UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23177

GOEHRING & ROZENCWAJG INVESTMENT FUNDS

(Exact name of Registrant as specified in charter)

110 Wall Street

New York, NY 10005-5991

(Address of principal executive offices) (Zip code)

Registrant’s Telephone Number, including Area Code: (646) 216-9777

Adam A. Rozencwajg

Goehring & Rozencwajg Associates, LLC

110 Wall Street

New York, NY 10005-5991

(Name and address of agent for service)

With copies To:

James M. Forbes, Esq.

Ropes & Gray LLP

Prudential Tower

800 Boylston St.

Boston, MA 02199-3600

Date of fiscal year end: May 31

Date of reporting period: June 1, 2017 – November 30, 2017

| Item 1. | Report to Stockholders. |

TABLE OF CONTENTS

| Manager Commentary | 1 |

| Disclosure of Fund Expenses | 7 |

| Schedule of Investments | 8 |

| Statement of Assets & Liabilities | 11 |

| Statement of Operations | 12 |

| Statement of Changes in Net Assets | 13 |

| Financial Highlights | 14 |

| Notes to Financial Statements | 16 |

| Additional Information | 23 |

| Goehring & Rozencwajg Resources Fund | Manager Commentary |

November 30, 2017 (Unaudited)

November 30, 2017

Dear Shareholders:

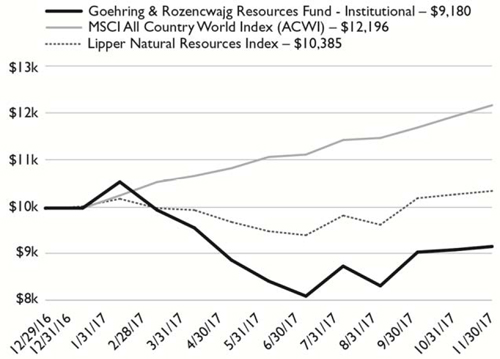

Investment Results

The Goehring & Rozencwajg Resources Fund Retail Share Class advanced by 8.67% from May 31st, 2017 until November 30th, 2017. The Fund slightly trailed the Lipper Natural Resources Index(1), which advanced by 8.90%, and the MSCI All Country World Index (ACWI)(2), which advanced by 9.94% between May 31, 2017 and November 30th, 2017. The Fund’s investments in agricultural related equities were the largest contributors to positive absolute performance, while the Fund’s investments in precious metals securities detracted from absolute performance.

Market Environment

During the period, natural resource related securities performed well, but did not manage to outperform the broad market. Energy prices were strong during the period with WTI crude oil advancing by nearly 19% while Brent crude advanced by 26%. Crude’s strength was due to the continued persistent draw-downs in both US and OECD crude oil and product inventories compared with long-term seasonal levels (a topic we have discussed at length in our quarterly letters). The rise in both US and global oil prices did not translate directly into strength in energy-related securities, with many oil companies advancing by less than 10% during the period, trailing both the commodity price and the broad market. We expect equity investors to remain very cautious on energy fundamentals going forward, particularly based on their expectations that US shale oil production growth will return the market to surplus and that the electric car will impair global demand for crude oil. We do not agree with these views, and invite you to please read our quarterly letter where we discuss these themes at great length. Our letter can be accessed on our website: www.gorozen.com. Copper prices advanced by 18% as the market began to realize that weak mine supply growth would not be enough to meet strong global demand going forward. Precious metals prices were flat during the period, rising less than 1% as were most precious metals related securities.

Investment Analysis

The Fund’s investments in securities of agricultural related companies were the largest contributors to positive absolute performance. The Fund’s three largest individual contributors to absolute performance were the following:

SQM – Shares of Quimica Y Minera de Chile SA advanced by 50.8% during the period as investors favored shares of companies with lithium exposure.

KL CN – Shares of Kirkland Lake Gold LTD advanced by 85.5% in USD terms during the period. During the period, Kirkland Lake announced a definitive agreement to merge with Newmarket Gold Inc. to create a new mid-tier gold company to be 57% owned by existing Kirkland Lake shareholders. Moreover, during the quarter, Kirkland Lake announced that it had received an unsolicited written Acquisition Proposal with a notional value of $1.44 bn payable in cash and shares of Silver Standard Resources. The proposal was made by Gold Fields Netherlands and Silver Standard Resources. Also, Kirkland Lake announced a strong operational quarter, raised its 2017 full year guidance and released strong drill results from its exploration program.

CF – Shares of CF Industries advanced by 39.3% during the period driven by a strong operational third quarter in which the company beat most analysts’ expectations.

| Semi-Annual Report | November 30, 2017 | 1 |

| Goehring & Rozencwajg Resources Fund | Manager Commentary |

November 30, 2017 (Unaudited)

The Fund’s three largest individual detractors from absolute performance were the following:

BAS – Shares of Basic Energy Services declined by 18.6% during the period, as investors remained cautious on the prospects of companies related to the energy service sector. Moreover, investors maintained concerns regarding Basic Energy Services’ liquidity profile going forward particularly with regards to its Asset Backed Lending Credit Facility. To address these concerns, Basic Energy Services entered into a new Asset Backed Lending Credit Facility announced October 2, 2017.

JONE – Shares of Jones Energy INC declined by 50.1% during the period. The weakness was partially explained by ongoing investor concerns regarding liquidity.

ESV – Shares of Ensco declined by 13.6% during the period, as investors remained negative on the prospects of companies related to the offshore drilling sector.

