Transforming Community-Based Healthcare January 18, 2022 Exhibit 99.1

FORWARD-LOOKING STATEMENTS All statements other than statements of historical facts contained in this presentation are forward-looking statements. Forward-looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics, projections of market opportunity and market share. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of LumiraDx Limited (“LumiraDx”)’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of LumiraDx. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; risks relating to the uncertainty of the projected financial information with respect to LumiraDx; risks relating to the uncertainty of the projected financial information with respect to LumiraDx; risks related to the rollout of LumiraDx’s Platform and tests and the timing of expected business and regulatory milestones; the effects of competition on LumiraDx’s future business; and those factors discussed under the header “Risk Factors” in the Proxy Statement and Prospectus filed pursuant to Rule 424B(3) with the Securities and Exchange Commission, or SEC, on September 30, 2021 and other filings with the SEC. If any of these risks materialize or LumiraDx’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that LumiraDx presently knows or that LumiraDx currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect LumiraDx’s expectations, plans or forecasts of future events and views as of the date of this presentation. LumiraDx anticipates that subsequent events and developments will cause LumiraDx’s assessments to change. However, while LumiraDx may elect to update these forward-looking statements at some point in the future, LumiraDx specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing LumiraDx’s assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. LumiraDx has no any obligation to update this presentation. INDUSTRY AND MARKET DATA This presentation includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties as well as our own estimates of potential market opportunities. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. LumiraDx believes that these third-party sources and estimates are reliable, but have not independently verified them. LumiraDx’s estimates of the potential market opportunities for its Platform include several key assumptions based on industry knowledge, industry publications, third-party research and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While LumiraDx believes that its own internal assumptions are reasonable, no independent source has verified such assumptions. The industry in which LumiraDx operates is subject to a high degree of uncertainty and risk due to a variety of important factors that could cause results to differ materially from those expressed in the estimates made by third parties and by LumiraDx. LumiraDx believes that due to the forward-looking nature of the foregoing projections, a quantitative reconciliation of non-IFRS measures to IFRS cannot be made available without unreasonable effort due to the nature and complexity of the reconciling item. Forward looking projections are not prepared in accordance with accounting standards. Consequently, no disclosure of estimated comparable IFRS measures is included and no reconciliation of the forward-looking non-IFRS financial measure is included. USE OF PROJECTIONS This presentation contains projected financial information with respect to LumiraDx, including, but not limited to, estimated results for fiscal years 2021 and 2024. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward-Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. LumiraDx’s independent auditor has not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, such auditor has not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. FINANCIAL INFORMATION; NON-IFRS FINANCIAL MEASURES Some of the financial information and data contained in this presentation is unaudited and does not conform to Regulation S-X promulgated under the Securities Act of 1933, as amended. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any SEC filings by LumiraDx. Some of the financial information and data contained in this presentation, has not been prepared in accordance with IFRS. LumiraDx believes these non-IFRS measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to LumiraDx’s financial condition and results of operations. LumiraDx’s management uses these non-IFRS measures for trend analyses, for purposes of determining management incentive compensation and for budgeting and planning purposes. LumiraDx believes that the use of these non-IFRS financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing LumiraDx’s financial measures with other similar companies, many of which present similar non-IFRS/GAAP financial measures to investors. The principal limitation of these non-IFRS financial measures is that they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-IFRS financial measures. All December 31, 2021 amounts are preliminary and subject to change in connection with the completion of the LumiraDx's audit for such period. Disclaimer

Our Mission We are focused on transforming community-based healthcare by providing fast, accurate and comprehensive diagnostic information to healthcare providers at the point of need, thereby enabling better medical decisions leading to improved outcomes at lower cost. Our diagnostic solutions are designed to be affordable and accessible for every individual around the world.

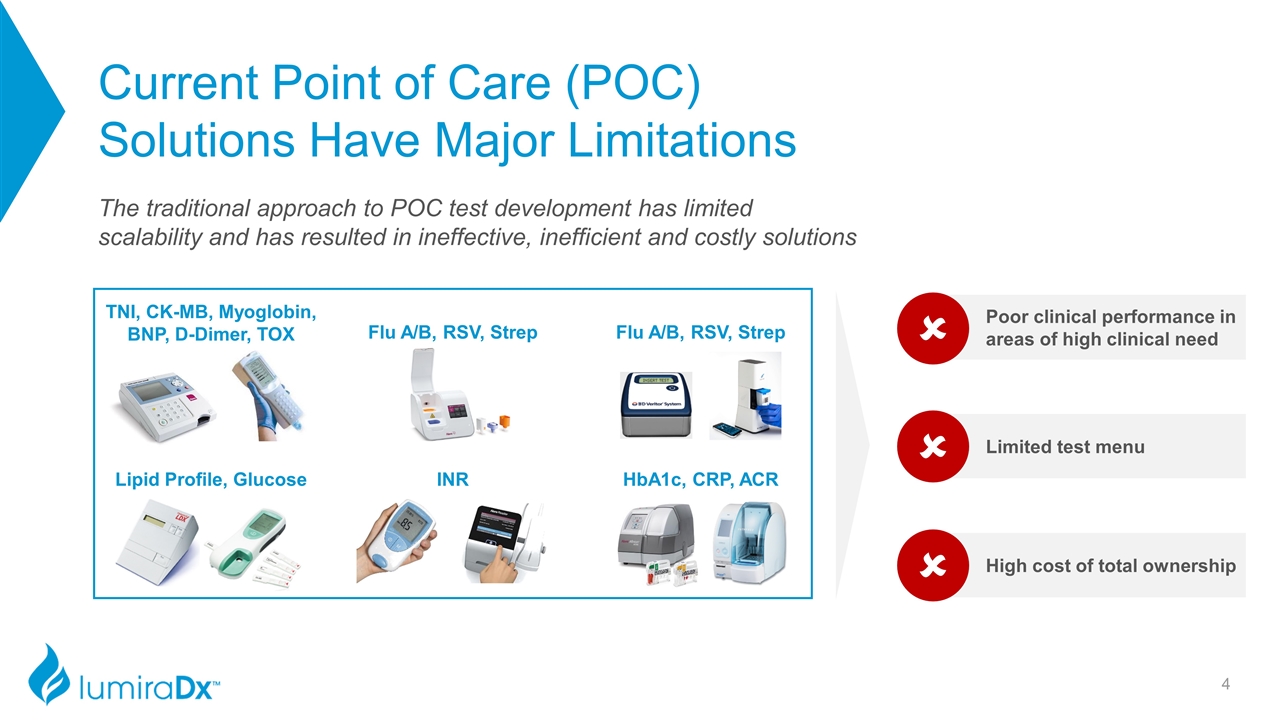

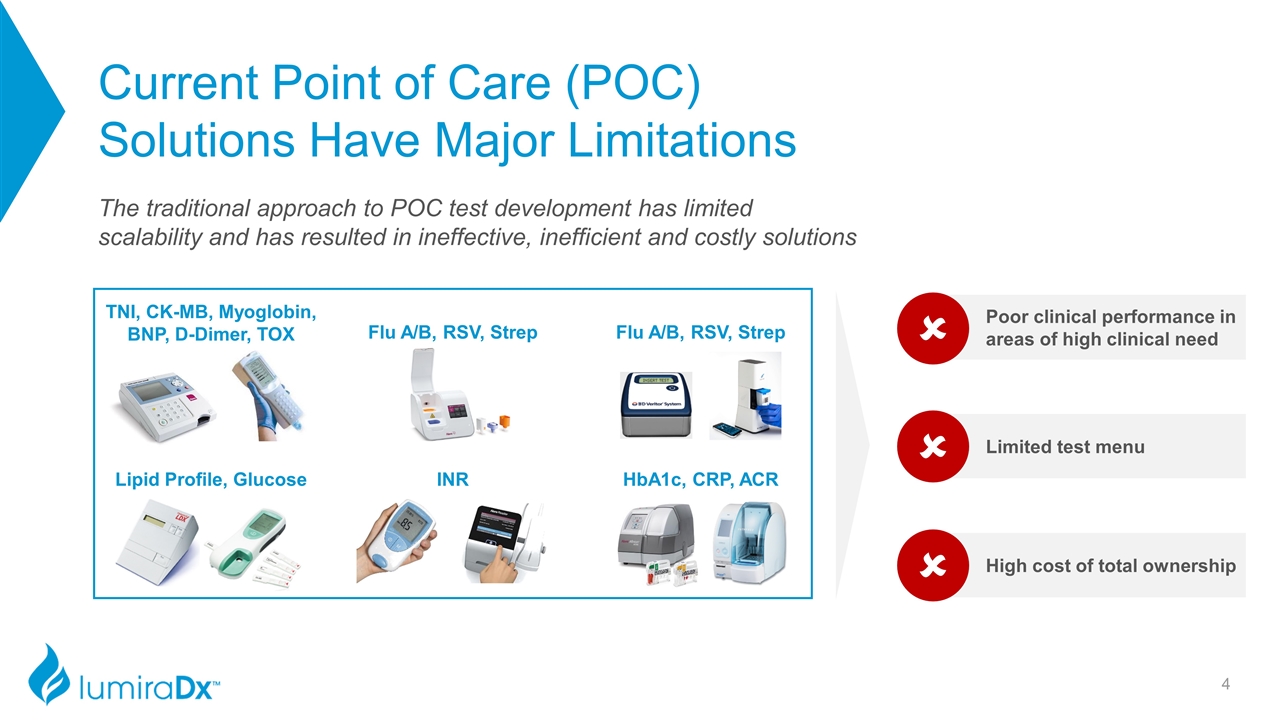

Current Point of Care (POC) Solutions Have Major Limitations The traditional approach to POC test development has limited scalability and has resulted in ineffective, inefficient and costly solutions Poor clinical performance in areas of high clinical need û Limited test menu û High cost of total ownership û Flu A/B, RSV, Strep Lipid Profile, Glucose HbA1c, CRP, ACR TNI, CK-MB, Myoglobin, BNP, D-Dimer, TOX Flu A/B, RSV, Strep INR

