- VREX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Varex Imaging (VREX) DEF 14ADefinitive proxy

Filed: 3 Jan 18, 12:00am

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

| VAREX IMAGING CORPORATION | ||||

(Name of Registrant as Specified in its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

January 3, 2018

Dear Stockholder:

You are cordially invited to attend Varex Imaging Corporation's 2018 Annual Meeting of Stockholders on Thursday, February 15, 2018 at 4:30 p.m. Mountain Time at our headquarters at 1678 S. Pioneer Road, Salt Lake City, Utah 84104.

The Secretary's formal notice of the meeting and the Proxy Statement appear on the following pages and describe the matters to be acted upon at the annual meeting. You also will have the opportunity to hear what has happened in our business in the past year.

We hope that you can join us. However, whether or not you plan to be there, please vote your shares as soon as possible so that your vote will be counted.

| | | |

|---|---|---|

| Sincerely, | ||

| Ruediger Naumann-Etienne Chairman of the Board |

Varex Imaging Corporation

1678 S. Pioneer Road

Salt Lake City, Utah 84104

January 3, 2018

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Varex Imaging Corporation will hold its annual meeting of stockholders on Thursday, February 15, 2018 at 4:30 p.m. Mountain Time at its headquarters at 1678 S. Pioneer Road, Salt Lake City, Utah 84104.

This annual meeting is being held for the following purposes:

The Board of Directors has selected December 18, 2017 as the record date for determining stockholders entitled to vote at the annual meeting. A list of stockholders as of that date will be available for inspection during ordinary business hours at our principal executive offices at 1678 S. Pioneer Road, Salt Lake City, Utah 84104 for 10 days before the annual meeting.

Except for those stockholders that have already requested printed copies of our proxy materials, we are furnishing our proxy materials for this annual meeting to you through the Internet. On or about January 3, 2018, we mailed to stockholders as of the record date a Notice of Internet Availability of Proxy Materials (the "Notice"). Certain stockholders who previously requested email notice in lieu of mail received the Notice by email. If you received a Notice by mail or email, you will not receive a printed copy of the proxy materials unless you specifically request one. Instead, the Notice instructs you on how to access and review all of the important information contained in our Proxy Statement and in our Annual Report on Form 10-K for the fiscal year ended September 29, 2017 (which was posted on the internet on January 3, 2018), as well as how to submit your proxy over the Internet. We believe that mailing or emailing the Notice and posting other materials on the Internet allows us to provide you with the information you need more quickly while lowering the costs of delivery and reducing the environmental impact of the annual meeting. If you received the Notice and would still like to receive a printed copy of our proxy materials, you may request a printed copy of the proxy materials by any of the following methods: through the Internet atwww.proxyvote.com; by telephone at 1-800-579-1639 or by sending an email tosendmaterial@proxyvote.com.

Whether or not you plan to attend the annual meeting, please vote your shares as soon as possible in accordance with the instructions provided to you to ensure that your vote is counted at the annual meeting.

| By Order of the Board of Directors, | ||

| ||

| Kimberley E. Honeysett Corporate Secretary |

| | Page | |||

|---|---|---|---|---|

PROXY SUMMARY | 1 | |||

GENERAL INFORMATION | 4 | |||

PROPOSAL ONE—ELECTION OF DIRECTORS | 9 | |||

Our Board; Selection of Nominees | 9 | |||

Nominee for Election for a Three-Year Term Ending with the 2021 Annual Meeting | 10 | |||

Directors Continuing until our 2019 Annual Meeting | 11 | |||

Directors Continuing until our 2020 Annual Meeting | 12 | |||

Director Qualifications Matrix | 14 | |||

Governance of the Company | 14 | |||

Board Committees and Committee Meetings | 17 | |||

PROPOSAL TWO—RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 20 | |||

Selection of the Accounting Firm | 20 | |||

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm | 20 | |||

Principal Accountant Fees and Services | 21 | |||

AUDIT COMMITTEE REPORT | 22 | |||

STOCK OWNERSHIP | 23 | |||

Beneficial Ownership of Certain Stockholders, Directors and Executive Officers | 23 | |||

Section 16(a) Beneficial Ownership Reporting Compliance | 24 | |||

EXECUTIVE COMPENSATION | 25 | |||

Executive Summary | 25 | |||

Business Highlights—Strategic Transformation | 25 | |||

Compensation Program Overview | 26 | |||

Summary Compensation Table | 28 | |||

Outstanding Equity Awards at Fiscal Year End | 31 | |||

Equity Compensation Plan Information | 32 | |||

Potential Payments upon Termination or Change in Control | 32 | |||

Compensation of Directors | 34 | |||

Compensation Committee Interlocks and Insider Participation | 37 | |||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 38 | |||

Review, Approval or Ratification of Related Person Transactions | 38 | |||

Transactions with Related Persons | 38 | |||

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and you should read the entire Proxy Statement carefully before voting. Varex Imaging Corporation ("we," "us" or the "Company") is an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), and, as such, is allowed to take advantage of certain exemptions from various reporting requirements that apply to other public companies that are not emerging growth companies, including, but not limited to, reduced disclosure with respect to financial statements and executive compensation, elimination of compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, and exemption from the requirements to hold a non-binding advisory vote on executive compensation.

Varex Imaging Corporation, a Delaware corporation formed in 2016, is a leading innovator, designer and manufacturer of X-ray imaging components, which include X-ray tubes, digital flat panel detectors and linear accelerators, which are key components of X-ray imaging systems. Prior to January 28, 2017, the Company was a business unit and then wholly-owned subsidiary of Varian Medical Systems, Inc. ("Varian"). On January 28, 2017, Varian completed its separation and distribution of the Company (the "Spin-off"). As a result of the Spin-off, the Company became an independent publicly-traded company.

| Annual Meeting of Stockholders | Meeting Agenda | |||

|---|---|---|---|---|

| Date: Time: Place: | Thursday, February 15, 2018 4:30 p.m. Mountain Time 1678 S. Pioneer Road Salt Lake City, Utah 84104 | • Election of one director • Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2018 | ||

Record Date: | December 18, 2017 | • Transact any other business that properly comes before the annual meeting | ||

Voting Matters and Vote Recommendation

| Voting Matter | Board vote recommendation | |||

|---|---|---|---|---|

| 1. | Election of directors | For the director nominee | ||

2. | Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2018 | For | ||

1

See Proposal One—"Election of Directors" for more information.

The following table provides summary information about the director nominee and our other Board members.

Name | Age | Director since | Occupation | Other public boards | AC | CC | NC | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nominee for Election for a Three-Year Term Ending with the 2021 Annual Meeting | ||||||||||||||

| Erich R. Reinhardt(a) | 71 | 2017 | Former CEO & President, Siemens Healthcare | — | M | C | ||||||||

Directors Continuing in Office until 2019 Annual Meeting | ||||||||||||||

Jay K. Kunkel(a) | 58 | 2017 | President Asia Pacific, Lear Corporation | — | M | C | ||||||||

Christine A. Tsingos(a)(b) | 59 | 2017 | Executive Vice President and CFO, Bio-Rad Laboratories | 1 | C | M | ||||||||

Directors Continuing in Office until 2020 Annual Meeting | ||||||||||||||

Jocelyn D. Chertoff(a) | 62 | 2017 | Chair of Radiology, Dartmouth Hitchcock Medical Center | — | M | M | ||||||||

Ruediger Naumann-Etienne(a) | 71 | 2017 | Managing Director, Intertec Group | 1 | M | M | ||||||||

Sunny S. Sanyal | 53 | 2017 | President and CEO of Varex | — | ||||||||||

| (a) | Independent Director | (b) | Audit Committee Financial Expert | |||

| AC | Audit Committee | |||||

| CC | Compensation and Management Development Committee | C | Chair | |||

| NC | Nominating and Corporate Governance Committee | M | Member |

The director nominee is a current director, and all directors attended at least 75% of the aggregate of all fiscal year 2017 meetings of the Board and each committee on which he or she served.

