Transforming Community-Based Healthcare May 2022 Exhibit 99.1

FORWARD-LOOKING STATEMENTS All statements other than statements of historical facts contained in this presentation are forward-looking statements. Forward-looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics, projections of market opportunity and market share. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of the management of LumiraDx Limited (“LumiraDx” or the “Company”) and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of LumiraDx. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; risks relating to the uncertainty of the projected financial information with respect to LumiraDx; risks related to the rollout of LumiraDx’s Platform and tests and the timing of expected business and regulatory milestones; the effects of competition on LumiraDx’s future business; uncertainty, downturns and changes in the markets LumiraDx serves, including demand for COVID-19 testing; and those factors discussed under the header “Risk Factors” in the Annual Report on Form 20-F filed by LumiraDx with the Securities and Exchange Commission, or SEC, on April 13, 2022 and other filings made by LumiraDx with the SEC. If any of these risks materialize or LumiraDx’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that LumiraDx presently knows or that LumiraDx currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect LumiraDx’s expectations, plans or forecasts of future events and views as of the date of this presentation. LumiraDx anticipates that subsequent events and developments will cause LumiraDx’s assessments to change. However, while LumiraDx may elect to update these forward-looking statements at some point in the future, LumiraDx specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing LumiraDx’s assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. LumiraDx has no obligation to update this presentation. INDUSTRY AND MARKET DATA This presentation includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties as well as our own estimates of potential market opportunities. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. LumiraDx believes that these third-party sources and estimates are reliable, but have not independently verified them. LumiraDx’s estimates of the potential market opportunities for its Platform include several key assumptions based on industry knowledge, industry publications, third-party research and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While LumiraDx believes that its own internal assumptions are reasonable, no independent source has verified such assumptions. The industry in which LumiraDx operates is subject to a high degree of uncertainty and risk due to a variety of important factors that could cause results to differ materially from those expressed in the estimates made by third parties and by LumiraDx. USE OF PROJECTIONS This presentation contains projected financial information with respect to LumiraDx, including, but not limited to, estimated results for fiscal year 2024. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward-Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. LumiraDx’s independent auditor has not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, such auditor has not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. Disclaimer

Our Mission We are focused on transforming community-based healthcare by providing fast, accurate and comprehensive diagnostic information to healthcare providers at the point of need, thereby enabling better medical decisions leading to improved outcomes at lower cost. Our diagnostic solutions are designed to be affordable and accessible for every individual around the world.

Current Point of Care (POC) Solutions Have Major Limitations The traditional approach to POC test development has limited scalability and has resulted in ineffective, inefficient and costly solutions Poor clinical performance in areas of high clinical need û Limited test menu û High cost of total ownership û Flu A/B, RSV, Strep Lipid Profile, Glucose HbA1c, CRP, ACR TNI, CK-MB, Myoglobin, BNP, D-Dimer, TOX Flu A/B, RSV, Strep INR

