UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

REGULATION A OFFERING STATEMENT

UNDER THE SECURITIES ACT OF 1933

Hathaway Activated

Carbon, Inc.

Corporate:

Hathaway Activated Carbon, Inc.

PO Box 356, 45 Franks Road

Leoma, Tennessee 38468

(931) 231-5450

| Best Efforts Offering of 200,000 - 7% Convertible Preferred Stock Shares |

| Offering Price per 7% Convertible Preferred Stock Share: $100.00 (USD) |

| Minimum Offering: 20,000 - 7% Convertible Preferred Stock Shares |

DIVIDEND POLICY: Dividends on this 7% Convertible Preferred Stock will be payable on a cumulative basis, when and if declared by the Company’s Board of Directors, or an authorized committee of the Board of Directors, at an annual rate of 7.00% on the stated value of $100.00 per share. Interest is calculated and accrues daily.

The proposed sale will begin as soon as practicable after this Offering Circular has been qualified by the Securities and Exchange Commission. A maximum of 200,000 - 7% Convertible Preferred Stock Shares are being offered to the public at $100.00 per 7% Convertible Preferred Stock Unit. The minimum number of 7% Convertible Preferred Stock Shares that must be sold prior to the Company having access to the Investment Proceeds is TWENTY THOUSAND Shares of 7% Convertible Preferred Stock Shares. A maximum of $20,000,000.00 will be received from the Offering. No Securities are being offered by any selling shareholders. The Company will receive all proceeds from the sale of Securities less any sales commission or finder’s fee of up to 5% of the Offering.

The Offering will commence promptly after the date of this Offering Circular and will close (terminate) upon the earlier of (1) the sale of 200,000 - 7% Convertible Preferred Stock Shares, (2) One Year from the date of Qualification of this Offering by the United States Securities and Exchange Commission, or (3) a date prior to the date of the one year anniversary of the Qualification of this Offering by the United States Securities and Exchange Commission as so determined by the Company’s Management (the “Offering Period”).

DATED: June 1st, 2017

THE COMPANY SHALL MAKE ARRANGEMENTS TO PLACE FUNDS RAISED IN THIS OFFERING IN AN ESCROW, TRUST OR SIMILAR ACCOUNT UNTIL THE MINIMUM OFFERING AMOUNT IS REACHED. UPON REACHING THE MINIMUM OFFERING AMOUNT, THE COMPANY SHALL GAIN ACCESS TO ALL FUNDS INVESTED IN THE COMPANY THROUGH THIS OFFERING. THE COMPANY HAS THE RIGHT TO TERMINATE THIS OFFERING OF SECURITIES AT ANY TIME, REGARDLESS OF THE NUMBER OF SECURITIES THAT HAVE SOLD. IF THE OFFERING TERMINATES BEFORE THE OFFERING MINIMUM IS ACHIEVED, OR IF ANY PROSPECTIVE INVESTOR’S SUBSCRIPTION IS REJECTED, ALL FUNDS RECEIVED FROM SUCH INVESTORS WILL BE RETURNED WITHOUT INTEREST OR DEDUCTION. ANY INVESTOR WHO PURCHASES SECURITIES IN THIS OFFERING WILL HAVE NO ASSURANCE THAT OTHER INVESTORS WILL INVEST IN THIS OFFERING. ACCORDINGLY, IF THE COMPANY SHOULD FILE FOR BANKRUPTCY PROTECTION OR A PETITION FOR INSOLVENCY BANKRUPTCY IS FILED BY CREDITORS AGAINST THE COMPANY, INVESTOR FUNDS MAY BECOME PART OF THE BANKRUPTCY ESTATE AND ADMINISTERED ACCORDING TO THE BANKRUPTCY LAWS.

THERE IS AT THIS TIME, NO PUBLIC MARKET FOR THE SECURITIES. HOWEVER, THE OFFERING HAS BEEN REGISTERED WITH THE STATE OF NEW YORK IN ORDER TO POSITION COMPANY SECURITIES FOR A POSSIBLE INITIAL PUBLIC OFFERING AT SOME POINT IN THE FUTURE.

THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SECURITIES AND EXCHANGE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES BEING OFFERED ARE EXEMPT FROM REGISTRATION. THE SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE.

THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS, AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THESE LAWS. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE REGULATORY AUTHORITY NOR HAS THE COMMISSION OR ANY STATE REGULATORY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

| Table of Contents |

| | |

| ITEM 2: DISTRIBUTION & SPREAD | 4 |

| ITEM 3. SUMMARY INFORMATION, RISK FACTORS AND DILUTION | 6 |

| ITEM 4. DILUTION | 16 |

| ITEM 5. PLAN OF DISTRIBUTION | 16 |

| ITEM 6. USE OF PROCEEDS TO ISSUER | 18 |

| ITEM 7. DESCRIPTION OF BUSINESS | 21 |

| ITEM 8. DESCRIPTION OF COMPANY PROPERTY | 43 |

| ITEM 9. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 43 |

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND SIGNIFANT EMPLOYEES | 44 |

| ITEM 11. EXECUTIVE COMPENSATION | 46 |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 46 |

| ITEM 13. INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS. | 47 |

| ITEM 14. SECURITIES BEING OFFERED | 47 |

| ITEM 15. ADDITIONAL INFORMATION REGARDING MANDATORY SHAREHOLDER ARBITRATION | 51 |

| ITEM 16. FINANCIAL STATEMENTS SECTION | 55 |

| Company Balance Sheet | 55 |

| Company Statement of Revenue and Expense | 56 |

| Statement of Shareholders Equity | 56 |

| Statement of Cash Flows | 56 |

| Notes to Financial Statements | 57 |

| ITEM 17. DESCRIPTION OF EXHIBITS | 58 |

ITEM 2: DISTRIBUTION & SPREAD

| | Number of

Securities Offered | Offering Price | Selling

Commissions | Proceeds To

Company |

| Per Security | ---- | $100.00 | $5.00 | $95.00 |

| | | | | |

| Total Minimum | 20,000 | $100.00 | $100,000.00 | $1,900,000.00 |

| | | | | |

| Total Maximum | 200,000 | $20,000,000.00 | $1,000,000.00 | $19,000,000.00 |

Figure 1: Distribution & Spread

| 1) | The Company is offering a maximum of 200,000 - 7% Convertible Preferred Stock Shares at the price indicated |

| 2) | Additional Fees for Legal Review and Opinion(s), Accounting Costs, and costs related to the drafting of this Registration Statement and Professional Services Fees should not exceed $100,000 USD. Any costs above $100,000 will be paid by the Executives of the Company. |

| 3) | The Shares will be offered on a “Best-Efforts” basis by the Company’s Officers, Directors and Employees, and may be offered through Broker-Dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”), or through other independent referral sources. As of the date of this Offering Circular, no selling agreements had been entered into by the Company with any Broker-Dealer firms. Selling commissions may be paid to Broker-Dealers who are members of FINRA with respect to sales of Shares made by them and compensation may be paid to consultants in connection with the Offering of Shares. The Company may also pay incentive compensation to Registered Broker-Dealers in the form of Common Stock or Stock Options with the Company. The Company will indemnify participating Broker-Dealers with respect to disclosures made in the Offering Circular. |

| 4) | The Shares are being Offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier I Offerings. The Shares will only be issued to Investors who satisfy the requirements set forth in Regulation A. |

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE COMPANY CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR SELLING LITERATURE. THESE SECURITIES ARE OFFERED UNDER AN EXEMPTION FROM REGISTRATION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THESE SECURITIES ARE EXEMPT FROM REGISTRATION.

INVESTMENT IN AN EMERGING GROWTH COMPANY INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSURER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE OFFER MADE BY THIS OFFERING CIRCULAR, NOR HAS ANY PERSON BEEN AUTHORIZED TO GIVE ANY INFORMATION OR MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON. THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER TO SELL OR SOLICITATION OF AN OFFER TO BUY IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICIATION WOULD BE UNLAWFUL OR ANY PERSON TO WHO IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICIATION. NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALE MADE HEREUNDER SHALL, UNDER ANY CIRCUMSTANCES, CREATE AN IMPLICATION THAT THERE AS HAS BEEN NO CHANGE IN THE AFFAIRS OF OUR COMPANY SINCE THE DATE HEREOF.

