U.S. SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2012

Commission File No.:001-04192

MFC Industrial Ltd.

(Translation of Registrant's name into English)

Suite #1620 - 400 Burrard Street, Vancouver, British Columbia, Canada V6C 3A6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):o

Note:Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):o

Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If "Yes" is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b):o

MANAGEMENT INFORMATION CIRCULAR

for the Annual General Meeting of Shareholders

of

MFC INDUSTRIAL LTD.

to be held on December 21, 2012

November 20, 2012

These materials are important and require your immediate attention. They require shareholders of MFC Industrial Ltd. to make important decisions. If you are in doubt as to how to make such decisions, please contact your financial, legal or other professional advisors. If you have any questions or require more information with regard to voting your shares, please contact MFC Industrial Ltd.

| |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 21, 2012 |

| |

TO: THE HOLDERS OF COMMON SHARES OF MFC INDUSTRIAL LTD.

NOTICE IS HEREBY GIVEN that the annual general meeting (the "Meeting") of shareholders of MFC Industrial Ltd. (the "Company") will be held at Suite 803, 8th Floor, Dina House, Ruttonjee Centre, 11 Duddell Street Central, Hong Kong SAR, China on Friday, December 21, 2012 at 9:00 a.m. (Hong Kong time), for the following purposes:

| 1. | | to receive and consider the financial statements of the Company for the financial year ended December 31, 2011; |

| |

| 2. | | to re-elect one Class I director of the Company; |

| |

| 3. | | to appoint auditors of the Company for the fiscal year ended December 31, 2012 and to authorize the directors to fix the remuneration of the auditors for the ensuing year; and |

| |

| 4. | | to transact such other business as may properly come before the Meeting and any and all adjournment(s) or postponement(s) thereof. |

Accompanying this Notice of Annual General Meeting are a management information circular, a form of proxy and a financial statement request form.

The board of directors of the Company has fixed the close of business (New York time) on November 15, 2012 as the record date for determining shareholders who are entitled to receive notice of the Meeting and attend and vote at the Meeting and any adjournment(s) or postponement(s) thereof. The accompanying management information circular provides additional information relating to the matters to be dealt with at the Meeting and forms part of this Notice of Meeting.

Registered shareholders (shareholders of record) who are unable to attend the Meeting in person are requested to complete, sign and date the enclosed form of proxy and return the form of proxy in the enclosed return envelope provided for that purpose. If you receive more than one form of proxy because you own common shares registered in different names or at different addresses, each form of proxy should be completed and returned. A form of proxy will not be valid unless it is deposited, by mail or by hand, to the attention of: Shareowner Services, PO Box 3550, South Hackensack, New Jersey, USA 07606-9562, by 9:00 a.m. (Hong Kong time) on December 19, 2012 (or a day other than a Saturday, Sunday or holiday which is at least 48 hours before the Meeting or any adjournment of the Meeting). The Chairman of the Meeting has the discretion to accept proxies received after that time.

DATED at Vancouver, British Columbia, this 20th day of November, 2012.

By order of the board of directors of the Company

/s/ Michael J. Smith

Michael J. Smith

Chairman of the Board of Directors

| |

| MANAGEMENT INFORMATION CIRCULAR |

| |

November 20, 2012

This Management Information Circular ("Circular") is being furnished to holders ("Shareholders") of Common Shares("Common Shares") in the capital of MFC Industrial Ltd. (the "Company") in connection with the solicitation of proxies by the board of directors (the "Board") and management of the Company for use at the annual general meeting to be held at 9:00 a.m. (Hong Kong time) on December 21, 2012 at Suite 803, 8th Floor, Dina House, Ruttonjee Centre,11 Duddell Street Central, Hong Kong SAR, China, and any adjournment(s) or postponement(s) thereof (the "Meeting")for the purposes set forth in the Notice of Annual General Meeting (the "Notice of Meeting"), which accompanies and is part of this Circular.

The Notice of Meeting, form of proxy, supplemental mailing card and this Circular will be mailed to Shareholders commencing on or about November 26, 2012. The information contained herein is given as of November 20, 2012, except as otherwise stated. Unless otherwise indicated, all references in this document to "$" and "dollars" are to United States Dollars and all references to "CDN$" are to Canadian dollars.

VOTING INFORMATION

Solicitation of Proxies

The solicitation of proxies by management of the Company will be conducted by mail and may be supplemented by telephone or other personal contact and such solicitation will be made without special compensation granted to the directors, officers and employees of the Company. The Company does not reimburse Shareholders, nominees or agents for costs incurred in obtaining, from the principals of such persons, authorization to execute forms of proxy, except that the Company has requested brokers and nominees who hold stock in their respective names to furnish this Circular and related proxy materials to their customers, and the Company will reimburse such brokers and nominees for their related out of pocket expenses. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Company.

No person has been authorized to give any information or to make any representation other than as contained in this Circular in connection with the solicitation of proxies. If given or made, such information or representations must not be relied upon as having been authorized by the Company. The delivery of this Circular shall not create, under any circumstances, any implication that there has been no change in the information set forth herein since the date of this Circular. This Circular does not constitute the solicitation of a proxy by anyone in any jurisdiction in which such solicitation is not authorized, or in which the person making such solicitation is not qualified to do so, or to anyone to whom it is unlawful to make such an offer of solicitation.

Record Date

The Board has set the close of business (New York time) on November 15, 2012 as the record date (the "Record Date") for determining which Shareholders shall be entitled to receive notice of and to vote at the Meeting. Only Shareholders of record as of the Record Date ("Registered Shareholders") are entitled to receive notice of and to vote at the Meeting. Persons who acquire Common Shares after the Record Date will not be entitled to vote such Common Shares at the Meeting.

1

Appointment of Proxyholders

Registered Shareholders are entitled to vote at the Meeting. A Shareholder is entitled to one vote for each Common Share that such Shareholder holds on the Record Date on the resolutions to be voted upon at the Meeting, and any other matter to come before the Meeting.

The persons named as proxyholders (the "Designated Persons") in the enclosed form of proxy are directors and/or officers of the Company.

A Registered Shareholder has the right to appoint a person or corporation (who need not be a Shareholder) to attend and act for or on behalf of that Shareholder at the Meeting, other than the Designated Persons named in the enclosed form of proxy. A Registered Shareholder may exercise this right by striking out the printed names and inserting the name of such other person and, if desired, an alternate to such person, in the blank space provided in the form of proxy.

In order to be voted, the completed form of proxy must be received by the Company, by mail or by hand, to the attention of Shareowner Services, PO Box 3550, South Hackensack, New Jersey, USA 07606-9562, by 9:00 a.m. (Hong Kong time) on December 19, 2012 (or a day other than a Saturday, Sunday or holiday which is at least 48 hours before the Meeting or any adjournment(s) or postponement(s) of the Meeting). The time limit for the deposit of proxies may be waived by the Board at its discretion without notice.

A proxy may not be valid unless it is dated and signed by the Registered Shareholder who is giving it or by that Shareholder's attorney-in-fact duly authorized by that Shareholder in writing or, in the case of a corporation, dated and executed by a duly authorized officer, or attorney-in-fact, for the corporation. If a form of proxy is executed by an attorney-in-fact for an individual Shareholder or joint Shareholders, or by an officer or attorney-in-fact for a corporate Shareholder, the instrument so empowering the officer or attorney-in-fact, as the case may be, or a notarially certified copy thereof, should accompany the form of proxy.