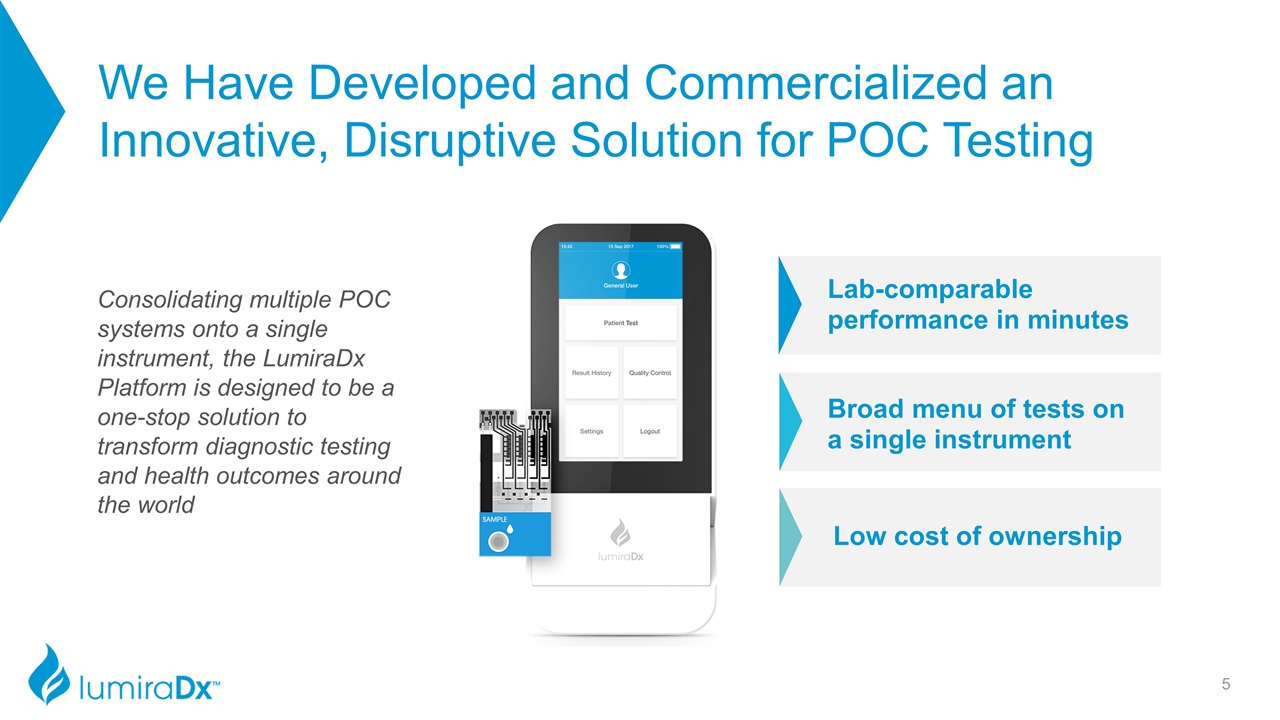

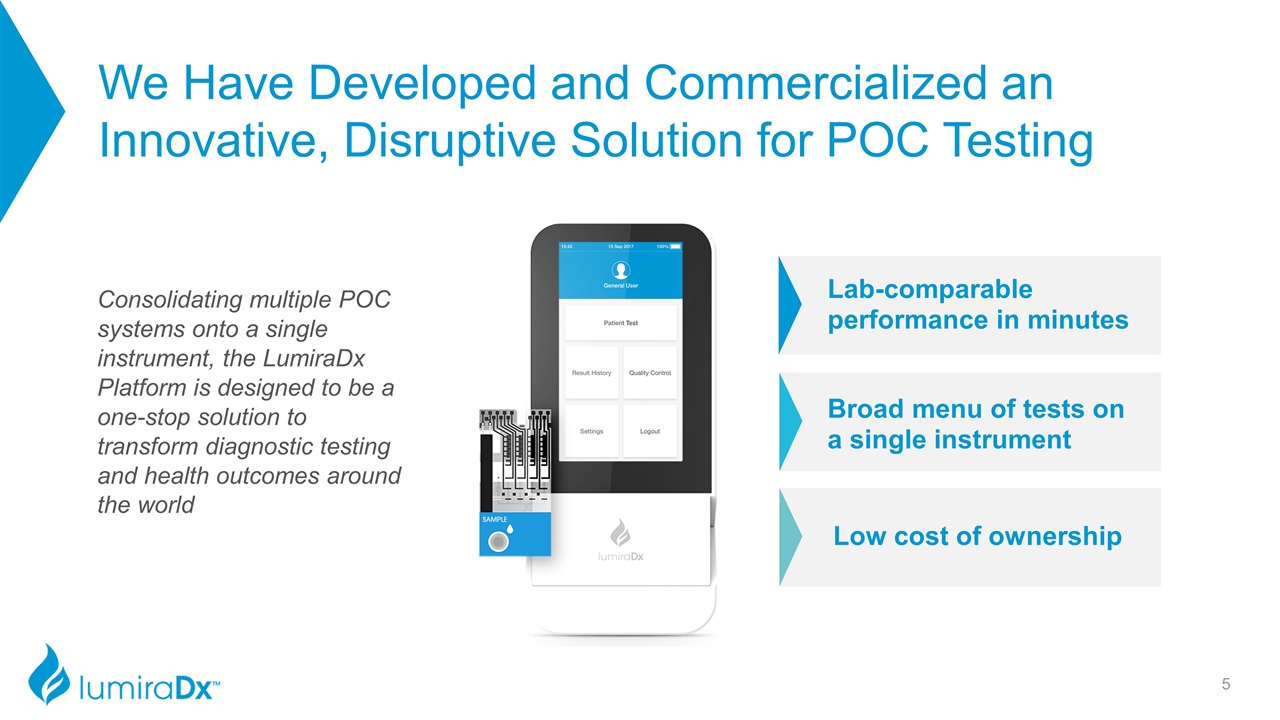

We Have Developed and Commercialized an Innovative, Disruptive Solution for POC Testing Consolidating multiple POC systems onto a single instrument, the LumiraDx Platform is designed to be a one-stop solution to transform diagnostic testing and health outcomes around the world Lab-comparable performance in minutes Broad menu of tests on a single instrument Low cost of ownership

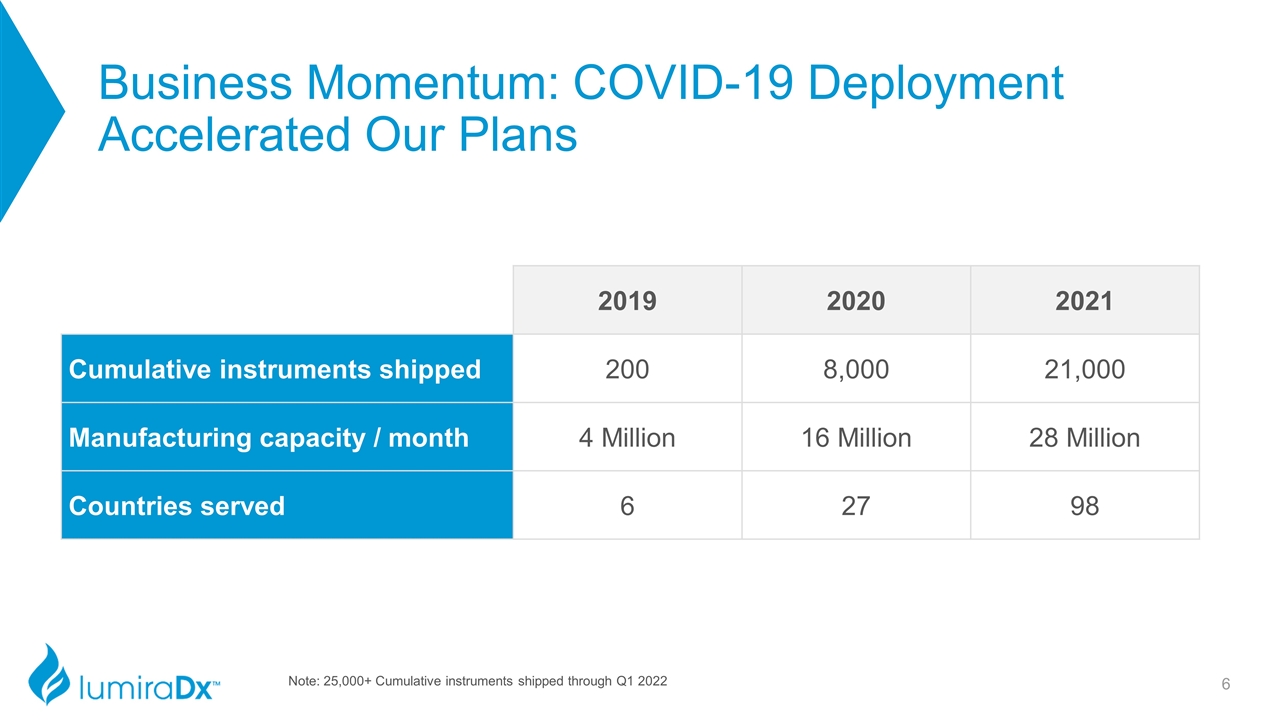

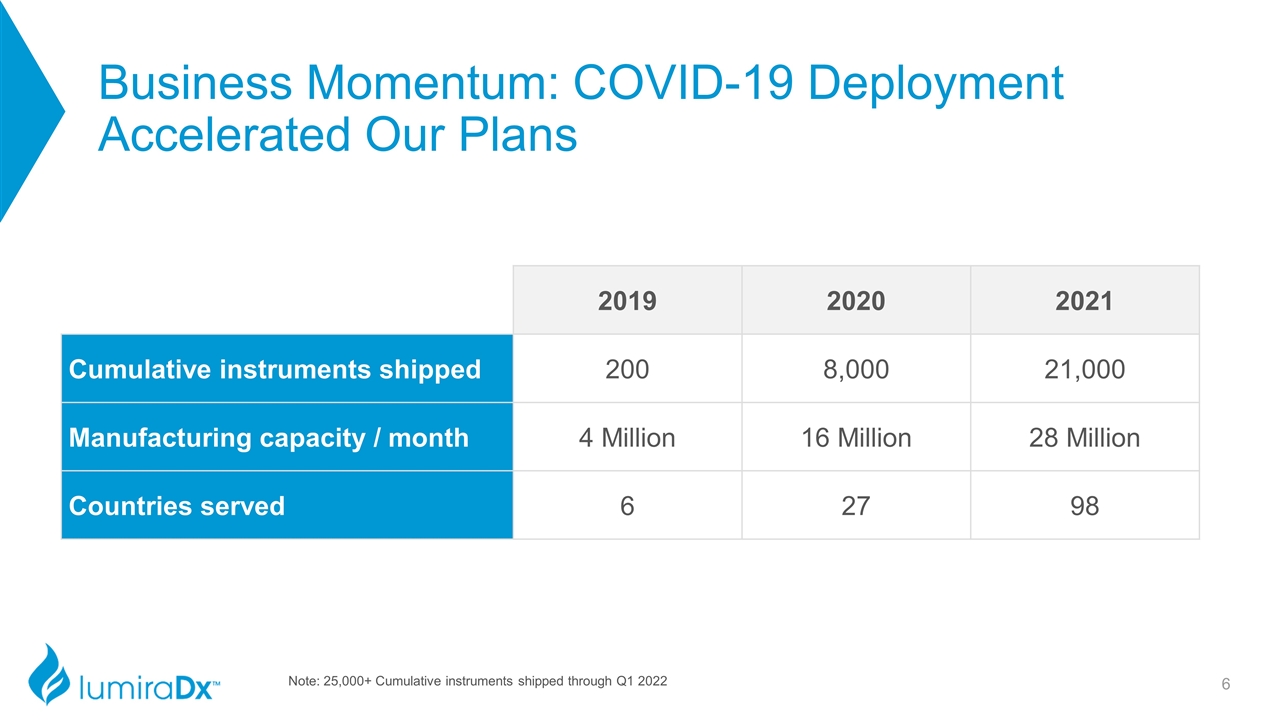

Business Momentum: COVID-19 Deployment Accelerated Our Plans 2019 2020 2021 Cumulative instruments shipped 200 8,000 21,000 Manufacturing capacity / month 4 Million 16 Million 28 Million Countries served 6 27 98 Note: 25,000+ Cumulative instruments shipped through Q1 2022