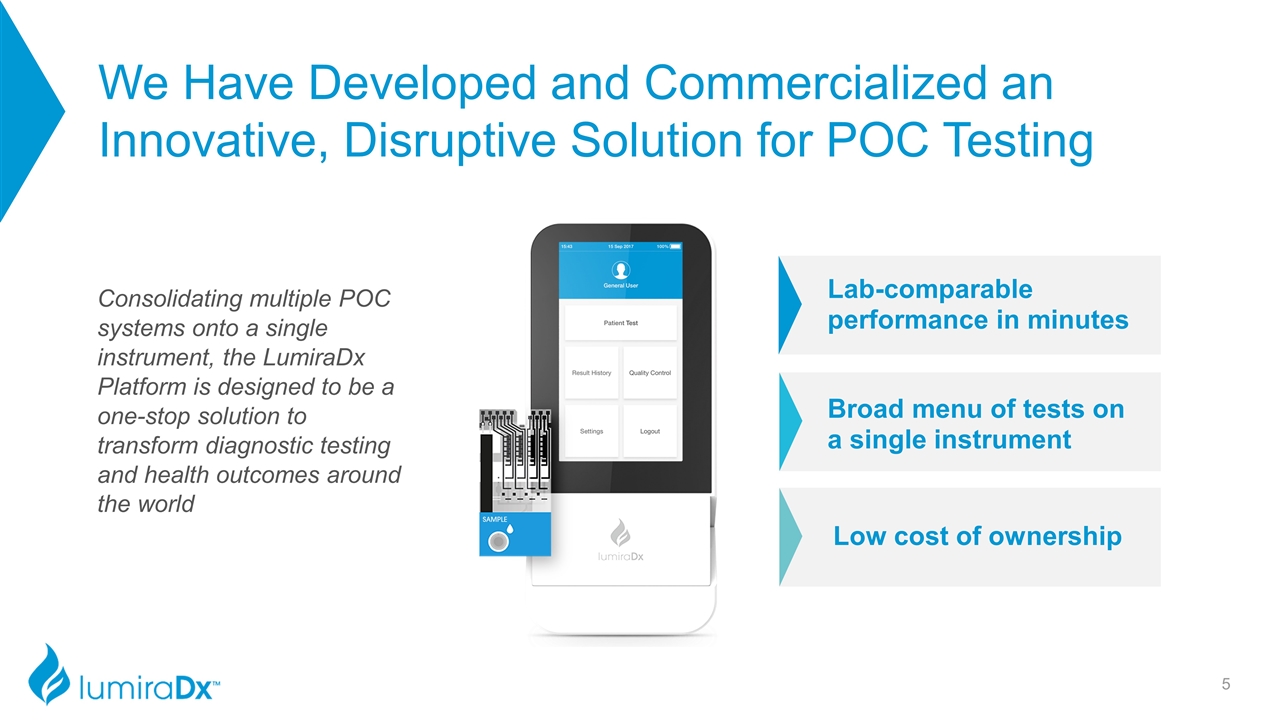

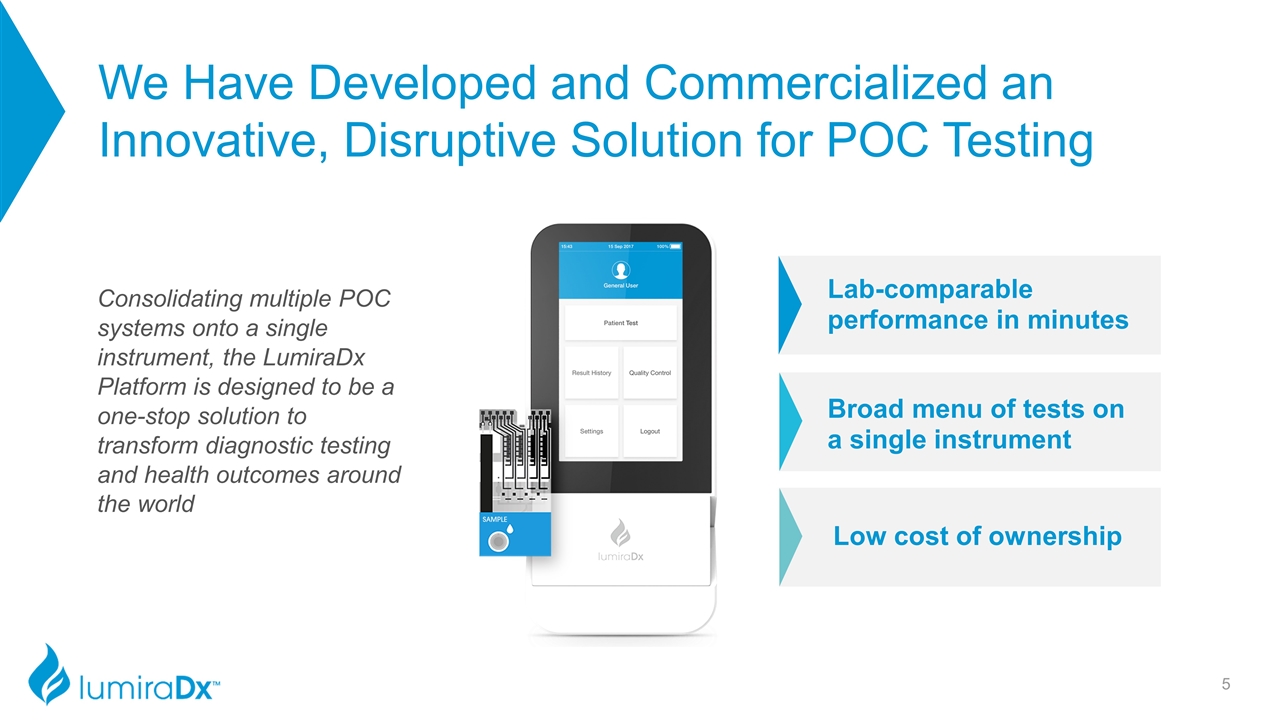

We Have Developed and Commercialized an Innovative, Disruptive Solution for POC Testing Consolidating multiple POC systems onto a single instrument, the LumiraDx Platform is designed to be a one-stop solution to transform diagnostic testing and health outcomes around the world Lab-comparable performance in minutes Broad menu of tests on a single instrument Low cost of ownership

