Exhibit 7.2

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMT-1

STATEMENT OF ELIGIBILITY

UNDER THE TRUST INDENTURE ACT OF 1939

OF A CORPORATION DESIGNATED TO ACT AS TRUSTEE

| ☐ | CHECK IF AN APPLICATION TO DETERMINE ELIGIBILITY OF A TRUSTEE PURSUANT TO SECTION 305(b) (2) |

GLAS TRUST COMPANY LLC

(Exact name of trustee as specified in its charter)

| | |

| A New Hampshire Limited Liability Company | | 81-4468886 |

(Jurisdiction of incorporation or organization if not a U.S. national bank) | | (I.R.S. Employer Identification No.) |

| | |

| 3 Second Street, Suite 206 Jersey City, NJ | | 07311 |

| (Address of principal executive offices) | | (Zip code) |

GLAS AMERICAS LLC

230 Park Avenue, 3rd floor West

New York, New York 10169

(212)808-3050

(Name, address and telephone number of agent for service)

AURORA CANNABIS INC.

(Exact name of obligor as specified in its charter)

| | |

| British Columbia, Canada | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| Suite 500 – 10355 Jasper Avenue Edmonton, Alberta | | T5J 1Y6 |

| (Address of principal executive offices) | | (Zip code) |

Shelf Indenture – Debt Securities

(Title of the indenture securities)

Item 1.General Information. Furnish the following information as to the trustee:

| | (a) | Name and address of each examining or supervising authority to which it is subject. |

Comptroller of the Currency

Treasury Department

Washington, D.C.

Federal Deposit Insurance Corporation

Washington, D.C.

Federal Reserve Bank of San Francisco

San Francisco, California 94120

| | (b) | Whether it is authorized to exercise corporate trust powers. |

The trustee is authorized to exercise corporate trust powers.

Item 2.Affiliations with Obligor. If the obligor is an affiliate of the trustee, describe each such affiliation.

None with respect to the trustee.

No responses are included for Items3-14 of this FormT-1 because the obligor is not in default as provided under Item 13.

Item 15.Foreign Trustee. Not applicable.

Item 16.List of Exhibits. List below all exhibits filed as a part of this Statement of Eligibility.

| | |

| |

Exhibit 1. | | A copy of the Limited Liability Company Agreement of the trustee now in effect. |

| |

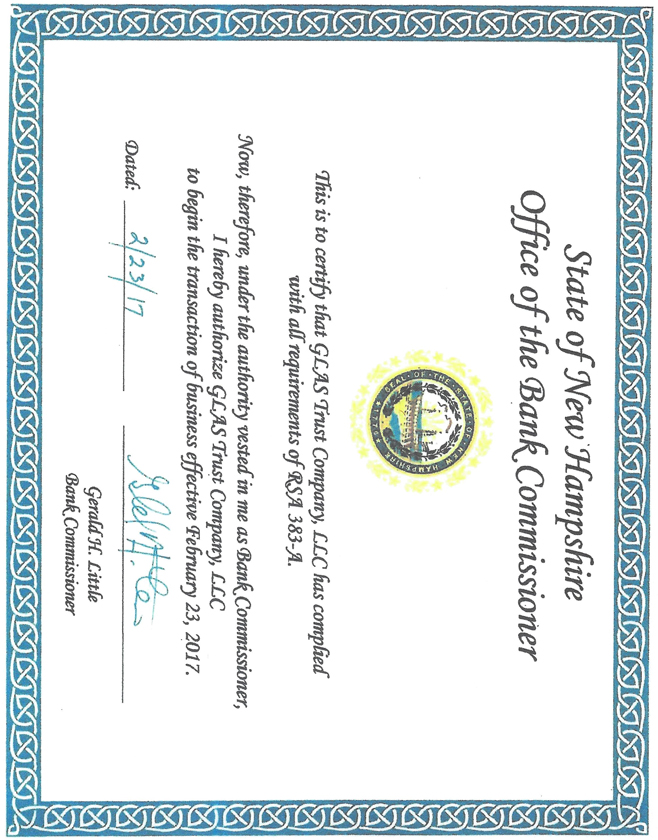

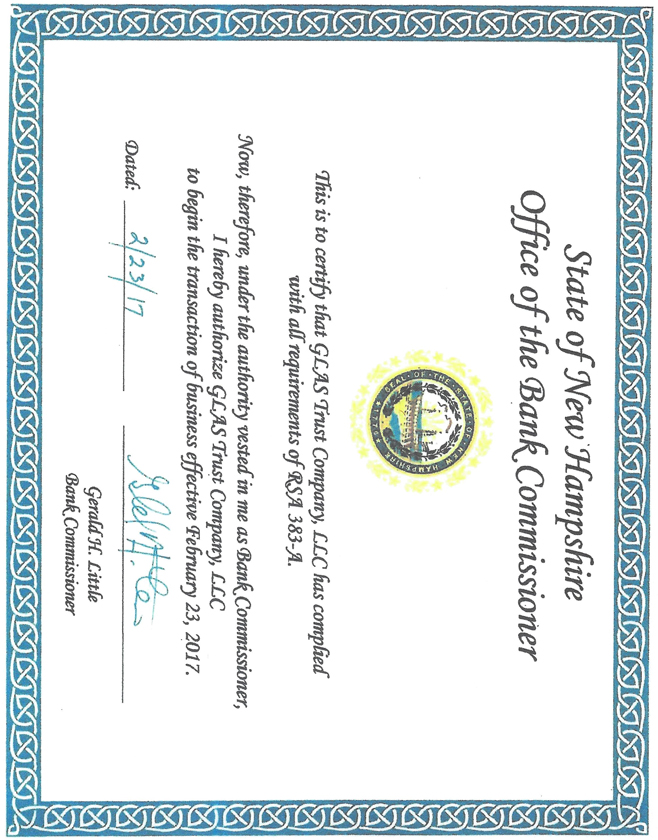

Exhibit 2. | | A copy of the State of New Hampshire – Office of the Bank Commissioner Certificate to Conduct Business for GLAS TRUST COMPANY LLC, dated February 23, 2017. |

| |

Exhibit 3. | | A copy of the State of New Hampshire Certificate to Exercise Corporate Trust Powers for GLAS TRUST COMPANY LLC, dated February 12, 2016. |

| |

Exhibit 4. | | Copy ofBy-laws of the trustee as now in effect. |

| |

Exhibit 5. | | Not applicable. |

| |

Exhibit 6. | | The consent of the trustee required by Section 321(b) of the Act. |

| |

Exhibit 7. | | A copy of the latest State of New Hampshire Call Report with Attestation of the trustee published pursuant to law or the requirements of its supervising or examining authority. |

| |

Exhibit 8. | | Not applicable. |

| |

Exhibit 9. | | Not applicable. |

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the trustee, GLAS Trust Company LLC , a New Hampshire Limited Liability Company organized and existing under the laws of the United States of America, has duly caused this statement of eligibility to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of New York and State of New York on the 10 day of May 2019.

|

| GLAS TRUST COMPANY LLC |

|

/s/ Adam Berman |

| Adam Berman |

| Vice President |

Exhibit 1

Limited Liability Company Agreement

STATE OF NEW HAMPSHIRE

| | | | |

| Filing fee: $35.00 | | | | FormLLC-3 RSA304-C:34 |

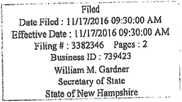

LIMITED LIABILITY COMPANY CERTIFICATE OF AMENDMENT

TO THE CERTIFICATE OF FORMATION

PURSUANT TO THE PROVISIONS OF CHAPTER304-C, SECTION 34 OF THE NEW HAMPSHIRE REVISED STATUTES ANNOTATED, THE UNDERSIGNED SUBMITS THE FOLLOWING CERTIFICATE OF AMENDMENT:

FIRST: The name of the limited liability company is:

GLAS LLC

SECOND: The text of each amendment is:

ARTICLE FIRST shall be deleted in its entirety and replaced with the following:

FIRST: The name of the limited liability company is:

| | | | |

| | GLAS Trust Company LLC |

| |

| | GLAS LLC |

| | |

| Dated: November 14, 2016 | | By: | |

|

| | | | Daniel Fisher, Manager |

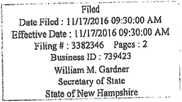

Be it known, that whereas the attached Certificate of Amendment to GLAS TRUST COMPANY LLC formerly GLAS LLC has complied with the provisions of the statutes of this State in such case made and provided, as appears from the petition duly approved by the Bank Commissioner and recorded in this office.

Now, therefore, I, William M. Gardner, Secretary of State do hereby certify that said Certificate of Amendment of GLAS TRUST COMPANY LLC formerly GLAS LLC has been filed with this office.

Business ID#: 739423

LIMITED LIABILITY COMPANY AGREEMENT

OF

GLAS LLC

This Limited Liability Company Agreement of GLAS LLC, dated as of February 8, 2016 (this “Agreement”), is entered into by GLAS Holdings Limited, an English company with an address of 45 Ludgate Hill, London EC4M 7JU, as the sole member (the “Member”).