2

Approval of Auditors for Fiscal Year 2018

See Proposal Two "Ratification of the Appointment of Our Independent Registered Public Accounting Firm" for more information.

| | | |

|---|---|---|

| We ask that our stockholders ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2018. | Below is summary information about PricewaterhouseCoopers LLP's fees for services provided in fiscal year 2017. The Company did not have stand-alone audit fees for fiscal year 2016 because, at the time, it was a business unit of Varian. |

Fiscal Year | 2017 | |||

|---|---|---|---|---|

Audit fees | $ | 1,438,473 | ||

Audit related fees | $ | 13,485 | ||

Tax fees | $ | 61,000 | ||

All other fees | — | |||

| | | | | |

Total | $ | 1,512,958 | ||

| | | | | |

| | | | | |

| | | | | |

| | | |

|---|---|---|

| Stockholder proposals submitted for inclusion in our 2019 proxy statement pursuant to SEC Rule 14a-8 must be received by us no later than September 5, 2018. | Notice of stockholder proposals to be raised from the floor of the 2019 Annual Meeting of Stockholders outside of SEC Rule 14a-8 must be delivered to us no earlier than October 18, 2018 and no later than November 17, 2018. |

3

Proposal Two is the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2018.

4

receive an email with instructions on how to view those materials and vote before the next annual meeting. Your choice to obtain documents by email will remain in effect until you notify us otherwise. Delivering future notices by email will help us further reduce the cost and environmental impact of our stockholder meetings.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of the shares and your shares are said to be held in "street name." Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank or other nominee how to vote their shares using the method described under "How do I vote and how do I revoke my proxy?" below.

Voting by proxy will not affect your right to vote your shares if you attend the Annual Meeting and want to vote in person—by voting in person you automatically revoke your proxy. You also may revoke your proxy at any time before the applicable voting deadline by giving our Secretary written notice of your revocation, by submitting a later-dated proxy card or by voting again using the telephone or Internet (your latest telephone or Internet proxy is the one that will be counted).

If you vote by proxy, the individuals named as proxyholders will vote your shares as you instruct. If you vote your shares over the telephone, you must select a voting option "For," "Withhold Authority" or "Abstain" (for directors), and "For," "Against" or "Abstain" (for Proposal Two) in order for your proxy to be counted on that matter. If you validly vote your shares over the Internet or by mail but do not provide any voting instructions, the individuals named as proxyholders will vote your shares FOR the director nominee and FOR Proposal Two. In that case, the proxyholders will have full discretion and authority to vote in the election of directors.

If your shares are registered in street name, you must vote your shares in the manner prescribed by your broker, bank or other nominee. In most instances, you can do this over the telephone or Internet, or if you have received or request a hard copy of the proxy statement and accompanying voting instruction form, you may mark, sign, date and mail your voting instruction form in the envelope your broker, bank or other nominee provides. The materials that were sent to you have specific instructions for how to submit your vote and the deadline for doing so. If you would like to revoke your proxy, you must follow the broker, bank or other nominee's instructions on how to

5

do so. If you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the broker, bank or other nominee holding your shares.

Broker Non-Votes—If your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote these shares on certain "routine" matters, including the ratification of the appointment of the independent registered public accounting firm. However, on non-routine matters such as the election of directors, your broker must receive voting instructions from you, as your broker does not have discretionary voting power for that particular item. So long as the broker has discretion to vote on at least one proposal, these "broker non-votes" are counted toward establishing a quorum. When voted on "routine" matters, broker non-votes are counted toward determining the outcome of that "routine" matter.

For Proposal Two, an affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote is required.

6

publicly disclose its decision. The director who tenders his or her resignation shall not participate in the recommendation of the Nominating Committee or the decision of the Board with respect to his or her resignation. If such incumbent director's resignation is not accepted by the Board, such director shall continue to serve until the next annual meeting and until his or her successor is duly elected, or his or her earlier resignation or removal. If a director's resignation is accepted by the Board, or if a nominee for director is not elected and the nominee is not an incumbent director, then the Board, in its sole discretion, may fill any resulting vacancy or decrease the size of the Board pursuant to the provisions of our Bylaws.

We do not expect any matters other than those listed in this Proxy Statement to come before the Annual Meeting. If any other matter is presented, your proxy gives the individuals named as proxyholders the authority to vote your shares to the extent authorized by Rule 14a-4(c) under the Exchange Act.

7

the past three years and any other material relationships, between such stockholder and a beneficial owner on whose behalf the potential candidacy is made and their affiliates and associates, or others acting in concert, on the one hand, and each potential candidate, and his/her affiliates and associates, or others acting in concert, on the other hand, including all information that would be required to be disclosed pursuant to Item 404 under Regulation S-K if the stockholder were a "registrant," all as described in our Bylaws. The notice must also include certain additional information about and representations by the stockholder and/or the beneficial owner, all as detailed in our Bylaws.

8

PROPOSAL ONE—

ELECTION OF DIRECTORS

BOARD RECOMMENDATION

VOTE "FOR" THE NOMINEE

Our Board; Selection of Nominees

Our Board is divided into three classes. Erich R. Reinhardt and Dow R. Wilson have terms expiring at the first annual meeting following the Spin-off, Christine A. Tsingos and Jay K. Kunkel have terms expiring at the second annual meeting following the Spin-off and Ruediger Naumann-Etienne, Sunny S. Sanyal and Jocelyn D. Chertoff have terms expiring at the third annual meeting following the Spin-off. Currently, directors are elected to a three-year term.

As discussed above, the current terms of Dr. Reinhardt and Mr. Wilson will expire at the Annual Meeting. Dr. Reinhardt has been recommended by the Nominating Committee and nominated by the Board for election by the stockholders to a three-year term. As contemplated as part of the Spin-off, Mr. Wilson will not stand for re-election as a director of the Company. Because a replacement for Mr. Wilson has not yet been identified, the Board, in accordance with the Company's Bylaws, has reduced the size of the Board from seven members to six effective immediately following the Annual Meeting.

In accordance with our certificate of incorporation, commencing with our 2020 Annual Meeting we will begin to declassify our board as follows: (i) commencing with the class of directors standing for election at our 2020 Annual Meeting, directors will stand for election for a two-year term; (ii) commencing with the class of directors standing for election at our 2021 Annual Meeting, directors will stand for election for a one-year term; and (iii) commencing with our 2022 Annual Meeting, and at each annual meeting thereafter, all directors will stand for election for a one-year term.

Our Nominating Committee is charged with identifying, evaluating and recommending to the full Board director nominees. There are no minimum qualifications for directors. The Nominating Committee generally seeks individuals who have or provide:

We believe that all of our directors should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform and carry out all director duties in a responsible manner. The Board believes that directors who are full-time employees of other companies

9

should not serve on more than three public company boards at one time, and that directors who are retired from full-time employment should not serve on more than four public company boards. Each director must also represent the interests of all stockholders.

When seeking new director candidates, the Nominating Committee will consider potential candidates for directors submitted by Board members, members of our management and our stockholders. The Nominating Committee does not evaluate candidates differently based upon the source of the nominee.

The individual named as proxyholders will vote your proxy for the election of the nominee unless you direct them to withhold your vote. If the nominee becomes unable to serve as a director before the Annual Meeting (or decides not to serve), the individuals named as proxyholders may vote for a substitute.

