UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by a Party other than the Registrant | þ |

Check the appropriate box:

| | þ | Preliminary Proxy Statement |

| | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | ¨ | Definitive Proxy Statement |

| | ¨ | Definitive Additional Materials |

| | ¨ | Soliciting Material Pursuant to Rule 14a-12 |

HEALTHWAREHOUSE.COM, INC.

(Name of Registrant as Specified in its Charter)

RX Investor Value Corporation, Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross, and Dr. Stephen J. Weiss

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

PRELIMINARY COPY

SUBJECT TO COMPLETION DATED AUGUST 5, 2016

Rx Investor Value Corporation

August __, 2016

Dear Fellow Shareholders of HealthWarehouse.com, Inc.:

Rx Investor Value Corporation, a Delaware corporation (“RIVC”), was established by its two shareholders and its two officers, Jeffrey T. Holtmeier and Rob Smyjunas to invest additional growth capital into Healthwarehouse.com. RIVC is the holder of 1,100 shares of Healthwarehouse.com, Inc. (OTC: HEWA). Mr. Holtmeier is the owner of record of 19,900 shares of HEWA and Mr. Smyjunas is the owner of record of 225,300 shares in addition to their holdings their holdings owned through RIVC. RIVC is nominating four highly qualified director candidates for election to HEWA’s board at its annual meeting of shareholders to be held on September 2, 2016. We are sending you the attached proxy statement and the enclosed BLUE proxy card to solicit your proxy to elect our director candidates.

RIVC believes that HEWA needs new and more active leadership at the board level to improve the company’s financial performance, growth profile, balance sheet and ultimately the company’s lagging stock performance. The current directors have had a number of years to make the necessary changes to improve the company’s performance. We believe that the time has come for more qualified, experienced and active directors to lead HEWA.

Our four director candidates are Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross and Dr. Stephen J. Weiss. They are experienced operators and directors and bring a wealth of experience and a track-record of performance in healthcare, digital commerce and corporate finance. Their individual backgrounds are more fully described in the attached proxy statement.

We ask for your support by completing, signing, dating and returning in the enclosed postage-paid envelope the enclosed BLUE proxy card. If you hold HEWA shares through a bank, broker or other nominee, you must provide voting instructions to that entity. If you have not received a BLUE voting instruction card from your bank, broker or other nominee, you should immediately contact the person responsible for your account to obtain a voting instruction card.

We urge you not to return any proxy card provided by HEWA. To support RIVC, you should return our BLUE proxy card and discard any proxy card you receive from HEWA. You do not need to (and should not) vote “withhold” on HEWA’s proxy card to vote for our director candidates. You should not vote for any of the director candidates nominated by HEWA, or on any other matter, by returning HEWA’s proxy card. If you have already provided HEWA with an executed proxy, you may revoke it by executing a later dated BLUE proxy card and sending it to us in the enclosed postage-paid envelope (or, if you hold your shares through a bank, broker or other nominee, by sending a later dated BLUE voting instruction card to that entity).

If you have any questions or require any assistance with providing your proxy or any other matters, please contact Okapi Partners, our proxy advisor, at 888-991-1296.

Thank you for your support,

Rx Investor Value Corporation

Rx Investor Value Corporation

Proxy Statement

This proxy statement and enclosed BLUE proxy card are being provided by Rx Investor Value Corporation in connection with its solicitation of proxies from you, the holders of shares of common stock of HealthWarehouse.com, Inc.., a Delaware corporation (OTC: HEWA), to elect our four director candidates to HEWA’s board of directors at HEWA’s annual meeting of shareholders to be held at 5:00 p.m. (EDT) at the offices of HealthWarehouse.com, Inc., 7107 Industrial Road, Florence, Kentucky 41042, including any adjournments or postponements thereof and any meeting which may be called in lieu thereof.

RIVC’s director candidates are Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross and Dr. Stephen J. Weiss. The backgrounds and qualifications of our director candidates are described in this proxy statement in the section titled “Our Director Candidates.”

HEWA has set the record date for determining shareholders entitled to notice of and to vote at the annual meeting as July 29, 2016. Shareholders of record at the close of business on the record date will be entitled to vote at the annual meeting. According to HEWA, as of the record date, there were 42,160,786 shares of Common Stock outstanding and entitled to vote at the annual meeting.

This solicitation of proxies is being made by RIVC. Further information regarding RIVC and its affiliates is included in this proxy statement in the section titled “Information About Us.” This solicitation of proxies is not being made by or on behalf of the board of directors or management of HEWA.

This proxy statement and the enclosed BLUE proxy card are first being sent to HEWA’s shareholders on or about August__, 2016.

WE URGE YOU TO COMPLETE, SIGN, DATE AND RETURN IN THE ENCLOSED POSTAGE-PAID ENVELOPE THE ENCLOSED BLUE PROXY CARD TO ELECT OUR DIRECTOR CANDIDATES. YOU WILL NOT BE ABLE TO VOTE FOR OUR DIRECTOR CANDIDATES BY RETURNING A PROXY CARD THAT IS PROVIDED BY HEWA.

IF YOU HOLD HEWA SHARES THROUGH A BANK, BROKER OR OTHER NOMINEE, YOU MUST PROVIDE VOTING INSTRUCTIONS TO THAT ENTITY. IF YOU HAVE NOT RECEIVED A BLUE VOTING INSTRUCTION CARD FROM YOUR BANK, BROKER OR OTHER NOMINEE, YOU SHOULD IMMEDIATELY CONTACT THE PERSON RESPONSIBLE FOR YOUR ACCOUNT TO OBTAIN A BLUE VOTING INSTRUCTION CARD.

WE URGE YOU NOT TO RETURN ANY PROXY CARD PROVIDED BY HEWA. TO SUPPORT RIVC, YOU SHOULD RETURN OUR BLUE PROXY CARD AND DISCARD ANY PROXY CARD YOU RECEIVE FROM HEWA. YOU DO NOT NEED TO (AND SHOULD NOT) VOTE “WITHHOLD” ON HEWA’S PROXY CARD TO VOTE FOR OUR DIRECTOR CANDIDATES. YOU SHOULD NOT VOTE FOR ANY OF THE DIRECTOR CANDIDATES NOMINATED BY HEWA, OR ON ANY OTHER MATTER, BY RETURNING HEWA’S PROXY CARD.

IF YOU HAVE ALREADY PROVIDED HEWA WITH AN EXECUTED PROXY, YOU MAY REVOKE IT BY EXECUTING A LATER DATED BLUE PROXY CARD AND SENDING IT TO US IN THE ENCLOSED POSTAGE-PAID ENVELOPE (OR, IF YOU HOLD YOUR SHARES THROUGH A

BANK, BROKER OR OTHER NOMINEE, BY SENDING A LATER DATED BLUE VOTING INSTRUCTION CARD TO THAT ENTITY).

SEE THE BACK COVER PAGE OF THIS PROXY STATEMENT FOR FURTHER INFORMATION ON HOW TO VOTE YOUR HEWA SHARES.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

This Proxy Statement and our BLUE proxy card are available at

Questions and Answers Relating to this Proxy Solicitation

What are you asking HEWA’s shareholders to do?

We are asking for your support for the election to HEWA’s board of directors of our four director candidates, Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross and Dr. Stephen J. Weiss.