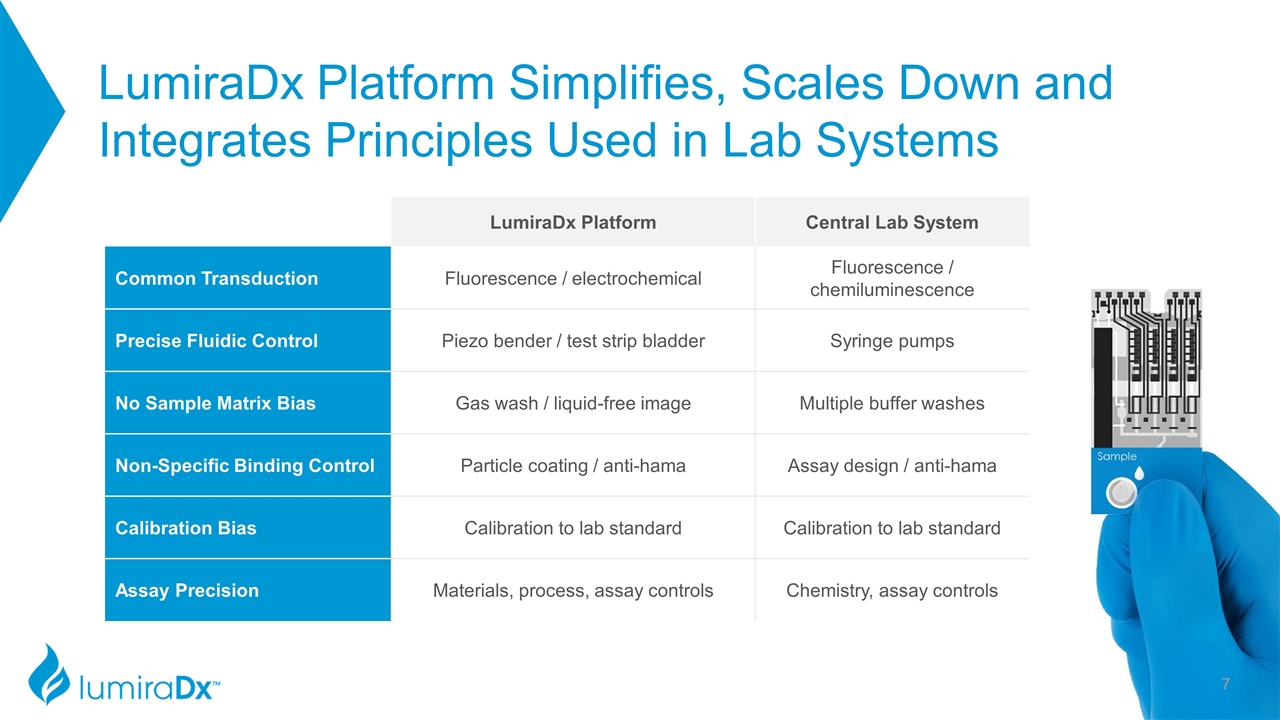

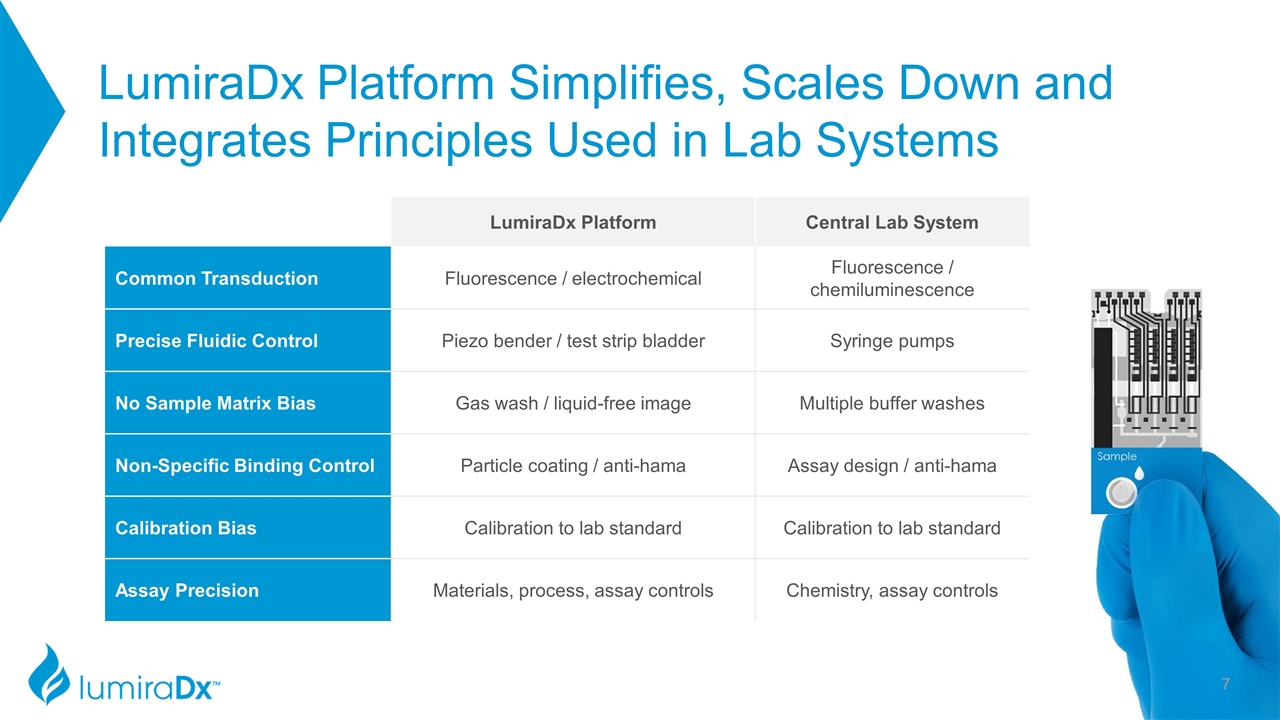

LumiraDx Platform Simplifies, Scales Down and Integrates Principles Used in Lab Systems LumiraDx Platform Central Lab System Common Transduction Fluorescence / electrochemical Fluorescence / chemiluminescence Precise Fluidic Control Piezo bender / test strip bladder Syringe pumps No Sample Matrix Bias Gas wash / liquid-free image Multiple buffer washes Non-Specific Binding Control Particle coating / anti-hama Assay design / anti-hama Calibration Bias Calibration to lab standard Calibration to lab standard Assay Precision Materials, process, assay controls Chemistry, assay controls