Market Outlook

At the start of 2017, many investors believed low OPEC quota compliance and lackluster demand would leave crude oil markets in perpetual surplus—a viewpoint we strongly disagreed with. As the year progressed, both US and OECD inventories drew sharply relative to seasonal average levels, and investors began to realize global crude oil markets were much tighter than originally believed. This resulted in continued upward pressure on crude prices, but energy related equities did not keep up with advancing oil prices. Many investors are now concerned that US shale production will once again oversupply global crude oil markets. Additionally, many investors are concerned that the arrival of the electric car will significantly (and permanently) negatively impact global oil demand. We believe neither of these issues will push global oil market into surplus in 2018 and instead inventories will continue to decline. Based on our models, we believe that once OECD inventories fall to 20 mm bbl. above “normal” levels, price will respond sharply. Based on our estimates, this will occur sometime in the first half of 2018. We believe the global oil deficit we saw in 2017, approaching 600,000 b/d, will only get bigger in 2018, and could approach 1 mm b/d.

We have not materially changed our outlook and continue to believe that oil related securities will be very strong performers going forward.

Adam Rozencwajg, CFA

Goehring & Rozencwajg Associates, LLC

Past performance does not guarantee future results. Fund prices fluctuate as the underlying assets have exposure to market fluctuations and other risks, as described in the Fund’s prospectus. Please visit www.gr-funds.com or call 1-844-464-6467 to obtain current performance information and for the current prospectus and statement of additional information. This report is for the information of shareholders of Goehring & Rozencwajg Resources Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. Please read the prospectus carefully before investing.

The views of Goehring & Rozencwajg Associates, LLC and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer's current views. The views expressed are those of the author only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should

| 2 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Manager Commentary |

November 30, 2017 (Unaudited)

not be assumed that any investment will be profitable or will equal the performance of the Fund or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Goehring & Rozencwajg Associates, LLC nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

Diversification does not eliminate the risk of experiencing investment losses.

The Goehring & Rozencwajg Resources Fund is distributed by ALPS Distributors, Inc. Goehring & Rozencwajg is not affiliated with ALPS Distributors, Inc.

The Fund is recently formed with limited operating history.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Adam Rozencwajg is a registered representative of ALPS Distributors, Inc. CFA Institute Marks are trademarks owned by the CFA Institute.

| (1) | Lipper Natural Resources Index is an unmanaged equally weighted index of the largest mutual funds in the Lipper Natural Resources category of funds. Index returns reflect the reinvestment of income dividends and capital gains, if any. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (2) | MSCI All Country World Index (ACWI), a broad-based securities index that will be used as a benchmark for assessing the performance of the Fund. The MSCI ACWI is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance data shown for the MSCI ACWI is net of dividend tax withholding. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Semi-Annual Report | November 30, 2017 | 3 |

| Goehring & Rozencwajg Resources Fund | Manager Commentary |

November 30, 2017 (Unaudited)

| AVERAGE ANNUAL TOTAL RETURN (for the period ended November 30, 2017) |

| 6 Month | Calendar YTD | Since Inception(1) | Expense Ratio(2) | ||

| Gross | Net(3) | ||||

| Goehring & Rozencwajg Resources Fund - Institutional - NAV | 8.77% | -8.20% | -8.20% | 17.39% | 0.93% |

| Goehring & Rozencwajg Resources Fund - Retail - NAV | 8.67% | -8.50% | -8.50% | 18.12% | 1.26% |

| MSCI All Country World Index (ACWI)(4) | 9.94% | 22.01% | 21.96% | ||

| Lipper National Resources Index(5) | 8.90% | 4.18% | 3.85% | ||

| TOP TEN HOLDINGS | |

| (as a % of Net Assets)* | |

| Pioneer Natural Resources Co. | 5.24% |

| Matador Resources Co. | 4.77% |

| Rowan Cos. PLC - Class A | 3.27% |

| Arch Coal, Inc. - Class A | 3.17% |

| Centennial Resource Development, Inc. - Class A | 3.13% |

| CF Industries Holdings, Inc. | 3.05% |

| Carrizo Oil & Gas, Inc. | 2.94% |

| Diamond Offshore Drilling, Inc. | 2.93% |

| Parsley Energy, Inc. - Class A | 2.89% |

| Cimarex Energy Co. | 2.80% |

| Top Ten Holdings | 34.19% |

| INDUSTRY SECTOR ALLOCATION | |

| (as a % of Net Assets) | |

| Exploration & Production | 38.1% |

| Oil & Gas Services & Equipment | 20.8% |

| Base Metals | 18.4% |

| Precious Metal Mining | 8.9% |

| Coal Operations | 5.7% |

| Agricultural Chemicals | 5.5% |

| Other Mined Minerals | 1.3% |

| Cash, Cash Equivalents, & Other Net Assets | 1.3% |

| * | Holdings are subject to change. |

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Shares of the Fund redeemed or exchanged within 30 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual's return. To obtain the Fund’s most recent month-end performance, visit www.gr-funds.com or call 1-844-464-6467. This report is for the information of shareholders of Goehring & Rozencwajg Resources Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. Please read the prospectus carefully before investing.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

| 4 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Manager Commentary |

November 30, 2017 (Unaudited)

| (1) | The Fund commenced operations on December 30, 2016. |

| (2) | Ratios as of the Prospectus dated September 30, 2017 and may differ from the ratios presented in the Financial Highlights. |

| (3) | Goehring & Rozencwajg Associates, LLC, the Fund’s investment adviser (the “Adviser”), has contractually agreed to limit the amount of the Fund’s total annual fund operating expenses, exclusive of Acquired Fund Fees and Expenses, brokerage expenses, interest expense, taxes and extraordinary expenses, to 0.92% and 1.25% of the Fund’s average daily net assets for Institutional Class shares and Retail Class shares, respectively. This agreement is in effect through September 30, 2018, may only be terminated before then by the Board of Trustees, and is reevaluated on an annual basis. With respect to the Fund, the Adviser shall be permitted to recover, on a class-by-class basis, expenses it has borne subsequent to the effective date of the agreement described above (whether through reduction of its management fee or otherwise) only to the extent that the Fund’s expenses in later periods fall below the lesser of (1) the expense limit in effect at the time the Adviser waives or limits the expenses and (2) the expense limit in effect at the time the Adviser seeks to recover the expenses; provided, however, that the Fund will not be obligated to pay any such reduced fees and expenses more than three years after the date on which the fee and expense was reduced. |

| (4) | MSCI All Country World Index (ACWI), a broad-based securities index that will be used as a benchmark for assessing the performance of the Fund, and the Lipper Natural Resources Index, an additional comparative index. The MSCI ACWI is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance data shown for the MSCI ACWI is net of dividend tax withholding. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (5) | Lipper Natural Resources Index is an unmanaged equally weighted index of the largest mutual funds in the Lipper Natural Resources category of funds. Index returns reflect the reinvestment of income dividends and capital gains, if any. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Semi-Annual Report | November 30, 2017 | 5 |

| Goehring & Rozencwajg Resources Fund | Manager Commentary |

November 30, 2017 (Unaudited)