Revocability of Proxy

Any Registered Shareholder who has returned a form of proxy may revoke it at any time before it has been exercised. In addition to revocation in any other manner permitted by law, a form of proxy may be revoked by instrument in writing, including a form of proxy bearing a later date, executed by the Registered Shareholder or by his or her attorney duly authorized in writing or, if the Registered Shareholder is a corporation, under its corporate seal or by a duly authorized officer or attorney thereof. The instrument revoking the form of proxy must be deposited at the same address where the original form of proxy was delivered at any time up to and including the last business day preceding the date of the Meeting, or any adjournment or adjournments thereof, or with the Chairman of the Meeting on the date of, but prior to the commencement of, the Meeting. A Registered Shareholder who has submitted a form of proxy may also revoke it by attending the Meeting in person (or if the Shareholder is a corporation, by a duly authorized representative of the corporation attending the Meeting) and registering with the scrutineer thereat as a Registered Shareholder present in person, whereupon such form of proxy shall be deemed to have been revoked.

Only Registered Shareholders have the right to revoke a form of proxy. Non-Registered Holders (as hereinafter defined) who wish to change their vote must, at least seven days before the Meeting, arrange for their respective Intermediaries (as hereinafter defined) to revoke the form of proxy on their behalf.

Voting of Common Shares and Proxies and Exercise of Discretion by Designated Persons

A Shareholder may indicate the manner in which the Designated Persons are to vote with respect to a matter to be voted upon at the Meeting by marking the appropriate space. If the instructions as to voting indicated in the proxy are certain, the Common Shares represented by the form of proxy will be voted or withheld from voting in accordance with the instructions given in the form of proxy. If the Shareholder specifies a choice in the form of proxy with respect to a matter to be acted upon, then the Common Shares represented will be voted or withheld from the vote on that matter accordingly.

If no choice is specified in the form of proxy with respect to a matter to be acted upon, the form of proxy confers discretionary authority with respect to that matter upon the Designated Persons named in the form of proxy. It is intended that the Designated Persons will vote the Common Shares represented by the form of proxy in favour of each matter identified in the form of proxy, including the vote for the election of the nominee to the Board and for the appointment of the independent auditors of the Company.

2

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to other matters which may properly come before the Meeting, including any amendments or variations to any matters identified in the Notice of Meeting, and with respect to other matters which may properly come before the Meeting. At the date of this Circular, management of the Company is not aware of any such amendments, variations, or other matters to come before the Meeting.

In the case of abstentions from, or withholding of, the voting of the Common Shares on any matter, the Common Shares that are the subject of the abstention or withholding will be counted for the determination of a quorum, but will not be counted as affirmative or negative on the matter to be voted upon.

NON-REGISTERED HOLDERS

Only Registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most Shareholders are "non-registered" Shareholders because the Common Shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the Common Shares. More particularly, a person is not a Registered Shareholder in respect of Common Shares which are held on behalf of that person (the "Non-Registered Holder") but which are registered either: (a) in the name of an intermediary (an "Intermediary") that the Non-Registered Holder deals with in respect of the Common Shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators or self-administered RRSP's, RRIF's, RESPs and similar plans); or (b) in the name of a clearing agency (such as CDS Clearing and Depository Services Inc. or the Depository Trust & Clearing Corporation) of which the Intermediary is a participant. In accordance with the requirements set out in Canadian National Instrument 54-101 –Communication with Beneficial Owners of Securities of a Reporting Issuer ("NI 54-101"), the Company has distributed copies of the Notice of Meeting, this Circular and the form of proxy (collectively, the "Meeting Materials") to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

| | (a) | | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Holder when submitting the proxy. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete the form of proxy and deposit it with the Company as provided above; or |

| |

| (b) | | more typically, be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a "proxy authorization form") which the Intermediary must follow. Typically, the proxy authorization form will consist of a one page pre-printed form. Sometimes, instead of a one page pre-printed form, the proxy authorization will consist of a regular printed proxy form accompanied by a page of instructions, which contains a removable label containing a bar-code and other information. In order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Holder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. |

In either case, the purpose of this procedure is to permit a Non-Registered Holder to direct the voting of the Common Shares which they beneficially own. Should a Non-Registered Holder who receives one of the above forms wish to vote at the Meeting in person, the Non-Registered Holder should strike out the names of the management proxyholders named in the form and insert the Non-Registered Holder's name in the blank space provided. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or proxy authorization form is to be delivered.

3

There are two kinds of beneficial owners – those who object to their name being made known to the issuers of securities which they own (called OBOs for Objecting Beneficial Owners) and those who do not object to the issuers of the securities they own knowing who they are (called NOBOs for Non-Objecting Beneficial Owners). Pursuant to NI 54-101, issuers can obtain a list of their NOBOs from Intermediaries for distribution of proxy-related materials directly to NOBOs.

These securityholder materials are being sent to both Registered Shareholders and Non-Registered Holders. If you are a Non-Registered Holder, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding on your behalf.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As at November 15, 2012, being the Record Date, there were a total of 62,552,126 Common Shares issued and outstanding. Each Common Share entitles the holder thereof to one vote at the Meeting. The following table sets forth, as of the date hereof, to the best of the Company's knowledge and based solely upon publicly available records and filings, the only persons or companies which beneficially own, or control or direct, directly or indirectly, voting securities carrying 10% or more of the votes attached to the issued and outstanding Common Shares as of the date hereof:

| Name | Amount Owned | Percent of Class |

| Peter Kellogg | 13,820,910(1) | 22.1% |

____________________

|

Note: |

| (1) | | In his public filings, Mr. Kellogg disclaims beneficial ownership of 10,097,211 of the Common Shares, or approximately 16.1% of the issued and outstanding Common Shares as of the date hereof. |

RECEIPT OF FINANCIAL STATEMENTS

The directors will place before the Meeting the consolidated financial statements of the Company for the year ended December 31, 2011 together with the auditors' report thereon, which are included in the annual report of the Company for the year ended December 31, 2011.

ELECTION OF DIRECTORS

The Company's Articles provide for three classes of directors with staggered terms. Each director holds office until the expiry of his or her term or until his or her successor is elected or appointed, unless his or her office is earlier vacated in accordance with the Articles of the Company or with the provisions of theBusiness Corporations Act(British Columbia). At each annual meeting of the Company, a class of directors is elected to hold office for a three-year term. Successors to the class of directors whose terms expire are identified as being of the same class as the directors they succeed and are elected to hold office for a term expiring at the third succeeding annual meeting of the Shareholders. A director appointed or elected to fill a vacancy on the Board holds office for the unexpired term of his or her predecessor.

At the Meeting, Shareholders will be called upon to re-elect one Class I director (the "nominee") by ordinary resolution. The Board has selected Indrajit Chatterjee as the nominee. Mr. Chatterjee is currently a member of the Company's Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

Dr. Shuming Zhao has one year remaining in his term as a Class II director of the Company, which term expires at the annual meeting of the Shareholders to be held in 2013. Dr. Zhao is also a member of the Company's Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Ravin Prakash was appointed by the Board as an additional director in April 2011. Mr. Prakash is a Class II director and has one year remaining in his term as a Class II director of the Company.