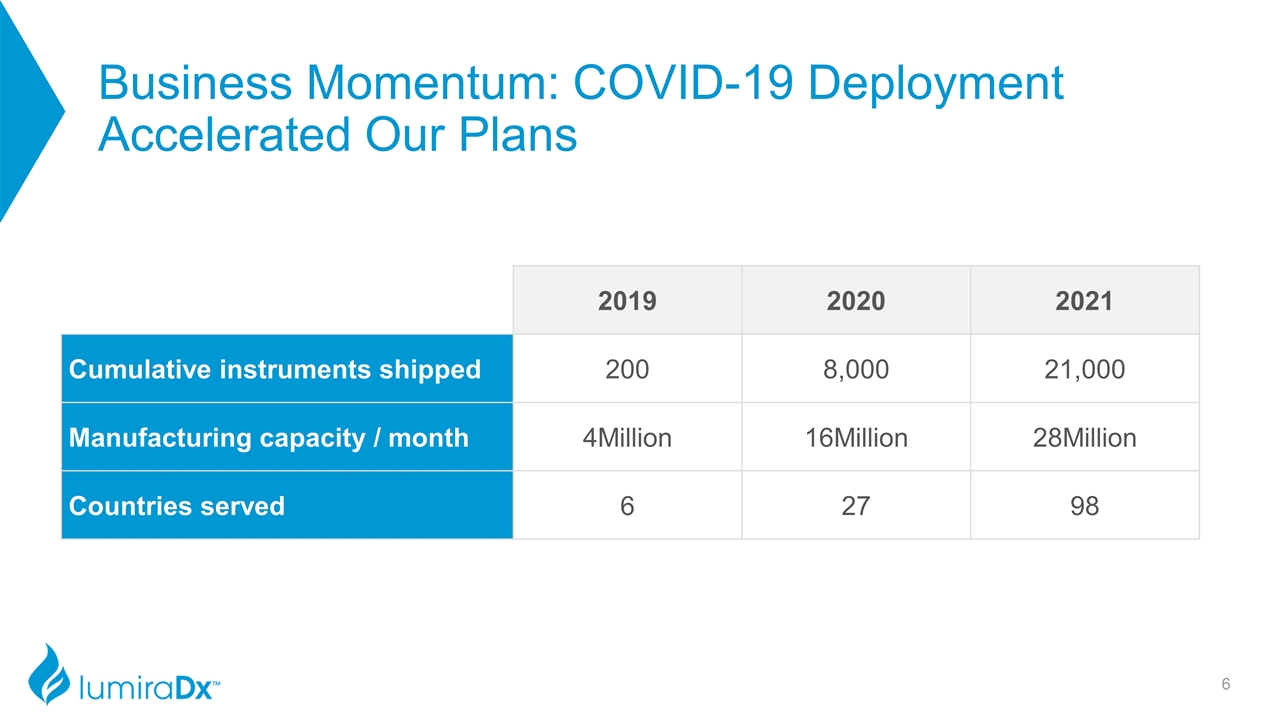

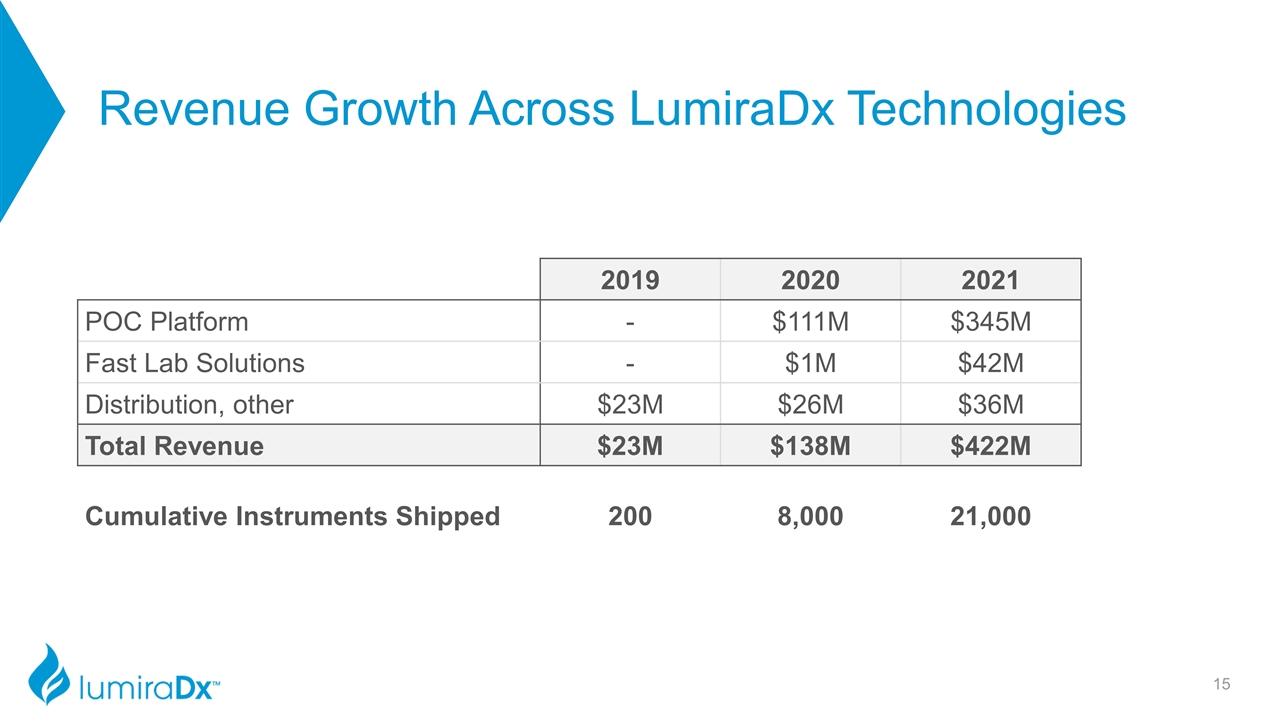

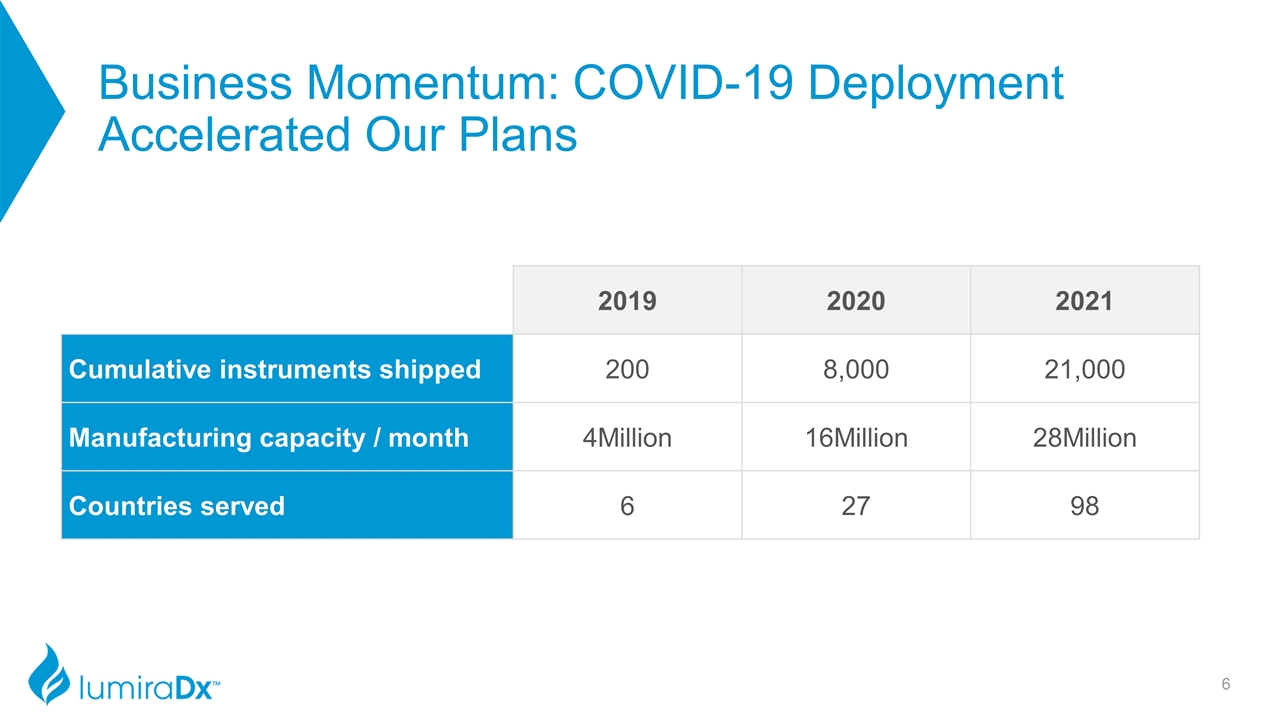

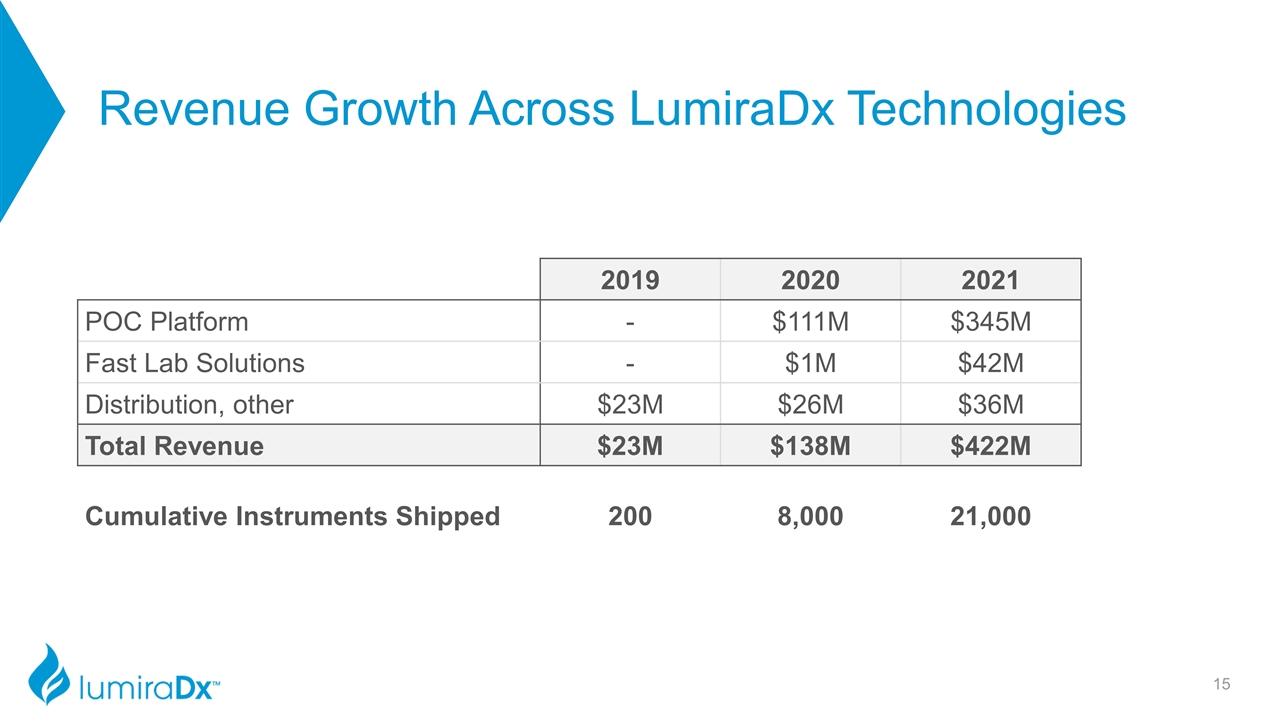

Business Momentum: COVID-19 Deployment Accelerated Our Plans 2019 2020 2021 Cumulative instruments shipped 200 8,000 21,000 Manufacturing capacity / month 4Million 16Million 28Million Countries served 6 27 98

