NI Holdings, Inc. Annual Meeting of Shareholders | September 15, 2017

SAFE HARBOR STATEMENT This presentation contains “forward - looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on our management’s beliefs and assumptions and on information currently available to management. These forward - looking statements include, without limitation, statements regarding our industry, business strategy, plans, goals, and expectations concerning our market position, product expansion, future operations, margins, profitability, future efficiencies, and other financial and operating information. When used in this discussion, the words “may,” believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “potential,” “could,” “will,” “future,” and the negative of these or similar terms and phrases are intended to identify forward - looking statements. Forward - looking statements involve known and unknown risks, uncertainties, inherent risks, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward - looking statements. Forward - looking statements represent our management’s beliefs and assumptions only as of the date of this presentation. Our actual future results may be materially different from what we expect due to factors largely outside our control, including the occurrence of severe weather conditions and other catastrophes, the cyclical nature of the insurance industry, future actions by regulators, our ability to obtain reinsurance coverage at reasonable rates and the effects of competition. These and other risks and uncertainties associated with our business are described under the heading “Risk Factors” in our most recently filed Annual Report on Form 10 - K, which should be read in conjunction with this presentation. The company and subsidiaries operate in a dynamic business environment, and therefore the risks identified are not meant to be exhaustive. Risk factors change and new risks emerge frequently. Except as required by law, we assume no obligation to update these forward - looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward - looking statements, even if new information becomes available in the future.