Set forth below are the names and ages of the nominee and the other continuing directors, the years they became directors, their principal occupations or employment for at least the past five years, the names of other public companies for which they serve as a director or have served as a director during the past five years. Also set forth are the specific experience, qualifications, attributes or skills that led our Nominating Committee to conclude that each person should serve as a director. All of our directors have held high-level positions in their fields and have experience in dealing with complex issues. We believe that each is an individual of high character and integrity and has the ability to exercise sound judgment.

Nominee for Election for a Three-Year Term Ending with the 2021 Annual Meeting

| Erich R. Reinhardt, PhD Age: 71 Director Since: 2017 Independent | Principal occupation, business experience and directorships • Advisor to the Chief Executive Officer of Siemens AG, a global technology company (May 2008-March 2011) • President and Chief Executive Officer, Siemens Healthineers, formerly Siemens Medical Solutions, a supplier to the healthcare industry (1994-April 2008) • Member of Managing Board, Siemens AG (2001-2008) • Public Company Board Memberships in past five years: Varian Medical Systems, Inc. Experience, qualifications, attributes or skills supporting directorship • Extensive experience and service in leadership roles at one of the world's leading technology companies; • Deep knowledge of marketing, government affairs, public policy and developing trends in networking and new media such as virtual collaboration, social media and information exchanges; and • Experience serving on the boards of directors and/or as a member of the compensation, nominating and corporate governance, strategy and IT committees of several public technology companies, a hospital, a university and a private company, and on the advisory board for two educational institutions. Committee Memberships • Audit Committee • Nominating and Corporate Governance Committee (Chairman) |

10

Directors Continuing until our 2019 Annual Meeting

| Jay K. Kunkel Age: 58 Director Since: 2017 Independent | Principal occupation, business experience and directorships • President Asia Pacific, Member of the Executive Council, and Company Officer, Lear Corporation (2013-Present) • Positions at Continental AG, a leading global supplier of automotive seating systems and electrical systems • President Asia, Member of the Management Board (2007-2013); • President Asia, Automotive Systems Division, Member of the Management Board (2005-2007) • Director, SRP International Group Ltd. (2004-2005) • Positions at PwC Financial Advisory Services • Head of Corporate Finance and M&A Advisory (2002-2003) • Managing Director and Regional Leader of Automotive & Manufacturing Practice (2000-2002) Experience, qualifications, attributes or skills supporting directorship • Extensive experience in manufacturing operations and the industrial market; • International experience, including in key markets in Asia; • Deep knowledge and core skills in corporate development and mergers and acquisitions; and • Expertise in project management and restructuring operations. Committee Memberships • Audit Committee • Compensation and Management Development Committee (Chairman) |

| Christine A. Tsingos Age: 59 Director Since: 2017 Independent | Principal occupation, business experience and directorships • Executive Vice President and Chief Financial Officer, Bio-Rad Laboratories, Inc., a leader in life science research and clinical diagnostics markets (2002-Present) • Chief Operating Officer, Chief Financial Officer and consultant, Attest Systems, Inc., a leading software company in the IT asset management sector (2000-2002) • Chief Financial Officer, Tavolo, Inc., a leading online retailer of specialty food, cookware and cooking-related content (1999-2000) • Other Current Public Company Board Memberships: Nanometrics, Inc., a manufacturer of semiconductor equipment. Experience, qualifications, attributes or skills supporting directorship • Expertise in finance, operations and financial reporting matters; • Extensive experience and critical insights in financial management, strategic planning, acquisitions, treasury and investor relations; • Over 20 years of public company experience and a proven track record, including being named Bay Area CFO of the Year in 2010 and among the Most Influential Women in Business 2008-2012; and • Service as chairwoman of the audit committee and member of the compensation committee of a public manufacturing company. Committee Memberships • Audit Committee (Chairwoman) • Nominating and Corporate Governance Committee |

11

Directors Continuing until our 2020 Annual Meeting

| Jocelyn D. Chertoff, MD Age: 62 Director Since: 2017 Independent | Principal occupation, business experience and directorships • Positions at Dartmouth Hitchcock Medical Center • Chair of the Department of Diagnostic Radiology and Vice President of the Regional Radiology Service Line (2015-Present) • Interim Chair of the Department of Diagnostic Radiology (2014-2015) • Vice Chair of Department of Diagnostic Radiology (2004-2012) • Practicing Radiologist since 1991 Experience, qualifications, attributes or skills supporting directorship • Deep knowledge and experience in radiology; • Provides significant end-user perspective to assist with product development as well as with relationships with existing and prospective X-ray imaging system manufacturers; and • Experience serving on a number of non-profit boards and committees. Committee Memberships • Compensation and Management Development Committee • Nominating and Corporate Governance Committee |

| Ruediger Naumann-Etienne, PhD Age: 71 Director Since: 2017 Chairman Since: 2017 Independent | Principal occupation, business experience and directorships • Owner and Managing Director, Intertec Group, an investment company specializing in the medical technology field (1989-present) • Chairman of the Board of Directors, Cardiac Science Corporation, a provider of cardiology products (2006-2010) • Vice-Chairman of the Board of Directors, Cardiac Science Corporation (2005-2006) • Chairman of Quinton Cardiology Systems, a predecessor of Cardiac Science Corporation (2000-2005) • Other Current Public Company Board Memberships: IRIDEX Corporation, a provider of light-based medical systems and delivery devices • Public Company Board Memberships in Past Five Years: Encision Inc. and Varian Medical Systems, Inc. |

12

Experience, qualifications, attributes or skills supporting directorship • Experience working in the medical device business for nearly three decades; • Experience working in senior business and finance executive roles with a leading electronics company for a decade; • Extensive experience with finance and mergers and acquisitions; • International experience, having lived and worked in Europe and Latin America, and gained fluency in four languages; and • Service as Chief Executive Director, Chairman or director, and a member of the audit, nominating and compensation committees, of a number of public medical device companies. Committee Memberships • Audit Committee • Compensation and Management Development Committee |

| Sunny S. Sanyal Age: 53 Director Since: 2017 | Principal occupation and business experience • President and Chief Executive Officer, Varex Imaging Corporation (January 2017-Present) • Senior Vice President and President, Imaging Components, Varian Medical Systems, Inc. (2014-2017) • Chief Executive Officer, T-System Inc., an information technology solutions and services provider (2010-2014) • Positions at McKesson Corporation, a healthcare services and information technology company • Chief Operating Officer, McKesson Provider Technologies (2006-2010) • Group President, Clinical Information Systems division (2004-2006) • Previous management positions with GE Healthcare, Accenture and IDX Systems Corporation Experience, qualifications, attributes or skills supporting directorship • Extensive experience in medical device and healthcare industry; • Key insight into Varex through his leadership position within Varian's Imaging Components business before becoming our President and Chief Executive Officer; and • Significant public company operational experience. |

13

Director Qualifications Matrix

The following matrix is provided to illustrate the skills and qualifications of the nominated and continuing members of our Board and demonstrate our commitment to inclusiveness and diversity.

| | Qualifications | Diversity | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Business Management | Financial Oversight or Expert | Component Manufacturing | Medical | Industrial/ Security | Gender/ Ethnic Diversity | International Experience | |||||||

Jocelyn D. Chertoff | X | X | ||||||||||||

Jay K. Kunkel | X | X | X | X | X | |||||||||

Ruediger Naumann-Etienne | X | X | X | X | ||||||||||

Erich R. Reinhardt | X | X | X | X | ||||||||||

Sunny S. Sanyal | X | X | X | X | X | |||||||||

Christine A. Tsingos | X | Expert | X | X | ||||||||||

Overview

We are committed to strong corporate governance. Our governance policies and practices include:

Ethical Conduct and Strong Governance

14

Director Independence

Majority Voting

Board Structure

15

Director and Executive Compensation

Director Independence

The Board has determined that Dr. Chertoff, Mr. Kunkel, Dr. Naumann-Etienne, Dr. Reinhardt, and Ms. Tsingos are "independent" for purposes of the NASDAQ listing requirements and under our Corporate Governance Guidelines. Mr. Sanyal, our President and CEO, is an employee and therefore not "independent." Mr. Wilson is the CEO of Varian, our former parent company, and therefore not "independent." The Board considered transactions and relationships, both direct and indirect, between each director (and his or her immediate family) and the Company and its subsidiaries and affirmatively determined that none of Dr. Chertoff, Mr. Kunkel, Dr. Naumann-Etienne, Dr. Reinhardt, and Ms. Tsingos has any material relationship, either direct or indirect, with us other than as a director and stockholder.