THIS OFFERING CIRCULAR MAY NOT BE REPRODUCED IN WHOLE OR IN PART. THE USE OF THIS OFFERING CIRCULAR FOR ANY PURPOSE OHER THAN AN INVESTMENT IN SECURITIES DESCRIBED HEREIN IS NOT AUTHORIZED AND IS PROHIBITED.

THIS OFFERING IS SUBJECT TO WITHDRAWAL OR CANCELLATION BY THE COMPANY AT ANY TIME AND WITHOUT NOTICE. THE COMPANY RESERVES THE RIGHT IN ITS SOLE DISCRETION TO REJECT ANY SUBSCRIPTION IN WHOLE OR IN PART NOTWITHSTANDING TENDER OF PAYMENT OR TO ALLOT TO ANY PROSPECTIVE INVESTOR LESS THAN THE NUMBER OF SECURITIES SUBSCRIBED FOR BY SUCH INVESTOR.

THE OFFERING PRICE OF THE SECURITIES IN WHICH THIS OFFERING CIRCULAR RELATES HAS BEEN DETERMINED BY THE COMPANY AND DOES NOT NECESSARILY BEAR ANY SPECIFIC RELATION TO THE ASSETS, BOOK VALUE OR POTENTIAL EARNINGS OF THE COMPANY OR ANY OTHER RECOGNIZED CRITERIA OF VALUE.

NASAA UNIFORM LEGEND:

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY THE FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND THE APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME.

FOR ALL RESIDENTS OF ALL STATES:

THE SHARES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF CERTAIN STATES AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF SAID ACT AND SUCH LAWS. THE INTERESTS ARE SUBJECT IN VARIOUS STATES TO RESTRICTION ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER SAID ACT AND SUCH LAWS PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, ANY STATE SECURITIES COMMISSION OR OTHER REGULATORY AUTHORITY, NOR HAVE ANY OF THE FOREGOING AUTHORITIES PASSED UPON OR ENDORSED THE MERITS OF THIS OFFERING OR THE ACCURACY OR ADEQUACY OF THE OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

ITEM 3. SUMMARY INFORMATION, RISK FACTORS AND DILUTION

Investing in the Company’s Securities is very risky. You should be able to bear a complete loss of your investment. You should carefully consider the following factors, including those listed in this Securities Offering.

Emerging Growth Company Status

The Company is an “emerging growth company” as defined in the Jumpstart our Business Startups Act (“JOBS Act”). For as long as the Company is an emerging growth company, the Company may take advantage of specified exemptions from reporting and other regulatory requirements that are otherwise applicable generally to other public companies. These exemptions include:

An exemption from providing an auditor’s attestation report on management’s assessment of the effectiveness of the Company’s systems of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002;

An exemption from compliance with any new requirements adopted by the Public Accounting Oversight Board (“PCAOB”), requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer;

An exemption from compliance with any other new auditing standards adopted by the PCAOB after April 5th, 2012, unless the United States Securities and Exchange Commission (“SEC”) determines otherwise; and

Reduced disclosure of executive compensation.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, the Company has chosen to “opt out” of such extended transition period and, as a result, the Company will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. The Company’s decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

The Company will cease to be an “emerging growth company” upon the earlies of (i) when the Company has $1.0 Billion or more in annual revenues, (ii) when the Company has at least $700 Million in market value of the Company’s Common Units held by non-affiliates, (iii) when the Company issues more than $1.0 Billion of non-convertible debt over a three-year period, or (iv) the last day of the fiscal year following the fifth anniversary of the Company’s Initial Public Offering.

The Company is an Emerging Growth Company with all Risks Associated with an Emerging Growth Company

Hathaway Activated Carbon, Inc. commenced operations in October of 2016 as a Delaware Stock Corporation. Accordingly, the Company has only a limited history upon which an evaluation of its prospects and future performance can be made. The Company’s proposed operations are subject to all business risks associated with new enterprises. The likelihood of the Company’s success must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the expansion of a business, operation in a competitive industry, and the continued development of advertising, promotions and a corresponding customer base. There is a possibility that the Company could sustain losses in the future. There can be no assurances that Hathaway Activated Carbon, Inc. will operate profitably.

Clean Coal Technology Company Investment Industry Risks

Clean Coal Technology Industry investments are subject to varying degrees of risk. The yields available from equity investments in Clean Coal Technology Companies depends on the amount of income earned and capital appreciation generated by the company as well as the expenses incurred in connection therewith. If any of the Company’s products or services does not generate income sufficient to meet operating expenses, the Company’s Common Stock value could adversely be affected.

Income from, and the value of, the Company’s products and services may be adversely affected by the general economic climate, the Clean Coal Technology market conditions such as oversupply of related products and services, or a reduction in demand for Clean Coal Technology products and services in the areas in which the Company’s products and services are located, competition from other Clean Coal Technology products and services suppliers, and the Company’s ability to provide adequate Clean Coal Technology products and services. Revenues from the Company’s products and services are also affected by such factors such as the costs of production and general regional and national market conditions.

Because Clean Coal Technology Industry investments are relatively illiquid, the Company’s ability to vary its Clean Coal Technology products and services portfolio promptly in response to economic or other conditions is limited. The relative illiquidity of its holdings could impede the Company’s ability to respond to adverse changes in the performance of its assets. No assurance can be given that the fair market value of the assets acquired by the Company will not decrease in the future. Investors have no right to withdrawal their equity commitment or require the Company to repurchase their respective Common Stock or Preferred Stock interests and the transferability of the Common Stock or Preferred Stock Shares is limited. Accordingly, investors should be prepared to hold their investment interest until the Company is dissolved and its assets are liquidated.

The Company May Experience Delays in Resolving Unexpected Technical Issues Arising in Completing Development and Implementation of Its Technology, such Delays May Increase Development Costs and Postpone Anticipated Sales and Revenues

The Company is planning to acquire a “proven technology”. The Company have to solve technical, manufacturing and/or equipment-related issues. Some of these issuers are ones that the Company cannot anticipate because the technology the Company is acquiring, refining and implementing is not in mass commercial operation. If the Company must revise existing manufacturing processes or order specialized equipment to address a particular issue, the Company may not meet its projected timetable for bringing commercial operations on line. Such delays may interfere with the Company’s projected schedules, delay the Company’s receipt of licensing and royalty revenues from operations and decrease royalties from operations.

The Company’s Business Depends on the Protection of Its Patents (which it plans to acquire through acquisition) and Other Intellectual Property, and the Company May Suffer if the Company Are Unable to Adequately Protect such Intellectual Property

The Company’s success and ability to compete are substantially dependent upon the Company’s intellectual property. The company shall rely on patent laws, trade secret protection and confidentiality or license agreements with its employees, consultants, strategic partners and others to protect its intellectual property rights. However, the steps the Company takes to protect its intellectual property rights may be inadequate. There are events outside of the Company’s control that pose a threat to the Company’s intellectual property rights as well as to the Company’s products and services. For example, effective intellectual property protection may not be available in every country in which the Company license its technology. Also, the efforts the Company will take to protect its proprietary rights may not be sufficient or effective. Also, protecting the Company’s intellectual property rights is costly and time consuming. Any unauthorized use of the Company’s intellectual property could make it more expensive to do business and harm the Company’s operating results. In addition, other parties may independently develop similar or competing technologies designed around any patents that may be issued to the Company.

The Company is planning to acquire technology that has been granted multiple U.S. patents and also have several more U.S. patent applications pending relating to certain aspects of the technology, and the Company may seek additional patents on future innovations of the technology (after the Company has acquired the technology). The Company’s ability to license the technology is substantially dependent on the validity and enforcement of these patents and patents pending. The Company cannot assure you that the Company’s patents will not be invalidated, circumvented or challenged, that patents will be issued for the patents pending, that the rights granted under the patents will provide the Company competitive advantages or that the Company’s current and future patent applications will be granted.

