UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| | ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | |

| | | For the fiscal year ended December 31, 2024 |

OR

| | ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report:

For the transition period from ______ to ______

Commission file number 333-214872

ATLAS CRITICAL MINERALS CORPORATION

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Republic of the Marshall Islands

(Jurisdiction of incorporation or organization)

Rua Antonio de Albuquerque, 156 – 17th Floor

Belo Horizonte, MG 30.112-010, Brazil

(Address of principal executive offices)

Rodrigo Menck

Rua Antonio de Albuquerque, 156 – 17th Floor

Belo Horizonte, MG 30.112-010, Brazil

Telephone: +1-888-412-0210

Email: rodrigo.menck@atlas-cm.com

(Name, Telephone, E-mail and/or Facsimile number and Address, of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Common Stock, par value $0.001 per share

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

There were 33,336,729 common shares outstanding on December 31, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| ☐ Large accelerated filer | ☐ Accelerated filer | ☒ Non-accelerated filer |

| | | ☐ Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on an attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ | Other | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F (“Annual Report”) contains or incorporates by reference forward-looking statements. All statements, other than statements of historical facts, which address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future are forward-looking statements. Such statements are characterized by terminology such as “anticipates,” “believes,” “expects,” “future,” “intends,” “assuming,” “projects,” “plans,” “may,” “will,” “should” and similar expressions or the negative of those terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about: the mineral industry; market size, share and demand, performance, our expectations, objectives, anticipations, intentions and strategies regarding the future, expected operating results, revenues and earnings and potential litigation. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, including those risks described under the heading “Risk Factors” set forth herein, or in the documents incorporated by reference herein or other filings we make with the U.S. Securities and Exchange Commission, that could cause actual results to differ materially from the results contemplated by the forward-looking statements.

Some of the factors that could cause actual results to differ are identified below, as well as in “Item 3.D Risk Factors”, including:

| · | our limited operating history; |

| · | doubts about our ability to continue as a going concern; |

| · | the commercialization of our mineral rights and mineral deposits; |

| · | the accuracy or inaccuracy of our exploration results; |

| · | our ability to earn a return on our exploration investments; |

| · | our ability to construct and operate mines; |

| · | our ability to profitably develop our mineral deposits; |

| · | our ability to raise capital and access the capital markets; |

| · | our ability to identify and develop projects; |

| · | our ability to retain and attract skilled personnel; |

| · | our ability to enter into partnerships or contracts on terms favorable to us; |

| · | our ability to obtain and maintain requisite licenses and permits; |

| · | global demand for critical minerals; |

| · | the global trade and tariff environment; |

| · | international conflicts or geopolitical tensions; |

| · | natural or man-made disasters; |

| · | government laws and regulations; |

| · | inflation and currency fluctuations; |

| · | our dependence on our controlling shareholder and CEO; |

| · | potential cybersecurity threats; |

| · | potential labor disruptions; |

| · | increasing compliance costs; |

| · | fluctuations in commodity prices; |

| · | perceptions or policies regarding Brazil; |

| · | the illiquidity of trading in our common stock. |

Other factors besides those listed above could also adversely affect us. Investors are cautioned that our forward-looking statements are not guarantees of future performance and the actual results or developments may differ materially from the expectations expressed in the forward-looking statements.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements also represent our estimates and assumptions only on the date that they were made. We expressly disclaim a duty to provide updates to these forward-looking statements, and the estimates and assumptions associated with them, after the date of this filing to reflect events or changes in circumstances or changes in expectations or the occurrence of anticipated events, unless as otherwise required by law.

We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

MARKET AND INDUSTRY DATA

Market and industry data used throughout this Annual Report on Form 20-F is based on management’s knowledge of the industry and their good faith estimates. Management’s estimates are based, among others, on industry sources, including analyst reports, as well as management’s review of independent industry surveys and publications representing publicly available information. All of the market data used in this Annual Report involves a number of assumptions and limitations. While we believe the estimated market position, market opportunity and market size information included in this Annual Report is reliable, such information, which in part is derived from management’s estimates and beliefs, is inherently uncertain and imprecise and has not been verified by any independent source. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the “Risk Factors” section of this Annual Report and elsewhere in this Annual Report.

PART I

Item 1. Identity of Directors, Senior Management and Advisers.

Not applicable.

Item 2. Offer Statistics and Expected Timetable.

Not applicable.

Item 3. Key Information.

3.A. [Reserved].

3.B. Capitalization and Indebtedness.

Not applicable.

3.C. Reasons for the Offer and Use of Proceeds.

Not applicable.

3.D. Risk Factors.

You should carefully consider the following risk factors and all other information contained in this Annual Report before purchasing our securities. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected, in which case, the value of our shares could decline, and you may lose some or all of your investment.

Business Risks

Our future performance is difficult to evaluate because we have a limited operating history.

Although we were incorporated in 2016, we only began to implement our current business strategy in 2024. Our current business strategy is focused on the exploration of critical minerals, and, through legacy operations, the exploration of iron and gold as well as quartzite production and sales. While we have had a small amount of revenue from the sale of quartzite mined by us, we have not realized any revenues to date from the sale of other minerals within our portfolio. Our operating cash flow needs have been financed primarily through debt or equity and not through cash flows derived from our operations. As a result, we have little historical financial and operating information available to help you evaluate and predict our future performance. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

There is substantial doubt about our ability to continue as a going concern.

We have received an unqualified opinion that included an explanatory paragraph on “going concern” from our independent registered public accounting firm, reflecting substantial doubt about our ability to continue as a going concern. Since we have been in business, we have not been profitable and such condition raises substantial doubt about our ability to continue as a going concern. There is uncertainty regarding our ability to implement our business plan and to grow our business to a greater extent than we can with our existing financial resources without additional financing. Our long-term future growth and success is dependent upon our ability to raise additional capital and implement our business plan. There is no assurance that we will be successful in implementing our business plan or that we will be able to generate sufficient cash from operations, the sale of securities, or the borrowing of funds, on favorable terms or at all. Our inability to generate significant revenue or obtain additional financing could have a material adverse effect on our ability to sustain continued operations, fully implement our business plan or grow our business.

We are an exploration-stage company, and there is no guarantee that our properties will result in the commercial extraction of mineral deposits.

We are engaged in the business of exploring and developing mineral properties with the intention of locating economic deposits of minerals. An economic deposit is a mineral property which can be reasonably expected to generate profits upon extraction and commercialization of its minerals after considering all costs involved. Our property interests are in the exploration stage. Accordingly, it is unlikely that we will realize profits in the short term, and we also cannot assure you that we will realize profits in the medium to long term. Any profitability in the future from our business will be dependent upon the development of at least one economic deposit and most likely further exploration and development of other economic deposits, each of which is subject to numerous risks.

Further, we cannot assure you that, even if an economic deposit of minerals is located, any of our property interests can be commercially mined. The exploration and development of mineral deposits involves a high degree of financial risk over a significant period which a combination of careful evaluation, experience and knowledge of management may not eliminate. While discovery of additional ore-bearing deposits may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to establish reserves by drilling and constructing mining and processing facilities at a particular site. It is impossible to ensure that our current exploration programs will result in profitable commercial mining operations. The profitability of our operations will be, in part, related to the cost and success of our exploration and development programs. which may be affected by several factors, such as the factors set forth under the heading “We face risks related to mining, exploration and mine construction, if warranted, on our properties” below. Additional expenditures are required to establish reserves which are sufficient to commercially mine and to construct, complete and install mining and processing facilities in those properties that are mined and developed.

In addition, exploration-stage projects like ours have no operating history upon which to base estimates of future operating costs and capital requirements. Exploration project items, such as any future estimates of reserves, metal recoveries or cash operating costs will to a large extent be based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, as well as future feasibility studies. Actual operating costs and economic returns of all exploration projects may materially differ from the costs and returns estimated, and accordingly our financial condition, results of operations, and cash flows may be negatively affected.

Because the probability of an individual prospective mineral deposit ever having reserves is not known, any funds spent on exploration and evaluation may be lost if our properties do not contain any reserves.

We are an exploration stage company, and we have no “reserves” as such term is defined by Regulation S-K Item 1300 (“Regulation S-K 1300”). We cannot assure you about the existence of economically extractable mineralization at this time, nor about the quantity or grade of any mineralization we may have found. Because the probability of an individual prospect ever having reserves is uncertain, any funds spent on evaluation and exploration may be lost and our properties may not contain any reserves. Even if we confirm reserves on our properties, any quantity or grade of reserves we indicate must be considered as estimates only until such reserves are mined. We do not know with certainty that economically recoverable minerals exist on our properties. In addition, the quantity of any reserves may vary depending on commodity prices. Any material change in the quantity or grade of reserves may affect the economic viability of our properties. Further, our lack of established reserves means that we are uncertain about our ability to generate revenue from our operations.

We face risks related to mining, exploration and mine construction, if warranted, on our properties.

Our level of profitability, if any, in future years will depend to a great degree on whether our exploration-stage properties can be brought into production. It is impossible to ensure that the current and future exploration programs and/or feasibility studies on our existing properties will establish reserves. Whether it will be economically feasible to extract a mineral depends on a number of factors, including, but not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; mineral prices; mining, processing and transportation costs; the willingness of lenders and investors to provide project financing; labor costs and possible labor strikes; and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us receiving an inadequate return on invested capital.

We are subject to the effects of changing prices.

Inflation rates have been relatively low and stable over the previous three decades; however, inflation rates rose significantly between 2021 and 2024 due in part to supply chain disruptions and the effects of the COVID-19 pandemic. Although inflation rates have stabilized at a moderate level, future economic shocks, such as those due to tariffs and trade wars, could increase inflation levels going forward. We bear the costs of operating and maintaining our assets, including labor and material costs as well as recertification and dry dock costs. Although we may be able to reduce some of our exposure to price increases through the rates we charge, competitive market pressures may affect our ability to pass along price adjustments, which may result in reductions in our operating margins and cash flows in the future.

We are subject to substantial competition in our markets, which could decrease our market share and profitability in the regions in which we operate.

The critical minerals markets in Brazil, North America, Asia and the other markets in which we will operate are highly competitive. We face consolidated markets with substantial competition from domestic and international competitors.

Our competitive position is impacted by price, logistics, production costs, exchange rate, among other factors. Some of our global competitors have greater financial and marketing resources, larger customer bases and a greater breadth of product offerings than we do. In addition, some of these competitors may be able to obtain financing on terms more favorable than we are. If we are unable to remain competitive, or our competitors are more aggressive in competing with us, this may have a material adverse effect on us.

Our long-term success will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities.

Our long-term success, including the recoverability of the carrying values of our assets, our ability to continue with exploration, development and commissioning and mining activities on our existing projects or to acquire additional projects, will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our operations by establishing ore bodies that contain commercially recoverable minerals and to develop these into profitable mining activities. We cannot assure you that any ore body that we extract mineralized materials from will result in achieving and maintaining profitability and developing positive cash flow.

We depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our ability to fund our ongoing operations, execute our business plan or pursue investments that we may rely on for future growth and could result in the failure of our business.

We need, and for the foreseeable future will continue to need, additional equity or debt financing beyond our existing cash to maintain and expand our operations. Until commercial production is achieved from one of our larger projects, we will continue to incur operating and investing net cash outflows associated with, among other things maintaining and acquiring exploration properties, undertaking ongoing exploration activities and the development of mines. As a result, we rely on access to capital markets as a source of funding for our capital and operating requirements. We cannot assure you that such additional funding will be available to us on satisfactory terms, or at all.

In order to finance our current operations and future capital needs, we will require additional funds through the issuance of additional equity and/or debt securities. Depending on the type and the terms of any financing we pursue, shareholders’ rights and the value of their investment in our shares could be reduced. Any additional equity financing will dilute shareholdings, and new or additional debt financing, if available, may involve restrictions on financing and operating activities. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of shareholders until the debt is paid. Interest on such debt securities would increase costs and negatively impact operating results.