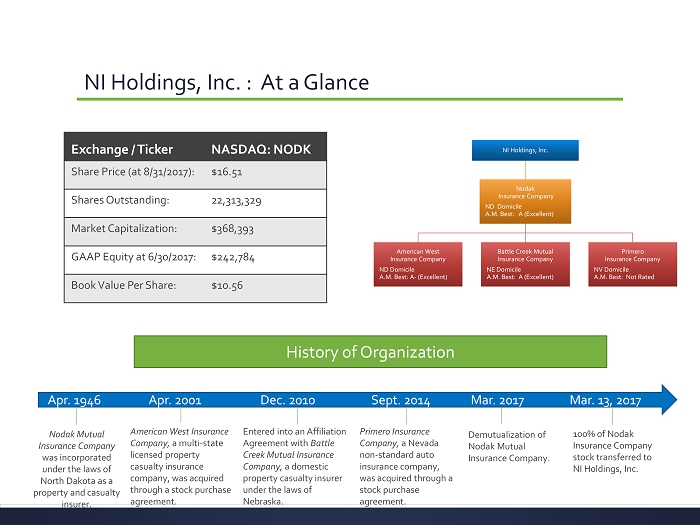

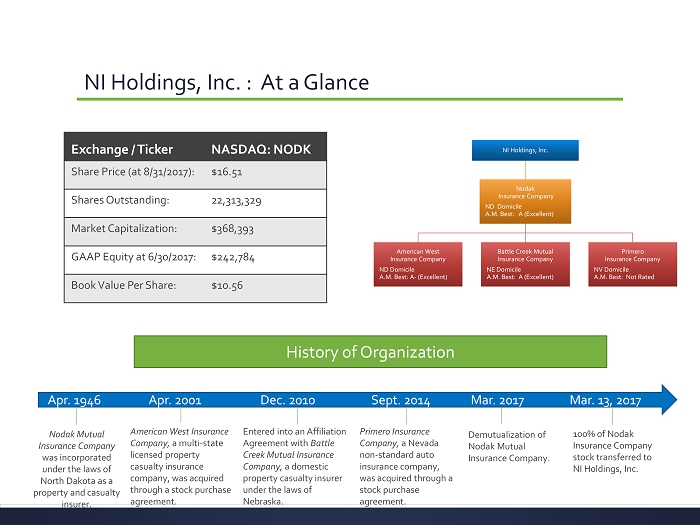

NI Holdings, Inc. : At a Glance Exchange / Ticker NASDAQ: NODK Share Price (at 8/31/2017): $16.51 Shares Outstanding: 22,313,329 Market Capitalization: $368,393 GAAP Equity at 6/30/2017 : $242,784 Book Value Per Share: $10.56 NI Holdings, Inc. Nodak Insurance Company ND Domicile A.M. Best: A (Excellent) American West Insurance Company ND Domicile A.M. Best: A - (Excellent) Battle Creek Mutual Insurance Company NE Domicile A.M. Best: A (Excellent) Primero Insurance Company NV Domicile A.M. Best: Not Rated History of Organization Apr. 1946 Apr. 2001 Dec. 2010 Sept. 2014 Mar. 2017 Mar. 13, 2017 100% of Nodak Insurance Company stock transferred to NI Holdings, Inc. Nodak Mutual Insurance Company was incorporated under the laws of North Dakota as a property and casualty insurer. American West Insurance Company, a multi - state licensed property casualty insurance company, was acquired through a stock purchase agreement. Entered into an Affiliation Agreement with Battle Creek Mutual Insurance Company, a domestic property casualty insurer under the laws of Nebraska. Primero Insurance Company, a Nevada non - standard auto insurance company, was acquired through a stock purchase agreement. Demutualization of Nodak Mutual Insurance Company.

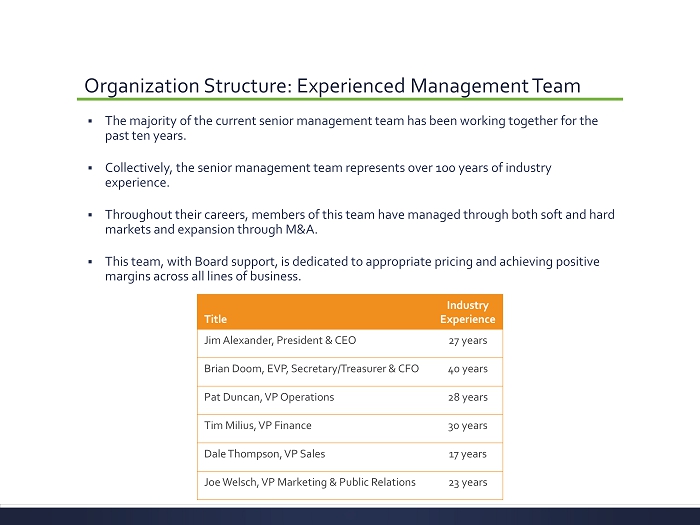

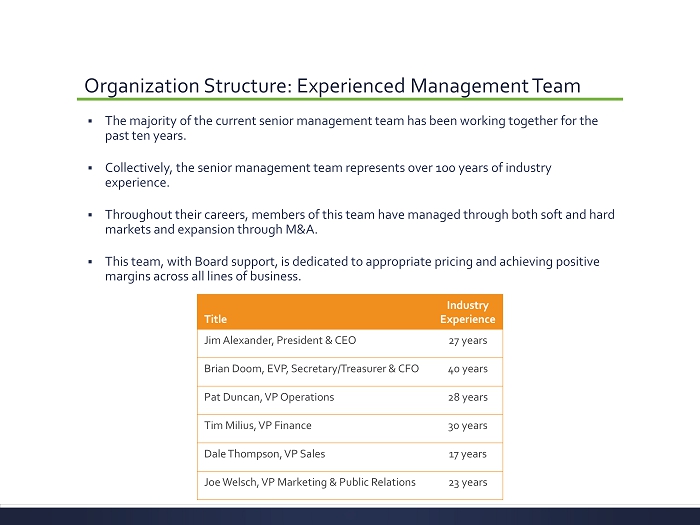

Organization Structure: Experienced Management Team ▪ The majority of the current senior management team has been working together for the past ten years. ▪ Collectively, the senior management team represents over 100 years of industry experience. ▪ Throughout their careers, members of this team have managed through both soft and hard markets and expansion through M&A. ▪ This team, with Board support, is dedicated to appropriate pricing and achieving positive margins across all lines of business. Title Industry Experience Jim Alexander, President & CEO 27 years Brian Doom, EVP , Secretary/Treasurer & CFO 40 years Pat Duncan, VP Operations 28 years Tim Milius, VP Finance 30 years Dale Thompson, VP Sales 17 years Joe Welsch, VP Marketing & Public Relations 23 years