Our reasons are simple. We believe that a change in leadership is long overdue:

The company has underperformed for 5 consecutive years.

| · | The stock price has dropped from $8.00 to its current $____. |

| · | The company is positioned to grow exponentially by disrupting the distribution of generic prescriptions; instead, revenue has declined by over 30% over the past five years. |

| · | During these 5 years, the company has not had the financial resources to operate beyond a 12 month horizon. This financial stress inhibits focusing on operations and growth. |

| · | The company has defaulted under its senior credit facility for the non-payment of it vendors. A legal advisor has sued the company for almost $1 million of past due fees. |

| · | The board has not held management accountable. Despite the company’s dismal performance, the board has recently increased the CEO’s salary and guaranteed a bonus. |

| · | The board has increased it’s director pay from $1,000 to $3,000 of monthly cash compensation in spite of the company’s dismal performance and the company having only $24,866 of cash on hand, as stated in the 10-Q for the quarterly period ended March 31, 2016. |

| · | The company has lost their licenses in certain states and have not remedied in a timely manner putting their VIPPS certification at risk. |

| · | The company continues to pay excessive interest rates for ongoing capital to a related party with short term extensions on the senior debt consistently renewed with warrant coverage. |

| · | The company seems to be beholding to the senior lender. |

| · | The company has ignored advice from experts and major shareholders to expand into profitable markets to leverage their platform. |

| · | The company continues to deliver sub-par customer service, creating a high churn rate of subscribers. |

| · | The company has not marketed their value properly to the market. |

| · | The cash prescription market is estimated at >$100 billion per year in the US and growing at more than 20% CGR and the company revenue continues to decline in spite of their position as the “ONLY VIPPS CERTIFIED ONLINE PHARMACY IN THE USA”. |

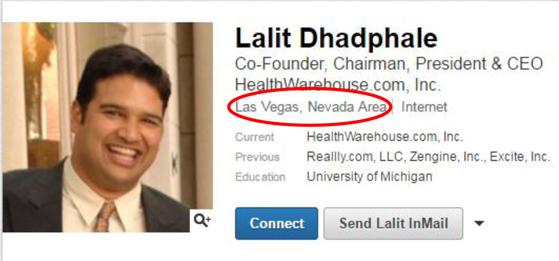

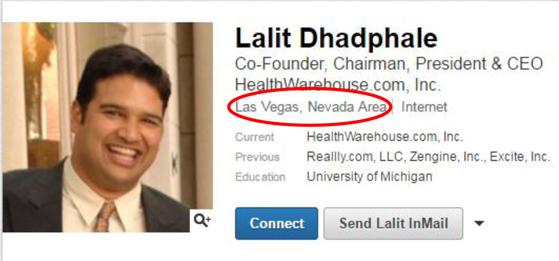

| · | The company’s CEO lives full time in Las Vegas and sporadically visits the Company’s headquarters |

| · | The company’s directors are apathetic to the poor results of management |

Our plan is to unleash the company’s dormant potential by:

| · | Infusing capital into the company tosettle vendor claims and to finance future growth. |

| · | Implementing a growth strategy whichunderstands consumer buying preferences, educates consumers about the company’s value proposition and which fulfills all generic prescriptions of the consumer. |

| · | Holding management accountable for performance metrics which create shareholder and only paying bonuses for results. |

| · | Aligning director compensation with growth and shareholder creation. |

Our director candidates have the experience and skill to execute this plan:

| · | Mr. Holtmeier is a serial entrepreneur who has rapidly grown digital marketing, telecommunications and technologies companies. He is an experienced director of both public and private companies. |

| · | Mr. Scott is a licensed pharmacist, and a successful entrepreneur in the both the mail order/on-line pharmacy industry and the call center industry. He owns 4,480,861 shares of common stock of the company, including warrants to purchase l,333,334 shares of common stock. |

| · | Mr. Ross is experienced as both a public company CFO and director. He has repositioned the product mix and refinanced the balance sheet that spurred the resurgence of a company on the brink of bankruptcy. |

| · | Dr. Weiss has founded and grown an on-line pharmacy. He is also an accomplished real estate investor. He owns 670,000 of common stock with right to purchase an additional 350,000 shares. |

As described more fully in this proxy statement, we believe our director candidates possess the skills, experience, energy and leadership abilities necessary to improve HEWA and actively create a growth profile which will lead to share price growth. Our director candidates will be active and responsible stewards of the trust placed in them by HEWA’s shareholders and will be committed to obtaining positive results for all shareholders.

Who are RIVC’s director candidates?

Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross and Dr. Stephen J. Weiss are highly qualified individuals with significant business experience. The principal occupation and business experience of each of these candidates is described in this proxy statement in the section titled “Our Director Candidates.” We believe that each of our director candidates will be considered independent under the listing standards of the OTC. None of our director candidates is affiliated with HEWA or any of its subsidiaries. If elected to HEWA’s board of directors, our director candidates will owe fiduciary duties to all of HEWA’s shareholders.

Who can provide a proxy?

If you are a record holder of HEWA shares as of the close of business on the record date for the annual meeting, which is July 29, 2016, you have the right to vote in person or by proxy on the election of directors and any other matters that may properly come before the annual meeting. If you are a record holder of HEWA shares at the close of business on the record date, you will retain your right to vote or provide a proxy even if you sell your HEWA shares after the record date.

How do I provide a proxy?

We urge you to complete, sign, date and return in the enclosed postage-paid envelope the enclosed BLUE proxy card to elect our director candidates. You will not be able to vote for our director candidates by returning a proxy card that is provided by HEWA. If you hold HEWA shares through a bank, broker or other nominee, you must provide voting instructions to that entity. If you have not received a BLUE voting instruction card from your bank, broker or other nominee, you should immediately contact the person responsible for your account to obtain a BLUE voting instruction card.

If you have already provided HEWA with an executed proxy, you may revoke that proxy by executing a later dated BLUE proxy card and sending it to us in the enclosed postage-paid envelope (or, if you hold your shares through a bank, broker or other nominee, by returning a later dated BLUE voting instruction card to that entity). We urge you not to sign or return any proxy card provided by HEWA. You do not need to (and should not) vote “withhold” on HEWA’s proxy card to vote for our director candidates. You should not vote on any other matter by returning HEWA’s proxy card. See the back cover page of this proxy statement for further information on how to vote your HEWA shares.

Can I vote by telephone or Internet?

If you hold your shares in registered form, information should be included with this proxy statement providing you instructions on how to vote by telephone or the Internet.

If you hold your shares through a bank, broker or other nominee, information may be included with this proxy statement from that entity providing you instructions on how to vote by telephone or the Internet. Many banks and brokerage firms participate in a program that allows eligible shareholders to vote by telephone or the Internet. If your bank or brokerage firm participates in the telephone or Internet voting program, then the bank or brokerage firm will provide you with instructions for voting by telephone or the Internet on the voting form that it provides to you. Telephone and Internet voting procedures, if available through your bank or brokerage firm, are designed to authenticate your identity and allow you to give your voting instructions and confirm that your instructions have been properly recorded.

If you have any questions or require any assistance with providing your proxy or any other matters, please contact Okapi Partners LLC, our proxy advisor, at 888-991-1296.

What is the deadline for providing a proxy?

We urge you to submit your proxy to us as soon as possible. For your proxy to be voted at the annual meeting, we must receive it on or prior to the date of the annual meeting. The annual meeting is scheduled to occur on September 2, 2016 at 5:00 p.m. (EDT) at the offices of HealthWarehouse.com, Inc., 7107 Industrial Road, Florence, Kentucky 41042.

Who is making this proxy solicitation?

