and disruption in the U.S. and world economies. The extent to which our results of operations or our overall value will be affectedby the COVID-19 virus will largely depend on future developments, which are highly uncertain and cannot be accurately predicted, including new information which may emerge concerning the severityof the COVID-19 virus and the actions required to be undertaken tocontain the COVID-19 virus or treat its impact. Given the uncertainty, no assurance can be given that the estimated value of our shares, as determined by our board of directors on April 24, 2020, has not declined. As a result of shutdowns, quarantines or actual viral health issues, construction and completion of our development projects may be delayed or we may incur additional costs beyond those assumed in determining our estimated net asset value. Market fluctuations may affect our ability to obtain necessary funds for our operations from current lenders or new borrowings. In addition, we may be unable to obtain financing for the acquisition of investments on satisfactory terms, or at all. The occurrence of any of the foregoing events or any other related matters could materially and adversely affect our financial performance and our overall value.

In reliance on the temporary relief from ongoing reporting requirements granted to filers pursuant to Rule 257(f) of the Securities Act of 1933, as amended, we delayed the filing of this Annual Report beyond April 29, 2020 due to circumstances relating to coronavirus disease 2019 or COVID-19. In particular, our board of directors determined to change our independent public accounting firm to KPMG, LLP (“KPMG”). Due to restrictions on travel and stay-at-home orders imposed as a result of COVID-19, the transition from our former auditor to KPMG was delayed, and as a result we were delayed in filing this Annual Report beyond April 29, 2020.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Our Investments

As of December 31, 2019, we had investments in two development projects through two separate Cottonwood Joint Ventures:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Project Name | | Property Location | | | Units to

be Built | | | Net Rentable

Square Feet | | | Estimated

Completion | | Investment

at 12/31/19 | | | Joint

Venture

Interest | | | Dated

Contracted | |

Park Avenue | | | Salt Lake City, UT | | | | 235 | | | | 167,130 | | | August 2021 | | $ | 12,013,089 | | | | 76.4 | % | | | 8/10/2018 | |

Cottonwood on Broadway | | | Salt Lake City, UT | | | | 254 | | | | 207,642 | | | October 2021 | | $ | 8,636,848 | | | | 81.2 | % | | | 8/6/2019 | |

We are required to commit up to a total of $15.8 million and $23.2 in capital for the development of Park Avenue and Cottonwood on Broadway, respectively. Unfunded amounts will be drawn as needed to complete the projects.

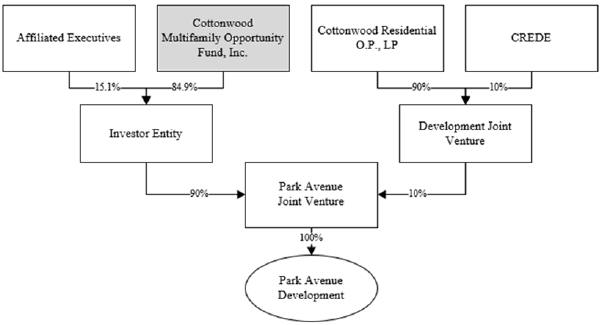

Park Avenue will include a mix of studio,one-bedroom, andtwo-bedroom units and have a fitness center, clubhouse, and resort-style pool and lounge area. The total development cost of the project is expected to be approximately $57,600,000, of which approximately $20,000,000 is expected to be funded by capital contributions from CROP, CREDE (aco-developer), affiliated executives, and us through the Park Avenue Joint Venture. SeeNote 3 of the consolidated financial statements for further discussion regarding this structure.

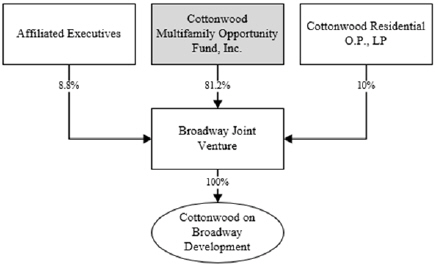

Cottonwood on Broadway will include a mix of studio,one-bedroom, andtwo-bedroom units and have a fitness center, clubroom, and aroof-top resort-style pool. The total development cost of the project is expected to be approximately $73,600,000, of which approximately $30,000,000 is expected to be funded by capital contributions from CROP, affiliated executives, and us through the Cottonwood on Broadway Joint Venture. SeeNote 3 of the consolidated financial statements for further discussion regarding this structure.

Results of Operations

For the year ended December 31, 2019, we had net losses of $71,841, primarily from asset management fees and other general and administrative expenses offset by interest income earned on cash received from our Offering. We expect asset management fees and other general and administrative expenses to increase in future periods as a result of more capital being deployed.

During 2018, we had losses of $138,021 from asset management fees and other general and administrative expenses.

During 2017 and 2018 CROP purchased 1.73 acres of contiguous land from three separate parties for development of Cottonwood on Broadway. In February 2019, CROP received a third party broker opinion of value which valued the land for $7.5 million. On August 6, 2019, we entered into a joint venture with CROP and affiliated executives of CROP, whereby we will contribute 81.2% of the capital required for the project, with CROP contributing 10% and the affiliated executives contributing the remaining 8.8%. As of December 31, 2019, we had contributed $8,636,848 to the joint venture.

2