Third Parties May Invalidate the Company’s Patents

Third parties may seek to challenge, invalidate, circumvent or render unenforceable any patents or proprietary rights acquired by the Company, issued to the Company, or licensed to the Company based on, among other things:

Subsequently discovered prior art;

Lack of entitlement to the priority of an earlier, related application; or

Failure to comply with the written description, best mode, enablement or other applicable requirements.

United States Patent Law requires that a patent must disclose the “best mode” of creating and using the invention covered by a patent. If the inventor of a patent knows of a better way, or “best mode”, to create the invention and fails to disclose it, that failure could result in the loss of patent rights. The Company’s decision to protect certain elements of the Company’s proprietary technology as trade secrets and to not disclose such technologies in patent applications, may serve as a basis for third parties to challenge and ultimately invalidate any of the Company’s related patents based on a failure to disclose the best mode of creating and using the invention claimed in the applicable patent. If a third party is successful in challenging the validity of the Company’s patents, the Company’s inability to enforce its intellectual property rights could seriously harm the Company’s business.

The Company May Be Liable for Infringing the Intellectual Property Rights of Others

The Company’s proposed technology may be subject of claims of intellectual property infringement in the future. The Company’s proposed technology may not be able to withstand any third-party claims or rights against their use. Any intellectual property claims, with or without merit, could be time-consuming, expensive to litigate or settle, could divert resources and attention and could require the Company to obtain a license to use the intellectual property of third parties. The Company may be unable to obtain a license from these third parties on favorable terms, if at all. Even if a license is available, the Company may have to pay substantial royalties to obtain it. If the Company cannot defend such claims or obtain necessary licenses on reasonable terms, the Company may be precluded from offering most or all of the technology, and the Company’s business and results of operations will be adversely affected.

Overseas Development of the Company’s Business is Subject to International Risks, which Could Adversely Affect the Company’s Ability to License Profitable Overseas Plants

The Company believes a significant portion of the growth opportunity for the business lies outside of the United States. Doing business in foreign countries may expose the Company to many risks that are not present domestically. The Company lacks significant experience dealing with such risks, including political, military, privatization, technology piracy, currency exchange and repatriation risks, and higher credit risks associated with customers. In addition, it may be more difficult for the Company to enforce legal obligations in foreign countries, and the Company may be at a disadvantage in any legal proceeding within the local jurisdiction. Local laws may also limit the Company’s ability to hold a majority interest in the projects that the Company may develop.

Coal Prices are Subject to Change and a Substantial or Extended Increase in Prices Could Materially and Adversely Affect the Company’s Revenues and Results of Operations

A significant portion of the Company’s revenues and results of operations are subject to the cost of coal because coal is a commodity and the prices the Company pays for coal is set by the marketplace. Prices for Coal generally tend to be cyclical, and over the last several years, coal prices have become more volatile. The contract prices the Company may pay in the future for coal depends upon numerous factors; including (but not limited to):

The domestic and foreign supply and demand for coal, including demand for U.S. Coal exports and domestic demand for electricity;

Domestic and foreign economic conditions, including economic downturns and the strength of the Global and U.S. Economies;

The quantity and quality of coal available from suppliers;

Competition for production of electricity from non-coal sources, including the price availability of alternative fuels, such as Natural Gas and Crude Oil, and alternative energy sources, such as nuclear, hydroelectric, wind and solar power, and the effects of technological developments related to these non-Coal and alternative energy sources;

Domestic air emissions standards for Coal-Fired Power Plants, and the availability of Coal-Fired Power Plants to meet these standards by installing scrubbers or other means;

Adverse weather, climatic or other natural conditions, including disasters;

Legislative, Regulatory and Judicial developments, Environmental Regulatory changes, or changes in Energy Policy and Energy Conservations measures that would adversely affect the Coal industry, such as legislation that limits carbon dioxide emissions or provide for increased funding and incentives for, or mandates the use of, alternative energy sources;

Domestic and Foreign Governmental Regulations and Taxes;

The quantity, quality and pricing of coal available in the resale market;

The capacity of, cost of, and proximity to, rail transportation facilities and rail transportation delays; Market price fluctuations for Sulfur Dioxide emission allowances; and

Subsidies designed to encourage the use of alternative energy sources.

A substantial or extended increase in the prices the Company pays for its future Coal sales contracts due to these other factors could materially and adversely affect the Company by increasing its costs, thereby materially and adversely affecting the Company’s results of operations.

The Company’s Coal Refining Operations Are Subject to Operating Risks, which Could Result in Materially Increased Operating Expenses and Decreased Production Levels, and Could Materially and Adversely Affect the Company’s Results of Operations

The Company’s proposed Coal Refining Operations are subject to a number of operating risks. Because the Company will maintain very little coal inventory, certain conditions or events could disrupt operations, adversely affect production and shipments and increase the cost of refining for varying lengths of time, which could have a material adverse effect on the Company’s results of operations. These conditions and events include, among others:

Adverse weather and natural disasters, such as heavy rains, flooding and other natural events affecting operations, transportation or customers;

The capacity of, and proximity to, rail transportation facilities and rail transportation delays or interruptions, including derailments;

Delays, challenges to, and difficulties in acquiring, maintaining or renewing necessary permits, including environmental permits;

A major incident at the refinery that causes all or part of the operations to cease for some period of time;

Current and future health, safety and environmental regulations or changes in interpretations of current regulations;

The value of the U.S. Dollar relative to other currencies, particularly where exports of Company product are concerned.

These changes, conditions and events may materially increase the Company’s costs of refining and delay or halt production at the refinery permanently or for varying lengths of time.

The Offering will be Conducted on a Best Efforts Basis, there can be No Assurance that the Company Can Raise the Capital it Needs

The 7% Convertible Preferred Stock Shares are being offered by the Company on a “Best Efforts” basis without the benefit of a Placement Agent. The Company can provide no assurance that this Offering will be completely sold out. If less than the maximum proceeds are available, the Company’s business plans and prospects for the current fiscal year could be adversely affected.

The Company needs at least $2,000,000 to begin Phase I, the Development Phase of the Project. With less than the entire $2,000,000 the Company will have to limit or eliminate important expenditures such as the hiring of essential labor and services, site development expenditures, and limit operations, all of which will hinder the Company’s ability to implement the Company’s business plan. Therefore, the Company has placed the minimum investment for this Offering at $2,000,000.

The Company shall establish an escrow account for the initial $2,000,000 of investment upon closing on the first placement. If the Offering terminates before the offering minimum is achieved, or if any prospective Investor’s subscription is rejected for any reason, all funds received from such Investors will be returned without interest or deduction. The Company has the right to terminate this offering of Securities at any time, regardless of the number of Securities that have sold.

The Company is Dependent on Current Management

In the early stages of development, the Company’s business will be significantly dependent on the Company’s management team. The Company’s success will be particularly dependent upon the services of Mr. Kevin Hathaway, the Company’s Founder and Chief Executive Officer.

The Company Could Potentially Face Risks Associated with Borrowing

The Company does intend to incur additional debt beyond the investment commitments provided in this offering. The Company plans to obtain both secure and unsecured debt in the future, from which possible risks could arise. When the Company incurs additional indebtedness, a portion of the Company’s cash flow will have to be dedicated to the payment of principal and interest on such new indebtedness. Typical loan agreements also might contain restrictive covenants, which may impair the Company’s operating flexibility. Such loan agreements would also provide for default under certain circumstances, such as failure to meet certain financial covenants. A default under a loan agreement could result in the loan becoming immediately due and payable and, if unpaid, a judgment in favor of such lender which would be senior to the rights of shareholders of the Company. A judgment creditor would have the right to foreclose on any of the Company’s assets resulting in a material adverse effect on the Company’s business, operating results or financial condition.

Unanticipated Obstacles to Execution of the Business Plan

The Company’s business plans may change significantly. Many of the Company’s potential business endeavors are capital intensive and may be subject to statutory or regulatory requirements. Management believes that the Company’s chosen activities and strategies are achievable in light of current economic and legal conditions with the skills, background, and knowledge of the Company’s principals and advisors. Management reserves the right to make significant modifications to the Company’s stated strategies depending on future events.