Board Meetings

The Board met three times in fiscal year 2017. Each of the three Board meetings included executive sessions of either the independent directors or the non-management directors, or both, with Dr. Naumann-Etienne presiding at such meetings. We have three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Nominating Committee. Each current director attended at least 75% of the total Board meetings and meetings of the committees on which they served that were held in fiscal year 2017. Directors are encouraged to attend meetings of committees on which they do not serve as members.

Board Leadership Structure

The Board has adopted Corporate Governance Guidelines designed to promote the functioning of the Board and its committees. These Guidelines and our Bylaws address Board composition, Board functions and responsibilities, qualifications, leadership structure, committees and meetings.

Our Bylaws require that the Chairman of the Board be chosen from among the directors and may not be the CEO. The Board has determined that having Dr. Naumann-Etienne, who is "independent" within the meaning of the NASDAQ listing standards, serve as Chairman and Mr. Sanyal serve as CEO is in the best interests of the stockholders. We have separated the roles of CEO and Chairman in recognition of the differences between the two roles. The CEO is responsible for setting our strategic direction and for our day-to-day leadership and performance, while the Chairman provides guidance to

16

the CEO and leads the Board. The Board believes its administration of its risk oversight function has not affected the Board's leadership structure.

The Board's Role in Risk Oversight

Our Company faces a number of risks, including operational, economic, financial, legal, regulatory and competitive risks. Our management is responsible for the day-to-day management of the risks we face. While our Board, as a whole, has ultimate responsibility for the oversight of risk management, it administers its risk oversight role in part through the Board committee structure, with the Audit Committee, the Compensation Committee, and the Nominating Committee responsible for monitoring and reporting on the material risks associated with their respective subject matter areas.

The Board's role in our risk oversight process includes receiving regular reports from members of senior management, as well as external advisors such as PricewaterhouseCoopers LLP ("PwC"), on areas of material risk to us, including operational, economic, financial, legal, regulatory and competitive risks. The full Board (or the appropriate committee in the case of risks that are reviewed by a particular committee) receives these reports from those responsible for the relevant risk in order to enable it to understand our risk exposures and the steps that management has taken to monitor and control these exposures. When a committee receives the report, the Chairman of the relevant committee generally provides a summary to the full Board at the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role. The Audit Committee assists the Board in oversight and monitoring of principal risk exposures related to financial statements, legal, ethical compliance, regulatory and other matters, as well as related mitigation efforts. The Compensation Committee assesses, at least annually, the risks associated with our compensation policies. The Nominating Committee assists the Board in oversight of risks that we have relative to compliance with corporate governance standards.

Board Committees and Committee Meetings

Each of our standing committees has a written charter approved by the Board that clearly establishes the committee's roles and responsibilities. Copies of the charters for the Audit Committee, the Compensation Committee, and the Nominating Committee, as well as our Corporate Governance Guidelines and Code of Conduct, can be found through the "Corporate Governance" link on the Investors page on our website atwww.vareximaging.com. Please note that information on, or that can be accessed through, our website is not part of the proxy soliciting materials, is not deemed "filed" with the SEC and is not to be incorporated by reference into any of our filings under the Securities Act of 1933, as amended, or the Exchange Act, and, except for information filed by the Company under the cover of Schedule 14A, is not deemed to be proxy soliciting materials.

Audit Committee

Chair:Ms. Tsingos

Additional Members:Mr. Kunkel, Dr. Naumann-Etienne, and Dr. Reinhardt

Meetings in Fiscal Year 2017:Eight

Committee Functions:

17

Member Qualifications

Each member of the Audit Committee meets the additional requirements regarding independence for Audit Committee members under NASDAQ listing requirements. The Board has determined that Ms. Tsingos is an "audit committee financial expert" as defined in Item 407(d)(5) of Regulation S-K under the Exchange Act based upon her experience as the chief financial officer of Bio-Rad Laboratories since 2002 and as the chief financial officer of Attest Systems, Inc. between 2000 and 2002. The Board has determined that Mr. Kunkel is financially literate based on his experience as the head of corporate finance and M&A advisory at PwC, as well as other business experience. The Board has determined that Dr. Naumann-Etienne is financially literate based upon his experience as the chief financial officer and principal accounting officer of Diasonics, Inc. between 1984 and 1987 and as group controller for Texas Instruments Inc. between 1982 and 1984, and his formal education represented by his doctorate degree in international finance from the University of Michigan. The Board has determined that Dr. Reinhardt is also financially literate based upon his experience as the CEO of Siemens Healthcare from 1994 to 2008, as well as other business experience.

Compensation and Management Development Committee

Chair:Mr. Kunkel

Additional Members:Dr. Chertoff and Dr. Naumann-Etienne

Meetings in Fiscal Year 2017:Three

Committee Functions:

The Compensation Committee determines all compensation for our executive group. Before making decisions on compensation for each of the executives other than the CEO, the Compensation Committee reviews with our CEO each individual's performance and accomplishments over the prior year. Except for his own position, our CEO makes recommendations to the Compensation Committee about base salary increases, any changes to the incentive plan target awards and the amount of equity awards for each executive. However, the Compensation Committee retains and does not delegate any of its exclusive power to determine all matters of executive compensation and benefits for executive officers. The Compensation Committee meets alone with its independent advisors to develop and

18

establish a proposal for CEO pay. This proposal is also reviewed with the other independent members of the Board.

Compensation Committee Advisors

To independently assist and advise the Compensation Committee, the Compensation Committee has retained Pay Governance LLC as its compensation consultant since 2017. The engagement with Pay Governance is exclusively with the Compensation Committee, which has sole authority to retain and terminate any compensation consultant or other advisor that it uses. Pay Governance has no relationship with the Company or management except as it may relate to performing services on behalf of the Compensation Committee. The Compensation Committee has assessed the independence of Pay Governance pursuant to SEC rules and concluded that no conflict of interest exists that would prevent it from independently representing the Compensation Committee.

The compensation consultant reviews and analyzes our executive compensation programs, compensation strategy and effectiveness of pay delivery. The compensation consultant provides market information on compensation trends and practices and makes recommendations to the Compensation Committee based on competitive data. The compensation consultant advises the Compensation Committee chair on agenda items for Compensation Committee meetings, reviews management proposals and is available to perform special projects at the Compensation Committee chair's request. The compensation consultant also periodically provides the Compensation Committee with updates on regulatory and legislative developments pertaining to executive compensation and compensation committee governance. The compensation consultant provides analyses and recommendations that inform the Compensation Committee's decisions, but does not decide or approve any compensation actions. As needed, the Compensation Committee also consults with the compensation consultant on program design changes.

Member Qualifications

In addition to being independent, each member of the Compensation Committee is a "non-employee director" for purposes of the Exchange Act and is an "outside director" for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Internal Revenue Code").

