UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 31, 2017

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-37999

REV Group, Inc.

(Exact name of Registrant as specified in its Charter)

Delaware | 26-3013415 |

( State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

111 East Kilbourn Avenue, Suite 2600 Milwaukee, WI | 53202 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (414) 290-0190

Securities registered pursuant to Section 12(b) of the Act: Common Stock, Par Value $0.001 Per Share; Common stock traded on the New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | |

Non-accelerated filer | | ☒ (Do not check if a smaller reporting company) | | Smaller reporting company | | ☐ |

| | | | | | |

Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on the New York Stock Exchange on April 28, 2017, was $493,134,020. The registrant’s common stock was not traded on April 29, 2017, the last day of the registrant’s most recently completed second fiscal quarter. For purposes of this calculation, shares of common stock held by each executive officer and director and by holders of more than 5% of the outstanding common stock have been excluded. However, the registrant has made no determination that such individuals are “affiliates” within the meaning of Rule 405 under the Securities Act of 1933.

The number of shares of the Registrant’s Common Stock outstanding as of December 15, 2017 was 64,145,945.

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Stockholders, scheduled to be held on March 7, 2018, are incorporated by reference into Part III of this Report.

Table of Contents

i

Cautionary Statement About Forward-Looking Statements

This Annual Report on Form 10-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “contemplate,” “aim” and other similar expressions, and include our segment net sales and other expectations described under “Overview” below, although not all forward-looking statements contain these identifying words. Investors are cautioned that forward-looking statements are inherently uncertain. A number of factors could cause actual results to differ materially from these statements, including, but not limited to increases in interest rates, availability of credit, low consumer confidence, availability of labor, significant increases in repurchase obligations, inadequate liquidity or capital resources, availability and price of fuel, a slowdown in the economy, increased material and component costs, availability of chassis and other key component parts, sales order cancellations, slower than anticipated sales of new or existing products, new product introductions by competitors, the effect of global tensions and integration of operations relating to mergers and acquisitions activities. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this Annual Report on Form 10-K or to reflect any changes in expectations after the date of this release or any change in events, conditions or circumstances on which any statement is based, except as required by law. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

| • | The impact of economic factors and adverse developments in economic conditions; |

| • | The seasonal nature of the markets in which we operate; |

| • | Disruptions in the supply of vehicle chassis or other critical materials; |

| • | Our ability to compete with other participants in the end markets we serve; |

| • | Our ability to successfully identify and integrate acquisitions; |

| • | Our business has certain working capital requirements, and a decline in operating results may have an adverse impact on our liquidity position; |

| • | The realization of contingent obligations; |

| • | Increases in the price of commodities or impact of currency value fluctuations on the cost or price of our products; |

| • | Our inability to successfully manage the implementation of a Company-wide enterprise resource planning system; |

| • | Our reliance on the performance of dealers; |

| • | The availability and terms of financing available to dealers and retail purchasers; |

| • | Our ability to retain and attract senior management and key employees; |

| • | Vehicle defects, delays in new model launches, recall campaigns, or increased warranty costs; |

| • | Cancellations, reductions or delays in customer orders; |

| • | The impact of federal, state and local regulations governing our products; |

| • | Unforeseen or recurring operational problems at any of our facilities and catastrophic events; |

| • | Federal and local government spending levels; |

| • | Our operations and the industries in which we operate are subject to governmental laws and regulations, including relating to environmental, health and safety matters; |

| • | The influence of AIP over us, including its contractual right to nominate a majority of our directors and other contractual rights; |

| • | Changes to tax laws or exposure to additional tax liabilities; |

| • | Failure to maintain the strength and value of our brands; and |

| • | Our being a “controlled company” within the meaning of the New York Stock Exchange rules and, as a result, qualifying for, and relying on, exemptions from certain corporate governance requirements. |

ii

Website and Social Media Disclosure

We use our website (www.revgroup.com) and corporate Twitter account (@revgroupinc) as routine channels of distribution of company information, including news releases, analyst presentations, and supplemental financial information, as a means of disclosing material non-public information and for complying with our disclosure obligations under Securities and Exchange Commission (“SEC”) Regulation FD. Accordingly, investors should monitor our website and our corporate Twitter account in addition to following press releases, SEC filings and public conference calls and webcasts. Additionally, we provide notifications of news or announcements as part of our investor relations website. Investors and others can receive notifications of new information posted on our investor relations website in real time by signing up for email alerts.

None of the information provided on our website, in our press releases, public conference calls and webcasts, or through social media channels is incorporated into, or deemed to be a part of, this Annual Report on Form 10-K or in any other report or document that we file with the SEC, and any references to our website or our social media channels are intended to be inactive textual references only.

iii

Table of Contents

PART I

Unless otherwise indicated or the context requires otherwise, references in this Annual Report on Form 10-K to the “Company,” “REV,” “we,” “us” and “our” refer to REV Group, Inc. and its consolidated subsidiaries.

Item 1. Business.

REV is a leading designer, manufacturer and distributor of specialty vehicles and related aftermarket parts and services. We serve a diversified customer base primarily in the United States through three segments: Fire & Emergency, Commercial and Recreation. We provide customized vehicle solutions for applications including: essential needs (ambulances, fire apparatus, school buses, mobility vans and municipal transit buses), industrial and commercial (terminal trucks, cut-away buses and street sweepers) and consumer leisure (recreational vehicles (“RVs”) and luxury buses). Our brand portfolio consists of 29 well-established principal vehicle brands including many of the most recognizable names within our served markets. Several of our brands pioneered their specialty vehicle product categories and date back more than 50 years. We believe that in most of our markets, we hold the first or second market share position and estimate that approximately 63% of our net sales during fiscal year 2017 came from products where we hold such share positions.

In fiscal year 2017, we sold approximately 17,600 units and we currently have an estimated installed base of approximately 250,000 vehicles in operation. We believe this provides us with a competitive advantage and recurring replacement vehicle sales as many customers are brand-loyal and fleet owners frequently seek to standardize their in-service fleets through repeat purchases of existing brands and product configurations. The specialty vehicle market is a complex and attractive market characterized by: (i) numerous niche markets with annual sales volumes generally between 3,000 and 25,000 units, (ii) highly customized vehicle configurations addressing unique customer applications and (iii) specialized customer bases and distribution channels (both dealer and direct). We believe the specialty vehicle market has historically been addressed primarily by smaller, less sophisticated companies, which has created an opportunity for market leadership by scaled and highly efficient producers such as REV. Under our current leadership, our focus on product innovation, life-cycle value leadership and operational improvement has strengthened our brands and market position while driving growth and expanding margins.

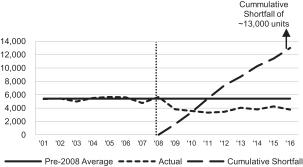

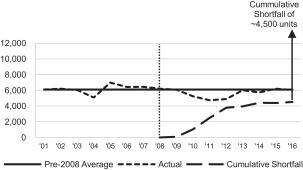

Our products are sold to municipalities, government agencies, private contractors, consumers and industrial and commercial end users. We have a diverse customer base with our top 10 customers representing approximately 23% of our net sales in fiscal year 2017, with no single customer representing more than 5% of our net sales over the same period. We believe our diverse end markets are favorably exposed to multiple secular growth drivers such as: rising municipal spending, a growing aged population, growing urbanization, growing student populations, the increasing popularity of outdoor and active lifestyles and the replacement of existing in-service vehicles including legislated replacements. In addition to these favorable underlying drivers of growth, we believe certain of our markets will benefit over the next several years from incremental demand created by the underinvestment in fleets following the 2008 recession. For example, as set forth in the charts below in “—Our Markets,” we estimate that the cumulative pent-up replacement demand in the fire and emergency market is approximately 17,500 units, which represents 179% of the total fire and emergency market unit sales volume in the United States and Canada in 2016. However, we cannot be certain as to the timing and extent to which the pent-up replacement demand may be released, as it is inherently uncertain and generally outside our control.

