Exhibit 99.1 September 2022

Disclaimer FORWARD-LOOKING STATEMENTS All statements other than statements of historical facts contained in this presentation are forward-looking statements. Forward-looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics, projections of market opportunity and market share, our future results of operations and financial position, business strategy, the Platform, other products, tests, ongoing and planned preclinical studies and clinical trials, regulatory submissions and approvals, research and development costs, timing and likelihood of success, as well as plans and objectives of management for future operations. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of the management of LumiraDx Limited (“LumiraDx” or the “Company”) and are not predictions of actual performance. These forward- looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of LumiraDx. These forward-looking statements are subject to a number of risks and uncertainties, including our ability to compete in the highly competitive markets in which we operate, and potential adverse effects of this competition; our ability to maintain revenues if our products and services do not achieve and maintain broad market acceptance, orif we are unable to keep pace or adapt to rapidly changing technology, evolving industry standards and changing regulatory environments; uncertainty, downturns and changes in the markets we serve; our expectations regarding the size of the POC market for the Platform, the size of the various addressable markets for certain tests and our ability to penetrate such markets by driving the conversion of healthcare providers' testing needs onto the Platform; our commercialization strategy, including our plans to initially focus our sales efforts on large healthcare systems, government organizations and national pharmacy chains that want to deploy comprehensive POC testing across their networks, our strategy on the commercialization of our current and future assays and our ability to launch and obtain regulatory approval for new tests; our ability to increase the installed base of our Instruments; our ability to repay or service our debt obligations and meet the financial covenants related to such debt obligations; our belief that we will be able to drive commercialization of the Platform through the launch of our SARS-CoV-2 antigen and SARS-CoV-2 antibody tests; the willingness of healthcare providers to use a POC system over central lab systems and the rate of adoption of the Platform by healthcare providers and other users; the scalability and commercial viability of our manufacturing methods and processes, especially in light of the anticipated demand for the Platform and our minimum commitments to supply the Instrument and test strips in a timely fashion; our ability to maintain our current relationships, or enter into new relationships, with diagnostics or research and development companies, third party manufacturers and commercial distribution collaborators; our ability to effectively manage our anticipated growth; our ability to rapidly develop and commercialize diagnostics tests that are accurate and cost-effective; the timing, progress and results of our diagnostic tests, including statements regarding launch plans and commercialization plans for such tests, all which may be delayed by or halted due to a number of factors, including the impact of the COVID-19 pandemic and the end of the COVID-19 pandemic; the timing, scope or likelihood of regulatory submissions, filings, approvals, authorizations, certifications, clinical trials or clearances; the pricing, coverage and reimbursement of the Instrument and tests, if approved; our ability to enforce our intellectual property rights and to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights and proprietary technology of third parties; developments and projections relating to our competitors and our industry; our ability to attract, motivate and retain qualified employees, including members of our senior management team; the effects of the COVID-19 pandemic, including mitigation efforts and economic effects, on any of the foregoing or other aspects of our business or operations; social, economic, and labor instability in the countries in which we or the third parties with whom we engage operate, including any impact of the current conflict between Russia and Ukraine; our expectations regarding the time during which we will be an emerging growth company under the JOBS Act and a foreign private issuer; the future trading price of our common shares and impact of securities analysts' reports on these prices; our ability to fully derive anticipated benefits from existing or future acquisitions, joint ventures, investments or dispositions; exchange rate fluctuations and volatility in global currency markets; potential adverse tax consequences resulting from the international scope of our operations, corporate structure and financing structure; U.S. tax legislation enacted in 2017, which could materially adversely affect our financial condition, results of operations and cash flows; increased risks resulting from our international operations and expectations of future expansion of such operations; our ability to comply with various trade restrictions, such as sanctions and export controls, resulting from our international operations; government and agency demand for our products and services and our ability to comply with government contracting regulations; our ability to operate in a litigious environment; and those factors discussed under the header “Risk Factors” in the Annual Report on Form 20-F filed by LumiraDx with the Securities and Exchange Commission, or SEC, on April 13, 2022, in the Form 6-K filed by LumiraDx with the SEC on August 16, 2022, and in other filings made by LumiraDx with the SEC. If any of these risks materialize or LumiraDx’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that LumiraDx presently knows or that LumiraDx currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward- looking statements reflect LumiraDx’s expectations, plans or forecasts of future events and views as of the date of this presentation. LumiraDx anticipates that subsequent events and developments will cause LumiraDx’s asse ssments to change. However, while LumiraDx may elect to update these forward-looking statements at some point in the future, LumiraDx specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing LumiraDx’s asse ssments as of any date subsequent to the date of thispresentation. Accordingly, undue reliance should not be placedupon the forward-looking statements. LumiraDx hasno obligation to update thispresentation. INDUSTRY AND MARKET DATA This presentation includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties as well as our own estimates of potential market opportunities. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. LumiraDx believes that these third-party sources and estimates are reliable, but has not independently verified them. LumiraDx’s estimates of the potential market opportunities for its Platform include several key assumptions based on industry knowledge, industry publications, third-party research and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While LumiraDx believes that its own internal assumptions are reasonable, no independent source has verified such assumptions. The industry in which LumiraDx operatesissubject to a high degree of uncertainty and riskdue to a variety of important factorsthat could cause resultsto differ materially from those expressed in the estimatesmade by third partiesand by LumiraDx. USE OF PROJECTIONS This presentation contains projected financial information with respect to LumiraDx, including, but not limited to, estimated results for fiscal year 2025. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward-Looking Statements” paragraph above. Actual results may differ materially from the results contemplated by the financial forecast information containedin thispresentation, and the inclusion of such information in thispresentation shouldnot be regardedasa representationby any person that the resultsreflected in such forecastswill be achieved. 2 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

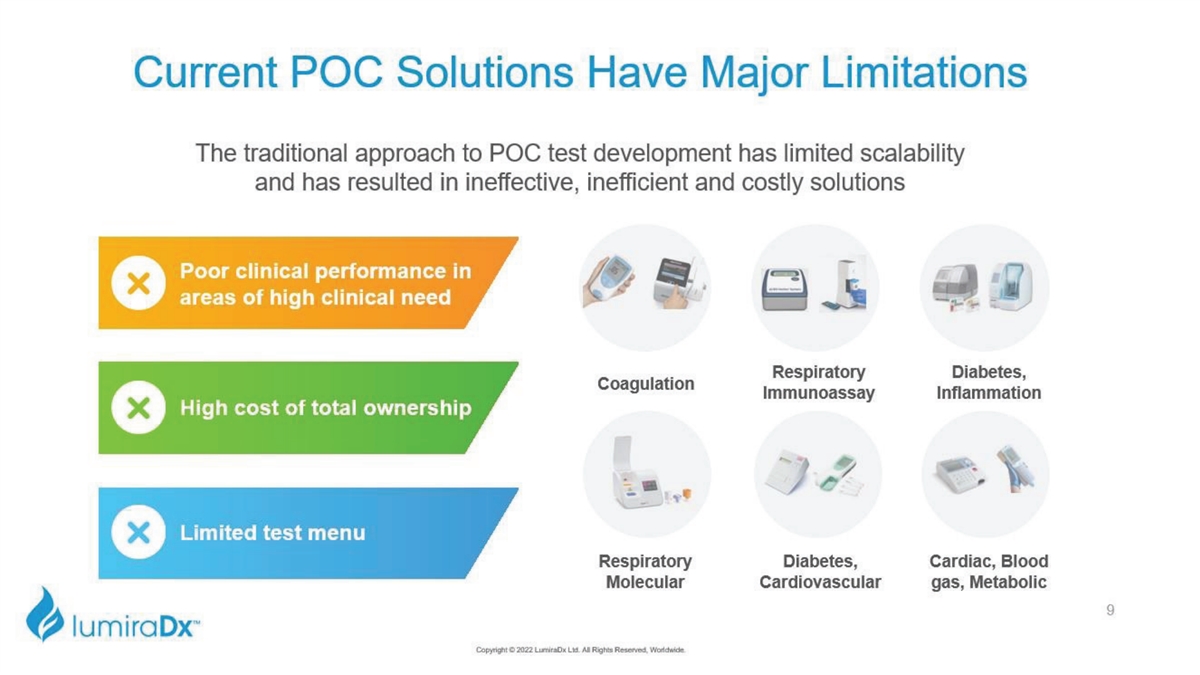

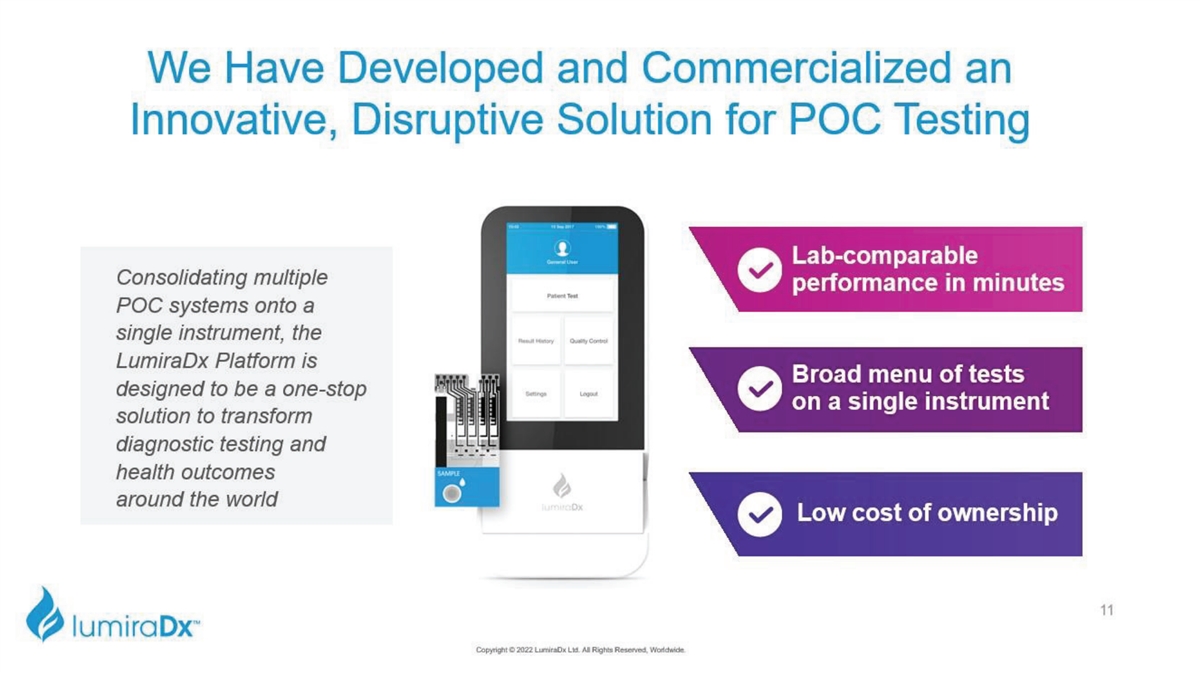

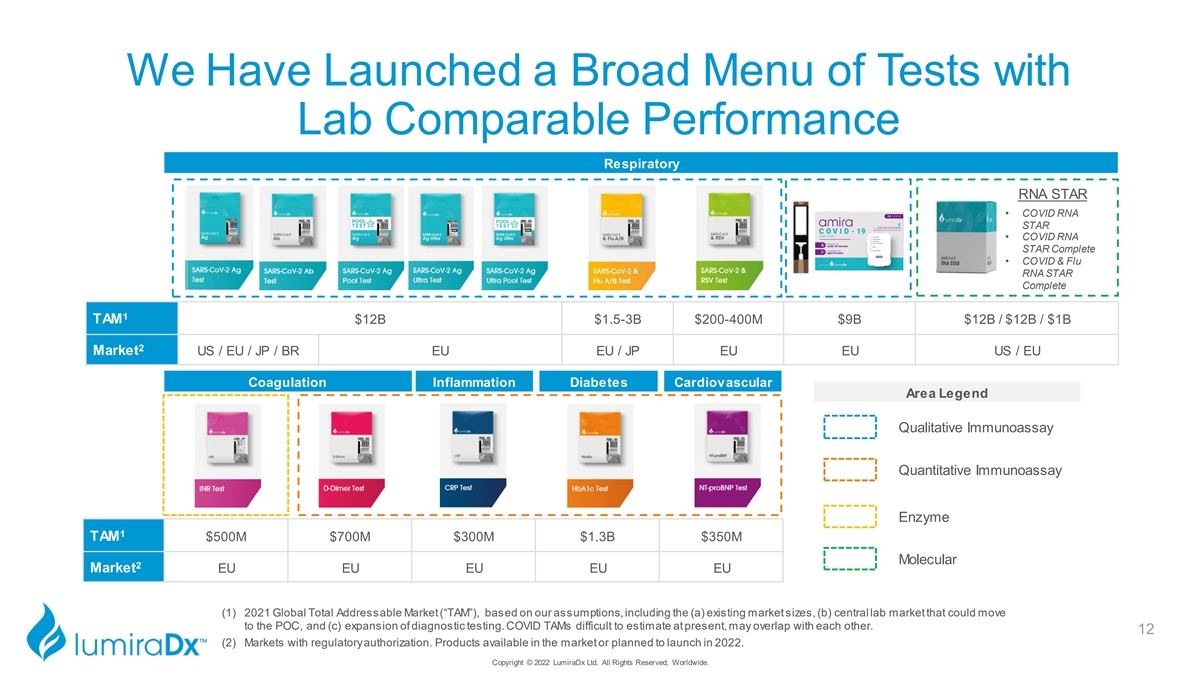

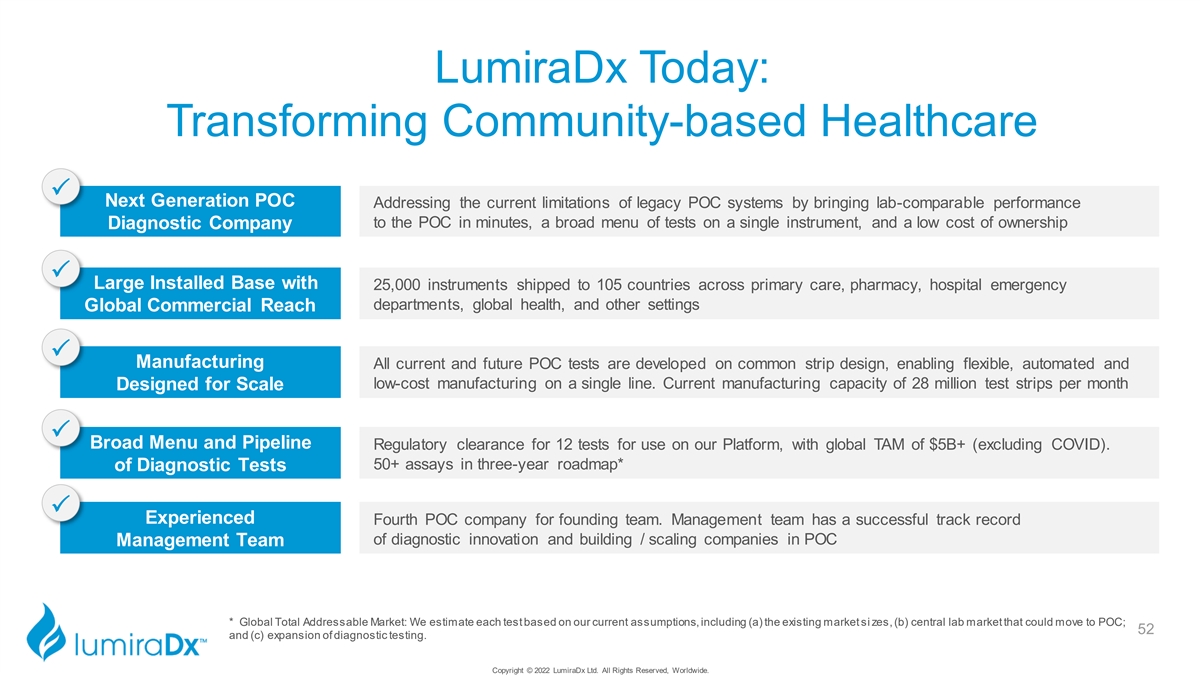

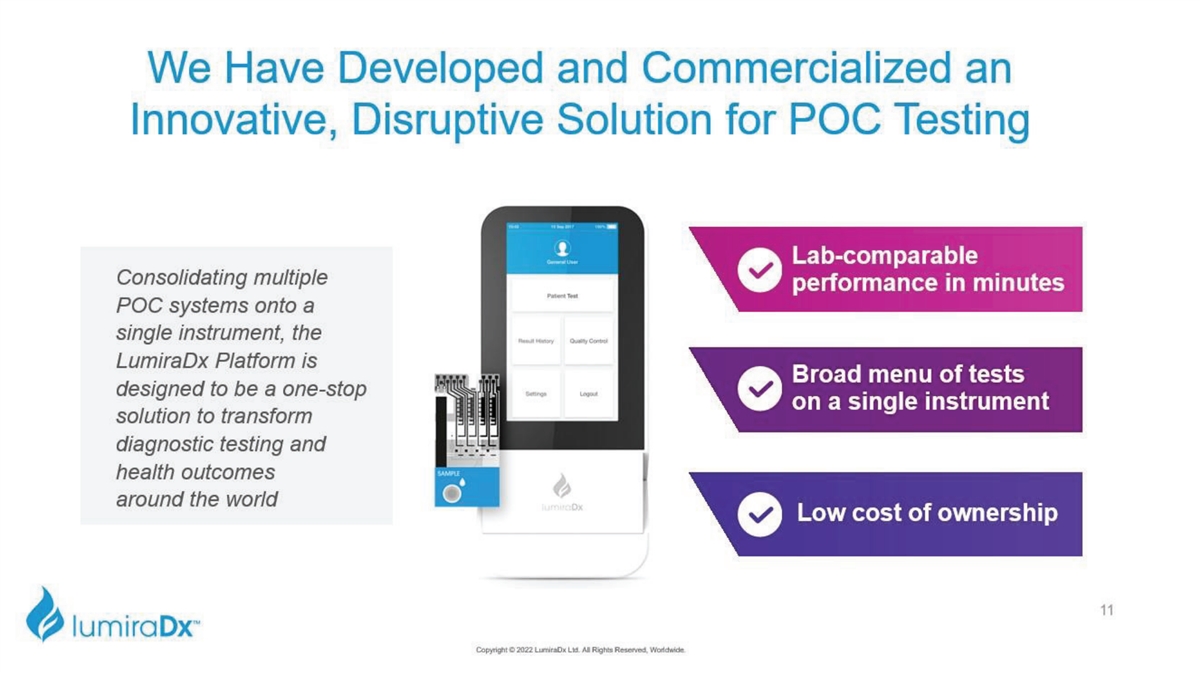

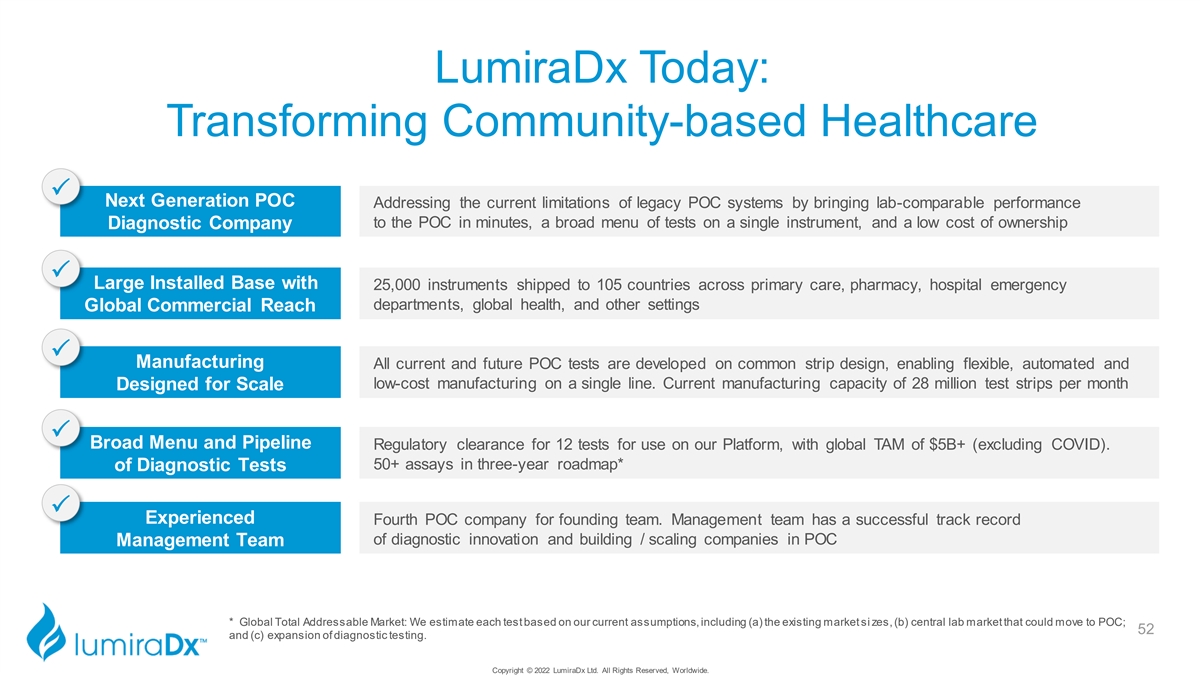

LumiraDx Today: Transforming Community-based Healthcare P (1) Next Generation POC Addressing the current limitations of legacy POC systems by bringing lab-comparable performance to the POC in minutes, a broad menu of tests on a single instrument, and a low cost of ownership Diagnostic Company P Large Installed Base with 25,000 instruments shipped to 105 countries across primary care, pharmacy, hospital emergency departments, global health, and other settings Global Commercial Reach P Manufacturing All current and future POC tests are developed on common strip design, enabling flexible, automated and low-cost manufacturing on a single line. Current manufacturing capacity of 28 million test strips per month Designed for Scale P (2) Broad Menu and Pipeline Regulatory clearance for 12 tests for use on our Platform, with global TAM of $5B+ (excluding COVID). 50+ assays in three-year roadmap of Diagnostic Tests P Experienced Fourth POC company for founding team. Management team has a successful track record of diagnostic innovation and building / scaling companies in POC Management Team (1) “POC” means point of care. 3 (2) Global Total Addressable Market (“TAM”): We estimate each test based on our current assumptions, including (a) the existing market sizes, (b) central lab market that could move to POC; and (c) expansion of diagnostic testing. Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

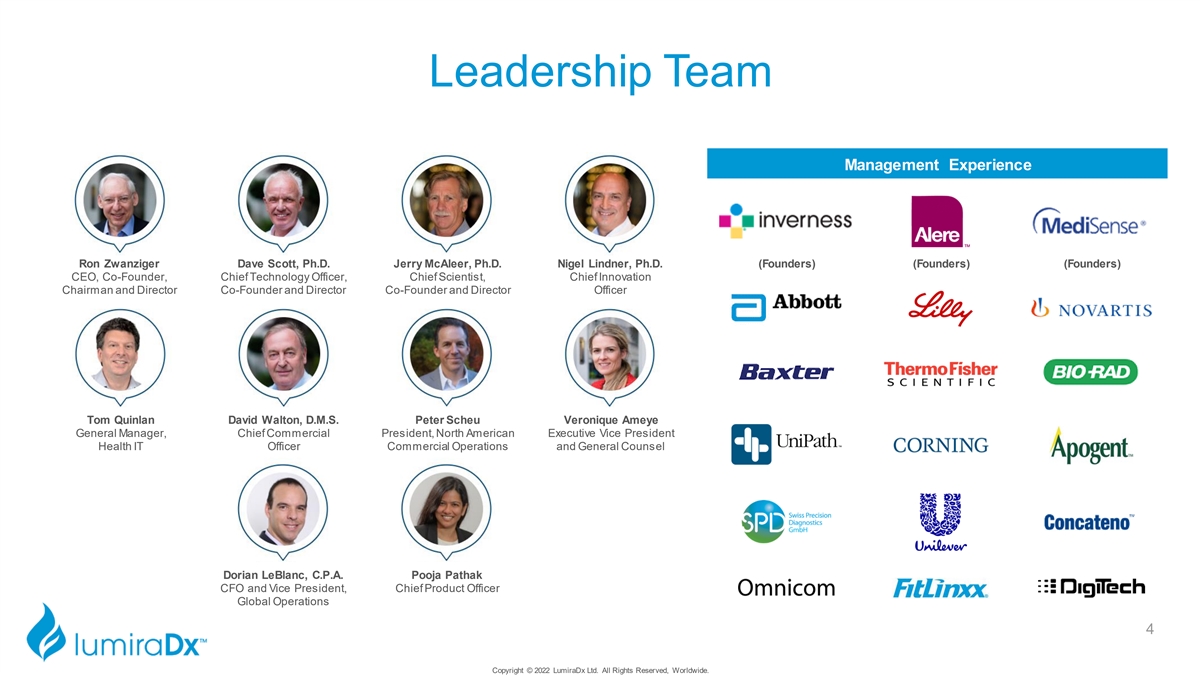

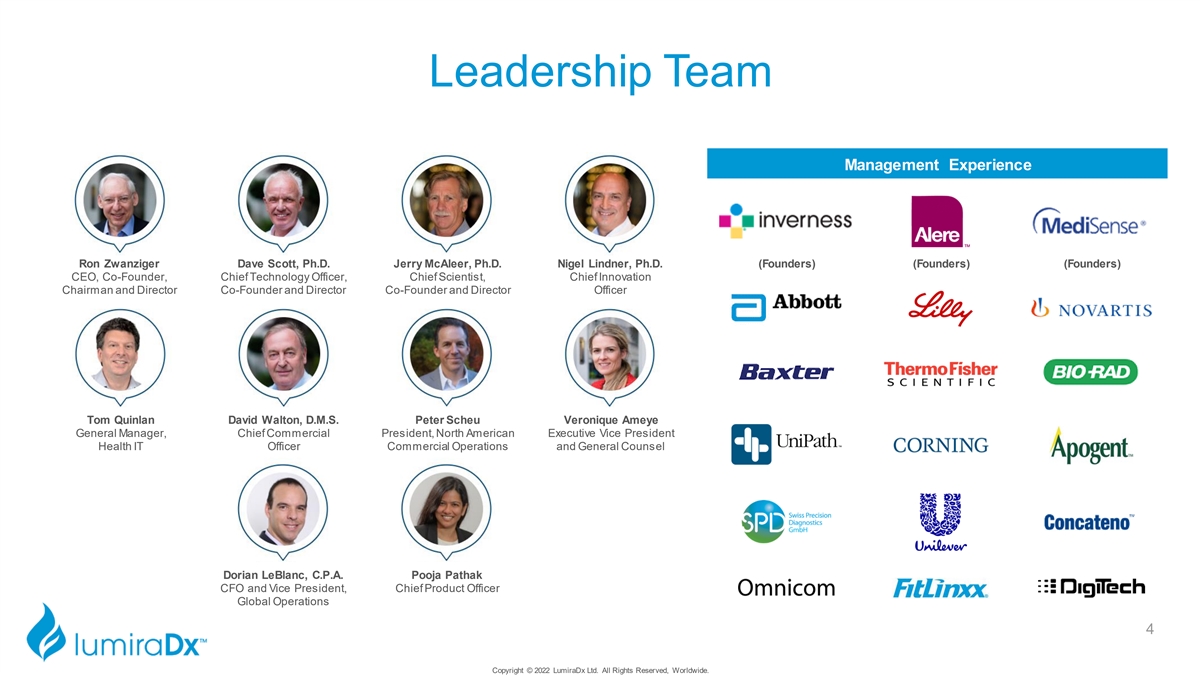

Leadership Team Management Experience Ron Zwanziger Dave Scott, Ph.D. Jerry McAleer, Ph.D. Nigel Lindner, Ph.D. (Founders) (Founders) (Founders) CEO, Co-Founder, Chief Technology Officer, Chief Scientist, Chief Innovation Chairman and Director Co-Founder and Director Co-Founder and Director Officer Tom Quinlan David Walton, D.M.S. Peter Scheu Veronique Ameye General Manager, Chief Commercial President, North American Executive Vice President Health IT Officer Commercial Operations and General Counsel Dorian LeBlanc, C.P.A. Pooja Pathak CFO and Vice President, Chief Product Officer Global Operations 4 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Company & Market Introduction Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