Management Discretion as to Use of Proceeds

The net proceeds from this Offering will be used for the purposes described under “Use of Proceeds.” The Company reserves the right to use the funds obtained from this Offering for other similar purposes not presently contemplated which it deems to be in the best interests of the Company and its Investors in order to address changed circumstances or opportunities. As a result of the foregoing, the success of the Company will be substantially dependent upon the discretion and judgment of Management with respect to application and allocation of the net proceeds of this Offering. Investors for the Shares offered hereby will be entrusting their funds to the Company’s Management, upon whose judgment and discretion the investors must depend.

Control by Management

As of June 1st, 2017, the Company’s Management owned approximately 100% of the Company’s outstanding Common Stock Shares and 0% of the Company's Preferred Stock Shares. Upon completion of this Offering, The Company’s Management will own approximately 100% of the outstanding Common Stock Shares of the Company and 0% of the outstanding Preferred Stock Shares of the Company. Investors will not have the ability to control either a vote of the Company’s Managers or any appointed officers. See “COMPANY MANAGERS” section.

Return of Profits

The Company has never declared or paid any cash dividends on its Common Stock. The Company currently intends to retain future earnings, if any, to finance the expansion of the Company’s Operations and Holdings. As a result, the Company does not anticipate paying any cash dividends to its Common Stock Holders for the foreseeable future.

The Company’s Continuing as a Going Concern Depends Upon Financing

If the Company does not raise sufficient working capital and continues to experience pre-operating losses, there will most likely be substantial doubt as to its ability to continue as a going concern. Because the Company has generated no revenue, all expenditures during the development stage have been recorded as pre-operating losses. Revenue operations have not commenced because the Company has not raised the necessary capital.

Raising Additional Capital by Issuing Securities May Cause Dilution to the Company’s Shareholders

The Company may need to, or desire to, raise substantial additional capital in the future. The Company’s future capital requirements will depend on many factors, including, among others:

The Company’s degree of success in capturing a larger portion of the Clean Coal Technology market;

The costs of acquiring new mines and increasing the number of companies paying the Company licensing fees;

The extent to which the Company acquires or invests in businesses, products, or technologies, and other strategic relationships; and

The costs of financing unanticipated working capital requirements and responding to competitive pressures.

If the Company raises additional funds by issuing equity or convertible debt securities, the Company will reduce the percentage of ownership of the then-existing shareholders, and the holders of those newly-issued equity or convertible debt securities may have rights, preferences, or privileges senior to those possessed by the Company’s then-existing shareholders. Additionally, future sales of a substantial number of shares of the Company’s Common Stock, or other equity-related securities in the public market could depress the market price of the Company’s Common Stock and impair the Company’s ability to raise capital through the sale of additional equity or equity-linked securities. The Company cannot predict the effect that future sales of the Company’s Common Stock, or other equity-related securities would have on the market price of the Company’s Common Stock.

The Company’s Preferred Stock is Equity and is Subordinate to all of our Existing and Future Indebtedness; our ability to Declare Annual Dividends on the Preferred Stock may be Limited

The Company’s Preferred Stock Shares are equity interest in the Company and do not constitute indebtedness. As such, the Preferred Stock will rank junior to all indebtedness and other non-equity claims on the Company with respect to assets available to satisfy claims on the Company, including in a liquidation of the Company. Additionally, unlike indebtedness, where principal and interest would be customarily be payable on specified due dates, in the case of preferred stock, like the Preferred Stock being offering through this Offering, (1) dividends are payable only when, as and if authorized and declared by the Company’s Board of Directors and (2) as an emerging growth company, our ability to declare and pay dividends is subject to the Company’s ability to earn net income and to meet certain financial regulatory requirements.

Dividends on the Company’s Preferred Stock are Cumulative

Dividends on the Company’s Preferred Stock are Cumulative. If the Company’s Board of Directors does not authorize and declare a dividend for any dividend period, holder of the Company’s Preferred Stock will not be entitled to receive a dividend cash payment for such period, and such undeclared dividend will accrue and become payable at a later dividend payment date. The Company’s Board of Directors may determine that it would be in the Company’s best interest to pay less than the full amount of the stated dividend on our Preferred Stock, at which time the undeclared portion of the dividend will accrue and become payable at a later dividend payment date. Factors that would be considered by the Company’s Board of Directors in making this determination are the Company’s financial condition and capital needs, the impact of current and pending legislation and regulations, economic conditions, tax considerations, and such other factors as our Board of Directors may deem relevant.

Certain Factors Related to Our Common Stock

Because the Company’s Common Stock may be considered a "penny stock," and a shareholder may have difficulty selling shares in the secondary trading market.

The Company’s Common Stock Securities may be subject to certain rules and regulations relating to "penny stock" (generally defined as any equity security that has a price less than $5.00 per share, subject to certain exemptions). Broker-dealers who sell penny stocks are subject to certain "sales practice requirements" for sales in certain nonexempt transactions (i.e., sales to persons other than established customers and institutional "qualified investors"), including requiring delivery of a risk disclosure document relating to the penny stock market and monthly statements disclosing recent price information for the penny stocks held in the account, and certain other restrictions. For as long as the Company’s Common Stock is subject to the rules on penny stocks, the market liquidity for such securities could be significantly limited. This lack of liquidity may also make it more difficult for the Company to raise capital in the future through sales of equity in the public or private markets.

The price of the Company’s Common Stock may be volatile, and a shareholder's investment in the Company’s Common Stock could suffer a decline in value.

There could be significant volatility in the volume and market price of the Company’s Common Stock, and this volatility may continue in the future. The Company’s Common Stock may be listed on the OTC Markets “OTCQB” or “OTCQX”, where there is a great chance for market volatility for securities that trade on these markets as opposed to a national exchange or quotation system. This volatility may be caused by a variety of factors, including the lack of readily available quotations, the absence of consistent administrative supervision of "bid" and "ask" quotations and generally lower trading volume. In addition, factors such as quarterly variations in our operating results, changes in financial estimates by securities analysts or our failure to meet our or their projected financial and operating results, litigation involving us, general trends relating to the Recreational Marijuana Industry, actions by governmental agencies, national economic and stock market considerations as well as other events and circumstances beyond our control could have a significant impact on the future market price of our Common Stock and the relative volatility of such market price.

Secondary Market

Prior to this offering, there has been no public market for the Company’s Preferred Stock. There are no assurances that the Company’s Preferred Stock will ever be listed on any regulated securities exchange. There can be no assurance that an active trading market for the Company’s Preferred Stock will develop, or, if developed, that an active trading market will be maintained. If an active market is not developed or sustained, the market price and liquidity of the Company’s Preferred Stock may be adversely affected.

The Company is not currently preparing any application for the Company's Securities to be admitted to listing and trading on the OTC Market or other Regulated Market. There can be no assurance that a liquid market for the Securities will develop or, if it does develop, that it will continue. If a market does develop, it may not be liquid. Therefore, investors may not be able to sell their Securities easily or at prices that will provide them with yield comparable to similar investments that have a developed secondary market. Illiquidity may have a severely adverse effect on the market value of the Securities and investors wishing to sell the Securities might therefore suffer losses.

The Company’s Securities initially may be listed for trade on a Closed Trading System with Limited Volume and Liquidity

The Company’s securities may not be freely quoted for trading on any stock exchange or through any other traditional trading platform. The Company’s securities may be issued, available for purchase and may be traded exclusively on a specific trading system that is registered with the United States Securities and Exchange Commission as an “Alternative Trading System” or an “ATS”. The Company does not have any plans to trade its securities on a specific ATS as of the date of this filing. Any disruptions to the operations of an ATS or a Broker Dealer’s Customer Interface with an ATS would materially disrupt trading in, or potentially result in a complete halt in the trading.

Because the Company’s Securities may be traded exclusively on a closed trading system, it is a possibility that there will be a limited number of holders of the Company’s Securities. In addition, and ATS is likely to experience limited trading volume with a relatively small number of securities trading on the ATS platform as compared to securities trading on traditional securities exchanges or trading platforms. As a result, this novel trading system may have limited liquidity, resulting in a lower or higher price, or greater volatility than would be the case with greater liquidity. Investors may not be able to resell their securities on a timely basis, or at all.

