UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

|

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-40852

LUMIRADX LIMITED

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

LumiraDx Limited

c/o Ocorian Trust (Cayman) Limited

PO Box 1350, Windward 3, Regatta Office Park

Grand Cayman KY1-1108

Cayman Islands

(Address of principal executive offices)

Dorian LeBlanc, Chief Financial Officer

LumiraDx, Inc.

221 Crescent Street, 5th Floor

Waltham, MA 02543

(888) 586-4721

Email: IR@lumiradx.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act.

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common shares, par value $0.0000028 per share |

|

LMDX |

|

The Nasdaq Stock Market |

Warrants exercisable to purchase common shares |

|

LMDXW |

|

The Nasdaq Stock Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of the period covered by the annual report.

As of December 31, 2021, the issuer had 45,241,767 common shares and 207,462,080 ordinary shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Emerging growth company |

|

☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

|

|

|

|

|

|

|

|

U.S. GAAP ☐ |

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

|

Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

i

ii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Unless otherwise stated or the context otherwise indicates, references to the “LumiraDx”, the “Company”, “we”, “our” or “us” refer to LumiraDx Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands, and its consolidated subsidiaries.

Trademarks, Service Marks

LumiraDx and its respective subsidiaries own or have rights to trademarks, trade names and service marks that they use in connection with the operation of their business. In addition, their names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and service marks appearing in this Annual Report on Form 20-F (“Annual Report”) are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this Annual Report are listed without the applicable ®, ™ and SM symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service marks.

Financial Information

The terms “dollar,” “USD” or “$” refer to the U.S. dollar and the term “euro,” “EUR” or “€” refer to the euro, unless otherwise indicated. The exchange rate used for conversion between U.S. dollars and euros is based on the ECB euro reference exchange rate published by the European Central Bank.

Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). None of the consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, any numerical discrepancies in any table between totals and sums of the amounts listed are due to rounding.

Market and Industry Data

Certain information included in this Annual Report concerning LumiraDx’s industry, including its total addressable market (“TAM”), the volume of tests and the shift of tests from the central lab to the point-of-care (“POC”) are based on its good faith estimates and assumptions derived from management’s knowledge of the industry and other information currently available to LumiraDx. This Annual Report also includes industry and market data that LumiraDx has obtained from periodic industry publications, third-party studies and surveys and other filings of public companies in its industry. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. This industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, LumiraDx does not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. LumiraDx is responsible for all of the disclosure contained in this Annual Report, and it believes the industry and market data that it obtained from third-party sources are reliable.

The industry in which LumiraDx operates, as well as the assumptions and estimates of its future performance and the future performance of the industry in which it operates, are subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section of this Annual Report titled “Item 3. Key Information—D. Risk Factors” and elsewhere in this Annual Report, that could cause results to differ materially from those expressed in these estimates.

iii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements regarding our current expectations or forecasts of future events. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future results of operations and financial position, business strategy, the LumiraDx Platform, tests, ongoing and planned preclinical studies and clinical trials, regulatory submissions and approvals, research and development costs, timing and likelihood of success, as well as plans and objectives of management for future operations are forward-looking statements. Many of the forward-looking statements contained in this Annual Report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate,” “will” and “potential,” among others.

Forward-looking statements appear in a number of places in this Annual Report and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified under “Item 3. Key Information—D. Risk Factors.” These forward-looking statements include:

•our ability to compete in the highly competitive markets in which we operate, and potential adverse effects of this competition;

•our ability to maintain revenues if our products and services do not achieve and maintain broad market acceptance, or if we are unable to keep pace with or adapt to rapidly changing technology, evolving industry standards and changing regulatory requirements;

•uncertainty, downturns and changes in the markets we serve;

•our expectations regarding the size of the POC market for the LumiraDx Platform (the “Platform”), which is an integrated system comprised of the POC diagnostic instrument (the “Instrument”) precise, low-cost microfluidic test strips, and seamless, secure digital connectivity, the size of the various addressable markets for certain tests and our ability to penetrate such markets by driving the conversion of healthcare providers’ testing needs onto the Platform;

•our commercialization strategy, including our plans to initially focus our sales efforts on large healthcare systems, government organizations and national pharmacy chains that want to deploy comprehensive POC testing across their networks;

•our belief that we will be able to drive commercialization of the Platform through the launch of our SARS-CoV-2 antigen and SARS-CoV-2 antibody tests;

•the willingness of healthcare providers to use a POC system over central lab systems and the rate of adoption of the Platform by healthcare providers and other users;

•the scalability and commercial viability of our manufacturing methods and processes, especially in light of the anticipated demand for the Platform and our minimum commitments to supply the Platform to customers;

•our ability to source suitable raw materials and components for the manufacture of the Instrument and test strips in a timely fashion;

•our ability to maintain our current relationships, or enter into new relationships, with diagnostics or research and development companies, third party manufacturers and commercial distribution collaborators;

•our ability to effectively manage our anticipated growth;

•our ability to rapidly develop and commercialize diagnostics tests that are accurate and cost-effective;

•the timing, progress and results of our diagnostics tests, including statements regarding launch plans and commercialization plans for such tests, all which may be delayed by or halted due to a number of factors, including the impact of the COVID-19 pandemic;

•the timing, scope or likelihood of regulatory submissions, filings, approvals, authorizations or clearances;

•the pricing, coverage and reimbursement of the Instrument and tests, if approved;

•our ability to repay or service our debt obligations and meet the financial covenants related to such debt obligations;

•our ability to enforce our intellectual property rights and to operate our business without infringing, misappropriating, or otherwise violating the intellectual property rights and proprietary technology of third parties; 1

iv

•developments and projections relating to our competitors and our industry;

•our ability to develop effective internal controls over financial reporting;

•our ability to attract, motivate and retain qualified employees, including members of our senior management team;

•the effects of the COVID-19 pandemic, including mitigation efforts and economic effects, on any of the foregoing or other aspects of our business or operations;

•our expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and a foreign private issuer;

•the future trading price of common shares and impact of securities analysts’ reports on these prices;

•our ability to fully derive anticipated benefits from existing or future acquisitions, joint ventures, investments or dispositions;

•exchange rate fluctuations and volatility in global currency markets;

•potential adverse tax consequences resulting from the international scope of our operations, corporate structure and financing structure;

•U.S. tax legislation enacted in 2017, which could materially adversely affect our financial condition, results of operations and cash flows;

•increased risks resulting from our international operations;

•our ability to comply with various trade restrictions, such as sanctions and export controls, resulting from our international operations;

•government and agency demand for our products and services and our ability to comply with government contracting regulations; and

•our ability to operate in a litigious environment.

These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of risks, uncertainties and assumptions described under the sections of this Annual Report titled “Item 3. Key Information—D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects” and elsewhere in this Annual Report. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

v

SUMMARY OF RISK FACTORS

The following is a summary of certain, but not all, of the risks that could adversely affect our business, operations and financial results. If any of the risks actually occur, our business could be materially impaired, the trading price of our common shares and warrants could decline, and you could lose all or part of your investment.