4

Michael J. Smith has two years remaining in his term as a Class III director of the Company, which term expires at the annual meeting of the Shareholders to be held in 2014. Mr. Smith is the President, Chief Executive Officer and Interim Chief Financial Officer of the Company. Ian Rigg was first appointed a director of the Company in March 2010. Mr. Rigg is a Class III director and has one year remaining in his term as a Class III director of the Company. Mr. Rigg is currently a member of the Company's Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

The following table sets forth information regarding Mr. Chatterjee, the management nominee for election at the Meeting as a Class I director of the Company, and each director of the Company whose term of office will continue after the Meeting:

| | | | Approximate number of |

| | | | Common Shares |

| Name, Place of Residence | | | beneficially owned, |

| and Present Position with | Principal Occupation, Business or | Director | directly or indirectly, as |

| the Company | Employment | Since | of the date hereof |

Michael J. Smith

Hong Kong SAR, China

Chairman of the Board, Chief

Executive Officer, Interim

Chief Financial Officer,

President and Director | Mr. Smith is the Chairman, Chief Executive Officer and Interim Chief Financial Officer of the Company. | 1986 | 272,727(1) |

Ian Rigg(2)(3)(4)

United Kingdom

Director | Mr. Rigg is a retired businessman. | 2010 | 7,230(5) |

Dr. Shuming Zhao(2)(3)(4)

Nanjing, China

Director | Dr. Zhao is a professor and the Dean of the School of Business, Nanjing University and the Dean of the School of Graduate Studies, Macau University of Science and Technology. Dr. Zhao is President of Jiangsu Provincial Association of Human Resource Management and Vice President of Jiangsu Provincial Association of Business Management and Entrepreneurs. | 2004 | Nil(6) |

Indrajit Chatterjee(2)(3)(4)

Gurgaon, India

Director | Mr. Chatterjee is a retired businessman and formerly responsible for marketing with the Transportation Systems Division of General Electric for India. | 2005 | Nil(7) |

Ravin Prakash

New Delhi, India

Director | Mr. Prakash is the President and Chief Executive Officer of Magnum Minerals Pvt. Ltd. | 2011 | Nil(8) |

____________________

Notes:

| (1) | | Mr. Smith also holds stock options to purchase up to 390,000 Common Shares. |

| (2) | | Member of the Audit Committee. |

| (3) | | Member of the Compensation Committee. |

| (4) | | Member of the Nominating and Corporate Governance Committee. |

| (5) | | Mr. Rigg also holds stock options to purchase up to 55,000 Common Shares. |

| (6) | | Dr. Zhao also holds stock options to purchase up to 55,000 Common Shares. |

| (7) | | Mr. Chatterjee holds stock options to purchase up to 55,000 Common Shares. |

| (8) | | Mr. Prakash holds stock options to purchase up to 200,000 Common Shares. |

While management does not contemplate that the nominee will be unable to serve as a director, if, prior to the Meeting, the nominee is unable to stand for re-election as a director for any reason, the Designated Persons shall have the discretionary authority to vote for the election of any other person or persons as a director.

5

At the Meeting, Shareholders will be asked to pass an ordinary resolution to elect Mr. Chatterjee as a Class I director of the Company to serve a term of three years until the close of the annual meeting of the Shareholders to be held in 2015.

Corporate Cease Trade Orders

Other than as otherwise disclosed herein, to the best of the Company's knowledge, the nominee has not, as of the date of this Circular, and has not been, within 10 years before the date hereof, a director, chief executive officer or chief financial officer of any company (including the Company) that was subject to a cease trade order, an order similar to a cease trade order or an order that denied such company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days, issued either while that person was acting in that capacity or after that person ceased to act in that capacity if it resulted from an event that occurred while that person was acting in that capacity.

Bankruptcies

To the best of the Company's knowledge, the nominee has not, as of the date of this Circular, and has not been, within 10 years before the date hereof, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of such company.

To the best of the Company's knowledge, the nominee has not, within 10 years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of such proposed nominee.

Penalties or Sanctions

To the best of the Company's knowledge, the nominee has not been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed nominee.

APPOINTMENT AND REMUNERATION OF AUDITORS

Management of the Company intends to recommend at the Meeting that Shareholders vote for the appointment of Deloitte & Touche LLP ("Deloitte") as auditors of the Company for the fiscal year ending December 31, 2012, and to authorize the directors to fix their remuneration for the ensuing year. The Deloitte was most recently appointed as auditors of the Company effective November 14, 2011.

STATEMENT OF EXECUTIVE COMPENSATION

General

Pursuant to applicable securities legislation, the Company is required to provide a summary of all annual compensation for services in all capacities to the Company and its subsidiaries for the most recently completed financial year in respect of the individuals comprised of any persons who acted as either the Chief Executive Officer or the Chief Financial Officer of the Company for any part of such year, and each of the other three most highly compensated executive officers of the Company, whose total compensation for the most recently completed financial year exceeded $150,000, and any individual who would have satisfied these criteria but for the fact that the individual was not serving as an executive officer, nor acting in a similar capacity, at the end of the most recently completed financial year (the "NEOs").

6

Compensation Discussion and Analysis

In determining executive compensation, the Compensation Committee aims to encourage and reward performance in order to maintain the position of the Company in a highly competitive environment. The Compensation Committee endeavours to ensure that the Company's compensation policies:

- attract and retain highly qualified and experienced executives and managers as well as align the compensation level of each executive to that executive's level of responsibility;

- recognize and reward contributions to the success of the Company as measured by the accomplishment of specific performance objectives; and

- ensure that a significant proportion of compensation is at risk and directly linked to the success of the Company.

The Compensation Committee believes that compensation packages for the Company's executives must be designed to attract and retain executives critical to the success of the Company, ensure that executive compensation is linked to both individual and corporate performance and focus executives on business factors that impact shareholder value. The Compensation Committee also considers the recommendations of the Chief Executive Officer for executives other than the Chief Financial Officer and the Chief Operating Officer, and relies on Board discussions in its analysis and recommendations. Compensation for the NEOs for the year ended December 31, 2011 consisted of two main components: (i) base salary; and (ii) annual performance incentives.

Base Salary

Base salary reflects annual compensation received by an executive for the position they hold and the role they perform within the Company. The objective of the base salary, consistent with market practice, is to provide a portion of compensation as a fixed cash amount. Base salaries are intended to attract and retain talented executives and to reflect the skill and level of responsibility of an executive, taking into account market conditions and salaries paid by the Company's competitors. Base salaries are targeted at median market values and balanced with relative roles and responsibilities within the Company. The relative base salary of executive officers reflects their experience and the accountability of their respective roles and the incumbent's performance in such roles. Base salaries are benchmarked internally against similar roles, and are then adjusted depending on a NEO's past performance, experience, individual qualifications, promotion or other change in responsibilities and expected future contributions to the Company.

Annual Performance Incentives

The Company's annual performance incentives are designed to reinforce the Company's business strategy as approved by the Board. The objective of awarding annual performance incentives is to provide a component of compensation that rewards near term performance results of the Company as a whole. Such incentives focus attention on the achievement of short term profitability with lesser emphasis on revenues. The annual performance incentives provide executives with the opportunity to earn cash incentives based on the achievement of pre-established individual performance objectives. Awards vary as a percentage of base salary and incentive targets for all levels are reviewed periodically to ensure ongoing market competitiveness. Performance objectives are based on the Company's business plan for the fiscal year as approved by the Board and are intended to be challenging but achievable.