The Member hereby forms a limited liability company pursuant to and in accordance with the provisions of New Hampshire state law as currently in effect of this date, and hereby agrees as follows:

1. Name. The name of the limited liability company is GLAS LLC (the “Company”).

2. Purpose. The purpose of the Company, and the nature of the business to be conducted and promoted by the Company, is to engage in any lawful act or activity permissible for a trust company under New Hampshire state law, and engaging in any and all activities necessary, advisable or incidental to the foregoing.

3. Powers of the Company. Subject to any limitations set forth in this Agreement, the Company shall have the power and authority to take any and all actions necessary, appropriate, proper, advisable, incidental or convenient to or for the furtherance of the purposes set forth in Section 2, including without limitation the power to borrow money and issue evidences of indebtedness in furtherance of the purposes of the Company; provided, however that the Company shall not have the power to accept deposits. Notwithstanding any other provision of this Agreement, the Member is authorized to execute and deliver any document on behalf of the Company without any vote or consent of any other person or entity.

4. Registered Office; Registered Agent. The name and address of the registered agent of the Company for service of process on the Company in the State of New Hampshire is Registered Agent Solutions, Inc., 10 Ferry St., Suite 313, Concord, NH 03301.

5. Fiscal Year. The fiscal year of the Company shall end on December 31.

6. Management: Authorized Persons.

(a) The Member hereby exclusively vests the power to manage, operate and set policies for the Company in a board of directors (the “Board of Directors”). The total

number of directors on the Board of Directors (the “Directors”) shall be not less than five (5), unless otherwise fixed at a different number by an amendment hereto or a resolution signed by the Member. The Board of Directors shall have the power to do any and all acts necessary or convenient to or for the furtherance of the purposes described herein, including all powers, statutory or otherwise, possessed by members under the laws of the State of New Hampshire. The Board of Directors may execute, deliver and file any certificates (and any amendments and/or restatements thereof) necessary for the Company to qualify to do business in a jurisdiction in which the Company may wish to conduct business, any documents required to obtain a U.S. taxpayer identification number and any documents otherwise required in order for the Company to conduct its affairs. A Director acting individually or in his or her capacity shall have the power to act for or bind the Company to the extent authorized to do so by the Board of Directors.

(b) The Member hereby appoints as the initial Directors of the Company: Brian Carne, Mia Drennan, Daniel Fisher, Barnaby Webb, Steven Hodgetts, and Stuart Draper. Brian Carne shall be the Chairman. Mia Drennan shall be the President. Daniel Fisher shall be Secretary. Barnaby Webb shall be the Treasurer. A Director shall remain in office until (i) removed by a written instrument signed by the Member, (ii) such Director resigns in a written instrument delivered to the Member, or (iii) such Director dies or is unable to serve, whichever occurs first. In the event of any such vacancy, the Member shall fill the vacancy. Each Director shall have one vote.

(c) Meetings of the Board of Directors shall be held at times and places agreed upon by a majority of the Directors. Directors may participate in such meetings by conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other, and such participation in a meeting shall constitute presence in person at such meeting. The presence of at least 50% of the Directors shall constitute a quorum for the transaction of business. Decisions of the Board of Directors shall require the approval of majority of the Directors present at a meeting;provided,however, that should the Board of Directors be unable to render a decision due to either a tie in the vote or more than one Director being recused with respect to the issue being voted upon, then the Member may make the decision in lieu of the Board of Directors.

7. Officers. The day to day functions of the Company may be managed and performed by a person or persons appointed by resolution of the Board of Directors as officers of the Company. At the outset, the Board of Directors shall appoint (i) a president of the Company that shall have all of the powers and duties that are functionally equivalent to the powers and duties held by the president of a corporation under New Hampshire law, (ii) a Treasurer of the Company that shall have all the powers and duties that are functionally equivalent to the powers and duties held by the treasurer of a corporation under New Hampshire law, and (iii) a Secretary of the Company that shall have all of the powers and duties that are functionally equivalent to the powers and duties

2

held by the secretary of a corporation under New Hampshire law. For the avoidance of doubt, (i) one person may be chosen to serve in multiple officer positions simultaneously and, (ii) a Director may also serve as an officer of the Company.

8. Dissolution. The Company shall dissolve, and its affairs shall be wound up, upon the first to occur of the following:(a) the written consent of the Member, (b) at any time there is no member of the Company, unless the Company is continued pursuant to applicable law or (c) the entry of a decree of judicial dissolution of the Company under applicable law.

9. Capital Contributions. The Member shall contribute the following amounts, in cash, and no other property, to the Company:

GLAS Holdings Limited $ 1.00

No loan made to the Company by the Member shall constitute a capital contribution to the Company for any purpose.

10. Additional Contributions. The Member is not required to make any additional capital contribution to the Company. The Member may make additional capital contributions to the Company in the form of cash, property, services or otherwise, and upon such contribution the Member’s capital account balance shall be adjusted accordingly.

11. Distributions. Distributions shall be made to the Member at the times and in the aggregate amounts determined by the Member. Notwithstanding anything to the contrary contained herein, the Company shall not make a Distribution to the Member on account of the interest of the Member in the Company if such distribution would violate applicable law.

12. MembershipInterest. The Company is authorized to issue a Membership Interest to the Member, such Interest representing the Member’s right to Distributions of the Company. The Company is authorized to issue and deliver to the Member a certificate or certificates representing the Membership Interest, and upon such issuance, the Membership Interest shall be validly issued.

13. Liability of Member. Except as otherwise provided by applicable law, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and neither the Member nor any officer or Director shall be obligated personally for any such debt, obligation or liability of the Company solely by reason of being a member, officer or Director of the Company.

3

14. Exculpation and Indemnification. Neither the Member nor any officer or Director of the Company shall be liable to the Company or any other person or entity who or that is bound by this Agreement for any loss, damage or claim incurred by reason of any act or omission performed or omitted by the Member or officer or Director in good faith on behalf of the Company and in a manner reasonably believed to be within the scope of the authority conferred on the Member, officer or Director by this Agreement, except that the Member, officer or Director shall be liable for any such loss, damage or claim incurred by reason of the Member’s or such officer’s or Director’s gross negligence or willful misconduct. To the full extent permitted by applicable law, the Member or an officer or Director shall be entitled to indemnification from the Company for any loss, damage or claim incurred by the Member or by such officer or Director by reason of any act or omission performed or omitted by the Member or by such officer or Director in good faith on behalf of the Company and in a manner reasonably believed to be within the scope of the authority conferred on the Member or such officer or Director by this Agreement, except that neither the Member nor any officer or Director shall be entitled to be indemnified in respect of any loss, damage or claim incurred by the Member or any such officer or Director by reason of gross negligence or willful misconduct with respect to such acts or omissions,provided, however, that any indemnity under this Section 13 shall be provided out of and to the extent of Company assets only, and neither the Member nor any officer or Director shall have personal liability on account thereof.

15. Amendments. This Agreement may not be modified, altered, supplemented or amended except pursuant to a written agreement executed and delivered by the Member.

16. Bankruptcy. The bankruptcy of the Member shall not cause the Member to cease to be a member of the Company and upon the occurrence of such an event, the Company shall continue without dissolution.

17. Counterparts. This Agreement may be executed in several counterparts, each of which shall be deemed an original and all of which shall together constitute one and the same instrument.

18. Governing Law. THIS AGREEMENT SHALL BE GOVERNED IN ALL RESPECTS, INCLUDING AS TO VALIDITY, INTERPRETATION AND EFFECT, BY THE INTERNAL LAWS OF THE STATE OF NEW HAMPSHIRE, WITHOUT GIVING EFFECT TO THE CONFLICT OF LAWS RULES THEREOF.

19. Separability of Provisions. Each provision of this Agreement shall be considered separable, and if for any reason any provision or provisions herein are determined to be invalid, unenforceable or illegal under any existing or future law, such invalidity, unenforceability or illegality shall not impair the operation of or affect those portions of this Agreement that are valid, enforceable and legal.

4

20. Sole Benefit of Member. Except as expressly provided in Section 13, the provisions of this Agreement are intended solely to benefit the Member and, to the fullest extent permitted by applicable law, shall not be construed as conferring any benefit upon any creditor of the Company (and no such creditor shall be a third-party beneficiary of this Agreement), and the Member shall not have any duty or obligation to any creditor of the Company to make any contributions or payments to the Company.

IN WITNESS WHEREOF, the undersigned, intending to be legally bound hereby, has duly executed this Agreement as of the date first above written.

|

| MEMBER: |

|

| GLAS HOLDINGS LIMITED |

|

|

5

| | | | |

| Filing fee: $100.00 | | | | Form LLC-1 |

| Use black print or type. | | | | RSA304-C:31 |

CERTIFICATE OF FORMATION

NEW HAMPSHIRE LIMITED LIABILITY COMPANY

THE UNDERSIGNED, under the New Hampshire Limited Liability Company Laws submits the following certificate of formation:

FIRST: The name of the limited liability company isGLAS LLC

.

Principal Business Information:

| | | | | | | | | | |

| Principal Office Address: | | 45 Ludgate Hill | | | | London EC4M 7JU | | | | |

| | (no. & street) | | | | (city/town) | | (state) | | (zip code) |

| | | | |

| Principal Mailing Address (if different): | | | | | | | | |

| | | | (no. & street) | | (city/town) | | (state) | | (zip code) |

Business Phone:

Business Email: directors@glas.agency

Please check if you would prefer to receive the Annual Report Reminder Notice by email.