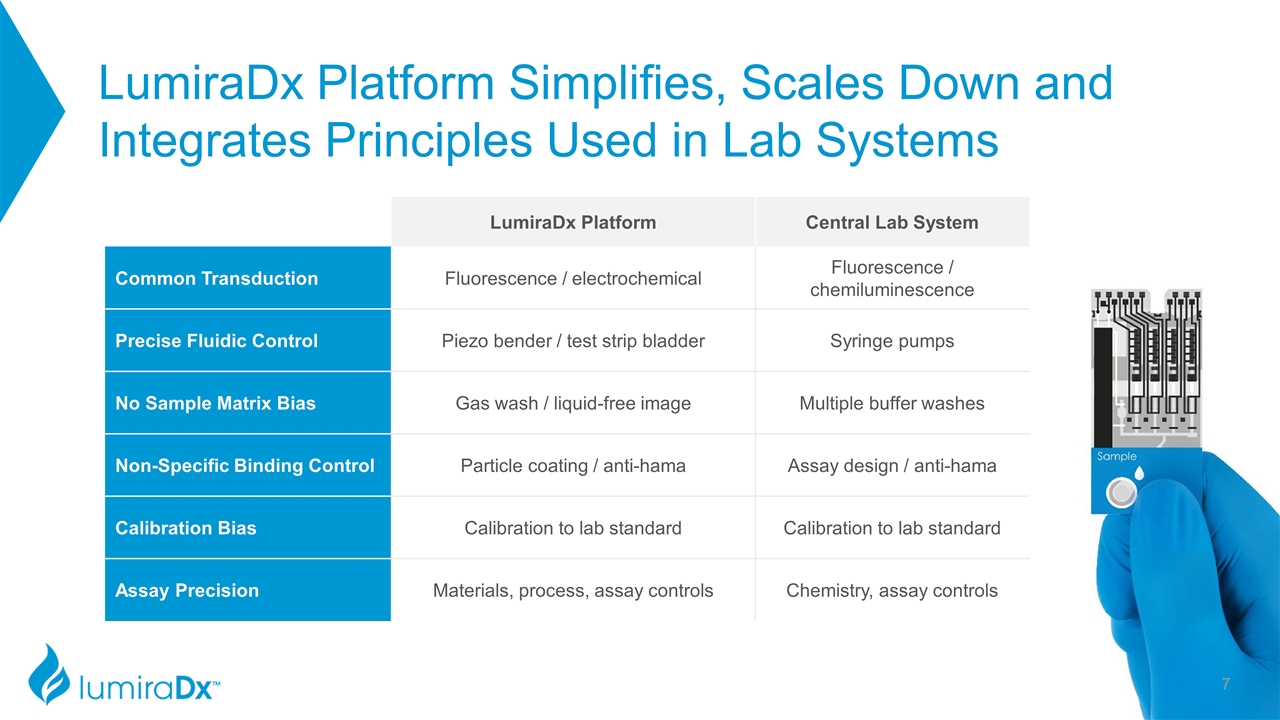

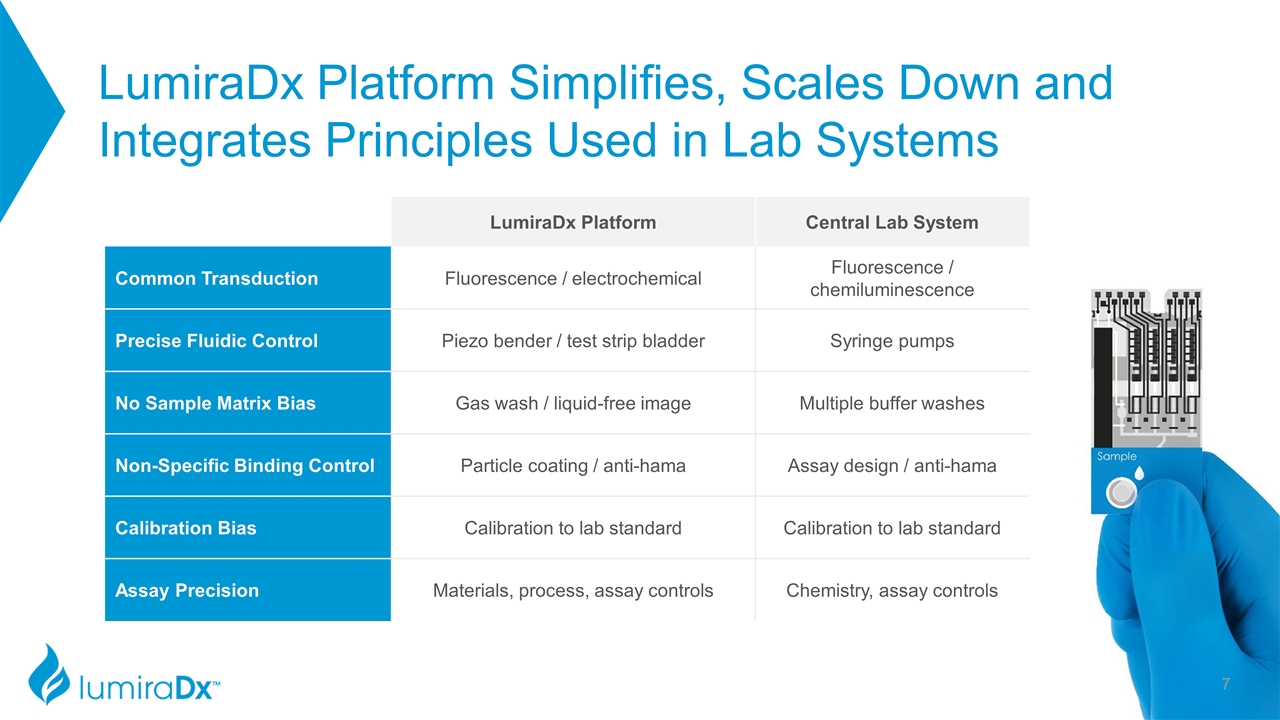

LumiraDx Platform Simplifies, Scales Down and Integrates Principles Used in Lab Systems LumiraDx Platform Central Lab System Common Transduction Fluorescence / electrochemical Fluorescence / chemiluminescence Precise Fluidic Control Piezo bender / test strip bladder Syringe pumps No Sample Matrix Bias Gas wash / liquid-free image Multiple buffer washes Non-Specific Binding Control Particle coating / anti-hama Assay design / anti-hama Calibration Bias Calibration to lab standard Calibration to lab standard Assay Precision Materials, process, assay controls Chemistry, assay controls