GROWTH OF $10,000 INVESTMENT IN THE FUND (for the period ended November 30, 2017)

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to November 30, 2017. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Retail Class shares, performance for which is not reflected in the graphs above. The performance of Retail Class shares is likely to be lower than the performance of the Institutional Class shares shown in the graphs above because of higher expenses paid by shareholders investing in the Retail Class shares as compared to Institutional Class shares.

| 6 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Disclosure of Fund Expenses |

November 30, 2017 (Unaudited)

As a shareholder of the Goehring & Rozencwajg Resources Fund (the “Fund”), you will incur two types of costs: (1) transaction costs, including applicable redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on June 1, 2017 and held until November 30, 2017.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as redemption fees or exchange fees. Therefore, the second line of each table below is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value June 1, 2017 | Ending Account Value November 30, 2017 | Expense Ratio(a) | Expenses Paid, and During Period June 1, 2017 - November 30, 2017(b) | |

| Institutional Class | ||||

| Actual | $1,000.00 | $1,087.70 | 0.92% | $4.81 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.46 | 0.92% | $4.66 |

| Retail Class | ||||

| Actual | $1,000.00 | $1,086.70 | 1.25% | $6.54 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.80 | 1.25% | $6.33 |

| (a) | Annualized, based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), divided by 365. |

| Semi-Annual Report | November 30, 2017 | 7 |

| Goehring & Rozencwajg Resources Fund | Schedule of Investments |

November 30, 2017 (Unaudited)

| Security Description | Shares | Value | ||||||

| COMMON STOCKS (97.6%) | ||||||||

| ENERGY (63.5%) | ||||||||

| Coal Operations (5.7%) | ||||||||

| Arch Coal, Inc. - Class A | 8,100 | $ | 668,736 | |||||

| Contura Energy, Inc. | 7,000 | 416,500 | ||||||

| Peabody Energy Corp.(a) | 3,554 | 118,384 | ||||||

| 1,203,620 | ||||||||

| Exploration & Production (38.0%) | ||||||||

| Carrizo Oil & Gas, Inc.(a) | 32,100 | 620,493 | ||||||

| Centennial Resource Development, Inc. -Class A(a) | 32,600 | 661,454 | ||||||

| Chaparral Energy, Inc. - Class A(a) | 14,200 | 340,800 | ||||||

| Cimarex Energy Co. | 5,100 | 592,161 | ||||||

| Concho Resources, Inc.(a) | 1,800 | 251,748 | ||||||

| Diamondback Energy, Inc.(a) | 1,900 | 207,689 | ||||||

| Energen Corp.(a) | 5,200 | 293,592 | ||||||

| EOG Resources, Inc. | 3,200 | 327,424 | ||||||

| Jones Energy, Inc. - Class A(a) | 163,592 | 163,363 | ||||||

| Linn Energy, Inc.(a) | 13,100 | 491,119 | ||||||

| Matador Resources Co.(a) | 35,200 | 1,006,720 | ||||||

| Newfield Exploration Co.(a) | 19,100 | 590,763 | ||||||

| Parsley Energy, Inc. - Class A(a) | 22,700 | 609,722 | ||||||

| PDC Energy, Inc.(a) | 12,700 | 583,565 | ||||||

| Pioneer Natural Resources Co. | 7,100 | 1,107,884 | ||||||

| RSP Permian, Inc.(a) | 5,200 | 190,996 | ||||||

| 8,039,493 | ||||||||

| Oil & Gas Services & Equipment (19.8%) | ||||||||

| Basic Energy Services, Inc.(a) | 22,700 | 507,799 | ||||||

| CES Energy Solutions Corp. | 45,200 | 215,113 | ||||||

| Diamond Offshore Drilling, Inc.(a) | 38,600 | 619,144 | ||||||

| Ensco PLC - Class A | 101,020 | 542,477 | ||||||

| Helmerich & Payne, Inc. | 2,100 | 123,018 | ||||||

| Noble Corp. PLC(a) | 112,800 | 471,504 | ||||||

| Ocean Rig UDW, Inc. - Class A(a) | 19,500 | 471,705 | ||||||

| Rowan Cos. PLC - Class A(a) | 47,800 | 691,666 | ||||||

| Transocean Ltd.(a) | 52,500 | 532,350 | ||||||

| 4,174,776 | ||||||||

| MATERIALS (34.1%) | ||||||||

| Agricultural Chemicals (5.5%) | ||||||||

| CF Industries Holdings, Inc. | 17,200 | 644,484 | ||||||

| Mosaic Co. | 21,300 | 517,377 | ||||||

| 1,161,861 | ||||||||

| Base Metals (18.4%) | ||||||||

| Amerigo Resources Ltd.(a) | 350,800 | 271,906 | ||||||

| Arizona Mining, Inc.(a) | 58,000 | 141,611 | ||||||

| Copper Mountain Mining Corp.(a) | 242,900 | 286,174 | ||||||

| Dalradian Resources, Inc.(a) | 107,900 | 119,596 | ||||||

See Notes to Financial Statements.

| 8 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Schedule of Investments |

