FILED PURSUANT TO RULE 424(h)

REGISTRATION FILE NOS. 333-207127 and 333-207127-01

This prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and we are not seeking an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 28, 2016

Prospectus dated , 2016

US$●(1)

SMART ABS Series 2016-2US Trust

Issuing Entity or Trust

Central Index Key: 0001685342

Perpetual Trustee Company Limited

(ABN 42 000 001 007)

in its capacity as trustee of the Trust

Issuer Trustee

| | |

Macquarie Leasing Pty Limited (ABN 38 002 674 982) Central Index Key: 0001549785 Depositor, Sponsor, Originator and Servicer | | Macquarie Securities Management Pty Limited

(ABN 26 003 435 443) Central Index Key: 0001541418 Manager |

Before you purchase any notes, be sure you understand the structure and the risks. You should review carefully the risk factors beginning on page 31 of this prospectus.

The notes will be obligations of the issuer trustee in its capacity as trustee of the trust and will not be obligations of the issuer trustee’s affiliates or obligations of or interests in Macquarie Leasing Pty Limited, Macquarie Securities Management Pty Limited or any of their affiliates.

| (1) | The issuer trustee, in its capacity as trustee of the SMART ABS Series 2016-2US Trust, will issue US$ notes with an aggregate initial principal balance of either US$500,000,000 or US$750,000,000. If such amount is US$500,000,000, the issuer trustee, in its capacity as trustee of the SMART ABS Series 2016-2US Trust, will issue the US$ notes described in the table below. |

| | | | | | |

| | | Initial Principal Balance(2) | | Interest Rate | | Maturity Date* |

Class A-1 Notes | | US$100,000,000 | | ●% | | Distribution Date in October 2017 |

Class A-2a Notes | | {US$175,000,000} | | ●% | | Distribution Date in August 2019 |

Class A-2b Notes | | | | One-month LIBOR + ●%** | |

Class A-3a Notes | | {US$140,000,000} | | ●% | | Distribution Date in March 2021 |

Class A-3b Notes | | | | One-month LIBOR + ●%** | |

Class A-4a Notes | | {US$85,000,000} | | ●% | | Distribution Date in December 2022 |

Class A-4b Notes | | | | One-month LIBOR + ●%** | |

Total | | US$500,000,000 | | | | |

| (2) | If the aggregate initial principal balance of US$ notes is US$750,000,000, the issuer trustee, in its capacity as trustee of the SMART ABS Series 2016-2US Trust, will issue US$150,000,000 of class A-1 notes, class A-2a notes and class A-2b notes with an aggregate initial principal balance of US$262,500,000, class A-3a notes and A-3b notes with an aggregate initial principal balance of US$210,000,000 and class A-4a notes and class A-4b notes with an aggregate initial principal balance of US$127,500,000. Such amount will depend on, among other factors, market conditions at the time of pricing. See “Risk Factors—Risks associated with unknown aggregate initial principal amount of US$ notes.” |

| * | If not a business day, the next business day. |

| ** | For a description of how one-month LIBOR is determined, see “Glossary of Certain Defined Terms” in this prospectus. |

| • | This prospectus relates to the “US$ notes” offered by this prospectus as specified above. The issuer trustee will also issue two classes of Australian Dollar denominated notes that are not offered under this prospectus (the “A$ notes”, and together with the US$ notes, the “notes”) with an aggregate initial principal balance of either (i) A$98,307,000, if the aggregate initial principal balance of US$ notes is US$500,000,000 or (ii) A$147,460,000, if the aggregate initial principal balance of US$ notes is US$750,000,000. The A$ notes will initially be retained by the sponsor or one or more of its affiliates. |

| • | The notes will be backed by a pool of lease contracts, hire purchase contracts and loan contracts in relation to motor vehicle assets (including cars, trucks, buses, trailers, forklifts and motorcycles) located in Australia. |

| • | The notes are not deposits and neither the notes nor the underlying receivables are insured or guaranteed by any company or governmental agency or instrumentality. |

| • | Interest and principal on the notes will be paid on the 14th day of each calendar month (or if not a business day, the next business day). The first distribution date will be November 14, 2016 or if not a business day, the next business day. Each class of US$ notes will be paid in full on its maturity date (or if not a business day, the next business day) if not paid in full prior to such date. |

| • | Credit enhancement for the Class A notes consists of subordination and excess spread. Liquidity enhancement for the Class A notes consists of a liquidity reserve account and the re-direction of principal. |

| • | Macquarie Bank Limited (ABN 46 008 583 542) is the fixed rate swap provider and Australia and New Zealand Banking Group Limited (ABN 11 005 357 522) is the currency swap provider. |

The pricing terms of the notes offered by this prospectus are:

| | | | | | |

| | | Price to Public | | Underwriting Commissions

and Discounts | | Proceeds to Depositor |

Class A-1 Notes | | ●% | | ●% | | ●% |

Class A-2a Notes | | ●% | | ●% | | ●% |

Class A-2b Notes | | ●% | | ●% | | ●% |

Class A-3a Notes | | ●% | | ●% | | ●% |

Class A-3b Notes | | ●% | | ●% | | ●% |

Class A-4a Notes | | ●% | | ●% | | ●% |

Class A-4b Notes | | ●% | | ●% | | ●% |

Total | | US$● | | US$● | | US$● |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Joint Lead Managers and Bookrunners for the US$ notes

J.P. Morgan, Citigroup, HSBC, nabSecurities, LLC and

SOCIETE GENERALE

Co-Manager for the US$ notes

Macquarie Capital

The date of this prospectus is , 2016

TABLE OF CONTENTS

TABLE OF CONTENTS

(cont’d)

ii

TABLE OF CONTENTS

(cont’d)

iii

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED IN THIS PROSPECTUS

This prospectus provides information about the SMART ABS Series 2016-2US Trust and the terms of the US$ notes to be issued by the issuer trustee in its capacity as trustee of the SMART ABS Series 2016-2US Trust. The A$ notes are not being offered by this prospectus.

This prospectus does not contain all of the information included in the registration statement. The registration statement also includes copies of various contracts and documents referred to in this prospectus. You may obtain copies of these documents for review. See “Where You Can Find More Information” in this prospectus. You should rely only on information provided or incorporated by reference in this prospectus and any informational and computational material filed as part of the registration statement filed with the United States Securities and Exchange Commission (the “SEC”) for any particular offering of notes. We have not authorised anyone to provide you with other information.

This prospectus begins with the following brief introductory sections:

