Note regarding forward-looking statements This presentation and other oral or written statements that we make from time to time may contain information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve substantial risks and uncertainties. We have tried, wherever possible, to identify such statements using words such as “anticipate,” “estimate,” “expect,” “project,” “may,” “will,” “could,” “intend,” “goal,” “target,” "guidance," “forecast,” “preliminary,” “objective,” “continue,” “aim,” “plan,” “believe” and other words and terms of similar meaning, or that are tied to future periods, in connection with a discussion of future operating or financial performance. In particular, these include, without limitation, statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends in operating and financial results, as well as statements regarding the expected benefits of the separation (the "Separation") from MetLife, Inc. ("MetLife"). Any or all forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining the actual future results of Brighthouse Financial. These statements are based on current expectations and the current economic environment and involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance. Actual results could differ materially from those expressed or implied in the forward-looking statements due to a variety of known and unknown risks, uncertainties and other factors. Although it is not possible to identify all of these risks and factors, they include, among others: differences between actual experience and actuarial assumptions and the effectiveness of our actuarial models; higher risk management costs and exposure to increased market and counterparty risk due to guarantees within certain of our products; the effectiveness of our variable annuity exposure management strategy and the impact of such strategy on net income volatility and negative effects on our statutory capital; the reserves we are required to hold against our variable annuities as a result of actuarial guidelines; a sustained period of low equity market prices and interest rates that are lower than those we assumed when we issued our variable annuity products; the potential material adverse effect of changes in accounting standards, practices and/or policies applicable to us, including changes in the accounting for long-duration contracts; our degree of leverage due to indebtedness; the effect adverse capital and credit market conditions may have on our ability to meet liquidity needs and our access to capital; the impact of changes in regulation and in supervisory and enforcement policies on our insurance business or other operations; the effectiveness of our risk management policies and procedures; the availability of reinsurance and the ability of our counterparties to our reinsurance or indemnification arrangements to perform their obligations thereunder; heightened competition, including with respect to service, product features, scale, price, actual or perceived financial strength, claims-paying ratings, credit ratings, e-business capabilities and name recognition; the ability of our insurance subsidiaries to pay dividends to us, and our ability to pay dividends to our shareholders; our ability to market and distribute our products through distribution channels; any failure of third parties to provide services we need, any failure of the practices and procedures of these third parties and any inability to obtain information or assistance we need from third parties, including MetLife; whether all or any portion of the tax consequences of the Separation are not as expected, leading to material additional taxes or material adverse consequences to tax attributes that impact us; the uncertainty of the outcome of any disputes with MetLife over tax-related or other matters and agreements, including the potential of outcomes adverse to us that could cause us to owe MetLife material tax reimbursements or payments, or disagreements regarding MetLife’s or our obligations under our other agreements; the impact on our business structure, profitability, cost of capital and flexibility due to restrictions we have agreed to that preserve the tax-free treatment of certain parts of the Separation; the potential material negative tax impact of potential future tax legislation that could decrease the value of our tax attributes and cause other cash expenses, such as reserves, to increase materially and make some of our products less attractive to consumers; whether the Separation will qualify for non-recognition treatment for federal income tax purposes and potential indemnification to MetLife if the Separation does not so qualify; the impact of the Separation on our business and profitability due to MetLife’s strong brand and reputation, the increased costs related to replacing arrangements with MetLife with those of third parties and incremental costs as a public company; whether the operational, strategic and other benefits of the Separation can be achieved, and our ability to implement our business strategy; our ability to attract and retain key personnel; and other factors described from time to time in documents that we file with the U.S. Securities and Exchange Commission (the “SEC”). For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements included and the risks, uncertainties and other factors identified in our Annual Report on Form 10-K for the year ended December 31, 2018 and our subsequent Quarterly Reports on Form 10-Q, particularly in the sections entitled “Risk Factors” and “Quantitative and Qualitative Disclosures About Market Risk,” as well as in our subsequent SEC filings. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. 2