Annual performance incentives are an important component of the total compensation that may be received by a NEO, primarily because they provide the NEO with the potential to receive an annual financial reward based on the achievement of specific goals. Annual performance incentives are designed to achieve three important objectives:

- to motivate and reward eligible executives who contribute to successfully achieving Company goals;

- to provide executives with a competitive total compensation package; and

- to attract and retain talented executives.

7

The Company's executive incentive program, implemented in 2009, offers cash incentive payouts in return for the Company's executive officers achieving certain short-term, operational and strategic targets as may be established by the Compensation Committee. The intention of the program was to align and motivate the Company's executive team during the Company's 2009 business restructuring program and through the subsequent three to five years. The incentive plan comprised three sets of incentive targets: short-term, operational and strategic. The operational and strategic targets are longer term targets to be based on a business and strategic plan to be developed by management and approved by the Board. Incentive payments against the short-term targets, if achieved and awarded, are to be paid each year whereas incentive payments against the operational and strategic targets may be earned annually but will accrue for distribution after three years. During the financial year ended December 31, 2011, annual performance incentives were earned by certain NEOs to reflect the satisfaction of certain discretionary performance targets in connection with the Company's business and operations.

Security Based Compensation

Options are granted to executive officers pursuant to the terms of the Company's 1997 stock option plan (the "Option Plan") and awards are available for grant under the 2008 equity incentive plan (the "Incentive Plan"). Grants under the Option Plan and the Incentive Plan are made based on the executive's contribution to the achievement of the Company's goals, taking into account the executive's existing level of equity incentives. In determining whether to grant option or awards under the Option Plan and the Incentive Plan to the executive officers, the Board takes into account previous grants. Please refer to the section of this Circular entitled "Statement of Executive Compensation – Option-Based Awards" below.

During the year ended December 31, 2011, options to purchase 2,635,000 Common Shares were granted to directors and certain employees of the Company.

Risk Management

The Company has taken steps to ensure its executive compensation program does not incent risk outside the Company's risk appetite. Some of the risk management initiatives currently employed by the Company are as follows:

- appointing a Compensation Committee comprised entirely of independent directors to oversee the executive compensation program; and

- use of discretion in adjusting bonus payments (if any) up or down as the Compensation Committee deems appropriate and recommends.

The Board and Compensation Committee has discussed and assessed risk related to the Company compensation policies and practices and is of the view that, when looked at in their totality, the Company's compensation policies and practices do not incentivize risk taking outside the Company's risk appetite. The Company does not have any formal policy respecting the purchase by an NEO or a director of financial instruments.

Compensation Governance

The Company has a Compensation Committee, comprised entirely of independent directors, being Dr. Shuming Zhao, Ian Rigg and Indrajit Chatterjee. The Compensation Committee is responsible for, among other things, developing the Company's approach to executive compensation and periodically reviewing the compensation of the directors. The Compensation Committee reviews and approves annual salaries, bonuses and other forms and items of compensation for the Company's senior officers and employees. Except for plans that are, in accordance with their terms or as required by law, administered by the Board or another particularly designated group, the Compensation Committee also administers and implements all of the Option Plan and other stock-based and equity-based benefit plans (including performance-based plans), recommends changes or additions to those plans and reports to the Board on compensation matters. The responsibilities, powers and operation of the Compensation Committee are detailed in the Compensation Committee's charter, a copy of which was filed with the Company's Information Circular on July 3, 2007, and is available on SEDAR at http://www.sedar.com.

The members of the Compensation Committee have direct experience relevant to executive compensation from their broad business experience and are well-versed in executive compensation matters. The members similarly bring a wide range of skills and experience that helps them make decisions in respect of the Company's compensation policies and practices and assess performance on both an individual and an organizational level. These skills and experiences include, but are not limited to: industry knowledge; operational experience; financial knowledge; and international business experience. For further information about the experience of the members of the Compensation Committee, see the section of Schedule "A" attached to this Circular entitled "Relevant Education and Experience".

8

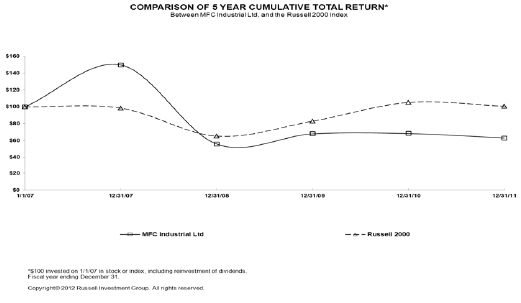

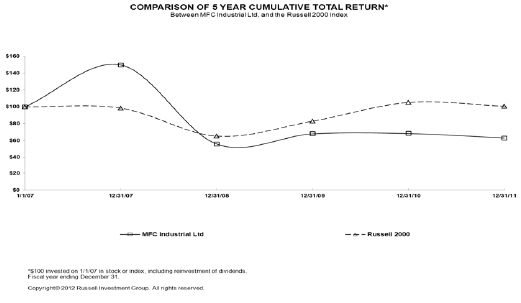

Performance Graph

The following chart compares the cumulative total return assuming a $100 investment in the Common Shares with the cumulative total return of the Russell 2000 Index over the five most recently completed financial years, assuming that the $100 investment was made on January 1, 2007 and assuming the reinvestment of dividends.

| | 1/1/07 | 31/12/07 | 31/12/08 | 31/12/09 | 31/12/10 | 31/12/11 |

| MFC Industrial Ltd. | $100 | $149.60 | $55.74 | $67.91 | $68.27 | $62.95 |

| Russell 2000 Index | $100 | $98.43 | $65.18 | $82.89 | $105.14 | $100.75 |

The performance of the Common Shares as set out in the graph above does not necessarily indicate future price performance. Executive compensation has generally followed the trend in shareholder returns, although market conditions in the 2008 fiscal year resulted in a disconnect between financial performance, share performance and compensation. As described above, the Compensation Committee considers various factors in determining the compensation of the NEOs. The Compensation Committee does not consider the price of the Common Shares to be a strong indicator of performance.

Option-Based Awards

Pursuant to the terms of the Option Plan, the Board currently administers and implements the Option Plan and the Incentive Plan and recommends changes or additions thereto. The Compensation Committee assists the Board in these respects. The Board determines all option-based awards to be granted pursuant to the Option Plan or the Incentive Plan and any special terms, including any exercise price or vesting provisions applicable thereto. When determining whether to grant new option-based awards to executive officers, the Board takes into account previous grants of option-based awards.

9

For a summary of the material provisions of the Option Plan, please refer to the section of this Circular entitled "Securities Authorized for Issuance under Equity Compensation Plans – Option Plan". For a summary of the material provisions of the Incentive Plan, please refer to the section of this Circular entitled "Securities Authorized for Issuance under Equity Compensation Plans - Incentive Plan".