There is, however, no guarantee that we will be able to secure any additional funding or be able to secure funding which will provide us with sufficient funds to meet our objectives, which may adversely affect our business and financial position. If we are unable to obtain additional financing as needed, at competitive rates, our ability to fund our current operations and implement our business plan and strategy will be affected, and we would be required to reduce the scope of our operations and scale back our exploration, development and mining programs. If such an inability to obtain financing persists, such measures could include eliminating operations or even seeking reorganization, in which case the holders of our securities could lose a substantial part or all of their investment.

Our quarterly and annual revenue, operating results and financial results are likely to fluctuate significantly in future periods.

Our quarterly and annual revenue, operating results and financial results are difficult to predict and may fluctuate significantly from period to period. Our revenues, net income and results of operations may fluctuate as a result of a variety of factors that are outside our control including, but not limited to, lack of sufficient working capital, equipment malfunction and breakdowns, inability to timely find spare machines or parts to fix the broken equipment, regulatory or licensing delays, severe weather phenomena, labor shortages, commodity price fluctuations, cost of key inputs such as fuel and electricity, currency fluctuation.

Our ability to manage growth will have an impact on our business, financial condition and results of operations.

Future growth may place strains on our financial, technical, operational and administrative resources and cause us to rely more on project partners and independent contractors, potentially adversely affecting our financial position and results of operations. Our ability to grow will depend on several factors, including:

| | ● | our ability to develop existing projects; |

| | | |

| | ● | our ability to identify new projects; |

| | | |

| | ● | our ability to continue to retain and attract skilled personnel; |

| | | |

| | ● | our ability to maintain or enter into relationships with project partners and independent contractors; |

| | | |

| | ● | the results of our exploration programs; |

| | | |

| | ● | the market prices for our minerals; |

| | | |

| | ● | our access to capital; |

| | | |

| | ● | our ability to enter into agreements for the sale of our minerals; |

| | | |

| | ● | our ability to obtain and maintain requisite licenses and permits; |

| | | |

| | ● | global demand for critical minerals; |

| | | |

| | ● | the global trade environment and the existence of trade barriers such as tariffs or sanctions; |

| | | |

| | ● | volatility resulting from international conflicts or geopolitical tensions; |

| | | |

| | ● | natural or man-made disasters and severe climate or weather events; |

| | | |

| | ● | government policies with respect to climate change or natural resource conservation; and |

| | | |

| | ● | Fluctuations in inflation and currency exchange rates. |

We may not be successful in upgrading our technical, operational and administrative resources or increasing our internal resources sufficiently to provide certain of the services currently provided by third parties, and we may not be able to maintain or enter into new relationships with project partners and independent contractors on financially attractive terms, if at all. Our inability to achieve or manage growth may materially and adversely affect our business, results of operations and financial condition.

Our operations and projects are subject to a range of transitional and physical risks related to climate change.

We believe that climate change has the potential to impact on the regions and sites in which we operate, as well as the surrounding communities. Long-term potential physical climate risks include, but are not limited to, higher temperature in all regions, higher intensity storm events in all regions, impacts to annual precipitation depending upon the latitude and proximity of the site to oceans.

Physical risks related to extreme weather events such as extreme precipitation, flooding, longer wet or dry seasons, flooding and drought conditions, increased temperatures, sea level rise, landslides, mine flooding, landslides, wildfires or brushfires, or more severe storms may have financial implications for the business. In particular, the effects of changes in rainfall and intensities, water shortages and changing storm patterns have from time to time adversely impacted, and may in the future adversely impact, our costs, production levels and financial performance.

There is also the potential for disruption to transport routes associated with the distribution of our products. For example, essential roads for entering in our mine sites, may be subject to a risk of flooding due to the potential for an increase in average temperatures, which may be related to climate change. Severe storm events can also result in unpermitted off-site discharges, slope instability, mine pit erosion and structural failures, tailings storage facility overtopping and other impacts, including water storage and treatment facility capacity considerations. Extended dry seasons or unseasonal dry conditions could exacerbate dust generation from operating activities that may require additional controls for continued operation or result in compliance breaches. Changing climatic conditions may also affect the likelihood of meeting closure success criteria and require adjustments to mine site rehabilitation and closure plans. The higher potential for extreme heat conditions may affect equipment efficiency.

Such events can temporarily slow or halt operations due to physical damage to assets, reduced worker productivity for safety protocols on site related to extreme temperatures or lightening events, worker aviation and bus transport to or from the site, and local or global supply route disruptions that may limit transport of essential materials, chemicals and supplies, which could have an adverse impact on our results of operations and financial position. Additional financial impacts could include increased capital or operating costs to increase water storage and treatment capacity, obtain or develop maintenance and monitoring technologies, increase resiliency of facilities and establish supplier climate resiliency and contingency plans.

An increase in frequency and duration of extreme weather conditions can be followed by extended power outages. Energy disruptions can have an adverse impact on our results of operations and financial position due to production delays or additional costs to ensure business continuity through reliable sources of on-site power generation. Energy transmission and supply may be impacted by wildfires, which may interrupt electrical power transmission lines to mine sites, and that may pose risks to on-site facilities and energy generators, fuel dispensing systems and supplies. In jurisdictions that rely on purchased hydroelectric power, such as in Brazil, extreme drought and extended dry seasons may impact the electric utility’s water supplies needed to generate hydroelectric power purchased by the mine to run operations, which would result in higher costs and/or limit energy availability for continuity of operations as well as impact our environmental systems and processes.

Our operations and projects are subject to a range of risks related to transitioning the business to meet regulatory, societal and investor expectations for operating in a low-carbon economy.

Climate change and the transition to a low-carbon economy is expected to impact on our operations in a number of ways. Mining activities are an energy and fuel intensive business, currently resulting in a significant carbon footprint. Transitioning to a low-carbon economy will require significant investment and may entail extensive policy, legal, technology, and market changes to address mitigation and adaptation requirements related to climate change. Depending on the nature, speed, focus and jurisdiction of these changes, transition risks may pose varying levels of financial and reputational risk to the business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to the potential impacts of climate change that are viewed as the result of emissions from the combustion of carbon-based fuels.

Policy and regulatory risk related to actual and proposed changes in climate- and water-related laws, regulations and taxes developed to regulate the transition to a low-carbon economy may result in increased costs for our operations and our suppliers, including increased energy, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Regulatory uncertainty may cause us to incur higher costs and lower economic returns than originally estimated for new development projects and operations, including closure reclamation obligations.

The development and deployment of technological improvements or innovations will be required to support the transition to a low-carbon economy, which could result in write-offs and early retirement of existing assets, increased costs to adopt and deploy new practices and processing including planning and design for mines, development of alternative power sources, site level efficiencies and other capital investments. Our investments in these technologies may also expose us to legal, operational and reputational and other risks. The pace of development of such technologies may be inadequate, such technologies may be insufficient, and we may not be able to deploy such technologies at a commercial scale.

There will be varied and complex market impacts due to climate change and the transition to a low-carbon economy. There will be shifts in supply and demand for certain commodities, products and services in connection with evolving consumer and investor sentiments. Market perceptions of the mining sector, and, in particular, the role that certain metals will or will not play in the transition to a low-carbon economy remains uncertain. Potential financial impacts may include reduced investment in certain minerals due to shifts in investor sentiment, increased production costs due to changing input prices, re-pricing of land valuation and assets, potential cost increases by insurers and lenders, and potential increases in taxation of the mining and metals sector.

Should the mining and metals sector not respond quickly enough to meeting globally accepted science-based reductions required to mitigate the long-term impacts of climate change, industry members may be subject to an increased risk of future climate litigation. In the U.S. and Canada, lawsuits have been filed against oil and gas companies to assign liability for climate-related impacts. Over time, litigation may also apply to other resource intensive sectors that fail to set and/or meet long-term reduction targets. While we are not currently subject to any lawsuits related to climate, no assurances can be provided that similar suits will not be brought in the future.

There is currently no generally accepted global definition (legal, regulatory or otherwise) of, nor market consensus as to what criteria qualify as, “green,” “social,” “sustainable” or “sustainability-linked” (and, in addition, the requirements of any such label may evolve from time to time), and therefore no assurance is or can be given that we will meet any or all investor expectations.

We are vulnerable to concentration risks because our operations are currently exclusive to Brazil.

Our mining activities are currently entirely focused on Brazil. Because of our geographic concentration, our operations are more vulnerable to local economic downturns and adverse project-specific risks than those of larger, more diversified companies.

We may not realize the anticipated benefits of the Option Agreement (as defined below) with Atlas Lithium, and if we are unable to consummate the transactions contemplated thereby, we will be unable to explore and develop the mineral rights that we would acquire under the Option Agreement.

Exercising the Option Agreement entered into with Atlas Lithium would materially increase the number of our mineral rights owned and available for exploration and development activities.

We may be unable to exercise the Option (as defined below) for a number of reasons. For example, Atlas Lithium may in its discretion elect to receive consideration for the Option exercise in the form of cash or our common stock. If Atlas Lithium requires payment in cash, we will be unable to exercise the Option unless we are able to arrange financing prior to the expiration of the term of such Option, and there can be no assurance that we would be able to arrange such financing on a timely basis or at all. The Option Agreement also provides that we may only exercise the Option upon or within twelve months after filing a Registration Statement on Form F-1 in connection with an uplisting of our common stock to the Nasdaq Stock Market. As of the date of this Annual Report, we have not made such a filing and may never do so. Furthermore, our reputation may be negatively impacted if we fail to exercise the Option, and such reputational harm could affect our ability to enter into future agreements to acquire mineral rights on terms that are favorable to us, or at all.

We are dependent upon information technology and operational technology systems, which are subject to disruption, damage, failure or cybersecurity attacks and risks associated with implementation, upgrade, operation and integration.

Our business operations rely heavily on technology platforms and systems to manage and optimize our diverse mining assets. These systems are critical to ensuring safety, operational efficiency, cost management, and meeting environmental, social, and governance (ESG) objectives. However, the increasing sophistication of cybersecurity threats, coupled with the adoption of emerging technologies such as artificial intelligence (AI), automation, and cloud-based platforms, poses important risks to our operations, financial performance, and reputation.

Our systems, as well as those of our third-party service providers, vendors, and partners, face a wide range of cybersecurity threats, including: Ransomware, malware, and phishing schemes targeting critical systems and sensitive data; unauthorized access and breaches affecting intellectual property, financial information, and operational data; vulnerabilities introduced through supply chain dependencies and third-party security weaknesses; human error, design flaws, and system misconfigurations.

The adoption of new technologies and the adoption of remote and flexible work arrangements enhances our operational capabilities but introduces additional risks. AI, for example, has the potential to improve efficiency and safety, it also presents unique vulnerabilities, including algorithmic biases that could lead to inaccurate decisions or unintended outcomes; data integrity risks, such as manipulation or corruption of datasets used to train AI systems; unauthorized access or exploitation of AI-powered systems, potentially compromising operations or sensitive data.

Additionally, the increased interconnectivity of automated and cloud-based systems and increase of remote workforce expands our cyber-attack surface, requiring heightened vigilance and advanced security measures.

Our cybersecurity program is designed to protect our technology platforms and address risks associated with the implementation of emerging technologies. While these efforts are designed to align with industry’s best practices, no system can eliminate all risks, especially given the pace of technological advancement and the evolving nature and increased frequency of cyber threats. In addition, we do not carry specific cybersecurity insurance to help mitigate such costs due to increased premiums and limited market availability.

Therefore, a successful cyberattack or other cybersecurity incident could result in future production and operational downtimes, data corruption, and unauthorized disclosure of sensitive information. Any material breaches, disruptions, or loss of business-critical information, our systems and procedures for preparing and protecting against such attempts and mitigating such risks may prove to be insufficient against future attacks. These events may subject us to significant expenses, remediation costs, disputes, financial losses, regulatory actions or investigations, litigation, reputational harm, and delays in the deployment of critical technologies, that could result in damages, material fines and penalties, and harm to our reputation, any of which could have a significant effect on our financial condition, results of operations, liquidity, and cash flows. The risks associated with the implementation of emerging technologies, if not effectively mitigated, could undermine the benefits of these advancements and impact our competitive position.