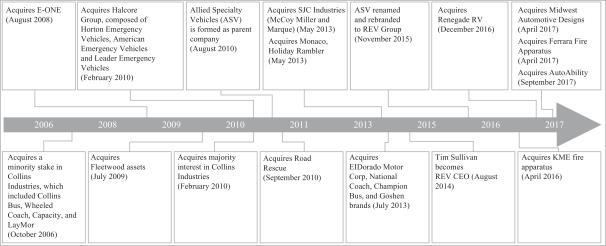

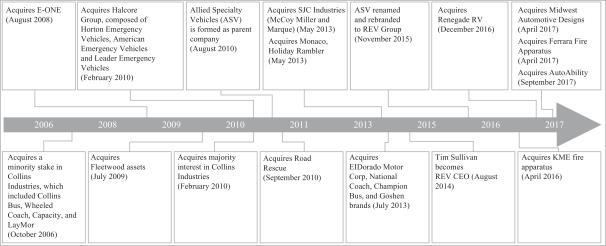

Our business model utilizes our unique scale to drive profitable organic and acquisitive growth. We seek to gain market share by delivering high-quality products with customized attributes tailored to our customers’ product specifications, while simultaneously reducing costs and shortening delivery lead times. We aim to achieve this by standardizing and optimizing certain processes across our segments in areas including: procurement, engineering and product development, lean manufacturing, dealer management, pricing, and aftermarket parts sales. We believe our manufacturing and service network, consisting of 21 manufacturing facilities and 12 aftermarket service locations (called Regional Technical Centers or “RTCs”), provides us with a competitive advantage through the sharing of best practices, manufacturing flexibility based on relative facility utilization levels, delivery costs and lead times, economies of scale, customer service capabilities, and a complementary distribution system. Our business consists primarily of design, engineering, integration, and assembly activities, which require low levels of capital expenditures. Additionally, our business has a highly variable cost structure that results in operational flexibility, which when combined with low levels of capital expenditures, we believe can produce high returns on invested capital. Furthermore, our broad presence across the specialty vehicle market and large manufacturing and distribution network are important differentiators in our ability to grow through acquisitions. We seek to make synergistic acquisitions that further enhance our existing market positions or enter REV into new, attractive product segments. In the past 11 years, we have successfully completed 14 acquisitions. We have demonstrated the ability to grow and enhance the earnings profile of acquired businesses by either consolidating acquired businesses into our existing plant footprint or by introducing REV processes and scale into the newly acquired businesses to drive profitable growth.

1

Table of Contents

Our management team has significant experience in highly specialized industrial manufacturing and aftermarket parts and services businesses. Beginning in 2014, our leadership team introduced several initiatives to accelerate growth and improve our profitability. These initiatives included: improving brand management, strengthening distribution, implementing a centralized enterprise-wide procurement strategy, growing adjacent and aftermarket products and services, improving production processes within our facilities, driving down total cost of quality, implementing value-based pricing strategies and reducing fixed costs.

We have delivered strong financial and operating results from fiscal year 2015 to fiscal year 2017, as set forth below:

| (1) | Net sales were $1,735 million, $1,926 million and $2,268 million for fiscal year 2015, fiscal year 2016 and fiscal year 2017, respectively, which represents a compound annual growth rate, or “CAGR,” of 14%; |

| (2) | We improved our operating performance, specifically: |

| • | Net income was $23 million, $30 million and $31 million for fiscal year 2015, fiscal year 2016 and fiscal year 2017, respectively, which represents a CAGR of 17%; |

| • | Adjusted Net Income was $34 million, $53 million and $76 million for fiscal year 2015, fiscal year 2016 and fiscal year 2017, respectively, which represents a CAGR of 49%; |

| • | Adjusted EBITDA was $90 million, $123 million and $163 million for fiscal year 2015, fiscal year 2016 and fiscal year 2017, respectively, which represents a CAGR of 34%; and |

| (3) | We drove approximately 6 basis points, 139 basis points and 197 basis points of expansion in our net income, Adjusted Net Income and Adjusted EBITDA margins, respectively. |

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” below for additional information regarding our non-GAAP measures, including a reconciliation of these measures to their most directly comparable GAAP measure.

During fiscal year 2017, the Company changed its fiscal year end from the last Saturday to the last calendar day in October of each year. Going forward the Company’s fiscal quarters will end on the last day of January, April, July and October.

2

Table of Contents

Our Products and Markets

We primarily sell new specialty vehicles which we design, engineer and manufacture in our production facilities. We are also focused on growing our higher gross margin aftermarket business which consists of parts sales, service and other ancillary revenue opportunities generated by our installed base of approximately 250,000 vehicles. We believe the majority of our new vehicle sales represent the replacement of in-service vehicles which are past their useful life, with additional sales derived from fleet expansions, new customers and adjacent product introductions.

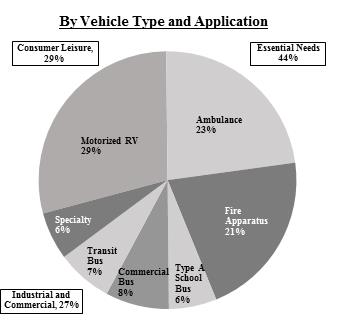

The following charts show a breakdown of our net sales for fiscal year 2017:

3

Table of Contents

The following chart sets forth summary information regarding our primary product line categories and end markets for our segments:

| | | | | | |

| | Fire & Emergency | | Commercial | | Recreation |

Overview | | The Fire & Emergency segment manufactures a wide range of fire apparatus and ambulance products. Fire & Emergency products are sold to municipal fire departments, EMS providers, and private fleets, typically purchasing through dealers. | | The Commercial segment manufactures transit and shuttle buses, Type A school buses, mobility vans and other specialty vehicles including sweepers and terminal trucks distributed both through dealers and direct. Commercial products are sold to municipalities, schools, and commercial and industrial customers. | | The Recreation segment manufactures motorized RV products sold to brand-loyal, repeat customers who purchase through dealers. |

| | | |

Selected Products | |

| |

| |

|

| | | |

Principal Brands | | Fire Apparatus | | Buses | | |

| |

| |

| |

|

| | | | | | |

| | | | Specialty | | |

| | | |

| |

|

| | | | | | |

| | Ambulance | | | | |

| |

| |

|  | |

|

| |

| |

| |

|

| |

| |

| | |

| | | |

Estimated Addressable Market Size(1) | | ~$3 billion | | ~$5 billion | | ~$6 billion |

| | | |

Estimated Addressable Market Units(1) | | Ambulance: ~6,300 Fire Apparatus: ~4,300 | | Type A School Bus: ~8,100 Cutaway Bus: ~14,800 Transit Bus: ~4,900 Mobility Vans: ~36,900 Terminal Trucks and Sweepers: ~7,600 | | Class A: ~22,700 Class B: ~4,100 Class C: ~28,000 |

Estimated REV Market Share by Units(1) | | ~44% | | ~12% | | Class A – ~14% Class B – ~12% Class C – ~2% |

| | | |

Fiscal Year 2017 Net Sales(2) | | $984 million | | $629 million | | $673 million |

| | | |

Market Positions for Selected Products | | #1 in Ambulance #2 in Fire Apparatus | | #1 in Type A School Bus #1 in Small & Medium Size Commercial Bus #2 in Terminal Trucks #1 in Light Broom Sweepers | | 14% Class A market share as of October 31, 2017 representing a 100 basis point increase from 2016. |

| | | |

Selected Customers and Dealers | |

| |

| |

|

| |

| |

| |

|

(1) | Based on 2016 industry market volumes in the United States and Canada. Estimated REV market share by units includes units sold by acquired companies in fiscal year 2017. |