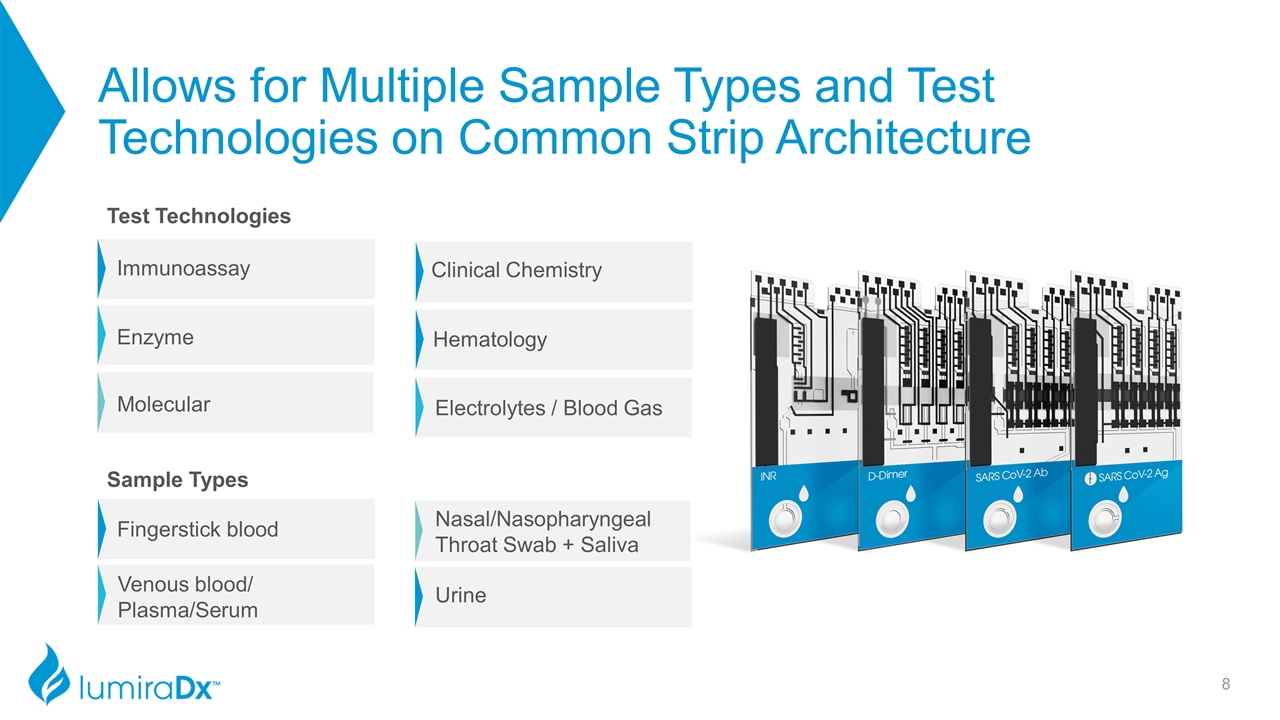

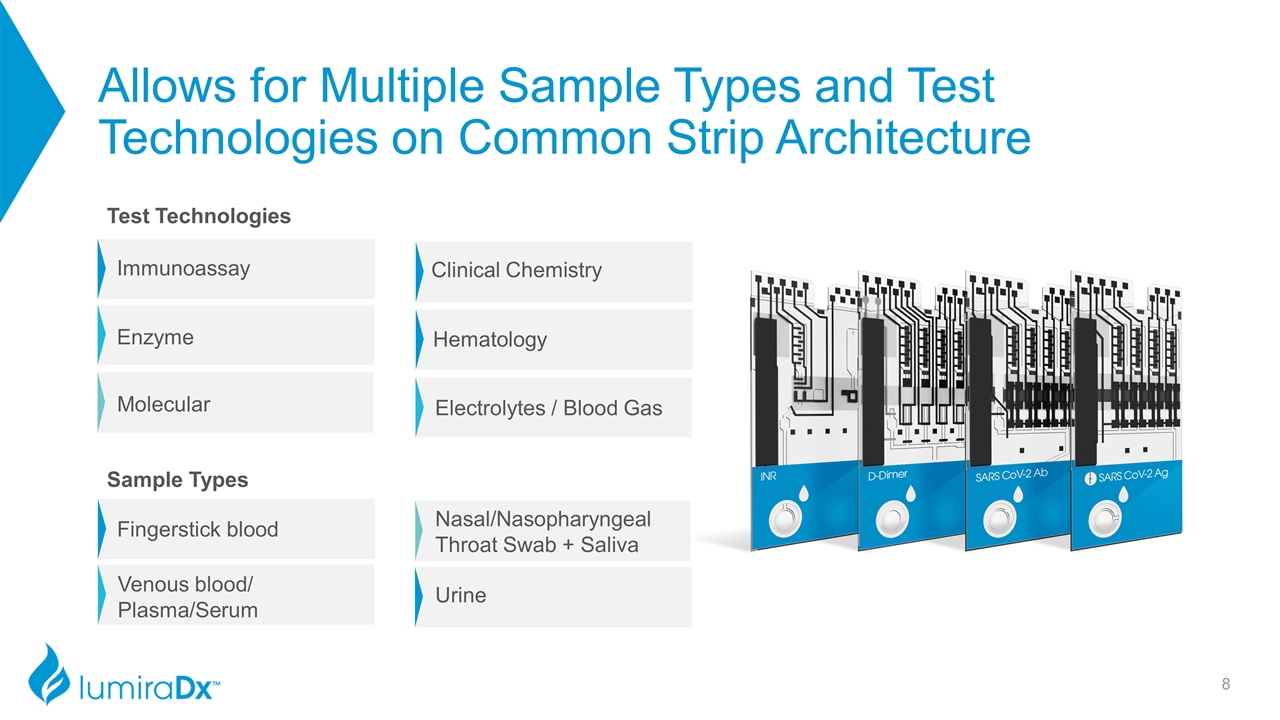

Allows for Multiple Sample Types and Test Technologies on Common Strip Architecture Immunoassay Enzyme Molecular Electrolytes / Blood Gas Clinical Chemistry Hematology Fingerstick blood Venous blood/ Plasma/Serum Nasal/Nasopharyngeal Throat Swab + Saliva Urine Test Technologies Sample Types

