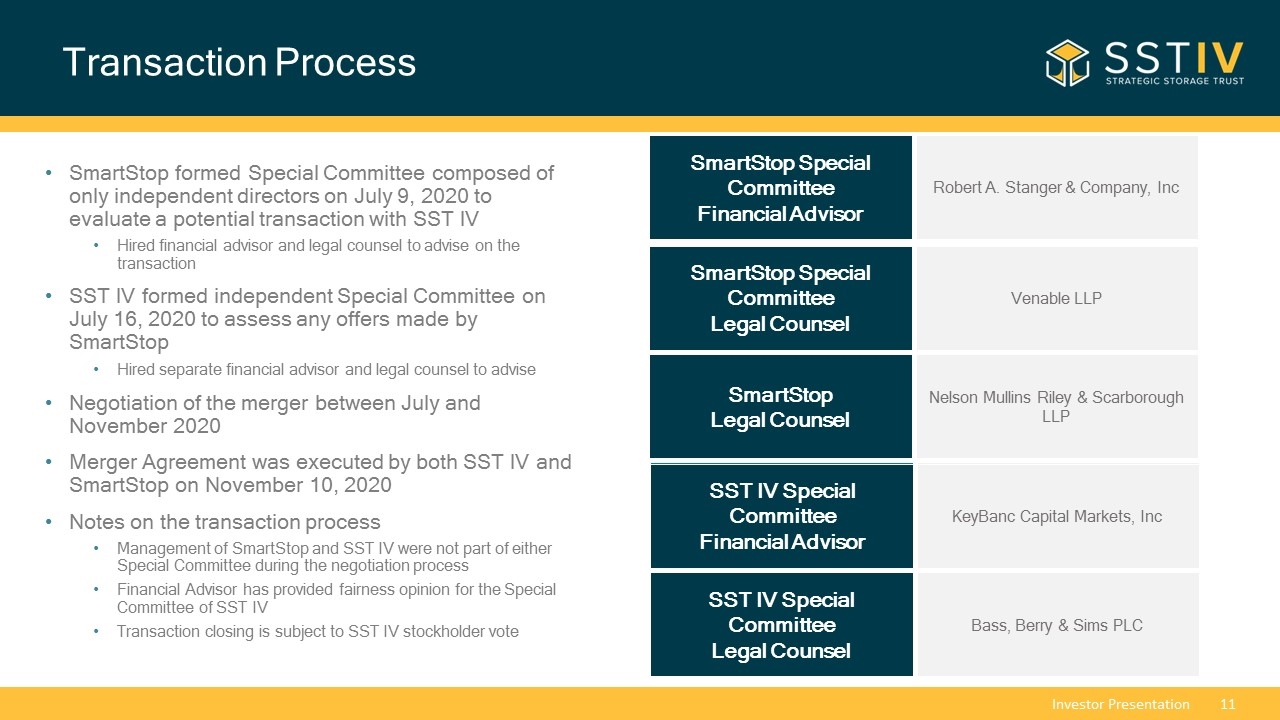

Transaction Process SST IV Special Committee Financial Advisor KeyBanc Capital Markets SST IV Special Committee Legal Counsel Bass, Berry & Sims PLC SmartStop Special Committee Financial Advisor Robert A. Stanger & Company, Inc SmartStop Special Committee Legal Counsel Venable LLP SmartStop Legal Counsel Nelson Mullins Riley & Scarborough LLP SST IV Special Committee Financial Advisor KeyBanc Capital Markets, Inc SmartStop formed Special Committee composed of only independent directors on July 9, 2020 to evaluate a potential transaction with SST IV Hired financial advisor and legal counsel to advise on the transaction SST IV formed independent Special Committee on July 16, 2020 to assess any offers made by SmartStop Hired separate financial advisor and legal counsel to advise Negotiation of the merger between July and November 2020 Merger Agreement was executed by both SST IV and SmartStop on November 10, 2020 Notes on the transaction process Management of SmartStop and SST IV were not part of either Special Committee during the negotiation process Financial Advisor has provided fairness opinion for the Special Committee of SST IV Transaction closing is subject to SST IV stockholder vote