(2) | Does not reflect the elimination of intersegment sales of approximately $22.3 million in fiscal year 2017. Includes sales by acquired companies in fiscal year 2017. |

4

Table of Contents

Our Fire & Emergency segment sells fire apparatus equipment under the Emergency One (“E-ONE”), Kovatch Mobile Equipment (“KME”) and Ferrara brands and ambulances under the American Emergency Vehicles (“AEV”), Horton Emergency Vehicles (“Horton”), Leader Emergency Vehicles (“Leader”), Marque, McCoy Miller, Road Rescue, Wheeled Coach and Frontline brands. We believe we are the largest manufacturer by unit volume of fire and emergency vehicles in the United States and have one of the industry’s broadest portfolios of products including Type I ambulances (aluminum body mounted on a heavy truck-style chassis), Type II ambulances (van conversion ambulance typically favored for non-emergency patient transportation), Type III ambulances (aluminum body mounted on a van-style chassis), pumpers (fire apparatus on a custom or commercial chassis with a water pump and small tank to extinguish fires), ladder trucks (fire apparatus with stainless steel or aluminum ladders), tanker trucks and rescue and other vehicles. Each of our individual brands is distinctly positioned and targets certain price and feature points in the market such that dealers often carry and customers often buy more than one REV Fire & Emergency product line. In April 2017, we acquired Ferrara, a leader in custom fire apparatus and rescue vehicles.

Fire & Emergency Product | | Description/Application |

Pumper / Tanker

| | • Most standard fire apparatus found in fire department fleets • Transports firefighters to the scene of an emergency • Onboard pump and water tank for immediate water supply upon arrival on scene to fight fires • Connects to more permanent water sources such as fire hydrants or water tenders for continuous firefighting capability |

| |

Aerial

| | • Transports firefighters to the scene of an emergency and supports fire suppression • Facilitates access or egress of firefighters and fire victims at height using a large telescopic ladder • Ladder is mounted on a turntable on a truck chassis allowing it to pivot around a stable base to transport firefighters and fire suppression to the scene • Typically contains a pump, provides a high-level water point for firefighting via elevated master water stream • Provides a platform from which tasks such as ventilation or overhaul can be executed |

ARFF

| | • Transports firefighters to the scene of an airport emergency • Highly specified (by the F.A.A.) fire engine designed for use at global airfields where F.A.A. regulated commercial planes land to assist with potential aircraft accidents • Has the ability to move on rough terrain outside the runway and airport area and provides large water capacity and a foam tank • Able to deliver a fire suppression chemical foam stream to the scene, which “flattens” the fire faster • Capability to reach an airplane quickly and rapidly extinguish large fires involving jet fuel |

| |

Ambulance Type I

| | • Transports paramedics and other emergency support technicians as well as a “mobile hospital” to the scene of an emergency • Patient compartment structural aluminum “box” mounted on a heavy truck chassis and used primarily for advanced life support and rescue work • Provides out of hospital medical care to the patient at the scene or while in transit |

| |

Ambulance Type II

| | • Transports paramedics and other emergency support technicians to the scene of an emergency • Van-based ambulance with relatively fewer ambulance modifications and containing relatively less medical equipment than Type I or Type III ambulances • Used for basic life support and to transfer of patients that require only basic life support services to a hospital or between places of medical treatment |

| |

Ambulance Type III

| | • Transports paramedics and other emergency support technicians as well as a “mobile hospital” to the scene of an emergency • Patient compartment structural aluminum “box” mounted on a cut-away van chassis and has the same use and application as a Type I ambulance |

5

Table of Contents

Our Commercial segment serves the bus market through the following principal brands: Collins Bus, Goshen Coach, ENC, ElDorado National, Krystal Coach, Federal Coach, Champion and World Trans. We serve the terminal truck market through the Capacity brand, the sweeper market through the Lay-Mor brand and the mobility van market through our recently recast Revability brand. We are a leading producer of small- and medium-sized buses, Type A school buses, transit buses, terminal trucks and street sweepers in the United States. Our products in the Commercial segment include cut-away buses (customized body built on various types and sizes of commercial chassis), transit buses (large municipal buses where we build our own chassis and body), luxury buses (bus-style limo or high-end luxury conversions), street sweepers (three- and four-wheel versions used in road construction activities), terminal trucks (specialized vehicle which moves freight in warehouses or intermodal yards and ports), Type A school buses (small school bus built on commercial chassis), and mobility vans (mini-van converted to be utilized by wheelchair passengers). Within each market segment, we produce a large number of customized configurations to address the diverse needs of our customers.

Commercial Product | | Description/Application |

Transit Bus

| | • Type of bus used on shorter-distance public transport routes to move passengers from place to place. Distinct from all-seated coaches used for longer-distance journeys and smaller minibuses • Operated by publicly-run transit authorities or municipal bus companies, as well as private transport companies on a public contract or on a fully independent basis • Often built to operator specifications for specific transport applications • First type of bus to benefit from low-floor technology in response to demand for equal access public service |

| |

Shuttle Bus

| | • Transports passengers between two fixed points • Facilitates short- or medium-distance journeys, such as airport shuttle buses • Commonly used in towns or cities with multiple terminal train stations or bus stations, for passenger interconnections • Passenger compartment mounted on a van or truck-style chassis typically with short-term luggage storage capability |

| |

Type A School Bus

| | • Transports students, typically children, to and from school, home and school events • Typically transports smaller numbers of passengers compared to the larger “Type C” or “Type D” school buses and is more economical in certain types of applications • Purpose-built vehicle distinguished from other types of buses by significant safety and design features mandated by federal and state regulations • Passenger compartment mounted on a van or truck-style chassis |

| |

Mobility Van

| | • Minivan that is modified to increase the interior size and floor space of the vehicle and provide a means of wheelchair entry such as a ramp or a powered lift • Some include platform lifts that can be raised and lowered from inside the vehicle down to the ground outside to accommodate driver or passenger access • Provides access for a wheelchair user via side-entry or rear-entry configurations |

| |

Sweeper

| | • Used in a variety of cleaning and preparation applications in road construction and paving industries • Typically used in street, highway or interstate construction projects • Applications use broom or push technology, as well as water cleaning capabilities • Some applications also include snow removal • Significant aftermarket parts such as sweeper brushes |

6

Table of Contents

Terminal Truck

| | • Custom built tractor used to move trailers and containers within a cargo yard, warehouse facility or intermodal facility • Includes a single person cab offset to the side of the engine with a short wheelbase and rear cab exit • Some units have a fifth wheel with an integrated lifting mechanism that allows the semi-trailer landing legs to remain in the down position during movement enabling efficient movement • Steel side wall cab and floor construction for protection in harsh and dangerous work environments |

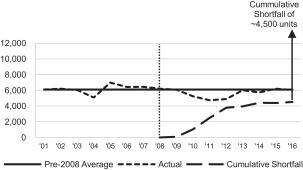

Our Recreation segment serves the RV market through six principal brands: American Coach, Fleetwood RV, Monaco Coach, Holiday Rambler, Renegade RV and Midwest Automotive Designs (“Midwest”). We believe our brand portfolio contains some of the longest standing, most recognized brands in the RV industry. Prior to the 2008 recession, as segments of larger public companies, the American Coach, Fleetwood RV, Monaco Coach and Holiday Rambler brands generated over $2 billion of annual sales in each of the calendar years 2004 and 2005 and represented approximately 36% of the motorized RV market in calendar year 2005 and an even higher percentage share of just the diesel portion of the Class A market. Under all six brands, REV provides a variety of highly recognized models such as: American Eagle, Dynasty, Discovery, Bounder, Pace Arrow, Verona and Weekender, among others. Our products in the Recreation segment include Class A motorized RVs (motorhomes built on a heavy duty chassis with either diesel or gas engine configurations), Class C and “Super C” motorized RVs (motorhomes built on a commercial truck or van chassis), a line of heavy-duty special application trailers, and as a result of the acquisition of Midwest, Class B RVs (motorhomes built on a van chassis). The Recreation segment also includes Goldshield Fiberglass, which produces a wide range of custom molded fiberglass products for the RV and broader industrial markets. Within our Recreation segment, we are one of the top producers of Class A diesel and gas motorized RVs with a 14% market share of the motorized Class A RV market as of October 31, 2017, which is a 100 basis point improvement from 2016. We are focused on recapturing the significant market share which our principal brands enjoyed prior to 2008. In December 2016, we acquired Renegade RV, a leader in the “Super C” segment of the RV market and producer of a line of heavy-duty special application trailers. In April 2017, we acquired Midwest, a leading producer of Class B RVs and custom luxury vans.

