Filed Pursuant to Rule 424(b)(3)

Registration No. 333-222986

CNL STRATEGIC CAPITAL, LLC

SUPPLEMENT NO. 4 DATED MAY 16, 2018

TO THE PROSPECTUS DATED MARCH 7, 2018

We are providing this Supplement No. 4 to you in order to supplement our prospectus dated March 7, 2018 (as supplemented to date, the “Prospectus”). This supplement provides information that shall be deemed part of, and must be read in conjunction with, the Prospectus. Capitalized terms used in this supplement have the same meanings in the Prospectus unless otherwise stated herein. The terms “we,” “our,” “us” and “Company” refer to CNL Strategic Capital, LLC.

Before investing in our shares you should read the entire Prospectus and this supplement, and consider carefully our business objectives, risks, fees and expenses. You should also carefully consider the information disclosed in the section of the Prospectus captioned “Risk Factors” before you decide to invest in our shares.

The purpose of this supplement is to disclose the following:

| ● | the status of our current public offering; |

| ● | an update to our prospectus summary; |

| ● | an update to our risk factors; |

| ● | an update to the prior performance of the Manager, the Sub-Manager and their respective affiliates; |

| ● | a “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section substantially the same as that which was included in our Quarterly Report on Form 10-Q, filed on May 15, 2018; |

| ● | an update to our portfolio; |

| ● | an update to our security ownership; |

| ● | an update to information regarding conflicts of interest and certain relationships and related party transactions; |

| ● | an update to our ERISA considerations; |

| ● | an update to our plan of distribution; |

| ● | our condensed consolidated unaudited financial statements and the notes thereto as of and for the period ended March 31, 2018, as included in our Quarterly Report on Form 10-Q, filed on May 15, 2018; and |

| ● | an update to our prior performance tables included in Appendix A of our Prospectus. |

Status of our Current Public Offering

Our registration statement on Form S-1 relating to our current public offering (the “Offering”) was declared effective by the Securities and Exchange Commission (the “SEC”) on March 7, 2018. As of May 10, 2018, we had issued 18,247 common shares (consisting of 299 Class A shares and 17,948 Class I shares) pursuant to the Offering, which includes 299 Class A shares issued pursuant to our distribution reinvestment plan, and received aggregate gross offering proceeds of $457,500.

Prospectus Summary

The following disclosure supersedes and replaces the third sentence of the second paragraph under the section “Prospectus Summary—Q: Who are Levine Leichtman Strategic Capital, LLC and LLCP?” and the third sentence of the third paragraph under the section “Business—The Manager and the Sub-Manager,” which appear on pages 3 and 77, respectively, of the Prospectus.

From 1984 through 1993, LLCP Founding Principals Arthur E. Levine and Lauren B. Leichtman made seven investments in their individual capacities prior to establishing LLCP. From 1994 through March 31, 2018, LLCP and its senior executives have managed approximately $9.6 billion of institutional capital, invested in a total of over 75 middle-market companies and currently has a team of 56 transactional and supporting professionals.

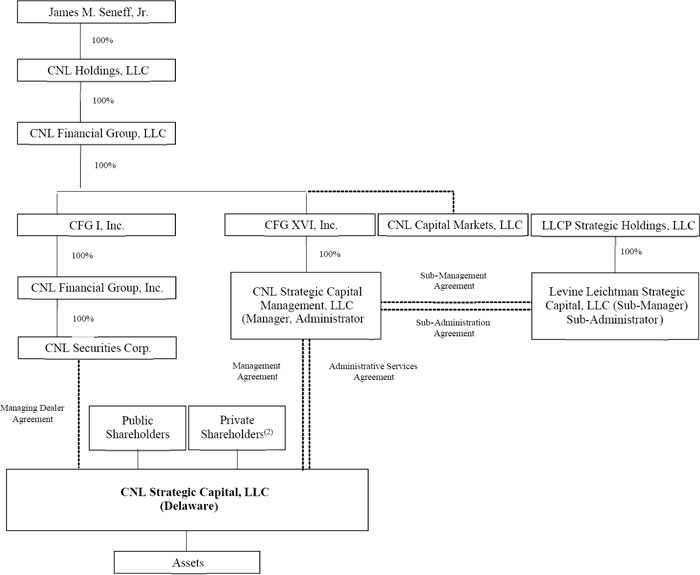

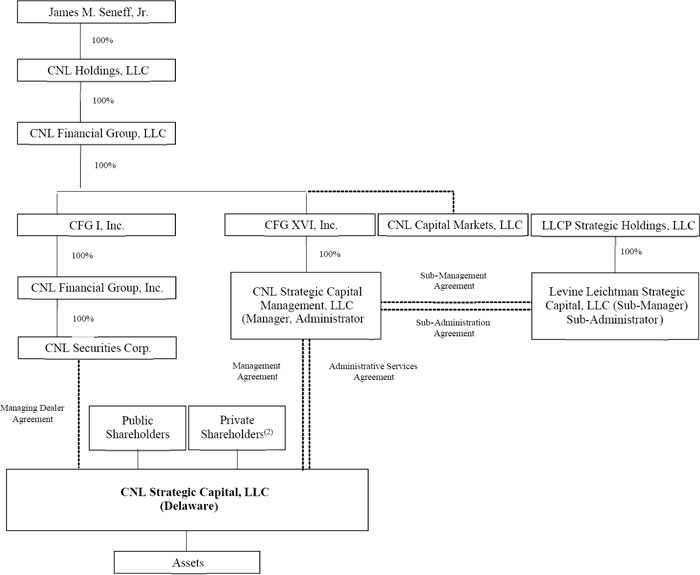

The following disclosure supersedes and replaces the structure chart and related disclosure under the section “Prospectus Summary—Q: What is the current ownership structure of CNL Strategic Capital, LLC?” which appears on page 6 of the Prospectus.

| Q: | What is the current ownership structure of CNL Strategic Capital, LLC? |

| A: | The following chart illustrates the general structure and ownership of the company and the management relationship between the Manager, the Sub-Manager and us.(1) |

| (1) | We have entered into the Management Agreement with the Manager and the Sub-Management Agreement with the Manager and the Sub-Manager. We have entered into a managing dealer agreement (the “Managing Dealer Agreement”) with the Managing Dealer. We have also entered into an administrative services agreement with the Administrator (the “Administrative Services Agreement”) and a sub-administration agreement with the Administrator and the Sub-Administrator (the “Sub-Administration Agreement”). Please see the disclosure below under “Compensation of The Manager, the Sub-Manager and the Managing Dealer” and “Management—Administrative Services” for a description of the compensation, reimbursements and distributions we contemplate paying (directly or indirectly) to the Manager, the Sub-Manager, the Managing Dealer, the Administrator, the Sub-Administrator and other affiliates in exchange for services provided to us. |

| (2) | Represents shareholders who purchased Class FA shares in the private offering. |

The following disclosure supersedes and replaces the first sentence of the sixth bullet under the sections “Prospectus Summary—Q: What conflicts of interest exist between us, the Manager, the Sub-Manager and their respective affiliates?” and “Conflicts of Interest and Certain Relationships and Related Party Transactions—Conflicts of Interest,” which appear on pages 7 and 130, respectively, of the Prospectus, and the twelfth sentence under the section “Risk Factors—Risks Related to the Manager, the Sub-Manager and Their Respective Affiliates—The Manager, the Sub-Manager and their respective affiliates, including our officers and some of our directors will face conflicts of interest including conflicts that may result from compensation arrangements with us and our affiliates, which could result in actions that are not in the best interests of our shareholders,” which appears on page 29 of the Prospectus.

Our board of directors will determine our net asset value with assistance from the Manager and the Sub-Manager and, because the base management fee is payable monthly and the base management fee for a certain month is calculated based on the average value of our gross assets at the end of that month and the immediately preceding calendar month and because the total return incentive fee reflects changes to our net asset value, a higher net asset value would result in a higher base management fee and incentive fee to the Manager and the Sub-Manager.

Risk Factors

The following risk factor supersedes and replaces the risk factor under the section “Risk Factors—Risks Related to This Offering and Our Shares—The U.S. Department of Labor, or the Department of Labor, has issued regulations that revise the definition of an ERISA fiduciary, and these regulations could have a significant effect on an investment in our shares,” which appears on page 24 of the Prospectus.

The U.S. Department of Labor, or the Department of Labor, has issued regulations that revise the definition of an ERISA fiduciary, and these regulations could have a significant effect on an investment in our shares.

The U.S. Department of Labor issued in 2016 its final regulation redefining “investment advice fiduciary” under ERISA and the Code. The final regulation significantly expanded the class of advisers and the scope of investment advice that are subject to fiduciary standards, imposing the same fiduciary standards on advisers to IRAs that have historically only applied to plans covered by ERISA. The Department of Labor also finalized certain prohibited transaction exemptions that allow investment advisers to receive compensation for providing investment advice under arrangements that would otherwise be prohibited due to conflicts of interest. Financial institutions that had been relying on the “Best Interest Contract Exemption” were permitted to comply with only a limited set of requirements through July 1, 2019. The United States Court of Appeals for the Fifth Circuit is currently expected to issue an order vacating the entire final regulation, the two special prohibited transaction exemptions that had come with the new rule, including the Best Interest Contract Exemption, and amendments to other long-standing prohibited transaction exemptions. The Department of Labor has announced that it intends to issue appropriate guidance in the future that will address the consequences of the disposition of the final regulation. Because the status of the final regulation is still developing and the application of the final regulation remains uncertain, plan fiduciaries and the beneficial owners of IRAs are urged to consult with their own advisors regarding this development.

The following risk factor is added to immediately follow the risk factor under the section “Risk Factors—Risks Related to This Offering and Our Shares—The U.S. Department of Labor, or the Department of Labor, has issued regulations that revise the definition of an ERISA fiduciary, and these regulations could have a significant effect on an investment in our shares,” which appears on page 24 of the Prospectus.

Our business could be adversely affected if we fail to maintain our qualification as a venture capital operating company, or VCOC, under the “plan assets” regulation under ERISA.

We sold and issued our Class FA shares in the private offering and used a substantial portion of the net proceeds from the private offering to acquire our initial businesses. We currently operate our business in a manner so that it is intended to qualify as a VCOC, as defined in the regulations governing plan assets, or the Plan Asset Regulations, promulgated under ERISA by the Department of Labor, and therefore are not subject to the ERISA fiduciary requirements with respect to our assets. However, if we fail to satisfy the requirements to qualify as a VCOC for any reason and no other exception under the Plan Asset Regulations applies, such failure could materially interfere with our activities or expose us to risks related to our failure to comply with the requirements. If no exception under the Plan Asset Regulations applied, the fiduciary responsibility standards of ERISA would apply to us, including the requirement of investment prudence and diversification, and certain transactions that we enter into, or may have entered into, in the ordinary course of business, might constitute or result in non-exempt prohibited transactions under Section 406 of ERISA or Section 4975 of the Code. A non-exempt prohibited transaction, in addition to imposing potential liability upon fiduciaries of a plan subject to Title I of ERISA or Section 4975 of the Code, may also result in the imposition of an excise tax under the Code upon a “party in interest” (as defined in ERISA) or “disqualified person” (as defined in the Code) with whom we engaged in the transaction. Therefore, our business could be adversely affected if we fail to quality as a VCOC under the Plan Asset Regulations.

Prior Performance of the Manager, the Sub-Manager and Their Respective Affiliates

This section supersedes and replaces the disclosure under the section “Prior Performance of the Manager, the Sub-Manager and their Respective Affiliates,”which begins on pages 60 of the Prospectus.

PRIOR PERFORMANCE OF THE MANAGER, THE SUB-MANAGER AND THEIR RESPECTIVE AFFILIATES

General

The information presented in this section represents the historical experience of certain programs sponsored or managed in the last ten years by CNL affiliates and LLCP and its affiliates, through December 31, 2017, except as otherwise indicated. The purpose of this prior performance information is to enable investors to evaluate accurately the experience of CNL affiliates and LLCP and its affiliates in sponsoring programs. Investors should not assume that they will experience returns, if any, comparable to those experienced by investors in the prior programs summarized in this section. Investors who purchase our shares will not thereby acquire an ownership interest in any of the entities to which the following information relates. Further, the private funds discussed in this section were conducted through privately held entities that were subject neither to the up-front commissions, fees and other expenses associated with this offering nor all of the laws and regulations that will apply to us as a publicly offered company.

Our structure and business strategy are different from certain of these prior programs and our performance will depend on factors that may not be applicable to or affect the performance of these programs. We consider a prior program to have a business objective similar to us if the program acquires, or has acquired, controlling and minority equity stakes in growing middle-market businesses located primarily in the United States. Although a business objective is similar, the specific acquisition criteria of a prior program may vary from program to program as compared to our acquisition criteria.

The prior performance tables included in this prospectus, beginning on page A-1, include further information regarding certain of the prior programs described herein.

Prior Programs Sponsored by CNL Affiliates

Since 1973, CNL affiliates have formed or acquired companies with more than $34 billion in assets. Prior to this offering, CNL affiliates have only sponsored real estate and credit investment programs. The company is the first program sponsored by CNL and its affiliates that targets the acquisition of controlling equity stakes in middle-market businesses. During the ten year period ended December 31, 2017, CNL affiliates have sponsored and managed seven public programs (the “CNL Public Programs”), which can be divided into two basic categories: the CNL Public REITs and the CNL BDCs. During the ten year period ended December 31, 2017, the CNL Public REITs have focused on investing in real properties, including healthcare, hotel, leisure, recreation and multifamily located primarily in the United States. The CNL Public REITs have raised a total of approximately $5.6 billion from retail investors and distributed approximately $2.6 billion in distributions to its investors through the end of year 2017. During this time, more than 250 properties have been disposed by the CNL Public REITs, representing approximately $5.0 billion in value. During the ten year period ended December 31, 2017, the CNL BDCs, which have focused on making debt investments in medium- and large-sized private companies located primarily in the United States and Western Europe, raised a total of approximately $3.6 billion from retail investors, invested approximately $10.9 billion, and distributed approximately $907.4 million in dividends to its investors through the end of year 2017. On November 14, 2017, shares of common stock of Corporate Capital Trust, Inc. (“CCT I”), one of the CNL BDCs, commenced trading on the New York Stock Exchange (the “Listing”) with the ticker symbol “CCT”. As part of the Listing, CNL terminated its advisory agreement with CCT I. As of December 31, 2017, Corporate Capital Trust II (“CCT II”), the other CNL BDC, had approximately 2,605 investors and $163.9 million invested across 98 positions in 82 issuers. Approximately $93.6 million of these investments were first lien senior secured loans.

Below is a description of the CNL Public Programs. All CNL Public Programs information is as of December 31, 2017, unless otherwise indicated. We believe that we do not share a comparable business strategy or business objective with any of the CNL Public Programs.

CNL Public REITs

The CNL Public REITs primarily focus on investing in real properties located in the United States. The five CNL Public REITs are described below:

| ● | CNL Lifestyle Properties, Inc. (“CNL Lifestyle Properties”) launched in 2004, closed in 2011 with a total of approximately $3.42 billion of capital raised and acquired approximately 150 properties. CNL Lifestyle Properties primarily focused on properties such as ski and mountain lifestyle properties, golf courses, attractions, marinas, senior living properties and additional lifestyle retail properties, and is in the process of selling its assets. As part of executing under its strategic alternative to provide liquidity to its stockholders, CNL Lifestyle Properties sold its remaining assets in April 2017, paid an interim liquidating distribution to its stockholders and made a final liquidating distribution and dissolved the company in December 2017. |

| ● | CNL Growth Properties, Inc. (“CNL Growth Properties”) launched in 2009, closed in 2014 with a total of approximately $209 million of capital raised and acquired more than ten properties. CNL Growth Properties primarily focused on investing in multifamily development properties that offered the potential for capital appreciation. As part of executing under its strategic alternative to provide liquidity to its stockholders, CNL Growth Properties sold its last property in September 2017, paid liquidating distributions to its stockholders and dissolved the company in October 2017. |

| ● | Global Income Trust, Inc.(“Global Income Trust”) launched in 2010, closed in 2013 with a total of approximately $83 million of capital raised and acquired nine properties. Global Income Trust primarily focused on investing in a portfolio of income-oriented commercial real estate and real estate-related assets. Global Income’s investments were made in both the United States and Germany. As part of executing under its strategic alternative to provide liquidity to its stockholders, Global Income Trust sold its remaining assets, paid a liquidating distribution to its shareholders and dissolved the company in December 2015. |

| ● | CNL Healthcare Properties, Inc.(“CNL Healthcare Properties”) launched in 2011, closed in 2015 with a total of approximately $1.77 billion of capital raised and acquired 152 properties. CNL Healthcare Properties primarily focuses on investing in senior housing, medical office building, acute care and post-acute care facility sectors, including stabilized, value add and development properties. |

| ● | CNL Healthcare Properties II, Inc. (“CNL Healthcare Properties II”) launched in 2016. As of December 31, 2017, it was in its primary offering period and had raised approximately $31.4 million and had acquired two properties. CNL Healthcare Properties II primarily focuses on investing in seniors housing, medical office building, acute care and post-acute care facility sectors, including stabilized, value add and development properties. |

CNL BDCs

The CNL BDCs primarily focus on making debt investments in medium- and large-sized private companies located primarily in the United States. The two CNL BDCs are described below:

| ● | CCT Ilaunched in 2011, closed in 2016 with a total of approximately $3.47 billion of capital raised. CCT I primarily focused on investing in medium- and large-sized private companies. Most of CCT I’s investments were made in both the United States and Western Europe. On November 14, 2017, as part of the Listing, CNL terminated its advisory agreement with CCT I. As of September 30, 2017, CCT I had 69,445 investors and $4.0 billion invested across 154 positions in 105 issuers. Approximately 61 of these investments were first lien senior secured loans. |

| ● | CCT II launched in 2016 and suspended its continuous public offering of its common shares of beneficial interest effective as of January 10, 2018. As of December 31, 2017, approximately $119.1 million in capital had been raised for CCT II. CCT II primarily focused on investing in medium- and large-sized private companies. Most of CCT II’s investments were made in the United States. As of December 31, 2017, CCT II had 2,605 investors and $163.9 million invested across 98 positions in 82 issuers. Approximately 49 of these investments were first lien senior secured loans. In connection with a transaction to transition the investment advisory services, as of April 9, 2018, CCT II is no longer sponsored or managed by CNL affiliates. |

As described above, we consider a program that acquires, or has acquired, controlling and minority equity stakes in growing middle-market businesses located primarily in the United States to have a business objective similar to ours. We believe the CNL Public REITs do not have business objectives similar to ours because they primarily invest in real properties. We also believe the CNL BDCs do not have business objectives similar to ours because they primarily make debt investments in medium- and large-sized private companies. Thus, we believe none of the CNL Public Programs has comparable business strategies or business objectives to that of the company and we have determined that no further historical performance information is necessary to be included in the prospectus in the form of prior performance tables.

Upon written request, you may obtain, without charge, a copy of the most recent annual report on Form 10-K filed with the SEC by any public program described above. We will provide exhibits to each such Form 10-K upon payment of a reasonable fee for copying and mailing expenses. These reports and exhibits, as well as other reports required to be filed with the SEC, are also available at the SEC’s website atwww.sec.gov.

Adverse Conditions and Other Developments Affecting CNL Public Programs

Certain of the prior programs sponsored by CNL affiliates have been affected by general economic conditions, capital market trends and other external factors during their respective operating periods.

CNL Lifestyle Properties

CNL Lifestyle Properties was a real estate investment trust that invested in income-producing properties with a focus on lifestyle-related industries. CNL Lifestyle Properties became effective on April 16, 2004 and invested in a total of 214 properties, with an aggregate initial purchase price of approximately $4.3 billion, across a variety of different lifestyle industries, including a majority within the ski & mountain lifestyle, golf, attractions, healthcare and marina industries. Commencing with the onset of the global financial crisis in 2008, certain properties owned by CNL Lifestyle Properties suffered declines in performance which had a negative impact on the fund’s net asset value. The public primary offering price for CNL Lifestyle Properties was $10.00 per share throughout three public primary offerings from April 2004 to April 2011.

Beginning in the second quarter of 2010, CNL Lifestyle Properties limited redemption requests to $1.75 million per quarter and in April 2012, increased this limitation to $3.0 million per quarter, prior to the suspension of its redemption plan effective September 26, 2014. Consistent with its articles of incorporation, in March 2014, CNL Lifestyle Properties appointed a special committee comprised of its independent directors of the board and announced the engagement of a financial advisor to assist management and its board of directors in evaluating various strategic alternatives to provide liquidity to stockholders. Beginning in March 2014 and continuing through April 2017, CNL Lifestyle Properties liquidated its assets through multiple transactions in order to provide liquidity to its stockholders.

In April 2017, CNL Lifestyle Properties sold its remaining 36 properties to EPR Properties (“EPR”) and Ski Resort Holdings, LLC in exchange for both cash and EPR stock. As a result of this transaction, CNL Lifestyle Properties paid an interim liquidating distribution to its stockholders in the form of cash and EPR stock. Inception to dissolution, CNL Lifestyle Properties has paid total distributions with a value from $10.37 to $6.50 for each outstanding share of the company’s common stock,depending on the timing of the stockholders’ initial investment, excluding shares sold under thedistribution reinvestment plan. CNL Lifestyle Properties finalized the liquidation process of its remaining de minimis assets and outstanding liabilities, made a final distribution to stockholders and dissolved the company in December 2017.

Global Income Trust

Global Income Trust (formally known as Macquarie CNL Global Income Trust, Inc.) was formed in March 2009 with the intent to acquire and operate a diverse portfolio of commercial real estate assets and real estate-related assets on a global basis. The company began raising capital in a public offering in April 2010, and the offering closed in April 2013. Global Income Trust acquired two Class A office buildings and two industrial warehouses in the United States. Those properties were leased to third-party tenants and those tenants included subsidiaries of Samsonite, Mercedes-Benz Financial, and FedEx Ground. Additionally, Global Income Trust acquired a portfolio of five neighborhood retail centers in Germany. BlackRock Real Estate, as successor toMacquarie Capital Funds Inc., was a co-investor and sub-advisor to Global Income Trust on the German properties. The aggregate initial purchase price of the nine properties was approximately $121 million.

Global Income Trust did not achieve a critical mass of investments which negatively impacted the net asset value of the fund relative to the $10.00 per share public primary offering price in effect from April 2010 through April 2013. In April 2013, when its offering closed, Global Income Trust terminated its dividend reinvestment program and suspended its share redemption plan. In August 2013, Global Income Trust’s board of directors appointed a special committee comprised of the independent directors of the board and announced the engagement of a financial advisor to assist management and its board of directors in evaluating strategic alternatives to provide liquidity to stockholders. During 2015, Global Income Trust, through multiple transactions, sold all of its net assets and paid a liquidating distribution of $7.01 for each outstanding share of the company’s common stock. As part of the $7.01 liquidating distribution, CNL Global Income Advisors, LLC, Global Income Trust’s advisor, made a direct payment to Global Income Trust’s stockholders with respect to previously paid reimbursements of certain organizational, offering and operating expenses. Global Income Trust paid total cash distributions from $10.46 to $8.45 for each outstanding share of the company’s common stock, depending on the timing of the stockholders’ investment, excluding shares sold under thedistribution reinvestment plan. Global Income Trust dissolved on December 31, 2015.

CNL Growth Properties

CNL Growth Properties (formally known as Global Growth Trust, Inc.) was launched in 2009 and acquired an interest in 18 properties with a capitalized cost of approximately $640 million. CNL Growth Properties acquired, developed, and operated 17 Class A multifamily communities in nine states with eight different regional and national development joint venture partners. CNL Growth Properties was the majority owner and managing member in each joint venture, with an ownership interest ranging from 54-95%. Beginning in January 2015 and continuing through September 2017, CNL Growth Properties successfully liquidated these properties through individual sales of each of the seventeen communities. CNL Growth Properties also acquired a three building office complex in 2011 which was sold in 2014.

The public primary offering price for CNL Growth Properties was $10.00 per share during the initial offering from October 2009 to April 2013, $10.84 per share during the follow-on offering from August 2013 to January 15, 2014, and then $11.00 per share thereafter until the offering closed in April 2014. Stockholders of CNL Growth Properties received total distributions, depending on the timing of the stockholders’ initial investment from $18.21 to $13.71 for each outstanding share of the company’s common stock (excluding shares sold under the distribution reinvestment plan). CNL Growth Properties was dissolved on October 31, 2017.

Prior Programs Sponsored by LLCP and its Affiliates

From 1984 through 1993, LLCP Founding Principals Arthur E. Levine and Lauren B. Leichtman made seven investments in their individual capacities prior to establishing LLCP. From 1994 through March 31, 2018, LLCP and the LLCP Senior Executives have managed approximately $9.6 billion of institutional capital. Over this time, LLCP has sponsored private funds that have focused on the acquisition of controlling and minority equity stakes in middle-market businesses located primarily in the United States. LLCP has also sponsored private funds that have focused on making value-oriented and special situation investments and acquiring stressed, distressed or over-leveraged companies, and private funds focused on acquiring regional businesses. LLCP has sponsored and managed twelve private funds (the “LLCP Private Funds”), raised a total of approximately $7.2 billion of capital commitments from over 130 institutional and other investors, and invested approximately $4.7 billion (excluding follow-on investments) in over 75 middle-market companies across various industries, including restaurant franchisors, consumer products and business services. See “Appendix A: Prior Performance Tables—Table I” for more detailed information about LLCP and its affiliates’ experience in raising and investing funds in connection with certain of these private funds. During this time, 43 businesses have been sold by the LLCP Private Funds. The aggregate investment cost of these businesses was approximately $1.4 billion with a realized value of approximately $3.0 billion. See “Appendix A: Prior Performance Tables—Table V” for more detailed information about sales of individual middle-market companies by certain of the LLCP Private Funds.

Below is a description of the LLCP Private Funds, which are divided into three basic categories: Private Acquisition Funds; Value Funds; and Regional Based Funds. All LLCP Private Funds information is as of December 31, 2017, unless otherwise indicated. We believe that we share a similar business objective with the Private Acquisition Funds, although the specific acquisition criteria for the businesses we acquire may vary from the Private Acquisition Funds’ acquisition criteria. We believe that we do not share a similar business objective with the Value Funds or the Regional Based Funds.

Private Acquisition Funds

The Private Acquisition Funds acquire, or have acquired, controlling and minority equity stakes in growing middle-market businesses located primarily in the United States.

The seven Private Acquisition Funds are described below:

| ● | Levine Leichtman Capital Partners, L.P.(“LLCP I”) launched in 1994, closed in 1994 with a total of approximately $102.5 million of capital commitments and made six investments. LLCP I primarily focused on companies in the U.S. with annual revenues of $50 to $500 million. LLCP I dissolved on November 30, 2009. |

| ● | Levine Leichtman Capital Partners II, L.P. (“LLCP II”) launched in December 1997, closed in August 1999 with a total of approximately $350 million of capital commitments and has made 12 investments. LLCP II primarily focused on companies in the U.S. with annual revenues ranging from $50 million to $500 million. LLCP II is currently in its wind-down period. |

| ● | Levine Leichtman Capital Partners III, L.P. (“LLCP III”) launched in June 2002, closed in December 2004 with a total of approximately $500 million of capital commitments and has made 14 investments. LLCP III primarily focused on companies in the U.S. with annual revenues ranging from $50 million to $500 million. LLCP III is currently in its liquidation period. |

| ● | Levine Leichtman Capital Partners IV, L.P. (“LLCP IV”) launched in September 2007, closed in October 2009 with a total of approximately $1.1 billion of capital commitments and has made 11 investments. LLCP IV primarily focused on companies in the U.S. with annual revenues ranging from $50 million to $500 million. LLCP IV’s investment period has expired; however, it may be called upon to provide follow-on capital for existing investments. |

| ● | Levine Leichtman Capital Partners V, L.P. (“LLCP V”) launched in September 2012, closed in March 2014 with a total of approximately $1.6 billion of capital commitments and has made 10 investments. LLCP V primarily focuses on companies in the U.S. with annual revenues ranging from $50 million to $500 million. LLCP V is not actively seeking new investment opportunities; however, it may be called upon to provide follow-on capital for existing investments. |

| ● | Levine Leichtman Capital Partners VI, L.P. (“LLCP VI”) launched in May 2017, and is currently fundraising with commitments of approximately $1.97 billion and a target size of $2.2 billion. LLCP VI has made two investments to date and primarily focuses on companies in the U.S. with annual revenues ranging from $50 million to $500 million. LLCP VI is currently in its investment period. |

| ● | Levine Leichtman Capital Partners Small Business Fund, L.P. (“SB Fund”) launched in May 2010, closed in February 2011 with a total of approximately $226 million of capital commitments and has made seven investments. The SB Fund focuses on companies in the U.S. with annual revenues of less than $50 million at the time of investment. The SB Fund’s investment period has expired; however, it may be called upon to provide follow-on capital for existing investments. |

| ● | LLCP Lower Middle Market Fund, L.P. (“LMM Fund”) launched in March 2016, closed in October 2016 with a total of $615 million of capital commitments and has made three investments. The LMM Fund focuses on U.S companies with annual revenues of less than $50 million at the time of investment. The LLM Fund is currently in its investment period. |

The table below sets forth certain performance data relating to the Private Acquisition Funds. From July 1995 through December 31, 2017, the Private Acquisition Funds invested approximately $3.9 billion in 66 investments generating a gross realized internal rate of return of 20.2% and a 2.1x cash-on-cash multiple. This performance and other data is not a guarantee or prediction of the returns that we may achieve in the future.

Private Acquisition Funds

Performance From Inception through December 31, 2017(1)

| ($ in thousands) | | As of December 31, 2017 | |

| | | Total Number of

Investments | | | Investment Amount(2)(3) | | | Realized Value(4)(5) | | | Unrealized Value(4) | | | Gross

Internal

Rate of

Return(6) | | | Net

Internal

Rate of

Return(7) | | | Management

& Incentive

Fees,

Expenses(8) | |

| LLCP I | | | 6 | | | $ | 98,560 | | | $ | 159,945 | | | $ | — | | | | 44.2 | % | | | 18.7 | % | | $ | 32,534 | |

| LLCP II | | | 12 | | | $ | 346,772 | | | $ | 497,128 | | | $ | — | | | | 10.7 | % | | | 6.0 | % | | $ | 61,098 | |

| LLCP III | | | 14 | | | $ | 470,356 | | | $ | 919,192 | | | $ | — | | | | 16.3 | % | | | 9.8 | % | | $ | 142,596 | |

| LLCP IV | | | 11 | | | $ | 899,654 | | | $ | 1,701,345 | | | $ | 436,616 | | | | 29.0 | % | | | 20.0 | % | | $ | 316,280 | |

| LLCP V | | | 11 | | | $ | 1,376,220 | | | $ | 367,970 | | | $ | 1,676,556 | | | | 19.0 | % | | | 12.1 | % | | $ | 118,158 | |

| LLCP VI | | | 2 | | | $ | 402,924 | | | $ | 2,043 | | | $ | 420,071 | | | | 30.9 | % | | | — | (9) | | $ | 21,726 | |

| SB Fund | | | 7 | | | $ | 141,097 | | | $ | 162,106 | | | $ | 160,390 | | | | 41.9 | %(10) | | | 32.5 | %(10) | | $ | 43,148 | |

| LMM Fund | | | 3 | | | $ | 195,650 | | | $ | 9,910 | | | $ | 209,780 | | | | 17.4 | % | | | — | (9) | | $ | 20,519 | |

| (1) | The private funds shown in this table were conducted through privately held entities that were subject neither to the up-front commissions, fees and other expenses associated with this offering nor all of the laws and regulations that will apply to us. |

| (2) | Excludes capital called for fund-level fees and expenses. |

| (3) | Investment Amount is determined as of the closing of the investment and includes all equity called and all debt funded or contractually committed to be funded by the collective investments herein. LLCP V and LLCP VI Investment Amounts include bridge financing, which is expected to be repaid to investors within two years of the closing of each investment and therefore will not be considered permanent capital. |

| (4) | Realized and Unrealized Value is calculated before fees, expenses, and general partner’s carried interest. Realized value represents the combination of cumulative interest and dividend payments as well as net proceeds derived from the ultimate sale transaction. Determinations of Unrealized Value are based upon the principal amount of the Fund’s investment in the underlying portfolio company’s debt securities (or possibly less if such debt security is impaired) at the time of determination plus the value of such Fund’s equity investment in the portfolio company, as valued by LLCP’s valuation committee. LLCP believes these values are reasonable and appropriate; however, there can be no assurance that proceeds will be realized on these investments, or that, if or when realized, the proceeds will be equal to the values estimated by LLCP. Unrealized Values are as of December 31, 2017. U.S. GAAP requires that foreign currency fluctuations be taken into account in determining value for purposes of the Fund’s financial statements; however fluctuations are removed for GL Education’s value in this table and the value is presented on a constant currency basis utilizing the applicable foreign exchange rate at closing of the investment. |

| (5) | Realized Value may include notes receivables, escrows, holdbacks, residual interests and other reserves that each fund believes will be received at the expiration of any applicable time periods or otherwise. |

| (6) | Gross Internal Rate of Return is calculated before fees, expenses, and general partner’s carried interest, calculated using a “time-zero” methodology in which the cash flows of all investments (actual amounts of contributions and distributions) are based from the same hypothetical starting date. |

| (7) | Net Internal Rate of Return is calculated after fees, expenses, and general partner’s carried interest, calculated using a “time-zero” methodology in which the cash flows of all investments (actual amounts of contributions and distributions) are based from the same hypothetical starting date. |

| (8) | Does not include unrealized carried interest. |

| (9) | Net Internal Rates of Return for LLCP VI and LMM Fund are not meaningful as these funds’ investments have been held for less than 18 months as of December 31, 2017. |

| (10) | The Gross Internal Rate of Return for the SB Fund is calculated excluding the effect of any fund-level leverage and, accordingly, is calculated based on limited partner capital only. The Net Internal Rate of Return for the SB Fund reflects the reduction of any debt service charges in connection with fund-level leverage. |

Regional Focused Funds

The two Regional Focused Funds are described below:

| ● | Levine Leichtman Capital Partners California Growth Fund, L.P. (“California Growth Fund”) launched in May 2007, closed in May 2007 with a total of approximately $40 million of capital commitments and has made two investments. The California Growth Fund primarily focused on investments in portfolio companies located in the State of California, with annual revenues of $50 million or less at the time of investment. The California Growth Fund also invested in one or more subsidiaries that directly hold or invest primarily in loan or debt obligations or participations therein of third parties. The California Growth Fund is currently in its wind-down period. |

| ● | Levine Leichtman Capital Partners Europe, L.P. (“Europe Fund”) launched in November 2014, closed in November 2014 with a total of approximately €100 million of capital commitments and has made two investments. The Europe Fund primarily focuses on investments in companies located in Western Europe (excluding the United Kingdom). The Europe Fund is currently in its investment period. |

Value Funds

The Value Funds primarily focus on making value-oriented investments. The two Value Funds are described below:

| ● | Levine Leichtman Capital Partners Deep Value Fund, L.P.(“Deep Value Fund”) launched in May 2005, closed in December 2006 with a total of approximately $508 of capital commitments and has made 39 investments. The Deep Value Fund focused primarily on investments in debt, debt-related and other securities of small and middle capitalization U.S.-based companies in stressed, distressed or other special situations. The Deep Value Fund dissolved in March 2018. |

| ● | Levine Leichtman Capital Partners Private Capital Solutions, L.P. (“PCS Fund”) launched in May 2011, closed in December 2012 with a total of approximately $227 million of capital commitments and has made five investments. The PCS Fund focuses primarily on making debt and equity investments in value-oriented, slower growth middle-market companies. The PCS Fund is currently in its investment period. |

As described above, we consider a private fund that acquires, or has acquired, controlling and minority equity stakes in growing middle-market businesses located primarily in the United States to have a business objective similar to ours. Thus, we believe the Private Acquisition Funds have business objectives similar to ours. With respect to the Value Funds, the Deep Value Fund did not have business objectives similar to ours because it primarily made debt investments in stressed, distressed or over-leveraged companies and the PCS Fund does not have business objectives similar to ours because it primarily makes investments in value-oriented, slower growth middle-market companies. With respect to the Regional Focused Funds, the California Growth Fund does not have business objectives similar to ours because it limits its investments to only companies in California and invests in loan and debt originations of third parties. The Europe Fund also does not have business objectives similar to ours because it limits its investment to only companies in Europe.

Adverse Conditions and Other Developments Affecting LLCP Private Funds

Certain of the prior programs sponsored by LLCP affiliates have been affected from time to time by general economic conditions, capital market trends and other external factors during their respective operating periods. However, there have been no major adverse business developments or conditions experienced by any LLCP-affiliated programs that would be material to investors, including as a result of recent general economic conditions. You should not rely on the past performance of investments by other LLCP-affiliated entities to predict our future results. Our business strategy and key employees differ from the business strategies and key employees of certain other LLCP-affiliated programs in the past, present and future.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Prospectus is hereby supplemented with the following “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is substantially the same as that which was included in our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2018. Unless otherwise defined in this supplement, capitalized terms are defined in such Quarterly Report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion is based on the unaudited condensed financial statements as of March 31, 2018 and for the period February 7, 2018 (commencement of operations) through March 31, 2018. This information should be read in conjunction with the accompanying unaudited condensed financial statements and the notes thereto included elsewhere in this supplement. Capitalized terms used in this section have the same meaning as in the accompanying unaudited condensed financial statements unless otherwise defined herein.

Overview

CNL Strategic Capital, LLC is a limited liability company that primarily seeks to acquire and grow durable, middle-market businesses. We are externally managed by CNL Strategic Capital Management, LLC, an entity that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. The Manager is controlled by CNL Financial Group, LLC, a private investment management firm specializing in alternative investment products. We have engaged the Manager under a management agreement pursuant to which the Manager is responsible for the overall management of our activities. The Manager has engaged Levine Leichtman Strategic Capital, LLC, a registered investment advisor, under a sub-management agreement pursuant to which the Sub-Manager is responsible for the day-to-day management of our assets. The Sub-Manager is an affiliate of Levine Leichtman Capital Partners, Inc.

The Manager and the Sub-Manager are collectively responsible for sourcing potential acquisition and debt financing opportunities, subject to approval by the Manager’s management committee that such opportunity meets our investment objectives and final approval of such opportunity by our board of directors, and monitoring and managing the businesses we acquire and/or finance on an ongoing basis. The Sub-Manager is primarily responsible for analyzing and conducting due diligence on prospective acquisitions and debt financings, as well as the overall structuring of transactions.

We target, for acquisition, businesses that are highly cash flow generative with annual revenues of primarily between $25 million and $500 million. Our business strategy is to acquire controlling equity stakes in combination with loan positions in middle-market businesses. Our business strategy seeks to provide long-term capital appreciation and current income, while protecting invested capital. In addition and to a lesser extent, we intend to acquire other debt and minority equity positions, which may include acquiring debt in the secondary market as well as minority equity stakes and loan positions via co-investments with other funds managed by the Sub-Manager or their affiliates. We expect that these positions will comprise a minority of our total assets.

We were formed as a Delaware limited liability company on August 9, 2016 and we intend to operate our business in a manner that will permit us to avoid registration under the Investment Company Act. We are not a “blank check” company within the meaning of Rule 419 of the Securities Act. We did not commence operations until February 7, 2018 as described below.

We offered through a private placement up to $85 million of Class FA limited liability company interests and up to $115 million of Class A limited liability company interests (one of the classes of Shares that constitute non-founder shares).

In October 2016, we confidentially submitted a registration statement on Form S-1 with the SEC in connection with the Public Offering. Through our Public Offering, we are offering, in any combination, four classes of shares: Class A shares, Class T shares, Class D shares and Class I shares. See “Notes to Condensed Consolidated Financial Statements” — Note 7. “Capital Transactions” included in this supplement for additional information related to our Offerings.

On February 7, 2018, we commenced operations when we met the minimum offering requirement of $80 million in Class FA shares under the Private Placement and issued approximately 3.3 million shares of Class FA shares for aggregate gross proceeds of $81.7 million, as described below under “Our Common Shares Offering.” On February 7, 2018, we acquired the initial businesses using a substantial portion of the net proceeds from the Private Placement. For a discussion of the initial businesses, see “—Portfolio and Investment Activity” below.

On March 7, 2018, our Registration Statement was declared effective by the SEC and we began offering $1,000,000,000 of Shares under the Public Offering, as further described below under “—Our Common Shares Offering—Public Offering.”

Our Common Shares Offering

As of December 31, 2017, we had issued 4,000 shares of the Company’s Class FA shares, to each of the Manager and Sub-Manager, for an aggregate purchase price of $200,000 (total of 8,000 Class FA shares). No selling commissions or dealer manager fees were paid in connection with the issuances.

Private Placement

We offered through the Private Placement up to $85 million of Class FA shares and up to $115 million of Class A shares (one of the classes of Shares that constitute non-founder shares) on a best efforts basis, which meant that the Placement Agent in connection with the Private Placement used its best efforts but was not required to sell any specific amount of shares. On February 7, 2018, we commenced operations when we met our minimum offering requirement of $80 million in Class FA shares under the Private Placement and we issued approximately 3.3 million Class FA shares at $25.00 per Class FA share resulting in gross proceeds of approximately $81.7 million. The $81.7 million in gross proceeds included a cash capital contribution of $2.4 million from the Manager in exchange for 96,000 Class FA shares and a cash capital contribution of $9.5 million from CNL Strategic Capital Investment, LLC, which is indirectly controlled by James M. Seneff, Jr., the chairman of the Company, in exchange for 380,000 Class FA shares. The $81.7 million also included 96,000 Class FA shares received in exchange for $2.4 million of non-cash consideration in the form of equity interests in Lawn Doctor received from an affiliate of the Sub-Manager pursuant to the Exchange Agreement. The $81.7 million in gross proceeds also included a cash capital contribution of approximately $0.4 million in exchange for 15,000 Class FA shares, from other individuals affiliated with the Manager. The Class FA shares and Class A shares in the Private Placement were offered for sale only to persons that were “accredited investors,” as that term is defined under the Securities Act, and Regulation D promulgated thereunder. No Class A shares were sold under the Private Placement.

We did not incur any selling commissions or placement agent fees from the sale of the approximately 3.3 million Class FA shares sold under the terms of the Private Placement. We did incur obligations to reimburse the Manager and Sub-Manager for organization and offering costs based on actual amounts raised. These organization and offering costs related to the Private Placement had been previously advanced by the Manager and Sub-Manager, as described further in “Notes to Condensed Consolidated Financial Statements” — Note 5. “Related Party Transactions” included in this supplement. Through March 31, 2018, we incurred approximately $0.7 million of organization and offering costs.

Public Offering

Once the Registration Statement became effective on March 7, 2018, we began offering up to $1,000,000,000 of Shares, on a best efforts basis, which means that CNL Securities Corp., as the Managing Dealer of the Public Offering, will use its best efforts, but is not required to sell any specific amount of Shares. We are offering, in any combination, four classes of Shares in the Public Offering: Class A shares, Class T shares, Class D shares and Class I shares. The initial minimum permitted purchase amount is $5,000 in Shares. The initial per share Public Offering price was $27.32 per Class A share, $26.25 per Class T share, $25.00 per Class D share and $25.00 per Class I share. There are differing selling fees and commissions for each class. We will also pay annual distribution and shareholder servicing fees, subject to certain limits, on the Class T and Class D shares sold in the Public Offering (excluding sales pursuant to the Company’s distribution reinvestment plan).

In April 2018, our board of directors approved new per share public offering prices for each share class in the Public Offering. The new public offering prices became effective on April 27, 2018. The following table provides the new public offering prices and applicable upfront selling commissions and dealer manager fees for each share class available in the Public Offering:

| | | | Class A | | | Class T | | | Class D | | | Class I | |

| Public Offering Price, Per Share | | | $ | 27.46 | | | $ | 26.38 | | | $ | 25.13 | | | $ | 25.13 | |

| Selling Commissions, Per Share | | | $ | 1.65 | | | $ | 0.79 | | | $ | — | | | $ | — | |

| Dealer Manager Fees, Per Share | | | $ | 0.68 | | | $ | 0.46 | | | $ | — | | | $ | — | |

In May 2018, after taking in consideration the effect of subsequent post-closing adjustments during the true up period relating to the working capital and tax indebtedness of our portfolio companies, our net asset value per Class FA share was adjusted to $25.16 as of March 31, 2018. See “Notes to Condensed Consolidated Financial Statements” — Note 9. “Financial Highlights” included in this supplement for information on the end of period net asset value for Class FA shares.

We are also offering, in any combination, up to $100,000,000 of Class A shares, Class T shares, Class D shares and Class I shares to be issued pursuant to our distribution reinvestment plan. The Public Offering had a minimum offering requirement of $2 million in Shares under the Private Placement or the Public Offering. As of February 2018, we had met the minimum offering requirement of $2 million of the Public Offering through the sale of more than $80 million in Class FA shares under the Private Placement.

Portfolio and Investment Activity

In October 2017, we entered into a merger agreement with LD Merger Sub, Inc., a wholly owned subsidiary of the Company, and LD Parent, Inc., the parent company of Lawn Doctor. The merger agreement was amended on February 6, 2018. On February 7, 2018, pursuant to the terms of the merger agreement and the Exchange Agreement, we acquired an approximately 63.9% equity interest in Lawn Doctor from an affiliate of the Sub-Manager, through an investment consisting of common equity and a debt investment in the form of a secured second lien loan to Lawn Doctor. After the closing of the merger, the consummation of the equity contribution pursuant to the Exchange Agreement and subsequent purchases of common equity in Lawn Doctor by certain members of Lawn Doctor’s senior management team, we own approximately 62.9% of the outstanding equity in Lawn Doctor. As of March 31, 2018, the cost basis of our investments in Lawn Doctor was approximately $30.5 million of common equity and $15.0 million of a debt investment. The purchase price is subject to adjustment based on, among other factors, Lawn Doctor’s working capital and indebtedness at closing.

In October 2017, we entered into a merger agreement with PFHI Merger Sub, Inc., a wholly owned subsidiary of the Company, and Polyform. The merger agreement was amended on February 6, 2018. On February 7, 2018, pursuant to the terms of the merger agreement, we acquired an approximately 87.1% equity interest in Polyform from an affiliate of the Sub-Manager, through an investment consisting of common equity and a debt investment in the form of a first lien secured term loan to Polyform. As of March 31, 2018, the cost basis of our investments in Polyform was approximately $15.8 million of common equity and $15.7 million of a debt investment. The purchase price is subject to adjustment based on, among other factors, Polyform’s working capital and indebtedness at closing.

The debt investments in the form of a secured second lien loan to Lawn Doctor and in the form of a first lien secured term loan to Polyform as described above accrue interest at a per annum rate of 16%. Each loan will mature in August 2023. The note purchase agreements contain customary covenants and events of default.

As of March 31, 2018, our investment portfolio included four distinct investment positions and the fair value of our portfolio was comprised of the following:

| | | As of March 31, 2018 | |

| Asset Category | | Cost | | | Fair Value | | | Fair Value Percentage of Investment Portfolio | |

| Senior debt | | | | | | | | | | | | |

| Senior secured debt - first lien | | $ | 15,700,000 | | | $ | 15,700,000 | | | | 20.3 | % |

| Senior secured debt - second lien | | | 15,000,000 | | | | 15,000,000 | | | | 19.4 | |

| Total senior debt | | $ | 30,700,000 | | | $ | 30,700,000 | | | | 39.7 | |

| Equity | | | 46,231,763 | | | | 46,756,212 | | | | 60.3 | |

| Total investments | | $ | 76,931,763 | | | $ | 77,456,212 | | | | 100.0 | % |

As of March 31, 2018, the weighted average yield on our debt portfolio was 16.0%.

Lawn Doctor

Lawn Doctor is a leading franchisor of residential lawn care programs and services. Lawn Doctor’s core service offerings provide residential homeowners with year-round monitoring and treatment by focusing on weed and insect control, seeding, and professionally and consistently-administered fertilization, using its proprietary line of equipment. Lawn Doctor is not involved in other lawn maintenance services, such as mowing, edging, and leaf blowing.

Lawn Doctor’s franchised business model has repeatedly received recognition as a leading franchisor of lawn care services by industry associations and trade magazines, and has a customer retention rate of more than 80% over the past three years, which reflects the high level of quality and customer service that Lawn Doctor has been able to sustain over the years. Lawn Doctor’s efforts on behalf of its franchisees (which include shared marketing programs and infrastructure, an extensive online presence, and comprehensive training) have attracted a strong core of dedicated franchise owners who, in turn, contribute to the continued growth and success of the Lawn Doctor brand.

Polyform

Polyform is a leading developer, manufacturer and marketer of polymer clay products worldwide. Through its two primary brands, Sculpey® and Premo!®, Polyform sells a comprehensive line of premium craft products to a diverse mix of customers including specialty and big box retailers, distributors and e-tailers. We believe Polyform is well regarded for its high quality, comprehensive line of polymer clays, clay molds, children kits, wax-base clays, non-dry clays, clay tools and accessories. Polyform’s strong brand recognition, unique product attributes and strong customer network have earned it one of the leading market share positions in the polymer clay segment within the United States. Polyform estimates that its products are available in approximately 8,900 retail locations through its major customers, plus many other locations through independent retailers. Products are shipped directly to 48 countries worldwide.

See “Notes to Condensed Consolidated Financial Statements” — Note 3. “Investments” included in this supplement for additional information related to our investments.

Adjusted EBITDA

When evaluating the performance of our portfolio, we monitor adjusted EBITDA to measure the financial and operational performance of our portfolio companies and their ability to pay contractually obligated debt payments to us. In connection with this evaluation, the Manager and Sub-Manager review monthly portfolio company operating performance versus budgeted expectations and conduct regular operational review calls with the management teams of the portfolio companies.

We present Adjusted EBITDA as a supplemental measure of the performance of our initial businesses. We define Adjusted EBITDA as net income (loss), plus (i) interest expense, net, and loan cost amortization, (ii) taxes and (iii) depreciation and amortization, as further adjusted for certain other non-recurring items that we do not consider indicative of the ongoing operating performance of our initial businesses. These further adjustments are itemized below. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Adjusted EBITDA, you should be aware that in the future our initial businesses may incur expenses that are the same as or similar to some of the adjustments in this presentation. This presentation of Adjusted EBITDA should not be construed as an inference that the future results of our initial businesses will be unaffected by unusual or non-recurring items.

We present Adjusted EBITDA because we believe it assists investors in comparing the performance of such businesses across reporting periods on a consistent basis by excluding items that we do not believe are indicative of their core operating performance.

Adjusted EBITDA has limitations as an analytical tool. Some of these limitations are: (i) Adjusted EBITDA does not reflect cash expenditures, or future requirements, for capital expenditures or contractual commitments; (ii) Adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs; (iii) Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on indebtedness; (iv) although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and Adjusted EBITDA does not reflect any cash requirements for such replacements; (v) Adjusted EBITDA does not reflect the impact of certain cash charges resulting from matters we do not consider to be indicative of the on-going operations of our initial businesses; and (vi) other companies in similar industries as our initial businesses may calculate Adjusted EBITDA differently, limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on the GAAP results and using Adjusted EBITDA only supplementally.

Summarized Net Income to Adjusted EBITDA Reconciliations (Unaudited)

Lawn Doctor

| | | Period February 7, 2018(1) through

March 31, 2018 | |

| Net Income (GAAP) | | $ | 23,635 | |

| Interest and Debt Related Expenses | | | 606,186 | |

| Depreciation and Amortization | | | 127,088 | |

| Income Tax Expense | | | 7,825 | |

| Transaction Costs | | | 313,895 | |

| Adjusted EBITDA (non-GAAP) | | $ | 1,078,629 | |

Polyform

| | | Period February 7, 2018(1) through March 31, 2018 | |

| Net Loss (GAAP) | | $ | (431,736 | ) |

| Interest and Debt Related Expenses | | | 428,946 | |

| Depreciation and Amortization | | | 291,465 | |

| Income Tax Benefit | | | (48,000 | ) |

| Transaction Costs | | | 313,895 | |

| Adjusted EBITDA (non-GAAP) | | $ | 554,570 | |

| (1) | February 7, 2018 is the date we acquired the portfolio companies. |

Factors Impacting Our Operating Results

We expect that the results of our operations will be affected by a number of factors. Many of the factors that will affect our operating results are beyond our control.

We will be dependent upon the earnings of and cash flow from the businesses that we acquire to meet our corporate overhead and management fee expenses and to make distributions. These earnings and cash flows, net of any minority interests in these businesses, will be available:

| ● | first, to meet management fees and corporate overhead expenses of the company; and |

| ● | second, to fund business operations and distributions by the company to shareholders. |

Size of assets

If we are unable to raise substantial funds, we will be limited in the number and type of acquisitions we may make. The size of our assets will be a key revenue driver. Generally, as the size of our assets grows, the amount of income we receive will increase. In addition, our assets may grow at an uneven pace as opportunities to acquire assets may be irregularly timed, and the timing and extent of the Manager’s and the Sub-Manager’s success in identifying such opportunities, and our success in making acquisitions, cannot be predicted.

Market conditions

From time to time, the global capital markets may experience periods of disruption and instability, which could materially and adversely impact the broader financial and credit markets and reduce the availability to us of debt and equity capital. Significant changes or volatility in the capital markets may also have a negative effect on the valuations of our businesses and other assets. While all of our assets are likely to not be publicly traded, applicable accounting standards require us to assume as part of our valuation process that our assets are sold in a principal market to market participants (even if we plan on holding an asset long term or through its maturity) and impairments of the market values or fair market values of our assets, even if unrealized, must be reflected in our financial statements for the applicable period, which could result in significant reductions to our net asset value for the period. Significant changes in the capital markets may also affect the pace of our activity and the potential for liquidity events involving our assets. Thus, the illiquidity of our assets may make it difficult for us to sell such assets to access capital if required, and as a result, we could realize significantly less than the value at which we have recorded our assets if we were required to sell them for liquidity purposes.

Results of Operations

From the time of our formation on August 9, 2016 through February 6, 2018, we had not commenced operations. Operations commenced on February 7, 2018, when aggregate subscription proceeds in excess of the minimum offering amount of $80 million were received in the Private Placement. We acquired our initial businesses on February 7, 2018 using a substantial portion of the net proceeds from the Private Placement. See “—Our Common Shares Offering” and “—Portfolio and Investment Activity” above for additional information.

As of March 31, 2018, the fair value of our investment portfolio totaled approximately $77.5 million. Our investments at March 31, 2018 consisted of two debt investments and two equity investments. See section entitled “—Portfolio and Investment Activity” above for discussion of the general terms and characteristics of our investments, and for information regarding investment activities during the period from February 7, 2018 (commencement of operations) through March 31, 2018.

The following is a summary of our operating results for the period from February 7, 2018 (commencement of operations) through March 31, 2018:

| Total investment income | | $ | 728,216 | |

| Net operating expense | | | 425,375 | |

| Net investment income | | | 302,841 | |

| Net change in unrealized appreciation | | | 524,449 | |

| Net increase in net assets resulting from operations | | $ | 827,290 | |

Investment Income

Investment income consisted of the following for the period from February 7, 2018 (commencement of operations) through March 31, 2018:

| Interest income | | $ | 728,216 | |

| Total investment income | | $ | 728,216 | |

As of March 31, 2018, our weighted average annual yield on our accruing debt investments was 16.0% based on amortized cost, as defined above in “—Portfolio and Investment Activity.” As of March 31, 2018, all of our debt investments had fixed rate interest. Interest income and total investment income for the period February 7, 2018 (commencement of operations) through March 31, 2018 was $728,216. We believe that our interest income and total investment income is not representative of either our stabilized performance or our future performance. We expect an increase in interest income and dividend income in future periods due to an increasing base of investments that we expect to result from the expected increase in capital available for investment as related to our Public Offering.

Operating Expenses

Our operating expenses for the period from February 7, 2018 (commencement of operations) through March 31, 2018 were as follows:

| Organization and offering expenses | | $ | 221,564 | |

| Base management fees | | | 88,562 | |

| Professional services | | | 73,581 | |

| Director fees and expenses | | | 37,070 | |

| Administrative services | | | 32,493 | |

| Custodian and accounting fees | | | 15,000 | |

| Other | | | 317 | |

| Total operating expenses | | | 468,587 | |

| Expense support | | | (43,212 | ) |

| Net expenses | | $ | 425,375 | |

Operating expenses were partially offset by expense support of $43,212 for the period from February 7, 2018 (commencement of operations) through March 31, 2018. We consider the following expense categories to be relatively fixed in the near term: administrative services, director fees and expenses, and custodian and accounting fees. Variable operating expenses include professional services, base management fees, performance–based incentive fees, distribution and shareholder servicing fees, and a component of other operating expenses related to transfer agency services and shareholder services. We expect these variable operating expenses to increase either in connection with the growth in the asset base (investment advisory fees and total return incentive fees), the number of shareholders and open accounts (transfer agency services and shareholder services, distribution and shareholder servicing fees) and the complexity of our investment processes and capital structure (professional services).

Organization and Offering Expenses

Organization expenses are expensed on our statement of operations as incurred. Offering expenses, which consist of amounts incurred for items such as legal, accounting, regulatory and printing work incurred related to our Offerings, are capitalized on our statement of assets and liabilities as deferred offering expenses and expensed to our statement of operations over the lesser of the offering period or 12 months; however, the end of the deferral period will not exceed 12 months from the date the offering expense is incurred by the Manager and the Sub-Manager.

Base Management Fee

Our base management fee is calculated for each share class at an annual rate of (i) for the non-founder shares, 2% of the product of (x) our average gross assets and (y) the ratio of non-founder share Average Adjusted Capital for a particular class to total Average Adjusted Capital and (ii) for the founder shares, 1% of the product of (x) our average gross assets and (y) the ratio of outstanding founder share Average Adjusted Capital to total Average Adjusted Capital, in each case excluding cash, and is payable monthly in arrears.

Total Return Incentive Fee

The Manager and Sub-Manager are also eligible to receive incentive fees based on the Total Return to Shareholders, as defined in the Management Agreement and Sub-Management Agreement, for each share class in any calendar year, payable annually in arrears. We will accrue (but not pay) the total return incentive fee on a quarterly basis, to the extent that it is earned, and will perform a final reconciliation at completion of each calendar year and the total return incentive fee shall be due and payable to the Manager no later than ninety (90) calendar days following the end of the applicable calendar year. The total return incentive fee may be reduced or deferred by the Manager and the Sub-Manager under the Management Agreement and the Expense Support and Conditional Reimbursement Agreement. We did not incur any total return incentive fees during the period February 7, 2018 (commencement of operations) through March 31, 2018.

Expense Support and Conditional Reimbursement Agreement

We have entered into an Expense Support and Conditional Reimbursement Agreement with the Manager and the Sub-Manager, pursuant to which each of the Manager and the Sub-Manager agrees to reduce the payment of base management fees, total return incentive fees and the reimbursements of reimbursable expenses due to the Manager and the Sub-Manager under the Management Agreement and the Sub-Management Agreement, as applicable, to the extent that our annual regular cash distributions exceed our annual net income (with certain adjustments). Expense Support is equal to the annual (calendar year) excess, if any, of (a) the distributions (as defined in the Expense Support and Conditional Reimbursement Agreement) declared and paid (net of our distribution reinvestment plan) to shareholders minus (b) the available operating funds. The Expense Support amount will be borne equally by the Manager and the Sub-Manager and will be calculated as of the last business day of the calendar year. Beginning on February 7, 2018 and continuing until the Expense Support and Conditional Reimbursement Agreement is terminated, the Manager and Sub-Manager shall equally conditionally reduce the payment of fees and reimbursements of reimbursable expenses in an amount equal to the conditional waiver amount (as defined in and subject to limitations described in the Expense Support and Conditional Reimbursement Agreement). The term of the Expense Support and Conditional Reimbursement Agreement has the same initial term and renewal terms as the Management Agreement or the Sub-Management Agreement, as applicable to the Manager or the Sub-Manager.

If, on the last business day of the calendar year, there are Excess Operating Funds, we will use such Excess Operating Funds to pay the Manager and the Sub-Manager all or a portion of the outstanding unreimbursed Expense Support amounts for each share class, as applicable, subject to the Conditional Reimbursements as described further in the Expense Support and Conditional Reimbursement Agreement. Our obligation to make Conditional Reimbursements shall automatically terminate and be of no further effect three years following the date which the Expense Support amount was provided and to which such Conditional Reimbursement relates, as described further in the Expense Support and Conditional Reimbursement Agreement.

Net Change in Unrealized Appreciation

For the period February 7, 2018 (commencement of operations) through March 31, 2018, net unrealized appreciation on investments consisted of the following:

| Unrealized appreciation | | $ | 524,449 | |

| Unrealized depreciation | | | — | |

| Total net unrealized appreciation | | $ | 524,449 | |

The unrealized appreciation of $524,449 pertains solely to our investment in the equity of Lawn Doctor, primarily as a result of, among other things, strong performance above expectations and the future growth opportunities of Lawn Doctor.

We are not aware of any material trends or uncertainties, favorable or unfavorable, that may be reasonably anticipated to have a material impact on either capital resources or the revenues or income to be derived from our investments, other than those described above, the risk factors, if any, identified in the “Risk Factors” of the Prospectus.

Net Assets

Net assets increased approximately $82.0 million during the period February 7, 2018 (commencement of operations) through March 31, 2018. The most significant increase in net assets during the quarter ended March 31, 2018 was attributable to capital transactions including the issuance of Class FA shares resulting in net proceeds of approximately $81.5 million. Additionally, during the quarter ended March 31, 2018, our operations resulted in an increase in net assets of approximately $0.8 million. These increases in net assets were partially offset by distributions to shareholders of approximately $0.3 million during the quarter ended March 31, 2018.

Our shares are illiquid investments for which there is currently not a secondary market. You should not expect to be able to resell your shares regardless of how we perform. If you are able to sell your shares, you will likely receive less than your purchase price. Our net asset value and annualized returns, which are based in part upon determinations of fair value of Level 3 investments by our board of directors, not active market quotations, are inherently uncertain. Past performance is not a guarantee of future results.

Liquidity and Capital Resources

Liquidity is a measure of our ability to meet potential cash requirements, including ongoing commitments, fund and maintain our assets and operations, repay borrowings, make distributions to our shareholders and other general business needs. We will use significant cash to fund acquisitions, repay principal and interest on our borrowings, make distributions to our shareholders and fund our operations. Our primary sources of cash will generally consist of:

| ● | the net proceeds of the Public Offering; |

| ● | distributions, interest earned and fees from our assets; |

| ● | proceeds from sales of assets and principal repayments from our assets; and |

| ● | unused borrowing capacity under our financing sources. |

We expect we will have sufficient cash from current sources to meet our liquidity needs for the next twelve months. However, we may opt to supplement our equity capital and increase potential returns to our shareholders through the use of prudent levels of borrowings. We may use debt when the available terms and conditions are favorable to long-term investing and well-aligned with our business strategy. In determining whether to borrow money, we seek to optimize maturity, covenant packages and rate structures. Most importantly, the risks of borrowing within the context of our business outlook and the impact on our businesses are extensively analyzed by the Manager and our board of directors in making this determination.

While we generally intend to hold our assets for the long term, certain assets may be sold in order to manage our liquidity needs, meet other operating objectives and adapt to market conditions. The timing and impact of future sales of our assets, if any, cannot be predicted with any certainty.

As of March 31, 2018 and December 31, 2017, we had approximately $5.6 million and $0.2 million of cash and cash equivalents, respectively.