UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23188

Partners Group Private Income Opportunities, LLC

(Exact name of registrant as specified in charter)

c/o Partners Group (USA) Inc.

1114 Avenue of the Americas, 37th Floor

New York, NY 10036

(Address of principal executive offices) (Zip code)

Robert M. Collins

1114 Avenue of the Americas, 37th Floor

New York, NY 10036

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 908-2600

Date of fiscal year end: March 31

Date of reporting period: September 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

PARTNERS GROUP PRIVATE INCOME OPPORTUNITIES, LLC

(a Delaware Limited Liability Company)

Semi-Annual Report

For the Six Months Ended September 30, 2018

(Unaudited)

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Table of Contents

For the Six Months Ended September 30, 2018 (Unaudited)

Schedule of Investments | 1-3 |

Statement of Assets and Liabilities | 4 |

Statement of Operations | 5 |

Statement of Changes in Net Assets | 6 |

Statement of Cash Flows | 7 |

Financial Highlights | 8-9 |

Notes to Financial Statements | 10-19 |

Fund Expenses | 20 |

Other Information | 21 |

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Schedule of Investments –

September 30, 2018 (Unaudited)

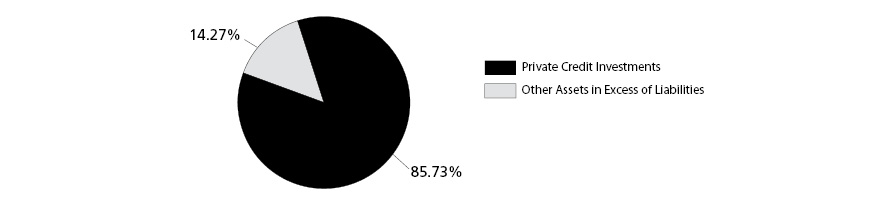

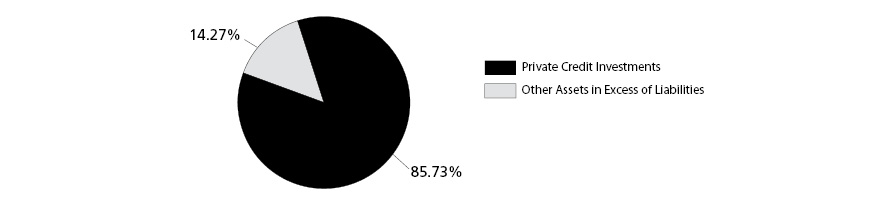

INVESTMENT PORTFOLIO AS A PERCENTAGE OF TOTAL NET ASSETS

Private Credit Investments (85.73%) Equity (1.56%) | | Investment Type | | | Acquisition

Date | | | Shares | | | Fair

Value* | |

North America (1.56%) | | | | | | | | | | | | | | | | |

BI Gen Holdings, Inc. +, a | | | Common equity | | | | 09/05/18 | | | | 14,561 | | | $ | 149,995 | |

CB Titan MidCo Holdings, Inc. +, a | | | Common equity | | | | 05/01/17 | | | | 56,634 | | | | 55,639 | |

KDOR Merger Sub Inc. +, a | | | Common equity | | | | 05/11/18 | | | | 250,000 | | | | 250,000 | |

KSLB Holdings, LLC +, a | | | Common equity | | | | 07/30/18 | | | | 252,000 | | | | 252,000 | |

Safari Co-Investment L.P. +, a, b | | | Limited partnership interest | | | | 03/14/18 | | | | — | | | | 256,820 | |

Shermco Intermediate Holdings, Inc. +, a | | | Common equity | | | | 06/05/18 | | | | 2,500 | | | | 57,500 | |

Total North America (1.56%) | | | | | | | | | | | | | | | 1,021,954 | |

Total Equity (1.56%) | | | | | | | | | | | | | | $ | 1,021,954 | |

Debt (84.17%) | Interest | | Acquisition

Date | | | Maturity

Date | | | Investment

Type | | | Principal | | | Fair

Value* | |

Asia - Pacific (0.98%) | | | | | | | | | | | | | | | | | | | | | |

C0001 Pty Ltd +, a | PIK 12.75% | | | 08/31/17 | | | | 08/31/23 | | | | Mezzanine | | | $ | 631,394 | | | | 645,145 | |

Total Asia - Pacific (0.98%) | | | | | | | | | | | | | | | | | | | | 645,145 | |

| | | | | | | | | | | | | | | | | | | | | | |

North America (52.71%) | | | | | | | | | | | | | | | | | | | | | |

Bracket Intermediate Holding Corp. +, a | Cash 8.13% + L (1.00% Floor)^^ | | | 09/05/18 | | | | 08/31/26 | | | | Second Lien | | | | 1,950,000 | | | | 1,950,000 | |

Bullhorn, Inc. +, a | Cash 6.75% + L (1.00% Floor)^^ | | | 11/21/17 | | | | 11/21/22 | | | | Senior | | | | 363,179 | | | | 368,052 | |

Chase Industries, Inc. a, c | Cash 7.25% + L (1.00% Floor)^^ | | | 05/11/18 | | | | 05/11/26 | | | | Second Lien | | | | 500,000 | | | | — | |

Chase Industries, Inc. +, a | Cash 8.00% + L (1.00% Floor)^^ | | | 05/11/18 | | | | 05/11/26 | | | | Second Lien | | | | 1,925,000 | | | | 2,000,000 | |

Checkers Holdings, Inc. +, a | Cash 8.00% + L (1.00% Floor)^ | | | 04/25/17 | | | | 04/25/25 | | | | Second Lien | | | | 446,200 | | | | 456,182 | |

Checkers Holdings, Inc. +, a | Cash 4.25% + L (1.00% Floor)^ | | | 05/09/17 | | | | 04/25/24 | | | | Senior | | | | 156,400 | | | | 159,580 | |

CIBT Global, Inc. +, a | Cash 4.00% + L (1.00% Floor)^^ | | | 06/19/17 | | | | 06/01/24 | | | | Senior | | | | 441,280 | | | | 444,612 | |

Diamond Parent Midco, Inc. +, a | Cash 5.50% + L (1.00% Floor)^^ | | | 05/12/17 | | | | 04/14/22 | | | | Senior | | | | 1,363,106 | | | | 1,392,677 | |

Edgewood Partners Holdings, LLC +, a | Cash 4.25% + L (1.00% Floor)^ | | | 09/29/17 | | | | 09/08/24 | | | | Senior | | | | 927,000 | | | | 936,154 | |

Explorer Holdings, Inc. +, a | Cash 8.25% + L (1.00% Floor)^^ | | | 07/31/17 | | | | 05/02/24 | | | | Second Lien | | | | 1,559,985 | | | | 1,597,459 | |

Galls, LLC +, a | Cash 6.25% + L (1.00% Floor)^ | | | 02/07/18 | | | | 01/31/25 | | | | Senior | | | | 420,995 | | | | 428,786 | |

GHX Ultimate Parent Corporation +, a | Cash 3.25% + L (1.00% Floor)^^ | | | 07/25/17 | | | | 06/22/24 | | | | Senior | | | | 994,781 | | | | 1,003,908 | |

Gopher Sub Inc. +, a | Cash 6.75% + L (0.75% Floor)^^ | | | 03/01/18 | | | | 02/02/26 | | | | Second Lien | | | | 2,089,500 | | | | 2,118,375 | |

Heartland Dental, LLC +, a | Cash 3.75% + L^^ | | | 05/15/18 | | | | 04/30/25 | | | | Senior | | | | 1,721,739 | | | | 1,737,671 | |

Heartland Dental, LLC a, c | Cash 3.75% + L^ | | | 05/15/18 | | | | 04/30/25 | | | | Senior | | | | 259,565 | | | | — | |

Idera, Inc. +, a | Cash 5.00% + L (1.00% Floor)^ | | | 08/03/17 | | | | 06/27/24 | | | | Senior | | | | 661,145 | | | | 674,311 | |

Institutional Shareholder Services Inc. +, a | Cash 7.75% + L (1.00% Floor)^^ | | | 10/27/17 | | | | 10/16/25 | | | | Second Lien | | | | 1,184,050 | | | | 1,201,900 | |

KSLB Holdings, LLC +, a | Cash 8.75% + L (1.00% Floor)^ | | | 07/30/18 | | | | 07/30/26 | | | | Second Lien | | | | 2,520,000 | | | | 2,438,100 | |

Ministry Brands, LLC +, a | Cash 4.00% + L (1.00% Floor)^ | | | 04/11/17 | | | | 12/02/22 | | | | Senior | | | | 1,281,437 | | | | 1,293,137 | |

National Spine & Pain Centers, LLC +, a | Cash 4.50% + L (1.00% Floor)^^ | | | 06/30/17 | | | | 06/02/24 | | | | Senior | | | | 545,288 | | | | 539,842 | |

Pearl Intermediate Parent, LLC a, c | Cash 6.25% + L^ | | | 03/21/18 | | | | 02/13/26 | | | | Second Lien | | | | 1,791,000 | | | | — | |

The accompanying notes are an integral part of these Financial Statements.