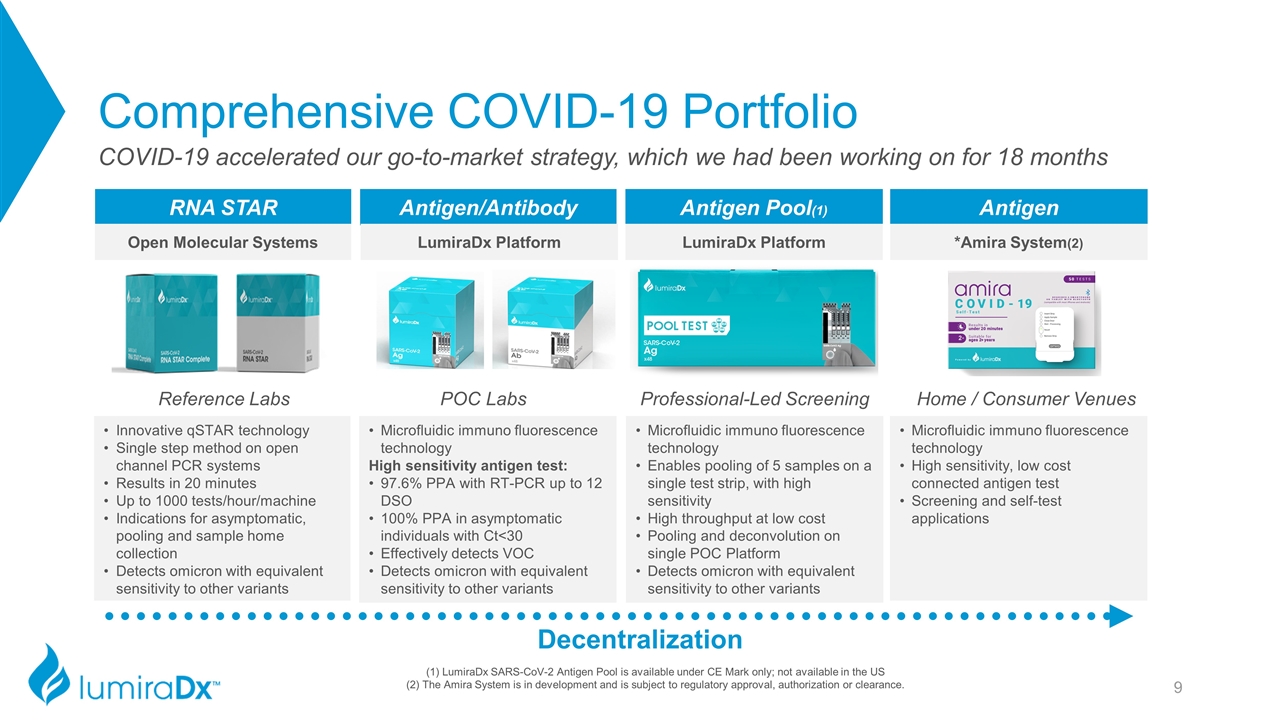

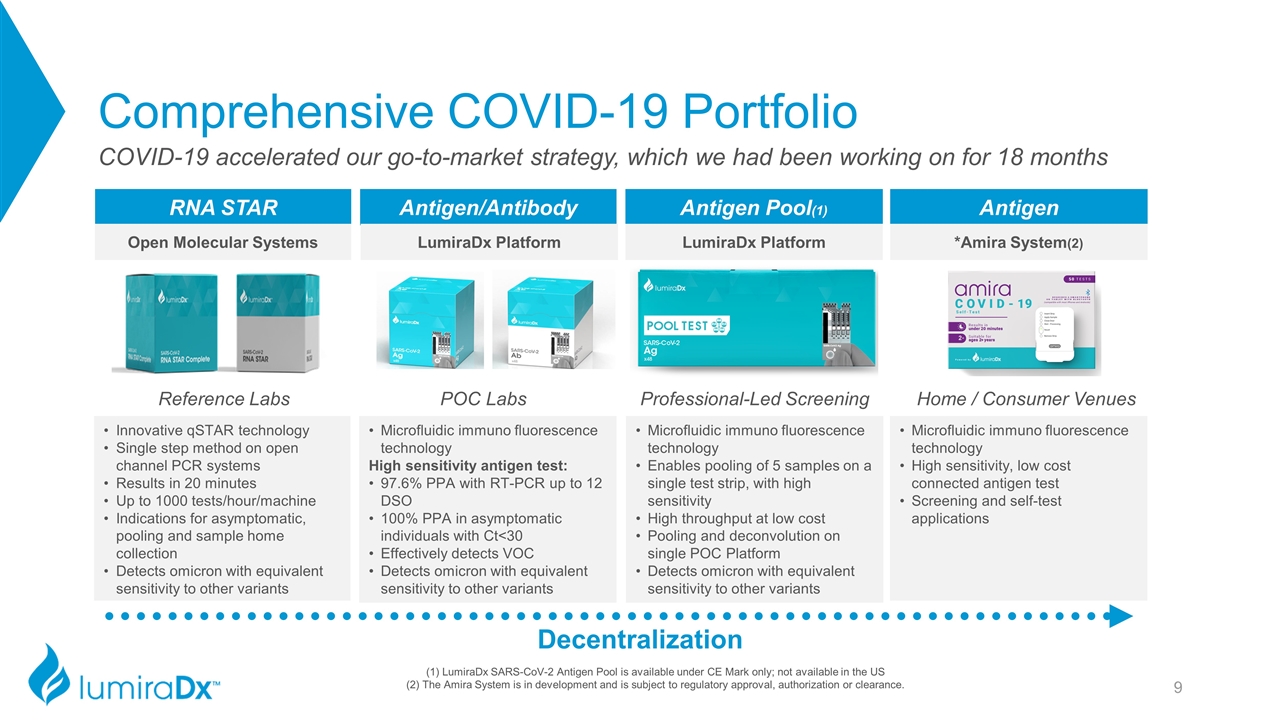

Reference Labs Comprehensive COVID-19 Portfolio Decentralization Antigen/Antibody Antigen Pool(1) Antigen RNA STAR POC Labs Professional-Led Screening Home / Consumer Venues COVID-19 accelerated our go-to-market strategy, which we had been working on for 18 months Open Molecular Systems LumiraDx Platform LumiraDx Platform *Amira System(2) (1) LumiraDx SARS-CoV-2 Antigen Pool is available under CE Mark only; not available in the US (2) The Amira System is in development and is subject to regulatory approval, authorization or clearance. Innovative qSTAR technology Single step method on open channel PCR systems Results in 20 minutes Up to 1000 tests/hour/machine Indications for asymptomatic, pooling and sample home collection Detects omicron with equivalent sensitivity to other variants Microfluidic immuno fluorescence technology High sensitivity antigen test: 97.6% PPA with RT-PCR up to 12 DSO 100% PPA in asymptomatic individuals with Ct<30 Effectively detects VOC Detects omicron with equivalent sensitivity to other variants Microfluidic immuno fluorescence technology Enables pooling of 5 samples on a single test strip, with high sensitivity High throughput at low cost Pooling and deconvolution on single POC Platform Detects omicron with equivalent sensitivity to other variants Microfluidic immuno fluorescence technology High sensitivity, low cost connected antigen test Screening and self-test applications

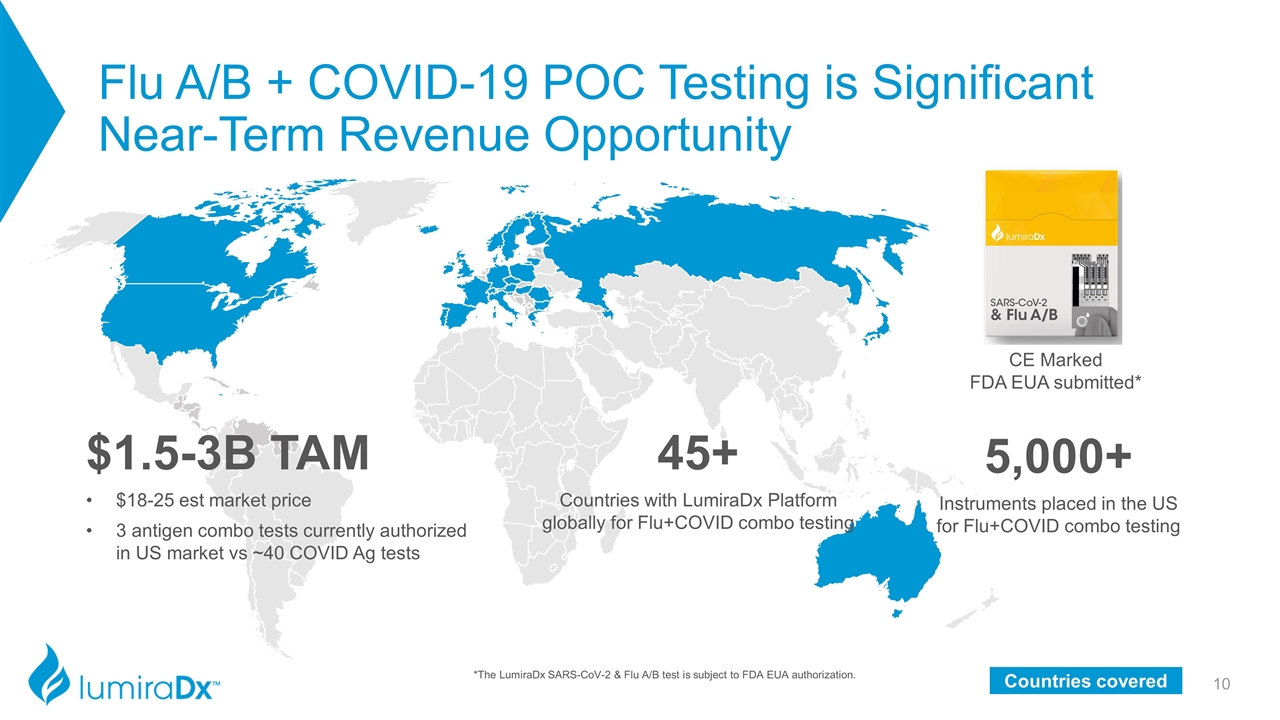

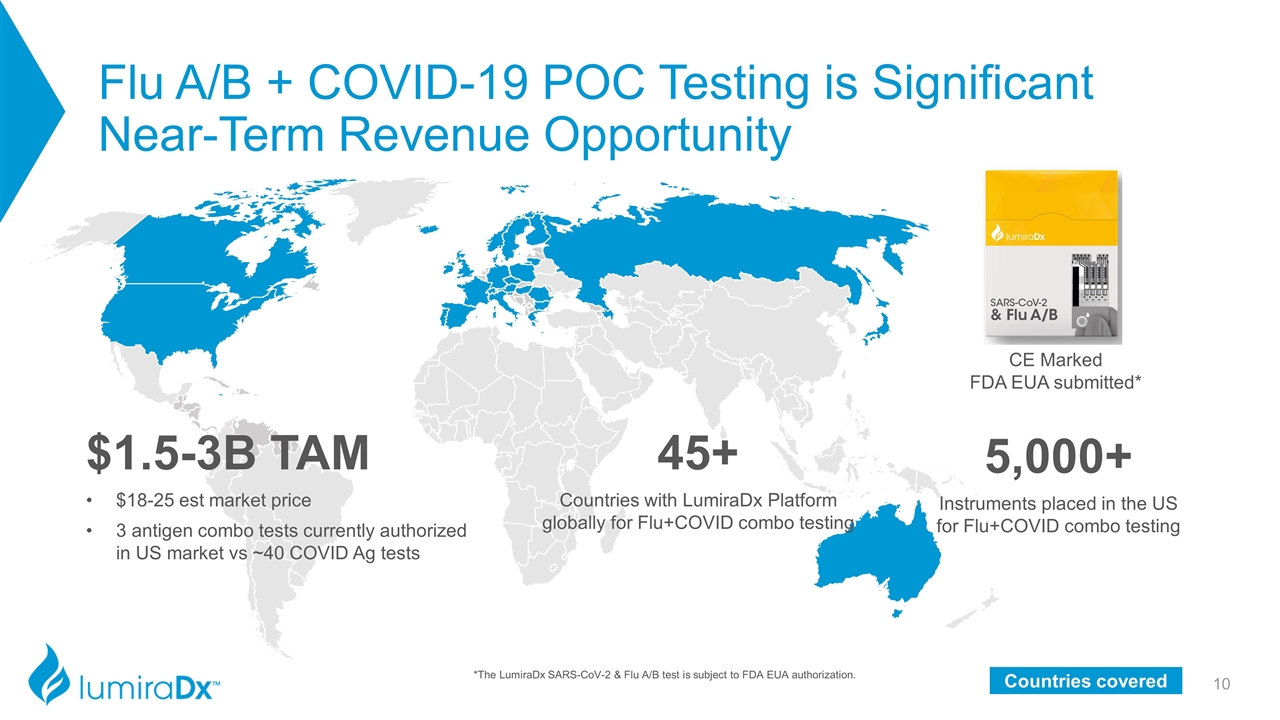

Flu A/B + COVID-19 POC Testing is Significant Near-Term Revenue Opportunity $1.5-3B TAM $18-25 est market price 3 antigen combo tests currently authorized in US market vs ~40 COVID Ag tests 45+ Countries with LumiraDx Platform globally for Flu+COVID combo testing 5,000+ Instruments placed in the US for Flu+COVID combo testing Countries covered CE Marked FDA EUA submitted* *The LumiraDx SARS-CoV-2 & Flu A/B test is subject to FDA EUA authorization.