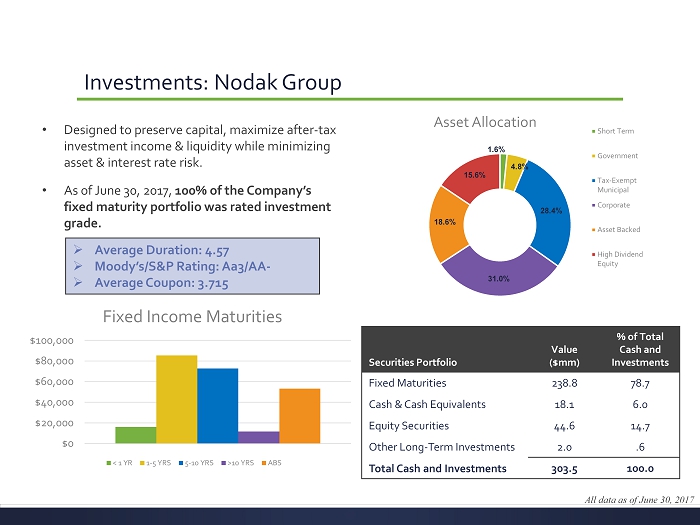

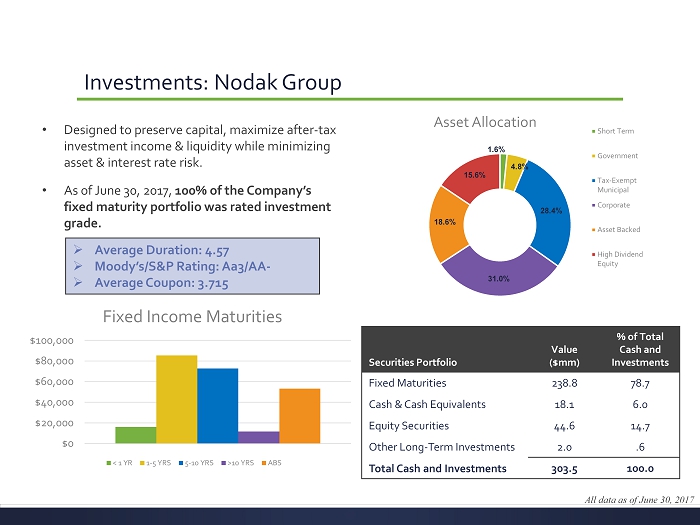

Investments: Nodak Group 1.6% 4.8% 28.4% 31.0% 18.6% 15.6% Asset Allocation Short Term Government Tax-Exempt Municipal Corporate Asset Backed High Dividend Equity All data as of June 30, 2017 $0 $20,000 $40,000 $60,000 $80,000 $100,000 Fixed Income Maturities < 1 YR 1-5 YRS 5-10 YRS >10 YRS ABS Securities Portfolio Value ($mm) % of Total Cash and Investments Fixed Maturities 238.8 78.7 Cash & Cash Equivalents 18.1 6.0 Equity Securities 44.6 14.7 Other Long - Term Investments 2.0 .6 Total Cash and Investments 303.5 100.0 • Designed to preserve capital, maximize after - tax investment income & liquidity while minimizing asset & interest rate risk. • As of June 30, 2017, 100% of the Company’s fixed maturity portfolio was rated investment grade. » Average Duration: 4.57 » Moody’s/S&P Rating: Aa3/AA - » Average Coupon: 3.715