This proxy solicitation is being made by RX Investor Value Corporation. We believe RIVC, together with other investors, who are operating as a group per XXXXXX, represents the largest single voting block of shareholder consisting of XX.X% of the outstanding shares based upon our most recent Schedule 13D filed with the SEC. RIVC owns 1,100 shares of common stock of HEWA as record owner and RIVC’s officers Jeffrey T. Holtmeier and Rob Smyjunas own 19,900 and 225,300 shares respectively. Mr. Holtmeier is one of our director candidates.

Why is RIVC making this proxy solicitation?

RIVC believes that HEWA needs new and more active leadership at the board level to improve the company’s financial performance, operating strategy, growth profile and ultimately the company’s lagging performance. The company’s stock price was once above $8.00. It has languished as a penny stock now for four years.Revenue has declined 32% from $10.4 million in 2011 to $7.0M in 2015. Since December 31, 2011 the company has not been able to secure adequate financing such that it can assure employees, vendors, customers and investors that it can continue operating as a going concern. We have significant concerns about this performance, but believe that there is tremendous opportunity for improvement at HEWA through new leadership. We believe this leadership must be in the form of a new, engaged directors, who will hold management accountable to a higher standard of performance.

We believe our director candidates possess the skills, experience, energy and leadership abilities necessary to improve HEWA and actively lead it in a new direction. Our director candidates will be active and responsible stewards of the trust placed in them by HEWA’s shareholders and will be committed to obtaining positive results for all shareholders.

How many proxies must be received for RIVC’s director candidates to be elected?

Under HEWA’s by-laws, shareholders are entitled to one vote for each share held by them on each matter coming before the annual meeting. HEWA directors are elected by a plurality of the votes cast at a meeting of shareholders at which a quorum is present, and cumulative voting is not permitted. The presence in person or by proxy of the holders of a majority of HEWA’s outstanding shares will constitute a quorum. HEWA is proposing that four directors be elected at the annual meeting for the available four board seats. Therefore, at the annual meeting, assuming a quorum is present, the four director nominees receiving the highest number of votes, whether cast in person or by proxy, will be elected to the HEWA board. Because the fourdirector candidates receiving the highest number of votes will be elected to HEWA’s board, every vote is important. We urge you to complete, sign, date and return in the enclosed postage-paid envelope the enclosed BLUE proxy card to elect our director candidates.

Can I revoke a proxy that I already provided to HEWA?

We urge you not to sign or return any proxy card or revocation card that may be sent to you by HEWA. If you have already provided HEWA with an executed proxy card or revocation card, you may revoke that document by executing a later dated BLUE proxy card and sending it to us in the enclosed postage-paid envelope (or, if you hold your shares through a bank, broker or other nominee, by returning a later dated BLUE voting instruction card to that entity). If you wish to revoke a proxy provided to HEWA, please send a copy of the revocation to Okapi Partners at the fax number included on the back cover page of this proxy statement so that we will be aware of all revocations and can attempt to ensure they are honored.

How do I vote on the other matters being presented by HEWA for vote at the annual meeting?

You can vote on all matters to be presented at the annual meeting on RIVC’s BLUE proxy card. We urge you not to return any proxy card provided by HEWA so as not to revoke your RIVC’s proxy card. Only the latest dated proxy card will be counted at the annual meeting.

The affirmative vote of a majority of the shares present or represented by proxy at the meeting or entitled to vote is required to approve HEWA’s executive compensation (say-on-pay) proposal. Due to the company’s declining financial performance, RIVC will vote its HEWA shares, and recommends that you vote your HEWA shares, “AGAINST” the company’s say-on-pay proposal. If you indicate your vote with respect to this proposal on our BLUE proxy card, we will vote your shares as instructed. If you do not specify a choice with respect to this proposal on our BLUE proxy card, we will vote your shares “AGAINST” this proposal.

The affirmative vote of a majority of the shares present or represented by proxy at the meeting or entitled to vote is required to ratify the appointment of Marcum LLP as HEWA’s independent auditors for the fiscal year ending December 31, 2016. RIVC will vote its shares “AGAINST” the company’s auditor ratification proposal due to what it believes are excessively high audit fees, which are disclosed in HEWA’s annual proxy statements. However, RIVC makes no recommendation with respect to this proposal. If you indicate your vote with respect to this proposal on our BLUE proxy card, we will vote your shares as instructed. If you do not specify a choice with respect to this proposal on our BLUE proxy card, we will vote your shares “AGAINST” with respect to this proposal.

Abstentions and proxies marked “withhold” for the election of directors, will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, but will not be counted for purposes of determining the number of votes cast with respect to a proposal. If your HEWA shares are held in the name of a brokerage firm and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to a proposal that is not a routine matter, the brokerage firm cannot vote the shares on that proposal. This is referred to as a “broker non-vote.” Under the rules and interpretations of the New York Stock Exchange, there are no “routine” proposals in a contested proxy solicitation. Because RIVC has initiated a contested proxy solicitation, there will be no “routine” matters at the annual meeting for any broker accounts that are provided with proxy materials by RIVC.

We urge you not to return any proxy card provided by HEWA. To support RIVC, you should return our BLUE proxy card and discard any proxy card you receive from HEWA. You do not need to (and should not) vote “withhold” on HEWA’s proxy card to vote for our director candidates. You should not attempt to vote for any of our director candidates, or on any other matter, by returning HEWA’s proxy card. If you have already provided HEWA with an executed proxy, you may revoke it by executing a later dated BLUE proxy card and sending it to us in the enclosed postage-paid envelope (or, if you hold your shares through a bank, broker or other nominee, by sending a later dated BLUE voting instruction card to that entity).

Who should I call if I have any questions?

If you have any questions, require any assistance in voting your HEWA shares, need any additional copies of our proxy materials, or have any other questions, please call Okapi Partners, our proxy advisor, at 888-991-1296.

Background to the Solicitation

The company has been operating in sub-standard manner for many years. The current board has had ample to time to reverse this course but has taken insufficient action. Due to its substandard financial performance and related inability to raise sufficient capital, the company’s Form 10K has disclosed that it may not be able to operate as a going concern for the past five years.

Excerpt from Footnote #2: Form 10K dated Dec 31, 2011

“As of December 31, 2011, the Company had negligible cash and a working capital deficiency of $2,404,464. During the year ended December 31, 2011, the Company generated revenues of $10,363,293, however and incurred a net loss of $5,712,199. During the year ended December 31, 2011, the Company generated $2,285,905 in net cash from financing activities, however, the Company used net cash in operating and investing activities of $2,799,580, and $883,868, respectively. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.”

Excerpt from Footnote #2: Form 10K dated Dec 31, 2012

“As of December 31, 2012, the Company had a working capital deficiency of $8,395,171 and an accumulated deficit of $20,828,674. During the year ended December 31, 2012, the Company incurred a net loss of $5,574,775 and used cash in operating activities of $947,911. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.”

Excerpt from Footnote #2: Form 10K dated Dec 31, 2013

“As of December 31, 2013, the Company had a working capital deficiency of $4,533,555 and an accumulated deficit of $28,130,668. During the years ended December 31, 2013 and 2012, the Company incurred net losses of $5,489,892 and $5,574,775, respectively and used cash in operating activities of $1,024,781 and $947,911, respectively. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.”

Excerpt from Footnote #2: Form 10K dated Dec 31, 2014

“As of December 31, 2014, the Company had a working capital deficiency of $4,237,165 and an accumulated deficit of $30,212,865. During the years ended December 31, 2014 and 2013, the Company incurred net losses of $1,783,279 and $5,489,892, respectively and used cash in operating activities of $875,769 and $1,024,781, respectively. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.”

Excerpt from Footnote #2: Form 10K dated Dec 31, 2015

“As of December 31, 2015, the Company had a working capital deficiency of $4,377,000 and an accumulated deficit of $31,159,401. During the years ended December 31, 2015 and 2014, the Company incurred net losses of $626,682 and $1,783,279, respectively and used cash in operating activities of $548,281 and $875,769, respectively. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.”

Indicative of the company’s inability to manage its financial affairs and loss of vendor confidence, the company disclosed in its Form 8-K dated May 24, 2016 that Taft Stettinius & Hollister, LLP has filed suit in the Court of Common Pleas for Hamilton County, Ohio for payment of $936,777 for past due legal services.

Contributing to the company’s poor financial condition is its declining revenue. Over the past five years, revenue has declined from a high of $11,081,429 in 2012 to the current year $7,018,137. Over this same time period the U.S. Department of Commerce reports that ecommerce continues to grow at approximately 15% per year.

Also, as the company has disclosed in its Form 8-K dated May 31, 2016, $212B of prescription brands have gone generic from 2009 to 2015. As the only Verified Internet Pharmacy Practice Site (VIPPS) licensed in all 50 states, the environment has been very conducive for HEWA to grow and take market. Instead the company has shrunk by over 30%.

Source: HEWA Form 10K filings

A consequence of declining financial performance and an inability to address its working capital deficiencies has been a severe decline share price to where it currently trades well below $1.00/ share. Investors have given the company a vote of no confidence; however, the board of directors do not seem to be listening. As the chart for HEWA below illustrates, the share price once was at a high of $8.00 in 2012 but since 2013 it has traded below $2.00. As of July 22, 2016, HEWA closed at $0.32.

Source: Charles Schwab & Co.

Why We Are Soliciting Proxies

Reasons for the Solicitation

We are soliciting your proxy to elect our four director candidates to the HEWA board of directors in an effort to solidify the company’s balance sheet so that the company can operate without concern that it will not be able to finance its operations and thus enable the company to implement a plan of accelerating revenue growth and improving financial performance. This in turn will lead to increased returns for all shareholders. We believe that five years is more than a sufficient amount of time to reverse the company’s performance and begin to capitalize on its unique market position.

We believe that the only way for the company to capitalize on its unique market position is through new leadership. We believe this leadership must be in the form of a new and more active board of directors who hold management accountable. We believe the HEWA board should be more actively involved in establishing and implementing new policies and practices in these areas. We believe these changes will result in improved company performance and improved returns for shareholders.

We believe our director candidates possess the skills, experience, energy and leadership abilities necessary to improve HEWA and actively lead it in a new direction. Our director candidates will be active and responsible stewards of the trust placed in them by HEWA’s shareholders and will be committed to obtaining positive results for all shareholders. If we are successful in our proxy solicitation, we plan to take the actions described at the end of this section.

The following is a summary of the reasons why we believe that change is necessary to achieve better results at HEWA.

1. We believe that HEWA’s stock has greatly underperformed.

As we noted above, a stock price which has decreased from $8.00 to less than $2.00 and has remained below $2.00 for over three years, is unacceptable performance.

New leadership through a new board, an effective operating strategy and fresh capital to fund both growth and the company’s working capital deficiency are required in order for sustained stock price appreciation.

2. We believe that HEWA’s financial performance has been subpar, and the company has not capitalized on the explosive growth of new generic drugs and its unique position as being the only licensed VIPPS in all 50 states.

Revenue has declined 32% from $10.4 million in 2011 to $7.0M in 2015. Revenues have increased from the period low, $6.1Min 2014, to $7.0M in 2016 on the fortuitous recognition in a Consumer Reports publication. Although beneficial, this is not a sustainable growth strategy.

The company needs a sustainable and effective growth strategy, that educates potential new customers of the company’s value proposition, and capital to fund it. The company should be both accelerating the growth of new customers as well as increasing their average spend.

3. HEWA has a serious working capital deficiency and one of its legal advisors is suing for payment. The company does not have sufficient liquidity to assure continued operations.

As of December 31, 2015, the company had a working capital deficiency of $4,377,000 and does not have the finances to address this. Taft Stettinius & Hollister, LLP has filed suit in the Court of Common Pleas for Hamilton County, Ohio for payment of $936,777 for past due legal services. This financial condition distracts the company from improving operations and likely has contributed to the poor operating performance by creating doubt amongst customers, vendors and customers about HEWA’s viability. It is also paying high rates of interest and distributing equity because it cannot secure appropriate financing.

The company needs new permanent capital with which it can eliminate its working capital deficiency and with which it can fund revenue growth.

4. The current Senior Lender is functioning as an insider, to the financial detriment of the Company.

Senior lender Tim Reilly and his Ohio limited liability company, Melrose Capital Advisors purchased Series Preferred B stock with inside knowledge of the company’s first quarter financial results, before the financials were publicly filed. Furthermore, he has purchased unsecured creditors from the company with board knowledge, however without disclosing this in public filings. This lack of transparency underlines the conflict of interest and leverage the senior lender has on the company, without the shareholder’s being notified. This breach of the board’s fiduciary duty can no longer be tolerated.

As noted in the company’s most recent 10-K, Tim Reilly and Melrose Capital Advisors has been the senior lender since 2013 and has accumulated 1,875,000 warrants of common stock over this time, an egregious amount that has diluted the shareholders. The board of directors is beholden to this senior lender for reasons that only can be attributed to self-serving entrenchment at the expense of the shareholders, another breach of fiduciary duty.

Below is a breakdown of the warrants received by the senior lender Tim Reilly and Melrose Capital Advisors:

On March 18, 2013 the board granted the lender warrants to purchase 750,000 shares at a purchase price of $0.35 per share. The lender later exercised the warrants on April 1, 2013 in a “cashless” transaction, and received 573,826 shares of Common Stock.

On September 30, 2013 the board granted the lender warrants to purchase 150,000 shares at a purchase price of $0.35 per share. On November 11, 2015 the board reset the lender’s purchase price to $0.12 per share.

On March 28, 2014 the board granted the lender warrants to purchase 150,000 shares at a purchase price of $0.35 per share. On November 11, 2015 the board reset the lender’s purchase price to $0.12 per share.

On April 29, 2014 the board granted the lender warrants to purchase 75,000 shares at a purchase price of $0.35 per share. On November 11, 2015 the board reset the lender’s purchase price to $0.12 per share.

On March 1, 2015 the board granted the lender warrants to purchase 500,000 shares at a purchase price of $0.10 per share.

On November 11, 2015 the board granted the lender warrants to purchase 250,000 shares at a purchase price of $0.12 per share.

On July 28, 2016, the board of directors approved and issued 2,253,528 shares of common stock to Dellave Holdings, LLC, of which Tim Reilly is the Managing Member, in exchange for the extinguishment of approximately $700,000 of accounts payable held by Dellave Holdings.

Note: This action took place one day before the record date for shareholders to be included in the upcoming September 3, 2016 meeting. The board of directors has again, betrayed their fiduciary duty to the shareholders in order to further entrench themselves.

The past record and continued actions by the board of directors could not be more clear: Provide favorable terms, arrangements and privileged information with Tim Reilly in exchange for his vote to keep them in their positions, at the expense of the shareholders.

Not only has the board of directors relentlessly issued shares to the senior lender, and then reset the price of those shares for the benefit of the lender, they also granted the lender a “Control of Accounts” mechanism. This action was approved by the board on October 22, 2015 and allows the lender to dictate the company’s bank to “Comply with all instructions it receives from Lender directing disposition of funds in the Accounts without further consent of Borrower.” This act can be triggered if the company is in default. This type of subservient action by the board to the senior lender is not only highly unusual but unsettling to shareholders as the company’s bank account is in perpetual jeopardy.

5. The board has not held management accountable.

Despite HEWA’s poor performance and falling short of it potential, the same CEO has led the company through the entire. In addition to not holding the CEO responsible for result, the board has permitted the CEO to reside 3 time zones away in Las Vegas, NV.

Source: www.linkedin.com

The company on disclosed in its proxy filing dated July 22, 2016 that it had increased the CEO’s annual salary from $100,000 to an initial base salary of $175,000 per year beginning May 9, 2016, with an increase to $185,000 per year on May 9, 2017, an annual target bonus of up to 100% of base salary under the annual bonus program for senior management of the Company, which bonus is payable 50% in cash and 50% in stock options, provided that for calendar years 2016 and 2017, Mr. Dhadphale will earn a minimum bonus of 30% of base salary. His new contract also provides for severance benefits of one year’s salary if the CEO leaves the company involuntarily.

We believe the board has acted irresponsibly in both increasing the compensation and guarantying a performance bonus in light of the company’s tenuous financial condition and lack luster performance.

5. We believe that HEWA’s corporate governance and shareholder relations have been poor.

As noted in the Company’s repeated filings over the last three years, the board has left the shareholders unaware the Company’s Senior Debt commitment and status. At times, the company has gone nearly an entire quarter without knowledge of whether the Company was pursuing other debt financing, as it sat in default month after month to the shareholder’s dismay and concern. This is not proper management of a public company and further reinforces the existing board of director’s disregard for providing crucial shareholder information.

6. We believe that HEWA will benefit from new and more active leadership at the board level.

We believe the concerns we have regarding HEWA’s financial performance, squandered achievement of its potential, and poor governance and shareholder relations can be solved by electing a new and more active board of directors that follows effective board practices. The solutions we see for HEWA cannot be achieved by a “business-as-usual” board that meets only five times per year. We believe it will take a board with solid credentials that is actively involved in developing programs and practices for the board and the company. When we say that our board nominees will actively lead HEWA in a new direction, we mean that our nominees will meet more regularly than the current HEWA board, will be actively involved in creating a robust growth strategy and cleaning up its balance sheet.

We also will hold senior management accountable for operating performance. We will not guarantee bonuses and will require that management devote their full attention to the attending of the company’s affairs. Given the company’s dismal performance, we find it completely unacceptable that the board has permitted the CEO to be disconnected from day-to-day operations and live in Nevada. We will require senior management to reside and work full-time in the greater Cincinnati area.

Concerning the chronic customer service issues the Company faces, HEWA's website currently states on its homepage that: "Processing time for OTC products remains 1-3 business days. Currently we're experiencing a surge in prescription medication order volume and are temporarily adding 2-4 extra days to normal prescription processing times. As always, we will try to ship your order as quickly as possible." This routine message can no longer be an excuse for failing and detached management.

This issue can and will be fixed with qualified proper management and capital allocation.

Our Plans for the Company

If we are successful in obtaining control of the HEWA board, it would be our intent to take the following actions:

| | • | Elect a new chairman of the board and implement changes to improve the company’s board practices, corporate governance and shareholder relations; |

| | • | Infuse new capital into the company to strengthen its balance sheet and remove doubt about the company’s ability to operate as a going concern; |

| | • | Infuse additional capital to finance new customer and revenue growth; |

| | • | Conduct an exhaustive review of the company’s SG&A and other expenses and implement cost-cutting measures where appropriate; |

| | • | Undertake performance reviews for each senior executive of the company and review their performance against appropriate benchmarks; and |

| | • | Attract new marketing and operations talent to the company. |

Our Commitment to HEWA and its Shareholders

With your support, we are committed to replacing the current HEWA board with four experienced, capable and energetic director candidates. Our slate of highly qualified directors has a track record of success in all areas that require attention. We are determined to effect positive change at HEWA, and we expect to be held accountable to the shareholders to whom we will ultimately report. Our director candidates will be active and responsible stewards of the trust placed in them by you and will be committed to obtaining positive results for all shareholders. Every vote is critical, so please vote the BLUE proxy card and indicate to the current board that you believe the company can do better.

Our Director Candidates

HEWA reports that its board of directors is currently comprised of five directors. The shareholders nominate and vote for four shareholders. The owners of the Series B Convertible Preferred nominate and elect one director. Under applicable law, each of our candidates, if elected, would hold office until HEWA’s next annual meeting of shareholders and until such person’s successor has been elected or until such person’s death, resignation, retirement or removal.

Under HEWA’s by-laws, shareholders are entitled to one vote for each share held by them on each matter coming before the annual meeting. HEWA directors are elected by a plurality of the votes cast at a meeting of shareholders at which a quorum is present, and cumulative voting is not permitted. The presence in person or by proxy of the holders of a majority of HEWA’s outstanding shares will constitute a quorum. HEWA is proposing that four directors be elected at the annual meeting. Therefore, at the annual meeting, assuming a quorum is present, the four director nominees receiving the highest number of votes, whether cast in person or by proxy, will be elected to the HEWA board.

If all of RIVC’s candidates are elected to the HEWA board, RIVC will control the board. RIVC, its affiliates and director candidates will vote their shares in favor of our four director candidates. RIVC is not soliciting proxies to vote shares in favor of any of HEWA’s candidates. To support RIVC, you should return only our BLUE proxy card and not vote HEWA’s proxy card or for any of their nominees.

Each of our director candidates has consented in writing to be nominated as a director of HEWA, to being named as a director nominee in this proxy statement and to serve on HEWA’s board of directors if elected or appointed to the board. At the annual meeting, we will nominate each of these director candidates for election to HEWA’s board of directors.

Our Candidates

The following sets forth information about each of RIVC’s director candidates. Included below is the name, age, present principal occupation, and other biographical and experience information for each of our director candidates. We believe that each of our director candidates will be considered currently independent under the listing standards of the OTC.

Nominees

Jeffrey T. Holtmeier, 58 years old, is an entrepreneur in technology and communications, with numerous companies founded, built and successfully sold or transitioned. Mr. Holtmeier is currently the Chief Executive Officer and Founder of GENext, LLC, where Mr. Holtmeier has worked since February 2001. A holding company, GENext controls assets including companies in China, the USA and Pakistan, and is unaffiliated with HEWA. He is a principal and Chairman of Cinnova, a Pakistan-based digital media and software development company focused on leading edge web and mobile applications. He has deep boardroom experience as a result of service on the Boards of Directors of a number of U.S. and Chinese companies, both public and private is also currently a board member and a member of the audit and special committee at iSign Solutions (ISGN), where he has served in various roles since August 2011.

Business address: 201 East Fifth Street Cincinnati, OH USA 45202.

Director qualifications: Mr. Holtmeier has experience on other public company boards of directors, as an entrepreneur, and in mergers and acquisitions. Other directorships: iSign Solutions, Inc. (OTC:ISGN)

Shareholding and dates acquired: 3,305 shares on 8/13/15; 5 shares on 8/18/15; 300 shares on 8/21/15; and 16,390 shares on 8/27/15, all through GENext LLC. Holtmeier conveyed 100 shares to RIVC on 4/26/16.

Brian Ross, 58 years old, is the Principal of Mid-Market Growth Partners. Mr. Ross started the company 2014 to provide consulting services and rigorous analytical tools to assist clients achieve their strategic objectives and to improve their financial results. In 2013, Mr. Ross founded AssuredMedPay, a healthcare start-up focused upon streamlining the payment process for individual responsible claims of corporate sponsored medical plans. Previously, Mr. Ross served as President (2010- 2011) and President and CEO (2011-2012) of KnowledgeWorks, an educational non-profit that provides innovative teaching pedagogies. Prior to joining KnowledgeWorks, Mr. Ross served both as the COO and CFO as part of his 13-year tenure at Cincinnati Bell.

Business address: 4410 Carver Woods Drive, Suite 103, Blue Ash, OH 45242

Director qualifications: Mr. Ross has experience as a financial executive and director of public companies. He is also designated a financial expert as defined by NASDAQ and securities laws.

Other directorships: Alaska Communications (NASDAQ: ALSK); Otelco, Inc. (Nasdaq: OTEL), Journal Media Group, Inc. (NYSE: JMG). Until the saleApril 2016 of the company to Gannett, Journal Media Group, Inc. (NYSE: JMG).

Shareholding and dates acquired: none

Mark Scott, 45 years old is a licensed pharmacist, and a successful entrepreneur in the both the mail order/on-line pharmacy industry and the call center industry. Mark earned his Bsc (Pharm) from the University of Manitoba in 1998. In 2002 Mark was a co-founder and President of Glenway Pharmacy, a mail order pharmacy in Winnipeg, Canada. Mark also co-founded “Goodway Management and Call Center” a company that specialized in mail order pharmaceutical sales to consumers. Mark also launched a near shore call center on the island of Barbados that also specialized in mail order pharmacy retailing. In 2012 Mark co-founded KpiConnect, a call center company that has no relation to the pharmacy industry.

Director Qualifications: Mr. Scott is a Pharmacist who also has extensive experience in the business-to-consumer mail-order and online retailing of pharmaceuticals. His expertise in the call center business is also a valuable asset to the customer service component required to acquire and maintain customers.

Shareholdings: Mr. Scott through Cormag Holdings, Ltd. Beneficially owns 4,480,861 shares of common stock of the company, including warrants to purchase l,333,334 shares of common stock. Cormag Holdings is a Canadian corporation and Mark Douglas Scott is the President, sole stockholder and director of Cormag and has sole voting and dispositive power with respect to the shares owned by Cormag. Mr. Scott is a Canadian citizen. Mr. Scott acquired 2,666,668 shares and 1,333,334 warrants on August 21 2014.

Dr. Stephen J. Weiss, 62 years old, graduated from the University of Manitoba School of Dentistry in 1977. He established a dental practice upon graduation at the age of twenty-three that grew to 30 employees and in the top 1% of dental practices in the city of Winnipeg, Manitoba.

In December of 1978, he began a tandem career in real estate investment and development in Scottsdale, Arizona and in 1998, with both businesses flourishing, he and his family elected to pursue the real estate business on a full time basis, establishing full time residence in Scottsdale, Arizona. Dr. Weiss’s real estate investments and developments are primarily focused in the Arizona market and secondarily in the Las Vegas market and Lafayette, Colorado. Dr. Weiss became a US citizen in July of 2003.

Dr. Weiss was also one of the founders of Prescription Drugs Canada, LLP, an online pharmacy based in Scottsdale, Arizona and Winnipeg, Manitoba to supply prescription drugs sourced in Canada at affordable prices for American residents, that was ultimately sold. Dr. Weiss’s real estate ventures include land acquisition, land syndications, residential land assembly, entitlement and sales to tract and custom homebuilders, shopping center development, office/warehouse development for condominium unit sales and rental.

Business address: 10405 E. McDowell Mountain Ranch Road, Suite 250, Scottsdale, AZ 85255

Director qualifications: Mr. Weiss has experience in healthcare and pharmaceutical industries, and has expertise in capital allocation and financial analysis.

Other directorships: none

Shareholding and dates acquired: 670,000 of common stock with right to purchase an additional 350,000 shares, acquired 8/15/14.

We recommend and urge you to vote FOR the election of our director candidates by completing, signing, dating and returning in the enclosed postage-paid envelope the enclosed BLUE proxy card. If you hold HEWA shares through a bank, broker or other nominee, you must provide voting instructions to that entity. If you have not received a BLUE voting instruction card from your bank, broker or other nominee, you should immediately contact the person responsible for your account to obtain a BLUE voting instruction card.

Our Proposed Compensation Program for Directors

The company disclosed in its proxy statement dated July 22, 2016, the following.“In February 2015, the Compensation Committee approved a new compensation plan for non-management directors, which included monthly cash compensation of $1,000 per director and quarterly stock option grants under our stock option plans with a grant date value of $3,000 per director. In July 2015, the Compensation Committee approved a revision to the compensation plan, changing the monthly cash compensation to $3,000 per director ($5,000 per director beginning April 2016) and the quarterly stock option grants under our stock option plans with a grant date value of $9,000 per director.”

This compensation took place while the company currently had only $24,866 of cash on hand, as stated in its most recent Form 10-Q. While the company is struggling to survive, the board has increased its monthly pay. This act is a total disconnect from the board maintaining its fiduciary duty.

If we are successful in our efforts to obtain control of the HEWA board, we will implement newnon-employee director compensation that is equity based. RIVC believes that HEWA has significant growth potential and correspondingly significant value creation for its shareholders.Equity based compensation more appropriatelyaligns director compensation with the interests of shareholders than the current cash compensation.

We plan to assess HEWA’s financial condition, the expected time commitment of the newly elected directors in light of HEWA’s financial condition and its current challenges, our plans to have a more active and involved board of directors and an increased number of board meetings from the board’s prior practices, and other relevant factors to make a determination regarding director compensation that we believe is fair and reasonable to our directors and HEWA’s shareholders.

How to Provide a Proxy to Us

We urge you to complete, sign, date and return in the enclosed postage-paid envelope the enclosed BLUE proxy card to elect our director candidates. You will not be able to vote for our director candidates by returning a proxy card that is provided by HEWA. If you hold HEWA shares through a bank, broker or other nominee, you must provide voting instructions to that entity. If you have not received a BLUE voting instruction card from your bank, broker or other nominee, you should immediately contact the person responsible for your account to obtain a BLUE voting instruction card. See the back cover page of this proxy statement for further information on how to vote your HEWA shares.

We urge you not to sign or return any proxy card or revocation card that may be sent to you by HEWA. If you have already provided HEWA with an executed proxy card or revocation card, you may revoke that document by executing a later dated BLUE proxy card and sending it to us in the enclosed postage-paid envelope (or, if you hold your shares through a bank, broker or other nominee, by returning a later dated BLUE voting instruction card to that entity).

WE URGE YOU NOT TO RETURN ANY PROXY CARD PROVIDED BY HEWA. YOU DO NOT NEED TO (AND SHOULD NOT) VOTE “WITHHOLD” ON HEWA’S PROXY CARD TO VOTE FOR OUR DIRECTOR CANDIDATES. YOU SHOULD NOT VOTE FOR ANY OF HEWA’S DIRECTOR NOMINEES ON ANY OTHER MATTER ON HEWA’S PROXY CARD.

If you have any questions or require any assistance with providing your proxy or any other matters, please contact Okapi Partners, our proxy advisor, at 888-991-1296.

Your proxy will authorize the proxy holders named on the proxy, with full powers of substitution and resubstitution, to raise and second motions to nominate candidates for election to HEWA’s board of directors, and to vote all HEWA shares that you hold as of the record date, at the annual meeting and at any adjournments or postponements of such meeting and at any meeting called in lieu of such meeting, in each case subject to applicable law.

Your proxy will be voted as directed by you thereon and in the discretion of the proxy holders with respect to any other matters that may properly come before the annual meeting, including any matters incidental to the conduct of the meeting. If no choice is specified by you with respect to the election of our director candidates, the proxy holders will vote your shares for each of our director candidates, against HEWA’s say-on-pay proposal, against the auditor ratification proposal, and vote in the discretion of the proxy holders on any other matters coming before the meeting, including any matters incidental to the conduct of the meeting. The proxy holders will not vote any of the proxies for any of the director candidates nominated by HEWA’s board.

In the event that (i) any of our director candidates is unable to serve or for good reason is unwilling to serve as a member of HEWA’s board of directors and/or (ii) HEWA or any other person takes or announces any action that has, or if consummated would have, the effect of disqualifying any or all of our director candidates, the proxy holders will have the right to nominate, and to vote your shares for the election of, such other nominees as RIVC may designate, subject to applicable law and the requirements of HEWA’s governing documents. If HEWA or any other person makes or announces any changes to HEWA’s certificate of incorporation or by-laws or takes or announces any other action that has, or if consummated would have, the effect of decreasing the size of its board of directors, the proxy holders will have the right to nominate, and vote your shares for the election of, the nominees that are selected in the sole discretion of the proxy holders, other than for any nominee for whom the authority to vote has been withheld on your proxy, subject to applicable law. Should the proxy holders identify or nominate substitute nominees before HEWA’s annual meeting, RIVC will supplement this proxy statement.

Any proxy may be revoked prior to the proxy being voted at the annual meeting. You may revoke a proxy by properly executing and delivering a later dated proxy or by delivering a written revocation of proxy. If you wish to revoke a proxy provided to HEWA, please send a copy to Okapi Partners at the fax number included on the back cover page of this proxy statement so that we will be aware of all revocations and can attempt to ensure they are honored.

At the annual meeting, HEWA is requesting approval, on an advisory, non-binding basis, of the compensation of HEWA’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the company’s compensation discussion & analysis, the compensation tables and the narrative discussion, as contained in HEWA’s proxy statement (so called “say-on-pay”). Due to the company’s declining financial performance, we recommend that you vote against this proposal. You may vote on this proposal on the enclosed BLUE proxy card (or through the BLUE voting instruction card provided by your bank, broker or other nominee). If you indicate your vote with respect to this proposal on our BLUE proxy card, we will vote your shares as instructed. If you return our BLUE proxy card and do not include directions on how to vote with respect to this proposal, the proxy holders will vote your shares against this proposal. You should not return HEWA’s proxy card to vote on this proposal, for any of the director candidates nominated by the HEWA board, or any other matter.

HEWA is submitting the selection of Marcum LLP as its independent auditors for ratification by shareholders at the annual meeting. RIVC will vote its shares “AGAINST” the company’s auditor ratification proposal due to what it believes are excessively high audit fees, which are disclosed in HEWA’s annual proxy statements. However, we make no recommendation to shareholders regarding how you should vote on this proposal. You may vote on this proposal on the enclosed BLUE proxy card (or through the BLUE voting instruction card provided by your bank, broker or other nominee). If you indicate your vote with respect to this proposal on our BLUE proxy card, we will vote your shares as instructed. If you return our BLUE proxy card and do not include directions on how to vote with respect to this proposal, the proxy holders will vote your shares against this proposal. You should not return HEWA’s proxy card to vote on this proposal, for any of the director candidates nominated by the HEWA board, or any other matter.

Your vote is important. Please complete, sign, date and return the enclosed BLUE proxy card in the enclosed postage-paid envelope today. If you hold HEWA shares through a bank, broker or other nominee, please vote in favor of our director candidates by providing voting instructions to your bank, broker or such other nominee. If you have not received a BLUE voting instruction card from your bank, broker or other nominee, you should immediately contact the person responsible for your account to obtain a BLUE voting instruction card. See the back cover page of this proxy statement for further information on how to vote your HEWA shares.

Other Matters Being Presented by HEWA at the Annual Meeting

Auditor Ratification

HEWA is submitting the selection of Marcum LLP as HEWA’s independent auditors for the fiscal year ending December 31, 2016 for ratification by shareholders at the annual meeting. RIVC will vote its shares “FOR” the company’s auditor ratification proposal. However, we make no recommendation to shareholders regarding how you should vote on this proposal.

You may vote on this proposal on the enclosed BLUE proxy card (or through the BLUE voting instruction card provided by your bank, broker or other nominee). If you indicate your vote with respect to this proposal on our BLUE proxy card, we will vote your shares as instructed. If you return our BLUE proxy card and do not include directions on how to vote with respect to this proposal, the proxy holders will vote your shares against this proposal. You should not return HEWA’s proxy card to vote on this proposal, for any of the director candidates nominated by the HEWA board, or any other matter.

Information About Us

Rx Investor Value Corporation, a Delaware corporation (“RIVC”), was established by its two shareholders and its two officers, Jeffrey T. Holtmeier and Rob Smyjunas to invest additional growth capital into Healthwarehouse.com.

Michael Peppel provides consulting services to RIVC, but is not a director, officer or promoter of RIVC. Mr. Peppel does not receive any compensation or payment of any kind for his consulting services to RIVC. Mr. Peppel’s consulting services to RIVC relate to industry knowledge. In 2010, Mr. Peppel pled guilty to criminal charges involving prohibited advanced recognition of revenue and associated charges connected to corporate financial transactions involving those funds, and fraud for actions relating to his services as chief executive officer of MCSI Inc., a publicly-traded audio-visual and technology company. He was sentenced on October 24, 2011 by a United States district court to seven days of imprisonment. The government appealed the sentence and, after its reversal, on June 4, 2013 he was resentenced and has completed that sentence. As part of a Consent Agreement with the SEC, Mr. Peppel has agreed to never serve as an officer or director of a publicly-traded company.

Solicitation of Proxies

This solicitation of proxies is being made by RIVC. Proxies may be solicited by mail, telephone, e-mail, fax, telegraph, in person or through advertisements or press releases. Each of our director candidates, the other participants named in this proxy statement, and other employees and agents of RIVC may assist in the solicitation of proxies without any additional remuneration.

We have retained Okapi Partners for advisory services in connection with this solicitation and to assist us in the solicitation of proxies. For such services, we have agreed to pay Okapi Partners a fee of up to $42,000, in addition to reimbursement of its out-of-pocket expenses. We have also agreed to indemnify Okapi Partners against liabilities and expenses arising out of its services to us in connection with this solicitation of proxies, except where any such liabilities arise out of any gross negligence or willful misconduct by Okapi Partners. It is anticipated that Okapi Partners will employ approximately 25 persons to solicit HEWA’s shareholders.

We plan to solicit proxies from individuals, banks, brokers, dealers, bank nominees, trust companies, and other nominees and institutional holders. We will be requesting banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the HEWA shares they hold of record, and we will reimburse these record holders for their reasonable out-of-pocket expenses in doing so.