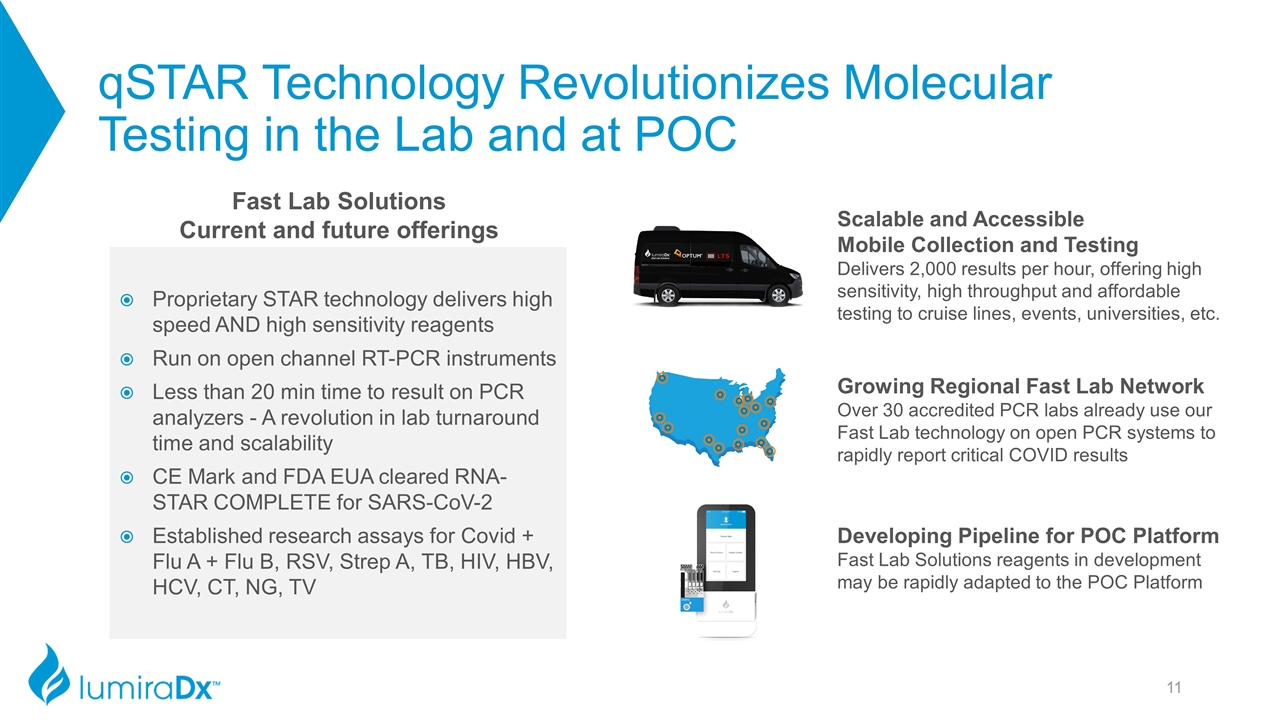

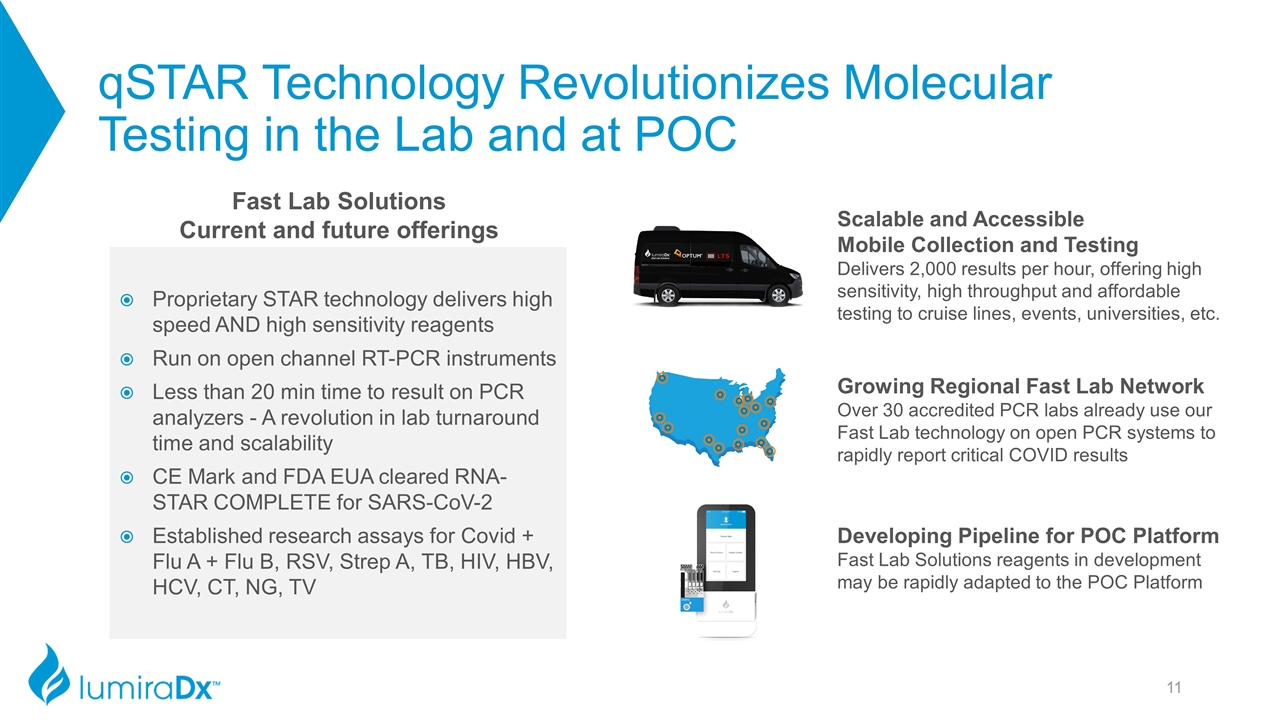

qSTAR Technology Revolutionizes Molecular Testing in the Lab and at POC Proprietary STAR technology delivers high speed AND high sensitivity reagents Run on open channel RT-PCR instruments Less than 20 min time to result on PCR analyzers - A revolution in lab turnaround time and scalability CE Mark and FDA EUA cleared RNA-STAR COMPLETE for SARS-CoV-2 Established research assays for Covid + Flu A + Flu B, RSV, Strep A, TB, HIV, HBV, HCV, CT, NG, TV Fast Lab Solutions Current and future offerings Growing Regional Fast Lab Network Over 30 accredited PCR labs already use our Fast Lab technology on open PCR systems to rapidly report critical COVID results Scalable and Accessible Mobile Collection and Testing Delivers 2,000 results per hour, offering high sensitivity, high throughput and affordable testing to cruise lines, events, universities, etc. Developing Pipeline for POC Platform Fast Lab Solutions reagents in development may be rapidly adapted to the POC Platform