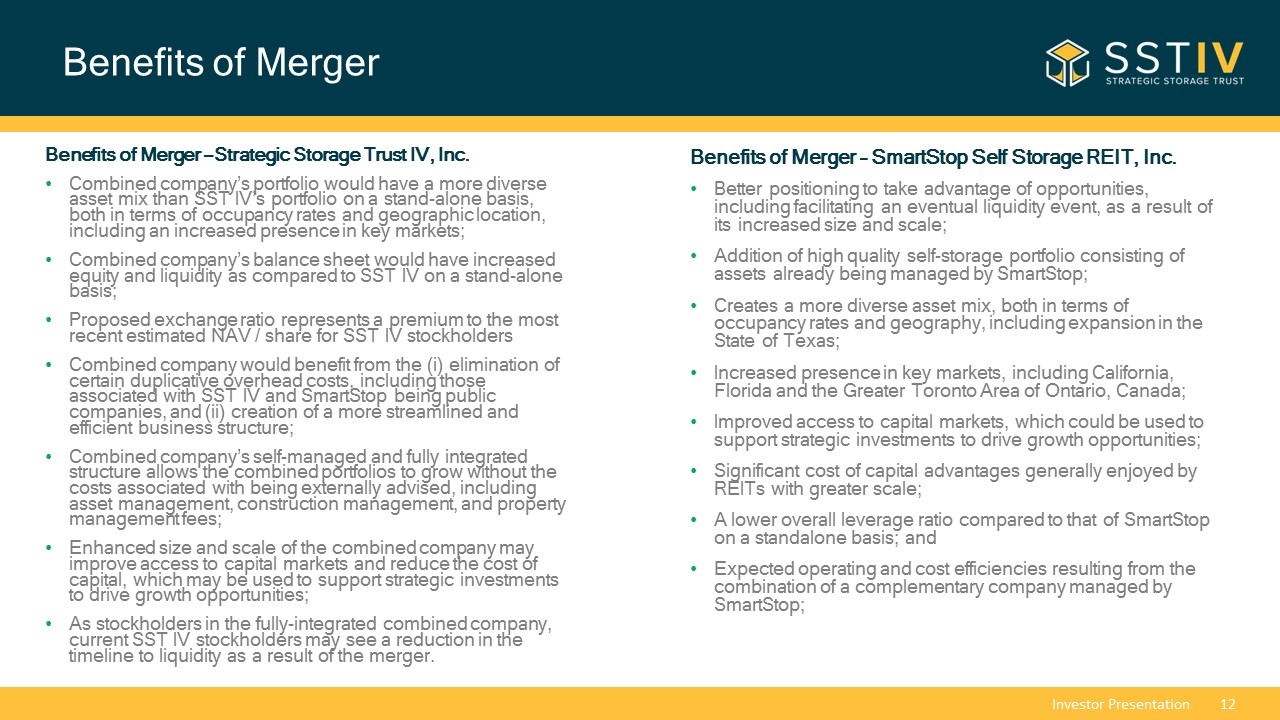

Benefits of Merger Benefits of Merger – SmartStop Self Storage REIT, Inc. Better positioning to take advantage of opportunities, including facilitating an eventual liquidity event, as a result of its increased size and scale; Addition of high quality self-storage portfolio consisting of assets already being managed by SmartStop; Creates a more diverse asset mix, both in terms of occupancy rates and geography, including expansion in the State of Texas; Increased presence in key markets, including California, Florida and the Greater Toronto Area of Ontario, Canada; Improved access to capital markets, which could be used to support strategic investments to drive growth opportunities; Significant cost of capital advantages generally enjoyed by REITs with greater scale; A lower overall leverage ratio compared to that of SmartStop on a standalone basis; and Expected operating and cost efficiencies resulting from the combination of a complementary company managed by SmartStop; Benefits of Merger – Strategic Storage Trust IV, Inc. Combined company’s portfolio would have a more diverse asset mix than SST IV’s portfolio on a stand-alone basis, both in terms of occupancy rates and geographic location, including an increased presence in key markets; Combined company’s balance sheet would have increased equity and liquidity as compared to SST IV on a stand-alone basis; Proposed exchange ratio represents a premium to the most recent estimated NAV / share for SST IV stockholders Combined company would benefit from the (i) elimination of certain duplicative overhead costs, including those associated with SST IV and SmartStop being public companies, and (ii) creation of a more streamlined and efficient business structure; Combined company’s self-managed and fully integrated structure allows the combined portfolios to grow without the costs associated with being externally advised, including asset management, construction management, and property management fees; Enhanced size and scale of the combined company may improve access to capital markets and reduce the cost of capital, which may be used to support strategic investments to drive growth opportunities; As stockholders in the fully-integrated combined company, current SST IV stockholders may see a reduction in the timeline to liquidity as a result of the merger.

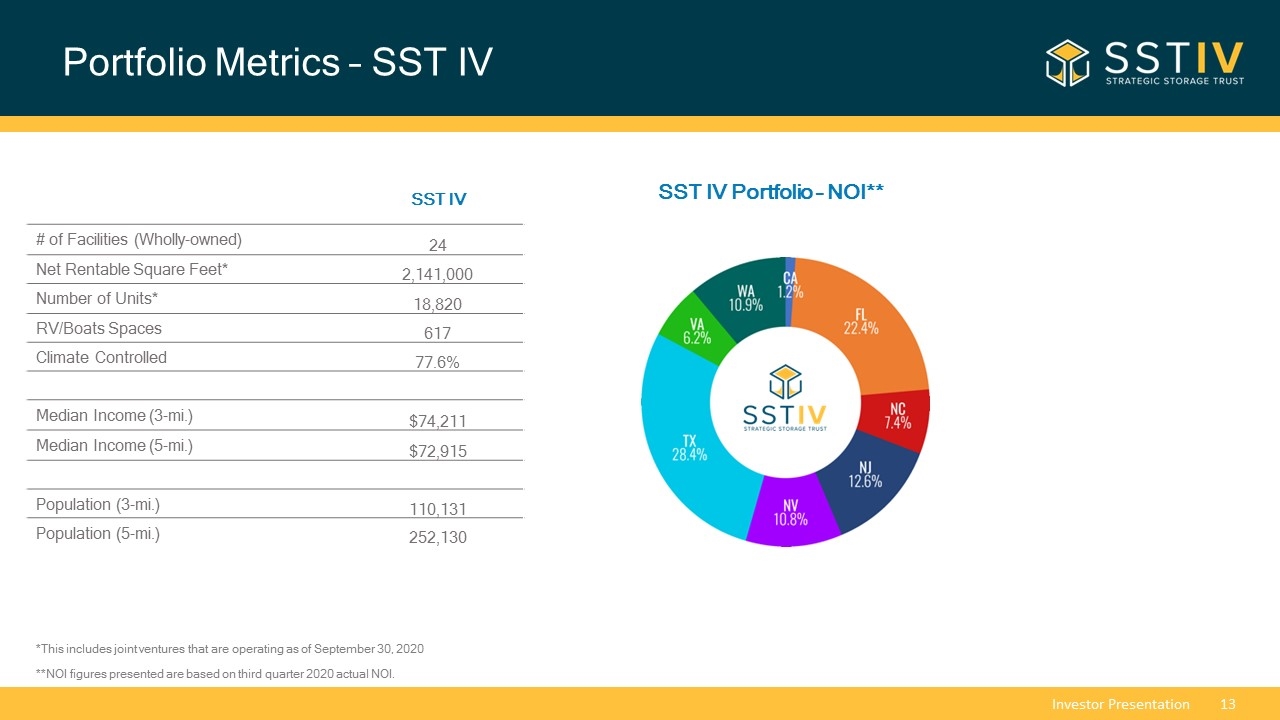

Portfolio Metrics – SST IV SST IV # of Facilities (Wholly-owned) 24 Net Rentable Square Feet* 2,141,000 Number of Units* 18,820 RV/Boats Spaces 617 Climate Controlled 77.6% Median Income (3-mi.) $74,211 Median Income (5-mi.) $72,915 Population (3-mi.) 110,131 Population (5-mi.) 252,130 SST IV Portfolio – NOI** *This includes joint ventures that are operating as of September 30, 2020 **NOI figures presented are based on third quarter 2020 actual NOI.

