Exhibit 99.1

Making it Possible Analyst & Investor Lunch February 27, 2019

Agenda 1. Brief overview of Eyenovia 2. Recent updates and accomplishments 3. Micro Stat MIST - 1 and MIST - 2 results 4. Discussion on in - office efficiency with Micro Stat with Robert Stapper, Director of Research at Keystone Research 5. Manufacturing strategy 6. Commercial strategy 7. Future opportunities 8. Summary 9. Q&A 1

Except for historical information, all of the statements, expectations, and assumptions contained in this presentation are forward - looking statements . Forward - looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions . These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management . These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict . Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward - looking statements due to numerous factors discussed from time to time in documents which we file with the SEC . In addition, such statements could be affected by risks and uncertainties related to, among other things : risks involved in clinical trials, including, but not limited to, the initiation, timing, progress and results of such trials ; the timing and our ability to submit applications for, and obtain and maintain regulatory approvals for, our product candidates and to raise money, including in light of U . S . government shut - downs ; our ability to develop and implement commercialization, marketing and manufacturing capabilities and strategies ; the potential advantages of our product candidates ; the rate and degree of market acceptance and clinical utility of our product candidates ; our estimates regarding the potential market opportunity for our product candidates ; intellectual property risks ; the impact of government laws and regulations ; and our competitive position . Any forward - looking statements speak only as of the date on which they are made, and except as may be required under applicable securities laws, we do not undertake any obligation to update any forward - looking statements . 2 Forward - Looking Statements

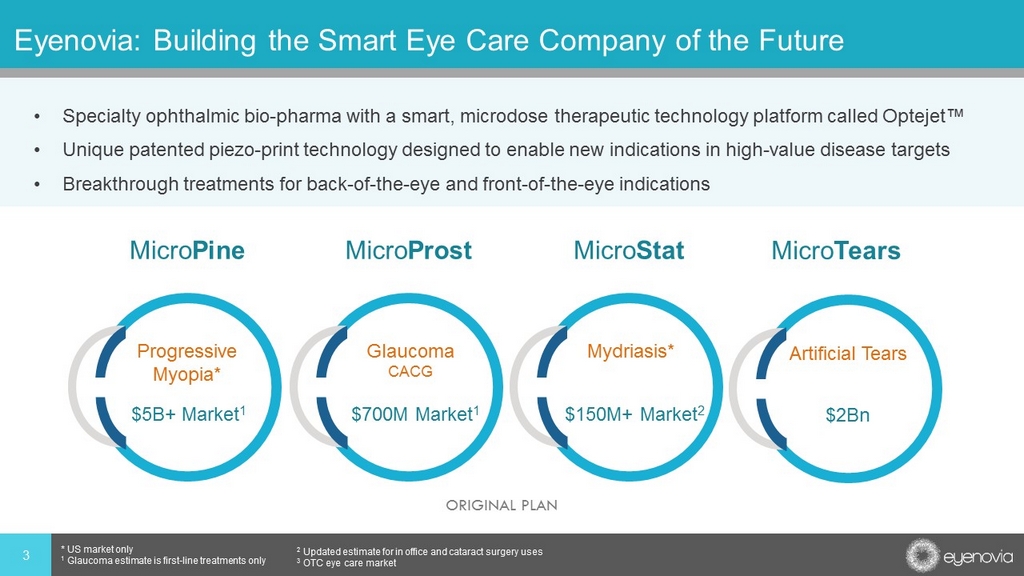

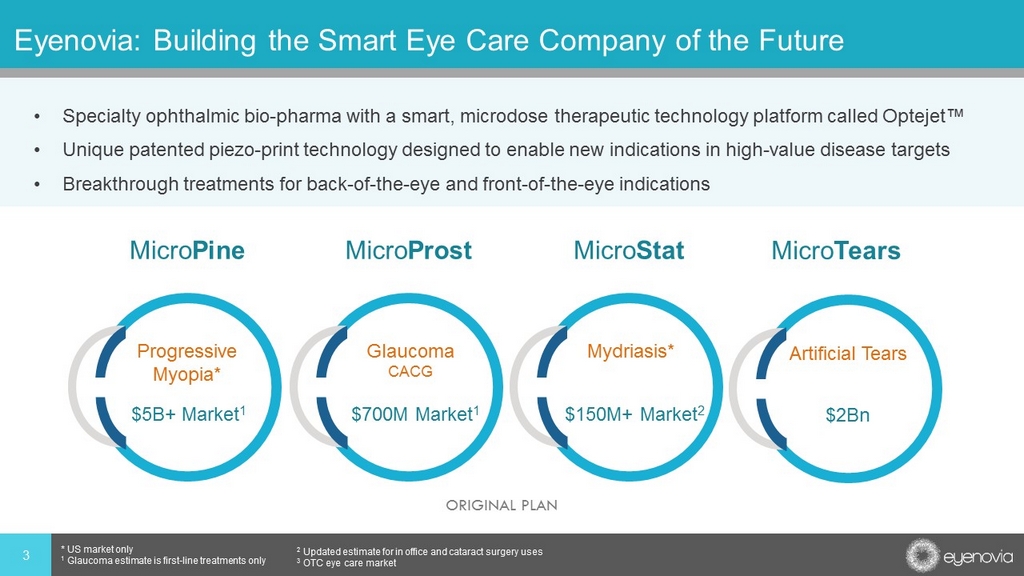

Eyenovia: Building the Smart Eye Care Company of the Future • Specialty ophthalmic bio - pharma with a smart, microdose therapeutic technology platform called Optejet™ • Unique patented piezo - print technology designed to enable new indications in high - value disease targets • Breakthrough treatments for back - of - the - eye and front - of - the - eye indications 3 * US market only 1 Glaucoma estimate is first - line treatments only 2 Updated estimate for in office and cataract surgery uses 3 OTC eye care market Progressive Myopia* Glaucoma CACG Mydriasis* $5B+ Market 1 $700M Market 1 $150M+ Market 2 Artificial Tears $2Bn ORIGINAL PLAN Micro Pine Micro Prost Micro Stat Micro Tears

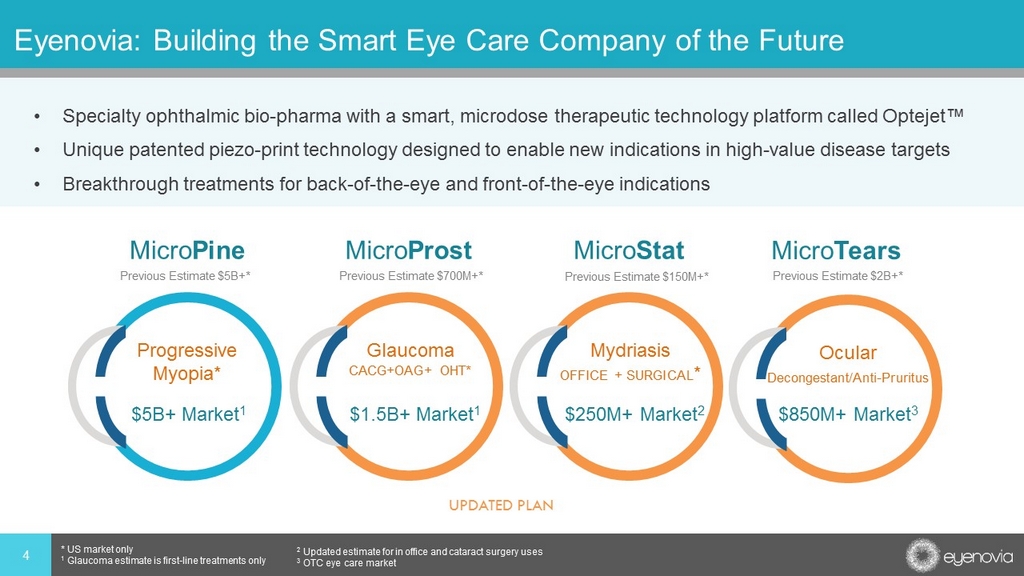

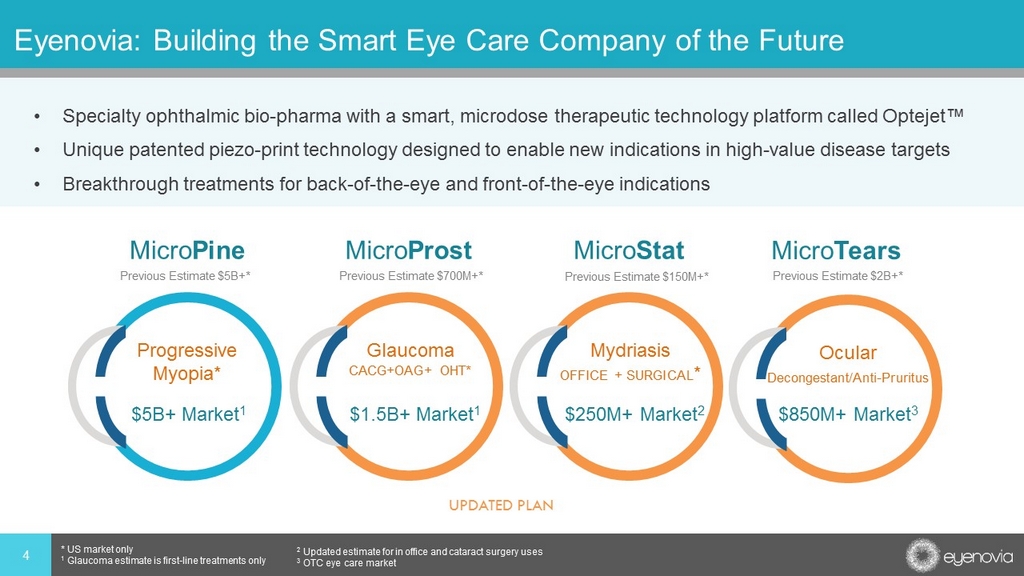

Eyenovia: Building the Smart Eye Care Company of the Future • Specialty ophthalmic bio - pharma with a smart, microdose therapeutic technology platform called Optejet™ • Unique patented piezo - print technology designed to enable new indications in high - value disease targets • Breakthrough treatments for back - of - the - eye and front - of - the - eye indications 4 * US market only 1 Glaucoma estimate is first - line treatments only 2 Updated estimate for in office and cataract surgery uses 3 OTC eye care market Progressive Myopia* Micro Pine Glaucoma CACG+OAG+ OHT* Micro Prost Mydriasis OFFICE + SURGICAL * Micro Stat $5B+ Market 1 $1.5B+ Market 1 $250M+ Market 2 Ocular Decongestant/Anti - Pruritus $850M+ Market 3 Micro Tears Previous Estimate $5B+* Previous Estimate $700M+* Previous Estimate $150M+* Previous Estimate $2B+* UPDATED PLAN

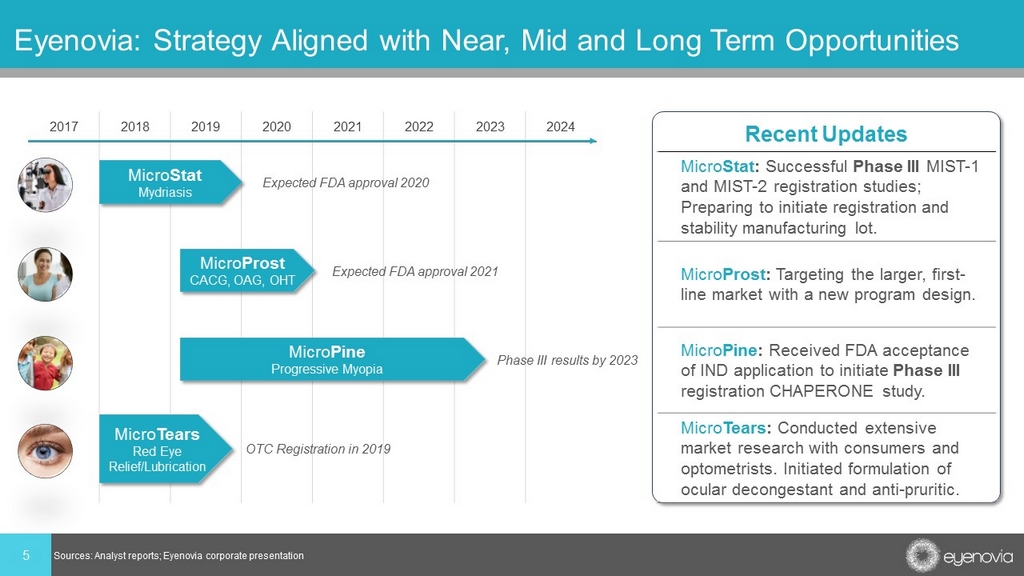

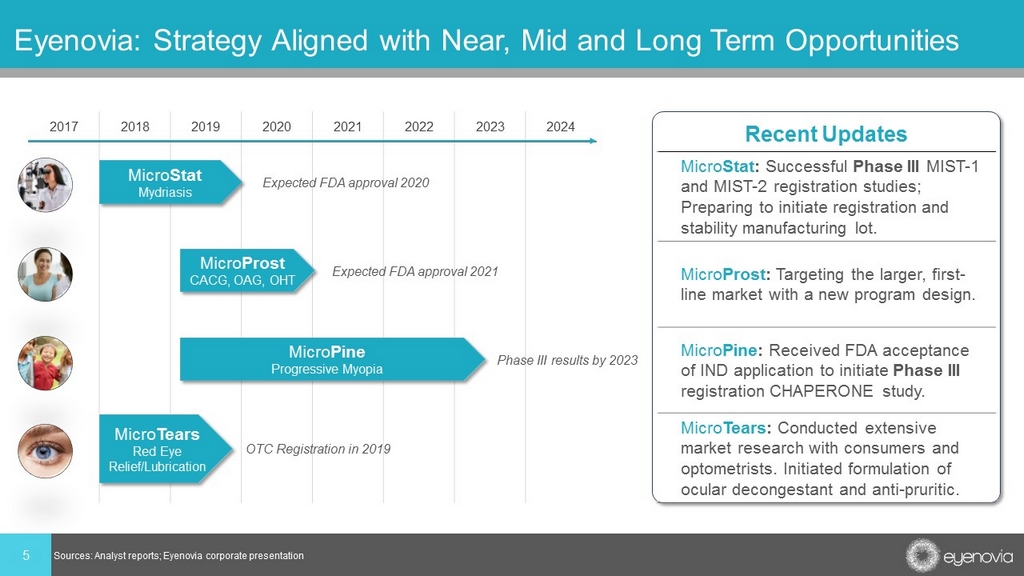

5 Eyenovia: Strategy Aligned with Near, Mid and Long Term Opportunities 2017 2018 2019 2020 2021 2022 2023 2024 Micro Stat Mydriasis Micro Prost CACG, OAG, OHT Micro Pine Progressive Myopia Expected FDA approval 2021 Expected FDA approval 2020 Phase III results by 2023 Sources: Analyst reports; Eyenovia corporate presentation Micro Tears Red Eye Relief/Lubrication OTC Registration in 2019 Recent Updates Micro Stat : Successful Phase III MIST - 1 and MIST - 2 registration studies; Preparing to initiate registration and stability manufacturing lot. Micro Prost : Targeting the larger, first - line market with a new program design. Micro Pine : Received FDA acceptance of IND application to initiate Phase III registration CHAPERONE study. Micro Tears : Conducted extensive market research with consumers and optometrists. Initiated formulation of ocular decongestant and anti - pruritic.

• Indispensable part of: – Comprehensive Eye Exam – Diabetic Retinal Exam – Macular Degeneration Retinal Exam – Retinopathy of Prematurity Screening • Current eyedropper paradigm use two medications, which can overdose the eye (100µL vs 7 µL) 1 – Phenylephrine 2.5% (1 - 2 drops) and Tropicamide 1% (1 - 2 drops) • Can be inefficient, and result in patient discomfort…and increased systemic/ocular exposure 6 Micro Stat for Pharmacologic Mydriasis 1 Bhurayanontachai, P., Saengkaew, S., & Apiromruck, P. (2016). Efficacy of an eye drop mixture for pupillary dilatation: A randomized comparative study. Journal of optometry, 10(2), 111 - 116. Estimated 80+ million mydriatic exams performed annually Estimated 4 million pharmacologic mydriasis applications annually for cataract surgery

Why should we be concerned about overdosing with eye drops? • Many ophthalmic drugs are compounds that were designed for cardiovascular or other systemic effect (beta blockers, phenylephrine and others) • When these drugs are overdosed to eye, they can seep into systemic circulation through periocular absorption and via nasolacrimal duct (bypassing liver metabolism, similar to IV delivery) • The result can be changes in blood pressure, heart rate and lung function 7 “Mean blood pressure increased significantly in infants given standard dilating drops..” 1 1 Acta Ophthalmol Scand. 1997

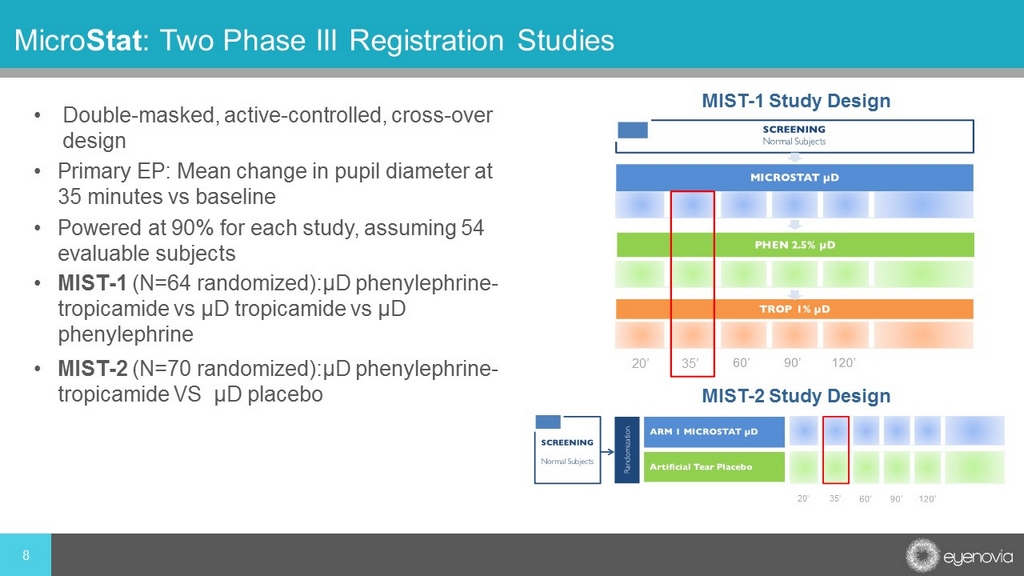

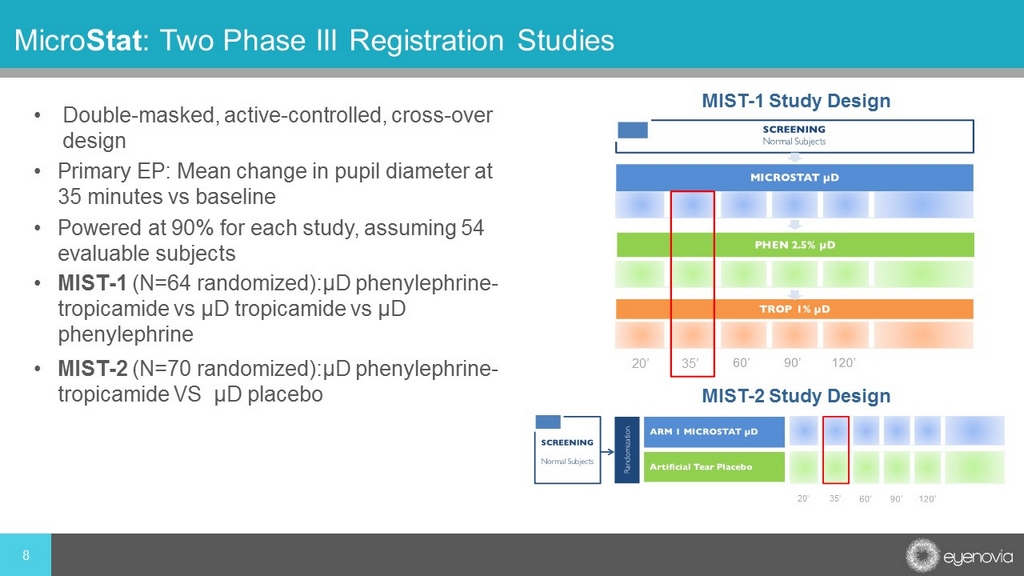

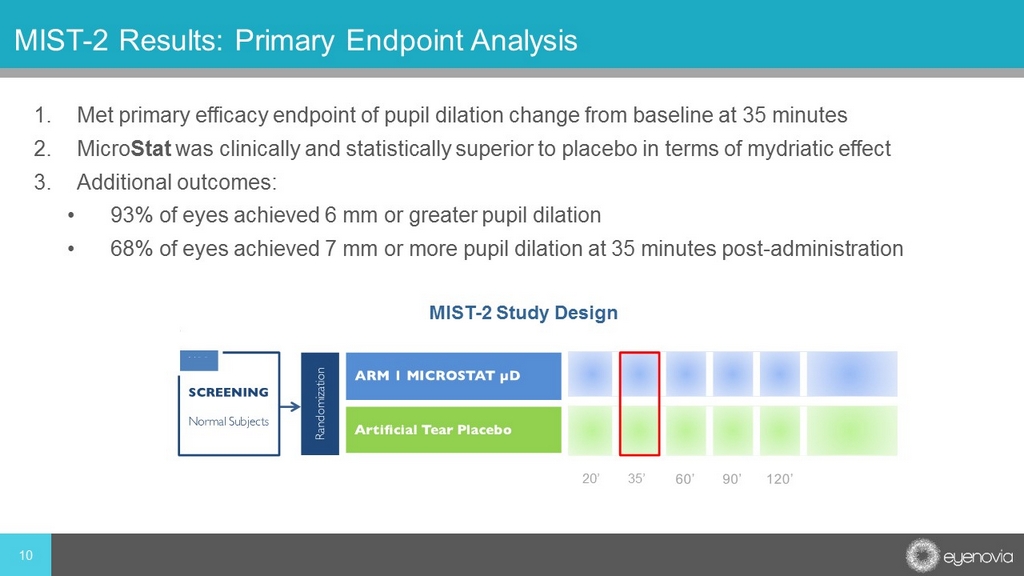

• Double - masked, active - controlled, cross - over design • Primary EP: Mean change in pupil diameter at 35 minutes vs baseline • Powered at 90% for each study, assuming 54 evaluable subjects 8 Micro Stat : Two Phase III Registration Studies • MIST - 1 (N=64 randomized):µD phenylephrine - tropicamide vs µD tropicamide vs µD phenylephrine • MIST - 2 (N=70 randomized):µD phenylephrine - tropicamide VS µD placebo MIST - 2 Study Design 20’ 35’ MIST - 1 Study Design 20’ 35’

1. Met primary efficacy endpoint of pupil dilation change from baseline at 35 minutes 2. Statistically larger 35 minute dilation for Micro Stat vs components 3. Additional outcomes: • 94% of eyes achieved 6 mm or greater pupil dilation at 35 minutes compared with 78% and 1.6% for the tropicamide - only and phenylephrine - only groups, respectively. • 57% of Micro Stat - treated eyes achieved 6 mm dilation or greater at 20 minutes versus 38% of the tropicamide - treated eyes and none in the phenylephrine - treated eyes 4. Treatment - emergent adverse events were mild and transient. There were no non - ocular adverse events. 9 MIST - 1 Results: Primary Endpoint Analysis

1. Met primary efficacy endpoint of pupil dilation change from baseline at 35 minutes 2. Micro Stat was clinically and statistically superior to placebo in terms of mydriatic effect 3. Additional outcomes: • 93% of eyes achieved 6 mm or greater pupil dilation • 68% of eyes achieved 7 mm or more pupil dilation at 35 minutes post - administration 10 MIST - 2 Results: Primary Endpoint Analysis MIST - 2 Study Design 20’ 35’

Pupil Diameter by Treatment at Baseline and 35 Minutes (PP Population) 11 MIST - 2 Results: MicroStat achieved significant dilation at 35 minutes

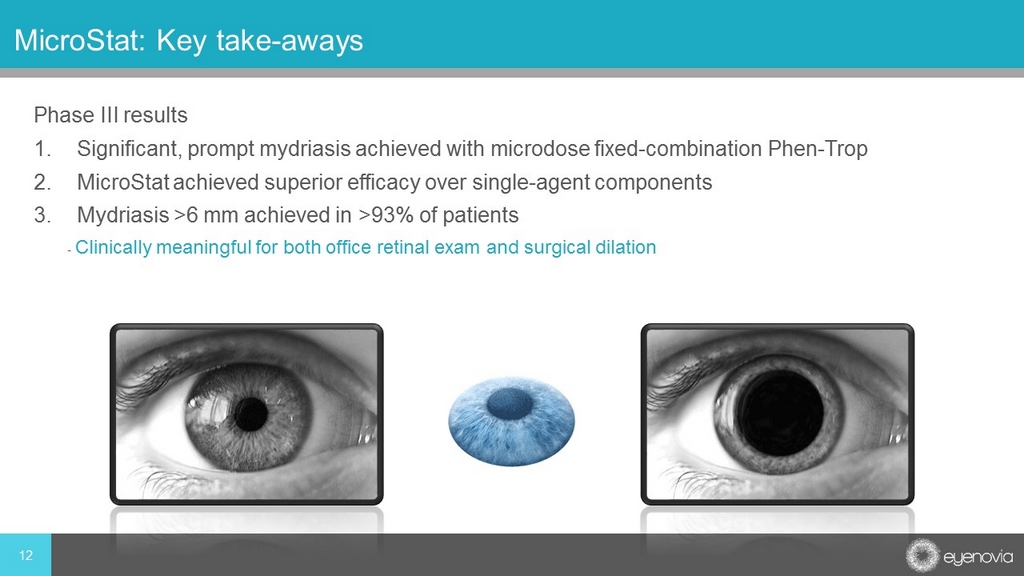

Phase III results 1. Significant, prompt mydriasis achieved with microdose fixed - combination Phen - Trop 2. MicroStat achieved superior efficacy over single - agent components 3. Mydriasis >6 mm achieved in >93% of patients - Clinically meaningful for both office retinal exam and surgical dilation 12 MicroStat: Key take - aways

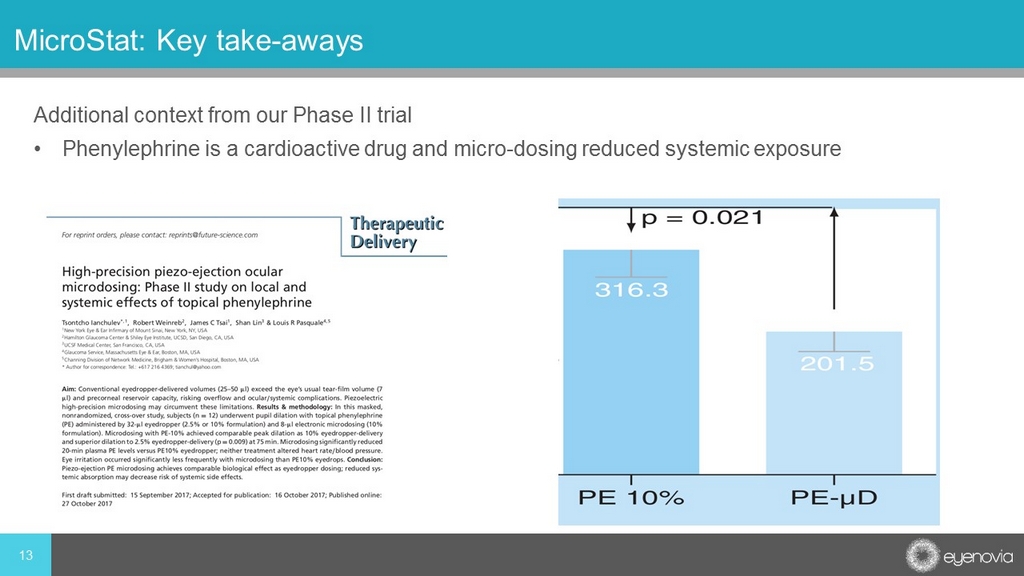

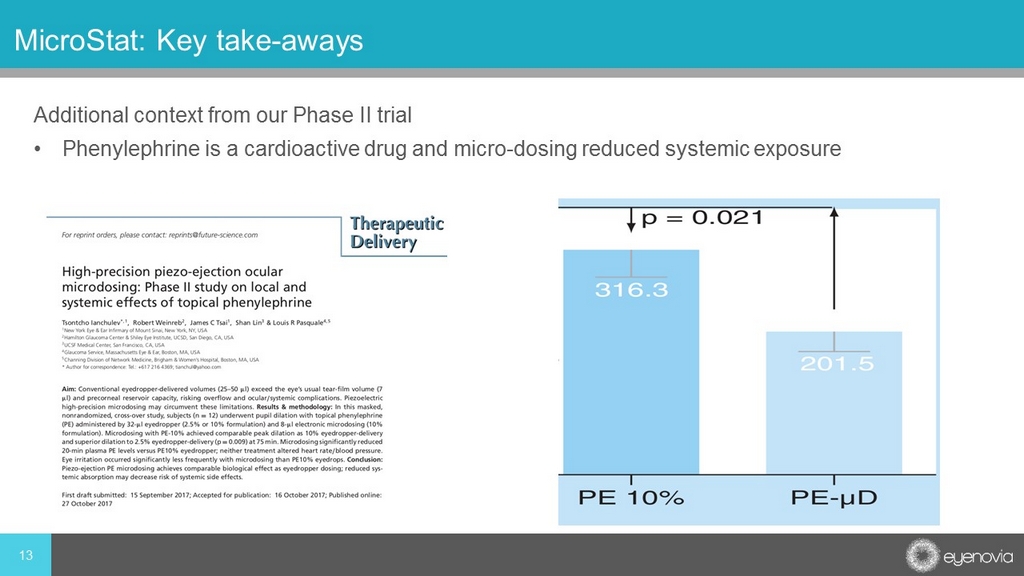

Additional context from our Phase II trial • Phenylephrine is a cardioactive drug and micro - dosing reduced systemic exposure 13 MicroStat: Key take - aways

• Discussion on how Micro Stat can improve in office efficiency and economics and the ease of use of Optejet, patient satisfaction and what it means for in office usage 14 Robert Stapper, Director of Research at Keystone Research

Optejet: Eyenovia’s Unique Technology Microdosing The micro - droplet achieves precise volumetric control to deliver 6 - 8 µL, which is physiological capacity of tear film Precise, targeted topical delivery Targeted delivery to the ocular surface and cornea, avoiding the conjunctival cul - de - sac Beat - the - blink speed of delivery Delivery of drug to ocular surface in less than 80 milliseconds beating the eye’s blink reflex of 100 milliseconds Smart electronics Mobile e - health technology integration designed to support improved compliance, monitoring and disease management Intellectual property 8 issued/7 pending patents U.S. & 27 issued/54 pending patents WW with runway to 2031 15

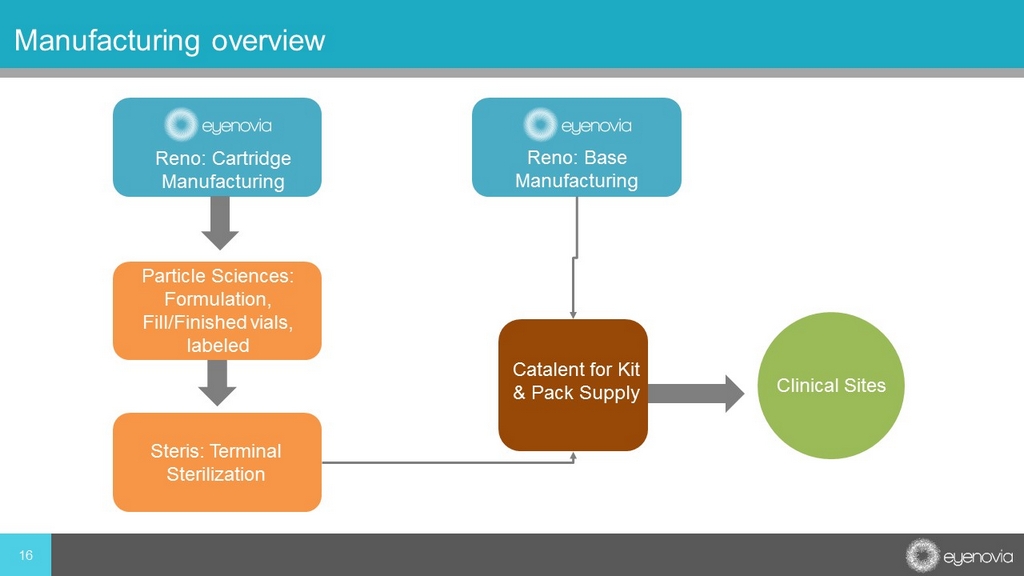

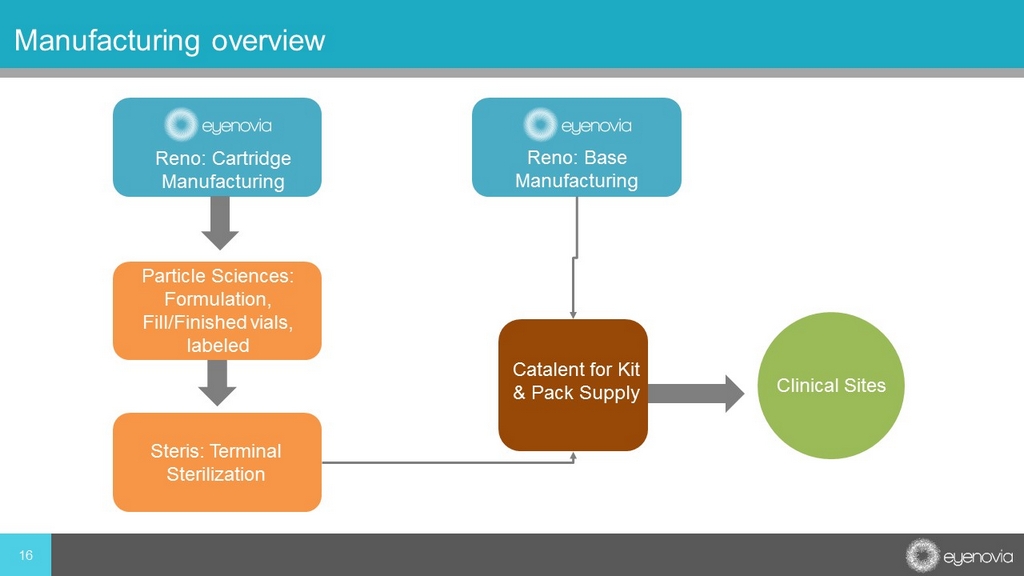

16 Manufacturing overview Reno: Cartridge Manufacturing Reno: Base Manufacturing Particle Sciences: Formulation, Fill/Finished vials, labeled Steris: Terminal Sterilization Catalent for Kit & Pack Supply Clinical Sites

17 Eyenovia is unlocking value in an estimated multi - billion dollar eye care market Technology Capabilities Microdosing of less than 9µL Precise targeted topical delivery to the ocular surface and cornea Beat - the - blink speed of delivery at 80 milliseconds Smart electronics and mobile connectivity Patient Benefits Retains efficacy but potentially minimizes local and systemic side effects , thus increasing tolerability Ease of use – 88% success vs. 50% for traditional eye droppers - and gentle delivery provide a better patient and physician user experience and potential outcome Faster than the eye’s blink reflex of 100 milliseconds which optimizes drug delivery and reduces irritation Assists in adherence/compliance and facilitates patient - to - physician discussion Optejet microdosing value proposition is the foundation for our strategy Optejet Platform

Micro Pine Alignment of unmet need and our value proposition Eyenovia is making new approaches in topical ophthalmic drug therapy possible through the Optejet platform Eyenovia Vision • Microdosing • Precise, targeted topical delivery • Beat - the - blink speed of delivery • Smart electronics Micro Tears Red/Itchy Eyes Micro Stat Mydriasis Micro Prost Glaucoma CACG, OAG, OHT Indications / Applications Eyenovia Programs Progressive Myopia 18

19 Development Pipeline Market Opportunity Preclinical/Formulation Phase I Phase II Phase III Near - Term Milestones Micro Pine* Reduction of Myopia Progression $5B+ Market Phase III Start 2019 Micro Prost* 1 Reduction of Intraocular Pressure in CACG, OAG and OHT $1.5B+ Market Phase III Start 2019 Micro Stat* 2 Pharmacologic Mydriasis (Pupil Dilation) $250M+ Market Phase III Completed NDA Being Prepared Micro Tears* 3 Red Eye Relief/Lubrication $850M+ Market OTC Monograph Registration 2019 OTC Back - of - the - eye Indications Front - of - the - eye Indications * US market only 1 Glaucoma estimate is first - line treatments only 2 Updated estimate for in office and cataract surgery uses 3 OTC eye care market

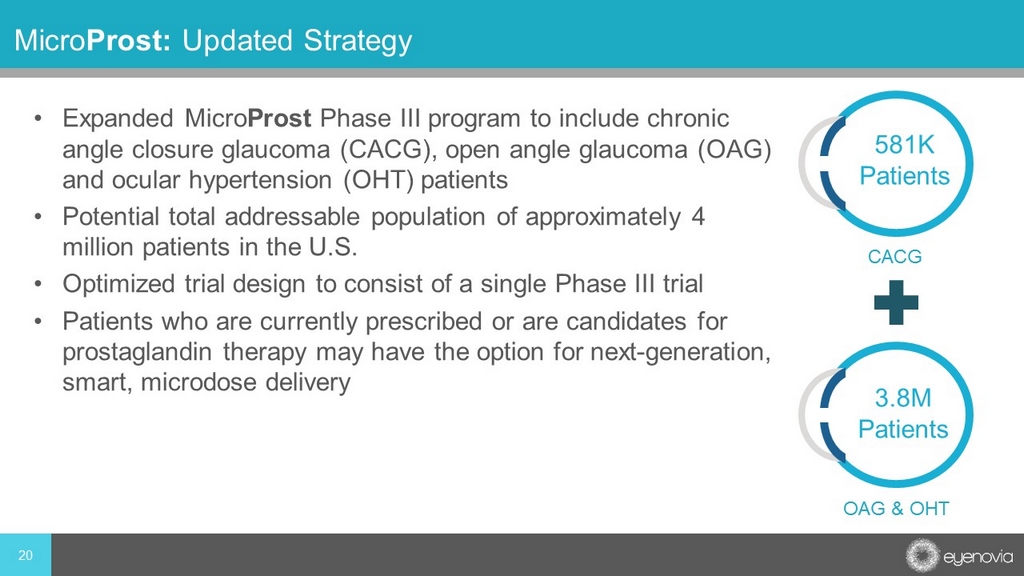

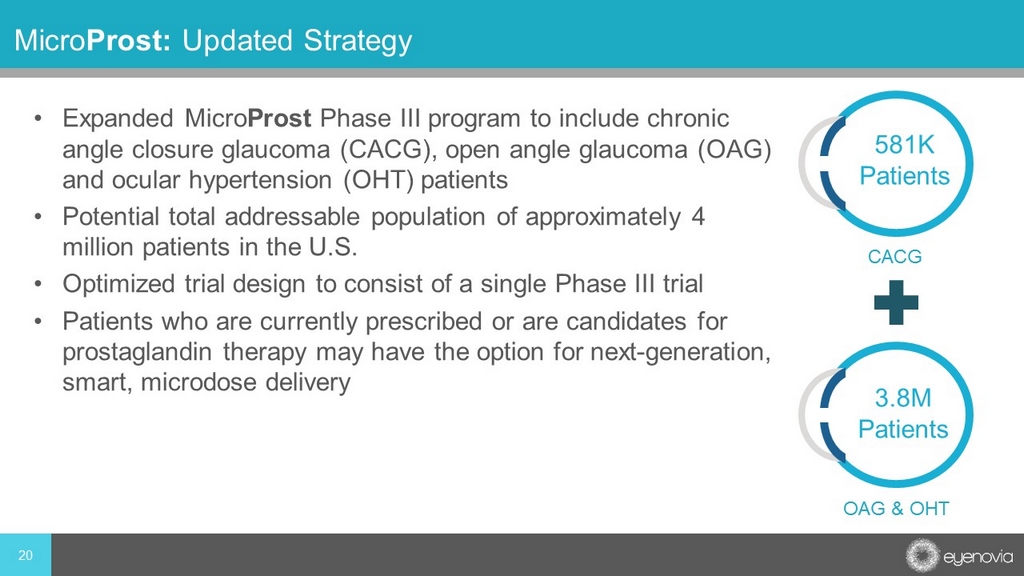

• Expanded Micro Prost Phase III program to include chronic angle closure glaucoma (CACG), open angle glaucoma (OAG) and ocular hypertension (OHT) patients • Potential total addressable population of approximately 4 million patients in the U.S. • Optimized trial design to consist of a single Phase III trial • Patients who are currently prescribed or are candidates for prostaglandin therapy may have the option for next - generation, smart, microdose delivery Micro Prost: Updated Strategy OAG & OHT CACG 3.8M Patients 581K Patients 20

• Formulation – Updated formulation for ocular decongestant and anti - pruritic – Will address both lubrication and eye redness relief in order to expand use for more cosmetic applications – Designed to address unmet medical and consumer needs: • lower medication rebound effect 1 • lower preservative exposure • easier and more pleasant to use • Commercial model similar to MicroStat with direct sales to optometrists using specialty pharmacy network (SPN) 21 Micro Tears: Update 1 Abelson MB, Butrus SI, Weston JH, Rosner B. Tolerance and absence of rebound vasodilation following topical ocular decongestant usage. Ophthalmology. 1984;91:1364 – 1367.

Two recently completed market research projects • 17 consumers in two, 2 - hour long focus groups in Long Beach, CA – One group of OTC eye drop users, mix of ages (21 - 65 years old, some over 65 years old), mix of male/female, must be people who use artificial tears, eye whiteners, etc. at least once daily – One group must include prescription eye drop users (e.g. glaucoma or Restatis or Xiidra), mix of ages (again including >65 years old), mix of male/female • 50 optometrists in an internet - based study – Prescreened for importance of retail to their overall practice 22 Micro Tears : Market Research

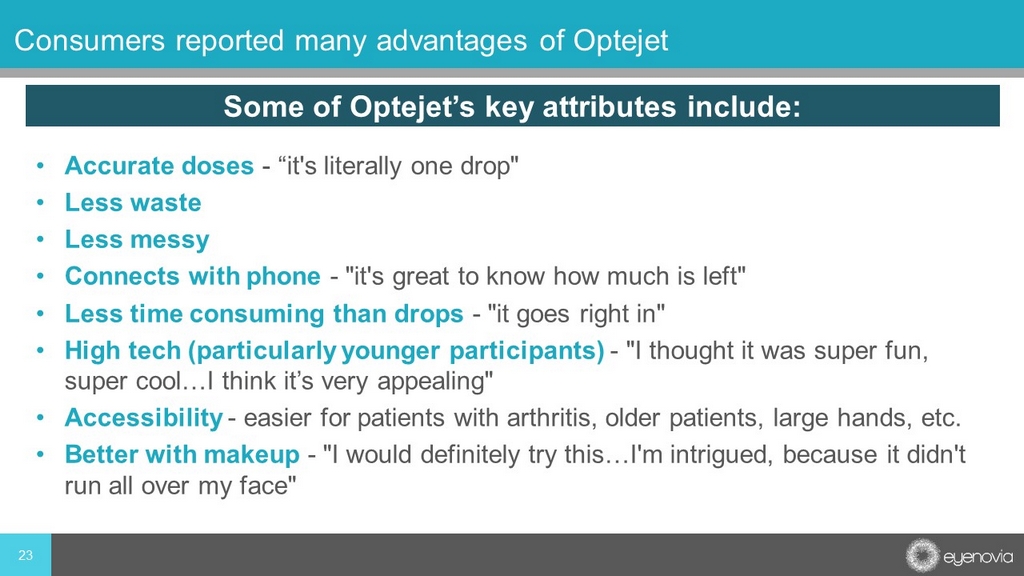

• Accurate doses - “it's literally one drop" • Less waste • Less messy • Connects with phone - "it's great to know how much is left" • Less time consuming than drops - "it goes right in" • High tech (particularly younger participants) - "I thought it was super fun, super cool…I think it’s very appealing" • Accessibility - easier for patients with arthritis, older patients, large hands, etc. • Better with makeup - "I would definitely try this…I'm intrigued, because it didn't run all over my face" 23 Consumers reported many advantages of Optejet Some of Optejet’s key attributes include:

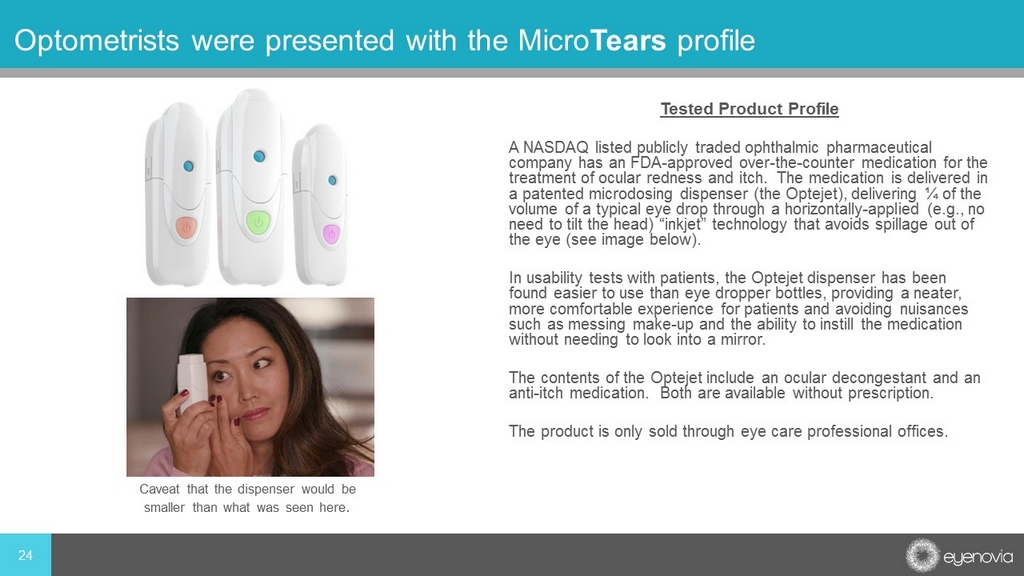

24 Optometrists were presented with the Micro Tears profile Tested Product Profile A NASDAQ listed publicly traded ophthalmic pharmaceutical company has an FDA - approved over - the - counter medication for the treatment of ocular redness and itch. The medication is delivered in a patented microdosing dispenser (the Optejet), delivering ¼ of the volume of a typical eye drop through a horizontally - applied (e.g., no need to tilt the head) “inkjet” technology that avoids spillage out of the eye (see image below). In usability tests with patients, the Optejet dispenser has been found easier to use than eye dropper bottles, providing a neater, more comfortable experience for patients and avoiding nuisances such as messing make - up and the ability to instill the medication without needing to look into a mirror. The contents of the Optejet include an ocular decongestant and an anti - itch medication. Both are available without prescription. The product is only sold through eye care professional offices. Caveat that the dispenser would be smaller than what was seen here .

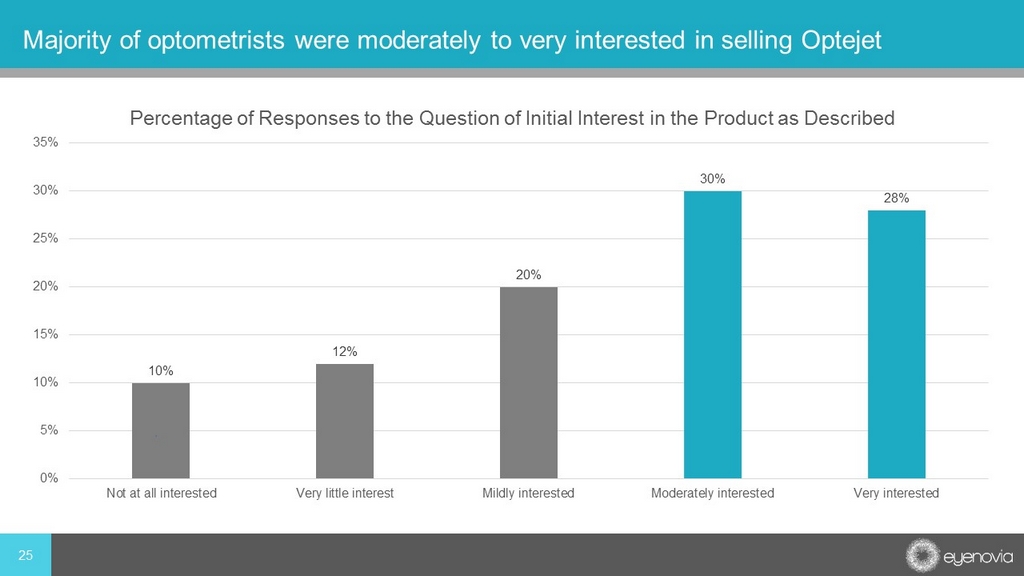

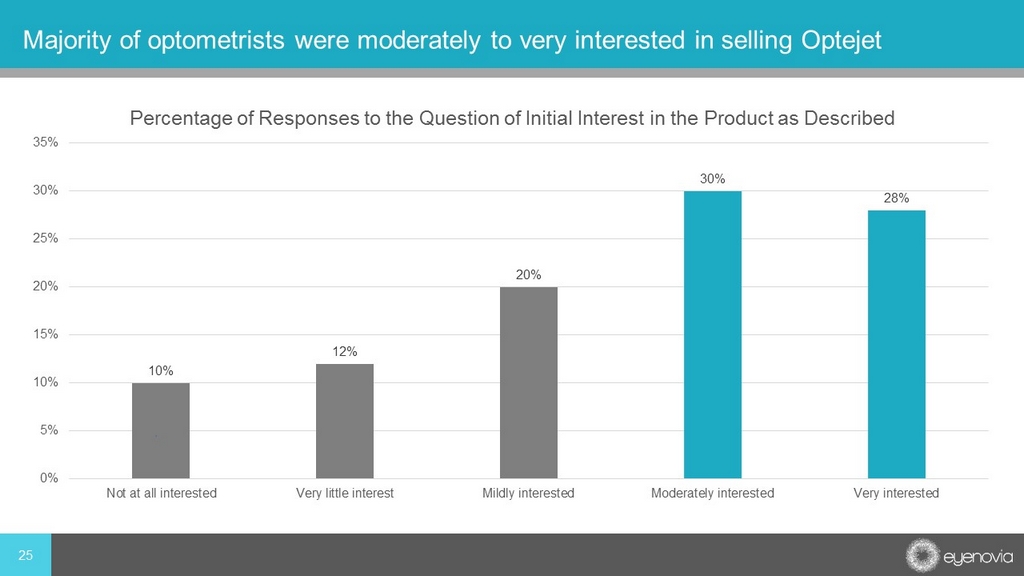

10% 12% 20% 30% 28% 0% 5% 10% 15% 20% 25% 30% 35% Not at all interested Very little interest Mildly interested Moderately interested Very interested Percentage of Responses to the Question of Initial Interest in the Product as Described 25 Majority of optometrists were moderately to very interested in selling Optejet

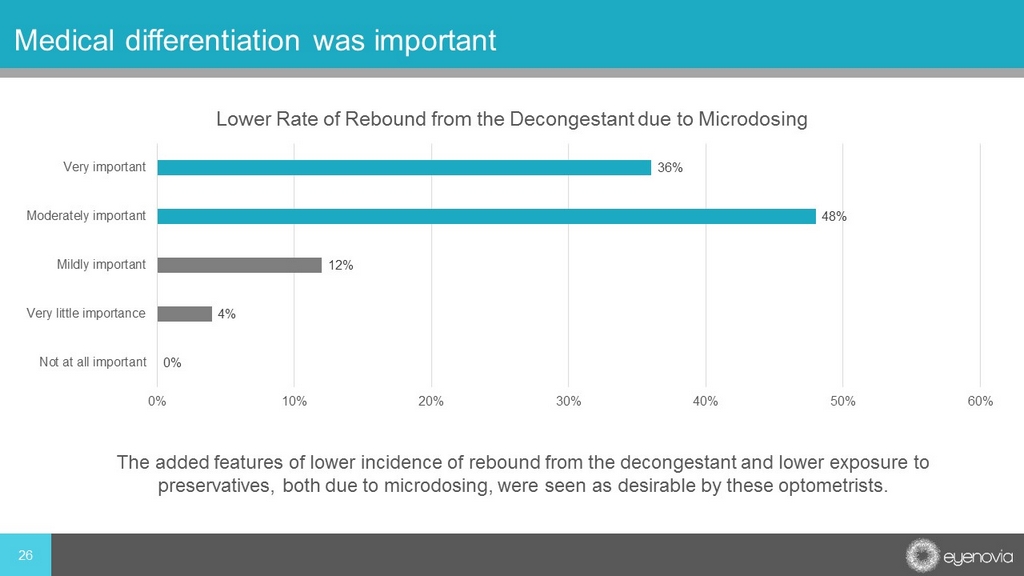

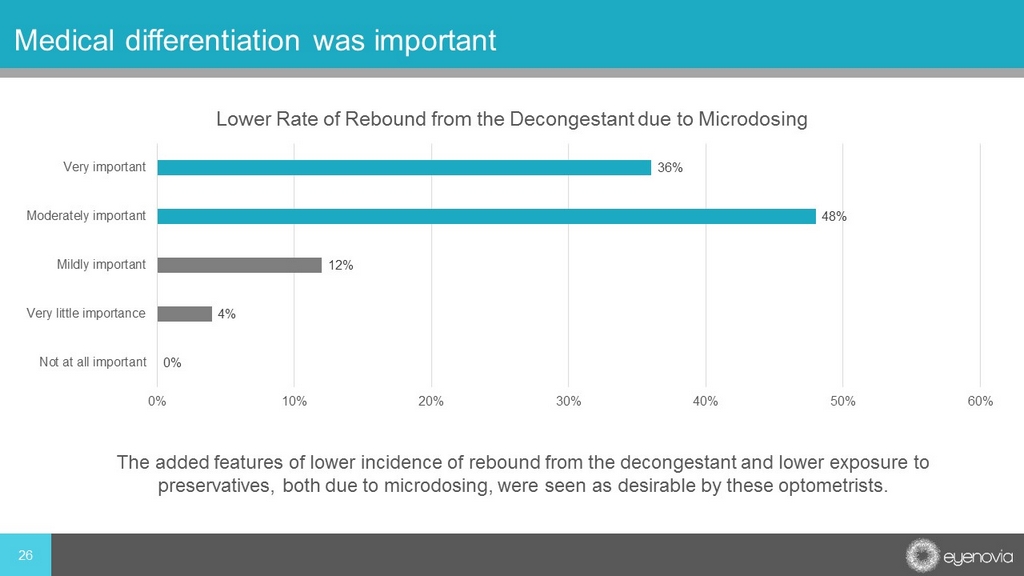

26 Medical differentiation was important 0% 4% 12% 48% 36% 0% 10% 20% 30% 40% 50% 60% Not at all important Very little importance Mildly important Moderately important Very important Lower Rate of Rebound from the Decongestant due to Microdosing The added features of lower incidence of rebound from the decongestant and lower exposure to preservatives, both due to microdosing, were seen as desirable by these optometrists.

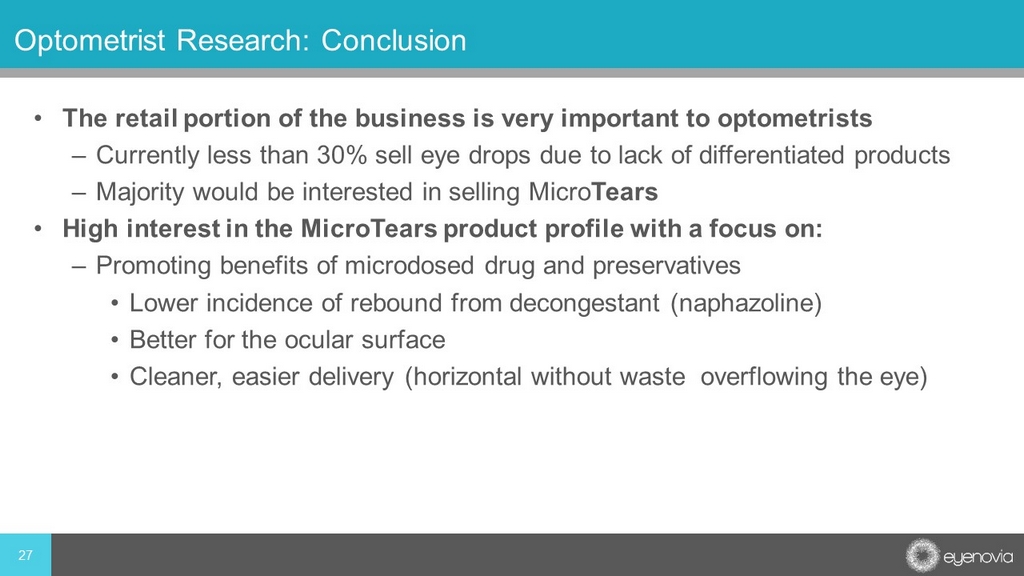

• The retail portion of the business is very important to optometrists – Currently less than 30% sell eye drops due to lack of differentiated products – Majority would be interested in selling Micro Tears • High interest in the MicroTears product profile with a focus on: – Promoting benefits of microdosed drug and preservatives • Lower incidence of rebound from decongestant (naphazoline) • Better for the ocular surface • Cleaner, easier delivery (horizontal without waste overflowing the eye) 27 Optometrist Research: Conclusion

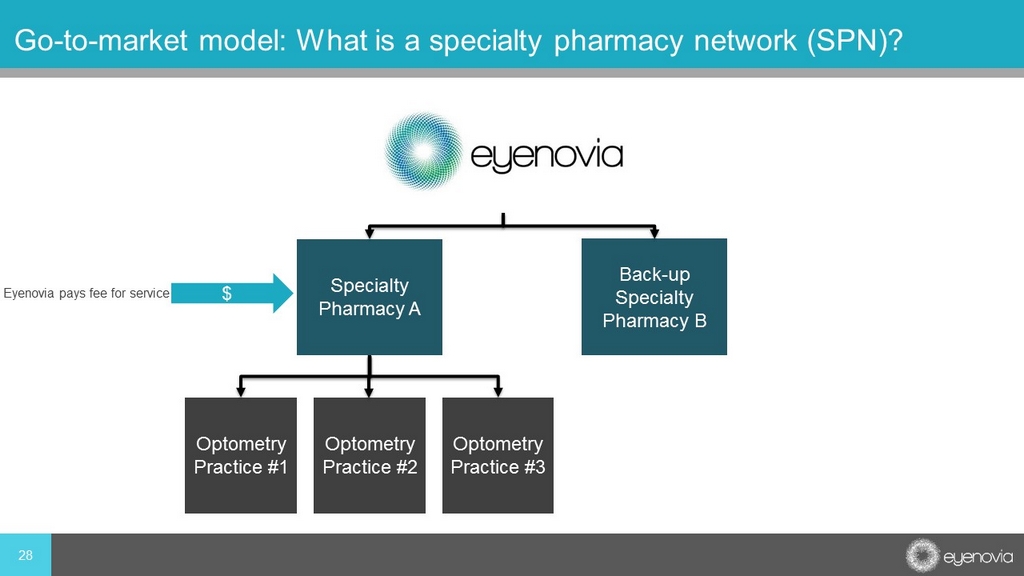

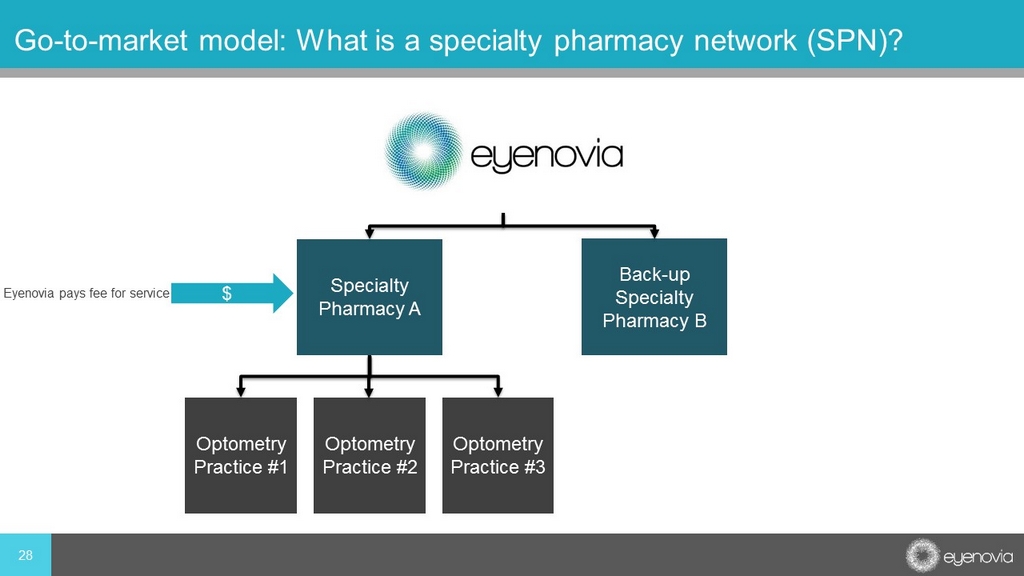

28 Go - to - market model: What is a specialty pharmacy network (SPN)? Specialty Pharmacy A Back - up Specialty Pharmacy B Optometry Practice #1 Optometry Practice #2 Optometry Practice #3 $ Eyenovia pays fee for service

Traditional Prescribing Process Source: Pembroke Consulting, 2012 $ Discounts of 2% to 5% Payer discounts and rebates of 20% to 70% to obtain favorable access 29

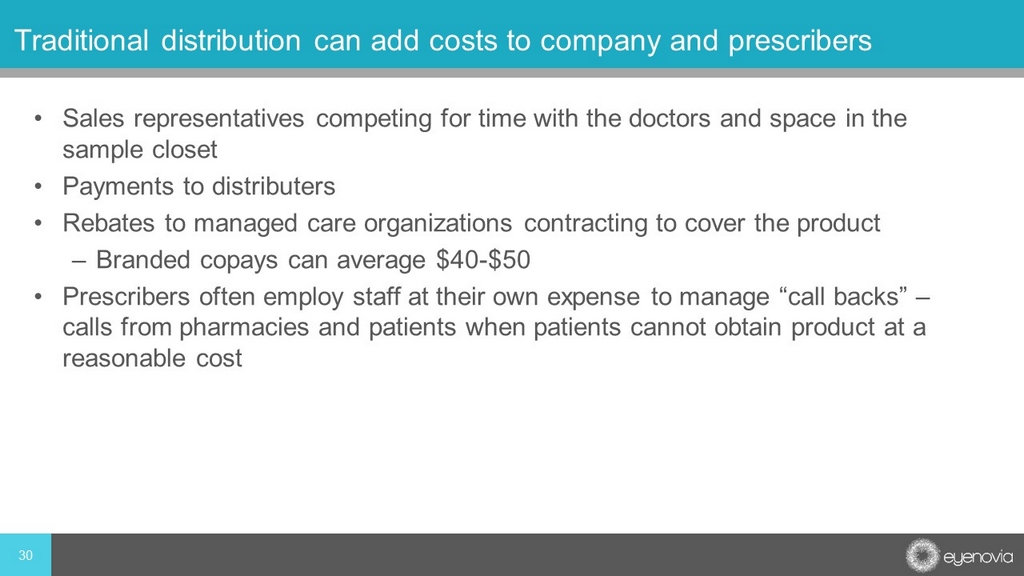

• Sales representatives competing for time with the doctors and space in the sample closet • Payments to distributers • Rebates to managed care organizations contracting to cover the product – Branded copays can average $40 - $50 • Prescribers often employ staff at their own expense to manage “call backs” – calls from pharmacies and patients when patients cannot obtain product at a reasonable cost 30 Traditional distribution can add costs to company and prescribers

31 Closed distribution model (SPN) potentially provides major benefits and cost savings Benefits of closed distribution model (SPN) Reduced costs – no wholesaler discounts; no need for large staff at EYEN to manage distribution Customer data sharing – EYEN strives to know who orders and when in order to link directly to sales force Consistent customer experience

Similar programs already exist in eye care Akorn (Cosopt and Zioptin) Sun Pharma (Xelpros) 32

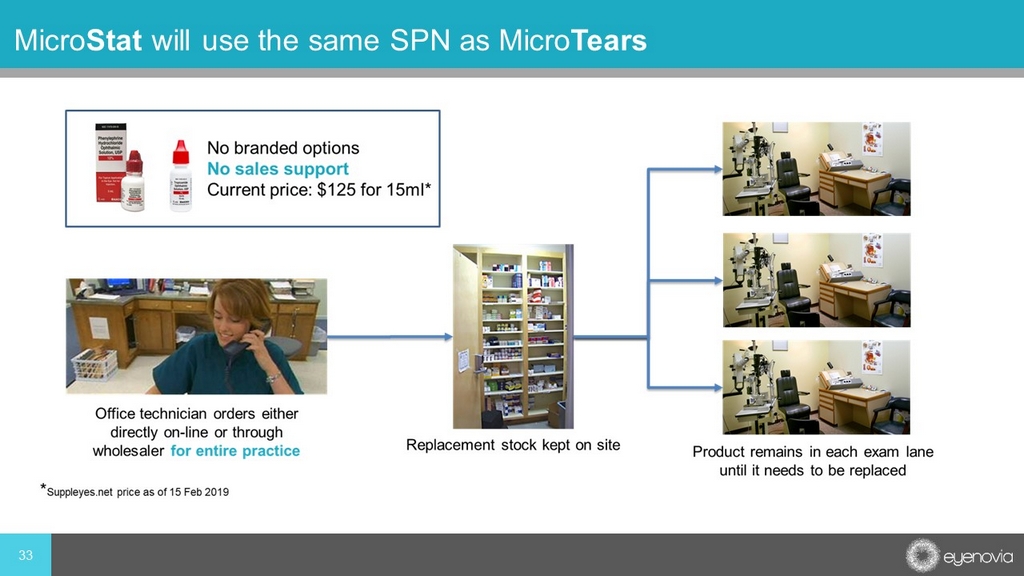

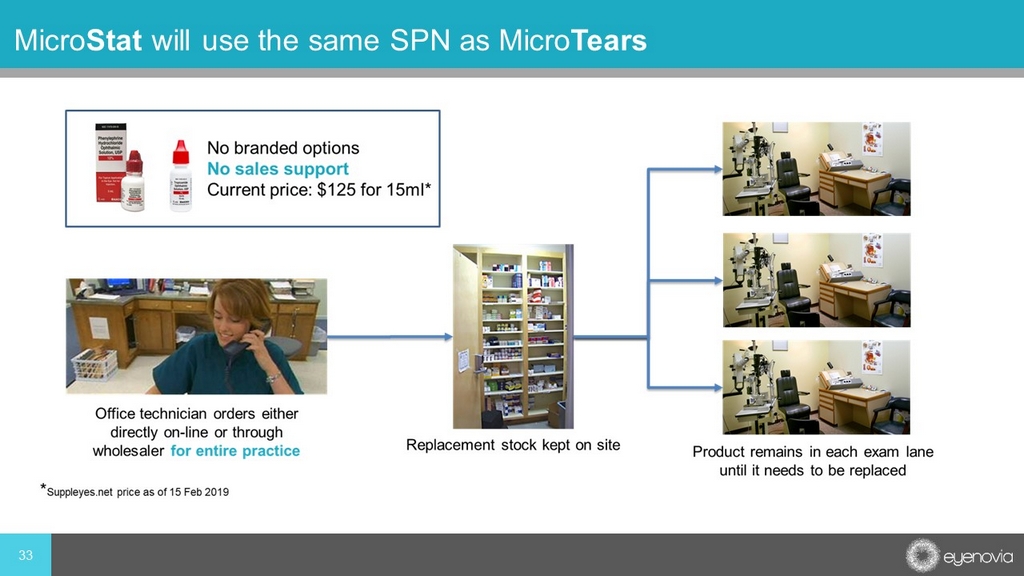

33 Micro Stat will use the same SPN as Micro Tears

34 Key Account Directors

• May be available to patients immediately • No discounts to distribution partners – Fee for service to SPN • Cost to patients may be similar to branded copays; less for patients using high - deductible plans • Requires smaller in - house staff to manage • ECPs report a strong preference for consistency in the patient experience when the Rx is filled 35 Micro Prost will explore SPN and reimbursement model

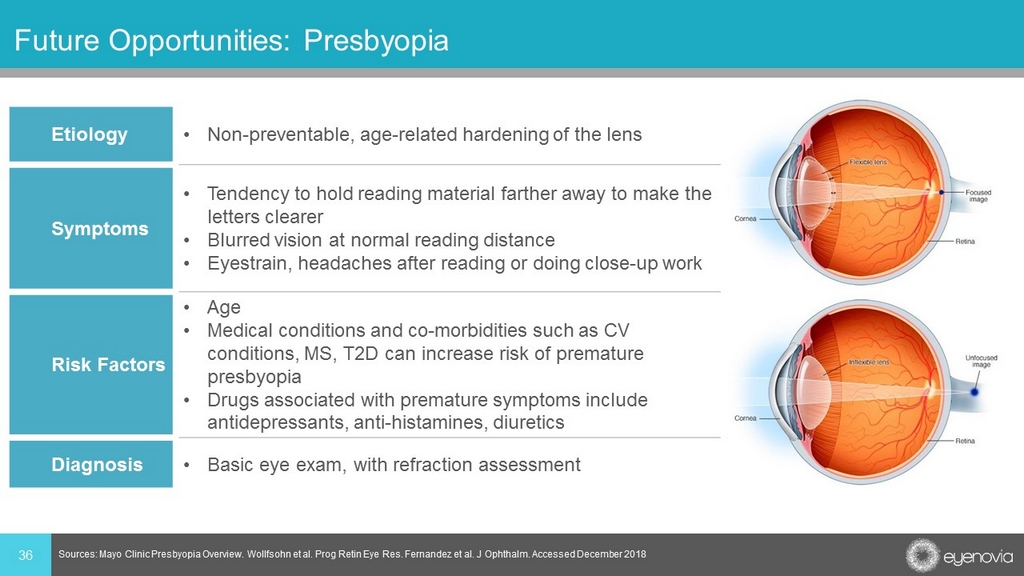

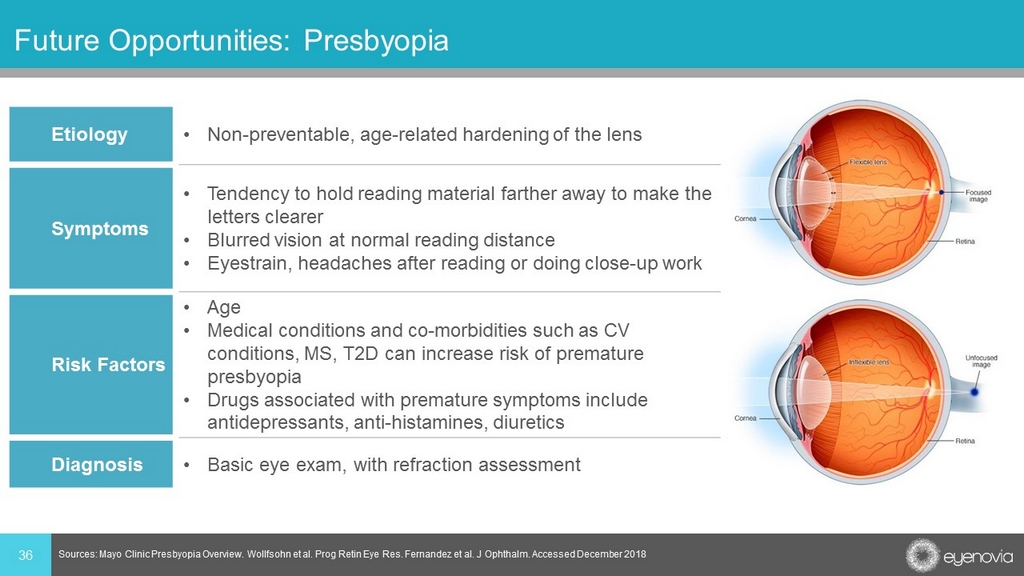

36 Future Opportunities: Presbyopia Sources: Mayo Clinic Presbyopia Overview. Wollfsohn et al. Prog Retin Eye Res. Fernandez et al. J Ophthalm. Accessed December 20 18 Etiology • Non - preventable, age - related hardening of the lens Symptoms • Tendency to hold reading material farther away to make the letters clearer • Blurred vision at normal reading distance • Eyestrain, headaches after reading or doing close - up work Risk Factors • Age • Medical conditions and co - morbidities such as CV conditions, MS, T2D can increase risk of premature presbyopia • Drugs associated with premature symptoms include antidepressants, anti - histamines, diuretics Diagnosis • Basic eye exam, with refraction assessment

• Prevalence expected to increase and reach ~123 million by 2020, representing over 1/3 of US population; driven by aging population • Nearly everyone experiences some degree of presbyopia after age 40 • Up to 1/3 of presbyopia sufferers are un - managed • Presbyopia is a significant and emotional event in an adult’s life – and often seen as the first sign of aging they cannot hide • Psychosocial impact is most important between onset (~40yo) and age 50 - 55; this subset is also most likely to respond to Rx treatment, and willing to pay for it Presbyopia: Prevalent Vision Correction Issue Sources: T, Fricke and N, Tahhan, Global Prevalence of Presbyopia and Vision Impairment from Uncorrected Presbyopia. 2018 Glo bal Presbyopia Market Scope Research Report. Cataract & Refractive Surgery Today Europe. Accessed December 2018. 20 Million Americans ( age 45 - 55) with Presbyopia 113 Million Americans with Presbyopia 37

38 Current Treatment Options are Exclusively Device - based Modalities Increasing Invasiveness Reading Glasses (Non - Prescription, Prescription) Visible treatment option Contact Lenses (Bifocal, Mono, Modified Mono, Monovision) May not eliminate need for glasses fully, not indicated if other ocular surface conditions Corneal Inlays Corneal haze, glare, drop in best - corrected visual acuity Refractive Surgery (Keratoplasty, LASIK, LASEK, PRK) Dry eye, under/over correction, astigmatism, flap problems Refractive Lens Exchange (Multifocal, Accommodative) Risk of retinal detachments, increased IOP, ptosis, glare, halos Treatment Options Cons & Potential Issues High unmet n eed for consumers with presbyopia unwilling to use glasses or ineligible / unwilling to go undergo invasive treatments

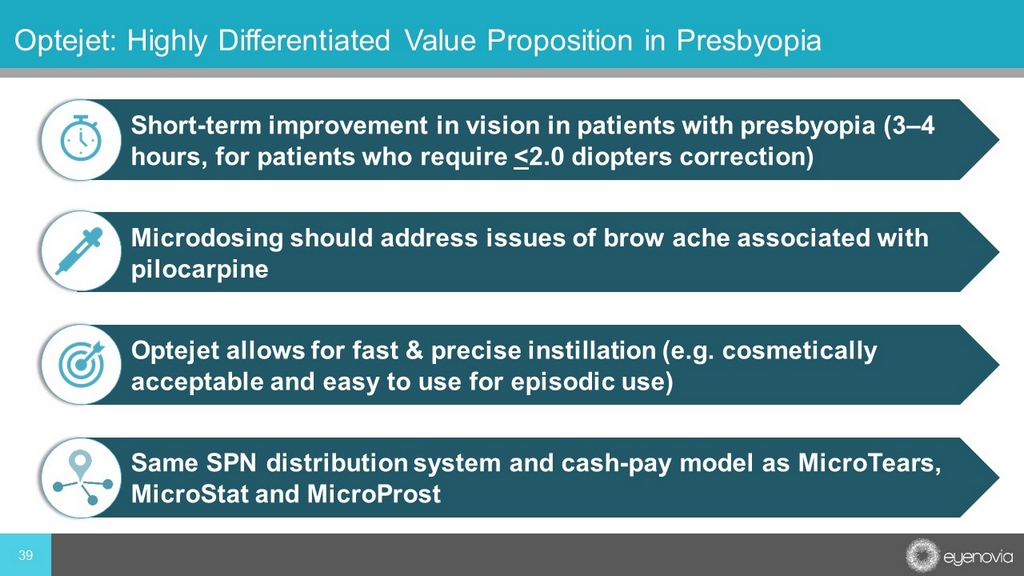

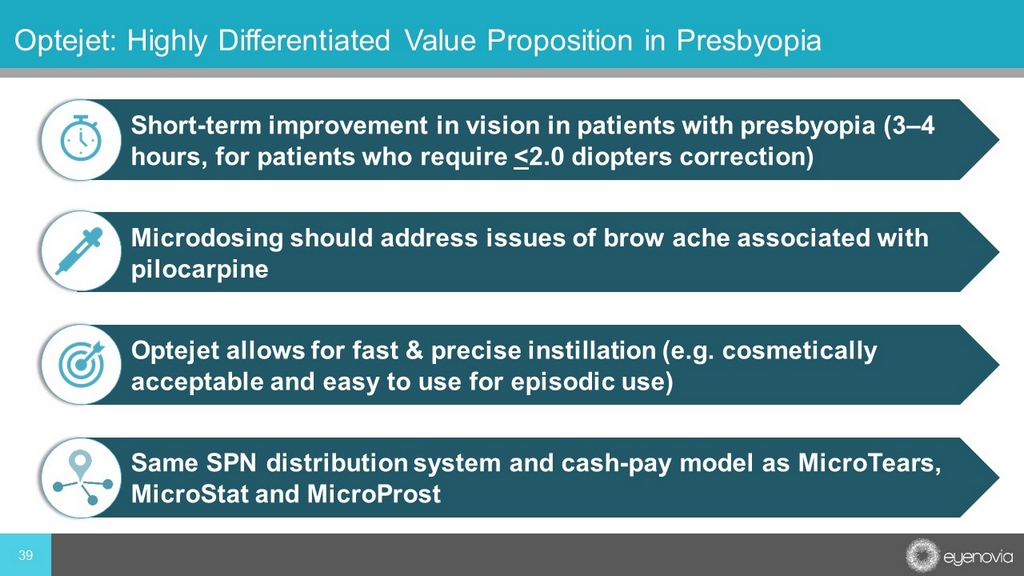

39 Optejet: Highly Differentiated Value Proposition in Presbyopia Short - term improvement in vision in patients with presbyopia (3 – 4 hours, for patients who require < 2.0 diopters correction) Microdosing should address issues of brow ache associated with pilocarpine Optejet allows for fast & precise instillation (e.g. cosmetically acceptable and easy to use for episodic use) Same SPN distribution system and cash - pay model as MicroTears, MicroStat and MicroProst

40 Ophthalmology Consumer Market Continues to Grow in the US Sources: Ophthalmic Single Use Surgical Product Market Report. 2015. MarketScope. Accessed December 2018. Refractive Surgery Premium IOLs Contact Lenses 5.0% 9.5% 6.5% Ophthalmology Consumer Market 2017 - 2023 Projected CAGR (Unit or Procedure Volume) Willingness to pay cash for refractive outcomes creates large opportunity for presbyopia

FDA Registration 2023 2021 2020 2019 Population Size Moderate Moderate High High Competitive Position High Medium Medium Low - Medium Value Proposition Designed to maximize treatment success for slowing Pediatric Progressive Myopia Addresses issues of self - instillation, tolerability and compliance within the broadest patient population Fast and effective mydriatic that may improve patient satisfaction and practice flow Micro Tears is a safe, easy - to - use product to relieve ocular itch and redness Go - to - Market strategy Available through the retail channel and expected to be covered by insurance Available through closed SPN and expected to be a cash - pay product at launch Sold directly to ECP offices Micro Tears will be sold as a premium cash - pay product in ECP offices 41 Eyenovia Aims to Successfully Launch Four Products in Ophthalmology by 2023 Micro Pine Micro Tears Micro Stat Micro Prost AL [2]6