In addition, we are subject to various legislation, regulations, directives and guidelines from federal, state, local and foreign agencies, that are intended to strengthen cybersecurity measures required for information and operational technology, and that apply to the collection, use, retention, protection, disclosure, transfer and other processing of personal information. Failure to comply with any of applicable legal requirements could result in enforcement action against us, including fines, which could harm our reputation and have a significant effect on our financial condition, results of operations, liquidity, and cash flows.

We depend upon Marc Fogassa, our Founder, Chief Executive Officer and Chairman.

Our success is largely dependent upon the personal efforts of Marc Fogassa, our Founder, Chief Executive Officer and Chairman. The loss of the services of Mr. Fogassa would have a material adverse effect on our business and prospects. See “Management.”

Our growth will require new personnel, which we will be required to recruit, hire, train and retain.

Our ability to recruit and assimilate new personnel will be critical to our performance. We will be required to recruit additional personnel and to train, motivate and manage employees, and our inability to successfully do so will adversely affect our plans.

We expect significant growth in the number of our employees if we determine that a mine at any of our properties is commercially feasible, we are able to raise sufficient funding and we elect to develop the property. This growth will place substantial demands on us and our management. Our ability to assimilate new personnel will be critical to our performance. We will be required to recruit additional personnel and to train, motivate and manage employees. We will also have to adopt and implement new systems in all aspects of our operations. This will be particularly critical in the event we decide not to use contract miners on any of our properties. We have no assurance that we will be able to recruit the personnel required to execute our programs or to manage these changes successfully.

Our workforce will be represented by labor unions and therefore be subject to collective bargaining agreements.

Production at our mines will be dependent upon the efforts of our employees and, consequently, our maintenance of good relationships with our employees. Due to union activities or other employee actions, we could experience labor disputes, work stops or other disruptions in production that could adversely affect us.

A portion of our workforce will be represented by labor unions and will therefore be subject to collective bargaining agreements, and if we are unable to enter into new agreements or renew existing agreements before they expire, our workers subject to collective bargaining agreements could engage in strikes or other labor actions that could materially disrupt our ability to provide services to our customers.

We cannot predict the outcome of future negotiations of collective bargaining agreements covering potential future employees.

Certain executive officers and directors may be in a position of conflict of interest.

Marc Fogassa, our Founder, Chief Executive and Chairman, also serves as chief executive officer and chairman of Atlas Lithium Corporation (“Atlas Lithium”). Rodrigo Nazareth Menck, our Chief Financial Officer and Treasurer, is a director at Atlas Lithium. Joel de Paiva Monteiro, Esq., one of our directors, is the Vice President of Administration, ESG Chief, and Secretary of Atlas Lithium. Areli Nogueira da Silva Júnior, one of our directors, is the Vice President of Mineral Exploration at Atlas Lithium. Atlas Lithium has significant equity ownership in us. These executives’ and directors’ services to both us and Atlas Lithium may result in potential conflicts of interest arising from their divided responsibilities and loyalties. As a result, they might not be able to devote sufficient time and attention to each company, which could negatively impact decision-making and performance. Any decision made by such persons involving us will be made in accordance with their duties and obligations to deal fairly and in good faith with us and such other companies. In addition, any such officer or director will declare, and refrain from voting on, any matter in which they may have a material interest.

Regulatory and Industry Risks

The mining industry subjects us to several risks.

In our operations, we are subject to the risks normally encountered in the mining industry, such as:

| | ● | the discovery of unusual or unexpected geological formations; |

| | | |

| | ● | accidental fires, floods, earthquakes or other natural disasters; |

| | | |

| | ● | unplanned power outages and water shortages; |

| | | |

| | ● | controlling water and other similar mining hazards; |

| | | |

| | ● | operating labor disruptions and labor disputes; |

| | | |

| | ● | the ability to obtain suitable or adequate machinery, equipment, or labor; |

| | | |

| | ● | our liability for pollution or other hazards; and |

| | | |

| | ● | other known and unknown risks involved in the conduct of exploration and operation of mines. |

The nature of these risks is such that liabilities could exceed any applicable insurance policy limits or could be excluded from coverage. There are also risks against which we cannot insure or against which we may elect not to insure. The potential costs which could be associated with any liabilities not covered by insurance, or in excess of insurance coverage, or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our future earnings and competitive position and, potentially, our financial viability.

Our operations and mineral projects will be subject to significant governmental regulations, including extensive environmental laws and regulations.

Mining activities in Brazil are subject to extensive federal, state, and local laws and regulations governing environmental protection, natural resources, prospecting, development, production, post-closure reclamation costs, taxes, labor standards and occupational health and safety laws and regulations, including mine safety, toxic substances and other matters. The costs associated with compliance with such laws and regulations can be substantial. In addition, changes in such laws and regulations, or more restrictive interpretations of current laws and regulations by governmental authorities, could result in unanticipated capital expenditures, expenses, or restrictions on, or suspensions of our operations and delays in the development of our properties.

Our exploration, development, mining and processing operations are subject to extensive laws and regulations governing land use and the protection of the environment, which generally apply to air and water quality, protection of endangered, protected or other specified species, hazardous waste management and reclamation. We have made, and expect to make in the future, significant expenditures to comply with such laws and regulations. Compliance with these laws and regulations imposes substantial costs and burdens, and can cause delays in obtaining, or failure to obtain, government permits and approvals which may adversely impact our closure processes and operations.

Increased global attention or regulation of consumption of water by industrial activities, as well as water quality discharge, and restricting or prohibiting the use of cyanide and other hazardous substances in processing activities could similarly have an adverse impact on our results of operations and financial position due to increased compliance and input costs.

We are required to obtain governmental permits in order to conduct development and mining operations, a process which is often costly and time-consuming.

We are required to obtain and renew governmental permits for our exploration activities and, prior to developing or mining any mineralization that we discover, we will be required to obtain new governmental permits. Obtaining and renewing governmental permits is a complex, costly and time-consuming process. The timeliness and success of permitting efforts are contingent upon many variables not within our control, including the interpretation of permit approval requirements administered by the applicable permitting authority. We may not be able to obtain or renew the permits that are necessary for our planned operations, or the cost and time required to obtain or renew such permits may exceed our expectations. Any unexpected delays or costs associated with the permitting process could delay the exploration, development or operation of our properties, which in turn could materially adversely affect our future revenues and profitability. In addition, key permits and approvals may be revoked or suspended or may be changed in a manner that adversely affects our activities.

Private parties, such as environmental activists, frequently attempt to intervene in the permitting process and to persuade regulators to deny necessary permits or seek to overturn permits that have been issued. Obtaining the necessary government permits involves numerous jurisdictions, public hearings and possibly costly undertakings. These third-party actions can materially increase the costs and cause delays in the permitting process and could cause us to not proceed with the development or operation of a property. In addition, our ability to successfully obtain key permits and approvals to explore for, develop, operate and expand operations will likely depend on our ability to undertake such activities in a manner consistent with the creation of social and economic benefits in the surrounding communities, which may or may not be required by law. Our ability to obtain permits and approvals and to successfully operate in particular communities may be adversely affected by real or perceived detrimental events associated with our activities.

Compliance with environmental regulations and litigation based on environmental regulations could require significant expenditures.

Environmental regulations mandate, among other things, the maintenance of air and water quality standards, and the rules on land development and reclamation. They also set forth limitations on the generation, transportation, storage, and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner that may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for mining companies and their officers, directors and employees. In connection with our current exploration activities or with our prior mining operations, we may incur environmental costs that could have a material adverse effect on our financial condition and results of operations. Any failure to remedy an environmental problem could require us to suspend operations or enter into interim compliance measures pending completion of the required remedy.

Moreover, government authorities and private parties may bring lawsuits based upon damage to property and injury to persons resulting from the environmental, health and safety impacts of prior and current operations, including operations conducted by other mining companies many years ago at sites located on properties that we currently own or formerly owned. These lawsuits could lead to the imposition of substantial fines, remediation costs, penalties and other civil and criminal sanctions. We cannot assure you that any such law, regulation, enforcement or private claim would not have a material adverse effect on our financial condition, results of operations or cash flows.

Our operations are subject to substantial health and safety regulations.

Our operations are subject to extensive and complex laws and regulations governing worker health and safety across our operating regions, and our failure to comply with applicable legal requirements can result in substantial penalties. Future changes in applicable laws, regulations, permits and approvals or changes in their enforcement or regulatory interpretation could substantially increase costs to achieve compliance, leading to the revocation of existing or future exploration or mining rights or otherwise have an adverse impact on our results of operations and financial position.

Our mines are inspected on a regular basis by government regulators who may issue citations and orders when they believe a violation has occurred under local mining regulations. If inspections result in an alleged violation, we may be subject to fines, penalties or sanctions and our mining operations could be subject to temporary or extended closures.

In addition to potential government restrictions and regulatory fines, penalties or sanctions, our ability to operate and thus our results of operations and financial position could be adversely affected by accidents, injuries, fatalities, or events that impact our workforce or that otherwise are, or are perceived to be, detrimental to the health and safety of our employees, the environment or the communities in which we operate.

Mineral prices are subject to unpredictable fluctuations.

Portions of our revenues may come from the extraction and sale of minerals. Our level of profitability, if any, in future years will depend to a great degree on the prices of minerals set by global markets. The price of minerals may fluctuate widely and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities, increased production due to new extraction developments and improved extraction and production methods and technological changes in the markets for the end products. The effect of these factors on the price of minerals, and therefore the economic viability of any of our exploration properties, cannot accurately be predicted.

Title to some of our properties may be insufficient, defective, or challenged.

The sufficiency or validity of our legal title in and to its properties may be uncertain or subject to challenges by third parties, including governmental authorities, communal groups, or private entities. In Brazil, exploration and mining rights are granted through a mining concession, pertaining to the mineral estate, and do not confer rights of ownership, possession, use, or access in or to the corresponding surface estate. Even though regulated by the mining law, surface rights must be acquired through purchase, lease, or easement from private parties, local communities, or governmental authorities. Failure to reach new, or renewal of existing agreements or disputes regarding these agreements may lead to blockades, suspension of operations, project delays, and on occasion, may lead to legal disputes. A determination of insufficient or defective legal title, or an adverse outcome from a challenge to the legal title of a property or mining right could result in loss, litigation, insurance claims, reputational damage, and the impairment, suspension, or cessation of exploration, development, or mining activities. Such outcomes could materially impact our operations, and result in significant financial losses that affect our business as a whole.

Our corporate governance practices are in compliance with, and are not prohibited by, the laws of the Republic of the Marshall Islands, and as such we are entitled to exemption from certain Nasdaq corporate governance standards. As a result, you may not have the same protections afforded to shareholders of companies that are subject to all of the Nasdaq corporate governance requirements.

Our corporate governance practices are in compliance with, and are not prohibited by, the laws of the Republic of the Marshall Islands. Therefore, we are exempt from many of Nasdaq’s corporate governance practices other than the requirements regarding the disclosure of a going concern audit option, submission of a listing agreement, notification of material non-compliance with Nasdaq corporate governance practices, and the establishment and composition of an audit committee and a formal written audit committee charter. To the extent we rely on these or other exemptions you may not have the same protections afforded to shareholders of companies that are subject to all of the Nasdaq corporate governance requirements.

Country and Currency Risks

Substantially all of our assets are located in Brazil and substantially all of our revenue are derived from our operations in such country. Accordingly, our results of operations will be subject, to a significant extent, to the economic, political and legal policies, developments and conditions in Brazil.

The economic, political and social conditions, as well as government policies, of Brazil could affect our business. Economic growth could be uneven, both geographically and among various sectors of the economy and such growth may not be sustained in the future. If in the future Brazil’s economy experiences a downturn or grows at a slower rate than expected, there may be less demand for spending in certain industries. A decrease in demand for spending in certain industries could materially and adversely affect our ability to become profitable.

Our ability to execute our business plan depends primarily on the continuation of a favorable mining environment in Brazil and our ability to freely sell our minerals.

Mining operations in Brazil are heavily regulated. Any significant change in mining legislation or other changes in Brazil’s current mining environment may slow down or alter our business prospects. Further, countries in which we may wish to sell our mined minerals may impose special taxes, tariffs, or otherwise place limits and controls on consumption of our mined minerals, including tariffs or trade restrictions imposed by the new U.S. presidential administration.

