Exhibit 99.1

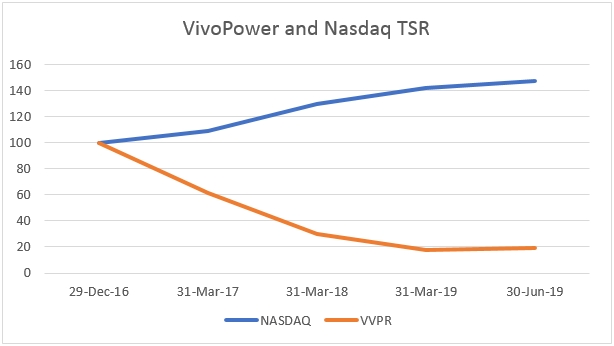

VivoPower International PLC VivoPower International PLC is an international solar and critical power services company, providing critical energy infrastructure generation and distribution solutions to a diverse range of commercial and industrial customers, including the development, construction, and sale of photovoltaic solar projects. Nasdaq: VVPR |

Contents

| The Reports | Page |

| Highlights | 1 |

| Chairman’s Statement | 2 |

| Interim Chief Executive’s Review | 3 |

| Strategic Report | 4 |

| Directors’ Report | 19 |

| Corporate Governance | 25 |

| Directors’ Remuneration Report | 28 |

| Independent Auditor’s Report to the Members of VivoPower International PLC | 34 |

| | |

| Group Financial Statements and Notes | |

| Consolidated Statement of Comprehensive Income | 38 |

| Consolidated Statement of Financial Position | 39 |

| Consolidated Statement of Cash Flow | 40 |

| Consolidated Statement of Changes in Equity | 41 |

| Notes to the Financial Statements | 42 |

| | |

| Parent Company Financial Statements and Notes | |

| Company Statement of Financial Position | 76 |

| Company Statement of Cash Flow | 77 |

| Company Statement of Changes in Equity | 78 |

| Notes to the Company Financial Statements | 79 |

| | |

| Other Information | |

| Company Information | 82 |

Highlights

| Accomplishments for Three Months Ended 30 June 2019 |

| | | |

| | ✔ | 49% growth in revenue over same period in prior year (unaudited) |

| | | |

| | ✔ | Forward order book in Critical Power Services increased by $19.9 million in the period, a 58% increase from 31 March 2019 |

| | | |

| | ✔ | Positive underlying EBITDA of $0.4 million for the period |

| | | |

| | ✔ | Further 40% ($2.0 million annualised) reduction in Corporate and Solar Development overheads |

| | | |

| | ✔ | Unrestricted cash resources increased to $7.1 million from $4.5 million at 31 March 2019 |

| | | |

| | ✔ | Net debt reduced by a further $1.7 million to $13.0 million (1) |

| | | |

| | | Three Months Ended | | | Year Ended 31 March | |

(US dollars in thousands, except per share data) | | 30 June 2019 | | | 2019 | | | 2018 | |

Revenue | | | 13,617 | | | | 39,036 | | | | 33,647 | |

Gross profit | | | 1,657 | | | | 6,310 | | | | 5,123 | |

Operating loss | | | (33 | ) | | | (5,410 | ) | | | (7,595 | ) |

Adjusted EBITDA (2) | | | 404 | | | | (1,176 | ) | | | (3,201 | ) |

Basic earnings per share (dollars) | | | (0.11 | ) | | | (0.83 | ) | | | (2.06 | ) |

Diluted earnings per share (dollars) | | | (0.11 | ) | | | (0.83 | ) | | | (2.06 | ) |

1. Excluding the effect of a change in accounting policy for operating leases as further described in Note 2.16 to the consolidated financial statements.

2. Adjusted EBITDA is a non-IFRS financial measure. We define Adjusted EBITDA as earnings before interest, taxes, depreciation and amortisation, impairment of assets, impairment of goodwill, and one-off non-recurring costs, including restructuring expenses, non-recurring remuneration and consulting fees. We believe that Adjusted EBITDA and Adjusted earnings per share provides investors and other users of our financial information consistency and comparability with our past financial performance, facilitates period-to-period comparisons of operations and facilitates comparisons with our peer companies, many of which use a similar non-IFRS or generally accepted accounting principles in the United States (“GAAP”) financial measure to supplement their IFRS or GAAP results, as applicable.

Chairman’s Statement

VivoPower International PLC (“VivoPower” or the “Company”) is changing its financial year end to 30 June, with effect from 30 June 2019, This is being done to deliver on further productivity and cost savings by harmonising with the financial year end of its ultimate parent entity, Arowana International Limited, This Chairman’s Statement is accordingly for the three month period ended 30 June 2019. The key developments during this period were as follows:

• | Year on year revenue growth of 49% with a positive underlying EBITDA result of $0.4 million for the quarter; |

• | Further growth in operating cashflow, resulting in unrestricted net cash balance increasing from $4.5 million to $7.1 million; |

• | Continued balance sheet improvement, with a further reduction in net debt from $14.7 million to $13 million (excluding the effect of the change in accounting policy with respect to leases); |

• | Further 58% increase in Australian Critical Power Services forward order book to another all-time record of $54.2 million; and, |

• | Additional value adding progress made in both the Australian as well as US solar development businesses. |

As mentioned in the Chairman’s Letter for the fiscal year ended 31 March 2019, VivoPower’s primary objective is to return to profitability this coming fiscal year. Given the results achieved for the quarter ended 30 June 2019, the board and leadership team remain confident that this objective can be delivered,

From a corporate governance standpoint, the Board expects to appoint another UK based non-executive director before the Company’s Annual General Meeting (AGM). The AGM is to be held on 23rd September 2019.

On behalf of the rest of the Board, I would like to take this opportunity to thank all of our stakeholders for their support and engagement during the period. Rest assured, the VivoPower team and the Board remains steadfastly committed to overcoming challenges and maximising value across its business units.

Kevin Chin, Chairman

21 August 2019

Chief Executive’s Review

This Annual Report is for the three months ended 30 June 2019. Following an internal review for further cost savings and efficiencies across the Group, the Company decided to change its fiscal year end to 30 June, effective with 30 June 2019. Moving forward, this allows the Company to align reporting periods with its Australian operations and majority shareholder, Arowana International Limited. This will eliminate duplication and overlap in budgeting, reporting, and audit requirements and facilitate further reduction in corporate overhead costs.

We are pleased with the results for this three-month period as it confirms the change in trajectory for the Company, the culmination of the effort of our entire team to strategically expand the business into sectors with strong tailwinds, improve and optimize our operations, reduce costs, and focus on profitability. Returning to sustained profitability is one of our primary objectives and we can begin to see the green shoots of progress in this area as we report a 49% growth in revenue over the same period last year and positive EBTIDA for the first time in over two years.

The backbone of our performance for the quarter continues to be Critical Power Services, where revenue grew 60% over the same period last year and produced a profit right to the bottom-line. The forward order book for Critical Power Services grew by $19.9 million in the three months ended 30 June 2019, on top of the $34.3 million reported at 31 March 2019. These orders have come largely from new industry sectors which have been targeted for growth, including solar, data centres, and health care. This confirmed growth is further supported by a strong business development pipeline of additional opportunities totalling $36.1 million across all these sectors as well the traditional business base in utilities, industrial, and mining.

Australian solar development continued strongly through the quarter, with approval of a new 5 MW project to be developed in conjunction with our partners, ITP Renewables, for completion by June 2020. The first 15 MW project developed with ITP is nearing completion and is expected to be ready for construction in October 2019. We believe that continued focus and investment in Australian solar development is strategic, not only for the returns which it can provide directly, but also for the pipeline of potential EPC work it can provide to J.A. Martin.

A primary focus continues to be maximising the value and monetise our U.S. portfolio of solar projects held in the ISS Joint Venture. After having remediated development process issues such as improper project documentation management and lack of proactive engagement with potential customers to secure power purchase agreements (“PPAs”) in the last six months, a dedicated inhouse sales advisor is now fully focused on securing value accretive corporate PPAs for all projects, extending the life and viability of projects, and actively marketing the portfolio to a range of targeted domestic and international investors, developers, and large corporates. We remain optimistic that our current strategy and focussed activity will produce meaningful value accretive progress on crystallisation of these assets in the next 12 months.

We will continue to be diligent in managing the overhead costs to ensure as much revenue as possible reaches the bottom-line and profitability can not only be restored but build a sustainable and resilient cash generative business that will result in maximum value for our shareholders.