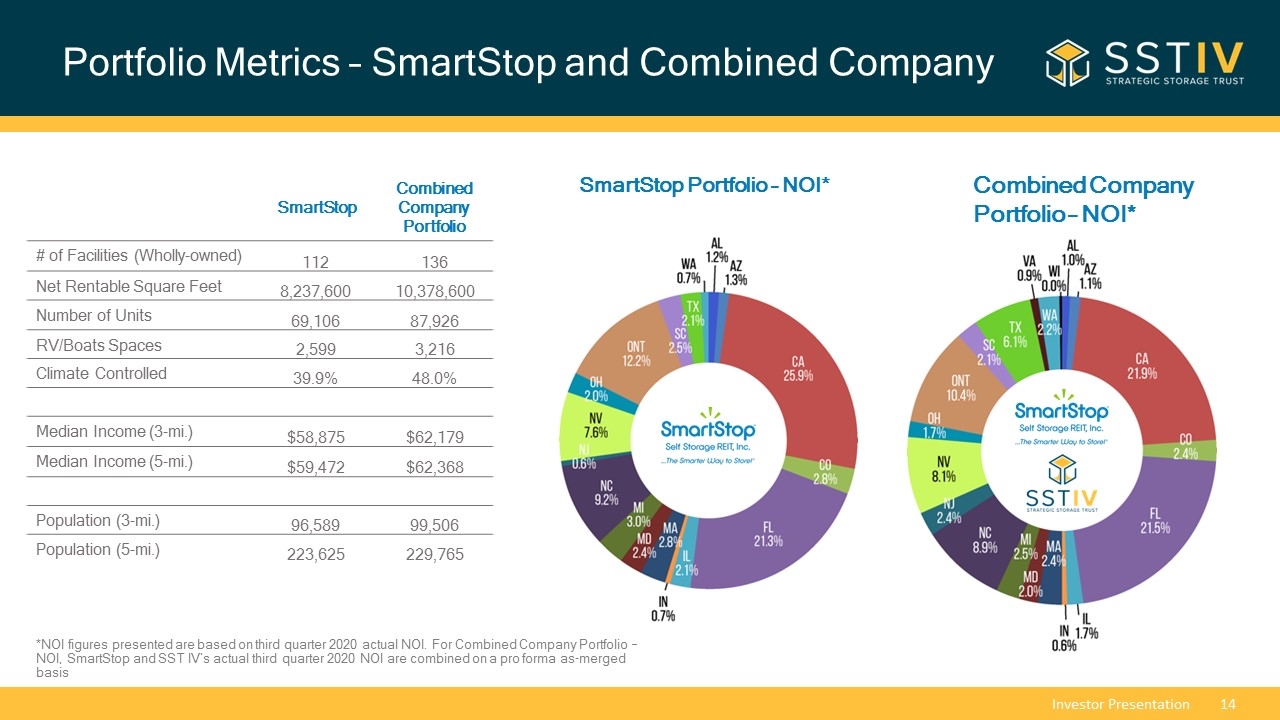

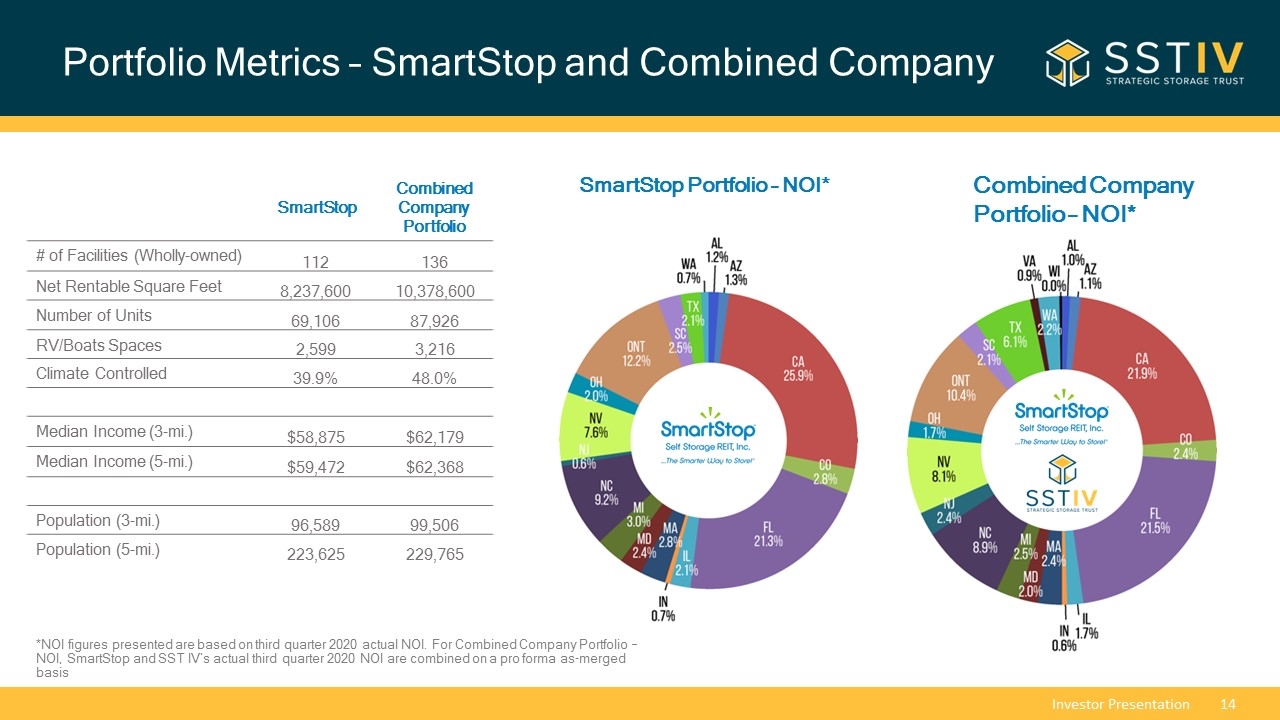

Portfolio Metrics – SmartStop and Combined Company SmartStop Portfolio – NOI* SmartStop Combined Company Portfolio # of Facilities (Wholly-owned) 112 136 Net Rentable Square Feet 8,237,600 10,378,600 Number of Units 69,106 87,926 RV/Boats Spaces 2,599 3,216 Climate Controlled 39.9% 48.0% Median Income (3-mi.) $58,875 $62,179 Median Income (5-mi.) $59,472 $62,368 Population (3-mi.) 96,589 99,506 Population (5-mi.) 223,625 229,765 Combined Company Portfolio – NOI* *NOI figures presented are based on third quarter 2020 actual NOI. For Combined Company Portfolio – NOI, SmartStop and SST IV’s actual third quarter 2020 NOI are combined on a pro forma as-merged basis

Distributions and Share Redemption Program SmartStop Self Storage REIT, Inc. No change to DRP Declared distributions for fourth quarter 2020 at annual rate of $0.60 / year, consistent with prior distribution rate Share Redemption Program partially reinstated for requests in connection with stockholder’s death, qualifying disability, or long-term care facility confinement Strategic Storage Trust IV, Inc. Distribution Reinvestment Plan (DRP) suspended, effective November 20, 2020 Beginning with October 2020’s earned distributions, all future distributions will be paid in cash October’s distributions paid November 20, 2020 Share Redemption Program (SRP) remains suspended After Completion of Merger Former SST IV stockholders who elected for DRP will return to DRP through SmartStop’s existing DRP Former SST IV stockholders will receive distributions at annual rate of $0.60/share, given SmartStop’s historical distribution rate* Former SST IV stockholders eligible for SmartStop’s partially-reinstated Share Redemption Program, in the case of stockholder’s death, qualifying disability, or long-term care facility confinement *Future distributions are at the sole discretion of SmartStop Self Storage REIT, Inc.’s board of directors and are not guaranteed