The perception of Brazil by the international community may affect us.

Brazil’s political environment and its environmental policies, in particular the preservation of the Amazon rain forest, are continuously scrutinized by the global media. If Brazil’s political environment, regulations or policies are perceived to be, inadequate, unfavorable or hostile by foreign customers or investors, we may lose the interest of investor groups or potential buyers of our minerals, which will have a negative impact on us.

Exposure to foreign exchange fluctuations and capital controls may adversely affect our costs, earnings and the value of some of our assets.

Our reporting currency is the U.S. dollar; however, we conduct our business in Brazil utilizing the Brazilian real. A large portion of our operating expenses are incurred in Brazilian real. An appreciation of the Brazilian real against the U.S. dollar would increase our costs in U.S. dollar terms. Our consolidated financials are directly impacted by movements in the Brazilian real to U.S. dollar exchange rate.

While not expected, Brazil may choose to adopt measures to restrict the entry of U.S. dollars or the repatriation of capital across borders. These measures would have a number of negative effects on us, reducing the immediately available capital that we could otherwise deploy for investment opportunities or the payment of expenses, and the ability to repatriate any profits.

Common Stock Risks

Our common stock price may be volatile.

The market price of our common stock has been and is likely to continue to be volatile and could fluctuate in price in response to various factors, many of which are beyond our control, including the following:

| | ● | our ability to grow revenues; |

| | | |

| | ● | our ability to achieve profitability; |

| | | |

| | ● | our ability to raise capital when needed; |

| | | |

| | ● | our ability to execute our business plan; |

| | | |

| | ● | legislative, regulatory, and competitive developments; and |

| | | |

| | ● | economic and external factors. |

In addition, the securities markets have from time-to-time experienced significant price and volume fluctuations that are unrelated to the operating performance of any company. These market fluctuations may also materially and adversely affect the market price of our common stock regardless of our actual operations and the results from those operations.

There is currently a very limited trading market for our Common Stock.

Our common stock trades on OTCQB, a platform of OTC Markets, and as of now it has low liquidity. We believe that liquidity will be dependent, among other things, on the perception of our business, alongside steps that we may take to raise investor awareness, including press releases, road shows, and participation in investor conferences. There can be no assurance as to when an increase in liquidity will occur.

Our common stock is currently defined as a “penny stock” and the rules imposed on the sale of the shares may affect your ability to resell any shares you may purchase, if at all.

Our common stock currently trades below $5.00 per share and is therefore defined as a “penny stock” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Exchange Act and penny stock rules generally impose additional sales practice and disclosure requirements on broker dealers who sell our securities. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser’s written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the SEC. Consequently, the penny stock rules may affect the ability of broker-dealers to make a market in or trade our common stock and may consequently affect a stockholder’s ability to resell any of our shares in the public markets.

We do not intend to pay regular future dividends on our common stock and thus stockholders must look for appreciation of our common stock to realize a gain on their investments.

We have never paid a dividend, and we do not have any plans to pay dividends in the foreseeable future. Our future dividend policy is within the discretion of our Board of Directors and will depend upon various factors, including future earnings, if any, our capital requirements and general financial condition, and other factors. Accordingly, stockholders must look solely to appreciation of our common stock to realize a gain on their investment. This appreciation may not occur or may occur only over a longer timeframe.

We may seek to raise additional funds, finance acquisitions, or develop strategic relationships by issuing securities that would dilute your ownership.

We may largely finance our operations by issuing equity securities, which may materially reduce the percentage ownership of our existing stockholders. Furthermore, any newly issued securities could have rights, preferences, and privileges senior to those of our existing common stock. Moreover, any issuances by us of equity securities may be at or below the prevailing market price of our stock and in any event may have a dilutive impact on the ownership interest of existing common stockholders, which could cause the market price of our common stock to decline. We may also raise additional funds through the incurrence of debt or the issuance or sale of other securities or instruments senior to our common stock. The holders of any debt securities or instruments that we may issue could have rights superior to the rights of our common stockholders.

Our Series A Convertible Preferred Stock has the effect of concentrating voting control over us in Marc Fogassa, our Chief Executive Officer and Chairman.

One share of our Series A Preferred Stock is issued, outstanding and held since July 2016 by Marc Fogassa, our Founder, Chief Executive Officer and Chairman. The Certificate of Designations, Preferences and Rights of our Series A Preferred Stock provides that for so long as Series A Preferred Stock is issued and outstanding, the holders of Series A Preferred Stock shall vote together as a single class with the holders of our common stock, with the holders of Series A Preferred Stock being entitled to 51% of the total votes on all matters regardless of the actual number of shares of Series A Preferred then outstanding, and the holders of common stock and any other class or series of capital stock entitled to vote with the common stock being entitled to their proportional share of the remaining 49% of the total votes based on their respective voting power. As a result, you may have limited ability to impact our operations and activities.

Marc Fogassa, our Founder, Chief Executive Officer and member of our Board of Directors, owns greater than 50% of our voting securities, which would cause us to be deemed a “controlled company” under the rules of Nasdaq.

As a result of his ownership of and the one issued and outstanding share of our Series A Preferred Stock, as well as ownership of our common stock, Mr. Fogassa, our Founder, Chief Executive Officer and Chairman, currently controls approximately 68% of the voting power of our securities.

You will need to keep records of your investment for tax purposes.

Each purchase or sale of securities, including our common stock, may result in tax consequences for you. We will not keep tax records for you. You, or someone on your behalf, will be required to keep your own tax records with regard to your transactions involving our securities.

Risks Related to World Events

Tariffs and other changes in international trade policy could adversely affect our business, financial condition and results of operations.

Materials and products imported into the EU, the United States and other countries are subject to import duties. In addition, we cannot predict whether future Brazilian, U.S. or international laws, regulations or specific or broad trade remedy actions or international agreements may impose additional duties or other restrictions on exports of minerals from Brazil. Any such changes in legislation and government policy may have a material adverse effect on our business. For example, in recent periods, the U.S. government has announced and, in particular following the U.S. presidential election in November 2024, may continue to announce, various import tariffs on goods imported from certain trade partners, such as the EU and China, which have resulted, and may continue to result, in reciprocal tariffs on goods exported from the United States to such trade partners. An escalating global trade war, including between the United States and China, could harm our business and growth prospects. Trade barriers and other governmental action related to tariffs or international trade agreements around the world have the potential to decrease demand for our minerals and adversely impact the markets in which we operate.

A resurgence of the COVID-19 pandemic, or the emergence of a new pandemic, may adversely affect our business.

A resurgence of the COVID-19 pandemic, or the emergence of a new pandemic, may adversely affect our business. In the recent past, the spread of COVID-19 caused public health officials in both Brazil and the U.S. to recommend precautions to mitigate the spread of the virus, especially as to international travel. In addition, certain states and municipalities in both countries enacted quarantine and “shelter-in-place” regulations and at times required non-essential businesses to close. There is no certainty that a resurgence of COVID-19, or a new pandemic, will not occur with restrictions imposed again in response. It is unclear how such restrictions, if put in place again, would contribute to a general slowdown in the global economy and would affect our business.

An escalation of the current war in Ukraine and the recent conflict in the Middle East, generalized conflict in Europe or the emergence of conflict elsewhere may adversely affect our business.

Global markets have experienced, and may continue to experience, volatility and disruption following the escalation of geopolitical tensions, including the ongoing war in Ukraine, recent conflicts in the Middle East, rising tensions between China and Taiwan, the relationship between China and the United States, and other sources of geopolitical uncertainty and instability. The length and impact of these ongoing military and economic conflicts is highly unpredictable. Such geopolitical events, terrorist or other attacks, wars (or threatened wars) or international hostilities may lead to armed conflict or acts of terrorism in other parts of the world, which in turn may contribute to further economic instability in the global financial markets and international commerce. While much uncertainty remains regarding the global impacts of the war in Ukraine and the recent conflict in the Middle East, it is possible that such tensions could adversely affect our business, financial condition, results of operation and cash flows. Furthermore, it is possible that third parties, such as our customers and suppliers, may be impacted by these conflicts, which could adversely affect our operations. These uncertainties could also adversely affect our ability to obtain additional financing on terms acceptable to us or at all.

Risks Relating to the Marshall Islands

We are incorporated in the Marshall Islands, which does not have a well-developed body of case law or bankruptcy law and, as a result, shareholders may have fewer rights and protections under Marshall Islands law than under a typical jurisdiction in the United States.

Our corporate affairs are governed by our articles of incorporation and bylaws and by the Marshall Islands Business Corporations Act (the “BCA”). The provisions of the BCA resemble provisions of the corporation laws of a number of states in the United States of America. However, there have been few judicial cases in the Marshall Islands interpreting the BCA. The rights and fiduciary responsibilities of directors under the law of the Marshall Islands are not as clearly established as the rights and fiduciary responsibilities of directors under statutes or judicial precedent in existence in certain U.S. jurisdictions. Shareholder rights may differ as well. While the BCA does specifically incorporate the non-statutory law, or judicial case law, of the State of Delaware and other states with substantially similar legislative provisions, our public shareholders may have more difficulty in protecting their interests in the face of actions by management, directors or controlling shareholders than would shareholders of a corporation incorporated in a U.S. jurisdiction. Further, the Marshall Islands does not have a well-developed body of bankruptcy law. As such, in the case of our bankruptcy, there may be a delay in bankruptcy proceedings and the ability of shareholders and creditors to receive recovery after a bankruptcy proceeding.

Service of process and enforcement of judgments may be more difficult.

We are incorporated under the laws of the Marshall Islands. Substantially all of our assets are located in Brazil. As a result, it may not be possible to effect service of process upon us within the United States of America or to enforce judgments obtained in U.S. courts against us.

Item 4. Information on the Company.

4.A. History and Development of the Company.

Date of Incorporation, Legal Form, Domicile, & Business Summary

On July 27, 2016, Atlas Critical Minerals Corporation (“Atlas Critical Minerals” or “the Company”) was incorporated as Jupiter Gold Corporation (“Jupiter Gold”) under the laws of the Republic of the Marshall Islands. Concurrently, Atlas Lithium Corporation (formerly known as Brazil Minerals, Inc.) (“Atlas Lithium”), a Nevada corporation, exchanged its 99.99% ownership in Mineração Jupiter Ltda (“MJL”), a Brazilian company, for 4,000,000 shares of Jupiter Gold’s common stock. Atlas Lithium held an approximate 32.70% interest in the Company as of December 31, 2024. The Company trades on the OTC Markets (OTCQB) under the symbol JUPGF.

Our registered office and principal executive offices are located at Rua Antonio de Albuquerque, 156 – 17th Floor, Belo Horizonte, MG 30.112-010, Brazil, and our telephone number is +1-888-412-0210. The information on, or that can be accessed through, our website is not part of and should not be incorporated by reference into this annual report or any other report we file or furnish to the U.S. Securities and Exchange Commission (the “SEC”). The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

On November 6, 2024 the Company and Apollo Resources Corporation, a Republic of the Marshall Islands corporation (“Apollo Resources”), entered into an Agreement and Plan of Merger, which provided for, among other things, the merger of Apollo Resources with and into the Company (the “Merger”), with the Company continuing its corporate existence as the surviving corporation. Prior to the Merger, Apollo Resources was a majority-owned subsidiary of Atlas Lithium.

On November 19, 2024, following satisfaction and/or waiver of the closing conditions in the Merger agreement, including approval of the transactions contemplated under the Merger Agreement by the requisite vote of the shareholders of Jupiter Gold and Apollo Resources, respectively, the Merger was consummated and Apollo Resources merged with and into the Company.

In connection with the consummation of the Merger, each share of outstanding Apollo Resources securities was cancelled and converted into 6.62 shares of the Company’s common stock. Immediately following the Merger, the holders of outstanding Apollo Resources securities owned approximately 59.40% of the Company’s outstanding securities. Our Founder, Chief Executive Officer and Chairman, Mr. Fogassa, who is also the Chief Executive Officer of Atlas Lithium, holds 34.4% of the Company’s outstanding equity interest following the Merger.