November 30, 2017 (Unaudited)

| Security Description | Shares | Value | ||||||

| Base Metals (continued) | ||||||||

| ERO Copper Corp.(a) | 84,500 | $ | 425,726 | |||||

| Excelsior Mining Corp.(a) | 169,300 | 139,099 | ||||||

| First Quantum Minerals Ltd. | 31,100 | 357,488 | ||||||

| Freeport-McMoRan, Inc.(a) | 34,900 | 485,808 | ||||||

| Hudbay Minerals, Inc. | 55,800 | 405,260 | ||||||

| KGHM Polska Miedz SA | 8,800 | 266,278 | ||||||

| Lundin Mining Corp. | 67,200 | 391,694 | ||||||

| Southern Copper Corp. | 9,500 | 399,475 | ||||||

| Turquoise Hill Resources Ltd.(a) | 60,500 | 178,475 | ||||||

| 3,868,590 | ||||||||

| Other Mined Minerals (1.3%) | ||||||||

| Auryn Resources, Inc.(a) | 44,400 | 69,518 | ||||||

| Mountain Province Diamonds, Inc.(a) | 34,700 | 93,061 | ||||||

| US Silica Holdings, Inc. | 3,300 | 109,460 | ||||||

| 272,039 | ||||||||

| Precious Metal Mining (8.9%) | ||||||||

| Agnico Eagle Mines Ltd. | 3,300 | 144,243 | ||||||

| Algold Resources Ltd.(a) | 278,300 | 30,200 | ||||||

| Endeavour Mining Corp.(a) | 18,600 | 336,635 | ||||||

| Golden Reign Resources Ltd.(a) | 713,600 | 146,575 | ||||||

| Kirkland Lake Gold Ltd. | 24,800 | 357,347 | ||||||

| Lion One Metals Ltd.(a) | 72,700 | 34,374 | ||||||

| Lundin Gold, Inc.(a) | 12,300 | 43,951 | ||||||

| Marathon Gold Corp.(a) | 138,500 | 112,719 | ||||||

| New Gold, Inc.(a) | 70,900 | 222,567 | ||||||

| Pan American Silver Corp. | 16,300 | 246,782 | ||||||

| TMAC Resources, Inc.(a)(b) | 23,000 | 132,814 | ||||||

| Torex Gold Resources, Inc.(a) | 8,300 | 82,154 | ||||||

| 1,890,361 | ||||||||

TOTAL COMMON STOCKS (Cost $20,406,194) | 20,610,740 | |||||||

| WARRANTS (0.5%) | ||||||||

| ENERGY (0.5%) | ||||||||

| Oil & Gas Services & Equipment (0.5%) | ||||||||

| Gulfmark Offshore, Inc. | ||||||||

| Expires 11/14/2024(c) | 2,641 | 77,223 | ||||||

| Expires 12/31/2049(c) | 920 | 26,901 | ||||||

| 104,124 | ||||||||

TOTAL WARRANTS (Cost $132,718) | 104,124 | |||||||

See Notes to Financial Statements.

| Semi-Annual Report | November 30, 2017 | 9 |

| Goehring & Rozencwajg Resources Fund | Schedule of Investments |

November 30, 2017 (Unaudited)

| Security Description | Principal | Value | ||||||

| CORPORATE BOND (0.6%) | ||||||||

| ENERGY (0.6%) | ||||||||

| Exploration & Production (0.1%) | ||||||||

| EV Energy Partners LP / EV Energy Finance Corp. | ||||||||

| 8.00%, 04/15/2019 | $ | 53,000 | $ | 26,765 | ||||

| Oil & Gas Services & Equipment (0.5%) | ||||||||

| Jones Energy Holdings LLC / Jones Energy Finance Corp. | ||||||||

| 6.75%, 04/01/2022 | $ | 150,000 | 105,000 | |||||

TOTAL CORPORATE BOND (Cost $153,701) | 131,765 | |||||||

| Security Description | Shares | Value | ||||||

| SHORT TERM INVESTMENTS (1.2%) | ||||||||

| Dreyfus Treasury Securities Cash Management (7 day yield 0.967%) | 258,412 | 258,412 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $258,412) | 258,412 | |||||||

TOTAL INVESTMENTS - (99.9%) (Cost $20,951,025) | 21,105,041 | |||||||

| Assets in Excess of Other Liabilities - (0.1%) | 19,066 | |||||||

| NET ASSETS - (100.0%) | $ | 21,124,107 | ||||||

| (a) | Non-income producing security. |

| (b) | Securities were originally issued pursuant to Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside of the United States from registration. Such securities cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. As of November 30, 2017, the aggregate market value of those securities was $132,814, which represents approximately 0.63% of net assets. |

| (c) | Fair valued security; valued in accordance with procedures approved by the Fund's Board of Trustees. As of November 30, 2017, these securities had a total value of $104,124 or 0.49% of total net assets. |

See Notes to Financial Statements.

| 10 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Statement of Assets and Liabilities |

November 30, 2017 (Unaudited)

| ASSETS: | ||||

| Investments, at value (cost $20,951,025) | $ | 21,105,041 | ||

| Receivable for shares sold | 10,714 | |||

| Due from adviser | 94,206 | |||

| Offering costs (Note 2) | 20,982 | |||

| Dividends receivable | 5,442 | |||

| Interest receivable | 2,412 | |||

| Prepaid assets | 9,339 | |||

| Total Assets | 21,248,136 | |||

| LIABILITIES: | ||||

| Payable to custodian | 15,406 | |||

| Payable for administration fees | 33,631 | |||

| Payable for distribution and service fees | 4,253 | |||

| Payable to trustees | 6,379 | |||

| Payable to chief compliance officer | 6,722 | |||

| Payable for transfer agency fees | 12,566 | |||

| Payable for professional fees | 36,326 | |||

| Accrued expenses and other liabilities | 8,746 | |||

| Total Liabilities | 124,029 | |||

| NET ASSETS | $ | 21,124,107 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid-in capital (Note 5) | $ | 20,956,510 | ||

| Accumulated net investment income | 10,190 | |||

| Accumulated net realized gain | 3,391 | |||

| Net unrealized appreciation | 154,016 | |||

| NET ASSETS | $ | 21,124,107 | ||

| PRICING OF SHARES | ||||

| Institutional Class: | ||||

| Net Asset Value, offering and redemption price per share | $ | 9.18 | ||

| Net Assets | $ | 16,574,498 | ||

| Shares of beneficial interest outstanding | 1,805,491 | |||

| Retail Class: | ||||

| Net Asset Value, offering and redemption price per share | $ | 9.15 | ||

| Net Assets | $ | 4,549,609 | ||

| Shares of beneficial interest outstanding | 497,273 | |||

See Notes to Financial Statements.