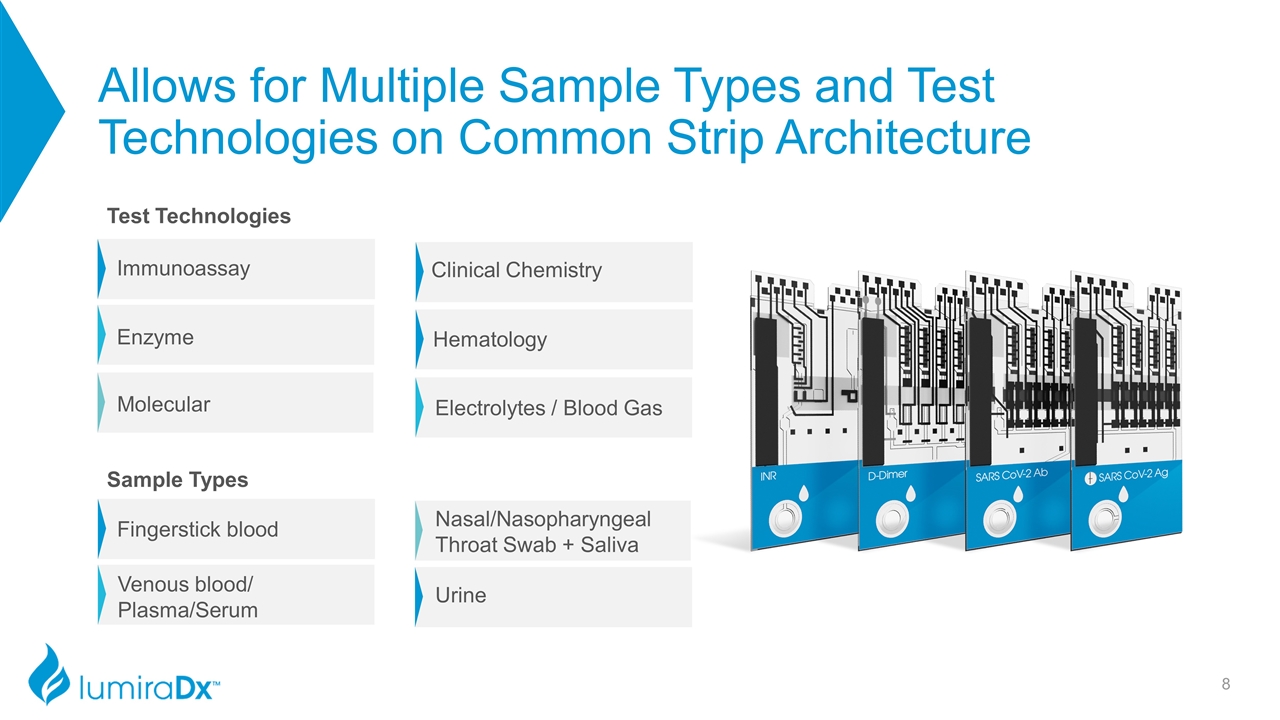

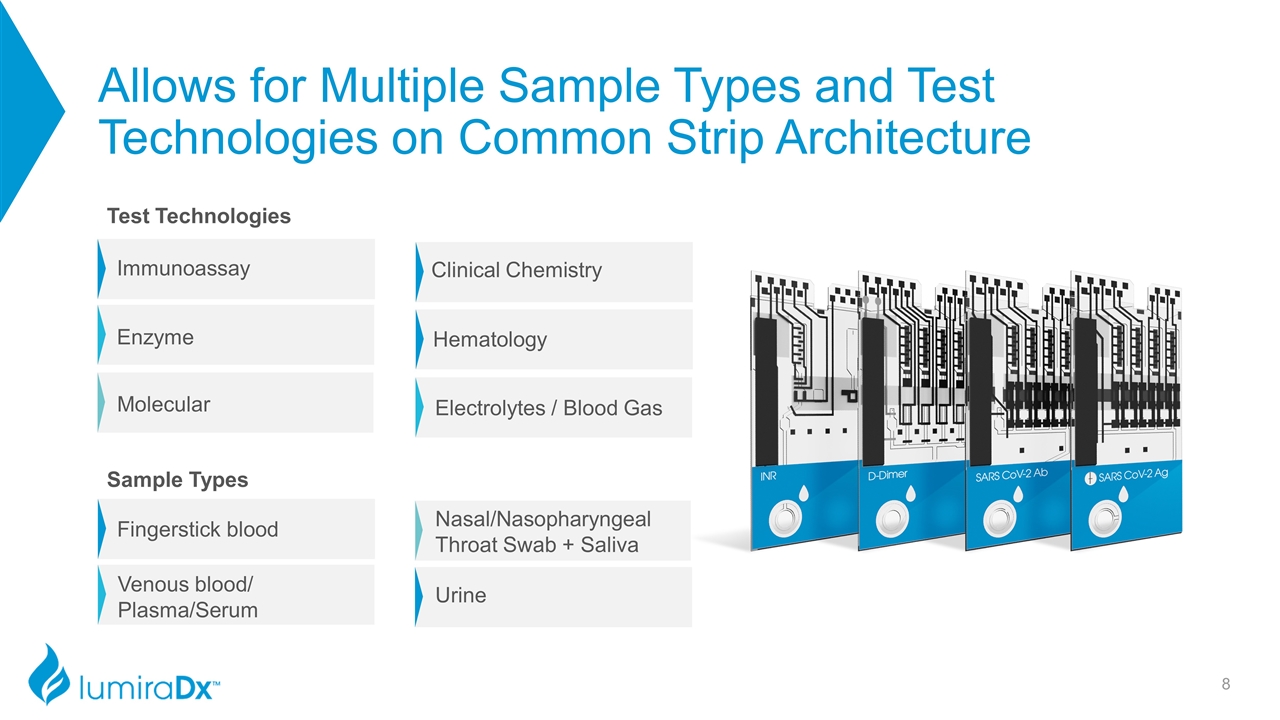

Allows for Multiple Sample Types and Test Technologies on Common Strip Architecture Immunoassay Enzyme Molecular Electrolytes / Blood Gas Clinical Chemistry Hematology Fingerstick blood Venous blood/ Plasma/Serum Nasal/Nasopharyngeal Throat Swab + Saliva Urine Test Technologies Sample Types