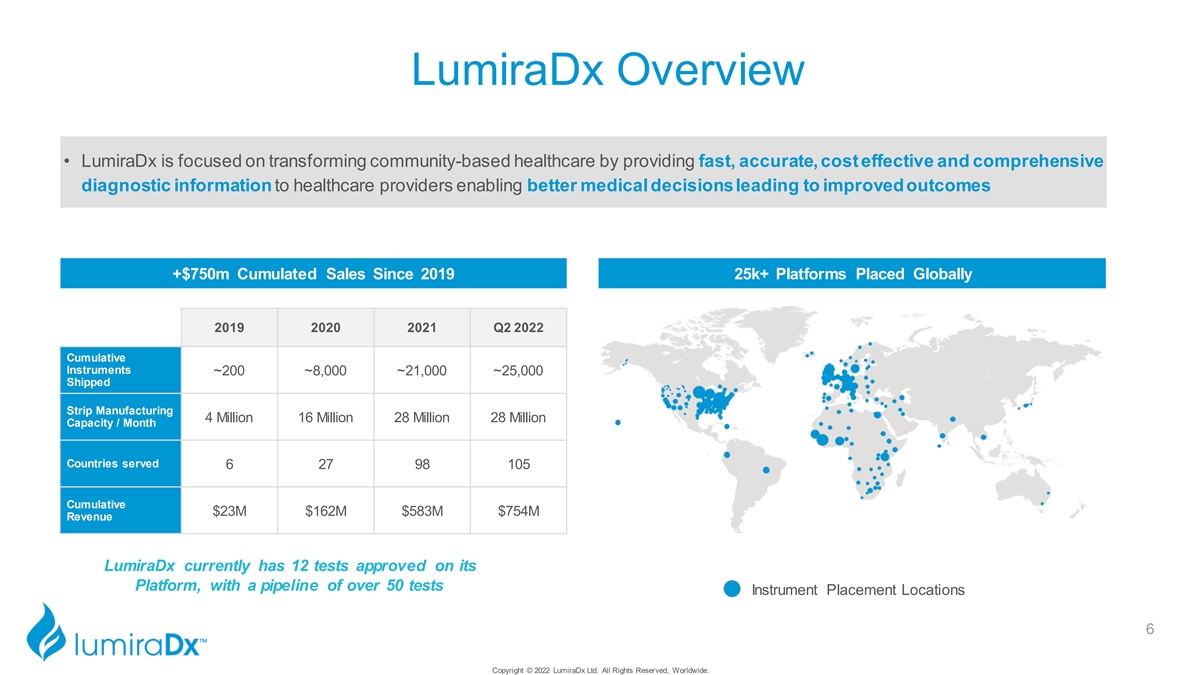

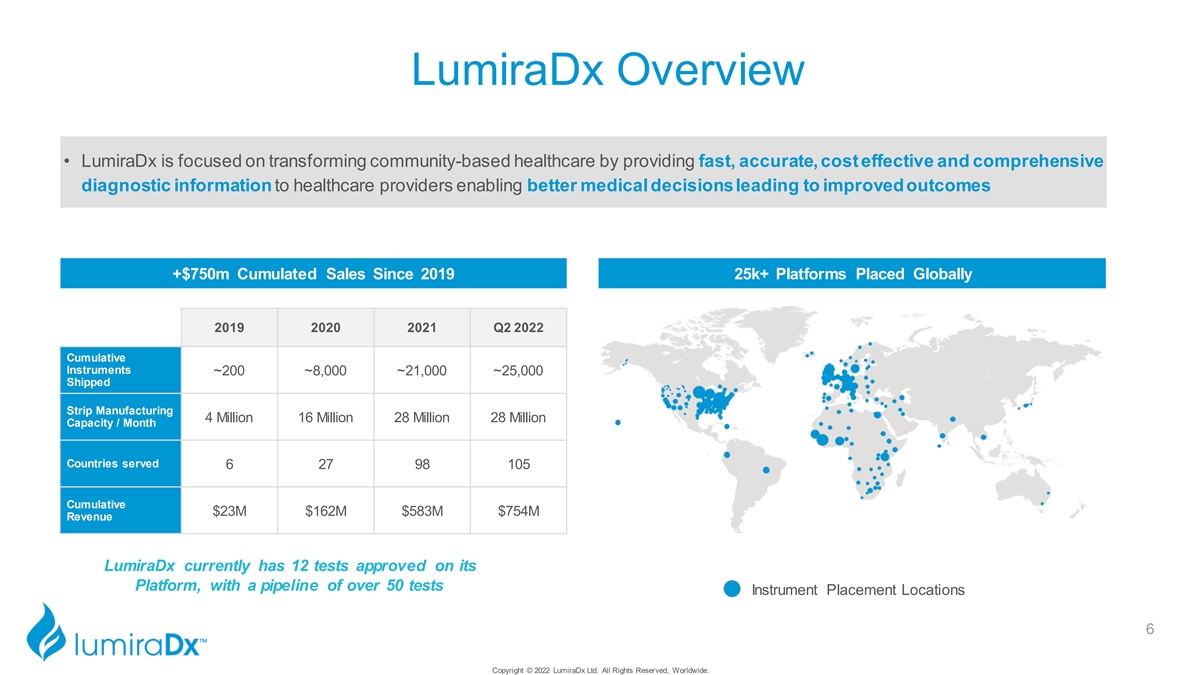

LumiraDx Overview • LumiraDx is focused on transforming community-based healthcare by providing fast, accurate, cost effective and comprehensive diagnostic information to healthcare providers enabling better medical decisions leading to improved outcomes +$750m Cumulated Sales Since 2019 25k+ Platforms Placed Globally 2019 2020 2021 Q2 2022 Cumulative Instruments ~200 ~8,000 ~21,000 ~25,000 Shipped Strip Manufacturing 4 Million 16 Million 28 Million 28 Million Capacity / Month Countries served 6 27 98 105 Cumulative $23M $162M $583M $754M Revenue LumiraDx currently has 12 tests approved on its Platform, with a pipeline of over 50 tests Instrument Placement Locations 6 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

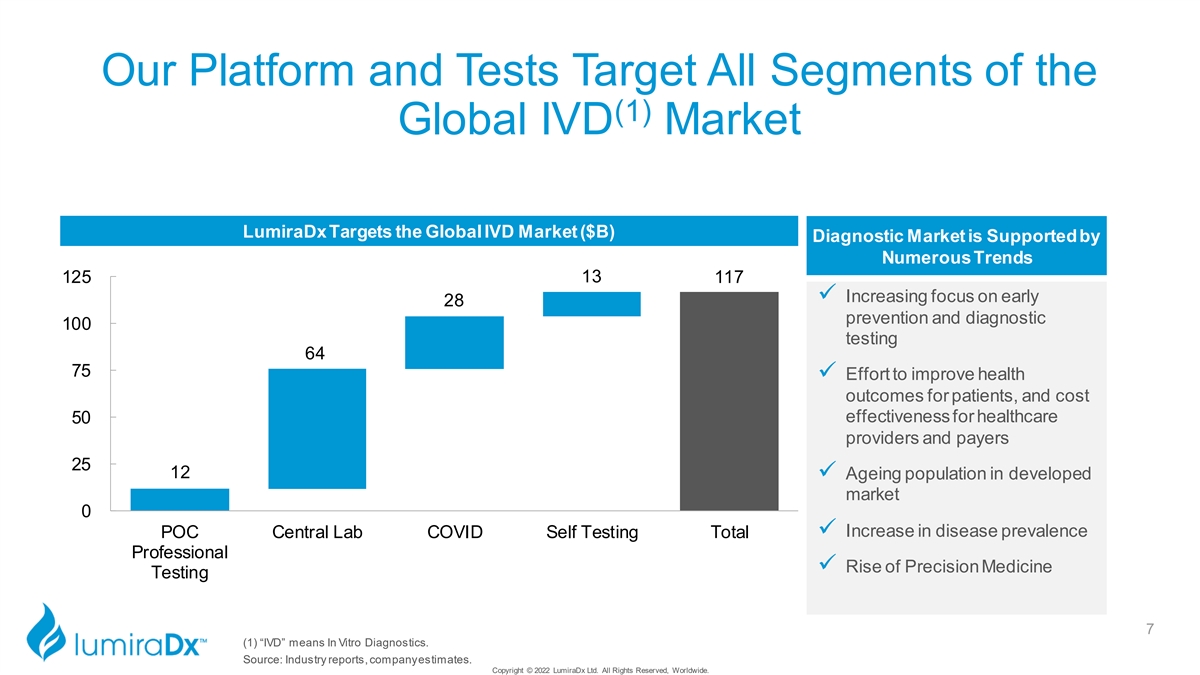

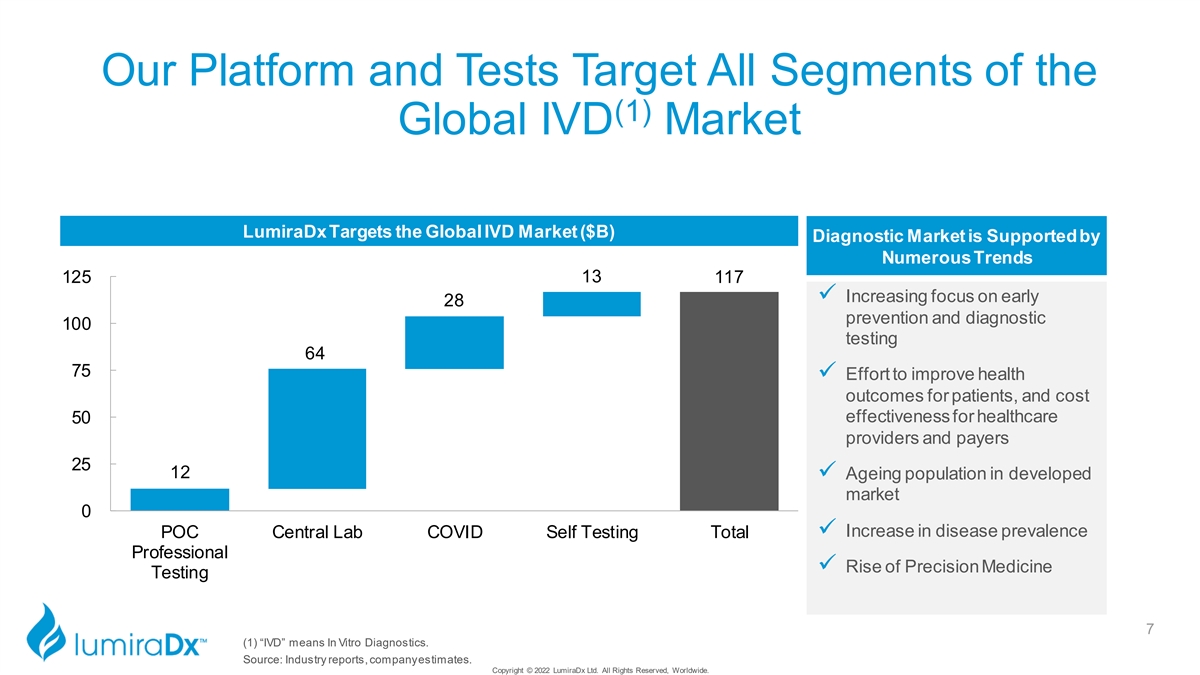

Our Platform and Tests Target All Segments of the (1) Global IVD Market LumiraDx Targets the Global IVD Market ($B) Diagnostic Market is Supported by Numerous Trends 13 125 117 ✓ Increasing focus on early 28 prevention and diagnostic 100 testing 64 75 ✓ Effort to improve health outcomes for patients, and cost effectiveness for healthcare 50 providers and payers 25 12 ✓ Ageing population in developed market 0 ✓ Increase in disease prevalence POC Central Lab COVID Self Testing Total Professional ✓ Rise of Precision Medicine Testing 7 (1) “IVD” means In Vitro Diagnostics. Source: Industry reports, company estimates. Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

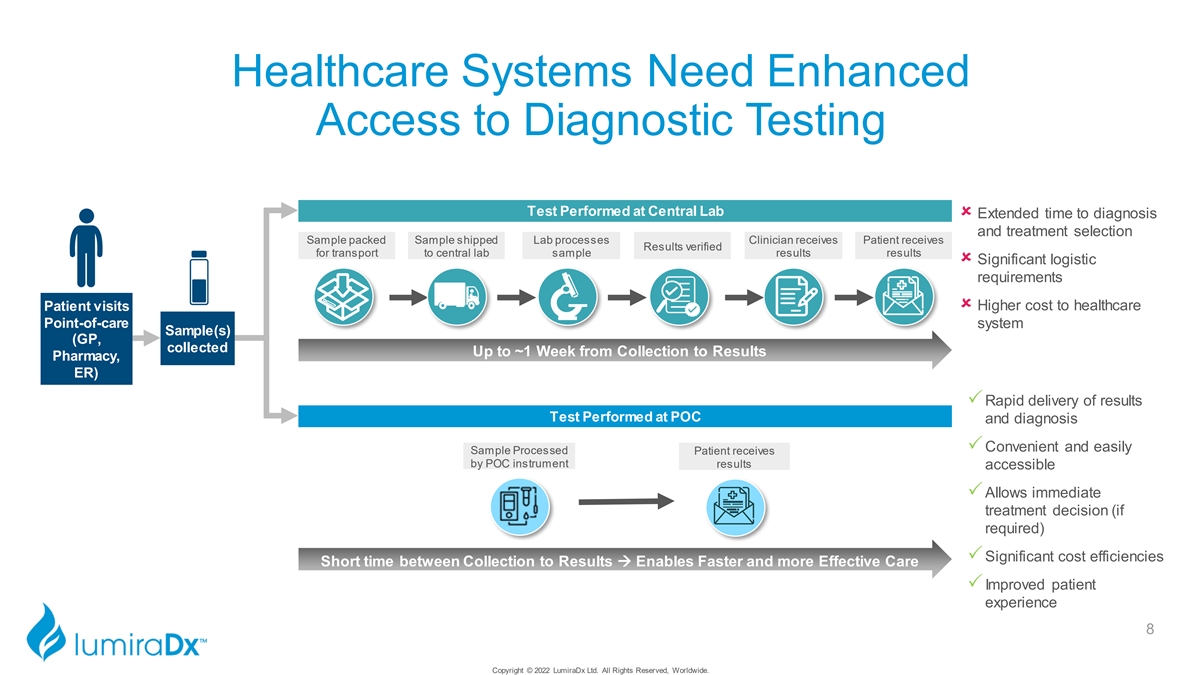

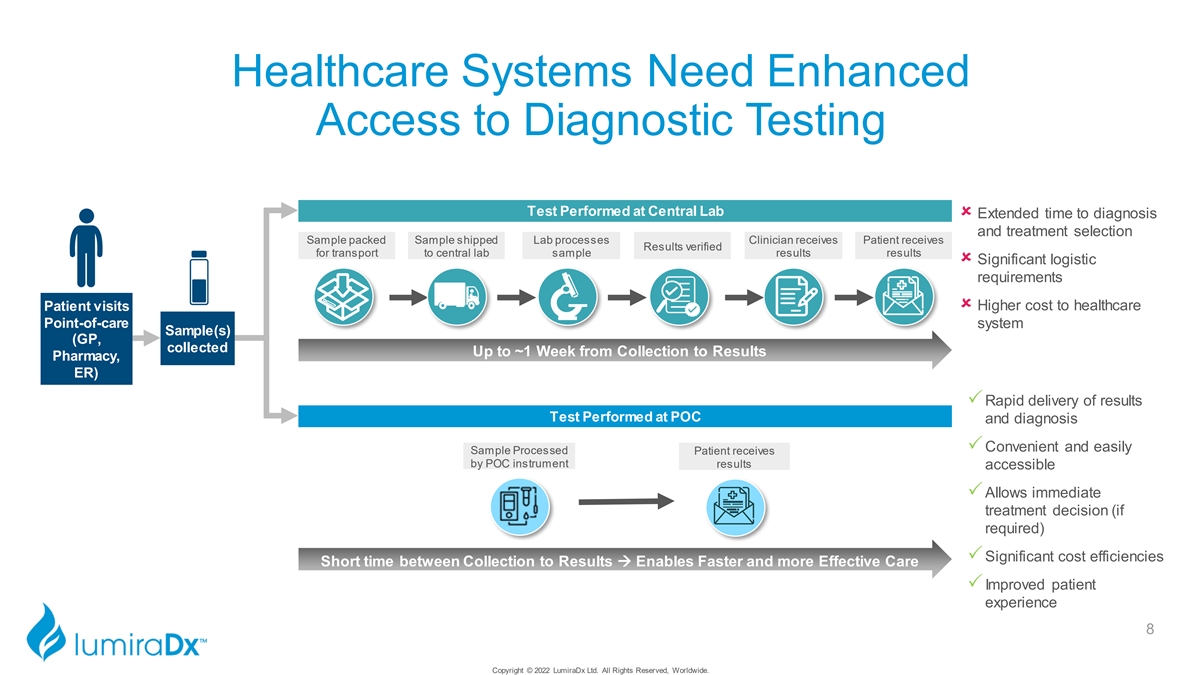

Healthcare Systems Need Enhanced Access to Diagnostic Testing Test Performed at Central Lab û Extended time to diagnosis and treatment selection Sample packed Sample shipped Lab processes Clinician receives Patient receives Results verified for transport to central lab sample results results û Significant logistic requirements û Higher cost to healthcare Patient visits Point-of-care system Sample(s) (GP, collected Up to ~1 Week from Collection to Results Pharmacy, ER) PRapid delivery of results Test Performed at POC and diagnosis PConvenient and easily Sample Processed Patient receives by POC instrument results accessible PAllows immediate treatment decision (if required) PSignificant cost efficiencies Short time between Collection to Results → Enables Faster and more Effective Care PImproved patient experience 8 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

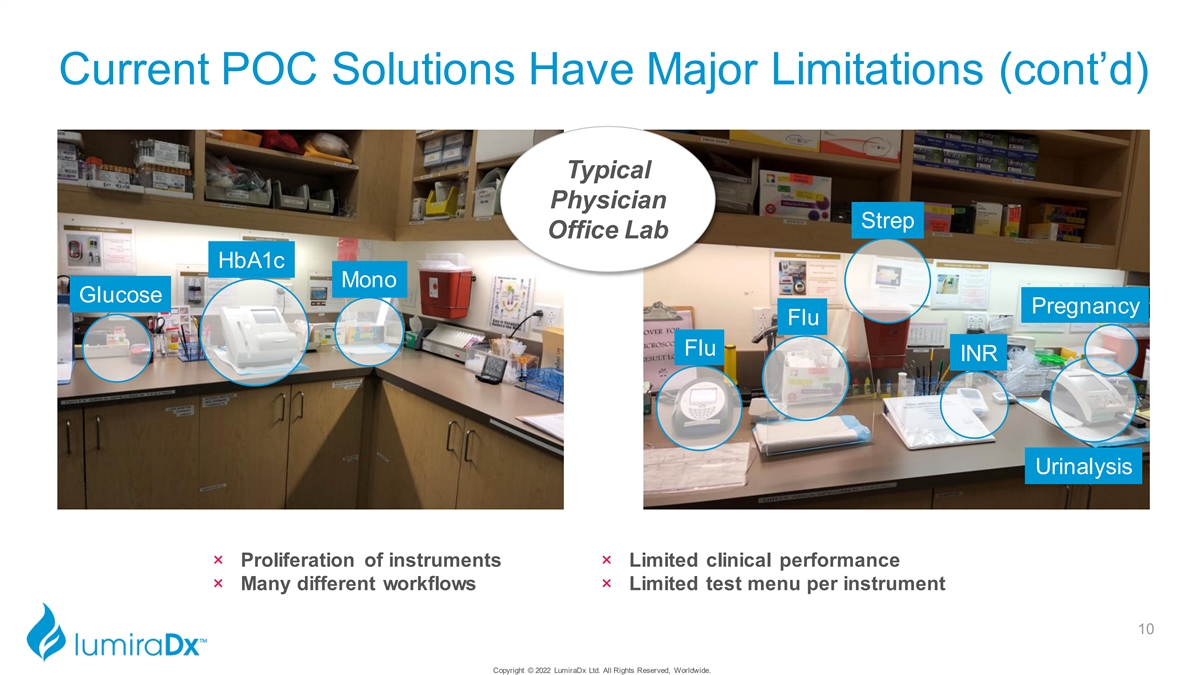

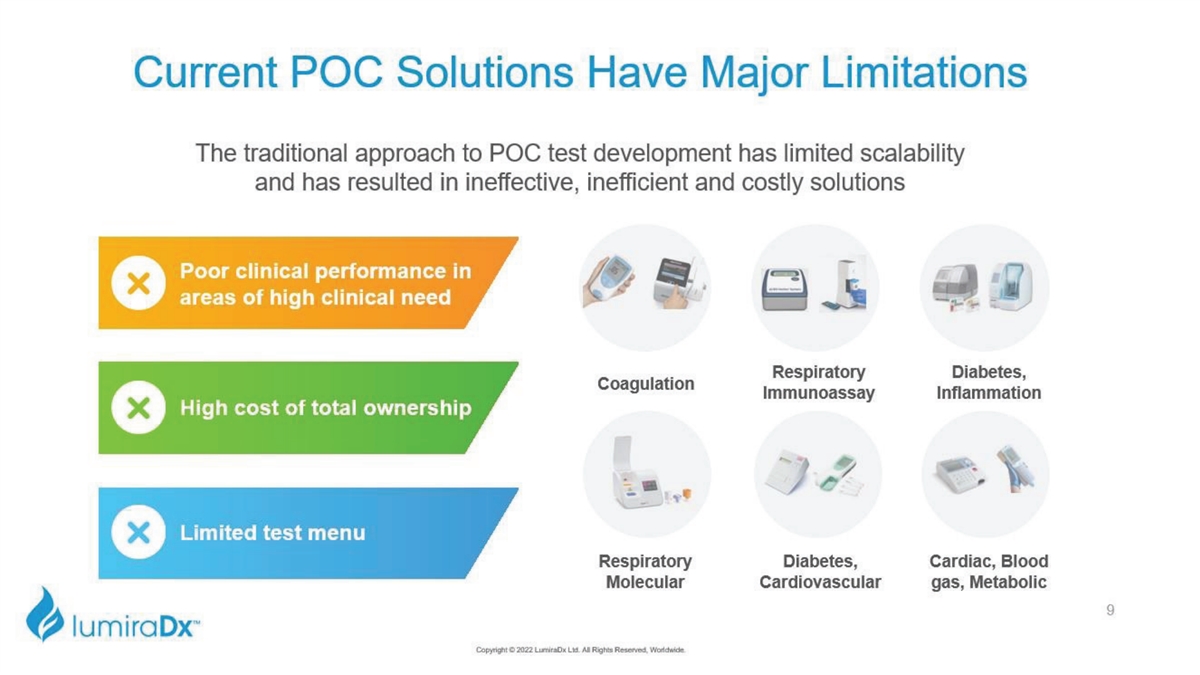

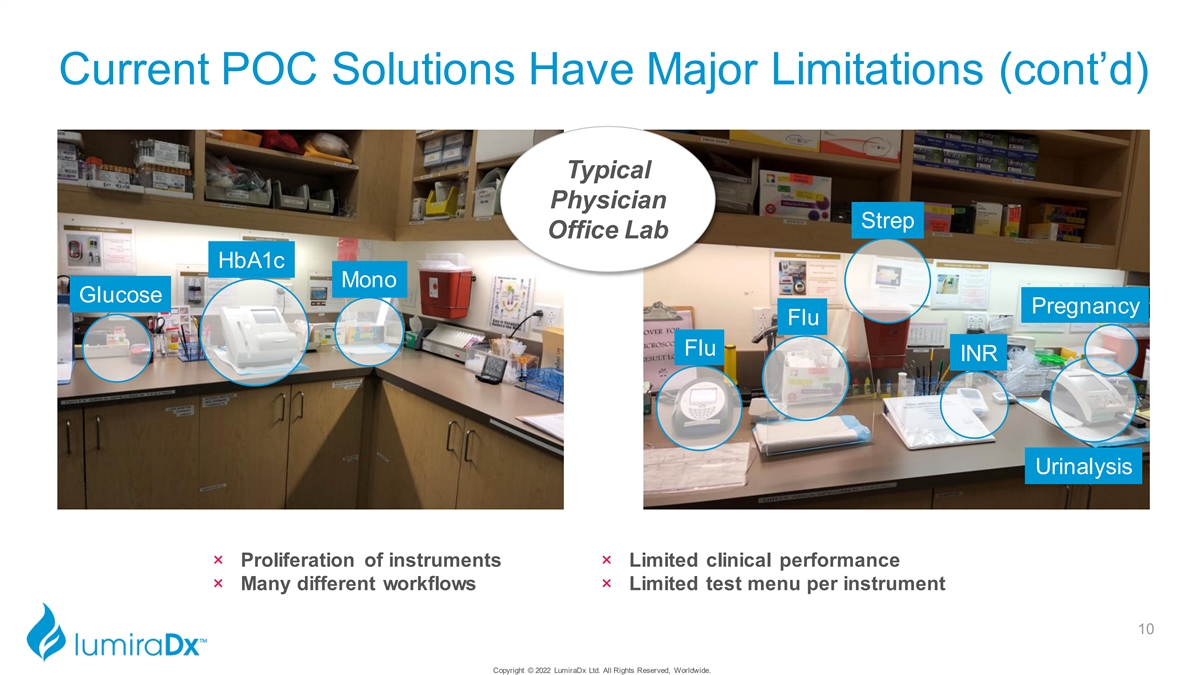

Current POC Solutions Have Major Limitations (cont’d) Typical Physician Strep Office Lab HbA1c Mono Glucose Pregnancy Flu Flu INR Urinalysis × Proliferation of instruments × Limited clinical performance × Many different workflows × Limited test menu per instrument 10 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