•We are at a pivotal point in the commercialization of our Platform, and we may not succeed for a variety of reasons.

•Our short-term revenue prospects will vary with the amount of demand for COVID-19 tests, the presence of variants, which may be further adversely impacted by wide-spread implementation of authorized vaccines or other vaccines or boosters that are subsequently approved or authorized.

•We may not obtain regulatory approval, authorization, certification or clearance of additional tests on our Platform or our Amira System, and we may not be able to successfully develop and commercialize additional tests on the Platform or the Amira System, including scaling up manufacturing and sales capacity.

•Our strategy to globally launch a broad menu of tests may not be as successful as currently envisioned.

•We may not be able to generate sufficient revenue from our Platform to achieve and maintain profitability.

•We may not be able to continue as a going concern if we require and are not able to obtain waivers of covenant violations or restructure our existing debt obligations.

•Business or economic disruptions or global health concerns, such as the ongoing COVID-19 pandemic, have harmed and may continue to seriously harm our business and increase our costs and expenses.

•We rely on a limited number of suppliers for the components of our Platform and our Amira System and for other materials and may not be able to find replacements or immediately transition to alternative suppliers.

•We may experience problems in scaling our manufacturing and commercial operations, and scaling may impact performance of our products.

•Our business and reputation will suffer if our products do not perform as expected.

•We currently derive a significant portion of our revenue from a small number of tests and key customers, and loss of any of these customers could cause a material reduction in revenues. A significant portion of our revenue remains COVID-19 related, and we may not be able to scale other assays sufficiently fast.

•The loss of any member of our senior management team or an inability to attract and retain highly skilled scientists, engineers, clinicians and salespeople could adversely affect our business.

•Our business and sale of our products are subject to extensive regulatory requirements and our products may not be compliant with the new regulatory framework applicable in the European Union (“E.U.”) beginning May 26, 2022, and approvals of products under the new regulatory regime may be delayed and consequently our ability to continue to commercialize such products in the E.U. may be impacted and this could impact revenues.

•If we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenue or achieve and sustain profitability.

•The dual class structure of our ordinary shares and our common shares has the effect of concentrating voting control with those holders of our share capital prior to the merger of our wholly owned subsidiary, LumiraDx Merger Sub, Inc., with and into CA Healthcare Acquisition Corp., a Delaware corporation (the “Merger”).

•If we are unable to obtain and maintain patent and other intellectual property protection for our products and technology, our ability to successfully commercialize any products we develop may be adversely affected.

•If any of our facilities were damaged or destroyed, or if we experience a significant disruption in the expansion of our operations for any reason, our ability to continue to operate our business and meet increased demand could be materially harmed.

vi

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Reserved

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

We operate in a market environment that is difficult to predict and that involves significant risks, many of which are beyond our control. You should carefully consider the risks described below before you decide to purchase our securities. Additional risks and uncertainties not presently known to us or that we do not currently believe are important to an investor, if they materialize, also may adversely affect us. If any of the events, contingencies, circumstances or conditions described in the following risks actually occur, our business, financial condition or results of operations could be seriously harmed.

Risks Related to Our Business and Strategy

We are at a pivotal point in the commercialization of our Platform, and we may not succeed for a variety of reasons.