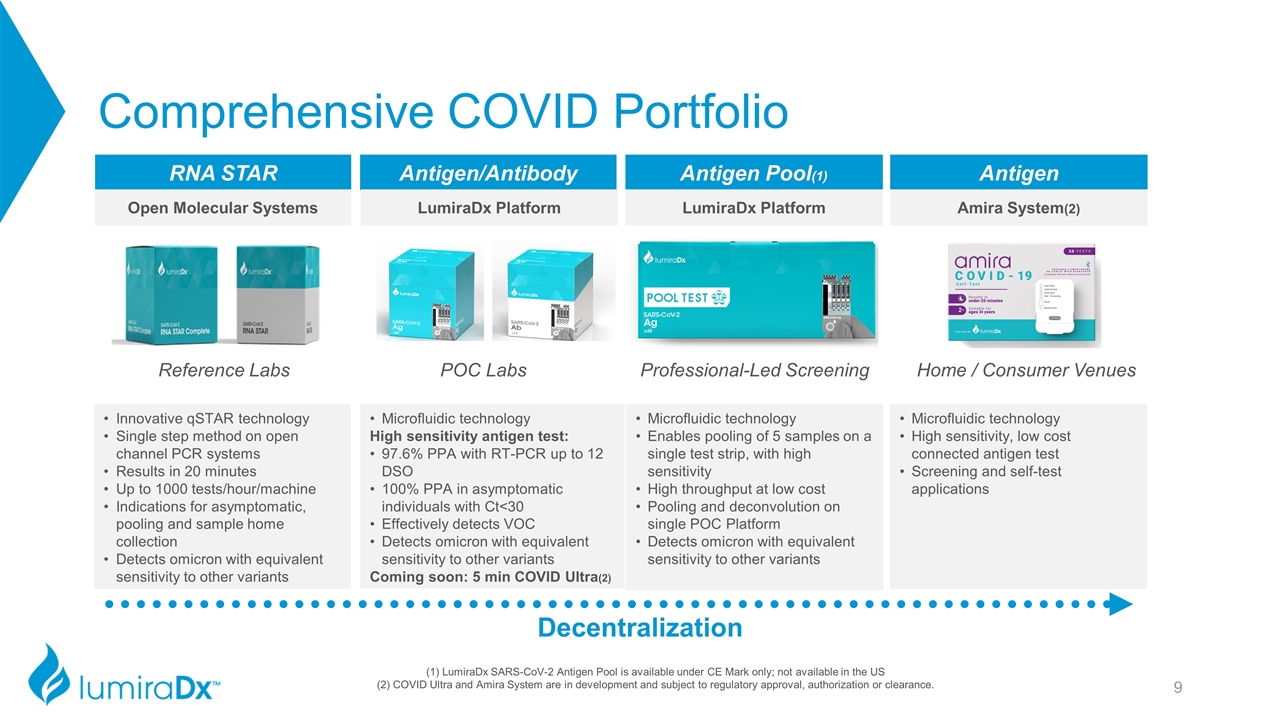

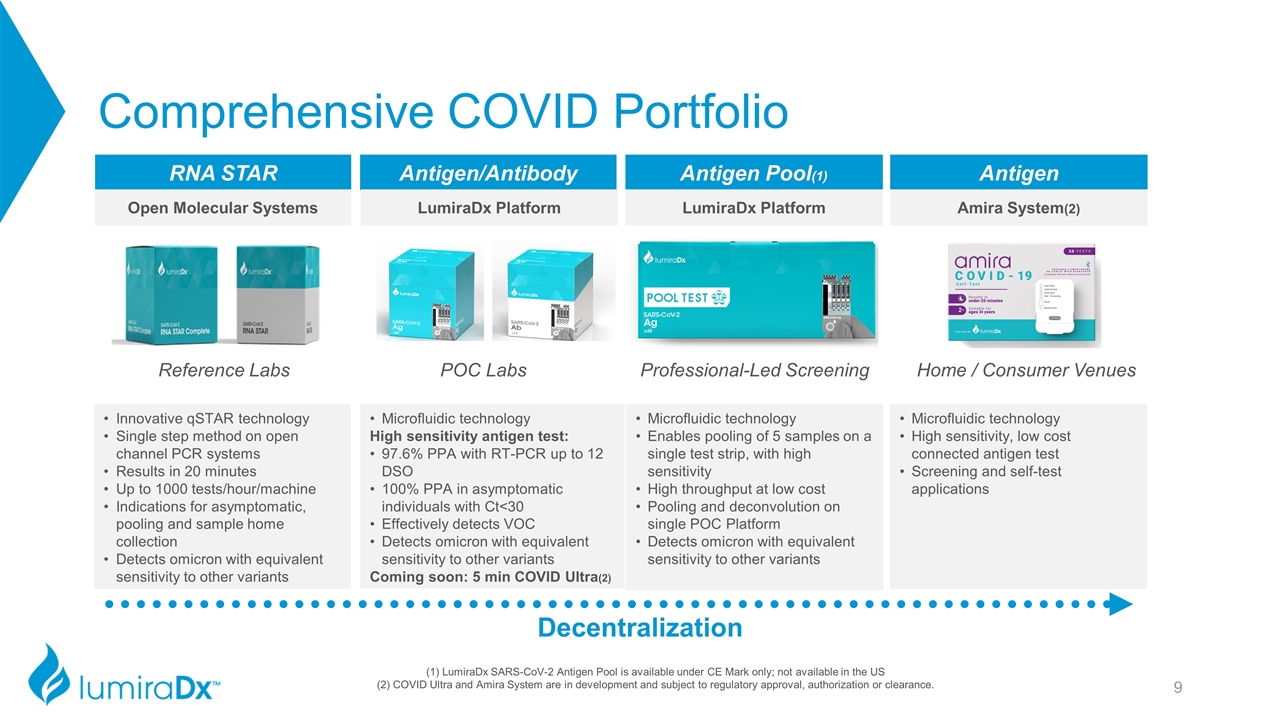

Reference Labs Comprehensive COVID Portfolio Decentralization Antigen/Antibody Antigen Pool(1) Antigen RNA STAR POC Labs Professional-Led Screening Home / Consumer Venues Open Molecular Systems LumiraDx Platform LumiraDx Platform Amira System(2) (1) LumiraDx SARS-CoV-2 Antigen Pool is available under CE Mark only; not available in the US (2) COVID Ultra and Amira System are in development and subject to regulatory approval, authorization or clearance. Innovative qSTAR technology Single step method on open channel PCR systems Results in 20 minutes Up to 1000 tests/hour/machine Indications for asymptomatic, pooling and sample home collection Detects omicron with equivalent sensitivity to other variants Microfluidic technology High sensitivity antigen test: 97.6% PPA with RT-PCR up to 12 DSO 100% PPA in asymptomatic individuals with Ct<30 Effectively detects VOC Detects omicron with equivalent sensitivity to other variants Coming soon: 5 min COVID Ultra(2) Microfluidic technology Enables pooling of 5 samples on a single test strip, with high sensitivity High throughput at low cost Pooling and deconvolution on single POC Platform Detects omicron with equivalent sensitivity to other variants Microfluidic technology High sensitivity, low cost connected antigen test Screening and self-test applications