Summary Compensation Table

During the fiscal year ended December 31, 2011, the Company paid an aggregate of approximately $1.6 million in cash compensation to its officers, excluding directors' fees. The following table (and notes thereto) states the name of each NEO, his or her total annual compensation, consisting of salary, bonus and other annual compensation, and long term compensation, for example Option Plan and/or Incentive Plan awards, for the three most recently completed financial years of the Company.

| SUMMARY COMPENSATION TABLE |

| | | | | Non-equity incentive | | | |

| | | | | compensation plan | | | |

| | | | | compensation | | | |

| | | | | ($) | | | |

| | | Share- | Option- | | Long- | | | |

| | | based | based | Annual | term | Pension | All Other | Total |

| Name and Principal | | Salary | awards | awards | incentive | incentive | value | Compensation | Compensation |

| Position | Year | ($) | ($) | ($)(1) | plans | plans | ($) | ($) | ($) |

Michael J. Smith

Chairman

Chief Executive

Officer and President | 2011 | 301,538 | - | 1,079,130(2) | 133,794 | - | - | 179,555(3) | 1,694,017 |

| 2010 | 253,034(4) | - | - | 100,000 | - | - | 150,670(5) | 503,704 |

| 2009 | 222,250 | - | - | - | - | - | 164,398 | 386,648 |

Ravin Prakash(6)

Director and

Executive Chairman

of Magnum Minerals

Private Limited | 2011 | 179,693 | - | 553,400(7) | 228,795 | - | - | 26,250(8) | 988,138 |

| 2010 | 16,600 | - | - | 17,100 | - | - | 5,000(8) | 38,700 |

| 2009 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

Prashant Sahu(9)

Executive Director of

Magnum Minerals

Private Limited | 2011 | 89,224 | - | - | 230,020 | - | - | - | 319,244 |

| 2010 | 5,540 | - | - | 17,100 | - | - | - | 22,640 |

| 2009 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

Roland Schulien(10)

Senior Vice

President Finance,

Europe | 2011 | 207,731 | - | - | 5,568 | - | - | 32,328(11) | 245,627 |

| 2010 | 26,189 | - | - | 666 | - | - | 2,560 | 29,415 |

| 2009 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

____________________

| Notes: |

| (1) | | The fair value of the stock-based compensation at the date of grant is determined by using the Black-Scholes model, with the following assumptions: a weighted average expected life of 3 years, expected volatility of 60.09%, risk-free interest rate of 0.97% and expected dividend yield of 2.58%. |

| (2) | | Represents options to purchase up to 390,000 Common Shares, which are exercisable at a price of $7.81 per common share and expire on January 1, 2016. |

| (3) | | Consists of housing allowances and medical benefits. |

| (4) | | Includes $3,000 in directors' fees. |

| (5) | | Includes housing expenses and medical expenses. |

| (6) | | Mr. Prakash joined the Company on November 15, 2010 as part of the acquisition of Mass Financial Corp., and, accordingly, the Company did not pay Mr. Prakash any compensation prior to November 15, 2010. |

| (7) | | Represents options to purchase up to 200,000 Common Shares, which are exercisable at a price of $7.81 per common share and expire on January 1, 2016. |

| (8) | | Represents fees payable to Mr. Prakash in his capacity as a director of the Company. |

| (9) | | Mr. Sahu joined the Company in November 15, 2010 as part of the acquisition of Mass Financial Corp., and, accordingly, the Company did not pay Mr. Sahu any compensation prior to November 15, 2010. |

| (10) | | Mr. Schulien joined the Company in November 15, 2010 as part of the acquisition of Mass Financial Corp., and, accordingly, the Company did not pay Mr. Schulien any compensation prior to November 15, 2010. |

| (11) | | Consists of auto benefits. |

10

Incentive Plan Awards

Outstanding Share-based Awards and Option-based Awards for NEOs

The following table states the name of each NEO, the number of options available for exercise, the option exercise price and the expiration date for each option. As at December 31, 2011 the value of "in-the-money" unexercised options held by the NEOs was $nil.

| Name | Option-based Awards | Share-based Awards |

| | | | | Shares | Market or | Market or |

| Number of | | | Value of | or units | payout value | payout value of |

| securities | | | unexercised | of shares | of share- | vested share- |

| underlying | Option | Option | in-the- | that | based awards | based awards |

| unexercised | exercise | expiration | money | have not | that have not | not paid out or |

| options | price | date | options | vested | vested | distributed |

| (#) | ($) | (dd/mm/yyyy) | ($) | (#) | ($) | ($) |

Michael J. Smith

Chairman

Chief Executive Officer and

President | 390,000 | 7.81 | 01/01/2016 | Nil | Nil | Nil | Nil |

Ravin Prakash

Director and Executive

Chairman of Magnum Minerals

Private Limited | 200,000 | 7.81 | 01/01/2016 | Nil | Nil | Nil | Nil |

Prashant Sahu

Executive Director of Magnum

Minerals Private Limited | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

Roland Schulien

Senior Vice President Finance,

Europe | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

Incentive Plan Awards – Value Vested or Earned During the Year for NEOs

The table below discloses the aggregate dollar value that would have been realized by an NEO if options under option-based awards had been exercised on the vesting-date, as well as the aggregate dollar value realized upon vesting of share-based awards by an NEO.

| Option-based awards – Value | Share-based awards – Value vested |

| vested during the year | during the year |

| Name | ($)(1) | ($) |

Michael J. Smith

Chairman

Chief Executive Officer and President | Nil | Nil |

Ravin Prakash

Director and Executive Chairman of Magnum Minerals

Private Limited | Nil | Nil |

Prashant Sahu

Executive Director of Magnum Minerals Private Limited | Nil | Nil |

Roland Schulien

Senior Vice President Finance, Europe | Nil | Nil |

____________________

| Note: |

| (1) | | The amount represents the aggregate dollar value that would have been realized if the options had been exercised on the vesting date, based on the difference between the closing price of the Common Shares of the Company on the New York Stock Exchange, Inc. and the exercise price on such vesting date. |

Pension Plan Benefits

As at December 31, 2011, the Company did not have any defined benefit, defined contribution or deferred compensation plans for any of its NEOs.

11

Termination and Change of Control Benefits

Effective March 1, 2008, the Company entered into an independent consulting agreement with Michael Smith, the Company's Chairman and Chief Executive Officer, pursuant to which he provides consulting services to the Company. In the event that the agreement is terminated by the Company or in the event of a change of control, Mr. Smith is entitled to receive a termination payment equal to the sum of three times the aggregate consulting fee paid to Mr. Smith in the previous twelve months plus the higher of his current bonus or the highest bonus received by him in the previous five years prior to such termination. In addition, all unvested rights in any stock options or other equity awards made to Mr. Smith will vest in full in the event of a change of control. Mr. Smith will also be entitled, for a period of 365 days following the earlier of the date of the termination of the agreement and the date of the change of control, to require the Company to purchase all or any part of the Common Shares held by Mr. Smith on the date of termination or date of change of control, at a price equal to the average closing market price of the Common Shares on the New York Stock Exchange for the ten preceding trading days. Assuming a discontinuance of Mr. Smith's services as a result of termination or a change of control effective December 31, 2011, the Company would have been required to make a maximum payment to Mr. Smith in the aggregate amount of $2,843,795 pursuant to the terms of his consulting arrangement.