Nominating and Corporate Governance Committee

Chair:Dr. Reinhardt

Additional Members:Dr. Chertoff and Ms. Tsingos

Meetings in Fiscal Year 2017:Three

Committee Functions:

19

PROPOSAL TWO—

RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

VOTE "FOR" THE RATIFICATION OF THE APPOINTMENT OF

PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2018

Selection of the Accounting Firm

The Audit Committee has appointed PricewaterhouseCoopers LLP as our independent registered public accounting firm to perform the audit of our financial statements for fiscal year 2018, and we are asking you and other stockholders to ratify this appointment.

The Audit Committee annually reviews the independent registered public accounting firm's independence, including reviewing all relationships between the independent registered public accounting firm and us and any disclosed relationships or services that may impact the objectivity and independence of the independent registered public accounting firm, and the independent registered public accounting firm's performance. Our Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The Audit Committee is also involved in the selection of the lead audit engagement partner whenever a rotational change is required, normally every five years.

As a matter of good corporate governance, the Board, upon recommendation of the Audit Committee, has determined to submit to stockholders for ratification the appointment of PwC. In the event that a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on Proposal Two does not ratify this appointment of PwC, the Audit Committee will review its future appointment of PwC.

We expect that a representative of PwC will be present at the Annual Meeting and that representative will have an opportunity to make a statement if he or she desires and will be available to respond to appropriate questions.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee must pre-approve all audit and permissible non-audit services to be provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally requested annually and any pre-approval is detailed as to the particular service, which must be classified in one of the four categories of services. The Audit Committee may also, on a case-by-case basis, pre-approve particular services that are not contained in the annual pre-approval request. In connection with this pre-approval policy, the Audit Committee also considers whether the categories of pre-approved services are consistent with the rules on accountant independence of the SEC.

20

Principal Accountant Fees and Services

The following is a summary of the fees billed or to be billed to us by PwC for professional services rendered for the fiscal year ended September 29, 2017. The Company did not have stand-alone audit fees for fiscal year 2016, because, at the time, it was a business unit of Varian.

Fee Category | Fiscal Year 2017 | |||

|---|---|---|---|---|

Audit Fees | $ | 1,438,473 | ||

Audit-Related Fees | 13,485 | |||

Tax Fees | 61,000 | |||

All Other Fees | — | |||

| | | | | |

Total Fees | $ | 1,512,958 | ||

Audit Fees. Consist of fees billed or expected to be billed for the audit of annual financial statements, review of quarterly financial statements and services normally provided in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. Consist of fees primarily related to the purchase of the medical imaging business of PerkinElmer, Inc. in May of 2017.

Tax Fees. Consist of fees for tax compliance services provided to Varex in connection with transactions between the Company's subsidiaries.

The Audit Committee determined that PwC's provision of these services, and the fees that we paid for these services, are compatible with maintaining the independence of the independent registered public accounting firm. The Audit Committee pre-approved all services that PwC provided in fiscal year 2017 in accordance with the pre-approval policy discussed above.

21

The Audit Committee of the Board (the "Audit Committee") consists of the four directors whose names appear below. Each member of the Audit Committee meets the definition of "independent director" and otherwise qualifies to be a member of the Audit Committee under NASDAQ listing requirements.

The Audit Committee's general role is to assist the Board in monitoring the Company's financial reporting process and related matters. Its specific responsibilities are set forth in its charter. The Audit Committee reviews its charter at least annually, and did so in the August 2017 Audit Committee meeting.

As required by the charter, the Audit Committee reviewed the Company's financial statements for fiscal year 2017 and met with management, as well as with representatives of PricewaterhouseCoopers LLP, the Company's independent registered public accounting firm, to discuss the financial statements. The Audit Committee also discussed with members of PricewaterhouseCoopers LLP the matters required to be discussed by Auditing Standard No. 16,Communications with Audit Committees.

In addition, the Audit Committee received the written disclosures and letters required by the applicable requirements of the Public Company Accounting Oversight Board regarding PricewaterhouseCoopers LLP's communications with the Audit Committee concerning independence and discussed with members of PricewaterhouseCoopers LLP its independence from management and the Company.

Based on these discussions, the financial statement review and other matters it deemed relevant, the Audit Committee recommended to the Board that the Company's audited financial statements for fiscal year 2017 be included in the Company's Annual Report on Form 10-K for the fiscal year ended September 29, 2017.

Furthermore, in connection with the standards for independence promulgated by the Securities and Exchange Commission, the Audit Committee reviewed the services provided by PricewaterhouseCoopers LLP, the fees the Company paid for these services, and whether the provision of the services is compatible with maintaining the independence of the independent registered public accounting firm. The Audit Committee deemed that the provision of the services is compatible with maintaining that independence.

The Audit Committee has selected PricewaterhouseCoopers LLP to be the Company's independent registered public accounting firm for fiscal year 2018. In doing so, the Audit Committee considered the results from its review of PricewaterhouseCoopers LLP's independence, including (a) all relationships between PricewaterhouseCoopers LLP and the Company and any disclosed relationships or services that may impact their objectivity and independence, (b) PricewaterhouseCoopers LLP's performance and qualification as an independent registered public accounting firm and (c) the fact that the PricewaterhouseCoopers LLP engagement audit partner is rotated on a regular basis as required by applicable laws and regulations. As a matter of good corporate governance, the Audit Committee has determined to submit its appointment of PricewaterhouseCoopers LLP to the stockholders for ratification. In the event that a majority of the shares of common stock present or represented at the Annual Meeting and entitled to vote on the matter does not ratify this appointment, the Audit Committee will review its future appointment of PricewaterhouseCoopers LLP.

| Christine A. Tsingos (Chair) Jay K. Kunkel Ruediger Naumann-Etienne Erich R. Reinhardt |

22

Beneficial Ownership of Certain Stockholders, Directors and Executive Officers

This table shows as of December 1, 2017: (1) the beneficial owners of more than five percent of our common stock and the number of shares they beneficially owned based on information provided in their most recent filings with the SEC; and (2) the number of shares each director, each nominee for director and each NEO and all directors, nominees for director and executive officers as a group beneficially owned, as reported by each person. Except as otherwise indicated, the address of each is 1678 S. Pioneer Road, Salt Lake City, Utah 84104. Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. Except as noted, each person has sole voting and investment power over the shares shown in this table. For each individual and group included in the table below, the percentage ownership is calculated by dividing the number of shares beneficially owned by the person or group, which includes the number of shares of common stock that the person or group had the right to acquire on or within 60 days after December 1, 2017 by the sum of the 37,739,440 shares of common stock outstanding on December 1, 2017, plus the number of shares of common stock that the person or group had the right to acquire on or within 60 days after December 1, 2017.

| | Amount and Nature of Common Stock Beneficially Owned | ||||||

|---|---|---|---|---|---|---|---|

| | Number of Shares Beneficially Owned | Percent of Class | |||||

Stockholders | |||||||

Blackrock, Inc.(1) | 3,971,127 | 10.5 | % | ||||

55 East 52nd Street, New York, NY 10055 | |||||||

QV Investors Inc.(2) | 2,004,283 | 5.3 | % | ||||

Livingston Place, South Tower, Suite 1008, 222 - 3rd Avenue SW Calgary, Alberta Canada T2P 0B4 | |||||||

Directors, Nominees for Director and Named Executive Officers | |||||||

Jocelyn D. Chertoff(3) | 3,515 | * | |||||

Kimberley E. Honeysett(4) | 6,456 | * | |||||

Jay K. Kunkel(5) | 3,861 | * | |||||

Ruediger Naumann-Etienne(6) | 22,637 | * | |||||

Erich R. Reinhardt(7) | 35,469 | * | |||||

Sunny S. Sanyal(8) | 242,491 | * | |||||

Christine A. Tsingos(9) | 3,861 | * | |||||

Clarence R. Verhoef(10) | 107,000 | * | |||||

Dow R. Wilson(11) | 23,661 | * | |||||

All directors, nominees for director and executive officers as a group (13 persons)(12) | 602,386 | 1.6 | % | ||||

23

Section 16(a) Beneficial Ownership Reporting Compliance

Under U.S. securities laws, directors, certain officers and persons holding more than 10% of our common stock must report their initial ownership of the common stock and any changes in that ownership to the SEC. The SEC has designated specific due dates for these reports and we must identify in this Proxy Statement those persons who did not file these reports when due. Based solely on our review of copies of the reports filed with the SEC and written representations of our directors and executive officers, we believe that each person who at any time during the 2017 fiscal year was a director or an executive officer or persons holding more than 10% of our common stock filed the required reports on time in fiscal year 2017, except for Mr. Sanyal and Mr. Verhoef who each filed a Form 4 amendment on February 24, 2017 to correctly report the number of stock options that were timely reported in the Form 4s filed on February 17, 2017.