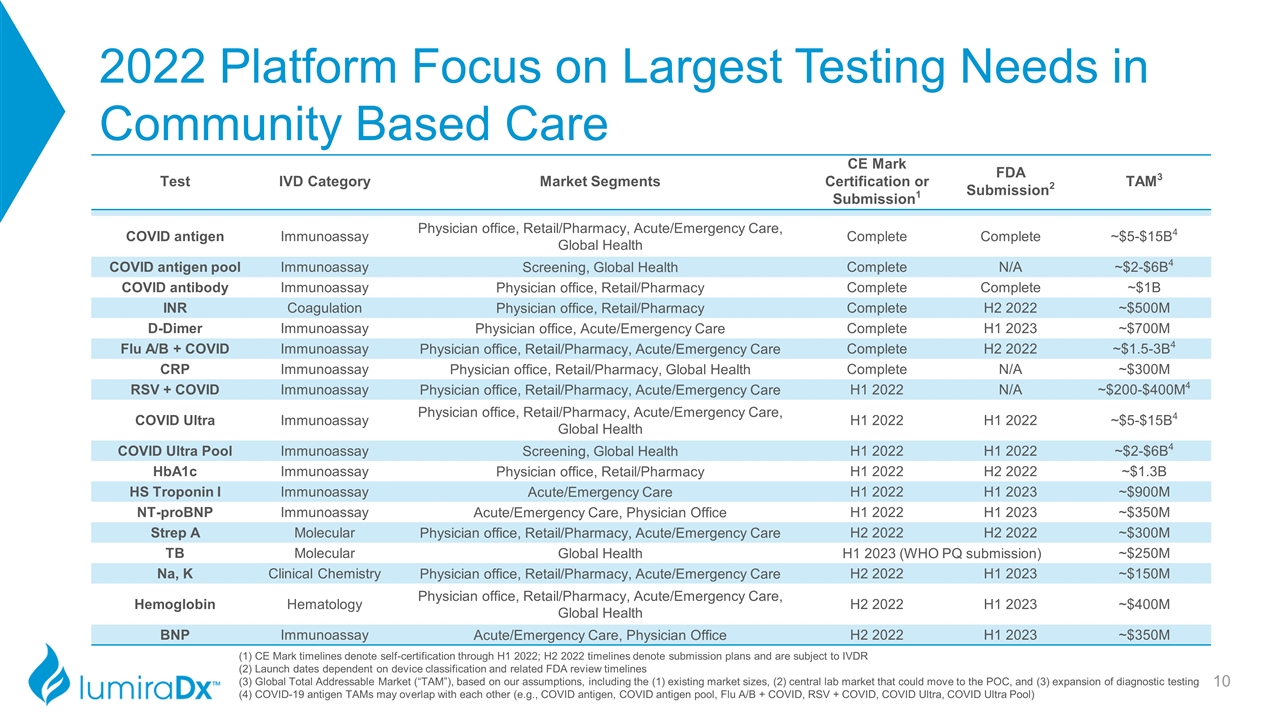

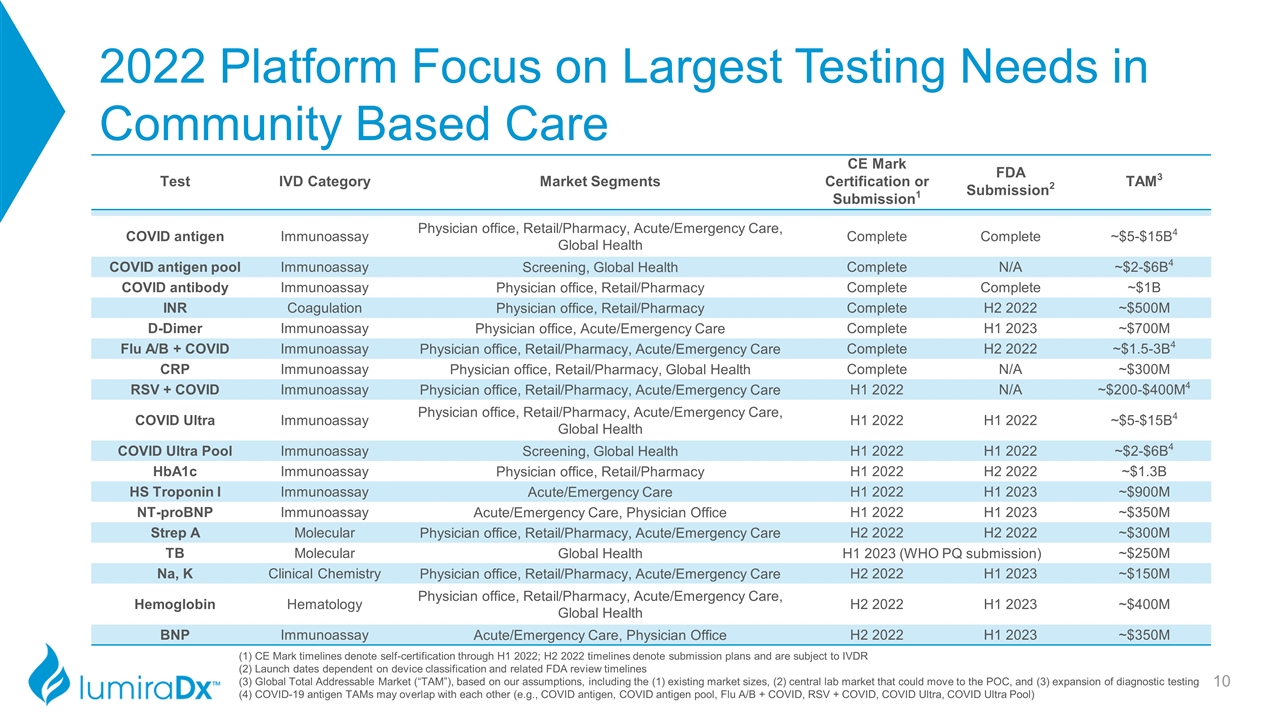

2022 Platform Focus on Largest Testing Needs in Community Based Care Test IVD Category Market Segments CE Mark Certification or Submission1 FDA Submission2 TAM3 COVID antigen Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health Complete Complete ~$5-$15B4 COVID antigen pool Immunoassay Screening, Global Health Complete N/A ~$2-$6B4 COVID antibody Immunoassay Physician office, Retail/Pharmacy Complete Complete ~$1B INR Coagulation Physician office, Retail/Pharmacy Complete H2 2022 ~$500M D-Dimer Immunoassay Physician office, Acute/Emergency Care Complete H1 2023 ~$700M Flu A/B + COVID Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care Complete H2 2022 ~$1.5-3B4 CRP Immunoassay Physician office, Retail/Pharmacy, Global Health Complete N/A ~$300M RSV + COVID Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care H1 2022 N/A ~$200-$400M4 COVID Ultra Immunoassay Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health H1 2022 H1 2022 ~$5-$15B4 COVID Ultra Pool Immunoassay Screening, Global Health H1 2022 H1 2022 ~$2-$6B4 HbA1c Immunoassay Physician office, Retail/Pharmacy H1 2022 H2 2022 ~$1.3B HS Troponin I Immunoassay Acute/Emergency Care H1 2022 H1 2023 ~$900M NT-proBNP Immunoassay Acute/Emergency Care, Physician Office H1 2022 H1 2023 ~$350M Strep A Molecular Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2022 H2 2022 ~$300M TB Molecular Global Health H1 2023 (WHO PQ submission) ~$250M Na, K Clinical Chemistry Physician office, Retail/Pharmacy, Acute/Emergency Care H2 2022 H1 2023 ~$150M Hemoglobin Hematology Physician office, Retail/Pharmacy, Acute/Emergency Care, Global Health H2 2022 H1 2023 ~$400M BNP Immunoassay Acute/Emergency Care, Physician Office H2 2022 H1 2023 ~$350M (1) CE Mark timelines denote self-certification through H1 2022; H2 2022 timelines denote submission plans and are subject to IVDR (2) Launch dates dependent on device classification and related FDA review timelines (3) Global Total Addressable Market (“TAM”), based on our assumptions, including the (1) existing market sizes, (2) central lab market that could move to the POC, and (3) expansion of diagnostic testing (4) COVID-19 antigen TAMs may overlap with each other (e.g., COVID antigen, COVID antigen pool, Flu A/B + COVID, RSV + COVID, COVID Ultra, COVID Ultra Pool)