SECOND: Describe the nature of the primary business or purposes (and if known, list the NAICS Code and Sub Code):The purpose of the company is to engage in any lawful act or activity permissible underNew Hampshire state law for a nondepository trust company and any act or activity necessary, proper,or incidental thereto. The company shall not have the power to accept deposits.

THIRD: The name of the limited liability company’s registered agent is:

|

| Registered Agent Solutions . |

The complete address of its registered office (agent’s business address) is:

| | | | | | | | |

| 10 Ferry St., Suite 313 | | Concord | | NH | | | 03301 | . |

| |

| (no. & street) | | (city/town) | | (state) | | | (zip code) | |

FOURTH: The management of the limited liability company is vested in a manager or managers.

| | | | |

| | Page 1 of 2 | | Form LLC-1 (9/2015) |

| | |

| CERTIFICATE OF FORMATION OF A | | FormLLC-1 |

| NEW HAMPSHIRE LIMITED LIABILITY COMPANY | | (Cont.) |

| | |

| *Signature: | | |

| Print or type name: | | Mia Drennan |

| Title: | | Manager |

| | (Enter “manager” or “member”) |

| Date signed: | | |

Note: The sale or offer for sale of membership interests of the limited liability company will comply with the requirements of the New Hampshire Uniform Securities Act (RSA421-B). The membership interests of the limited liability company: 1) have been registered or when offered will be registered under RSA421-B; 2) are exempted or when offered will be exempted under RSA421-B; 3) are or will be offered in a transaction exempted from registration under RSA421-B; 4) are not securities under RSA421-B; OR 5) are federal covered securities under RSA421-B. The statement above shall not by itself constitute a registration or a notice of exemption from registration of securities within the meaning of sections 448 and 461 (i)(3) of the United States Internal Revenue Code and the regulation promulgated thereunder.

* Must be signed by a manager; if no manager, must be signed by a member.

DISCLAIMER: All documents filed with the Corporation Division become public records and will be available for public inspection in either tangible or electronic form.

Mailing Address - Corporation Division, NH Dept, of State, 107 N Main St, Rm 204, Concord, NH 03301-4989

Physical Location - State House Annex, 3rd Floor, Rm 317, 25 Capitol St, Concord, NH

| | | | |

| | Page 2 of 2 | | Form LLC-1 (9/2015) |

CERTIFICATE

I, William M. Gardner, Secretary of State of the State of New Hampshire, do hereby certify that GLAS LLC is a New Hampshire limited liability company filed on February 12, 2016. I further certify that it is in good standing as far as this office is concerned, having paid the fees required by law; and that a certificate of cancellation has not been filed.

| | | | |

| |  | | |

| | |

| Date: 2/26/2016 Filed Documents |

| (Annual Report History, View Images, etc.) |

|

For a blank Annual Registration Report, click here. |

Business Name History | | |

Name | | Name Type |

GLAS LLC | | Legal |

Limited Liability Company - Domestic - Information |

| Business ID: | | 739423 |

| Status: | | Good Standing |

| Entity Creation Date: | | 2/4/2016 |

| Principal Office Address: | | 45 Ludgate Hill |

| | London EC4M 7 JU |

| Principal Mailing Address: | | No Address |

| Last Annual Report Filed Date: | | |

Last Annual Report Filed: | | 0 |

Registered Agent | | |

| Agent Name: | | Registered Agent Solutions Inc |

| Office Address: | | 10 Ferry Street S313 |

| | Concord NH 03301 |

| Mailing Address: | | |

NEW!File Annual Report Online. |

Important Note: The status reflected for each entity on this website only refers to the status of the entity’s filing requirements with this office. It does not necessarily reflect the disciplinary status of the entity with any state agency. Requests for disciplinary information should be directed to agencies with licensing or other regulatory authority over the entity. |

1/2

| | | | |

| 2/26/2016 | | Business Entity | | |

2/2

Confidential Exhibit B

Please see the signed Limited Liability Company Agreement of GLAS LLC, the Certificate of Formation, the Certificate of Good Standing for GLAS LLC, and confirmation of the Certificate of Good Standing’s filing with the New Hampshire Corporate Division attached.

LIMITED LIABILITY COMPANY AGREEMENT

OF

GLAS LLC

This Limited Liability Company Agreement of GLAS LLC, dated as of February 8, 2016 (this “Agreement”), is entered into by GLAS Holdings Limited, an English company with an address of 45 Ludgate Hill, London EC4M 7JU, as the sole member (the “Member”).

The Member hereby forms a limited liability company pursuant to and in accordance with the provisions of New Hampshire state law as currently in effect of this date, and hereby agrees as follows:

1. Name. The name of the limited liability company is GLAS LLC (the “Company”).

2. Purpose. The purpose of the Company, and the nature of the business to be conducted and promoted by the Company, is to engage in any lawful act or activity permissible for a trust company under New Hampshire state law, and engaging in any and all activities necessary, advisable or incidental to the foregoing.

3. Powers of the Company. Subject to any limitations set forth in this Agreement, the Company shall have the power and authority to take any and all actions necessary, appropriate, proper, advisable, incidental or convenient to or for the furtherance of the purposes set forth in Section 2, including without limitation the power to borrow money and issue evidences of indebtedness in furtherance of the purposes of the Company; provided, however that the Company shall not have the power to accept deposits. Notwithstanding any other provision of this Agreement, the Member is authorized to execute and deliver any document on behalf of the Company without any vote or consent of any other person or entity.

4. Registered Office; Registered Agent. The name and address of the registered agent of the Company for service of process on the Company in the State of New Hampshire is Registered Agent Solutions, Inc., 10 Ferry St., Suite 313, Concord, NH 03301.

5. Fiscal Year. The fiscal year of the Company shall end on December 31.

6. Management; Authorized Persons.

(a) The Member hereby exclusively vests the power to manage, operate and set policies for the Company in a board of directors (the “Board of Directors”). The total

number of directors on the Board of Directors (the “Directors”) shall be not less than five (5), unless otherwise fixed at a different number by an amendment hereto or a resolution signed by the Member. The Board of Directors shall have the power to do any and all acts necessary or convenient to or for the furtherance of the purposes described herein, including all powers, statutory or otherwise, possessed by members under the laws of the State of New Hampshire. The Board of Directors may execute, deliver and file any certificates (and any amendments and/or restatements thereof) necessary for the Company to qualify to do business in a jurisdiction in which the Company may wish to conduct business, any documents required to obtain a U.S. taxpayer identification number and any documents otherwise required in order for the Company to conduct its affairs. A Director acting individually or in his or her capacity shall have the power to act for or bind the Company to the extent authorized to do so by the Board of Directors.

(b) The Member hereby appoints as the initial Directors of the Company: Brian Carne, Mia Drennan, Daniel Fisher, Barnaby Webb, Steven Hodgetts, and Stuart Draper. Brian Carne shall be the Chairman. Mia Drennan shall be the President. Daniel Fisher shall be Secretary. Barnaby Webb shall be the Treasurer. A Director shall remain in office until (i) removed by a written instrument signed by the Member, (ii) such Director resigns in a written instrument delivered to the Member, or (iii) such Director dies or is unable to serve, whichever occurs first. In the event of any such vacancy, the Member shall fill the vacancy. Each Director shall have one vote.

(c) Meetings of the Board of Directors shall be held at times and places agreed upon by a majority of the Directors. Directors may participate in such meetings by conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other, and such participation in a meeting shall constitute presence in person at such meeting. The presence of at least 50% of the Directors shall constitute a quorum for the transaction of business. Decisions of the Board of Directors shall require the approval of majority of the Directors present at a meeting;provided, however, that should the Board of Directors be unable to render a decision due to either a tie in the vote or more than one Director being recused with respect to the issue being voted upon, then the Member may make the decision in lieu of the Board of Directors.

7. Officers. The day to day functions of the Company may be managed and performed by a person or persons appointed by resolution of the Board of Directors as officers of the Company. At the outset, the Board of Directors shall appoint (i) a president of the Company that shall have all of the powers and duties that are functionally equivalent to the powers and duties held by the president of a corporation under New Hampshire law, (ii) a Treasurer of the Company that shall have all the powers and duties that are functionally equivalent to the powers and duties held by the treasurer of a corporation under New Hampshire law, and (iii) a Secretary of the Company that shall have all of the powers and duties that are functionally equivalent to the powers and duties

2

held by the secretary of a corporation under New Hampshire law. For the avoidance of doubt, (i) one person may be chosen to serve in multiple officer positions simultaneously and, (ii) a Director may also serve as an officer of the Company.

8. Dissolution. The Company shall dissolve, and its affairs shall be wound up, upon the first to occur of the following: (a) the written consent of the Member, (b) at any time there is no member of the Company, unless the Company is continued pursuant to applicable law or (c) the entry of a decree of judicial dissolution of the Company under applicable law.

9. Capital Contributions. The Member shall contribute the following amounts, in cash, and no other property, to the Company:

GLAS Holdings Limited $ 1.00

No loan made to the Company by the Member shall constitute a capital contribution to the Company for any purpose.