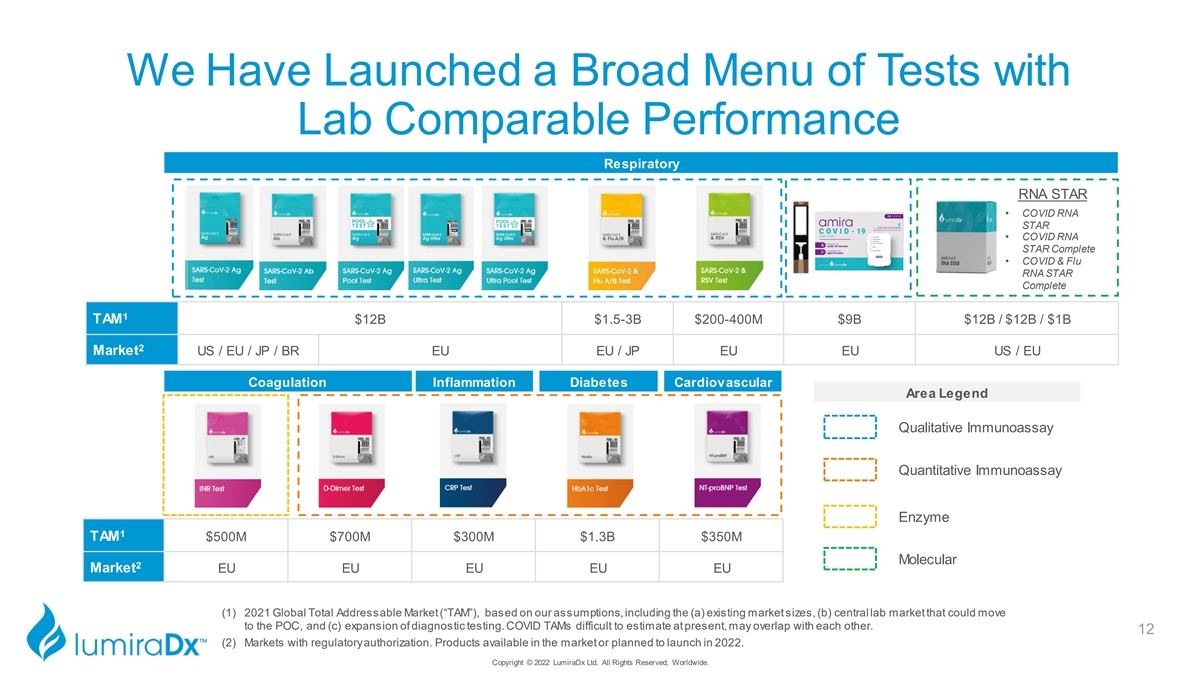

We Have Launched a Broad Menu of Tests with Lab Comparable Performance Respiratory RNA STAR • COVID RNA STAR • COVID RNA STAR Complete • COVID & Flu RNA STAR Complete 1 TAM $12B $1.5-3B $200-400M $9B $12B / $12B / $1B 2 Market US / EU / JP / BR EU EU / JP EU EU US / EU Coagulation Inflammation Diabetes Cardiovascular Area Legend Qualitative Immunoassay \\\A Quantitative Immunoassay Enzyme 1 TAM $500M $700M $300M $1.3B $350M Molecular 2 Market EU EU EU EU EU (1) 2021 Global Total Addressable Market (“TAM”), based on our assumptions, including the (a) existing market sizes, (b) central lab market that could move to the POC, and (c) expansion of diagnostic testing. COVID TAMs difficult to estimate at present, may overlap with each other. 12 (2) Markets with regulatory authorization. Products available in the market or planned to launch in 2022. Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

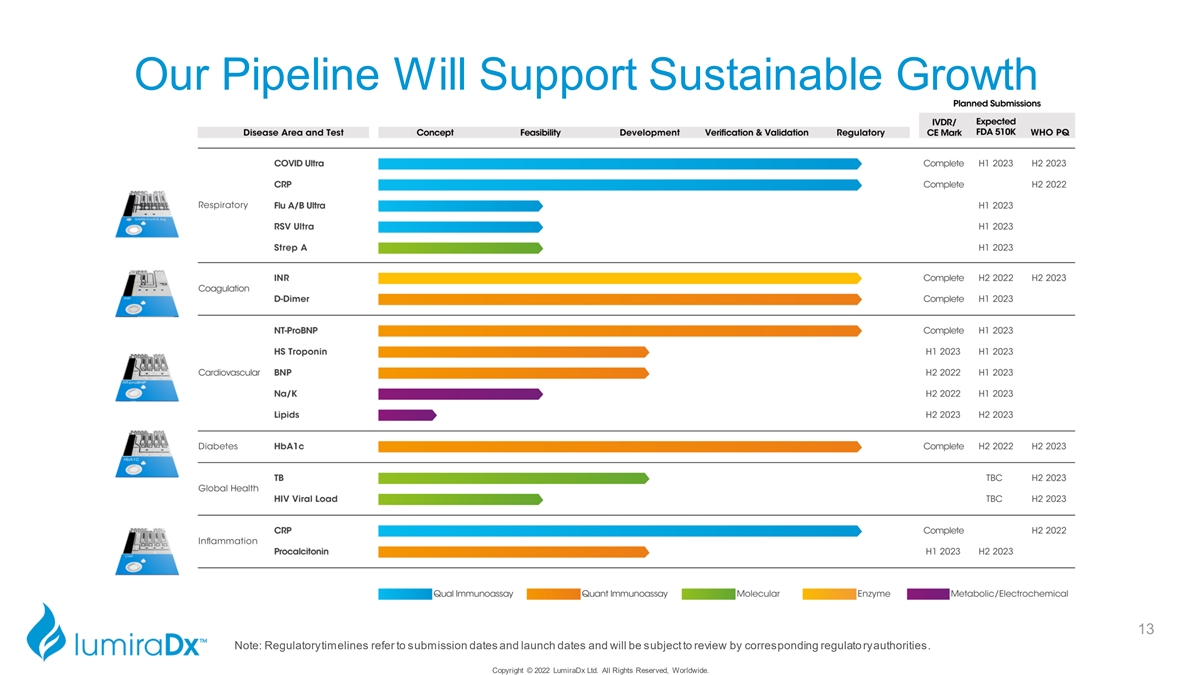

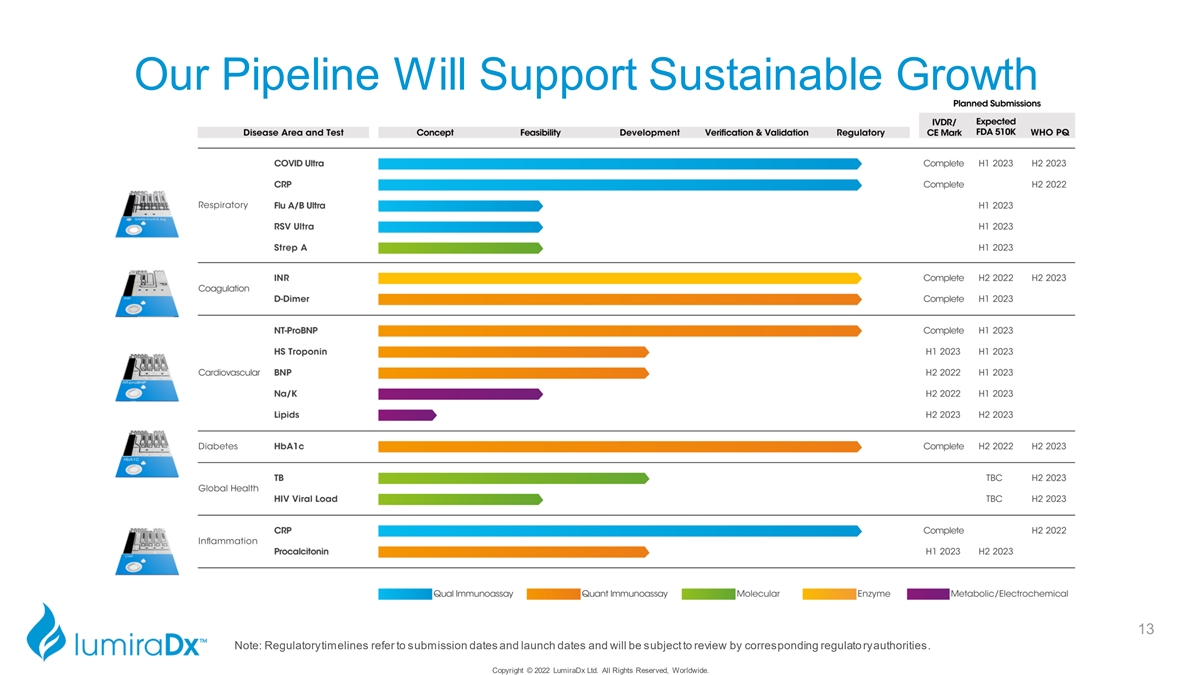

Our Pipeline Will Support Sustainable Growth 13 Note: Regulatory timelines refer to submission dates and launch dates and will be subject to review by corresponding regulatory authorities. Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Platform Technology & Manufacturing Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

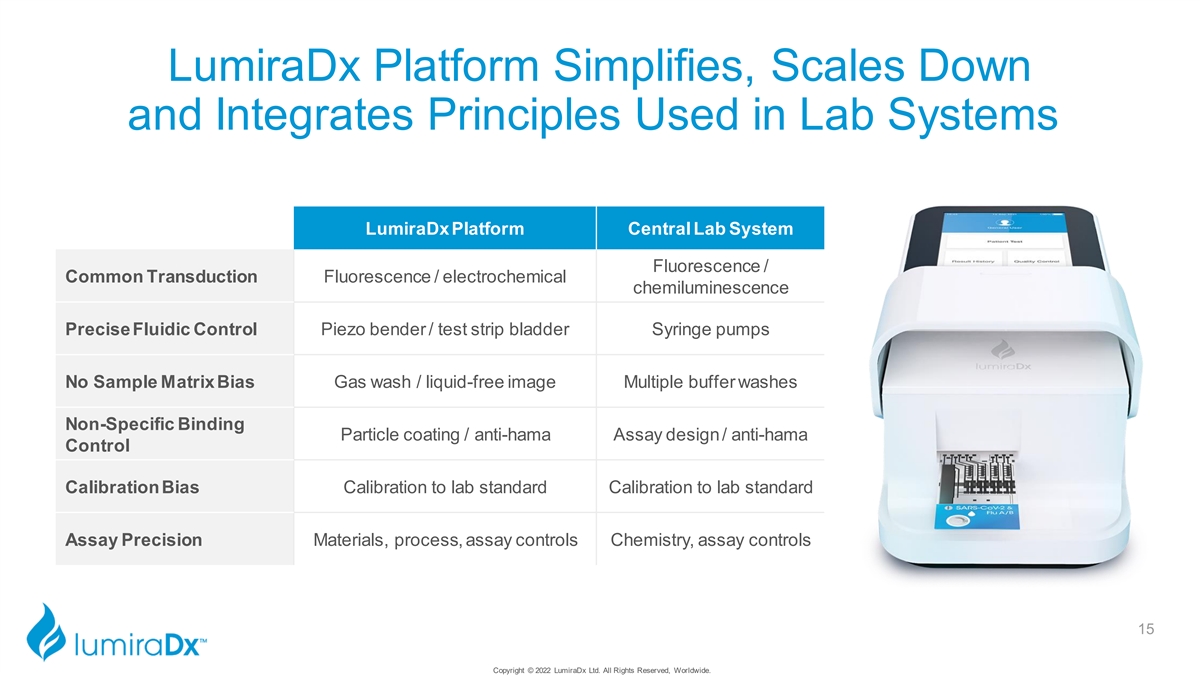

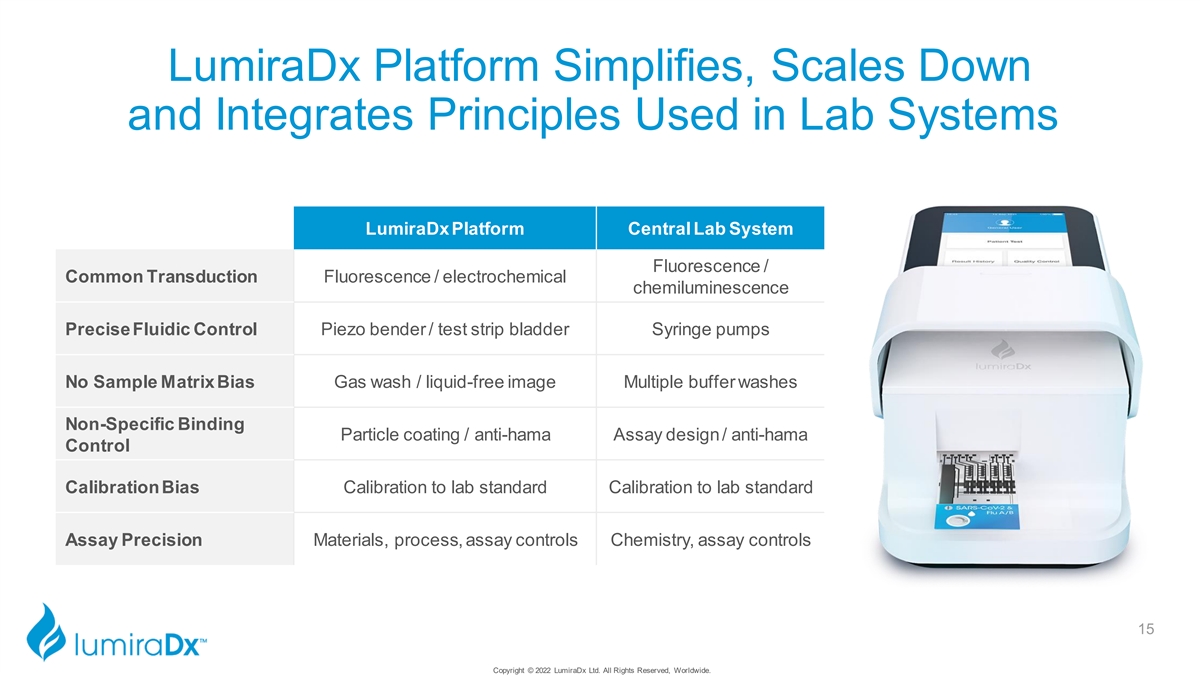

LumiraDx Platform Simplifies, Scales Down and Integrates Principles Used in Lab Systems LumiraDx Platform Central Lab System Fluorescence / Common Transduction Fluorescence / electrochemical chemiluminescence Precise Fluidic Control Piezo bender / test strip bladder Syringe pumps No Sample Matrix Bias Gas wash / liquid-free image Multiple buffer washes Non-Specific Binding Particle coating / anti-hama Assay design / anti-hama Control Calibration Bias Calibration to lab standard Calibration to lab standard Assay Precision Materials, process, assay controls Chemistry, assay controls 15 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Our Platform Allows for Multiple Sample Types and Test Technologies on Common Strip Architecture Test Technologies Immunoassay Clinical Chemistry Enzyme Hematology Molecular Electrolytes / Blood Gas Sample Types Nasal/Nasopharyngeal Fingerstick blood Throat Swab + Saliva Venous blood/ Urine Plasma/Serum 16 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

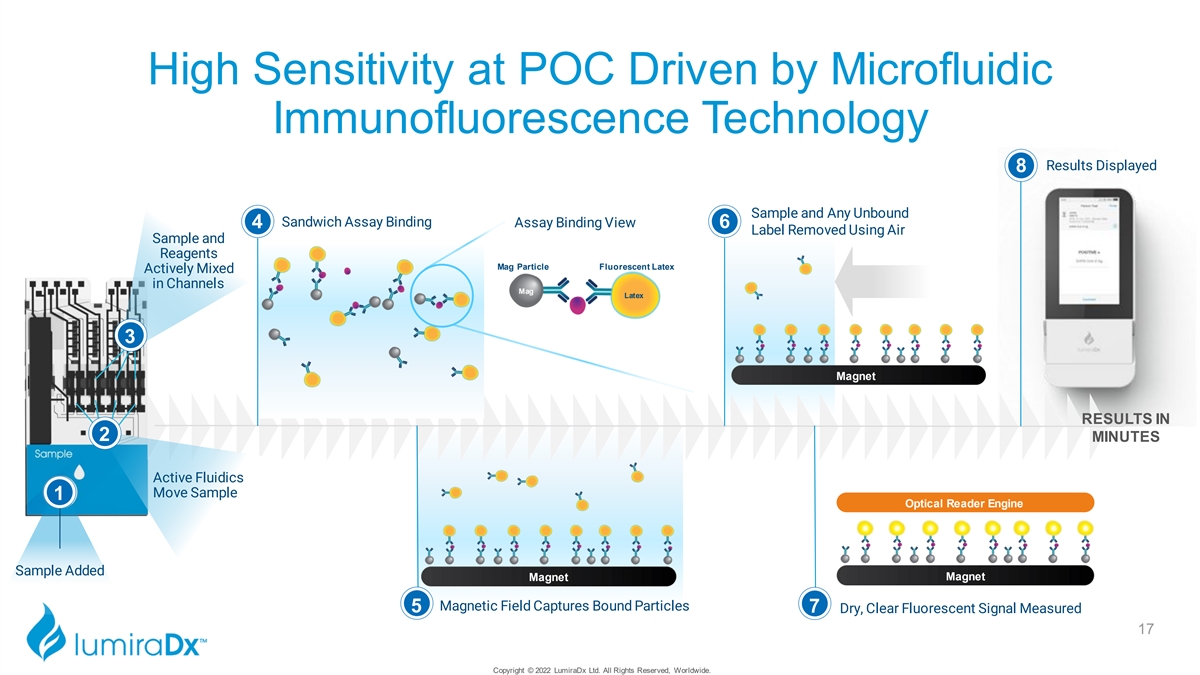

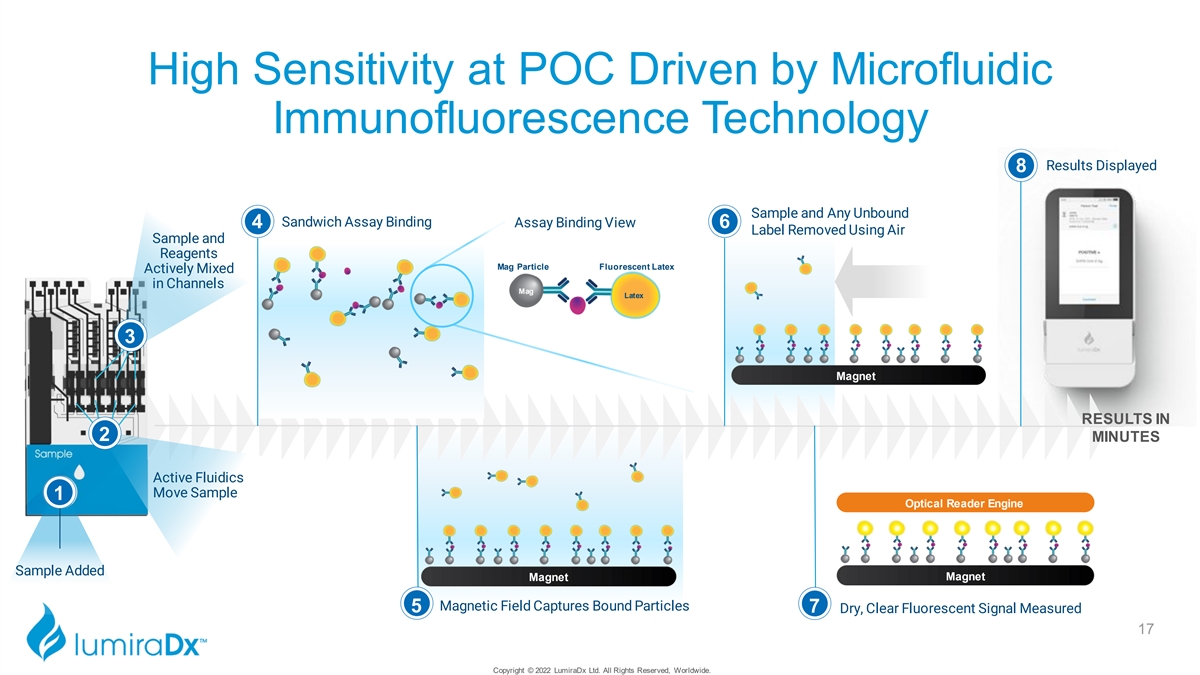

High Sensitivity at POC Driven by Microfluidic Immunofluorescence Technology Results Displayed 8 Sample and Any Unbound Sandwich Assay Binding Assay Binding View 4 6 Label Removed Using Air Sample and Reagents Mag Particle Fluorescent Latex Actively Mixed in Channels Mag Latex 3 Magnet RESULTS IN 2 MINUTES Active Fluidics Move Sample 1 Optical Reader Engine Sample Added Magnet Magnet Magnetic Field Captures Bound Particles 5 7 Dry, Clear Fluorescent Signal Measured 17 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Highly Scalable Manufacturing Enables Global Growth Strategy ž Test strips manufactured on a common platform using a high volume, web-based, automated manufacturing process ž Platform manufacturing facilities located in Alloa, Stirling, and Glasgow Scotland with total current capacity of over 28 million test strips per month with possibility to expand further ž Instrument manufactured by Flextronics (a contract manufacturer) at its facility in Althofen, Austria 18 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Simple, Common Strip Design Enables Low Cost and Disruptive Market Pricing Testing Prices* 5 – 10x Central Lab 2 – 3x Central Lab Base Price Central Lab LumiraDx POC Other POC * company estimate 19 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

