- INVH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Invitation Homes (INVH) DEF 14ADefinitive proxy

Filed: 18 Apr 19, 6:02am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

Invitation Homes Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

Notice of Annual Meeting

and

Proxy Statement

2019 Annual Meeting of Stockholders

May 30, 2019

Dear Fellow Stockholders:

On behalf of the Board of Directors of Invitation Homes Inc., I invite you to attend our 2019 annual meeting of stockholders (the “Annual Meeting”) at 11:30 a.m., local (Eastern) time, on Thursday, May 30, 2019, at the offices of Simpson Thacher & Bartlett LLP, located at 425 Lexington Ave, New York, NY 10017.

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over the Internet, we have sent stockholders of record at the close of business on April 2, 2019 a Notice of Internet Availability of Proxy Materials on or about April 18, 2019. The notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as in the attached Proxy Statement.

Attached to this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the meeting.

Your vote is important to us. Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented and voted. You may vote your shares on the Internet, by telephone or by completing, signing and promptly returning a proxy card, or you may vote in person at the Annual Meeting. Each of these options will ensure that your shares will be represented and voted at the Annual Meeting.

On behalf of the Board of Directors and employees of Invitation Homes Inc., we appreciate your continued support.

Sincerely,

Dallas B. Tanner

President and Chief Executive Officer

April 18, 2019

Notice of 2019 Annual Meeting of Stockholders

DATE AND TIME: THURSDAY, MAY 30, 2019 11:30 a.m., local (Eastern) time | PLACE: SIMPSON THACHER & BARTLETT LLP 425 Lexington Ave, New York, NY 10017

| |

ITEMS OF BUSINESS:

| 1. | To elect the director nominees listed in the Proxy Statement. |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2019. |

| 3. | To approve, in anon-binding advisory vote, the compensation paid to our named executive officers. |

| 4. | To determine, in anon-binding advisory vote, whether anon-binding stockholder vote to approve the compensation paid to our named executive officers should occur every one, two or three years. |

| 5. | To consider such other business as may properly come before the 2019 annual meeting of stockholders (the “Annual Meeting”) and any adjournments or postponements thereof. |

The Proxy Statement following this Notice of Annual Meeting of Invitation Homes Inc., a Maryland corporation, describes these matters in detail. We have not received notice of any other proposals to be presented at the Annual Meeting.

RECORD DATE:

The Board of Directors of Invitation Homes Inc. established the close of business on April 2, 2019 as the record date for the Annual Meeting. Accordingly, holders of record of our common stock at the close of business on that date are entitled to notice of, and to vote at, the Annual Meeting and any postponements or adjournments of the meeting.

VOTING BY PROXY:

To ensure your shares are voted, you may vote your shares over the Internet, by telephone or by requesting a proxy card to complete, sign and return by mail. If your shares are held by a broker, bank or other nominee, please follow their instructions to authorize your proxy.

By Order of the Board of Directors of Invitation Homes Inc.,

Mark A. Solls

Executive Vice President,

Chief Legal Officer and Secretary

Dallas, Texas

April 18, 2019

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about April 18, 2019.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 30, 2019

|

The Notice of Annual Meeting, Proxy Statement and Annual Report are available free of charge at www.proxyvote.com, a site that does not have “cookies” that identify visitors to the site.

|

| i | 2019 Proxy Statement |

|

PROXY STATEMENT

April 18, 2019

Why am I receiving these materials?

This Proxy Statement and related proxy materials are first being made available to stockholders of Invitation Homes Inc., a Maryland corporation (“Invitation Homes,” the “Company,” “we,” “our” or “us”) on or about April 18, 2019, for use at our 2019 annual meeting of stockholders (the “Annual Meeting”) to be held on Thursday, May 30, 2019, at 11:30 a.m., local (Eastern) time, at the offices of Simpson Thacher & Bartlett LLP, located at 425 Lexington Ave, New York, NY 10017, and any adjournments or postponements thereof. Proxies are being solicited by the Board of Directors of the Company (the “Board”) to give all stockholders of record at the close of business on April 2, 2019 (the “Record Date”) an opportunity to vote on matters properly presented at the Annual Meeting. The mailing address of our principal executive offices is Invitation Homes Inc., 1717 Main Street, Suite 2000, Dallas, Texas 75201.

There are four proposals to be considered and voted on at the Annual Meeting:

Proposal 1: | To elect the director nominees listed in this Proxy Statement. | |

Proposal 2: | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2019. | |

Proposal 3: | To approve, in anon-binding advisory vote, the compensation paid to our named executive officers. | |

Proposal 4: | To determine, in anon-binding advisory vote, whether anon-binding stockholder vote to approve the compensation paid to our named executive officers should occur every one, two or three years. | |

Stockholders as of the close of business on the Record Date may vote at the Annual Meeting or any postponement or adjournment thereof. As of the Record Date, there were 524,989,775 shares of our common stock outstanding. You have one vote for each share of common stock held by you as of the Record Date, including shares:

| • | Held directly in your name as “stockholder of record” (also referred to as “registered stockholder”); and |

| • | Held for you in an account with a broker, bank or other nominee (shares held in “street name”). Street name holders generally cannot vote their shares directly and instead must instruct the broker, bank or other nominee how to vote their shares. Please refer to information from your broker, bank or other nominee on how to submit voting instructions. |

The presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting will constitute a quorum to transact business at the Annual Meeting. Stockholders who properly authorize a proxy but who instruct their proxy holder to abstain from voting on one or more matters are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “brokernon-votes,” described below, also are counted as present and entitled to vote for purposes of determining a quorum.

| 1 | 2019 Proxy Statement |

General Information(continued)

|

A brokernon-vote occurs when shares held by a broker, bank or other nominee are not voted with respect to a proposal because (1) the broker, bank or other nominee has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker, bank or other nominee lacks the authority to vote the shares at his/her discretion. Under current New York Stock Exchange (“NYSE”) interpretations that govern brokernon-votes, Proposals 1, 3 and 4 are considerednon-discretionary matters, and a broker, bank or other nominee will lack the authority to vote shares at his/her discretion on such proposals. Proposal 2 is considered a discretionary matter and a broker, bank or other nominee will be permitted to exercise his/her discretion. This means that, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other nominee, your shares will not be voted on Proposals 1, 3 and 4 but will be voted on Proposal 2 in the discretion of your broker, bank or other nominee.

