“Applicable UCC” means the Uniform Commercial Code as from time to time in effect in the State of Delaware, except as otherwise provided in the Security Documents.

“Bankruptcy Code” means Title 11 of the United States Code entitled “Bankruptcy,” as now and hereafter in effect, or any successor thereto.

“Business Day” means each day which is not a Legal Holiday.

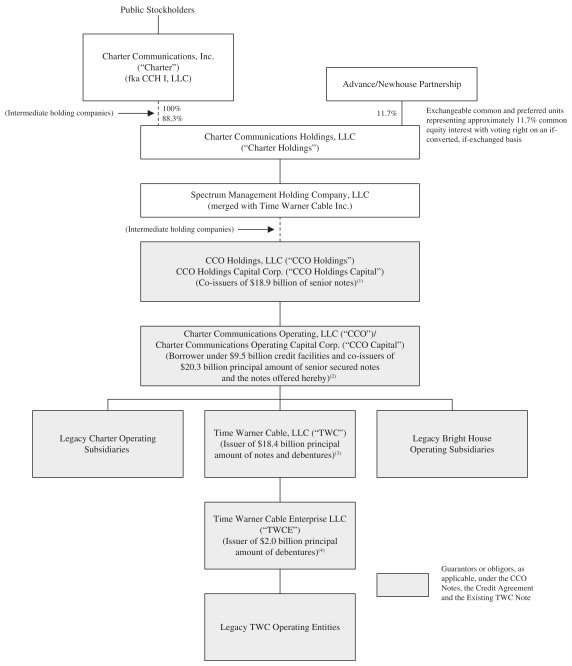

“CCH” means Charter Communications Holdings, LLC, a Delaware limited liability company, together with its successors.

“CCH I” means, collectively, CCH I, LLC, a Delaware limited liability company, and CCH I Capital Corp., a Delaware corporation, together with its successors.

“CCH II” means, collectively, CCH II, LLC, a Delaware limited liability company, and CCH II Capital Corp., a Delaware corporation, together with its successors.

“CCHC” means Charter Communications Holding Company, LLC, a Delaware limited liability company, together with its successors.

“Charter Group” means the collective reference to the Designated Holding Companies, CCO and its Subsidiaries.

“Chattel Paper” has the meaning ascribed to such term in the Applicable UCC.

“Code” means the Internal Revenue Code of 1986, as amended.

“Collateral” means all property and assets, whether now owned or hereafter acquired, in which Liens are, from time to time, purported to be granted to secure Obligations in respect of the Notes pursuant to the Security Documents.

“Collateral Agent” means The Bank of New York Mellon Trust Company, N.A. until a successor replaces it and, thereafter, means such successor.

“Collateral Release Event” shall occur on the first date when (A) there is no Equally and Ratably Secured Indebtedness outstanding (or, all Equally and Ratably Secured Indebtedness outstanding on such date shall cease to constitute Equally and Ratably Secured Indebtedness substantially concurrently with the release of the Liens on the Collateral securing the Notes and the Note Guarantees) and (B) the Issuers have delivered an Officers’ Certificate to the Trustee certifying that the condition set forth in clause (A) above is satisfied.

“Consolidated Net Worth” means, with respect to any Person, at the date of any determination, the consolidated stockholders’ or owners’ equity of the holders of Equity Interests or partnership interests of such Person and its subsidiaries, determined on a consolidated basis in accordance with GAAP consistently applied, which, for the avoidance of doubt, may, at the Issuers’ option, be calculated on a consolidated basis in accordance with GAAP on a pro forma basis to give effect to any assets acquired or to be acquired on or before the date of calculation.

“Credit Agreement” means the Credit Agreement, dated as of March 18, 1999, as amended and restated as of December 21, 2017, among CCO Holdings, LLC, CCO, the lenders party thereto, Bank of America, N.A., as administrative agent, and the other parties thereto together with the related documents thereto (including any term loans and revolving loans thereunder, any guarantees and security documents), as further amended, extended, renewed, restated, supplemented or otherwise modified (in whole or in part, and without limitation as

S-45