The Number of Securities Traded on an ATS May be Very Small, Making the Market Price More Easily Manipulated

While the Company understands that many ATS platforms have adopted policies and procedures such that security holders are not free to manipulate the trading of securities contrary to applicable law, and while the risk of market manipulation exists in connection with the trading of any securities, the risk may be greater for the Company’s Securities because the ATS the Company chooses may be a closed system that does not have the same breath of market and liquidity as the national market system. There can be no assurance that the efforts by an ATS to prevent such behavior will be sufficient to prevent such market manipulation.

An ATS is Not a Stock Exchange and has Limited Quoting Requirements for Issuers, of for the Securities Held

Unlike the more expansive listing requirements, policies and procedures of the NASDAQ Global Market or other NMS Trading Platforms, there are no minimum price requirements and limited listing requirements for securities to be traded on an ATS. As a result, trades of the Company’s Securities may not be at prices that represent the national best bid or offer prices that could be considered similar securities.

Shares of the Company’s Preferred Stock and Common Stock may in the future be Subject to the Penny Stock Rules

The Company may decide to list its securities on the OTC Markets Group’s OTCQB or OTCQB in 24 to 48 months of the completion of this Offering. Company’s Common Stock and Preferred Stock may in the future if traded on the OTC Market Group’s “OTCQB”, which may well make it difficult for a Investor of Shares of the Company’s Common Stock or Preferred Stock to sell all, or a party of the Common Stock or Preferred Stock Shares when the Investors wish, or, if the Common Stock or Preferred Stock Shares can be sold, to get what the Investor may consider to be an adequate price for the Common Stock or Preferred Stock Shares. The Shares of the Company’s Common Stock may trade at prices which make them subject to the United States Securities and Exchange Commission’s “Penny Stock Rules”, which may also limit the liquidity of the Common Stock Shares, or adversely affect the price at which the Common Stock Shares can be sold, or both.

The Company Cannot Assure Investors that the Market for the Company’s Common Stock will Continue at any Trading Volume, or that the Market Price of Shares of the Company’s Common Stock Will Not Decline Following Conversion

The Company cannot predict the prices at which the Company’s Common Stock will trade. The offering price for the Shares being sold in this Offering has been determined by the Company based largely on the Company’s perception of the amount of money in which the Company needs to raise at this time to grow the Company. The Company cannot assure you that the Offering price per Share will bear any relationship on the market price of the Company’s Common Stock may trade after converting of the 7% Convertible Preferred Stock Shares.

The Market Price for the Company’s Common Stock May Fluctuate Significantly

The market price and liquidity of the market for the Company’s Shares of Common Stock that will prevail in the market after an investor converts from the 7% Convertible Preferred Stock Shares to the Company’s Common Stock Shares may be higher or lower than the price that Investors of the Company’s Common Stock pay for the Common Stock at the time the Investors purchase the 7% Convertible Preferred Stock Shares, and may be significantly affected by numerous factors, some of which are beyond the control of the Company, and may not be directly related to the Company’s operating performance. These factors include, but are not limited to:

Significant volatility in the market price and trading volume of securities of companies in the Company’s Market

Sector, which is not necessarily related to the operating performance of these companies;

The mix of products that the Company provides during any period;

Delays between the Company’s expenditures to develop and market the Company’s products, and the generation of sales from those marketing efforts;

Changes in the amount that the Company spends to expand its products to new areas, or to develop new products;

Changes in the Company’s expenditures to promote its services;

Announcements of acquisitions by the Company, or one of the Company’s competitors;

Changes in regulatory policies or tax guidelines;

Changes or perceived changes in earnings, or variations in operating results;

Any shortfall in revenue, or net income, or any increase in losses from levels expected by Investors or securities analysts; and

General economic trends and other external factors.

If Equity Research Analysts Do Not Publish Research Reports about the Company, of if the Research Analysts Issue Unfavorable Commentary or Downgrade the Company’s Common Stock Shares, the Price of the Company’s Common Stock Shares Could Decline

The trading market for the Company’s Common Stock Shares will rely in part on the research and reports that equity research analysts publish about the Company, and the Company’s business. The Company does not have control over research analysts, and the Company does not have commitments from research analysts to write research reports about the Company. The price of the Company’s Common Stock Shares could decline if one or more equity research analysts downgrades the Company’s Common Stock Shares, issues an unfavorable commentary, or ceases publishing reports about the Company.

Future Sales of the Company’s Shares Could Reduce the Market Price of the Company’s Common Stock Shares

The price of the Company’s Common Stock could decline if there are substantial sales of the Company’s Common Stock, particularly by the Company’s Directors or its Executive Officer(s), or when there is a large number of Shares of the Company’s Common Stock available for sale. The perception in the public market that the Company’s Stockholders might sell the Company Shares could also depress the market price of the Company’s Shares. If this occurs, or continues to occur, it could impair the Company’s ability to raise additional capital through the sale of securities should the Company desire to do so.

Unavailability of Rule 144 for Resales

The Company is regarded under Rule 12b-2 of the Securities Exchange Act of 1934 as a shell company. Shareholders who hold shares which are not subject to a registration statement under the Securities Act often rely upon Rule 144 for their resale. Rule 144 is not available for the resale of securities initially issued by either reporting or non-reporting shell companies (other than a business combination related shell company) or an issuer that has been, at any time previously, a reporting or non-reporting shell company, unless the issuer meets specified conditions. A security holder may resell securities pursuant to Rule 144’s Safe Harbor if the following conditions are met:

| 1) | The Issuer of Securities that was formerly a reporting or non-reporting company has ceased to be a shell; |

| 2) | The Issuer of the Securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; |

| 3) | The Issuer of the Securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months (or for such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |

| 4) | At least one year has elapsed from the time the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company. |

Offering Price

The price of the Securities offered has been arbitrarily established by our current Managers, considering such matters as the state of the Company’s business development and the general condition of the industry in which it operates. The Offering price bears little relationship to the assets, net worth, or any other objective criteria.

Compliance with Securities Laws

The Company’s Securities are being offered for sale in reliance upon certain exemptions from the registration requirements of the Securities Act, and applicable state securities laws. If the sale of Securities were to fail to qualify for these exemptions, Investors may seek rescission of their purchases of Securities. If a number of Investors were to obtain rescission, we would face significant financial demands, which could adversely affect the Company as a whole, as well as any non-rescinding Investors.

NOTICE REGARDING AGREEMENT TO ARBITRATE

THIS OFFERING MEMORANDUM REQUIRES THAT ALL INVESTORS ARBITRATE ANY DISPUTE ARISING OUT OF THEIR INVESTMENT IN THE COMPANY. ALL INVESTORS FURTHER AGREE THAT THE ARBITRATION WILL BE BINDING AND HELD IN THE STATE OF TENNESSEE, IN THE COUNTY OF LAWRENCE. EACH INVESTOR ALSO AGREES TO WAIVE ANY RIGHTS TO A JURY TRIAL. OUT OF STATE ARBITRATION MAY FORCE AN INVESTOR TO ACCEPT A LESS FAVORABLE SETTLEMENT FOR DISPUTES. OUT OF STATE ARBITRATION MAY ALSO COST AN INVESTOR MORE TO ARBITRATE A SETTLEMENT OF A DISPUTE.

Projections: Forward Looking Information

Management has prepared projections regarding anticipated financial performance. The Company’s projections are hypothetical and based upon a presumed financial performance of the Company, the addition of a sophisticated and well-funded marketing plan, and other factors influencing the business. The projections are based on Management’s best estimate of the probable results of operations of the Company and the investments made by management, based on present circumstances, and have not been reviewed by independent accountants and/or auditing counsel. These projections are based on several assumptions, set forth therein, which Management believes are reasonable. Some assumptions, upon which the projections are based, however, invariably will not materialize due the inevitable occurrence of unanticipated events and circumstances beyond Management’s control. Therefore, actual results of operations will vary from the projections, and such variances may be material. Assumptions regarding future changes in sales and revenues are necessarily speculative in nature. In addition, projections do not and cannot take into account such factors as general economic conditions, unforeseen regulatory changes, the entry into a market of additional competitors, the terms and conditions of future capitalization, and other risks inherent to the Company’s business. While Management believes that the projections accurately reflect possible future results of operations, those results cannot be guaranteed.