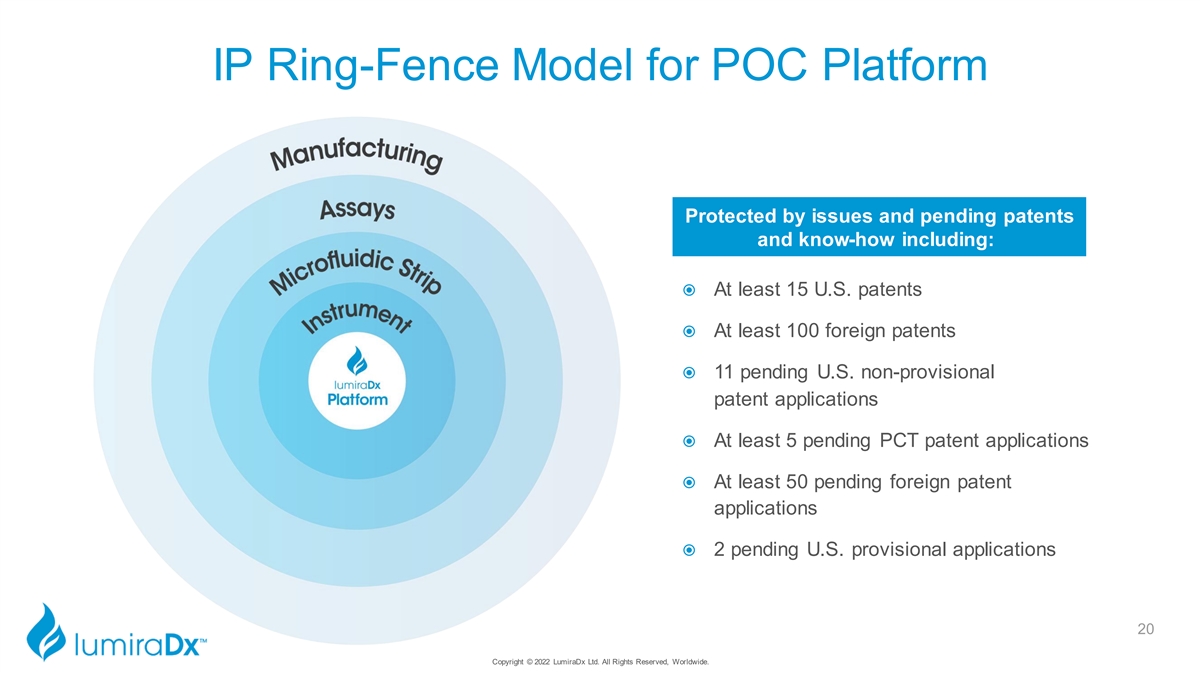

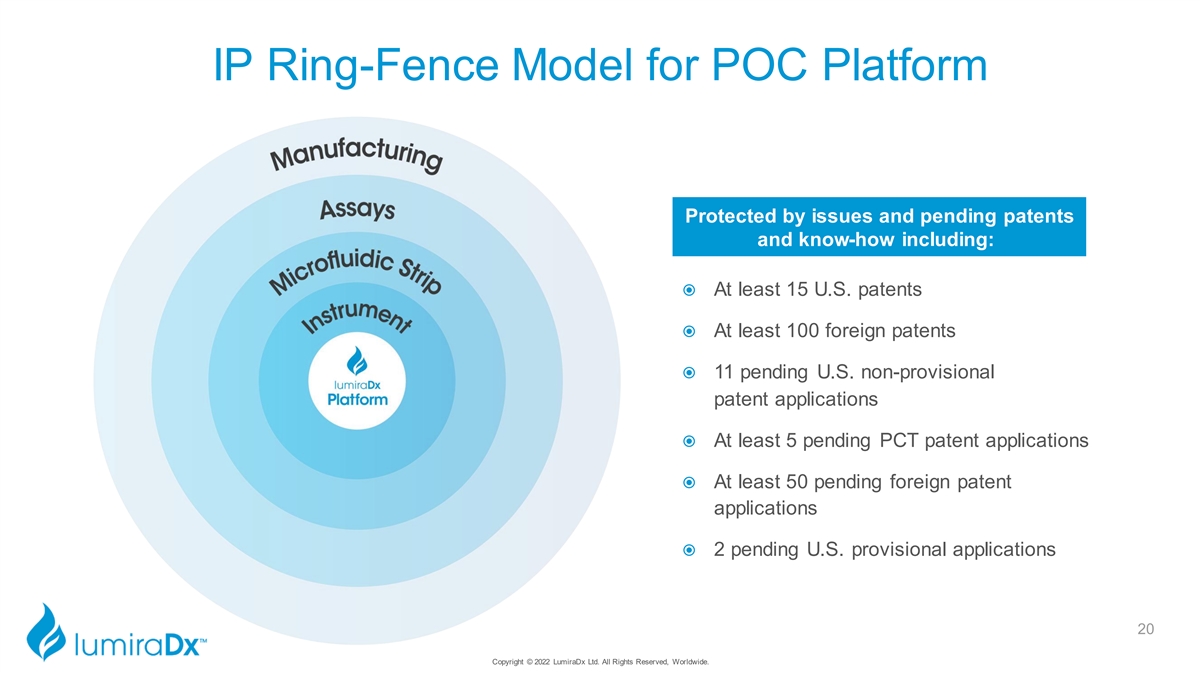

IP Ring-Fence Model for POC Platform Protected by issues and pending patents and know-how including: ž At least 15 U.S. patents ž At least 100 foreign patents ž 11 pending U.S. non-provisional patent applications ž At least 5 pending PCT patent applications ž At least 50 pending foreign patent applications ž 2 pending U.S. provisional applications 20 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Comprehensive Diagnostic Solutions from Lab to Home Fast Lab Solutions LumiraDx Platform Antigen Reference Labs POC Labs Home, Screening Venues • Innovative qSTAR technology • Actively controlled microfluidic technology • Actively controlled microfluidic technology • Single step method on open channel PCR • Lab comparable performance at point of care • Lab comparable performance at point of need, systems • Multiple technologies, sample types and tests on designed for the home • Results in 20 minutes a single system • Authorized tests: COVID antigen (POC) • Up to 1000 tests/hour/machine • Authorized tests: COVID antigen/antibody, D- • Pipeline areas: Chronic disease management, • Authorized tests: COVID RNA STAR, COVID Dimer, INR, CRP, HbA1c,NT-ProBNP global health screening RNA STAR Complete, COVID & Flu RNA STAR • Pipeline areas: Respiratory, Cardiovascular, Complete, COVID Dual Target RNA STAR Coagulation, Diabetes, Sexual Health, Global Complete Health, Virology • Pipeline areas: Respiratory, Sexual Health, Global Health, Virology Decentralization 21 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

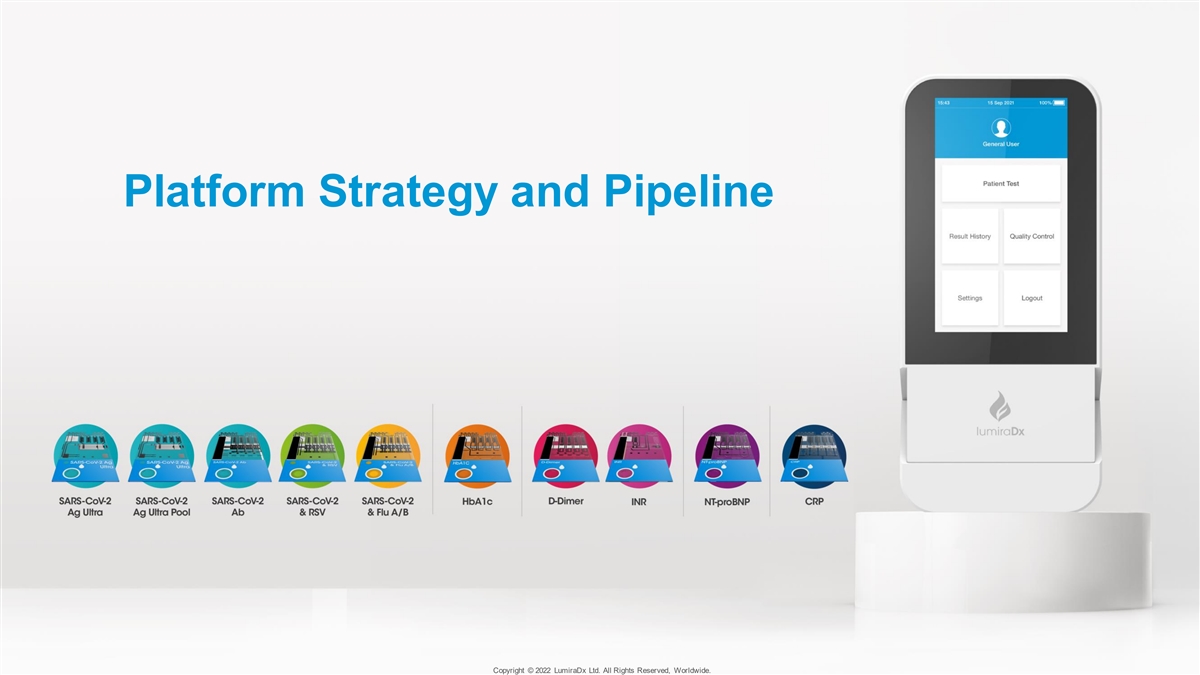

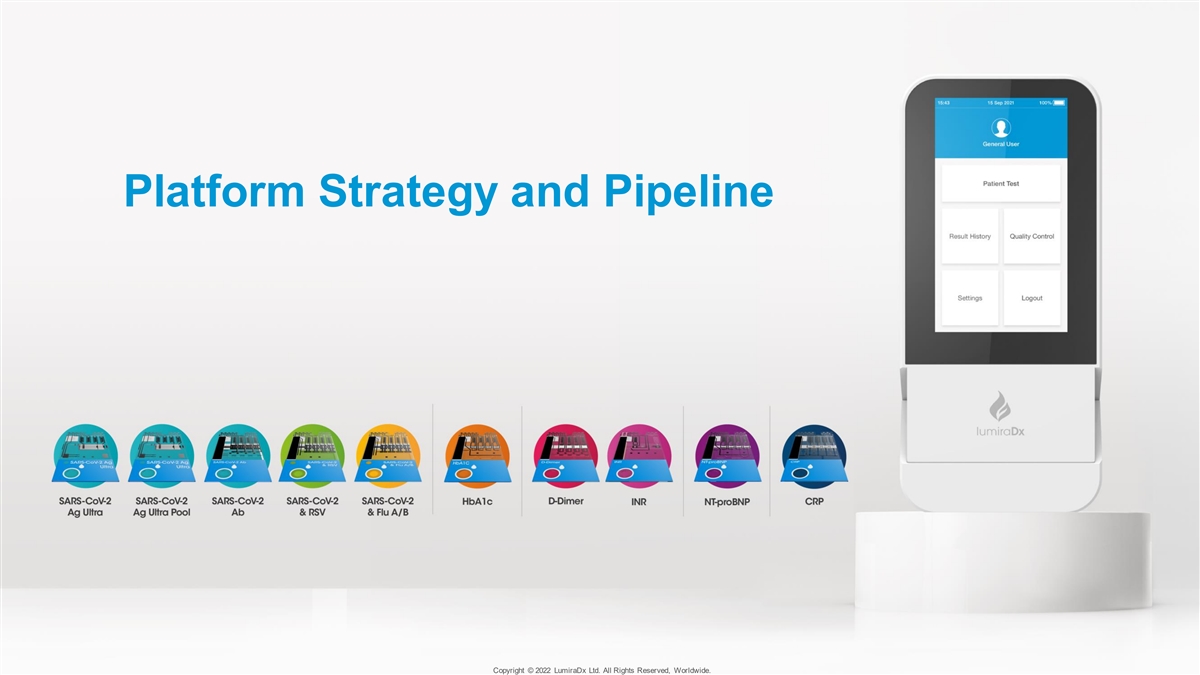

Platform Strategy and Pipeline Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Platform Strategy Focused on Improving and Expanding the POC Testing Experience Raise the standard for POC testing 1 performance, speed, access and experience Consolidate multiple POC instruments 2 to a single lab comparable platform Develop comprehensive test menus 3 by disease and care setting 23 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

1 Raise the Standard for POC Testing Performance, Speed, Access and Experience Example: Rule of Venous Thromboembolism with LumiraDxD-Dimer test ž High sensitivity and speed: ULTRA product line delivers high sensitivity results for respiratory disease diagnosis, taking test times from 15-30 minutes down to 5 minutes ž Easy sample collection: Only quantitative fingerstick blood-based tests for D-Dimer and NT- proBNP to aid faster clinical decisions in community settings ž Built to expand access: Portable system (2.2 lbs, low footprint, battery operated, room temp reagents) ž 100% negative predictive value at the 500 μg/L cut off, when and cloud-based connectivity enables centrally used in combination with a pretest probability score managed program in the community ž Fingerstick sample, results in 6 minutes ž Strong correlation with the laboratory reference, in particular around the clinically relevant values of <750 μg/L FEU 24 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

1 Real World Evidence Supports LumiraDx COVID Antigen Test Molecular-Like Performance • Analysis inclusive of >680,000 test results from Avera McKennan Hospital & University Health Center • Sensitivity of LumiraDx microfluidic test similar to PCR in asymptomatic and symptomatic individuals, higher than lateral flow tests Copyright © 2020 LumiraDx Ltd. All Rights Reserved, Worldwide.

1 Introducing High Sensitivity Respiratory Testing with Ultra => Results in 5 minutes ž High sensitivity: COVID Ultra PPA 97.4% at Ct <34 ž Fast results: 5 minutes from sample application ž Full respiratory pipeline: COVID, Flu A/B, RSV, Strep A Grouping N PPA Ct < 34 (all) 39 97.4% Ct < 33 (all) 38 97.4% Ct < 30 (all) 35 97.1% Ct < 25 (all) 25 100% 26 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

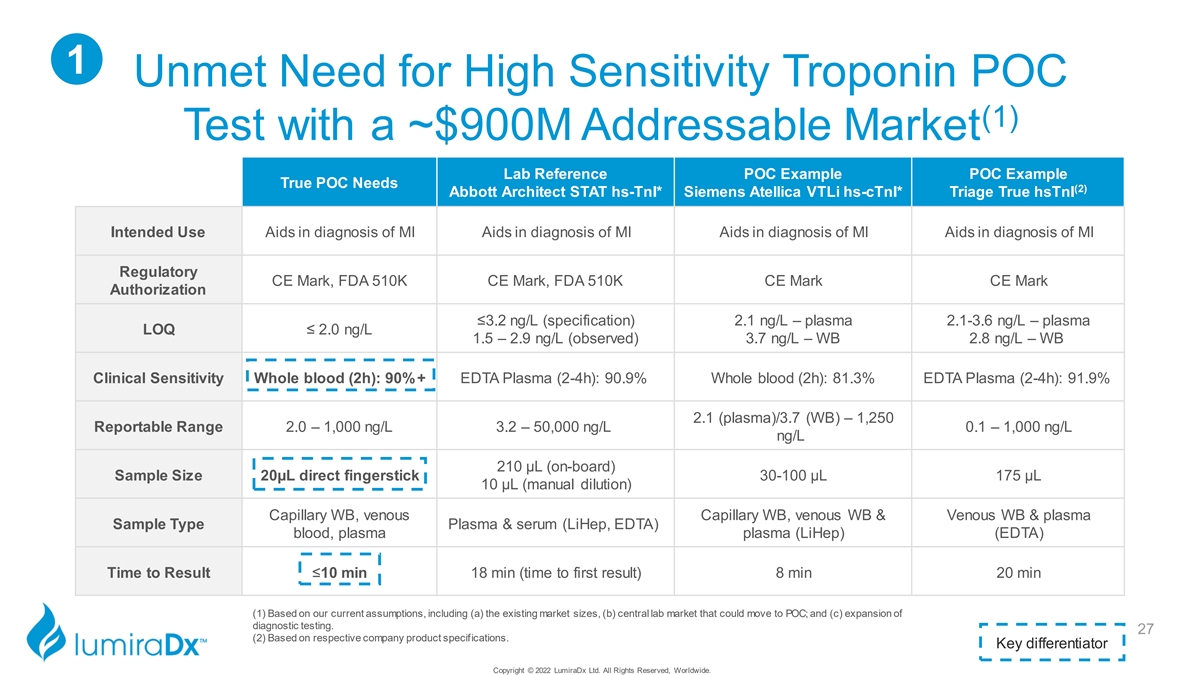

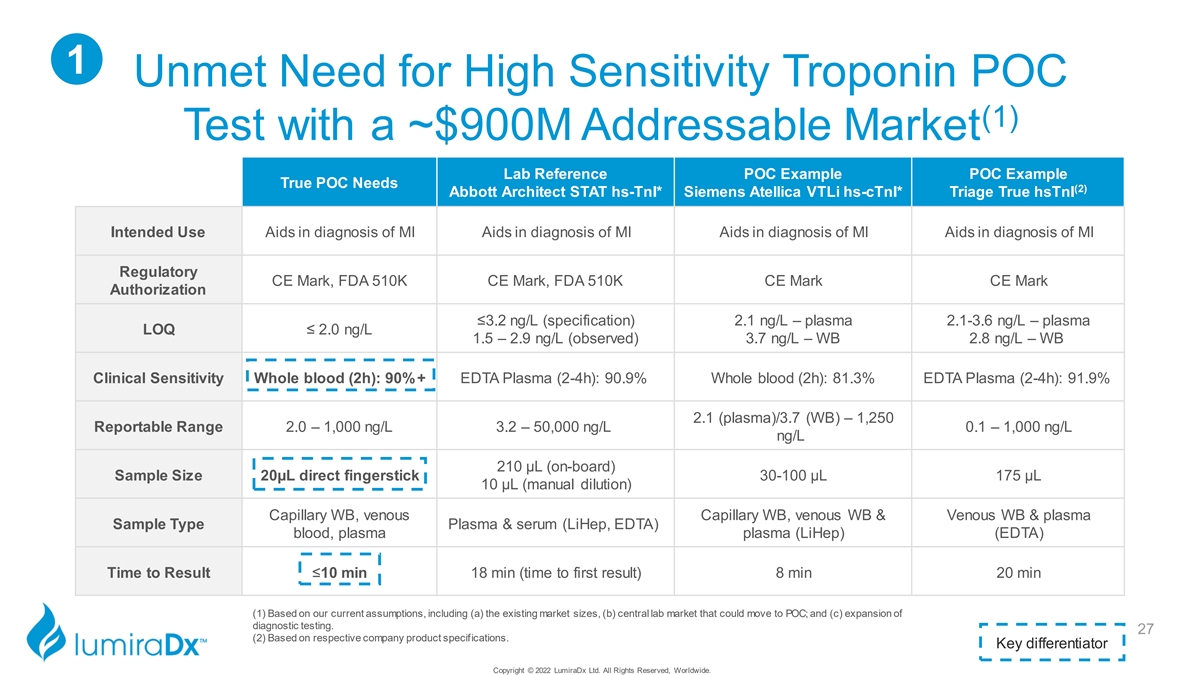

1 Unmet Need for High Sensitivity Troponin POC (1) Test with a ~$900M Addressable Market Lab Reference POC Example POC Example True POC Needs (2) Abbott Architect STAT hs-TnI* Siemens Atellica VTLi hs-cTnI* Triage True hsTnI Intended Use Aids in diagnosis of MI Aids in diagnosis of MI Aids in diagnosis of MI Aids in diagnosis of MI Regulatory CE Mark, FDA 510K CE Mark, FDA 510K CE Mark CE Mark Authorization ≤3.2 ng/L (specification) 2.1 ng/L – plasma 2.1-3.6 ng/L – plasma LOQ ≤ 2.0 ng/L 1.5 – 2.9 ng/L (observed) 3.7 ng/L – WB 2.8 ng/L – WB Clinical Sensitivity Whole blood (2h): 90%+ EDTA Plasma (2-4h): 90.9% Whole blood (2h): 81.3% EDTA Plasma (2-4h): 91.9% 2.1 (plasma)/3.7 (WB) – 1,250 Reportable Range 2.0 – 1,000 ng/L 3.2 – 50,000 ng/L 0.1 – 1,000 ng/L ng/L 210 µL (on-board) Sample Size 20µL direct fingerstick 30-100 µL 175 µL 10 µL (manual dilution) Capillary WB, venous Capillary WB, venous WB & Venous WB & plasma Sample Type Plasma & serum (LiHep, EDTA) blood, plasma plasma (LiHep) (EDTA) Time to Result ≤10 min 18 min (time to first result) 8 min 20 min (1) Based on our current assumptions, including (a) the existing market sizes, (b) central lab market that could move to POC; and (c) expansion of diagnostic testing. 27 (2) Based on respective company product specifications. Key differentiator Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

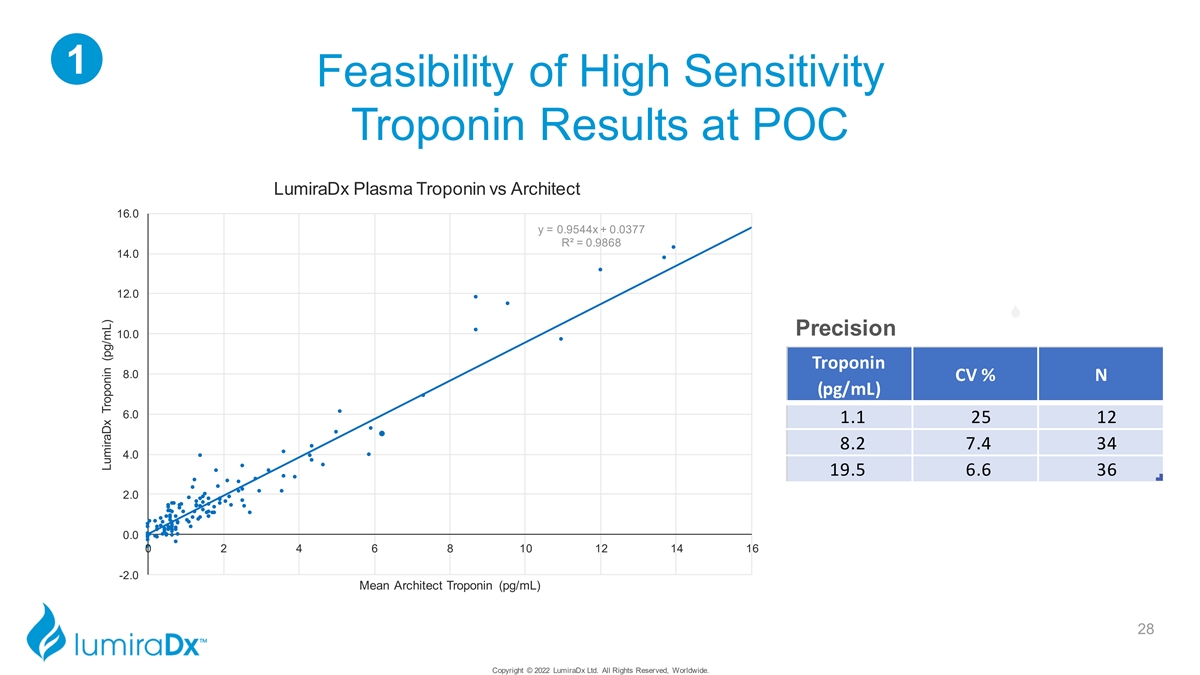

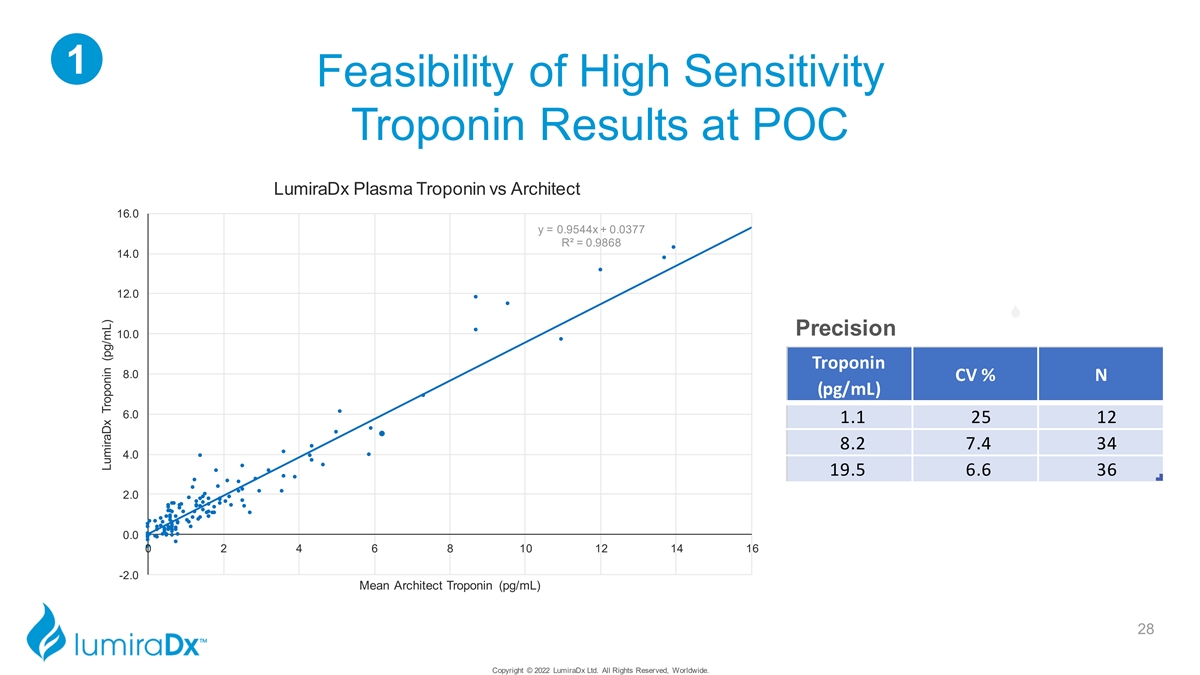

1 Feasibility of High Sensitivity Troponin Results at POC LumiraDx Plasma Troponin vs Architect 16.0 y = 0.9544x + 0.0377 R² = 0.9868 14.0 12.0 Precision 10.0 Troponin 8.0 CV % N (pg/mL) 6.0 1.1 25 12 8.2 7.4 34 4.0 19.5 6.6 36 2.0 0.0 0 2 4 6 8 10 12 14 16 -2.0 Mean Architect Troponin (pg/mL) 28 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide. LumiraDx Troponin (pg/mL)

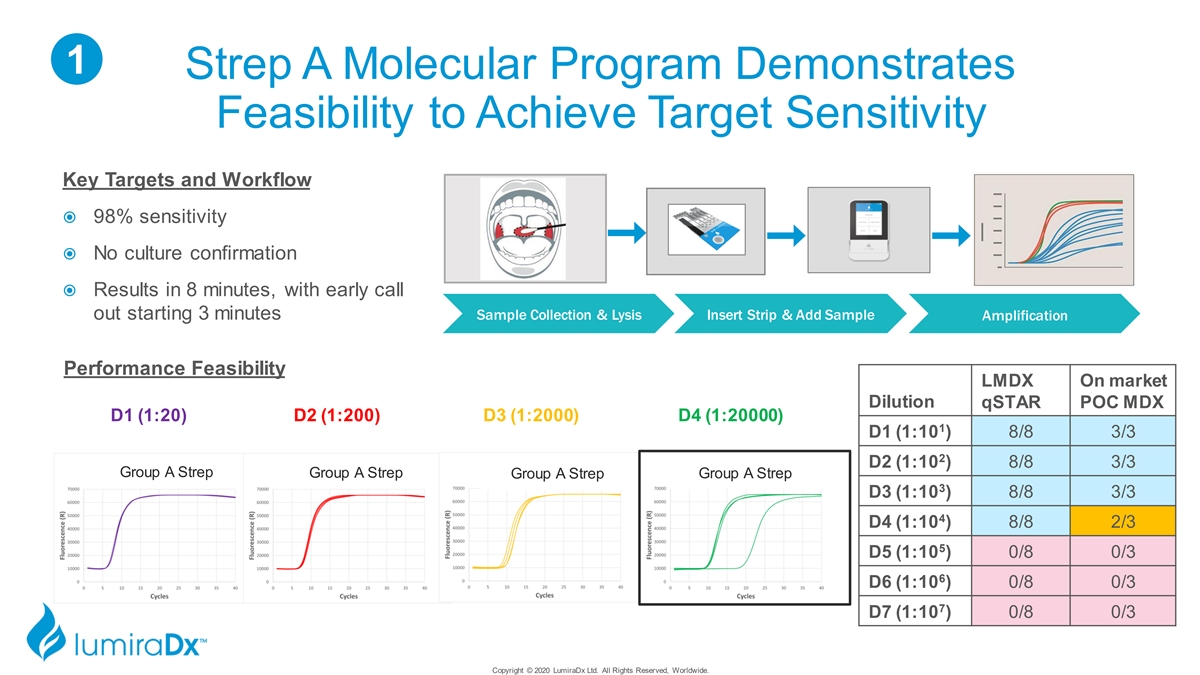

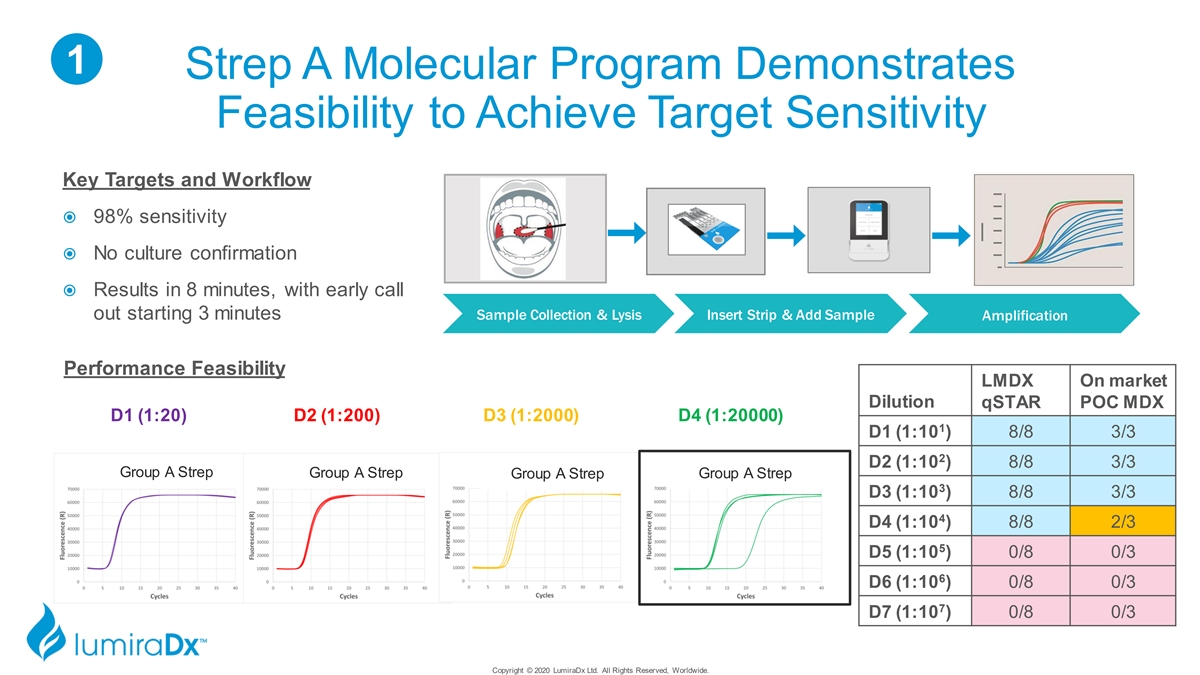

1 Strep A Molecular Program Demonstrates Feasibility to Achieve Target Sensitivity Key Targets and Workflow ž 98% sensitivity ž No culture confirmation ž Results in 8 minutes, with early call out starting 3 minutes Sample Collection & Lysis Insert Strip & Add Sample Amplification Performance Feasibility LMDX On market Dilution qSTAR POC MDX D1 (1:20) D2 (1:200) D3 (1:2000) D4 (1:20000) 1 D1 (1:10 ) 8/8 3/3 2 D2 (1:10 ) 8/8 3/3 Group A Strep Group A Strep Group A Strep Group A Strep 3 D3 (1:10 ) 8/8 3/3 4 D4 (1:10 ) 8/8 2/3 5 D5 (1:10 ) 0/8 0/3 6 D6 (1:10 ) 0/8 0/3 7 D7 (1:10 ) 0/8 0/3 Copyright © 2020 LumiraDx Ltd. All Rights Reserved, Worldwide.

1 TB Molecular Program Demonstrates Feasibility to Develop Swab Based POC Test Key Targets and Workflow Value Proposition ž Tongue swab sample POC TB test has opportunity to increase patients linked to care ž Results in 20 minutes ž Access to testing for HIV+ and Pediatric Populations, currently underserved Performance Feasibility Copy No of number % positivity positives (cp/rxn) 8/8 100 11 8/8 100 5.6 33/38 87 1.3 3/8 33 0.6 TB Care Cascade in Indian Public Health System Copyright © 2020 LumiraDx Ltd. All Rights Reserved, Worldwide.

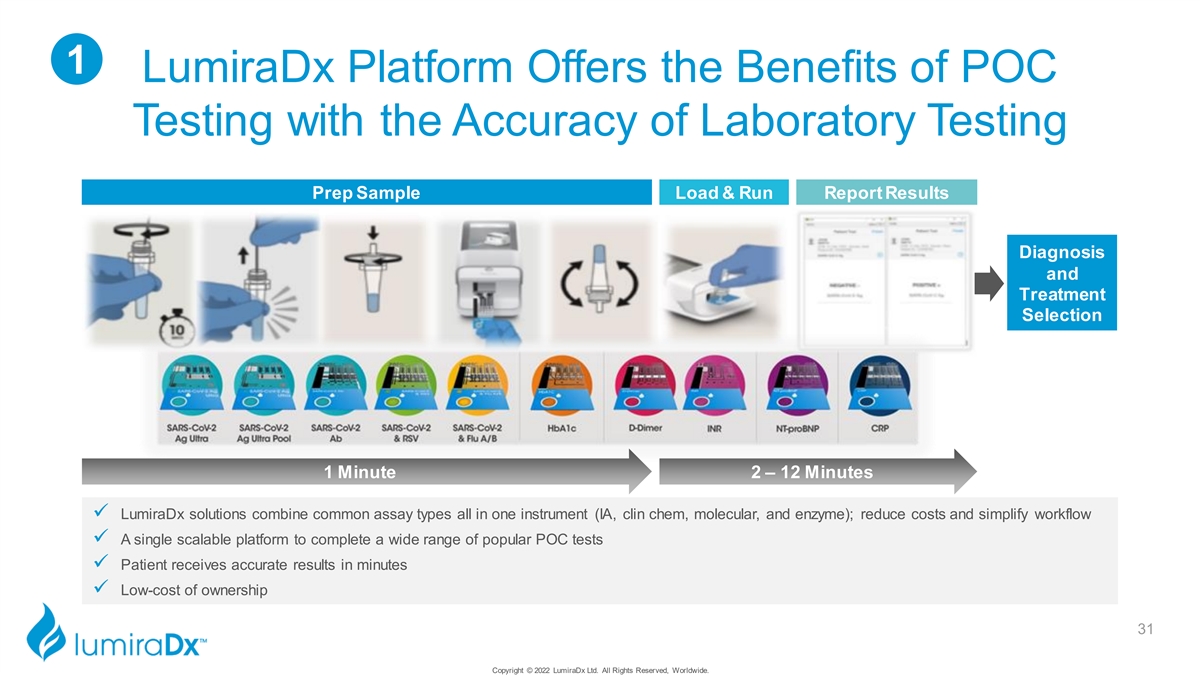

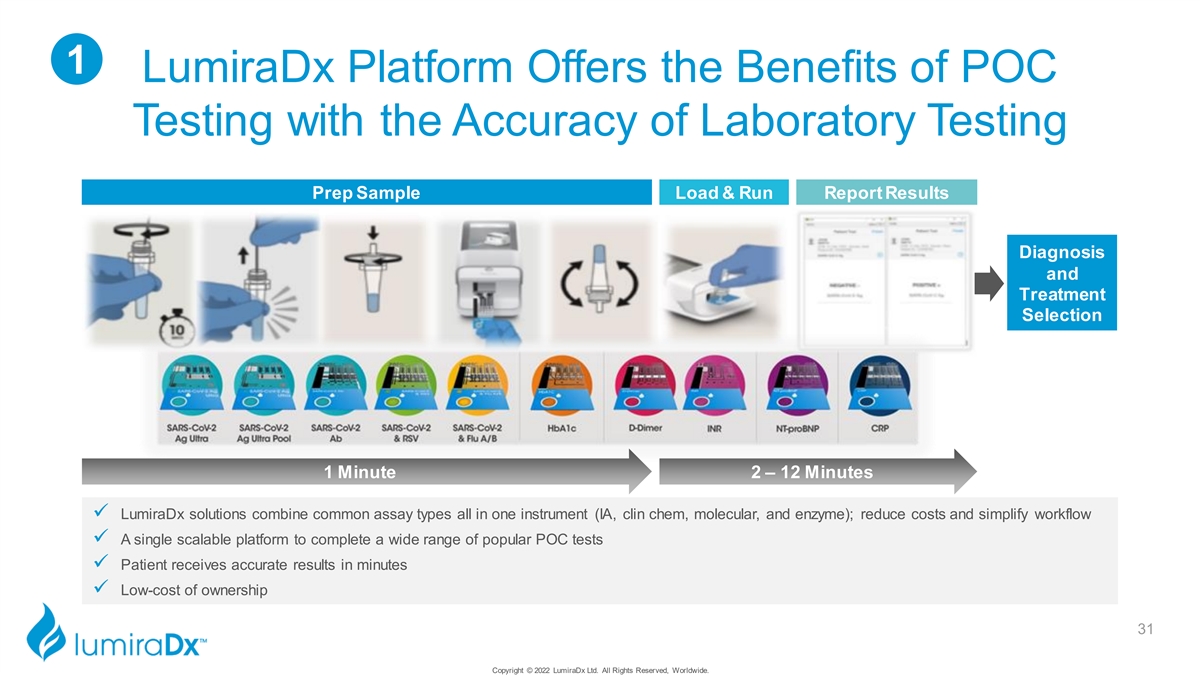

1 LumiraDx Platform Offers the Benefits of POC Testing with the Accuracy of Laboratory Testing Prep Sample Load & Run Report Results Diagnosis and Treatment Selection 1 Minute 2 – 12 Minutes ✓ LumiraDx solutions combine common assay types all in one instrument (IA, clin chem, molecular, and enzyme); reduce costs and simplify workflow ✓ A single scalable platform to complete a wide range of popular POC tests ✓ Patient receives accurate results in minutes ✓ Low-cost of ownership 31 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

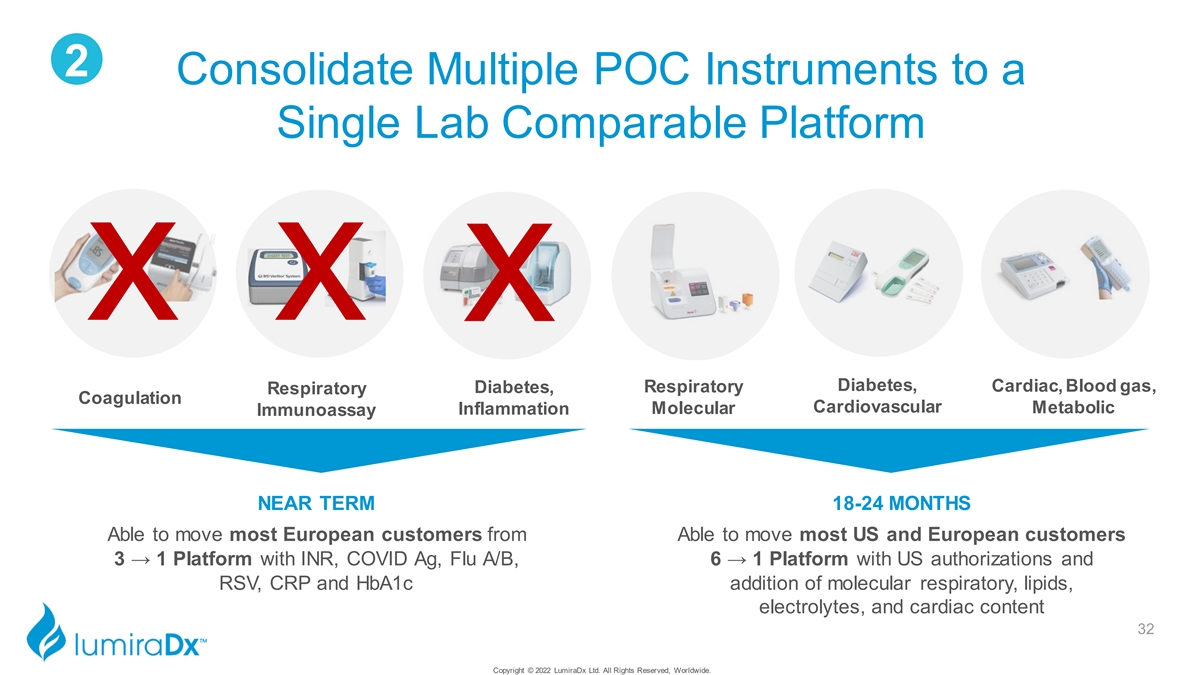

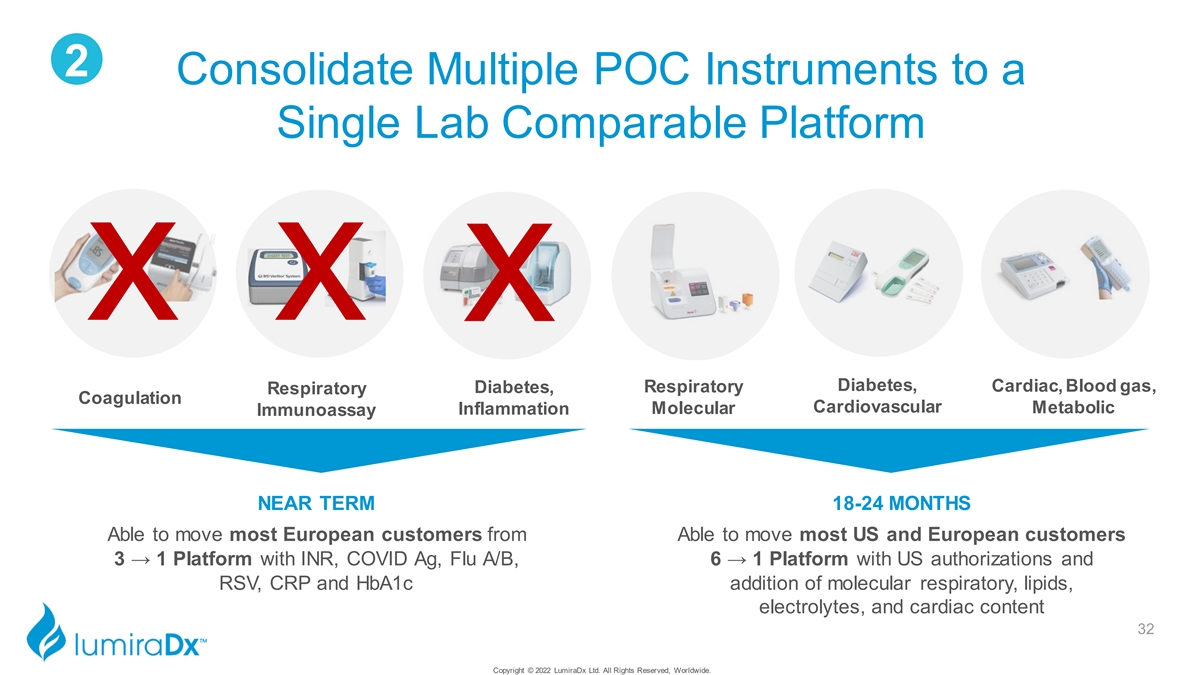

2 Consolidate Multiple POC Instruments to a Single Lab Comparable Platform x x x Diabetes, Respiratory Cardiac, Blood gas, Diabetes, Respiratory Coagulation Cardiovascular Molecular Metabolic Inflammation Immunoassay NEAR TERM 18-24 MONTHS Able to move most European customers from Able to move most US and European customers 3 → 1 Platform with INR, COVID Ag, Flu A/B, 6 → 1 Platform with US authorizations and RSV, CRP and HbA1c addition of molecular respiratory, lipids, electrolytes, and cardiac content 32 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

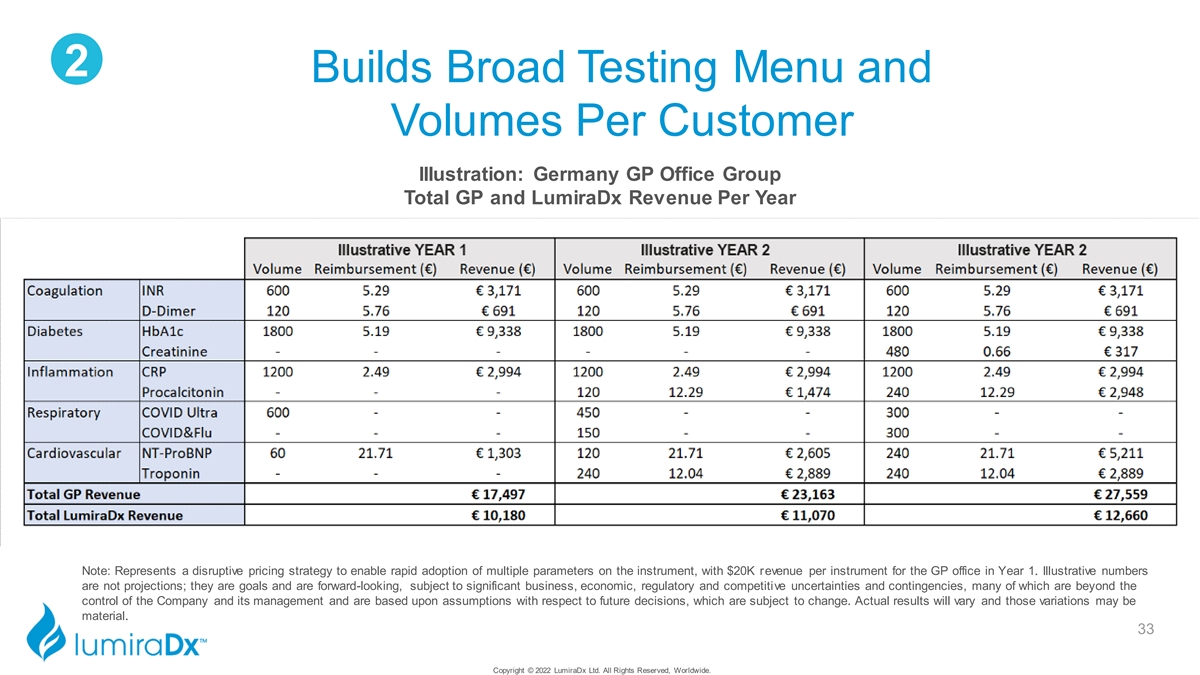

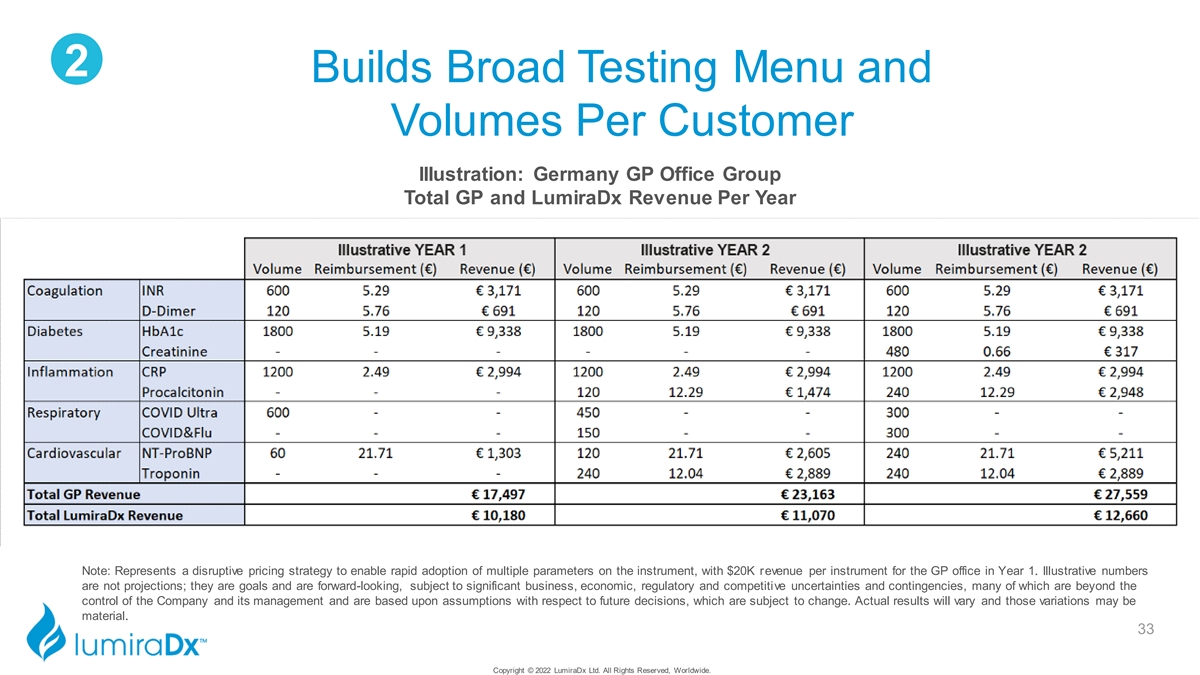

2 Builds Broad Testing Menu and Volumes Per Customer Illustration: Germany GP Office Group Total GP and LumiraDx Revenue Per Year Note: Represents a disruptive pricing strategy to enable rapid adoption of multiple parameters on the instrument, with $20K revenue per instrument for the GP office in Year 1. Illustrative numbers are not projections; they are goals and are forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. 33 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

3 Significant Progress in Meeting Community Based Testing Needs Antimicrobial Rule out of Venous Coagulation Heart Failure Diabetes screening & Application stewardship Thromboembolism monitoring diagnosis monitoring TAM* $300M $700M $500M $350M $1.3B POC Fingerstick sample, Fingerstick sample, Fingerstick sample, Fingerstick sample, Fingerstick sample, Specifications results in 4 min results in 6 min results in 1 min results in 12 min results in 7 min Commercial Commercially Commercially Commercially CE Mark CE Mark Expected H2 2022 Launch Expected H2 2022 Launch Status* Available Available Available 34 * Global Total Addressable Market: We estimated for each test based on our current assumptions, including the (a) existing market sizes, (b) central lab market that could move to the POC, and (c) expansion of diagnostic testing. Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

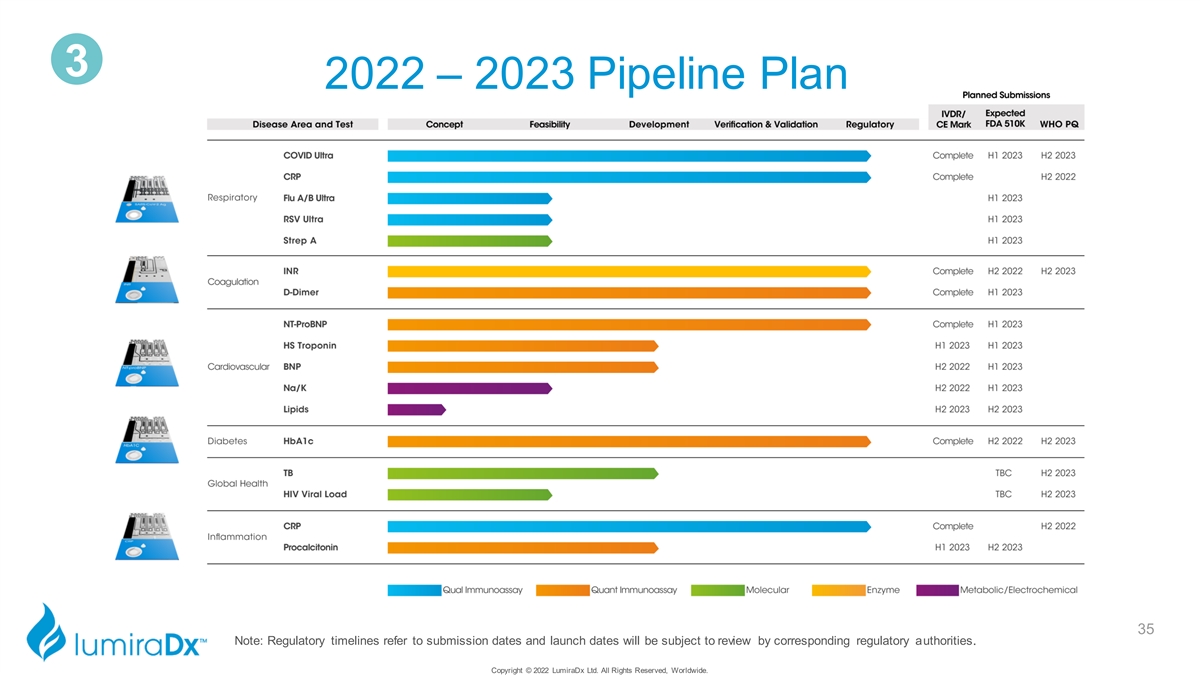

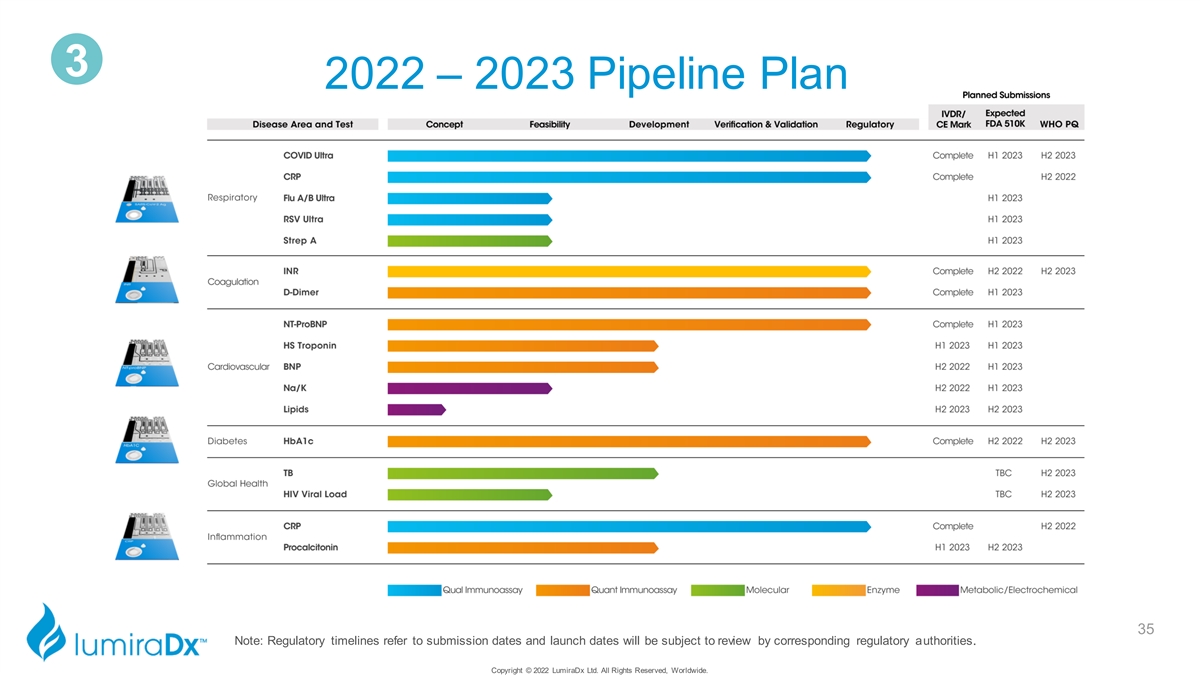

3 2022 – 2023 Pipeline Plan 35 Note: Regulatory timelines refer to submission dates and launch dates will be subject to review by corresponding regulatory authorities. Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