24

The following discussion describes certain aspects of the compensation program for our named executive officers ("NEOs"). As an "emerging growth company" we have reduced disclosure obligations regarding executive compensation.

In January 2017, the Company separated from Varian and became a separate publicly traded company. Due to the timing of the Spin-off, our executives were initially compensated under the executive compensation program established by Varian until the Spin-off was consummated. In addition, Varian's Compensation and Management Development Committee (the "Varian Compensation Committee") approved the design of our fiscal 2017 annual cash incentive program. For fiscal year 2018, the Compensation Committee reviewed and revised our executive compensation program to better align its targeted results with our business strategy and objectives as a stand-alone, publicly-traded company. These changes included adopting an annual cash incentive plan that includes free cash flow and EBITDA margin percentage performance measures as well as a revenue growth measure.

Business Highlights—Strategic Transformation

Fiscal year 2017 was transformational for the Company, as we completed the Spin-off and embarked upon a number of operational and capital initiatives to position our business for future growth.

Our key operational and strategic accomplishments included:

Our financial accomplishments included:

25

Philosophy of Our Executive Compensation Programs

The Compensation Committee believes that attracting, motivating and retaining a team of high-performing executives with strong industry expertise is critical to advancing the interests of stockholders. To promote these objectives, the Compensation Committee is guided by a pay for performance philosophy that helps us attract key talent, align with shareholders, create long term value and recognize individual performance, experience and knowledge in making compensation decisions.

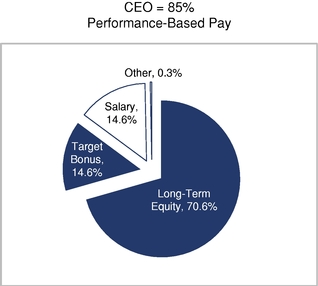

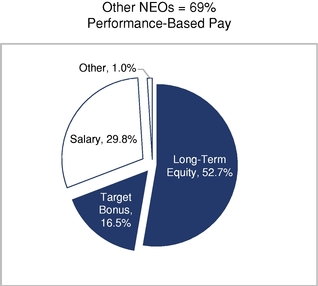

Pay for Performance. Our executive compensation programs are heavily weighted towards performance-based compensation that provides a direct link between corporate performance and pay outcomes for our executives. Our programs also tie pay outcomes to the achievement of key strategic objectives that we believe will drive longer-term value to stockholders. The Compensation Committee regularly assesses our programs to ensure they are aligned with the Company's evolving business strategy and are effective in supporting its talent needs.

|  |

26

in shares of Varex common stock equivalent to a multiple of their base salary. Executives have five years after becoming subject to the guidelines to meet the minimum ownership guidelines.

| | | | | | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| Role | | Holding Guideline | ||||||

| | | | | | | | | |

| CEO | 6 times base salary | |||||||

| | | | | | | | | |

| CFO | 3 times base salary | |||||||

| | | | | | | | | |

| Other Officers | 1 times base salary | |||||||

| | | | | | | | | |

Named Executive Officers

The following executives were our NEOs in 2017:

Name | Title | |

|---|---|---|

| Sunny S. Sanyal | President and Chief Executive Officer | |

| Clarence R. Verhoef | Senior Vice President and Chief Financial Officer | |

| Kimberley E. Honeysett | Senior Vice President, General Counsel and Corporate Secretary |

Compensation Components

Each program component and its rationale are highlighted below:

| | | | | | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| Component | | Purpose and Role | ||||||

| | | | | | | | | |

| | Base salary | | • Provide a competitive, fixed level of cash compensation to attract and retain talented and skilled senior executives. | | ||||

| | | | • Recognize sustained performance, capabilities, job scope, experience, and internal pay equity. | | ||||

| Annual cash incentives | • Motivate and reward achievement of annual financial results that drive stockholder value. | |||||||

• Reward achievement of strategic goals that provide the foundation for future growth and profitability. | ||||||||

| | Stock options | | • Align executives with stockholders on gains in equity value. | | ||||

| | | | • Encourage retention through time-based vesting over four years and a seven-year period to exercise the options. | | ||||

| Restricted stock units | • Align executives with stockholders through use of equity. | |||||||

• Encourage executive retention through time-based vesting over four years. | ||||||||

| | Executive benefits and perquisites | | • Provide the same 401(k) and other benefits as non-executive employees. | | ||||

| | | | • Provide a competitive retirement benefit by allowing executives to defer compensation pursuant to a non-qualified deferred compensation plan. | | ||||

| | | | • Facilitate executive health and focus on our business by providing reimbursement for annual physical exams and financial counseling. | | ||||

| | | | | | | | | |

27

How We Make Compensation Decisions

Role of the Compensation and Management Development Committee. The Compensation Committee oversees the development and administration of our executive compensation programs, including the underlying philosophy and related policies. The Compensation Committee's responsibilities include (i) determining the compensation and performance goals for our President and CEO, (ii) determining the compensation and performance goals for our other Section 16 Officers and vice presidents reporting to the CEO, (iii) determining a market peer group to ensure our executive compensation programs are competitive, and (iv) performing an annual risk assessment of our executive compensation programs.

Role of CEO. The CEO makes recommendations to the Compensation Committee as requested on incentive plan design, financial and strategic performance goals, performance and compensation for other executives, and management transitions and succession. The CEO does not make recommendations or participate in discussions regarding his own compensation.

Role of the Compensation Consultant. The Compensation Committee retained Pay Governance LLC, a nationally-recognized independent compensation consulting firm, to advise on certain compensation matters. Pay Governance does not provide other services to the Company or the Company's management.

Pay Governance advises the Compensation Committee with respect to compensation trends and best practices, competitive pay levels, equity grant practices and competitive levels, peer group benchmarking, incentive plan design, and relevant Proxy Statement disclosure.

The following table sets forth certain information about the compensation of the NEOs for each of the last two fiscal years during which such individuals were NEOs.