| Semi-Annual Report | November 30, 2017 | 11 |

| Goehring & Rozencwajg Resources Fund | Statement of Operations |

For the Six Months ended November 30, 2017 (Unaudited)

| INVESTMENT INCOME: | ||||

| Interest | $ | 8,896 | ||

| Dividends | 69,438 | |||

| Foreign taxes withheld | (1,329 | ) | ||

| Total Investment Income | 77,005 | |||

| EXPENSES: | ||||

| Investment advisory fee (Note 6) | 54,059 | |||

| Administration fee | 94,937 | |||

| Distribution and service fees | ||||

| Retail Class | 6,449 | |||

| Custodian fee | 24,685 | |||

| Professional fees | 51,679 | |||

| Transfer agent fee | 26,716 | |||

| Trustees fees and expenses | 25,379 | |||

| Registration and filing fees | 11,367 | |||

| Printing fees | 4,051 | |||

| Chief compliance officer fee | 20,055 | |||

| Offering cost expense | 116,191 | |||

| Other expenses | 3,820 | |||

| Total Expenses | 439,388 | |||

| Less fees waived/reimbursed by investment adviser | ||||

| Institutional Class | (236,584 | ) | ||

| Retail Class | (140,683 | ) | ||

| Total fees waived/reimbursed by investment adviser (Note 6) | (377,267 | ) | ||

| Net Expenses | 62,121 | |||

| NET INVESTMENT INCOME | 14,884 | |||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | ||||

| Net realized gain/(loss) on: | ||||

| Investments | 97,847 | |||

| Foreign currency transactions | (7,337 | ) | ||

| Net realized gain | 90,510 | |||

| Change in unrealized appreciation/(depreciation) on: | ||||

| Investments | 1,131,241 | |||

| Net change in unrealized depreciation | 1,131,241 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 1,221,751 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 1,236,635 | ||

See Notes to Financial Statements.

| 12 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Statements of Changes in Net Assets |

| For the Six Months Ended November 30, 2017 (Unaudited) | For the Period Ended May 31, 2017(a) | |||||||

| OPERATIONS: | ||||||||

| Net investment income/(loss) | $ | 14,884 | $ | (10,010 | ) | |||

| Net realized gain/(loss) | 90,510 | (88,276 | ) | |||||

| Net change in unrealized appreciation/(depreciation) | 1,131,241 | (977,225 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 1,236,635 | (1,075,511 | ) | |||||

| BENEFICIAL SHARE TRANSACTIONS (Note 5): | ||||||||

| Institutional Class | ||||||||

| Shares sold | 12,766,245 | 3,490,000 | ||||||

| Net increase from beneficial share transactions | 12,766,245 | 3,490,000 | ||||||

| Retail Class | ||||||||

| Shares sold | 1,368,748 | 3,341,010 | ||||||

| Shares redeemed | (3,020 | ) | — | |||||

| Net increase from beneficial share transactions | 1,365,728 | 3,341,010 | ||||||

| Net increase in net assets | 15,368,608 | 5,755,499 | ||||||

| NET ASSETS: | ||||||||

| Beginning of year | 5,755,499 | — | ||||||

| End of year(including accumulated net investment income/(loss) of $10,190 and $(4,694)) | $ | 21,124,107 | $ | 5,755,499 | ||||

| (a) | Commenced operations on December 30, 2016. |

See Notes to Financial Statements.

| Semi-Annual Report | November 30, 2017 | 13 |

| Goehring & Rozencwajg Resources Fund | Financial Highlights |

| Institutional Class | For a share outstanding throughout the periods presented |

| For the Six Months Ended November 30, 2017 (Unaudited) | For the Period Ended May 31, 2017(a) | |||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 8.44 | $ | 10.00 | ||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||

| Net investment income/(loss)(b) | 0.01 | (0.01 | ) | |||||

| Net realized and unrealized gain/(loss) on investments | 0.73 | (1.55 | ) | |||||

| Total from investment operations | 0.74 | (1.56 | ) | |||||

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | 0.74 | (1.56 | ) | |||||

| NET ASSET VALUE, END OF PERIOD | $ | 9.18 | $ | 8.44 | ||||

| TOTAL RETURN(c) | 8.77 | % | (15.60 | %) | ||||

| SUPPLEMENTAL DATA: | ||||||||

| Net assets, End of Period (in 000s) | $ | 16,574 | $ | 2,935 | ||||

| RATIOS TO AVERAGE NET ASSETS | ||||||||

| Operating expenses excluding reimbursement/waiver | 6.70 | %(d) | 23.90 | %(d) | ||||

| Operating expenses including reimbursement/waiver | 0.92 | %(d) | 0.92 | %(d) | ||||

| Net investment loss including reimbursement/waiver | 0.22 | %(d) | (0.28 | %)(d) | ||||

| PORTFOLIO TURNOVER RATE(e) | 11 | % | 5 | % | ||||

| (a) | Commenced operations on December 30, 2016. |

| (b) | Calculated using the average shares method. |

| (c) | Assumes an initial investment at commencement of operations, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal year. Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | Annualized. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

| 14 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Financial Highlights |

| Retail Class | For a share outstanding throughout the periods presented |

| For the Six Months Ended November 30, 2017 (Unaudited) | For the Period Ended May 31, 2017(a) | |||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 8.42 | $ | 10.00 | ||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||