1

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Schedule of Investments –

September 30, 2018 (Unaudited) (continued)

Private Credit Investments (continued) Debt (84.17%) | Interest | | Acquisition Date | | | Maturity Date | | | Investment Type | | | Principal | | | Fair Value* | |

North America (continued) | | | | | | | | | | | | | | | | | | | | | |

Pearl Intermediate Parent, LLC +, a | Cash 2.75% + L^ | | | 03/16/18 | | | | 02/14/25 | | | | Senior | | | $ | 1,161,345 | | | $ | 1,153,722 | |

Pearl Intermediate Parent, LLC +, a | Cash 6.25% + L^ | | | 03/21/18 | | | | 02/13/26 | | | | Second Lien | | | | 597,000 | | | | 602,250 | |

Peraton Corp. +, a | Cash 5.25% + L (1.00% Floor)^ | | | 06/09/17 | | | | 04/29/24 | | | | Senior | | | | 589,500 | | | | 590,278 | |

Prometric Holdings, Inc. +, a | Cash 7.50% + L (1.00% Floor)^^ | | | 01/29/18 | | | | 01/29/26 | | | | Second Lien | | | | 994,250 | | | | 1,001,630 | |

Radiology Partners, Inc. +, a | Cash 7.25% + L^^ | | | 08/10/18 | | | | 07/09/26 | | | | Second Lien | | | | 2,979,823 | | | | 2,968,649 | |

Shermco Intermediate Holdings, Inc. a, c | Cash 4.50% + L (1.00% Floor)^ | | | 06/05/18 | | | | 06/05/20 | | | | Senior | | | | 690,000 | | | | — | |

Shermco Intermediate Holdings, Inc. +, a | Cash 4.50% + L (1.00% Floor)^ | | | 06/05/18 | | | | 06/05/24 | | | | Senior | | | | 620,713 | | | | 661,250 | |

SSH Group Holdings, Inc. +, a | Cash 8.25% + L^^ | | | 08/21/18 | | | | 07/30/26 | | | | Senior | | | | 2,120,000 | | | | 2,107,704 | |

Surgery Center Holdings, Inc. +, a | Cash 3.25% + L (1.00% Floor)^ | | | 10/03/17 | | | | 08/31/24 | | | | Senior | | | | 1,313,375 | | | | 1,318,346 | |

TecoStar Holdings, Inc. +, a | Cash 8.50% + L (1.00% Floor)^^ | | | 05/01/17 | | | | 11/01/24 | | | | Second Lien | | | | 511,875 | | | | 535,500 | |

Vetcor Professional Practices LLC a, c | Cash 6.50% + L^ | | | 07/02/18 | | | | 07/02/26 | | | | Second Lien | | | | 613,333 | | | | — | |

Vetcor Professional Practices LLC +, a | Cash 6.50% + L^ | | | 07/02/18 | | | | 07/02/26 | | | | Second Lien | | | | 2,990,000 | | | | 2,916,434 | |

Total North America (52.71%) | | | | | | | | | | | | | | | | | | | 34,596,509 | |

| | | | | | | | | | | | | | | | | | | | | | |

Western Europe (30.48%) | | | | | | | | | | | | | | | | | | | | | |

Alpha Bidco SAS +, a | Cash 3.25% + E^^ | | | 08/02/18 | | | | 06/29/25 | | | | Senior | | | | 1,161,298 | | | | 1,168,150 | |

Altran Technologies S.A. +, a | Cash 2.75% + E## | | | 04/10/18 | | | | 03/20/25 | | | | Senior | | | | 849,539 | | | | 855,835 | |

Atlas Packaging GmbH +, a | Cash 7.75% + E# | | | 09/14/18 | | | | 07/31/26 | | | | Second Lien | | | | 2,863,761 | | | | 2,763,529 | |

CD&R Firefly Bidco Limited +, a | Cash 7.75% + L^^ | | | 06/21/18 | | | | 06/18/26 | | | | Second Lien | | | | 2,146,496 | | | | 2,190,302 | |

Cidron Atrium SE +, a | Cash 7.00% + E (0.50% Floor)### | | | 02/28/18 | | | | 02/28/26 | | | | Second Lien | | | | 1,053,333 | | | | 1,060,192 | |

EG America LLC +, a | Cash 4.00% + L^^ | | | 05/22/18 | | | | 02/07/25 | | | | Senior | | | | 1,485,000 | | | | 1,497,403 | |

EG Finco Limited +, a | Cash 7.75% + E (1.00% Floor)### | | | 06/21/18 | | | | 04/20/26 | | | | Second Lien | | | | 2,379,848 | | | | 2,411,904 | |

EG Finco Limited +, a | Cash 4.00% + E### | | | 06/20/18 | | | | 02/07/25 | | | | Senior | | | | 1,499,669 | | | | 1,510,576 | |

Everest Bidco SAS +, a | Cash 7.50% + L (1.00% Floor)^^ | | | 07/10/18 | | | | 07/04/26 | | | | Second Lien | | | | 1,962,146 | | | | 1,903,282 | |

Kiwi VFS Sub II S.A.R.L. +, a | Cash 8.50% + L (1.00% Floor)^^^ | | | 07/27/17 | | | | 07/28/25 | | | | Second Lien | | | | 180,675 | | | | 195,000 | |

Pharmathen Global B.V. +, a | Cash 4.25% + E### | | | 08/02/17 | | | | 08/02/23 | | | | Senior | | | | 433,092 | | | | 426,162 | |

RivieraTopco SARL +, a | PIK 8.50%; E (1.00% Floor)### | | | 12/08/17 | | | | 05/08/24 | | | | Mezzanine | | | | 1,240,644 | | | | 1,271,482 | |

Sigma US Corp. +, a | Cash 3.00% + L^ | | | 08/03/18 | | | | 07/02/25 | | | | Senior | | | | 1,000,000 | | | | 1,002,230 | |

Sisaho International SAS +, a | Cash 4.00% + E## | | | 07/06/17 | | | | 05/06/22 | | | | Senior | | | | 740,327 | | | | 744,029 | |

Virgin Media Bristol, LLC +, a | Cash 2.50% + L^ | | | 03/22/18 | | | | 01/15/26 | | | | Senior | | | | 1,007,500 | | | | 1,002,670 | |

Total Western Europe (30.48%) | | | | | | | | | | | | | | | | | | | 20,002,746 | |

Total Debt (84.17%) | | | | | | | | | | | | | | | | | | $ | 55,244,400 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Private Credit Investments (Cost $56,097,621)(85.73%) | | | | | | | | | | | | | | | | | | $ | 56,266,354 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Investments (Cost $56,097,621)(85.73%) | | | | | | | | | | | | | | | | | | | 56,266,354 | |

| | | | | | | | | | | | | | | | | | | | | |

Other Assets in Excess of Liabilities (14.27%) | | | | | | | | | | | | | | | | | | | 9,365,460 | |

| | | | | | | | | | | | | | | | | | | | | |

Net Assets (100.00%) | | | | | | | | | | | | | | | | | | $ | 65,631,814 | |

* | The Fair Value of any Investment may not necessarily reflect the current or expected future performance of such Investment or the Fair Value of the Fund’s interest in such Investment. Furthermore, the Fair Value of any Investment has not been calculated, reviewed, verified or in any way approved by such Investment or its general partner, manager or sponsor (including any of its affiliates). Please see Note 2.b for further detail regarding the valuation policy of the Fund. |

+ | The fair value of the investment was determined using significant unobservable inputs. |

^ | The interest rate on these loans is subject to the greater of a LIBOR floor or 1 month LIBOR plus a base rate. The 1 month LIBOR as of September 30, 2018 was 2.26%. |

^^ | The interest rate on these loans is subject to the greater of a LIBOR floor or 3 month LIBOR plus a base rate. The 3 month LIBOR as of September 30, 2018 was 2.40%. |

The accompanying notes are an integral part of these Financial Statements.