Director Compensation

The following table provides a summary of compensation, consisting wholly of directors' fees, paid by the Company during the fiscal year ended December 31, 2011 to the directors of the Company.

| DIRECTOR COMPENSATION TABLE(1) |

| | | Option- | Non-equity | | | |

| Fees | Share-based | based | incentive plan | | All other | |

| Earned | awards | awards | compensation | Pension value | compensation | Total |

| Name | ($) | ($) | ($) | ($) | ($) | ($) | ($) |

| Dr. Shuming Zhao | 39,000 | - | 152,185 | - | - | - | 191,185 |

| Ian Rigg | 39,000 | - | 152,185 | - | - | - | 191,185 |

| Indrajit Chatterjee | 96,500 | - | 152,185 | - | - | - | 248,685 |

____________________

| Note: |

| (1) | | Compensation provided to the Company's Chairman, Michael Smith and Ravin Prakash, is disclosed in the table above under the heading "Summary Compensation Table". |

Narrative Discussion

A total of $0.7 million was paid to directors of the Company for services rendered as directors or for committee participation or assignments, during the most recently completed financial year. The Company's directors are each paid an annual fee of $30,000 and $750 for each directors' meeting attended as well as additional fees, as applicable, for their respective participation on the Company's Audit and Compensation Committees. The Company also reimburses its directors and officers for expenses incurred in connection with their services as directors and officers.

12

Incentive Plan Compensation for Directors

Outstanding Share-based Awards and Option-based Awards for Directors

The following table states the name of each director, the number of options available for exercise, the option exercise price and the expiration date for each option. As at December 31, 2011 the value of "in-the-money" unexercised options held by the directors was $nil.

| Option-based Awards | Share-based Awards |

| | | | | Shares | Market or | Market or |

| Number of | | | Value of | or units | payout value | payout value of |

| securities | | | unexercised | of shares | of share- | vested share- |

| underlying | Option | Option | in-the- | that | based awards | based awards |

| unexercised | exercise | expiration | money | have not | that have not | not paid out or |

| options | price | date | options | vested | vested | distributed |

| Name | (#) | ($) | (dd/mm/yyyy) | ($) | (#) | ($) | ($) |

| Dr. Shuming Zhao | 55,000 | 7.81 | 01/01/2016 | Nil | Nil | Nil | Nil |

| Ian Rigg | 55,000 | 7.81 | 01/01/2016 | Nil | Nil | Nil | Nil |

| Indrajit Chatterjee | 55,000 | 7.81 | 01/01/2016 | Nil | Nil | Nil | Nil |

Incentive Plan Awards – Value Vested or Earned During the Year for Directors

The table below discloses the aggregate dollar value that would have been realized by a director if options under option-based awards had been exercised on the vesting-date, as well as the aggregate dollar value realized upon vesting of share-based awards by a director.

| Option-based awards – Value | Share-based awards – Value vested |

| vested during the year | during the year |

| Name | ($)(1) | ($) |

| Dr. Shuming Zhao | Nil | Nil |

| Ian Rigg | Nil | Nil |

| Indrajit Chatterjee | Nil | Nil |

____________________

| Note: |

| (1) | | The amount represents the aggregate dollar value that would have been realized if the options had been exercised on the vesting date, based on the difference between the closing price of the Common Shares of the Company on the New York Stock Exchange and the exercise price on such vesting date. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out securities authorized for issuance under compensation plans as of December 31, 2011:

| | | Number of Common Shares |

| Number of Common Shares | Weighted average | remaining available for issuance |

| to be issued upon exercise of | exercise price of | under equity compensation plans |

| outstanding options, | outstanding options, | (excluding securities reflected in |

| Plan Category | warrants and rights | warrants and rights | second column) |

Equity compensation plans

approved by securityholders

(Option Plan) | 1,720,000 | 7.81 | 12,344 |

Equity compensation plans

approved by securityholders

(Incentive Plan) | 915,000 | 7.81 | 585,000 |

| Total | 2,635,000 | Not Applicable | 597,344 |

Option Plan

The Option Plan provides for the grant of incentive stock options to purchase Common Shares to the Company's directors, officers and key employees and other persons providing ongoing services to the Company. The Option Plan is administered by the Board. The maximum number of Common Shares which may be reserved and set aside for issuance under the Option Plan is 5,524,000. Each option upon its exercise entitles the grantee to purchase one Common Share. The exercise price of an option may not be less than the closing market price of the Common Shares on the New York Stock Exchange, Inc. on the day prior to the date of grant of the option. In the event the Common Shares are not traded on such day, the exercise price may not be less than the average of the closing bid and ask prices of the Common Shares on the New York Stock Exchange for the ten trading days immediately prior to the date the option is granted. Options may be granted under the Option Plan for an exercise period of up to ten years from the date such options are granted. During the year ended December 31, 2011, options to purchase 1,720,000 Common Shares were granted to directors, officers and certain employees under the Option Plan. There are 1,720,000 options outstanding as of the date hereof. There were 12,344 options available for grant under the Option Plan as of the date hereof.

13

Incentive Plan

At the Company's annual and special meeting of the Shareholders held in September 2008, the Shareholders passed a resolution approving the Incentive Plan to further align the interests of the Company's employees and directors with those of the Shareholders by providing incentive compensation opportunities tied to the performance of the Common Shares and by promoting increased ownership of the Common Shares by such individuals.

Pursuant to the terms of the Incentive Plan, the Board, the Compensation Committee or such other committee of the Board as is appointed by the Board to administer the Incentive Plan, may grant Awards (as hereinafter defined) under the Incentive Plan, establish the terms and conditions for those Awards, construe and interpret the Incentive Plan and establish the rules for the Incentive Plan's administration. The Board or the relevant committee may grant nonqualified stock options, incentive stock options, stock appreciation rights, restricted stock awards, stock unit awards, stock awards, performance stock awards and tax bonus awards (each, an "Award") under the Incentive Plan. Awards may be granted to employees, directors, officers or consultants of the Company or any affiliate or any person to whom an offer of employment with the Company or any affiliate is extended. The Board or the relevant committee has the authority to determine which employees, directors, officers, consultants and prospective employees should receive Awards. Non-employee directors and consultants may not receive incentive stock options.

The maximum number of Common Shares that may be issuable pursuant to all Awards granted under the Incentive Plan is 1,500,000 Common Shares. Forfeited, cancelled, returned and lapsed Awards are not counted against the 1,500,000 Common Shares. Any Awards or portions thereof that are settled in cash and not by issuance of Common Shares are not counted against the 1,500,000 Common Shares. The Company granted 915,000 stock options under the Incentive Plan to directors and certain employees during the year ended December 31, 2011. There were 585,000Awards available for grant under the Incentive Plan as of the date hereof.