| Net investment income/(loss)(b) | 0.01 | (0.02 | ) | |||||

| Net realized and unrealized gain/(loss) on investments | 0.72 | (1.56 | ) | |||||

| Total from investment operations | 0.73 | (1.58 | ) | |||||

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | 0.73 | (1.58 | ) | |||||

| NET ASSET VALUE, END OF PERIOD | $ | 9.15 | $ | 8.42 | ||||

| TOTAL RETURN(c) | 8.67 | % | (15.80 | %) | ||||

| SUPPLEMENTAL DATA: | ||||||||

| Net assets, End of Period (in 000s) | $ | 4,550 | $ | 2,821 | ||||

| RATIOS TO AVERAGE NET ASSETS | ||||||||

| Operating expenses excluding reimbursement/waiver | 8.43 | %(d) | 24.63 | %(d) | ||||

| Operating expenses including reimbursement/waiver | 1.25 | %(d) | 1.25 | %(d) | ||||

| Net investment loss including reimbursement/waiver | 0.31 | %(d) | (0.61 | %)(d) | ||||

| PORTFOLIO TURNOVER RATE(e) | 11 | % | 5 | % | ||||

| (a) | Commenced operations on December 30, 2016. |

| (b) | Calculated using the average shares method. |

| (c) | Assumes an initial investment at commencement of operations, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal year. Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | Annualized. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

| Semi-Annual Report | November 30, 2017 | 15 |

| Goehring & Rozencwajg Resources Fund | Notes to Financial Statements |

November 30, 2017 (Unaudited)

1. ORGANIZATION

The Goehring & Rozencwajg Resources Fund (the “Fund”) is a no-load investment portfolio of Goehring & Rozencwajg Investment Funds (the “Trust”), an open-end series management investment company organized as a Massachusetts business trust on July 14, 2016, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on December 30, 2016. The Fund is a diversified investment company with an investment objective which seeks to maximize total return, which consists of income on its investments and capital appreciation. The Fund currently offers Retail Class Shares and Institutional Class Shares. Each share class of the Fund represents an investment in the same portfolio of securities, but each share class has its own expense structures. The Board of Trustees (the “Board”) may establish additional funds and classes of shares at any time in the future without shareholder approval. The Fund’s Investment Adviser is Goehring & Rozencwajg Associates, LLC (the “Adviser”).

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange, or if there is no closing price or official closing price, the last sale price. If there have been no sales on that day, the securities are valued at the mean of the current bid and ask price. U.S. and non U.S. government and corporate debt securities are typically traded in the over-the-counter market internationally, and are generally valued using prices supplied by a pricing vendor approved by the Board of Trustees based on the mid point of quotes from multiple dealers and other factors deemed relevant by the pricing vendor. In the case of other securities not traded on an exchange, or if closing prices are not otherwise available, the market price is typically determined by independent third-party pricing vendors approved by the Fund’s Board of Trustees using a variety of pricing techniques and methodologies. U.S. government and agency securities are valued by a third-party pricing vendor at the mean between the closing bid and asked prices. Other than with respect to the debt securities discussed above, the market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Fund’s Board of Trustees, which may use, instead of quotes from dealers, a matrix, formula or other method that takes into consideration market indices, yield curves and other specific adjustments. Derivatives are valued using market quotations, a price supplied by a pricing service or counterparty, or using the fair value procedures discussed below, depending on the type of derivative and the availability of market quotations. Short-term debt obligations

| 16 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Notes to Financial Statements |

November 30, 2017 (Unaudited)

that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. Investments in the underlying funds are based on the underlying fund’s net asset value. Available cash is generally invested into a money market fund by the Fund’s custodian, and is valued at the latest net asset value per share as reported to the Fund’s administrator.

When the price quotations described above are not available, or when the Adviser believes that they are unreliable, the Fund’s assets may be priced using fair value procedures approved by the Board of Trustees. Because the Fund invests in investments that may be thinly traded or for which the price quotations described above may not be readily available or may be unreliable – such as securities of small capitalization companies, securities of issuers located in emerging markets, high yield securities and derivatives – the Fund may use fair valuation procedures more frequently than funds that invest primarily in securities that are more liquid – such as equity securities of large capitalization domestic issuers. The Fund may also use fair value procedures if the Adviser determines that a significant event has occurred between the time at which a market price is determined and the time at which the Fund’s NAV is calculated. In particular, the value of non-U.S. securities may be materially affected by events occurring after the close of the market on which they are traded, but before the Fund prices its shares.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| Semi-Annual Report | November 30, 2017 | 17 |

| Goehring & Rozencwajg Resources Fund | Notes to Financial Statements |

November 30, 2017 (Unaudited)

The following is a summary of each input used to value the Fund as of November 30, 2017:

Investments in Securities at Value* | Level 1 - Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

| GOEHRING & ROZENCWAJG RESOURCES FUND | ||||||||||||||||

| Common Stocks | $ | 20,610,740 | $ | — | $ | — | $ | 20,610,740 | ||||||||

| Warrants | — | 104,124 | — | 104,124 | ||||||||||||

| Corporate Bonds | — | 131,765 | — | 131,765 | ||||||||||||

| Short Term Investments | 258,412 | — | — | 258,412 | ||||||||||||

| Total | $ | 20,869,152 | $ | 235,889 | $ | — | $ | 21,105,041 | ||||||||

| * | See Schedule of Investments for industry classification. |

The Fund recognizes transfers between levels as of the end of the period. For the six months ended November 30, 2017, the Funds did not have any transfers in/(out) of Level 1 and Level 2 securities. For the six months ended November 30, 2017, the Funds did not have any securities that used significant unobservable inputs (Level 3) in determining fair value.

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund. All of the realized and unrealized gains and losses and net investment income, are allocated daily to each class in proportion to its average daily net assets.