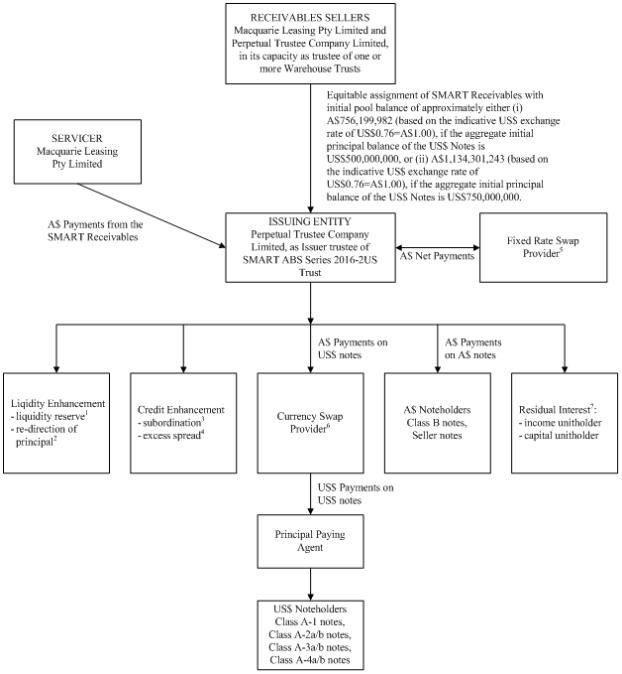

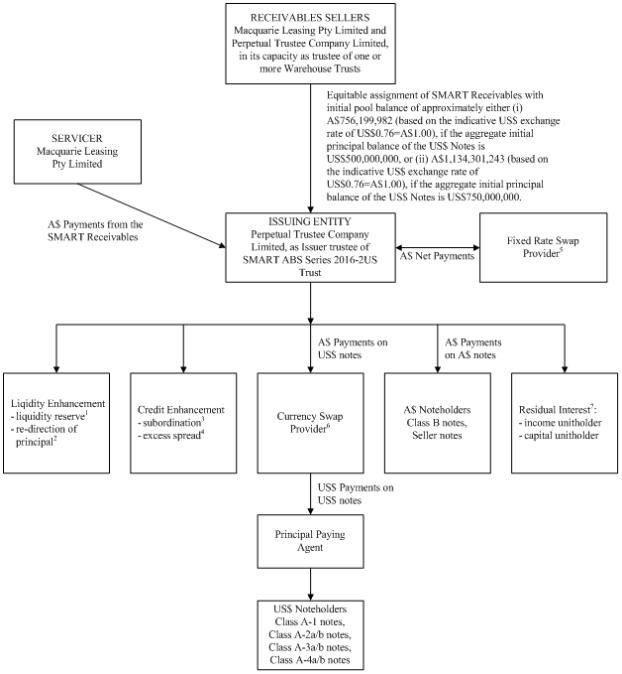

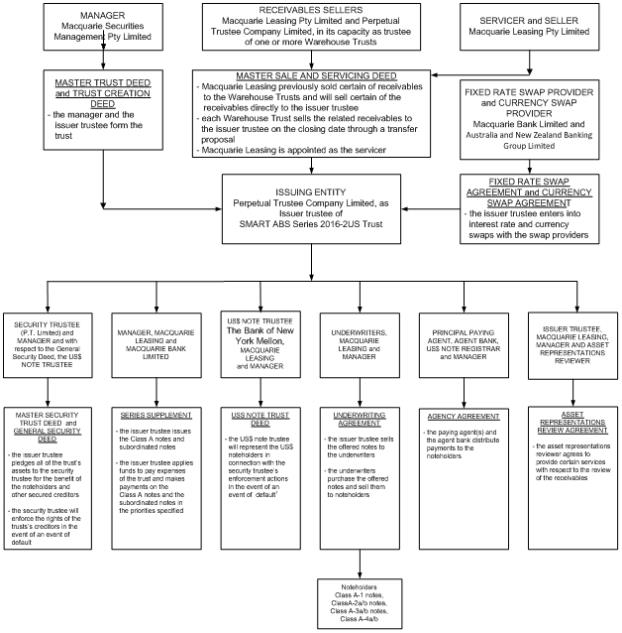

| | • | | Transaction Structure Diagram—illustrates the structure of this securitisation transaction, |

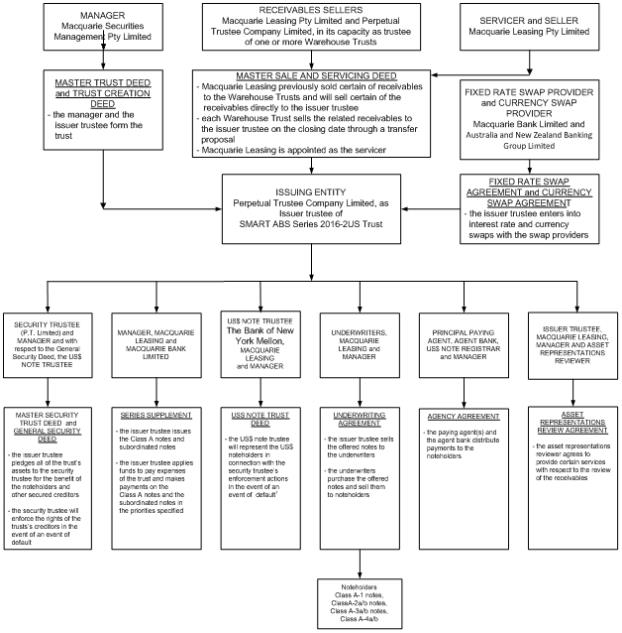

| | • | | Transaction Parties and Documents Diagram—illustrates the role that each transaction party and transaction document plays in this securitisation transaction, |

| | • | | Summary—describes the main terms of the notes, the cash flows in this securitisation transaction and the credit enhancement available to the notes, and |

| | • | | Risk Factors—describes some of the risks of investing in the US$ notes. |

The other sections of this prospectus contain more detailed descriptions of the notes and the structure of the trust that will be formed in connection with the issuance of your US$ notes. We include cross-references in this prospectus to captions in these materials where you can find further related discussions. The preceding Table of Contents provides the pages on which these captions are located.

In this prospectus, the terms “we”, “us” and “our” refer to Macquarie Leasing Pty Limited. In addition, “Macquarie Management” refers to Macquarie Securities Management Pty Limited, “Macquarie Leasing” refers to Macquarie Leasing Pty Limited and “Macquarie Bank” refers to Macquarie Bank Limited.

An index of defined terms with page numbers of definitions of all defined terms can be found in Appendix A of this prospectus, and a glossary of certain defined terms can be found in Appendix B of this prospectus.

DISCLAIMERS

No Guarantee by Macquarie Entities

The notes do not represent deposits or other liabilities of Macquarie Bank or any member company of the Macquarie Group and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. None of Macquarie Bank, Macquarie Leasing, the manager or any other member company of the Macquarie Group guarantees any particular rate of return on, or the performance of, the notes nor do they guarantee the repayment of capital from the notes.

No Guarantee by Other Transaction Parties

The notes do not represent deposits of Perpetual Trustee Company Limited, in its personal capacity, as trustee of the SMART ABS Series 2016-2US Trust or as trustee of any other trust, or deposits or liabilities of P.T. Limited, in its personal capacity or as security trustee of the security trust or as security trustee of any other trust, The Bank of New York Mellon, in its personal capacity or as US$ note trustee, principal paying agent, US$ note registrar or agent

iv

bank, Australia and New Zealand Banking Group Limited (ABN 11 005 357 522), as currency swap provider, the underwriters or any of their respective associates.

Perpetual Trustee Company Limited’s liability as issuer trustee to make payments of interest and principal on the notes is limited to the extent of the assets of the trust available therefor. All claims against Perpetual Trustee Company Limited in relation to the notes may only be satisfied out of the assets of the trust and are limited in recourse to the assets of the trust.

None of Perpetual Trustee Company Limited, in its personal capacity, as trustee of the SMART ABS Series 2016-2US Trust or as trustee of any other trust, P.T. Limited, in its personal capacity or as security trustee of the security trust or as security trustee of any other trust, The Bank of New York Mellon, in its personal capacity or as US$ note trustee, principal paying agent, US$ note registrar or agent bank, Australia and New Zealand Banking Group Limited, as currency swap provider, the underwriters or any of their respective associates, guarantees the payment or repayment or the return of any principal invested in, or any particular rate of return on, the notes or the performance of the assets of the trust.

In addition, none of the obligations of Perpetual Trustee Company Limited, in its capacity as trustee of the SMART ABS Series 2016-2US Trust, or of the manager are guaranteed in any way by Perpetual Trustee Company Limited, in its personal capacity or as trustee of any other trust, P.T. Limited, in its personal capacity or as security trustee of the security trust or as security trustee of any other trust, The Bank of New York Mellon, in its personal capacity or as US$ note trustee, principal paying agent, US$ note registrar or agent bank, Australia and New Zealand Banking Group Limited, as currency swap provider, the underwriters or any of their respective associates.

The Notes are Subject to Investment Risk

The holding of the notes is subject to investment risk, including possible delays in repayment and loss of income and principal invested.

For further details of the investment risk involved, see “Risk Factors” in this prospectus.

Additional Disclaimers

The notes will be the obligations solely of the issuer trustee in its capacity as trustee of the SMART ABS Series 2016-2US Trust.

The issuer trustee is not liable to satisfy any obligations or liabilities in relation to the notes or the trust from its personal assets except any obligations or liabilities arising from (and to the extent of) any reduction in its indemnity from the assets of the trust resulting from any fraud, negligence or wilful default (as defined in the transaction documents) on the part of the issuer trustee or any other person whose acts or omissions the issuer trustee is liable for under the transaction documents.

Save as summarised in the above paragraph, each noteholder is required to accept a final distribution of moneys under the master security trust deed and the general security deed in full and final satisfaction of all moneys owing to it, and any debt represented by any shortfall that exists after any such final distribution will be extinguished.

The US$ notes will be issued as book-entry notes. The A$ notes will be issued in the form of registered debt securities.

Neither Perpetual Trustee Company Limited (in its individual capacity or as trustee of the SMART ABS Series 2016-2US Trust) nor P.T. Limited (in its individual capacity or as security trustee) has had any involvement in the preparation of this prospectus (other than in respect of the sections of this prospectus entitled “Transaction Parties—The Issuer Trustee”, “Transaction Parties—The Security Trustee” and, only to the extent that it relates to the issuer trustee or the security trustee, “Legal Proceedings”), nor have they authorised or caused the issue of this prospectus.

v

The currency swap provider has not had any involvement in the preparation of this prospectus (other than (i) in respect of the first four paragraphs of the section of this prospectus entitled “The Currency Swaps and Fixed Rate Swap—The Currency Swaps—The Currency Swap Provider” (other than the phrase “and, if any replacement Currency Swap is entered into, will be the Currency Swap Provider under such replacement Currency Swap”) and (ii) and in respect of any documents incorporated by reference into this prospectus referred to in the section of this prospectus entitled “The Currency Swaps and the Fixed Rate Swap—The Currency Swaps—Incorporation of Certain Documents by Reference”, nor has it authorised or caused the issue of this prospectus.

The fixed rate swap provider has not had any involvement in the preparation of this prospectus (other than in respect of the section of this prospectus entitled “The Fixed Rate Swap—The Fixed Rate Swap Provider”, nor has it authorised or caused the issue of this prospectus.