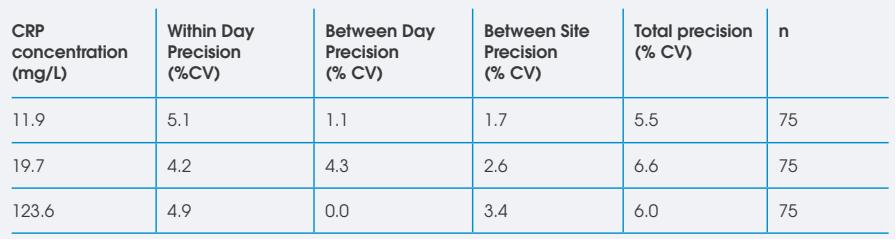

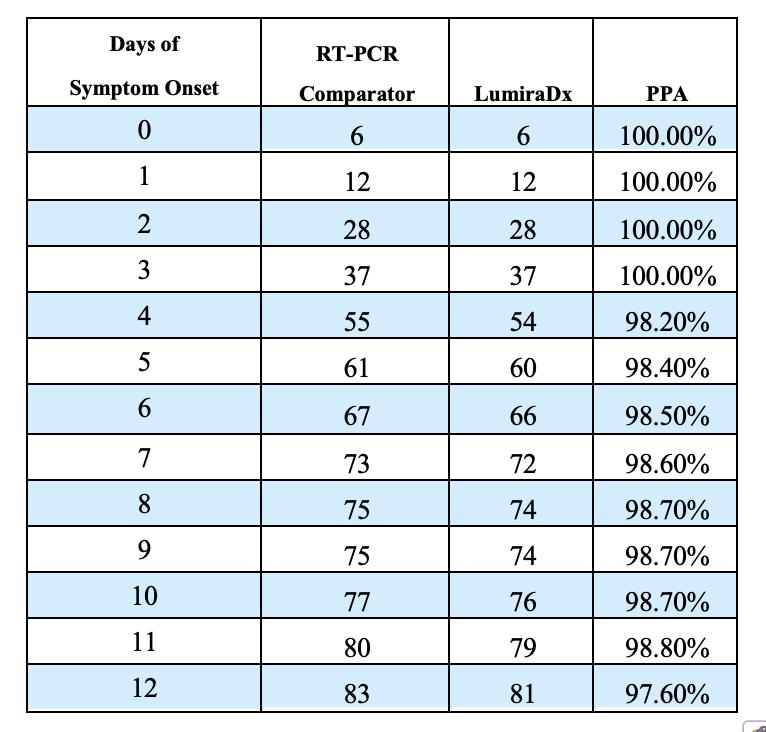

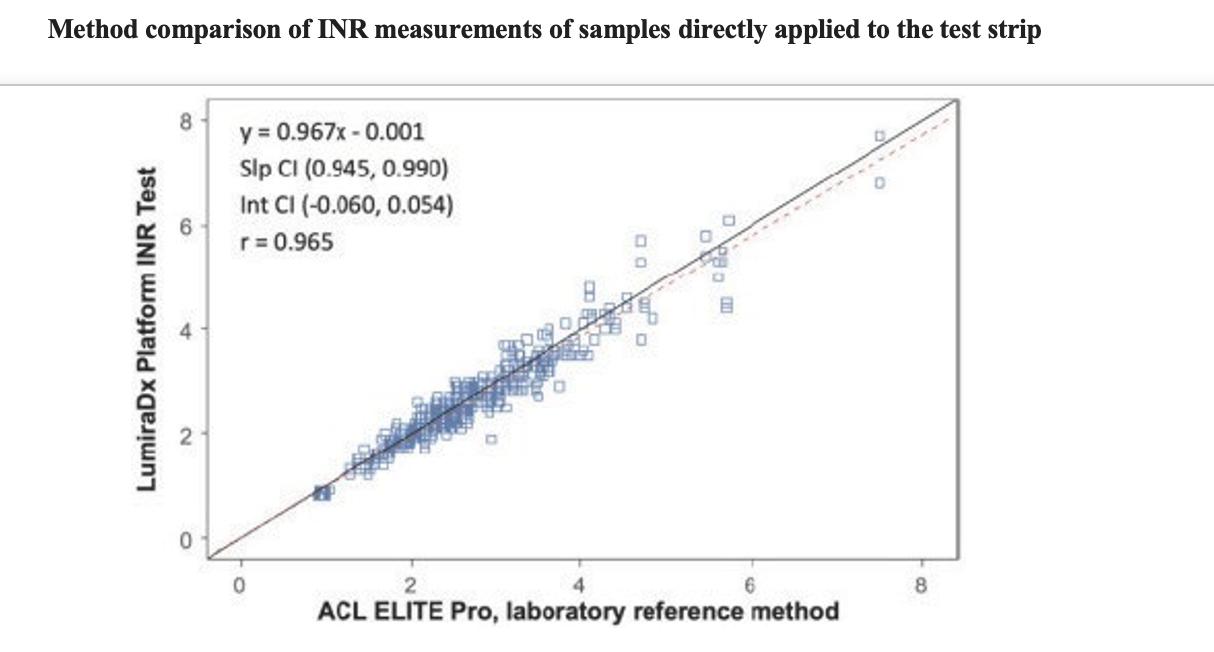

Since our inception in 2014 until December 31, 2021, we have incurred $460.6 million in research and development costs to develop our Platform, our mass screening testing system (the “Amira System”), and our Fast Lab Solutions products which support high-complexity laboratory testing (“Fast Labs Solutions”). As of the date of this Annual Report, we have eight POC diagnostic tests developed and launched for our Platform: our SARS-CoV-2 antigen test and SARS-CoV-2 antibody test, commercially available under Emergency Use Authorization (“EUA”) and CE Marks, which we introduced to the U.S. and European markets in 2019; our INR test, our SARS-CoV-2 antigen pool test, our D-Dimer test, our CRP test and our SARS-CoV-2 Ag & Flu A/B tests, all of which are CE Marked. We also received EUAs for our molecular lab reagent kits, LumiraDx SARS-CoV-2 RNA STAR and LumiraDx SARS-CoV-2 RNA STAR Complete, achieved CE mark for LumiraDx SARS-CoV-2 RNA STAR Complete and commenced sales in the U.S. and Europe. We have submitted an EUA request to the U.S. Food and Drug Administration (“FDA”) for our SARS-CoV-2 Ag & Flu A/B tests. To date we have not yet received authorization for this combo test and currently the FDA has indicated that authorization will be not be provided as further information is required, amongst other things, additional data points related to Flu A/B testing. There can therefore be no guarantee that authorization will be granted by the FDA and timing on updated submissions depends on the prevalence of Flu A/B and our ability to collect further data.

We have engaged in a large, broad-scale launch of our SARS-CoV-2 antigen test and we are relying on such test to create brand awareness and a revenue base to support our cost infrastructure as well as to create an installed base of the Instrument.

While we have launched certain tests, including our SARS-CoV-2 antigen test and our SARS-CoV-2 antibody test, we have limited commercial experience with our Platform. The launch of additional tests may be delayed, be less successful than we anticipate, or fail for any of the reasons that large commercial launches are ultimately unsuccessful. For example:

•Our tests, produced at large scale, might not perform to standards that we have experienced to date. We therefore may not obtain or maintain regulatory approval, authorization, certification or clearance for some of our

1

diagnostic tests in research and development, which may have a significant impact on the commercialization of our Platform.

•We have a number of diagnostic tests in our near-term pipeline. We may not receive relevant regulatory approval, authorization, certification or clearance for some or all of these in a timely fashion, or at all, and this may impact significantly on the commercialization of our Platform.

•Unexpected or inconsistent clinical data from existing and future clinical trials, or a regulator’s or the market’s perception of these clinical data when compared to our internal comparative data, may adversely impact our ability to obtain regulatory approval, authorization, certification or clearance for, or market acceptance of, our diagnostic tests.

•We make our Instrument, Amira System and test strips on sophisticated manufacturing systems, and these may not operate at large scale as anticipated.

•We may have difficulty sourcing raw materials and components, including micro processing or semiconductor chips or capacitors, to make our Instrument, Amira System and test strips in a timely fashion in necessary quantities, or these materials and components might not comply with our specifications, which are exacting.

•We may not be able to supply our Platform through sales channels that are effective and efficient.

•Potential users of our Platform might not accept our Platform as being better than those POC systems already available, at the prices we charge or at all.

•Governmental and third-party payors might decline to cover our products or reimburse our users for the cost of our Instrument and test strips at favorable rates or at all.

•We may not be able to scale-up and sustain operations to a level that allows our investments in technology, equipment, personnel and other resources to achieve sustainable and profitable commercial activities.

•Our management, manufacturing, sales and marketing, logistics, research and development, regulatory and other personnel might not be able to sustain the high level of operations that we anticipate and that we will require to produce our anticipated revenue and allow us to operate profitably.

•External factors, such as the ongoing COVID-19 pandemic, or political or social instability or unrest in our principal markets, such as the recent conflict between Russia and Ukraine, and its potential impact might adversely affect us in ways that we have not planned for.

Operations of the type and scope that we plan are subject to many uncertainties, and many that are undertaken are unsuccessful. We cannot be certain that we will be able to achieve our business objectives as described in this Annual Report, and if our assumptions regarding these risks and uncertainties are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from our expectations and our business, financial condition and results of operations could be adversely affected.

Our short-term revenue prospects will vary with the amount of demand for COVID-19 tests.

Our short-term revenue prospects will continue to vary with the amount of demand for our SARS-CoV-2 antigen test, SARS-CoV-2 antigen pool test and SARS CoV-2 antibody test and the presence of various variants of the virus. Since the beginning of the COVID-19 pandemic, three vaccines for COVID-19 have received EUAs from the FDA and two of those later received marketing approval. As additional effective COVID-19 vaccines or treatments are developed, approved or authorized and rolled out to protect against and treat the virus, demand for our SARS-CoV-2 antigen test, SARS-CoV-2 antigen pool test and SARS CoV-2 antibody test may be impacted and the size of our market opportunity for such tests may be impacted. While we believe that our SARS-CoV-2 antigen, SARS-CoV-2 antigen pool test and SARS-CoV-2 antibody tests will remain in demand as new variants could appear and COVID-19 vaccines or boosters are rolled out and following such rollout to be used as a verification tool to test the efficacy of such vaccines in triggering an immune response, and to facilitate maintaining open economies, the presence of variants, their impact or the availability and efficacy of such vaccines/boosters or the mitigation of the COVID-19 pandemic earlier than expected for any other reason could negatively impact demand for our Platform and sales of our Instrument, test strips and other products. While our SARS-CoV-2 antigen test detects major global SARS-CoV-2 variants including Delta, Gamma, Epsilon, Alpha, Beta and Omicron variants, there is no guarantee that our tests will be able to accurately detect all variants of concern. In addition, competitors may produce more accurate tests or tests which receive more favorable demand, both of which may impact our revenue streams and profitability. It is not unreasonable to expect COVID-19 may become a more seasonal flu-like illness, subject to seasonality which will impact revenue cycles.