How many votes are required to approve each proposal?

With respect to the election of directors (Proposal 1), under our Bylaws, directors are elected by a plurality vote, which means that the director nominees with the greatest number of votes cast, even if less than a majority, will be elected. There is no cumulative voting in the election of directors.

Pursuant to the terms of the stockholders agreement entered into with affiliates of The Blackstone Group L.P. (collectively, “Blackstone”) described under “Transactions with Related Persons,” Blackstone has agreed to vote their shares of our common stock in favor of all persons nominated by our Board to serve as our directors. As of the Record Date, Blackstone beneficially owned and had the right to vote approximately 34.3% of the outstanding shares of our common stock and has advised us that they intend to vote all such shares in favor of the director nominees listed herein.

With respect to the ratification of our independent registered public accounting firm (Proposal 2), the approval, in anon-binding advisory vote, of the compensation paid to our named executive officers (Proposal 3) and the determination, in anon-binding advisory vote, whether anon-binding vote to approve the compensation paid to our named executive officers should occur every one, two or three years (Proposal 4), under our Bylaws, approval of the proposal requires a majority of the votes cast.

With respect to the election of directors (Proposal 1), you may vote “FOR” or “WITHHOLD” with respect to each nominee. Votes that are “withheld” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting. Brokernon-votes will not affect the outcome of this proposal.

With respect to the ratification of our independent registered public accounting firm (Proposal 2), you may vote “FOR,” “AGAINST” or “ABSTAIN.” For Proposal 2, abstentions will not affect the outcome of this proposal; however, as this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal.

With respect to the approval, in anon-binding advisory vote, of the compensation paid to our named executive officers (Proposal 3), you may vote “FOR,” “AGAINST” or “ABSTAIN.” For Proposal 3, abstentions and brokernon-votes will not affect the outcome of this proposal.

With respect to the determination, in anon-binding advisory vote, of whether anon-binding advisory vote to approve the compensation paid to our named executive officers should occur every one, two or three years (Proposal 4), you may vote “ONE YEAR,” “TWO YEARS,” “THREE YEARS” or “ABSTAIN.” For Proposal 4, abstentions and brokernon-votes will not affect the outcome of this proposal.

If you sign and submit your proxy card without voting instructions, your shares will be voted in accordance with the recommendation of the Board with respect to the proposals and in accordance with the discretion of the holders of the proxy with respect to any other matters that may be voted upon.

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of election.

| 2019 Proxy Statement | 2 |

General Information(continued)

|

How does the Board recommend that I vote?

Our Board recommends that you vote your shares as set forth below:

| Proposal 1: | To elect the director nominees listed in this Proxy Statement.

“FOR” each of the nominees for election as directors set forth in this Proxy Statement.

Our Board unanimously believes that all of the director nominees listed in this Proxy Statement have the requisite qualifications to provide effective oversight of the Company’s business and management. | |

| Proposal 2: | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2019.

“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2019.

Our Audit Committee and the Board believe that the retention of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2019 is in the best interest of the Company and its stockholders. | |

| Proposal 3: | To approve, in anon-binding advisory vote, the compensation paid to our named executive officers.

“FOR” the approval, in anon-binding advisory vote, of the compensation paid to our named executive officers.

We are seeking anon-binding advisory vote to approve, and our Board recommends that you approve, the 2018 compensation paid to our named executive officers, which is described in the section of this Proxy Statement titled “Executive Compensation.” | |

| Proposal 4: | To determine, in anon-binding advisory vote, whether anon-binding stockholder vote to approve the compensation paid to our named executive officers should occur every one, two or three years.

For every “ONE YEAR,” on anon-binding, advisory basis, with respect to how frequently anon-binding stockholder vote to approve the compensation paid to our named executive officers should occur.

Our Board believes that an annual advisory vote on executive compensation is consistent with our policy of seeking input from our stockholders on corporate governance matters and our executive compensation philosophy, policies and practices even though it is not required by law, and unanimously recommends that you vote “One Year” with respect to how frequently anon-binding stockholder vote to approve the compensation paid to our named executive officers should occur. | |

How do I authorize a proxy to vote my shares without attending the Annual Meeting?

If you are a stockholder of record, you may authorize a proxy to vote on your behalf at the Annual Meeting. Specifically, you may authorize a proxy:

By Internet—If you have Internet access, you may authorize your proxy by going towww.proxyvote.comand by following the instructions on how to complete an electronic proxy card. You will need the control number included on your proxy card in order to vote by Internet.

By Telephone—If you have access to a touch-tone telephone, you may authorize your proxy by dialing1-800-690-6903 and by following the recorded instructions. You will need the control number included on your proxy card in order to vote by telephone.

By Mail—You may authorize your proxy by mail by completing, signing and dating the enclosed proxy card where indicated and by mailing or otherwise returning the card in the envelope that has been provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity.

| 3 | 2019 Proxy Statement |

General Information(continued)

|

If you hold your shares in street name, you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your broker, bank, or other nominee on how to submit voting instructions.

Internet and telephone voting facilities will close at 11:59 p.m. Eastern time on May 29, 2019, and mailed proxy cards must be received no later than May 29, 2019.

How do I vote my shares in person at the Annual Meeting?

First, you must satisfy the requirements for admission to the Annual Meeting (see below). Then, if you are a stockholder of record and prefer to vote your shares at the Annual Meeting, you must bring proof of identification along with your proof of ownership. You may vote shares held in street name at the Annual Meeting only if you obtain a signed proxy from the record holder (for example, your broker, bank or other nominee) giving you the right to vote the shares.

Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by Internet, telephone or mail so that your vote will be counted even if you later decide not to attend the Annual Meeting.

When and where will the meeting be held?

Our Annual Meeting will be held at 11:30 a.m., local (Eastern) time, on Thursday, May 30, 2019, at the offices of Simpson Thacher & Bartlett LLP, located at 425 Lexington Ave, New York, NY 10017. To obtain directions to the Annual Meeting, please contact Investor Relations at844-456-INVH (4684) or IR@InvitationHomes.com.

May I change my vote or revoke my proxy?