2

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Schedule of Investments –

September 30, 2018 (Unaudited) (continued)

^^^ | The interest rate on these loans is subject to the greater of a LIBOR floor or 6 month LIBOR plus a base rate. The 6 month LIBOR as of September 30, 2018 was 2.60%. |

^^^^ | The interest rate on these loans is subject to the greater of a LIBOR floor or 12 month LIBOR plus a base rate. The 12 month LIBOR as of September 30, 2018 was 2.92%. |

# | As of September 30, 2018, 1 month Euribor was -0.37%. |

## | As of September 30, 2018, 3 month Euribor was -0.32%. |

### | As of September 30, 2018, 6 month Euribor was -0.27%. |

a | Private credit investments are generally issued in private placement transactions and as such are generally restricted as to resale. Each investment may have been purchased on various dates and for different amounts. The date of the first purchase is reflected under Acquisition Date as shown in the Schedule of Investments. Total fair value of restricted investments as of September 30, 2018 was $56,266,354, or 100.00% of net assets. As of September 30, 2018, the aggregate cost of each investment restricted to resale was $150,000, $56,635, $250,000, $252,000, $256,811, $57,500, $695,270, $1,907,501, $364,075, $—, $1,927,382, $448,249, $156,689, $441,700, $98,078, $1,321,419, $18,954, $927,527, $1,565,047, $421,551, $995,590, $2,091,143, $1,722,171, $—, $662,159, $1,184,540, $2,439,236, $1,284,094, $545,819, $—, $1,161,550, $597,149, $590,045, $996,214, $2,945,750, $—, $623,046, $2,098,997, $1,313,820, $513,703, $—, $2,919,509, $1,161,050, $904,377, $2,776,939, $2,183,889, $1,109,012, $1,485,368, $2,379,548, $1,497,457, $1,938,083, $189,736, $442,137, $1,296,038, $1,002,655, $726,876, and $1,003,533, respectively, totaling $56,097,621. |

b | Investment does not issue shares. |

c | Investment has been committed to but has not been funded by the Fund. |

Legend:

E - Euribor

L - Libor

PIK - Payment-in-kind

A summary of outstanding financial instruments at September 30, 2018 is as follows:

Forward Foreign Currency Contracts

| Settlement Date | | Counterparty | | | Currency

Purchased | | | Currency

Sold | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

| October 25, 2018 | | | Bank of America | | | $ | 3,421,842 | | | £ | 2,600,000 | | | $ | 3,393,075 | | | $ | 28,767 | |

| December 20, 2018 | | | Bank of America | | | $ | 13,057,485 | | | € | 11,100,000 | | | $ | 12,969,429 | | | $ | 88,056 | |

| | | | | | | | | | | | | | | | | | | $ | 116,823 | |

The accompanying notes are an integral part of these Financial Statements.

3

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Statement of Assets and Liabilities –

September 30, 2018 (Unaudited)

Assets | | | | |

Private Credit Investments, at fair value (cost $56,097,621) | | $ | 56,266,354 | |

Cash and cash equivalents | | | 8,472,641 | |

Cash denominated in foreign currencies (cost $2,522,876) | | | 2,491,044 | |

Receivable for investment sold | | | 4,768 | |

Interest receivable | | | 217,434 | |

Unrealized appreciation on forward foreign currency contracts | | | 116,823 | |

Receivable from Adviser | | | 377,284 | |

Prepaid assets | | | 23,895 | |

Total Assets | | $ | 67,970,243 | |

| | | | | |

Liabilities | | | | |

Investment purchases payable | | $ | 323,628 | |

Distribution, servicing and transfer agency fees payable | | | 28,148 | |

Repurchase amounts payable for tender offers | | | 352,528 | |

Shareholder distributions payable | | | 618,254 | |

Incentive fee payable | | | 318,330 | |

Management fee payable | | | 397,955 | |

Professional fees payable | | | 73,195 | |

Accounting and administration fees payable | | | 201,352 | |

Board of Managers' fees payable | | | 2 | |

Custodian fees payable | | | 25,037 | |

Total Liabilities | | $ | 2,338,429 | |

| | | | | |

Commitments and contingencies (See note 11) | | | | |

| | | | | |

Net Assets | | $ | 65,631,814 | |

| | | | | |

Net Assets consists of: | | | | |

Paid-in capital | | $ | 65,081,731 | |

Accumulated net investment loss | | | (31,332 | ) |

Accumulated net realized gain on investments, forward foreign currency contracts and foreign currency transactions | | | 327,691 | |

Accumulated net unrealized appreciation on investments, forward foreign currency contracts and foreign currency translation | | | 253,724 | |

Net Assets | | $ | 65,631,814 | |

| | | | | |

Class A Shares | | | | |

Net assets | | $ | 10 | |

Shares outstanding | | | 2 | |

Net asset value per share | | $ | 5.16 | |

Class I Shares | | | | |

Net assets | | $ | 65,631,804 | |

Shares outstanding | | | 12,679,397 | |

Net asset value per share | | $ | 5.18 | |

The accompanying notes are an integral part of these Financial Statements.

4

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Statement of Operations –

For the Six Months Ended September 30, 2018 (Unaudited)

Investment Income | | | | |

Interest | | $ | 1,899,353 | |

Other fee income | | | 103,002 | |

Total Investment Income | | | 2,002,355 | |

| | | | | |

Operating Expenses | | | | |

Management fees | | | 397,955 | |

Professional fees | | | 150,164 | |

Accounting and administration fees | | | 201,002 | |

Board of Managers' fees | | | 58,668 | |

Insurance expense | | | 2,348 | |

Custodian fees | | | 21,450 | |

Incentive fee | | | 207,307 | |

Transfer agency fees | | | | |

Class I Shares | | | 28,004 | |

Offering costs | | | 27,707 | |

Other expenses | | | 110,297 | |

Total Expenses | | | 1,204,902 | |

Expense waiver from Adviser | | | (377,284 | ) |

Net Expenses | | | 827,618 | |

| | | | | |

Net Investment Income | | | 1,174,737 | |

| | | | | |

Net Realized Gain (Loss) and Change in Unrealized Appreciation (Depreciation) on Investments, Forward Foreign Currency Contracts and Foreign Currency | | | | |

Net realized loss from Private Credit Investments | | | (174,734 | ) |

Net realized loss on foreign currency transactions | | | (71,698 | ) |

Net realized gain (loss) on forward foreign currency contracts | | | 495,310 | |

Net change in accumulated unrealized appreciation (depreciation) on: | | | | |

Private Credit Investments | | | (260,676 | ) |

Foreign currency translation | | | (35,250 | ) |

Forward foreign currency contracts | | | 91,927 | |

| | | | | |

Net Realized Gain (Loss) and Change in Unrealized Appreciation (Depreciation) on Investments, Forward Foreign Currency Contracts and Foreign Currency | | | 44,879 | |

| | | | | |

Net Increase (Decrease) in Net Assets From Operations | | $ | 1,219,616 | |

The accompanying notes are an integral part of these Financial Statements.

5

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Statement of Changes in Net Assets

| | | For the Six

Months Ended

September 30,

2018

(Unaudited) | | | For the

Year Ended

March 31,

2018 | |

Increase (decrease) in Net Assets resulting from operations: | | | | | | | | |

Net investment income (loss) | | $ | 1,174,737 | | | $ | 629,134 | |

Net realized gain (loss) on investments, foreign currency transactions, and forward foreign currency contracts | | | 248,878 | | | | 91,390 | |

Net change in unrealized appreciation (depreciation) on investments, foreign currency translation and forward foreign currency contracts | | | (203,999 | ) | | | 457,723 | |

Net increase in Net Assets resulting from operations: | | $ | 1,219,616 | | | $ | 1,178,247 | |

| | | | | | | | | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income | | | | | | | | |

Class A Shares^ | | $ | — | # | | $ | — | # |

Class I Shares | | | (1,418,332 | ) | | | (428,917 | ) |

Net realized gains | | | | | | | | |

Class A Shares^ | | | — | | | | — | |

Class I Shares | | | — | | | | (531 | ) |

Total distributions to Shareholders | | $ | (1,418,332 | ) | | $ | (429,448 | ) |

| | | | | | | | | |

Capital transactions (see note 5): | | | | | | | | |

Issuance of common Shares | | | | | | | | |

Class A Shares^ | | $ | — | | | $ | 10 | |

Class I Shares | | | 15,091,750 | | | | 49,044,490 | |

Reinvestment of common Shares | | | | | | | | |

Class A Shares^ | | $ | — | # | | $ | — | # |

Class I Shares | | | 657,931 | | | | 290,078 | |

Redemption of common Shares | | | | | | | | |

Class I Shares | | | (352,528 | ) | | | — | |

Total increase in Net Assets resulting from capital transactions | | $ | 15,397,153 | | | $ | 49,334,578 | |

| | | | | | | | | |

Total increase in Net Assets | | $ | 15,198,437 | | | $ | 50,083,377 | |

| | | | | | | | | |

Net Assets at beginning of period | | $ | 50,433,377 | | | $ | 350,000 | |

Net Assets at end of period | | $ | 65,631,814 | | | $ | 50,433,377 | |

Accumulated undistributed net investment income (loss) | | $ | (31,332 | ) | | $ | 212,263 | |

^ | Class A commenced operations on June 1, 2017. |

# | Amount rounds to less than $1. |

The accompanying notes are an integral part of these Financial Statements.

6

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Statement of Cash Flows –

For the Six Months Ended September 30, 2018 (Unaudited)

CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

Net Increase in Net Assets from Operations | | $ | 1,219,616 | |

Adjustments to reconcile Net Increase (decrease) in Net Assets from Operations to net cash provided by (used in) operating activities: | | | | |

Net change in accumulated unrealized (appreciation) depreciation on investments | | | 260,676 | |

Net change in unrealized (appreciation) depreciation on forward foreign currency contracts | | | (91,927 | ) |

Net realized (gain) from investments, forward foreign currency contracts and foreign currency transactions | | | (248,878 | ) |

Purchases of investments | | | (48,384,029 | ) |

Proceeds from sales of investments | | | 34,010,105 | |

Net realized gain on forward foreign currency contracts | | | 495,310 | |

Amortization of premium and accretion of discount, net | | | (33,391 | ) |

Amortization of deferred offering costs | | | 27,707 | |

Increase in interest receivable | | | (55,820 | ) |

Decrease in due from affiliate | | | 189,412 | |

Increase in investment sales receivable | | | (4,768 | ) |

Decrease in miscellaneous receivable | | | 425,844 | |

Increase in prepaid assets | | | (3,443 | ) |

Increase in investment purchases payable | | | 323,628 | |

Increase in management fee payable | | | 88,979 | |

Increase in administrative services expense payable | | | 8,038 | |

Decrease in professional fees payable | | | (68,195 | ) |

Increase in accounting and administrative fees payable | | | 48,497 | |

Decrease in Board of Managers' fees payable | | | (5,719 | ) |

Increase in custodian fees payable | | | 7,231 | |

Increase in incentive fees payable | | | 207,307 | |

Decrease in due to affiliate | | | (189,412 | ) |

Net Cash (Used in) Operating Activities | | | (11,773,232 | ) |

| | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

Proceeds from issuance of Shares | | | 15,091,750 | |

Distributions paid | | | (142,147 | ) |

Net Cash Provided by Financing Activities | | | 14,949,603 | |

| | | | | |

Net change in cash and cash equivalents | | | 3,176,371 | |

| | | | | |

Effect of exchange rate changes on cash | | | (71,698 | ) |

| | | | | |

Cash and cash equivalents at beginning of period | | | 7,859,012 | |

Cash and cash equivalents at End of Period | | $ | 10,963,685 | |

| | | | | |

Supplemental and non-cash financing activities | | | | |

Cash paid during the period for interest | | | — | |

Paid-in-kind interest income | | | — | |

Net amortization of premium on investments | | | 33,391 | |

Reinvestment of common Shares | | | 657,931 | |

Tender offers redeemed | | $ | (352,528 | ) |

The accompanying notes are an integral part of these Financial Statements.

7

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Financial Highlights

| | | Class A Shares | |

| | | Six

Months Ended

September 30,

2018

(unaudited) | | | For the Period

from June 1,

2017 through

March 31,

2018^ | |

Per Share Operating Performance:(1) | | | | | | | | |

Net asset value, beginning of period | | $ | 5.18 | | | $ | 5.00 | |

Income from investment operations: | | | | | | | | |

Net investment income(2) | | | 0.10 | | | | 0.06 | |

Net realized and unrealized gains (losses) on investments | | | — | | | | 0.12 | |

Net Increase in Net Assets from Operations | | | 0.10 | | | | 0.18 | |

Distributions from: | | | | | | | | |

Net investment income | | | (0.12 | ) | | | — | |

Net realized gains | | | — | | | | — | |

Total distributions | | | (0.12 | ) | | | — | |

Net asset value, end of period | | $ | 5.16 | | | $ | 5.18 | |

Total Return(3)(4) | | | 2.06 | % | | | 3.50 | % |

| | | | | | | | | |

Ratios and supplemental data: | | | | | | | | |

Net assets, end of period in thousands (000's) | | $ | — | * | | $ | — | * |

Net investment income (loss) to average net assets before Incentive Fee(5) | | | 4.56 | % | | | 1.77 | % |

Ratio of gross expenses to average net assets, excluding Incentive Fee(5)(6) | | | 3.13 | % | | | 4.49 | % |

Incentive Fee to average net assets(4) | | | 0.34 | % | | | 0.29 | % |

Ratio of gross expenses and Incentive Fee to average net assets(5)(6)(7) | | | 3.47 | % | | | 4.78 | % |

Expense waivers to average net assets(5) | | | (1.22 | )% | | | (2.48 | )% |

Ratio of net expenses and Incentive Fee to average net assets(5)(7) | | | 2.25 | % | | | 2.30 | % |

Ratio of net expenses to average net assets, excluding Incentive Fee(5) | | | 1.91 | % | | | 2.01 | % |

| | | | | | | | | |

Portfolio Turnover(4) | | | 66.22 | % | | | 19.18 | % |

^ | Class A commenced operations on June 1, 2017. |

(1) | Selected data for a Net Asset Value per Share outstanding throughout the period. |

(2) | Calculated using average shares outstanding. |

(3) | Total investment return reflects the changes in Net Asset Value on the effects of the performance of the Fund during the period and adjusted for cash flows related to capital contributions or withdrawals during the period. |

(6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by/to the Adviser. |

(7) | The Incentive Fee and/or organizational expenses are not annualized. |

* | Amount rounds to less than $1,000. |

The accompanying notes are an integral part of these Financial Statements.

8

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Financial Highlights

| | | Class I Shares | |

| | | Six

Months Ended

September 30,

2018

(unaudited) | | | For the

Year Ended

March 31,

2018 | |

Per Share Operating Performance(1) | | | | | | | | |

Net asset value, beginning of period | | $ | 5.19 | | | $ | 5.00 | |

Income from investment operations: | | | | | | | | |

Net investment income (loss)(2) | | | 0.10 | | | | 0.14 | |

Net realized and unrealized gain (loss) on investments | | | 0.01 | | | | 0.13 | |

Net Increase in Net Assets from Operations | | | 0.11 | | | | 0.27 | |

Distributions from: | | | | | | | | |

Net investment income | | | (0.12 | ) | | | (0.08 | ) |

Net realized gains | | | — | | | | — | * |

Total distributions | | | (0.12 | ) | | | (0.08 | ) |

Net asset value, end of period | | $ | 5.18 | | | $ | 5.19 | |

Total Return(3)(4) | | | 1.92 | % | | | 5.48 | % |

| | | | | | | | | |

Ratio/Supplemental Data: | | | | | | | | |

Net assets, end of period in thousands (000's) | | $ | 65,632 | | | $ | 50,433 | |

Net investment income (loss) to average net assets before Incentive Fee(5) | | | 4.47 | % | | | 3.23 | % |

Ratio of gross expenses to average net assets, excluding Incentive Fee(5)(6) | | | 3.22 | % | | | 5.51 | % |

Incentive Fee to average net assets(4) | | | 0.34 | % | | | 0.48 | % |

Ratio of gross expenses and Incentive Fee to average net assets(5)(6)(7) | | | 3.56 | % | | | 5.99 | % |

Expense waivers to average net assets(5) | | | (1.22 | )% | | | (3.51 | )% |

Ratio of net expenses and Incentive Fee to average net assets(5)(7) | | | 2.34 | % | | | 2.48 | % |

Ratio of net expenses to average net assets, excluding Incentive Fee(5) | | | 2.00 | % | | | 2.00 | % |

| | | | | | | | | |

Portfolio Turnover(4) | | | 66.22 | % | | | 19.18 | % |

(1) | Selected data for a Net Asset Value per Share outstanding throughout the period. |

(2) | Calculated using average shares outstanding. |

(3) | Total investment return reflects the changes in Net Asset Value based on the effects of the performance of the Fund during the period and adjusted for cash flows related to capital contributions or withdrawals during the period. |

(6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by/to the Adviser. |

(7) | The Incentive Fee and/or organizational expenses are not annualized. |

* | Amount rounds to less than $0.005. |

The accompanying notes are an integral part of these Financial Statements.

9

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited)

1. Organization

Partners Group Private Income Opportunities, LLC (the “Fund”) is a Delaware limited liability company which was organized on August 16, 2016 and commenced operations on April 1, 2017. The Fund is registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified, closed-end management investment company. The Fund is managed by Partners Group (USA) Inc. (the “Adviser”), an investment adviser registered under the Investment Advisers Act of 1940, as amended (the “Advisers Act”) pursuant to an investment management agreement between the Fund and the Adviser (the “Investment Management Agreement”). The board of managers of the Fund (the “Board”) has overall responsibility for the management and supervision of the business operations of the Fund. As permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Fund, any committee of the Board, or the Adviser. The Fund’s investment objective is to generate attractive risk-adjusted returns and current income by investing in a diversified portfolio of predominantly credit related opportunities. Limited liability company interests in the Fund (the “Shares”) are offered only to investors that represent that they are an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended. Holders of Shares becomes shareholders of the Fund (the “Shareholders”).

The Fund offers two separate classes of Shares designated as Class A Shares (the “Class A Shares”) and Class I Shares (the “Class I Shares”). While the Fund currently intends to offer two classes of Shares, in the future it may offer additional classes of Shares. The Class A Shares and the Class I Shares have, and each additional class of Shares issued by the Fund, if any, will have different characteristics, particularly in terms of the sales charges that Shareholders in that class bear, and the distribution and service fees that are charged to such class. The Adviser has received an exemptive order from the SEC with respect to the Fund’s multi-class structure.

Each class of Shares represents a pro-rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses and net investment income and losses, other than class-specific expenses, are allocated daily to each class of Shares based on the relative net assets of each class of Shares to the total net assets of the Fund. Each class of Shares differs in its distribution and service plan, if any, and certain other class specific expenses.

Class I Shares were first issued on March 8, 2017 when 70,000 Class I Shares were issued for $350,000. Class A Shares were first issued on June 1, 2017 (the “Initial Closing Date”) when 2 Class A Shares were issued for $10. As of September 30, 2018, no additional Class A Shares have been issued.

2. Significant Accounting Policies

The Fund is an investment company. Accordingly, these financial statements have applied the guidance set forth in Accounting Standards Codification (“ASC”) 946, Financial Services—Investment Companies. The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

a. Basis of Accounting

The Fund’s accounting and reporting policies conform with U.S. generally accepted accounting principles (“U.S. GAAP”).

b. Valuation of Investments

Investments held by the Fund consititute a diversified portfolio of predominantly credit-related opportunities, including but not limited to, first and second lien senior secured loans, secured unitranche debt, unsecured debt (e.g., mezzanine debt), structurally subordinated instruments and equity instruments, as well as public debt, corporate bonds and other debt securities (”Private Credit Investments”).

The Adviser estimates the fair value of the Fund’s Private Credit Investments in conformity with U.S GAAP and the Fund’s valuation procedures (the “Valuation Procedures”). The Valuation Procedures, which have been approved by the Board, require evaluation of all relevant factors reasonably available to the Adviser at the time the Fund’s Private Credit Instruments are valued. The input or methodologies used for valuing the Fund’s Private Credit Investments are not necessarily an indication of the risk associated with investing in those investments.

10

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

Fair value determinations for Private Credit Investments for which exchange or market quotations are readily available are valued based on such market quotations unless the Adviser determines that such market quotations do not represent fair value. In determining whether market quotations represent fair value, the Adviser considers different factors such as the source and the nature of the quotations in order to determine whether the quotations represent fair value. The Adviser makes use of reputable financial information providers in order to obtain the relevant quotations.

For debt and equity securities, which are not valued by reference to market quotations, the fair value is determined in good faith by the Adviser. In determining the fair values of these investments, the Adviser will typically apply widely recognized market and income valuation methodologies including, but not limited to, earnings and multiple analysis, discounted cash flow method and third party valuations. In order to determine a fair value, these methods are applied to the latest information provided by the underlying investment or other business counterparties (e.g., debt agents) such as last twelve months or forecast / budgeted EBITDA, sales, and net income figures or forecast cash flows. Because of the inherent uncertainty in valuation, the estimated values may differ from the values that would be been used had a ready market for the securities existed, and the differences could be material.

In certain circumstances the Adviser may determine that cost best approximates the fair value of the particular Private Credit Investment.

The Valuation Procedures are implemented by the Adviser and State Street Bank and Trust Company, the Fund’s administrator (the “Administrator”). Both the Adviser and the Administrator report to the Board. For third-party information, the Administrator monitors and reviews the methodologies of the various pricing services employed by the Fund. The Adviser employs valuation techniques for Private Credit Investments held by the Fund, which include discounted cash flow methods and market comparables. The Adviser and one or more of its affiliates act as investment advisers to clients other than the Fund . When clients other than the Fund also hold Private Credit Investments held by the Fund, the Adviser values such Private Credit Investments in consultation with its affiliates. The valuations attributed to Private Credit Investments held by the Fund and other clients of the Adviser might differ as a result of differences in accounting, regulatory and other factors applicable to the Fund and the other clients.

c. Cash and Cash Equivalents

Pending investment in Private Credit Investments and in order to maintain liquidity, the Fund holds cash, including amounts held in foreign currencies, in short-term interest bearing deposit accounts. At times, those amounts may exceed any applicable federally insured limits. The Fund has not experienced any losses in such accounts and does not believe that it is exposed to any significant credit risk on such accounts.

d. Foreign Currency Translation

The books and records of the Fund are maintained in U.S. Dollars. Generally, assets and liabilities denominated in currencies other than the U.S. Dollar are translated into U.S. Dollar equivalents using valuation date exchange rates, while purchases, realized gains and losses, income and expenses are translated at the transaction date exchange rates. As of September 30, 2018, the Fund’s investments denominated in foreign currencies were as follows:

Currency | Number of

investments |

Australian Dollars | 1 |

British Pound Sterling | 3 |

Euros | 11 |

The Fund does not isolate the portion of the results of operations due to fluctuations in foreign exchange rates from changes in fair values of the investments during the period.

11

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

e. Forward Foreign Currency Exchange Contracts

The Adviser may cause the Fund to enter forward foreign currency exchange contracts as a way of managing foreign exchange rate risk. These contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date may be entered into either as a hedge or as a cross hedge against either specific transactions or portfolio positions. The objective of the Fund’s foreign currency hedging transactions is to reduce the risk that the U.S. Dollar value of the Fund’s foreign currency denominated investments will decline in value due to changes in foreign currency exchange rates. All forward foreign currency exchange contracts are “marked-to-market” daily at the applicable translation rates resulting in unrealized gains or losses. Realized gains or losses are recorded at the time the forward foreign currency exchange contract is offset by entering into a closing transaction or by the delivery or receipt of the currency. Risk may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. Dollar.