2

Our molecular lab reagent kits, LumiraDx SARS-CoV-2 RNA STAR and LumiraDx SARS-CoV-2 RNA STAR Complete will also be subject to these demand fluctuations. In addition, we have announced the plan to roll out a five-minute SARS-CoV-2 Ag Ultra test and a five-minute SARS-CoV-2 Ag Ultra Pool test. The launch of such tests may be subject to further validation and clinical trials and regulatory clearances. Launches may be delayed as clinical trials require the presence of virus for clinical testing. Completion of trials may be impacted or delayed in case of low prevalence of the virus.

We have also submitted an EUA request to the FDA for our SARS-CoV-2 Ag & Flu A/B tests. To date we have not yet received authorization for this combo test and currently the FDA has indicated that authorization will be not be provided as further information is required, amongst other things, additional data points related to Flu A/B testing. There can therefore be no guarantee that authorization will be granted by the FDA and timing on updated submissions depends on the prevalence of Flu A/B and our ability to collect further data.

New product development involves a lengthy and complex process and we may be unable to commercialize additional tests on our Platform on a timely basis, or at all.

The launch of additional tests on our Platform may be delayed or may not be successful. There can be no assurance that our Platform will accurately and rapidly identify biomarkers associated with conditions and diseases of importance to our customers, including COVID-19, for a variety of technical reasons or that our Platform will compete with market alternatives or gain market acceptance. Our diagnostic tests which are in development will take time to develop and commercialize, if we are able to commercialize them at all.

Many other POC testing systems are designed for one or few related tests, increasing the odds of creating a successful test but decreasing the odds of developing a system with broad testing abilities. Our strategy involves designing a platform that is diverse and powerful enough to produce high-quality testing abilities for a broad array of tests. While we believe this strategy will result in an industry-leading standard for POC tests, it also creates a very high hurdle for success, which we may not ultimately clear. Various tests may require improved product performance specifications over time.

Further, there can be no assurance that any new diagnostic tests we develop will have acceptable clinical performance. Before we can commercialize any new diagnostic tests, we will need to expend significant funds in order to:

•conduct substantial research and development, including validation studies and potentially clinical trials;

•further develop and scale our research and development efforts to accommodate different test strip designs or adjustments; and

•further develop and scale our infrastructure to be able to analyze increasingly large amounts of data.

Our Platform development process involves a high degree of risk, and development efforts may fail for many reasons, including:

•failure of the products to perform as expected at the research or development stage;

•lack of validation data; or

•failure to demonstrate the clinical utility of the products or pass clinical trials or obtain relevant regulatory approval, authorization, certification or clearance.

As we develop our Platform and our diagnostic tests, we will have to make significant investments in product development, marketing and selling resources. In addition, competitors may develop and commercialize competing products faster than we are able to do so.

Our Amira System may not obtain regulatory approval, authorization, certification or clearance, and we may not be able to successfully develop and commercialize our Amira System, including scaling up manufacturing and sales capacity.

We have started adjusting our high performing SARS-CoV-2 antigen test for mass screening applications with our Amira System, which is based upon our Platform and our SARS-CoV-2 antigen test. Our Amira System is still under development, which we may not be able to complete successfully. We currently have a prototype Amira System including strips, device and patient mobile device application. We are moving to design freeze of the system and clinical validation. We are simultaneously tooling up high volume manufacturing lines, for the strip and instrument, while we progress through design freeze and the verification and validation (“V&V”) phase. Even if successfully developed, our Amira System will require regulatory approval, authorization, certification or clearance prior to commercialization. In addition, we may need to seek regulatory approval, authorization, certification or clearance for specific or limited use cases based on our commercialization plans and then seek separate approval, authorization, certification or clearance over time for other settings, such as home-use settings. For example, we submitted a pre-EUA request to FDA in February 2021 and expect to complete POC clinical testing and achieve CE Mark during the first half of 2022. We started clinical testing of our Amira System in the first quarter

3

of 2022, but we may not receive positive clinical data or we may need to perform additional clinical testing to obtain regulatory approval, authorization, certification or clearance for our Amira System. Revenues related to the Amira System depend on development of mass screening opportunities and continued need for COVID-19 testing in keeping economies open and mass screening testing requirements.

We expect to continue to devote significant operational and financial resources to the development and commercialization of our Amira System to meet expected demand for mass screening applications, including at schools, airports, universities, for return-to-work screening and over time for testing in the home. Our ability to produce the planned volume of Amira COVID-19 tests will be dependent on our ability, and the ability of our contract manufacturers, to successfully and rapidly scale up manufacturing and sales capacities. These efforts may divert management’s attention and resources from other diagnostic tests, including our SARS-CoV-2 antigen test and our SARS-CoV-2 antibody test, available on our Platform. We may encounter significant difficulties in our efforts to scale, manufacture and supply our Amira System and we cannot guarantee that any of these challenges will be met in a timely manner or at all.

We may not be able to generate sufficient revenue from our Platform to achieve and maintain profitability.

We believe our commercial success is dependent upon our ability to successfully market and sell our Platform to customers, including large healthcare systems, government organizations, national pharmacy chains and community-based healthcare settings, to launch and commercialize our Instrument and diagnostic tests, including those for COVID-19, to continue to expand our current relationships and develop new relationships with diagnostic companies, and to develop and commercialize new POC diagnostic tests. We are scaling our operations assuming a rapid uptake of our Instrument and our SARS-CoV-2 antigen and SARS-CoV-2 antibody tests, but the demand for our Platform may not increase for a number of reasons, including due to the evolving nature of the COVID-19 pandemic, or unsuccessful execution of our strategy designed to meet the increased demand for COVID-19 tests, or otherwise. If we are unsuccessful in the commercialization of our SARS-CoV-2 antigen and antibody tests, then we will need significant financial resources to maintain our operations. We have experienced early revenue growth from the sale of our Platform to healthcare professionals, principally for our SARS-CoV-2 antigen tests, INR tests and from the sale of third-party distribution products and our anticoagulation management programs. We may not be able to continue revenue growth or maintain existing revenue levels.

Our existing customers and collaborators may decide to decrease or discontinue their use of our Platform due to changes in research and product development plans, changes in the occurrence of certain diseases, such as COVID-19, failures in clinical trials, financial constraints, or utilization of internal testing resources or tests performed by other parties, which are circumstances outside of our control. In addition to reducing our revenue, this may reduce our exposure to early stage research that facilitates the incorporation of newly-developed information about various tests into our Platform.

We are currently not profitable. Even if we succeed in increasing the adoption of our Platform by large healthcare systems, government organizations, national pharmacy chains and community-based healthcare settings, maintaining and creating relationships with our existing and new customers and collaborators and developing and commercializing additional POC diagnostic tests, we may not be able to generate sufficient revenue to achieve or maintain profitability.