All information contained in this prospectus is given as of the date hereof. Neither the delivery of this prospectus nor any sale made in connection with this prospectus will, under any circumstances, create any implication that:

| | • | | there has been no change in the information contained in this prospectus since the date hereof; |

| | • | | there has been no material change in the affairs of the trust or any party named in this prospectus since the date of this prospectus or the date upon which this prospectus has been most recently amended or supplemented; or |

| | • | | any other information supplied in connection with the US$ notes is correct as of any time subsequent to the date on which it is supplied or, if different, the date indicated in the document containing the same. |

The contents of this prospectus should not be construed as providing legal, business, accounting or tax advice. You should consult your own legal, business, accounting and tax advisers prior to making a decision to invest in the US$ notes.

Investor Representations and Restrictions on Resale

Each purchaser of US$ notes, by its acceptance thereof, will be deemed to have represented to, warranted and agreed with the issuer trustee, Macquarie Management, Macquarie Leasing, the US$ note trustee, the security trustee and the underwriters that (i) the purchaser is not a “retail client” within the meaning of section 761G of the Australian Corporations Act 2001 (Cth), who received its offer in any state or territory of Australia, (ii) the purchaser is not an “associate” (as defined in Section 128F of the Australian Income Tax Assessment Act of 1936 (Cth)) of the issuer trustee, Macquarie Leasing or Macquarie Bank and (iii) either (a) the purchaser is not acquiring such US$ notes (or an interest therein) with the plan assets of (1) an “employee benefit plan” (as defined in Section 3(3) of the United States Employee Retirement Income Security Act of 1974, as amended (“ERISA”)) that is subject to Title I of ERISA, (2) a “plan” (as defined in Section 4975(e)(1) of the United States Internal Revenue Code of 1986, as amended (the “Code”)) that is subject to Section 4975 of the Code, (3) an entity that is deemed to hold “plan assets” of the foregoing under 29 C.F.R. § 2510.3-101, as modified by Section 3(42) of ERISA (each such entity, and each plan described in (1) or (2), a “Benefit Plan Investor”); or (4) a non-U.S., governmental or church plan that is subject to any non-U.S. or U.S. federal, state or local law that is similar to Section 406 of ERISA or Section 4975 of the Code (“Similar Law”) or (b) its acquisition and holding of such US$ notes does not constitute and will not result in a non-exempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code (due to the applicability of a statutory or administrative exemption from the prohibited transaction rules) or a violation of any Similar Law; provided, further, that if, at the time of acquisition of the US$ notes, the ratings on the US$ notes are below investment grade or the US$ Notes have been characterised as other than indebtedness for applicable local law purposes, the purchaser or transferee will be deemed to represent and warrant that it is not a Benefit Plan Investor or other plan that is subject to Similar Law. Each purchaser of US$ notes, by its acceptance thereof, will be deemed to have agreed that any transfer of the US$ notes in violation of the foregoing representations and warranties will be void. No purchaser may offer to resell or resell a US$ note unless the offer or sale (i) is made to a person who is not a “retail client” within the meaning of section 761G of the Australian Corporations Act 2001 (Cth), receiving its offer in any state or territory of Australia and (ii) complies with any applicable laws in all jurisdictions in which the offer or sale is made.

vi

European Union Due Diligence Requirements

Investors should be aware of the European Union risk retention and due diligence requirements which currently apply, or are expected to apply in the future, in respect of various types of European Economic Area-regulated investors including credit institutions, investment firms, authorised alternative investment fund managers, institutions for occupational retirement provision, insurance and reinsurance undertakings and undertakings for collective investment in transferable securities (“UCITS Funds”). Under these regulations, prior to investing in an asset-backed security, and while it holds that investment, a European Economic Area-regulated investor must be able to demonstrate that, among other things, it has a comprehensive and thorough understanding of the securitisation transaction and its structural features by satisfying prescribed due diligence requirements and ongoing monitoring obligations. Failure to comply with these requirements may result in various penalties including the imposition of a penal capital charge on a relevant European Economic Area-regulated investor because of its exposure to securitisation positions through its holding of the notes.

These rules, when implemented, may apply to investments in securities already issued. Each prospective investor is required to independently assess and determine the sufficiency of the information in this prospectus and the sufficiency of any other information which may be made available to the investor for the purposes of complying with any due diligence and monitoring requirements and with any corresponding national measures which may be relevant. None of Macquarie Bank, Macquarie Leasing, the manager, any member of the Macquarie Group, Perpetual Trustee Company Limited, P.T. Limited, The Bank of New York Mellon or the underwriters makes any representation that such information or any other information which may be made available to investors is sufficient in all circumstances for such purposes. Purchasers of the US$ notes are responsible for analysing their own regulatory position and are advised to consult with their own investment and legal advisors regarding the suitability of the US$ notes for investment and the requirements for compliance under these and other regulations. See “Legal Investment Considerations—European Union (“EU”) Risk Retention and Due Diligence Requirements” in this prospectus.

European Economic Area

In relation to each Relevant Member State, each underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State it has not made and will not make an offer of notes which are the subject of the offering contemplated by this prospectus to the public in that Relevant Member State other than:

| (a) | to any legal entity which is a qualified investor as defined in the Prospectus Directive; |

| (b) | to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), subject to obtaining the prior consent of the relevant underwriter or underwriters nominated by the issuer trustee for any such offer; or |

| (c) | in any other circumstances falling within Article 3(2) of the Prospectus Directive, |

provided that no such offer of notes shall require the issuer trustee or the depositor or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

For the purposes of this provision, the expression an “offer of notes” in relation to any notes in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and any notes to be offered so as to enable an investor to decide to purchase or subscribe the notes, as the same may be varied in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State. The expression “Prospectus Directive” means Directive 2003/71/EC (as amended, including by Directive 2010/73/EU) and includes any relevant implementing measure in each Relevant Member State.

vii

NOTICE TO RESIDENTS OF UNITED KINGDOM

THIS PROSPECTUS MAY ONLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED IN THE UNITED KINGDOM TO PERSONS AUTHORISED TO CARRY ON A REGULATED ACTIVITY UNDER THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED (THE “FSMA”), OR OTHERWISE HAVING PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFYING AS INVESTMENT PROFESSIONALS UNDER ARTICLE 19(5) (“INVESTMENT PROFESSIONALS”) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMENDED (THE “ORDER”), OR TO PERSONS FALLING WITHIN ARTICLE 49(2)(A) TO (D) (“HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.”) OF THE ORDER, OR TO ANY OTHER PERSON TO WHOM THIS PROSPECTUS MAY OTHERWISE LAWFULLY BE COMMUNICATED OR CAUSE TO BE COMMUNICATED. NEITHER THE US$ NOTES NOR THIS PROSPECTUS ARE AVAILABLE TO OTHER CATEGORIES OF PERSONS IN THE UNITED KINGDOM AND NO ONE FALLING OUTSIDE SUCH CATEGORIES IS ENTITLED TO RELY ON, AND MUST NOT ACT ON, ANY INFORMATION IN THIS PROSPECTUS. THE COMMUNICATION OF THIS PROSPECTUS TO ANY PERSON IN THE UNITED KINGDOM OTHER THAN THE CATEGORIES STATED ABOVE IS UNAUTHORISED AND MAY CONTRAVENE THE FSMA.

NOTICE TO RESIDENTS OF THE EUROPEAN ECONOMIC AREA

THIS PROSPECTUS HAS BEEN PREPARED ON THE BASIS THAT ANY OFFER OF THE NOTES IN ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA WHICH HAS IMPLEMENTED THE PROSPECTUS DIRECTIVE (EACH, A “RELEVANT MEMBER STATE”) WILL BE MADE PURSUANT TO AN EXEMPTION UNDER THE PROSPECTUS DIRECTIVE FROM THE REQUIREMENT TO PUBLISH A PROSPECTUS FOR OFFERS OF NOTES. ACCORDINGLY, ANY PERSON MAKING OR INTENDING TO MAKE AN OFFER IN A RELEVANT MEMBER STATE OF THE NOTES WHICH ARE THE SUBJECT OF THE OFFERING CONTEMPLATED IN THIS PROSPECTUS MAY ONLY DO SO IN CIRCUMSTANCES IN WHICH NO OBLIGATION ARISES FOR THE ISSUER TRUSTEE, THE DEPOSITOR OR ANY OF THE UNDERWRITERS TO PUBLISH A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE IN RELATION TO SUCH OFFER. NONE OF THE ISSUER TRUSTEE, THE DEPOSITOR OR ANY OF THE UNDERWRITERS HAVE AUTHORISED, NOR DO THEY AUTHORISE, THE MAKING OF ANY OFFER OF THE NOTES IN CIRCUMSTANCES IN WHICH AN OBLIGATION ARISES FOR THE ISSUER TRUSTEE, THE DEPOSITOR OR ANY OF THE UNDERWRITERS TO PUBLISH A PROSPECTUS FOR SUCH OFFER. THE EXPRESSION “PROSPECTUS DIRECTIVE” MEANS DIRECTIVE 2003/71/EC (AS AMENDED, INCLUDING BY DIRECTIVE 2010/73/EU), AND INCLUDES ANY RELEVANT IMPLEMENTING MEASURE IN THE RELEVANT MEMBER STATE.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus constitute forward-looking statements. Because forward-looking statements made in this prospectus involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, those described in this prospectus under “Risk Factors”, the composition of the receivables, loss ratios, delinquency ratios, the actions of competitors, general economic conditions (especially in Australia), changes in interest rates, unemployment, the rate of inflation and consumer perceptions of the economy, compliance with U.S. and Australian federal and state laws, including consumer protection laws, tort laws and, in relation to the U.S., ERISA and changes in such laws, customer preferences and various other matters, many of which are beyond the control of the Sponsor, Macquarie Management and their respective affiliates.

viii

PRESENTATION OF CURRENCIES AND OTHER INFORMATION

In this prospectus, references to “U.S. Dollars” and “US$” are references to U.S. currency and references to “Australian Dollars” and “A$” are references to Australian currency. Unless otherwise stated in this prospectus, any translations of Australian Dollars into U.S. Dollars have been made at the US$ Exchange Rate as of the date of this prospectus. On the date hereof the “US$ Exchange Rate” is a rate of US$0.76* = A$1.00; hereafter, it is the rate for any class or sub-class of US$ Notes specified in the applicable Currency Swap or in any replacement Currency Swap. Use of such rate is not a representation that Australian Dollar amounts actually represent such U.S. Dollar amounts or could be converted into U.S. Dollars at that rate.