During the six months ended September 30, 2018, the Fund entered into two long/short forward foreign currency exchange contracts. As disclosed in the Statement of Assets and Liabilities, the Fund had $116,823 in unrealized appreciation on forward foreign currency exchange contracts. As disclosed in the Statement of Operations, the Fund had $495,310 in net realized gains and $91,927 change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts. The outstanding forward foreign currency exchange contract amounts at September 30, 2018 are representative of contract amounts during the period.

f. Investment Income

The Fund records distributions of cash or in-kind securities on a Private Credit Investment at fair value based on the information contained in notices provided to the Fund when the distributions on Private Credit Investments are received. Thus, the Fund recognizes within the Statement of Operations its share of realized gains or (losses) and the Fund’s share of net investment income or (loss) based upon information received about distributions on Private Credit Investments. Unrealized appreciation (depreciation) on investments within the Statement of Operations includes the Fund’s share of unrealized gains and losses, realized undistributed gains/losses, and the Fund’s share of undistributed net investment income or (loss) from Private Credit Investments for the relevant period.

For certain transactions, the Fund accounts for particular income received as other income and transaction income. The other income includes transfer fees, amendment fees, unfunded fees and any other income which is not categorized as an item of interest income. The transaction income is an extraordinary item of income for certain investments. It includes break-up fees, directors’ fees, financial advisory fees, topping fees, investment banking fees, monitoring fees, organizational fees, syndication fees, and any other fees payable to the Fund in connection with the purchase, monitoring, or disposition of Fund investments or unconsummated transactions.

g. Fund Expenses

The Fund bears all expenses incurred in the business of the Fund on an accrual basis, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Fund’s account; legal fees; accounting, auditing, and tax preparation fees; custodial fees; fees for data and software providers; costs of insurance; registration expenses; Board fees; and expenses of meetings of the Board.

h. Deferred Offering Costs

Offering costs in connection with the offering of Shares of the Fund consist primarily of fees and expenses incurred in connection with the offering of Shares, including legal, printing and other costs, as well as costs associated with the preparation and filing of the Fund’s registration statement. The Fund’s offering costs, whether borne by the Adviser or the Fund, were capitalized and amortized over the 12-month period beginning on June 1, 2017.

j. Income Taxes

The Fund recognizes tax positions in its financial statements only when it is more likely than not that the position will be sustained upon examination by the relevant taxing authority based on the technical merits of the position. A position that meets this standard is measured at the largest amount of benefit that will more likely than not be realized upon settlement. The Fund reports any interest expense related to income tax matters in income tax expense, and any income tax penalties under expenses in the Statements of Operations.

12

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

The Fund’s tax positions have been reviewed based on applicable statutes of limitation for tax assessments, which may vary by jurisdiction, and based on such review, the Fund has concluded that no additional provision for income tax is required in the Fund’s financial statements. The Fund is subject to potential examination by certain taxing authorities in various jurisdictions. The Fund’s tax positions are subject to ongoing interpretation of laws and regulations by taxing authorities.

Effective January 1, 2017, the Fund filed an election with the Internal Revenue Service to be treated as an association taxable as a corporation for U.S. federal income tax purposes. Furthermore, effective January 1, 2017, the Fund elected to be treated for U.S. federal income tax purposes and intends to qualify annually, as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”). If the Fund were to fail to meet the requirements of Subchapter M of the Code to qualify as a RIC, and if the Fund were ineligible to or otherwise were not to cure such failure, the Fund would be subject to tax on its taxable income at corporate rates, whether or not distributed to Shareholders, and all distributions out of earnings and profits would be taxable to Shareholders as ordinary income. In addition, the Fund could be required to recognize unrealized gains, pay substantial taxes and interest and make substantial distributions before re-qualifying as a RIC that is accorded special tax treatment under Subchapter M of the Code. The Fund intends to comply with the requirements under Subchapter M of the Code and to distribute substantially all of its taxable income and gains to Shareholders and to meet certain diversification and income requirements with respect to its investments.

k. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in capital from operations during the reporting period. Actual results can differ from those estimates.

l. Disclosures about Offsetting Assets and Liabilities

The Fund is subject to Financial Accounting Standards Board’s (“FASB”) Disclosures about Offsetting Assets and Liabilities which requires an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The guidance requires retrospective application for all comparative periods presented.

For financial reporting purposes, the Fund does not offset derivative assets and liabilities that are subject to Netting Agreements (“MNA”) or similar arrangements in the Statement of Assets and Liabilities. The Fund has adopted the new disclosure requirements on offsetting in the following table which presents the Fund’s derivative assets by type, net of amounts available for offset under a MNA and net of the related collateral received by the Fund as of September 30, 2018:

Counterparty | | Gross

Amounts of

Recognized

Assets | | | Gross Amounts Offset

in the Statement of

Assets and Liabilities | | | Net Amounts of

Assets Presented

in the Statement of

Assets and Liabilities | | | Collateral

Pledged | | | Net Amount1 | |

Bank of America | | $ | 116,823 | | | $ | — | | | $ | — | | | $ | — | | | $ | 116,823 | |

1 | Net amount represents the net amount receivable from the counterparty in the event of default. |

m. Recently Adopted Accounting Pronouncement

As of September 30, 2018, there are no recent accounting pronouncements under consideration by the Fund.

13

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

3. Fair Value Measurements

In conformity with U.S. GAAP, investments are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Estimated values may differ from the values that would have been used if a ready market existed or if the investments were liquidated at the valuation date. A three-tier hierarchy is used to distinguish between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Fund’s investments. The inputs are summarized in the three broad levels listed below:

Valuation of Investments

● | Level 1 – Quoted prices are available in active markets for identical investments as of the measurement date. The type of investments included in Level 1 include marketable securities that are primarily traded on a securities exchange or over-the-counter. The fair value is determined to be the last sale price on the determination date, or, if no sales occurred on any such date, the mean between the closing bid and ask prices on such date. The Fund does not apply a blockage discount to the quoted price for these investments, even in situations where the Fund holds a large position and a sale could reasonably impact the quoted price. |

● | Level 2 – Pricing inputs are other than quoted prices in active markets (i.e. Level 1 pricing) and fair value is determined through the use of models or other valuation methodologies through direct or indirect corroboration with observable market data. Investments which are generally included in this category include corporate notes, convertible notes, warrants and restricted equity securities. The fair value of legally restricted equity securities may be discounted depending on the likely impact of the restrictions on liquidity and the Adviser’s estimates. |

● | Level 3 – Pricing inputs are unobservable for the investment and include situations where there is little, if any, market activity for the investment. The inputs into the determination of fair value require significant management judgment and/or estimation. Investments that are included in this category are equity and debt investments that are privately owned, as well as convertible notes and warrants that are not actively traded. The fair value for investments using Level 3 pricing inputs are based on the Adviser’s estimates that consider a combination of various performance measurements including the timing of the transaction, the market in which the investment operates, comparable market transactions, performance and projections and various performance multiples as applied to earnings before interest, taxes, depreciation and amortization or a similar measure of earnings for the latest reporting period and forward earnings, brokers quotes as well as discounted cash flow analysis. |

The following table presents the Fund’s Investments at September 30, 2018 measured at fair value. Due to the inherent uncertainty of estimates, fair value determinations based on estimates may materially differ from the values that would have been used had a ready market for the securities existed.

Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Private Credit Investments: | | | | | | | | | | | | | | | | |

Debt | | $ | — | | | $ | — | | | $ | 55,244,400 | | | $ | 55,244,400 | |

Equity | | | — | | | | — | | | | 1,021,954 | | | | 1,021,954 | |

Total Private Credit Investments* | | $ | — | | | $ | — | | | $ | 56,266,354 | | | $ | 56,266,354 | |

Total Investments | | $ | — | | | $ | — | | | $ | 56,266,354 | | | $ | 56,266,354 | |

Other Financial Instruments |

Foreign Currency Exchange Contracts** | | $ | 116,823 | | | $ | — | | | $ | — | | | $ | 116,823 | |

Total Foreign Currency Exchange Contracts | | $ | 116,823 | | | $ | — | | | $ | — | | | $ | 116,823 | |

* | Private Credit Investments are detailed in Note 2.b. |

** | Forward Foreign Currency Exchange Contracts are detailed in Note 2.e. |

14

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

3. Fair Value Measurements (continued)

The following is a reconciliation of the amount of the account balances on April 1, 2018 and September 30, 2018 of those investments in which significant unobservable inputs (Level 3) were used in determining value:

Investments | | Balance as

of April 1,

2018 | | | Realized

gain/(loss) | | | Net change

in unrealized

appreciation/

(depreciation) | | | Gross

purchases | | | Gross

sales | | | Net

amortization

of premium/

discount | | | Net transfers

in or out of

Level 3 | | | Balance as of

September 30,

2018 | |

Private Credit Investments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Debt | | $ | 41,978,384 | | | $ | (197,734 | ) | | $ | (257,064 | ) | | $ | 35,409,225 | | | $ | (21,720,056 | ) | | $ | 31,645 | | | $ | — | | | $ | 55,244,400 | |

Equity | | | 316,065 | | | | — | | | | (3,612 | ) | | | 709,501 | | | | — | | | | — | | | | — | | | | 1,021,954 | |

Total Private Credit Investments | | $ | 42,294,449 | | | $ | (197,734 | ) | | $ | (260,676 | ) | | $ | 36,118,726 | | | $ | (21,720,056 | ) | | $ | 31,645 | | | $ | — | | | $ | 56,266,354 | |

Transfers between levels of the fair value hierarchy are reported at the beginning of the reporting period in which they occur. For the six months ended September 30, 2018, there were no transfers between levels.

The amount of the net change in unrealized depreciation for the six months ended September 30, 2018 relating to investments in Level 3 assets still held at September 30, 2018 is $(168,700), which is included as a component of net change in accumulated unrealized appreciation on investments on the Statement of Operations.

The following is a summary of quantitative information about significant unobservable valuation inputs approved by the Adviser for Level 3 Fair Value Measurements for investments held as of September 30, 2018:

Type of Security | | Fair Value at

September 30,

2018

(000’s)* | | Valuation Technique(s) | Unobservable Input | Range

(weighted average) |

Private Credit Investments: | | | | | | | |

Debt | | $ | 25,902 | | Broker quotes | Indicative quotes for an inactive market | n/a – n/a (n/a) |

| | | $ | 12,640 | | Discounted cash flow | Discount factor | 4.07% – 12.76% (7.77%) |

| | | $ | 15 | | Exit price | Recent transaction price | n/a – n/a (n/a) |

| | | $ | 16,875 | | Recent financing | Recent transaction price | n/a – n/a (n/a) |

Equity | | $ | 462 | | Market comparable companies | Enterprise value to EBITDA multiple | 9.41x – 17.50x (12.14x) |

| | | $ | 560 | | Recent financing | Recent transaction price | n/a – n/a (n/a) |

* | Level 3 fair value includes accrued interest. |

15

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

3. Fair Value Measurements (continued)

Level 3 equity investments valued by using an unobservable input factor are directly affected by a change in that factor. For Level 3 debt investments, the Fund arrives at a fair value through the use of an earnings and multiples analysis and a discounted cash flows analysis which consider credit risk and interest rate risk of the particular investment. Significant increases or decreases in these inputs in isolation would result in a significantly lower or higher fair value measurement.

4. Distributions/Allocation of Shareholders Capital

The Fund contemplates declaring quarterly dividends each calendar year constituting all or substantially all of its investment company taxable income. From time to time, the Fund may also pay special interim distributions in the form of cash or Shares at the discretion of the Board. Unless Shareholders elect to receive distributions in the form of cash, the Fund intends to make its ordinary distributions in the form of additional Shares under a dividend reinvestment plan. Any distributions reinvested will nevertheless remain taxable to Shareholders that are U.S. persons.

5. Share Transactions/Subscription and Repurchase of Shares

Shares are generally offered for purchase as of the first day of each calendar month, except that Shares may be offered more or less frequently as determined by the Board in its sole discretion.

Pursuant to the conditions of an exemptive order issued by the SEC, and in compliance with Rule 12b-1 under the Investment Company Act, the Fund has adopted a Distribution and Service Plan (the “Distribution Plan”) with respect to its Class A Shares which allows the Fund to pay distribution fees for the promotion and distribution of its Class A Shares and the provision of personal services to holders of Class A Shares. Under the Distribution Plan, the Fund may pay as compensation to the Fund’s distributor or other qualified recipients up to 0.70% on an annualized basis of the Fund’s net asset value attributable to Class A Shares (the “Distribution Fee”). The Distribution Fee is paid out of the Fund’s assets and decreases the net profits or increases the net losses of the Fund solely with respect to Class A Shares. Class I Shares are not subject to the Distribution Fee and do not bear any expenses associated therewith. In addition, subscriptions for Class A Shares may be subject to a sales load (the “Sales Load”) of up to 3.50% of the subscription amount. No Sales Load may be charged without the consent of the distributor.

The Board may, from time to time and in its sole discretion, cause the Fund to repurchase Shares from Shareholders pursuant to written tenders by Shareholders at such times and on such terms and conditions as established by the Board. In determining whether the Fund should offer to repurchase Shares, the Board considers the recommendation of the Adviser, as well as a variety of other operational, business and economic factors. The Adviser anticipates recommending to the Board that, under normal circumstances, the Fund conducts quarterly repurchase offers for Shares having an aggregate value of no more than 5% of the Fund’s net assets on or about the first anniversary of the Initial Closing Date and each January 1st, April 1st, July 1st and October 1st. A 2.00% early repurchase fee will be charged by the Fund with respect to any repurchase of Shares from a Shareholder at any time prior to the day immediately preceding the first anniversary of the Shareholder’s purchase of such Shares.

16

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

5. Share Transactions/Subscription and Repurchase of Shares (continued)

Transactions in Fund Shares were as follows:

| | | For the Six Months Ended

September 30, 2018 | | | For the Year Ended

March 31, 2018 | |

| | | Shares | | | Dollar Amounts | | | Shares | | | Dollar Amounts | |

Class A Shares^ | | | | | | | | | | | | | | | | |

Sales | | | — | | | $ | — | | | | 2 | | | $ | 10 | |

Redemptions | | | — | | | | — | | | | — | | | | — | |

Reinvestments | | | — | | | | — | | | | — | | | | — | |

Net increase (decrease) | | | — | | | $ | — | | | | 2 | | | $ | 10 | |

Class I Shares | | | | | | | | | | | | | | | | |

Sales | | | 2,907,211 | | | $ | 15,091,750 | | | | 9,586,451 | | | $ | 49,044,490 | |

Redemptions | | | (68,104 | ) | | | (352,528 | | | | — | | | | — | |

Reinvestments | | | 127,375 | | | | 657,931 | | | | 56,464 | | | | 290,078 | |

Net increase (decrease) | | | 2,966,482 | | | $ | 15,397,153 | | | | 9,642,915 | | | $ | 49,334,568 | |

^ | Class A commenced operations on June 1, 2017 |

6. Management Fee, Incentive Fee and Fees and Expenses of Managers

Under the terms of the Investment Management Agreement the Adviser is responsible for providing day-to-day investment management and certain other services to the Fund, subject to the ultimate supervision of, and any policies established by the Board. Under the Investment Management Agreement, the Adviser is responsible for developing, implementing and supervising the Fund’s investment program.

In consideration for its services under the Investment Management Agreement, the Fund pays the Adviser a monthly investment management fee (the “Investment Management Fee”) equal to 1.25% on an annualized basis of the Fund’s net asset value. The Investment Management Fee is paid to the Adviser out of the Fund’s assets, and therefore decreases the net profits or increases the net losses of the Fund. For the six months ended September 30, 2018, the Adviser earned $397,955 in Investment Management Fees (subject to waiver, deferral or reduction under the Expense Limitation Agreement as defined below).

In addition, the Investment Management Agreement provides that an incentive fee (the “Incentive Fee”) is payable to the Adviser at the end of each calendar quarter (and at certain other times). The Incentive Fee is calculated and payable quarterly in arrears equal to 15% of the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the Investment Management Fee, but excluding the Incentive Fee). For the six months ended September 30, 2018 an aggregate Incentive Fee of $207,306 was earned by the Adviser.