Novel Coronavirus (COVID-19) Update

Protecting Our Customers & Employees Social Distancing: Allowing only one customer in our office at a time and enforcing stay-at-home when sick procedures for employees Cleanliness: Thorough cleaning at each of our facilities and installation of plastic dividers. Employees are required to wear masks, and ill customers are asked to call us or visit us online Security: Security systems remain online, and staff are performing routine inspections Communication: Call center remains open, and customers can access accounts and pay bills online Prioritizing the health and safety of customers and employees, while ensuring locations continue to stay open

COVID-19’s Impact Paused rate increase for existing customers during the second quarter 2020 Declined to charge or waived various late fees during second quarter 2020 Resumed existing tenant rate increases and late fee collections during third quarter 2020 Same-store move-ins increased in approximately 16% in Q3 2020 compared to Q3 2019 Same-store move-outs increased approximately 1% for the third quarter 2020 as compared to 2019 Same-store asking rates for new customers declined during the third quarter 2020 as compared to 2019 Current months rent collections were effectively unchanged on a year-over-year basis at approximately 97% during the third quarter 2020 Same-store occupancy rates Average third quarter 2020: 93.5%, up approximately 390 basis points from prior year

Business Continuity and Positioning Continue to rent units through the call center and via the online leasing capabilities of the SmartStop website As of March 13 (~9 months), the majority of our corporate employees were working remotely with no interruption of key business functions Significant liquidity across our storage programs, both in cash and availability Continuing to pay stockholder distributions and are confident that self storage is well suited to weather all economic environments Well positioned with the SmartStop Self Storage platform to grow in the future

Strategic Storage Trust IV, Inc.