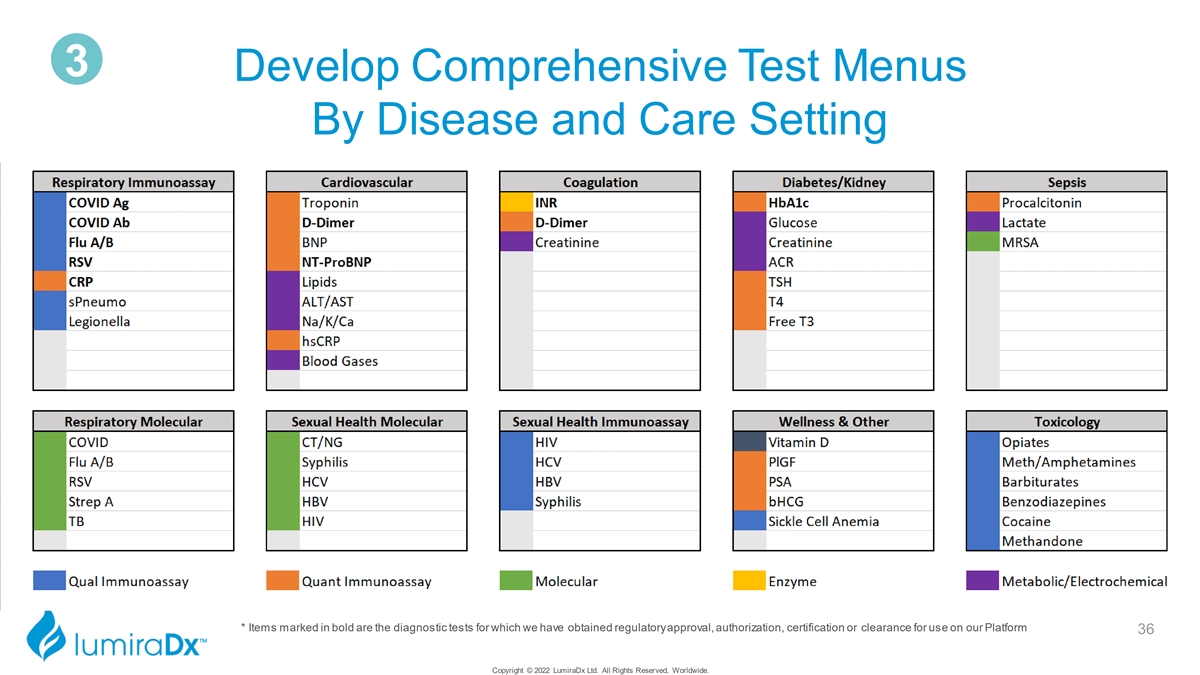

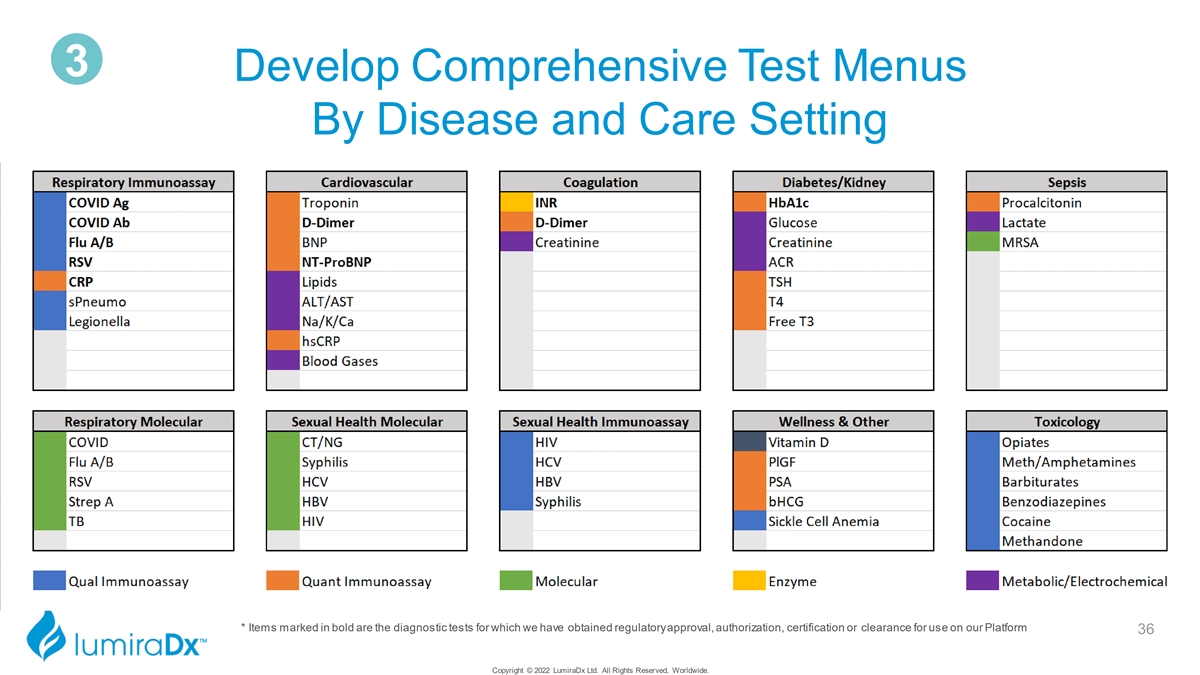

3 Develop Comprehensive Test Menus By Disease and Care Setting * Items marked in bold are the diagnostic tests for which we have obtained regulatory approval, authorization, certification or clearance for use on our Platform 36 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Leveraging our Technology Beyond the Platform: Diagnostic Solutions From Lab to Home Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

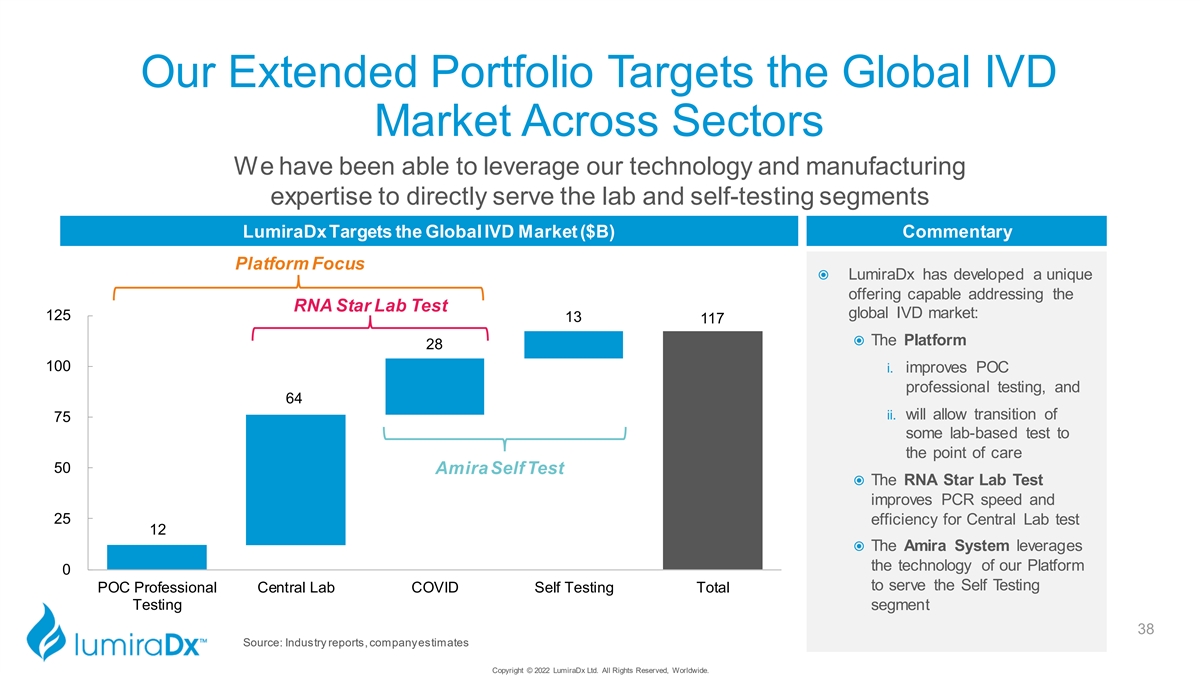

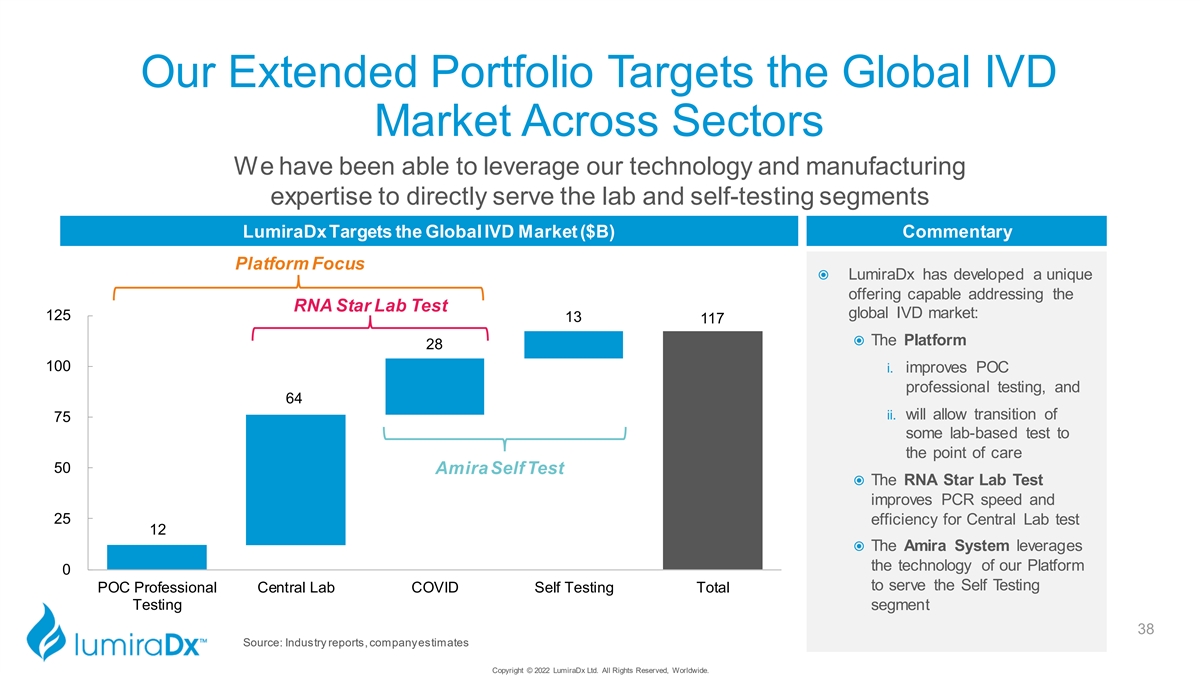

Our Extended Portfolio Targets the Global IVD Market Across Sectors We have been able to leverage our technology and manufacturing expertise to directly serve the lab and self-testing segments LumiraDx Targets the Global IVD Market ($B) Commentary Platform Focus ž LumiraDx has developed a unique offering capable addressing the RNA Star Lab Test global IVD market: 125 13 117 ž The Platform 28 100 i. improves POC professional testing, and 64 ii. will allow transition of 75 some lab-based test to the point of care 50 Amira Self Test ž The RNA Star Lab Test improves PCR speed and 25 efficiency for Central Lab test 12 ž The Amira System leverages the technology of our Platform 0 to serve the Self Testing POC Professional Central Lab COVID Self Testing Total Testing segment 38 Source: Industry reports, company estimates Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

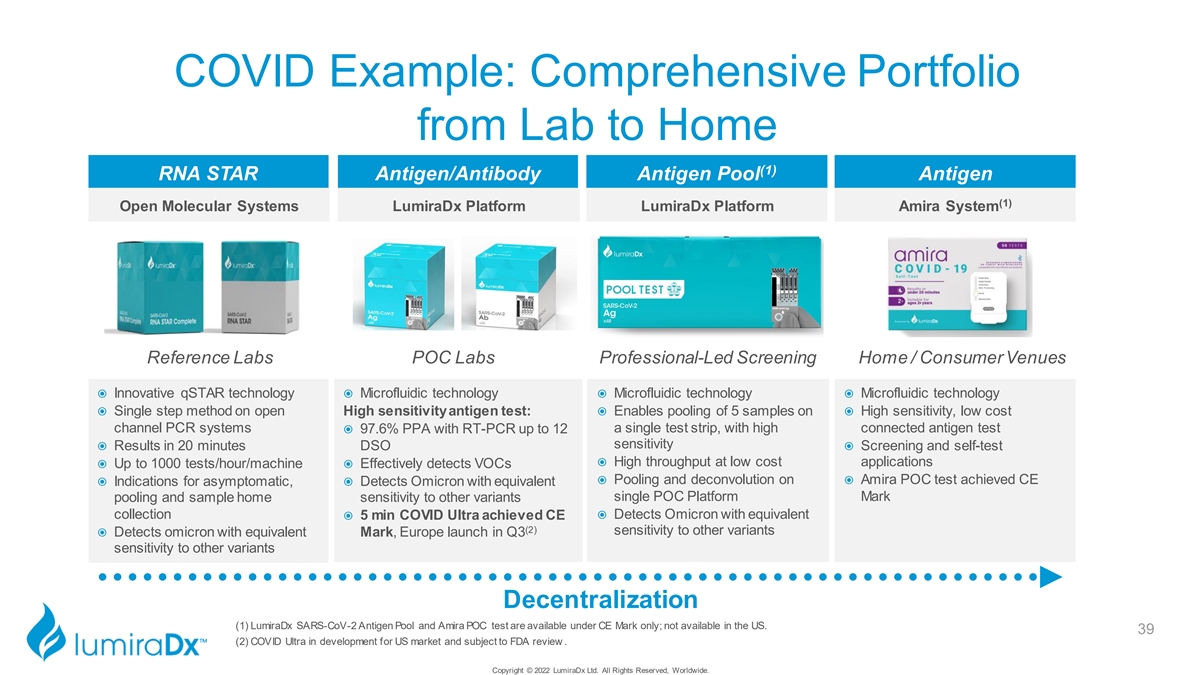

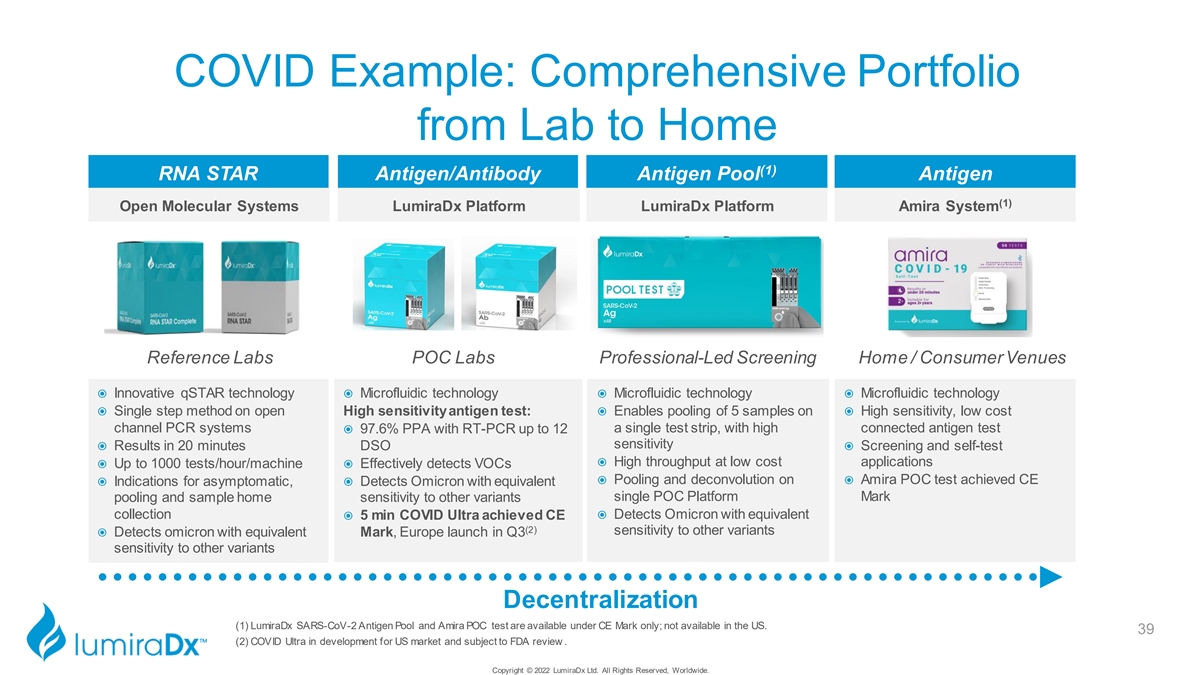

COVID Example: Comprehensive Portfolio from Lab to Home (1) RNA STAR Antigen/Antibody Antigen Pool Antigen (1) Open Molecular Systems LumiraDx Platform LumiraDx Platform Amira System Reference Labs POC Labs Professional-Led Screening Home / Consumer Venues ž Innovative qSTAR technologyž Microfluidic technologyž Microfluidic technologyž Microfluidic technology ž Single step method on open High sensitivity antigen test: ž Enables pooling of 5 samples on ž High sensitivity, low cost channel PCR systems a single test strip, with high connected antigen test ž 97.6% PPA with RT-PCR up to 12 sensitivity ž Results in 20 minutes DSOž Screening and self-test ž High throughput at low cost applications ž Up to 1000 tests/hour/machinež Effectively detects VOCs ž Pooling and deconvolution on ž Amira POC test achieved CE ž Indications for asymptomatic, ž Detects Omicron with equivalent single POC Platform Mark pooling and sample home sensitivity to other variants collectionž Detects Omicron with equivalent ž 5 min COVID Ultra achieved CE (2) sensitivity to other variants ž Detects omicron with equivalent Mark, Europe launch in Q3 sensitivity to other variants Decentralization (1) LumiraDx SARS-CoV-2 Antigen Pool and Amira POC test are available under CE Mark only; not available in the US. 39 (2) COVID Ultra in development for US market and subject to FDA review . Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

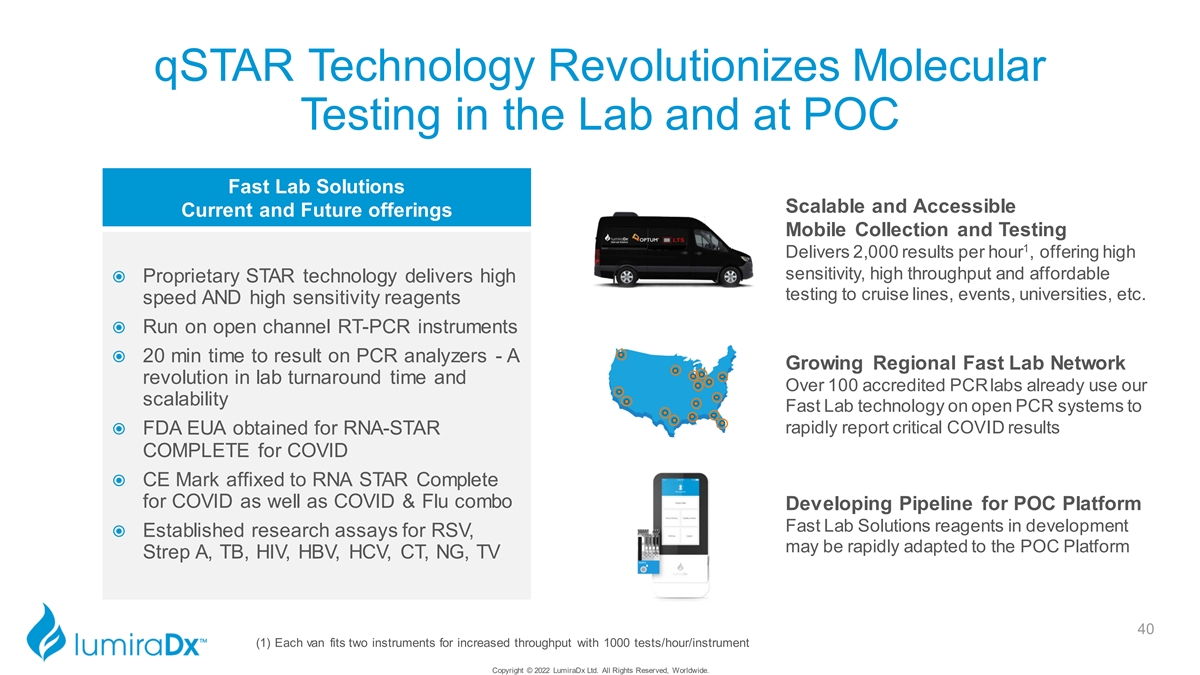

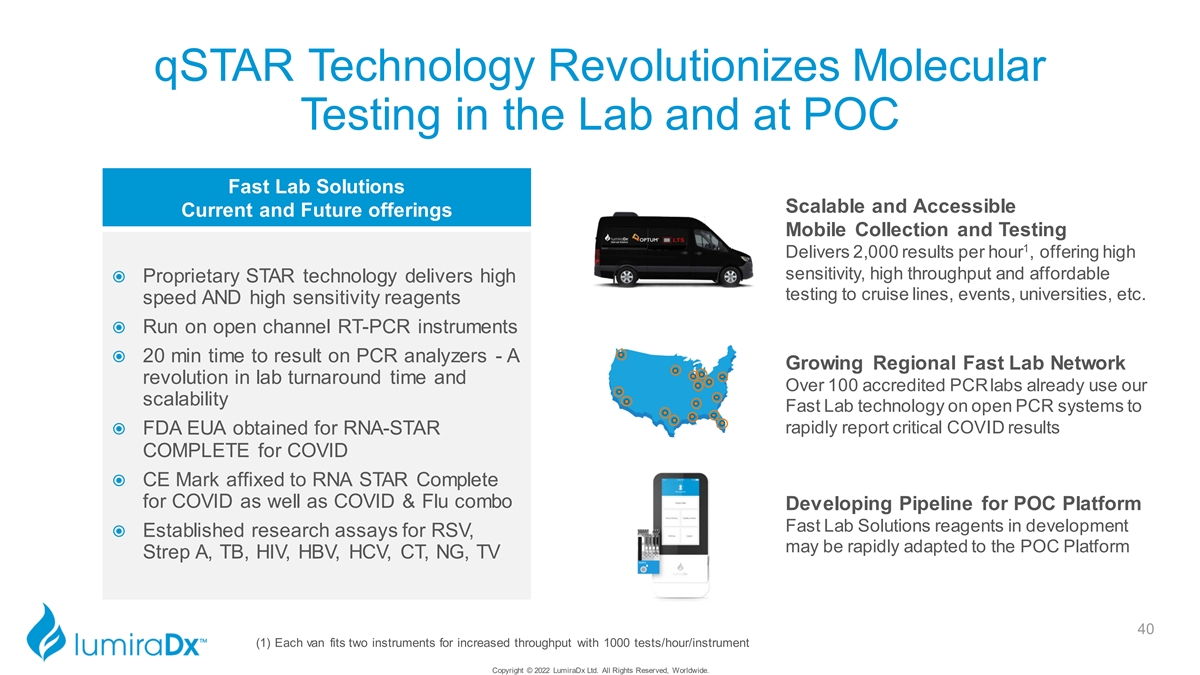

qSTAR Technology Revolutionizes Molecular Testing in the Lab and at POC Fast Lab Solutions Scalable and Accessible Current and Future offerings Mobile Collection and Testing 1 Delivers 2,000 results per hour , offering high sensitivity, high throughput and affordable ž Proprietary STAR technology delivers high testing to cruise lines, events, universities, etc. speed AND high sensitivity reagents ž Run on open channel RT-PCR instruments ž 20 min time to result on PCR analyzers - A Growing Regional Fast Lab Network revolution in lab turnaround time and Over 100 accredited PCR labs already use our scalability Fast Lab technology on open PCR systems to rapidly report critical COVID results ž FDA EUA obtained for RNA-STAR COMPLETE for COVID ž CE Mark affixed to RNA STAR Complete for COVID as well as COVID & Flu combo Developing Pipeline for POC Platform Fast Lab Solutions reagents in development ž Established research assays for RSV, may be rapidly adapted to the POC Platform Strep A, TB, HIV, HBV, HCV, CT, NG, TV 40 (1) Each van fits two instruments for increased throughput with 1000 tests/hour/instrument Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

