UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23226)

Listed Funds Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Kent P. Barnes, Secretary

Listed Funds Trust

c/o U.S. Bank Global Fund Services

777 East Wisconsin Avenue, 10th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1681

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: November 30, 2022

Item 1. Reports to Stockholders.

(a)

Wahed FTSE USA Shariah ETF

(HLAL)

Wahed Dow Jones Islamic World ETF

(UMMA)

SEMI-ANNUAL REPORT

November 30, 2022

(Unaudited)

Wahed ETFs

Table of Contents

(Unaudited)

| | |

Shareholder Expense Example | 2 |

Schedule of Investments | 3 |

Statements of Assets and Liabilities | 11 |

Statements of Operations | 12 |

Statements of Changes in Net Assets | 13 |

Financial Highlights | 15 |

Notes to Financial Statements | 17 |

Supplemental Information | 26 |

1

Wahed ETFs

Shareholder Expense Example

November 30, 2022 (Unaudited)

As a shareholder of a fund you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (June 1, 2022 to November 30, 2022).

ACTUAL EXPENSES

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account

Value

6/1/22 | Ending

Account

Value

11/30/22 | Annualized

Expense

Ratios | Expenses

Paid

During the

Period(1) |

Wahed FTSE USA Shariah ETF | | | | |

Actual | $1,000.00 | $ 984.30 | 0.50% | $2.49 |

Hypothetical (5% return before expenses) | $1,000.00 | $ 1,022.56 | 0.50% | $2.54 |

Wahed Dow Jones Islamic World ETF | | | | |

Actual | $1,000.00 | $ 960.60 | 0.65% | $3.19 |

Hypothetical (5% return before expenses) | $1,000.00 | $ 1,021.81 | 0.65% | $3.29 |

(1) | Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 183/365 (to reflect the six-month period). |

2

Wahed FTSE USA Shariah ETF

Schedule of Investments

November 30, 2022 (Unaudited)

| | Shares | | | Value | |

COMMON STOCKS — 98.6% | | | | | | | | |

Administrative and Support Services — 0.4% | | | | | | | | |

Allegion PLC (b) | | | 1,085 | | | $ | 123,310 | |

Baker Hughes Co. | | | 11,959 | | | | 347,050 | |

Robert Half International, Inc. | | | 1,327 | | | | 104,541 | |

Rollins, Inc. | | | 2,874 | | | | 116,225 | |

RXO, Inc. (a) | | | 1,339 | | | | 25,441 | |

| | | | | | | | 716,567 | |

Air Transportation — 0.1% | | | | | | | | |

Delta Air Lines, Inc. (a) | | | 1,995 | | | | 70,563 | |

United Airlines Holdings, Inc. (a) | | | 1,033 | | | | 45,628 | |

| | | | | | | | 116,191 | |

Ambulatory Health Care Services — 0.2% | | | | | | | | |

Laboratory Corp. of America Holdings | | | 1,101 | | | | 265,011 | |

Quest Diagnostics, Inc. | | | 1,413 | | | | 214,536 | |

| | | | | | | | 479,547 | |

Apparel Manufacturing — 0.3% | | | | | | | | |

Lululemon Athletica, Inc. (a) | | | 1,373 | | | | 522,166 | |

VF Corp. | | | 4,328 | | | | 142,045 | |

| | | | | | | | 664,211 | |

Beverage and Tobacco Product Manufacturing — 0.2% | | | | | | | | |

Keurig Dr. Pepper, Inc. | | | 10,579 | | | | 409,090 | |

| | | | | | | | | |

Broadcasting (except Internet) — 0.1% | | | | | | | | |

Liberty Broadband Corp. - Class A (a) | | | 222 | | | | 20,024 | |

Liberty Broadband Corp. - Class C (a) | | | 1,502 | | | | 136,472 | |

| | | | | | | | 156,496 | |

| | Shares | | | Value | |

Building Material and Garden Equipment and Supplies Dealers — 0.1% | | | | | | | | |

Snap-on, Inc. | | | 642 | | | $ | 154,465 | |

Chemical Manufacturing — 14.3% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 2,731 | | | | 847,047 | |

Albemarle Corp. | | | 1,446 | | | | 401,974 | |

Biogen, Inc. (a) | | | 1,786 | | | | 545,034 | |

BioMarin Pharmaceutical, Inc. (a) | | | 2,284 | | | | 230,638 | |

Bio-Techne Corp. | | | 1,944 | | | | 165,221 | |

Bristol-Myers Squibb Co. | | | 26,353 | | | | 2,115,619 | |

Catalent, Inc. (a) | | | 2,071 | | | | 103,819 | |

CF Industries Holdings, Inc. | | | 2,495 | | | | 269,934 | |

Church & Dwight Co., Inc. | | | 2,987 | | | | 244,546 | |

Dow, Inc. | | | 8,888 | | | | 453,021 | |

DuPont de Nemours, Inc. | | | 6,184 | | | | 436,034 | |

Eli Lilly & Co. | | | 10,382 | | | | 3,852,553 | |

FMC Corp. | | | 1,560 | | | | 203,798 | |

Gilead Sciences, Inc. | | | 15,395 | | | | 1,352,143 | |

Horizon Therapeutics PLC (a)(b) | | | 2,779 | | | | 278,706 | |

International Flavors & Fragrances, Inc. | | | 3,199 | | | | 338,518 | |

Linde PLC (b) | | | 6,188 | | | | 2,082,138 | |

Merck & Co., Inc. | | | 30,925 | | | | 3,405,461 | |

Pfizer, Inc. | | | 69,243 | | | | 3,471,152 | |

PPG Industries, Inc. | | | 2,968 | | | | 401,333 | |

Regeneron Pharmaceuticals, Inc. (a) | | | 1,271 | | | | 955,411 | |

The Estee Lauder Cos., Inc. | | | 2,840 | | | | 669,644 | |

The Mosaic Co. | | | 4,321 | | | | 221,667 | |

The Procter & Gamble Co. | | | 29,211 | | | | 4,357,113 | |

West Pharmaceutical Services, Inc. | | | 914 | | | | 214,479 | |

Westlake Chemical Corp. | | | 413 | | | | 44,459 | |

| | | | | | | | 27,661,462 | |

Clothing and Clothing Accessories Stores — 0.9% | | | | | | | | |

Ross Stores, Inc. | | | 4,197 | | | | 493,861 | |

The TJX Cos., Inc. | | | 14,370 | | | | 1,150,318 | |

| | | | | | | | 1,644,179 | |

Computer and Electronic Product Manufacturing — 26.6% (c) | | | | | | | | |

Advanced Micro Devices, Inc. (a) | | | 19,946 | | | | 1,548,408 | |

Agilent Technologies, Inc. | | | 3,746 | | | | 580,554 | |

Analog Devices, Inc. | | | 6,399 | | | | 1,100,052 | |

Apple, Inc. | | | 188,900 | | | | 27,962,868 | |

Bio-Rad Laboratories, Inc. - Class A (a) | | | 263 | | | | 109,068 | |

Cisco Systems, Inc. | | | 51,381 | | | | 2,554,662 | |

Danaher Corp. | | | 7,954 | | | | 2,174,706 | |

Dell Technologies, Inc. | | | 3,181 | | | | 142,476 | |

Fortive Corp. | | | 4,446 | | | | 300,330 | |

GlobalFoundries, Inc. (a)(b) | | | 780 | | | | 50,196 | |

Hologic, Inc. (a) | | | 3,023 | | | | 230,232 | |

The accompanying notes are an integral part of the financial statements.

3

Wahed FTSE USA Shariah ETF

Schedule of Investments

November 30, 2022 (Unaudited) (Continued)

| | Shares | | | Value | |

Computer and Electronic Product Manufacturing (c) (continued) | | | | | | | | |

HP, Inc. | | | 12,639 | | | $ | 379,674 | |

Illumina, Inc. (a) | | | 1,959 | | | | 427,218 | |

Intel Corp. | | | 50,048 | | | | 1,504,944 | |

International Business Machines Corp. | | | 11,095 | | | | 1,652,045 | |

Juniper Networks, Inc. | | | 3,978 | | | | 132,228 | |

Lam Research Corp. | | | 1,683 | | | | 795,018 | |

Marvell Technology, Inc. | | | 10,508 | | | | 488,832 | |

Medtronic PLC (b) | | | 16,478 | | | | 1,302,420 | |

Micron Technology, Inc. | | | 13,543 | | | | 780,756 | |

ON Semiconductor Corp. (a) | | | 5,288 | | | | 397,656 | |

PerkinElmer, Inc. | | | 1,564 | | | | 218,538 | |

QUALCOMM, Inc. | | | 13,750 | | | | 1,739,237 | |

Roper Technologies, Inc. | | | 1,291 | | | | 566,604 | |

Teradyne, Inc. | | | 1,930 | | | | 180,360 | |

Thermo Fisher Scientific, Inc. | | | 4,830 | | | | 2,705,862 | |

Trane Technologies PLC (b) | | | 2,900 | | | | 517,416 | |

Trimble, Inc. (a) | | | 3,109 | | | | 185,760 | |

Waters Corp. (a) | | | 750 | | | | 259,950 | |

Western Digital Corp. (a) | | | 3,877 | | | | 142,482 | |

Zebra Technologies Corp. (a) | | | 639 | | | | 172,710 | |

| | | | | | | | 51,303,262 | |

Construction of Buildings — 0.4% | | | | | | | | |

DR Horton, Inc. | | | 3,833 | | | | 329,638 | |

Lennar Corp. - Class A | | | 2,995 | | | | 263,051 | |

PulteGroup, Inc. | | | 2,775 | | | | 124,264 | |

| | | | | | | | 716,953 | |

Couriers and Messengers — 1.2% | | | | | | | | |

FedEx Corp. | | | 2,935 | | | | 534,816 | |

United Parcel Service, Inc. | | | 9,029 | | | | 1,713,072 | |

| | | | | | | | 2,247,888 | |

Data Processing, Hosting and Related Services — 0.4% | | | | | | | | |

Fiserv, Inc. (a) | | | 7,323 | | | | 764,228 | |

| | | | | | | | | |

Electrical Equipment, Appliance and Component Manufacturing — 0.3% | | | | | | | | |