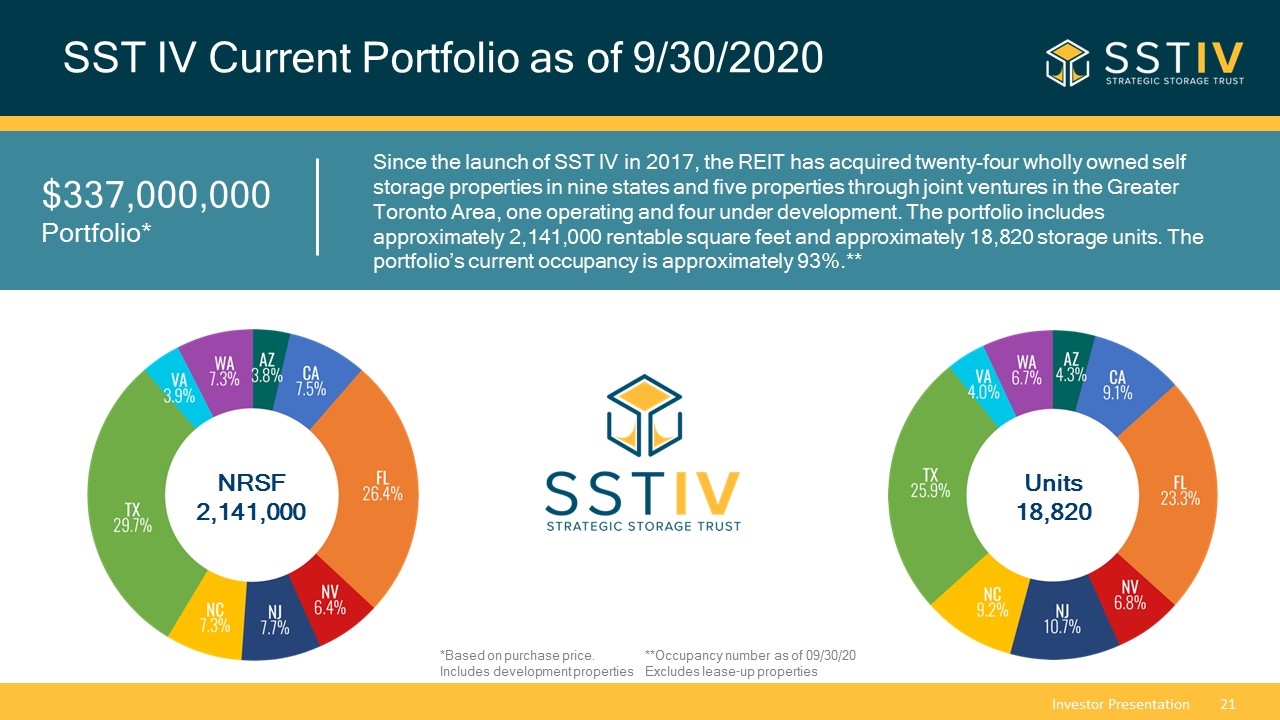

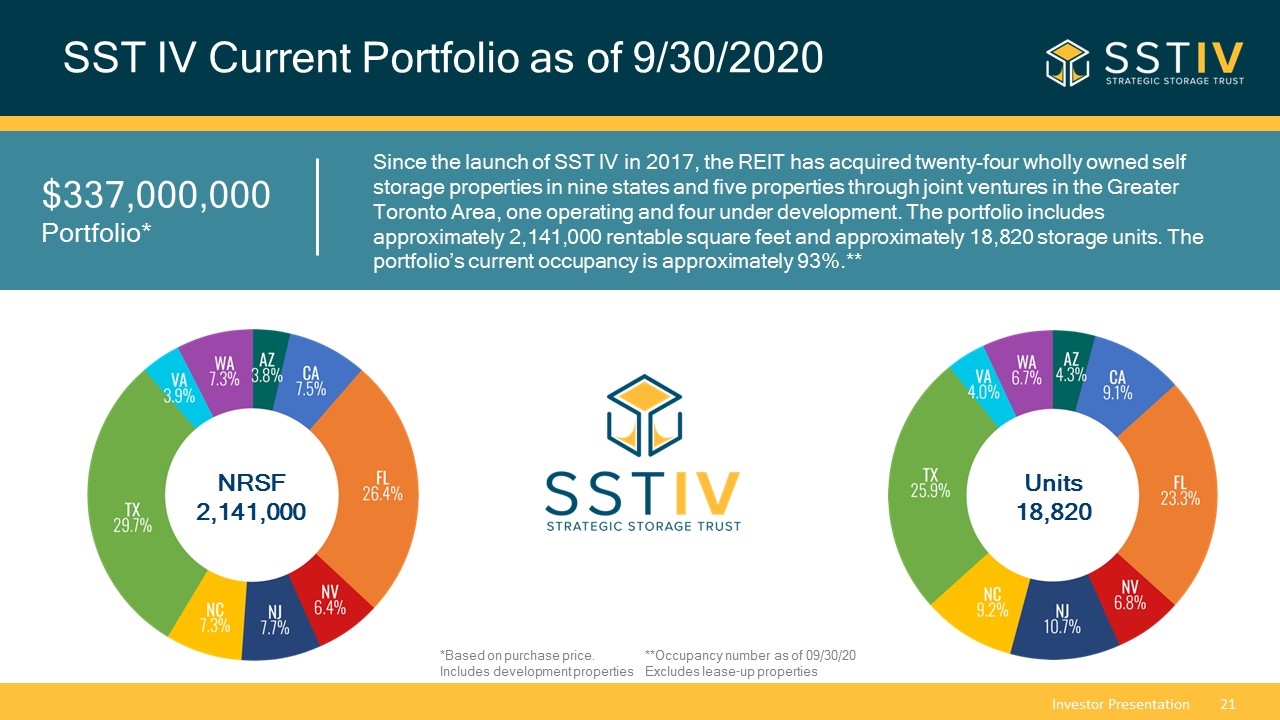

SST IV Current Portfolio as of 9/30/2020 $337,000,000 Portfolio* Since the launch of SST IV in 2017, the REIT has acquired twenty-four wholly owned self storage properties in nine states and five properties through joint ventures in the Greater Toronto Area, one operating and four under development. The portfolio includes approximately 2,141,000 rentable square feet and approximately 18,820 storage units. The portfolio’s current occupancy is approximately 93%.** NRSF 2,141,000 Units 18,820 **Occupancy number as of 09/30/20 Excludes lease-up properties *Based on purchase price. Includes development properties

Equity Update Equity Update as of 9/30/2020(1) Approx. $257 Million raised Approx. 40.6% loan to asset value Distributions(2) SST IV pays a distribution rate of approximately $0.00427 per day per share (equivalent to $1.56 per share annually) to Class A, Class T and Class W stockholders of record. The T share distribution is reduced by an ongoing stockholder servicing fee equal to an annual rate of 1% of the T share purchase price. The W share distribution is reduced by an ongoing dealer manager servicing fee equal to an annual rate of 0.50% of the W share purchase price. (1) Offering suspended as of April 30th, 2020 (2) We have paid and may continue to pay, distributions from sources other than cash flow from operations, therefore, we will have fewer funds available for acquisitions of properties and our stockholders overall return may be reduced. Future distributions are at the sole discretion of our board of directors and are not guaranteed. Puyallup, Washington Property

