Additional Management Incentives

In pursuing the sale of the Company we must not disincentivize the management team and employees. That is why I think it would be appropriate to have additional, substantial incentives for the management team for realizing full value for the company. I have specific ideas that I would be glad to share with you, but suffice it to say that these incentives should not reward management merely for the stock price rising from the current, deeply depressed levels. Instead, a reasonable threshold for value creation should be set, and if it is met or exceeded, then management should receive a well-earned substantial reward.

Return of Capital

When the Company raised capital via a secondary equity offering in 2019, the primary purpose was to invest organically in additional top-of-funnel marketing. Since that time, the Board has determined that the returns on the additional top-of-funnel marketing were unacceptably low and has stopped spending capital on that. I commend you and the Board for being mindful of the returns on our capital and being evidence-based in your decision-making.

I have a long-term time horizon and want to optimize the value of our Company for the long-term, as I believe you do. Therefore, I do not think that we should take any return of capital actions that would jeopardize the resiliency of our Company in case the external environment takes a turn for the worse or operational improvements take longer to materialize. However, once the Company is solidly profitable and the external environment has stabilized, I strongly believe it is appropriate to return the shareholders’ capital back to us if there are no compelling organic investment opportunities with high return on capital and low execution risk.

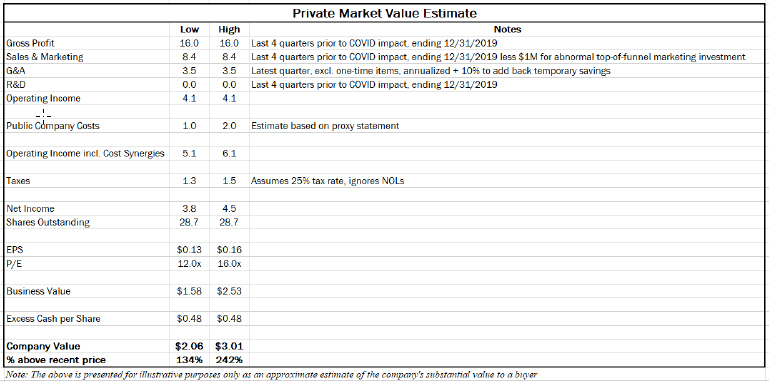

At the end of fiscal Q4 2020 ending June 30th, 2020, the Company’s balance sheet shows cash of $14.6M, of which $0.624M is restricted. The Company also has a PPP loan in the amount of $0.965M. Per share, cash was 51c, and excluding restricted cash and subtracting the amount of the PPP loan cash per share was slightly above 45c.

The stock price, currently around 88c, is near multi-year lows. Returning the cash to the shareholders will provide a substantial return. Furthermore, spending this cash on acquisitions or other uncertain ventures will drastically change the risk profile of the Company as an investment. That is not the assumption under which Silver Ring made its investment, nor do I have reason to believe that other shareholders, many of whom have patiently waited for returns for years, expected this turn of events.

The Company has a $5M asset-backed credit line for working capital. It was free cash flow positive in its latest quarter. Looking at the last 2 years, the largest intra-year seasonal swing in working capital has been less than $3M. These factors lead me to conclude that a very small portion of our current cash balance is required to run the business and that the rest can be safely returned to shareholders once we are confident that the Company can sustain and grow its profits.

4

Silver Ring Value Partners Limited Partnership • One Boston Place, Suite 2600, Boston, MA 02108 • www.silverringvaluepartners.com