Yes. Whether you have authorized a proxy by Internet, telephone or mail, if you are a stockholder of record, you may change your voting instructions or revoke your proxy by:

| • | sending a written statement to that effect to our Corporate Secretary at Invitation Homes Inc., 1717 Main Street, Suite 2000, Dallas, Texas 75201, provided such statement is received no later than May 29, 2019; |

| • | authorizing a proxy again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m. on May 29, 2019; |

| • | submitting a properly signed proxy card with a later date that is received by our Corporate Secretary at Invitation Homes Inc., 1717 Main Street, Suite 2000, Dallas, Texas 75201, no later than May 29, 2019; or |

| • | attending the Annual Meeting, revoking your proxy and voting in person. |

If you hold shares in street name, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also change your vote or revoke your proxy in person at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Do I need a ticket to be admitted to the Annual Meeting?

You will need yourproof of identification along with either your proxy card or proof of stock ownership to enter the Annual Meeting. If your shares are held beneficially in the name of a broker, bank or other nominee and you wish to be admitted to attend the Annual Meeting, you must present proof of your ownership of our stock, such as a bank or brokerage account statement.

Do I also need to present identification to be admitted to the Annual Meeting?

Yes, all stockholders must present a form of personal identification in order to be admitted to the Annual Meeting.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

| 2019 Proxy Statement | 4 |

General Information(continued)

|

Could other matters be decided at the Annual Meeting?

At the date this Proxy Statement went to press, we did not know of any matters that may be properly presented at the Annual Meeting other than those referred to in this Proxy Statement.

If other matters are properly presented at the Annual Meeting for consideration and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by our directors, officers and other Company employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers, banks and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

| 5 | 2019 Proxy Statement |

|

PROPOSAL NO. 1—ELECTION OF DIRECTORS

At present, the number of directors that comprise our Board is set at 12 and, upon the recommendation of the Nominating and Corporate Governance Committee, our Board has considered and nominated each of the following nominees for aone-year term expiring at our annual meeting of stockholders to be held in 2020 (the “2020 Annual Meeting”) or until his or her successor is duly elected and qualifies or until his or her earlier death, resignation, retirement, disqualification or removal: Bryce Blair, Jana Cohen Barbe, Richard D. Bronson, Kenneth A. Caplan, Michael D. Fascitelli, Robert G. Harper, Jeffrey E. Kelter, John B. Rhea, Janice L. Sears, William J. Stein, Barry S. Sternlicht and Dallas B. Tanner. Action will be taken at the Annual Meeting for the election of these nominees. All 12 nominees currently serve on the Board. All of the nominees have indicated that they will be willing and able to serve as directors, but, if any of them should decline or be unable to act as a director, the individuals designated in the proxy cards as proxies will exercise the discretionary authority provided to vote for the election of such substitute nominee selected by our Board, unless the Board alternatively acts to reduce the size of the Board or maintain a vacancy on the Board in accordance with our Bylaws. The Board has no reason to believe that any such nominees will be unable or unwilling to serve.

Nominees for Election to the Board of Directors in 2019

The following information describes the offices held, other business directorships and the term of service of each director nominee. Beneficial ownership of equity securities of the director nominees is shown under “Ownership of Securities” below. The biographical description for each nominee below includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board that such person should serve as a director.

| BRYCE BLAIR | ||||

| Age:60

Director since:September 2013

|

Mr. Blair has served as the Chairperson of our Board since November 2017 and, from January 2017 to November 2017 as our Executive Chairperson. Prior to our initial public offering (the “IPO”) in January 2017, Mr. Blair served on the Boards of our predecessor entities, Invitation Homes L.P., Preeminent Holdings Inc., Invitation Homes 3 L.P., Invitation Homes 4 L.P., Invitation Homes 5 L.P. and Invitation Homes 6 L.P. (collectively, the “IH Holding Entities”) since September 2013 and as Executive Chairperson thereof since November 2014. Mr. Blair currently serves as the Chairman of the Board of PulteGroup, Inc. (NYSE: PHM), one of the largest home builders in the U.S. Additionally, he serves on the Board of Regency Centers Corp. (NYSE: REG), one of the largest owners of shopping centers in the U.S., where he chairs the Nominating and Corporate Governance Committee. Mr. Blair also currently serves on the Advisory Board of the Boston College Center for Real Estate and Urban Action and the Advisory Board of Home Start, anon-profit focused on ending homelessness in the greater Boston area. Mr. Blair is the former Chairman and Chief Executive Officer of AvalonBay Communities, Inc. (“AvalonBay”) (NYSE: AVB), a real estate investment trust (“REIT”) focused on the development, acquisition and management of multifamily housing throughout the U.S., where he served as Chief Executive Officer from 2001 to 2012 and Chairman from 2002 through 2013. Prior to his role as Chief Executive Officer and Chairman, he served as AvalonBay’s President, Chief Operating Officer, Chief Investment Officer and Senior Vice President of Development, Acquisitions and Construction. Prior to the formation of Avalon Properties in 1993, Mr. Blair was a Partner with Trammell Crow Residential. Mr. Blair also previously served as a Senior Advisor to McKinsey and Co. and as a part time faculty member at Boston College. Mr. Blair is the past Chairman of the National Association of Real Estate Investment Trusts (“Nareit”), where he also served on the Executive Committee and on the Board of Governors. He is a past member of the Urban Land Institute (“ULI”), where he served as a Trustee and was past chairman of the Multi-Family Council. Mr. Blair is a past member of the Young Presidents Organization and a former member of the World Presidents Organization.

| 2019 Proxy Statement | 6 |

Proposal No. 1—Election of Directors(continued)

|

Our Board considered Mr. Blair’s experience in real estate development and investment, including his having spent over 10 years as chairman and chief executive officer of a public REIT experience managing day to day operations and preparation and review of complex financial reporting statements as Chief Executive Officer of AvalonBay Communities, Inc., his experience as the Chairman of Nareit and his prior director positions.

| DALLAS B. TANNER | ||||

| Age:38

Director since:January 2019

| |||

Mr. Tanner has served as our President and Chief Executive Officer (CEO) and a Board member since January 2019. As a founding member of our business, Mr. Tanner has been at the forefront of creating the single-family rental industry. Since the founding of Invitation Homes in April 2012, he has served as Executive Vice President and Chief Investment Officer, and from August 2018 to January 2019 as Interim President. Prior to our IPO in February 2017, he served on the boards of the IH Holding Entities. Mr. Tanner has 17 years of real estate experience through the establishment of numerous real estate platforms. In 2005, he founded Treehouse Group, for which he privately sourced funds for platform investments, including single-family rental homes, multifamily properties, manufactured housing, residential land, bridge financing and property management. Mr. Tanner continues to be involved in Treehouse Group’s interest in Pathfinder Ventures, a Southwest-focused commercial real estate fund. In addition, he was a partner in a successful acquisition of First Scottsdale Bank of Arizona. Mr. Tanner served on the Maricopa County (Arizona) Flood Control Board and on the advisory board of First Scottsdale Bank. He is actively involved in American Indian Services and served as a missionary in the Netherlands and Belgium.

