U.S. SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2013

Commission File No.:001-04192

MFC Industrial Ltd.

(Translation of Registrant's name into English)

Suite #1620 - 400 Burrard Street, Vancouver, British Columbia, Canada V6C 3A6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):¨

Note:Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):¨

Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If "Yes" is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b):¨

SIGNATURES

Pursuant to the requirements of theSecurities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

MFC INDUSTRIAL LTD.

| By: | /s/ Michael Smith |

| | Michael Smith |

| Chairman, President and |

| Chief Executive Officer |

| |

| Date: | December 13, 2013 |

NEWS RELEASE

|

Corporate

MFC Industrial Ltd.

Rene Randall

1 (604) 683 8286 ex 224

rrandall@bmgmt.com | Investors

Cameron Associates

Kevin McGrath

1 (212) 245 4577

kevin@cameronassoc.com |

MFC WILLING TO SUPPORT PROPORTIONATE BOARD REPRESENTATION TO END PROXY CONTEST

NEW YORK (December 13, 2013) . . . MFC Industrial Ltd. ("MFC" or the "Company") (NYSE: MIL) today announced that, in the best interests of the Company, it is prepared to support the election to MFC's board of directors at its shareholders' meeting to be held on December 27, 2013 of two of Peter Kellogg's and IAT Reinsurance Company, Ltd.'s (the "Kellogg Group") nominees who are independent from such group and mutually acceptable in consideration of the termination of the current proxy contest by the Kellogg Group.

Mr. Michael Smith, Chief Executive Officer, stated: “We believe that this proposal is a fair compromise, in the best interests of MFC and provides one-third representation on the MFC board, which is proportionate to the Kellogg Group's current ownership position."

Mr. Smith concluded: "We have received feedback from our other shareholders that indicates support for a resolution as proposed.We hope this will positively end the current proxy contest and allow us to focus our efforts on the Company's long-term growth strategy and to continue to build shareholder value."

About MFC Industrial Ltd.

MFC is a global commodity supply chain company and is active in a broad spectrum of activities, including its integrated commodities operations, mineral and hydrocarbon interests, which focus on metals, energy, chemicals, plastics and wood products. MFC also provides logistics, financial and risk management services to producers and consumers of commodities. Our global business activities are supported by our captive commodities sources through strategic direct or indirect investments and other commodities sources secured by us from third parties.

To obtain further information on the company, please visit our website at www.mfcindustrial.com.

PAGE 1/1

| ATTENTION SHAREHOLDERS OF MFC INDUSTRIAL LTD. |

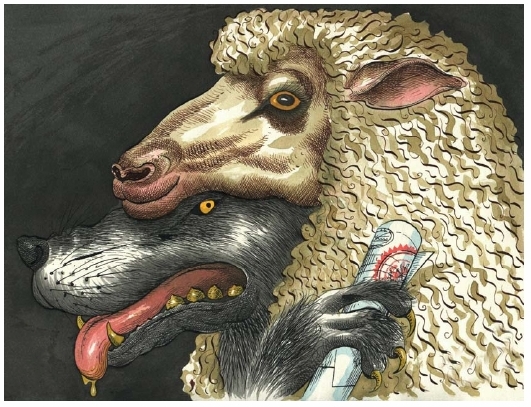

The MFC Board of Directors Encourages You to Read the Enclosed Letter toLearn Why They Are More Convinced than Ever that Dissidents

PETER KELLOGG and IAT REINSURANCE

and his hand-picked nominees

SHOULD NOT BE TRUSTED TO CONTROL

YOUR COMPANY

| For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500 |

| PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORWHITE VIF TODAY |

PROTECT YOUR INVESTMENT!

VOTE THE ENCLOSEDWHITEPROXY TODAY

December 13, 2013

Dear fellow shareholder:

The annual general and special meeting of our shareholders scheduled for December 27, 2013, is rapidly approaching. As you know, your Board of Directors and management team are committed to creating shareholder value and have adistinguished track record of doing so. Despite our history of substantial value creation, two dissident shareholders, PeterKelloggandIATReinsuranceCompanyLtd.(the “Kellogg Group”),areattemptingtotakecontrolofyourcompany.