I appreciate the ongoing support of our shareholders, suppliers, customers, employees, and other stakeholders in our effort to restore profitability and build the value and enhance the saleability of our assets. While we are not where we want to be yet, I am confident that we are on the right path and the promising signs we see in this report will mature more significantly over the next 12 months to produce meaningful transformation of the business in due course.

Art Russell

Interim Chief Executive Officer

21 August 2019

Strategic Report

Principal Activities

VivoPower is an international solar and critical power services company that focuses on small and medium scale solar development, engineering, procurement and construction (“EPC”) and selected solar asset ownership and maintenance. Headquartered in London, VivoPower has operations in the United States, Australia and the United Kingdom.

Management analyses our business in three reportable segments: Critical Power Services, Solar Development, and Corporate Office. Critical Power Services is represented by J.A. Martin Electrical Pty Limited (“J.A. Martin”) and Kenshaw Electrical Pty Limited (“Kenshaw”) operating in Australia with a focus on the design, supply, installation and maintenance of power and control systems, including for solar farms. Solar Development is the development and sale of commercial and utility scale PV solar power projects in the U.S. and Australia. Corporate Office is the Company’s corporate functions, including costs to maintain the Nasdaq public company listing, comply with applicable SEC reporting requirements, and related investor relations and is located in the United Kingdom. See Note 4.2 to our consolidated financial statements included herein for a breakdown of our financial results by reportable segment.

Critical Power Services

VivoPower, through its wholly-owned Australian subsidiaries, J.A. Martin and Kenshaw, provide critical energy infrastructure generation and distribution solutions including the design, supply, installation and maintenance of power and control systems to a customer base in excess of 750 active commercial and industrial customers and is considered a trusted power adviser. J.A. Martin and Kenshaw are headquartered in the Hunter Valley and Newcastle region, which is the most densely populated industrial belt in Australia. Structural and cyclical factors have created a strong operating environment for our Critical Power Services businesses, particularly the strong growth in infrastructure investment, recovery in the mining sector, and increasing demand for data centres and solar farms.

J.A. Martin and Kenshaw are owned by VivoPower through a holding company called Aevitas, which was formed in 2013 and acquired by VivoPower in December 2016.

The Critical Power Services businesses have several core competencies, encompassing a range of electrical, mechanical and non-destructive testing services.

J.A. Martin Electrical Pty Limited

Founded in 1968, J.A. Martin is a specialised industrial electrical engineering and power services company that has been servicing the largest commercial and industrial belt in Australia, the Newcastle and Hunter Valley region in NSW, for more than 50 years.

J.A. Martin operates from three premises in New South Wales, including a factory in Newcastle which manufactures, and services customised industrial switchboards and motor control centres. It has two office and workshop facilities, in the Hunter Valley for servicing the infrastructure, mining and industrial sectors, and in the Liverpool Plains for servicing customers in the infrastructure and mining sectors.

J.A. Martin’s core competencies include: customised industrial switchboard and motor control centre design, manufacture and maintenance; industrial electrical engineering, project management for mining, infrastructure and industrial applications; solar farm electrical contracting and EPC; electrical maintenance and servicing; and, industrial, mining and infrastructure CCTV and data cabling. With 117 employees and a fleet of 66 service vehicles J.A. Martin has built a strong reputation throughout eastern Australian for exceptional engineering and design, delivered on time and budget, supported by a high-level of quality and service.

J.A. Martin serviced over 250 customers in the past year across a diverse range of industries, including solar farms, grain handling and agriculture, water and gas utilities, cotton gins, commercial buildings, mining, marine and rail infrastructure. J.A. Martin’s commitment to health & safety and quality, as recognised by their AS 4801 and ISO 9001 certifications, has positioned them to service some of the largest and most respected firms in the world.

Strategic Report (continued)

With their history and core business centred in the industrial and mining sector of New South Wales, J.A. Martin has recently taken a firm foothold in the Australian solar electrical and EPC market, focusing on the small and medium sized solar projects segment of the market. The Australian solar generation market has a strong long-term growth outlook. Bloomberg New Energy Finance energy outlook forecasts renewable power investment in Australia will reach more than $138 billion by 2050. In addition, there is significant growth of behind the meter ground mount and roof-top solar installations as commercial, industrial and government entities respond to concerns about energy security and costs by embracing cheaper solar power solutions. J.A. Martin has recently completed the provision of electrical installation and services for its third solar farm. J.A. Martin has now also been approved by the Clean Energy Council of Australia allowing them to complete the entire EPC process, not just the electrical component, and as a result is very well positioned competitively to leverage the strong growth outlook for Australian solar.

Revenue is earned entirely within Australia and is comprised of the following activities:

| | | Three Months Ended 30 June | | | Year Ended 31 March | |

(US dollars in thousands) | | 2019 | | | 2018 (unaudited) | | | 2019 | | | 2018 | |

Electrical installation projects | | | 774 | | | | 1,030 | | | | 8,375 | | | | 6,165 | |

Electrical service contracts | | | 2,986 | | | | 2,244 | | | | 7,361 | | | | 9,425 | |

Electrical switchboard manufacturing | | | 1,813 | | | | 2,466 | | | | 4,949 | | | | 4,372 | |

Total revenue | | | 5,573 | | | | 5,740 | | | | 20,685 | | | | 19,962 | |

Revenue reported for the three months ended 30 June 2019 is materially impacted by the decrease in the exchange rate of the Australian dollar to the U.S. dollar. If the same exchange rate applicable to the three months ended 30 June 2018 was applied, revenue for the three months ended 30 June 2019 would be reported at $6.0 million instead of $5.6 million.

J.A. Martin is a business-to-business enterprise and obtains most of its business through tender processes or from extension of services to existing or previous customers.

There is no material seasonality which impacts this business.

With over 50 years of history, J.A. Martin sources its supplies from a large number of domestic suppliers based on competitive pricing, reliable delivery, product performance, and past business relationships. These relationships are integral to the realisation of its commercial goals and ability to meet the demands of customers in a competitive marketplace.

With over 250 active customers for the year ended 30 June 2019, the business is not reliant upon any one customer, nor is the business dependent on any one patent, license, material contract, or process. Further, there are no government regulations which are material to the business, beyond those generally applicable to all businesses within the same statutory regime.

Kenshaw Electrical Pty Limited

Founded in 1981, Kenshaw has a unique mix of electrical, mechanical and non-destructive testing capabilities for customers across a broad range of industries, operating from its facilities in Newcastle, New South Wales, and Canberra, Australian Capital Territory. Kenshaw’s success has been built on the capability of its highly skilled personnel to be able to provide a wide range of power generation solutions, products and services across the entire life-cycle for electric motors, power generation, mechanical equipment and non-destructive testing. From the head office in Newcastle, Kenshaw’s engineers provide regular and responsive service to long-standing clients ranging from data centres, hospitals, mining and agriculture to aged care, transport and utility services.

Kenshaw’s core competencies include: generator design, turn-key sales and installation; generator servicing and emergency breakdown services; customised motor modifications; non-destructive testing services including crack testing; diagnostic testing such as motor testing, oil analysis, thermal imaging and vibration analysis; and, industrial electrical services.

Strategic Report (continued)

A growing market for Kenshaw is the data centre sector and it is benefiting from this growth through Kenshaw’s long-term relationship with one of Australia’s leading data centre companies,

A second key growth market for Kenshaw is hospitals and aged care facilities. According to a 2015 Intergenerational Report by the Australian Treasury Department, this is expected to require the development of approximately 76,000 new locations by 2024 in order to meet demand, as the number of Australians aged 65 years and over is forecast to more than double over the next 40 years. Kenshaw has built up significant experience through servicing longstanding customers such as Hunter New England Health, Anglican Care, and BUPA for which it delivers customised critical back up power solutions and services as well as generator and thermal imaging services.

Recent contract wins in the active treatment hospital sector, has also placed critical care power infrastructure as a priority for growth over the coming years. The Australian Government is providing record investment in health care across hospital funding. Nationwide, the Australian Government’s hospital funding contribution to states and territories is projected to grow from $21.2 billion in 2018/19 to an estimated $29.1 billion in 2024/25.