Our Board considered Mr. Tanner’s experience in real estate investment, including the establishment of numerous real estate platforms, and as a founding member of our business, experience managing day-to-day operations of our Company and his prior executive positions.

| JANA COHEN BARBE | ||||

| Age:56

Director since:November 2018

| |||

Ms. Barbe joined our Board in November 2018. Ms. Barbe is a senior partner and the former Global Vice Chairman of Dentons, the world’s largest law firm. Ms. Barbe joined Dentons’ predecessor firm, Sonnenschein Nath & Rosenthal, in 1995 and became the first woman appointed to Dentons’ global board in 2010. Ms. Barbe also leads theTax-Oriented Investments Practice, which she founded and where she advises many of the nation’s leading financial institutions and insurance companies in connection with affordable housing and community development investments. Previously, she chaired the firm’s Real Estate Practice and Financial Institutions Sector. Ms. Barbe is the president emerita of Thresholds and is an impassioned advocate for women in law and business.

Our Board considered Ms. Barbe’s real estate and finance background, including chairing Dentons’ Real Estate Practice and Financial Institutions Sector, and her strategic vision and risk management experience, which are a complement to the skills and qualifications of our existing directors.

| 7 | 2019 Proxy Statement |

Proposal No. 1—Election of Directors(continued)

|

| RICHARD D. BRONSON | ||||

| Age:74

Director since:November 2017

| |||

Mr. Bronson has served on our Board since November 2017. Prior to our merger (the “Merger”) with Starwood Waypoint Homes (“SWH”) in November 2017, from January 2016 to November 2017, Mr. Bronson served on the Board of SWH and, from January 2014 to January 2016, served on the Board of Starwood Waypoint Residential Trust (“SWAY”), SWH’s predecessor. Mr. Bronson has been the Chief Executive Officer of The Bronson Companies, LLC, a real estate development company, since 2000 and has been involved in the development of several shopping centers and office buildings throughout the U.S. Mr. Bronson currently serves on the Board of Starwood Property Trust, Inc. (NYSE: STWD) and was previously a director of TRI Pointe Group, Inc. (NYSE: TPH) and Mirage Resorts Inc. He also previously served as President of New City Development, an affiliate of Mirage Resorts Inc., where he oversaw many of the company’s new business initiatives and activities outside Nevada, and was Vice President of the International Council of Shopping Centers, an association representing 50,000 industry professionals in more than 80 countries. Mr. Bronson currently serves on the Board of the Neurosurgery Division at UCLA Medical Center and is a member of the Western Real Estate Business Editorial Board.

Our Board considered Mr. Bronson’s experience and knowledge in the real estate industry, which the Board believes provides us with valuable insight into potential investments and the current state of the real estate markets.

| KENNETH A. CAPLAN | ||||

| Age:45

Director since:May 2018 | |||

Mr. Caplan has served on our Board since May 2018. Mr. Caplan is a Senior Managing Director and the GlobalCo-Head of Blackstone’s real estate group. Prior to this, Mr. Caplan served as Global Chief Investment Officer of Blackstone’s real estate group and, prior to that, as Blackstone’s Head of Real Estate Europe. Before joining Blackstone in 1997, Mr. Caplan worked for Lazard Frères & Co. in the real estate investment banking group. Mr. Caplan currently serves on the Board of Trustees of Prep for Prep. Following our IPO, Mr. Caplan previously served on our Board from January 2017 until the consummation of the Merger in November 2017.

Our Board considered Mr. Caplan’s experience as GlobalCo-Head of Blackstone’s real estate group and, before that, as its Global Chief Investment Officer, which the Board believes will provide us with significant insight into the real estate industry. Additionally, the Board believes that Mr. Caplan’s specific experience in Europe will provide us with additional global experience and perspective.

| 2019 Proxy Statement | 8 |

Proposal No. 1—Election of Directors(continued)

|

| MICHAEL D. FASCITELLI | ||||

| Age:62

Director since:November 2017 | |||

Mr. Fascitelli has served on our Board since November 2017. From January 2016 to November 2017, Mr. Fascitelli served on the Board of SWH and, from January 2014 to January 2016, served on the Board of SWAY. Since June 2013, Mr. Fascitelli has been the owner and principal of MDF Capital LLC, a private investment firm. Mr. Fascitelli is also aco-founder and a Managing Partner of Imperial Companies, a real estate investment and development company. Mr. Fascitelli has served as member of the Board of Trustees of Vornado Realty Trust (NYSE: VNO) since 1996. He served as the President of Vornado Realty Trust from 1996 to April 2013 and as its Chief Executive Officer from May 2009 to April 2013. Mr. Fascitelli served as the President of Alexander’s Inc., a REIT and an affiliate of Vornado Realty Trust, from August 2000 to April 2013. Prior to joining Vornado Realty Trust in 1996, from December 1992 to December 1996, Mr. Fascitelli was a partner at Goldman Sachs & Co., an investment banking firm, where he was in charge of its real estate practice. Mr. Fascitelli also serves as the chairman of the investment committee and a board member of Cadre, a real estate technology company. He serves as a board member of Child Mind Institute, The Rockefeller University, ULI and University of Rhode Island. Mr. Fascitelli is a former Commissioner of the Port Authority of New York and New Jersey and a past Chairman of the Wharton Real Estate Center, where he served on the executive committee.