By now, you may have received a dissident proxy circular and blue proxy card from the dissident shareholders. TheKelloggGroup’scircularand otherrecentdisclosuresbytheKelloggGrouphavevalidatedourseriousconcernsregarding the Kellogg Group's true intentions and their questionable past activities. The Kellogg Group has made veryvague and misleading accusations against us and our existing Board and management team in an attempt to divert your attention from the Kellogg Group's true intentions – to take control of MFC’s significant assets – your assets –without paying you any “control premium” – OR FOR THAT MATTER ANYTHING AT ALL!We urge you to ignore thesideshows and vote yourWHITEproxy orWHITEvoting instruction form and protect MFC from the Kellogg Group'sself-serving plan to line their own pockets.

Your Board and management team are committed to and have a track record of

creating shareholder value |

Your existing Board and management are implementing a long-term growth strategy. In 2012, in order to further MFC’s long-term growth strategy, we completed two key strategic acquisitions, the acquisition of Compton Petroleum in September, and the acquisition of a controlling interest in ACC Resources and Possehl Mexico S.A. de C.V. in November. In November 2013, we also entered into an agreement with an established oil and gas company whereby it committed to spending a minimum of C$50 million on our undeveloped lands.

Your existing Board and management have a demonstrated record of generating strong returns for you. Consider the following:

| ü | | the compound annual growth rate of MFC’s shares was 20.1% over the 10-year period from December 31, 2002 to December 31, 2012, compared to just 4.9% for the S&P 500 Index over the same period. |

| | | | |

| ü | | betweenDecember 31, 2002 andSeptember30,2013,ournetbookvalueincreasedbyover300%from $180.6 million to $735.3 million. |

| | | |

| ü | | during the same period, our total assets – your assets – increased by over 350% from $282.7 million to $1.3 billion. |

| | | |

| ü | | we have generated superior returns for you through spinouts. Most recently in 2010, we distributed shares of KHD to you, and in 2013 a third party made an offer to acquire all of these shares for cash consideration of €6.45 per share. |

| | | | |

| ü | | in2011,yourBoardadoptedanannualcashdividendpolicy,whichhaspaidyouincreasinglyattractivedividendseachyear. Ourannualcashdividendfor2013representsayieldofapproximately 2.8%,ascomparedtoanannualdividendyieldofapproximately 2.5%fortheNYSECompositeIndexin2012. |

| For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500 |

| PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORWHITE VIF TODAY |

P a g e |2

| Don’t trust the Kellogg Group’s disingenuous concerns regarding MFC’s “strategic direction” |

Your Company has been based on solid principles, honesty and transparency. On the other hand, the dissidents havebeenattempting tosecretlyaccumulateownership inyourCompanyanddepriveyoufinancialbenefitsthatyourBoardhasenactedthataffordyousubstantialfinancialcompensations.YourBoardofDirectorswantsyoutoconsider the following facts. Between April and October 2013 alone, the Kellogg Group acquired over 1.6 million MFC shares for approximately $13.1 million. Interestingly, these purchases increased the Kellogg Group’s holdings to 33%of our outstanding shares, which is exactly the threshold necessary to defeat any transaction requiring special majority approval.Thesearenottheactions ofsomeonewhohasgenuineconcernsbut,instead,aremore in linewith ascheme tocomplete asecrettakeover ofMFC. Whydoesn'ttheKelloggGrouptellyouthetruthabout itshiddenagenda? Shareholders must look at the facts and not allow themselves to be fooled by the Kellogg Group's rhetoric and overtures of camaraderie. There is no valid reason for a costly and disruptive proxy contest. Shareholders shouldaskthemselves: iftheKelloggGroup'sconcernsregardingthe"strategicdirection" andgovernance ofMFCarelegitimate, why has the Kellogg Group been continually purchasing MFC shares?

| The Kellogg Group has no plan or strategic vision for MFC |

You should be wary of the motives of the Kellogg Group's nominees. The Kellogg Group has not provided you any plan or strategic vision for MFC in the event that its scheme to take control of the MFC Board is successful. This is because it has no plan, other than to raid MFC’s significant assets – your assets – for its own purposes. The Kellogg Group’sundisclosed business plans could include granting a significant loan to the Kellogg Group in light of its liquidity crunch.

The Kellogg Group’s recent disclosures only further validate our serious concerns regarding its true intentions. Insteadof offering a concrete strategy for MFC’s future, the Kellogg Group’s dissident circular demonstrates that the Kellogg Group ishopingto workwithexisting managementtofigureout aplan “on thefly”. Notonly is such lack of forethought reckless, it presumes existing management will remain in their current positions. Several members of keymanagement have already indicated that they are considering their positions in light of the proxy contest, and if theKellogg Group is successful, they intend to explore alternative opportunities. If this happens, this will have a seriousnegative impact on MFC’s business and operations.

| The Kellogg Group nominees lack knowledge of our business and international strategies |

TheKelloggGroup nomineeshavelittle ornorelevant operationexpertise inrunning aglobalcommoditiessupplychain company. Almost all of the Kellogg Group nominees are anchored in North America, and lack the internationalexperiencenecessary torunMFC’s operations. Thislack ofinternationalexperiencecould seriously impactMFC’sbusiness and operations, and could negatively impact the existing Board and management’s long-term strategic plans.

| For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500 |

| PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORVIF TODAY |

P a g e |3

Don’t be fooled! The Kellogg Group launched this proxy contest only because it is under short-term financial

pressure and wants to raid MFC’s significant assets – your assets |

In order to deflect shareholders' attention from the serious questions raised by us regarding the Kellogg Group's trueintentions, the Kellogg Group has made various claims regarding its liquidity, focusing on its consolidated assets andlong-termdebt. Sincethe2009financialcrisis,wehave allseenmanyinstitutionsprofessfinancialstrengthwhenreally it is all a financial "house of cards". In its most recent Schedule13D, the Kellogg Group disclosed that it holds itsMFC shares in margin accounts. Ask yourself,why would the Kellogg Group seek to borrow $50 million from us andwhy would an offshore "insurance company" and its affiliates utilize high interest margin accounts if they have access to liquidity?It isabsurdforaninsurancecompany todiscloseitsshort-termfinancialassetsandnotdiscloseitsinsurance liabilities. This is what insurance companies do. Why does IAT not disclose its year-end audited and mostcurrent financial statements, including truthful mark-to-market accounting of its holdings, instead of hiding behind thesecrecy rules of an offshore tax haven? Shareholders have all seen this movie before.

The Kellogg Group fails to explain why it was seeking to borrow $50 million from us in the third quarter of 2011, if, infact, its financial position is as it now claims. At the same time, IAT's chief financial officer, David Pirrung, wrote to the IRS in relation to amounts required by the IRS to be paid by IAT, stating that:

“In response to these and subsequent bills, including the ones which I am paying today,as Chief Financial Officer of the taxpayer, I have made substantial and strenuous efforts topromptlypayamountstotalingapproximately $170millionwhich isapproximately20% of the [Kellogg] Group's capital base.This is a particularly difficult economic time to liquidate holdings of such a significant percentage of the taxpayer's entire holdings and Ihave to take great pains to determine how best to liquidate assets without jeopardizingthe company's continuing operations(emphasis added).”

The Kellogg Group is trying to take control of MFC without paying you – the owners of MFC – a control premium,

or for that matter not paying you anything at all! |

MFC shareholders should be under no illusion that the Kellogg Group’s efforts areanything other than an attempt toacquire control of your Board. As compared to the Kellogg Group’s 33% ownership interest in MFC, the Kellogg Groupis seeking the appointment of about 75% of the Board. In view of this, we recently publicly announced that we wereprepared to support the election to our Board of two of the Kellogg Group’s nominees who are independent from suchgroupandmutuallyacceptable tobothsides. Webelieved(andcontinue tobelieve)thatthisproposalwas afaircompromise,inthebestinterestsofMFCandprovidesone-thirdrepresentationontheMFCboard,which isproportionate to the Kellogg Group's current ownership position. We hoped that this fair proposal would positively end the proxy contest and allow us to focus our efforts on MFC’s long-term growth strategy and to continue to build shareholder value. We have not yet had any response from the Kellogg Group to our proposal.

