UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23177

(Investment Company Act file number)

GOEHRING & ROZENCWAJG INVESTMENT FUNDS

(Exact name of Registrant as specified in charter)

Principal Executive Offices

115 Broadway, 5th Floor, New York, NY 10006

(Address of principal executive offices)

(646) 216-9777

(Registrant’s telephone number, including area code)

Adam A. Rozencwajg

Goehring & Rozencwajg Associates, LLC

115 Broadway, 5th Floor,

New York, NY 10006

(Name and address of agent for service)

Copy to:

Michael Doherty, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, NY 10036

Date of fiscal year end: May 31

Date of reporting period: June 1, 2023 – May 31, 2024

Item 1. Reports to Stockholders.

| (a) | The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

MAY 31, 2024

ANNUAL SHAREHOLDER REPORT

INSTITUTIONAL : GRHIX

Goehring & Rozencwajg Resources Fund

FUND OVERVIEW

This annual shareholder report contains important information about Goehring & Rozencwajg Resources Fund - Institutional for the period of June 1, 2023 to

May 31, 2024.

You can find additional information about the Fund at https://www.gr-funds.com/ .. You can also request this information by contacting us at 1-844-464-6467.

WHAT WERE THE FUND'S COST FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|---|---|

| Goehring & Rozencwajg Resources Fund - Institutional | $98.25 | 0.92% |

HOW DID THE FUND PERFORM LAST YEAR?

Performance of the Fund over the past fiscal year was driven by improving equity valuations in natural resource sectors, as inflationary pressures persisted and the challenges associated with alternative energy sources continued to develop.

Markets continue to show long term fundamentals favorable to the strategy with periods of increased volatility.

During the fiscal year ended May 31, 2024, the Fund's current investment strategies did not materially change, and resulted in strong relative and absolute returns for the period.

HOW DID THE FUND PERFORM SINCE INCEPTION?

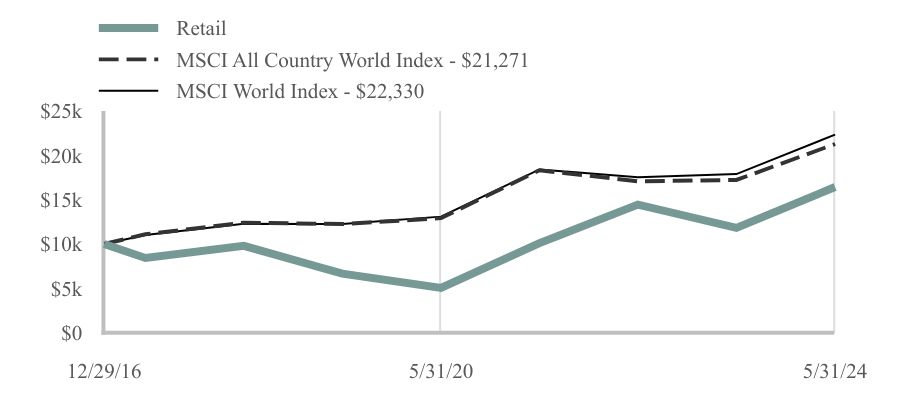

The Goehring & Rozencwajg Resources Fund - Institutional Fund returned 39.71% for the 12 months ended May 31, 2024. This is in contrast to the MSCI All Country World Index Index, which had a 23.56% return for the same time period. Please see below tables for additional indexes.

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Institutional | MSCI All Country World Index - $21,271 | MSCI World Index - $22,330 | |

|---|---|---|---|

| '24 | $16,835.53 | $21,271.05 | $22,329.98 |

| '23 | $12,050.31 | $17,215.66 | $17,875.52 |

| '22 | $14,704.63 | $17,070.45 | $17,512.69 |

| '21 | $10,236.43 | $18,312.47 | $18,398.81 |

| '20 | $5,113.56 | $12,910.16 | $13,083.50 |

| '19 | $6,712.88 | $12,245.24 | $12,251.00 |

| '18 | $9,823.82 | $12,405.67 | $12,286.69 |

| '17 | $8,440.00 | $11,092.69 | $11,012.74 |

| '16 | $10,000.00 | $10,000.00 | $10,000.00 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The chart presented above does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

FUND STATISTICS

- Total Net Assets$408,941,576

- # of Portfolio Holdings80

- Portfolio Turnover Rate (Institutional)11%

- Advisory Fees Paid$2,360,506

AVERAGE ANNUAL TOTAL RETURNS

| Institutional | 1 Year | 5 Year | Since Inception |

|---|---|---|---|

| Institutional (Incep. December 29, 2016) | 39.71% | 20.19% | 7.27% |

| MSCI All Country World Index | 23.56% | 11.68% | 10.71% |

| MSCI World Index | 24.92% | 12.76% | 11.44% |

Past performance does not guarantee future results. Call 1-844-464-6467 for current month-end performance.

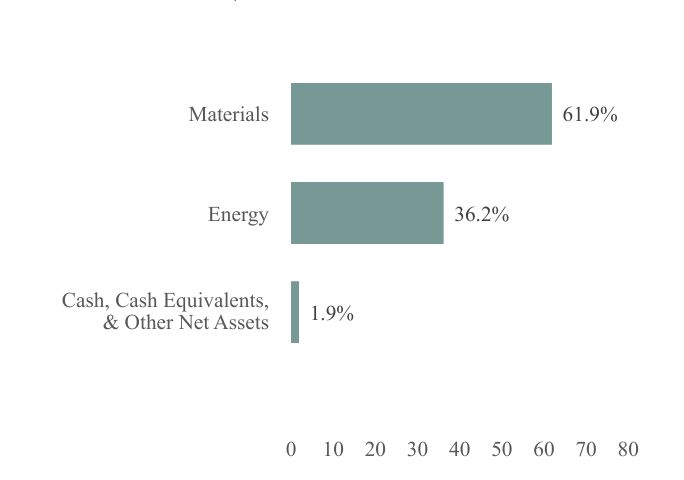

WHAT DID THE FUND INVEST IN?

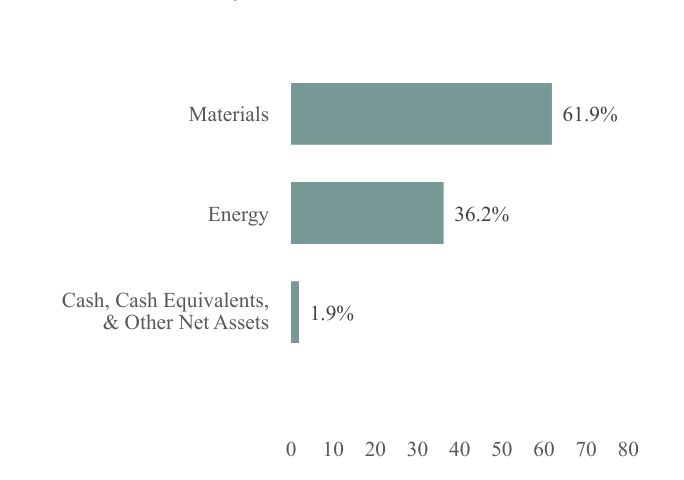

SECTOR WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|---|

| Cash, Cash Equivalents, & Other Net Assets | 1.9% |

| Energy | 36.2% |

| Materials | 61.9% |

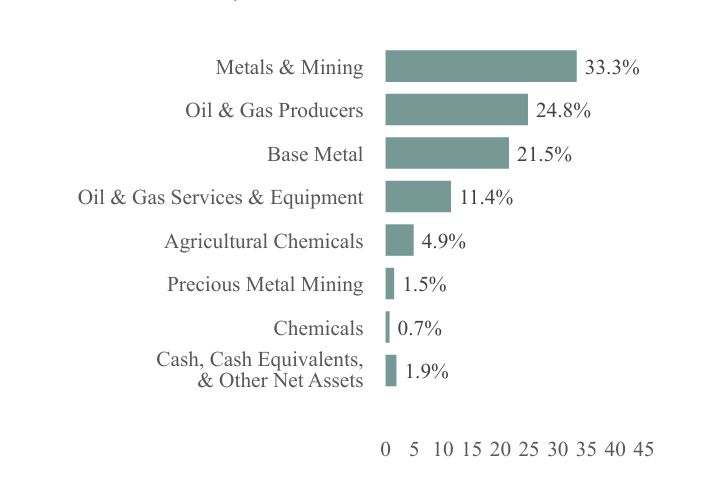

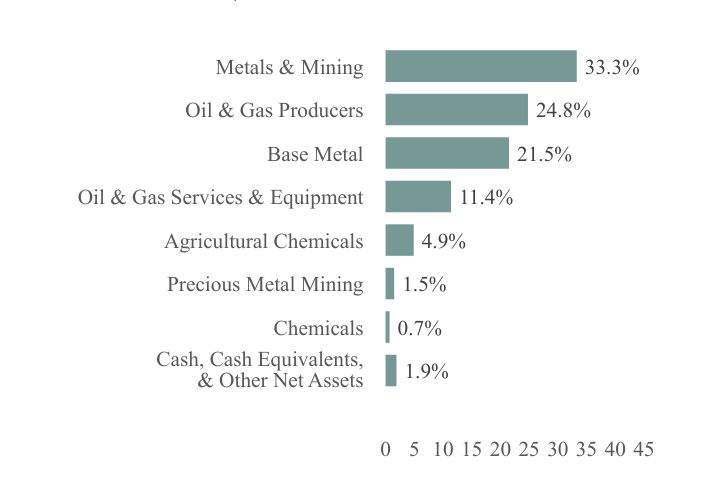

INDUSTRY WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|---|

| Cash, Cash Equivalents, & Other Net Assets | 1.9% |

| Chemicals | 0.7% |

| Precious Metal Mining | 1.5% |

| Agricultural Chemicals | 4.9% |

| Oil & Gas Services & Equipment | 11.4% |

| Base Metal | 21.5% |

| Oil & Gas Producers | 24.8% |

| Metals & Mining | 33.3% |

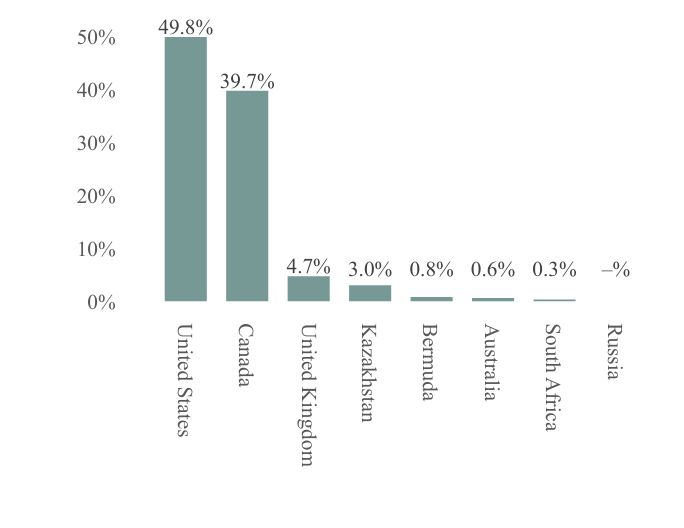

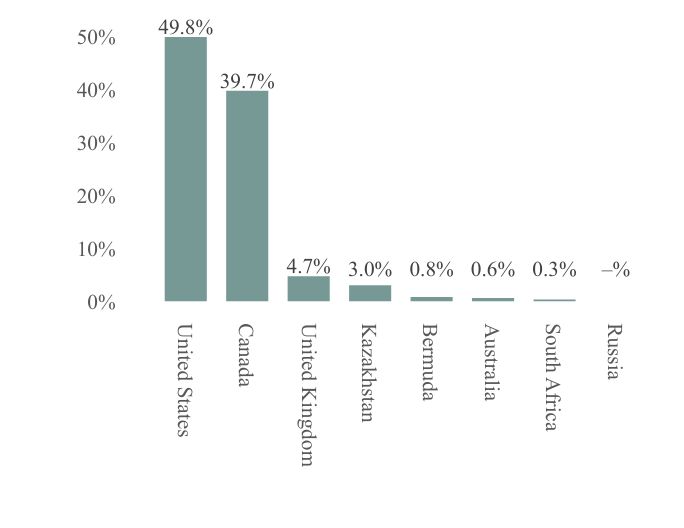

COUNTRY WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|---|

| United States | 49.8% |

| Canada | 39.7% |

| United Kingdom | 4.7% |

| Kazakhstan | 3.0% |

| Bermuda | 0.8% |

| Australia | 0.6% |

| South Africa | 0.3% |

| Russia | -% |

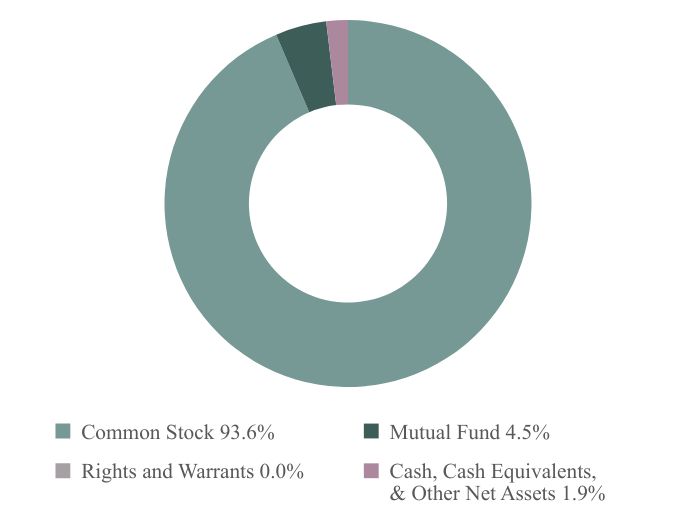

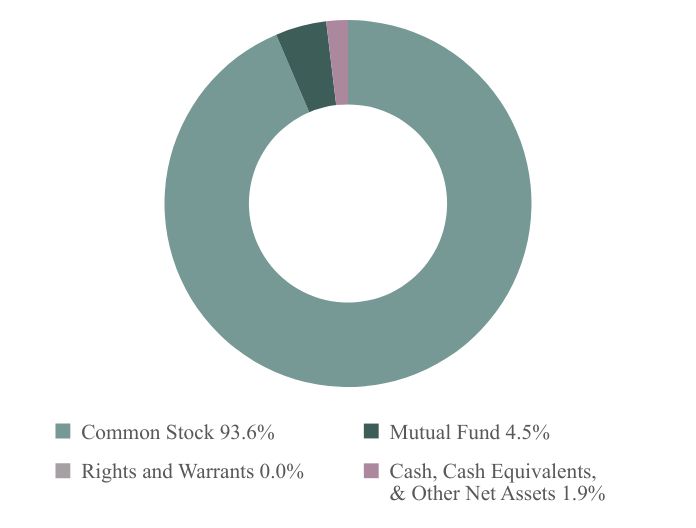

ASSET CLASS WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|---|

| Common Stock | 93.6% |

| Mutual Fund | 4.5% |

| Rights and Warrants | 0.0% |

| Cash, Cash Equivalents, & Other Net Assets | 1.9% |

MATERIAL FUND CHANGES

There have been no material fund changes during the reporting period.

Goehring & Rozencwajg Resources Fund

MAY 31, 2024

ANNUAL SHAREHOLDER REPORT

INSTITUTIONAL : GRHIX

CHANGES IN AND DISAGREEMENTS IN ACCOUNTANTS

There have been no changes in or disagreement with the Fund's independent accounting firm during the reporting period.

HOUSEHOLDING

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 1-844-464-6467.

Goehring & Rozencwajg Associates, LLC

1-844-464-6467

info@gorozen.com

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.gr-funds.com/.

Distributor, ALPS Distributors, Inc.

38035R208–A–05312024

MAY 31, 2024

ANNUAL SHAREHOLDER REPORT

RETAIL : GRHAX

Goehring & Rozencwajg Resources Fund

FUND OVERVIEW

This annual shareholder report contains important information about Goehring & Rozencwajg Resources Fund - Retail for the period of June 1, 2023 to

May 31, 2024.

You can find additional information about the Fund at https://www.gr-funds.com/ .. You can also request this information by contacting us at 1-844-464-6467.

WHAT WERE THE FUND'S COST FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|---|---|

| Goehring & Rozencwajg Resources Fund - Retail | $133.32 | 1.25% |

HOW DID THE FUND PERFORM LAST YEAR?

Performance of the Fund over the past fiscal year was driven by improving equity valuations in natural resource sectors, as inflationary pressures persisted and the challenges associated with alternative energy sources continued to develop.

Markets continue to show long term fundamentals favorable to the strategy with periods of increased volatility.

During the fiscal year ended May 31, 2024, the Fund's current investment strategies did not materially change, and resulted in strong relative and absolute returns for the period.

HOW DID THE FUND PERFORM SINCE INCEPTION?

The Goehring & Rozencwajg Resources Fund - Retail Fund returned 39.11% for the 12 months ended May 31, 2024. This is in contrast to the MSCI All Country World Index Index, which had a 23.56% return for the same time period. Please see below tables for additional indexes.

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Retail | MSCI All Country World Index - $21,271 | MSCI World Index - $22,330 | |

|---|---|---|---|

| '24 | $16,422.17 | $21,271.05 | $22,329.98 |

| '23 | $11,804.75 | $17,215.66 | $17,875.52 |

| '22 | $14,446.57 | $17,070.45 | $17,512.69 |

| '21 | $10,090.91 | $18,312.47 | $18,398.81 |

| '20 | $5,049.72 | $12,910.16 | $13,083.50 |

| '19 | $6,652.65 | $12,245.24 | $12,251.00 |

| '18 | $9,783.83 | $12,405.67 | $12,286.69 |

| '17 | $8,420.00 | $11,092.69 | $11,012.74 |

| '16 | $10,000.00 | $10,000.00 | $10,000.00 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The chart presented above does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

FUND STATISTICS

- Total Net Assets$408,941,576

- # of Portfolio Holdings80

- Portfolio Turnover Rate (Retail)11%

- Advisory Fees Paid$2,360,506

AVERAGE ANNUAL TOTAL RETURNS

| Retail | 1 Year | 5 Year | Since Inception |

|---|---|---|---|

| Retail (Incep. December 29, 2016) | 39.11% | 19.81% | 6.91% |

| MSCI All Country World Index | 23.56% | 11.68% | 10.71% |

| MSCI World Index | 24.92% | 12.76% | 11.44% |

Past performance does not guarantee future results. Call 1-844-464-6467 for current month-end performance.

WHAT DID THE FUND INVEST IN?

SECTOR WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|---|

| Cash, Cash Equivalents, & Other Net Assets | 1.9% |

| Energy | 36.2% |

| Materials | 61.9% |

INDUSTRY WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|---|

| Cash, Cash Equivalents, & Other Net Assets | 1.9% |

| Chemicals | 0.7% |

| Precious Metal Mining | 1.5% |

| Agricultural Chemicals | 4.9% |

| Oil & Gas Services & Equipment | 11.4% |

| Base Metal | 21.5% |

| Oil & Gas Producers | 24.8% |

| Metals & Mining | 33.3% |

COUNTRY WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|---|

| United States | 49.8% |

| Canada | 39.7% |

| United Kingdom | 4.7% |

| Kazakhstan | 3.0% |

| Bermuda | 0.8% |

| Australia | 0.6% |

| South Africa | 0.3% |

| Russia | -% |

ASSET CLASS WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|---|

| Common Stock | 93.6% |

| Mutual Fund | 4.5% |

| Rights and Warrants | 0.0% |

| Cash, Cash Equivalents, & Other Net Assets | 1.9% |

MATERIAL FUND CHANGES

There have been no material fund changes during the reporting period.

Goehring & Rozencwajg Resources Fund

MAY 31, 2024

ANNUAL SHAREHOLDER REPORT

RETAIL : GRHAX

CHANGES IN AND DISAGREEMENTS IN ACCOUNTANTS

There have been no changes in or disagreement with the Fund's independent accounting firm during the reporting period.

HOUSEHOLDING

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 1-844-464-6467.

Goehring & Rozencwajg Associates, LLC

1-844-464-6467

info@gorozen.com

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.gr-funds.com/.

Distributor, ALPS Distributors, Inc.

38035R109–A–05312024

| (b) | Not applicable. |

Item 2. Code of Ethics.

| (a) | The Registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or any persons performing similar functions on behalf of the Registrant. |

| (b) | For purposes of this item, “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote: |

| (1) | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| (2) | Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant; |

| (3) | Compliance with applicable governmental laws, rules, and regulations; |

| (4) | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

| (5) | Accountability for adherence to the code. |

| (c) | During the period covered by this report, no amendments to the provisions of the code of ethics adopted in Item 2(a) above were made. |

| (d) | During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in Item 2(a) above were granted. |

| (e) | Not applicable. |

| (f) | The Registrant’s Code of Ethics is attached hereto as Exhibit 19(a)(1). |

Item 3. Audit Committee Financial Expert.

| (a)(1) | The Board of Trustees has determined that it has an audit committee financial expert serving on the Fund's audit committee that possesses the attributes identified in Item 3(b) to Form N-CSR. |

| (a)(2) | The name of the audit committee financial expert is Edward O'Brien. Mr. O'Brien has been deemed “independent” as that term is defined in Item 3(a)(2) of Form N-CSR. |

| (a)(3) | Not applicable to Registrant. |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees: For the Registrant’s fiscal year ended May 31, 2024 and May 31, 2023, the aggregate fees billed for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements were $40,500 and $34,500, respectively. |

| (b) | Audit-Related Fees: The aggregate fees billed for the registrant’s fiscal years ended May 31, 2024 and May 31, 2023 for assurance and related services by the registrant’s principal accountant reasonably related to the performance of audit of the registrant’s financial statements and not reported under Paragraph (a) of this Item were $0 and $0, respectively. Such services consisted of a report of the Fund’s transfer agent internal controls pursuant to Rule 17Ad-13, semi-annual report review and a report on the Fund’s anti-money laundering controls and policies. |

| (c) | Tax Fees: For the Registrant’s fiscal year ended May 31, 2024 and May 31, 2023, the aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $6,200 and $5,650. The fiscal year 2024 and 2023 tax fees were for services pertaining to federal and state income tax return review, review of year-end dividend distributions and excise tax preparation. |

| (d) | All Other Fees: For the Registrant’s fiscal years ended May 31, 2024 and May 31, 2023, aggregate fees billed to the Registrant by the principal accountant for services provided by the principal accountant other than the services reported in paragraphs (a) through (c) of this Item 4 were $0 and $2,070, respectively. |

| (e) | (1) | Audit Committee Pre-Approval Policies and Procedures: All services to be performed by the Registrant’s principal accountant must be pre-approved by the Registrant’s Audit Committee. |

| (2) | No services described in paragraphs (b) through (d) of this Item 4 were approved by the Registrant’s audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Not applicable to Registrant. |

| (g) | The aggregate non-audit fees of $0 and $0 were billed by the registrant’s principal accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the fiscal years ended May 31, 2024 and May 31, 2023. |

| (h) | Not applicable to Registrant. |

| (i) | Not applicable to Registrant. |

| (j) | Not applicable to Registrant. |

Item 5. Audit Committee of Listed Registrants.

Not applicable to Registrant.

Item 6. Investments.

| (a) | The Schedule of Investments is included in the financial statements filed under Item 7 of this Form. |

| (b) | Not applicable to Registrant. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

TABLE OF CONTENTS

| Item 7 – Financial Statements and Financial Highlights for Open-End Management Investment Companies | 1 |

| Schedule of Investments | 2 |

| Statement of Assets and Liabilities | 6 |

| Statement of Operations | 7 |

| Statements of Changes in Net Assets | 8 |

| Financial Highlights | 10 |

| Notes to Financial Statements and Financial Highlights | 14 |

| Report of Independent Registered Public Accounting Firm | 24 |

| Tax Designations | 26 |

| Item 8 – Changes in and Disagreements with Accountants for Open-End Management Investment Companies | 27 |

| Item 9 – Proxy Disclosures for Open-End Management Investment Companies | 28 |

| Item 10 – Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies | 29 |

| Item 11 – Statement Regarding Basis for Approval of Investment Advisory Contract | 30 |

Goehring & Rozencwajg Resources Fund

ITEM 7 – Financial Statements and Financial Highlights for

Open-End Management Investment Companies

See Notes to Financial Statements.

| Annual Report | May 31, 2024 | 1 |

| Goehring & Rozencwajg Resources Fund | Schedule of Investments |

May 31, 2024

| Security Description | Shares | Value | ||||||

| COMMON STOCKS (93.6%) | ||||||||

| ENERGY (36.2%) | ||||||||

| Oil & Gas Producers (24.8%) | ||||||||

| Antero Resources Corp.(a) | 426,600 | $ | 15,199,758 | |||||

| Birchcliff Energy, Ltd. | 2,321,441 | 10,577,166 | ||||||

| Chesapeake Energy Corp. | 55,647 | 5,059,982 | ||||||

| Civitas Resources, Inc. | 97,643 | 7,182,619 | ||||||

| Comstock Resources, Inc. | 367,900 | 4,308,109 | ||||||

| Diamondback Energy, Inc. | 35,369 | 7,047,627 | ||||||

| EQT Corp. | 304,560 | 12,514,370 | ||||||

| Exxon Mobil Corp. | 22,402 | 2,626,859 | ||||||

| Matador Resources Co. | 145,608 | 9,238,828 | ||||||

| Range Resources Corp. | 742,954 | 27,422,432 | ||||||

| 101,177,750 | ||||||||

| Oil & Gas Services & Equipment (11.4%) | ||||||||

| Borr Drilling, Ltd.(b) | 502,409 | 3,461,598 | ||||||

| CES Energy Solutions Corp. | 181,036 | 959,008 | ||||||

| Diamond Offshore Drilling, Inc.(a) | 456,860 | 6,935,135 | ||||||

| Noble Corp. PLC | 93,664 | 4,351,629 | ||||||

| NOV, Inc. | 92,405 | 1,739,062 | ||||||

| Oceaneering International, Inc.(a) | 238,986 | 5,659,188 | ||||||

| Schlumberger NV | 93,167 | 4,275,434 | ||||||

| Seadrill, Ltd.(a) | 245,852 | 12,752,343 | ||||||

| Tidewater, Inc.(a) | 3,914 | 404,434 | ||||||

| Transocean Ltd.(a) | 424,744 | 2,633,413 | ||||||

| Valaris, Ltd.(a) | 26,635 | 2,061,549 | ||||||

| Vital Energy, Inc.(a) | 30,239 | 1,477,175 | ||||||

| 46,709,968 | ||||||||

| MATERIALS (57.4%) | ||||||||

| Agricultural Chemicals (4.9%) | ||||||||

| CF Industries Holdings, Inc. | 66,315 | 5,287,295 | ||||||

| Corteva, Inc. | 45,036 | 2,519,314 | ||||||

| Mosaic Co. | 219,518 | 6,789,692 | ||||||

| Nutrien Ltd. | 93,097 | 5,456,415 | ||||||

| 20,052,716 | ||||||||

| Base Metal (17.0%) | ||||||||

| Amerigo Resources Ltd. | 1,398,918 | 1,775,654 | ||||||

| Cameco Corp. | 380,830 | 21,139,874 | ||||||

| ERO Copper Corp.(a) | 181,217 | 3,858,481 | ||||||

| Excelsior Mining Corp.(a) | 660,482 | 111,457 | ||||||

| First Quantum Minerals Ltd. | 148,237 | 1,904,420 | ||||||

| Freeport-McMoRan, Inc. | 115,327 | 6,081,193 | ||||||

| GMK Norilskiy Nickel PAO(a) | 5 | – | ||||||

| Hudbay Minerals, Inc. | 400,082 | 3,904,098 | ||||||

| Ivanhoe Mines Ltd. - Class A(a) | 609,094 | 8,794,871 | ||||||

See Notes to Financial Statements.

| 2 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Schedule of Investments |

May 31, 2024

| Lundin Mining Corp. | 256,932 | 2,953,978 | ||||||

| Mako Mining Corp.(a) | 259,171 | 648,427 | ||||||

| NAC Kazatomprom JSC | 293,104 | 12,090,540 | ||||||

| NexGen Energy, Ltd.(a) | 735,392 | 5,721,350 | ||||||

| Trilogy Metals, Inc.(a) | 703,001 | 337,845 | ||||||

| 69,322,188 | ||||||||

| Chemicals (0.7%) | ||||||||

| Intrepid Potash, Inc.(a) | 101,790 | 2,731,026 | ||||||

| Metals & Mining (33.3%) | ||||||||

| Alamos Gold, Inc. | 480,000 | 8,020,800 | ||||||

| Alpha Metallurgical Resources, Inc. | 43,527 | 13,728,850 | ||||||

| Arch Coal, Inc. - Class A | 34,147 | 5,939,188 | ||||||

| Artemis Gold, Inc.(a) | 754,590 | 5,885,243 | ||||||

| Asante Gold Corp.(a) | 1,739,370 | 1,620,749 | ||||||

| Bellevue Gold, Ltd.(a)(b) | 1,930,709 | 2,517,808 | ||||||

| Brixton Metals Corp.(a) | 6,291,800 | 461,631 | ||||||

| Caledonia Mining Corp. PLC | 127,278 | 1,330,055 | ||||||

| Calibre Mining Corp.(a) | 1,630,568 | 2,464,485 | ||||||

| Centrus Energy Corp.(a) | 107,220 | 5,321,329 | ||||||

| CONSOL Energy, Inc. | 122,178 | 12,666,192 | ||||||

| Denison Mines Corp.(a) | 1,856,700 | 4,493,214 | ||||||

| Encore Energy Corp.(a) | 558,300 | 2,707,755 | ||||||

| Energy Fuels, Inc.(a) | 577,500 | 4,042,500 | ||||||

| Equinox Gold Corp.(a) | 791,868 | 4,299,368 | ||||||

| Erdene Resource Development Corp.(a)(b) | 4,005,400 | 1,454,692 | ||||||

| Foran Mining Corp.(a) | 2,675,936 | 8,344,200 | ||||||

| GMK Norilskiy Nickel PAO(c) | 285,500 | – | ||||||

| GoGold Resources, Inc.(a) | 1,890,495 | 2,219,298 | ||||||

| Ivanhoe Electric, Inc.(a) | 870,076 | 9,892,763 | ||||||

| K92 Mining, Inc.(a)(b) | 248,900 | 1,391,554 | ||||||

| Loncor Gold, Inc.(a) | 4,573,000 | 1,593,731 | ||||||

| Los Andes Copper, Ltd.(a) | 94,103 | 686,294 | ||||||

| Minera Alamos, Inc.(a) | 2,676,909 | 765,982 | ||||||

| Mountain Province Diamonds, Inc.(a) | 321,015 | 44,751 | ||||||

| Novagold Resources, Inc.(a) | 180,690 | 710,112 | ||||||

| Orezone Gold Corp.(a) | 5,029,311 | 2,656,813 | ||||||

| Orla Mining, Ltd.(a) | 675,050 | 2,867,706 | ||||||

| Osisko Mining, Inc.(a) | 1,134,500 | 2,572,072 | ||||||

| Pan American Silver Corp. | 141,330 | 3,109,260 | ||||||

| Reunion Gold Corp.(a) | 6,160,501 | 2,983,184 | ||||||

| Skeena Resources, Ltd.(a) | 782,242 | 3,460,816 | ||||||

| Trilogy Metals, Inc.(a) | 18,700 | 9,406 | ||||||

| Triple Flag Precious Metals Corp. | 48,312 | 797,904 | ||||||

| United Co. RUSAL International PJSC(a)(c) | 1,326,798 | – | ||||||

| Uranium Energy Corp.(a) | 881,822 | 6,296,209 | ||||||

| Ur-Energy, Inc.(a) | 1,577,500 | 2,839,500 |

See Notes to Financial Statements.

| Annual Report | May 31, 2024 | 3 |

| Goehring & Rozencwajg Resources Fund | Schedule of Investments |

May 31, 2024

| Victoria Gold Corp.(a) | 1,075,520 | 6,391,806 | ||||||

| 136,587,220 | ||||||||

| Precious Metal Mining (1.5%) | ||||||||

| Endeavour Mining PLC | 286,490 | 6,219,773 | ||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $275,943,906) | 382,800,641 | |||||||

| MUTUAL FUND (4.5%) | ||||||||

| MATERIALS (4.5%) | ||||||||

| Base Metal (4.5%) | ||||||||

| Sprott Physical Uranium Trust(a) | 892,535 | 18,375,239 | ||||||

| TOTAL MUTUAL FUND | ||||||||

| (Cost $11,259,465) | 18,375,239 | |||||||

| WARRANTS (0.0%) | ||||||||

| ENERGY (0.0%) | ||||||||

| Oil & Gas Services & Equipment (0.0%)(d) | ||||||||

| Diamond Offshore Drilling, Inc., Expires 12/31/2049, Strike Price $29.22 | 4,732 | 2,603 | ||||||

| MATERIALS (0.0%) | ||||||||

| Metals & Mining (0.0%)(d) | ||||||||

| Brixton Metals Corp. Warrants, Expires 11/21/2025, Strike Price $0.23 | 2,395,500 | – | ||||||

| Erdene Resource Development Co Warrants, Expires 12/31/2024, Strike Price $0.40 | 1,500,000 | 104,553 | ||||||

| Loncor Gold Restricted Warrants, Expires 05/05/2025, Strike Price $0.60(b) | 2,000,000 | – | ||||||

| Loncor Gold Warrants, Expires 12/31/2049, Strike Price $0.00(b) | 900,000 | – | ||||||

| 104,553 | ||||||||

| TOTAL WARRANTS | ||||||||

| (Cost $431,663) | 107,156 |

See Notes to Financial Statements.

| 4 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Schedule of Investments |

May 31, 2024

| Security Description | Shares | Value | ||||||

| SHORT TERM INVESTMENTS (0.8%) | ||||||||

| Dreyfus Treasury Securities Cash Management, Institutional Class (7 day yield 5.201%) | 3,083,442 | 3,083,442 | ||||||

| TOTAL SHORT TERM INVESTMENTS | ||||||||

| (Cost $3,083,442) | 3,083,442 | |||||||

| TOTAL INVESTMENTS - (98.9%) | ||||||||

| (Cost $290,718,476) | 404,366,477 | |||||||

| Assets in Excess of Other Liabilities - (1.1%) | 4,575,099 | |||||||

| NET ASSETS - (100.0%) | $ | 408,941,576 | ||||||

| (a) | Non-income producing security. |

| (b) | Securities were originally issued pursuant to Rule 144 or Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside of the United States from registration. Such securities cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. As of May 31, 2024, the aggregate market value of those securities was $3,614,607, which represents approximately 0.88% of net assets. |

| (c) | Level 3 security in accordance with fair value hierarchy. |

| (d) | Less than 0.05% |

COUNTRY COMPOSITION

(As of May 31, 2024)

| United States | 49.9% |

| Canada | 39.7% |

| Great Britain | 4.6% |

| Kazakhstan | 3.0% |

| Bermuda | 0.8% |

| Australia | 0.6% |

| South Africa | 0.3% |

| Russia | –% |

| Total | 98.9% |

Percentages are based upon common stocks, rights, warrants, corporate bonds, private securities and short term investments as a percentage of net assets.

See Notes to Financial Statements.

| Annual Report | May 31, 2024 | 5 |

| Goehring & Rozencwajg Resources Fund | Statement of Assets and Liabilities |

May 31, 2024

| ASSETS: | ||||

| Investments, at value (cost $290,718,476) | $ | 404,366,477 | ||

| Cash | 1,513,166 | |||

| Foreign currency, at value (cost $194,813) | 194,813 | |||

| Receivable for shares sold | 3,569,877 | |||

| Dividends receivable | 992,737 | |||

| Interest receivable | 54,746 | |||

| Prepaid assets | 18,276 | |||

| Total Assets | 410,710,092 | |||

| LIABILITIES: | ||||

| Payable for investments purchased | 1,124,285 | |||

| Payable for shares redeemed | 318,794 | |||

| Payable to adviser | 210,893 | |||

| Payable for administration fees | 4,136 | |||

| Payable to trustees | 1,448 | |||

| Payable to chief compliance officer | 48,154 | |||

| Payable for transfer agency fees | 6,746 | |||

| Payable for professional fees | 48,717 | |||

| Accrued expenses and other liabilities | 5,343 | |||

| Total Liabilities | 1,768,516 | |||

| NET ASSETS | $ | 408,941,576 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid-in capital (Note 5) | $ | 326,407,098 | ||

| Total distributable earnings | 82,534,478 | |||

| NET ASSETS | $ | 408,941,576 | ||

| PRICING OF SHARES | ||||

| Institutional Class: | ||||

| Net Asset Value, offering and redemption price per share | $ | 14.89 | ||

| Net Assets | $ | 379,619,661 | ||

| Shares of beneficial interest outstanding | 25,500,866 | |||

| Retail Class: | ||||

| Net Asset Value, offering and redemption price per share | $ | 14.70 | ||

| Net Assets | $ | 29,321,915 | ||

| Shares of beneficial interest outstanding | 1,994,165 | |||

See Notes to Financial Statements.

| 6 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Statement of Operations |

For the Year ended May 31, 2024

| INVESTMENT INCOME: | ||||

| Interest | $ | 3,201 | ||

| Dividends | 4,587,470 | |||

| Foreign taxes withheld | (78,567 | ) | ||

| Total Investment Income | 4,512,104 | |||

| EXPENSES: | ||||

| Investment advisory fee (Note 6) | 2,360,506 | |||

| Administration fee | 213,895 | |||

| Distribution and service fees | ||||

| Retail Class | 56,524 | |||

| Custodian fee | 68,684 | |||

| Professional fees | 143,484 | |||

| Transfer agent fee | 85,394 | |||

| Trustees fees and expenses | 98,001 | |||

| Registration and filing fees | 62,407 | |||

| Printing fees | 25,914 | |||

| Chief compliance officer fee | 42,806 | |||

| Insurance expense | 7,702 | |||

| Other expenses | 24,116 | |||

| Total Expenses | 3,189,433 | |||

| Less fees waived by investment adviser | ||||

| Institutional Class | (646,017 | ) | ||

| Retail Class | (43,786 | ) | ||

| Total fees waived/reimbursed by investment adviser (Note 6) | (689,803 | ) | ||

| Net Expenses | 2,499,630 | |||

| NET INVESTMENT INCOME | 2,012,474 | |||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | ||||

| Net realized gain/(loss) on: | ||||

| Investments | 8,505,011 | |||

| Foreign currency transactions | (108,554 | ) | ||

| Net realized gain | 8,396,457 | |||

| Change in unrealized appreciation/(depreciation) on: | ||||

| Investments | 76,700,415 | |||

| Translation of asset and liabilities denominated in foreign currency | (2,296 | ) | ||

| Net change in unrealized appreciation/(depreciation) | 76,698,119 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 85,094,576 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 87,107,050 | ||

See Notes to Financial Statements.

| Annual Report | May 31, 2024 | 7 |

| Goehring & Rozencwajg Resources Fund | Statements of Changes in Net Assets |

| Year Ended May 31, 2024 | Year Ended May 31, 2023 | |||||||

| OPERATIONS: | ||||||||

| Net investment income | $ | 2,012,474 | $ | 3,259,827 | ||||

| Net realized gain | 8,396,457 | 739,817 | ||||||

| Net change in unrealized appreciation/(depreciation) | 76,698,119 | (43,378,095 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 87,107,050 | (39,378,451 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| From distributable earnings | ||||||||

| Retail | (734,816 | ) | (265,779 | ) | ||||

| Institutional | (7,116,670 | ) | (2,421,539 | ) | ||||

| Total distributions | (7,851,486 | ) | (2,687,318 | ) | ||||

| BENEFICIAL SHARE TRANSACTIONS (Note 5): | ||||||||

| Institutional Class | ||||||||

| Shares sold | 166,631,433 | 81,474,184 | ||||||

| Dividends reinvested | 5,464,195 | 1,914,672 | ||||||

| Shares redeemed | (36,144,108 | ) | (40,833,199 | ) | ||||

| Net increase from beneficial share transactions | 135,951,520 | 42,555,657 | ||||||

| Retail Class | ||||||||

| Shares sold | 6,219,152 | 5,902,164 | ||||||

| Dividends reinvested | 677,226 | 232,170 | ||||||

| Shares redeemed | (4,850,305 | ) | (5,352,698 | ) | ||||

| Net increase from beneficial share transactions | 2,046,073 | 781,636 | ||||||

| Net increase in net assets | 217,253,157 | 1,271,524 | ||||||

| NET ASSETS: | ||||||||

| Beginning of year | 191,688,419 | 190,416,895 | ||||||

| End of year | $ | 408,941,576 | $ | 191,688,419 | ||||

See Notes to Financial Statements.

| 8 | www.gr-funds.com |

Page Intentionally Left Blank

| Goehring & Rozencwajg Resources Fund | Financial Highlights |

| Institutional Class | For a share outstanding throughout the periods presented |

| NET ASSET VALUE, BEGINNING OF PERIOD |

| INCOME/(LOSS) FROM OPERATIONS: |

| Net investment income/(loss)(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from investment operations |

| LESS DISTRIBUTIONS: |

| From net investment income |

| Total distributions |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE |

| NET ASSET VALUE, END OF PERIOD |

| TOTAL RETURN(c) |

| SUPPLEMENTAL DATA: |

| Net assets, End of Period (in 000s) |

| RATIOS TO AVERAGE NET ASSETS |

| Operating expenses excluding reimbursement/waiver |

| Operating expenses including reimbursement/waiver |

| Net investment income/(loss) including reimbursement/waiver |

| PORTFOLIO TURNOVER RATE |

See Notes to Financial Statements.

| 10 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Financial Highlights |

| Institutional Class | For a share outstanding throughout the periods presented |

For the Year Ended May 31, 2024 | For the Year Ended May 31, 2023 | For the Year Ended May 31, 2022 | For the Year Ended May 31, 2021 | For the Year Ended May 31, 2020 | ||||||||||||||

| $ | 11.00 | $ | 13.61 | $ | 9.79 | $ | 4.99 | $ | 6.59 | |||||||||

| 0.11 | 0.21 | 0.09 | 0.00 | (b) | 0.03 | |||||||||||||

| 4.20 | (2.66 | ) | 4.06 | 4.93 | (1.59 | ) | ||||||||||||

| 4.31 | (2.45 | ) | 4.15 | 4.93 | (1.56 | ) | ||||||||||||

| (0.42 | ) | (0.16 | ) | (0.33 | ) | (0.13 | ) | (0.04 | ) | |||||||||

| (0.42 | ) | (0.16 | ) | (0.33 | ) | (0.13 | ) | (0.04 | ) | |||||||||

| 3.89 | (2.61 | ) | 3.82 | 4.80 | (1.60 | ) | ||||||||||||

| $ | 14.89 | $ | 11.00 | $ | 13.61 | $ | 9.79 | $ | 4.99 | |||||||||

| 39.71 | % | (18.05 | %) | 43.65 | % | 100.18 | % | (23.82 | %) | |||||||||

| $ | 379,620 | $ | 171,581 | $ | 166,177 | $ | 78,230 | $ | 26,088 | |||||||||

| 1.19 | % | 1.24 | % | 1.31 | % | 2.02 | % | 2.43 | % | |||||||||

| 0.92 | % | 0.92 | % | 0.92 | % | 0.92 | % | 0.92 | % | |||||||||

| 0.80 | % | 1.72 | % | 0.79 | % | (0.02 | %) | 0.50 | % | |||||||||

| 11 | % | 3 | % | 22 | % | 18 | % | 84 | % | |||||||||

| (a) | Calculated using the average shares method. |

| (b) | Less than $0.005 per share. |

| (c) | Assumes an initial investment at commencement of operations, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal year. Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See Notes to Financial Statements.

| Annual Report | May 31, 2024 | 11 |

| Goehring & Rozencwajg Resources Fund | Financial Highlights |

| Retail Class | For a share outstanding throughout the periods presented |

| NET ASSET VALUE, BEGINNING OF PERIOD |

| INCOME/(LOSS) FROM OPERATIONS: |

| Net investment income/(loss)(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from investment operations |

| LESS DISTRIBUTIONS: |

| From net investment income |

| Total distributions |

| REDEMPTION FEES ADDED TO PAID IN CAPITAL |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE |

| NET ASSET VALUE, END OF PERIOD |

| TOTAL RETURN(b) |

| SUPPLEMENTAL DATA: |

| Net assets, End of Period (in 000s) |

| RATIOS TO AVERAGE NET ASSETS |

| Operating expenses excluding reimbursement/waiver |

| Operating expenses including reimbursement/waiver |

| Net investment income/(loss) including reimbursement/waiver |

| PORTFOLIO TURNOVER RATE |

See Notes to Financial Statements.

| 12 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Financial Highlights |

| Retail Class | For a share outstanding throughout the periods presented |

For the Year Ended May 31, 2024 | For the Year Ended May 31, 2023 | For the Year Ended May 31, 2022 | For the Year Ended May 31, 2021 | For the Year Ended May 31, 2020 | ||||||||||||||

| $ | 10.89 | $ | 13.49 | $ | 9.72 | $ | 4.95 | $ | 6.55 | |||||||||

| 0.06 | 0.17 | 0.05 | (0.03 | ) | 0.02 | |||||||||||||

| 4.15 | (2.63 | ) | 4.02 | 4.91 | (1.59 | ) | ||||||||||||

| 4.21 | (2.46 | ) | 4.07 | 4.88 | (1.57 | ) | ||||||||||||

| (0.40 | ) | (0.14 | ) | (0.31 | ) | (0.11 | ) | (0.03 | ) | |||||||||

| (0.40 | ) | (0.14 | ) | (0.31 | ) | (0.11 | ) | (0.03 | ) | |||||||||

| 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | ||||||||||||||

| 3.81 | (2.60 | ) | 3.77 | 4.77 | (1.60 | ) | ||||||||||||

| $ | 14.70 | $ | 10.89 | $ | 13.49 | $ | 9.72 | $ | 4.95 | |||||||||

| 39.11 | % | (18.29 | %) | 43.16 | % | 99.83 | % | (24.09 | %) | |||||||||

| $ | 29,322 | $ | 20,107 | $ | 24,240 | $ | 16,387 | $ | 4,137 | |||||||||

| 1.43 | % | 1.57 | % | 1.65 | % | 2.24 | % | 2.82 | % | |||||||||

| 1.25 | % | 1.25 | % | 1.25 | % | 1.25 | % | 1.25 | % | |||||||||

| 0.43 | % | 1.40 | % | 0.42 | % | (0.38 | %) | 0.34 | % | |||||||||

| 11 | % | 3 | % | 22 | % | 18 | % | 84 | % | |||||||||

| (a) | Calculated using the average shares method. |

| (b) | Assumes an initial investment at commencement of operations, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal year. Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See Notes to Financial Statements.

| Annual Report | May 31, 2024 | 13 |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

1. ORGANIZATION

The Goehring & Rozencwajg Resources Fund (the "Fund") is a no-load investment portfolio of Goehring & Rozencwajg Investment Funds (the “Trust”), an open-end series management investment company organized as a Massachusetts business trust on July 14, 2016, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on December 30, 2016. The Fund is a diversified investment company with an investment objective which seeks to maximize total return, which consists of income on its investments and capital appreciation. The Fund currently offers Retail Class Shares and Institutional Class Shares. Each share class of the Fund represents an investment in the same portfolio of securities, but each share class has its own expense structure. The Board of Trustees (the “Board”) may establish additional funds and classes of shares at any time in the future without shareholder approval. The Fund’s Investment Adviser is Goehring & Rozencwajg Associates, LLC (the “Adviser”).

The Fund will concentrate its investments in the securities of natural resources companies and other investments which provide economic exposure to natural resources or natural resources companies. When a Fund concentrates its investments in a particular sector or in particular industries, financial, economic, business, and other developments affecting issuers in that sector or in those industries will have a greater effect on that Fund than if it had not concentrated its assets in that sector or in those industries. The Fund’s concentration in natural resources investments exposes it to the price movements of natural resources to a greater extent than if it were more broadly diversified. By investing primarily in natural resources investments, the Fund runs the risk of performing poorly during an economic downturn or a decline in demand for natural resources.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange, or if there is no closing price or official closing price, the last sale price. If there have been no sales on that day, the securities are valued at the mean of the current bid and ask price. U.S. and non U.S. government and corporate debt securities are typically traded in the over-the-counter market internationally, and are generally valued using prices supplied by a pricing vendor approved by the Board based on the midpoint of quotes from multiple dealers and other factors deemed relevant by the pricing vendor. In the case of other securities not traded on an exchange, or if closing prices are not otherwise available, the market price is typically determined by independent third-party pricing vendors approved by the Fund’s Board using a variety of pricing techniques and methodologies. U.S. government and agency securities are valued by a third-party pricing vendor at the mean between the closing bid and ask prices. Other than with respect to the debt securities discussed above, the market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Fund’s Board, which may use, instead of quotes from dealers, a matrix, formula or other method that takes into consideration market indices, yield curves and other specific adjustments. Derivatives are valued using market quotations, a price supplied by a pricing service or counterparty, or using the fair value procedures discussed below, depending on the type of derivative and the availability of market quotations. Short-term debt obligations that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. Investments in the underlying funds are based on the underlying fund’s net asset value. Available cash is generally invested into a money market fund by the Fund’s custodian, and is valued at the latest net asset value per share as reported to the Fund’s administrator.

| 14 | www.gr-funds.com |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

When the price quotations described above are not available, or when the Adviser believes that they are unreliable, the Fund’s assets may be priced using fair value procedures approved by the Board. Because the Fund invests in investments that may be thinly traded or for which the price quotations described above may not be readily available or may be unreliable – such as securities of small capitalization companies, securities of issuers located in emerging markets, high yield securities and derivatives – the Fund may use fair valuation procedures more frequently than funds that invest primarily in securities that are more liquid – such as equity securities of large capitalization domestic issuers. The Fund may also use fair value procedures if the Adviser determines that a significant event has occurred between the time at which a market price is determined and the time at which the Fund’s NAV is calculated. In particular, the value of non-U.S. securities may be materially affected by events occurring after the close of the market on which they are traded, but before the Fund prices its shares.

Foreign Currency Translation: Assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Transactions denominated in foreign currencies, including purchases and sales of investments, and income and expenses, are translated into U.S. dollar amounts on the date of those transactions. Adjustments from foreign currency transactions are reflected in the statement of operations.

The Fund does not isolate the portion of the results of operations arising from the effect of changes in foreign exchange rates on investments from fluctuations arising from changes in market prices of investments held. Those fluctuations are included with net unrealized gain from portfolio investments and foreign currency.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

| Annual Report | May 31, 2024 | 15 |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of each input used to value the Fund as of May 31, 2024:

| Investments in Securities at Value* | Level 1 - Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

| Common Stocks | $ | 382,800,640 | $ | – | $ | – | $ | 382,800,640 | ||||||||

| Warrants | 2,603 | 104,553 | – | 107,156 | ||||||||||||

| Mutual Fund | 18,375,239 | – | – | 18,375,239 | ||||||||||||

| Short Term Investments | 3,083,442 | – | – | 3,083,442 | ||||||||||||

| Total | $ | 404,261,924 | $ | 104,553 | $ | – | $ | 404,366,477 | ||||||||

| * | See Schedule of Investments for industry classification. |

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis. Interest income, which includes accretion or amortization of discounts or premiums, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund. All of the realized and unrealized gains and losses and interest income is recognized on an accrual basis, are allocated daily to each class in proportion to its average daily net assets.

Class Expenses: Expenses that are specific to a class of shares of the Fund, including distribution fees (Rule 12b-1 fees), are charged directly to that share class.

| 16 | www.gr-funds.com |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

Federal Income Taxes: The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of its net taxable income and net capital gains, if any, each year so that the Fund will not be subject to excise tax on undistributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the year ended May 31, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required.

The Fund’s tax return is subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and three years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders: The Fund normally pays dividends and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and other income the Fund receives from its investments, including short-term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

3. TAX BASIS INFORMATION

Reclassifications: As of May 31, 2024, no permanent differences on book and tax accounting were reclassified. These differences had no effect on net assets:

| Paid-in Capital | Distributable Earnings | |||||

| $ | – | $ | – |

Tax Basis of Investments: As of May 31, 2024, the aggregate cost of investments, gross unrealized appreciation/(depreciation) and net unrealized appreciation/(depreciation) for federal tax purposes was as follows:

| Gross unrealized appreciation (excess of value over tax cost) | $ | 106,255,673 | ||

| Gross unrealized depreciation (excess of tax cost over value) | (16,057,937 | ) | ||

| Net appreciation (depreciation) of foreign currency and derivatives | (2,243 | ) | ||

| Net unrealized appreciation | $ | 90,195,493 | ||

| Cost of investments for income tax purposes | $ | 314,168,741 |

| Annual Report | May 31, 2024 | 17 |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

The difference between the federal income tax cost of portfolio investments and other financial instruments and the financial statement cost is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are due to the tax deferral of losses on wash sales and certain market to market adjustments.

Components of Distributable Earnings: As of May 31, 2024, components of distributable earnings were as follows:

| Undistributed ordinary income | $ | 7,931,214 | ||

| Accumulated capital loss | (15,592,229 | ) | ||

| Net unrealized appreciation | 90,195,493 | |||

| Other cumulative effect of timing differences | - | |||

| Total | $ | 82,534,478 |

Capital Losses: Under current law, capital losses maintain their character as short-term or long-term and are carried forward to the next tax year without expiration. As of the current fiscal year end, the following amounts are available as carry forwards to the next tax year:

| Short-Term | Long-Term | |||||

| $ | 11,095,357 | $ | 4,496,872 | |||

Capital loss carryovers used during the year ended May 31, 2024, were $6,735,796.

Capital Losses arising in the post-October period of the current fiscal year may be deferred to the next fiscal year if the fund elects to defer the recognition of these losses. When this election is made, any losses recognized during the period are treated as having occurred on the first day of the next fiscal year separate from and in addition to the application of normal capital loss carry forwards as described above.

There are no post-October losses deferred in the current year.

Tax Basis of Distributions to Shareholders: The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain were recorded by the Fund.

The tax character of distributions for the year ended May 31, 2024, were as follows:

| Distributions Paid From: | ||||

| Ordinary Income | $ | 7,851,486 | ||

| Total | $ | 7,851,486 | ||

| 18 | www.gr-funds.com |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

The tax character of distributions for the year ended May 31, 2023, were as follows:

| Distributions Paid From: | ||||

| Ordinary Income | $ | 2,687,318 | ||

| Total | $ | 2,687,318 | ||

4. SECURITIES TRANSACTIONS

The cost of purchases and proceeds from sales of securities (excluding short-term securities) during the year ended May 31, 2024, was as follows:

| Purchases of Securities | Proceeds from Sales of Securities | |||||

| $ | 155,788,145 | $ | 29,000,541 | |||

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Fund consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Fund or its creditors solely by reason of the purchaser’ ownership of the shares. Shares have no pre-emptive rights.

For the Year Ended May 31, 2024 | For the Year Ended May 31, 2023 | |||||||

| Institutional Class | ||||||||

| Shares sold | 12,218,809 | 6,691,933 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 416,161 | 162,951 | ||||||

| Shares redeemed | (2,730,556 | ) | (3,470,122 | ) | ||||

| Net increase in shares outstanding | 9,904,414 | 3,384,762 | ||||||

| Retail Class | ||||||||

| Shares sold | 464,085 | 494,814 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 52,134 | 19,946 | ||||||

| Shares redeemed | (369,089 | ) | (465,236 | ) | ||||

| Net increase in shares outstanding | 147,130 | 49,524 | ||||||

Shares redeemed within 30 days of purchase may incur a 2% short-term redemption fee deducted from the redemption amount. The Fund had redemption fees of $3,288 during the year ended May 31, 2024, and had redemption fees of $63,319 during the year ended May 31, 2023.

| Annual Report | May 31, 2024 | 19 |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

The Adviser, subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Board. Pursuant to the Investment Advisory Agreement (the “Advisory Agreement”), the Fund pays the Adviser an annual management fee of 0.90%, based on the Fund’s average daily net assets. The management fee is paid on a monthly basis.

The Adviser has contractually agreed to limit the amount of the Fund’s total annual fund operating expenses, exclusive of acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses, to 0.92% and 1.25% of the Fund’s average daily net assets for Institutional Class shares and Retail Class shares, respectively. This agreement is in effect through September 30, 2024, may only be terminated before then by the Board, and is reevaluated on an annual basis. With respect to the Fund, the Adviser shall be permitted to recover, on a class-by-class basis, expenses it has borne subsequent to the effective date of the agreement described above (whether through reduction of its management fee or otherwise) only to the extent that the Fund’s expenses in later periods fall below the lesser of (1) the expense limit in effect at the time the Adviser waives or limits the expenses and (2) the expense limit in effect at the time the Adviser seeks to recover the expenses; provided, however, that the Fund will not be obligated to pay any such reduced fees and expenses more than three years after the date on which the fee and expense was reduced. Fees waived by the Adviser for the year ended May 31, 2024, are disclosed in the Statement of Operations.

For the year ended May 31, 2024, the fee waivers were as follows:

| Fund | Fees Waived/Reimbursed by Adviser | |||

| Institutional Class | $ | (528,672 | ) | |

| Retail Class | (31,653 | ) | ||

| TOTAL | $ | (560,325 | ) | |

As of May 31, 2024, the balances of recoupable expenses for the Fund were as follows:

| Fund | Expiring in Fiscal Year 2024 | Expiring in Fiscal Year 2025 | Expiring in Fiscal Year 2026 | Expiring in Fiscal Year 2027 | ||||||||||||

| Institutional Class | $ | 450,412 | $ | 432,662 | $ | 546,978 | $ | 528,672 | ||||||||

| Retail Class | 83,049 | 74,725 | 69,639 | 31,653 | ||||||||||||

| TOTAL | $ | 533,461 | $ | 507,387 | $ | 616,617 | $ | 560,325 | ||||||||

Distributor: ALPS Distributors, Inc. (“ADI” or the “Distributor”) (an affiliate of ALPS Fund Services, Inc.) ("ALPS") acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, although it is not obliged to sell any particular amount of shares.

| 20 | www.gr-funds.com |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

ADI is not entitled to any compensation from the Fund for its services as Distributor; however, ADI receives compensation from the Adviser. ADI is registered as a broker-dealer with the U.S. Securities and Exchange Commission.

The Fund has adopted a Distribution and Services Plan pursuant to Rule 12b-1 of the 1940 Act (the "Plan”). The Plan allows the Fund, as applicable, to use the Fund’s assets to pay fees in connection with the distribution and marketing of the Fund’s shares and/or the provision of shareholder services to the Fund’s shareholders. The Plan permits payment for services in connection with the administration of plans or programs that use shares of the Fund as their funding medium and for related expenses. The recipients of such payments may include other affiliates of the Adviser, broker-dealers, financial institutions, plan sponsors and administrators and other financial intermediaries through which investors may purchase shares of the Fund. The Plan permits the Fund to make total payments at an annual rate of up to 0.25% of the average daily net asset value of the Retail Class. Because these fees are paid out of the Fund’s assets on an ongoing basis, over time they will increase the cost of an investment in the Fund, and Plan fees may cost an investor more than other types of sales charges.

Under the Shareholder Services Plan (a “Services Plan”), the Fund is authorized to compensate certain financial institutions, including broker-dealers and Fund affiliates which may include the Distributor, Adviser and/or the transfer agent (the “Participating Organizations”), for providing services to the Fund or the Fund’s shareholders. This compensation may be used by the financial institution for payments to financial institutions and persons who provide administrative and support services to their customers who may from time to time beneficially own Retail Class shares. The Services Plan permits the Fund to make total payments at an annual rate of up to 0.15% of the Fund’s average daily net assets attributable to its Retail Class shares. However, the Fund may pay fees under the Services Plan at a lesser rate. Shareholder Services Plan fees are included with distribution and service fees on the Statement of Operations.

Fund Administrator Fees and Expenses: ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund. Pursuant to an Administration Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assist in the Fund’s operations. Several officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. Administration fees paid by the Fund for the year ended May 31, 2024, are disclosed in the Statement of Operations.

The Administrator is also reimbursed by the Fund for certain out-of-pocket expenses.

Transfer Agent: ALPS serves as transfer, dividend paying and shareholder servicing agent for the Fund. ALPS receives an annual minimum fee, a fee based upon the number of shareholder accounts, and is also reimbursed by the Fund for certain out-of-pocket expenses. Transfer agent fees paid by the Fund for the year ended May 31, 2024, are disclosed in the Statement of Operations.

Compliance Services: ALPS provides services that assist the Fund’s chief compliance officer in monitoring and testing the policies and procedures of the Fund in conjunction with requirements under Rule 38a-1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out-of-pocket expenses by the Fund. Compliance services fees paid by the Fund for the year ended May 31, 2024, are disclosed in the Statement of Operations.

| Annual Report | May 31, 2024 | 21 |

| Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

Beneficial Ownership: The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the Fund under Section 2(a)(9) of the 1940 Act. As of May 31, 2024, there were no entities that beneficially owned 25% or greater of a Fund’s outstanding shares.

7. PRINCIPAL RISKS

The following is a description of select principal risks of the Fund’s portfolio, which may adversely affect its net asset value, yield and total return. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. As with any mutual fund, there is no guarantee that the Fund will achieve its investment objective. The Fund's prospectus and statement of additional information provide details of the risks the Fund is subject to.

Commodities Risk: Commodity prices can be extremely volatile, and exposure to commodities can cause the net asset value of the Fund’s shares to decline or fluctuate more than if the Fund had a broader range of investments. To the extent that the Fund is more heavily exposed to a commodity sub-sector that undergoes a period of weakness, an investor can expect poor returns from the Fund.

Natural Resources Investment Risk: Investment in companies in the natural resources industries can be significantly affected by (often rapid) changes in supply of, or demand for, various natural resources. They may also be affected by changes in energy prices, international political and economic developments, environmental incidents, energy conservation, the success of exploration projects, changes in commodity prices, and tax and other government regulations. Energy prices may decline sharply, and a prolonged slump in energy prices is likely to have a negative effect on companies that extract, process or deliver energy-related commodities. Managers and investors applying environmental, social or governance ("ESG") screens may preclude investment in some or all natural resources-related companies, which could adversely affect the performance of such companies, and in turn, the Fund.

Concentration Risk: The Fund concentrates its investments in natural resources investments. Concentrating in natural resources investments increases the risk of loss because the stocks of many or all of the companies in the natural resources industry may decline in value due to a development adversely affecting the industry or one or more particular sub-industries or commodities. In addition, investors may buy or sell substantial amounts of the Fund’s shares in response to factors affecting or expected to affect the natural resources industry, resulting in extreme inflows and outflows of cash into and out of the Fund. Such inflows or outflows might affect management of the Fund adversely to the extent they were to cause the Fund’s cash position or cash requirements to exceed normal levels.

Market Disruption and Geopolitical Risk: Geopolitical and other events, such as war (including Russia's military invasion of Ukraine), terrorist attacks, natural environmental disasters, or widespread pandemics (such as COVID-19) or other adverse public health developments may disrupt securities markets and adversely affect global economies and markets. In March 2023, number of U.S. domestic banks and non-U.S. banks experienced financial difficulties and, in some cases, failures. There can be no certainty that the actions taken by regulators to limit the effect of those financial difficulties and failures on other banks or other financial institutions or on the U.S. or non-U.S. economies generally will be successful. It is possible that more banks or other financial institutions will experience financial difficulties or fail, which may affect adversely other U.S. or non-U.S. financial institutions and economies. These events, as well as other changes in non-U.S. and U.S. economic and political conditions, could adversely affect the value of the Fund’s investments.

| 22 | www.gr-funds.com |

Goehring & Rozencwajg Resources Fund | Notes to Financial Statements and Financial Highlights |

May 31, 2024

8. INDEMNIFICATIONS

Under the Fund’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

9. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

| Annual Report | May 31, 2024 | 23 |

Goehring & Rozencwajg Resources Fund | Report of Independent Registered Public Accounting Firm |

GRANT THORNTON LLP 500 North Akard, Suite 1200 Dallas, TX 75201 | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| D +1 214 561 2300 | ||

| F +1 214 561 2370 |

Board of Trustees and Shareholders Goehring & Rozencwajg Resources Fund | ||

Opinion on the financial statements We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Goehring & Rozencwajg Resources Fund (the “Fund”), a portfolio of the Goehring & Rozencwajg Investment Funds, as of May 31, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the related notes (collectively referred to as the "financial statements”) and the financial highlights for each of the five years in the period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of May 31, 2024, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

| ||

Basis for opinion These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

| ||

| We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. | ||

| Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of securities owned as of May 31, 2024, by correspondence with the custodian and broker. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audit provides a reasonable basis for our opinion. | ||

| GT.COM | Grant Thornton LLP is a U.S. member firm of Grant Thornton International Ltd (GTIL). GTIL and each of its member firms are separate legal entities and are not a worldwide partnership. |

| 24 | www.gr-funds.com |

Goehring & Rozencwajg Resources Fund | Report of Independent Registered Public Accounting Firm |

| ||

| We have served as the Fund’s auditor since 2016. | ||

| Dallas, Texas | ||

| July 26, 2024 |

| Annual Report | May 31, 2024 | 25 |

| Goehring & Rozencwajg Resources Fund | Tax Designations |

May 31, 2024 (Unaudited)

1. FUND HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-PORT within 60 days after the end of the period. Copies of the Fund’s Form N-PORT are available without charge on the SEC's website at http://www.sec.gov. Quarterly portfolio holdings are also available on the Fund's website at http://www.gr-funds.com/#holdings

2. FUND PROXY VOTING POLICIES, PROCEDURES AND SUMMARIES

The Fund’s policies and procedures used in determining how to vote proxies and information regarding how the Fund voted proxies relating to portfolio securities during the most recent prior 12-month period ending June 30 are available without charge, (1) upon request, by calling (toll-free) 1-844-464-6467 and (2) on the SEC’s website at http://www.sec.gov.

3. TAX DESIGNATIONS

The Fund designates the following for federal income tax purposes for the calendar year ended December 31, 2023:

Qualified Dividend Income – 47.92%

Corporate Dividends Received Deduction – 37.66%

In early 2024 if applicable, shareholders of record should have received this information for the distributions paid to them by the Fund during the calendar year 2023 via Form 1099. The Fund will notify shareholders in early 2025 of amounts paid to them by the Fund, if any, during the calendar year 2024.

| 26 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Item 8 – Changes in and Disagreements with Accountants for Open-End Management Investment Companies |

May 31, 2024 (Unaudited)

There have been no changes in or disagreement with the Fund's independent accounting firm during the reporting period.

| Annual Report | May 31, 2024 | 27 |

| Goehring & Rozencwajg Resources Fund | Item 9 – Proxy Disclosures for Open-End Management Investment Companies |

May 31, 2024 (Unaudited)

There were no matters submitted to a vote of shareholders during the reporting period.

| 28 | www.gr-funds.com |

| Goehring & Rozencwajg Resources Fund | Item 10 – Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies |

May 31, 2024 (Unaudited)

Included under Item 7 in the Notes to Financial Statements.

| Annual Report | May 31, 2024 | 29 |

Goehring & Rozencwajg Resources Fund | Item 11 – Statement Regarding Basis for Approval of Investment Advisory Contract |

May 31, 2024 (Unaudited)

This is not applicable for this reporting period.

| 30 | www.gr-funds.com |

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Any changes in and disagreements with accountants and on accounting and financial disclosure are filed under Item 7 of this Form.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Any remuneration paid to directors, officers, and others are filed under Item 7 of this Form.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Not applicable.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to Registrant.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

| (a) | Not applicable to Registrant. |

| (b) | Not applicable to Registrant. |

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to Registrant.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees, where those changes were implemented after the Registrant last provided disclosure in response to the requirements of Item 407(c)(2) of Regulation S-K, or this Item.

Item 16. Controls and Procedures.

| (a) | The Registrant’s principal executive officer and principal financial officer have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the 1940 Act) are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report. |