10. Additional Contributions. The Member is not required to make any additional capital contribution to the Company. The Member may make additional capital contributions to the Company in the form of cash, property, services or otherwise, and upon such contribution the Member’s capital account balance shall be adjusted accordingly.

11. Distributions. Distributions shall be made to the Member at the times and in the aggregate amounts determined by the Member. Notwithstanding anything to the contrary contained herein, the Company shall not make a Distribution to the Member on account of the interest of the Member in the Company if such distribution would violate applicable law.

12. Membership Interest. The Company is authorized to issue a Membership Interest to the Member, such Interest representing the Member’s right to Distributions of the Company. The Company is authorized to issue and deliver to the Member a certificate or certificates representing the Membership Interest, and upon such issuance, the Membership Interest shall be validly issued.

13. Liability of Member. Except as otherwise provided by applicable law, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and neither the Member nor any officer or Director shall be obligated personally for any such debt, obligation or liability of the Company solely by reason of being a member, officer or Director of the Company.

3

14. Exculpation and Indemnification. Neither the Member nor any officer or Director of the Company shall be liable to the Company or any other person or entity who or that is bound by this Agreement for any loss, damage or claim incurred by reason of any act or omission performed or omitted by the Member or officer or Director in good faith on behalf of the Company and in a manner reasonably believed to be within the scope of the authority conferred on the Member, officer or Director by this Agreement, except that the Member, officer or Director shall be liable for any such loss, damage or claim incurred by reason of the Member’s or such officer’s or Director’s gross negligence or willful misconduct. To the full extent permitted by applicable law, the Member or an officer or Director shall be entitled to indemnification from the Company for any loss, damage or claim incurred by the Member or by such officer or Director by reason of any act or omission performed or omitted by the Member or by such officer or Director in good faith on behalf of the Company and in a manner reasonably believed to be within the scope of the authority conferred on the Member or such officer or Director by this Agreement, except that neither the Member nor any officer or Director shall be entitled to be indemnified in respect of any loss, damage or claim incurred by the Member or any such officer or Director by reason of gross negligence or willful misconduct with respect to such acts or omissions,provided, however, that any indemnity under this Section 13 shall be provided out of and to the extent of Company assets only, and neither the Member nor any officer or Director shall have personal liability on account thereof.

15. Amendments. This Agreement may not be modified, altered, supplemented or amended except pursuant to a written agreement executed and delivered by the Member.

16. Bankruptcy. The bankruptcy of the Member shall not cause the Member to cease to be a member of the Company and upon the occurrence of such an event, the Company shall continue without dissolution.

17. Counterparts. This Agreement may be executed in several counterparts, each of which shall be deemed an original and all of which shall together constitute one and the same instrument.

18. Governing Law. THIS AGREEMENT SHALL BE GOVERNED IN ALL RESPECTS, INCLUDING AS TO VALIDITY, INTERPRETATION AND EFFECT, BY THE INTERNAL LAWS OF THE STATE OF NEW HAMPSHIRE, WITHOUT GIVING EFFECT TO THE CONFLICT OF LAWS RULES THEREOF.

19. Separability of Provisions. Each provision of this Agreement shall be considered separable, and if for any reason any provision or provisions herein are determined to be invalid, unenforceable or illegal under any existing or future law, such invalidity, unenforceability or illegality shall not impair the operation of or affect those portions of this Agreement that are valid, enforceable and legal.

4

20. Sole Benefit of Member. Except as expressly provided in Section 13, the provisions of this Agreement are intended solely to benefit the Member and, to the fullest extent permitted by applicable law, shall not be construed as conferring any benefit upon any creditor of the Company (and no such creditor shall be a third-party beneficiary of this Agreement), and the Member shall not have any duty or obligation to any creditor of the Company to make any contributions or payments to the Company.

IN WITNESS WHEREOF, the undersigned, intending to be legally bound hereby, has duly executed this Agreement as of the date first above written.

|

| MEMBER: |

|

| GLAS HOLDINGS LIMITED |

|

5

CERTIFICATE OF INCUMBENCY

OF GLAS TRUST COMPANY LLC

I, Brian Carne (the “Chair”), of GLAS TRUST COMPANY LLC (the “Trust Company”), having its principal offices at 45 Ludgate Hill, London, United Kingdom EC4M7JU, incorporated on 8th of February, 2016 in the State of New Hampshire, do hereby certify that the following persons were designated and appointed to the offices below, and that said persons do continue to hold such offices at this time, and the signatures set forth opposite the names are the genuine signatures as of the date of this Certificate of Incumbency, 20th of September, 2017.

| | | | | | |

| Name | | Title | | Signature | | |

| | | |

| Mia Drennan | | President | |

| | |

| Daniel Fisher | | EVP/Corporate Secretary | |

| | |

| Barnaby Webb | | Treasurer | |

| | |

| Stuart Draper | | Director | |

| | |

| Steve Hodgetts | | Director | |

| | |

| Michael Amato | | Vice President | |

| | |

| Adam Berman | | Vice President | |

| | |

| Martin Reed | | Vice President | |

| | |

This Certificate of incumbency is hereby authorized pursuant to the Trust Company’s authority under Article 3 of the Limited Liability Company Operating Agreement dated 8th of February 2016.

|

|

|

| Brian Carne, Chair |

IN WITNESS WHEREOF, I have hereunto signed my names this 20th day of September 2017.

|

|

| Daniel R. Fisher, Corporate Secretary |

Exhibit 2

Office of the Bank Commissioner Certificate to Conduct Business

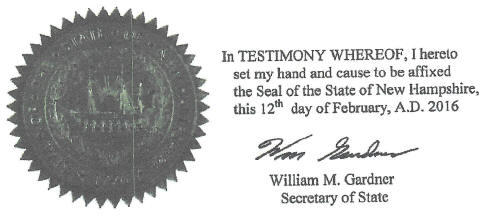

Exhibit 3

State of New Hampshire Certificate to Exercise Corporate Trust Powers

State of New Hampshire

Department of State

Be it known, that whereas Mia Drennan have associated themselves with the intention of forming a trust company under the name of GLAS LLC, for the purpose of forming a non depository trust company and any act or activity necessary, proper, or incidental thereto. The company shall not have the power to accept deposits, and has complied with the provisions of the statutes of this state as duly approved by the Bank Commissioner and recorded in this office.

Now, therefore, I William M. Gardner, secretary of state, do hereby certify that said Mia Drennan and their successors, are legally organized and established as, and are hereby made, an existing trust company under the name of GLAS LLC, with the powers, rights and privileges, and subject to the limitations, duties, and restrictions, which by law appertain thereto.

| | |

| | Witness my official signature hereunto subscribed, and the Seal of the State of New Hampshire, this Twelfth day of February in the year of 2016. |

| |  |

| | William M. Gardner Secretary of State |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Exhibit 4

Copy ofBy-Laws for the Trustee

BYLAWS

OF

GLAS TRUST COMPANY LLC

ARTICLE I

SHAREHOLDERS

Section 1.Annual Meeting.An annual meeting shall be held once each calendar year for the purpose of electing directors and for the transaction of such other business as may properly come before the meeting. The annual meeting shall be held at the time and place designated by the Board of Directors from time to time.

Section 2.SpecialMeetings.Special meetings of the shareholders may be requested by the Chairman, President, the Board of Directors, or the holders of a majority of the outstanding voting shares.

Section 3.Notice. Written notice of all shareholder meetings, whether regular or special meetings, shall be provided under this section or as otherwise required by law. The Notice shall state the place, date, and hour of meeting, and if for a special meeting, the purpose of the meeting. Such notice shall be mailed to all shareholders of record at the address shown on the corporate books, at least 10 days prior to the meeting. Such notice shall be deemed effective when deposited in ordinary U.S. mail, properly addressed, with postage prepaid.

Section 4.Place of Meeting. Shareholders’ meetings shall be held at the corporation’s principal place of business unless otherwise stated in the notice. Shareholders of any class or series may participate in any meeting of shareholders by means of remote communication to the extent the Board of Directors authorizes such participation for such class or series. Participation by means of remote communication shall be subject to such guidelines and procedures as the Board of Directors adopts. Shareholders participating in a shareholders’ meeting by means of remote communication shall be deemed present and may vote at such a meeting if the corporation has implemented reasonable measures: (1) to verify that each person participating remotely is a shareholder, and (2) to provide such shareholders a reasonable opportunity to participate in the meeting and to vote on matters submitted to the shareholders, including an opportunity to communicate, and to read or hear the proceedings of the meeting, substantially concurrent with such proceedings.

Section 5.Quorum. A majority of the outstanding voting shares, whether represented in person or by proxy, shall constitute a quorum at a shareholders’ meeting. In the absence of a quorum, a majority of the represented shares may adjourn the meeting to another time without further notice. If a quorum is represented at an adjourned meeting, any business may be transacted that might have been transacted at the meeting as originally scheduled. The shareholders present at a meeting represented by a quorum may continue to transact business until adjournment, even if the withdrawal of some shareholders results in representation of less than a quorum.