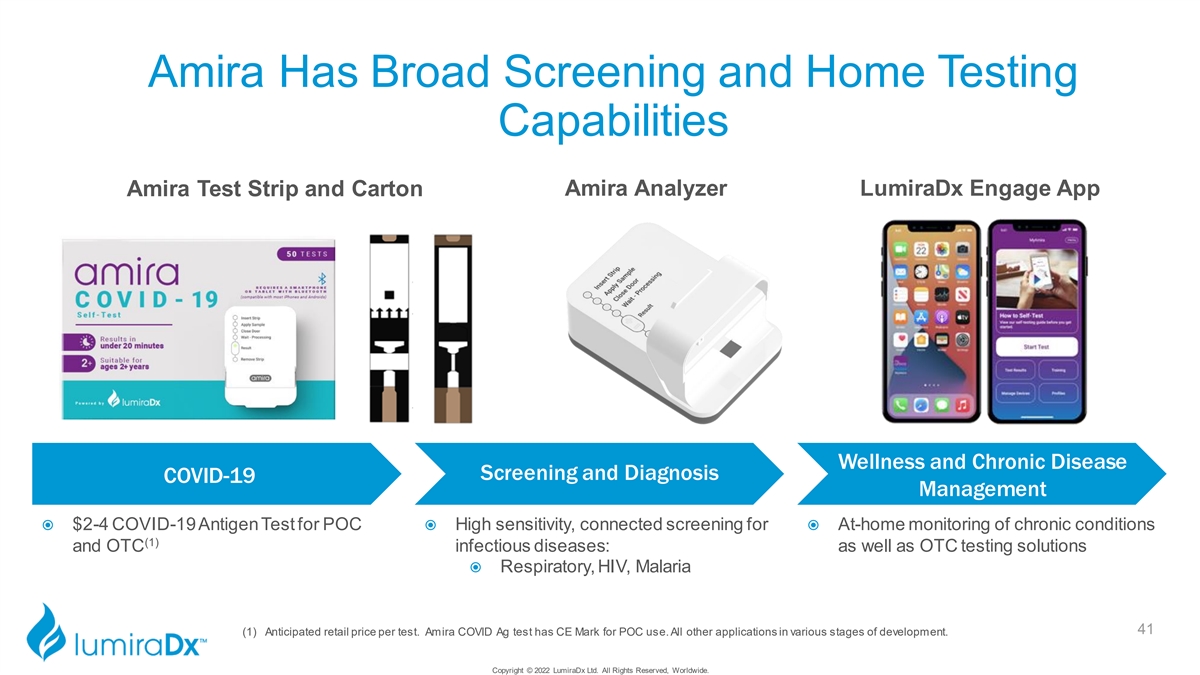

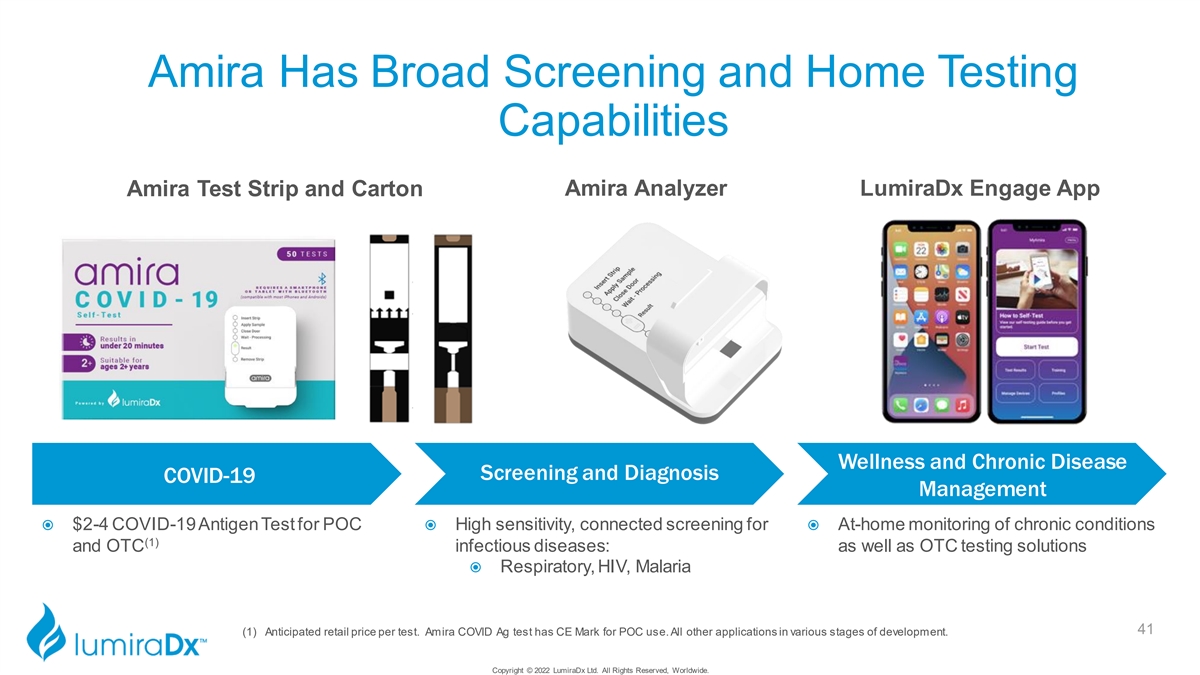

Amira Has Broad Screening and Home Testing Capabilities Amira Test Strip and Carton Amira Analyzer LumiraDx Engage App Wellness and Chronic Disease Screening and Diagnosis COVID-19 Management ž $2-4 COVID-19 Antigen Test for POC ž High sensitivity, connected screening for ž At-home monitoring of chronic conditions (1) and OTC infectious diseases: as well as OTC testing solutions ž Respiratory, HIV, Malaria 41 (1) Anticipated retail price per test. Amira COVID Ag test has CE Mark for POC use. All other applications in various stages of development. Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

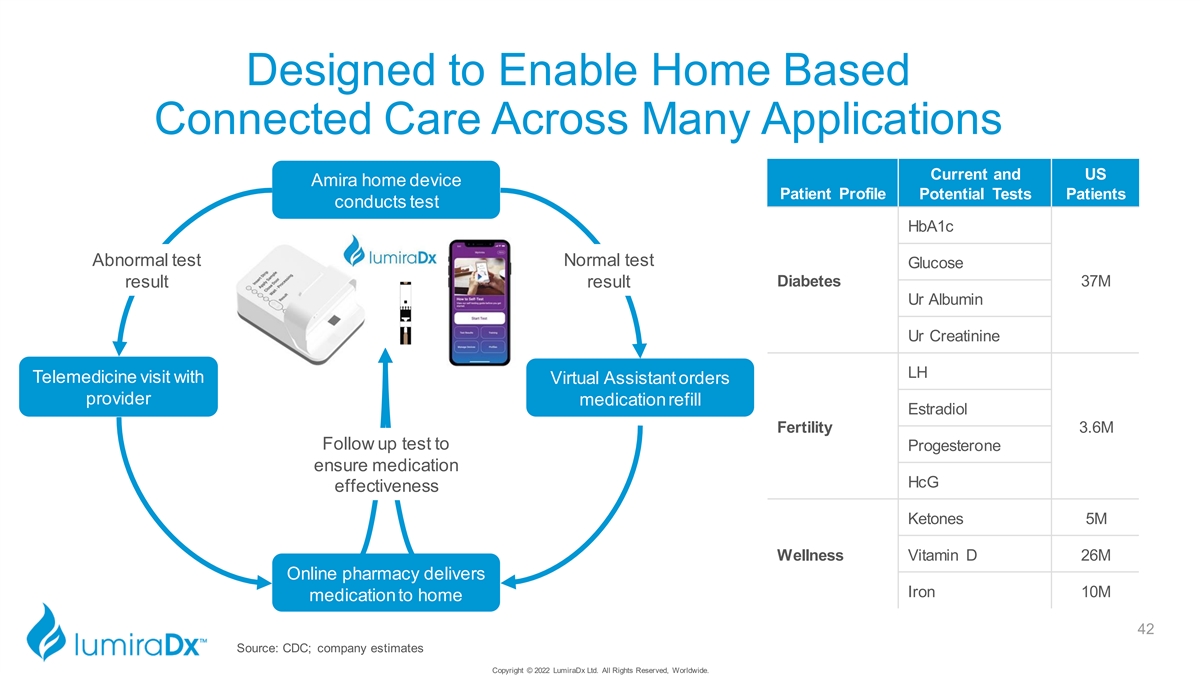

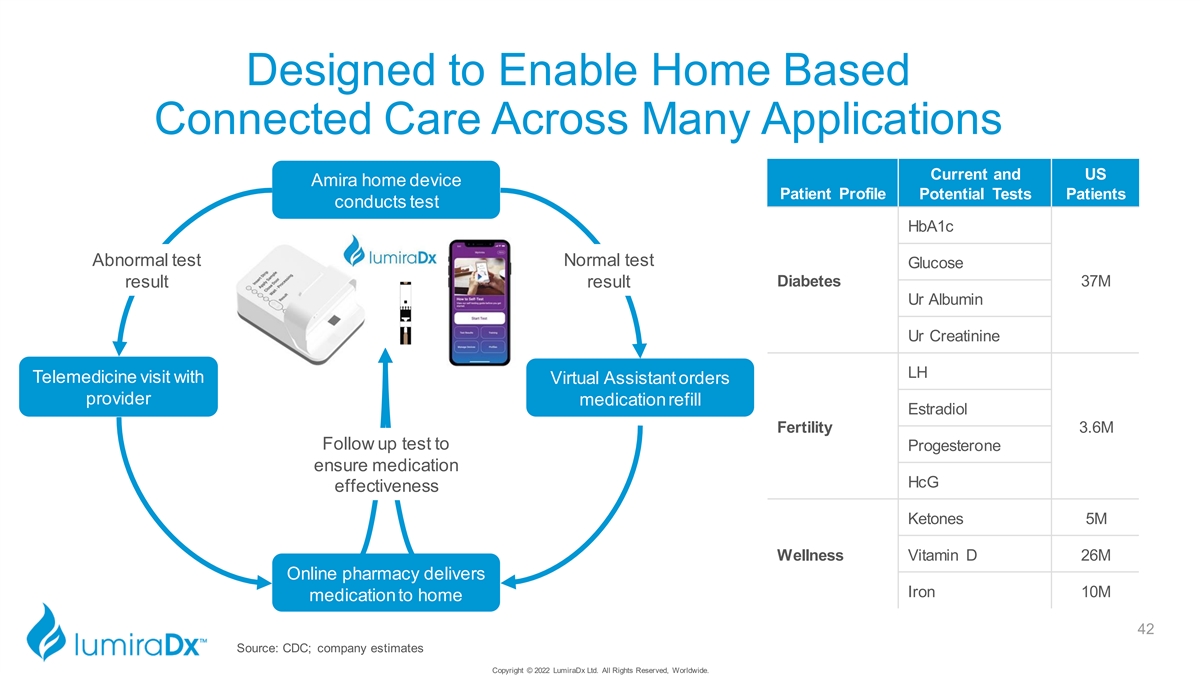

Designed to Enable Home Based Connected Care Across Many Applications Current and US Amira home device Patient Profile Potential Tests Patients conducts test HbA1c Abnormal test Normal test Glucose Diabetes 37M result result Ur Albumin Ur Creatinine LH Telemedicine visit with Virtual Assistant orders provider medication refill Estradiol Fertility 3.6M Follow up test to Progesterone ensure medication HcG effectiveness Ketones 5M Wellness Vitamin D 26M Online pharmacy delivers Iron 10M medication to home 42 Source: CDC; company estimates Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Commercial Strategy and Customer Stories Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Global Commercial Footprint and Platform Placements to Drive Penetration of TAM* ž 200+ commercial employees located in 27 countries ž Direct sales operations in Western Europe, USA, Japan, Colombia, Brazil, India and Africa ž Distribution in another >30 countries. Total reach: 105 countries ž Over time, plan to operate with a direct commercial presence in each of the largest diagnostics markets, including China, South Korea, Southeast Asia and Latin America to ensure broad access of our Instrument Placement Locations Platform globally 44 * as of March 2022 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Customer Focused Growth Strategy Near-Term Opportunities Physician Office / Pharmacy Acute / Emergency Care Global Health Instruments 8,500+ 5,400+ 5,100+ (1) shipped US and Global Health Strategic Partner Systems COVID Antigen / Ultra Ö Flu A/B + COVID Ö HS Troponin RSV + COVID-19 Ö TB Molecular BNP Strep A Molecular HIV Viral Load D-Dimer Ö COVID Antigen / Ultra Ö CRP Ö NT-proBNPÖ (2) Key Products HbA1c Ö CRP Ö COVID Antigen / Ultra Ö INR Ö D-Dimer Ö Flu A/B + COVIDÖ Na/K INR Ö RSV + COVID-19Ö Lipids HbA1c Ö Procalcitonin D-Dimer NT-proBNP (1) Total instrument shipments are 25,000+ with 6,000+ estimated for use in COVID screening applications with future testing needs to be determined (2) Tests critical to launch in customer segment are bolded; tests with regulatory authorization in initial market, and currently commercially available or planned to be 45 available in H2 2022, are checkedÖ Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

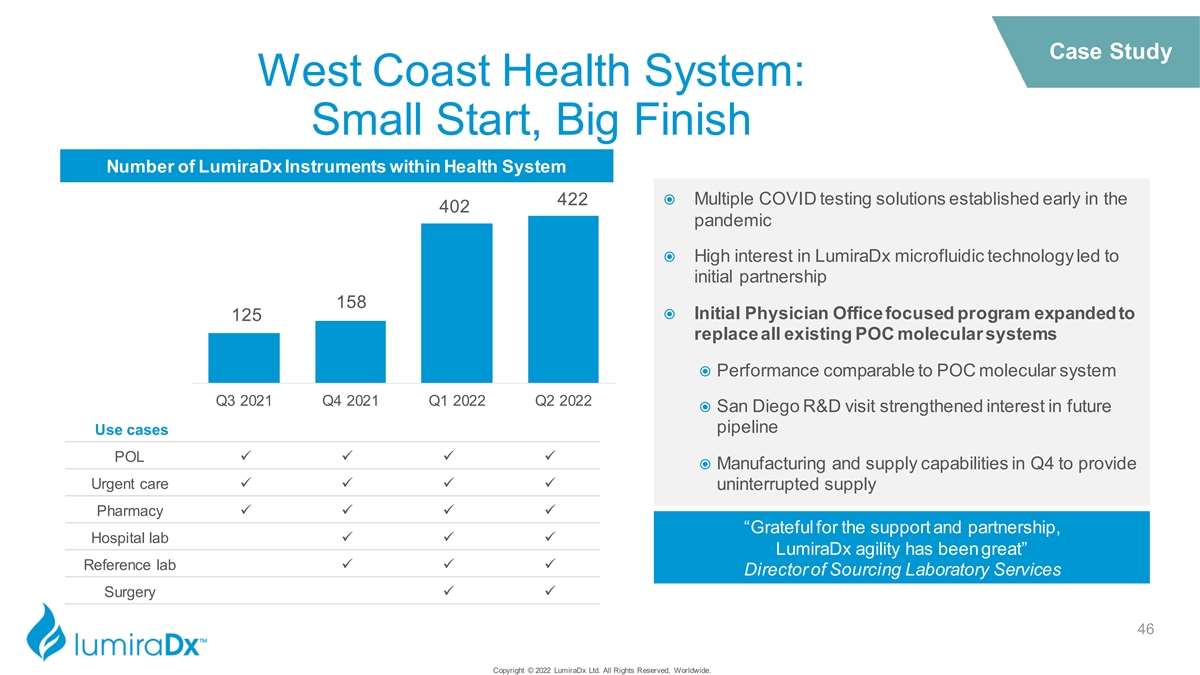

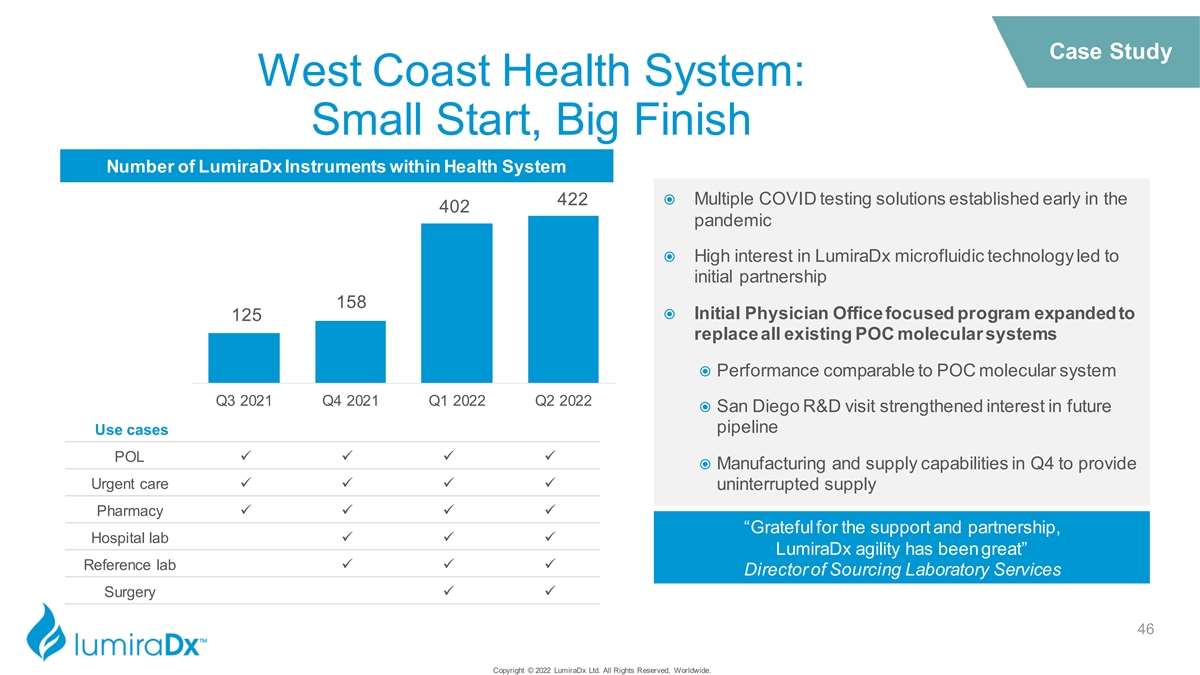

Case Study West Coast Health System: Small Start, Big Finish Number of LumiraDxInstruments within Health System 422ž Multiple COVID testing solutions established early in the 402 pandemic ž High interest in LumiraDx microfluidic technology led to initial partnership 158 ž Initial Physician Office focused program expanded to 125 replace all existing POC molecular systems ž Performance comparable to POC molecular system Q3 2021 Q4 2021 Q1 2022 Q2 2022 ž San Diego R&D visit strengthened interest in future pipeline Use cases POL✓✓✓✓ ž Manufacturing and supply capabilities in Q4 to provide Urgent care✓✓✓✓ uninterrupted supply Pharmacy✓✓✓✓ “Grateful for the support and partnership, Hospital lab✓✓✓ LumiraDx agility has been great” Reference lab✓✓✓ Director of Sourcing Laboratory Services Surgery✓✓ 46 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

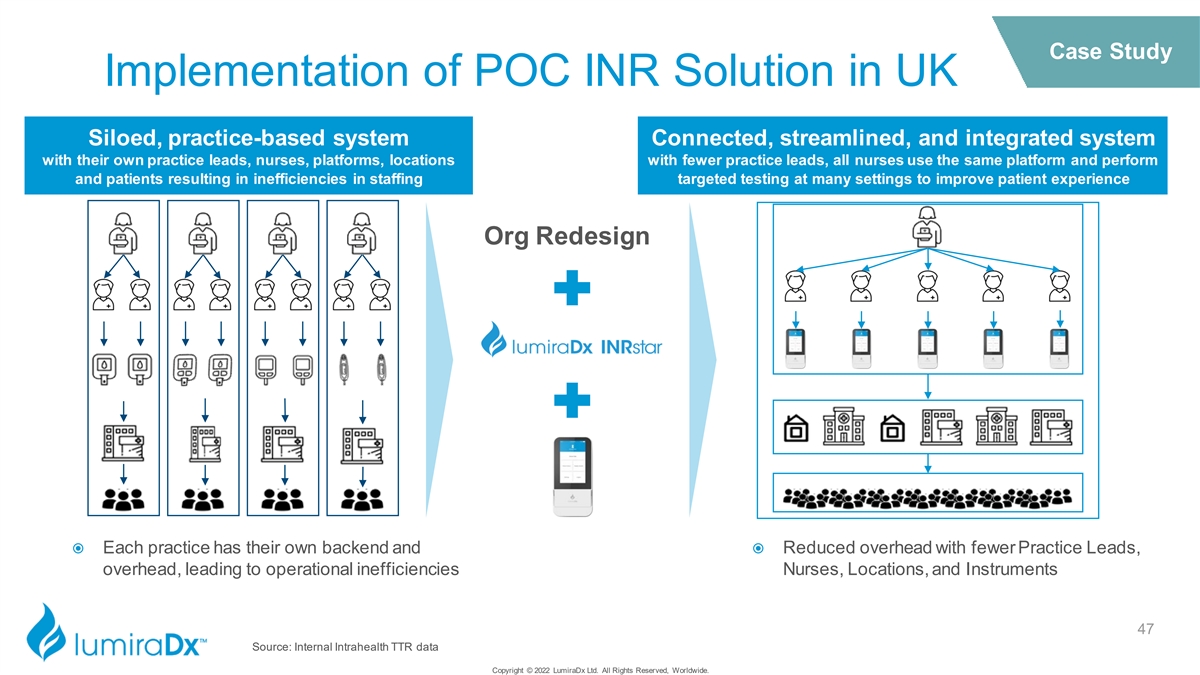

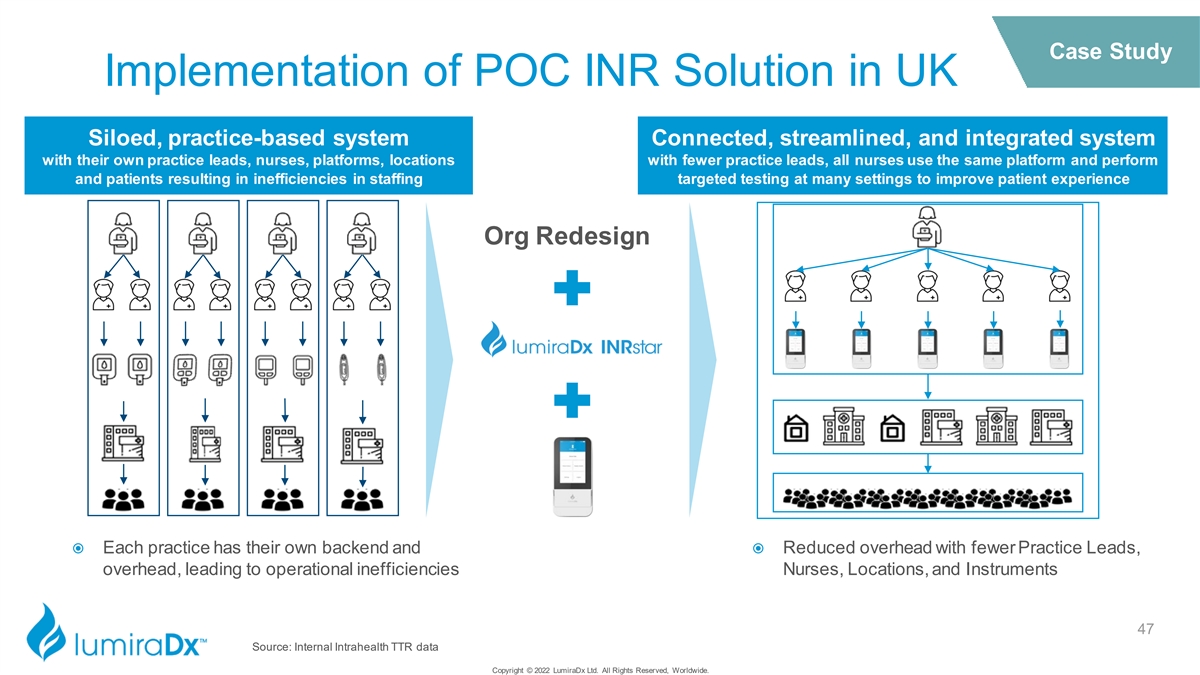

Case Study Implementation of POC INR Solution in UK Siloed, practice-based system Connected, streamlined, and integrated system with their own practice leads, nurses, platforms, locations with fewer practice leads, all nurses use the same platform and perform and patients resulting in inefficiencies in staffing targeted testing at many settings to improve patient experience Org Redesign ž Each practice has their own backend and ž Reduced overhead with fewer Practice Leads, overhead, leading to operational inefficiencies Nurses, Locations, and Instruments 47 Source: Internal Intrahealth TTR data Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