CORPORATE GOVERNANCE DISCLOSURE

The disclosure noted below is in accordance with National Instrument 58-101 –Disclosure of Corporate Governance Practices. The section references in this section are to Form 58-101F1.

| 1. | | Board of Directors |

| |

| | (a) | | Indrajit Chatterjee, Dr. Shuming Zhao and Ian Rigg are independent directors of the Company. |

| |

| | (b) | | Michael J. Smith is an executive officer of the Company and is therefore not an independent director. Ravin Prakash is an officer of a subsidiary of the Company and is therefore not an independent director. |

| |

| | (c) | | A majority of the Company's directors are independent. |

| | |

| | (d) | | The following directors are also directors of another reporting issuer (or the equivalent in a foreign jurisdiction), as identified next to his name: |

| | Director | Reporting Issuers or Equivalent in a Foreign Jurisdiction |

| | Dr. Shuming Zhao | Little Swan Company Ltd. (China) |

| Michael J. Smith | 0915988 B.C. Ltd. |

14

| | (e) | | During fiscal 2011 (the Company's most recently completed financial year), the independent directors held three meetings at which non-independent directors and members of management were not in attendance. In addition, the Board holds frequent meetings and has open communication in order to facilitate open and candid discussion among its independent directors. |

| |

| (f) | | The Chairman of the Board is Michael J. Smith and the Board has determined that he is not an independent director. Refer to Item 3 –Position Description for Chairman of the Board. The Board believes that this structure best reflects the entrepreneurial leadership of the Company. The Board is satisfied that the autonomy of the Board and its ability to function independently of management are protected through measures such as the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee being composed of all or a majority of independent directors and each committee being chaired by an independent director. In addition, in order to provide leadership for its independent directors, the Board encourages its independent members to discuss matters separate from the non-independent Board members and to seek the advice of financial, legal or other consultants when necessary. |

| |

| (g) | | The following table shows the attendance record of each director for all Board meetings held during fiscal 2011 (including all Board actions by written consent in lieu of a meeting): |

| | Director | Board Meetings Attended | % of Board Meetings Attended |

| Michael J. Smith | 23 | 100 |

| Ian Rigg | 23 | 100 |

| | Dr. Shuming Zhao | 23 | 100 |

| Indrajit Chatterjee | 23 | 100 |

| Ravin Prakash(1) | 18 | 100 |

| ____________________ |

| | | |

| | Note: |

| (1) | | Mr. Prakash was appointed to the Board in April 2011 and has attended all of the Board meetings held (including all Board actions by written consent in lieu of a meeting) since his appointment. |

2. | | Board Mandate |

| | |

| | The Board has adopted the following mandate and terms of reference for directors: |

| | |

| | The Board is responsible for the stewardship of the Company on behalf of the Shareholders. |

| | |

| | In directing the affairs of the Company and delegating to management the day-to-day business of the Company, the Board endorses the guidelines for responsibilities of the Board as set out by regulatory authorities on corporate governance in Canada and the United States, and as incorporated into the Company's Nominating and Corporate Governance Committee Mandate. |

| | |

| | The Board's primary responsibilities are to supervise the management of the Company, to establish an appropriate corporate governance system, and to set a tone of high professional and ethical standards. The Board is also responsible for: |

| | |

| | - selecting and assessing members of the Board;

- choosing, assessing and compensating the Chief Executive Officer of the Company, approving the compensation of all executive officers and ensuring that an orderly management succession plan exists;

- reviewing and approving the Company's strategic plan, operating plan, capital budget and financial goals, and reviewing its performance against those plans;

- adopting a code of conduct and a disclosure policy for the Company, and monitoring performance against those policies;

|

15

| | - ensuring the integrity of the Company's internal control and management information systems;

- approving the Company's financial statements and related public disclosures prior to such disclosure;

- approving any major changes to the Company's capital structure, including significant investments or financing arrangements; and

- reviewing and approving any other issues which, in the view of the Board or management, may require Board scrutiny.

|

| | |

The Board will have a majority of members who will be unrelated and independent from management and will act as a cohesive team in ensuring effective governance of the Company. It will monitor the performance of management against stated goals and its own effectiveness through regular, formal self-evaluations. |

| | |

| 3. | | Position Descriptions |

| | |

| | | Chairman of the Board |

| | |

| | The Board has developed and approved the following position description for the Chairman of the Board: Position: Chairman of the Board Reports to: the Board General Accountability The Chairman of the Board reports to the Board. The Chairman, working with the Chief Executive Officer, guides and directs management to ensure that all matters relating to the stewardship and mandate of the Board are completely disclosed and discussed with the Board. On a demand basis, the Chairman of the Board assists the Chief Executive Officer and provides guidance on those matters of Board interest and provides a sounding board to the Chief Executive Officer on issues and concerns. Nature and Scope The Chairman performs the following additional functions: |

| | |

| | - is responsible for managing the process of the Board and for ensuring that the Board discharges the responsibility in its mandate;

- schedules regular meetings of the Board and works with the Chief Executive Officer on the agenda to see that all Board matters are properly and adequately addressed and the appropriate information is sent to directors in a timely fashion;

- ensures that all members of the Board have the full opportunity to participate and question management regarding development of the Company;

- provides opportunity for all independent Board members to make comments in the absence of management and to freely give independent guidance; and

- conducts Shareholders' meetings and determines the democratic will of Shareholders.

|

16

| | | Chairman of the Nominating and Corporate Governance Committee The Board has developed and approved the following position description for the Chairman of the Nominating and Corporate Governance Committee: Position: Chairman of the Nominating and Corporate Governance Committee Reports to: the Board General Accountability The Chairman of the Nominating and Corporate Governance Committee reports to the Board. The Chairman, working with the committee and outside advisors as necessary, ensures that the Nominating and Corporate Governance Committee mandate is met, especially with regards to the appropriate tone from the top, governance processes, regulatory compliance, and succession planning. As needed, he or she also performs other responsibilities and functions as directed by the Board in the discharge of its mandate. Nature and Scope The Chairman performs the following functions: - manages the process of the committee, its efficiency during meetings, and helps ensure that the committee discharges the responsibility in its mandate;

- sets and approves the agenda of each meeting;

- through outside counsel and other assistance, remains informed on any issues that may arise to affect the Company's compliance policies and practices;

- assists in monitoring compliance with the Company's stated policies and procedures regarding governance;

- ensures that all members of the committee have full opportunity to participate and to actively question management and any outside experts as necessary, to ensure that the committee mandate regarding appropriate governance policies, procedures and disclosure is met; and

- provides guidance and opinions as necessary to the Chief Executive Officer, Chief Financial Officer and the Company's Compliance Officer, as applicable, to establish and ensure adherence to the Company's governance and compliance practices.

Chairman of the Audit Committee The Board has developed and approved the following position description for the Chairman of the Audit Committee: Position: Chairman of the Audit Committee Reports to: the Board General Accountability The Chairman of the Audit Committee reports to the Board. The Chairman, working with the committee and outside auditors, ensures that the Audit Committee complies with its charter. |

17

| | | As needed, he or she also performs other responsibilities and functions as directed by the Board in the discharge of its charter. Nature and Scope The Chairman performs the following functions: - manages the process of the committee and ensures that the committee discharges the responsibility in its charter;

- reviews and approves the agenda of each meeting prior to the meeting;

- through consultation with management and auditors, remains informed on any issues that may arise as part of a quarterly review or annual audit;

- ensures that all members of the committee have full opportunity to participate and to actively question management and the auditors, in order to satisfy themselves that the committee mandate regarding overseeing full and fair disclosure of the Company's financial position is met; and

- provides guidance and opinions as necessary to management to facilitate the continued improvement of the Company's financial control and disclosure practices.