Class Expenses: Expenses that are specific to a class of shares of the Fund, including distribution fees (Rule 12b-1 fees), are charged directly to that share class. Expenses that are common to all Funds generally are allocated among the Funds in proportion to their average daily net assets.

Offering Costs: Offering costs, including costs of printing initial prospectuses, legal and registration fees, are being amortized over twelve months from the inception date of the Fund. Amounts amortized during the period ended November 30, 2017 for the Fund are shown on the Statement of Operations. As of November 30, 2017, $20,982, of offering costs remain to be amortized for the Fund.

Federal Income Taxes: The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of its net taxable income and net capital gains, if any, each year so that the Fund will not be subject to excise tax on undistributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the six months ended November 30, 2017, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required.

| 18 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Notes to Financial Statements |

November 30, 2017 (Unaudited)

The Fund’s tax return is subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and three years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders: The Fund normally pays dividends and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and other income the Fund receives from its investments, including short-term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

3. TAX BASIS INFORMATION

Tax Basis of Investments: As of November 30, 2017, the aggregate cost of investments, gross unrealized appreciation/(depreciation) and net unrealized appreciation/(depreciation) for Federal tax purposes was as follows:

| Goehring & Rozencwajg Resources Fund | ||||

| Gross unrealized appreciation (excess of value over tax cost) | $ | 1,623,309 | ||

| Gross unrealized depreciation (excess of tax cost over value) | (1,558,135 | ) | ||

| Net unrealized appreciation | $ | 65,174 | ||

| Cost of investments for income tax purposes | $ | 21,039,867 | ||

Tax Basis of Distributions to Shareholders: The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain were recorded by each Fund.

There were no distributions paid by the Fund for the period ended May 31, 2017.

The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end. Accordingly, tax basis balances have not been determined as of November 30, 2017.

4. SECURITIES TRANSACTIONS

The cost of purchases and proceeds from sales of securities (excluding short-term securities) during the six months ended November 30, 2017 was as follows:

| Purchases of Securities | Proceeds from Sales of Securities | |||||||

| Goehring & Rozencwajg Resources Fund | $ | 15,691,869 | $ | 1,298,523 | ||||

| Semi-Annual Report | November 30, 2017 | 19 |

| Goehring & Rozencwajg Resources Fund | Notes to Financial Statements |

November 30, 2017 (Unaudited)

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Fund consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Fund or its creditors solely by reason of the purchaser’ ownership of the shares. Shares have no pre-emptive rights.

| For the Six Months Ended November 30, 2017 (Unaudited) | For the Period Ended May 31, 2017 | |||||||

| Institutional Class | ||||||||

| Shares sold | 1,457,663 | 347,828 | ||||||

| Net increase in shares outstanding | 1,457,663 | 347,828 | ||||||

| Retail Class | ||||||||

| Shares sold | 162,794 | 334,810 | ||||||

| Shares redeemed | (331 | ) | — | |||||

| Net increase in shares outstanding | 162,463 | 334,810 | ||||||

Shares redeemed within 30 days of purchase may incur a 2% short-term redemption fee deducted from the redemption amount. The Fund did not have redemption fees during the six months ended November 30, 2017 and period ended May 31, 2017.

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

The Adviser, subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Board. Pursuant to the Investment Advisory Agreement (the “Advisory Agreement”), the Fund pays the Adviser an annual management fee of 0.90%, based on the Fund’s average daily net assets. The management fee is paid on a monthly basis.

The Adviser has contractually agreed to limit the amount of the Fund’s total annual fund operating expenses, exclusive of acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses, to 0.92% and 1.25% of the Fund’s average daily net assets for Institutional Class shares and Retail Class shares, respectively. This agreement is in effect through September 30, 2018, may only be terminated before then by the Board, and is reevaluated on an annual basis. With respect to the Fund, the Adviser shall be permitted to recover, on a class-by-class basis, expenses it has borne subsequent to the effective date of the agreement described above (whether through reduction of its management fee or otherwise) only to the extent that the Fund’s expenses in later periods fall below the lesser of (1) the expense limit in effect at the time the Adviser waives or limits the expenses and (2) the expense limit in effect at the time the Adviser seeks to recover the expenses; provided, however, that the Fund will not be obligated to pay any such reduced fees and expenses more than three years after the date on which the fee and

| 20 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Notes to Financial Statements |

November 30, 2017 (Unaudited)

expense was reduced. Fees waived/reimbursed by the Adviser for the six months ended November 30, 2017 are disclosed in the Statement of Operations.

For the six months ended November 30, 2017, the fee waivers and/or reimbursements were as follows:

| Fund | Fees Waived/Reimbursed by Adviser | |||

| Goehring & Rozencwajg Resources Fund | ||||

| Institutional Class | $ | (236,584 | ) | |

| Retail Class | (140,683 | ) | ||

| TOTAL | $ | (377,267 | ) | |

As of November 30, 2017, the balances of recoupable expenses for the Fund were as follows:

| Fund | Expiring in 2020 | Expiring in 2021 | ||||||

| Goehring & Rozencwajg Resources Fund | ||||||||

| Institutional Class | $ | 266,866 | $ | 236,584 | ||||

| Retail Class | 259,851 | 140,683 | ||||||

| TOTAL | $ | 526,717 | $ | 377,267 | ||||

Distributor: ALPS Distributors, Inc. (“ADI” or the “Distributor”) (an affiliate of ALPS Fund Services Inc. (“ALPS”)) acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, although it is not obliged to sell any particular amount of shares.

ADI is not entitled to any compensation from the Fund for its services as Distributor; however, ADI receives compensation from the Adviser. ADI is registered as a broker-dealer with the U.S. Securities and Exchange Commission.

The Fund has adopted a separate Distribution and Services Plan pursuant to Rule 12b-1 of the 1940 Act. The Plan allows the Fund, as applicable, to use the Fund’s assets to pay fees in connection with the distribution and marketing of the Fund’s shares and/or the provision of shareholder services to the Fund’s shareholders. The Plan permits payment for services in connection with the administration of plans or programs that use shares of the Fund as their funding medium and for related expenses. The recipients of such payments may include other affiliates of the Adviser, broker-dealers, financial institutions, plan sponsors and administrators and other financial intermediaries through which investors may purchase shares of the Fund. The Plans permit the Fund to make total payments at an annual rate of up to 0.25% of the average daily net asset value of the Retail Class. Because these fees are paid out of the Fund’s assets on an ongoing basis, over time they will increase the cost of an investment in the Fund, and Plan fees may cost an investor more than other types of sales charges.

Under the Shareholder Services Plan (a “Services Plan”), the Fund is authorized to compensate certain financial institutions, including broker-dealers and Fund affiliates which may include the Distributor, Adviser and/or the transfer agent (the “Participating Organizations”), for providing services to the Fund or the Fund’s shareholders. This compensation may be used by the financial

| Semi-Annual Report | November 30, 2017 | 21 |

| Goehring & Rozencwajg Resources Fund | Notes to Financial Statements |

November 30, 2017 (Unaudited)

institution for payments to financial institutions and persons who provide administrative and support services to their customers who may from time to time beneficially own Retail Class shares. The Services Plan permits the Fund to make total payments at an annual rate of up to 0.15% of the Fund’s average daily net assets attributable to its Retail Class shares. However, the Fund may pay fees under the Services Plan at a lesser rate. Shareholder Services Plan fees are included with distribution and service fees on the Statement of Operations.

Fund Administrator Fees and Expenses: ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund. Pursuant to an Administration Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assist in the Fund’s operations. Several officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. Administration fees paid by the Fund for the six months ended November 30, 2017 are disclosed in the Statement of Operations.

The Administrator is also reimbursed by the Fund for certain out-of-pocket expenses.

Transfer Agent: ALPS serves as transfer, dividend paying and shareholder servicing agent for the Fund. ALPS receives an annual minimum fee, a fee based upon the number of shareholder accounts, and is also reimbursed by the Fund for certain out-of-pocket expenses. Transfer agent fees paid by the Fund for the six months ended November 30, 2017 are disclosed in the Statement of Operations.

Compliance Services: ALPS provides services that assist the Fund’s chief compliance officer in monitoring and testing the policies and procedures of the Fund in conjunction with requirements under Rule 38a-1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out-of-pocket expenses by the Fund. Compliance services fees paid by the Fund for the six months ended November 30, 2017 are disclosed in the Statement of Operations.

Beneficial Ownership: The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the Fund under Section 2(a)(9) of the 1940 Act. As of November 30, 2017, the following entities beneficially owned 25% or greater of a Fund’s outstanding shares:

| Goehring & Rozencwajg Resources Fund | Beneficial Owner | Percentage |

| Institutional Class | Leigh Goehring | 80.89% |

| Retail Class | Leigh Goehring | 92.06% |

7. INDEMNIFICATIONS

Under the Fund’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

| 22 | www.gr-funds.com | |

| Goehring & Rozencwajg Resources Fund | Additional Information |

November 30, 2017 (Unaudited)

1. FUND HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q within 60 days after the end of the period. Copies of the Fund’s Form N-Q are available without charge on the SEC website at http://www.sec.gov. You may also review and copy the Form N-Q at the SEC’s Public Reference Room in Washington, DC. For more information about the operation of the Public Reference Room, please call the SEC at 1-800-SEC-0330.

2. FUND PROXY VOTING POLICIES, PROCEDURES AND SUMMARIES

The Fund’s policies and procedures used in determining how to vote proxies and information regarding how the Fund’s voted proxies relating to portfolio securities during the most recent prior 12-month period ending May 31 are available without charge, (1) upon request, by calling (toll-free) 1-844-464-6467 and (2) on the SEC’s website at http://www.sec.gov.

| Semi-Annual Report | November 30, 2017 | 23 |

| Item 2. | Code of Ethics. |

Not applicable to this Report.

| Item 3. | Audit Committee Financial Expert. |

Not applicable to this Report.

| Item 4. | Principal Accountant Fees and Services. |

Not applicable to this Report.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable to Registrant.

| Item 6. | Investments. |

| (a) | Schedule of Investments is included as part of the Report to Stockholders filed under Item 1 of this Form N-CSR. |

| (b) | Not applicable. |

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable to Registrant.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

Not applicable to Registrant.

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable to Registrant.

| Item 10. | Submission of Matters to Vote of Security Holders. |

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees, where those changes were implemented after the Registrant last provided disclosure in response to the requirements of Item 407(c)(2) of Regulation S-K, or this Item.

| Item 11. | Controls and Procedures. |

| (a) | The Registrant’s principal executive officer and principal financial officer have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report. |

| (b) | There was no change in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940, as amended) during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

| Item 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. |

Not applicable.

| Item 13. | Exhibits. |

| (a)(1) | The Code of Ethics that applies to the Registrant’s principal executive officer and principal financial officer is attached hereto as Exhibit 12.A.1. |

| (a)(2) | The certifications required by Rule 30a-2(a) of the Investment Company Act of 1940, as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto as Exhibit 99.Cert. |

| (a)(3) | Not applicable. |

| (b) | The certifications by the Registrant’s principal executive officer and principal financial officer, as required by Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto as Exhibit 99.906Cert. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Goehring & Rozencwajg Investment Funds | |||

| By: | /s/ Adam A. Rozencwajg | ||

| Adam A. Rozencwajg | |||

| President | |||

| Date: | February 8, 2018 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below on behalf of the Registrant and in the capacities and on the dates indicated.

| Goehring & Rozencwajg Investment Funds | |||

| By: | /s/ Adam A. Rozencwajg | ||

Adam A. Rozencwajg | |||

| Principal Executive Officer and Principal Financial Officer | |||

| Date: | February 8, 2018 | ||