Recreation Product | | Description/Application |

Class A Motorized RVs (Gas, Diesel)

| | • Class A motorized RVs can be as long as 45 feet and are usually equipped with a rear master suite including a full bathroom and shower and many include a washer/dryer unit on board • Today’s Class A motorized RVs tend to have multiple slide outs (some can expand to a width of over 14 feet), large flat screen TV’s, surround sound systems and even dishwashers and ice machines • Keeps users comfortably on the road for long periods of time including comfortable sleeping accommodations and basement storage to carry ample supplies • Constructed on a commercial truck chassis, a specially designed motor vehicle chassis or a commercial bus chassis, a Class A motorized RV resembles a bus in design and has a flat or vertical front end with large forward windows |

Class C Motorized RVs

| | • Class C motorized RVs make use of a standard van or truck chassis as the driving portion of the RV, allowing better access to the cab portion from the outside, since there are entry doors on both sides • The house (or camper) portion of the RV extends over the cab area which commonly has a sleeping compartment or other uses such as storage or entertainment • Fewer amenities and living space compared to Class A motorized RVs while meeting requirements for comfortable living • A Class C motorized RV is equipped with a kitchen/dining area featuring a refrigerator/freezer, a propane range (sometimes with an oven), a microwave oven and a table with seating. It also has a lavatory with a bath/shower, one or more sleeping areas and additional seating towards the front. An air conditioner, water heater, furnace and outside canopy are also typically included • Class C motorized RVs often feature a towing hitch enabling the pulling of a light weight trailer for boats or a small car or truck |

| |

7

Table of Contents

Class B Motorized RVs

| | • Class B motorized RVs can range from 16 to 22 feet, are typically built on a automotive van chassis or panel-truck shells, and are built on several different gas or diesel chassis depending on the motorhome. • Class B motorized RVs drive more like the family car, are easier to park and maneuver, but also offer the comforts and conveniences of a home on the road. • Typically equipped with a “wet bath” configuration, which includes toilet, shower, and sink. • Fewer amenities than a Class A and Class C unit, the Class B will typically have seating for 6 to 8 people, a small kitchenette complete with refrigerator and microwave, and comes equipped with flat screen TV/surround sound, roof mounted A.C., and a smaller generator. • Limited sleeping capacity, typically a 2 person, overnight coach. • Class B motorized RVs have a broad appeal due to its versatility, and ease of driving. They are typically used for shorter overnight trips, older couples no longer wanting to drive a large coach, families involved in sports, tailgating, and even larger families in need of space for a primary driving vehicle. |

To enhance our market-leading positions, we complement growth from strategic acquisitions with new product development across our three segments. New product development is primarily designed to provide our customers with high-quality products that have varied and unique feature sets and product capabilities at attractive price points. We introduced eight new products in fiscal year 2016 and have introduced 17 new products in fiscal year 2017. In addition to new product development, our businesses are continuously customizing and designing our vehicles to meet individual customers’ needs and applications. In our RV business specifically, our new model design cycle follows similar timelines as the automotive industry, whereby new models and configurations are introduced or upgraded annually.

Upon request, we facilitate financing for our dealers and end customers by providing them with access to our third-party bank partners. All such financing transactions are recorded on our bank partners’ balance sheets. We support these transactions under both non-recourse and recourse agreements with the banks, and in return, we earn a fee for arranging these transactions. We believe that offering customers finance options to purchase vehicles from us will help REV form a more complete relationship with our customers, help drive incremental vehicle sales and allow us to participate in finance revenue streams from third parties through arrangement fees.

Our Markets

We operate primarily in the United States in the fire and emergency, commercial and recreation markets. For fiscal year 2017 our net sales to international markets (including Canada) amounted to $84 million, representing approximately 4% of our overall net sales for the period. We sell internationally through dealers and agents to end markets that utilize U.S.-style chassis and product configurations. In December 2017, we also established a joint venture with China’s Chery Holding Group in Wuhu to manufacture RVs, ambulances and other specialty vehicles for distribution within China and select international markets. We and Chery will initially focus on RVs, with 6 models, and ambulances, with 3 models. The joint venture will also explore the development of other types of specialty vehicles. These products will be sold in China and internationally through Chery’s existing distribution network. The first vehicles are targeted to be made available to the market in second half of 2018.

Fire and Emergency Markets

According to industry sources, there were approximately 10,600 fire apparatus and ambulance units shipped in 2016 in the United States and Canada, representing a 3% and 23% increase over the annual industry volumes for 2014 and 2011, respectively. Fire and emergency products are used by municipalities and private contractors to provide essential services such as emergency response, patient transport and fire suppression, among other activities. Nearly all fire apparatus and ambulances are customized in some form; however, they share many common production, sales and component attributes such as similar manufacturing and engineering processes, raw materials (aluminum, lights, wire harnesses, paint and coatings, among others), and dealer-based distribution channels. The sales prices for our fire and emergency products can vary considerably given their highly customized nature, but generally range from $160,000 to $650,000 for pumper trucks, $475,000 to $1,200,000 for aerial fire trucks and $65,000 to $350,000 for ambulances. Demand is driven primarily by the replacement of in-service fleets, as well as by factors such as a growing aged population and a growing overall population (driving increased patient transportation and emergency response needs), new real estate developments, taller buildings (requiring more aerial vehicles), international airport growth (requiring Federal Aviation Administration-specified ARFF vehicles), and higher municipal funding levels. Local tax revenues are an important source of funding for fire and emergency response departments in addition to Federal grant money and locally raised funding. We estimate that ambulances have useful lives of five to seven years and generally operate on a 24/7 schedule, driving significant annual mileage which ultimately creates a

8

Table of Contents

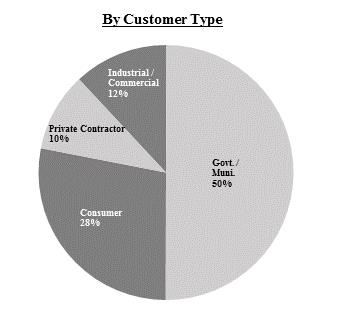

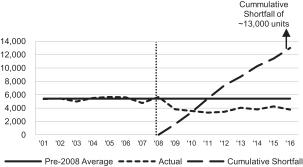

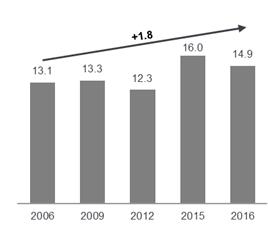

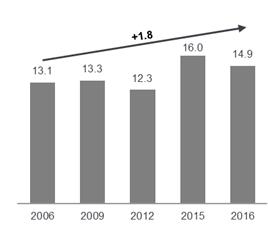

replacement or remount sale as their underlying chassis wears out. We estimate that pumper trucks and aerial fire trucks have useful lives of 10-12 years and 20-30 years, respectively, and that these fire apparatus vehicles become obsolete before they wear out due to the fact that technology continues to advance and the vehicles would otherwise have a long life span because they generally operate at lower levels of annual miles driven. We believe there is significant pent-up replacement demand for fire apparatus and ambulances as annual unit shipment levels since the 2008 recession have remained well below pre-recession averages. As set forth in the charts below, we estimate the cumulative pent-up replacement demand at approximately 17,500 units, which we believe is incremental to ongoing normalized levels of demand. However, we cannot be certain as to the timing and extent to which the pent-up replacement demand may be released, as it is inherently uncertain and generally outside our control.

| | |

Fire Apparatus | | Ambulance |

Unit Sales | | Unit Sales |

| |

|

Source: Fire Apparatus Manufacturers’ Association, Management estimates | | Source: National Truck Equipment Association—Ambulance Manufacturers Division, Management estimates |

We believe that a growing aged population, longer life expectancy, urbanization and the increasing use of emergency vehicles for non-critical care transport are all positive trends for the ambulance market.