Section 6.Informal Action. Any action required to be taken, or which may be taken, at a shareholders meeting, may be taken without a meeting and without prior notice if a consent in writing, setting forth the action so taken, is signed by the shareholders who own all of the shares entitled to vote with respect to the subject matter of the vote.

ARTICLE II

DIRECTORS

Section 1.Number of Directors. The corporation shall be managed by a Board of Directors consisting of 6 director(s).

Section 2.Election and Term of Office. The directors shall be elected at the annual shareholders’ meeting. Each director shall serve a term of 2 years year(s), or until a successor has been elected and qualified.

Section 3.Quorum. A majority of directors shall constitute a quorum.

Section 4.Adverse Interest.In the determination of a quorum of the directors, or in voting, the disclosed adverse interest of a director shall not disqualify the director or invalidate his or her vote.

Section 5.Regular Meeting. An annual meeting shall be held, without notice, immediately following and at the same place as the annual meeting of the shareholders. The Board of Directors may provide, by resolution, for additional regular meetings without notice other than the notice provided by the resolution.

Section 6.Special Meeting.Special meetings may be requested by the Chairman, President, Vice-President, Secretary, or any two directors by providing five days’ written notice by ordinary United States mail, effective when mailed. Minutes of the meeting shall be sent to the Board of Directors within two weeks after the meeting.

Section 7.Procedures. The vote of a majority of the directors present at a properly called meeting at which a quorum is present shall be the act of the Board of Directors, unless the vote of a greater number is required by law or by these by-laws for a particular resolution. A director of the corporation who is present at a meeting of the Board of Directors at which action on any corporate matter is taken shall be presumed to have

assented to the action taken unless their dissent shall be entered in the minutes of the meeting. The Board shall keep written minutes of its proceedings in its permanent records.

If authorized by the governing body, any requirement of a written ballot shall be satisfied by a ballot submitted by electronic transmission, provided that any such electronic transmission must either set forth or be submitted with information from which it can be determined that the electronic transmission was authorized by the member or proxy holder.

Section 8.Informal Action.Any action required to be taken at a meeting of directors, or any action which may be taken at a meeting of directors or of a committee of directors, may be taken without a meeting if a consent in writing setting forth the action so taken, is signed by all of the directors or all of the members of the committee of directors, as the case may be.

Section 9.Removal/Vacancies. A director shall be subject to removal, with or without cause, at a meeting of the shareholders called for that purpose. Any vacancy that occurs on the Board of Directors, whether by death, resignation, removal or any other cause, may be filled by the remaining directors. A director elected to fill a vacancy shall serve the remaining term of his or her predecessor, or until a successor has been elected and qualified.

Section 10.Resignation. Any director may resign effective upon giving written notice to the chairperson of the board, the president, the secretary or the Board of Directors of the corporation, unless the notice specifies a later time for the effectiveness of such resignation. If the resignation is effective at a future time, a successor may be elected to take office when the resignation becomes effective.

Section 11.Committees.To the extent permitted by law, the Board of Directors may appoint from its members a committee or committees, temporary or permanent, and designate the duties, powers and authorities of such committees.

ARTICLE III

OFFICERS

Section 1.Number of Officers. The officers of the corporation shall be a President, one or more Vice-Presidents (as determined by the Board of Directors), a Treasurer, and a Secretary.

President/Chairman.The Chairman and the President shall be the chief executive officers and either shall preside at all meetings of the Board of Directors and its Executive Committee, if such a committee is created by the Board.

Vice President. The Vice President shall perform the duties of the President in the absence of the President and shall assist that office in the discharge of its leadership duties.

Secretary.The Secretary shall give notice of all meetings of the Board of Directors and Executive Committee, if any, shall keep an accurate list of the directors, and shall have the authority to certify any records, or copies of records, as the official records of the corporation. The Secretary shall maintain the minutes of the Board of Directors’ meetings and all committee meetings.

Treasurer/CFO. The Treasurer shall be responsible for conducting the financial affairs of the corporation as directed and authorized by the Board of Directors and Executive Committee, if any, and shall make reports of the corporation’s finances as required, but no less often than at each meeting of the Board of Directors and Executive Committee.

Section 2.Election and Term of Office.The officers shall be elected annually by the Board of Directors at the first meeting of the Board of Directors, immediately following the annual meeting of the shareholders. Each officer shall serve a one year term or until a successor has been elected and qualified.

Section 3.Removal or Vacancy. The Board of Directors shall have the power to remove an officer or agent of the corporation. Any vacancy that occurs for any reason may be filled by the Board of Directors.

ARTICLE IV

CORPORATE SEAL, EXECUTION OF INSTRUMENTS

The corporation shall not have a corporate seal. All instruments that are executed on behalf of the corporation which are acknowledged and which affect an interest in real estate shall be executed by the Chairman, President or any Vice-President and the Secretary or Treasurer. All other instruments executed by the corporation, including a release of mortgage or lien, may be executed by the Chairman, President or any Vice-President. Notwithstanding the preceding provisions of this section, any written instrument may be executed by any officer(s) or agent(s) that are specifically designated by resolution of the Board of Directors.

ARTICLE V

AMENDMENT TO BYLAWS

The bylaws may be amended, altered, or repealed by the Board of Directors or the shareholders by a majority of a quorum vote at any regular or special meeting; provided however, that the shareholders may from time to time specify particular provisions of the bylaws which shall not be amended or repealed by the Board of Directors.

ARTICLE VI

INDEMNIFICATION

Any director or officer who is involved in litigation by reason of his or her position as a director or officer of this corporation shall be indemnified and held harmless by the corporation to the fullest extent authorized by law as it now exists or may subsequently be amended (but, in the case of any such amendment, only to the extent that such amendment permits the corporation to provide broader indemnification rights).

ARTICLE VII

STOCK CERTIFICATES

The corporation may issue shares of the corporation’s stock without certificates. Within a reasonable time after the issue or transfer of shares without certificates, the corporation shall send the shareholder a written statement of the information that is required by law to be on the certificates. Upon written request to the corporate secretary by a holder of such shares, the secretary shall provide a certificate in the form prescribed by the directors.

ARTICLE VIII

DISSOLUTION

The corporation may be dissolved only with authorization of its Board of Directors given at a special meeting called for that purpose, and with the subsequent approval by no less thantwo-thirds (2/3) vote of the members.

Certification

Daniel R Fisher, Secretary of GLAS Trust Company LLC hereby certifies that the foregoing is a true and correct copy of the bylaws of the above-named corporation, duly adopted by the incorporator(s) on September 20, 2017.

EXHIBIT 6

May 2, 2019

Securities and Exchange Commission

Washington, D.C. 20549

Gentlemen:

In accordance with Section 321(b) of the Trust Indenture Act of 1939, as amended, the undersigned hereby consents that reports of examination of the undersigned made by Federal, State, Territorial, or District authorities authorized to make such examination may be furnished by such authorities to the Securities and Exchange Commission upon its request therefor.

| | |

| Very truly yours, | | |

| |

| GLAS TRUST COMPANY LLC | | |

| |

/s/ Adam Berman | | |

| Adam Berman | | |

| Vice President | | |

Exhibit 7

State of New Hampshire Call Report with Attestation

Quarter Ending:

Instructions:

This worksheet replaces the FFIEC 041 Report filing forNon-Depository Trust Companies

Please do not change the formatting, location of cells, or add calculations to the cells. The Department will be merging the information into a database and these changes will inhibit our ability to import the file.

The worksheets found in the excel file are based on the FFIEC 041 report. When filling out the forms please follow the instructions found at http://www.fdic.gov/regulations/resources/call/index.html. All New Hampshirenon-depository trust companies must file quarterly. Disregard any instructions that state or imply quarterly filing is not necessary. When completing the call report, all dollar amounts should be rounded to thousands.

The “Attestation” worksheet needs to be printed off and signed as detailed on the worksheet. After the necessary signatures are gathered the form needs to be mailed to the department. This needs to be received no later than 32 days after the quarter end.

The Department is requesting additional information to be reported quarterly on Call Report ScheduleRC-T for those institutions or their subsidiaries offering fiduciary and related services. This change will begin with the September 30, 2008 filing period. Please be aware that this particular Call Report schedule will differ from the FFIEC forms & instructions given the presence of two additional reporting items in the Memoranda section of ScheduleRC-T. New reporting will include the following: 1) Accounts where the institution is named or serves as a fiduciary of an account to be funded at a later date (‘‘dry trusts”), and 2) Accounts where the institution is named or serves as “Trust Protector”.