The expense of preparing, assembling, printing and mailing this proxy statement and related materials and the cost of soliciting proxies will be borne by RIVC. If RIVC is successful in obtaining the election of one or more of its director candidates to the HEWA board, RIVC may request that HEWA reimburse the costs and expenses incurred by RIVC in connection with this solicitation and our efforts to obtain board representation. If our director candidates comprise a majority of the HEWA board of directors after the conclusion of this solicitation, we anticipate that they will approve the reimbursement of our fees and expenses. RIVC does not anticipate that such reimbursement would be presented to the shareholders of HEWA for a vote, but RIVC would favor such presentation for a vote if a sufficient number of shareholders of HEWA expressed a desire for such vote to occur. We anticipate that our fees and expenses incurred in connection with this solicitation and our other efforts to obtain board representation could total up to $XXXXX or more. We estimate that our expenses to date total approximately $XXXXX.

Information About HEWA

Based on documents publicly filed by HEWA, the mailing address of the principal executive offices of HEWA is 7107 Industrial Road, Florence, Kentucky 41042.

Forward-Looking Statements

This proxy statement contains statements that are not historical facts but are “forward-looking” in nature. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or conditions to be materially different from any future results or conditions expressed or implied by such forward-looking statements. In some cases, such forward-looking statements may be identified by terminology such as “may,” “will,” “could,” “should,” “expects,” “intends” or “believes” or the negative of such terms or other comparable terminology. Shareholders should not place undue reliance on any such forward-looking statements.

Questions

If you have any questions about anything in this proxy statement or the procedures to be followed to execute and deliver a proxy, please contact Okapi Partners, our proxy advisor, at the toll-free telephone number included on the back cover page of this proxy statement.

Rx Investor Value Corporation

August __, 2016

Important: How to Provide a Proxy to Us

Your vote is important. No matter how many HEWA shares you own, please provide a proxy to vote in favor of our director candidates by taking five steps:

| | • | Check the boxes indicating a vote FOR our four director candidates on the enclosed BLUE proxy card; |

| | • | Check the box indicating a vote AGAINST on HEWA’s say-on-pay proposal on the enclosed BLUE proxy card; |

| | • | Check the box indicating your vote on HEWA’s auditor ratification proposal, or leave the box unchecked, on the enclosed BLUE proxy card; |

| | • | SIGN and DATE the enclosed BLUE proxy card; and |

| | • | MAIL the enclosed BLUE proxy card to us in the enclosed postage-paid envelope. |

If any of your HEWA shares are held in the name of a bank, broker or other nominee, only that entity can vote your HEWA shares and only upon receipt of your specific instructions. Accordingly, if you received a BLUE voting instruction card from your bank, broker or other nominee, you should immediately complete, sign, date and return the BLUE voting instruction card to that entity. If you have not received a BLUE voting instruction card from your bank, broker or other nominee, you should immediately contact the person responsible for your account to obtain a BLUE voting instruction card. We urge you to confirm to us in writing any voting instructions provided to a bank, broker or other nominee, by calling or sending a faxed copy of the executed voting instruction card to Okapi Partners, our proxy advisor, at the toll-free telephone number or fax number provided below, so that we will be aware of all instructions given and can attempt to ensure that such instructions are followed.

We urge you not to sign any proxy card or revocation card that may be sent to you by HEWA. To support RIVC, you should return our BLUE proxy card and discard any proxy card you receive from HEWA. You do not need to (and should not) vote “withhold” on HEWA’s proxy card to vote for our director candidates. You should not vote for any of the director candidates nominated by HEWA, or on any other matter, by returning HEWA’s proxy card.

If you have already provided HEWA with an executed proxy, you may revoke it by executing a later dated BLUE proxy card and sending it to us in the enclosed postage-paid envelope (or, if you hold your shares through a bank, broker or other nominee, by sending a later dated BLUE voting instruction card to that entity).

If you have any questions, require any assistance in voting your HEWA shares, need any additional copies of our proxy materials, or have any other questions, please call XXXXXXX, our proxy advisor, at the toll-free telephone number included below.

PRELIMINARY COPY

SUBJECT TO COMPLETION DATED AUGUST 5, 2016

XXXXXXXXX

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Toll-free number: 888-991-1296

Fax: (973) 338-1430

[FORM OF PROXYCARD]

HEALTHWAREHOUSE.COM, INC.

2016 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF rx iNVESTOR vALUE cORPORATION, Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross, and Dr. Stephen J. Weiss

THE BOARD OF DIRECTORS OF HEALTHWAREHOUSE.COM

IS NOT SOLICITING THIS PROXY

The undersigned appoints each of Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross, and Dr. Stephen J. Weiss, as attorney and agent with full power of substitution to vote all shares of common stock or preferred stock of HealthWarehouse.com. (the “Company”) which the undersigned would be entitled to vote if personally present at the 2016 Annual Meeting of Stockholders of the Company scheduled to be held at the offices of the Company, on September 2, 2016 at 5:00 P.M (local time) (including any adjournments or postponements thereof and any meeting called in lieu thereof, the “Annual Meeting”).

The undersigned hereby revokes any other proxy or proxies heretofore given to vote or act with respect to the shares of common stock or preferred stock of the Company held by the undersigned, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the herein named attorneys and proxies or their substitutes with respect to any other matters as may properly come before the Annual Meeting that are unknown to RX Investor Value Corporation, Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross, and Dr. Stephen J. Weiss (collectively, “RIVC”) a reasonable time before this solicitation.

IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED “FOR” PROPOSAL 1 AND “AGAINST” PROPOSALS 2 AND 3.

This Proxy will be valid until the completion of the Annual Meeting. This Proxy will only be valid in connection with RX Investor Value Corporation, solicitation of proxies for the Annual Meeting.

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

☐ Please mark vote as in this example

RIVC STRONGLY RECOMMENDS THAT STOCKHOLDERS VOTE IN FAVOR OF THE NOMINEES LISTED BELOW IN PROPOSAL 1. RIVC RECOMMENDS A VOTE AGAINST PROPOSALS 2 and 3.

1. RIVC’s proposal to elect Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross, and Dr. Stephen J. Weiss to serve as directors of the Company until the 2017 annual meeting of stockholders.

| | FOR ALL NOMINEES | | WITHHOLD AUTHORITY | | FOR ALL EXCEPT |

| Jeffrey T. Holtmeier | | o | | o | | o ___________ |

| Mark Scott | | o | | o | | o ___________ |

| Brian A. Ross | | o | | o | | o ___________ |

| Dr. Stephen J. Weiss | | o | | o | | o ___________ |

RIVC does not expect that our Nominees will be unable to stand for election, but, in the event that any Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by this proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Company’s Bylaws and applicable law. In addition, RIVC has reserved the right to nominate substitute person(s) if the Company makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of Common Stock represented by this proxy card will be voted for such substitute nominee(s).

RIVC intends to use this proxy to vote “FOR” Jeffrey T. Holtmeier, Mark Scott, Brian A. Ross, and Dr. Stephen J. Weiss. The names, background and qualification of the candidates who have been nominated by the Company, and other information about them, can be found in the Company’s proxy statement.

Note: If you do not wish for your shares of Common Stock to be voted “FOR” a particular nominee, mark the “FOR ALL EXCEPT” box and write the name of the Nominee you do not support on the line below. Your shares will be voted for the remaining nominee.

2. Company’s proposal to ratify the appointment of Marcum LLP as independent registered public accounting firm for the year ending December 31, 2016.

3. Company’s proposal to cast a non-binding advisory vote to approve executive compensation.

4. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting.

| | | |

| DATED: | | |

| |

(Signature) |

| |

(Signature, if held jointly) |

| |

(Title) |

WHEN SHARES ARE HELD JOINTLY, JOINT OWNERS SHOULD EACH SIGN. EXECUTORS, ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH SIGNING. PLEASE SIGN EXACTLY AS NAME APPEARS ON THIS PROXY.