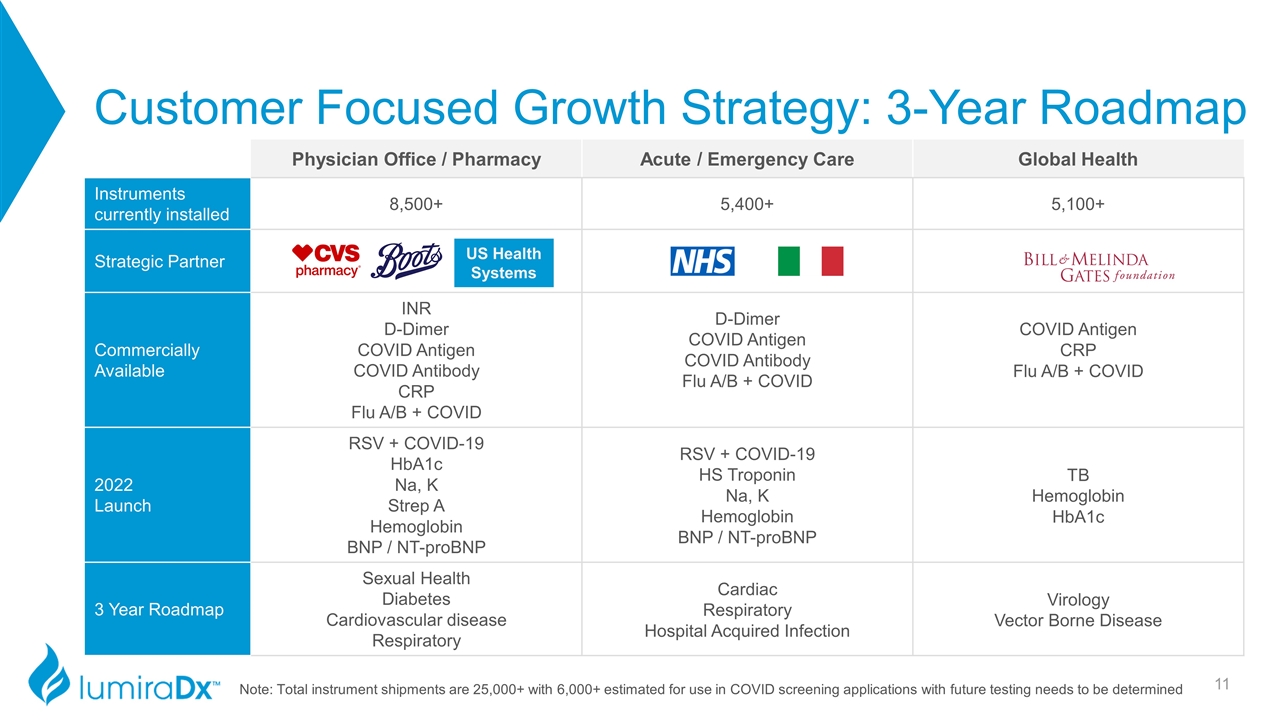

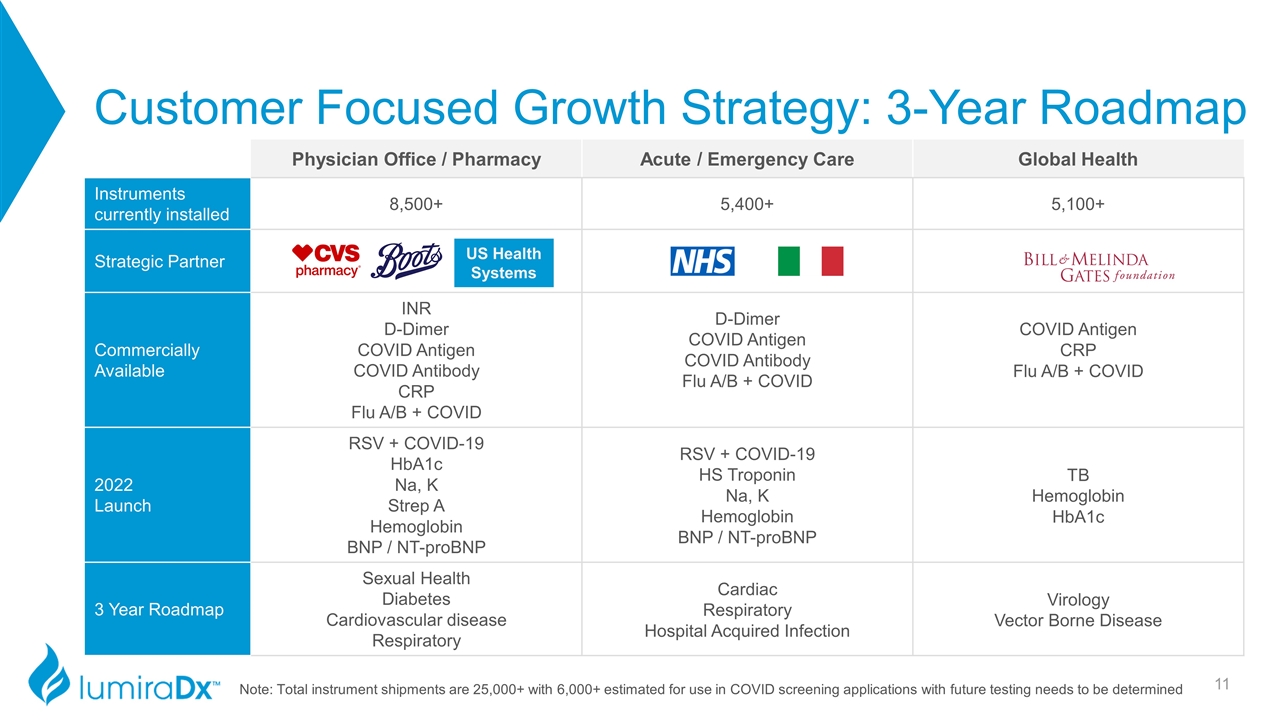

Customer Focused Growth Strategy: 3-Year Roadmap Physician Office / Pharmacy Acute / Emergency Care Global Health Instruments currently installed 8,500+ 5,400+ 5,100+ Strategic Partner Commercially Available INR D-Dimer COVID Antigen COVID Antibody CRP Flu A/B + COVID D-Dimer COVID Antigen COVID Antibody Flu A/B + COVID COVID Antigen CRP Flu A/B + COVID 2022 Launch RSV + COVID-19 HbA1c Na, K Strep A Hemoglobin BNP / NT-proBNP RSV + COVID-19 HS Troponin Na, K Hemoglobin BNP / NT-proBNP TB Hemoglobin HbA1c 3 Year Roadmap Sexual Health Diabetes Cardiovascular disease Respiratory Cardiac Respiratory Hospital Acquired Infection Virology Vector Borne Disease Note: Total instrument shipments are 25,000+ with 6,000+ estimated for use in COVID screening applications with future testing needs to be determined US Health Systems

