Sanofi to Acquire Bioverativ A Strategically and Financially Compelling Acquisition in Specialty Care January 22, 2018 Exhibit 99.2

Forward Looking Statements This presentation contains forward-looking statements. Forward-looking statements are statements that are not historical facts, and may include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. Although Sanofi’s management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Sanofi, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include among other things, risks related to Sanofi’s ability to complete the acquisition on the proposed terms or on the proposed timeline, including the receipt of required regulatory approvals, the possibility that competing offers will be made, other risks associated with executing business combination transactions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the acquisition will not be realized, risks related to future opportunities and plans for the combined company, including uncertainty of the expected financial performance and results of the combined company following completion of the proposed acquisition, disruption from the proposed acquisition making it more difficult to conduct business as usual or to maintain relationships with customers, employees, manufacturers, suppliers or patient groups, and the possibility that, if the combined company does not achieve the perceived benefits of the proposed acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Sanofi’s shares could decline, as well as other risks related Sanofi’s and Bioverativ’s respective businesses, including the ability to grow sales and revenues from existing products and to develop, commercialize or market new products, competition, including potential generic competition, the uncertainties inherent in research and development, including future clinical data and analysis, regulatory obligations and oversight by regulatory authorities, such as the FDA or the EMA, including decisions of such authorities regarding whether and when to approve any drug, device or biological application that may be filed for any such product candidates as well as their decisions regarding labelling and other matters that could affect the availability or commercial potential of such product candidates, the absence of guarantee that the product candidates if approved will be commercially successful, risks associated with intellectual property, including the ability to protect intellectual property and defend patents, future litigation, the future approval and commercial success of therapeutic alternatives, and volatile economic conditions. While the list of factors presented here is representative, no list should be considered a statement of all potential risks, uncertainties or assumptions that could have a material adverse effect on Sanofi’s consolidated financial condition or results of operations. The foregoing factors should be read in conjunction with the risks and cautionary statements discussed or identified in the public filings with the SEC and the AMF made by Sanofi, including those listed under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in Sanofi’s annual report on Form 20-F for the year ended December 31, 2016. The forward-looking statements speak only as of the date hereof and, other than as required by applicable law, Sanofi does not undertake any obligation to update or revise any forward-looking information or statements.

Additional Information and Where to Find It The tender offer for the outstanding shares of Bioverativ common stock (“Bioverativ”) referenced in this presentation has not yet commenced. This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Bioverativ, nor is it a substitute for the tender offer materials that Sanofi and its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (the “SEC”) upon commencement of the tender offer. At the time the tender offer is commenced, Sanofi and its acquisition subsidiary will file tender offer materials on Schedule TO, and Bioverativ will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. The tender offer materials (including an Offer to Purchase, a related Letter of Transmittal and certain other tender offer documents) and the Solicitation/Recommendation Statement will contain important information. HOLDERS OF SHARES OF BIOVERATIVE ARE URGED TO READ THESE DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT Bioverativ STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of shares of Bioverativ at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s web site at www.sec.gov. Additional copies may be obtained for free by contacting Sanofi or on Sanofi’s website at https://en.sanofi.com/investors.

Agenda Executing on our 2020 strategic roadmap Olivier Brandicourt - Chief Executive Officer Sustaining leadership in rare diseases Bill Sibold - EVP, Sanofi Genzyme Financial transaction highlights Jérôme Contamine - EVP, Chief Financial Officer

Olivier Brandicourt Chief Executive Officer EXECUTING ON OUR 2020 STRATEGIC ROADMAP

Deal is Consistent with our Strategic Priority of Sustaining Leadership in Rare Diseases Multiple Sclerosis Immunology Oncology Diabetes/Cardiovascular Vaccines Rare Diseases Emerging Markets Consumer Healthcare Sustain Leadership Build Competitive Positions

A Strategically and Financially Attractive Transaction EM – Emerging Markets Leadership position in the large and attractive hemophilia market Leverage opportunities with new platform in rare blood disorders Offers pipeline in other rare blood disorders Complementary fit with fitusiran Maximize commercial potential with Sanofi infrastructure in EM(1) Immediately accretive to Business EPS Projected to have a ROIC exceeding cost of capital within 3 years

