PROSPECTUS SUPPLEMENT

(to Prospectus dated December 22, 2017)

$1,500,000,000

Charter Communications Operating, LLC

Charter Communications Operating Capital Corp.

$400,000,000 Senior Secured Floating Rate Notes due 2024

$1,100,000,000 4.500% Senior Secured Notes due 2024

Charter Communications Operating, LLC, a Delaware limited liability company (“CCO”), and Charter Communications Operating Capital Corp., a Delaware corporation (“CCO Capital” and, together with CCO, the “Issuers”), are offering $400,000,000 aggregate principal amount of Floating Rate Senior Secured Notes due 2024 (the “Floating Rate Notes”) and $1,100,000,000 aggregate principal amount of 4.500% Senior Secured Notes due 2024 (the “Fixed Rate Notes” and, together with the Floating Rate Notes, the “Notes”). The Floating Rate Notes will bear interest at a floating rate equal to LIBOR plus 165 basis points, which LIBOR rate will be reset quarterly as further described herein. See “Description of Notes—Principal, Maturity and Interest.” The Floating Rate Notes will mature on February 1, 2024 and the Fixed Rate Notes will mature on February 1, 2024. The Issuers will pay interest on the Floating Rate Notes quarterly on each February 1, May 1, August 1 and November 1, commencing November 1, 2018. The Issuers will pay interest on the Fixed Rate Notes on each February 1 and August 1, commencing February 1, 2019.

The Issuers may redeem some or all of the Floating Rate Notes at any time on or after January 1, 2024 at a price equal to 100% of the principal amount of the Floating Rate Notes to be redeemed, plus accrued and unpaid interest, if any, to the redemption date, as described in this prospectus supplement. There is no sinking fund for the Floating Rate Notes.

The Issuers may redeem some or all of the Fixed Rate Notes at any time prior to January 1, 2024 at a price equal to 100% of the principal amount of the Fixed Rate Notes redeemed, plus accrued and unpaid interest, if any, to the redemption date and a “make-whole” premium, as described in this prospectus supplement. The Issuers may redeem some or all of the Fixed Rate Notes at any time on or after January 1, 2024 at a price equal to 100% of the principal amount of the Fixed Rate Notes to be redeemed, plus accrued and unpaid interest, if any, to the redemption date, as described in this prospectus supplement. There is no sinking fund for the Fixed Rate Notes.

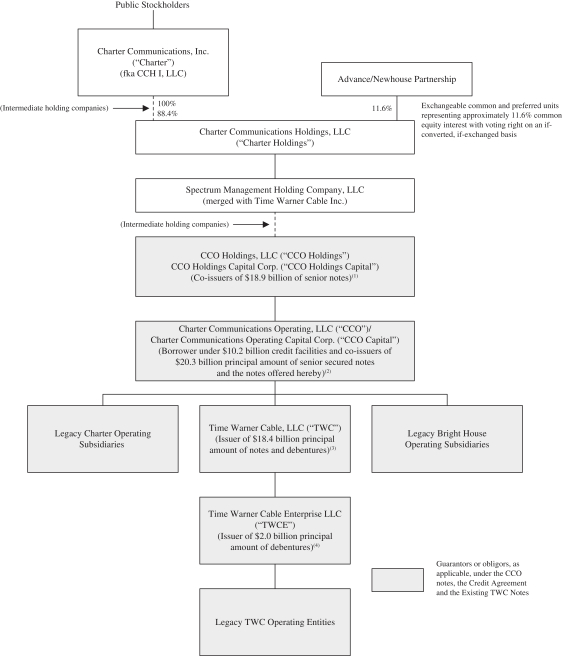

The Notes will be the Issuers’ senior secured obligations and will rank equally in right of payment with all of the Issuers’ existing and future senior debt. The Notes will be effectively senior to the Issuers’ unsecured debt to the extent of the value of the assets securing the Notes and structurally subordinated to the debt and other liabilities of the Issuers’ subsidiaries that do not guarantee the Notes. The Notes will be guaranteed on a senior secured basis by (i) all of the subsidiaries of CCO and CCO Capital that guarantee the obligations of CCO under the Credit Agreement (as defined herein) (such subsidiaries, the “Subsidiary Guarantors”) and (ii) CCO Holdings, LLC, a Delaware limited liability company (“CCO Holdings”). The Notes and the guarantees will be secured by apari passu, first priority security interest, subject to permitted liens, in the Issuers’ and the Subsidiary Guarantors’ assets that secure obligations under the Credit Agreement, the Existing TWC Notes and the Existing Secured Notes (each as defined below under “Certain Definitions”).

This prospectus supplement includes additional information about the terms of the Notes, including optional redemption prices and covenants.

See “Risk Factors,” which begins on page S-10 of this prospectus supplement and page 4 of the accompanying prospectus, for a discussion of certain of the risks you should consider before investing in the Notes.

| | | | | | | | | | | | | | | | |

| | | Per Floating

Rate Note | | | Total | | | Per

Fixed Rate

Note | | | Total | |

Public offering price(1) | | | 100.000 | % | | $ | 400,000,000 | | | | 99.893 | % | | $ | 1,098,823,000 | |

Underwriting discount | | | 0.625 | % | | $ | 2,500,000 | | | | 0.624 | % | | $ | 6,864,000 | |

Estimated proceeds to us, before expenses(1) | | | 99.375 | % | | $ | 397,500,000 | | | | 99.269 | % | | $ | 1,091,959,000 | |

| (1) | Plus accrued interest from July 3, 2018, if settlement occurs after that date. |

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Issuers expect that delivery of the Notes will be made in New York, New York on or about July 3, 2018.

Joint Book-Running Managers

| | | | | | |

| BofA Merrill Lynch | | Credit Suisse | | Deutsche Bank Securities | | Goldman Sachs & Co. LLC |

| Mizuho Securities | | RBC Capital Markets | | UBS Investment Bank | | Wells Fargo Securities |

Co-Managers

| | | | | | |

| MUFG | | Scotiabank | | SMBC Nikko | | SunTrust Robinson Humphrey |

| TD Securities | | Credit Agricole CIB | | US Bancorp | | LionTree |

| Great Pacific Securities | | Mischler Financial Group, Inc. | | R. Seelaus & Co., Inc. | | The Williams Capital Group, L.P. |

The date of this prospectus supplement is June 28, 2018.