IftheKelloggGroup’sproposalsaresuccessful,theKelloggGroupwillcompleteitstakeover ofMFCwithoutanycompensation being paid to you.We urge you not to cede control of your Board without receiving a change of controlpremium. The following timeline of significant events exposes the Kellogg Group's true intentions:

____________________

| Date | | Event |

| 1999 | | The Kellogg Group acquires more than 10% of the outstanding MFC shares. |

| | |

| 2003-2006 | | The 2003 Rights Plan is in place. The Kellogg Group fails to disclose its trading activities in order for shareholders to determine whether the Kellogg Group has triggered the 2003 Rights Plan. Why would the Kellogg Group not disclose this information as legally required if they had not triggered the 2003 Rights Plan? |

| For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500 |

| PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORVIF TODAY |

P a g e |4

| Date | | Event |

| 2008 | | The IRS finds that the Kellogg Group unlawfully avoided taxes and orders the Kellogg Group to pay in excess of $186 million in unpaid taxes and interest. |

| | | |

| June – November 2011 | | The Kellogg Group pays the IRS in excess of $186 million in unpaid taxes and interest. |

| | | |

| October 2011 | | IAT complains to the IRS about its liquidity crunch and losing20% of its overall capital base as a result of payments to the IRS. |

| | |

| Q3 2011 | | The Kellogg Group approaches MFC for a $50 million loan, which MFC does not grant. |

| | | |

| January 2013 | | The Kellogg Group announces the acquisition of an additional 7.1% of the MFC shares, increasing its ownership to 30.9% of the outstanding MFC shares. The pricing and timing of these acquisitions were not provided. |

| | |

| April 2013 | | The Kellogg Group seeks to recover from the IRS over $186 million in taxes, interest and "hot interest" it paid the IRS in June 2011 as a result of its failed tax scheme. |

| | |

| April 2013 | | The Kellogg Group acquires an additional 542,503 MFC shares, increasing its ownership to 31.8% of the outstanding MFC shares. |

| | |

| May 2013 | | The Kellogg Group acquires an additional 101,338 MFC shares, increasing its ownership to 32.0% of the outstanding MFC shares. |

| |

| July 2013 | | The Kellogg Group acquires an additional 403,000 MFC shares, increasing its ownership to 32.8% of the outstanding MFC shares. |

| | |

| August 2013 | | The Kellogg Group acquires an additional 302,200 MFC shares, increasing its ownership to 33.3% of the outstanding MFC shares. |

| | |

| September 2013 | | The Kellogg Group acquires an additional 257,400 MFC shares, increasing its ownership to 33.7% of the outstanding MFC shares. |

| |

| October 2013 | | The Kellogg Group files an amended Schedule 13D disclosing that Mr. Kellogg has approached MFC concerning the appointment ofone additional director and ownership of 33.0% of the MFC shares. |

| | |

| October 2013 | | Alternative dispute resolution proceedings between the Kellogg Group and the IRS are stayed. |

| | |

| November 11, 2013 | | MFC adopts a shareholder rights plan. |

| | |

| November 25, 2013 | | The Kellogg Group launches its proxy contest for control of MFC. |

____________________

Against this backdrop, it is apparent why the Kellogg Group chose now to launch its proxy contest – it wants "control" of MFC without paying you anything. We believe that the Kellogg Group's vague and misleading reference to "strategic direction" for launching its proxy contest is simply designed to distract you from its hidden agenda.If the Kellogg Group wants control of MFC it should make a tender offer to all MFC shareholders on equal terms, with a premium for such control, and let shareholders decide if its offer is sufficient."

| This Proxy Contest isNOT about corporate governance |

Instead of addressing our serious concerns, the Kellogg Group has chosen to focus in the Kellogg circular on MFC's executive compensation practices and related governance policies. This is laughable given that MFC's chairman and chief executive officer's compensation, including annual bonuses, are generally on the lower end in comparison to industry and market peers.

| For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500 |

| PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORVIF TODAY |

P a g e |5

Mr. Kellogg's only listed company directorship is with Nam Tai Electronics Inc. ("Nam Tai"), whose shoddy disclosure and dubious corporate governance practices are informative of what shareholders can expect if the Kellogg Group nominees are elected. In 2012, under Mr. Kellogg's direct supervision, Nam Taipaid its executive Chairman (who is, in fact, also its chief financial officer and the president of a subsidiary) total compensation of approximately $1.5 million, more than 2.5 times the compensation paid by MFC to its chairman and chief executive officer, while Nam Tai's book value was less than half of MFC's at the end of 2012 and its share price has declined from over $16.00 per share in December 2012 to under $7.25 per share on December 9, 2013.