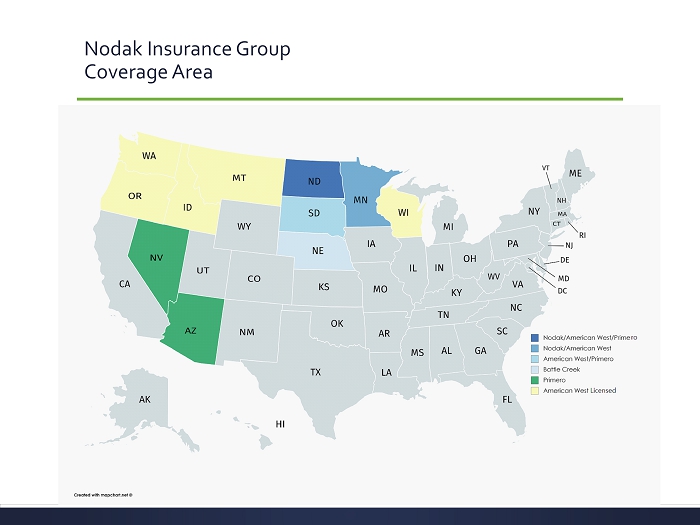

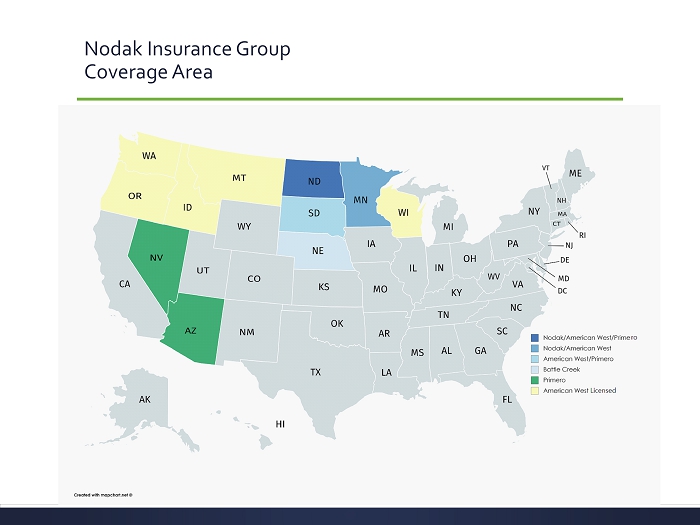

Nodak Insurance Group Coverage Area

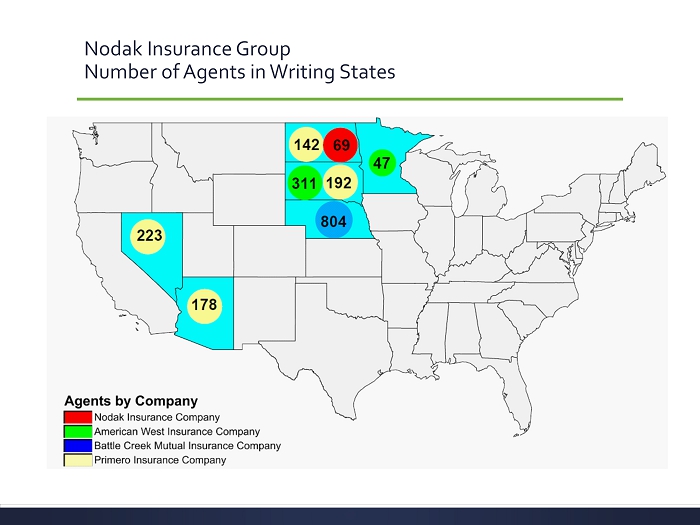

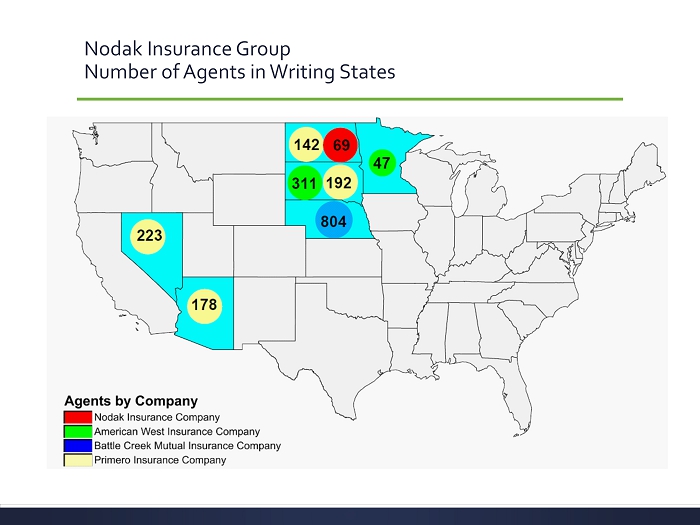

Nodak Insurance Group Number of Agents in Writing States

Nodak Insurance Group 2016 Direct Premiums Written by State

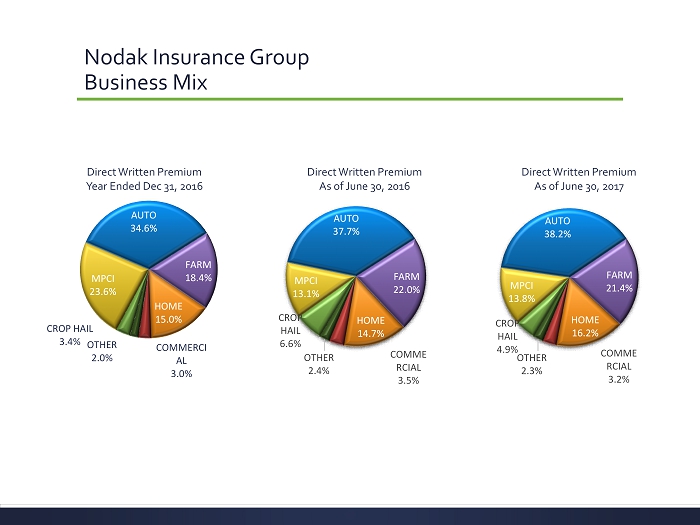

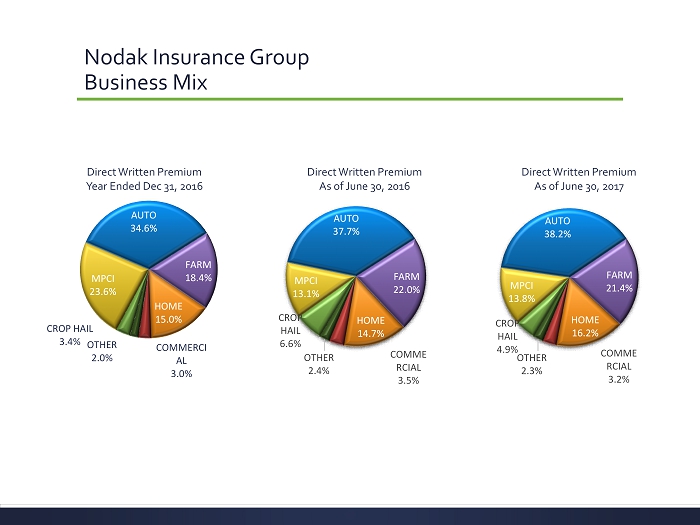

Nodak Insurance Group Business Mix CROP HAIL 3.4% MPCI 23.6% [CATEGORY NAME] [VALUE] FARM 18.4% HOME 15.0% COMMERCI AL 3.0% OTHER 2.0% Direct Written Premium Year Ended Dec 31, 2016 CROP HAIL 6.6% MPCI 13.1% AUTO 37.7% FARM 22.0% HOME 14.7% COMME RCIAL 3.5% OTHER 2.4% Direct Written Premium As of June 30, 2016 CROP HAIL 4.9% MPCI 13.8% AUTO 38.2% FARM 21.4% HOME 16.2% COMME RCIAL 3.2% OTHER 2.3% Direct Written Premium As of June 30, 2017