Generac Holdings, Inc. (a) | | | 772 | | | | 81,461 | |

Rockwell Automation, Inc. | | | 1,454 | | | | 384,176 | |

Whirlpool Corp. | | | 647 | | | | 94,805 | |

| | | | | | | | 560,442 | |

Fabricated Metal Product Manufacturing — 0.6% | | | | | | | | |

Emerson Electric Co. | | | 7,352 | | | | 704,101 | |

Nucor Corp. | | | 3,207 | | | | 480,890 | |

| | | | | | | | 1,184,991 | |

| | Shares | | | Value | |

Food Manufacturing — 1.1% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 6,877 | | | $ | 670,507 | |

Bunge Ltd. (b) | | | 1,725 | | | | 180,849 | |

Mondelez International, Inc. - Class A | | | 16,874 | | | | 1,140,851 | |

The JM Smucker Co. | | | 1,259 | | | | 193,899 | |

| | | | | | | | 2,186,106 | |

Food Services and Drinking Places — 0.3% | | | | | | | | |

Cintas Corp. | | | 1,051 | | | | 485,331 | |

| | | | | | | | | |

Funds, Trusts and Other Financial Vehicles — 0.1% | | | | | | | | |

Garmin Ltd. (b) | | | 1,900 | | | | 176,681 | |

| | | | | | | | | |

Gasoline Stations — 2.3% | | | | | | | | |

Chevron Corp. | | | 24,282 | | | | 4,451,133 | |

| | | | | | | | | |

General Merchandise Stores — 0.3% | | | | | | | | |

Burlington Stores, Inc. (a) | | | 785 | | | | 153,609 | |

Dollar Tree, Inc. (a) | | | 2,552 | | | | 383,540 | |

| | | | | | | | 537,149 | |

Health and Personal Care Stores — 1.2% | | | | | | | | |

CVS Health Corp. | | | 16,195 | | | | 1,649,947 | |

Ulta Beauty, Inc. (a) | | | 631 | | | | 293,314 | |

Walgreens Boots Alliance, Inc. | | | 8,737 | | | | 362,585 | |

| | | | | | | | 2,305,846 | |

Hospitals — 0.1% | | | | | | | | |

Universal Health Services, Inc. - Class B | | | 771 | | | | 100,885 | |

| | | | | | | | | |

Machinery Manufacturing — 2.0% | | | | | | | | |

Applied Materials, Inc. | | | 10,663 | | | | 1,168,665 | |

Carrier Global Corp. | | | 10,257 | | | | 454,590 | |

Cummins, Inc. | | | 1,726 | | | | 433,502 | |

Dover Corp. | | | 1,761 | | | | 249,974 | |

IDEX Corp. | | | 927 | | | | 220,153 | |

Ingersoll Rand, Inc. | | | 4,847 | | | | 261,593 | |

KLA Corp. | | | 1,740 | | | | 684,081 | |

Pentair PLC (b) | | | 2,025 | | | | 92,684 | |

Xylem, Inc. | | | 2,203 | | | | 247,507 | |

| | | | | | | | 3,812,749 | |

Management of Companies and Enterprises — 1.3% | | | | | | | | |

Abbott Laboratories | | | 21,200 | | | | 2,280,696 | |

LyondellBasell Industries NV - Class A (b) | | | 3,192 | | | | 271,352 | |

| | | | | | | | 2,552,048 | |

The accompanying notes are an integral part of the financial statements.

4

Wahed FTSE USA Shariah ETF

Schedule of Investments

November 30, 2022 (Unaudited) (Continued)