On November 19, 2024, our Articles of Incorporation were amended and restated in order to (i) increase the authorized share capital of the Company to 200,000,000 shares, and (ii) increase the number of shares of authorized common stock to 190,000,000 shares. The foregoing description is only a summary of the Amended and Restated Articles of Incorporation and is qualified in its entirety by reference to the full Amended and Restated Articles of Incorporation, which are filed as Exhibit 1.1 hereto and incorporated by reference.

After the Merger, the Company’s wholly owned subsidiaries now include Mineracao Jupiter Ltda, Mineração Apollo Ltda, Mineração Duas Barras Ltda, and RST Recursos Minerais Ltda.

On December 18, 2024, the Company entered into an Option Agreement (the “Option Agreement”) with Atlas Lithium Corporation (“Atlas Lithium”)), pursuant to which the Company acquired an option to acquire 100% of the equity interests of Brazil Minerals Resources Corporation (“BMR”), a wholly-owned subsidiary of Atlas Lithium (the “Option”). As consideration for the Option, the Company issued to Atlas Lithium 797,957 shares of our common stock, representing $500,000 divided by a value per share of $0.6266.

The Option is exercisable no earlier than the filing by the Company of a Form F-1 registration statement with the SEC and within 12 months thereafter. If the Option is exercised, the Company and Atlas Lithium shall enter into a definitive purchase agreement for the purchase of BMR pursuant to which the Company shall pay to Atlas Lithium total consideration of $8,000,000, which at the discretion of Atlas Lithium shall be in the form of cash, shares of the Company’s common stock, or a combination of cash and shares of the Company’s common stock. In the event that the Option is exercised, Atlas Lithium shall additionally be entitled to a perpetual royalty of one point five percent (1.5%) of the revenues resulting from the mineral rights owned by BMR as of the date of the Option Agreement.

On December 20, 2024, the Articles of Incorporation of the Company, a Republic of the Marshall Islands corporation were amended to change the name of the Company to from Jupiter Gold Corporation to Atlas Critical Minerals Corporation. This name change was carried out to reflect a broader focus of the Company following its merger with Apollo Resources. On January 27, 2025, in connection with such an amendment, the Company filed a Certificate of Correction to correct the omission of a reference to the Company’s original Articles of Incorporation, dated July 27, 2016, in Section 2 of the Articles of Amendment.

We have no debt, except for operational payables. We have been primarily funded to date by sales of our common stock. We are prohibited from issuing variable-rate convertible debt by our Bylaws.