Revenue is earned entirely within Australia and is comprised of the following activities:

| | | Three Months Ended 30 June | | | Year Ended 31 March | |

(US dollars in thousands) | | 2019 | | | 2018 (unaudited) | | | 2019 | | | 2018 | |

Generator sales and installation | | | 6,381 | | | | 1,120 | | | | 11,095 | | | | 5,919 | |

Generator service and non-destructive testing | | | 1,178 | | | | 1,091 | | | | 1,744 | | | | 1,786 | |

Motor sales and overhaul | | | 377 | | | | 470 | | | | 4,276 | | | | 3,965 | |

Total revenue | | | 7,936 | | | | 2,681 | | | | 17,115 | | | | 11,670 | |

Kenshaw has a regional based marketing strategy, utilising sales staff on the road and internally, open and private tenders, targeted billboard advertising, and web-based advertising. New business is developed through a number of channels including: targeted cold calling, leveraging of existing relationships, breakdown services, and formal tendering process. Kenshaw also maintains strong relationships with key suppliers and consultants who will refer new and potential clients to us for projects and other works.

There is no material seasonality which impacts this business.

Kenshaw’s relationship with its primary suppliers enables it to sell and service their equipment as dealers or agents. It is a primary supplier and service agent for Cummins generators and WEG electric motors. Kenshaw also maintains long term relationships with other equipment manufacturers such as Toshiba and FG Wilson. This allows it to offer a complete solution to its clients with flexibility of product choice. While equipment manufacturers are vital to success, it is the working relationships with all its suppliers that allows Kenshaw to maintain our competitive advantage in delivering orders and projects.

For the three months ended 30 June 2019, 76% (year ended 31 March 2019: 32%) of Kenshaw’s revenue was earned from one customer and this customer is expected to continue to provide significant revenue in future years. However, with almost 500 active customers for the year ended 30 June 2019, the business is not solely reliant upon this customer, nor is the business reliant on any one patent, license, material contract, or process. Further, there are no government regulations which are material to the business, beyond those generally applicable to all businesses within the same statutory regime.

Solar Development

VivoPower continues to prioritise the development, construction, and sale of solar projects in Australia, leveraging the customer relationships of J.A. Martin and Kenshaw and providing a pipeline of development of EPC opportunities to J.A. Martin. With respect to the U.S., the Company’s focus remains on the monetisation of our portfolio of solar projects, with a view to then using the proceeds to execute a strategic redeployment.

Strategic Report (continued)

Successful solar development requires an experienced team that can manage many work streams on a parallel path, from initially identifying attractive locations, to land control, permitting, interconnection, power marketing, and project sale to investors. Rather than build a substantial team internally to accomplish all of these activities, our business model is to joint venture on a non-exclusive basis with existing experienced project development teams so that multiple projects can be advanced simultaneously and allow us to focus on provision of capital, project management, and marketing and sale of projects. In Australia we have partnered with ITP Renewables (“ITP”), a global leader in renewable energy engineering, strategy and construction, and energy sector analytics. In the U.S., we have partnered with Innovative Solar Systems, LLC (“Innovative Solar”), one of the top solar developers in the U.S., having delivered 2.4 GW of projects to date, with another 13 GW in their current project pipeline.

Since long-term investors typically value projects on the basis of long-term rates of return (IRR), the development profit that may be created by a developer is the difference between the cost to develop projects and the fair market value of such projects. We believe that successful project development results in a significantly lower cost basis than buying projects that are already developed. With this approach, we believe that we can achieve attractive risk-adjusted returns in the current market. To achieve these returns, we focus on managing capital in a disciplined manner during the early development stages and seeking strategic investors with a low cost of capital once projects achieve an advanced stage.

The stages of solar development can be broadly characterised as: (i) early stage; (ii) mid-stage; (iii) advanced stage; (iv) construction; and, (v) operation. Our business model is to work through the development process from early stage through to advanced stage, and then sell those projects that have completed the advanced stage of development, also known as “shovel-ready” projects, to investors who will finance construction and ultimately own and operate the project.

Early stage development is primarily focused on securing site control, data collection, community engagement, preliminary permitting, and offtake analysis. We consider site control to be achieved once we have obtained purchase or lease options, easements or other written rights of access to the land necessary for the construction and operation of the solar project.

Mid-stage development is focused on:

| | ● | Transmission Interconnection Queue and Study - identification of a point of interconnection to the transmission or distribution system, obtaining a queue position with the relevant electric system operator, and completing at least one feasibility, screening, or system impact study (or equivalent). An interconnection study and its approval by the relevant transmission or distribution system operator is a prerequisite to the design and construction of the facilities that will interconnect the solar project with the transmission or distribution system. |

| | ● | Environmental Impact Study and Permitting. Completion of an environmental impact study (or equivalent) is often a prerequisite to obtaining zoning/use permits. Depending on the size and location of the project, we generally initiate the studies needed for an environmental impact study approximately 18 months prior to the anticipated construction start date and receive the material permits before an interconnection is agreed with the relevant utility. To consider this milestone completed, we will have either finished an environmental impact study or received the material permits for the construction and operation of our solar project. |

The most important goal of the advanced stage is to obtain an interconnection agreement with the relevant electric system operator and a revenue contract to sell power, usually through a Power Purchase Agreement (“PPA”). Long-term PPAs range from 5 to 15 years with creditworthy off takers, typically obtained by responding to requests for proposals or conducting bilateral negotiations with utility, commercial, industrial, municipal, or financial enterprises. In certain markets with liquid electricity trading, it is possible to enter into financial hedges to support a minimum price of power sold into such markets.

Strategic Report (continued)

A project in the advanced stage indicates a higher degree of confidence for successful completion. However, a project may become unachievable during any stage of development for a variety of reasons including, loss of land control, unsuitable studies, uneconomic interconnection or increased construction costs. Should a project be deemed not to be viable at any stage of development, the project will be discontinued. Accordingly, our focus is to continuously and rigorously evaluate project viability through the earlier development stages and identify projects which will not be viable as early as possible.

Once completing the advanced stage of development, a project is considered to be shovel-ready. Prior to construction, VivoPower seeks qualified investors to purchase projects in order to maximise the return on our capital and opportunities from capital recycling. Potential purchases are identified and engaged from those parties known to VivoPower, its development partners, previous investors, and generally within the renewable energy industry.

Depending on the purchasing party and their particular investment objectives and capabilities, VivoPower may enter into a development agreement with them to manage construction on their behalf. During the construction stage, key contracts such as the PPA and interconnection agreements are finalised and executed. Estimated costs to build and operate the project are determined with selected contractors, internal technical resources and engineers. All the definitive contracts between the projects, financing parties and the EPC firm who will build the project will be executed, the construction is completed, and project is commissioned and interconnected to the grid, achieving its commercial operations date (“COD”) under the PPA.

Once achieving COD, the operational stage begins, and the project generates electricity and sells power. During this phase, VivoPower may provide ongoing services encompassing operations, maintenance and optimisation of these solar plants pursuant to long-term contracts. In addition, if a minority equity stake is retained, VivoPower may realise revenues from the sale of power.

The solar energy development industry is competitive. Competition within the industry is strong and can be expected to continue to increase. Some of our competitors have substantially more operating experience, access to financial, engineering, construction, business development or other resources important for solar energy development, larger footprints or brand recognition. We compete with energy and infrastructure funds and renewable energy companies and developers, as well as conventional power companies, to acquire, invest in and develop energy projects. Competition in the solar energy sector can be significantly affected by legal, regulatory and tax changes, as well as environmental and energy incentives provided by governmental authorities.

Our business is affected by various regulatory frameworks, particularly ones relating to energy and the environment. These include the rules and regulations of the Federal Energy Regulatory Commission, the U.S. Environmental Protection Agency, regional organisations that regulate wholesale electrical markets, state agencies that regulate energy development and generation and environmental matters, and foreign governmental bodies that occupy roles similar to the foregoing.

Our business is also affected by various policy mechanisms that have been used by governments to accelerate the adoption of solar power or renewable energy technologies generally. Examples of such policy mechanisms include rebates, performance-based incentives, feed-in tariffs, tax credits, accelerated depreciation schedules and net metering policies. In some cases, such mechanisms are scheduled to be reduced or to expire or could be eliminated altogether. Rebates are provided to purchasers of solar systems based on the cost and size of the purchaser’s solar power system. Performance-based incentives provide payments to a solar system purchaser based on the energy produced by their solar power system. Feed In Tariffs (“FITs”) pay solar system purchasers for solar power system generation based on energy produced at a rate that is generally guaranteed for a period of time. Tax credits and accelerated depreciation schedules permit an owner of a solar project to claim applicable credits and deduct depreciation from income on an accelerated basis on their tax returns. Net metering policies allow customers to deliver to the electric grid any excess electricity produced by their on-site solar power systems, and to be credited for that excess electricity at a rate that is often at or near the full retail price of electricity.

Strategic Report (continued)

In addition, many states in the U.S. and Australia have adopted renewable portfolio standards or similar mechanisms which mandate that a certain portion of electricity delivered by utilities to their customers come from eligible renewable energy resources. Some states significantly expanded their renewable portfolio standards in recent years.

Our business is also affected by trade policy and regulations. Examples include tariffs on solar modules and solar cells. Such tariffs can have a significant impact on the pricing and supply of solar cells and solar modules, and as a result impact the sale value and/or economic viability of projects.

Australia

VivoPower had previously developed and acquired a diverse portfolio of operating solar projects in Australia, totalling 2.7 MW across 81 sites in every Australian state and the Australian Capital Territory. VivoPower’s Australia projects are fully-contracted with commercial, municipal and non-profit customers under long-term power purchase agreements. Pursuant to the Company’s strategy to recycle development capital, we have partially monetised these projects, having completed the sale of the Amaroo Solar Project (0.6 MW) in February 2018, the Express Power Portfolio of solar projects (0.2 MW) in September 2018, and the Juice Capital Portfolio of solar projects (0.3 MW) in November 2018.

The Company’s remaining operating portfolio of solar projects consists primarily of the Sun Connect portfolio, a portfolio originally of 68 commercial and industrial sites totalling 1.6 GW acquired in December 2015, spread across five Australian states, with power purchase agreement end dates between 2033 and 2035. The Company has invested considerable time and effort to improve the portfolio including site performance evaluation, warranty replacements of faulty components, and customer communication. To date, a total of 15 sites have been disposed for gross proceeds of $228,000. Moving forward, as individual sites continue to reach the conclusion of the finance leases by which they were initially funded, VivoPower will collect an increasing stream of monthly revenue from retained projects. Revenue from remaining owned projects is currently $10,000 per month, and that figure will increase to as much as $26,000 per month by June 2022, subject to the number of sites sold in the interim. The Company will continue its focus on sale of the individual sites, while continuing to pursue portfolio-wide sale opportunities if available.

In addition to the Sun Connect Portfolio, VivoPower is continuing to develop and finance new small to medium sized solar projects throughout Australia, both individually and with experienced partners. Following a term sheet signed in February 2018, VivoPower entered into a definitive investment agreement with ITP in July 2018, for the development of a portfolio of utility-scale solar projects in New South Wales to an aggregate minimum target of 50 MW. ITP is a global leader in renewable energy engineering, strategy and construction, and in energy sector analytics. Under the terms of the investment agreement, VivoPower funds up to 1.4 cents per watt (AC) of development costs per project in exchange for a 60% equity stake in each project, with an opportunity to achieve a sale and transfer at multiple stages, as early as shovel-ready. The projects will be developed on a merchant basis, with corporate offsite PPAs sought on an opportunistic basis during the development period.

The Company commenced development of the first project under the ITP investment agreement, Yoogali Solar Farm, in July 2018. Yoogali Solar Farm is a 15 MW project that is expected to be shovel-ready in October 2019. Discussions are already underway with various investors seeking to acquire the project and, depending on the investor, VivoPower may remain involved to construct the project for a development fee to be agreed. A second solar project under the ITP agreement has recently been approved and is expected to complete development by June 2020.

VivoPower believes its continued focus and investment in the Australian solar market is strategic, not only for the returns which it can provide but also for the pipeline of potential EPC work it can provide to J.A. Martin. While this business has been slow to develop momentum, which we believe is largely a result of limited investment capital and historic projects which required significant attention but produced minimal income, we believe that with capital being recycled from both the Australian historic projects and sale of the U.S. portfolio, this business has the capacity to grow exponentially over the next two to five years and contribute significant development profits to VivoPower and EPC opportunities to J.A. Martin.

Strategic Report (continued)

The Australian renewable energy market is expected to experience very strong growth over the coming years. According to Bloomberg, new renewable and flexible generators are expected to make up 78% of Australia’s energy capacity by 2050, up from just 33% in 2017. Over the same period, fossil fuels will decline from 67% to 17% of Australia’s capacity mix, driven by the increasing affordability of renewables along with retirements of coal and other traditional sources of generation. Over US$138 billion is forecast to be invested in new renewables and battery storage in Australia over that period, compared to less than US$25 billion in other sources.

Already the world leader in residential solar penetration, Australia will continue to add home rooftop solar, while at the same time seeing a boom in larger-scale commercial, industrial and utility-scale installations over the coming decade. With new solar already far less expensive than building or extending the lives of existing coal and gas generators, and nearly cheaper than running existing coal, Australia’s solar boom is expected to continue even in the absence of any additional incentives or other legislation.

The Company believes that the combined project development, financing and construction expertise of VivoPower and J.A. Martin uniquely positions us as a broad-spectrum service provider to the burgeoning Australian solar market.

United States

The Company’s key objective in the United States is to enhance the value and then monetise its portfolio of U.S. solar projects, with a view to using the proceeds to execute a strategic pivot for the Company in the next twelve months.

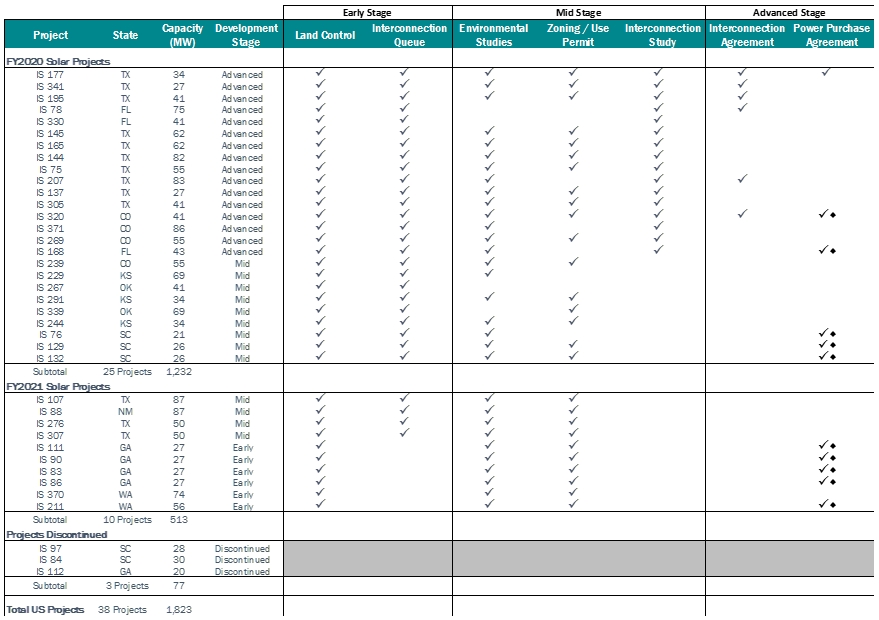

VivoPower’s portfolio of U.S. solar projects is held by Innovative Solar Ventures I, LLC (“ISS Joint Venture”), a joint venture with an affiliate of Innovative Solar. The ISS Joint Venture provides a 50% ownership in a diversified portfolio of 38 solar projects in 9 states across the United States, with a combined potential electrical generating capacity of 1.8 GW.

Under the terms of the ISS Joint Venture, the Company has committed to invest $14.2 million in the ISS Joint Venture for its 50% equity interest, after reducing the commitment by $0.8 million in potential brokerage commissions that have not been required and which have been credited towards the Company’s commitment. The $14.2 million commitment is allocated to each of the 38 projects based on monthly capital contributions determined with reference to completion of specific project development milestones under an approved development budget for the ISS Joint Venture. To 30 June 2019, the Company contributed $13.1 million of the $14.2 million commitment to the ISS Joint Venture, leaving a remaining capital commitment at 30 June 2019, of $1.1 million, which is recorded in trade and other payables.

With respect to any sale, 2/3 of the first $15 million of cumulative gross proceeds of project sales are distributed to VivoPower, 1/3 of the following $15 million, and 50% thereafter.

Of the original 38 projects, three have been discontinued as we considered them less economically attractive versus other projects and did not want to invest further capital in them. The remainder of the projects are in various stages of development as summarised below and are all being actively marketed for sale with an expectation of full realisation within the next twelve months. The reflection of projects in fiscal years is based on the expected date the project will complete the advanced stage of development and be ‘shovel-ready’ and is for indicative purposes only as projects may be sold at any stage of development. None of these projects have been written up in value and continue to be carried at cost.

Strategic Report (continued)

| | ♦ | Project is eligible for a PPA under PURPA, a U.S. federal law that requires utilities in regulated areas to offer PPAs to renewable energy providers with Qualifying Facilities. |

Financial Results

Three Months Ended 30 June 2019

| | | Three Months Ended 30 June | |

(US dollars in thousands) | | 2019 | | | 2018 (unaudited | ) |

Revenue from contracts with customers | | | 13,617 | | | | 9,111 | |

Costs of sales | | | (11,960 | ) | | | (7,446 | ) |

Gross profit | | | 1,657 | | | | 1,665 | |

General and administrative expenses | | | (1,291 | ) | | | (2,079 | ) |

Gain/(loss) on sale of assets | | | 38 | | | | (4 | ) |

Depreciation and amortisation | | | (437 | ) | | | (411 | ) |

Operating loss | | | (33 | ) | | | (829 | ) |

Restructuring costs | | | (525 | ) | | | (40 | ) |

Finance expense – net | | | (796 | ) | | | (842 | ) |

Loss before taxation | | | (1,354 | ) | | | (1,711 | ) |

Income tax | | | (92 | ) | | | 12 | |

Loss for the period | | | (1,446 | ) | | | (1,699 | ) |

During the three months ended 30 June 2019, the Company and its subsidiaries (the “Group”) generated revenue of $13.6 million, gross profit of $1.7 million, operating loss of $0.03 million and a net loss of $1.4 million. For the three months ended 30 June 2018, the Group generated revenue of $9.1 million, gross profit of $1.7 million, operating loss of $0.8 million, and a net loss of $1.7 million.

Adjusted EBITDA for the three months ended 30 June 2019 was a profit of $0.4 million, compared to a loss of $0.4 million for the same period in the previous year. Adjusted EBITDA is a non-IFRS financial measure. We define Adjusted EBITDA as earnings before interest, taxes, depreciation and amortisation, impairment of assets, impairment of goodwill, and one-off non-recurring costs, including restructuring expenses, non-recurring remuneration and consulting fees.

Strategic Report (continued)

The results of operations for the three months ended 30 June 2019 reflect a period of significant growth for the Critical Power Services business segment. Kenshaw in particular has won a number of new contracts with data centre and hospital sector customers. These have contributed to a $5.1 million growth in Critical Power Services revenues, to $13.5 million, compared to $8.4 million in the three months ended 30 June 2018. Solar revenues of $0.1 million result from sale of Solar Renewable Energy Certificates (“SREC’s”). By contrast Solar revenues were $0.6 million higher in the three months ended 30 June 2018, resulting from distributions from the Group’s investments in NC-31 and NC-47 solar projects in North Carolina, United States (together, the “NC Projects”) prior to their sale in July 2018.

The results of operations for the three months ended 30 June 2019, also reflect savings of $0.8 million in general and administrative costs compared to the three months ended 30 June 2018. There was significant effort to rationalise the cost base of the Solar Development business in the year. Headcount reduction and bringing in-house previously outsourced business activities has generated savings of $0.8 million in labour, legal and professional fees, and travel expenses.

The results of operations for the three months ended 30 June 2019 further reflect restructuring costs of $0.5 million for legal and professional fees related to disputes with former employees, as further described in Note 7 to the consolidated financial statements.

Management analyses our business in three reportable segments: Critical Power Services, Solar Development, and Corporate Office. Critical Power Services is represented by J.A. Martin and Kenshaw operating in Australia with a focus on the design, supply, installation and maintenance of power and control systems. Solar Development is the development and sale of commercial and utility scale PV solar power projects in U.S. and Australia. Corporate Office is all United Kingdom based corporate functions. The following are the results of operations for the three months ended 30 June by reportable segment:

Three Months Ended 30 June 2019 (US dollars in thousands) | | Critical Power Services | | | Solar Development | | | Corporate Office | | | Total | |

Revenue from contracts with customers | | | 13,484 | | | | 133 | | | | - | | | | 13,617 | |

Costs of sales | | | (11,864 | ) | | | (96 | ) | | | - | | | | (11,960 | ) |

Gross profit | | | 1,620 | | | | 37 | | | | - | | | | 1,657 | |

General and administrative expenses | | | (567 | ) | | | (206 | ) | | | (518 | ) | | | (1,291 | ) |

Gain/(loss) on sale of assets | | | 5 | | | | 41 | | | | (8 | ) | | | 38 | |

Depreciation and amortisation | | | (422 | ) | | | (14 | ) | | | (1 | ) | | | (437 | ) |

Operating profit/(loss) | | | 636 | | | | (142 | ) | | | (527 | ) | | | (33 | ) |

Restructuring costs | | | (15 | ) | | | (39 | ) | | | (471 | ) | | | (525 | ) |

Finance expense – net | | | (358 | ) | | | (49 | ) | | | (389 | ) | | | (796 | ) |

Profit/(loss) before taxation | | | 263 | | | | (230 | ) | | | (1,387 | ) | | | (1,354 | ) |

Income tax | | | (92 | ) | | | - | | | | - | | | | (92 | ) |

Profit/(loss) for the period | | | 171 | | | | (230 | ) | | | (1,387 | ) | | | (1,446 | ) |

Strategic Report (continued)

Three Months Ended 30 June 2018 (unaudited) (US dollars in thousands) | | Critical Power Services | | | Solar Development | | | Corporate Office | | | Total | |

Revenue from contracts with customers | | | 8,416 | | | | 695 | | | | - | | | | 9,111 | |

Costs of sales | | | (7,294 | ) | | | (152 | ) | | | - | | | | (7,446 | ) |

Gross profit | | | 1,122 | | | | 543 | | | | - | | | | 1,665 | |

General and administrative expenses | | | (662 | ) | | | (721 | ) | | | (696 | ) | | | (2,079 | ) |

Loss on sale of assets | | | (4 | ) | | | - | | | | - | | | | (4 | ) |

Depreciation and amortisation | | | (375 | ) | | | (34 | ) | | | (2 | ) | | | (411 | ) |

Operating profit/(loss) | | | 82 | | | | (212 | ) | | | (698 | ) | | | (828 | ) |

Restructuring costs | | | - | | | | - | | | | (40 | ) | | | (40 | ) |

Finance expense – net | | | (256 | ) | | | (164 | ) | | | (422 | ) | | | (842 | ) |

Loss before taxation | | | (174 | ) | | | (377 | ) | | | (1,160 | ) | | | (1,711 | ) |

Income tax | | | 8 | | | | 4 | | | | - | | | | 12 | |

Loss for the period | | | (166 | ) | | | (373 | ) | | | (1,160 | ) | | | (1,699 | ) |

Finance expense for the three months ended 30 June 2019 remained at $0.8 million, with interest on convertible loan notes and preferred share financing in Critical Power Services and the $19.0 million Arowana shareholder loan in line with prior year at $0.4 million. An increase in interest payable of $0.1 million in Critical Power Services arose due from interest on debtor finance borrowings introduced in August 2018. This increase was offset by non-recurrence of interest on the $2.0 million short-term loan from SolarTide, LLC outstanding in the comparative period.

As of 30 June 2019, the Group’s current assets were $36.3 million (31 March 2019: $29.8 million), which was comprised of $7.1 million (31 March 2019: $4.5 million) of cash and cash equivalents, $0.6 million restricted cash (31 March 2019: $1.3 million), $15.0 million (31 March 2019: $10.4 million) of trade and other receivables, and $13.5 million (31 March 2019: $13.5 million) of assets held for sale related to the ISS Joint Venture portfolio.

Current liabilities were $29.1 million (31 March 2019: $20.8 million), primarily due to a $5.1 million increase in contract liabilities related to critical power contracts in process at 30 June 2019, $0.6 million due the change in accounting policy related to operating leases as further described in Note 2.16 to the consolidated financial statements, and a $0.8 million short-term shareholder loan advanced in the three months ended 30 June 2019.

Current asset-to-liability ratio at 30 June 2019 was 1.25:1 (31 March 2019: 1.43:1).

As of 30 June 2019, the Group had net assets of $22.5 million (31 March 2019: $24.0 million), including intangible assets of $31.8 million (31 March 2019: $32.3 million). Property, plant and equipment increased from $1.2 million at 31 March 2019 to $3.0 million at 30 June 2019, principally due the $1.6 million impact of the change in accounting policy related to operating leases as referenced above.

Cash generated for the three months ended 30 June 2019 was $2.6 million (year-ended 31 March 2019: $2.7 million), arising from cash generated by operating activities of $2.2 million (year-ended 31 March 2019: cash used $1.6 million), cash used in investing activities of $0.4 million (year-ended 31 March 2019: cash generated $11.9 million), and cash generated by financing activities of $0.7 million (year-ended 31 March 2019: cash used $7.6 million). At 30 June 2019, the Group had cash reserves of $7.1 million (31 March 2019: $4.5 million) and debt of $21.4 million (31 March 2019: $19.3 million), giving a net debt position of $14.3 million (31 March 2019: $14.7 million). The impact of the change in accounting policy with respect to operation leases as referenced above is an increase in debt of $1.3 million during the period.

Cash flows from investing activities in the current period comprised $0.1 million proceeds from sale of other project assets in Australia, offset by purchase of $0.4 million of operating assets in Critical Power Services businesses.

Strategic Report (continued)

Cash flows from financing activities totalled $0.7 million in the three months ended 30 June 2019. Inflows comprised an $0.8 million short-term shareholder loan, $0.2 million of additional debtor finance borrowings in Critical Power Services and $0.7 million transfer from restricted cash, principally due to settlement of the $0.5 million preferred supplier escrow. Partly offsetting these inflows were lease repayments of $0.1 million for right-of-use assets in Critical Power Services businesses and $0.8 million finance expenses.

Year Ended 31 March 2019

| | | Year Ended 31 March | |

(US dollars in thousands) | | 2019 | | | 2018 | |

Revenue from contracts with customers | | | 39,036 | | | | 33,647 | |

Costs of sales | | | (32,726 | ) | | | (28,524 | ) |

Gross profit | | | 6,310 | | | | 5,123 | |

General and administrative expenses | | | (7,685 | ) | | | (12,814 | ) |

Gain/(loss) on sale of assets | | | (2,615 | ) | | | 1,356 | |

Depreciation and amortisation | | | (1,420 | ) | | | (1,260 | ) |

Operating loss | | | (5,410 | ) | | | (7,595 | ) |

Restructuring costs | | | (2,017 | ) | | | (1,873 | ) |

Impairment of assets | | | - | | | | (10,191 | ) |

Impairment of goodwill | | | - | | | | (11,092 | ) |

Finance expense – net | | | (3,239 | ) | | | (3,386 | ) |

Loss before taxation | | | (10,666 | ) | | | (34,137 | ) |

Income tax | | | (557 | ) | | | 6,258 | |

Loss for the year | | | (11,223 | ) | | | (27,879 | ) |

During the year ended 31 March 2019, the Company and its subsidiaries (the “Group”) generated statutory revenue of $39.0 million, gross profit of $6.3 million, operating loss of $5.4 million and a net loss of $11.2 million. For the year ended 31 March 2018, the Group generated revenue of $33.6 million, gross profit of $5.1 million, operating loss of $7.6 million, and a net loss of $27.9 million.

Adjusted EBITDA for the year ended 31 March 2019 was a loss of $1.2 million, compared to a loss of $3.2 million in the previous year. Adjusted EBITDA is a non-IFRS financial measure. We define Adjusted EBITDA as earnings before interest, taxes, depreciation and amortisation, impairment of assets, impairment of goodwill, and one-off non-recurring costs, including restructuring expenses, non-recurring remuneration and consulting fees.

The results of operations for the year ended 31 March 2019 reflect a year of significant growth for the Critical Power Services business segment. Kenshaw in particular has won a number of new contracts with data centre and hospital sector customers. These have contributed to a $6.0 million growth in Critical Power Services revenues, to $37.8 million, compared to $31.8 million in the year ended 31 March 2018. Solar revenues of $1.2 million comprise $0.4 million from sale of Solar Renewable Energy Certificates (“SREC’s”) and $0.8 million distributions from the Group’s investments in NC-31 and NC-47 solar projects in North Carolina, United States (together, the “NC Projects”) prior to their sale in July 2018. By contrast Solar revenues were $0.6 million higher in the year ended 31 March 2018, due principally to non-recurrence of development fee revenue recognised on the NC-47 project which was completed in April 2017.

None of the 38 solar projects in the ISS Joint Venture achieved a shovel-ready stage of development during the year and accordingly did not contribute to profitability in the year ended 31 March 2019.

The results of operations for the year ended 31 March 2019, reflect savings of $5.1 million in general and administrative costs. There was significant effort to rationalise the cost base of the Solar Development business in the year. Headcount reduction and bringing in-house previously outsourced business activities has generated savings of $4.1 million in labour, legal and professional fees, and travel expenses. Partly offsetting these savings were $0.6 million increase in labour and other overhead costs in Critical Power Services, required to support their growth in operations. Furthermore, there was a saving in one-time costs of $1.6 million for third party consulting fees incurred in the year ended 31 March 2018 on international solar procurement consulting, project evaluations, engineering review and technical validation related to the EPC contract for NC-31.

Strategic Report (continued)

The results of operations for the year ended 31 March 2019 also reflects restructuring costs of $2.0 million comprised of $1.8 million of legal and professional fees related to disputes with former employees, as further described in Note 7 to the financial statements, and $0.2 million of further workforce reduction actions were also incurred in the year.

Management analyses our business in three reportable segments: Critical Power Services, Solar Development, and Corporate Office. Critical Power Services is represented by J.A. Martin and Kenshaw operating in Australia with a focus on the design, supply, installation and maintenance of power and control systems. Solar Development is the development and sale of commercial and utility scale PV solar power projects in U.S. and Australia. Corporate Office is all United Kingdom based corporate functions. The following are the results of operations for the years ended 31 March by reportable segment:

Year Ended 31 March 2019 (US dollars in thousands) | | Critical Power Services | | | Solar Development | | | Corporate Office | | | Total | |

Revenue from contracts with customers | | | 37,800 | | | | 1,236 | | | | - | | | | 39,036 | |

Costs of sales | | | (32,317 | ) | | | (409 | ) | | | - | | | | (32,726 | ) |

Gross profit | | | 5,483 | | | | 827 | | | | - | | | | 6,310 | |

General and administrative expenses | | | (2,823 | ) | | | (2,148 | ) | | | (2,714 | ) | | | (7,685 | ) |

Loss on sale of assets | | | (30 | ) | | | (2,585 | ) | | | - | | | | (2,615 | ) |

Depreciation and amortisation | | | (1,272 | ) | | | (140 | ) | | | (8 | ) | | | (1,420 | ) |

Operating profit/(loss) | | | 1,358 | | | | (4,046 | ) | | | (2,722 | ) | | | (5,410 | ) |

Restructuring costs | | | (8 | ) | | | 7 | | | | (2,016 | ) | | | (2,017 | ) |

Impairment of assets | | | - | | | | - | | | | - | | | | - | |

Impairment of goodwill | | | - | | | | - | | | | - | | | | - | |

Finance expense – net | | | (1,354 | ) | | | (221 | ) | | | (1,664 | ) | | | (3,239 | ) |

Loss before taxation | | | (4 | ) | | | (4,260 | ) | | | (6,402 | ) | | | (10,666 | ) |

Income tax | | | (572 | ) | | | 15 | | | | - | | | | (557 | ) |

Loss for the year | | | (576 | ) | | | (4,245 | ) | | | (6,402 | ) | | | (11,223 | ) |

Year Ended 31 March 2018 (US dollars in thousands) | | Critical Power Services | | | Solar Development | | | Corporate Office | | | Total | |

Revenue | | | 31,807 | | | | 1,840 | | | | - | | | | 33,647 | |

Costs of sales | | | (27,482 | ) | | | (1,042 | ) | | | - | | | | (28,524 | ) |

Gross profit | | | 4,325 | | | | 798 | | | | - | | | | 5,123 | |

General and administrative expenses | | | (2,173 | ) | | | (6,468 | ) | | | (4,173 | ) | | | (12,814 | ) |

Gain on sale of assets | | | 213 | | | | 1,143 | | | | - | | | | 1,356 | |

Depreciation and amortisation | | | (1,233 | ) | | | (19 | ) | | | (8 | ) | | | (1,260 | ) |

Operating profit/(loss) | | | 1,132 | | | | (4,546 | ) | | | (4,181 | ) | | | (7,595 | ) |

Restructuring costs | | | (335 | ) | | | (964 | ) | | | (574 | ) | | | (1,873 | ) |

Impairment of assets | | | - | | | | (10,191 | ) | | | - | | | | (10,191 | ) |

Impairment of goodwill | | | - | | | | (11,092 | ) | | | - | | | | (11,092 | ) |

Finance expense – net | | | (1,283 | ) | | | (400 | ) | | | (1,703 | ) | | | (3,386 | ) |

Loss before taxation | | | (486 | ) | | | (27,193 | ) | | | (6,458 | ) | | | (34,137 | ) |

Income tax | | | (85 | ) | | | 6,291 | | | | 52 | | | | 6,258 | |

Loss for the year | | | (571 | ) | | | (20,902 | ) | | | (6,406 | ) | | | (27,879 | ) |

The $2.6 million loss on sale of assets in the Solar Development segment in the current year is comprised of a $1.9 million provision for onerous contracts related to future obligations to purchase SRECs from the NC Projects, discontinued solar development projects in the ISS Joint Venture ($0.8 million), and a correction to the gain on the sale of Amaroo solar project reported in the prior year ($0.3 million), offset by a gain on sale of the NC Projects ($0.4 million).

Strategic Report (continued)

As a result of the sale of VivoRex, LLC, on 2 July 2019 as disclosed in Note 29 to the financial statements, total onerous contract provisions of $2.3 million, including the $1.9 million referenced above, were reversed and taken into income as a gain on sale of assets subsequent to year-end.

Financing costs decreased by $0.2 million year-over-year. Interest on convertible loan notes and preferred share financing in Critical Power Services and the $19.0 million Arowana shareholder loan remained in line with prior year. $0.2 million of borrowing costs was incurred in the year related to a $2.0 million short-term loan (“DEPCOM Loan”) provided by SolarTide, LLC, an affiliate of DEPCOM Power, an engineering, procurement, and construction firm that was involved in the development of the NC Projects. Foreign exchange movements were also reduced in the current year. Partly offsetting these reductions, an additional $0.2 million interest on debtor finance borrowings were incurred in the year.

As of 31 March 2019, the Group had net assets of $24.0 million (2018: $37.0 million), including intangible assets of $32.3 million (2017: $36.4 million) and non-current investments of nil (2018: $14.1 million).

As of 31 March 2019, the Group’s current assets were $29.8 million (2018: $21.3 million), which was comprised of $4.5 million (2018: $1.9 million) of cash and cash equivalents, $1.3 million restricted cash (2018: nil), $10.4 million (2018: $7.9 million) of trade and other receivables, and $13.5 million (2018: $11.4 million) of assets held for sale related to the ISS Joint Venture portfolio (2018: NC Projects). Current liabilities were $20.8 million (2018: $20.6 million), which resulted in a current asset-to-liability ratio of 1.43:1 (2018: 1.03:1) at year-end.

Cash generated for the year was $2.7 million (2018: cash used $9.0 million), arising from cash used by operating activities of $1.6 million (2018: cash generated $8.9 million), cash generated by investing activities of $11.9 million (2018: used $16.6 million), and cash used in financing activities of $7.6 million (2018: $1.3 million). At 31 March 2019, the Group had cash reserves of $4.5 million (2018: $1.9 million), restricted cash of $1.3 million (2018: nil) and debt of $19.3 million (2018: $22.3 million), giving a net debt position of $13.4 million (2018: $20.4 million).

Cash flows from investing activities in the current year comprised $11.8 million proceeds from the sale of NC Projects and $0.5 million proceeds from sale of other project assets in Australia. These were offset by purchase of $0.2 million of operating assets in Critical Power Services businesses and $0.3 million investment in solar projects in Australia.

Cash flows from financing activities included $2.0 million repayment of the DEPCOM Loan, a $4.0 million advance from NES on the sale proceeds of NC Projects, that was repaid on completion in July 2018. Also, the Group repaid the $0.8 million short-term loan from Arowana and $0.8 million of the parent company loan from Arowana. Finance lease repayments were $0.3 million, net of repayments, for motor vehicle assets in Critical Power Services businesses. $1.3 million transfers to restricted cash were made for security on debtor finance arrangements in Critical Power Services and cash held in escrow to fund a $0.5 million liability to DEPCOM. Also finance expense outflows of $3.2 million were incurred. Offsetting these, the Group received $0.8 million funding from debtor finance arrangements established in Critical Power Services.

Principal Risks and Uncertainties

VivoPower is exposed to a number of risks and uncertainties which could have a material impact on the Group’s long-term performance and could cause actual results to differ materially from historical and expected results.

Market risk

The Group’s financial performance is tied very closely to the business activity within both the renewable energy and the investment management sectors. Capital and project availability are identified as being key market risks.

Operational risk

VivoPower operates within local, and national, laws and regulations which from time to time may change.

Strategic Report (continued)

Competitive risk

Having the ability to pay developers down-payments to secure pipeline is advantageous, but there is competition from parties pursuing similar transactions. VivoPower expects greater competition from other parties entering the sector with this capability.

People risk

Attraction and retention of key staff is essential to the continued success of the business. The Board recognises that the future success of the Group will depend to a substantial extent not only on the ability and experience of its senior management, but also on individuals and teams that support the projects. Staff are remunerated appropriately and employees are encouraged to develop their skills.

International risk

As the Group operates internationally, it is subject to the tax laws and regulations of several countries. In addition, conducting business on different continents presents logistical and management challenges whether related to local standards, business cultures or compliance. The Group takes careful steps to comply with all applicable tax and other laws, rules and regulations.

Financial risk

It is the Group’s policy to manage identifiable financial risks. The Group operates internationally and so has exposure to movements in exchange rates, in particular between the US Dollar, GB Pound and Australian Dollar. The Group ensures that it holds sufficient cash amounts to meet all working capital requirements.

For further discussion on financial risk refer to note 28 of the financial statements.

Employees

People are central to our business and the contribution of talented and motivated employees is vital to the continued success of the Group. The Group has a policy of keeping employees informed of, and engaged in, its business strategy through regular briefings and team meetings. Employee involvement at all levels is encouraged.

It is a policy of the Group to recruit, develop and promote people on merit and to treat everyone equally regardless of their race, ethnic origin or nationality, age, gender, sexual orientation, disability, religion or belief.

The Group gives every consideration to applications for employment from disabled persons where the requirements of the position may be adequately covered by the abilities of the applicant concerned. In the event of members of staff becoming disabled, ways are examined to ensure that their employment with the Group continues and that the appropriate training is arranged. It is the policy of the Group to ensure that the training, career development and promotion of disabled employees should, as far as possible, be the same as that of other employees.

The table shows, as per required quoted company regulations, the number of staff of each gender employed at the Company and their level of seniority.

| | Female | Male | Total |

Directors | 1 | 2 | 3 |

Senior Manager | 7 | 17 | 24 |

Employees | 8 | 149 | 157 |

Total | 16 | 168 | 184 |

Strategic Report (continued)

Health and Safety

The health and safety of the Group’s employees, customers, and visitors is of primary importance. The Group is committed to creating and maintaining a safe and healthy working environment. Health and safety audits and risk assessments, including fire risk assessments, are carried out regularly.

The Environment

The Group recognizes the importance of environmental responsibility and believes that its direct activities have a positive impact on the environment as the Company facilitates greater use of renewable energy. In addition, lightly damaged solar panels, that would have otherwise been bound for landfill, are donated to charity.

Communities

VivoPower has maintained an active program of community involvement in the locations we operate, including support for local children’s sport teams and engagement with other worthwhile causes supported by our employees. In addition, as noted above, the Company donates lightly damaged solar panels to a charity that provides aid to the impoverished, supports local education initiatives, and assists with charitable renewable energy projects.

B Corp Certification

VivoPower became certified as a B Corp in April 2018. Consistent with this certification, the shareholders approved changes to the Articles of Association of the Company at the last annual general meeting on 20 August 2018, to include:

| | (i) | the purposes of the Company are to promote the success of the Company for the benefit of its members as a whole and, through its business and operations, to have a material positive impact on society and the environment, taken as a whole; |

| | (ii) | in exercising the powers of the Company, a Director shall have regard to, among other matters, stakeholder interests such as: |

| | a. | the likely consequences of any decision in the long term; |

| | b. | the interests of the Company's employees; |

| | c. | the need to foster the Company's business relationships with suppliers, customers and others; |

| | d. | the impact of the Company's operations on the community and the environment; |

| | e. | the desirability of the Company maintaining a reputation for high standards of business conduct; and, |

| | f. | the need to act fairly as between members of the Company. |

As a B Corp, the Company is committed to continuously improve its B Corp score and deliver on the B Corp triple bottom line of Planet, People and Profit.

The Directors consider the Company’s ongoing commitment to B Corp certification and continual improvement thereunder as the primary means by which the Directors have had regard to the matters set out in section 172(1) of the Companies Act 2006 when performing their duty to act in the way most likely to promote the success of the Company for the benefit of its members as a whole.

The Strategic Report comprising pages 4 to 18 was approved by the Board and signed on its behalf by:

Kevin Chin

Chairman

21 August 2019

Directors’ Report

The Directors are pleased to present their report and the audited financial statements of VivoPower International PLC (“the Company”) and its subsidiary undertakings (together “the Group”) for the three months ended 30 June 2019. Subsidiary and associated undertakings are listed in Note 13 to the financial statements.

Directors

The Directors who held office during the period and up until the date of this report:

| | Appointed | Resigned | |

| Non-executive Directors | | | |

| Kevin Chin | 27 April 2016 | | |

| Peter Sermol | 21 December 2016 | | |

| Shimi Shah | 28 December 2017 | | |

Pursuant to Articles of the Company, the Directors are divided into three classes, as nearly equal in number as possible and designated as Class A, Class B and Class C. The initial term of Class A Directors expired at the Company’s first annual general meeting in September 2017, Class B Directors at the 2018 annual general meeting, and for Class C Directors will expire at the 2019 annual general meeting. At each annual general meeting, successors to the class of Directors whose term expired at that annual general meeting are elected for a term to expire at the third annual meeting following such election.

There are currently no Class A Directors. Peter Sermol is a Class B Director and was re-elected at the 2018 annual general meeting for a three-year term. Kevin Chin and Shimi Shah are Class C Directors and their term will expire at the 2019 annual general meeting.

Kevin Chin and Shimi Shah have both offered themselves for re-election to a further three-year term. Kevin and Shimi’s biographies are set out below. They both have a Non-Executive Directors Appointment Letter as described in the Director’s Remuneration Report on page 28. A resolution to reappoint Kevin Chin and Shimi Shah will be proposed at the forthcoming Annual General Meeting.

The Company maintains insurance cover for all Directors and officers of Group companies against liabilities which may be incurred by them while acting as Directors or officers of Group companies.

Details of Directors’ total remuneration are contained in the Directors’ Remuneration Report on page 28.

Details of the current Board of Directors and their relevant experience is provided below.

Kevin Chin

Kevin has extensive experience in “hands on” strategic and operational management having served as CEO, CFO and COO of various companies across a range of industries, including solar energy, software, traffic management, education, funds management and vocational education. He also has significant international experience in private equity, buyouts of public companies, mergers and acquisitions and capital raisings as well as funds management, accounting, litigation support and valuations.

Kevin is the founder of Arowana & Co. (Arowana), a diversified investment group with operating companies across the U.K., U.S., Asia, Australia and New Zealand. Arowana has listed companies on the Australian Stock Exchange and NASDAQ as well as unlisted companies. Arowana International Limited, listed on the Australian Stock Exchange is the largest shareholder in VivoPower.

Over his twenty-five year career, Kevin has held a number of strategic and operational leadership roles and was also previously with LFG, J.P. Morgan, Ord Minnett, PwC and Deloitte. Kevin holds a Bachelor of Commerce degree from the University of New South Wales where he was one of the inaugural University Co-Op Scholars with the School of Banking and Finance. He is also a qualified Chartered Accountant and a Fellow of FINSIA, where he was a curriculum writer and lecturer in the Master of Applied Finance programme.

Directors’ Report (continued)

Peter Sermol

Peter has over thirty years of experience in institutional finance. Peter is the co-founder of North Star Solar Ltd, a company focused on installing U.K. rooftop solar PV and battery storage which developed a model to install renewable technologies with energy savings repaying capex.

Prior to this, with his proven track record in trading distressed debt, Peter ran the Toronto office of Amstel Securities, a Dutch regulated brokerage firm for eight years. During this period Peter expanded the office to focus on uncovering and seeding uncorrelated investment opportunities. Taking a sector agnostic view, investments ranged from Latin American NPL’s, financing Canadian property developers, Australian non-conforming loans, U.S. viatical life insurance policies, U.S. non-prime auto loans. During this period, he also served as CEO of an online media distribution company.

Previously, Peter worked with specialist brokerage and advisory firms including Anca Capital Partners and Amstel as well as co-founding his own brokerage firm, Global Markets Ltd trading Asian Convertible Bonds and GDRs. Peter studied marine electronics at the Merchant Naval College, Greenhithe.

Shimi Shah

Shimi has been actively involved in investing and venture capital for over 20 years. Shimi is the Chairperson of Carousel Solutions, a technology and business advisory group, focusing on assisting companies navigate expansion into and out of the Middle East and Europe, build diversified businesses, appoint boards, and provide efficient technology solutions to mitigate security risk and increase productivity.

Shimi is also an active independent director and advisory board member. She is a board director of Bboxx, a $25 million revenue distributed energy business, chairs the leading kid’s club design company called Worldwide Kids Club, is part of the advisory committee for the Green Gateway Fund, a $250 million clean technology and sustainability fund and is on the advisory board of the North East Fund, a $200 million regional development fund. She also sits on the board of the Pay It Forward Foundation based in the U.S.

Prior to this, she was CEO at FORSA LLC, Managing Partner at Partnerships UK (PUK), Chief Investment Officer at Hanson Capital, and has worked at 3i and Citigroup. Shimi holds Masters in Management from Queens’ College, Cambridge, and Bachelor of Science degree from King’s College, London, in Management and Economics. She is an active member of the Young President’s Organization (YPO) in Europe and Africa.

Statement of Directors Responsibilities

The directors are responsible for preparing the Annual Report and Accounts for the Group and parent company financial statements in accordance with applicable law and regulations.

Company law requires the directors to prepare Group and parent company financial statements for the financial period. Under that law they have elected to prepare the Group financial statements in accordance with International Financial Reporting Standards and applicable law and have elected to prepare the financial statements for Company under the same methodology.

Under company law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the Group and parent company and of their profit or loss for that period. In preparing each of the Group and parent company financial statements, the directors are required to:

● | select suitable accounting policies and then apply them consistently; |

● | make judgements and estimates that are reasonable and prudent; |

● | state whether applicable IFRSs have been followed, subject to any material departures disclosed and explained in the financial statements; and, |

● | prepare the financial on the going concern basis unless it is inappropriate to presume that the Group and parent company will continue in business. |

Directors’ Report (continued)

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Group’s and parent company’s transactions and disclose with reasonable accuracy at any time the financial position of the Group and parent company and enable them to ensure that its financial statements comply with the Companies Act 2006. They have general responsibility for taking such steps as are reasonably open to them to safeguard the assets of the Group and parent company and to prevent and detect fraud and other irregularities.

This annual report and financial statements together with the Notice of Annual General Meeting and other information regarding the Group may be viewed on the Company’s website at www.vivopower.com.

The Directors are responsible for the maintenance and integrity of the corporate and financial information included on the Company’s website. Legislation in the United Kingdom governing the preparation and dissemination of the financial statements may differ from the legislation in other jurisdictions in which the Company operates, including the U.S. and Australia.

The Directors consider the Company’s ongoing commitment to B Corp certification and continual improvement thereunder, as discussed on page 18 of the Strategic Report, as the primary means by which the Directors have had regard to the matters set out in section 172(1) of the Companies Act 2006 when performing their duty to act in the way most likely to promote the success of the Company for the benefit of its members as a whole.

Directors’ Insurance and Indemnities

The Directors have the benefit of the indemnity provisions contained in the Company’s Articles of Association and the Company has maintained throughout the year directors’ and officers’ liability insurance for the benefit of the Company, the Directors and its officers.

The Company has entered into qualifying third-party indemnity arrangements for the benefit of all its Directors in a form and scope which comply with the requirements of the Companies Act 2006 and which were in force throughout the year and remain in force.

Future Developments