Commercial Markets

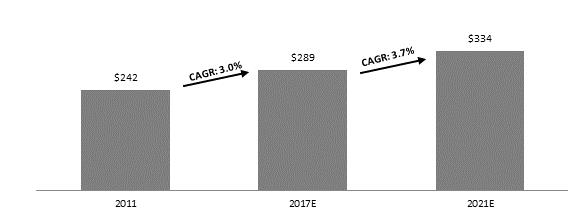

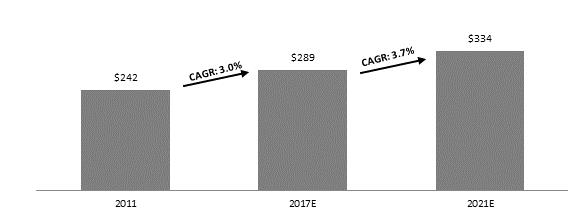

REV’s Commercial segment addresses a broad variety of products and end markets. The transit and shuttle bus market includes applications such as airport car rental and hotel/motel shuttles, paramedical transit vehicles for hospitals and nursing homes, tour and charter operations, daycare and student transportation, mobility vans for wheelchair users, and numerous other applications. According to industry sources, shipments of cutaway buses (those buses that are up to 35 feet in length) were approximately 14,800 units in 2017. We believe the commercial bus markets we serve will sustain positive long-term growth supported by growing levels of urbanization which will require increasing commercial bus usage, increased government transportation spending as shown in the chart below, an aging and growing U.S. population driving demand for shuttle buses and mobility vans, a necessary replacement cycle of public and private bus customers and the introduction of new bus products.

The demand for school buses is driven by the need for student transportation primarily in the United States and Canada. Within this market, we believe important demand drivers are the increasing number of students, the replacement cycle of in-service vehicles, substitution by private contract companies as the provider of student transportation from school districts (thus requiring the purchase of new buses) and legislated replacements. Insurance providers and state legislatures are increasingly requiring replacement of non-conforming vans which often drives a substitution purchase of our Type A product because of its numerous legislated safety features and benefits versus traditional van products. There are more than 14,000 school districts in the United States responsible for operating approximately 500,000 school buses. Approximately 19% of the school buses sold in 2016 were Type A buses, which we produce, and the remainder were Type B and C buses which we do not currently produce. The following chart shows the shuttle bus unit sales and U.S. school bus unit sales during the time periods shown below.

9

Table of Contents

Shuttle Bus Unit Sales | | U.S. School Bus Unit Sales |

(in thousands) | | (in thousands) |

| | CAGR: 6.4%  |

Source: Management estimates and School Bus Fleet, School Bus Sales Report (2016) |

Terminal truck demand is driven by replacement of in-service fleets, growth in trade and the increased use of intermodal freight services and warehouses. We anticipate ongoing growth in global trade will result in higher future intermodal freight traffic growth. Sweeper demand is also driven by replacement of in-service fleets by contractors and rental companies as well as growth in infrastructure and construction spending. Sweepers are used in various applications within the construction and road and highway infrastructure markets.

The sales prices for our bus and specialty vehicles can vary considerably, but generally range from $35,000 to $55,000 for Type A school buses, $40,000 to $190,000 for shuttle buses, $100,000 to $500,000 for transit buses and $25,000 to $165,000 for other specialty vehicles. We estimate that Type A school buses have useful lives of 8-10 years, that shuttle buses have useful lives of 5-10 years, that transit buses have useful lives of approximately 12 years and other specialty vehicles have useful lives of 5-7 years.

The following chart shows the estimated amount spent in 2011 by U.S. state and local governments and municipalities for transportation and the amount projected to be spent in 2016 and 2021, together with CAGRs calculated for the time periods shown below. The trends shown in this chart, however, are not a guarantee that similar growth in U.S. state and local transportation spending will continue.

U.S. State and Local Transportation Spending

(in billions)

Source: USGovernmentspending.com

10

Table of Contents

Recreation Markets

The RV industry includes various types and configurations of both motorized and towable RVs of which we currently manufacture and sell Class A (diesel and gas), Class B (as a result of the acquisition of Midwest) and Class C motorized RVs. Motorized RVs are self-contained units built on motor vehicle chassis with their own lighting, plumbing, heating, cooking, refrigeration, sewage holding and water storage facilities. Class A RVs are generally constructed on medium-duty chassis which are supplied complete with engine and drivetrain components by major motor vehicle manufacturers. We then design, fabricate and install the living area and driver’s compartment of these motorized RVs. Class B RVs are built on a consumer van chassis with the entire living area contained within the existing van frame. Class C RVs are built on consumer truck or van chassis which include an engine, drivetrain and a finished cab section. In Class Cs we design, fabricate and install the living area to connect to the driver’s compartment and the cab section. Super Class C RVs are motorhomes built on a commercial truck or van chassis.

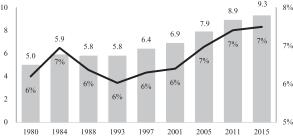

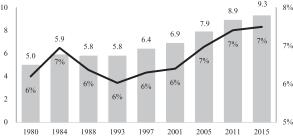

According to the RV Consumer Report from 2011, an industry report published by the University of Michigan, approximately nine million households in the United States own an RV. Motorized RVs are a consumer leisure purchase and therefore factors that drive demand include: consumer wealth (including the value of primary housing residences and the stock market level), consumer confidence, availability of financing and levels of disposable income. We believe end customers tend to be brand-loyal and repeat buyers who make decisions based on brand, quality, product configuration (primarily floorplan design, features and product styling), service availability and experience and price. Lifestyle trends are expected to support the growth of the RV market. We believe RVs are becoming more popular through increased interest in nature-based tourism and a growing preference for adventure travel among the growing urban populations. According to the Recreation Vehicle Industry Association, or RVIA, RV sales will continue to benefit from the aging “baby boomers” as more people enter the primary RV ownership age group of 55 to 70 years old. RVIA estimates that the number of consumers between the ages of 55 and 70 will total 56 million by 2020, 27% higher than in 2010. In addition to the growth tied to aging demographics, there are approximately 45 million active U.S. campers, many of which are outside the aforementioned demographic, representing an opportunity to expand the RV customer base.

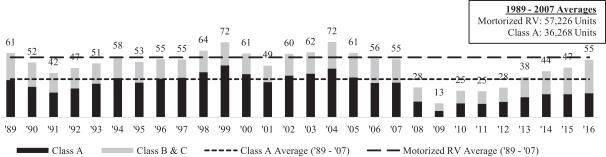

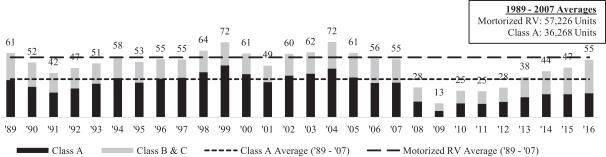

We believe the near-term RV industry outlook is positive. Year-over-year sales have increased for five years (2011 to 2016) and participation rates continue to grow, which demonstrates a long-term trend toward RV ownership. In 2016, shipments of motorized RVs were approximately 55,000 units, which is an increase of approximately 16% compared to 2015 according to RVIA. In particular, approximately 22,700 Class A RVs were shipped in 2016, which represents a volume level that is approximately 38% below the pre-2008 recession historical average of shipped units from 1989 to 2007. Further, this volume level is approximately 51% below the industry’s peak volume in 2004 when approximately 46,000 Class A RV units were shipped. Accordingly, we believe industry volumes of Class A RVs, where REV’s market position is strongest, can recover to be in line with, or in excess of, pre-2008 recession historical averages.

The sales prices for our RVs can vary considerably, but generally range from $65,000 to $600,000. We estimate that RVs have useful lives of 8-15 years.

Motorized RV North American Market Size

Units in 000s

11

Table of Contents

| | |

| | |

RV Participation |

U.S. Households that Own RVs (in millions) | | RV Ownership % of U.S. Households |

|

Source: University of Michigan Study (The RV Consumer in 2011),RVdailyreport.com and U.S. Census Bureau |

Our Strengths

We believe we have the following competitive strengths:

Market Leader Across All Segments with a Large Installed Base— We believe we are a market leader in each of the fire and emergency, commercial and recreation vehicle markets. Approximately 63% of our net sales during fiscal year 2017 are in markets in which we believe we hold the first or second market share positions. We believe we are the largest manufacturer by unit volume of fire and emergency vehicles in the United States. We also believe our Commercial segment is the #1 producer of small- and medium-sized commercial buses as well as Type A school buses in the United States. We believe we are also a leading producer of transit buses, terminal trucks, mobility vans and street sweepers. Within our Recreation segment, we are one of the top producers of Class A diesel and gas motorized RVs with a 14% market share as of October 31, 2017, which is a 100 basis point improvement from 2016. We are also a leader in high-end Class B RVs under the Midwest brand.

We estimate that the replacement value of our installed base of approximately 250,000 vehicles across our segments is approximately $36 billion, which we believe is a significant competitive advantage for both new unit sales and aftermarket parts and service sales, as brand awareness drives customer loyalty and fleet owners frequently seek to standardize their in-service fleets through repeat purchases of existing brands and product configurations. For example, one of the largest municipal fire departments in the United States has its fleet of ambulances standardized on REV branded product configuration and feature sets that satisfy this customer’s unique specifications and standards.

Broad Product Portfolio and Well-Recognized Brands— Our product portfolio is comprised of high-quality vehicles sold under 29 well-established principal vehicle brands that in many instances pioneered their market segments. For example, the first Type A yellow school bus was developed and sold by Collins Bus and the first Type I ambulance was developed and sold by Horton. We believe our product portfolio represents the broadest product offering in our markets and enables us to attract and retain top dealers who in many instances sell multiple REV brands in their territories. Our vehicle platforms are highly customizable and can meet nearly all product specifications demanded by our customers. In each of the markets that we serve, we believe our brands are among the most recognized in the industry, representing performance, quality, reliability, durability, technological leadership and superior customer service.

Selling into Attractive, Growing End Markets— Each of our segments serves end markets that are supported by what we believe to be favorable, long-term demographic, economic and secular trends. We believe that the growing aged population in the United States will increase demand for products across all of our segments, as older demographics are a key demand driver for products such as emergency vehicles, mobility vans and RVs. In the Fire & Emergency segment, increasing legislated changes requiring shorter replacement cycles will create a source of recurring demand for our products as in-service vehicles achieve mileage or age limits. Additionally, fire and emergency vehicle purchases fell below historical replacement rates following the 2008 recession, and we estimate the cumulative pent-up replacement demand is approximately 17,500 units, which represents 179% of the total unit sales volume in the United States and Canada in 2016. Our Commercial segment is poised to grow as a result of increasing urbanization within the United States which will require greater use of commercial buses. We believe demand for our school buses and our fire and emergency vehicles will grow with increasing state and local government spending. In addition, we believe our RV segment is poised for long-term growth driven by increased RV participation rates and market unit recoveries to historical average levels. Additionally, we believe the current U.S. camper base of 45 million people represents an opportunity to expand the RV customer base. Though our net sales are primarily derived from sales in the United States, similar positive market dynamics exist in other parts of the world providing an opportunity for future global growth in each of our segments. Only approximately 4% of our net sales in fiscal year 2017 were from sales to customers outside the United States.

12

Table of Contents

Unique Scale and Business Model— As the only manufacturer of specialty vehicles across all three of our product segments and one of the largest participants in our markets by net sales, we enjoy a unique position relative to many of our competitors that we believe provides a competitive advantage and an enhanced growth profile. Many of our products contain similar purchased components, such as chassis, engines, lighting, wiring and other commodities which increase our leverage with and relevance to key suppliers. The operational processes across our different products are based on common elements, such as chassis preparation and production, body fabrication, product assembly and painting which allow us to develop best practices across our manufacturing system and implement those processes to drive operational efficiency. Our platform also allows us to leverage the combined engineering resources and product development resources from our broad network to bring new products, features and customer specific customization to market faster. Our business model makes us more desirable to our distribution channel partners as we are able to provide them with a full line of products to address our mutual customers’ needs across a wider variety of price and product feature elements which gives dealers the opportunity to sell to a larger customer base and grow their sales and earnings. Additionally, our scale allows us to more efficiently amortize investments in service locations, parts sales infrastructure and information technology tools, among others.

Business Model Produces Highly Attractive Financial Characteristics— Our core production processes are primarily design, engineering, component integration and assembly in nature, creating a business model that produces attractive financial characteristics such as a highly variable cost structure, low levels of maintenance capital expenditures as a percentage of net sales, attractive levels of return on invested capital and strong revenue visibility. Based on our historical results of operations, we estimate that across all three of our segments, approximately 83% of our cost of goods sold are comprised of direct materials (including chassis) and direct labor which are variable in nature because these costs are associated with the specific production of our vehicles in each period and therefore are adjusted within a given period based on production levels in that period. Our remaining cost of goods sold are comprised of certain indirect labor and overhead costs which are fixed or semi-variable in nature because these costs are not linked to specific vehicle volumes in a given period and the time required to adjust these levels of spending is longer and management decisions regarding these costs are made based on longer term trends and forecasts. In addition, our selling, general and administrative expenses are primarily comprised of salaried payroll expenses which we structure efficiently around the level of demand in our markets. Over the last three completed fiscal years, our capital expenditures, as a percentage of net sales, has totaled less than 2%. As a result of low levels of capital investments required and efficient use of working capital (including the taking of deposits in certain of our markets), we believe that our business produces attractive returns on invested capital. Finally, our business carries a high-quality backlog which enables strong visibility into future net sales which ranges from two to twelve months depending on the product and market. This visibility into future production needs and net sales enables us to more effectively plan and predict our business.

Experienced Consolidator with Proven Ability to Integrate Acquisitions and Drive Business Improvement— Throughout our history, we have complemented organic growth with strategic acquisitions, resulting in meaningful cost and commercial synergies and accelerated growth. Over the last ten years, we have completed 13 acquisitions across our Fire & Emergency, Commercial and Recreation segments and continue to actively consider future potential acquisitions that complement and expand our current product portfolio. Our scale and plant network, strong end market positions, access to low cost capital and reputation as an active and effective strategic acquirer, position us favorably to continue to grow and enhance value through strategic acquisitions. The specialty vehicle market is highly fragmented with a large number of smaller producers within our existing markets as well as in new markets where we believe there would be synergies with REV. Our management team is highly experienced in integrating and improving the businesses we acquire, as evidenced by the improved financial performance of many of our acquisitions under our ownership. We believe all of these attributes position REV as an acquirer of choice in the specialty vehicles market.

13

Table of Contents

The Evolution of REV

Experienced Management Team with Proven Track Record —Our management team has many years of industry experience, and a demonstrated track record of managing and growing publicly-traded industrial businesses. From fiscal year 2015 to fiscal year 2017, our management team has increased net income from $22.9 million to $31.4 million and Adjusted EBITDA from $90.1 million to $162.5 million, respectively, while expanding net income and Adjusted EBITDA margins approximately 6 basis points and 197 basis points, respectively, over the same period.