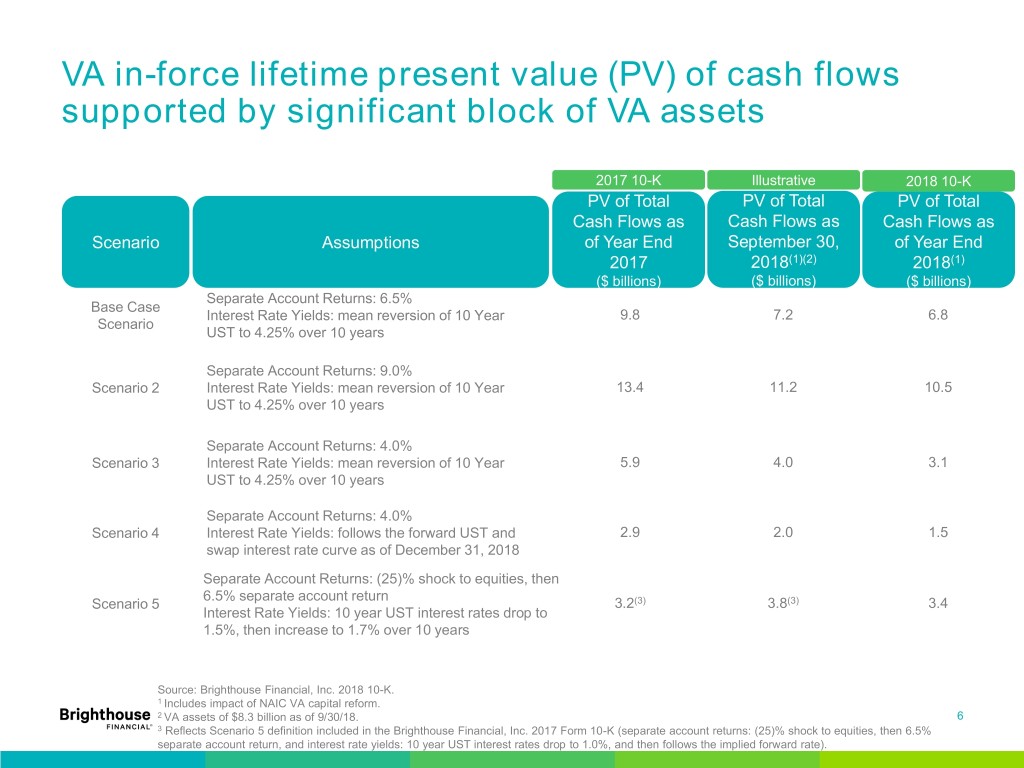

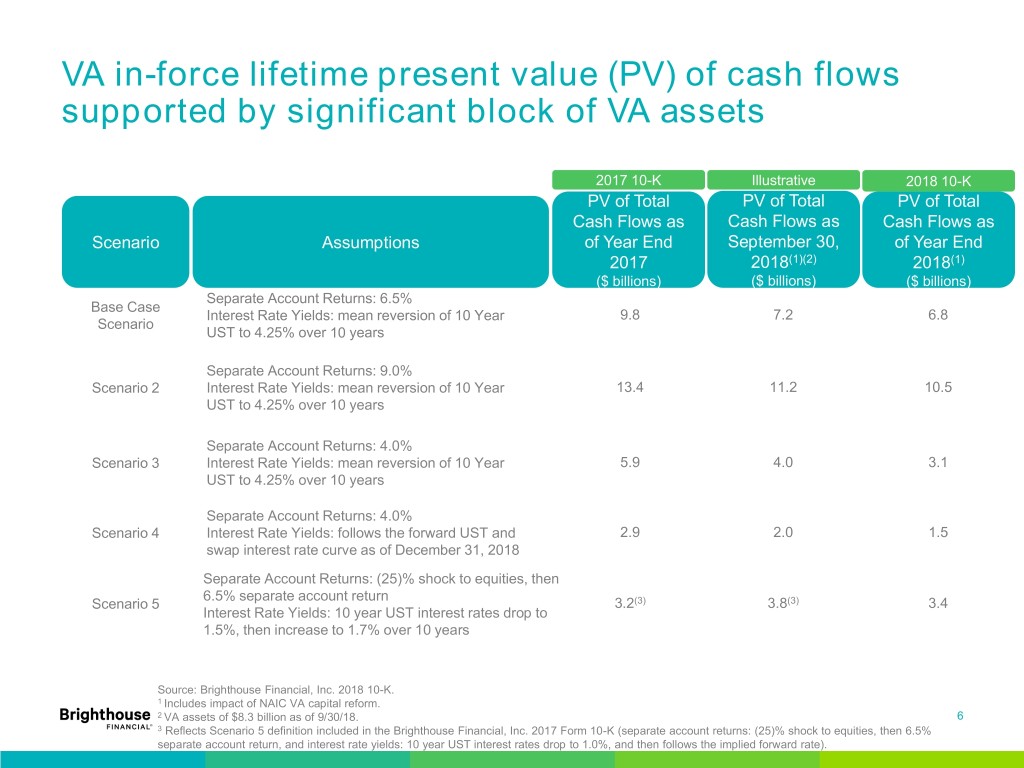

VA in-force lifetime present value (PV) of cash flows supported by significant block of VA assets 2017 10-K Illustrative 2018 10-K PV of Total PV of Total PV of Total Cash Flows as Cash Flows as Cash Flows as Scenario Assumptions of Year End September 30, of Year End 2017 2018(1)(2) 2018(1) ($ billions) ($ billions) ($ billions) Separate Account Returns: 6.5% Base Case Interest Rate Yields: mean reversion of 10 Year 9.8 7.2 6.8 Scenario UST to 4.25% over 10 years Separate Account Returns: 9.0% Scenario 2 Interest Rate Yields: mean reversion of 10 Year 13.4 11.2 10.5 UST to 4.25% over 10 years Separate Account Returns: 4.0% Scenario 3 Interest Rate Yields: mean reversion of 10 Year 5.9 4.0 3.1 UST to 4.25% over 10 years Separate Account Returns: 4.0% Scenario 4 Interest Rate Yields: follows the forward UST and 2.9 2.0 1.5 swap interest rate curve as of December 31, 2018 Separate Account Returns: (25)% shock to equities, then 6.5% separate account return Scenario 5 3.2(3) 3.8(3) 3.4 Interest Rate Yields: 10 year UST interest rates drop to 1.5%, then increase to 1.7% over 10 years Source: Brighthouse Financial, Inc. 2018 10-K. 1 Includes impact of NAIC VA capital reform. 2 VA assets of $8.3 billion as of 9/30/18. 6 3 Reflects Scenario 5 definition included in the Brighthouse Financial, Inc. 2017 Form 10-K (separate account returns: (25)% shock to equities, then 6.5% separate account return, and interest rate yields: 10 year UST interest rates drop to 1.0%, and then follows the implied forward rate).