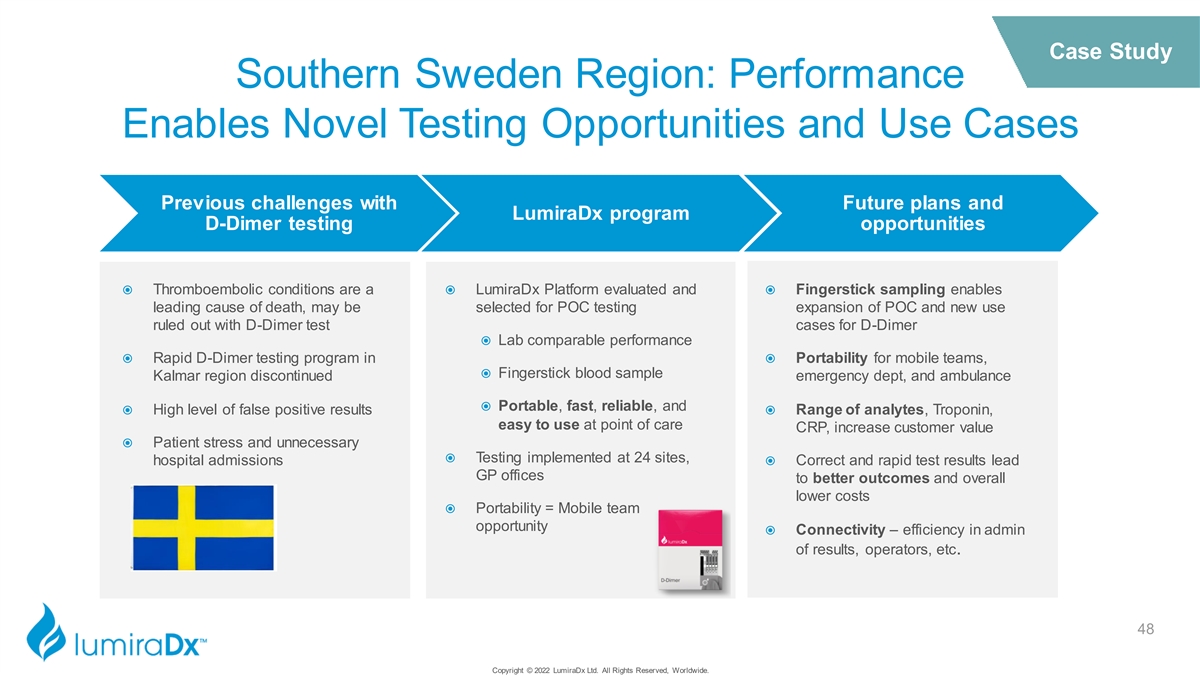

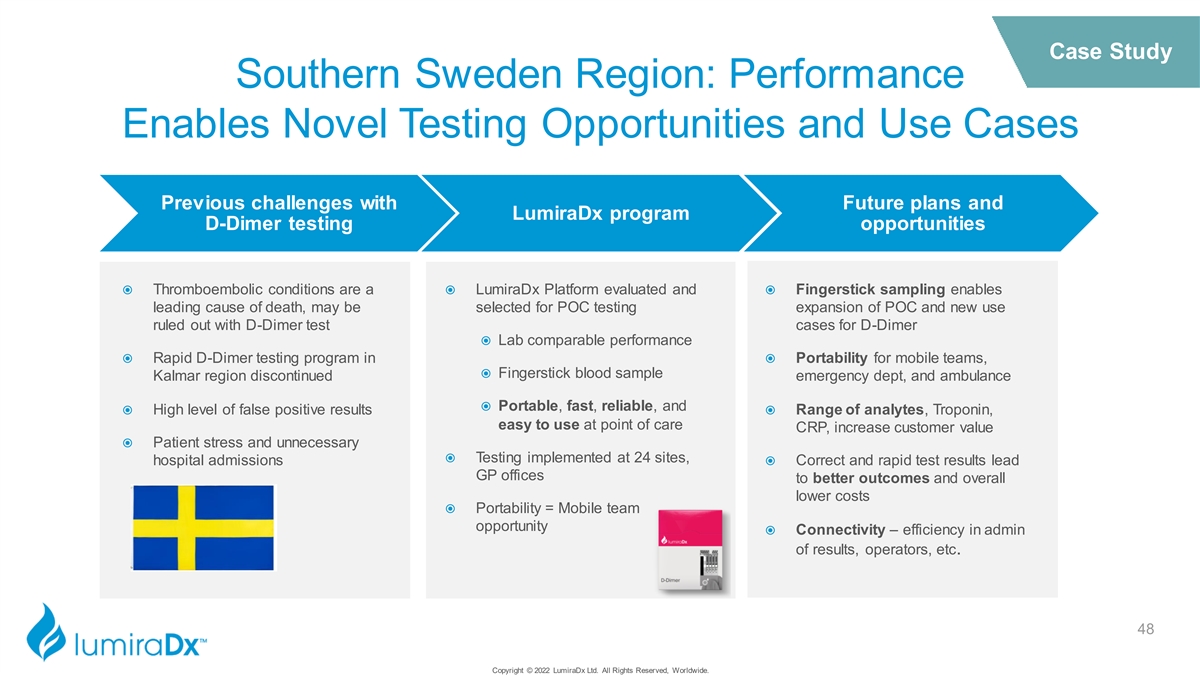

Case Study Southern Sweden Region: Performance Enables Novel Testing Opportunities and Use Cases Previous challenges with Future plans and LumiraDx program D-Dimer testing opportunities ž Thromboembolic conditions are a ž LumiraDx Platform evaluated and ž Fingerstick sampling enables leading cause of death, may be selected for POC testing expansion of POC and new use ruled out with D-Dimer test cases for D-Dimer ž Lab comparable performance ž Rapid D-Dimer testing program in ž Portability for mobile teams, ž Fingerstick blood sample Kalmar region discontinued emergency dept, and ambulance ž Portable, fast, reliable, and ž High level of false positive resultsž Range of analytes, Troponin, easy to use at point of care CRP, increase customer value ž Patient stress and unnecessary ž Testing implemented at 24 sites, hospital admissions ž Correct and rapid test results lead GP offices to better outcomes and overall lower costs ž Portability = Mobile team opportunity ž Connectivity – efficiency in admin of results, operators, etc. 48 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Company Profile & 2025 Outlook Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

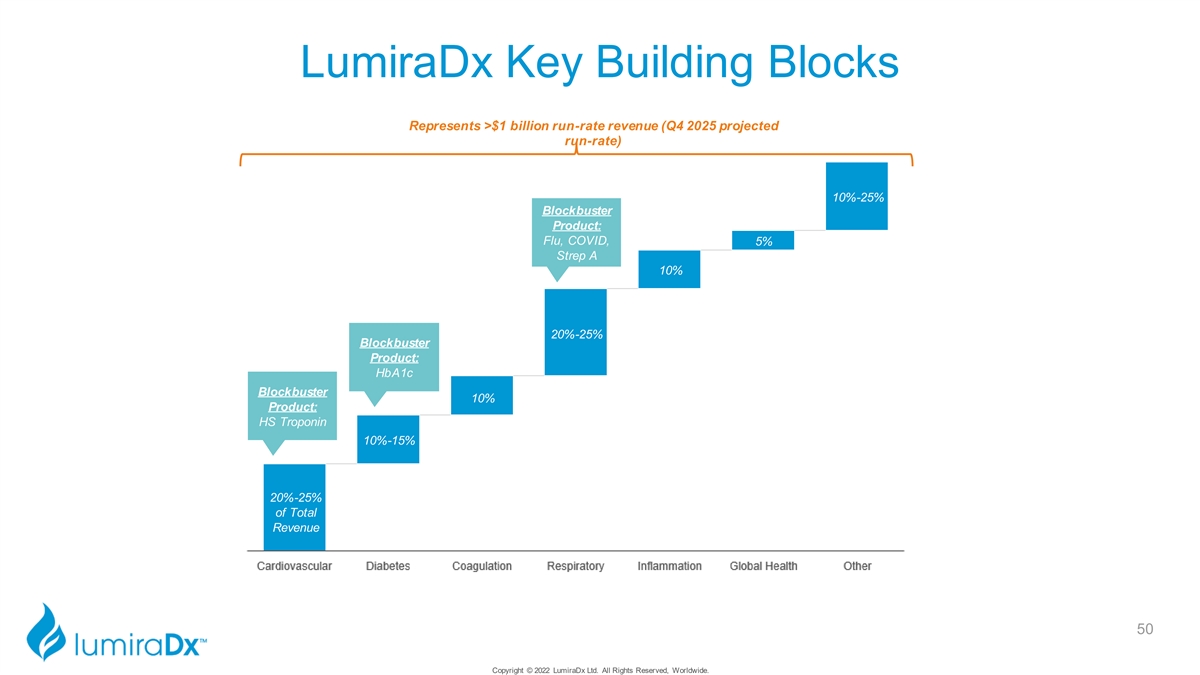

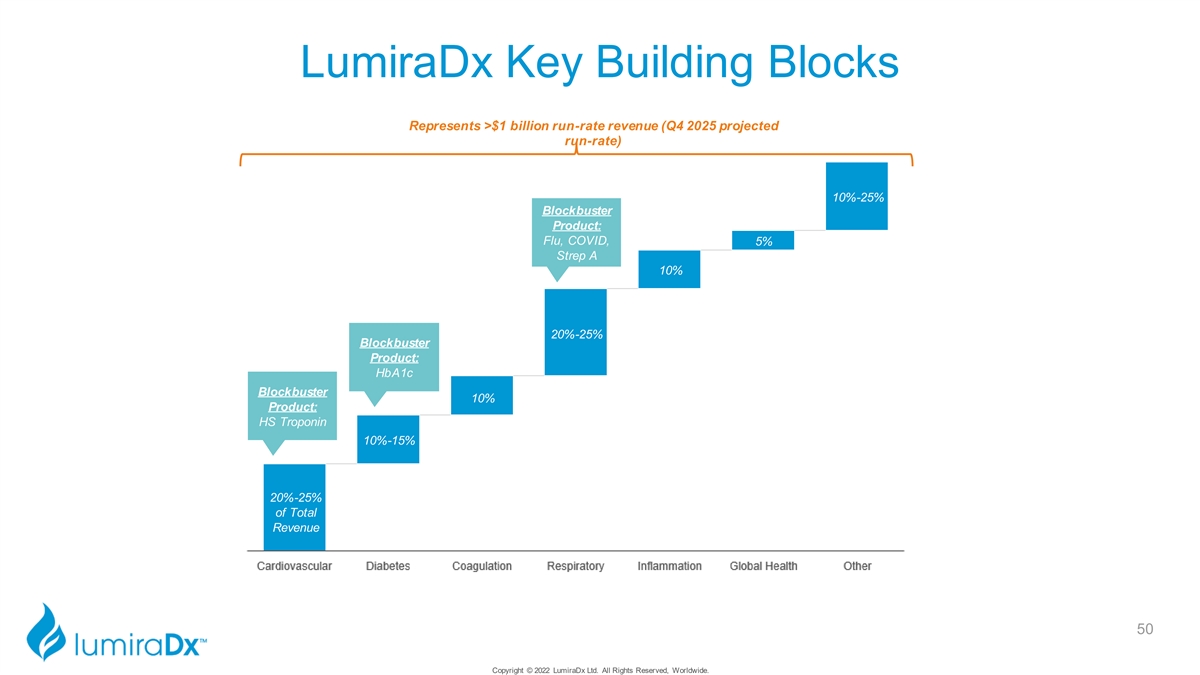

LumiraDx Key Building Blocks Represents >$1 billion run-rate revenue (Q4 2025 projected run-rate) 10%-25% Blockbuster Product: Flu, COVID, 5% Strep A 10% 10% 5-10% 5-10% 20%-25% Blockbuster Product: 15-20% HbA1c Blockbuster 10% Pro 2d 0% uc to :f HS TrT oo pto an l in Revenue 10%-15% 20%-25% of Total Revenue 50 Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

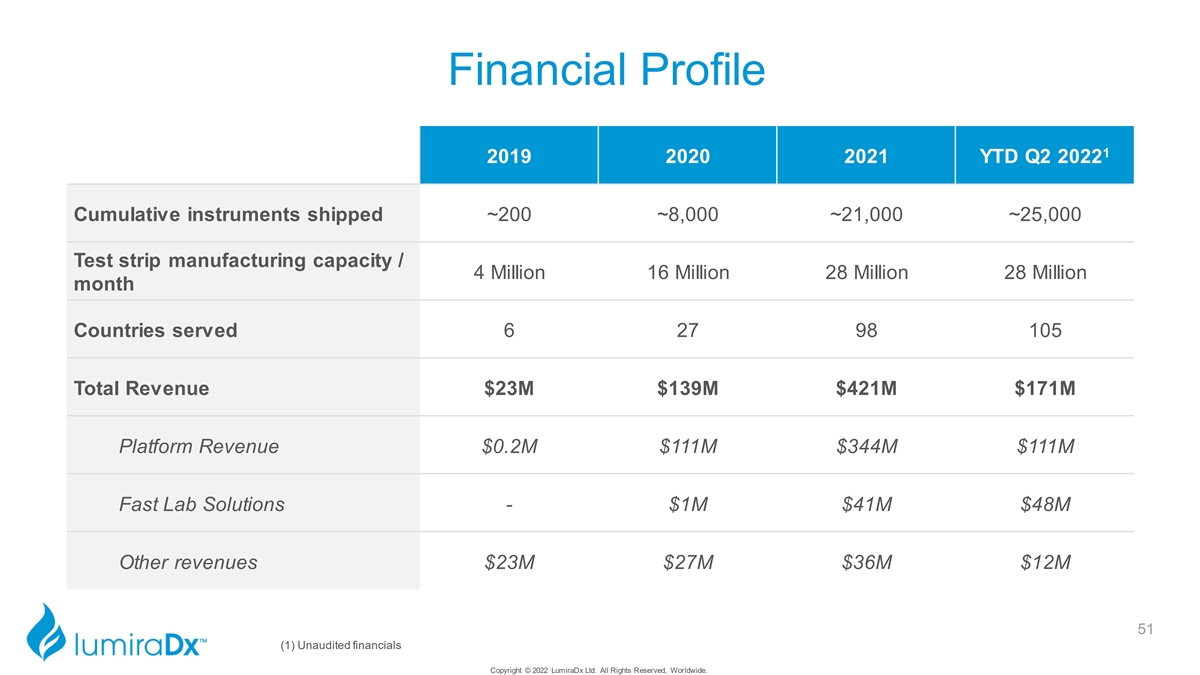

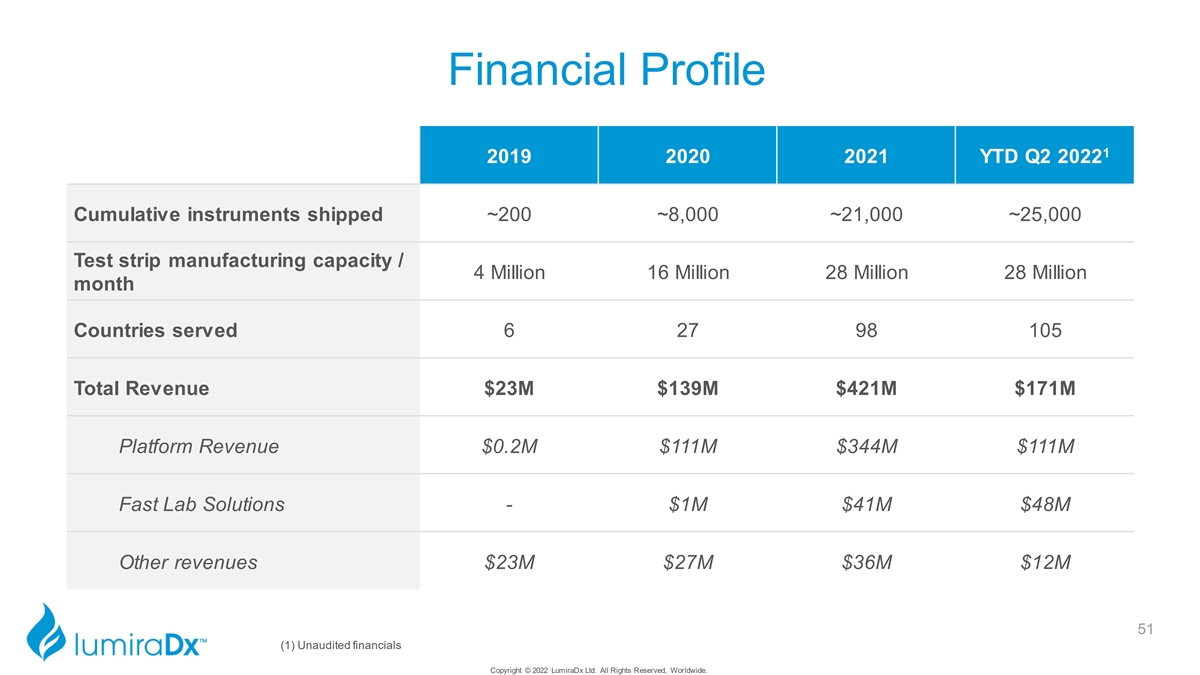

Financial Profile 1 2019 2020 2021 YTD Q2 2022 Cumulative instruments shipped ~200 ~8,000 ~21,000 ~25,000 Test strip manufacturing capacity / 4 Million 16 Million 28 Million 28 Million month Countries served 6 27 98 105 Total Revenue $23M $139M $421M $171M Platform Revenue $0.2M $111M $344M $111M Fast Lab Solutions - $1M $41M $48M Other revenues $23M $27M $36M $12M 51 (1) Unaudited financials Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

LumiraDx Today: Transforming Community-based Healthcare P Next Generation POC Addressing the current limitations of legacy POC systems by bringing lab-comparable performance to the POC in minutes, a broad menu of tests on a single instrument, and a low cost of ownership Diagnostic Company P Large Installed Base with 25,000 instruments shipped to 105 countries across primary care, pharmacy, hospital emergency departments, global health, and other settings Global Commercial Reach P Manufacturing All current and future POC tests are developed on common strip design, enabling flexible, automated and low-cost manufacturing on a single line. Current manufacturing capacity of 28 million test strips per month Designed for Scale P Broad Menu and Pipeline Regulatory clearance for 12 tests for use on our Platform, with global TAM of $5B+ (excluding COVID). 50+ assays in three-year roadmap* of Diagnostic Tests P Experienced Fourth POC company for founding team. Management team has a successful track record of diagnostic innovation and building / scaling companies in POC Management Team * Global Total Addressable Market: We estimate each test based on our current assumptions, including (a) the existing market si zes, (b) central lab market that could move to POC; 52 and (c) expansion of diagnostic testing. Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

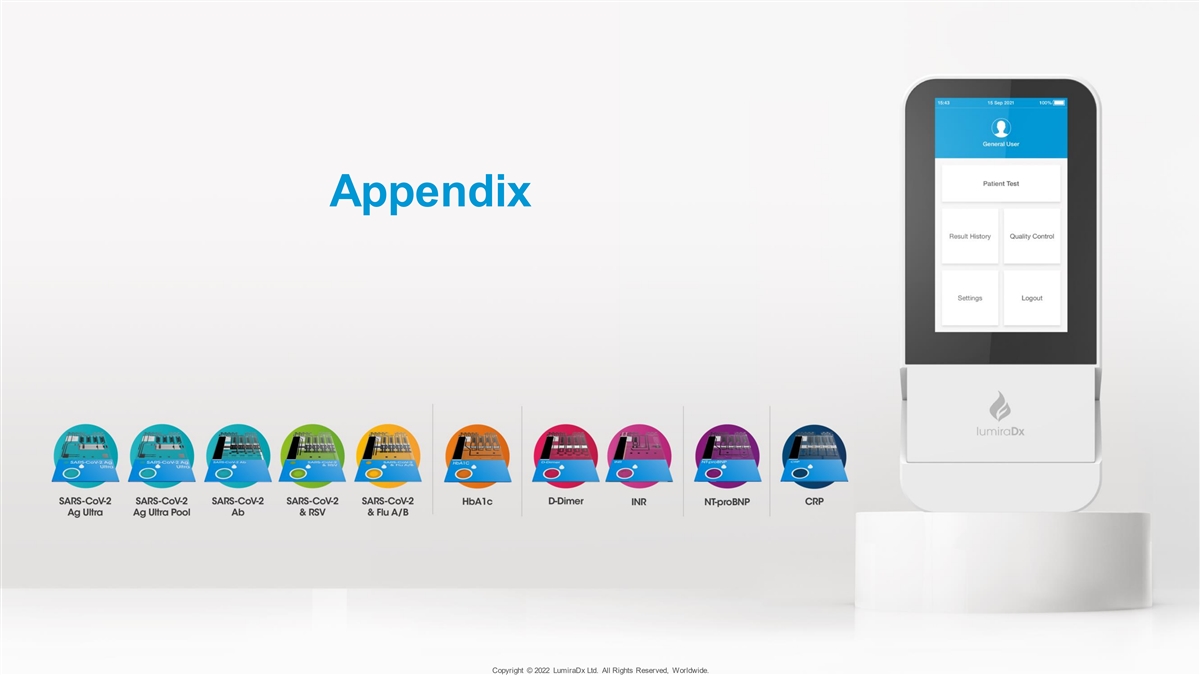

Appendix Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

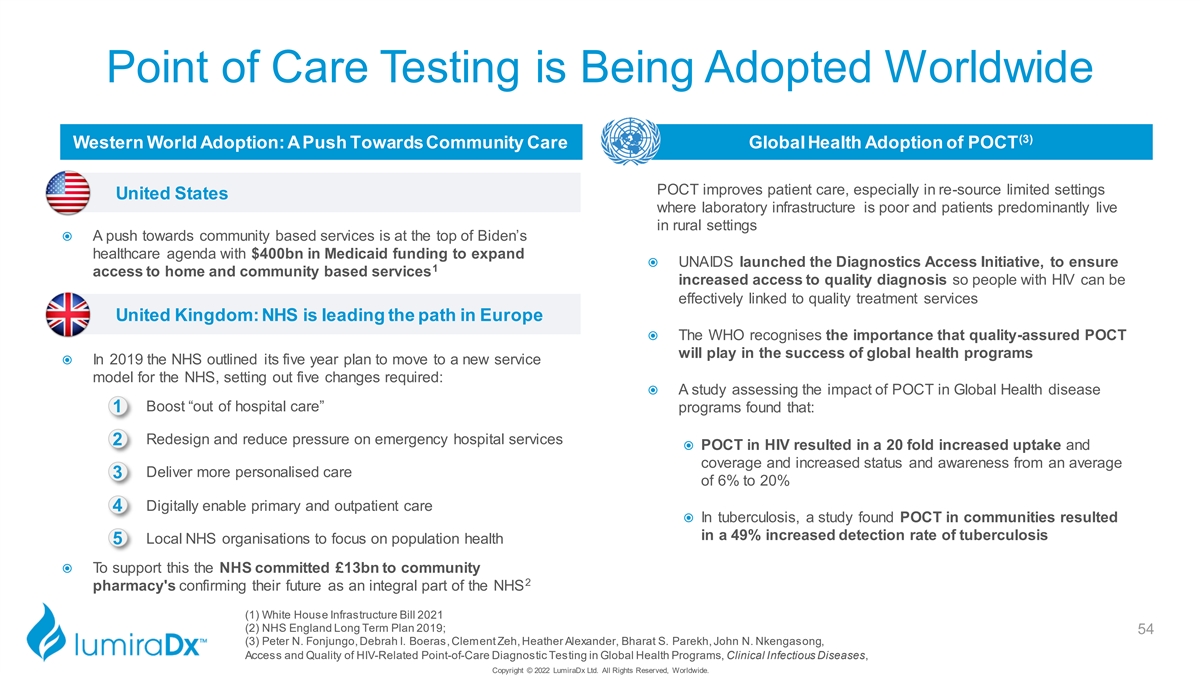

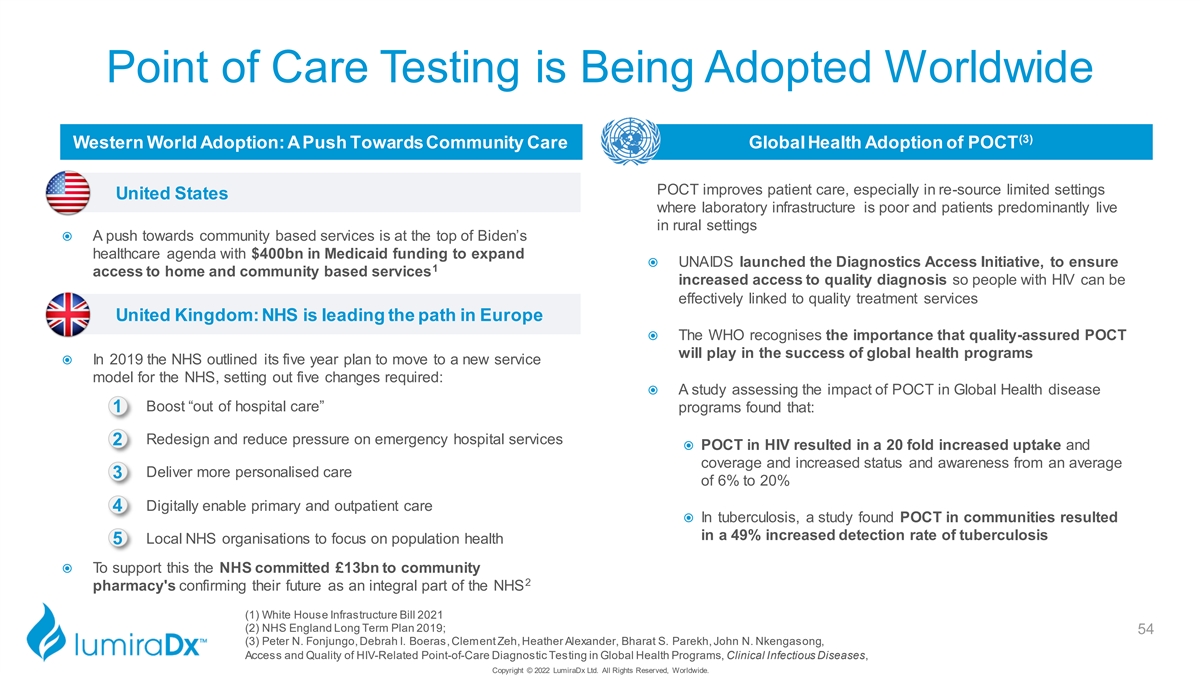

Point of Care Testing is Being Adopted Worldwide (3) Western World Adoption: A Push Towards Community Care Global Health Adoption of POCT POCT improves patient care, especially in re-source limited settings United States where laboratory infrastructure is poor and patients predominantly live in rural settings ž A push towards community based services is at the top of Biden’s healthcare agenda with $400bn in Medicaid funding to expand ž UNAIDS launched the Diagnostics Access Initiative, to ensure 1 access to home and community based services increased access to quality diagnosis so people with HIV can be effectively linked to quality treatment services United Kingdom: NHS is leading the path in Europe ž The WHO recognises the importance that quality-assured POCT will play in the success of global health programs ž In 2019 the NHS outlined its five year plan to move to a new service model for the NHS, setting out five changes required: ž A study assessing the impact of POCT in Global Health disease • Boost “out of hospital care” 1 programs found that: 2 • Redesign and reduce pressure on emergency hospital services ž POCT in HIV resulted in a 20 fold increased uptake and coverage and increased status and awareness from an average • Deliver more personalised care 3 of 6% to 20% 4 • Digitally enable primary and outpatient care ž In tuberculosis, a study found POCT in communities resulted in a 49% increased detection rate of tuberculosis • Local NHS organisations to focus on population health 5 ž To support this the NHS committed £13bn to community 2 pharmacy's confirming their future as an integral part of the NHS (1) White House Infrastructure Bill 2021 (2) NHS England Long Term Plan 2019; 54 (3) Peter N. Fonjungo, Debrah I. Boeras, Clement Zeh, Heather Alexander, Bharat S. Parekh, John N. Nkengasong, Access and Quality of HIV-Related Point-of-Care Diagnostic Testing in Global Health Programs, Clinical Infectious Diseases, Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.

Copyright © 2022 LumiraDx Ltd. All Rights Reserved, Worldwide.