It is incomprehensible, given Mr. Kellogg's abysmal stewardship of Nam Tai, that he is now making ridiculous and misleading comments regarding MFC. Consider the following:

|  | | Although listed on the New York Stock Exchange (like MFC), Nam Tai was relocated to the British Virgin Islands, a jurisdiction known for its rather lax corporate governance standards for domestic corporations. |

| | | | |

|  | | The Kellogg Group’s claim that MFC’s public disclosure is boilerplate and inadequate is disingenuous at best, especially when judged against Nam Tai’s public disclosure practices. Nam Tai’s entire proxy circular, for example, is only abouttwo pages long, the majority of which is boilerplate, giving shareholdersabsolutely no information on board and committee practices, including member selection, executive and director compensation, incentive plan compensation, indebtedness of management to Nam Tai, termination and change of control benefits, and risk management. |

| | | |

|  | | Nam Tai’s corporate governance guidelines, code of ethics and audit, compensation and nominating/corporate governance committee charters are not even included in Nam Tai’s annual report, which is where shareholders are usually given access to these documents, and the link to these documents in Nam Tai’s annual report is not even operational. |

| | | |

|  | | Nam Tai is choosing to take advantage of BVI’s corporate laws, which permit Nam Tai to not publicly file quarterly financial statements. As a result, Nam Tai publicly files its financial statements only once a year, and shareholders must rely on Nam Tai’s quarterly “highlights” press release for selected quarterly financial information. Against this, shareholders should judge the Kellogg Group’s call for “more transparent financial reporting” from MFC. If the Kellogg Group is elected, it may well be that shareholders are robbed of important financial disclosure, and there may be plans for another Nam Tai-type relocation in the works. |

Given the foregoing, it is no surprise that, in May 2013, a class action law suit was filed in the United States, District Court, Southern District of New York against Nam Tai and certain of its directors alleging that the defendants mademisleading statements and failed to disclose material adverse facts about Nam Tai’s business, operations and prospects. As it now attempts to paint itself as a defender of corporate governance, why has the Kellogg Group not expressed any "concern" or "apologies" regarding Nam Tai under Mr. Kellogg's watch?

What happened at Nam Tai was not the sole instance of the Kellogg Group or one of his recruited nominees being cited for a breach of fiduciary duty or misleading the public. For example, Mr. Kellogg, as a director of CityFed Financial Corporation ("CityFed"), was the subject of monetary and non-monetary claims for relief by the Office of Thrift Supervision and the Federal Deposit Insurance Corporation for CityFed's failure to maintain sufficient capital as an insured depository institution. CityFed ultimately paid over $3 million in restitution for its failures. Mr. Kellogg was also the subject of litigation brought by the Resolution Trust Company for, among other things, an alleged breach of fiduciary duty, negligence under federal common law and gross negligence under both federal common law and New Jersey State law, in the approval of large acquisition, development and construction loans which allegedly resulted in damages to CityFed of approximately $100 million. Though CityFed and its directors were found liable at multiple jurisdictional levels, the US Supreme Court ultimately found that the parties were not liable.

The Kellogg Group nominee Mr. Grange is also the subject of an ongoing lawsuit which alleges, among other things, multiple material breaches of his fiduciary duty as the chief restructuring officer of a number of medical centers. It is alleged that Mr. Grange did not fulfil his responsibility in managing the restructuring of the plaintiff's business, conducted a liquidation of the plaintiff's assets without his permission and did not consult the plaintiff on any major issues involving his companies, as Mr. Grange was required to do under his contract. The lawsuit is currently stayed pending the resolution of the plaintiff's bankruptcy proceedings.

| For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500 |

| PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORVIF TODAY |

P a g e |6

The Kellogg Group nominee Mr. Harris is the subject of an ongoing class action lawsuit brought by purchasers of Kosmos Energy Ltd. ("Kosmos") common shares from its May 2011 initial public offering. The lawsuit alleges that Kosmos's disclosure for the initial public offering, which Harris signed-off on as a director of Kosmos, contained material misrepresentations. Upon proper disclosure of these facts, Kosmos's stock price fell roughly 25% from its initial offering price. Investors have claimed $150 million in compensation.

| We believe that the Kellogg Group triggered MFC’s 2003 rights plan and is hiding the truth from shareholders |