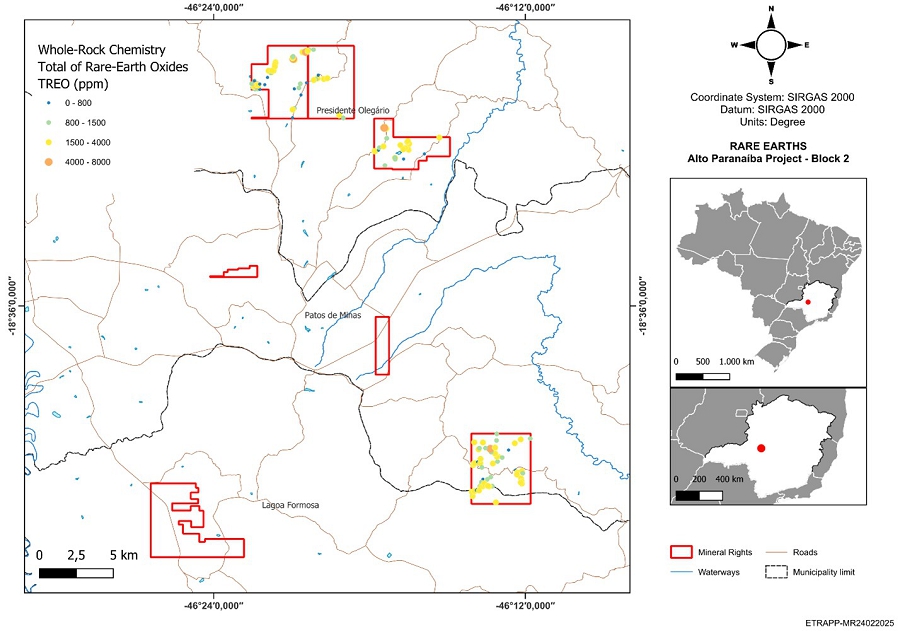

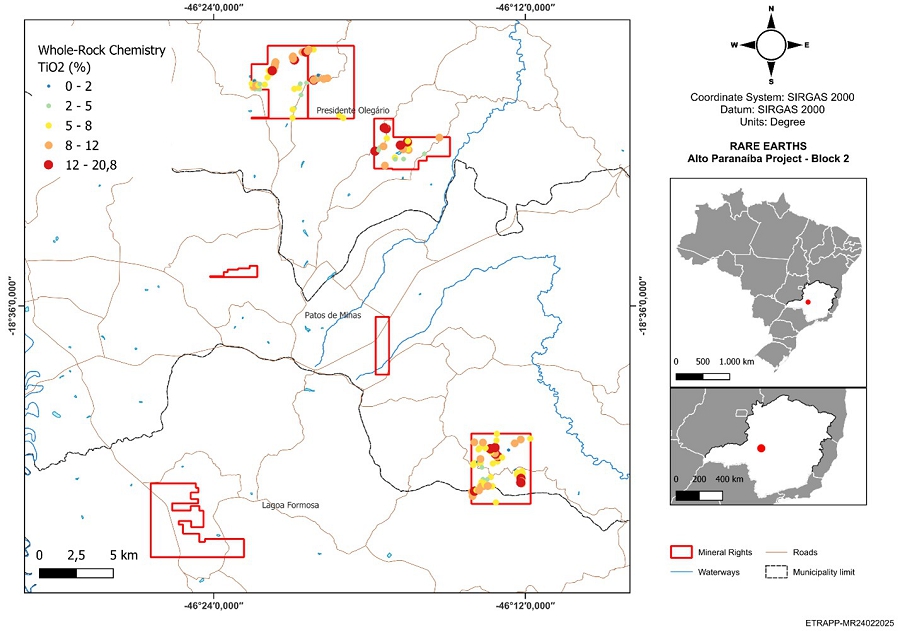

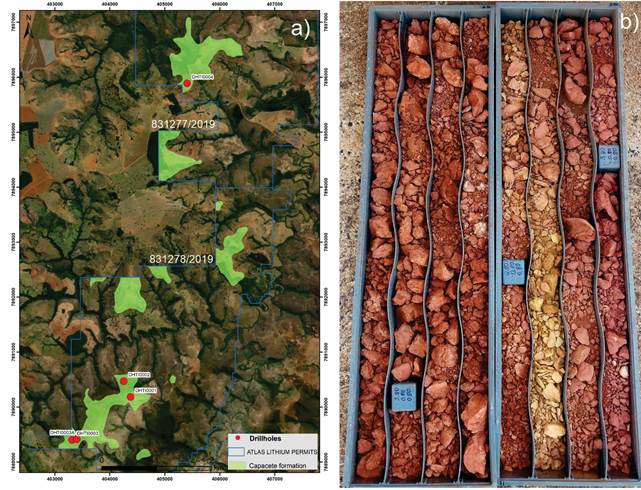

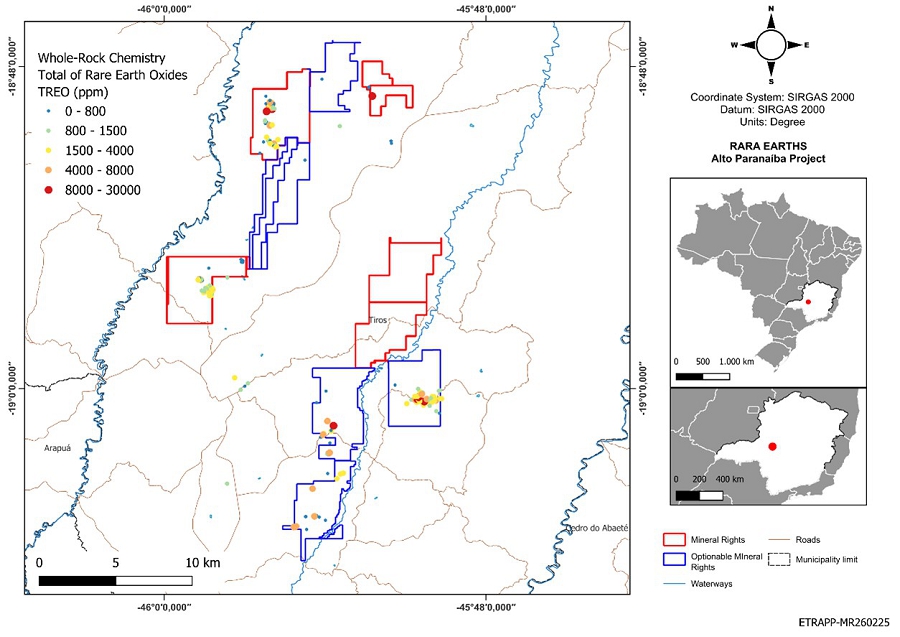

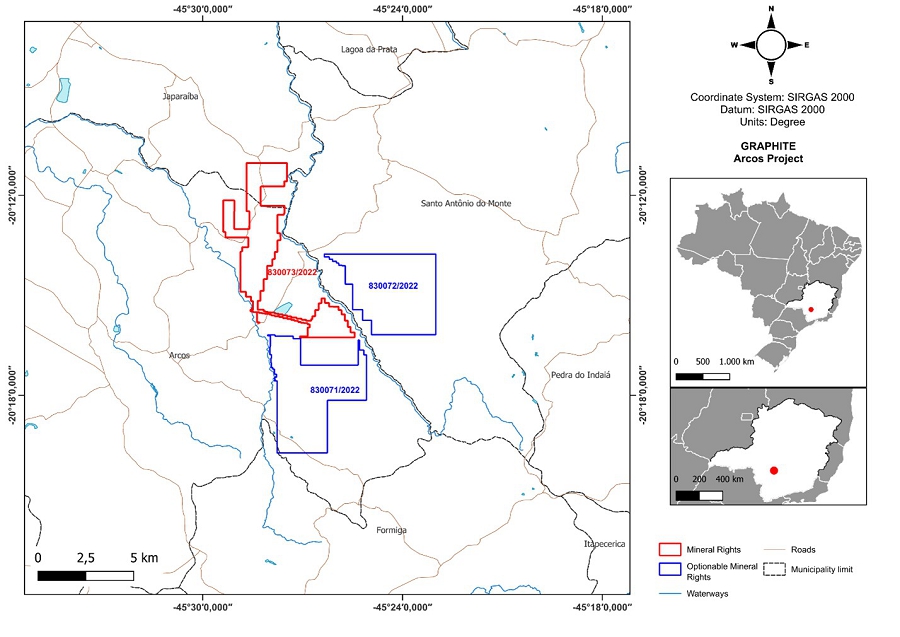

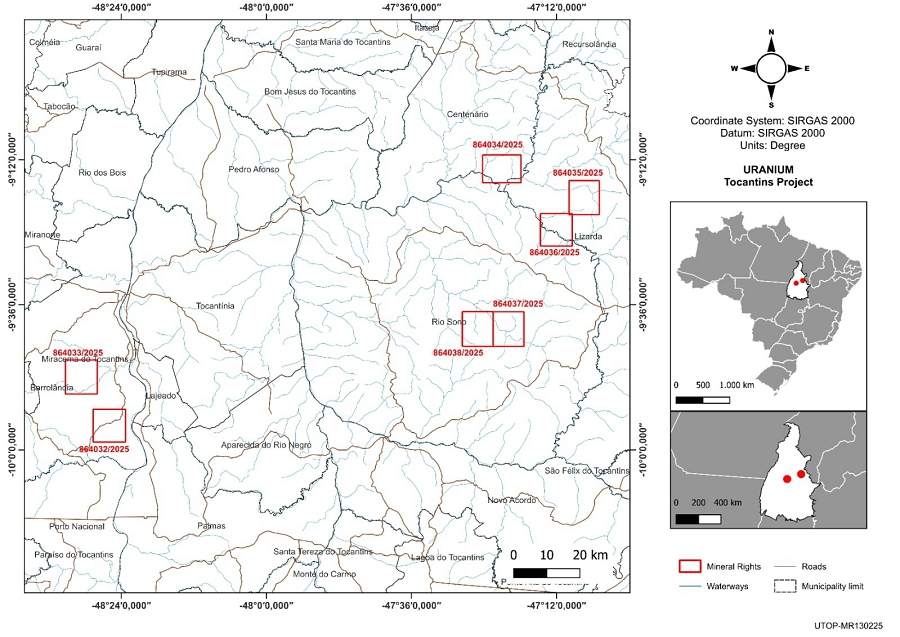

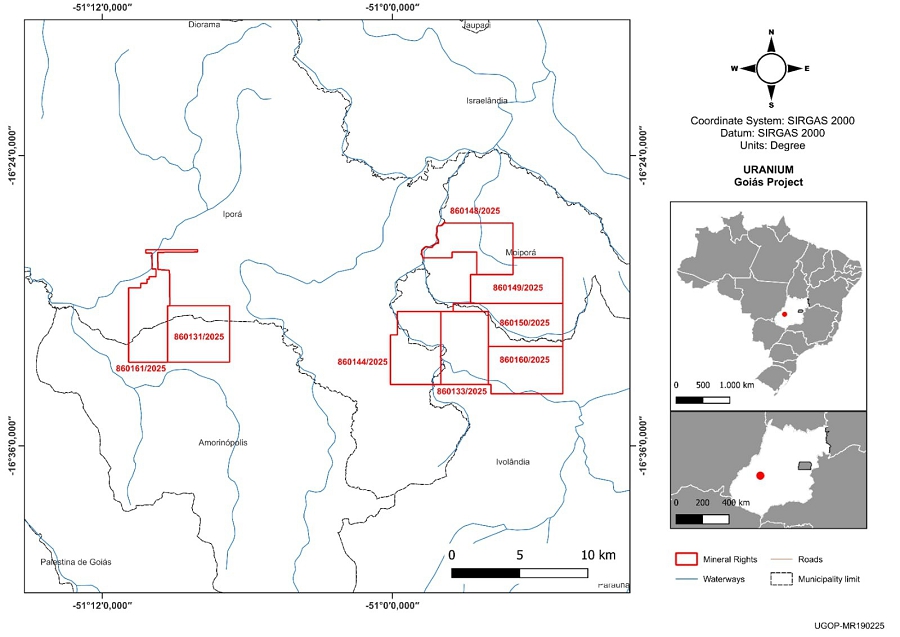

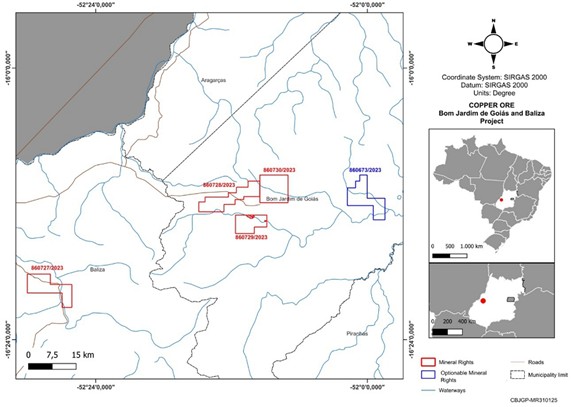

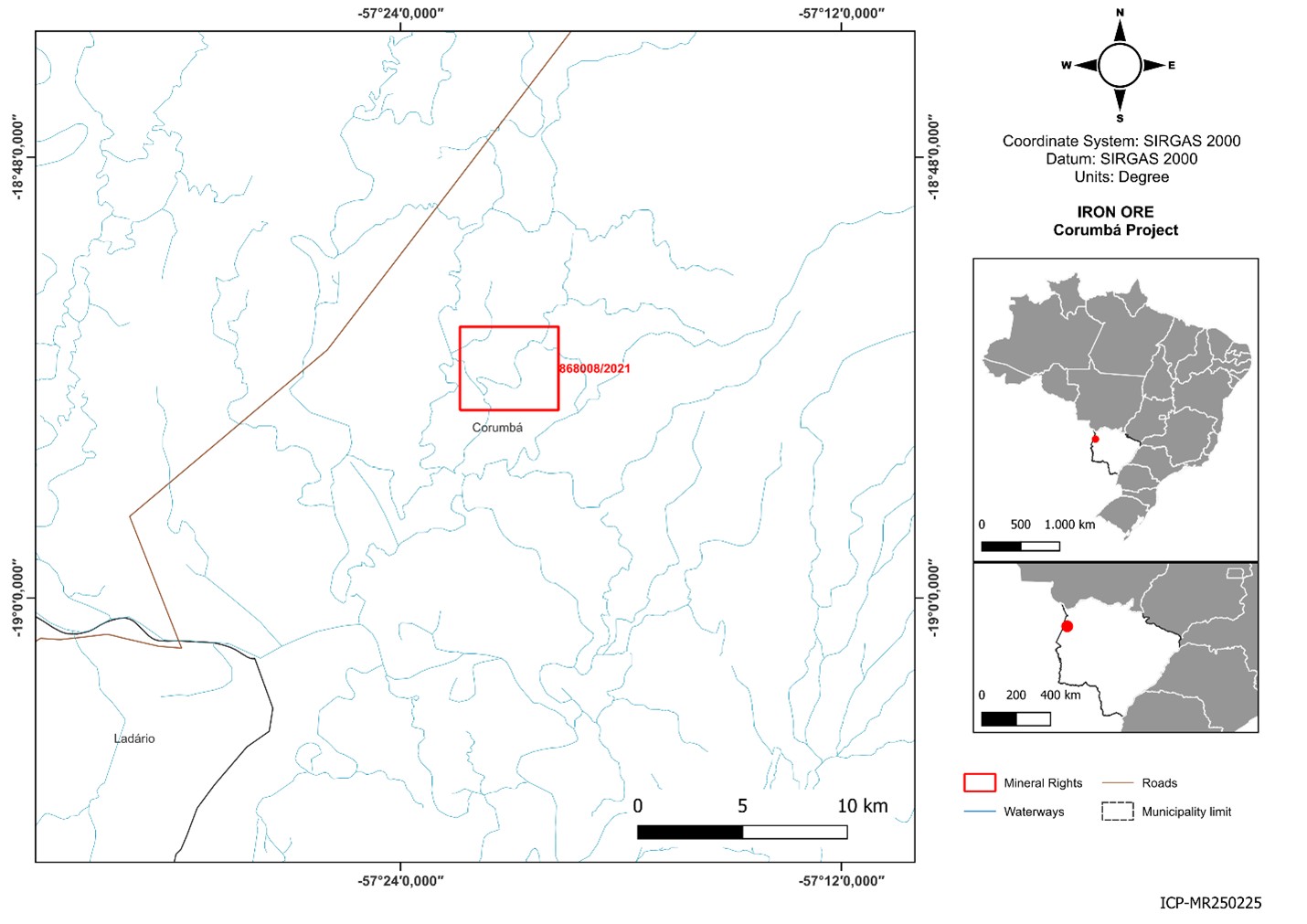

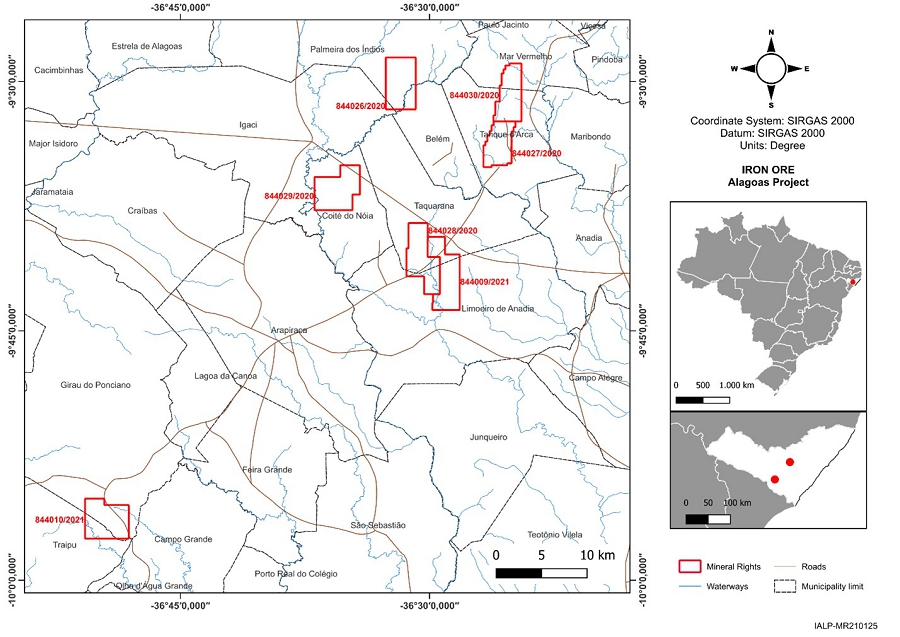