Our Growth Strategies

We plan to continue pursuing several strategies to grow our earnings, expand our market share and further diversify our revenue stream, including:

Drive Margin Expansion Through Controllable Operational Initiatives— Our focus on driving operational improvement initiatives across the organization has enabled the increase of our net income, Adjusted Net Income and Adjusted EBITDA margins by 6 basis points, 139 basis points and 197 basis points, respectively, from fiscal year 2015 to fiscal year 2017. Our initiatives have also resulted in improved safety results, as measured by the 25% decrease in our total recordable incident rate in fiscal year 2017 versus the prior fiscal year. We have achieved these improvements as a result of successfully implementing lean manufacturing initiatives across the organization, consolidating procurement functions, centralizing certain commercial decision making, reducing cost of quality, improving operational and safety performance and improving the total life-cycle value proposition for our customers. We believe we have established an enterprise-wide culture focused on continuous improvement, implementing measurable performance targets and sharing of best practices across the entire organization. Our Fire & Emergency segment had Adjusted EBITDA of $109 million in fiscal year 2017, which represents an Adjusted EBITDA margin of 11%, and we are targeting to further enhance Adjusted EBITDA margins in our Fire & Emergency, Commercial and Recreation segments over time. We continuously strive to identify and act on additional profitability improvement initiatives in many of our business units.

Develop Innovative New Customer Offerings— Due to the specific customer requirements for our products, we are continually enhancing and customizing our product offerings by introducing new features to enhance customer utility across a variety of price points. We seek to expand our addressable market by developing innovative products and services that extend our market leading combination of features, performance, quality and price to new customer bases, new markets or new segments of existing markets. We introduced eight new products in fiscal year 2016 and introduced 17 new products in fiscal year 2017. We believe our process of constant innovation will not only help us increase net sales but also achieve lower costs and generate higher margins as our new products are frequently designed to leverage existing procurement relationships and for ease of manufacturability. In addition, there are multiple natural product adjacencies where REV has valuable brand equity, leading technology and cost positions where we believe we can generate strong demand for new products. For example, we introduced the 100’ Metro Quint aerial fire truck under the E-ONE brand in the first half of fiscal year 2017 to address the larger municipal market with a 100’ aerial and shorter wheelbase which improves maneuverability, and a new M1 Ambulance under the Frontline brand in fiscal year 2016 to address a lower specification segment of the ambulance market. We introduced the Sabre terminal truck in fiscal year 2015, which provided a new cab design and feature set while improving manufacturability for REV as a result of improved design features such as a weldless frame. By delivering innovative new customer offerings and customizations, we believe we can grow our net sales and market share.

14

Table of Contents

Enhance Sales and Distribution Model— We believe that we are an attractive specialty vehicle OEM partner for dealers due to the breadth and quality of our product offerings, our brand recognition, our ability to produce products at varied price and feature points, as well as our aftermarket support capabilities. We intend to continue to leverage this strength to enhance our distribution network through selectively adding dealers in new territories, strengthening dealers in our existing network and expanding our direct sales and service capabilities in targeted markets. Our goal is to partner with the leading dealers in each market and to provide the necessary resources to ensure our partner dealers can best position REV products to compete successfully within their regions. We will also continue to optimize our go-to-market channel strategy (e.g., distribution or direct sale) based on the specific market dynamics and customer composition by region. We have historically focused on customers within the United States; however, we believe there is demand internationally for our products and we also seek to expand our distribution globally.

Accelerate Aftermarket Growth— Our end users’ large in-service fleets create strong demand for aftermarket parts in order to keep vehicles running and to support their residual value. We estimate the size of our installed base’s aftermarket parts market opportunity to be approximately $800 million annually, with significant importance placed on timely parts availability given the high cost of vehicle downtime, and our total aftermarket parts net sales in fiscal years 2017, 2016 and 2015 were $77.4 million, $73.8 million and $68.9 million, respectively. We have formalized an aftermarket strategy and are investing in building out capabilities to take advantage of this significant, high margin opportunity across our segments. We have created a dedicated management team to oversee our aftermarket business, and are centralizing our aftermarket parts and services business to broaden market coverage and ensure parts availability while reducing lead time. We are establishing a web-based technology platform to provide our customers with real time data on parts availability and pricing. We also made substantial investments in our services network infrastructure including over $28 million in fiscal years 2015 through 2017, in the aggregate, for the establishment of new RTCs across the United States, development of our parts system infrastructure and the expansion of capacity across several existing service locations. In early fiscal year 2017, we announced a new service partnership with Ryder Systems, Inc. where our bus customers are able to leverage Ryder’s extensive maintenance network of over 800 service locations with a program designed to deliver nationwide vehicle maintenance services. We believe we are well positioned to provide the most extensive and integrated service support network to our end customers and dealer partners.

Pursue Value Enhancing Acquisitions— We seek to pursue acquisitions which enhance our existing market positions, gain us entry to new products or markets and achieve our targeted financial returns. We have a long history of acquisitions with 14 transactions completed over the past 11 years. Given our leadership positions within our markets and our existing facility, service and distribution network, we believe we have many inherent advantages in making acquisitions and have demonstrated the ability to successfully identify, execute and integrate acquisitions while realizing synergies. We believe that we have a clear acquisition strategy in place, targeting acquisitions with significant synergies to drive long-term value creation for shareholders. We will seek acquisitions of companies with strong brands and complementary products and distribution networks that align well with our aftermarket strategies and provide strong synergies with our existing business. In addition, we will target acquisitions which further diversify or broaden our product offerings and geographic reach, and simultaneously produce attractive financial returns.

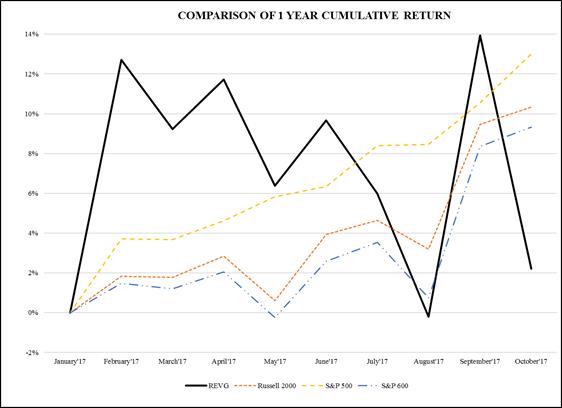

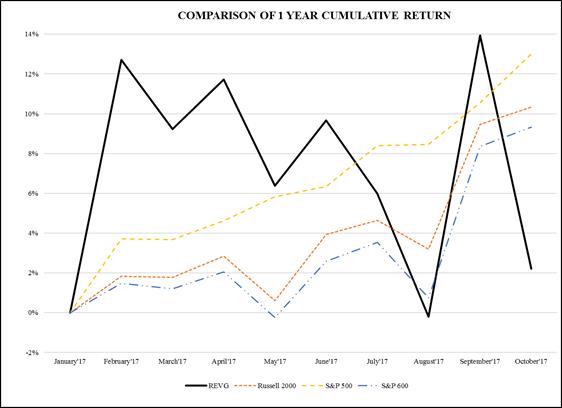

Our Initial Public Offering

On January 26, 2017, we announced the pricing of an initial public offering (“IPO”) of shares of our common stock, which began trading on the New York Stock Exchange on January 27, 2017. On February 1, 2017, we completed the IPO of 12.5 million shares of common stock at a price of $22.00 per share. The Company received $275.0 million in gross proceeds from the IPO, or approximately $253.6 million in net proceeds after deducting the underwriting discount and expenses related to the IPO. The net proceeds of the IPO were used to partially pay down the Company’s existing debt. The Company redeemed the entire outstanding balance of its Senior Secured Notes (the “Notes”), including a prepayment premium and accrued interest, plus it partially paid down a portion of the then outstanding balance of its revolving credit facility. Immediately prior to closing of the IPO, the Company completed an 80-for-one stock split of its Class A common stock and Class B common stock and reclassified the Class A common stock and Class B common stock into a single class of common stock, which was the same class as the shares sold in the IPO.