ITEM 4. DILUTION

An emerging growth company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash from outside investors, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of the new investors stake is diluted because each share of the same type is worth the same amount, and the new investor has paid more for the shares than earlier investors.

The Company has had no issues of shares in the previous year. The current equity holders would experience a dilution of approximately 9.09% in their equity position after placement of this entire Offering of 200,000 shares.

| Name & Address | | Equity Owned Prior to Offering | | Equity Owned After Offering |

| | | | | |

| Mr. Kevin Hathaway | | Common Stock: 1,000,000 Shares | | Common Stock: 1,000,000 Shares |

| 45 Franks Road | | Preferred Shares: No Shares | | Preferred Shares: No Shares |

| Leoma, Tennessee 38468 | | Equity Stake: 50.0% | | Equity Stake: 45.455% |

| | | | | |

| Mrs. Laura Hathaway | | Common Stock: 1,000,000 Shares | | Common Stock: 1,000,000 Shares |

| 45 Franks Road | | Preferred Shares: No Shares | | Preferred Shares: No Shares |

| Leoma, Tennessee 38468 | | Equity Stake: 50.0% | | Equity Stake: 45.455% |

| | | | | |

Figure 2: Dilution of Existing Shares After Offering

Future Dilution

The Company, for business purposes, may from time to time issue additional shares, which may result in dilution of existing shareholders. Dilution is a reduction in the percentage of a stock caused by the issuance of new stock. Dilution can also occur when holders of stock options (such as company employees) or holders of other optionable securities exercise their options. When the number of shares outstanding increases, each existing stockholder will own a smaller, or diluted, percentage of the Company, making each share less valuable. Dilution may also reduce the value of existing shares by reducing the stock’s earnings per share. There is no guarantee that dilution of the Common Stock will not occur in the future.

The Company is currently planning a total of three equity rounds, including the current round, for the scope of the project being undertaken. There is currently no intention to increase the total number of shares authorized by the company prior to IPO (notwithstanding a requirement by a public stock exchange to conduct a share split which may increase the number of shares authorized, but would not dilute shareholders’ equity stake). There is no guarantee that equity rounds in addition to the three planned equity rounds will be required in the future which would further dilute all shares. The three equity rounds currently planned are:

| | Exemption | Shares | $/Share | Total | Type Shares |

| Round 1: | A+ Tier I | 200,000 | $100 | $20MM | Preferrred, Convertible, 7% Cumulative Dividend |

| Round 2: | A+ Tier II | 150,000 | $150 | $30MM | Preferrred, Convertible, 7% Cumulative Dividend |

| IPO Round: | None | 150,000 | $200 | $30MM | Common shares expected to trade in the $300/share range |

| | | | | | |

Figure 3: Currently Planned Equity Rounds

ITEM 5. PLAN OF DISTRIBUTION

The Offering will commence promptly after the date of this Offering Circular and will close (terminate) upon the earlier of (1) the sale of 200,000 - 7% Convertible Preferred Stock Shares, (2) One Year from the date this Offering is qualified by the United States Securities and Exchange Commission, or (3) a date prior the one year anniversary date on which the United States Securities and Exchange Commission has Qualified this Offering that is so determined by the Company’s Management (the “Offering Period”).

The 7% Convertible Preferred Stock Shares are being offered by the Company on a “Best Efforts” basis without the benefit of a Placement Agent. The Company can provide no assurance that this Offering will be completely sold out. If less than the maximum proceeds are available, the Company’s business plans and prospects for the current fiscal year could be adversely affected.

The Company may place the 7% Convertible Preferred Stock Shares that are being offered directly to investors that are introduced by individuals who may receive a Finder’s Fee of up to FIVE PERCENT of the Offering Proceeds.

The Company shall make arrangements to place funds raised in this Offering in an escrow, trust or similar account until the minimum offering amount is reached. Upon reaching the minimum offering amount, the Company shall gain access to all funds invested in the Company through this Offering. The Company has the right to terminate this offering of Securities at any time, regardless of the number of Securities that have sold. If the Offering terminates before the offering minimum is achieved, or if any prospective Investor’s subscription is rejected, all funds received from such Investors will be returned without interest or deduction. Any investor who purchases securities in this Offering will have no assurance that other Investors will invest in this Offering. Accordingly, if the Company should file for bankruptcy protection or a petition for insolvency bankruptcy is filed by creditors against the Company, Investor funds may become part of the bankruptcy estate and administered according to the bankruptcy laws.

The Securities to be offered with this proposed offering shall be initially offered by Company, mainly by Mr. Kevin Hathaway, the Company’s Chief Executive Officer. The Company may choose to engage members of the Financial Regulatory Authority (“FINRA”) to sell the Securities for the Company, though the Company has not yet engaged the Services of any FINRA Broker Dealers. The Company may engage a FINRA Broke Dealer to offer the Securities to prospective investors on a “best efforts” basis, and the Company’s Broker Dealers will have the right to engage such other FINRA Broker Dealer member firms as it determines to assist in the Offering. The Company will update this Registration Statement via an amendment to this Registration Statement upon any engagement of a FINRA Broker Dealer to offer the securities.

The Company anticipates that any FINRA Broker Dealer Manager will receive selling commissions of up to FIVE PERCENT of the Offering Proceeds, which it may re-allow and pay to participating FINRA Broker Dealers who sell the Company’s Securities which results in the sale of the Company’s Securities. The Company’s FINRA Broker Dealer Manager may also sell the Securities as part of a selling group, thereby becoming entitled to retain a greater portion of the selling commissions. Any portion of the selling commissions retained by the FINRA Broker Dealer Manager would be included within the amount of selling commissions payable by the Company and not in addition to.

The Company anticipates that that its FINRA Broker Dealer Manager may enter into an agreement with the Company to purchase “Underwriter Warrants”. Should the Company enter into an Underwriter Warrants Agreement with its FINRA Broker Dealer Manager, a copy of the agreement will be filed with the United States Securities and Exchange Commission as an Exhibit to an amended Registration Statement of which this Offering is part.

The Company anticipates that the Company and any FINRA Broker Dealer will each enter into a Broker Dealer Manager Agreement, which will be filed with the United States Securities and Exchange Commission as an Exhibit to an amended Registration Statement of which this Offering is part, for the sale of the Company’s Securities. FINRA Broker Dealers desiring to become members of a Selling Group will be required to execute a Participating Broker Dealer Agreement with the Company’s FINRA Broker Dealer, either before or after the date of this Registration Statement.

In order to subscribe to purchase the Securities, a prospective Investor must complete, sign and deliver the executed Subscription Agreement, Investor Questionnaire and Form W-9 to HATHAWAY ACTIVATED CARBON, INC. and either mail or wire funds for its subscription amount in accordance with the instructions included in the Subscription Package.

The Company reserves the right to reject any Investor’s subscription in whole or in part for any reason. If the Offering terminates or if any prospective Investor’s subscription is rejected, all funds received from such Investors will be returned without interest or deduction.

In addition to this Offering Circular, subject to limitations imposed by applicable securities laws, we expect to use additional advertising, sales and other promotional materials in connection with this Offering. These materials may include public advertisements and audio-visual materials, in each case only as authorized by the Company. Although these materials will not contain information in conflict with the information provided by this Offering and will be prepared with a view to presenting a balanced discussion of risk and reward with respect to the Securities, these materials will not give a complete understanding of this Offering, the Company or the Securities and are not to be considered part of this Offering Circular. This Offering is made only by means of this Offering Circular and prospective Investors must read and rely on the information provided in this Offering Circular in connection with their decision to invest in the Securities.