Chairman of the Compensation Committee The Board has developed and approved the following position description for the Chairman of the Compensation Committee: Position: Chairman of the Compensation Committee Reports to: the Board General Accountability The Chairman of the Compensation Committee reports to the Board. The Chairman, working with the committee and using outside information as necessary, ensures that the Compensation Committee mandate is met, especially with regards to the appropriate total compensation for the executive officers. As needed, he or she also performs other responsibilities and functions as directed by the Board in the discharge of its mandate. Nature and Scope The Chairman performs the following functions: - manages the process of the committee and ensures that the committee discharges the responsibility in its mandate;

- reviews and approves the agenda of each meeting prior to the meeting;

- through consultation with management and the use of outside benchmarks, such as competitive compensation surveys, remains informed on any issues that may arise within the Company with regard to compensation of its executives;

- ensures that all members of the committee have full opportunity to participate and to actively question management and any outside experts, as necessary, to ensure that the committee mandate regarding recommending the Chief Executive Officer's compensation and approving the compensation package of the Company's other executive officers is met; and

- provides guidance and opinions, as necessary, to the Chief Executive Officer and to the Company's human resources officer, if applicable, to enable the continued improvement of the Company's compensation practices.

|

18

Chief Executive Officer

The Board has developed and approved the following position description for the Chief Executive Officer:

- responsible for the management and operational control of the Company; and

- provides vision, leads the development of long term strategy and drives profitable growth and shareholder value.

Major responsibilities:

- leads and manages the Company within the guidelines established by the Board;

- communicates a clear vision for the Company to team members, investors, customers and business partners;

- recommends to the Board strategic directions for the Company's business and when approved by the Board, successfully implements the corresponding strategic, business and operational plans;

- directs and monitors the activities of the Company in a manner that ensures agreed upon targets are met and that the assets of the Company are safeguarded and optimized in the best interests of all the shareholders;

- develops and implements operational policies to guide the Company within the limits prescribed by its bylaws and the strategy framework adopted by the Board;

- develops and recommends the corporate and organizational structure and staffing to the Board;

- leads the Company and its key managers to successfully deliver on established financial and strategic goals and, where appropriate, recruits top notch executives to help drive positive change;

- develops and maintains an annual (or more frequently if required) Board approved plan for the development and succession of senior management;

- manages and oversees communications and disclosure to the Shareholders, the public and regulatory bodies in a transparent comprehensive and honest manner;

- meets regularly with and maintains relationships with the financial community; and

- meets regularly, and as required, with the Chairman and committees of the Board to review material issues and to ensure that Board members are provided in a timely manner with all information and access to management necessary to permit the Board to fulfill its statutory and other obligations.

| 4. | | Orientation and Continuing Education |

| |

| | (a) | | The Company has a formal process to orient and educate new recruits to the Board regarding the role of the Board, its committees and its directors, as well as the nature and operations of the Company's business. This process provides for an orientation day with key members of the management staff, and further provides key reference and background materials, such as the current Board approved business and strategic plan, the most recent Board approved budget, the most recent annual report, the audited financial statements and copies of the interim quarterly financial statements. The Company also provides new directors with the terms of reference for each of the directors, the Chairman of the Board, the terms of reference for the Chief Executive Officer, the statement of general business principles and code of ethics, and the charters for each committee of the Board, each of which have been approved by the Board. |

| | | | |

| | (b) | | The Board does not provide continuing education for its directors. Each director is responsible to maintain the skills and knowledge necessary to meet his or her obligations as a director of the Company. |

19

| 5. | | Ethical Business Conduct |

| | | | |

| | (a) | | The Board has adopted a written Code of Ethics. |

| | |

| | | | (i) | | A copy of the Code of Ethics can be obtained by written request to the President of the Company at Suite 1620, 400 Burrard Street, Vancouver, British Columbia, Canada V6C 3A6. A copy of the Code of Ethics is also available online, as an Appendix to the Company's Management Information Circular dated September 25, 2009 filed under the Company's profile on SEDAR at http://www.sedar.com. |

| | |

| | | | (ii) | | The Code of Ethics was adopted by the Audit Committee of the Company on November 9, 2006. Since that date, the Board has conducted an assessment of its performance, including the extent to which the Board and each director comply with the Code of Ethics. It is intended that such assessment will be conducted annually. The Board will be assessing other mechanisms by which it can monitor compliance with the Code of Ethics in an efficient manner. |

| | |

| | | | (iii) | | There has been no conduct of any director or officer that would constitute a departure from the Code of Ethics, and therefore, no material change reports have been filed in this regard. |

| | |

| | (b) | | Pursuant to the terms of reference for directors which has been adopted by the Board, directors are instructed to declare any conflicts of interest in matters to be acted on by the Board, to ensure that such conflicts are handled in an appropriate manner and to disclose any contracts or arrangements with the Company in which the director has an interest. Any director expressing a conflict or interest in a matter to be considered by the Board is asked to leave the meeting for the duration of the discussion related to the matter at hand, and to abstain from voting with respect to such matter. |

| | |

| | (c) | | The Board encourages and promotes a culture of ethical business conduct through the adoption and monitoring of the Code of Ethics, an insider trading policy and such other policies that may be adopted by the Board from time to time. In addition, the Audit Committee has adopted a written code of conduct, which sets out the standards of ethical behaviour required for all employees and officers of the Company and its subsidiaries. The Board conducts regular reviews with management for compliance with such policies. |

| | | | |

| 6. | | Nomination of Directors |

| | | | |

| | (a) | | The Board has appointed a Nominating and Corporate Governance Committee, which is responsible for assisting the Board in identifying new director nominees. When identifying candidates for membership on the Board, the Nominating and Corporate Governance Committee takes into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity and the extent to which the candidate would fill a present need on the Board. As part of the process, the Nominating and Corporate Governance Committee is responsible for conducting background searches and is empowered to retain search firms to assist in the nominations process. Once candidates have completed a screening process and met with a number of the existing directors, they are formally put forward as nominees for approval by the Board. |

20

| | (b) | | The Nominating and Corporate Governance Committee is composed entirely of independent directors. |

| | | | |

| | (c) | | The responsibilities, powers and operation of the Nominating and Corporate Governance Committee are detailed in its charter, a copy of which was filed with the Company's Information Circular that was filed, on July 3, 2007, and is available on SEDAR at http://www.sedar.com. |

| | | | |

| 7. | | Compensation |

| | | | |

| | (a) | | The Board has appointed a Compensation Committee, which is responsible for, among other things, developing the Company's approach to executive compensation and periodically reviewing the compensation of the directors. The Compensation Committee reviews and approves annual salaries, bonuses and other forms and items of compensation for the Company's senior officers and employees. Except for plans that are, in accordance with their terms or as required by law, administered by the Board or another particularly designated group, the Compensation Committee also administers and implements all of the Company's stock option and other stock-based and equity-based benefit plans (including performance-based plans), recommends changes or additions to those plans and reports to the Board on compensation matters. |

| | |

| | (b) | | The Compensation Committee is composed entirely of independent directors. |

| | |

| | (c) | | The responsibilities, powers and operation of the Compensation Committee are detailed in its charter, a copy of which was filed with the Company's Information Circular that was filed on July 3, 2007, and is available on SEDAR at http://www.sedar.com. |

| | | | |

| 8. | | Other Board Committees |

| | | | |

| | The Company has no other standing committees other than the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. |

| | | | |

| 9. | | Assessments |

| | | | |

| | The Board intends that individual director assessments be conducted by other directors, taking into account each director's contributions at Board meetings, service on Board committees, experience base and their general ability to contribute to one or more of the Company's major needs. However, the Board has not yet implemented such a process of assessment. |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS