Exhibit 1

RX Investor Value Corporation

August 30, 2016

Dear Fellow Stockholders of HealthWarehouse.com, Inc.:

We are writing to express our concerns regarding the relationship between Senior Lender Timothy Reilly and HealthWarehouse.com, Inc.

Reilly, through his entity Melrose Capital, owns the company's senior debt, which as publicly disclosed, is not only secured by all of the company's assets and cash flows, but bears an effective interest rate of 41% per annum. Melrose received 1.8 million warrants granted by the board since 2013 in exchange for various increases and extensions of this senior debt. Reilly, through another of his affiliated entities, Dellave, received an additional 2.3 million shares the board granted in a full value exchange of payables he bought at a discount, at the expense of the company and us stockholders. Reilly, through still another affiliated entity, MVI Holdings, owns a substantial majority of the company's Series B shares, which are permitted to vote at a ratio of 11.66 votes per share. In addition to Reilly, the current director Mr. Heimbrock, and the company's Chief Financial Officer, Dan Seliga, are or were at one time employed by MVI, and Reilly's daughters continue to own a substantial number of shares in MVI.

But that is not all. From his late filed Schedule 13D on August 15, 2016, Reilly for the first time discloses that he has also been actively accumulating shares in his own name. In fact, through these previously unreported open market purchases, Reilly now owns almost 1.3 million shares in his own name, in addition to shares owned through affiliates MVI, Dellave, and Melrose. Any acquisitions by family members were not identified.

Here's a table of Reilly's share ownership:

| · | 2,523,528 common shares from full-value exchange of discounted payables (Dellave) |

| · | 573,826 common shares from exercise of warrants granted as part of senior credit (Melrose) |

| · | 1,173,103 common shares personally owned |

| · | 97,000 common shares personally owned |

| · | 5,770,686 common share voting rights associated with Series B shares (MVI) |

10,138,143 voting shares

This represents an astounding 21.3 % of the voting power of the company!

And that's even before counting any shares that may be owned by family members, and before counting the 721,776 shares that the company's chief financial officer, Mr. Seliga owns from the warrants Melrose gifted to him while he was acting as CFO of the company which we discuss below. It is also before the 68,000 shares owned by Reilly's affiliate, board member Mr. Heimbrock. Add those shares in, and the Reilly-affiliates account for 22.7 % of the outstanding vote.

So why does this matter to you as a stockholder?

First, Reilly, is, and has been, a company insider. He attends board meetings, and has extensive visibility into the company. In his position of company insider, he has been able to engineer the favorable payables transactions for his benefit (as described in our letter dated August 22, 2016), appoint board members, and accumulate a substantial amount of personal and affiliated shares. More importantly, even though a company insider, he has been accumulating these shares quietly, without ever filing any required insider reports with the SEC, so that quite literally, until his late 13D filing on August 15, 2016, nobody could track these accumulations.

Second, we are concerned that Reilly's personal accumulation alone accounts for a substantial amount of trading volume of the company's shares, enough to visibly swing the share price during days of active trading.

Third, even if otherwise proper, the amount of ownership alone accounts for an enormous accumulation of power especially when combined with his position as the company's Senior Lender. This concentrates enormous leverage in the hands of one person. Expensive senior debt, generous warrant grants, payables transactions on questionable terms, gifts of stock to company officers; how much power should the current board have permitted one person to have?

And, while the current board touts that they want to put the company up for sale, who will be first and second in line, BEFORE any common stockholders receive anything? Reilly and his daughters who collectively own 95.7% of the Series B preferred. Upon a sale they would receive a combined $4.8M before the common shareholders received a dime. In its Form 8-K filed on August 8, 2016, the company disclosed its intentions to hire an investment banker with the purpose of exploring a sale of the company. The company's share price has risen 300% since the date which RIVC signed its confidentiality agreement with HEWA. The company's enterprise value exceeds two times revenue. How much more valuable can the company be than its current share price?

To sell the company at this time we believe is tantamount to a fire sale. The company has disclosed in every year in its Form 10-K since 2011 that it does not have the financial resources to adequately operate the company, revenue is in a long-term slide, the company has not kept all of its state licenses properly current and the company's own web site states that it cannot ship product timely.

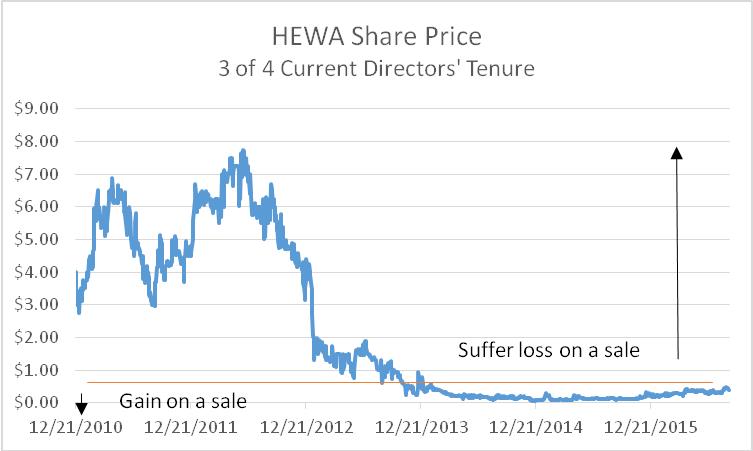

Who benefits from a sale? Not all shareholders. If a shareholder purchased shares at historical prices (see below), we believe he or she will sell shares at a loss if the company is sold in the near future.

Who owns shares purchased at a price below the current market price? Reilly owns approximately 2.9 million shares the board has granted to him in exchange for credit extensions and payables exchanged. Based upon the dates at which the Board has granted these shares, he owns these shares at a cost basis below the current market price. Mr. Seliga owns 0.7 million shares, he received via a gift from Reilly, at a cost basis of $0.10 and $0.12/ share, which are below the current market price. It is also worth noting that prior to joining HEWA, the company disclosed that Mr. Seliga had been a Managing Director of Melrose Capital and had been providing consulting services presumably as a Melrose Managing Director since August 2013. In Mr. Seliga's Form 4 filing dated July 29, 2016, he disclosed that on July 27, 2016 he had exercised warrants into 1,125,00 shares. It was also disclosed that Reilly as Managing Member of Melrose Partners had gifted these warrants that HEWA had granted to Melrose to extend the company's credit agreement. We question why Reilly would gift these shares to Seliga. Does this gift create a conflict of interest for Seliga when he was acting as the company's Chief Financial Officer while he was supposedly negotiating terms for the company's loan agreement with Reilly, the company's Senior Lender?

Also, as we outline above in a sale Reilly and his daughters are entitled to receive $4.8M preferential liquidation proceeds in a sale, which we speculate is considerably greater than Reilly's purchase price. We believe that the economic interest of Reilly and possibly the board itself is not aligned with many shareholders, in particular the long-term holders who have endured with the company over a period of disappointing performance.

We represent shareholders who believe the company has great potential but is far from fulfilling it. We oppose the board and others who would sell the company now before it fulfills its potential. We believe we have the plan, the experience and know-how to help HEWA achieve this potential, which will benefit all shareholders, not just a subset of shareholders.

| Sincerely, | ||

| RX INVESTOR VALUE CORPORATION | ||

| By: /s/ Jeffrey T. Holtmeier | ||

| Name: Jeffrey T. Holtmeier | ||

| Title: Chief Executive Officer |

If you have any questions or require any assistance with providing your proxy or any other matters, please contact Okapi Partners LLC, our proxy advisor, at (877) 259-6290.

RX INVESTOR VALUE CORPORATION ("RIVC") HAS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE "SEC") A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY CARD TO BE USED IN CONNECTION WITH THE SOLICITATION OF PROXIES FROM STOCKHOLDERS OF HEALTHWAREHOUSE.COM, INC. (THE "COMPANY") IN CONNECTION WITH THE COMPANY'S 2016 ANNUAL MEETING OF STOCKHOLDERS. ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY RIVC, MARK SCOTT, JEFFREY HOLTMEIER, BRIAN ROSS, MICHAEL PEPPEL AND DR. STEPHEN WEISS AND RELATED PARTICIPANTS IN THE SOLICITATION (COLLECTIVELY, THE "PARTICIPANTS") BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND AN ACCOMPANYING PROXY CARD ARE BEING FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, OKAPI PARTNERS, RIVC'S PROXY SOLICITOR, WILL PROVIDE COPIES OF THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARDWITHOUT CHARGE UPON REQUEST BY CALLING OKAPI TOLL-FREE AT 877-259-6290.

INFORMATION ABOUT THE PARTICIPANTS AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS BY SECURITY HOLDINGS IS CONTAINED IN THE DEFINITIVE SCHEDULE 14A FILED BY RIVC WITH THE SEC. THIS DOCUMENT CAN BE OBTAINED FREE OF CHARGE FROM THE SOURCES INDICATED ABOVE. MARK SCOTT OWNS 4,480,861 SHARES OF THE COMPANY. RIVC OWNS 1,100 SHARES OF THE COMPANY. BRIAN ROSS OWNS 0 SHARES OF THE COMPANY. MICHAEL PEPPEL OWNS 0 SHARES OF THE COMPANY. JEFFREY HOLTMEIER OWNS 19,900 SHARES OF THE COMPANY. DR. STEPHEN WEISS OWNS 1,020,000 SHARES OF THE COMPANY.