| | Shares | | | Value | |

Merchant Wholesalers Durable Goods — 1.5% | | | | | | | | |

Copart, Inc. (a) | | | 5,228 | | | $ | 347,976 | |

Fastenal Co. | | | 7,058 | | | | 363,558 | |

Flex Ltd. (a)(b) | | | 5,663 | | | | 124,473 | |

Genuine Parts Co. | | | 1,686 | | | | 309,094 | |

Henry Schein, Inc. (a) | | | 1,659 | | | | 134,246 | |

Johnson Controls International PLC (b) | | | 8,659 | | | | 575,304 | |

LKQ Corp. | | | 3,143 | | | | 170,759 | |

TE Connectivity Ltd. (b) | | | 3,996 | | | | 503,976 | |

WW Grainger, Inc. | | | 555 | | | | 334,698 | |

| | | | | | | | 2,864,084 | |

Merchant Wholesalers Nondurable Goods — 0.6% | | | | | | | | |

AmerisourceBergen Corp. | | | 1,794 | | | | 306,218 | |

Cardinal Health, Inc. | | | 3,322 | | | | 266,325 | |

McKesson Corp. | | | 1,768 | | | | 674,810 | |

| | | | | | | | 1,247,353 | |

Mining (except Oil and Gas) — 0.9% | | | | | | | | |

Freeport-McMoRan, Inc. | | | 17,706 | | | | 704,699 | |

Martin Marietta Materials, Inc. | | | 766 | | | | 280,724 | |

Newmont Goldcorp Corp. | | | 9,437 | | | | 447,974 | |

Southern Copper Corp. | | | 1,040 | | | | 63,461 | |

Vulcan Materials Co. | | | 1,648 | | | | 302,128 | |

| | | | | | | | 1,798,986 | |

Miscellaneous Manufacturing — 5.8% | | | | | | | | |

3M Co. | | | 6,928 | | | | 872,720 | |

Align Technology, Inc. (a) | | | 965 | | | | 189,777 | |

Becton Dickinson and Co. | | | 3,511 | | | | 875,433 | |

Boston Scientific Corp. (a) | | | 17,809 | | | | 806,213 | |

DENTSPLY SIRONA, Inc. | | | 2,629 | | | | 79,554 | |

Edwards Lifesciences Corp. (a) | | | 7,715 | | | | 595,984 | |

Intuitive Surgical, Inc. (a) | | | 4,382 | | | | 1,184,849 | |

Johnson & Johnson | | | 32,025 | | | | 5,700,450 | |

STERIS PLC (b) | | | 1,249 | | | | 231,989 | |

Teleflex, Inc. | | | 565 | | | | 132,278 | |

The Cooper Cos., Inc. | | | 592 | | | | 187,279 | |

Zimmer Biomet Holdings, Inc. | | | 2,600 | | | | 312,260 | |

| | | | | | | | 11,168,786 | |

Miscellaneous Store Retailers — 0.2% | | | | | | | | |

Tractor Supply Co. | | | 1,346 | | | | 304,613 | |

| | | | | | | | | |

Motor Vehicle and Parts Dealers — 0.4% | | | | | | | | |

Advance Auto Parts, Inc. | | | 735 | | | | 110,978 | |

O’Reilly Automotive, Inc. (a) | | | 754 | | | | 651,863 | |

Sensata Technologies Holding PLC (b) | | | 1,913 | | | | 86,276 | |

| | | | | | | | 849,117 | |

| | Shares | | | Value | |

Nonmetallic Mineral Product Manufacturing — 0.2% | | | | | | | | |

Corning, Inc. | | | 9,362 | | | $ | 319,525 | |

Mohawk Industries, Inc. (a) | | | 644 | | | | 65,257 | |

| | | | | | | | 384,782 | |

Nonstore Retailers — 0.2% | | | | | | | | |

eBay, Inc. | | | 6,858 | | | | 311,628 | |

| | | | | | | | | |

Oil and Gas Extraction — 1.8% | | | | | | | | |

Coterra Energy, Inc. | | | 9,500 | | | | 265,145 | |

Devon Energy Corp. | | | 8,076 | | | | 553,368 | |

EOG Resources, Inc. | | | 7,259 | | | | 1,030,270 | |

Marathon Oil Corp. | | | 8,383 | | | | 256,771 | |

Phillips 66 | | | 5,979 | | | | 648,363 | |

Pioneer Natural Resources Co. | | | 2,963 | | | | 699,238 | |

| | | | | | | | 3,453,155 | |

Other Information Services — 1.7% | | | | | | | | |

Meta Platforms, Inc. - Class A (a) | | | 28,365 | | | | 3,349,907 | |

| | | | | | | | | |

Paper Manufacturing — 0.2% | | | | | | | | |

International Paper Co. | | | 4,446 | | | | 165,036 | |

Packaging Corp. of America | | | 1,257 | | | | 170,814 | |

Westrock Co. | | | 3,420 | | | | 129,686 | |

| | | | | | | | 465,536 | |

Personal and Laundry Services — 0.0% (d) | | | | | | | | |

IAC, Inc. (a) | | | 961 | | | | 49,866 | |

| | | | | | | | | |

Petroleum and Coal Products Manufacturing — 3.7% | | | | | | | | |

Exxon Mobil Corp. | | | 51,507 | | | | 5,734,789 | |

Marathon Petroleum Corp. | | | 6,118 | | | | 745,234 | |

Valero Energy Corp. | | | 4,862 | | | | 649,660 | |

| | | | | | | | 7,129,683 | |

Plastics and Rubber Products Manufacturing — 0.0% (d) | | | | | | | | |

Newell Brands, Inc. | | | 4,663 | | | | 60,479 | |

| | | | | | | | | |

Primary Metal Manufacturing — 0.1% | | | | | | | | |

Steel Dynamics, Inc. | | | 2,132 | | | | 221,579 | |

| | | | | | | | | |

Professional, Scientific and Technical Services — 2.2% | | | | | | | | |

Amdocs Ltd. (b) | | | 1,478 | | | | 131,335 | |

AppLovin Corp. - Class A (a) | | | 2,774 | | | | 39,973 | |

Cognizant Technology Solutions Corp. - Class A | | | 6,408 | | | | 398,642 | |

Eaton Corp. PLC (b) | | | 4,968 | | | | 812,020 | |

Exact Sciences Corp. (a) | | | 2,194 | | | | 98,620 | |

The accompanying notes are an integral part of the financial statements.

5

Wahed FTSE USA Shariah ETF

Schedule of Investments

November 30, 2022 (Unaudited) (Continued)

| | Shares | | | Value | |

Professional, Scientific and Technical Services (continued) | | | | | | | | |

F5, Inc. (a) | | | 734 | | | $ | 113,484 | |

Gartner, Inc. (a) | | | 949 | | | | 332,501 | |

Gen Digital, Inc. | | | 7,100 | | | | 163,016 | |

ICON PLC (a) | | | 991 | | | | 213,501 | |

Omnicom Group, Inc. | | | 2,543 | | | | 202,830 | |

Palo Alto Networks, Inc. (a) | | | 3,575 | | | | 607,392 | |

Paychex, Inc. | | | 3,956 | | | | 490,663 | |

Paycom Software, Inc. (a) | | | 632 | | | | 214,311 | |

The Interpublic Group of Cos., Inc. | | | 4,944 | | | | 169,876 | |

Vmware, Inc. - Class A (a) | | | 2,186 | | | | 265,577 | |

| | | | | | | | 4,253,741 | |

Publishing Industries (except Internet) — 16.1% | | | | | | | | |

Adobe, Inc. (a) | | | 5,825 | | | | 2,009,217 | |

Akamai Technologies, Inc. (a) | | | 1,936 | | | | 183,649 | |

ANSYS, Inc. (a) | | | 1,076 | | | | 273,627 | |

Autodesk, Inc. (a) | | | 2,675 | | | | 540,216 | |

Bill.com Holdings, Inc. (a) | | | 1,212 | | | | 145,949 | |

Cadence Design Systems, Inc. (a) | | | 3,351 | | | | 576,506 | |

Ceridian HCM Holding, Inc. (a) | | | 1,707 | | | | 116,827 | |

Electronic Arts, Inc. | | | 3,429 | | | | 448,445 | |

Microsoft Corp. | | | 92,399 | | | | 23,574,681 | |

News Corp. - Class A | | | 4,884 | | | | 93,529 | |

News Corp. - Class B | | | 1,520 | | | | 29,564 | |

Okta, Inc. (a) | | | 1,910 | | | | 101,841 | |

PTC, Inc. (a) | | | 1,302 | | | | 165,627 | |

salesforce.com, Inc. (a) | | | 11,900 | | | | 1,906,975 | |

Synopsys, Inc. (a) | | | 1,891 | | | | 642,070 | |

Tyler Technologies, Inc. (a) | | | 502 | | | | 172,055 | |

Yandex NV - Class A (a)(b)(e)(f) | | | 3,809 | | | | — | |

ZoomInfo Technologies, Inc. (a) | | | 3,506 | | | | 100,272 | |

| | | | | | | | 31,081,050 | |

Securities, Commodity Contracts, and Other Financial Investments and Related Activities — 0.0% (d) | | | | | | | | |

Clarivate PLC (a)(b) | | | 5,888 | | | | 57,644 | |

| | | | | | | | | |

Specialty Trade Contractors — 0.1% | | | | | | | | |

Quanta Services, Inc. | | | 1,761 | | | | 263,939 | |

| | | | | | | | | |

Support Activities for Agriculture and Forestry — 0.3% | | | | | | | | |

Corteva, Inc. | | | 8,787 | | | | 590,135 | |

| | | | | | | | | |

Support Activities for Mining — 2.1% | | | | | | | | |

ConocoPhillips | | | 15,900 | | | | 1,963,809 | |

Diamondback Energy, Inc. | | | 2,155 | | | | 318,983 | |

Halliburton Co. | | | 11,372 | | | | 430,885 | |

| | Shares | | | Value | |

Support Activities for Mining (continued) | | | | | | | | |

Hess Corp. | | | 3,523 | | | $ | 506,995 | |

Schlumberger Ltd. (b) | | | 17,304 | | | | 892,021 | |

| | | | | | | | 4,112,693 | |

Support Activities for Transportation — 0.2% | | | | | | | | |

Expeditors International of Washington, Inc. | | | 1,927 | | | | 223,648 | |

JB Hunt Transport Services, Inc. | | | 1,052 | | | | 193,452 | |

XPO Logistics, Inc. (a) | | | 1,339 | | | | 51,712 | |

| | | | | | | | 468,812 | |

Telecommunications — 0.2% | | | | | | | | |

ResMed, Inc. | | | 1,794 | | | | 412,979 | |

| | | | | | | | | |

Transit and Ground Passenger Transportation — 0.4% | | | | | | | | |

Uber Technologies, Inc. (a) | | | 23,346 | | | | 680,302 | |

| | | | | | | | | |

Transportation Equipment Manufacturing — 3.9% | | | | | | | | |

Aptiv PLC (a)(b) | | | 3,347 | | | | 357,024 | |

Autoliv, Inc. | | | 1,071 | | | | 94,676 | |

BorgWarner, Inc. | | | 2,893 | | | | 122,981 | |

Gentex Corp. | | | 2,837 | | | | 81,989 | |

Lear Corp. | | | 721 | | | | 103,997 | |

PACCAR, Inc. | | | 4,195 | | | | 444,292 | |

Tesla, Inc. (a) | | | 31,428 | | | | 6,119,032 | |

Westinghouse Air Brake Technologies Corp. | | | 2,261 | | | | 228,564 | |

| | | | | | | | 7,552,555 | |

Truck Transportation — 0.2% | | | | | | | | |

Old Dominion Freight Line, Inc. | | | 1,264 | | | | 382,499 | |

| | | | | | | | | |

Utilities — 0.8% | | | | | | | | |

Avangrid, Inc. | | | 865 | | | | 36,996 | |

Constellation Energy Corp. | | | 4,046 | | | | 388,902 | |

NRG Energy, Inc. | | | 2,935 | | | | 124,591 | |

PPL Corp. | | | 8,985 | | | | 265,237 | |

Sempra Energy | | | 3,865 | | | | 642,324 | |

Vistra Corp. | | | 5,073 | | | | 123,426 | |

| | | | | | | | 1,581,476 | |

TOTAL COMMON STOCKS (Cost $168,532,641) | | | | | | | 190,485,279 | |

The accompanying notes are an integral part of the financial statements.