Prior to the enforcement of the Security under the Master Security Trust Deed and the General Security Deed, determinations and payments to US$ Noteholders in respect of principal and interest will be converted from Australian Dollars to U.S. Dollars at the US$ Exchange Rate described in “The Currency Swaps and the Fixed Rate Swap—The Currency Swaps—Payments under the Currency Swaps” in this prospectus (or, if no Currency Swap is in place with respect to a class or sub-class of US$ Notes or if a Currency Swap is in place but a Currency Swap Provider Payment Default is subsisting in respect of that Currency Swap, at the rate available to the Issuer Trustee in the spot exchange market) and paid in accordance with the provisions set forth in “Description of the Notes—Application of Available Income”, “—Available Income and Other Calculations” and “—Payments of Principal Prior to Enforcement of the Security” in this prospectus. Following the enforcement of the Security under the Master Security Trust Deed and the General Security Deed, determinations and payments to US$ Noteholders in respect of principal and interest will be converted from Australian Dollars to U.S. Dollars and paid in accordance with the priorities set forth in “Description of the Notes—Post-Enforcement Priority of Payments” in this prospectus.

References in this prospectus to statutes followed by “(Cth)” are to legislation enacted by the federal parliament of the Commonwealth of Australia.

| * | Indicative US$ Exchange Rate, subject to revision and finalisation. |

ix

SUMMARY

This summary highlights selected information from this prospectus and does not contain all of the information that you need to consider in making your investment decision. This summary contains an overview of some of the concepts and other information to aid your understanding. All of the information contained in this summary is qualified by the more detailed explanations in other parts of this prospectus.

Transaction Overview

Perpetual Trustee Company Limited, in its capacity as trustee of the SMART ABS Series 2016-2US Trust, will use the proceeds from the issuance and sale of the notes to purchase a pool of receivables from Macquarie Leasing Pty Limited and Perpetual Trustee Company Limited, in its capacity as trustee of each of the warehouse trusts established under the SMART securitisation programme. See “Description of the Assets of the Trust—Acquisition of the SMART Receivables on the Closing Date” in this prospectus.

The receivables consist of lease contracts, hire purchase contracts and loan contracts in relation to motor vehicle assets (including cars, trucks, buses, trailers, forklifts and motorcycles) that are located in Australia. Perpetual Trustee Company Limited, in its capacity as trustee of the SMART ABS Series 2016-2US Trust, will rely on collections (including proceeds of the SMART Receivables) to make payments on the notes and will be solely liable for the payment of the notes.

Transaction Parties

Issuing Entity | Perpetual Trustee Company Limited (ABN 42 000 001 007), in its capacity as trustee of the Trust. The depositor has previously caused separate trusts to be formed for prior securitization transactions and may in the future cause additional separate trusts to be formed for additional securitisation transactions. The SMART ABS Series 2016-2US Trust was established under Australian law pursuant to the master trust deed, and a series supplement and a trust creation deed. |

Trust | SMART ABS Series 2016-2US Trust |

Issuer Trustee | Perpetual Trustee Company Limited (ABN 42 000 001 007), in its capacity as trustee of the Trust. Perpetual Trustee Company Limited, in its capacity as trustee of the trust, will issue the notes and one or more classes of units. The unitholders hold the beneficial interest in the trust. |

Depositor | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

Manager | Macquarie Securities Management Pty Limited (ABN 26 003 435 443) |

Sponsor | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

Originator | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

Receivables Sellers | Macquarie Leasing Pty Limited (ABN 38 002 674 982) and Perpetual Trustee Company Limited, in its capacity as trustee of each of SMART J Warehouse Trust, SMART U Warehouse Trust, SMART ANZ Warehouse Trust, SMART O Warehouse Trust and SMART S Warehouse Trust (the “warehouse trusts”). Macquarie Securities Management Pty Limited is the manager of each of the warehouse trusts. |

Servicer | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

1

Security Trustee | P.T. Limited (ABN 67 004 454 666) |

US$ Note Trustee, Principal Paying Agent, Agent Bank and US$ Note Registrar | The Bank of New York Mellon |

Asset Representations Reviewer | Clayton Fixed Income Services LLC, a Delaware limited liability company. |

Income Unitholder | Macquarie Bank Limited (ABN 46 008 583 542) |

Capital Unitholder | Macquarie Bank Limited (ABN 46 008 583 542) |

Underwriters for US$ Notes | J.P. Morgan Securities LLC |

| | Citigroup Global Markets Inc. |

| | HSBC Securities (USA) Inc., |

| | Macquarie Capital (USA) Inc. |

| | SG Americas Securities, LLC |

Fixed Rate Swap Provider | Macquarie Bank Limited (ABN 46 008 583 542) |

Currency Swap Provider | Australia and New Zealand Banking Group Limited (ABN 11 005 357 522) |

2

Transaction Structure Diagram

| 1. | On the closing date, Macquarie Bank will deposit approximately either (i) A$7,561,999.82, if the aggregate initial principal balance of US$ notes is US$500,000,000 or (ii) A$11,343,012.43, if the aggregate initial principal balance of US$ notes is US$750,000,000, (an amount representing approximately 1.00% of the aggregate of the initial pool balance on the closing date) in the liquidity reserve account maintained by the issuer trustee. |

| 2. | In the event that the issuer trustee has received insufficient income collections in any monthly period, after giving effect to a draw from the liquidity reserve, to meet payments of interest on the Class A notes and certain expenses, the issuer trustee will apply available principal collections in the amount of that deficit towards those required payments. Principal collections applied towards such required payments may be reimbursed by the application of excess income collections received by the issuer trustee in subsequent monthly periods, if any, or by drawing on the liquidity reserve to the extent the balance of the liquidity reserve exceeds the required reserve amount. |

3

| 3. | Interest payments on the subordinated notes will always be subordinated to interest payments on the Class A notes. Principal payments on the subordinated notes will be subordinated to principal payments on the Class A notes only if the pro rata paydown test is not satisfied. The priority of payments of interest and principal will change after the enforcement of the Security under the master security trust deed and the general security deed. The initial amount of subordination provided by the subordinated notes for the Class A notes will be 14% of the initial aggregate outstanding principal balance of the SMART Receivables Pool, or (i) A$98,307,000 (based on the indicative US$ exchange rate of US$0.76=A$1.00), if the aggregate initial principal balance of US$ notes is US$500,000,000 or (ii) A$147,460,000 (based on the indicative US$ exchange rate of US$0.76=A$1.00), if the aggregate initial principal balance of US$ notes is US$750,000,000. |

| 4. | Excess spread in the form of excess interest collections is available, as a component of available income, for allocation towards total principal collections to satisfy any unreimbursed principal draws, defaulted amounts and prior unreimbursed charge-offs. |

| 5. | The issuer trustee will owe monthly fixed rate A$ payments to the fixed rate swap provider and the fixed rate swap provider will owe monthly floating rate A$ (based on the BBSW swap rate) payments to the issuer trustee. These monthly payments will be netted against each other and one net payment will be made between the issuer trustee and the fixed rate swap provider. |

| 6. | The currency swap provider will receive A$ floating rate payments (based on the BBSW swap rate and the applicable spread) from the issuer trustee in respect of interest on the US$ notes and pay US$ fixed rate or floating rate (at LIBOR plus the applicable spread) amounts as interest on the US$ notes to the principal paying agent for distribution to US$ noteholders. The currency swap provider will receive A$ payments from the issuer trustee in respect of principal on the US$ notes, convert such A$ payments to US$ at the exchange rate specified in the currency swap agreement and pay US$ amounts as principal to the principal paying agent for distribution to US$ noteholders. If a currency swap is not in place for a class or sub-class of US$ notes or if a currency swap is in place but a currency swap provider payment default is subsisting in respect of that currency swap, the issuer trustee will (i) in the case of payments of interest, exchange in the spot exchange market the amount in A$ necessary to pay interest (in US$) due and payable on such class or sub-class of the US$ notes for the interest period relating to that distribution date plus any interest amounts in respect of such US$ notes remaining unpaid from prior distribution dates and interest owing on any such unpaid amounts and (ii) in the case of payments of principal, exchange the A$ allocated to such class or sub-class of US$ notes for US$ in the spot exchange market, and in each case, pay such US$ to the principal paying agent to be paid to the noteholders of that class or sub-class of US$ notes. |

| 7. | The residual interest in the trust will be held by Macquarie Bank Limited, an affiliate of the sponsor, as the initial income unitholder and as the capital unitholder. The income unitholder will receive excess interest collections not required to make prior ranking payments. |