Our Board considered Mr. Fascitelli’s executive experience as President and Chief Executive Officer of Vornado Realty Trust and his extensive knowledge of and experience in the real estate industry, which the Board believes provide us with valuable experience and insight.

| ROBERT G. HARPER | ||||

| Age:41

Director since:January 2017 | |||

Mr. Harper has served on our Board since January 2017. Mr. Harper currently serves as the Head of U.S. Asset Management for Blackstone. Since joining Blackstone in 2002, Mr. Harper has been involved in analyzing Blackstone’s real estate equity and debt investments in all property types. From September 2016 to May 2017, Mr. Harper served as a director and a member of the compensation committee of ESH Hospitality, Inc. and from January 2017 to December 2017, Mr. Harper served as a director of Park Hotels & Resorts Inc. Mr. Harper has previously served as Head of Europe for the Blackstone Real Estate Debt Strategies business and, prior to joining Blackstone, Mr. Harper worked for Morgan Stanley’s real estate private equity group.

Our Board considered Mr. Harper’s affiliation with Blackstone, significant experience in working with companies closely affiliated with private equity sponsors, particularly in the real estate industry, experience with real estate investing and extensive financial background.

| 9 | 2019 Proxy Statement |

Proposal No. 1—Election of Directors(continued)

|

| JEFFREY E. KELTER | ||||

| Age:64

Director since:November 2017 | |||

Mr. Kelter has served on our Board since November 2017. From January 2016 to November 2017, Mr. Kelter served on the Board of SWH and, from January 2014 to January 2016, served on the Board of SWAY. Mr. Kelter is a founding partner of KSH Capital, which provides real estate entrepreneurs with capital and expertise to grow their platforms. Prior to founding KSH Capital, Mr. Kelter was the founding partner and Chief Executive Officer of KTR Capital Partners, a private equity real estate investment and operating company focused on industrial properties throughout North America, until its May 2015 sale to Prologis, Inc. (NYSE: PLD). From 1997 to 2004, Mr. Kelter was President and Chief Executive Officer and served on the Board of Keystone Property Trust (“Keystone”), an industrial REIT. Mr. Kelter founded the predecessor to Keystone in 1982, and took the company public in 1997, where he and the management team directed its operations until its sale in 2004. Prior to forming Keystone, he served as President and Chief Executive Officer of Penn Square Properties, Inc., a real estate company which he founded in 1982. Mr. Kelter currently serves on the Board of Gramercy Property Trust (NYSE: GPT) and is a trustee of the ULI, Cold Spring Harbor Laboratory, Westminster School and Trinity College.

Our Board considered Mr. Kelter’s executive experience as President and Chief Executive Officer of Keystone and Penn Square and his extensive experience of over 20 years in commercial real estate.

| JOHN B. RHEA | ||||

| Age:53

Director since:October 2015 | |||

Mr. Rhea has served on our Board since January 2017 and, prior to our IPO, from October 2015 to January 2017, served on the Boards of the IH Holding Entities. Mr. Rhea has served as President, Capital Markets and Corporate Finance at Siebert Cisneros Shank & Co., LLC, a full-service investment banking firm, since June 2017. Mr. Rhea is also Managing Partner of RHEAL Capital Management, LLC, a real estate development and investment firm he founded in March 2014, specializing in multifamily rental housing andmixed-use projects. Mr. Rhea previously served as a Senior Advisor to The Boston Consulting Group, a worldwide management consulting firm from July 2014 to September 2017. From May 2009 to January 2014, Mr. Rhea was a senior appointee of Michael R. Bloomberg, Mayor of the City of New York, where he served as Chairman and Chief Executive Officer of the New York City Housing Authority. Prior to his service with the Bloomberg Administration, Mr. Rhea was Managing Director andCo-Head of Consumer and Retail investment banking at Barclays Capital (and its predecessor firm Lehman Brothers) from May 2005 to April 2009. Previously, Mr. Rhea served as Managing Director at JPMorgan Chase & Co. from May 1997 to April 2005. Earlier in his career, Mr. Rhea worked at PepsiCo, Inc. and The Boston Consulting Group. Mr. Rhea has served on and chaired severalnon-profit boards and is currently a director of Wesleyan University, Red Cross Greater New York and University of Detroit Jesuit High School.

Our Board considered Mr. Rhea’s significant experience in our industry, including in development and regulation and his prior senior positions at real estate companies and regulatory bodies, including as Chairman and CEO of the New York City Housing Authority, and other companies.

| 2019 Proxy Statement | 10 |

Proposal No. 1—Election of Directors(continued)

|

| JANICE L. SEARS | ||||

| Age:58

Director since:January 2017 | |||

Ms. Sears has served on our Board since January 2017. Ms. Sears serves on the Board and is the Audit Committee Chairperson of Essex Property Trust, Inc. (NYSE: ESS), a fully integrated multifamily REIT, and as the Board Chairperson of The Swig Company, LLC, a corporate owner of office properties nationwide. From March 2014 to January 2016, Ms. Sears served as a Director and as the Audit Committee Chairperson of BioMed Realty Trust, Inc. and, from 1998 to 2009, was a Managing Director, Western Region Head in the Real Estate, Gaming & Lodging Investment Banking Group at Banc of America Securities where she was also the San Francisco Market President for Bank of America. From 1988 to 1998, Ms. Sears was Head of Client Management for Bank of America’s Commercial Real Estate Group in California, where she oversaw client relationships with REITs, home builders and real estate opportunity funds. From September 1982 to June 1988, Ms. Sears was a Real Estate Economist at both Chemical Bank and Citicorp in New York. Her professional activities have included Nareit, ULI and the National Association of Corporate Directors. Ms. Sears is the past President and past Treasurer of the San Francisco Chapter of the National Charity League and most recently sat on the Boards of the San Francisco Chamber of Commerce, the San Francisco Economic Development Council and Leadership San Francisco. She acts as an advisor to the Audit Committee of the educationnon-profit San Francisco Art Institute, and as an advisor to Helix, an early-stage real estate focused software company backed by Google Ventures, DFJ and others.

Our Board considered Ms. Sears’ knowledge of capital markets and accounting methods and principles, as well as her extensive financial background and experience working in the commercial real estate and REIT industry.

| WILLIAM J. STEIN | ||||

| Age:57

Director since:October 2012 | |||

Mr. Stein has served on our Board since January 2017 and, prior to our IPO, from October 2012 to January 2017, served on the Boards of the IH Holding Entities. Mr. Stein has been a Senior Managing Director of Blackstone since January 2006. Since joining Blackstone in 1997, Mr. Stein has been involved in the direct asset management and asset management oversight of Blackstone’s global real estate platform. Before joining Blackstone, Mr. Stein was a Vice President at Heitman Real Estate Advisors and JMB Realty Corp. Mr. Stein currently serves on the Board of Nevada Property 1 LLC (The Cosmopolitan of Las Vegas), where he serves on the Audit Committee, and on the Board of BRE Select Hotels Corp (a voluntary filer with the Securities and Exchange Commission (the “SEC”)). He previously served on the Board of Hilton Worldwide Holdings Inc. (NYSE: HLT), Extended Stay America, Inc. (NYSE: STAY), La Quinta Holdings Inc. (NYSE: LQ) and Brixmor Property Group Inc. (NYSE: BRX). Mr. Stein is a member of the University of Michigan Ross School of Business Advisory Board and the University of Michigan Real Estate Fund Advisory Board.

Our Board considered Mr. Stein’s tenure with Blackstone, his involvement in the direct asset management and asset management oversight of Blackstone’s global real estate platform, his extensive financial background and his experience as an asset manager focusing on real estate investments.

| 11 | 2019 Proxy Statement |

Proposal No. 1—Election of Directors(continued)

|

| BARRY S. STERNLICHT | ||||

| Age:58

Director since:November 2017 | |||

Mr. Sternlicht has served on our Board since November 2017. From January 2016 to November 2017, Mr. Sternlicht served as one of the twoCo-Chairmen of SWH’s Board and, from 2012 to January 2016, served on the Board of SWAY. Mr. Sternlicht has been the President and Chief Executive Officer of Starwood Capital Group, a private investment firm with a primary focus on global real estate, since its formation in 1991. During this time, Mr. Sternlicht has structured investment transactions with an asset value of more than $84 billion. From 1995 through early 2005, Mr. Sternlicht was the Chairman of the Board of Starwood Hotels & Resorts Worldwide, Inc. (NYSE: HOT), a company he founded in 1995, until its acquisition by Marriott International, Inc. and as its Chief Executive Officer from January 1999 to October 2004. Mr. Sternlicht has served as Chairman of the Board and Chief Executive Officer of Starwood Property Trust, Inc. (NYSE: STWD) since its inception in 2009. From January 2013 to March 2017, Mr. Sternlicht served as Chairman of the Board of TRI Pointe Group, Inc. (NYSE: TPH). Mr. Sternlicht is currently the Chairman of the Board of Baccarat, S.A. and serves on the Board of The Estée Lauder Companies, Inc. (NYSE: EL). From 2012 to 2014, Mr. Sternlicht served on the Board of Restoration Hardware Holdings, Inc. (NYSE: RH) and is a former Trustee of Brown University, on whose Board he served for 12 years. He also currently serves on the Boards of The Robin Hood Foundation, the Real Estate Roundtable, the Dreamland Film & Performing Arts Center and the Executive Advisory Board of Americans for the Arts. Mr. Sternlicht is a member of the U.S. Olympic and Paralympic Foundation Trustee Council, the World Presidents Organization and the ULI.

Our Board considered Mr. Sternlicht’s extensive experience in both the real estate markets and as a senior executive and director of other publicly traded companies, which the Board believes enables him to provide us with leadership and financial expertise as well as insight into the current status of the global financial markets.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

| 2019 Proxy Statement | 12 |

|

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

The business and affairs of the Company are managed under the direction of our Board, as provided by Maryland law, and the Company conducts its business through meetings of the Board and its four standing committees: the Audit Committee, the Compensation and Management Development Committee (the “Compensation Committee”), the Nominating and Corporate Governance Committee and the Investment and Finance Committee.

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance include:

| • | our Board is not classified whereby each of our directors is subject to annual reelection, and we will not classify our Board in the future without the approval of our stockholders; |

| • | our independent directors meet regularly in executive sessions without the presence of our corporate officers ornon-independent directors; |

| • | we have opted out of the Maryland business combination and control share acquisition statutes and cannot opt in without stockholder approval; |

| • | our directors and executive officers are subject to stock ownership and retention requirements; |

| • | our directors are not expected to serve after reaching age 75; |

| • | we intend that no director serve more than 15 years on our Board; |

| • | stockholders holding a majority of outstanding shares have the right to amend, alter or repeal our Bylaws, or adopt new Bylaws, at a duly called meeting of stockholders; |

| • | our stockholders may act by written consent; |

| • | we do not have a stockholder rights plan, and we will not adopt a stockholder rights plan in the future without stockholder approval; and |

| • | we have instituted a range of other corporate governance best practices, including limits on the number of directorships held by our directors to prevent “overboarding,” a robust director education program, rotation of committee members, regular Board and committee evaluations and a commitment to Board refreshment and diversity. |

The stockholders agreement described under “Transactions with Related Persons—Stockholders Agreement” provides that Blackstone has the right to nominate directors to serve on our Board based on its percentage ownership of our common stock. Currently, Blackstone has the right to nominate three directors and it has designated Messrs. Caplan, Harper and Stein, each of whom are employed by Blackstone. The provisions of the stockholders agreement regarding the nomination of directors will remain in effect until Blackstone is no longer entitled to nominate a director to our Board, unless Blackstone requests the termination of such rights at an earlier date.

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and the NYSE rules, a director is not independent unless the Board affirmatively determines that, in addition to not have a disqualifying relationship, as set forth in the NYSE rules, he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries which, in the opinion of the Board would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our Corporate Governance Guidelines define independence in accordance with the independence definition in the current NYSE corporate governance rules for listed companies. Our Corporate Governance Guidelines require the Board to review the independence of all directors at least annually. In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the NYSE independence definition, the Board will determine, considering all relevant facts and circumstances, whether such relationship is material and whether such relationship would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

| 13 | 2019 Proxy Statement |

The Board of Directors and Certain Governance Matters(continued)

|

The Nominating and Corporate Governance Committee undertook reviews of director independence and made recommendations to our Board as to those directors meeting the requisite NYSE independence standards applicable to serve on the Board and any heightened standards to serve on a committee of the Board. As a result of these reviews, the Board has affirmatively determined that each of Jana Cohen Barbe, Richard D. Bronson, Kenneth A. Caplan, Michael D. Fascitelli, Jonathan D. Gray (who served as our director until the 2018 annual meeting of stockholders), Robert G. Harper, Jeffrey E. Kelter, John B. Rhea, Janice L. Sears, William J. Stein and Barry S. Sternlicht is independent under all applicable NYSE standards for Board service and under our Corporate Governance Guidelines. At the committee level, the Board has affirmatively determined that each of Jana Cohen Barbe, Richard D. Bronson, John B. Rhea and Janice L. Sears, as a member of the Audit Committee, is “independent” for purposes of Rule10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and that each of Jana Cohen Barbe, Michael D. Fascitelli, Jeffrey E. Kelter, John B. Rhea and William J. Stein, as a member of the Compensation Committee, is “independent” for purposes of Section 10C(b) of the Exchange Act.

In making its independence determinations, the Board considered and reviewed all information known to it, including information identified through directors’ questionnaires.

Our Articles of Incorporation and our Bylaws provide that our Board will consist of such number of directors as may from time to time be fixed by the Board, but may not be more than 15 or fewer than the minimum number permitted by Maryland law, which is one.

Our Board is led by our Chairperson, and the Chairperson position is separate from our President and CEO position. We believe that the separation of the Chairperson and President and CEO positions is appropriate corporate governance for us at this time. Accordingly, Mr. Blair serves as Chairperson, while Mr. Tanner serves as our President and CEO. Our Board believes that this structure best encourages the free and open dialogue of competing views and provides for strong checks and balances. Additionally, our Chairperson’s attention to Board and committee matters allows the President and CEO to focus more specifically on overseeing the Company’sday-to-day operations, as well as strategic opportunities and planning.

Committees of the Board of Directors; Meetings of the Board of Directors and its Committees

Our Board has established an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and an Investment and Finance Committee. The following table summarizes the current membership of each of the Board’s committees.

Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Investment and Finance Committee | ||||

Bryce Blair*

| ||||||||

Dallas B. Tanner

| Member

| |||||||

Jana Cohen Barbe

| Member

| Member

| ||||||

Richard D. Bronson

| Member

| Member

| ||||||

Kenneth A. Caplan

| Member | |||||||

Michael D. Fascitelli

| Member

| Chairperson

| ||||||

Robert G. Harper

| Member

| Member | ||||||

Jeffrey E. Kelter

| Member

| Member

| ||||||

John B. Rhea

| Member

| Chairperson

| ||||||

Janice L. Sears

| Chairperson

| Member

| ||||||

William J. Stein

| Member

| Chairperson

| ||||||

Barry S. Sternlicht

| ||||||||

| * | Chairperson of the Board |

| 2019 Proxy Statement | 14 |

The Board of Directors and Certain Governance Matters(continued)

|

All directors are expected to make every effort to attend all meetings of the Board, meetings of the committees of which they are members and our annual meeting of stockholders. During the year ended December 31, 2018, the Board held six meetings, the Audit Committee held seven meetings, the Compensation Committee held five meetings, the Nominating and Corporate Governance Committee held four meetings and the Investment and Finance Committee held five meetings. In 2018, each director attended at least 75% of the meetings of the Board and of the committees on which he or she served as a member during the time in which he or she served as a member of the Board or such committees. We expect all directors to attend any meeting of stockholders, and 10 of our 11 directors who were nominees attended the 2018 annual meeting of stockholders.

Audit Committee

Each member of the Audit Committee has been determined to be “independent” in accordance with our Audit Committee charter and applicable NYSE and Exchange Act rules applicable to boards of directors generally and audit committees in particular. The Board has also determined that each member of the Audit Committee is “financially literate” within the meaning of the NYSE rules and that each of Mr. Rhea, Mr. Bronson and Ms. Sears qualifies as an “audit committee financial expert” as defined by applicable SEC rules.

The Audit Committee is responsible for, among other things:

| • | assisting the Board with its oversight of our accounting and financial reporting process and financial statement audits; |

| • | assisting the Board with its oversight of our disclosure controls procedures and our internal control over financial reporting; |

| • | assessing the independent registered public accounting firm’s qualifications and independence; |

| • | engaging the independent registered public accounting firm; |

| • | overseeing the performance of our internal audit function and independent registered public accounting firm; |

| • | assisting with our compliance with legal and regulatory requirements in connection with the foregoing; and |

| • | overseeing our exposure to risks facing the Company, including, but not limited to, financial risks, information technology risks, tax risks, legal risks and enterprise risks. |

Compensation and Management Development Committee

Each member of the Compensation Committee has been determined to be “independent” in accordance with our Compensation and Management Development Committee charter and the applicable NYSE and Exchange Act rules applicable to boards of directors generally and compensation committees in particular.

The Compensation Committee is responsible for, among other things:

| • | establishing and reviewing the Company’s overall compensation philosophy; |

| • | overseeing the goals, objectives and compensation of our President and CEO, including evaluating the performance of the President and CEO in light of those goals; |

| • | reviewing and determining the salaries, performance-based incentives, and other matters related to the compensation of our other executive officers; |

| • | making recommendations to the Board regarding director compensation; |

| • | approving our benefit and other compensation plans and setting the terms of and making awards thereunder; and |

| • | assisting with our compliance with the compensation rules, regulations and guidelines promulgated by the NYSE, the SEC and other laws, as applicable. |

For a description of our process for determining compensation, including the role of the Compensation Committee’s independent compensation consultant, see “Executive Compensation—Compensation Discussion and Analysis.”