6

Wahed FTSE USA Shariah ETF

Schedule of Investments

November 30, 2022 (Unaudited) (Continued)

| | Shares | | | Value | |

REAL ESTATE INVESTMENT TRUSTS (REITs) — 1.0% | | | | | | | | |

Real Estate — 0.8% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 1,999 | | | $ | 311,064 | |

Prologis, Inc. | | | 9,036 | | | | 1,064,350 | |

Regency Centers Corp. | | | 2,103 | | | | 139,702 | |

| | | | | | | | 1,515,116 | |

Wood Product Manufacturing — 0.2% | | | | | | | | |

Weyerhaeuser Co. | | | 9,227 | | | | 301,815 | |

TOTAL REITS | | | | | | | |

| (Cost $1,800,565) | | | | | | | 1,816,931 | |

| | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | |

| (Cost $170,333,206) — 99.6% | | | | | | | 192,302,210 | |

Other assets and liabilities, net — 0.4% | | | | | | | 820,544 | |

NET ASSETS — 100.0% | | | | | | $ | 193,122,754 | |

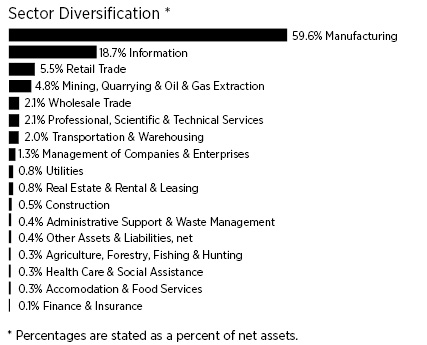

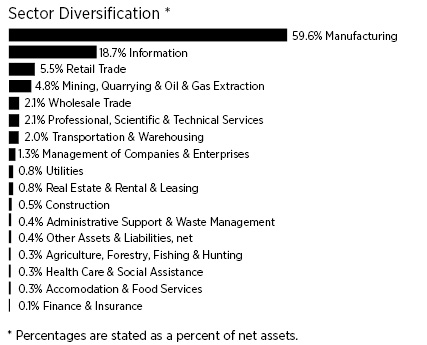

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

(a) | Non-income producing security. |

(b) | Foreign issued security. |

(c) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. |

(d) | Amount is less than 0.05%. |

(e) | Value determined based on estimated fair value. The value of this security totals $-, which represents 0.00% of total net assets. Classified as Level 3 in the fair value hierarchy. Please refer to Note 2 of the Notes to Financial Statements. |

(f) | Security has been deemed illiquid according to the Fund’s liquidity guidelines. The value of these securities total $-, which represents 0.0% of total net assets. |

The accompanying notes are an integral part of the financial statements.

7

Wahed Dow Jones Islamic World ETF

Schedule of Investments

November 30, 2022 (Unaudited)

| | Shares | | | Value | |

COMMON STOCKS — 99.3% (b) | | | | | | | | |

Aerospace and Defense — 0.6% | | | | | | | | |

Safran SA | | | 1,785 | | | $ | 215,810 | |

| | | | | | | | | |

Apparel and Textile Products — 2.7% | | | | | | | | |

adidas AG | | | 910 | | | | 114,556 | |

Hermes International | | | 2,725 | | | | 354,801 | |

Cie Financiere Richemont SA | | | 164 | | | | 260,472 | |

Kering SA | | | 362 | | | | 211,490 | |

| | | | | | | | 941,319 | |

Automotive — 1.5% | | | | | | | | |

BYD Co. Ltd. - Class H | | | 4,788 | | | | 117,469 | |

Denso Corp. | | | 2,625 | | | | 141,352 | |

Ferrari NV | | | 673 | | | | 146,838 | |

NIO, Inc. - ADR (a) | | | 7,445 | | | | 95,147 | |

| | | | | | | | 500,806 | |

Biotechnology and Pharmaceuticals — 16.6% | | | | | | | | |

Astellas Pharma, Inc. | | | 9,634 | | | | 146,920 | |

AstraZeneca PLC | | | 5,442 | | | | 723,656 | |

CSL Ltd. | | | 2,542 | | | | 510,899 | |

Daiichi Sankyo Co. Ltd. | | | 10,274 | | | | 332,650 | |

Genmab A/S (a) | | | 334 | | | | 151,148 | |

Novartis AG | | | 12,455 | | | | 1,093,530 | |

Novo Nordisk A/S - Class B | | | 8,367 | | | | 1,023,911 | |

Roche Holding AG - Non-Voting Share | | | 3,516 | | | | 1,135,896 | |

Roche Holding AG - Voting Share | | | 131 | | | | 52,029 | |

Sanofi | | | 5,930 | | | | 528,034 | |

| | | | | | | | 5,698,673 | |

| | Shares | | | Value | |

Chemicals — 2.9% | | | | | | | | |

Air Liquide SA | | | 2,685 | | | $ | 382,126 | |

Givaudan SA | | | 29 | | | | 96,367 | |

Koninklijke DSM NV | | | 893 | | | | 112,453 | |

LG Chem Ltd. | | | 227 | | | | 127,369 | |

Shin-Etsu Chemical Co. Ltd. | | | 2,214 | | | | 278,773 | |

| | | | | | | | 997,088 | |

Commercial Support Services — 2.8% | | | | | | | | |

Compass Group PLC | | | 22,254 | | | | 496,123 | |

Recruit Holdings Co. Ltd. | | | 8,966 | | | | 278,155 | |

Waste Connections, Inc. | | | 1,344 | | | | 192,465 | |

| | | | | | | | 966,743 | |

Construction Materials — 0.6% | | | | | | | | |

Sika AG | | | 755 | | | | 187,809 | |

| | | | | | | | | |

E-Commerce Discretionary — 4.6% | | | | | | | | |

JD.com, Inc. - ADR | | | 23,990 | | | | 1,371,748 | |

Pinduoduo, Inc. - ADR (a) | | | 2,689 | | | | 220,606 | |

| | | | | | | | 1,592,354 | |

Electrical Equipment — 2.9% | | | | | | | | |

ABB, Ltd. | | | 8,859 | | | | 272,999 | |

Assa Abloy AB - Class B | | | 5,083 | | | | 113,588 | |

Daikin Industries Ltd. | | | 1,514 | | | | 243,093 | |

Schneider Electric SE | | | 2,582 | | | | 369,328 | |

| | | | | | | | 999,008 | |

Food — 2.9% | | | | | | | | |

Nestle SA | | | 8,550 | | | | 1,008,142 | |

| | | | | | | | | |

Health Care Facilities and Services — 0.9% | | | | | | | | |

Lonza Group AG | | | 364 | | | | 187,282 | |

Wuxi Biologics Cayman, Inc. (a)(c) | | | 18,803 | | | | 120,808 | |

| | | | | | | | 308,090 | |

Household Products — 6.2% | | | | | | | | |

Kao Corp. | | | 17,549 | | | | 686,793 | |

L’Oreal SA | | | 1,318 | | | | 481,493 | |

Reckitt Benckiser Group PLC | | | 3,837 | | | | 271,793 | |

Unilever PLC | | | 13,807 | | | | 681,389 | |

| | | | | | | | 2,121,468 | |

Industrial Support Services — 0.4% | | | | | | | | |

Ferguson PLC | | | 1,203 | | | | 134,125 | |

| | | | | | | | | |

Internet, Media and Services — 5.9% | | | | | | | | |

Meituan - Class B (a)(c) | | | 21,680 | | | | 454,404 | |

NAVER Corp. | | | 795 | | | | 112,723 | |

Prosus NV | | | 6,290 | | | | 404,718 | |

Tencent Holdings Ltd. | | | 28,232 | | | | 1,038,784 | |

| | | | | | | | 2,010,629 | |

The accompanying notes are an integral part of the financial statements.

8

Wahed Dow Jones Islamic World ETF

Schedule of Investments

November 30, 2022 (Unaudited) (Continued)

| | Shares | | | Value | |

Machinery — 3.1% | | | | | | | | |

Atlas Copco AB - Class A | | | 13,208 | | | $ | 159,975 | |

Atlas Copco AB - Class B | | | 8,124 | | | | 89,104 | |

FANUC Corp. | | | 972 | | | | 141,857 | |

Keyence Corp. | | | 1,055 | | | | 432,010 | |

SMC Corp. | | | 297 | | | | 131,451 | |

Techtronic Industries Co. Ltd. | | | 9,778 | | | | 116,251 | |

| | | | | | | | 1,070,648 | |

Medical Equipment and Devices — 2.6% | | | | | | | | |

Alcon, Inc. | | | 2,639 | | | | 177,438 | |

EssilorLuxottica SA | | | 1,565 | | | | 285,703 | |

Hoya Corp. | | | 1,901 | | | | 191,544 | |

Olympus Corp. | | | 6,755 | | | | 135,836 | |

Terumo Corp. | | | 4,009 | | | | 116,156 | |

| | | | | | | | 906,677 | |

Metals and Mining — 6.5% | | | | | | | | |

Anglo American PLC | | | 6,778 | | | | 275,051 | |

Barrick Gold Corp. | | | 8,830 | | | | 142,966 | |

BHP Group Ltd. | | | 26,365 | | | | 803,728 | |

Rio Tinto Ltd. | | | 2,720 | | | | 199,681 | |

Rio Tinto PLC | | | 7,607 | | | | 505,956 | |

Vale SA - ADR | | | 18,981 | | | | 313,186 | |

| | | | | | | | 2,240,568 | |

Oil and Gas Producers — 1.0% | | | | | | | | |

Canadian Natural Resources Ltd. | | | 5,769 | | | | 341,748 | |

Lukoil PJSC - ADR (d)(e) | | | 3,928 | | | | — | |

Lukoil PJSC - GDR (d)(e) | | | 224 | | | | — | |

| | | | | | | | 341,748 | |

Renewable Energy — 0.4% | | | | | | | | |

Vestas Wind Systems A/S | | | 5,342 | | | | 132,712 | |

| | | | | | | | | |

Retail - Discretionary — 1.5% | | | | | | | | |

Fast Retailing Co. Ltd. | | | 319 | | | | 184,738 | |

Industria de Diseno Textil SA | | | 5,550 | | | | 142,064 | |

Wesfarmers Ltd. | | | 6,040 | | | | 196,465 | |

| | | | | | | | 523,267 | |

Semiconductors — 14.1% | | | | | | | | |

ASML Holding NV | | | 2,122 | | | | 1,225,962 | |

Infineon Technologies AG | | | 23,333 | | | | 757,265 | |

SK Hynix, Inc. | | | 2,862 | | | | 184,456 | |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 29,028 | | | | 2,408,743 | |

Tokyo Electron Ltd. | | | 834 | | | | 269,493 | |

| | | | | | | | 4,845,919 | |

| | Shares | | | Value | |

Software — 6.1% | | | | | | | | |

Atlassian Corp. PLC - Class A (a) | | | 1,612 | | | $ | 212,059 | |

Constellation Software, Inc. | | | 98 | | | | 156,757 | |

Dassault Systemes SE | | | 3,593 | | | | 129,799 | |

SAP SE | | | 5,623 | | | | 604,797 | |

Shopify, Inc. - Class A (a) | | | 24,541 | | | | 1,000,321 | |

| | | | | | | | 2,103,733 | |

Technology Hardware — 6.6% | | | | | | | | |

Murata Manufacturing Co. Ltd. | | | 3,348 | | | | 179,085 | |

Nidec Corp. | | | 2,815 | | | | 172,160 | |

Nintendo Co. Ltd. | | | 6,062 | | | | 256,052 | |

Samsung Electronics Co. Ltd. | | | 27,154 | | | | 1,280,645 | |

Samsung SDI Co. Ltd. | | | 287 | | | | 158,640 | |

Telefonaktiebolaget LM Ericsson - Class B | | | 16,138 | | | | 98,549 | |

Xiaomi Corp. - Class B (a)(c) | | | 77,482 | | | | 102,442 | |

| | | | | | | | 2,247,573 | |

Technology Services — 3.1% | | | | | | | | |

Adyen NV (a)(c) | | | 131 | | | | 197,444 | |

Amadeus IT Group SA (a) | | | 2,117 | | | | 111,735 | |

Capgemini SE | | | 788 | | | | 138,744 | |

Experian PLC | | | 5,066 | | | | 175,262 | |

RELX PLC | | | 10,434 | | | | 287,286 | |

Wolters Kluwer NV | | | 1,378 | | | | 149,264 | |

| | | | | | | | 1,059,735 | |

Transportation and Logistics — 2.8% | | | | | | | | |

Canadian National Railway Co. | | | 3,164 | | | | 403,033 | |

Canadian Pacific Railway Ltd. | | | 4,858 | | | | 394,639 | |

DSV A/S | | | 993 | | | | 153,822 | |

| | | | | | | | 951,494 | |

TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $39,366,479) — 99.3% | | | | | | | 34,106,138 | |

| | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | |

| (Cost $39,366,479) — 99.3% | | | | | | | 34,106,138 | |

Other assets and liabilities, net — 0.7% | | | | | | | 251,019 | |

NET ASSETS — 100.0% | | | | | | $ | 34,357,157 | |

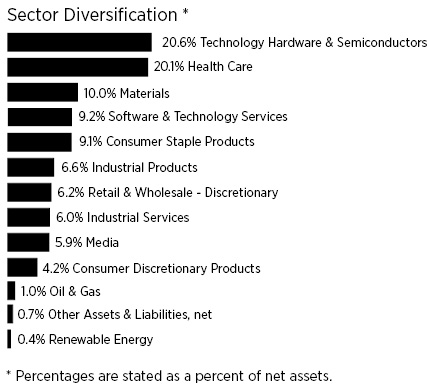

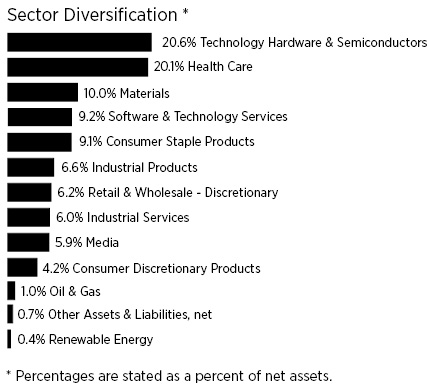

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

GDR - Global Depositary Receipt

PLC - Public Limited Company

(a) | Non-income producing security. |

(b) | Foreign issued security. |

The accompanying notes are an integral part of the financial statements.

9

Wahed Dow Jones Islamic World ETF

Schedule of Investments

November 30, 2022 (Unaudited) (Continued)

(c) | Security exempt from registration pursuant to Rule 144a under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

(d) | Value determined based on estimated fair value. The value of this security totals $-, which represents 0.00% of total net assets. Classified as Level 3 in the fair value hierarchy. Please refer to Note 2 of the Notes to Financial Statements. |

(e) | Security has been deemed illiquid according to the Fund’s liquidity guidelines. The value of these securities total $-, which represents 0.0% of total net assets. |

COUNTRY | Percentage of

Net Assets |

Switzerland | 13.3% |

Japan | 12.6% |

United Kingdom | 10.7% |

Cayman Islands | 9.9% |

France | 8.7% |

Canada | 7.7% |

Taiwan | 7.0% |

Netherlands | 6.5% |

Republic of Korea | 5.4% |

Australia | 5.0% |

Germany | 4.3% |

Denmark | 4.3% |

Sweden | 1.3% |

Brazil | 0.9% |

Spain | 0.7% |

Jersey | 0.4% |

China | 0.3% |

Hong Kong | 0.3% |

Russian Federation | 0.0%* |

Total Country | 99.3% |

TOTAL INVESTMENTS | 99.3% |

Other assets and liabilities, net | 0.7% |

NET ASSETS | 100.0% |

* | Less than 0.05% of net assets. |

The accompanying notes are an integral part of the financial statements.

10

Wahed ETFs

Statements of Assets and Liabilities

November 30, 2022 (Unaudited)

| | | Wahed FTSE USA

Shariah ETF | | | Wahed Dow Jones

Islamic World ETF | |

Assets | | | | | | | | |

Investments, at value (cost $170,333,206 and $39,366,479, respectively) | | $ | 192,302,210 | | | $ | 34,106,138 | |

Cash | | | 490,985 | | | | 215,387 | |

Dividends receivable | | | 404,968 | | | | 52,717 | |

Other receivables | | | — | | | | 19 | |

Total assets | | | 193,198,163 | | | | 34,374,261 | |

| | | | | | | | | |

Liabilities | | | | | | | | |

Payable to Adviser | | | 75,409 | | | | 17,104 | |

Total liabilities | | | 75,409 | | | | 17,104 | |

Net Assets | | $ | 193,122,754 | | | $ | 34,357,157 | |

| | | | | | | | | |

Net Assets Consists of: | | | | | | | | |

Paid-in capital | | $ | 180,932,240 | | | $ | 40,394,950 | |

Total distributable earnings (accumulated losses) | | | 12,190,514 | | | | (6,037,793 | ) |

Net Assets | | $ | 193,122,754 | | | $ | 34,357,157 | |

| | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 5,125,000 | | | | 1,750,000 | |

Net Asset Value, redemption price and offering price per share | | $ | 37.68 | | | $ | 19.63 | |

The accompanying notes are an integral part of the financial statements.

11

Wahed ETFs

Statements of Operations

For the Six Months Ended November 30, 2022 (Unaudited)

| | | Wahed FTSE USA

Shariah ETF | | | Wahed Dow Jones

Islamic World ETF | |

Investment Income | | | | | | | | |

Dividend income (net of withholding tax and issuance fees of $570 and $20,190, respectively) | | $ | 1,449,644 | | | $ | 202,279 | |

Total investment income | | | 1,449,644 | | | | 202,279 | |

| | | | | | | | | |

Expenses | | | | | | | | |

Investment advisory fees | | | 426,603 | | | | 97,653 | |

Total expenses | | | 426,603 | | | | 97,653 | |

Net Investment Income | | | 1,023,041 | | | | 104,626 | |

| | | | | | | | | |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investments | | | (7,576,806 | ) | | | (775,373 | ) |

Foreign currency transactions | | | — | | | | (1,803 | ) |

Net realized loss on investments and foreign currency transactions | | | (7,576,806 | ) | | | (777,176 | ) |

Net change in unrealized appreciation/depreciation on: | | | | | | | | |

Investments | | | 5,268,267 | | | | (115,918 | ) |

Foreign currency translation | | | — | | | | (148 | ) |

Net change in unrealized appreciation/depreciation on investments and foreign currency translation | | | 5,268,267 | | | | (116,066 | ) |

Net realized and unrealized loss on investments | | | (2,308,539 | ) | | | (893,242 | ) |

Net decrease in net assets from operations | | $ | (1,285,498 | ) | | $ | (788,616 | ) |

The accompanying notes are an integral part of the financial statements.

12

Wahed FTSE USA Shariah ETF

Statements of Changes in Net Assets

| | | Six Months

Ended

November 30,

2022

(Unaudited) | | | Year Ended

May 31, 2022 | |

From Operations | | | | | | | | |

Net investment income | | $ | 1,023,041 | | | $ | 1,539,832 | |

Net realized gain (loss) on investments | | | (7,576,806 | ) | | | 8,424,889 | |

Net change in net unrealized appreciation/depreciation on investments | | | 5,268,267 | | | | (3,373,278 | ) |

Net increase (decrease) in net assets resulting from operations | | | (1,285,498 | ) | | | 6,591,443 | |

| | | | | | | | | |

From Distributions | | | | | | | | |

Distributable earnings | | | (925,930 | ) | | | (1,384,308 | ) |

Total distributions | | | (925,930 | ) | | | (1,384,308 | ) |

| | | | | | | | | |

From Capital Share Transactions | | | | | | | | |

Proceeds from shares sold | | | 31,399,750 | | | | 79,475,180 | |

Cost of shares redeemed | | | (3,551,177 | ) | | | (26,702,197 | ) |

Net increase in net assets resulting from capital share transactions | | | 27,848,573 | | | | 52,772,983 | |

| | | | | | | | | |

Total Increase in Net Assets | | | 25,637,145 | | | | 57,980,118 | |

| | | | | | | | | |

Net Assets | | | | | | | | |

Beginning of period | | | 167,485,609 | | | | 109,505,491 | |

End of period | | $ | 193,122,754 | | | $ | 167,485,609 | |

| | | | | | | | | |

Changes in Shares Outstanding | | | | | | | | |

Shares outstanding, beginning of period | | | 4,350,000 | | | | 3,000,000 | |

Shares sold | | | 875,000 | | | | 2,000,000 | |

Shares redeemed | | | (100,000 | ) | | | (650,000 | ) |

Shares outstanding, end of period | | | 5,125,000 | | | | 4,350,000 | |

The accompanying notes are an integral part of the financial statements.

13

Wahed Dow Jones Islamic World ETF

Statements of Changes in Net Assets

| | | Six Months

Ended

November 30,

2022

(Unaudited) | | | Period Ended

May 31, 2022(1) | |

From Operations | | | | | | | | |

Net investment income | | $ | 104,626 | | | $ | 317,520 | |

Net realized gain (loss) on investments and foreign currency transactions | | | (777,176 | ) | | | 70,376 | |

Net change in net unrealized appreciation/depreciation on investments and foreign currency translation | | | (116,066 | ) | | | (5,144,423 | ) |

Net decrease in net assets resulting from operations | | | (788,616 | ) | | | (4,756,527 | ) |

| | | | | | | | | |

From Distributions | | | | | | | | |

Distributable earnings | | | (330,150 | ) | | | (162,500 | ) |

Total distributions | | | (330,150 | ) | | | (162,500 | ) |

| | | | | | | | | |

From Capital Share Transactions | | | | | | | | |

Proceeds from shares sold | | | 3,396,580 | | | | 36,975,825 | |

Transaction fees (Note 4) | | | 1,880 | | | | 20,665 | |

Net increase in net assets resulting from capital share transactions | | | 3,398,460 | | | | 36,996,490 | |

| | | | | | | | | |

Total Increase in Net Assets | | | 2,279,694 | | | | 32,077,463 | |

| | | | | | | | | |

Net Assets | | | | | | | | |

Beginning of period | | | 32,077,463 | | | | — | |

End of period | | $ | 34,357,157 | | | $ | 32,077,463 | |

| | | | | | | | | |

Changes in Shares Outstanding | | | | | | | | |

Shares outstanding, beginning of period | | | 1,550,000 | | | | — | |

Shares sold | | | 200,000 | | | | 1,550,000 | |

Shares redeemed | | | — | | | | — | |

Shares outstanding, end of period | | | 1,750,000 | | | | 1,550,000 | |

(1) | The Fund commenced operations on January 7, 2022. |

The accompanying notes are an integral part of the financial statements.

14

Wahed FTSE USA Shariah ETF

Financial Highlights

For a Share Outstanding Throughout Each Period

| | | Six Months

Ended

November 30,

2022

(Unaudited) | | | Year Ended

May 31, 2022 | | | Year Ended

May 31, 2021 | | | Period Ended

May 31, 2020(1) | |

Net Asset Value, Beginning of Period | | $ | 38.50 | | | $ | 36.50 | | | $ | 26.00 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | | |

Income (Loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income(2) | | | 0.22 | | | | 0.40 | | | | 0.36 | | | | 0.40 | |

Net realized and unrealized gain (loss) on investments | | | (0.84 | ) | | | 1.96 | | | | 10.44 | | | | 0.90 | |

Total from investment operations | | | (0.62 | ) | | | 2.36 | | | | 10.80 | | | | 1.30 | |

| | | | | | | | | | | | | | | | | |

Less distributions paid: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.20 | ) | | | (0.36 | ) | | | (0.30 | ) | | | (0.28 | ) |

From net realized gains | | | — | | | | — | | | | — | | | | (0.02 | ) |

Total distributions paid | | | (0.20 | ) | | | (0.36 | ) | | | (0.30 | ) | | | (0.30 | ) |

| | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 37.68 | | | $ | 38.50 | | | $ | 36.50 | | | $ | 26.00 | |

| | | | | | | | | | | | | | | | | |

Total return, at NAV(3)(4) | | | -1.57 | % | | | 6.43 | % | | | 41.70 | % | | | 5.30 | % |

Total return, at Market(3)(4) | | | -1.76 | % | | | 6.50 | % | | | 41.81 | % | | | 5.39 | % |

| | | | | | | | | | | | | | | | | |

Supplemental Data and Ratios: | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 193,123 | | | $ | 167,486 | | | $ | 109,505 | | | $ | 32,506 | |

| | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets(5) | | | 0.50 | % | | | 0.50 | % | | | 0.50 | % | | | 0.50 | % |

| | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets(5) | | | 1.20 | % | | | 1.01 | % | | | 1.08 | % | | | 1.81 | % |

| | | | | | | | | | | | | | | | | |

Portfolio turnover rate(4)(6) | | | 18 | % | | | 16 | % | | | 19 | % | | | 15 | % |

(1) | The Fund commenced operations on July 15, 2019. |

(2) | Per share net investment income was caclulated using average shares outstanding. |

(3) | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

(4) | Not annualized for periods less than one year. |

(5) | Annualized for periods less than one year. |

(6) | Excludes in-kind transactions associated with creations and redemptions of the Fund. |

The accompanying notes are an integral part of the financial statements.

15

Wahed Dow Jones Islamic World ETF

Financial Highlights

For a Share Outstanding Throughout each Period

| | | Six Months

Ended

November 30,

2022

(Unaudited) | | | Period Ended

May 31, 2022(1) | |

Net Asset Value, Beginning of Period | | $ | 20.70 | | | $ | 25.00 | |

| | | | | | | | | |

Income (Loss) from investment operations: | | | | | | | | |

Net investment income(2) | | | 0.07 | | | | 0.25 | |

Net realized and unrealized loss on investments and foreign currency | | | (0.93 | ) | | | (4.44 | ) |

Total from investment operations | | | (0.86 | ) | | | (4.19 | ) |

| | | | | | | | | |

Less distributions paid: | | | | | | | | |

From net investment income | | | (0.21 | ) | | | (0.13 | ) |

Total distributions paid | | | (0.21 | ) | | | (0.13 | ) |

| | | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Transaction fees (See Note 4) | | | 0.00 | (7) | | | 0.02 | |

| | | | | | | | | |

Net Asset Value, End of Period | | $ | 19.63 | | | $ | 20.70 | |

| | | | | | | | | |

Total return, at NAV(3)(4) | | | -3.94 | % | | | -16.76 | % |

Total return, at Market(3)(4) | | | -2.25 | % | | | -16.62 | % |

| | | | | | | | | |

Supplemental Data and Ratios: | | | | | | | | |

Net assets, end of period (000’s) | | $ | 34,357 | | | $ | 32,077 | |

| | | | | | | | | |

Ratio of expenses to average net assets(5) | | | 0.65 | % | | | 0.65 | % |

| | | | | | | | | |

Ratio of net investment income to average net assets(5) | | | 0.70 | % | | | 2.91 | % |

| | | | | | | | | |

Portfolio turnover rate (4)(6) | | | 7 | % | | | 8 | % |

(1) | The Fund commenced operations on January 7, 2022. |

(2) | Per share net investment income was caclulated using average shares outstanding. |

(3) | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

(4) | Not annualized for periods less than one year. |

(5) | Annualized for periods less than one year. |

(6) | Excludes in-kind transactions associated with creations and redemptions of the Fund. |

The accompanying notes are an integral part of the financial statements.

16

Wahed ETFs

Notes to Financial Statements

November 30, 2022 (Unaudited)

1. ORGANIZATION

The Wahed FTSE USA Shariah ETF (“HLAL”) and Wahed Dow Jones Islamic World ETF (“UMMA”) (each a “Fund” and collectively, the “Funds”) are non-diversified series of Listed Funds Trust (the “Trust”), formerly Active Weighting Funds ETF Trust. The Trust was organized as a Delaware statutory trust on August 26, 2016, under a Declaration of Trust amended on December 21, 2018, and is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

HLAL is a passively-managed exchange-traded fund (“ETF”). The Fund’s objective is to track the total return performance, before fees and expenses, of the FTSE USA Shariah Index (the “Index”). The Index is composed of common stocks of large and mid-capitalization U.S. companies the characteristics of which meet the requirements of the Shariah and are consistent with Islamic principles as interpreted by subject-matter experts.

UMMA is an actively-managed ETF. The Fund’s objective is to seek long-term capital appreciation. UMMA seeks to achieve its objective by investing in a portfolio of global companies (excluding U.S. domiciled companies) the characteristics of which meet the requirements of Shariah and are consistent with Islamic principles as interpreted by subject-matter experts. Wahed Invest LLC (“Wahed” or the “Adviser”), the Fund’s investment adviser, seeks to invest the Fund’s assets in securities similar to the components of, and to achieve returns similar to those of, the Dow Jones Islamic International Titans 100 Index (the “Index”). The Index is a data-driven index owned and maintained by S&P Dow Jones Indices, is designed to measure the stock performance of the largest ex-U.S. companies that have passed rules-based screens for adherence to Shariah investment guidelines. The Fund commenced operations on January 7, 2022.

Costs incurred by the Funds in connection with the organization, registration and the initial public offering of shares were paid by the Adviser.

2. SIGNIFICANT ACCOUNTING POLICIES

Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. Each Fund prepares its financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and follows the significant accounting policies described below.

Use of Estimates

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Share Transactions

The net asset value (“NAV”) per share of each Fund will be equal to each Fund’s total assets minus each Fund’s total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the New York Stock Exchange (“NYSE”) is open for trading.

Fair Value Measurement

In calculating the NAV, each Fund’s exchange-traded equity securities will be valued at fair value, which will generally be determined using the last reported official closing or last trading price on the exchange or market on which the security is primarily traded at the time of valuation. Such valuations are typically categorized as Level 1 in the fair value hierarchy described below.

Securities listed on the NASDAQ Stock Market, Inc. are generally valued at the NASDAQ official closing price.

17

Wahed ETFs

Notes to Financial Statements

November 30, 2022 (Unaudited) (Continued)

If market quotations are not readily available, or if it is determined that a quotation of a security does not represent fair value, then the security is valued at fair value as determined in good faith by the Adviser using procedures adopted by the Board of Trustees of the Trust (the “Board”). The circumstances in which a security may be fair valued include, among others: the occurrence of events that are significant to a particular issuer, such as mergers, restructurings or defaults; the occurrence of events that are significant to an entire market, such as natural disasters in a particular region or government actions; trading restrictions on securities; thinly traded securities; and market events such as trading halts and early market closings. Due to the inherent uncertainty of valuations, fair values may differ significantly from the values that would have been used had an active market existed. Fair valuation could result in a different NAV than a NAV determined by using market quotations. Such valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy described below.

FASB ASC Topic 820, Fair Value Measurements and Disclosures (“ASC 820”) defines fair value, establishes a framework for measuring fair value in accordance with U.S. GAAP, and requires disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly, and how that information must be incorporated into fair value measurements. Under ASC 820, various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the following hierarchy:

| | ● | Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| | ● | Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | ● | Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

Foreign securities, currencies and other assets denominated in foreign currencies are translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar using the applicable currency exchange rates as of the close of the NYSE, generally 4:00 p.m. Eastern Time.

All other securities and investments for which market values are not readily available, including restricted securities, and those securities for which it is inappropriate to determine prices in accordance with the aforementioned procedures, are valued at fair value as determined in good faith under procedures adopted by the Board, although the actual calculations may be done by others. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

18

Wahed ETFs

Notes to Financial Statements

November 30, 2022 (Unaudited) (Continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The hierarchy classification of inputs used to value each Fund’s investments at November 30, 2022, are as follows:

Wahed FTSE USA Shariah ETF

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments - Assets: | | | | | | | | | | | | | | | | |

Common Stocks* | | $ | 190,485,279 | | | $ | — | | | $ | — | ^ | | $ | 190,485,279 | |

REITs* | | | 1,816,931 | | | | — | | | | — | | | | 1,816,931 | |

Total Investments - Assets | | $ | 192,302,210 | | | $ | — | | | $ | — | | | $ | 192,302,210 | |

* | See the Schedule of Investments for industry classifications. |

^ | The Wahed FTSE USA Shariah ETF held a Level 3 security at the end of the period valued at $-. The security classified as Level 3 is deemed immaterial. |

Wahed Dow Jones Islamic World ETF

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments - Assets: | | | | | | | | | | | | | | | | |

Common Stocks* | | $ | 34,106,138 | | | $ | — | | | $ | — | ^ | | $ | 34,106,138 | |

Total Investments - Assets | | $ | 34,106,138 | | | $ | — | | | $ | — | | | $ | 34,106,138 | |

* | See the Schedule of Investments for industry classifications. |

^ | The Wahed Dow Jones Islamic World ETF held Level 3 securities at the end of the period valued at $-. The securities classified as Level 3 are deemed immaterial. |

Level 3 Reconciliation Disclosure

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

Wahed FTSE USA Shariah ETF

| | | Common Stocks | |

Balance as of May 31, 2022 | | $ | — | |

Realized gain (loss) | | | — | |

Change in unrealized net depreciation | | | — | |

Purchases | | | — | |

(Sales) | | | — | |

Transfer in/(out) of Level 3 | | | — | |

Balance as of November 30, 2022 | | | — | |

| | | | | |

Change in unrealized appreciation/depreciation during the period for Level 3 investments held at November 30, 2022 | | $ | — | |

The Level 3 investments as of November 30, 2022 represented 0.00% of net assets. Certain Russian-issued securities continue to be untradeable due to the ongoing conflict in Russia and Ukraine, which has caused significant disruption and volatility in the global stock market.

19

Wahed ETFs

Notes to Financial Statements

November 30, 2022 (Unaudited) (Continued)

Wahed Dow Jones Islamic World ETF

| | | Common Stocks | |

Balance as of May 31, 2022 | | $ | — | |

Realized gain (loss) | | | — | |

Change in unrealized net depreciation | | | — | |

Purchases | | | — | |

(Sales) | | | — | |

Transfer in/(out) of Level 3 | | | — | |

Balance as of November 30, 2022 | | | — | |

| | | | | |

Change in unrealized appreciation/depreciation during the period for Level 3 investments held at November 30, 2022 | | $ | — | |

The Level 3 investments as of November 30, 2022 represented 0.00% of net assets. Certain Russian-issued securities continue to be untradeable due to the ongoing conflict in Russia and Ukraine, which has caused significant disruption and volatility in the global stock market.

Security Transactions

Investment transactions are recorded as of the date that the securities are purchased or sold (trade date). Realized gains and losses from the sale or disposition of securities are calculated based on the specific identification basis.

The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments and currency gains or losses realized between the trade and settlement dates on securities transactions from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

The Funds report net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign currency transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on each Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in the values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

Investment Income

Dividend income is recognized on the ex-dividend date. Withholding taxes on foreign dividends, a portion of which may be reclaimable, has been provided for in accordance with the Funds’ understanding of the applicable tax rules and regulations. Dividend withholding tax reclaims are filed in certain countries to recover a portion of the amounts previously withheld. Dividends received on investments that represent a return of capital are classified as a reduction of cost of investments.

Distributions received from each Fund’s investments in real estate investment trusts (“REITs”) may be characterized as ordinary income, net capital gain, or a return of capital. The proper characterization of REIT distributions is generally not known until after the end of each calendar year. As such, the Funds must use estimates in reporting the character of its income and distributions received during the current calendar year for financial statement purposes. The actual character of distributions to each Fund’s shareholders will be reflected on the Form 1099 received by shareholders after the end of the calendar year. Due to the nature of REIT investments, a portion of the distributions received by each Fund’s shareholders may represent a return of capital.

Tax Information, Dividends and Distributions to Shareholders and Uncertain Tax Positions

The Funds are treated as separate entities for Federal income tax purposes. Each Fund intends to qualify as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). To qualify and remain eligible for the special tax treatment accorded to RICs, each Fund must meet certain annual

20

Wahed ETFs

Notes to Financial Statements

November 30, 2022 (Unaudited) (Continued)

income and quarterly asset diversification requirements and must distribute annually at least 90% of the sum of (i) its investment company taxable income (which includes dividends, interest and net short-term capital gains) and (ii) certain net tax-exempt income, if any. If so qualified, each Fund will not be subject to Federal income tax.

Distributions to shareholders are recorded on the ex-dividend date. The Funds generally pay out dividends from net investment income, if any, quarterly, and distribute their net capital gains, if any, to shareholders at least annually. The Funds may also pay a special distribution at the end of the calendar year to comply with Federal tax requirements. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their Federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed earnings and profit for tax purposes are reported as a tax return of capital.

Management evaluates each Fund’s tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. Interest and penalties related to income taxes would be recorded as income tax expense. The Funds’ Federal income tax returns are subject to examination by the Internal Revenue Service (the “IRS”) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. As of May 31, 2022, the Funds’ most recent fiscal year or period end, the Funds had no material uncertain tax positions and did not have a liability for any unrecognized tax benefits. As of May 31, 2022, the Funds’ most recent fiscal year or period end, the Funds had no examination in progress and management is not aware of any tax positions for which it is reasonably possible that the amounts of unrecognized tax benefits will significantly change in the next twelve months.

The Funds recognized no interest or penalties related to uncertain tax benefits in the 2022 fiscal year or period. At May 31, 2022, the Funds’ most recent fiscal year or period end, the tax periods from commencement of operations remained open to examination in the Funds’ major tax jurisdiction.

Indemnification

In the normal course of business, the Funds expect to enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these anticipated arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

Investment Advisory Agreement

The Trust has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Under the Advisory Agreement, the Adviser provides a continuous investment program for the Funds’ assets in accordance with their investment objectives, policies and limitations, and oversees the day-to-day operations of the Funds subject to the supervision of the Board, including the Trustees who are not “interested persons” of the Trust as defined in the 1940 Act.

Pursuant to the Advisory Agreement between the Trust, on behalf of the Funds, and Wahed, each Fund pays a unified management fee to the Adviser, which is calculated daily and paid monthly, at an annual rate of 0.50% of HLAL’s average daily net assets and at an annual rate of 0.65% of UMMA’s average daily net assets. Wahed has agreed to pay all expenses of the Funds except the fee paid to Wahed under the Advisory Agreement, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and expenses (if any).

21

Wahed ETFs

Notes to Financial Statements

November 30, 2022 (Unaudited) (Continued)

At November 30, 2022, a majority of the outstanding shares of the Funds were held in separately managed accounts of the Adviser.

Distribution Agreement and 12b-1 Plan

Quasar Distributors, LLC (“Quasar” or, the “Distributor”), a wholly owned subsidiary of Foreside Financial Group, serves as each Fund’s distributor pursuant to a Distribution Services Agreement. The Distributor receives compensation for the statutory underwriting services it provides to the Funds. The Distributor enters into agreements with certain broker-dealers and others that will allow those parties to be “Authorized Participants” and to subscribe for and redeem shares of the Funds. The Distributor will not distribute shares in less than whole Creation Units and does not maintain a secondary market in shares.

The Board has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the 1940 Act (“Rule 12b-1 Plan”). In accordance with the Rule 12b-1 Plan, each Fund is authorized to pay an amount up to 0.25% of the Fund’s average daily net assets each year for certain distribution-related activities. As authorized by the Board, no Rule 12b-1 fees are currently paid by the Funds and there are no plans to impose these fees. However, in the event Rule 12b-1 fees are charged in the future, they will be paid out of each Fund’s assets. The Adviser and its affiliates may, out of their own resources, pay amounts to third parties for distribution or marketing services on behalf of the Funds.

Administrator, Custodian and Transfer Agent

U.S. Bancorp Fund Services LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or “Administrator”) serves as administrator, transfer agent and fund accounting agent of the Funds pursuant to a Fund Servicing Agreement. U.S. Bank N.A., an affiliate of Fund Services, serves as the Funds’ custodian pursuant to a Custody Agreement. Under the terms of these agreements, the Adviser pays each Fund’s administrative, custody and transfer agency fees.

A Trustee and all officers of the Trust are affiliated with the Administrator and Custodian.

4. CREATION AND REDEMPTION TRANSACTIONS

Shares of the Funds are listed and traded on the NASDAQ Stock Market LLC, (the “Exchange”). Each Fund issues and redeems shares on a continuous basis at NAV only in large blocks of shares called “Creation Units.” Creation Units are to be issued and redeemed principally in kind for a basket of securities and a balancing cash amount. Shares generally will trade in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day. Market prices for the shares may be different from their NAV. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the NYSE is open for trading. The NAV of the shares of each Fund will be equal to the Fund’s total assets minus the Fund’s total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent; however, for purposes of determining the price of Creation Units, the NAV will be calculated to four decimal places.

Creation Unit Transaction Fee

Authorized Participants will be required to pay to the Custodian a fixed transaction fee (the “Creation Unit Transaction Fee”) in connection with the issuance of Creation Units. The standard Creation Unit Transaction Fee will be the same regardless of the number of Creation Units purchased by an investor on the applicable Business Day. The Creation Unit Transaction Fee charged by the Funds for each creation order is $500.

An additional variable fee of up to a maximum of 2% of the value of the Creation Units subject to the transaction imposed by cash purchases, non-standard orders, or partial cash purchases of Creation Units. The variable charge is primarily designed to cover additional costs (e.g., brokerage taxes) involved with buying the securities with cash. Each Fund may determine to not charge a variable fee on certain orders when the Adviser has determined that doing so is in the best interests of Fund shareholders. Variable fees, if any, received by the Funds are displayed in the Capital Share Transactions section on the Statements of Changes in Net Assets.

22

Wahed ETFs

Notes to Financial Statements

November 30, 2022 (Unaudited) (Continued)

Only “Authorized Participants” may purchase or redeem shares directly from the Funds. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Funds. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees. Securities received or delivered in connection with in-kind creates and redeems are valued as of the close of business on the effective date of the creation or redemption.

A Creation Unit will generally not be issued until the transfer of good title of the deposit securities to the Funds and the payment of any cash amounts have been completed. To the extent contemplated by the applicable participant agreement, Creation Units of the Funds will be issued to such authorized participant notwithstanding the fact that the Funds’ deposits have not been received in part or in whole, in reliance on the undertaking of the authorized participant to deliver the missing deposit securities as soon as possible. If the Funds or its agents do not receive all of the deposit securities, or the required cash amounts, by such time, then the order may be deemed rejected and the authorized participant shall be liable to the Funds for losses, if any.

5. FEDERAL INCOME TAX

The tax character of distributions paid was as follows:

| | | Six months ended November 30, 2022 | |

| | | Ordinary

Income(1) | | | Long-Term

Capital Gain | |

Wahed FTSE USA Shariah ETF | | $ | 925,930 | | | $ | — | |

Wahed Dow Jones Islamic World ETF | | | 330,150 | | | | — | |

| | | Fiscal Year/Period Ended May 31, 2022 | |

| | | Ordinary

Income(1) | | | Long-Term

Capital Gain | |

Wahed FTSE USA Shariah ETF | | $ | 1,384,308 | | | $ | — | |

Wahed Dow Jones Islamic World ETF | | | 162,500 | | | | — | |

(1) | Ordinary income includes short-term capital gains. |

At May 31, 2022, the Funds’ most recent fiscal year or period end, the components of distributable earnings (accumulated losses) and cost of investments on a tax basis, including the adjustments for financial reporting purposes as of the most recently completed Federal income tax reporting year, were as follows:

| | | Wahed FTSE USA

Shariah ETF | | | Wahed Dow

Jones Islamic

World ETF | |

Federal Tax Cost of Investments | | $ | 152,093,402 | | | $ | 36,824,952 | |

Gross Tax Unrealized Appreciation | | $ | 27,531,638 | | | $ | 400,214 | |

Gross Tax Unrealized Depreciation | | | (12,703,930 | ) | | | (5,544,637 | ) |

Net Tax Unrealized Appreciation (Depreciation) | | | 14,827,708 | | | | (5,144,423 | ) |

Undistributed Ordinary Income | | | 361,423 | | | | 234,117 | |

Other Accumulated Gain (Loss) | | | (787,189 | ) | | | (8,721 | ) |

Total Distributable Earnings / (Accumulated Losses) | | $ | 14,401,942 | | | $ | (4,919,027 | ) |

23

Wahed ETFs

Notes to Financial Statements

November 30, 2022 (Unaudited) (Continued)

The difference between book-basis and tax-basis unrealized appreciation is attributable primarily to the tax deferral of losses on wash sales.

At May 31, 2022, the Funds’ most recent fiscal year or period end, Wahed FTSE USA Shariah ETF and Wahed Dow Jones Islamic World ETF had short-term capital losses of $787,189 and $8,721, respectively, which will be carried forward indefinitely to offset future realized capital gains. During the period ended May 31, 2022, the Funds’ most recent fiscal year or period end, Wahed FTSE USA Shariah ETF utilized a long-term capital loss carryover in the amount of $279,231.

6. INVESTMENT TRANSACTIONS

During the six month period ended November 30, 2022, the Funds realized net capital gains resulting from in-kind redemptions, in which shareholders exchanged Fund shares for securities held by the Funds rather than for cash. Because such gains are not taxable to the Funds, and are not distributed to shareholders, they have been reclassified from total distributable earnings (accumulated losses) to paid in-capital. The amount of realized gains and losses from in-kind redemptions included in realized gain/(loss) on investments in the Statements of Operations is as follows:

| | | Realized Gains | | | Realized Losses | |

Wahed FTSE USA Shariah ETF | | $ | 450,308 | | | $ | (956,670 | ) |

Wahed Dow Jones Islamic World ETF | | | — | | | | — | |

Purchases and sales of investments (excluding short-term investments), creations in-kind and redemptions in-kind for the six months ended November 30, 2022, were as follows:

| | | Purchases | | | Sales | | | Creations In-Kind | | | Redemptions

In-Kind | |

Wahed FTSE USA Shariah ETF | | $ | 29,876,271 | | | $ | 29,905,393 | | | $ | 30,788,129 | | | $ | 3,069,345 | |

Wahed Dow Jones Islamic World ETF | | | 2,147,633 | | | | 1,957,103 | | | | 3,114,486 | | | | — | |

7. PRINCIPAL RISKS

As with all ETFs, shareholders of the Funds are subject to the risk that their investment could lose money. Each Fund is subject to the principal risks, any of which may adversely affect the Fund’s NAV, trading price, yield, total return and ability to meet its investment objective.