| | |

| | Filed by Goldman Sachs BDC, Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed under Rule 14a-6(b) of the Securities Exchange Act of 1934 Subject Company: Goldman Sachs Middle Market Lending Corp. File No. of Related Registration Statement: 333-235856 |

Asset Management Goldman Sachs BDC, Inc. We still need your vote for our Special Meeting. VOTE YOUR SHARES TODAY!

We still need your vote on our proposed merger. Our Board of Directors unanimously recommends that you respond to this solicitation by voting FOR each of the proposals to be considered at the meeting. August 26, 2020 Fellow Stockholder, We recently distributed proxy material for the Goldman Sachs BDC, Inc. (“GSBD”) Special Meeting of Stockholders to be held on October 2, 2020. As of the date of this letter, we have not received voting instructions for your account. Your vote for our Special Meeting is extremely important, regardless of the number of shares you own. We cannot close our proposed merger with Goldman Sachs Middle Market Lending Corp. without stockholder approval. To avoid delay of our Special Meeting and the proposed merger, you are encouraged to vote your shares as soon as possible. We believe your vote FOR the proposals listed on the enclosed voting instruction form will yield multiple benefits for GSBD stockholders, including accretion to net investment income, improved portfolio metrics, balance sheet deleveraging and economies of scale. If you do not vote, the effect will be the same as voting against the merger and the charter amendment proposals. I encourage you to vote your shares using any one of the methods described below. If you have any questions about voting, please call our proxy solicitor, Broadridge, at 1-833-670-0593. If you have already voted your shares in the time it took this letter to reach you, thank you for your participation and support of GSBD. Sincerely, Brendan McGovern President and CEO

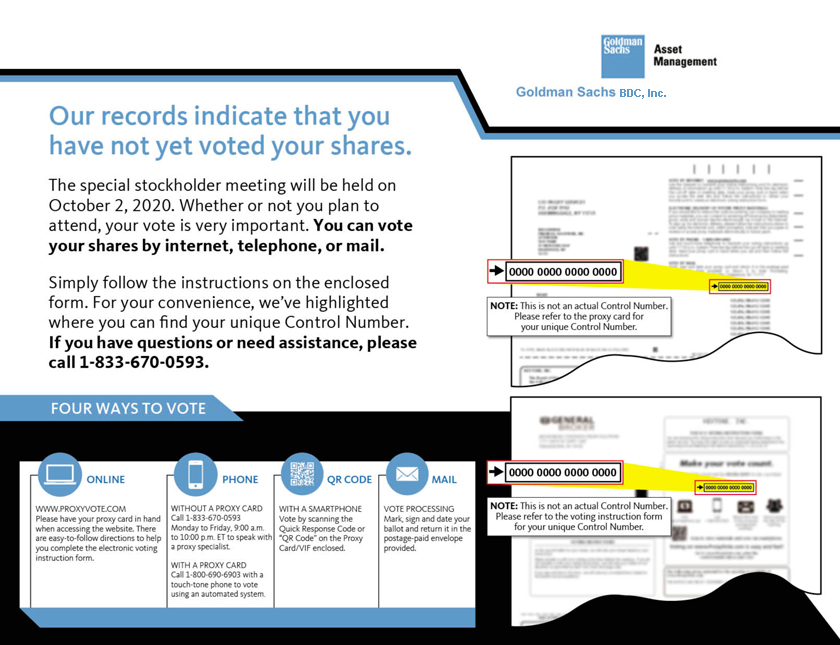

Management Goldman Sachs BDC, Inc. Our records indicate that you have not yet voted your shares. The special stockholder meeting will be held on October 2, 2020. Whether or not you plan to attend, your vote is very important. You can vote—· your shares by internet, telephone, or mail. Simply follow the instructions on the enclosed form. For your convenience, we’ve highlighted NOTE: This is not an actual Control Number. where you can find your unique Control Number. Please refer to the proxy card for your unique Control Number. If you have questions or need assistance, please calll-833-670-0593. VOTE PROCESSING Please have your proxy card in hand Vote by scanning the Mark, sign and date your when accessing the website. There Monday to Friday, 9:00a.m. Quick Response Code or ballot and return it in the are easy-to-follow directions to help to 10:00 p.m. ET to speak “QR Code” on the Proxy postage-paid envelope you complete the electronic voting a proxy specialist Card/VIF enclosed. provided. instruction form. WITH A PROXY CARD Calll-800-690-6903 with a touch-tone phone to vote using an automated system.

Forward-Looking Statements

This communication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this communication may constitute forward-looking statements and are not guarantees of future performance or results of Goldman Sachs BDC, Inc. (“GSBD”), Goldman Sachs Middle Market Lending Corp. (“MMLC”), or, following the merger, the combined company and involve a number of risks and uncertainties. Such forward-looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or similar words. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in filings made by GSBD and MMLC with the Securities and Exchange Commission (“SEC”), including those contained in the Proxy Statement (as defined below). Certain factors could cause actual results to differ materially from those projected in these forward-looking statements. Factors that could cause actual results to differ materially include: the ability of the parties to consummate the merger on the expected timeline, or at all, failure of GSBD or MMLC to obtain the requisite stockholder approval for the Proposals (as defined below) as set forth in the Proxy Statement, the ability to realize the anticipated benefits of the merger, effects of disruption on the business of GSBD and MMLC from the proposed merger, the effect that the announcement or consummation of the merger may have on the trading price of GSBD’s common stock on New York Stock Exchange; the combined company’s plans, expectations, objectives and intentions as a result of the merger, any decision by MMLC to pursue continued operations, any termination of the Amended and Restated Agreement and Plan of Merger, future operating results of GSBD or MMLC, the business prospects of GSBD and MMLC and the prospects of their portfolio companies, actual and potential conflicts of interests with Goldman Sachs Asset Management, L.P. (“GSAM”) and other affiliates of GSAM, general economic and political trends and other factors, the dependence of GSBD’s and MMLC’s future success on the general economy and its effect on the industries in which they invest; and future changes in laws or regulations and interpretations thereof. Neither GSBD nor MMLC undertakes any duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this communication.

Additional Information and Where to Find It

This communication relates to a proposed business combination involving GSBD and MMLC, along with related proposals for which stockholder approval will be sought (collectively, the “Proposals”). In connection with the Proposals, each of GSBD and MMLC has filed relevant materials with the SEC, including a registration statement on Form N-14, which includes a joint proxy statement of GSBD and MMLC and a prospectus of GSBD (the “Proxy Statement”). The Proxy Statement was mailed to stockholders of GSBD and MMLC on or about August 11, 2020. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. STOCKHOLDERS OF EACH OF GSBD AND MMLC ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GSBD, MMLC, THE MERGER AND THE PROPOSALS. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC’s web site, http://www.sec.gov or, for documents filed by GSBD, from GSBD’s website at http://www.GoldmanSachsBDC.com.

Participants in the Solicitation

GSBD and MMLC and their respective directors, executive officers and certain other members of management and employees of GSAM and its affiliates, may be deemed to be participants in the solicitation of proxies from the stockholders of GSBD and MMLC in connection with the Proposals. Information about the directors and executive officers of GSBD and MMLC is set forth in the Proxy Statement. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the GSBD and MMLC stockholders in connection with the Proposals are contained in the Proxy Statement and other relevant materials filed with the SEC. This document may be obtained free of charge from the sources indicated above.