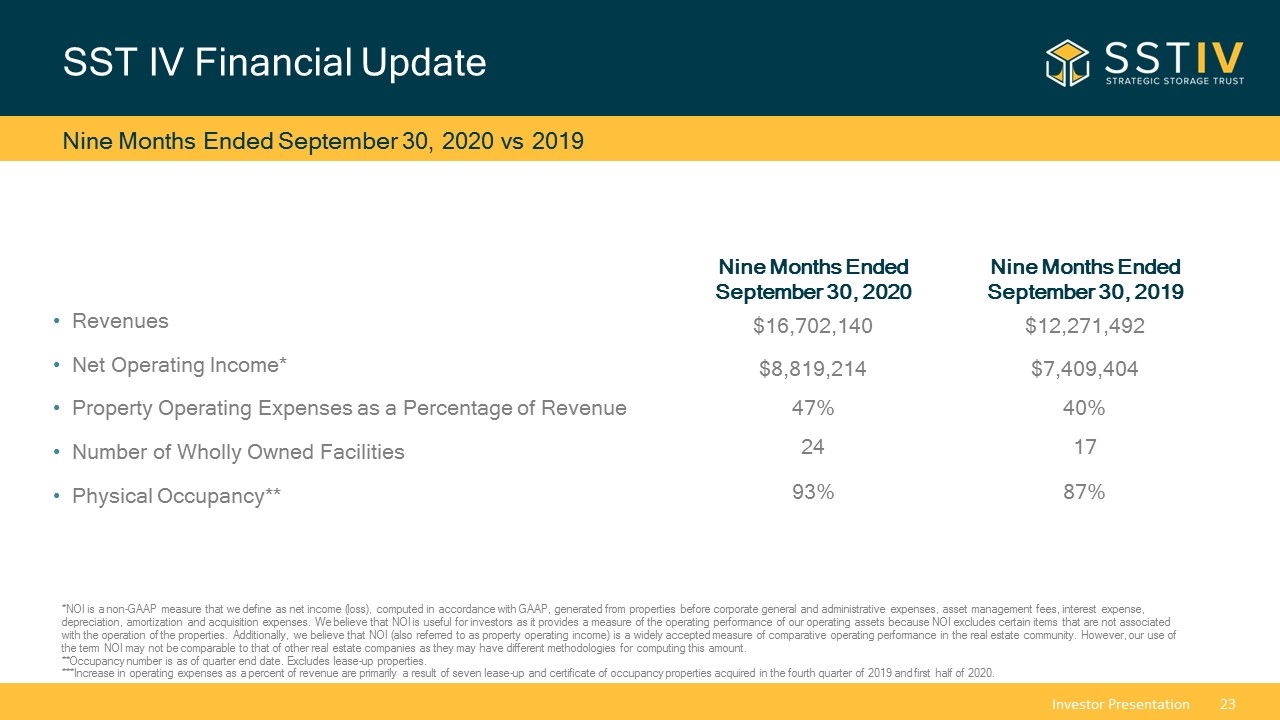

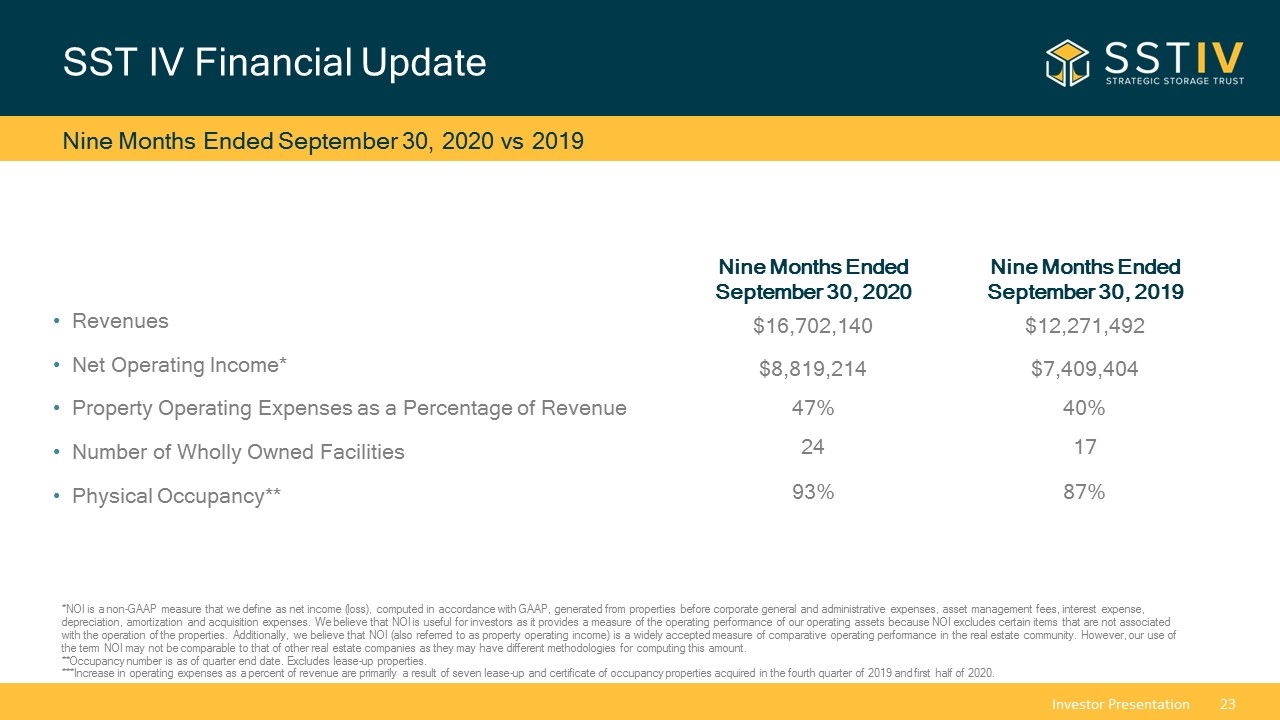

SST IV Financial Update Nine Months Ended September 30, 2020 vs 2019 Modified FFO Revenues Net Operating Income* Property Operating Expenses as a Percentage of Revenue Number of Wholly Owned Facilities Physical Occupancy** Nine Months Ended September 30, 2020 $16,702,140 $8,819,214 47% 24 93% Nine Months Ended September 30, 2019 $12,271,492 $7,409,404 40% 17 87% *NOI is a non-GAAP measure that we define as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization and acquisition expenses. We believe that NOI is useful for investors as it provides a measure of the operating performance of our operating assets because NOI excludes certain items that are not associated with the operation of the properties. Additionally, we believe that NOI (also referred to as property operating income) is a widely accepted measure of comparative operating performance in the real estate community. However, our use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. **Occupancy number is as of quarter end date. Excludes lease-up properties. ***Increase in operating expenses as a percent of revenue are primarily a result of seven lease-up and certificate of occupancy properties acquired in the fourth quarter of 2019 and first half of 2020.

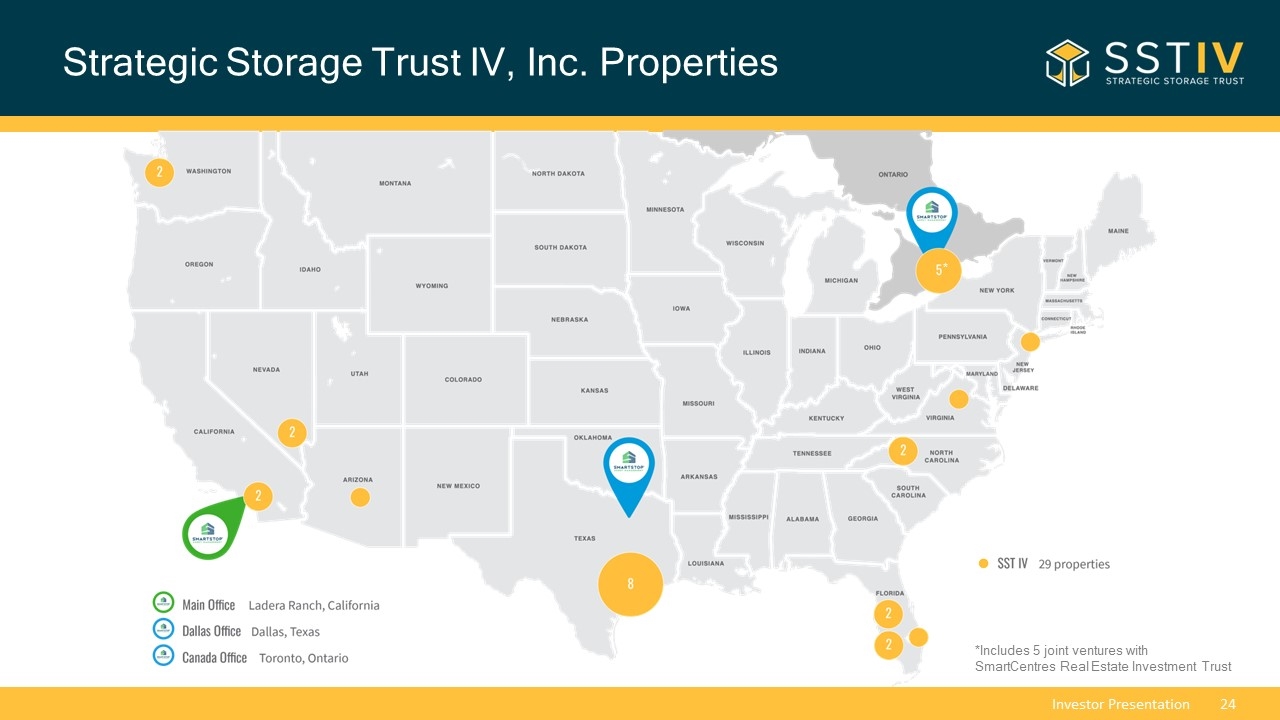

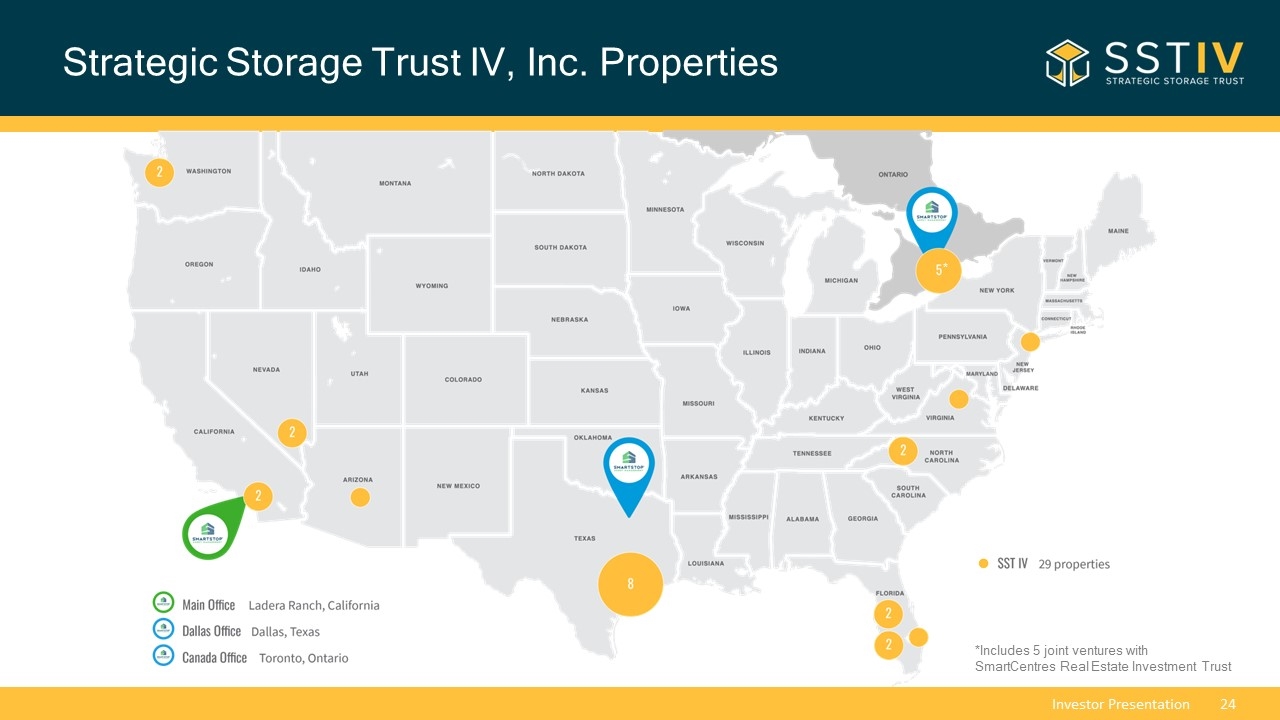

Strategic Storage Trust IV, Inc. Properties *Includes 5 joint ventures with SmartCentres Real Estate Investment Trust *

Recent Acquisition 13788 W. Greenway Rd Surprise, Arizona 716 Units 78,775 NRSF Approx. 87% Occupancy* Purchase Price: $7,825,000 *Occupancy number as of 10/31/2020 Acquired at C of O 12/17/2019

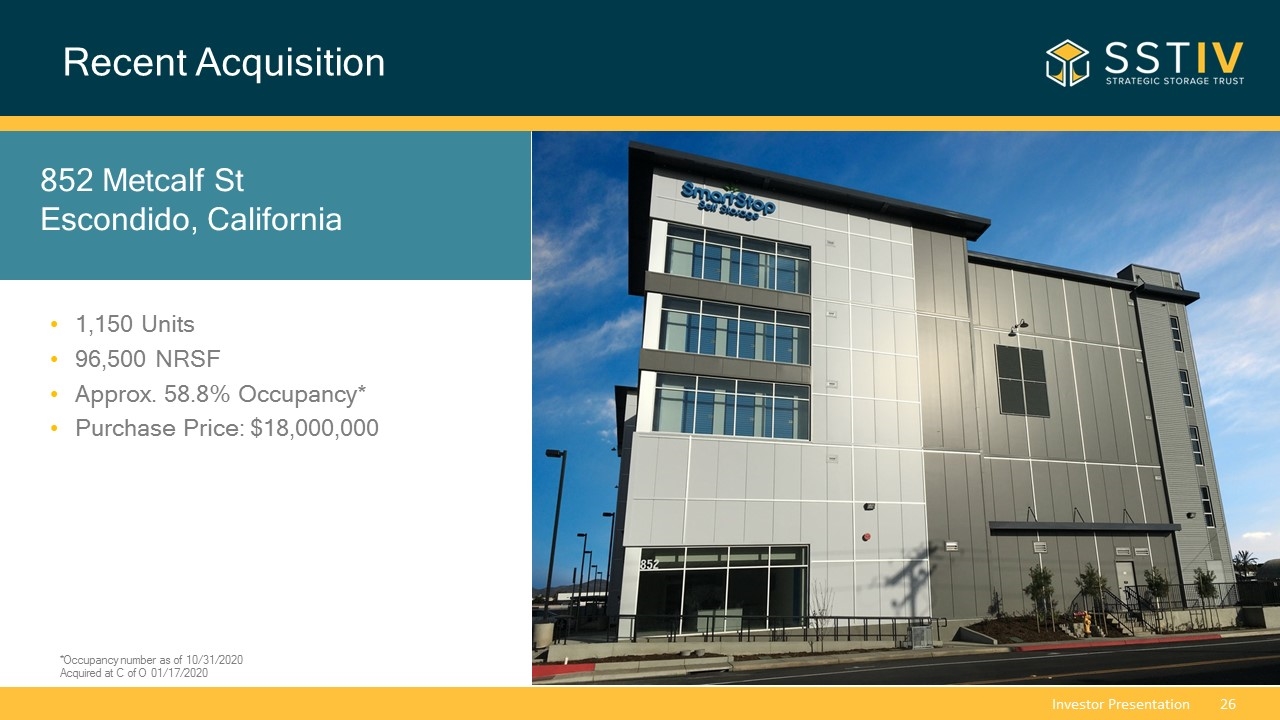

Recent Acquisition 852 Metcalf St Escondido, California 1,150 Units 96,500 NRSF Approx. 58.8% Occupancy* Purchase Price: $18,000,000 *Occupancy number as of 10/31/2020 Acquired at C of O 01/17/2020

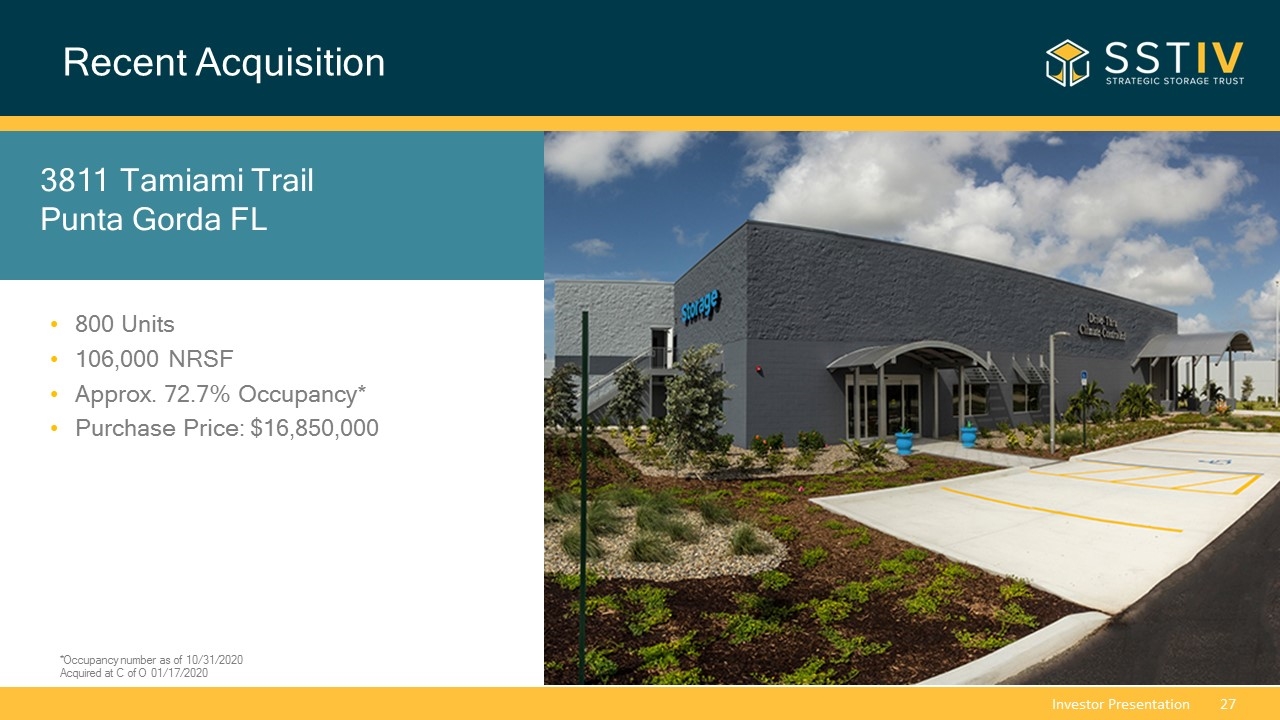

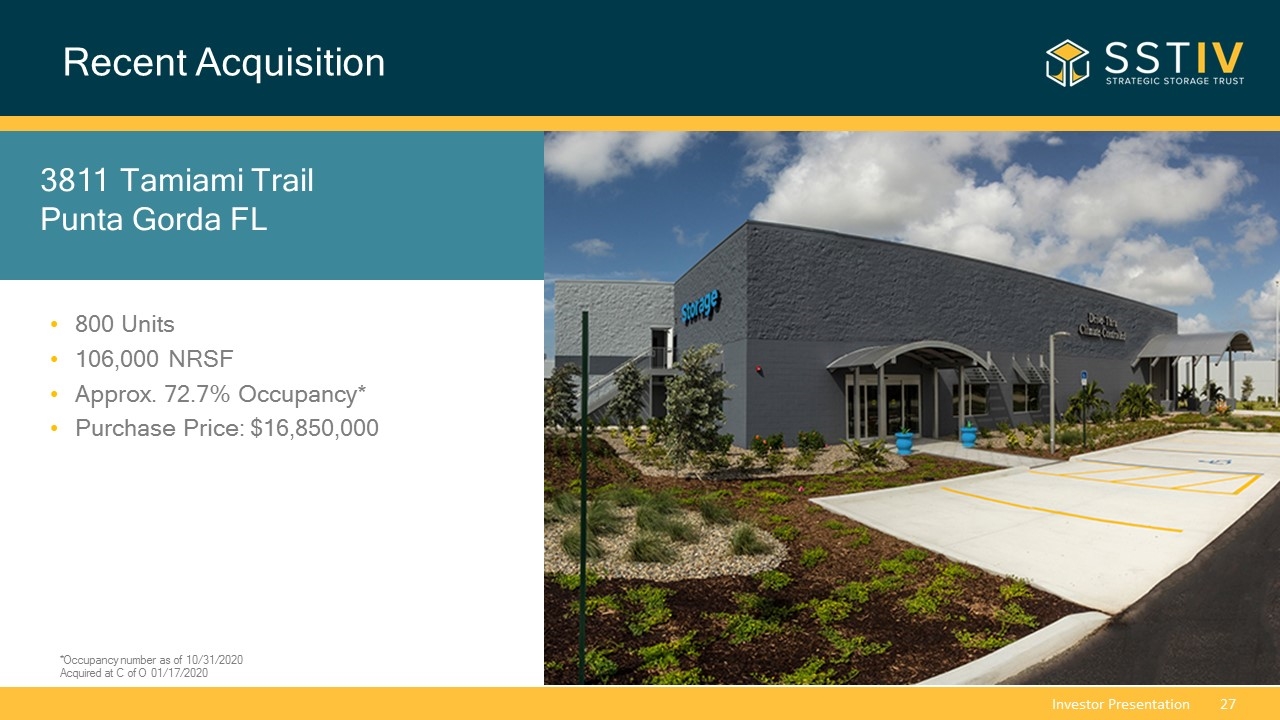

Recent Acquisition 3811 Tamiami Trail Punta Gorda FL 800 Units 106,000 NRSF Approx. 72.7% Occupancy* Purchase Price: $16,850,000 *Occupancy number as of 10/31/2020 Acquired at C of O 01/17/2020

Recent Development Opening 145 Wicksteed Ave North York, ONT* 1,000 Units 100,000 NRSF Approx. 19.6% Occupancy** Developed Property *Property owned through a Joint Venture with SmartCentres REIT **Occupancy number as of 10/31/2020 Operational as of 6/18/2020

Strategic Storage Trust IV, Inc. Goals Monthly Distributions(1) Capital Appreciation Recession Resistant(2) Hedge Against Inflation & Increasing Interest Rates (Due to month to month rents) No Tenant Improvements / Leasing Commissions(3) Goal of Meeting Current & Future Income Needs (1)Distributions are at the sole discretion of the Board of Directors and are not guaranteed. Demand for storage is driven by major demographic trends which are going to happen regardless of GDP growth rates, unemployment or what the S&P 500 is doing accordingly, [self] storage is recession resistant.” Source: “Gates: Recession-resistant property is best for investors” - Austin Business Journal by Cody Lyon, Staff Writer, September 2011. Past performance is no indication of future results. It is possible to lose money on this investment. While the self storage industry may be resistant to recessions, there is no guarantee that a related investment will realize a profit or prevent against loss. We will not pay commissions in connection with the leasing of our self storage units; however, we will pay certain fees associated with the day–to-day management and operations of our self storage facilities.

Self Storage Companies Publicly Traded Self Storage Companies NYSE: EXR NYSE: PSA NYSE: CUBE NYSE: LSI NYSE: UHAL NYSE: NSA Public Non-Traded Self Storage REITs

Next Steps Main Office 10 Terrace Road Ladera Ranch, CA 92694 877.32.REIT5 (877.327.3485) info@strategicREIT.com Company Info: StrategicREIT.com Storage Rentals: SmartStopSelfStorage.com Investor Services 866.418.5144

Questions?