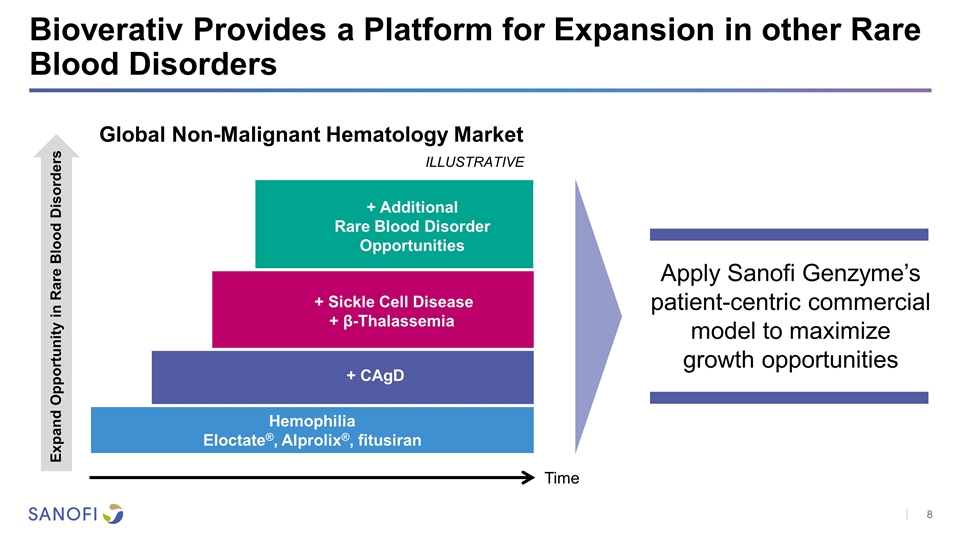

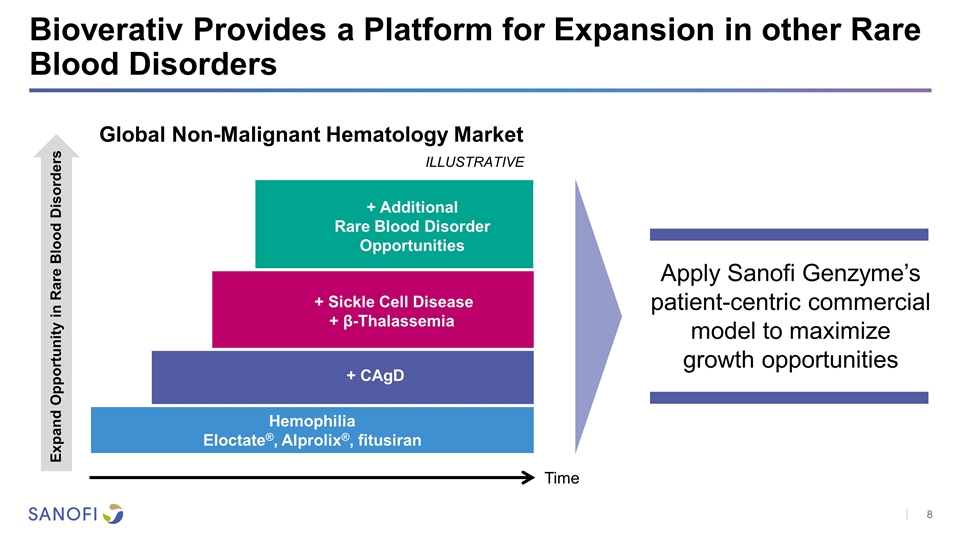

Bioverativ Provides a Platform for Expansion in other Rare Blood Disorders Apply Sanofi Genzyme’s patient-centric commercial model to maximize growth opportunities Expand Opportunity in Rare Blood Disorders Hemophilia Eloctate®, Alprolix®, fitusiran + CAgD + Sickle Cell Disease + β-Thalassemia + Additional Rare Blood Disorder Opportunities Time Global Non-Malignant Hematology Market ILLUSTRATIVE

SUSTAINING LEADERSHIP IN RARE DISEASES Bill Sibold Executive Vice President, Sanofi Genzyme

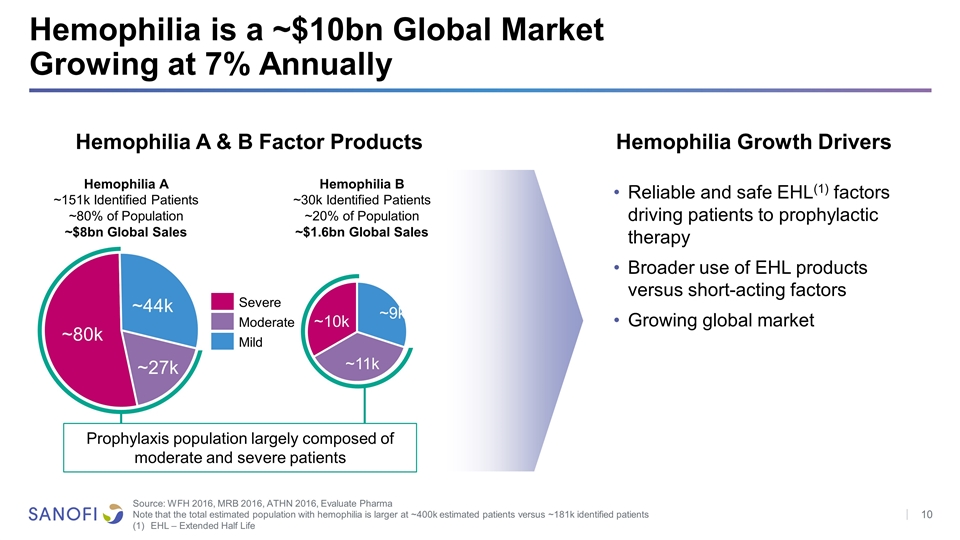

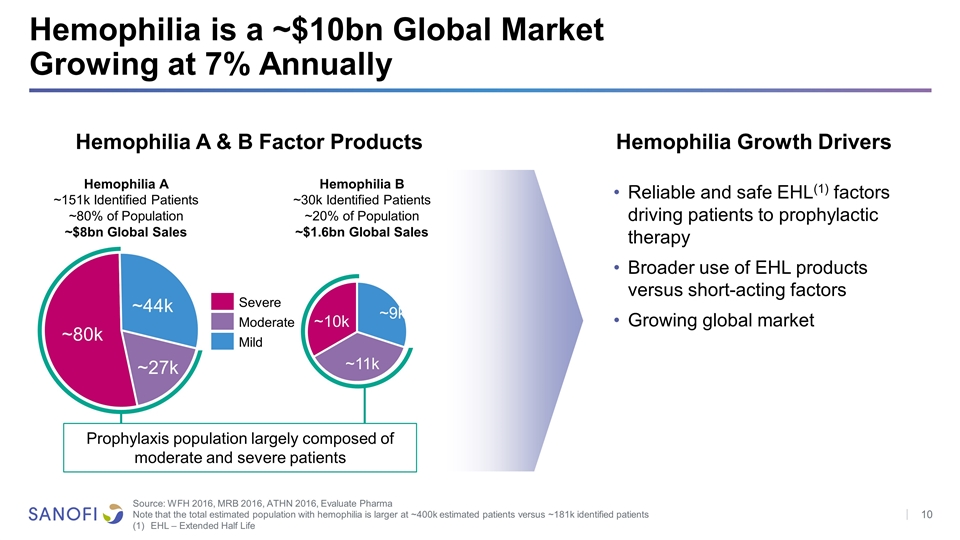

Hemophilia is a ~$10bn Global Market Growing at 7% Annually Source: WFH 2016, MRB 2016, ATHN 2016, Evaluate Pharma Note that the total estimated population with hemophilia is larger at ~400k estimated patients versus ~181k identified patients EHL – Extended Half Life Hemophilia A ~151k Identified Patients ~80% of Population ~$8bn Global Sales Hemophilia B ~30k Identified Patients ~20% of Population ~$1.6bn Global Sales Hemophilia A & B Factor Products Hemophilia Growth Drivers Reliable and safe EHL(1) factors driving patients to prophylactic therapy Broader use of EHL products versus short-acting factors Growing global market Severe Moderate Mild Prophylaxis population largely composed of moderate and severe patients

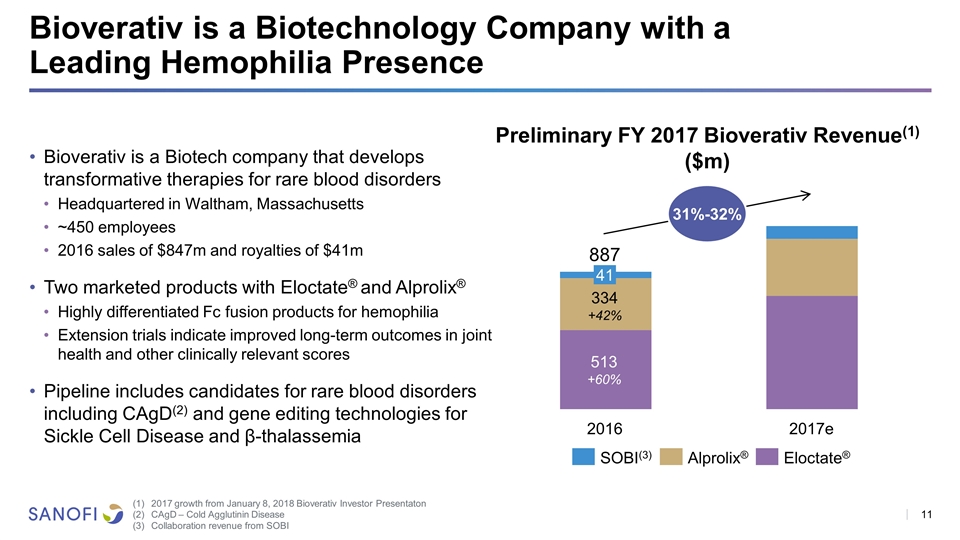

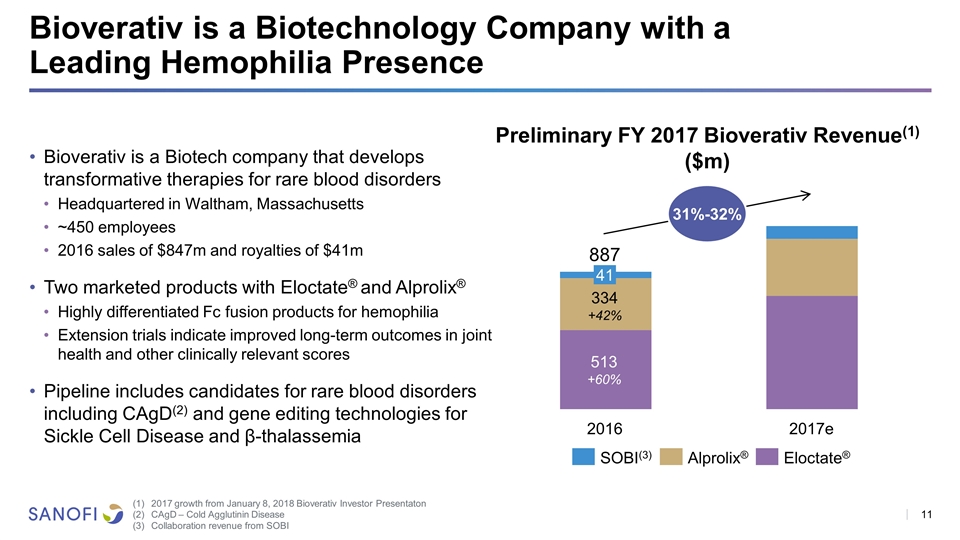

Bioverativ is a Biotechnology Company with a Leading Hemophilia Presence Bioverativ is a Biotech company that develops transformative therapies for rare blood disorders Headquartered in Waltham, Massachusetts ~450 employees 2016 sales of $847m and royalties of $41m Two marketed products with Eloctate® and Alprolix® Highly differentiated Fc fusion products for hemophilia Extension trials indicate improved long-term outcomes in joint health and other clinically relevant scores Pipeline includes candidates for rare blood disorders including CAgD(2) and gene editing technologies for Sickle Cell Disease and β-thalassemia 887 +60% +42% (3) ® ® Preliminary FY 2017 Bioverativ Revenue(1) ($m) 2017 growth from January 8, 2018 Bioverativ Investor Presentaton CAgD – Cold Agglutinin Disease Collaboration revenue from SOBI 31%-32%

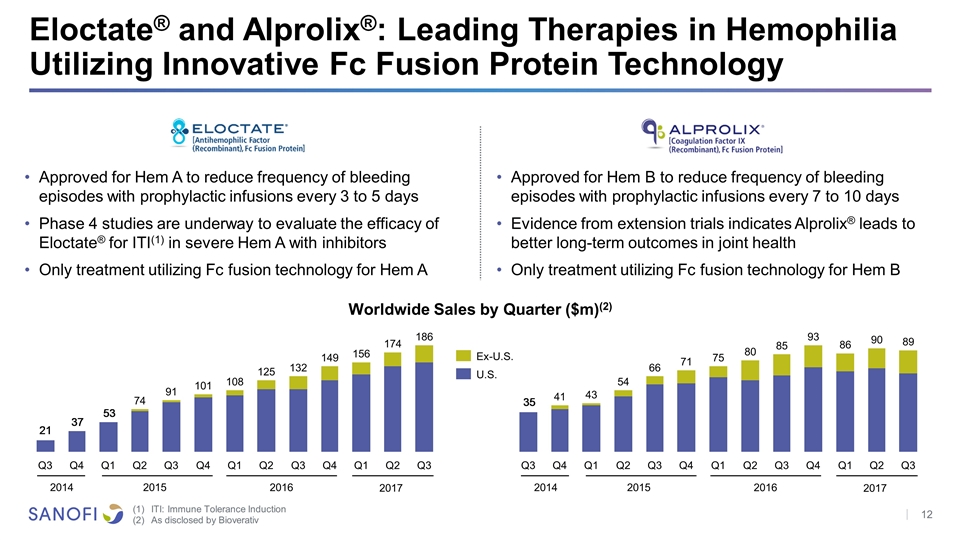

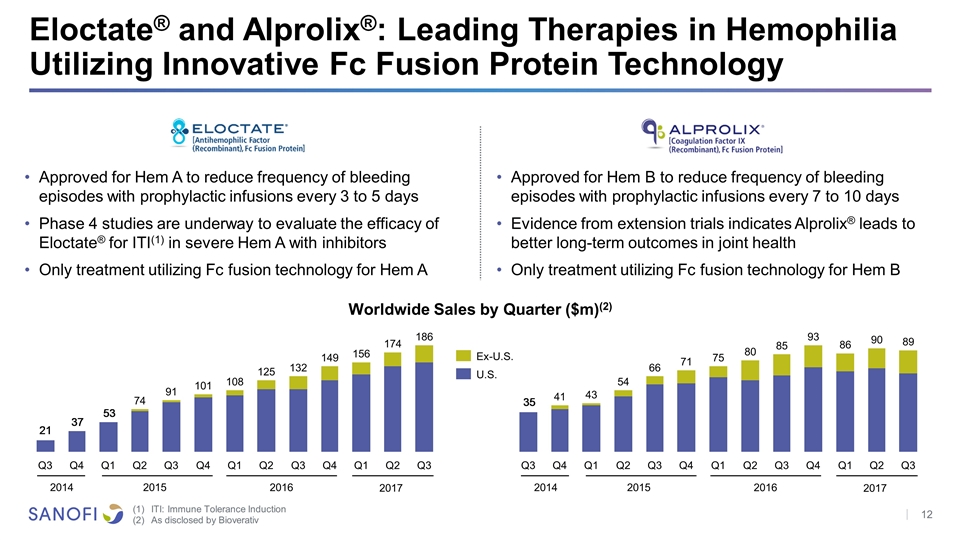

Eloctate® and Alprolix®: Leading Therapies in Hemophilia Utilizing Innovative Fc Fusion Protein Technology Approved for Hem A to reduce frequency of bleeding episodes with prophylactic infusions every 3 to 5 days Phase 4 studies are underway to evaluate the efficacy of Eloctate® for ITI(1) in severe Hem A with inhibitors Only treatment utilizing Fc fusion technology for Hem A Approved for Hem B to reduce frequency of bleeding episodes with prophylactic infusions every 7 to 10 days Evidence from extension trials indicates Alprolix® leads to better long-term outcomes in joint health Only treatment utilizing Fc fusion technology for Hem B Worldwide Sales by Quarter ($m)(2) Ex-U.S. ITI: Immune Tolerance Induction As disclosed by Bioverativ 2017 2016 2015 2014 2017 2016 2015 2014

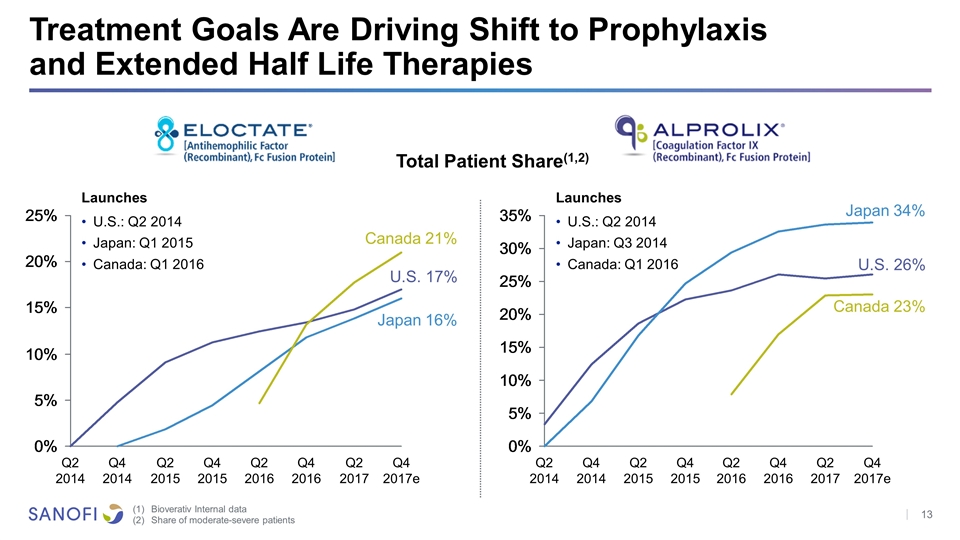

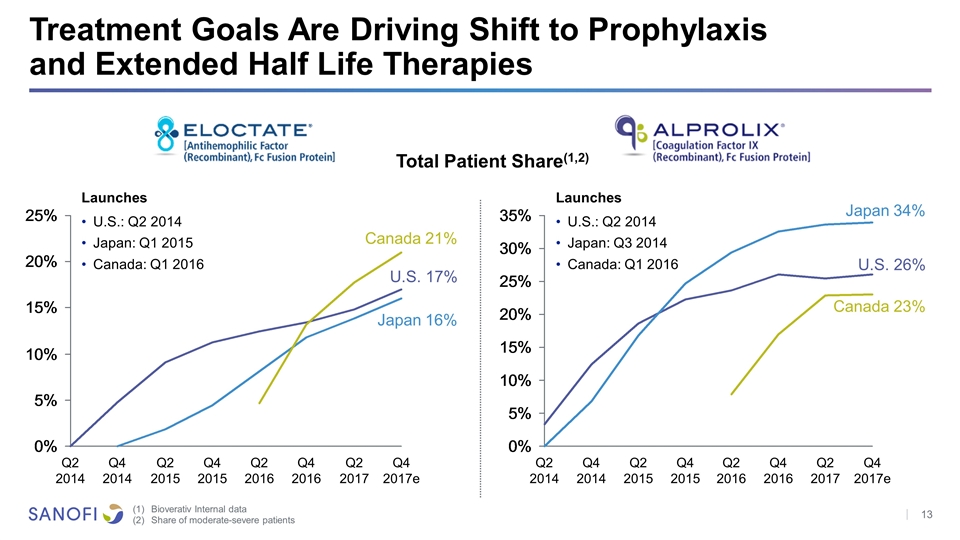

Treatment Goals Are Driving Shift to Prophylaxis and Extended Half Life Therapies Bioverativ Internal data Share of moderate-severe patients U.S. 17% Japan 16% Canada 21% Total Patient Share(1,2) Launches U.S.: Q2 2014 Japan: Q1 2015 Canada: Q1 2016 U.S. 26% Japan 34% Canada 23% Launches U.S.: Q2 2014 Japan: Q3 2014 Canada: Q1 2016

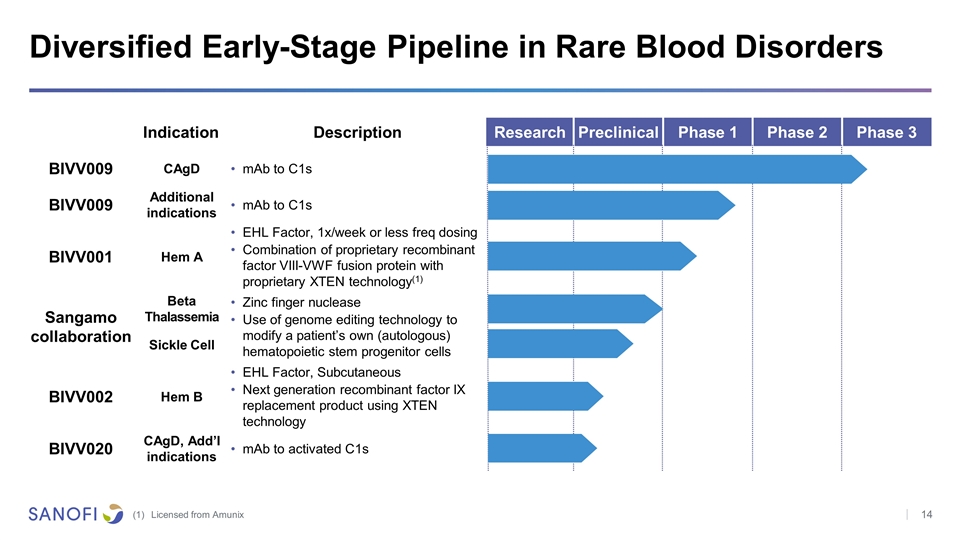

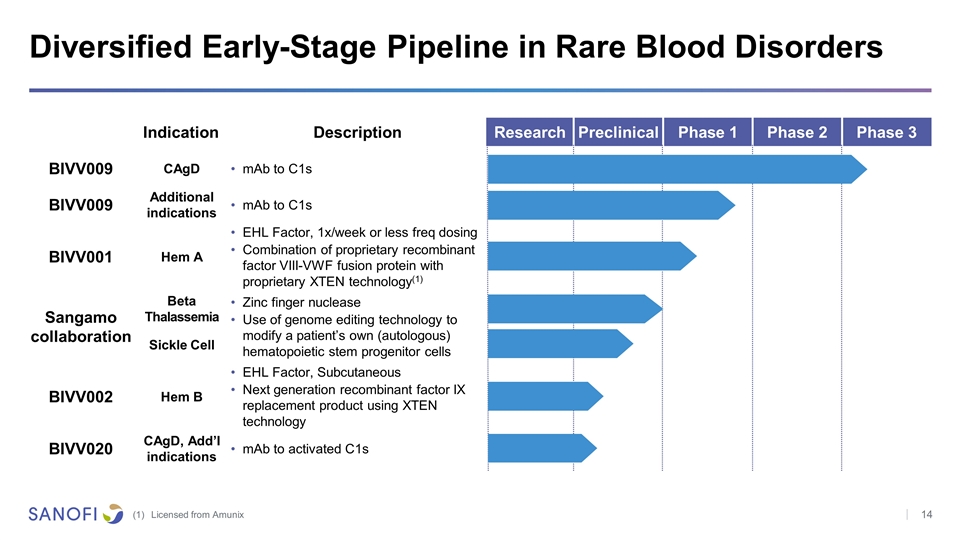

Diversified Early-Stage Pipeline in Rare Blood Disorders Licensed from Amunix Indication Description Research Preclinical Phase 1 Phase 2 Phase 3 BIVV009 CAgD mAb to C1s BIVV009 Additional indications mAb to C1s BIVV001 Hem A EHL Factor, 1x/week or less freq dosing Combination of proprietary recombinant factor VIII-VWF fusion protein with proprietary XTEN technology(1) Sangamo collaboration Beta Thalassemia Zinc finger nuclease Use of genome editing technology to modify a patient’s own (autologous) hematopoietic stem progenitor cells Sickle Cell BIVV002 Hem B EHL Factor, Subcutaneous Next generation recombinant factor IX replacement product using XTEN technology BIVV020 CAgD, Add’I indications mAb to activated C1s

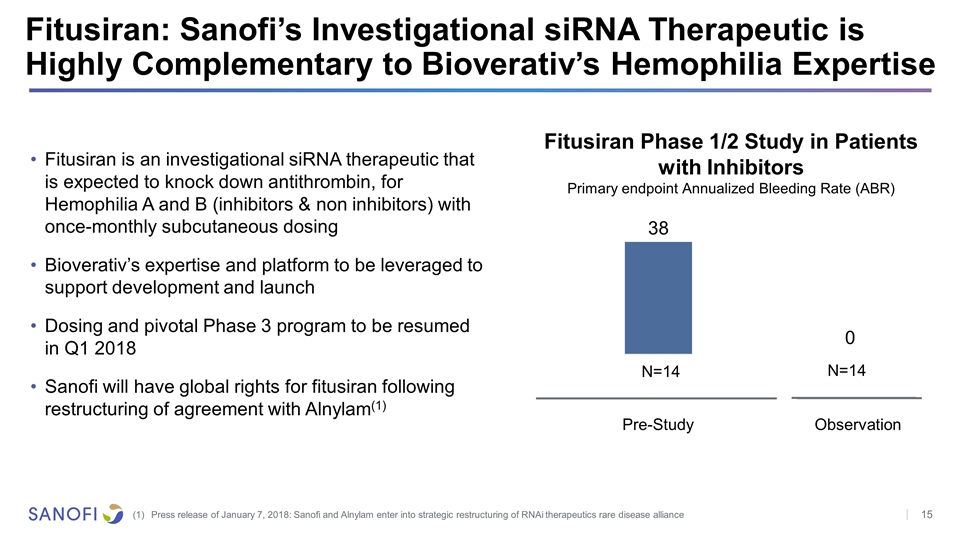

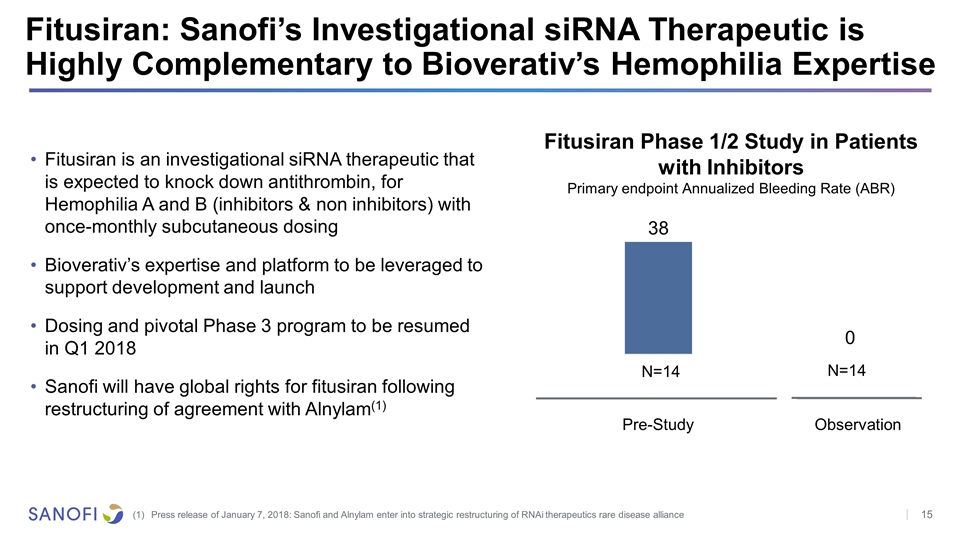

Fitusiran: Sanofi’s Investigational siRNA Therapeutic is Highly Complementary to Bioverativ’s Hemophilia Expertise Press release of January 7, 2018: Sanofi and Alnylam enter into strategic restructuring of RNAi therapeutics rare disease alliance Fitusiran is an investigational siRNA therapeutic that is expected to knock down antithrombin, for Hemophilia A and B (inhibitors & non inhibitors) with once-monthly subcutaneous dosing Bioverativ’s expertise and platform to be leveraged to support development and launch Dosing and pivotal Phase 3 program to be resumed in Q1 2018 Sanofi will have global rights for fitusiran following restructuring of agreement with Alnylam(1) Fitusiran Phase 1/2 Study in Patients with Inhibitors Primary endpoint Annualized Bleeding Rate (ABR) N=14 N=14 38 0 Observation Pre-Study

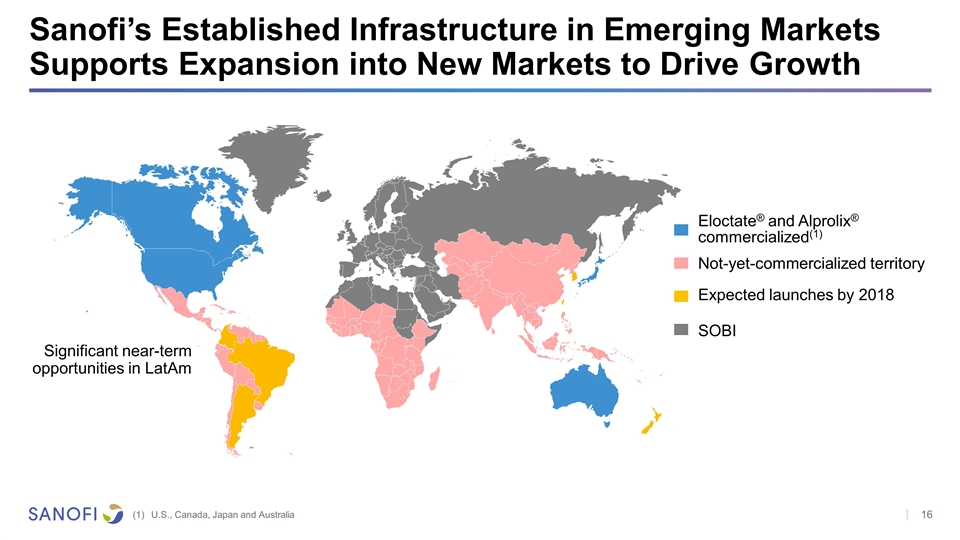

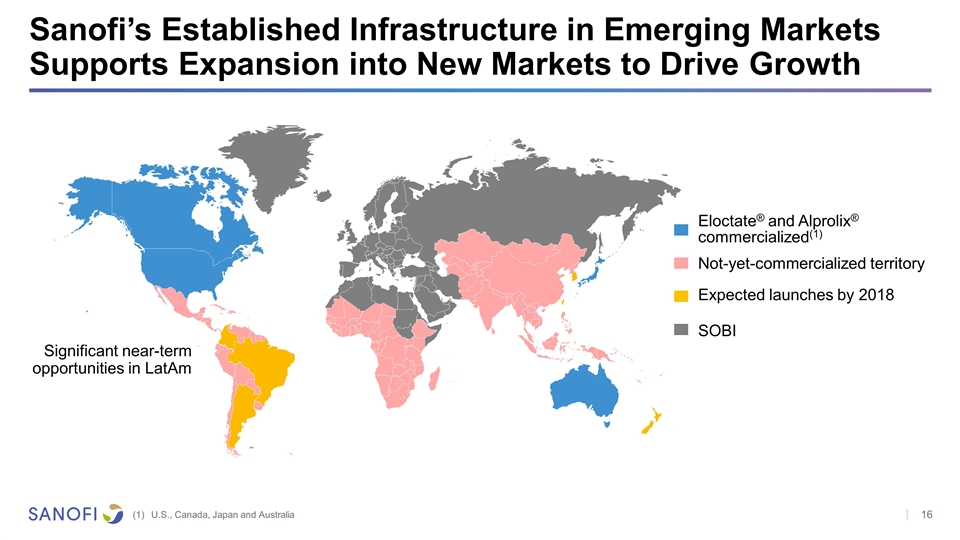

Sanofi’s Established Infrastructure in Emerging Markets Supports Expansion into New Markets to Drive Growth Expected launches by 2018 Eloctate® and Alprolix® commercialized(1) Not-yet-commercialized territory Significant near-term opportunities in LatAm SOBI U.S., Canada, Japan and Australia

FINANCIAL TRANSACTION HIGHLIGHTS Jérôme Contamine Executive Vice President, Chief Financial Officer

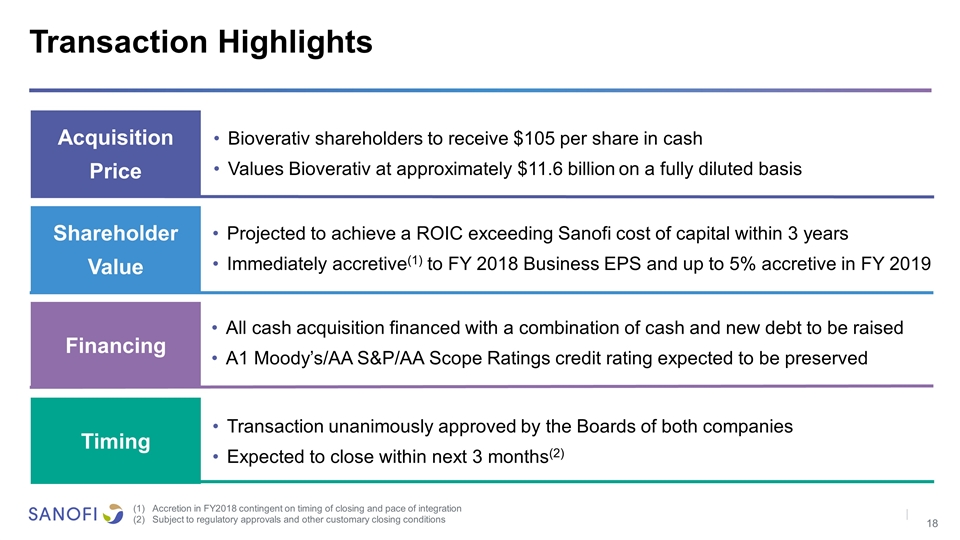

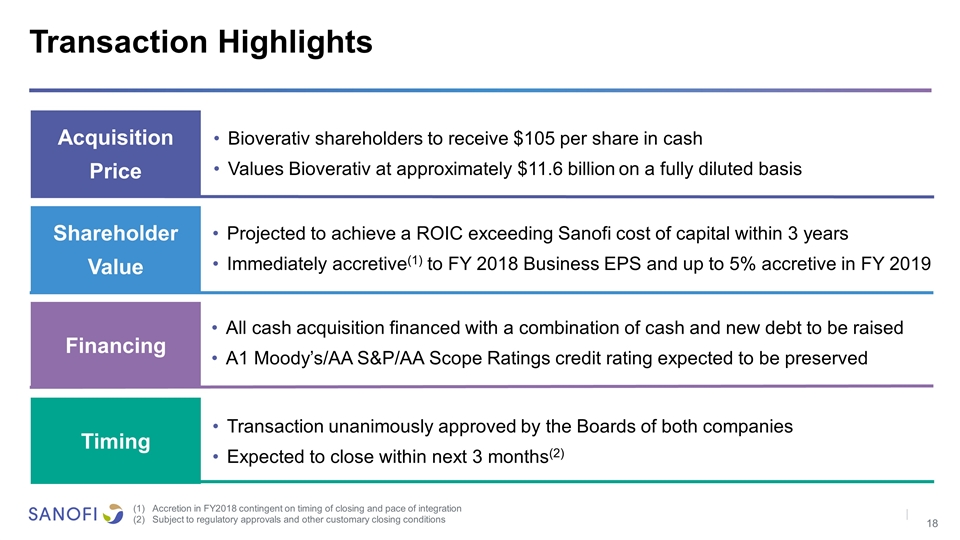

Acquisition Price Shareholder Value Financing Bioverativ shareholders to receive $105 per share in cash Values Bioverativ at approximately $11.6 billion on a fully diluted basis Timing Projected to achieve a ROIC exceeding Sanofi cost of capital within 3 years Immediately accretive(1) to FY 2018 Business EPS and up to 5% accretive in FY 2019 All cash acquisition financed with a combination of cash and new debt to be raised A1 Moody’s/AA S&P/AA Scope Ratings credit rating expected to be preserved Transaction unanimously approved by the Boards of both companies Expected to close within next 3 months(2) Transaction Highlights Accretion in FY2018 contingent on timing of closing and pace of integration Subject to regulatory approvals and other customary closing conditions

Q&A SESSION Jérôme Contamine EVP Chief Financial Officer Bill Sibold EVP Sanofi Genzyme Olivier Brandicourt Chief Executive Officer