17

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

6. | Management Fee, Incentive Fee and Fees and Expenses of Managers (continued) |

The Adviser has entered into an expense limitation agreement (the “Expense Limitation Agreement”) with the Fund dated March 20, 2017, pursuant to which the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Annual Net Expenses (excluding taxes, brokerage commissions, interest from borrowing, borrowing costs, certain transaction-related expenses arising out of investments made by the Fund, extraordinary expenses, the Incentive Fee and acquired fund fees and expenses) do not exceed 2.70% on an annualized basis with respect to the Class A Shares and 2.00% on an annualized basis with respect to the Class I Shares (the “Expense Limit”). For a period not to exceed three years from the date on which a Waiver is made, the Adviser may recoup amounts waived or assumed, provided (a) it is able to effect such recoupment and remain in compliance with the Expense Limit and (b) such recoupment does not cause the Fund’s expense ratio after recoupment to exceed the Fund’s net expense ratio in place at the time such amounts were waived. The Expense Limitation Agreement may be terminated by the Adviser or the Fund upon thirty days’ written notice to the other party. During the period ended September 30, 2018, the fund accrued $377,284 pursuant to the Expense Limitation Agreement that Partners Group has agreed to pay. These amounts may be subject to conditional repayment by the Fund as described above.

In consideration of the services rendered by each Manager who was not an “interested person” of the Fund, as defined by the Investment Company Act (each, an “Independent Manager”), the Fund pays each Independent Manager an annual fee of $29,333. The Independent Managers do not receive any pension or retirement benefits. The Fund also reimburses the expenses of the Independent Managers in connection with their services as Managers.

Under Section 2(a)(3) of the Investment Company Act, a portfolio company is defined as “affiliated” if the Fund owns five percent or more of its outstanding voting securities. At September 30, 2018, the Fund did not hold any affiliated investments.

8. | Accounting and Administration Agreement |

The Administrator serves as administrator and accounting agent to the Fund and provides certain accounting, record keeping and investor related services under an Accounting and Administration Agreement between the Fund and the Administrator. For these services the Administrator receives a fixed monthly fee, based upon average net assets, fees on portfolio transactions, as well as reasonable out of pocket expenses. For the six months ended September 30, 2018, the Fund accrued $201,002 in administration and accounting fees.

9. | Investment Transactions |

Total purchases of investments for the six months ended September 30, 2018 amounted to $48,384,029. Total distribution proceeds from sale, redemption, or other disposition of investments for the six months ended September 30, 2018 amounted to $34,010,105.

10. Indemnification

In the normal course of business, the Fund may enter into contracts that provide general indemnification. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund under such agreements, and therefore cannot be established; however, based on management’s experience, the risk of loss from such claims is considered remote.

11. Commitments

As of September 30, 2018, the Fund had funded $93,128,152 or 94.5% of the $98,502,865 of its total commitments to Private Credit Investments.

18

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Notes to Financial Statements – September 30, 2018 (Unaudited) (continued)

12. Risk Factors

An investment in the Fund involves significant risks, including industry risk, liquidity risk, interest rate risk and economic conditions risk, that should be carefully considered prior to investing and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. The Fund invests substantially all of its available capital in Private Credit Investments. Typically, Private Credit Investments are in restricted securities that are not traded in public markets and subject to substantial holding periods, so that the Fund may not be able to resell some of its holdings for extended periods, which may be several years. The Fund may have a concentration of Private Credit Investments in a particular industry or sector. Investment performance of the sector may have a significant impact on the performance of the Fund. The Fund’s investments are also subject to the risk associated with investing in private securities. The investments in private securities are illiquid, can be subject to various restrictions on resale, and there can be no assurance that the Fund will be able to realize the value of such investments in a timely manner.

Investments in Shares provide limited liquidity because Shareholders will not be able to redeem Shares on a daily basis because the Fund is a closed-end fund. Therefore investment in the Fund is suitable only for investors who can bear the risks associated with the limited liquidity of Shares and should be viewed as a long-term investment. No guarantee or representation is made that the investment objective will be met.

13. Tax Information

As of September 30, 2018, the Fund’s aggregate investment unrealized appreciation and depreciation based on cost for U.S. federal income tax purposes were as follows:

| | | Investments | | | Forward

Foreign

Currency

Contracts | |

Tax Cost | | $ | 56,097,621 | | | $ | 16,479,327 | |

Gross unrealized appreciation | | | 485,115 | | | | 116,823 | |

Gross unrealized depreciation | | | (316,382 | ) | | | — | |

Net unrealized investment appreciation | | $ | 168,733 | | | $ | 116,823 | |

The tax cost of the Fund’s investments as of September 30, 2018, approximates their amortized cost.

14. Subsequent Events

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and has determined there have not been any events that have occurred that would require adjustments or disclosures in the financial statements or the accompanying notes.

19

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Fund Expenses — for the period from April 1, 2018 through September 30, 2018 (Unaudited)

Example: As a Shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1 fees), and other Fund expenses. This Example is intended to help you understand your ongoing costs (in U.S. Dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The actual and hypothetical expense Examples are based on an investment of $1,000 invested at the beginning of a six month period and held through the period ended September 30, 2018.

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on redemption/exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Beginning

Account Value

(04/01/18) | | | Ending

Account Value

(09/30/18) | | | Expenses

Paid During

the Period* | | | Annualized Net

Expense Ratio** | |

Actual | | | | | | | | | | | | | | | | | |

Class A Shares | | | $ | 1,000.00 | | | $ | 1,020.60 | | | $ | 12.64 | | | | 2.50% | |

Class I Shares | | | $ | 1,000.00 | | | $ | 1,019.20 | | | $ | 13.54 | | | | 2.68% | |

| | | Beginning

Account Value

(04/01/18) | | | Ending

Account Value

(09/30/18) | | | Expenses

Paid During

the Period* | | | Annualized Net

Expense Ratio** | |

| Hypothetical (5% annual return before expenses) | | | | | | | | | | | | | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 1,012.60 | | | $ | 12.59 | | | | 2.50% | |

| Class I Shares | | $ | 1,000.00 | | | $ | 1,011.70 | | | $ | 13.49 | | | | 2.68% | |

* | Expenses are calculated using to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the opening of business on April 1, 2018. |

** | Annualized ratio of expenses to average net assets for the period from April 1, 2018 through September 30, 2018. The expense ratio includes the effect of expenses waived or reimbursed by the Fund’s investment adviser. |

20

Partners Group Private Income Opportunities, LLC

(a Delaware Limited Liability Company)

Other Information (Unaudited)

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Fund’s Form N-PX filing is available: (i) without charge, upon request, by calling 1-877-748-7209 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available, without charge and upon request, on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the Public Reference Room may be obtained by calling 1-800-SEC-0330.

21

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this form.

(b) Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

(a) Not applicable.

(b)(1) Identification of Portfolio Manager(s) or Management Team Members and Description of Role of Portfolio Manager(s) or Management Team Members

Effective July 1, 2018, Mr. Adam Howarth was appointed as a portfolio manager for the registrant.

Name of Investment

Committee Member | Title | Length of

Time of

Service to

the Fund | Business Experience During the Past 5 Years | Role of Investment Committee Member |

| Adam Howarth | Managing Director | Since 2009* | Managing Director, Partners Group (2013-Present); Partners Group (2007-Present). | Portfolio Management |

| * | Mr. Howarth served as a portfolio manager for the registrant from 2009-2011 and as deputy portfolio manager from 2014-2018. |

(b)(2) Other Accounts Managed by Portfolio Manager(s) or Management Team Member and Potential Conflicts of Interest

As of September 30, 2018, Mr. Howarth was primarily responsible for the day-to-day portfolio management of the following accounts:

Number of Other Accounts Managed and Total Value

of Assets by Account Type for Which There is No Performance-Based Fee | Number of Other Accounts and Total Value of Assets

for Which Advisory Fee is Performance-Based |

Registered

investment

companies | Other pooled

investment

vehicles | Other accounts | Registered

investment

companies | Other pooled

investment