We believe that the Kellogg Group triggered MFC's 2003 shareholder rights plan (the "2003 Rights Plan") between 2003 and 2006. The Kellogg Group continues to fail to provide you, the owners of MFC, with legally required disclosure regarding its transactions in MFC shares during this period and seeks to sidestep the issue entirely.This is very concerning for us because the Kellogg Group has unfairly deprived you of your rights under the 2003 Rights Plan to purchase MFC shares at a very substantial discount to market price,representing an economic loss to you and your fellow shareholders (other than the Kellogg Group) potentially in excess of hundreds of millions of dollars, and unfairly maintained the Kellogg Group’s share position in MFC, which may well have been diluted to approximately 3% of the outstanding MFC shares. Why does the Kellogg Group not disclose its acquisitions during the relevant period? What is the Kellogg Group hiding?

The Kellogg Group failed to comply with securities rules designed to level the playing field

for all shareholders, at your expense! |

The Kellogg Group has yet to address the serious issues raised by us in our management proxy circular dated November 29, 2013, including the Kellogg Group's numerous and ongoing violations of Canadian and United States securities laws and unlawful acquisitions of MFC shares at the expense of other shareholders. Further, based on their insurance regulatory filings, it is apparent that a significant portion of the Kellogg Group's ownership of MFC shares is held by its U.S. regulated insurance companies like Harco National Insurance Company, Wilshire Insurance Company, Occidental Fire and Casualty Company of North Carolina, Acceptance Indemnity Insurance Company and Transguard Insurance Company of America, Inc., which have all traded in MFC shares over the years. Why does the Kellogg Group not comply with the rules and make truthful disclosure about all of the group's trading activities? It is now clear that the Kellogg Group had been waiting in the weeds to ambush this year’s annual general meeting of MFC in an attempt to seize control of your Board.

YOUR EXISTING BOARD AND MANAGEMENT IS WORKING TO CREATE VALUE FOR YOU!

THE KELLOGG GROUP WILL ONLY WORK TO CREATE VALUE FOR ITSELF!

Your Board and management team is committed to creating shareholder value by protecting your interests. Regardless of the number of shares you own, we ask for your support by casting your vote by completing and returning ONLY yourWHITE proxy orWHITE VIF well in advance of the well in advance of theproxy voting deadline of December 24, 2013 at 4:00 p.m. (Hong Kong time).

| For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500 |

| PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORVIF TODAY |

P a g e |7

Thank you for your continued support.

Yours Truly,

Michael J. Smith

Chairman of the Board of Directors

| For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500 |

| PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORVIF TODAY |

HOW TO CAST YOUR VOTE IN SUPPORT OF MANAGEMENT

MAKE YOUR VOICE HEARD BY VOTING YOURWHITEPROXY OR VIF TODAY

| REGISTERED | BENEFICIAL |

| VOTING METHOD | SHAREHOLDERS | SHAREHOLDERS |

| If your shares are held in | |

| your name and | If your shares are held |

| represented by a physical | with a broker, bank or |

| certificate | other intermediary |

INTERNET |  | www.cesvote.com | www.proxyvote.com |

FACSIMILE |  | 1-412-299-9191 | Call the number listed on your voting instruction form and vote using the 12 digit control number provided therein |

TELEPHONE |  | 1-888-693-VOTE (8683) toll free | Call the toll-free listed on your voting instruction form and vote using the 12 digit control number provided therein |

MAIL |  | Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided to: Corporate Election Services

PO Box 3230

Pittsburgh, PA 15230 | Complete, date and sign theWHITE voting instruction form and return it in the enclosed postage-paid envelope |

QUESTIONS OR REQUESTS FOR ASSISTANCE MAY BE DIRECTED TO THE PROXY SOLICITOR:

105 Madison Avenue, New York, NY, 10016

Tel: 212-929-5500 Fax: 212-929-0308

Email: proxy@mackenziepartners.com

New York London Los Angeles Palo Alto Washington DC

NORTH AMERICAN TOLL FREE:

(800) 322-2885

For assistance, please call MacKenzie Partners North America toll free at 1-800-322-2885 or collect at (212) 929-5500

PROTECT YOUR INVESTMENT – VOTE ONLY YOURWHITE PROXY ORWHITE VIF TODAY |