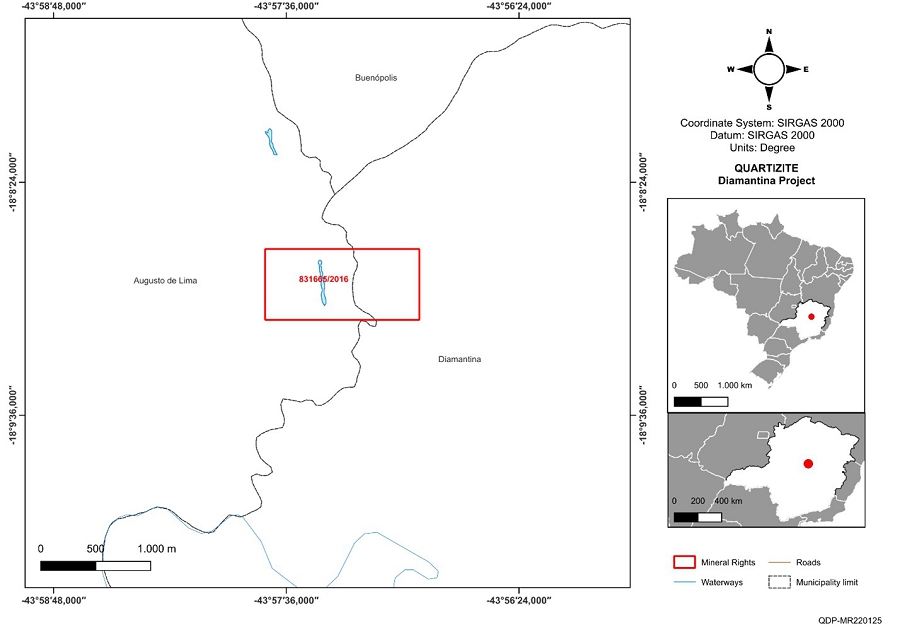

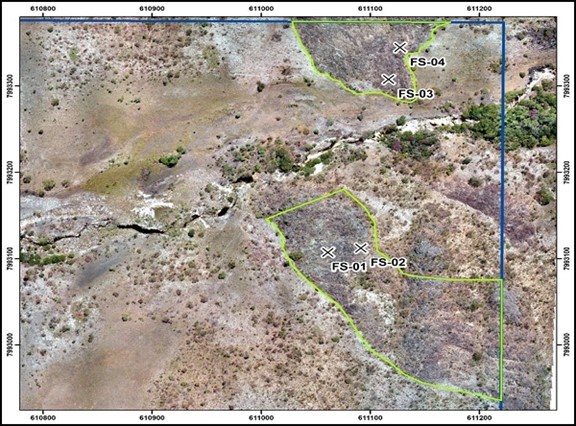

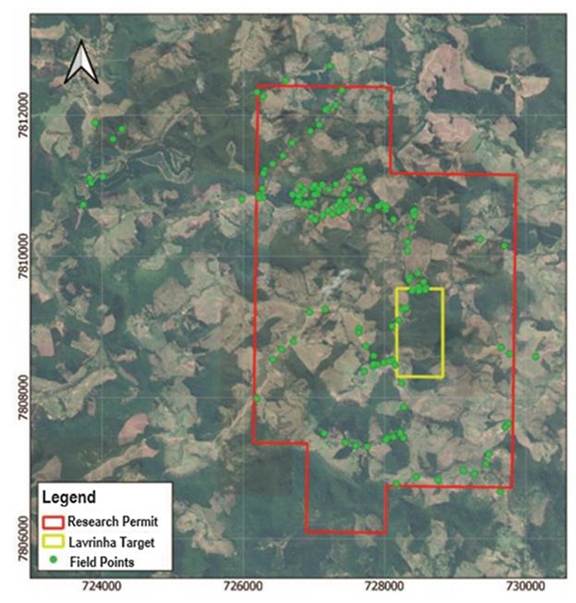

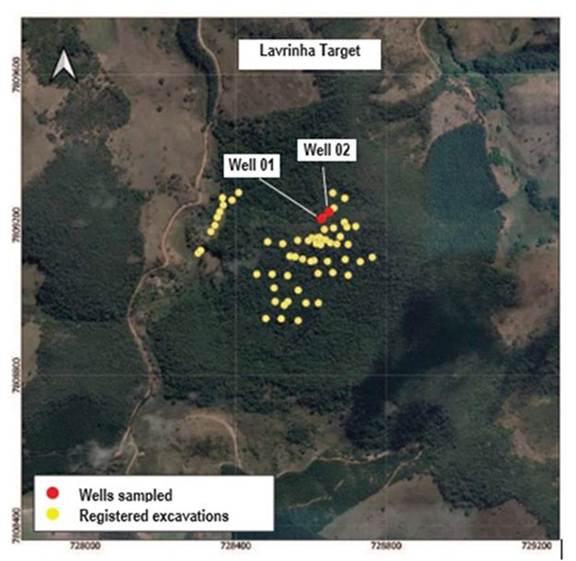

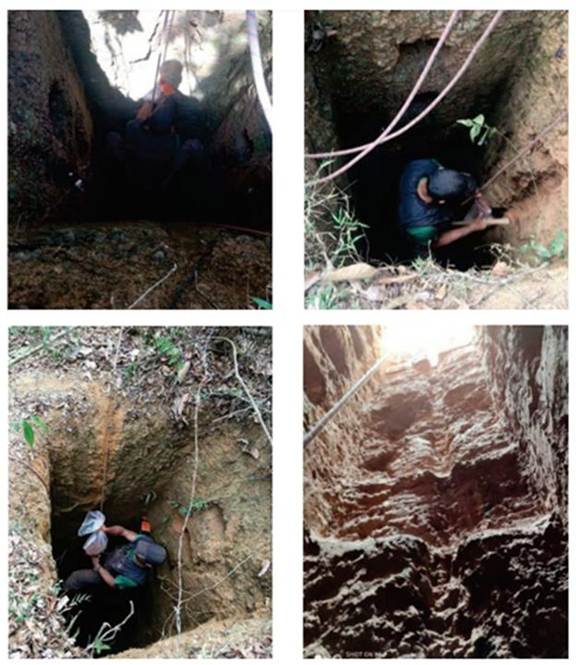

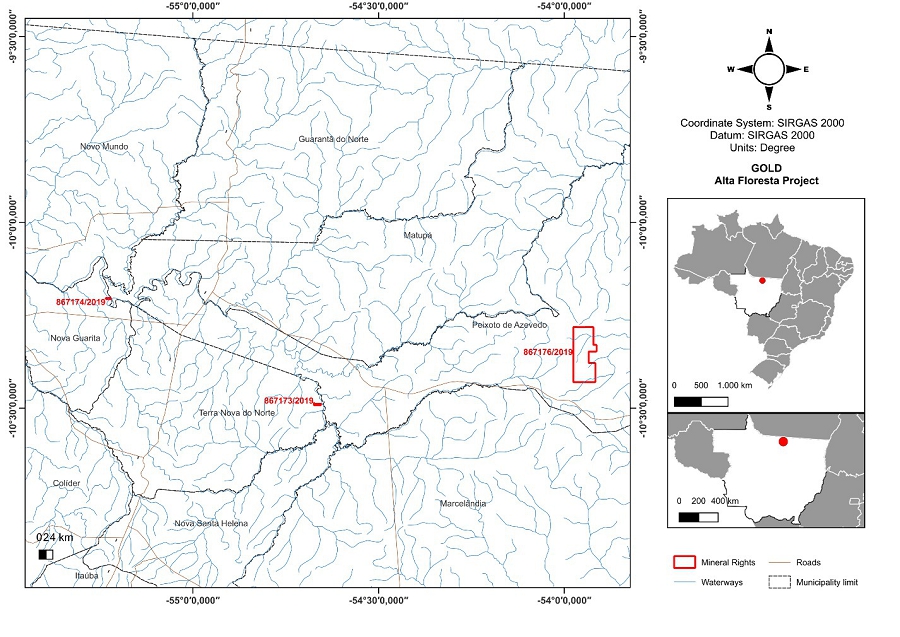

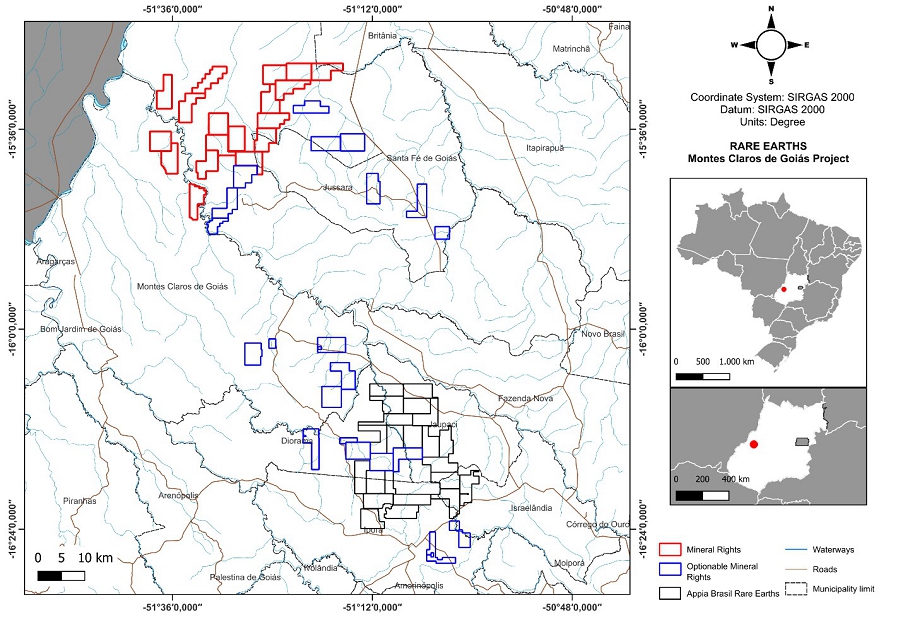

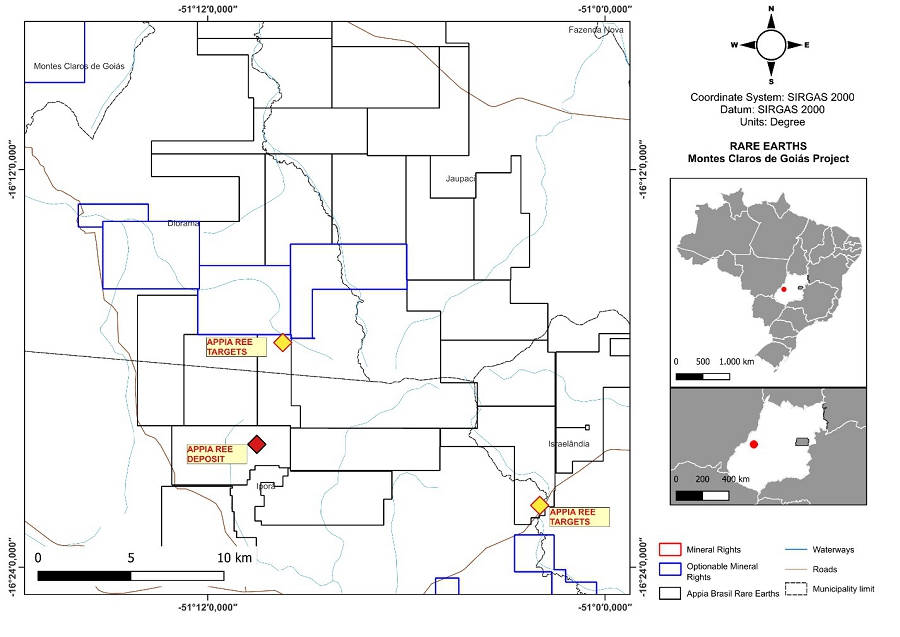

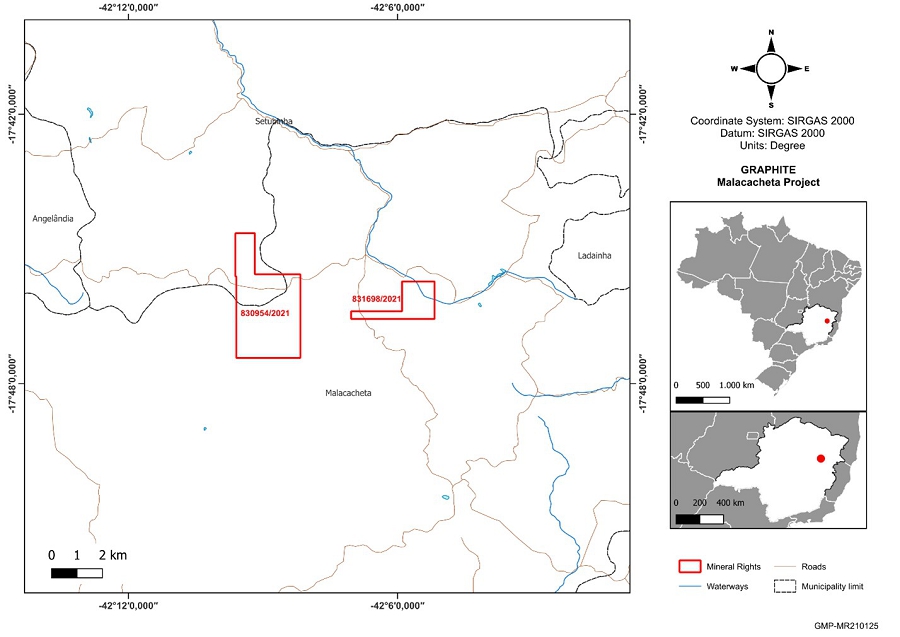