ITEM 6. USE OF PROCEEDS TO ISSUER

The Company seeks to raise maximum gross proceeds of $20,000,000 from the sale of Securities in this Offering. The Company intends to apply these proceeds substantially as set forth herein, subject only to reallocation by Company Management in the best interests of the Company.

| A. Sale of Company 7% Convertible Preferred Stock Shares | | |

| | | | | | | | | |

| Category | | Maximum

Proceeds | | Percentage

of Max Total

Proceeds | | Minimum

Proceeds | | Percentage

of Min

Total Proceeds |

Proceeds from

Sale of

Securities | | $19,000,000 | | 95.00% | | $1,900,000 | | 95.00% |

| | | | | | | | | |

| B. Offering Expenses | | | | | | |

| | | | | | | | | |

| Category | | Maximum

Proceeds | | Percentage

of Maximum

Proceeds | | Minimum

Proceeds | | Percentage

of Minimum

Proceeds |

Offering

Expenses | | $100,000 | | 0.526% | | $100,000 | | 5.26% |

Figure 4: Sale of Securities Proceeds and Offering Expenses

Footnotes:

| 1) | The Company is offering a maximum of 200,000 - 7% Convertible Preferred Stock Shares at the price indicated |

| 2) | Additional Fees for Legal Review and Opinion(s), Accounting Costs, and costs related to the drafting of this Registration Statement and Professional Services Fees should not exceed $100,000 USD. Any costs above $100,000 will be paid by the Executives of the Company. |

| 3) | The Shares will be offered on a “best-efforts” basis by the Company’s Officers, Directors and Employees, and may be offered through Broker-Dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”), or through other independent referral sources. As of the date of this Offering Circular, no selling agreements had been entered into by the Company with any Broker-Dealer firms. Selling commissions may be paid to Broker-Dealers who are members of FINRA with respect to sales of Shares made by them and compensation may be paid to consultants in connection with the Offering of Shares. The Company may also pay incentive compensation to Registered Broker-Dealers in the form of Common Stock or Stock Options with the Company. The Company will indemnify participating Broker-Dealers with respect to disclosures made in the Offering Circular. |

| 4) | The Shares are being Offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier I Offerings. The Shares will only be issued to Investors who satisfy the requirements set forth in Regulation A. |

| A. | Use of Investment Proceeds |

Proceeds from the Offering will be used to begin the execution of Phase I, the Development Phase of the Project which consists of the tasks necessary to acquire the technology and to develop a pre-commercial production line in order to conduct soil amendment market development activities.

| Acquisition of C2O Tech | | $12,000,000 |

| Pre-Commercial Plant | | $5,000,000 |

| Offering Fees | | $1,000,000 |

| Offering Expenses | | $100,000 |

| Operations | | $1,000,000 |

| Tavel | | $100,000 |

| Main Site Deposit | | $500,000 |

| Professional Fees | | $100,000 |

| 2nd Round Costs | | $200,000 |

| | | |

| Total: | | $20,000,000 |

Figure 5: Use of Investment Proceeds

| B. | Use of Investment Funds - Employee Projections |

The company shall employ approximately eight personnel, positions identified below, to carry the company through Phase I. The personnel shall require approximately $1,600,000 annually including salary and benefits. Two years of salary expenses have been budgeted, even though we expect to move the project into Phase II within one years’ time. A short list of prospective employees for each position is available upon request. Due to the downturn in many industrial companies, example coal, steel, oil, etc., there are many highly qualified mid-level and senior C-level executives that could fill the positions identified below.

President. Kevin Hathaway shall perform the duties of Acting President until the Project is commission at the beginning of Phase III. At that time, the VP of Operations and Training would be the natural choice to replace Mr. Hathaway and that individual would then backfill his/her position. Mr. Hathaway has been in discreet discussion with a candidate for the role for some time. The candidate is a Columbia MBA Graduate with experience in investment banking, business development and strategic development and operations in the coal industry.

Executive Assistant and Travel Management. This highly qualified individual would perform the duties of coordinating calendars, setting meetings, travel arrangements, etc. for the entire management team. A seasoned EA is required as this position is key to the smooth flow of information across the management team.

VP of Operations and Training. This shall be one of the first hires that is conducted. The highly-qualified professional should have a technical foundation with business and management skills developed through experience in mid-level and senior ranks of a large industrial corporation. Leadership, strong character and good communications skills are essential.

VP of Logistics. Logistics is probably the next most important aspect of the Project since large volumes of value-added commodities need to be transported daily by rail and by truck. This professional need to have experience moving large volumes of bulk commodities in the U.S. West, and be very well connected throughout that network. Familiarity of rail transportation is essential.

VP of Sales and Marketing. Long-term offtake agreements with large, investment-grade trading partners is essential to the underwriting process of the project funding. This professional must have a long and successful track record of sales in the oil sector, or the coal sector, or the steel sector of the economy. The ability to understand and develop the activated carbon market is key.

VP of Quality and Safety. Quality and Safety are essential to a successful project. This key individual shall be hired about half-way through Phase I to become familiar with the plant design and construction plans. The individual will work closely with the design engineers to ensure that work safety and product quality are “baked into” the project design. Strict safety and quality protocols shall be enforced throughout construction, testing, training and operation of the Project.

VP of Technology Development. The VP of technology development shall participate in the development, employment and protection of all technology used by the Project. Technology shall be developed and adapted to exploit new and developing markets such as the soil amendment market. As new technologies are developed, patent fillings and other measures shall be enforced to protect the Company’s technological advantage.

Controller and Human Resources. The controller and HR employee shall be one of the first employees hired by the Company. A highly qualified, mid-career professional that can carry both disciplines of controlling the Company’s capital resources and managing the human resources is required.

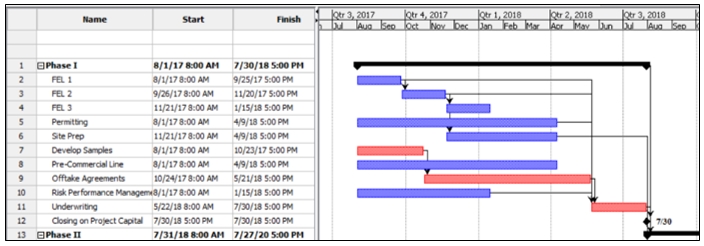

| C. | Project Phases Timeline |

The Project would consist of three primary phases.

Phase I: Development. This includes detailed engineering, permitting, and site preparation. For this project, development also includes the construction of a pre-production line to produce activated carbon.

Phase II: Construction. This includes procurement, construction, plant shakedown and employee training Commercial Operations Date (COD): The expected date for plant commissioning

Phase III: Operations. The continuous cycle of plant operations to safely produce a higher quality product in the most efficient way possible.

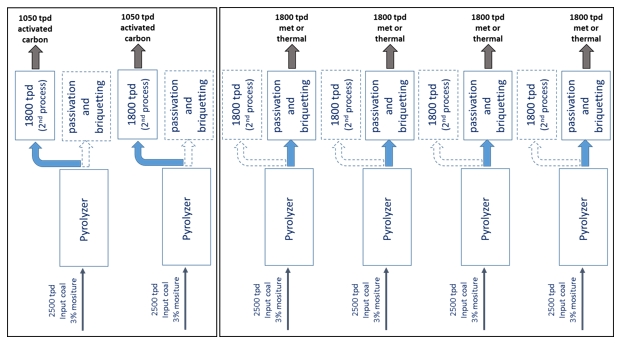

Figure 6: Project Phases Timeline

| D. | Phase I Timeline – Month 1 through Month 12 |

A more detailed Gantt Chart of the tasks involved in Phase I is provided below. Clearly, the critical path is to secure the requisite product offtake agreements to negotiate underwriting in order to secure the structured debt for Phase II. The Company has a number of prospects for the offtakes, as well as an approach to provide risk management packages in lieu of an offtake agreement.

Figure 7: Phase I Timeline - Month 1 through Month 12

ITEM 7. DESCRIPTION OF BUSINESS

| A. | Overview of the Opportunity |

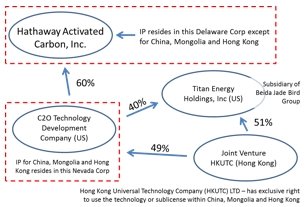

The Company has a binding agreement to acquire the assets of C2O Technologies, LLC and its subsidiary C2O Technology Development Corporation which is a joint venture company with Beida Jade Bird Group. The assets of C2O Technologies, LLC include intellectual property for a proprietary process known as the C2O-Rinker Process, control of C2O Technology Development Corporation, proprietary rights to the pyrolyzer which was co-developed with Carrier Corporation, and development work accomplished on prospective projects domestically and abroad. C2O Technology Development Corporation maintains the intellectual property for the C2O-Rinker Process in China, Mongolia and Hong Kong, and has minority ownership in a Hong Kong company that has exclusive rights to deploy the C2O-Rinker Process to China, Mongolia and Hong Kong.