Business or economic disruptions or global health concerns, such as the ongoing COVID-19 pandemic, have and may continue to seriously harm our business and increase our costs and expenses.

The global impact of the ongoing COVID-19 pandemic has been rapidly evolving in many countries, including the U.K. where our main research, development and manufacturing operations are located, as well as in other countries, and has led to the implementation of various responses, including government-imposed quarantines, travel restrictions, business and school closures and other public health safety measures. These responses to the COVID-19 pandemic have impacted and may continue to materially and adversely impact our business and results of operations due to, among other factors:

•a potential for delays in launches of our non-COVID-19 diagnostic tests given reduced and limited access to clinical trial sites for our other tests and social distancing and other measures that restrict ability to work on such tests;

•a delay in regulatory approval, authorization, certification or clearance by FDA, and other applicable regulators to some of our diagnostic assays in development, if such regulators focus their resources on and give priority to COVID-19 testing and treatments or to a specific form of COVID-19 testing that is different than our tests;

•a disproportionate impact on the healthcare groups and other healthcare professionals with whom we contract;

•supply shortages for materials used to manufacture our COVID-19 products, including of swabs and extraction buffers necessary for use with our SARS-CoV-2 antigen test and of chips and other components that are subject to global shortages and necessary to manufacture our Instrument and our Amira System;

4

•disruptions to our supply chains and sales and marketing efforts due to restrictions on courier delivery services and other transportation systems;

•disruptions to operations at our current and future manufacturing systems and facilities and those of our third-party vendors, collaborators, and suppliers;

•difficulty accessing the capital and credit markets on favorable terms, or at all, a severe disruption and instability in the global financial markets, and deteriorations in credit and financing conditions which could affect our access to capital necessary to fund our existing and scaled business operations or address maturing liabilities on a timely basis;

•the potential negative impact on the health or productivity of employees, especially if a significant number of them are impacted;

•a deterioration in our ability to ensure business continuity during a disruption; and

•social, economic, and labor instability in the countries in which we or the third parties with whom we engage operate, including any impact of the current conflict between Russia and Ukraine.

This pandemic, as well as intensified measures undertaken to contain the spread of COVID-19, including variants such as Omicron, could decrease healthcare industry spending; adversely affect demand for our Platform; cause one or more of our customers to file for bankruptcy protection or go out of business; cause one or more of our customers to fail to renew, terminate, or renegotiate their contracts; affect the ability of our business development team to travel worldwide to potential customers and the ability of our professional services teams to conduct in-person services and trainings; impact expected spending from new customers; negatively impact collections of accounts receivable; lead to the closure of our existing or future manufacturing facilities or any of our other production, research and/or distribution facilities; and restrict the movement of people and goods, which could negatively impact employee availability (particularly, in respect of our research and development (“R&D”) and sales and marketing teams), any of which would harm our business, results of operations, and financial condition. In addition, while we have taken remote work, group isolation and other measures to prevent an outbreak among our employees, further waves of the COVID-19 pandemic, including new variants, could further disrupt our operations as the success of the measures we have implemented is uncertain. Any changes in the regulations, travel restrictions and other public safety measures that have been or may be imposed by countries in response to the COVID-19 pandemic could impact our COVID-19 testing volumes and, in particular, as such regulations, travel restrictions and public safety measures are lifted, our COVID-19 testing volumes may decrease.

The loss of any member of our senior management team or our inability to attract and retain highly skilled scientists, engineers, software developers, technicians and salespeople could adversely affect our business.

Our success depends on the skills, experience and performance of key members of our senior management team, including Ron Zwanziger, our Chairman and Chief Executive Officer, Dave Scott, Ph.D., our Chief Technology Officer, and Jerry McAleer, Ph.D., our Chief Scientist. The individual and collective efforts of these employees will be essential as we continue to develop our Platform and additional products, and as we expand our commercial activities. The loss or incapacity of existing members of our executive management team or key scientists and engineers could adversely affect our operations, particularly if we experience difficulties hiring qualified successors. We do not have any employment agreements (other than brief at-will offer letters) or non-compete agreements with our co-founders (i.e., Ron Zwanziger, Dave Scott and Jerry McAleer), and because of their knowledge of the industry and our operations, we believe the loss of any one of their services, or any of them leaving and providing services to any of our competitors, could result in a disruption of our operations and/or put us at a competitive disadvantage, which will likely have a material adverse effect on our business.

Our R&D programs and manufacturing operations depend on our ability to attract and retain highly skilled scientists, engineers, software developers and technicians. We may not be able to attract or retain a sufficient number of qualified scientists, engineers, software developers and technicians in the future due to the competition for qualified personnel in our industry. We also face competition from universities and public and private research institutions in recruiting and retaining highly qualified scientific personnel. We may also have difficulties locating, recruiting or retaining a sufficient number of qualified sales people to successfully scale up our sales and marketing efforts to meet expected demands. Recruiting and retention difficulties can limit our ability to support our R&D and sales and marketing programs. In addition, all of our employees in the U.S. are at-will, which means that either we or the employee may terminate their employment at any time. We also do not maintain “key person” insurance on any of our employees.

5

Our Platform may never achieve significant commercial market acceptance.

Our Platform may never gain significant acceptance in the marketplace and, therefore, may never generate substantial revenue or profits for us. Our ability to achieve commercial market acceptance for our Platform will depend on several factors, including:

•our ability to demonstrate the clinical utility and cost effectiveness of our Platform and its potential advantages over existing POC systems, or for certain tests, over central lab counterparts, to the medical community;

•our ability, and that of our collaborators, to secure and maintain FDA and other applicable regulatory clearance, authorization or approval for certain components of our Platform;

•our ability to expand our test menu and provide a broad range of tests on our Platform while maintaining consistency and precision;

•our ability to obtain relevant regulatory approval, authorization, certification or clearance for our diagnostic assays in development, particularly those in our near-term pipeline;

•the agreement by commercial third-party payors and government payors to cover and to reimburse our Instrument and test strips, the scope and extent of which will affect healthcare providers’ willingness to pay for our Instrument and test strips and likely heavily influence their decisions to recommend use of our Platform;

•the willingness of healthcare providers to use a POC system over central lab counterparts and the rate of adoption of our Platform by healthcare providers and other users; and

•the impact of our investments in our Platform innovation and commercial growth.

We believe that the successful completion of clinical trials, publication of scientific and medical results in peer-reviewed journals, and presentations at leading conferences will be important to facilitate the broad adoption of our Platform. Publication in leading medical journals is subject to a peer-review process, and peer reviewers may not consider the results of studies involving our Platform sufficiently novel or worthy of publication.

The failure of our Platform to be listed in physician guidelines or of our clinical trials to produce favorable results or to be published in peer-reviewed journals could limit the adoption of our Platform. We may not be successful in addressing these or other factors that might affect the market acceptance of our Platform and technologies. Failure to achieve widespread market acceptance of our Platform would materially harm our business, financial condition and results of operations.