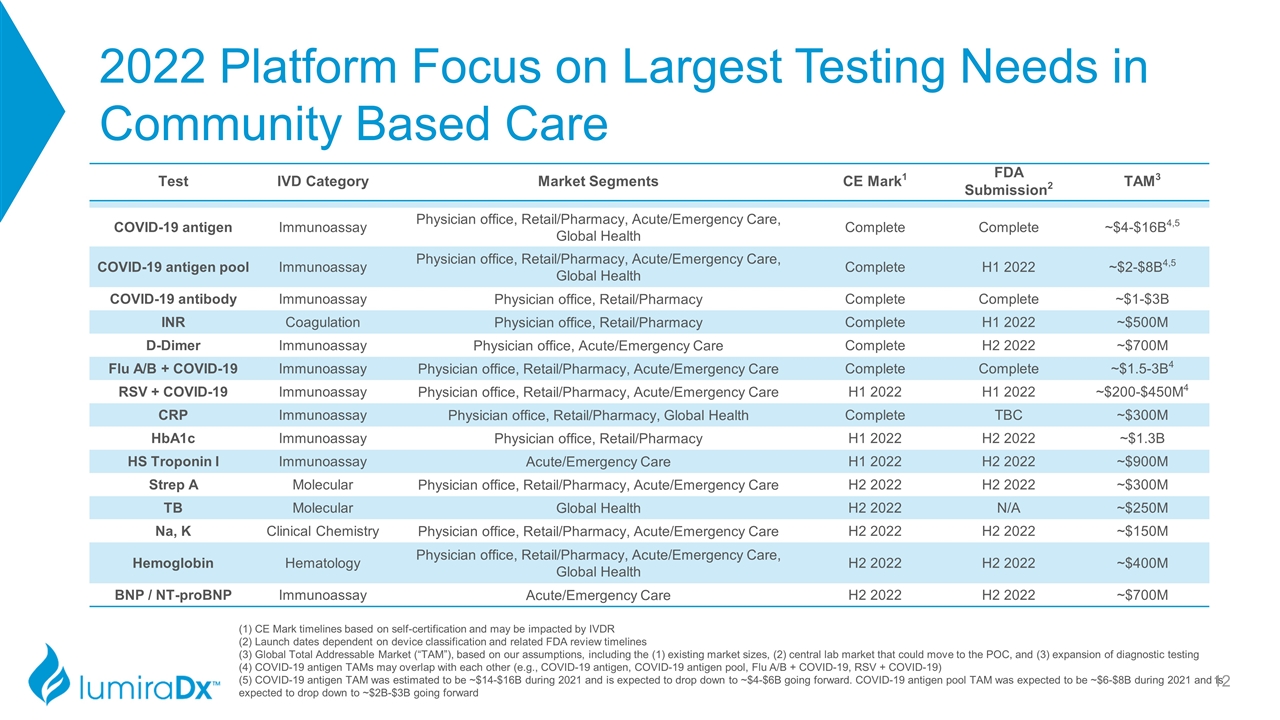

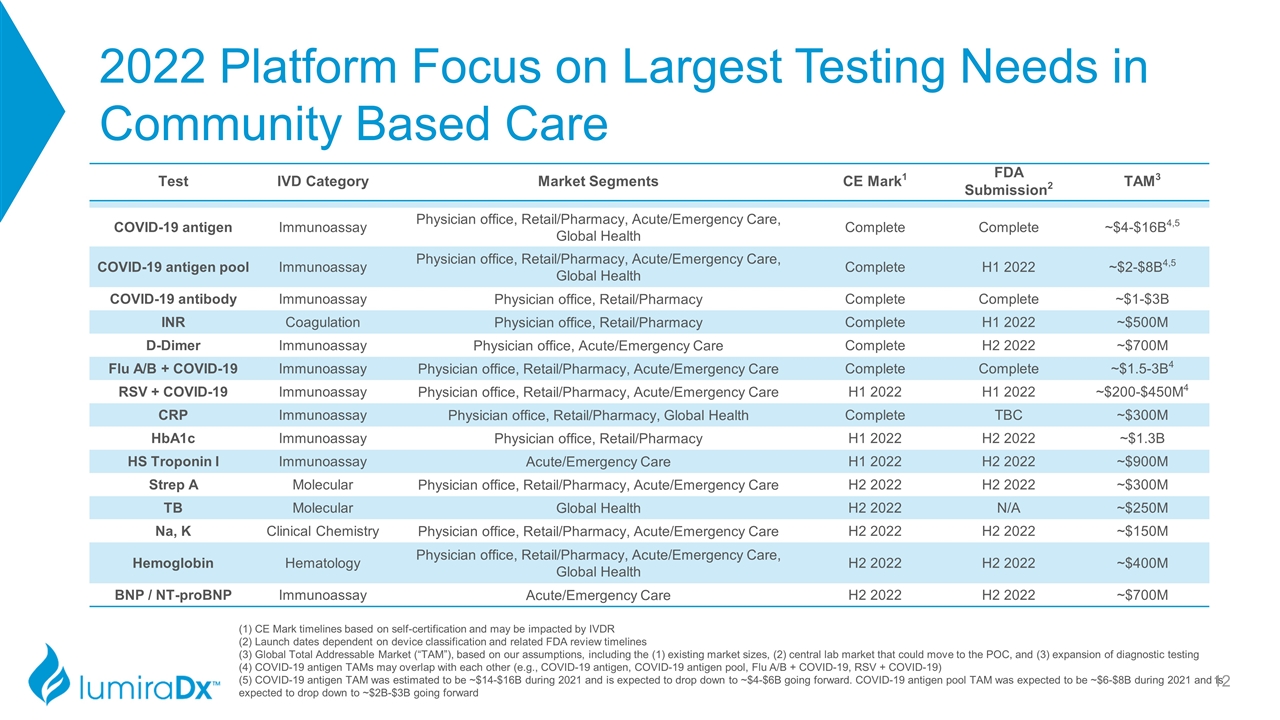

2022 Platform Focus on Largest Testing Needs in Community Based Care Test IVD Category Market Segments CE Mark1 FDA Submission2 TAM3 COVID-19 antigen Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health Complete Complete ~$4-$16B4,5 COVID-19 antigen pool Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health Complete H1 2022 ~$2-$8B4,5 COVID-19 antibody Immunoassay Physician office, Retail/Pharmacy Complete Complete ~$1-$3B INR Coagulation Physician office, Retail/Pharmacy Complete H1 2022 ~$500M D-Dimer Immunoassay Physician office, Acute/Emergency Care Complete H2 2022 ~$700M Flu A/B + COVID-19 Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care Complete Complete ~$1.5-3B4 RSV + COVID-19 Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care H1 2022 H1 2022 ~$200-$450M4 CRP Immunoassay Physician office, Retail/Pharmacy, Global Health Complete TBC ~$300M HbA1c Immunoassay Physician office, Retail/Pharmacy H1 2022 H2 2022 ~$1.3B HS Troponin I Immunoassay Acute/Emergency Care H1 2022 H2 2022 ~$900M Strep A Molecular Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2022 H2 2022 ~$300M TB Molecular Global Health H2 2022 N/A ~$250M Na, K Clinical Chemistry Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2022 H2 2022 ~$150M Hemoglobin Hematology Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health H2 2022 H2 2022 ~$400M BNP / NT-proBNP Immunoassay Acute/Emergency Care H2 2022 H2 2022 ~$700M (1) CE Mark timelines based on self-certification and may be impacted by IVDR (2) Launch dates dependent on device classification and related FDA review timelines (3) Global Total Addressable Market (“TAM”), based on our assumptions, including the (1) existing market sizes, (2) central lab market that could move to the POC, and (3) expansion of diagnostic testing (4) COVID-19 antigen TAMs may overlap with each other (e.g., COVID-19 antigen, COVID-19 antigen pool, Flu A/B + COVID-19, RSV + COVID-19) (5) COVID-19 antigen TAM was estimated to be ~$14-$16B during 2021 and is expected to drop down to ~$4-$6B going forward. COVID-19 antigen pool TAM was expected to be ~$6-$8B during 2021 and is expected to drop down to ~$2B-$3B going forward

Customer Focused Growth Strategy: 3-Year Roadmap Physician Office / Pharmacy Acute / Emergency Care Global Health Instruments currently installed ~7,500 ~4,500 ~5,000 Strategic Partner Commercially Available INR D-Dimer COVID-19 Antigen COVID-19 Antibody CRP Flu A/B + COVID-19 D-Dimer COVID-19 Antigen COVID-19 Antibody Flu A/B + COVID-19 COVID-19 Antigen CRP Flu A/B + COVID-19 2022 Launch RSV + COVID-19 HbA1c Na, K Strep A Hemoglobin BNP / NT-proBNP RSV + COVID-19 HS Troponin Na, K Hemoglobin BNP / NT-proBNP TB Hemoglobin HbA1c 3 Year Roadmap Sexual Health Diabetes Cardiovascular disease Respiratory Cardiac Respiratory Hospital Acquired Infection Virology Vector Borne Disease Note: Total instrument shipments are 21,000 with 4,000 estimated for use in COVID-19 screening applications with future testing needs to be determined US Health Systems

21K Platform Placements Globally and Further Market Access Plans Instrument Placement Locations North America US registered: COVID-19 Ag (EUA), COVID-19 Ab (EUA), COVID + Flu A/B submitted Canada: COVID-19 Ag submitted Europe and Middle East CE Mark: COVID-19 Ag, COVID-19 Pool, COVID-19 Ab, INR, D-Dimer, CRP, COVID + Flu A/B Registrations underway in Middle East and Russia Africa WHO PQ: COVID-19 Ag and transition to country procurement in process, currently available through EUA South America Brazil (ANVISA): COVID-19 Ag, COVID-19 Ag Pool, COVID-19 Ab, D-Dimer, INR Colombia: COVID-19 Ag Asia Pacific India, Japan, Hong Kong, and Australia registered Registration underway in Indonesia, Thailand, Malaysia, Singapore, others

Revenue Growth Across LumiraDx Technologies 2019 2020 2021 POC Platform - $111M $345M Fast Lab Solutions - $1M $42M Distribution, other $23M $26M $36M Total Revenue $23M $138M $422M Cumulative Instruments Shipped 200 8,000 21,000

Financial Profile 2024 Projected Revenues - $1.00 - $1.25 Billion COVID/Flu products – 15%-20% of total revenue High Sensitivity Troponin – 15%-20% of total revenue BNP – 5%-10% of total revenue HbA1c – 5%-10% of total revenue Strong mix across other Platform pipeline products Amira Platform – 5%-10% of total revenue Fast Lab Solutions – 5%-7% of total revenue Gross Margins exceeding 65% Highly automated, scalable manufacturing drives immediately high gross margins Installed manufacturing equipment flexible across full product line, high efficiency Operating Margins approximately 40% LumiraDx Platform drives significant operational efficiencies for users and the Company Lower operating margins in near term to scale global commercial organization

Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.