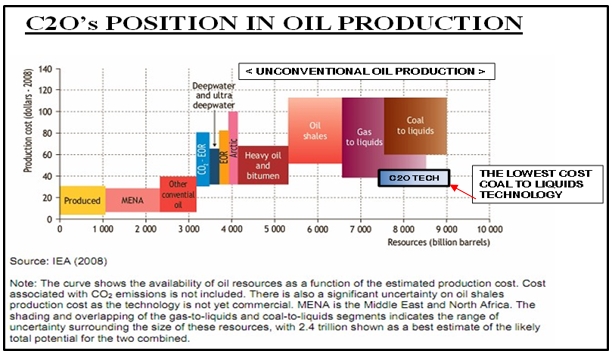

The Company plans to deploy the C2O-Rinker Process to the Powder River Coal Basin (PRB) of Northeastern Wyoming with the option to produce a variety of agriculture, metallurgical and energy products in combination:

Activated Carbon which can be used as a soil amendment (agriculture),

Pulverized Coal Injection (PCI) that is used in the production of steel (metallurgical),

Upgraded thermal coal that is clean and “sulfur compliant” (energy),

Synthetic crude oil with properties similar to Louisiana Light Sweet (LLS) (energy),

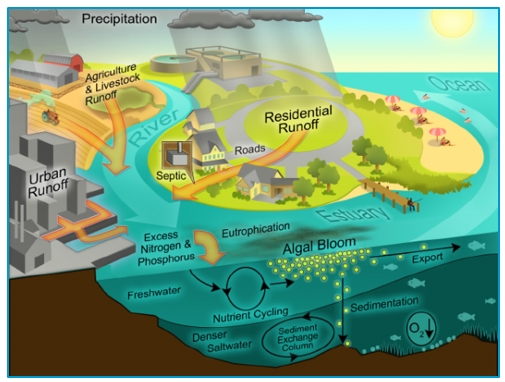

Activated carbon for the emerging soil amendment market has the most upside profit potential of the products that would be produced. Activated carbon has been used as a soil amendment over the ages, and most notably by the civilizations of the Amazon River region. Large and very successful civilizations were able to produce food from what is today relatively poor soils through the use of charcoal (biochar) mixed with soil as an amendment. Biochar, a form of activated carbon, was used as a soil amendment to retain organic nutrients available from human and animal waste as well as soil moisture in order to enhance the fertility of the soil. The Amazon Civilization practice of using activated carbon as a soil amendment is called Terra Preta (a documentary is available online at: https://www.youtube.com/watch?v=-YS8I6AZRfg). Today, the secrets of Terra Preta are being rediscovered by academia through the efforts Cornell University, and Arizona State University in what is now being called the Biochar Revolution (additional information can be found at: http://www.css.cornell.edu/faculty/lehmann/)

Activated carbon produced by a plant processing coal through the C2O-Rinker Process would have molecular properties that are very similar to the type of activated carbon used as a soil amendment in the process known as Terra Preta. Depending on the baseline soil properties, adding a soil amendment like activated carbon can increase crop yields by as much as 30%. The mechanics behind the increased crop yields involves enhanced retention of plant nutrients and soil moisture. Activated carbon from coal (coal char) is already being used on soils as an agent to clean up toxic chemical spills, but is not currently available at a price point to be used in commercial agriculture to enhance crop yields. A proposed plant utilizing the C2O-Rinker Process can produce activated carbon at the volume and price point that is economical for producing a soil amendment product for commercial agriculture.

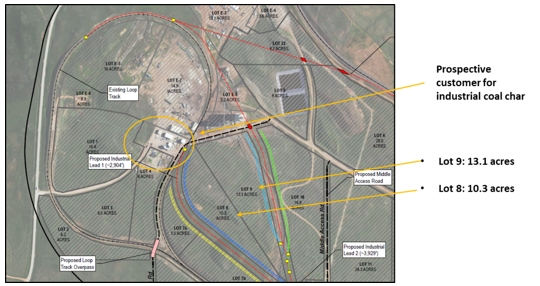

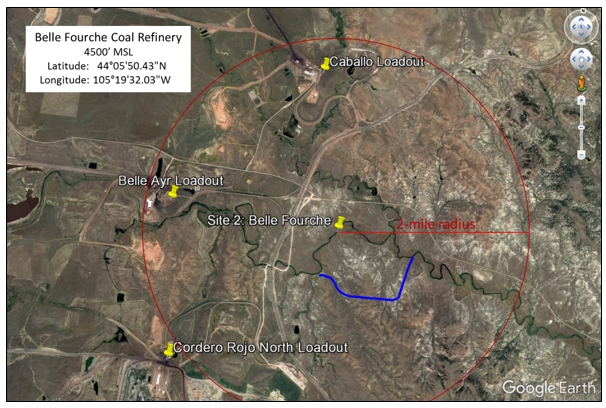

The proven C2O-Rinker Process is currently being fielded to China and is available to be fielded to the Powder River Basin of Wyoming and Montana, USA. The Company plans to work closely with the Wyoming Business Council (Cheyenne) and the Western Research Institute (Laramie), and the University of Wyoming School of Energy Resources (SER - Laramie) to field a full-scale coal refining plant by the second half of 2020. The full-scale plant is envisioned to have six lines, processing 3,000 short tons of coal per line per day of input coal (18,000 short tons per day total). The daily production of the plant (300 days per year) is expected to be:

| · | 6,300 t/d of soil amendment product |

| · | 10,260 bbl/day of synthetic crude |

The Company expects to process low-grade coal costing at $10/ton through a coal refinery employing the C2O-Rinker Process to make products worth an estimated $63.50 per input ton at an estimated direct cost of $5/input ton thereby yielding an estimated $48.50/input ton in operating profit. Annual EBITDA from the project is expected to approximate $48.50/input ton across 18,000 input tons per day for 300 days per year, or approximately $262MM at optimal market and operating conditions.

| i. | The Intellectual Property |

A total of seven patents have been granted in the United States to protect the intellectual property behind the C2O-Rinker Process. Three of the seven patents have been granted in China, and one of the seven patents has been granted in South Africa. Fifteen additional patent applications are pending from the seven original United States filings are in various stages of processing in the countries of Australia, Canada, China, Hong Kong, India, Indonesia, Mongolia and Vietnam. There are additional process patents under development to protect the process in which the soil amendment product is manufactured.

| | | | | | | Granted | |

| | | Application | Filing | Publication | Publication | Patent | |

| | Title | Number | Date | Number | Date | Number | Issue Date |

| | | | | | | | |

| 1 | Sub-Bituminous Coal Processing | | | | | | |

| Using Increased Partial Pressure | 12/556935 | 10-Sep-09 | 11/0011722 | 20-Jan-11 | 8,470,134 | 25-Jun-13 |

| 2 | Bituminous Coal Processing Using | | | | | | |

| Partial Pressure and Pre-Treatment | 12/556977 | 10-Sep-09 | 11/0011720 | 20-Jan-11 | 8,366,882 | 5-Feb-13 |

| 3 | Coal Processing Using Iron | | | | | | |

| Separataion Process | 12/557041 | 10-Sep-09 | 11/0011719 | 20-Jan-11 | 8,394,240 | 12-Mar-13 |

| 4 | Coal Processing with Added | | | | | | |

| Biomass and Volatile Control | 13/234781 | 16-Sep-11 | 12/0066967 | 22-Mar-12 | 9,163,192 | 20-Oct-15 |

| 5 | Two-Zone Coal Processing Stages | | | | | | |

| for Increased Efficiency | 13/231149 | 13-Sep-11 | 13/0062186 | 14-Mar-13 | 9,074,138 | 7-Jul-15 |

| 6 | Process for Treating Coal to | | | | | | |

| Improve Recovery of Condensable | | | | | | |

| Coal Derived Liquids | 14/151.385 | 9-Jan-14 | 14/0190074 | | | |