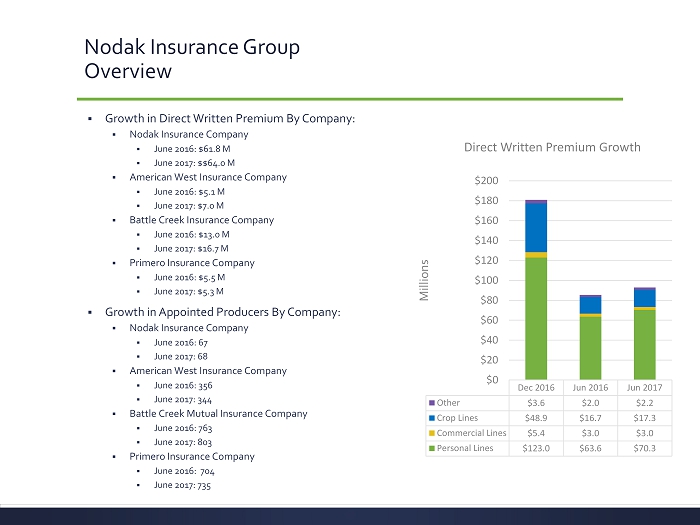

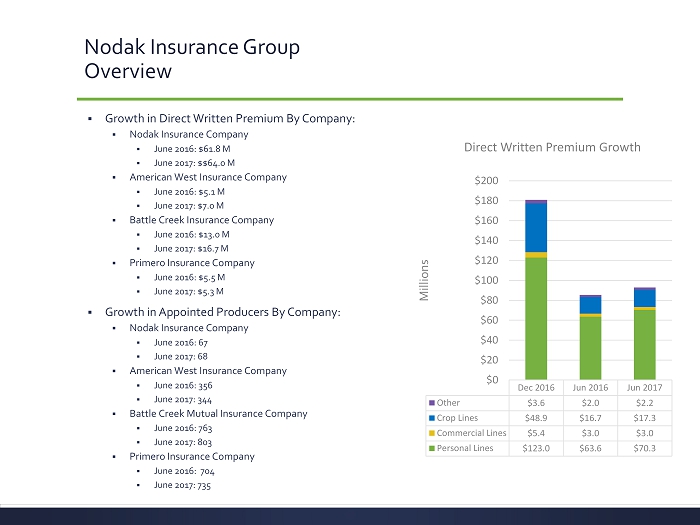

Nodak Insurance Group Overview ▪ Growth in Direct Written Premium By Company: ▪ Nodak Insurance Company ▪ June 2016: $61.8 M ▪ June 2017: $$64.0 M ▪ American West Insurance Company ▪ June 2016: $5.1 M ▪ June 2017: $7.0 M ▪ Battle Creek Insurance Company ▪ June 2016: $13.0 M ▪ June 2017: $16.7 M ▪ Primero Insurance Company ▪ June 2016: $5.5 M ▪ June 2017: $5.3 M ▪ Growth in Appointed Producers By Company: ▪ Nodak Insurance Company ▪ June 2016: 67 ▪ June 2017: 68 ▪ American West Insurance Company ▪ June 2016: 356 ▪ June 2017: 344 ▪ Battle Creek Mutual Insurance Company ▪ June 2016: 763 ▪ June 2017: 803 ▪ Primero Insurance Company ▪ June 2016: 704 ▪ June 2017: 735 Dec 2016 Jun 2016 Jun 2017 Other $3.6 $2.0 $2.2 Crop Lines $48.9 $16.7 $17.3 Commercial Lines $5.4 $3.0 $3.0 Personal Lines $123.0 $63.6 $70.3 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 Millions Direct Written Premium Growth

Award - Winning Workplace ▪ Nodak Insurance Company and Battle Creek Mutual Insurance Company are rated A (Excellent) by A.M. Best. American West Insurance Company carries an A - (Excellent) rating. Primero Insurance Company is not rated. ▪ Nodak Insurance Company is recognized as one of Ward’s 50 Top Performing Property/Casualty Insurance Companies for five consecutive years and six in the last seven years. ▪ Nodak Insurance Company is recognized by United Way of Cass - Clay as one of the top 50 most generous workplaces.