Our Equity Sponsor

Our primary equity holders are funds and an investment vehicle associated with AIP CF IV, LLC, which we collectively refer to as “American Industrial Partners,” “AIP” or “our Sponsor” and which indirectly own approximately 52.7% of our voting equity as of December 15, 2017. AIP is an operations and engineering-focused private equity firm headquartered in New York, New York, that has been investing in the industrial middle market for over 27 years. AIP invests when it believes it can significantly improve the underlying business’ performance through the implementation of an operating agenda to grow earnings and value—a “business building” investment strategy. As of October 31, 2017, AIP’s assets under management were $4.7 billion from three current funds on behalf of leading pension, endowment and financial institutions.

15

Table of Contents

Distribution

We distribute either through our direct sales force or our well-established dealer network, consisting of approximately 700 dealers. Substantially all of our dealers are independently owned. Whether we sell directly to the customer or through a dealer depends largely on the product line and the customer base. We provide our direct sales force representatives and dealers with training on the operation and specifications of our products. We strive to keep our direct sales force representatives and dealers up to date on our product offerings and new features as well as market trends. We believe our scale enables us to dedicate certain sales and marketing efforts to particular products, customers or geographic regions, which we believe enables us to develop expertise valued by our customers.

As one of the leaders in each of our markets, we believe our distribution network consists of many of the leading dealers within each segment. We believe our extensive dealer network has the ability to meet the needs of end customers with high to low value added products, such as vehicles, equipment, components and parts and services, at a variety of price points and order sizes. As a result, most of our dealers have sold our products for over a decade and are serving a well-established installed base of end customers, creating cost advantages and entrenched positions due to customer loyalty. We believe we are a key supplier to many of the leading customers in our markets, such as FDNY (ambulances and fire apparatus), AMR (ambulances), First Student (school buses), PACE (transit buses), Panama Port (terminal trucks) and Lazydays (RVs), among others. We also periodically assist our dealers in composing bid packages for larger opportunities that involve our product lines. We continue to grow and enhance our distribution network into underserved areas. In addition, we evaluate export opportunities from time to time in select international markets through our direct sales force and our established international dealerships and agents.

Fire & Emergency Segment

We sell our ambulances through internal direct sales personnel and a national independent dealer network. The direct sales force is responsible for establishing new accounts and servicing existing customers in California, Florida, Ohio and other selected markets across the United States. Approximately 50 dealers cover our domestic market sales and we believe most hold a leading position in ambulance sales in their respective regions, providing us with a significant competitive advantage. In addition, we export to most of the international markets that utilize a United States style chassis such as certain countries in the Middle East and Latin America.

Our fire apparatus business uses its direct sales force and its dealer network comprised of approximately 80 dealers in the United States and Canada and approximately 30 international dealers to sell its products. We have continued to grow our distribution network into underserved areas. For example, historically our fire apparatus business did not serve the stainless steel component of the industry, but we have recently invested in a new facility to service that market. As such, we believe there are significant opportunities to grow our dealer footprint to serve this market. We believe that with our new product and dealer network in this area, we will begin to capture additional market share going forward.

Commercial Segment

We utilize dealer distribution in markets where a well-managed and experienced dealer is available. Selling through a dealer can be more cost effective than utilizing direct sales personnel in some cases. As a result, we continually evaluate potential dealer relationships to determine if the addition of a dealer in a given region would be advantageous to net sales and our market share. In addition to our dealer network, we also utilize direct national accounts, such as school transportation contractors, national child care providers, hotels, rental car and parking lot operators, nursing and retirement homes and church organizations.

The Capacity brand utilizes a combination of a direct sales force, international agents and dealers to market its products worldwide. Capacity also utilizes an extensive network of dealers in the United States and Canada.

The Lay-Mor brand and the recently recast Revability brand are principally marketed in both commercial and rental markets through the manufacturer’s representatives who are supported by our internal sales efforts with key customers, such as national equipment rental companies. Our direct sales personnel work directly with national customers to ensure that Lay-Mor and Revability equipment meets customers’ specifications and is qualified for sale throughout their national network.

Recreation Segment

We sell our RV products through a national independent dealer network with internal sales personnel responsible for working directly with these dealers. RV purchases are sensitive to wholesale and retail financing, consumer confidence and disposable income, making them discretionary products. Due to these industry dynamics, the RV market was negatively affected by the most recent economic downturn and has been improving toward historical annual volume levels. The largest RV buying group is people between

16

Table of Contents

the ages of 35 and 54, with an average age of all RV owners of 45, according to the RVIA. Buyers of RVs are brand loyal, repeat buyers who make decisions based on brand, product configuration (primarily floor plan design, features and product styling), service and price. This buying group is expected to grow as the baby boom generation continues to age. For many of these buyers, a motor home purchase is the second biggest purchase in their lifetime; therefore, the shopping timeline is longer than other consumer purchases. The buying process normally starts with online searches, followed by show visits and eventually a dealership visit for the purchase.

Customers and End Markets

Our end markets include the municipal market (vehicles for essential services such as emergency response, patient transportation and student transportation), the private contractor market (privately owned fleets that provide transportation services), the consumer market (vehicles for transportation, leisure and mobility needs) and the industrial/commercial markets (vehicles for transportation, construction projects and global port and intermodal transportation applications). Based on aggregated available industry data, we estimate that the combined size of our annual addressable markets is approximately 112,000 vehicles with $800 million of potential aftermarket parts sales at current market volume levels.

Our top 10 customers combined accounted for approximately 23% of our net sales for fiscal year 2017, with no customer representing more than 5% of our net sales in the same period. We and our predecessor and acquired companies have operated in our businesses for many years, and many of our brands have been trusted names in the marketplace for decades. As a result, we are able to take advantage of many long-term customer relationships.

Approximately 50% of our net sales in fiscal year 2017 were made directly or indirectly to governmental bodies, including municipalities, such as fire departments, school districts, hospitals and the U.S. federal government. In fiscal year 2017, our approximate direct or indirect net sales by end market was as follows: 50% government, 28% consumer, 10% private contractor and 12% industrial/commercial.

For fiscal years 2017 and 2016, approximately 96% and 99%, respectively, of our net sales were to customers located in the United States and Canada.

Growth in our end markets are driven by various macro-economic and demographic factors including:

| • | Population demographics—Overall population growth and the aging population creates greater needs for essential services such as emergency care, healthcare services, transportation and interest in retirement activities including travel and leisure. |

| • | Increasing state and local government investment—Improving housing prices, improving economies and new housing starts all create an increasing tax base and greater demand for essential services provided by governmental agencies. |

| • | Pent-up replacement demand for essential vehicles—Since the 2008 recession, the replacement volumes of fire apparatus and ambulances in the United States has lagged behind historical averages that we believe create a necessarily higher replacement demand in the future for the vehicles we produce. |

| • | Urbanization of the U.S. population—Growing urban population characterized by higher populations and the movement of people to the cities within the United States drives additional construction and housing demand that results in greater need for transportation and emergency services to maintain service and response levels by our end customers. |

| • | Increasing popularity for outdoor lifestyles—There is a growth of interest in outdoor recreational activities and the opportunity to better access large areas through the use of RVs. The RV lifestyle and demand for our vehicles is supported by the continued positive growth in the consumer base which includes the increased industry penetration of the baby boomer generation as well as the fastest growing RV owner group which includes Generation X consumers, as estimated by RVIA. |

Manufacturing and Service Capabilities