4

Transaction Parties and Documents Diagram

| 1. | Generally, only the US$ note trustee may enforce, or direct the security trustee to enforce, the obligations of the issuer trustee or the manager to the US$ noteholders under the US$ notes and any other transaction document. No US$ noteholder is entitled to proceed directly against the issuer trustee, Macquarie Leasing or the manager in respect of the US$ notes or any other transaction document. The US$ note trustee will act at the direction of the US$ noteholders. See “Description of the Transaction Documents—The US$ Note Trust Deed—Duties of the US$ Note Trustee” in this prospectus. |

5

Summary of the Notes

The issuer trustee will issue four classes and two sub-classes of notes under a series supplement, the master trust deed and, in the case of US$ notes, a US$ note trust deed. The notes of one class or sub-class may differ from the notes of another class or sub-class in certain respects, including:

| • | | as to seniority and the timing and priority of payments, |

| • | | whether and how the priority changes over time or with performance of the receivables pool, or |

| • | | upon the occurrence of certain events of default and the related consequences. |

The Class A-1 notes, the Class A-2a notes, the Class A-3a notes and the Class A-4a notes bear a fixed rate of interest (the “US$ fixed rate notes”). The Class A-2b notes, the Class A-3b notes and the Class A-4b notes bear a floating rate of interest (the “US$ floating rate notes”). In addition to the US$ notes, the issuer trustee will also issue the A$ notes, which are not being offered by this prospectus. The A$ notes consist of subordinated notes (the “subordinated notes”), comprised of the Class B notes and the seller notes, which are denominated in Australian Dollars. The notes that are offered pursuant to this prospectus will rank senior to the subordinated notes. The subordinated notes will be sold in private transactions, initially to Macquarie Bank and/or one or more of its affiliates. The A$ notes are transferable, subject to relevant restrictions on transfer. However, Macquarie Bank has committed that it or Macquarie Leasing will retain a material net economic interest of not less than five percent of the outstanding principal balance of the SMART Receivables as of the cut-off date at least until the Class A notes have been paid in full. Such retained interest will initially be comprised of the seller notes. It is a condition to the issuance of the Class A notes that each class of the subordinated notes be issued on the closing date.

The US$ notes and the A$ notes will be limited recourse obligations of the issuer trustee backed by the same pool of receivables. The initial principal balance for the US$ notes will be finalised once the exchange rate under the currency swaps has been determined.

The Class A-2a notes and the Class A-2b notes are collectively referred to as the “Class A-2 notes”. The Class A-3a notes and the Class A-3b notes are collectively referred to as the “Class A-3 notes”. The Class A-4a notes and the Class A-4b notes are collectively referred to as the “Class A-4 notes”. Each of the Class A-2a notes, the Class A-2b notes, the Class A-3a notes, and the Class A-3b notes, the Class A-4a notes and the Class A-4b notes is referred to as a “sub-class” of the Class A notes. The notes will be issued in six classes: the Class A-1 notes, the Class A-2 notes, the Class A-3 notes, the Class A-4 notes, the Class B notes and the seller notes, each referred to as a “class” of notes.

Money Market Notes

The Class A-1 notes will be structured to be “eligible securities” for purchase by money market funds under paragraph (a)(12) of Rule 2a-7 under the United States Investment Company Act of 1940, as amended. Rule 2a-7 includes additional criteria for investments by money market funds, including additional requirements relating to portfolio maturity, liquidity and risk diversification, some of which have recently been amended. If you are a money market fund contemplating a purchase of Class A-1 notes, you or your advisor should consider these requirements and consider whether an investment in the Class A-1 notes satisfies the fund’s investment objectives and policies before making a purchase.

Key Terms of the Notes

| | |

| Indicative Cut-Off Date | | The open of business on September 1, 2016. |

| |

| Cut-Off Date | | The open of business on October 1, 2016. |

| |

| Closing Date | | Subject to the satisfaction of certain conditions precedent, on or about October 14, 2016. |

6

| | |

| Distribution Dates | | The 14th day of each calendar month (or if such day is not a business day, the next business day). The first distribution date is November 14, 2016. |

| |

| Business Day | | Any day on which banks are open for business in Sydney, Melbourne, New York City and London other than a Saturday, a Sunday or a public holiday in Sydney, Melbourne, New York City or London. |

7

If the aggregate initial principal balance of US$ notes is US$500,000,000, the issuer trustee, in its capacity as trustee of the

SMART ABS Series 2016-2US Trust, will issue the US$ notes described in the table below.

US$ Notes

| | | | | | | | | | | | | | |

US$ Notes to be Issued at

Closing | | Class A-1

notes | | Class A-2a

notes | | Class A-2b

notes | | Class A-3a

notes | | Class A-3b

notes | | Class A-4a

notes | | Class A-4b

notes |

Initial Invested Amount | | US$100,000,000 | | {US$175,000,000} | | {US$140,000,000} | | {US$85,000,000} |

| | | | |

% of Total Initial Invested Amount of notes (based on A$ equivalents) | | 17.40% | | 30.45% | | 24.36% | | 14.79% |

| | | | | | | |

Interest Rate | | ●% | | ●% | | One-month

LIBOR + ●%* | | ●% | | One-month

LIBOR + ●%* | | ●% | | One-month

LIBOR + ●% |

| | | | | | | |

Interest Accrual Method | | Actual/360 | | 30/360 | | Actual/360 | | 30/360 | | Actual/360 | | 30/360 | | Actual/360 |

| |

Clearance/Settlement | | DTC/Euroclear/Clearstream, Luxembourg |

| | | | | | | |

CUSIP | | 83191GAA7 | | 83191GAB5 | | 83191GAC3 | | 83191G AD1 | | 83191G AE9 | | 83191G AF6 | | 83191G AG4 |

| | | | | | | |

ISIN | | US83191GAA76 | | US83191GAB59 | | US83191GAC33 | | US83191GAD16 | | US83191GAE98 | | US83191GAF63 | | US83191GAG47 |

| | | | |

Maturity Date | | Distribution Date

in October 2017 | | Distribution Date in

August 2019 | | Distribution Date in

March 2021 | | Distribution Date in

December 2022 |

A$ Notes

| | | | |

A$ Notes to be Issued at Closing | | Class B notes | | Seller notes |

Initial Invested Amount | | A$15,124,000 | | A$83,183,000 |

| | |

% of Total Initial Invested Amount of notes (based on A$ equivalents)** | | 2.00% | | 11.00% |

| | |

Interest Rate | | One-month

BBSW + ●% | | One-month

BBSW + ●% |

| | |

Interest Accrual Method | | Actual/365 | | Actual/365 |

| | |

Clearance/Settlement | | Registered | | Registered |

| | |

Maturity Date | | The Distribution

Date falling in

October 2024 | | The Distribution

Date falling in

October 2024 |

| * | LIBOR means, in respect of an Interest Period, the rate that the Agent Bank determines as USD-LIBOR-ICE or LIBOR for such Interest Period as the rate for one month deposits in US$ in the London interbank market which appears on the Rate Page as of 11:00 a.m. (London time) on the US$ Floating Rate Set Date. |

If the rate referred to in the paragraph above does not appear on the Rate Page on the relevant US$ Floating Rate Set Date, the USD-LIBOR-ICE for that Interest Period will be determined as if the Issuer Trustee and the Agent Bank had specified “USD-LIBOR-Reference Banks” as the applicable “Floating Rate Option”. For this purpose “USD-LIBOR-Reference Banks” means that the rate for an Interest Period will be determined on the basis of the rates at which deposits in US$ are offered by the Reference Banks (being four major banks in the London interbank market determined by the Agent Bank) at approximately 11:00 a.m., London time, on the US$ Floating Rate Set Date to prime banks in the London interbank market for a period of one month commencing on the first day of the Interest Period and in a Representative Amount (as defined in the 2006 ISDA Definitions of the International Swaps and Derivatives Association). The Agent Bank will request the principal London office of each of the Reference Banks to provide a quotation of its rate. If at least two such quotations are provided, the USD-LIBOR-ICE for that Interest Period will be the arithmetic mean of the quotations. If fewer than two quotations are provided as requested, the USD-LIBOR-ICE for that Interest Period will be the arithmetic mean of the rates quoted by not less than two major banks in New York City, selected by the Agent Bank, at approximately 11:00 a.m., New York City time, on that US$ Floating Rate Set Date for loans in US$ to leading European banks for a period of one month commencing on the first day of the Interest Period and in a Representative Amount. If no such rates are available in New York City, then the USD-LIBOR-ICE for such Interest Period will be the most recently determined rate in accordance with the preceding paragraph. For additional information, see “Glossary of Certain Defined Terms” in this prospectus.

| ** | Based on the indicative US$ exchange rate of US$0.76=A$1.00, subject to revision and finalization. |

8

If the aggregate initial principal balance is US$750,000,000, the issuer trustee, in its capacity as trustee of the SMART ABS Series 2016-2US Trust, will issue the US$ notes described in the table below.