Information:

| | |

| Name of Institution: | | GLAS Trust Company LLC |

| Filing Period (Quarter ending): | | 31-Dec-18 |

| Date Report was emailed: | | 30-Jan |

| | | | |

Information on person to contact with question on this call report filing | | |

| | Primary Contact | | Secondary Contact |

| | |

| Name: | | Brian Carne | | Dan Fisher |

| Phone Number: | | +44 20 3764 9320 | | (212) 808 3050 |

| E-Mail Address: | | brian.carne@glas.agency | | dan.fisher@glas.agency |

USA PATRIOT ACT Section 314(a) Anti-Money Laundering Contact Information:

To facilitate the 314(a) process, you will need to provide the following information for two (2) individuals who will serve as the Point of Contact (POC) for your institution. Any changes to the POCs will need to be reported in writing to the New Hampshire Banking Department.

| | | | |

| POC Name: | | Primary Contact Brian Carne | | Secondary Contact Dan Fisher |

| POC Title: | | Chairman | | Secretary |

| Mailing Address: |

| Street | | 45 Ludgate Hill | | 3 Second Street, Suite 206 |

| PO BOX | | | | |

| City, State, Zip | | London, EC4M 7JU, UK | | Jersey City, NJ 07302 |

| Email Address: | | brian.carne@glas.agency | | dan.fisher@glas.agency |

| Phone Number: | | +44 20 3764 9320 | | (212) 808 3050 |

| | | | |

Revised 3/18/14

Quarter Ending:

Attestation

This report is required by RSA 383:13

| | |

| Name of Institution: | | GLAS Trust Company LLC |

Date report was sent electronically to the New Hampshire Banking Department: 30-Jan-19

Information in the report is for Quarter Ending: 31 December 2018

NOTE: The report must be signed by an authorized officer and attested to by not less than two directors (trustees).

I,Martin Reed, Senior Vice President/ Corporate Secretary

Typed Name and Title of Officer Authorized to Sign Report

of the named bank do hereby declare that the report sent electronically to the New Hampshire Banking Department has been prepared in conformance with the instructions issued by the FFIEC and are true to the best of my knowledge and belief.

| | |

| | 30-Jan-19 |

| Signature of Office Authorized to Sign Report | | Date of Signature |

We, the undersigned directors (trustees), attest to the correctness of the report sent electronically to the New Hampshire Banking Department and declare that it has been examined by us and to the best of our knowledge and belief has been prepared in conformance with the instruction issued by the FFIEC and is true and correct.

| | |

| | Steven Hodgetts |

| Signature of Director (Trustee) | | Printed Name of Director (Trustee) |

| | Daniel Fisher |

| Signature of Director (Trustee) | | Printed Name of Director (Trustee) |

| |

Signature of Director (Trustee) | | Printed Name of Director (Trustee) |

The signed “Attestation” needs to be received by the department no later than 32 days after the quarter end.

Revised 9/16/13

Quarter Ending:

Schedule Rl -- Income Statement

All Report of Income schedules are to be entered on a calendaryear-to-date basis in thousands of dollars.

| | | | | | | | |

| 1 | | | | Interest Income: | | | | |

| 1. a. | | | | Interest and fee income on loans: | | | | |

| | (1) | | Loans secured by real estate | | | | |

| | (2) | | Commercial and industrial loans | | | | |

| | (3) | | Loans to individuals for household, family, and other personal expenditures: | | | | |

| | | | (a) Credit cards | | | | |

| | | | (b) Other (includes single payment, installment, all student loans, and revolving credit plans other than credit cards) | | | | |

| | (4) | | Loans to foreign governments and official institutions | | | | |

| | (5) | | All other loans | | | | |

| | (6) | | Total interest and fee income on loans (sum of items 1.a.(1) through 1.a.(5)) | | | | |

| 1. b. | | | | Income from lease financing receivables | | | | |

| 1. c. | | | | Interest income on balances due from depository institutions | | | | |

| 1. d. | | | | Interest and dividend income on securities | | 8 | | |

| | (1) | | U.S. Treasury securities and U.S. Government agency obligations (excluding mortgage-backed securities) | | | | |

| | (2) | | Mortgage-backed securities | | | | |

| | (3) | | | | | | |

| | | | All other securities (includes securities issued by states and political subdivisions in the U.S.) | | | | |

| 1. e. | | | | Interest income from trading assets | | | | |

| 1. f. | | | | Interest income on federal funds sold and securities purchased under agreements to resell | | | | |

| 1. g. | | | | Other interest income | | | | |

| 1. h. | | | | Total interest income (sum of items 1.a.(6) through 1.g) | | | | 8 |

| 2. | | | | Interest expense: | | | | |

| 2. a. | | | | Interest on deposits: | | | | |

| | (1) | | Transaction accounts (interest-bearing demand deposits, NOW accounts, ATS accounts, and telephone and preauthorized transfer accounts) | | | | |

| | (2) | | Nontransaction accounts: | | | | |

| | | | (a) Savings deposits (includes MMDAs) | | | | |

| | | | (b) Time deposits of $100,000 or more | | | | |

| | | | (c) Time deposits of less than $100,000 | | | | |

| 2. b. | | | | Expense of federal funds purchased and securities sold under agreements to repurchase | | | | |

| 2. c. | | | | Interest on trading liabilities and other borrowed money | | | | |

| 2. d. | | | | Interest on subordinated notes and debentures | | | | |

| 2. e. | | | | Total interest expense (sum of items 2. a though 2. d) | | | | |

| 3. | | | | Net interest income (item 1.h minus 2.e) | | | | 8 |

| 4. | | | | Provision for loan and lease losses | | | | |

| 5. | | | | Noninterest income: | | | | |

| 5. a. | | | | Income from fiduciary activities | | 1,398 | | |

| 5. b. | | | | Service charges on deposit accounts | | | | |

| 5. c. | | | | Trading revenue | | | | |

| 5. d. | | (1) | | Fees and commissions from securities brokerage | | | | |

| | (2) | | Investment banking, advisory, and underwriting fees and commissions | | | | |

| | (3) | | Fees and commissions from annuity sales | | | | |

| | (4) | | Underwriting income from insurance and reinsurance activities | | | | |

| | (5) | | Income from other insurance activities | | | | |

| 5. e. | | | | Venture capital revenue | | | | |

| 5. f. | | | | Net servicing fees | | | | |

| 5. g. | | | | Net securitization income | | | | |

| 5. h. | | | | Not applicable | | | | |

| 5. i. | | | | Net gains (losses) on sales of loans and leases | | | | |

| 5. j. | | | | Net gains (losses) on sales of other real estate owned | | | | |

| 5. k. | | | | Net gains (losses) on sales of other assets (excluding securities) | | | | |

| 5. l. | | | | Other noninterest income* | | | | |

| 5. m. | | | | Total noninterest income (sum of items 5.a though 5.1) | | | | 1,398 |

| 6. a. | | | | Realized gains (losses) onheld-to-maturity securities | | | | |

| 6. b. | | | | Realized gains (losses) onavailable-for-sale securities | | | | |

| 7. | | | | Noninterest expense: | | | | |

| 7. a. | | | | Salaries and employee benefits | | | | |

| 7. b. | | | | Expenses of premises and fixed assets (net of rental income) (excluding salaries and employee benefits and mortgage interest) | | | | |

| 7. c. | | | | (1) Goodwill impairment losses | | | | |

| | | | (2) Amortization expense and impairment losses for other intangible assets | | 1 | | |

| 7. d. | | | | Other noninterest expense* | | 1,313 | | |

| 7. e. | | | | Total noninterest expense (sum of items 7, a though 7.d) | | | | 1,314 |

| 8. | | | | Income (loss) before income taxes and extraordinary items and other adjustments (item 3 plus or minus items 4, 5.m, 6.a, 6.b and 7.e) | | | | 92 |

| 9. | | | | Applicable income taxes (on item 8) | | | | 14 |

| 10. | | | | Income (loss) before extraordinary items and other adjustments (item 8 minus item 9) | | | | 78 |

| 11. | | | | Extraordinary items and other adjustments, net of income taxes* | | | | |

| 12. | | | | Net income (loss) attributable to bank and noncontrolling (minority) interests (sum of items 10 and 11) | | | | 78 |

| 13. | | | | LESS: Net income (loss) attributable to noncontrolling (minority) interests (if net income, report as a positive value; if net loss, report as a negative value) | | | | |

| 14. | | | | Net income (loss) attributable to bank (item 12 minus item 13) | | | | 78 |

| * | Describe on Schedule RI-E - Explanations |

Revised 9/16/13

Quarter Ending:

Schedule Rl - Continued

All Report of Income schedules are to be entered on a calendaryear-to-date basis in thousands of dollars.

| | | | | | | | |

| | | | Memoranda | | | | |

| | | | |

| 14. | | | | Other-than-temporary impairment losses onheld-to-maturity andavailable-for-sale debt securities: | | | | |

| | a. | | Total other-than-temporary impairment losses | | | | |

| | b. | | Portion of losses recognized in other comprehensive income (before income taxes) | | | | |

| | c. | | Net impairment losses recognized in earnings (included in Schedule RI, items 6.a | | | | |

| | | | and 6.b)(Memorandum item 14.a minus Memorandum item 14.b) | �� | | | |

| | | | |

| | | | *Memoranda Items1-13 Omitted | | | | |

Revised 9/16/13

Quarter Ending:

Schedule RI-A -- Changes in Equity Capital

| | | | | | |

| | Indicate decreases and losses in parentheses. Dollar Amounts in Thousands | | |

| 1. | | Total equity capital most recently reported for the previous year end, Reports of Condition and Income (i.e., after adjustments from amended Reports of Income) | | 1,504 | | |

| 2. | | Restatements due to corrections of material accounting errors and changes in accounting principles* | | | | |

| 3. | | Balance end of previous calendar year as restated (sum of items 1 and 2) | | 1,504 | | |

| 4. | | Net income (loss) (must equal Schedule RI, item 14) | | 78 | | |

| 5. | | Sale, conversion, acquisition, or retirement of capital stock, net (excluding treasury stock transactions) | | | | |

| 6. | | Treasury stock transactions, net | | | | |

| 7. | | Changes incident to business combinations, net | | | | |

| 8. | | LESS: Cash dividends declared on preferred stock | | | | |

| 9. | | LESS: Cash dividends declared on common stock | | | | |

| 10. | | Other comprehensive income | | | | |

| 11. | | Other transactions with parent holding company* (not included in items 5, 6, 8, or 9 above) | | 20 | | Capital Contribution |

| 12. | | Total equity capital end of current period (sum of items 3 through 11) (must equal Schedule RC, item 27 .a) | | 1,602 | | |

| * | Describe on ScheduleRl-E-Explanations |

| | | | |

| | | ScheduleRl-E -- Explanations | | Quarter Ending: |

ScheduleRl-E is to be completed each quarter on a calendaryear-to-date basis.

| | | | | | | | |

| | | | Dollar Amounts in Thousands | | |

| | | | | | |

| 1. | | | | Other noninterest income (from Schedule Rl, item 5.1) | | | | |

| | | | Itemize and describe amounts greater than $25,000 that exceed 3% of Schedule Rl, item 5.1: | | | | see below |

| 1. a. | | | | Income and fees from the printing and sale of checks | | | | |

| 1. b. | | | | Earnings on/increase in value of cash surrender value of life insurance | | | | |

| 1. c. | | | | Income and fees from automated teller machines (ATMs) | | | | |

| 1. d. | | | | Rent and other income from other real estate owned | | | | |

| 1. e. | | | | Safe deposit box rent | | | | |

| 1. f. | | | | Net change in the fair values of financial instruments accounted for under a fair value option | | | | |

| 1. g. | | | | Bank card and credit card interchange fees | | | | |

| 1. h. | | | | Gains on bargain purchases | | | | |

| 1. i. | | | | | | | | |

| 1. j. | | | | | | | | |

| 1. k. | | | | | | | | |

| 2. | | | | Other noninterest expense (from Schedule Rl, item 7.d) | | | | |

| | | | Itemize and describe amounts greater than $25,000 that exceed 3% of Schedule Rl, item 7.d: | | | | see below |

| 2. a. | | | | Data processing expenses | | | | |

| 2. b. | | | | Advertising and marketing expenses | | | | |

| 2. c. | | | | Directors’ fees | | | | |

| 2. d. | | | | Printing, stationery, and supplies | | | | |

| 2. e. | | | | Postage | | | | |

| 2. f. | | | | Legal fees and expenses | | | | |

| 2. g. | | | | FDIC deposit insurance assessments | | | | |

| 2. h. | | | | Accounting and auditing expenses | | 89 | | |

| 2. i. | | | | Consulting and advisory expenses | | | | |

| 2. j. | | | | | | | | |

| 2. k. | | | | Telecommunications expenses | | | | |

| 2. I. | | | | | | | | |

| 2. m. | | | | | | | | |

| 2. n. | | | | | | | | |

| 3. | | | | Extraordinary items and other adjustments and applicable income tax effect (from Schedule Rl, item 11) (itemize and describe all extraordinary items and other adjustments): | | | | |

| 3. a. | | (1) | | | | | | |

| | (2) | | Applicable income tax effect | | | | |

| 3. b. | | (1) | | | | | | |

| | (2) | | Applicable income tax effect | | | | |

| 3. c. | | (1) | | | | | | |

| | (2) | | Applicable income tax effect | | | | |

| 4. | | | | Cumulative effect of changes in accounting principles and corrections of material accounting errors (from Schedule RI-A, item 2) (itemize and describe all such effects): | | | | |

| 4. a. | | | | | | | | |

| 4. b. | | | | | | | | |

| 5. | | | | Other transactions with parent holding company (from Schedule RI-A, item 11) (itemize and describe all such transactions): | | | | |

| 5. a. | | | | Introduction of initial capital as membership interest. | | | | |

| 5. b. | | | | | | | | |

| 6. | | | | Adjustments to allowance for loan and lease losses; (itemize and describe all adjustments) | | | | |

| 6. a. | | | | | | | | |

| 6. b. | | | | | | | | |

| 7. | | | | Other explanations (the space below is provided for the bank to briefly describe, at its option, any | | | | |

| | | | other significant items affecting the Report of Income): | | | | |

| | | | Comments? (Yes or No) | | | | |

| | | | Other explanations (please type or print clearly): | | | | |

| | | | |

| | | | Itemize and describe amounts greater than $25,000 that exceed 3% of Schedule Rl, item 7.d: | | | | |

| | | | $57k Insurance costs | | | | |

| | | | $639k expenses for services provided by GLAS Americas to Trust Co | | | | |

| | | | $68k Bank service charges | | | | |

| | | | $173k Commission for new deals | | | | |

| | | | $165k expense allocation for services by GLAS Ltd | | | | |

| | | | $89k Professional Services for Audit & Tax services | | | | |

| | | | |

| | | | Itemize and describe amounts greater than $25,000 that exceed 3% of Schedule Rl, item 5.1: | | | | |

| | | | |

| | | | $58k Murray Energy Agency Fees | | | | |

| | | | $74k 9W Billable Hours | | | | |

| | | | $55k GNC Collateral Fees | | | | |

| | | | $556k Murray Energy Transfer Fees | | | | |

| | | | $167k Advanz Transfer Fees | | | | |

Revised 9/16/13

| | | | | | | | | | |

| | | Schedule RC -- Balance Sheet | | Quarter Ending: | |

| | |

| | | | | Dollar Amounts in Thousands | |

| | | |

| | ASSETS | | | | | | | | |

| 1. | | Cash and balances due from depository institutions : | | | | | | | | |

| 1. a. | | Noninterest-bearing balances and currency and coin | | | 202 | | | | | |

| 1. b. | | Interest-bearing balances | | | 1,505 | | | | | |

| 2. | | Securities: | | | | | | | | |

| 2. a. | | Held-to-maturity securities (from Schedule RC-B, column A) | | | | | | | | |

| 2. b. | | Available-for-sale securities (from Schedule RC-B, column D) | | | | | | | | |

| 3. | | Federal funds sold and securities purchased under agreements to resell: | | | | | | | | |

| 3. a. | | Federal funds sold | | | | | | | | |

| 3. b. | | Securities purchased under agreements to resell | | | | | | | | |

| 4. | | Loans and lease financing receivables: | | | | | | | | |

| 4. a. | | Loans and leases held for sale | | | | | | | | |

| 4. b. | | Loans and leases, net of unearned income | | | | | | | | |

| 4. c. | | LESS: Allowance for loan and lease losses | | | | | | | | |

| 4. d. | | Loans and leases, net of unearned income and allowance (item 4.b minus 4.c) | | | | | | | | |

| 5. | | Trading assets | | | | | | | | |

| 6. | | Premises and fixed assets (including capitalized leases) | | | 2 | | | | | |

| 7. | | Other real estate owned | | | | | | | | |

| 8. | | Investments in unconsolidated subsidiaries and associated companies | | | | | | | | |

| 9. | | Direct and indirect investments in real estate ventures | | | | | | | | |

| 10. | | Intangible assets: | | | | | | | | |

| 10. a. | | Goodwill | | | | | | | | |

| 10. b. | | Other intangible assets | | | | | | | | |

| 11. | | Other assets (from Schedule RC-F) | | | 294 | | | | | |

| 12. | | Total assets (sum of items 1 though 11) | | | | | | | 2,003 | |

| | | |

| | LIABILITIES | | | | | | | | |

| 13. | | Deposits: | | | | | | | | |

| 13. a. | | In domestic offices: | | | | | | | | |

| | (1) Noninterest-bearing | | | | | | | | |

| | (2) Interest-bearing | | | | | | | | |

| 13. b. | | Not applicable | | | | | | | | |

| 14. | | Federal funds purchased and securities sold under agreements to repurchase: | | | | | | | | |

| 14. a. | | Federal funds purchased | | | | | | | | |

| 14. b. | | Securities sold under agreements to repurchase | | | | | | | | |

| 15. | | Trading liabilities | | | | | | | | |

| 16. | | Other borrowed money (includes mortgage indebtedness and obligations under capitalized leases) | | | | | | | | |

| 17. | | | | | | | | | | |

| and | | | | | | | | | | |

| 18. | | Not applicable | | | | | | | | |

| 19. | | Subordinated notes and debentures | | | | | | | | |

| 20. | | Other liabilities (from Schedule RC-G) | | | 401 | | | | | |

| 21. | | Total liabilities (sum of items 13 through 20) | | | | | | | 401 | |

| 22. | | Not applicable | | | | | | | | |

| | | |

| | EQUITY CAPITAL | | | | | | | | |

| 23. | | Perpetual preferred stock and related surplus | | | | | | | | |

| 24. | | Common Stock | | | 1,565 | | | | | |

| 25. | | Surplus (exclude all surplus related to preferred stock) | | | | | | | | |

| 26. a. | | Retained earnings | | | 37 | | | | | |

| 26. b. | | Accumulated other comprehensive income (includes net unrealized holding gains (losses) on available-for-sale securities, accumulated net gains (losses) on cash flow hedges, and minimum pension liability adjustments.) | | | | | | | | |

| 26. c. | | Other equity capital components | | | | | | | | |

| 27. a. | | Total bank equity capital (sum of items 23 through 26.c) | | | | | | | 1,602 | |

| 27. b. | | Noncontrolling (minority) interests in consolidated subsidiaries | | | | | | | | |

| 28. | | Total equity capital (sum of items 27.a and 27.b) | | | | | | | 1,602 | |

| 29. | | Total liabilities and equity capital (sum of items 21 and 28) | | | | | | | 2,003 | |

| | | |

| | Memorandum | | | | | | | | |

| | Indicate in the box at the right the year of the last completed audit, that conforms to the | | | | | | | | |

| | standards listed in NH RSA 384:43, “Annual Audits”. | | | | | | | 2017 | |

Revised 9/13/13

| | |

| Schedule RC-B -- Securities | | Quarter Ending: |

| | | | | | | | | | | | |

| | | | | | Dollar Amounts in Thousands |

| | | | | | Held to maturity | | Available for sale |

| | | | | | (Column A)

Amortized Cost | | (Column B)

Fair Value | | (Column C)

Amortized Cost | | (Column D)

Fair Value |

| 1. | | | | U.S. Treasury securities | | | | | | | | |

| 2. | | | | U.S. Government agency obligations (exclude mortgage-backed securities): | | | | | | | | |

| 2. a. | | | | Issued by U.S. Government agencies | | | | | | | | |

| 2. b. | | | | Issued by U.S. Government-sponsored agencies | | | | | | | | |

| 3. | | | | Securities issued by states and political subdivisions in the U.S. | | | | | | | | |

| 4. | | | | Mortgage-backed securities (MBS): | | | | | | | | |

| 4. a. | | | | Pass-through securities: | | | | | | | | |

| | (1) | | Guaranteed by GNMA | | | | | | | | |

| | (2) | | Issued by FNMA and FHLMC | | | | | | | | |

| | (3) | | Other pass-through securities | | | | | | | | |

| 4. b. | | | | Other mortgage-backed securities (include CMOs, REMICs and stripped MBS): | | | | | | | | |

| | (1) | | Issued or guaranteed by U.S. Government agencies or sponsored agencies | | | | | | | | |

| | (2) | | Collateralized by MBS issued or guaranteed by U.S. Government agencies or | | | | | | | | |

| | | | sponsored agencies | | | | | | | | |

| | (3) | | All other residential MBS | | | | | | | | |

| 4. c. | | | | Commercial MBS: | | | | | | | | |

| | (1) | | Commercial mortgage pass-through securities | | | | | | | | |

| | | | (a) Issued or guaranteed by FNMA, FHLMC, or GNMA | | | | | | | | |

| | | | (b) Other pass-through securities | | | | | | | | |

| | (2) | | Other commercial MBS: | | | | | | | | |

| | | | (a) Issued or guaranteed by U.S. Government agencies or sponsored agencies | | | | | | | | |

| | | | (b) All other commercial MBS | | | | | | | | |

| 5. | | | | Asset-backed securities and structured financial products: | | | | | | | | |

| | a. | | Asset-backed securities (ABS) | | | | | | | | |

| | b. | | Structured financial products: | | | | | | | | |

| | (1) | | Cash | | | | | | | | |

| | (2) | | Synthetic | | | | | | | | |

| | (3) | | Hybrid | | | | | | | | |

| 6. | | | | Other debt securities: | | | | | | | | |

| 6. a. | | | | Other domestic debt securities | | | | | | | | |

| 6. b. | | | | Foreign debt securities | | | | | | | | |

| 7. | | | | Investments in mutual funds and other equity securities with readily determinable fair values | | | | | | | | |

| 8. | | | | Total (sum of items 1 through 7) (total of column A must equal Schedule RC, item 2.a) (total of column D must equal Schedule RC, item 2.b) | | | | | | | | |

| | | | | | |

| | | | Memoranda | | | | | | | | |

| | | | | | Dollar Amounts in Thousands |

| 1. | | | | Pledged securities1 | | | | | | | | |

1 Includes held-to-maturity securities at amortized cost and available-for-sale securities at fair value.

Revised 9/16/13

| | | | | | |

| | Schedule RC-F -- Other Assets | | Quarter Ending: |

| | | | Dollar Amounts in Thousands |

| 1. | | Accrued interest receivable | | | | |

| 2. | | Net deferred tax assets | | | | |

| 3. | | Interest-only strips receivable (not in the form of a security) on: | | | | |

| 3. a. | | Mortgage loans | | | | |

| 3. b. | | Other financial assets | | | | |

| 4. | | Equity securities that DO NOT have readily determinable fair values | | | | |

| 5. | | Life insurance assets: | | | | |

| a. | | General account life insurance assets | | | | |

| b. | | Separate account life insurance assets | | | | |

| c. | | Hybrid account life insurance assets | | | | |

| 6. | | All other assets (itemize and describe amounts greater than $25,000 that exceed 25% of this item) | | | | 294 |

| 6. a. | | Prepaid expenses | | 151 | | |

| 6. b. | | Repossessed personal property (including vehicles) | | | | |

| 6. c. | | Derivatives with a positive fair value held for purposes other than trading | | | | |

| 6. d. | | Retained interests in accrued interest receivables related to securitized credit cards | | | | |

| 6. e. | | FDIC loss-sharing indemnification assets | | | | |

| 6. f. | | Prepaid deposit insurance assessments | | | | |

| 6. g. | | Account receivables | | 112 | | |

| 6. h. | | | | | | |

| 6. i. | | | | | | |

| 7. | | Total (sum of items 1 through 6) (must equal Schedule RC, item 11) | | | | 294 |

| | | |

| | 6. Itemized amounts $147k are prepayments to GLAS entities for future services to be provided $74k are hours billed and due for Nine West deal | | | | |

Revised 9/16/13

| | | | |

| | Schedule RC-G -- Other Liabilities | | Quarter Ending: |

| | | | | | | | |

| | | | Dollar Amounts in Thousands | | |

| 1. a. | | Interest accrued and unpaid on deposits | | | | | | |

| 1. b. | | Other expenses accrued and unpaid (includes accrued income taxes payable) | | | | 46 | | |

| 2. | | Net deferred tax liabilities | | | | | | |

| 3. | | Allowance for credit losses on off-balance sheet credit exposures | | | | | | |

| 4. | | All other liabilities (itemize and describe amounts greater than $25,000 that exceed 25% of this item) | | | | 355 | | Item: $349k Deferred Revenue |

| 4. a. | | Accounts payable | | | | | | |

| 4. b. | | Deferred compensation liabilities | | | | | | |

| 4. c. | | Dividends declared but not yet payable | | | | | | |

| 4. d. | | Derivatives with a negative fair value held for purposes other than trading | | | | | | |

| 4. e. | | | | | | | | |

| 4. f. | | | | | | | | |

| 4. g. | | | | | | | | |

| 5. | | Total (sum of items 1 though 4) (must equal Schedule RC, item 20) | | | | 401 | | |

Revised 9/16/13

| | |

| Schedule RC-T -- Fiduciary and Related Services | | Quarter Ending: |

| | | | | | | | | | | | |

| FIDUCIARY AND RELATED ASSETS | | (Column A) Managed Assets | | (Column B) Non-Managed Assets | | (Column C) Number of Managed Accounts | |

| (Column D)

Number of

Non-Managed

Accounts |

|

| 4. | | Personal trust and agency accounts | | | | | | | | | | |

| 5. | | Retirement related trust and agency accounts: | | | | | | | | | | |

| 5. a. | | Employee benefit -- defined contribution | | | | | | | | | | |

| 5. b. | | Employee benefit -- defined benefit | | | | | | | | | | |

| 5. c. | | Other employee benefit and retirement-related accounts | | | | | | | | | | |

| 6. | | Corporate trust and agency accounts USD | | | | 8,344,736 | | | | | 23 | |

| 7. | | Investment management and investment advisory agency accounts | | | | | | | | | | |

| 8. | | Foundation and endowment trust and agency accounts | | | | | | | | | | |

| 9. | | Other fiduciary accounts | | | | | | | | | | |

| 10. | | Total fiduciary accounts (sum of items 4 through 9) | | | | | | | | | | |

| 11. | | Custody and safekeeping accounts | | | | 8,344,736 | | | | | 23 | |

| 12. | | Not applicable | | | | | | | | | | |

| 13. | | Individual Retirement Accounts, Health Savings Accounts, and other similar accounts (included in items 5.c. and 11) | | | | | | | | | | |

| | | | | | | | | | |

| | | | |

| FIDUCIARY AND RELATED SERVICES INCOME | | | | | | | | | | |

| 14. | | Personal trust and agency accounts | | | | | | | | | | |

| 15. | | Employee benefit and retirement related trust and agency accounts: | | | | | | | | | | |

| 15. a. | | Employee benefit -- defined contribution | | | | | | | | | | |

| 15. b. | | Employee benefit -- defined benefit | | | | | | | | | | |