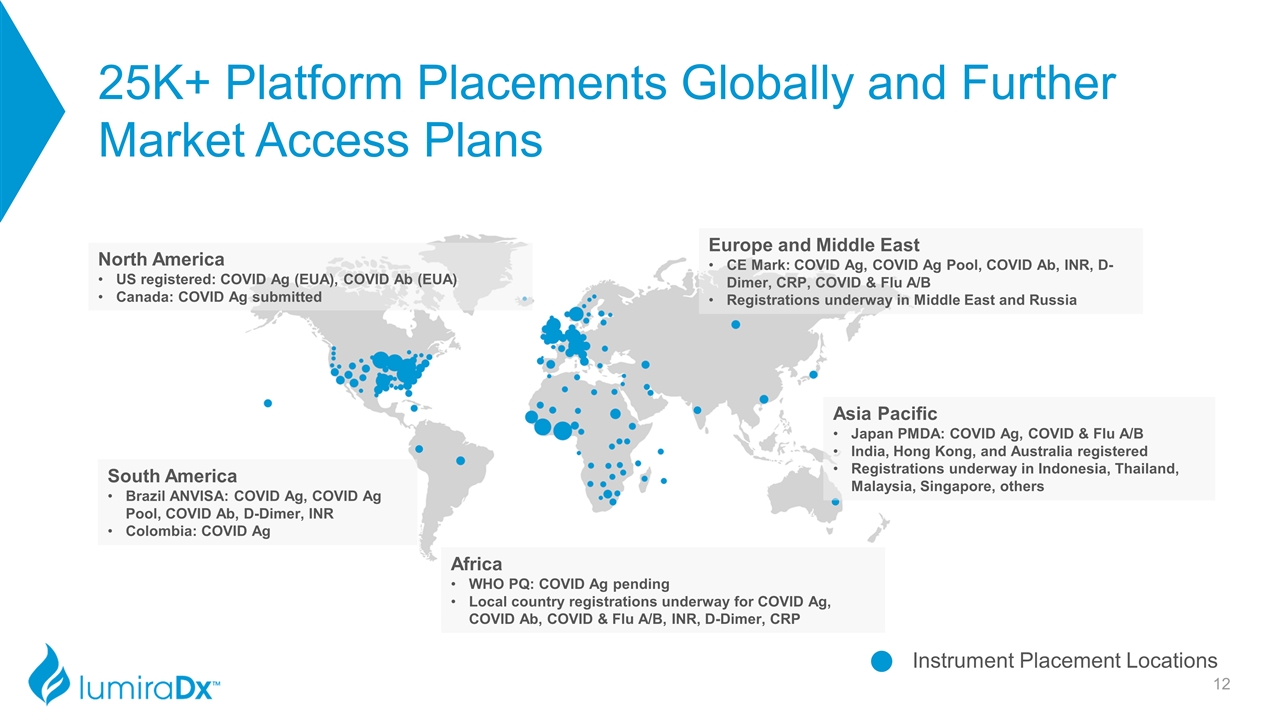

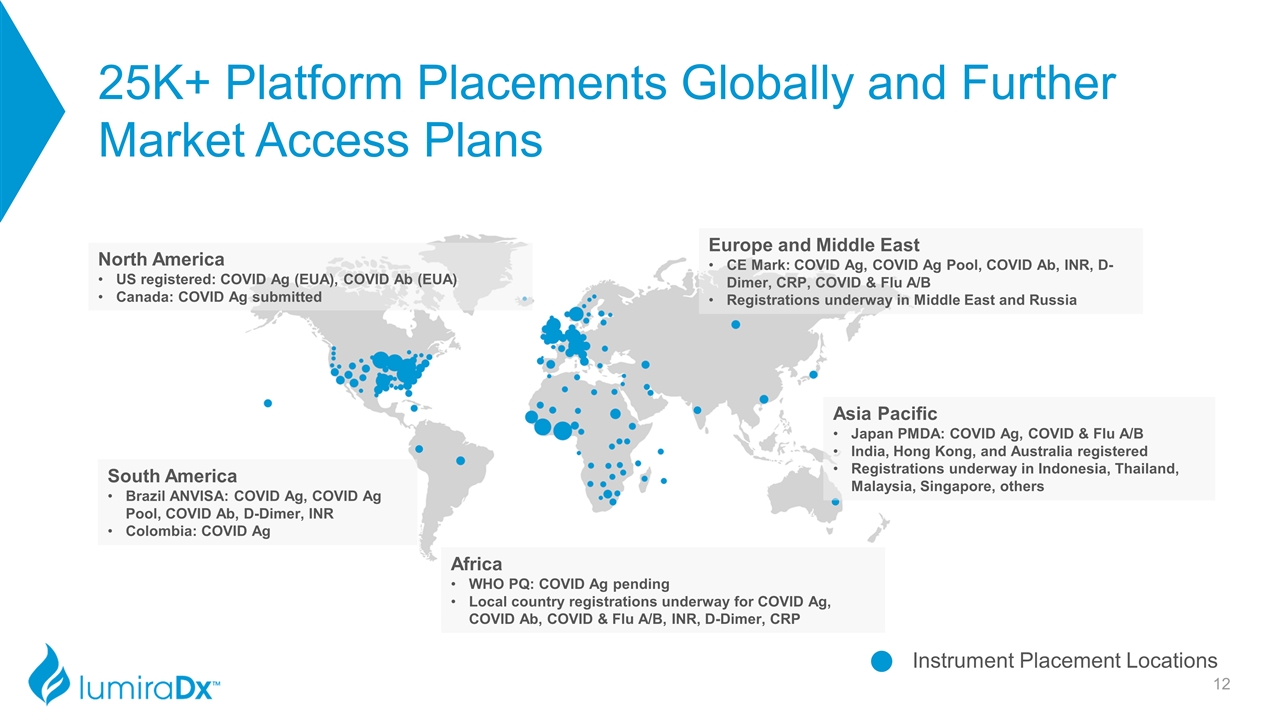

25K+ Platform Placements Globally and Further Market Access Plans Instrument Placement Locations North America US registered: COVID Ag (EUA), COVID Ab (EUA) Canada: COVID Ag submitted Europe and Middle East CE Mark: COVID Ag, COVID Ag Pool, COVID Ab, INR, D-Dimer, CRP, COVID & Flu A/B Registrations underway in Middle East and Russia Africa WHO PQ: COVID Ag pending Local country registrations underway for COVID Ag, COVID Ab, COVID & Flu A/B, INR, D-Dimer, CRP South America Brazil ANVISA: COVID Ag, COVID Ag Pool, COVID Ab, D-Dimer, INR Colombia: COVID Ag Asia Pacific Japan PMDA: COVID Ag, COVID & Flu A/B India, Hong Kong, and Australia registered Registrations underway in Indonesia, Thailand, Malaysia, Singapore, others

Financial Profile 2024 Projected Revenues - $1.00+ Billion COVID/Flu/Respiratory products – 15%-20% of total revenue High Sensitivity Troponin – 15%-20% of total revenue BNP – 5%-10% of total revenue HbA1c – 5%-10% of total revenue Strong mix across other Platform pipeline products Amira Platform – 5%+ of total revenue Fast Lab Solutions – 5%+ of total revenue Gross Margins exceeding 65% Highly automated, scalable manufacturing drives immediately high gross margins Installed manufacturing equipment flexible across full product line, high efficiency Operating Margins approximately 40% LumiraDx Platform drives significant operational efficiencies for users and the Company Lower operating margins in near term to scale global commercial organization

Confidential and Proprietary Copyright © 2021 LumiraDx Ltd. All Rights Reserved, Worldwide. For discussion purposes only.