US$ Notes

| | | | | | | | | | | | | | |

US$ Notes to be Issued at

Closing | | Class A-1

notes | | Class A-2a

notes | | Class A-2b

notes | | Class A-3a

notes | | Class A-3b

notes | | Class A-4a

notes | | Class A-4b

notes |

Initial Invested Amount | | US$150,000,000 | | US$262,500,000 | | US$210,000,000 | | US$127,500,000 |

| | | | |

% of Total Initial Invested Amount of notes (based on A$ equivalents) | | 17.40% | | 30.45% | | 24.36% | | 14.79% |

| | | | | | | |

Interest Rate | | ●% | | ●% | | One-month

LIBOR + ●%* | | ●% | | One-month

LIBOR + ●%* | | ●% | | One-month

LIBOR + ●% |

| | | | | | | |

Interest Accrual Method | | Actual/360 | | 30/360 | | Actual/360 | | 30/360 | | Actual/360 | | 30/360 | | Actual/360 |

| |

Clearance/Settlement | | DTC/Euroclear/Clearstream, Luxembourg |

| | | | | | | |

CUSIP | | 83191GAA7 | | 83191GAB5 | | 83191GAC3 | | 83191G AD1 | | 83191G AE9 | | 83191G AF6 | | 83191G AG4 |

| | | | | | | |

ISIN | | US83191GAA76 | | US83191GAB59 | | US83191GAC33 | | US83191GAD16 | | US83191GAE98 | | US83191GAF63 | | US83191GAG47 |

| | | | |

Maturity Date | | Distribution Date

in October 2017 | | Distribution Date in

August 2019 | | Distribution Date in

March 2021 | | Distribution Date in

December 2022 |

A$ Notes

| | | | |

A$ Notes to be Issued at Closing | | Class B notes | | Seller notes |

Initial Invested Amount | | A$22,686,000 | | A$124,774,000 |

| | |

% of Total Initial Invested Amount of notes (based on A$ equivalents)** | | 2.00% | | 11.00% |

| | |

Interest Rate | | One-month

BBSW + ●% | | One-month

BBSW + ●% |

| | |

Interest Accrual Method | | Actual/365 | | Actual/365 |

| | |

Clearance/Settlement | | Registered | | Registered |

| | |

Maturity Date | | The Distribution

Date falling in

October 2024 | | The Distribution

Date falling in

October 2024 |

| * | LIBOR means, in respect of an Interest Period, the rate that the Agent Bank determines as USD-LIBOR-ICE or LIBOR for such Interest Period as the rate for one month deposits in US$ in the London interbank market which appears on the Rate Page as of 11:00 a.m. (London time) on the US$ Floating Rate Set Date. |

If the rate referred to in the paragraph above does not appear on the Rate Page on the relevant US$ Floating Rate Set Date, the USD-LIBOR-ICE for that Interest Period will be determined as if the Issuer Trustee and the Agent Bank had specified “USD-LIBOR-Reference Banks” as the applicable “Floating Rate Option”. For this purpose “USD-LIBOR-Reference Banks” means that the rate for an Interest Period will be determined on the basis of the rates at which deposits in US$ are offered by the Reference Banks (being four major banks in the London interbank market determined by the Agent Bank) at approximately 11:00 a.m., London time, on the US$ Floating Rate Set Date to prime banks in the London interbank market for a period of one month commencing on the first day of the Interest Period and in a Representative Amount (as defined in the 2006 ISDA Definitions of the International Swaps and Derivatives Association). The Agent Bank will request the principal London office of each of the Reference Banks to provide a quotation of its rate. If at least two such quotations are provided, the USD-LIBOR-ICE for that Interest Period will be the arithmetic mean of the quotations. If fewer than two quotations are provided as requested, the USD-LIBOR-ICE for that Interest Period will be the arithmetic mean of the rates quoted by not less than two major banks in New York City, selected by the Agent Bank, at approximately 11:00 a.m., New York City time, on that US$ Floating Rate Set Date for loans in US$ to leading European banks for a period of one month commencing on the first day of the Interest Period and in a Representative Amount. If no such rates are available in New York City, then the USD-LIBOR-ICE for such Interest Period will be the most recently determined rate in accordance with the preceding paragraph. For additional information, see “Glossary of Certain Defined Terms” in this prospectus.

| ** | Based on the indicative US$ exchange rate of US$0.76=A$1.00, subject to revision and finalization. |

9

Establishment of the SMART ABS Series 2016-2US Trust

Macquarie Leasing and the manager established the SMART securitisation programme pursuant to a master trust deed dated March 11, 2002. The master trust deed provides the general terms and structure for securitisation under the SMART securitisation programme. The series supplement to be entered into by and among the manager, Macquarie Bank, Macquarie Leasing and the issuer trustee sets out the specific details of the trust including, among other things, the notes that will be issued in respect of the SMART ABS Series 2016-2US Trust by the issuer trustee and the distributions of interest and principal payments by the issuer trustee in respect of the trust. These details may vary from the terms set forth in the master trust deed.

Each securitisation under the SMART securitisation programme is a separate transaction with a separate trust. The assets of the SMART ABS Series 2016-2US Trust will not be available to pay the obligations of any other trust established under the SMART securitisation programme, and the assets of other trusts will not be available to pay the obligations of the SMART ABS Series 2016-2US Trust. See “The SMART Securitisation Programme” in this prospectus.

The beneficial interest in the trust is held by Macquarie Bank Limited as the initial income unitholder and capital unitholder. The income unit may be transferred. The capital units are not transferable. The unitholders are only entitled to receive payments or distributions after payment of all prior ranking entitlements described under “Description of the Notes—Application of Available Income” and “—Payments of Principal Prior to Enforcement of the Security” in this prospectus.

As of the closing date and prior to the issuance of the notes, the issuer trustee has no indebtedness as trustee of the trust and the trust is capitalised to A$10 for the benefit of the income unitholder and the capital unitholder.

Following the issuance of the notes, assets of the trust will include:

| | • | | the SMART Receivables Pool, including all payments made on the SMART Receivables and proceeds received in relation to the underlying motor vehicles; |

| | • | | all retained title rights in relation to the SMART Receivables; |

| | • | | rights under the mortgages and any collateral securities securing the SMART Receivables and the insurance policies in relation to any mortgages or collateral securities relating to the SMART Receivables (see “Legal Aspects of the Receivables” in this prospectus for a description of the concept of a mortgage and its enforcement); |

| | • | | the other authorised short-term investments of the trust, including amounts on deposit in the bank accounts established in connection with the trust and any instruments in which these amounts or other assets of the trust are invested; and |

| | • | | the issuer trustee’s rights under the transaction documents, including rights under the currency swap and any other swap agreement. |

See “Description of the Assets of the Trust—Assets of the Trust” and “—Acquisition of the SMART Receivables on the Closing Date” in this prospectus.

Servicing of the Receivables

Macquarie Leasing will act as the servicer for the SMART Receivables. The servicer is responsible for, among other things, ensuring that the servicing of the SMART Receivables is in accordance with the servicing standards, managing all payments due under the terms and provisions of the SMART Receivables, and notifying the issuer trustee promptly after becoming aware of any servicer default. The issuer trustee will pay the servicer a monthly servicing fee specified in this prospectus.

For a more detailed description of the servicing of the SMART Receivables, you should read “Servicing of the SMART Receivables” and “Description of the Transaction Documents—The Master Sale and Servicing Deed—Undertakings of the Servicer” in this prospectus.

The SMART Receivables Pool

The primary asset of the trust will be the SMART Receivables Pool, a pool of lease contracts, hire purchase contracts and loan contracts secured by new and used motor vehicles (including cars, trucks,

10

buses, trailers, forklifts and motorcycles) located in Australia.

A finance lease is an agreement where the lessor, as owner, rents a motor vehicle to the lessee. The lease agreement specifies the rental, term, payment timing, residual value and other general terms and conditions. The residual value is set in accordance with Australian tax guidelines. Upon the return of the motor vehicle to the lessor upon termination or expiration of the lease agreement, the lessee is required to pay the lessor the amount, if any, by which the residual value exceeds the sale proceeds of the motor vehicle. The lessee does not have a guaranteed option to purchase the motor vehicle at the end of the lease term but typically negotiates to do so.