Name and Principal Position | Fiscal Year | Salary ($)(1) | Bonus(2) ($) | Stock Awards(3) ($) | Option Awards(4) ($) | Non-Equity Incentive Plan Compensation(5) ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation(6) ($) | Total ($) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sunny S. Sanyal | 2017 | 567,408 | — | 1,164,008 | 4,160,806 | 630,000 | — | 37,414 | 6,559,636 | |||||||||||||||||||

President and Chief | 2016 | 538,329 | — | 1,195,993 | 364,005 | 380,946 | — | 78,659 | 2,557,932 | |||||||||||||||||||

Executive Officer | ||||||||||||||||||||||||||||

Clarence R. Verhoef | 2017 | 361,114 | — | 300,015 | 1,057,403 | 247,500 | — | 123,439 | 2,089,471 | |||||||||||||||||||

Senior Vice President and | 2016 | 361,432 | — | 433,279 | 216,670 | 175,353 | — | 36,725 | 1,223,459 | |||||||||||||||||||

Chief Financial Officer | ||||||||||||||||||||||||||||

Kimberley E. Honeysett | 2017 | 310,491 | 25,000 | 162,486 | 487,500 | 178,750 | 352,515 | 1,516,742 | ||||||||||||||||||||

Senior Vice President, | ||||||||||||||||||||||||||||

General Counsel and | ||||||||||||||||||||||||||||

Corporate Secretary | ||||||||||||||||||||||||||||

The grant date fair value for RSU awards granted in 2017 was determined using the closing price of the Company's common stock on the grant date multiplied by the number of shares subject to the award. The grant date fair value for RSU awards granted during fiscal year 2016 was determined using the closing price of Varian's common stock on the grant date multiplied by the number of shares subject to the award. The grant date fair value for PSU awards granted during fiscal year 2016 was based on the probable outcome of the performance conditions using the Monte Carlo simulation model on the grant date with assumptions as set forth in Note 12 of the Notes to Consolidated Financial Statements included in Varian's Annual Report on Form 10-K for fiscal year 2016, excluding the effect of estimated forfeitures.

28

These amounts reflect our calculation of the value of these awards, and do not necessarily correspond to the actual value that was or may ultimately be realized by the NEOs.

Name | Company Contributions to 401(k) ($)(a) | Other ($)(b)(c) | |||||

|---|---|---|---|---|---|---|---|

Sunny S. Sanyal | 20,979 | 16,435 | |||||

Clarence R. Verhoef | 13,570 | 109,869 | |||||

Kimberley E. Honeysett | 18,586 | 333,929 | |||||

Salary: During fiscal year 2017, except for the change in control agreements discussed below, none of the NEOs had a written employment agreement with the Company, but were and remain "at-will" employees. Following the completion of the Spin-Off, each NEO's base salary rate was adjusted based on competitive market rates and set below the competitive market 25th percentile as part of the Company's pay strategy to emphasize performance-based incentives. NEO salaries were as follows: Mr. Sanyal, $600,000; Mr. Verhoef, $375,000; and Ms. Honeysett, $325,000.

Stock and Option Awards: In fiscal year 2017, the Compensation Committee granted long-term equity compensation to the NEOs in the form of nonqualified stock option and RSU awards to further incentivize and retain the executives. The stock option and RSU awards were granted on February 16, 2017 under the Company's 2017 Omnibus Stock Plan. Each NEO received a stock option award that vests over four years with 25% of the shares covered by the stock option vesting on February 15, 2018 and the remainder vesting monthly during the following 36-month period. Each NEO also received a RSU award that vests over four years, with 25% of the shares covered by the award vesting each year, beginning on February 15, 2018. In addition, Messrs. Sanyal and Verhoef each received stock option awards to replace the value of the portion of their Varian PSU awards which was forfeited as a result of the Spin-Off. Stock option awards granted to replace Varian PSUs that were forfeited with two years remaining in the performance period will vest on February 15, 2019 and stock option awards granted to replace Varian PSUs that were forfeited with one year remaining in the performance period will vest on February 15, 2018.

Vesting of the stock option and RSU awards will occur only if the NEO is employed by the Company or an affiliate through each vesting date, except in cases involving death, disability, or termination without cause or good reason in the change of control context. Additionally, such awards will accelerate in the event of certain corporate transactions if such awards are not assumed, continued or substituted. See "Potential Payments Upon Termination or Change in Control."

29

Set forth below are the value of the stock option and RSU awards to the NEOs in fiscal year 2017:

Name | Value of Stock Options ($) | Value of RSU's ($) | Total Combined Value of Equity Awards ($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Sunny S. Sanyal | 4,160,806 | 1,164,008 | 5,324,814 | |||||||

Clarence R. Verhoef | 1,057,403 | 300,015 | 1,357,418 | |||||||

Kimberley E. Honeysett | 487,500 | 162,486 | 649,986 | |||||||

The dollar value of the equity awards in the table above equals the grant date fair value of the actual number of stock options and RSUs. The value of each stock option award was based on a Black-Scholes value. The value of each RSU award was equal to the closing price of the Company's common stock on the date of grant. Additional information about equity awards granted in fiscal year 2017 is provided below in the Outstanding Equity Awards at Fiscal Year End table.

Non-Equity Incentive Plan Compensation: The amounts in the "Non-Equity Incentive Plan Compensation" column of the Summary Compensation Table represent the actual cash incentive awards earned by the NEOs under an annual cash incentive plan for fiscal 2017 that was established under Varian's Management Incentive Plan. For fiscal year 2017, the Varian Compensation Committee established a pool of funds of up to 3% of the Company's fiscal year 2017 EBIT to be available for annual cash incentives payable to the NEOs and expressed a maximum percentage of such pool for each NEO. Under the plan, the Compensation Committee retained discretion to reduce each NEO's maximum share of such pool, based all or in part on EBIT and top line growth metrics set by Varian, individual performance and other factors determined by the Compensation Committee in its sole discretion. Under this framework, the Compensation Committee determined the actual fiscal 2017 annual cash incentive payouts as a percentage of each NEO's target award opportunity were as follows. These payments were based on a variety of factors including the successful spin off of the Company from Varian and the completion of the acquisition of the medical imaging business of Perkin Elmer.

Name | Target (% of Base Salary) | Payout as a % of Target (Fiscal Year 2017) | |||||

|---|---|---|---|---|---|---|---|

Sunny S. Sanyal | 100 | % | 105 | % | |||

Clarence R. Verhoef | 60 | % | 110 | % | |||

Kimberley E. Honeysett | 50 | % | 110 | % | |||

All Other Compensation: The NEOs also received certain other compensation, as follows:

30

Outstanding Equity Awards at Fiscal Year End:

The following table sets forth the outstanding equity awards of the NEOs as of the end of fiscal year 2017:

| | Option Awards(1)(9) | Stock Awards | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name | Grant Date | Number of Securities Underlying Unexercised Options Exercisable (#) | Number of Securities Underlying Unexercised Options Unexercisable (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(13) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |||||||||||||||||||

Sunny S. Sanyal | 02/21/2014 | 161,330 | (3) | — | 27.77 | 02/21/2021 | — | — | — | — | ||||||||||||||||||

| 02/13/2015 | 60,711 | (4) | 9,792 | (4) | 30.74 | 02/13/2022 | — | — | — | — | ||||||||||||||||||

| 02/12/2016 | 42,368 | (5) | 37,912 | (5) | 25.17 | 02/12/2023 | — | — | — | — | ||||||||||||||||||

| 02/16/2017 | — | 12,467 | (6) | 31.08 | 02/16/2024 | — | — | — | — | |||||||||||||||||||

| 02/16/2017 | — | 34,889 | (7) | 31.08 | 02/16/2024 | — | — | — | — | |||||||||||||||||||

| 02/16/2017 | — | 34,254 | (7) | 31.08 | 02/16/2024 | — | — | — | — | |||||||||||||||||||

| 02/16/2017 | — | 396,525 | (8) | 31.08 | 02/16/2024 | — | — | — | — | |||||||||||||||||||

| 02/13/2015 | — | — | — | — | 4,700 | (10) | 159,048 | — | — | |||||||||||||||||||

| 02/12/2016 | — | — | — | — | 5,511 | (11) | 186,492 | — | — | |||||||||||||||||||