A limited number of customers currently represent a substantial portion of our revenue. If we fail to retain these customers, our revenue could decline significantly.

We currently derive a substantial portion of our revenue from sales to certain key customers, including CVS Pharmacy Inc. (“CVS”) in the U.S. and the National Health Service (“NHS”) in the U.K. As a result, our revenue could fluctuate materially and could be materially and disproportionately impacted by purchasing decisions of these customers or any other significant future customers. Our agreements with CVS and NHS do not have minimum purchase requirements. Any of our significant customers may decide to purchase less than they have in the past, may alter their purchasing patterns at any time with limited notice, or may decide not to continue to use our Platform and test strips at all, any of which could cause our revenue to decline and adversely affect our financial condition and results of operations.

We rely on a limited number of suppliers or, in some cases, sole source suppliers, for the components of our Platform and our Amira System and for other materials and may not be able to find, or immediately transition to, alternative suppliers.

We rely on several sole source suppliers for certain components or accessories and materials used in our Instrument and our test strips, such as reagents. In addition, we currently rely solely on Flextronics Ltd. (“Flextronics”), as the sole manufacturer of our Instrument, with components and assemblies supplied by Flextronics and by outside vendors, and our facilities as the sole suppliers of our test strips.

In the case of any alternative supplier for our Instrument, the components of our Instrument or our test strips, there can be no assurance that replacement components or, with regards to the test strips, reagents, swabs or other accessories will be available or will meet our quality control and performance requirements for our operations or products. For example, in November 2020, there was a shortage of a component for use in our Instrument which significantly constrained the production and delivery of our Instrument to customers until we added an additional supplier. We may also have difficulty sourcing raw materials and components, including micro processing or semiconductor chips or capacitors, in a timely fashion in necessary quantities, or these materials and components might not comply with our specifications, which are exacting. An interruption in our ability to develop and produce our Instrument, Amira System or test strips could occur if we encounter delays or difficulties in securing components of our Instrument, Amira System or our test strips, including due to the

6

COVID-19 pandemic, and if we cannot then obtain an acceptable substitute. Any changes in such materials could lead to required changes in performance, regulatory approval, authorization, certification or clearance processes. If we encounter delays or difficulties in securing, reconfiguring or revalidating the equipment and reagents we require for our Platform, our business, financial condition, results of operations and reputation could be adversely affected.

Because of a long lead-time to delivery of certain components of our manufacturing system and Platform, we are required to place orders for a variety of items well in advance of scheduled production runs. We have increased our flexibility to purchase strategic components within shorter lead times by entering into scale up arrangements with the suppliers of these components. Although we attempt to match our inventory and production capabilities to estimates of marketplace demand, to the extent Instrument and test strip orders materially vary from our estimates, we may experience continued constraints in our Platform production and delivery capacity, which could adversely impact our financial condition and results of operations. Should our need for raw materials and components used in production continue to fluctuate, we could incur additional costs associated with either expediting or postponing delivery of those materials. In an effort to control costs, we have implemented a lean manufacturing system. Managing the change from discrete to continuous flow production requires time and management commitment. Lean initiatives and limitations in our supply chain capabilities may result in component shortages that delay shipments and cause fluctuations in revenue.

Further, we believe that there are a limited number of other equipment manufacturers that are currently capable of supplying and servicing the equipment necessary for the manufacturing of our Instrument, Amira System and test strips. We have spent significant time and resources developing our manufacturing processes with our existing collaborators, and the use of equipment or materials furnished by these replacement suppliers would require us to significantly alter our operations. It could take a very long time to obtain a new manufacturing system for test strips if additional capacity were needed. Transitioning to a new supplier would therefore be time consuming and expensive, may result in interruptions or delays in our operations, could affect the performance specifications of our operations or could require that we revalidate our Platform and could require us to obtain additional clearance, authorization, approval, accreditation or licensure for the changes. There can be no assurance that we will be able to secure alternative equipment, reagents, and other materials, and bring such equipment, reagents, and materials on line and revalidate them without experiencing interruptions in our workflow.

We may experience manufacturing problems or delays that could limit the growth of our revenue or increase our losses.

Our current and planned manufacturing operations are critical to our commercialization plans, and these operations may not be sufficient to withstand the demands we intend to place on them. Any disruption in the operation of any of our facilities or the facilities of our suppliers could impact our supply chain and operation of our Platform and our ability to conduct our business and generate revenue. We may encounter unforeseen situations that would result in delays or shortfalls in our production as well as delays or shortfalls caused by our outsourced manufacturing suppliers and by other third-party suppliers who manufacture components for our Platform, including delays caused by or constraints on capacity as a result of the COVID-19 pandemic. If we are unable to keep up with demand for our Platform, our revenue could be impaired, market acceptance for our Platform could be adversely affected and our customers might instead purchase our competitors’ products. Our inability to successfully manufacture the components of our Platform would have a material adverse effect on our operating results.

If our or our suppliers’ or collaborators’ present or future facilities were to be damaged, destroyed or otherwise unable to operate, whether due to fire, floods, storms, tornadoes, earthquakes, other inclement weather events or natural disasters, employee malfeasance, terrorist acts, public health crises or pandemics, power outages, or otherwise, it may render it difficult or impossible for us to increase our manufacturing and other operations sufficiently to meet increased demand, and our business could be severely disrupted. Our facilities and the equipment we use to manufacture our Platform would be costly to replace and could require substantial lead time to repair or replace.

As we continue to expand our business, we may experience problems in scaling our manufacturing and commercial operations, and if we are unable to support demand for our Platform, our Amira System and our future tests, including ensuring that we have adequate capacity to meet increased demand, or we are unable to successfully manage the evolution of our Platform or our Amira System, our business could suffer.

In connection with the commercialization of our Platform, we have added, and expect to continue to add, personnel in the areas of sales, marketing, manufacturing, regulatory, quality assurance, customer and technical service and other support functions. We also continue to scale our manufacturing, sales and marketing capabilities. As our sales volume grows, we will need to continue to increase our workflow capacity for sales, customer service, billing and general process improvements, expand our internal quality assurance program and to scale up our manufacturing systems for our Platform quickly. We will need additional sales, scientific and technical personnel to market our Platform and our Amira System and follow up on any reported quality issues. Our Amira System is focused on mass screening opportunities and over-the-counter (“OTC”) sales, and marketing channels for professional and OTC sales vary significantly and may require additional support. We will also need to secure additional facilities, purchase additional equipment, some of which can take several months or more to

7

procure, setup, and validate, and to significantly and rapidly increase our capacity to meet increased demand. There is no assurance that any of these increases in scale, expansion of personnel, equipment, software and computing capacities, or process enhancements will be successfully implemented on a timely basis, or at all, or that we will have adequate space in our facilities to accommodate such required expansion. Even if these and other measures are implemented successfully, we still expect to experience continued capacity constraints as we commercialize our products.