A significant portion of the lease contracts included in the SMART Receivables are novated leases. A novated lease is an agreement where an employee, as lessee, leases a motor vehicle and then novates it to the employer who pays the lease rentals while the lessee remains its employee. The lessee remains fully liable to perform and observe all of the other obligations under the lease agreement not related to payment of the rentals, including obligations relating to the residual value.

The finance leases and novated leases described below that constitute SMART Receivables both arise pursuant to lease contracts.

A loan contract is an alternative method of financing motor vehicles. Under a loan contract, the purchaser of a motor vehicle executes a mortgage document over the motor vehicle against which Macquarie Leasing provides a loan financing the purchase on agreed terms. The purchaser remains the legal owner of the motor vehicle and Macquarie Leasing takes a mortgage over the motor vehicle. See “Origination of the SMART Receivables—Types of SMART Receivables—Loan Contracts” in this prospectus.

A consumer loan is a loan contract pursuant to which a consumer obligor purchases a motor vehicle for personal, domestic or household use. Under a consumer loan, the consumer obligor executes a mortgage document over the purchased motor vehicle against which Macquarie Leasing provides a loan financing the purchase on agreed terms. The purchaser is required to make prescribed instalment payments and a final balloon payment to Macquarie Leasing. The purchaser must be the owner of the motor vehicle and obtains clear title on completion of all

repayments. See “Origination of the SMART Receivables—Types of SMART Receivables—Consumer Loans” in this prospectus.

A hire purchase contract is an agreement whereby the purchaser of a motor vehicle obtains possession of the motor vehicle before paying in full for it or obtaining legal title. Under a hire purchase contract, the purchaser pays prescribed instalments which together with an initial deposit (if any) and a final balloon payment (if any) enable Macquarie Leasing, as owner of the motor vehicle, to recoup its capital outlay and interest on that outlay. The purchaser has a guaranteed option to purchase the motor vehicle during the term of the hire purchase contract. Before the purchaser exercises its option to purchase and pays all amounts owed to Macquarie Leasing under the relevant hire purchase contract, Macquarie Leasing remains the legal owner of the motor vehicle, subject to the issuer trustee’s beneficial ownership of the motor vehicle being legally perfected following the occurrence of a perfection of title event. For a description of when a perfection of title event will be triggered, see “Description of the Transaction Documents—The Master Sale and Servicing Deed—Perfection of Title Event” in this prospectus.

If the aggregate initial principal balance of the US$ notes is US$500,000,000, the manager expects the SMART Receivables Pool to be acquired on the closing date to have characteristics similar to those in the following table, except that the number of contracts and the aggregate outstanding principal balance of the actual SMART Receivables Pool may be smaller:

Selected Data for the Indicative Receivables Pool as of the Indicative Cut-Off Date if the aggregate initial principal balance of the US$ Notes is US$500,000,000

| | | | |

Number of Receivables | | | 22,697 | |

Outstanding Principal Balance (A$) | | | 756,199,982 | |

Weighted Average Receivable Interest Rate (% p.a.) | | | 6.57 | |

Average Receivable Balance (A$) | | | 33,317.18 | |

Maximum Receivable Balance (A$) | | | 577.20 | |

Minimum Receivable Balance (A$) | | | 539,085.85 | |

Maximum Term Remaining (months) | | | 81.00 | |

Range of Original Term (months) | | | 6 to 84 | |

Range of Remaining Term (months) | | | 3 to 81 | |

Weighted Average Original Term (months) | | | 54.17 | |

Weighted Average Term Remaining (months) | | | 46.69 | |

Weighted Average Seasoning (months) | | | 7.48 | |

Weighted Average Balloon (A$) | | | 11,700.53 | |

11

| | | | |

Weighted Average Balloon by Original Balance (%) | | | 20.74 | % |

Weighted Average Balloon by Current Balance (%) | | | 24.00 | % |

Largest Customer Exposure (A$) | | | 561,073.53 | |

Largest Customer Exposure (%) | | | 0.07 | % |

New Vehicles by Current Balance (%) | | | 64.08 | % |

Used Vehicles by Current Balance (%) | | | 35.92 | % |

If the aggregate initial principal balance of the US$ notes is US$750,000,000, the manager expects the SMART Receivables Pool to be acquired on the closing date to have characteristics similar to those in the following table, except that the number of contracts and the aggregate outstanding principal balance of the actual SMART Receivables Pool may be smaller:

Selected Data for the Indicative Receivables Pool as of the Indicative Cut-Off Date if the aggregate initial principal balance of the US$ Notes is US$750,000,000

| | | | |

Number of Receivables | | | 34,095 | |

Outstanding Principal Balance (A$) | | | 1,134,301,243 | |

Weighted Average Receivable Interest Rate (% p.a.) | | | 6.58 | |

Average Receivable Balance (A$) | | | 33,268.84 | |

Maximum Receivable Balance (A$) | | | 426.36 | |

Minimum Receivable Balance (A$) | | | 539,085.85 | |

Maximum Term Remaining (months) | | | 81.00 | |

Range of Original Term (months) | | | 6 to 84 | |

Range of Remaining Term (months) | | | 3 to 81 | |

Weighted Average Original Term (months) | | | 54.22 | |

Weighted Average Term Remaining (months) | | | 46.79 | |

Weighted Average Seasoning (months) | | | 7.44 | |

Weighted Average Balloon (A$) | | | 11,513.59 | |

Weighted Average Balloon by Original Balance (%) | | | 20.65 | % |

Weighted Average Balloon by Current Balance (%) | | | 23.84 | % |

Largest Customer Exposure (A$) | | | 561,073.53 | |

Largest Customer Exposure (%) | | | 0.05 | % |

New Vehicles by Current Balance (%) | | | 63.92 | % |

Used Vehicles by Current Balance (%) | | | 36.08 | % |

The information in the above tables set forth in summary format various details relating to each Indicative Receivables Pool. All percentages are by aggregate outstanding principal balance of the Receivables in the relevant category. All amounts have been rounded to the nearest Australian cent. The information is provided as of the indicative cut-off date. The cut-off date for the actual SMART Receivables Pool to be acquired by the issuer trustee

on behalf of the trust on the closing date will be the open of business on October 1, 2016.

The manager will add or remove receivables to or from the SMART Receivables Pool to reflect any change in the final US$ exchange rate in order that the Class A notes constitute 87% of the initial pool balance and 87% of the total amount of Class A notes and subordinated notes issued. See “The SMART Receivables Pool and the Indicative Receivables Pools—Eligibility Criteria and Selection of the SMART Receivables” in this prospectus.

The Receivables in each Indicative Receivables Pool were randomly selected by Macquarie Leasing for inclusion in each Indicative Receivables Pool from those motor vehicle receivables held by Macquarie Leasing or Perpetual Trustee Company Limited, in its capacity as trustee of each of the warehouse trusts established under the SMART securitisation programme for which Macquarie Leasing, directly or indirectly, holds the beneficial interest, which comply with the eligibility criteria set out under “The SMART Receivables Pool and the Indicative Receivables Pools—Eligibility Criteria and Selection of the SMART Receivables” in this prospectus as at the indicative cut-off date. The SMART Receivables will be randomly selected by Macquarie Leasing for inclusion in the SMART Receivables Pool from the Receivables in each Indicative Receivables Pool which comply with the eligibility criteria as at the cut-off date. While the characteristics of the actual SMART Receivables Pool may vary somewhat from the characteristics of each Indicative Receivables Pool, Macquarie Leasing does not expect that variance to be material.

The manager may substitute Receivables proposed to be acquired by the issuer trustee on the closing date with other eligible Receivables, add additional eligible Receivables or remove eligible Receivables at any time up until the closing date.

Depositor Review of Receivables

As required by Item 1111 of Regulation AB and Rule 193 of the Securities Act, the depositor has performed a review of the SMART Receivables designed and effected to provide reasonable assurance that the disclosure about the SMART Receivables in this prospectus is accurate in all material respects.

The depositor has engaged a third party to review a sample of 124 contract files randomly selected from the contracts in the Indicative Receivables Pool and

12

compare certain contract information in the sample contracts relevant to the data and information about the SMART Receivables in this prospectus, such as original principal balance, contract yield, maturity date and remaining term, to the information in the depositor’s Infolease system, which the depositor made available on data tapes. The third party reviewer found 1 error out of 1,860 data points reviewed or compared in the sample contracts. The depositor considers the error to be immaterial and non-financial in nature and that the findings of the third party reviewer do not indicate any systemic errors in the receivables data or other errors that could have a material adverse effect on the data and information about the SMART Receivables in this prospectus. The review of the SMART Receivables and this prospectus performed by the depositor and the results of the review are described under “Depositor Review of Receivables” in this prospectus.

Security for the Notes

The issuer trustee will pledge all of the assets of the trust to the security trustee in order to secure the issuer trustee’s payment obligations to the Class A noteholders, the subordinated noteholders and the other secured creditors. See “Description of the Transaction Documents—The Master Security Trust Deed and the General Security Deed—The Security” in this prospectus. The security trustee’s role in the transaction will be to maintain the Security over the assets of the trust and to take steps to liquidate the assets of the trust upon the occurrence of certain events of default. See “Description of the Transaction Documents—The Master Security Trust Deed and the General Security Deed—Events of Default” and “— Enforcement of the Security” in this prospectus.