| 02/16/2017 | — | — | — | — | 37,452 | (12) | 1,267,376 | — | — | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 264,409 | 525,839 | 47,663 | 1,612,916 | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Clarence R. Verhoef | 11/09/2012 | 21,047 | (2) | — | 22.84 | 11/09/2019 | — | — | — | — | ||||||||||||||||||

| 02/21/2014 | 22,063 | (3) | — | 27.77 | 02/21/2021 | — | — | — | — | |||||||||||||||||||

| 02/13/2015 | 23,347 | (4) | 3,769 | (4) | 30.74 | 02/13/2022 | — | — | — | — | ||||||||||||||||||

| 02/12/2016 | 25,219 | (5) | 22,567 | (5) | 25.17 | 02/12/2023 | — | — | — | — | ||||||||||||||||||

| 02/16/2017 | — | 4,795 | (6) | 31.08 | 02/16/2024 | — | — | — | — | |||||||||||||||||||

| 02/16/2017 | — | 14,537 | (7) | 31.08 | 02/16/2024 | — | — | — | — | |||||||||||||||||||

| 02/16/2017 | — | 102,197 | (8) | 31.08 | 02/16/2024 | — | — | — | — | |||||||||||||||||||

| 02/13/2015 | — | — | — | — | 1,809 | (10) | 61,217 | — | — | |||||||||||||||||||

| 02/12/2016 | — | — | — | — | 5,741 | (11) | 194,275 | — | — | |||||||||||||||||||

| 02/16/2017 | — | — | — | — | 9,653 | (12) | 326,658 | — | — | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 91,676 | 147,865 | 17,203 | 582,150 | — | — | |||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Kimberley E. Honeysett | 02/12/2016 | 4,847 | (5) | 4,342 | (5) | 25.17 | 02/12/2023 | |||||||||||||||||||||

| 02/16/2017 | — | 55,357 | (8) | 31.08 | 02/16/2024 | — | — | — | — | |||||||||||||||||||

| 02/13/2015 | — | — | — | — | 1,356 | (10) | 45,887 | — | — | |||||||||||||||||||

| 02/12/2016 | — | — | — | — | 2,209 | (11) | 74,753 | — | — | |||||||||||||||||||

| 02/16/2017 | — | — | — | — | 5,228 | (12) | 176,916 | — | — | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4,847 | 59,699 | 8,793 | 297,556 | — | — | |||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Grant Date | General Vesting Schedule (based on outstanding stock option awards) | ||

|---|---|---|---|---|

| (2) | 11/09/2012* | 33-1/3% vested on 11/9/2013; pro-rata monthly thereafter until fully vested on 11/11/2015. | ||

| (3) | 02/21/2014* | 33-1/3% vested on 2/21/2015; pro-rata monthly thereafter until fully vested on 2/21/2017. | ||

| (4) | 02/13/2015* | 33-1/3% vested on 2/13/2016; pro-rata monthly thereafter until fully vested on 2/13/2018. | ||

| (5) | 02/12/2016* | 33-1/3% vested on 2/12/2017; pro-rata monthly thereafter until fully vested on 2/12/2019. | ||

| (6) | 02/16/2017 | 100% vests on 2/16/2018. | ||

| (7) | 02/16/2017 | 100% vests on 2/16/2019. | ||

| (8) | 02/16/2017 | 25% vests on 2/16/2018; pro-rata monthly thereafter until fully vested on 2/16/2021. |

31

| (10) | 02/13/2015* | 331/3% on 2/15/2016; 331/3% on 2/15/2017 and 331/3% on 2/15/2018. | ||

(11) | 02/12/2016* | 331/3% on 2/15/2017; 331/3% on 2/15/2018 and 331/3% on 2/15/2019. | ||

(12) | 02/16/2017 | 25% on 02/15/18; 25% on 02/15/2019; 25% on 02/15/2020 and 25% on 02/15/2021. |

Equity Compensation Plan Information

The following table provides information as of September 29, 2017 with respect to the shares of our common stock that may be issued under our existing equity compensation plans.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted average exercise price of outstanding options, warrants and rights(1) (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by security holders | 2,448,156 | (2) | $ | 29.11 | 4,560,549 | (3) | ||||

Equity compensation plans not approved by security holders | — | — | — | |||||||

| | | | | | | | | | | |

Total | 2,448,156 | $ | 29.11 | 4,560,549 | ||||||

| | | | | | | | | | | |

Potential Payments upon Termination or Change in Control

Change in Control Agreements

In January 2017, each of the NEOs entered into a Change in Control Agreement (each, a "CIC Agreement") that was approved by our Board of Directors. Under the CIC Agreements, if the Company terminates the NEO's employment other than by reason of death, disability, retirement or "cause", or if the NEO voluntarily terminates for "good reason", in either case, within 60 days prior to, or 18 months following, a change in control of the Company, then the NEO will be entitled to: (i) a lump sum severance payment, (ii) a lump sum payment equal to a pro-rata portion of the NEO's target

32

bonus under the Company's annual incentive plan, (iii) full vesting of all outstanding stock options and stock awards, and (iv) up to 18 months of Company paid COBRA premiums; provided, however, that if the payment of COBRA premiums violates applicable law, the NEO will instead receive a taxable lump sum payment equal to 18 months of COBRA premiums.

The amount of the lump sum severance payment in the case of each of the NEOs will be equal to a multiple of the sum of: (A) the NEO's base salary and (B) the greater of (x) the NEO's most recently established target annual bonus under the Company's annual cash incentive plan and (y) the average annual cash incentive that was paid to the NEO in the three fiscal years ending prior to the date of termination under the Company's annual cash incentive plan or the Varian MIP. The severance multiple for Mr. Sanyal is 2.5 and the severance multiple for Mr. Verhoef and Ms. Honeysett is 2.0. If the NEO has not completed at least three full fiscal years of service with the Company prior to the NEO's termination date, then the amount determined in (y) above will be based on the average annual cash incentive for the number of full fiscal years that the NEO has completed.

As a condition to receiving such severance benefits, an NEO must execute a release of all of his rights and claims relating to his employment and comply with certain post-termination restrictions, including, among other things, continuing to comply with the terms of his proprietary information and non-disclosure agreement, and for a period of 12 months, complying with certain non-solicitation and non-competition provisions that are set forth in the NEO's CIC Agreement.

In addition, if within 18 months after a change in control, the NEO incurs a separation from service by reason of the NEO's death or disability, the NEO or, if applicable, the NEO's estate will be entitled to death or long-term disability benefits from the Company no less favorable than the most favorable benefits to which the NEO would have been entitled had the death or disability occurred at any time during the period commencing one year prior to the change in control under the plans of the Company.

The CIC Agreements with the NEOs do not provide for tax gross-ups of payments subject to the "golden parachute" excise tax under Section 4999 of the Internal Revenue Code of 1986, as amended (the "Code"). Each CIC Agreement instead contains a "better after-tax" provision, which provides that if any of the payments to the NEO constitutes a parachute payment under Section 280G of the Code, the payments will either be (i) reduced or (ii) provided in full to the NEO, whichever results in the NEO receiving the greater amount after taking into consideration the payment of all taxes, including the excise tax under Section 4999 of the Code.

Pre-Spin-Off Equity Grants

For stock option awards granted by Varian, if the NEO's employment terminates due to retirement, his or her unvested stock options will continue to vest in accordance with their original vesting schedules following the termination date. If the NEO's service terminates due to death, his or her unvested stock options will fully vest on such termination date. In addition, for stock option awards granted by Varian on or after November 9, 2015 but before the Spin-Off, if the NEO's service terminates due to death, his or her unvested stock options will fully vest on such termination date. Stock options may be exercisable for up to three years from the date the NEO's employment terminates due to retirement or death and one year from the date the NEO's employment terminates due to disability, unless in each case the stock option term expires earlier.