As additional diagnostic products are commercialized and new tests are developed, we may need to implement adjustments to our Platform and our processes and hire new personnel with different qualifications. Failure to manage this growth or transition could result in delays in the development of new test strips, higher product costs, declining product quality, deteriorating customer service, and slower responses to competitive challenges. A failure in any one of these areas could make it difficult for us to meet market expectations for our Platform and our Amira System and could damage our reputation and the prospects for our business.

If any of our facilities were damaged or destroyed, or if we experience a significant disruption in the expansion of our operations for any reason, our ability to continue to operate our business and meet increased demand could be materially harmed.

As we expand our capacity, we believe it may be necessary to both expand our existing facilities and to add one or more new facilities to meet anticipated demand. We are also in the process of scaling our manufacturing facilities and adding warehouse and office space, which are expected to continue to be rolled out in the next few years, with necessary adjustments based on market needs. Failure to complete, or timely complete, these expansion projects on time or at all, may significantly delay our workflows and operations, which may adversely affect our business, financial condition and results of operation. In addition, our financial condition may be adversely affected if we are unable to complete these expansion projects on budget and otherwise on terms and conditions acceptable to us. Finally, our financial condition will be adversely affected if demand for our Platform and our Amira System does not materialize in line with our current expectations and if, as a result, we end up building excess capacity that does not yield a reasonable return on our investment.

We have devoted and continue to devote significant resources for the scale-up and commercialization of our COVID-19 tests.

We are working toward the large-scale technical development and manufacturing scale-up in several countries and larger scale deployment of our COVID-19 tests, including our SARS-CoV-2 antigen test, SARS-CoV-2 antibody test, SARS-CoV-2 antigen pool test, our SARS-CoV-2 RNA STAR and SARS-CoV-2 RNA STAR Complete molecular lab reagent kits, as well as our five-minute SARS-CoV-2 Ag Ultra test, five-minute SARS-CoV-2 Ag Ultra Pool test and our Amira System. The number of potential tests that we are able to produce and bring to market is dependent on our ability, and the ability of our contract manufacturers, to successfully and rapidly scale up manufacturing capacity and our ability to scale up our marketing and sales capacities. To support these scale-ups, we will need to expend significant resources and capital quickly, and we therefore have diverted and expect to continue to divert resources and capital from our other non-COVID-19 diagnostic tests. Our ability to produce and successfully bring to market our COVID-19 tests will also depend on our ability to further scale up on our manufacturing, sales and marketing capacities.

We have entered into, and may continue to enter into, contractual arrangements with customers, suppliers, distributors, manufacturers or other collaborators that contain restrictions or minimum commitments which limit our ability to develop, manufacture, supply, commercialize and distribute our COVID-19 tests. If we fail to meet contractual obligations under our agreements or if we enter into agreements that restrict our ability to develop, manufacture, supply, commercialize and distribute our COVID-19 tests, we may be required to pay damages to the counterparty or contest disagreements or disputes, which could have a material and adverse effect on our financial condition and operations.

Given the rapidity of both the onset of the COVID-19 pandemic and our commercialization efforts with respect to our COVID-19 tests, as well as the complexity of the economics of a diagnostic test for a pandemic, we are still considering how to adjust our pricing strategy for these tests and cannot provide assurance as to the ultimate impact of each COVID-19 test on our financial condition and results of operations. Focus on such COVID-19 tests could have the lasting impacts of significant diversions of resources and attention away from the development of other non-COVID-19 diagnostic tests; a possible reduction in our ability to rapidly pivot research, development and commercialization back to other areas of focus; and lost time associated with addressing the demand for our COVID-19 tests. We have started diverting focus from COVID-19 tests onto other tests, such as the roll-out of recently CE marked D-Dimer and CRP tests in Europe, but this transition and our focus may depend on the onset of new variants and peaks in demand for additional COVID-19 testing, as such there may be various fluctuations in supply and demand and impact on overall sales and sales of other tests.

8

We are continuously updating and improving our Platform based on the needs of various tests, and this may impact changes, such as upgrades or new versions of our Instrument.

Our Platform is continuously evolving and will continue to do so as more tests are added to our Platform. A specific test may require specific test strip or design changes which could also impact Instrument set up. In addition, we are continuously improving our Instrument and have a pipeline of upgrades to make the Instrument more robust and further lower the costs over time. This may require regular updates to our Instrument, including software upgrades and in certain cases the need to swap out the Instrument for an updated version. Despite our rigorous testing and quality assurance processes, it is possible that our Instrument may prove to operate less reliably than we anticipated or degrade in efficacy over time. If this occurs, this may likewise necessitate updates to our design or software or replacement of Instruments, which could adversely affect our financial condition, results of operations and/or reputation. The replacement or refurbishment for further use of an Instrument may require sales and customer support and may lead to older versions of our Platform becoming obsolete which could have an adverse impact on our financial results. The need for an upgrade to an Instrument may impact the commercialization of certain diagnostic assays which require an upgraded Instrument.

Our current tests or any tests that we develop to cover additional menu or diagnostic testing may not be successfully developed or commercialized or gain the acceptance of the public or the medical community.

We plan to implement a broad range of tests on our Platform over time. Each test requires a significant amount of R&D and comes with its own technical challenges. In addition, we aim for all tests to provide lab-comparable results based on comparison against the lab standard reference for such test, where such lab reference is available. In light of the technical and complicated nature of some test strips, R&D timelines may be delayed and lab-comparable results or expected performance criteria may not be met or only be met over time as improvements are rolled out. This may affect our ability to launch or commercialize our tests and could have an adverse impact on our financial results. While we have encouraging internal data for many diagnostic tests, we have not yet performed multi-site, external clinical analyses of most of these tests or otherwise compared these results against clinical results.

While our SARS-CoV-2 antigen test detects major global SARS-CoV-2 variants including Delta, Gamma, Epsilon, Alpha, Beta and Omicron variants, there is no guarantee that our tests will be able to accurately detect all variants of concern. Sensitivity and specificity concerns with respect to COVID-19 tests generally could negatively affect demand for our Platform and therefore our business, revenues and profits. Similar concerns about our collaborators, though unrelated to us, could likewise create negative publicity, which could negatively impact demand for our Platform or harm our reputation. These concerns could be wrongly attributed to our tests and could negatively affect sales of our Instrument. Additionally, concerns about COVID-19 tests generally could adversely affect our business as the general public may associate our SARS-CoV-2 antigen, SARS-CoV-2 antigen pool test and SARS-CoV-2 antibody tests with them. In addition, the medical community is continuously learning and publishing scientific literature about COVID-19 and the success of our COVID-19 tests will depend, in part, on the ability of the tests to detect the virus (or antibodies) or variants of the virus and on acceptance of the test results by the public and medical community. If any of our tests or those of other parties developing similar products receive negative or unfavorable publicity, or the medical community publishes information criticizing the accuracy, effectiveness or utility of COVID-19 tests, whether or not ours, it could result in a decrease in demand for any product that we may develop. In addition, responses by the U.S. federal, state or foreign governments to negative public perception or ethical concerns related to COVID-19 tests may result in new legislation or regulations that could limit our ability to develop or commercialize any product, obtain or maintain regulatory approval, authorization, certification or clearance, if applicable, identify alternate regulatory pathways to market or otherwise achieve profitability. More restrictive statutory regimes, government regulations or negative public opinion would have an adverse effect on our business, financial condition, results of operations and prospects, and may delay or impair the development and commercialization of our products or demand for any products we may commercialize.