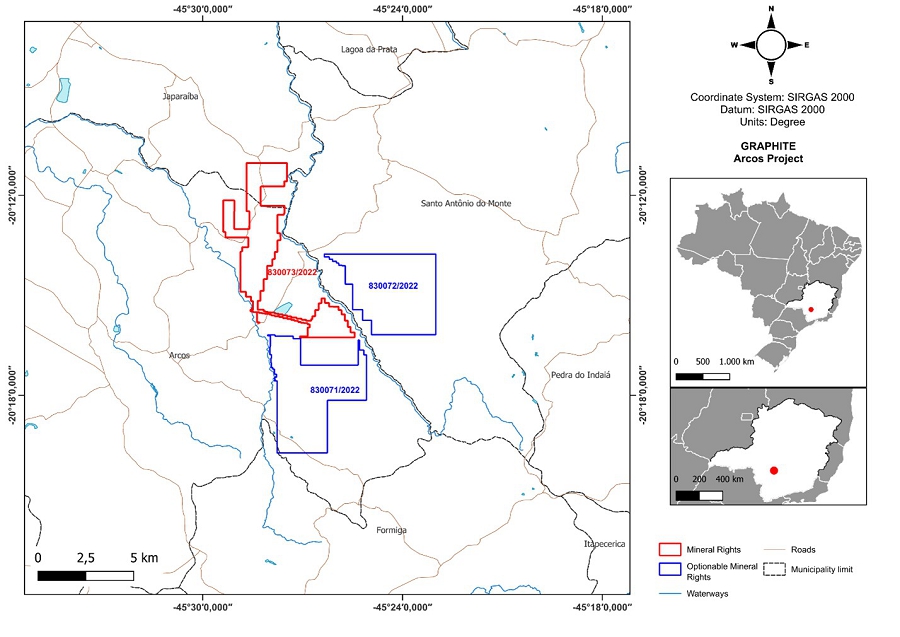

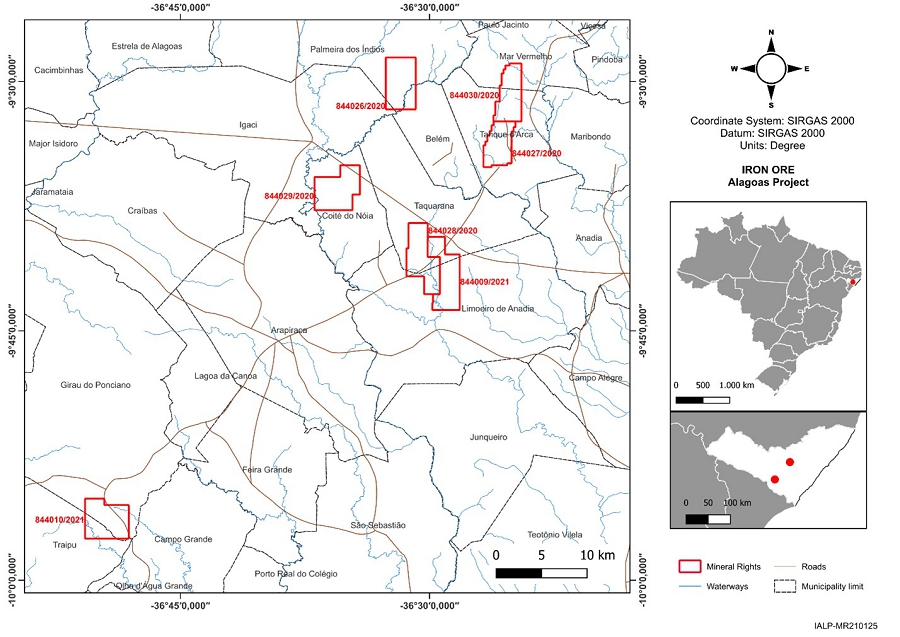

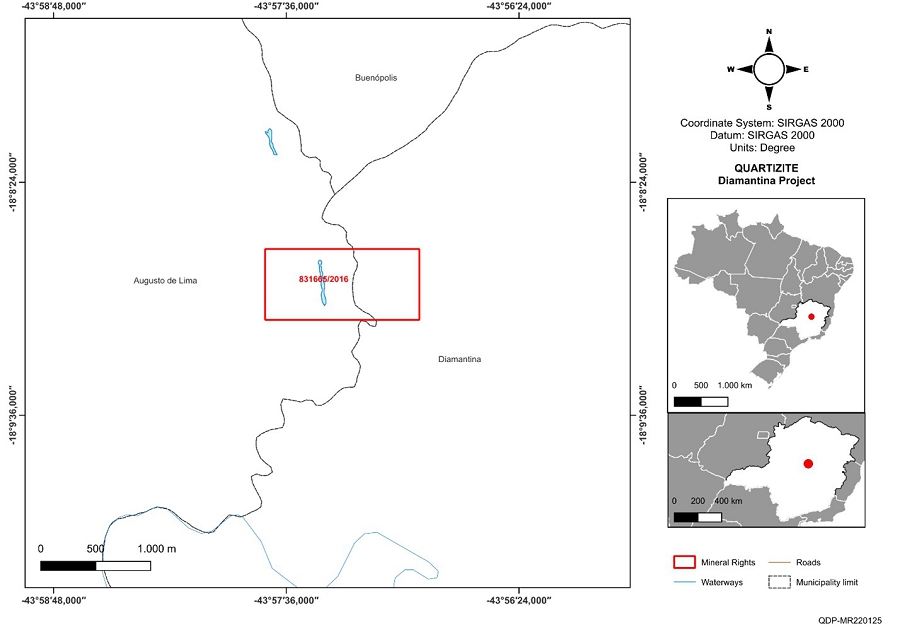

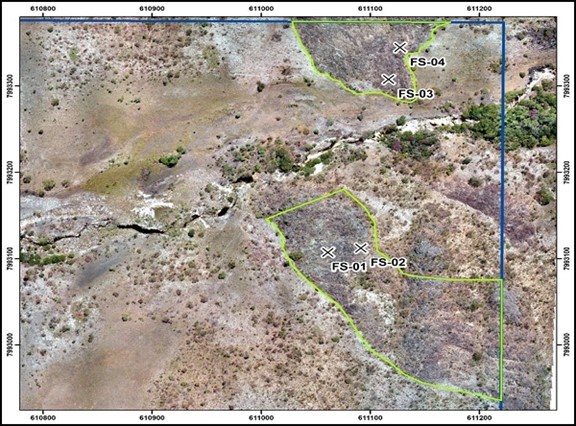

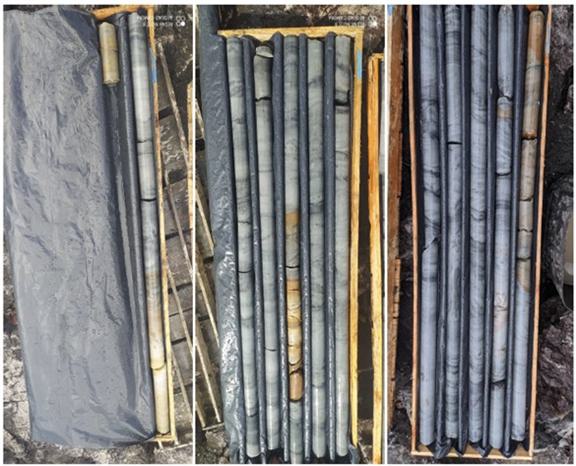

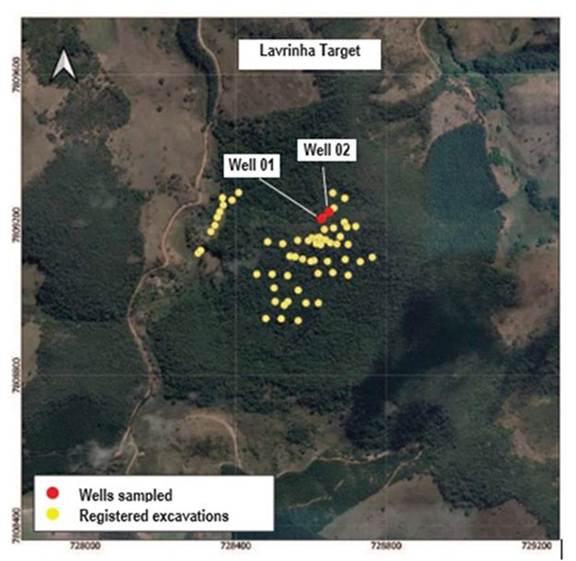

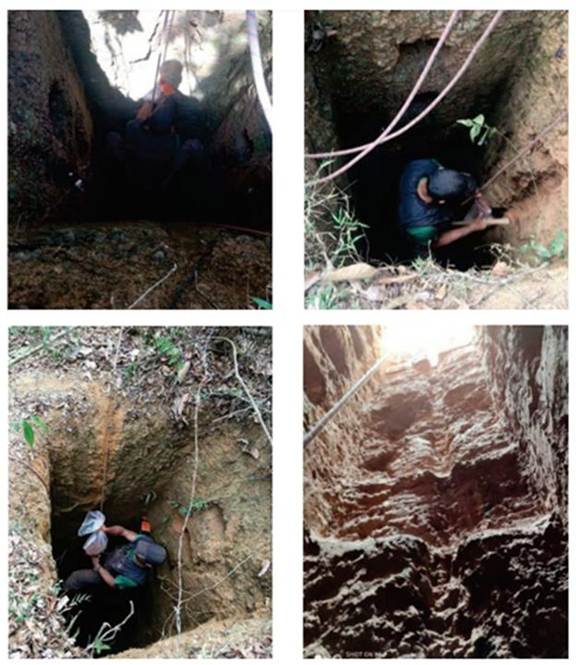

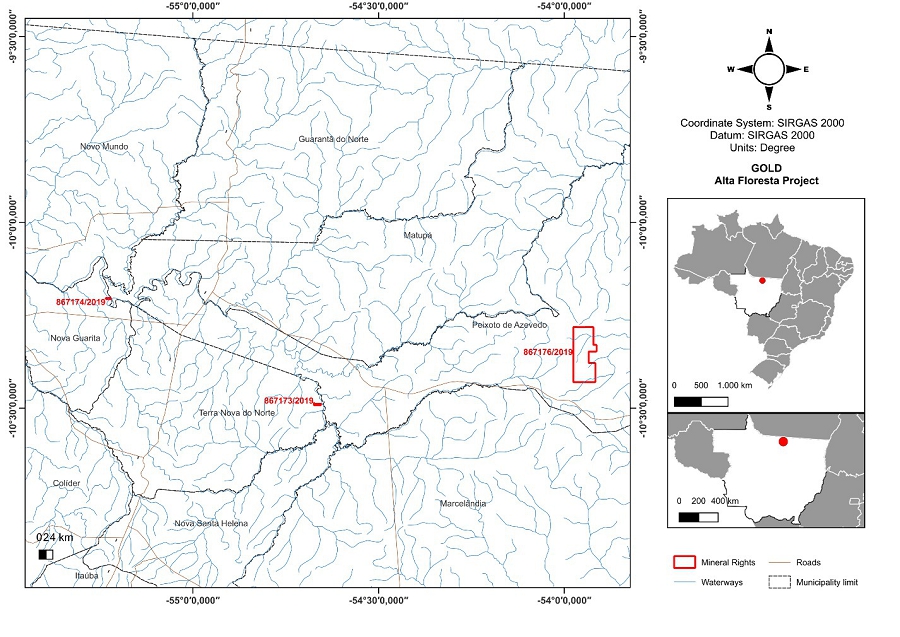

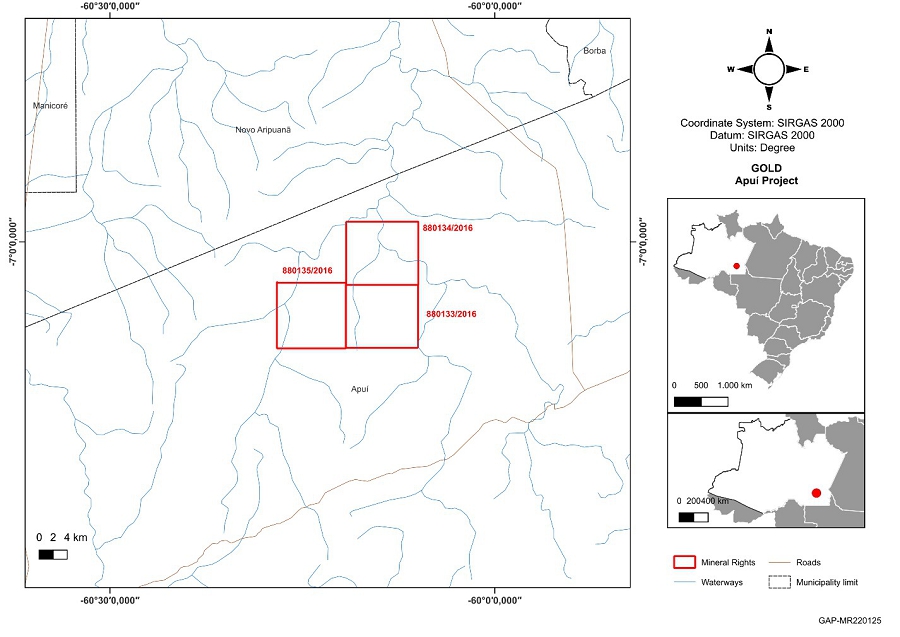

4.B. Business Overview.