Representations and Warranties of Macquarie Leasing and Certifications of the Manager

In connection with each transfer of Receivables by Macquarie Leasing to the warehouse trusts, Macquarie Leasing has previously provided certain representations and warranties as at the cut-off date relating to each such transfer of those Receivables from Macquarie Leasing to the relevant warehouse trust. In connection with its acquisition of the relevant SMART Receivables from each warehouse trust, as of the Cut-Off Date the issuer trustee will hold the benefit of such representations and warranties previously given by Macquarie Leasing to the related warehouse trust.

Although Macquarie Leasing will not repeat any of the representations and warranties previously given to the relevant warehouse trust, the manager will certify to the issuer trustee that to the best of its knowledge and belief all SMART Receivables purchased by the issuer trustee from a warehouse trust under a transfer proposal and included in the SMART Receivables Pool comply with the eligibility criteria described under “The SMART Receivables Pool and the Indicative Receivables Pools—Eligibility Criteria and Selection of the SMART Receivables” in this prospectus at the Cut-Off Date. However, the manager is not required to make any inquiry or investigation into whether any SMART Receivable complies with any of the specified eligibility criteria. The issuer trustee’s sole remedy for breach by the manager is to bring an action against the manager. There is no contractual indemnity or repurchase obligation by the manager.

In connection with the transfer of Receivables by Macquarie Leasing to the issuer trustee directly, Macquarie Leasing will provide certain representations and warranties, including as to compliance of such Receivables with the eligibility criteria described under “The SMART Receivables Pool and the Indicative Receivables Pools— Eligibility Criteria and Selection of the SMART Receivables” in this prospectus, as at the Cut-Off Date. The issuer trustee will hold the benefit of such representations and warranties to be given by Macquarie Leasing from the Cut-Off Date. The manager will not make any certification to the issuer trustee with respect to the eligibility of the SMART Receivables purchased by the issuer trustee from Macquarie Leasing directly. See “Description of the Assets of the Trust—Macquarie Leasing’s Representations and Warranties in Relation to the SMART Receivables” in this prospectus.

If any representation and warranty provided by Macquarie Leasing in respect of a SMART Receivable was incorrect when given either (at the time of transfer to the relevant warehouse trust (in the case of any SMART Receivable transferred by Macquarie Leasing to the relevant warehouse trust) or at the time of transfer to the issuer trustee (in the case of any SMART Receivable transferred by Macquarie Leasing to the issuer trustee directly)), and such breach is not remedied to the satisfaction of the issuer trustee within 5 business days of Macquarie Leasing, the manager or the issuer trustee giving notice of the breach to the other two parties, Macquarie Leasing is required to repurchase the relevant SMART Receivable. This repurchase remedy is available to the issuer trustee only if

13

Macquarie Leasing gives or receives notice of the breach not later than 5 business days before the end of a 120-day prescribed period commencing on the date on which Macquarie Leasing sold the SMART Receivables to the relevant warehouse trust or to the issuer trustee, as applicable.

If the issuer trustee discovers the breach after the last day that the notice of breach described above can be given, the issuer trustee (as purchaser of the SMART Receivables sold from a warehouse trust) will have an indemnity claim against Macquarie Leasing for costs, damages or losses resulting from such representation and warranty being incorrect when given. The issuer trustee and Macquarie Leasing must agree on the amount of such costs, damages or losses; otherwise, Macquarie Leasing’s external auditors must make such determination. The amount of such costs, damages or losses will not exceed the principal amount outstanding, together with any accrued but unpaid interest and any outstanding fees, in respect of the relevant SMART Receivable.

During the 120-day prescribed period, the issuer trustee’s sole remedy for any of the representations or warranties in respect of a SMART Receivable being incorrect when given is the right to require repurchase of such SMART Receivable as described above. Macquarie Leasing has no other liability for any loss or damage caused by any breach of any representations or warranties to the issuer trustee, any noteholder or any other person during that 120-day prescribed period. After the 120-day prescribed period has ended, the issuer trustee’s sole remedy for a breach of a representation or warranty with respect to a SMART Receivable is the right to make an indemnity claim against Macquarie Leasing, and Macquarie Leasing will not be required to repurchase any of the SMART Receivables with respect to which it has breached a representation or warranty. See “Description of the Assets of the Trust—Macquarie Leasing’s Representations and Warranties in Relation to the SMART Receivables—Consequences of a Breach of the Representations and Warranties” in this prospectus. With respect to some of the SMART Receivables to be acquired by the issuer trustee on the closing date from the warehouse trusts, the 120-day prescribed period has expired. With respect to the SMART Receivables to be acquired by the issuer trustee directly from Macquarie Leasing, the 120-day prescribed period will commence on the closing date.

Macquarie Leasing has not received any requests to repurchase or indemnity claims with respect to an underlying asset due to a breach of any representation or warranty in regard to any of its prior securitisation transactions.

Credit Enhancement

The following forms of credit enhancement will be available to support payments of interest and principal on the US$ notes:

Subordination

The subordinated notes will always be subordinated to the Class A notes in their right to receive interest payments.

To the extent the Pro Rata Paydown Test is not satisfied with respect to the applicable distribution date prior to the enforcement of the Security under the master security trust deed and the general security deed, the issuer trustee will pay principal to each class of notes sequentially, beginning with the Class A-1 notes, and will not pay principal on any class of notes until the principal amount of all more senior classes of notes is paid in full. The A$ notes will be subordinated to the US$ notes in their right to receive principal payments. Principal payments on each more junior sub-class of the Class A notes will be subordinated to principal payments on the most senior class of the Class A notes, with each of (i) the Class A-2a notes and the Class A-2b notes, (ii) the Class A-3a notes and the Class A-3b notes and (iii) the Class A-4a notes and the Class A-4b notes constituting a single class.

To the extent the Pro Rata Paydown Test is satisfied with respect to the applicable distribution date prior to the enforcement of the Security under the master security trust deed and the general security deed, the issuer trustee will pay principal pari passu and on a pro rata basis towards each of the Class A notes, the Class B notes and the seller notes. Among the Class A notes, all principal allocated to the Class A notes will be applied sequentially by sub-class, with principal payments on each more junior sub-class of the Class A notes subordinated to principal payments on the most senior class of Class A notes (with each of (i) the Class A-2a notes and the Class A-2b notes, (ii) the Class A-3a notes and the Class A-3b notes and (iii) the Class A-4a notes and the Class A-4b notes constituting a single sub-class).

Following the enforcement of the Security under the master security trust deed and the general security deed, the security trustee or a receiver will pay principal sequentially towards repayment of the Class A notes, the Class B notes and the seller notes.

14

Among the Class A notes, principal payments will first be made to reduce the collateralised amount of the Class A-1 notes and will then be made pari passu and on a pro rata basis to reduce the collateralised amounts of the Class A-2 notes, the Class A-3 notes and the Class A-4 notes, with each of (i) the Class A-2a notes and the Class A-2b notes, (ii) the Class A-3a notes and the Class A-3b notes and (iii) the Class A-4a notes and the Class A-4b notes constituting a single class. The A$ notes will be fully subordinated to the US$ notes in their right to receive principal payments following the enforcement of the Security under the master security trust deed and the general security deed.

The support provided to the Class A notes by the subordinated notes is intended to enhance the likelihood that the Class A notes will receive expected payments of interest and principal. The initial amount of support provided by the subordinated notes to the Class A notes as a percentage of the total initial invested amount of the notes is 13%.

Excess Interest Collections

On each distribution date, any available income (other than the liquidity reserve balance excess) remaining after payment of (i) interest on the notes (other than seller notes) and (ii) trust expenses will be allocated towards total principal collections to the extent needed to satisfy unreimbursed principal draws, defaulted amounts and unreimbursed charge-offs.

See “Description of the Notes—Application of Available Income”, “—Payments of Principal Prior to Enforcement of the Security”, “—Credit Enhancement” and “—Liquidity Enhancement” in this prospectus.

Liquidity Enhancement

The following forms of liquidity enhancement will be available to enhance the likelihood of timely payment of interest on the US$ notes:

Liquidity Reserve Balance

On the closing date, Macquarie Bank will deposit approximately either (i) A$7,561,999.82, if the aggregate initial principal balance of US$ notes is US$500,000,000 or (ii) A$11,343,012.43, if the aggregate initial principal balance of US$ notes is US$750,000,000, (an amount representing approximately 1.00% of the aggregate of the initial

pool balance on the closing date) in the liquidity reserve account maintained by the issuer trustee to be applied as the liquidity reserve balance. In the event that the issuer trustee has received insufficient collections in any monthly period to meet payments of interest on the Class A notes and certain expenses, the issuer trustee may in certain circumstances apply the liquidity reserve balance to make those required payments.

Each liquidity reserve draw is repayable on the next distribution date to the extent that the issuer trustee has sufficient funds available to it for this purpose. See “Description of the Notes—Available Income and Other Calculations—The Liquidity Reserve Draw” in this prospectus.

Re-Direction of Principal