We have limited data on the performance of our Platform to date and limited experience in marketing and selling our Platform, and if we are unable to expand our direct sales and marketing force to adequately address our customers’ needs, our business may be adversely affected.

We have limited data on the performance of our Platform to date and limited experience in marketing and selling our Platform, which had its formal commercial launch in Europe in 2019 with our INR test and 2021 for our CRP and D-Dimer tests in Europe. We do not currently have, and may not be successful in developing, the capacity to market, sell, or distribute our Platform or other products we may develop effectively or in volumes high enough to support our planned growth.

We currently and will continue to sell our Platform on a region or country specific basis across our footprint in Europe, the U.S., South America, Africa and Asia using a combination of direct sales and sales through our distributors. Our future sales will depend in large part on our ability to develop and substantially expand our sales force and to significantly increase the scope of our marketing efforts. Our target market of identifying customers in healthcare systems, government organizations, national pharmacy chains and community-based healthcare settings is a large and diverse market. As a result, we believe it is

9

necessary to develop a large sales force that includes sales representatives with a variety of specific technical backgrounds. We will also need to attract and develop a significant amount of marketing personnel with industry expertise. Competition for such employees is intense. We may not be able to attract and retain personnel or be able to build an efficient and effective sales and marketing force, which could negatively impact sales and market acceptance of our products and limit our revenue growth and potential profitability.

Our expected future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain, and integrate additional employees. Our future financial performance and our ability to commercialize our products and to compete effectively will depend, in part, on our ability to manage this potential future growth effectively, without compromising quality.

We also enlist distributors, and we may potentially enlist local collaborators, to assist with sales, distribution, and customer support. Locating, qualifying, and engaging a significant number of distribution collaborators with local industry experience and knowledge will be necessary to effectively market and sell our products. We may not be successful in finding, attracting, and retaining a sufficient number of distributors or other collaborators or we may not be able to enter into such arrangements on favorable terms, or at all. Our sales in low and middle income countries also depend on support from our global health partners, such as the Bill and Melinda Gates Foundation (“BMGF”) and from national governments. Developing such relationships may require significant resources, time and management attention and could adversely affect our ability to make sales.

Sales practices utilized by our distributors that are locally acceptable may not comply with sales practices standards required under the laws of the U.K., U.S. or other jurisdictions that apply to us, which could create additional compliance costs and risk and demand additional resources, time and management attention. If our sales and marketing efforts are not successful, we may not achieve significant market acceptance for our products, which would materially and adversely impact our business and anticipated financial condition and results of operations.

If we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenue or achieve and sustain profitability.

The diagnostics industry, including in vitro diagnostics (“IVD”) and POC systems, is rapidly evolving, and we face competition from companies that offer products in our targeted application areas. Our principal competition comes from established diagnostic companies. Our competitors include laboratory or POC companies such as Abbott Laboratories, Becton, Dickinson and Company, Danaher Corporation, GenMark Diagnostics, Inc., Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Quidel Corporation, Roche Diagnostics Corporation, Siemens Healthineers AG, Inc. and many others. In addition to diagnostic systems, we believe these companies may also develop their own approved or cleared diagnostic kits, which can be sold to the clients who have purchased their systems. In addition, new and existing companies could seek to develop tests that compete with ours.

For each of our eight available tests, we face competition from other commercially available tests, including:

•For our SARS-CoV-2 antigen test and SARS-CoV-2 antigen pool test: Quidel Sofia, BD Veritor Plus System, Abbott BinaxNOW COVID-19 Ag Card, general lateral flow tests and others.

•For our SARS CoV-2 antibody test: Roche Elecsys Anti-SARS-CoV-2, Accelerate Diagnostics BioCheck SARS-CoV-2 Antibody Test Kits, SD Biosensor Q COVID-19 IgM/IgG Rapid Test and others.

•For our SARS-CoV-2 Ag & Flu A/B tests: same as above antigen tests, Roche and SD Biosensor SARS-CoV-2 and Influenza A/B tests.

•For our INR test: Roche Coaguchek and others.

•For our D-Dimer test: Roche Cobas h232 and others.

•For our CRP test: Affinion (Abbott) and others.

Our tests in development are designed and validated against their respective lab standard.

Many of our current and future competitors are either publicly traded, or are divisions of publicly-traded companies, and may enjoy a number of competitive technological, financial and market access advantages over us, including:

•greater name and brand recognition;

•substantially greater financial and human resources and expertise;

•broader or superior product lines;

•larger sales forces and more established distributor networks;

10

•substantial intellectual property portfolios;

•larger and more established customer bases, relationships with healthcare professionals and third-party payors; and

•better established, larger scale, and lower cost manufacturing capabilities.

We believe that the principal competitive factors in all of our target markets include:

•cost of instruments and consumables;

•flexibility and ease of use;

•accuracy, including sensitivity and specificity, and reproducibility of results;

•reputation among customers;

•innovation in product offerings; and

•compatibility with existing processes.

Furthermore, even if we do develop new marketable products or services, our current and future competitors may develop products and services that are more commercially attractive than ours, and they may bring those products and services to market earlier or more effectively than us. If we are unable to compete successfully against current or future competitors, we may be unable to increase market acceptance for and sales of our Platform, which could prevent us from increasing or sustaining our revenues or achieving sustained profitability. Our competitors may also use their patent portfolios, developed in connection with developing their tests, to allege that our Platform infringes their patents, and we could face litigation with respect to such allegations and the validity of such patents.

The diagnostic industry is subject to rapidly changing technology which could make our Platform and other products we develop obsolete.

Our industry is characterized by rapid technological changes, frequent new product introductions and enhancements and evolving industry standards, all of which could make our Platform and the other products we are developing obsolete. Our future success will depend on our ability to anticipate and keep pace with the evolving needs of our customers on a timely and cost-effective basis and to pursue new market opportunities that develop as a result of technological and scientific advances. The attractiveness of our Platform partly depends on the ability to continue to add additional assays and tests in a timely manner. Failure to deliver such tests in the timelines suggested may affect our business plan and ability to obtain greater market penetration, or otherwise cause us to lose market share.

In recent years, there have been advances in methods used to analyze very large amounts of information. We must continuously enhance our Platform and develop new products to keep pace with evolving standards of care. If we do not update our Platform, including successfully developing new tests for our Instrument, such as multiplex test strips with the ability to detect an increased number of markers in a single sample, it could become obsolete and sales of our Platform and any new products could decline, which would have a material adverse effect on our business, financial condition, and results of operations.

Our business and reputation will suffer if our products do not perform as expected, particularly as test strip volume increases, or if we are unable to establish and comply with stringent quality standards to assure that the highest level of quality is observed in the performance of our Platform, our Amira System and our Fast Lab Solutions.