Nominating and Corporate Governance Committee

Each member of our Nominating and Corporate Governance Committee has been determined to be “independent” in accordance with our Nominating and Corporate Governance Committee charter and the applicable NYSE rules.

| 15 | 2019 Proxy Statement |

The Board of Directors and Certain Governance Matters(continued)

|

The Nominating and Corporate Governance Committee is responsible for, among other things:

| • | developing a set of governance principles applicable to the Company and overseeing the Company’s governance policies; |

| • | identifying, reviewing, assessing and making recommendations to the Board as to candidates to serve on the Board and its committees; |

| • | considering matters related to director independence and conflicts of interest; |

| • | recommending those to serve as committee chairpersons; and |

| • | overseeing the annual evaluation of the Board and management. |

Investment and Finance Committee

The Board has established an Investment and Finance Committee composed solely of members of the Board. The Investment and Finance Committee is responsible for, among other things:

| • | overseeing matters related to the Company’s investments in real estate assets proposed by management; |

| • | overseeing the performance of the Company’s assets; |

| • | reviewing the Company’s investment and disposition policies, procedures, strategies and programs; and |

| • | reviewing the Company’s capital raising and other financing activities. |

Committee Charters and Corporate Governance Guidelines

Our commitment to good corporate governance is reflected in our Corporate Governance Guidelines, which describe our Board’s views and policies on a wide range of governance topics. These Corporate Governance Guidelines are reviewed periodically by our Nominating and Corporate Governance Committee and, to the extent deemed appropriate in light of emerging practices, revised accordingly upon recommendation to and approval by our Board.

Our Corporate Governance Guidelines, Audit Committee charter, Compensation Committee charter, Nominating and Corporate Governance Committee charter, Investment and Finance Committee charter, and other corporate governance information are available on our website at www.invitationhomes.com under “About Us”—“Investors”—“Corporate Governance”—“Governance Documents.” Any stockholder may also request them in print, without charge, by contacting the Corporate Secretary of Invitation Homes Inc., 1717 Main Street, Suite 2000, Dallas, Texas 75201.

Executive sessions, which are meetings of thenon-management members of the Board, are regularly scheduled throughout the year. In addition, at least once a year, the independent directors meet in a private session that excludes management and directors who have not been determined independent. At each of these meetings, thenon-management and independent directors in attendance, as applicable, will determine which member will preside at such session.

Code of Business Conduct and Ethics

We maintain a Code of Business Conduct and Ethics (the “Code of Conduct”) that is applicable to all of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions which is posted on our website at www.invitationhomes.com under “About Us”—“Investors”—“Corporate Governance”—“Governance Documents.” Our Code of Conduct sets forth our policies and expectations on a number of topics, including, but not limited to, conflicts of interest, compliance with laws, use of our assets and business conduct and fair dealing. Our Code of Conduct is a “code of ethics,” as defined by Item 406 of RegulationS-K promulgated by the SEC. We intend to make any legally required disclosures regarding amendments to, or waivers of, provisions of our Code of Conduct on our website rather than by filing a Current Report on Form8-K and within the time period required under applicable rules and regulations.

| 2019 Proxy Statement | 16 |

The Board of Directors and Certain Governance Matters(continued)

|

We face various forms of risk in our business ranging from broad economic, housing market, and interest rate risks, to more specific factors, such as credit risk related to our residents,re-leasing of properties and competition for properties. See Part I. Item 1A. “Risk Factors” in our Annual Report on Form10-K for the fiscal year ended December 31, 2018 (the “2018 Form10-K”). Our Board believes that effective risk management involves our entire corporate governance framework. Both management and the Board have key responsibilities in managing risk throughout the Company. The Board has overall responsibility in the oversight of risk management related to the Company and its business. A fundamental part of risk oversight is not only understanding the material risks a company faces and the steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The Board is supported in its risk oversight function by its Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Investment and Finance Committee. Each of these committees regularly meets with and reports to the Board. Management is responsible for identifying material risks, implementing appropriate risk management strategies, integrating risk management into our decision-making process and ensuring that information with respect to material risks is transmitted to senior executives and the Board. Members of the Board regularly meet with members of management and other key personnel who advise the Board on areas of enterprise risk, the Company’s risk mitigation and response strategies and any incidents that have arisen.

| 17 | 2019 Proxy Statement |

The Board of Directors and Certain Governance Matters(continued)

|

The table below shows the Board’s and management’s key responsibilities in managing and overseeing risk throughout the Company.

Risk Oversight Responsibilities

Board

| ||||||||

Risk Areas Strategic • Reputation • Market Dynamics • Acquisitions & Dispositions

Operational • Sales & Marketing • Service & Delivery • Information Systems & Cybersecurity • Infrastructure & Assets • Hazards & Weather • People

Financial • Financial Reporting & Internal Controls • Capital Structure • Market • Liquidity & Credit • Tax

Legal, Regulatory & Compliance • Environmental • Social • Governance | Responsibilities

• Overall oversight of the risk management process • Development of business strategy and major resource allocation • Leadership of management succession planning • Business conduct and compliance oversight • Receipt of regular reports from Board committees on specific risk oversight responsibilities

| |||||||

Board Committees

| ||||||||

| Audit | Compensation |

Nominating and Corporate Governance

|

Investment and Finance

| |||||

• Oversight of enterprise risk management activities • Oversight of accounting and financial reporting • Oversight of integrity of financial statements • Oversight of compliance with legal and regulatory requirements applicable to accounting and financial reporting processes • Oversight of the performance of internal audit function • Oversight of the effectiveness of internal controls • Oversight of registered public accounting firm’s qualifications, performance and independence

|

• Oversight of compensation-related risks and overall philosophy, as further described under “Other Matters—Risk Mitigation” in our Compensation Discussion and Analysis below • Oversight of regulatory compliance with respect to compensation matters |

• Overall corporate governance leadership • Provides recommendations regarding Board and Committee composition • Board succession planning • Oversight of regulatory compliance and corporate governance initiatives • Oversight of the evaluation of the Board and management |

• Oversight of asset portfolio and potential acquisitions and divestitures • Oversight of investment and financing policies and practices • Review of proposed equity and debt transactions, swaps and hedging transactions • Overall oversight of finance requirements, plans and strategies | |||||

Management

| ||||||||

Responsibilities

• Identify material risks • Implement appropriate risk management strategies • Integrate risk management into our decision making process • Ensure that information with respect to material risks is transmitted to senior executives and the Board

| ||||||||

| 2019 Proxy Statement | 18 |

The Board of Directors and Certain Governance Matters(continued)

|

Environmental, Social and Governance Initiatives

Our Board believes that integrating environmental, social and governance (“ESG”) initiatives into our strategic business objectives is critical to our long-term success. Through our integrated and ongoing approach to sustainability and corporate responsibility, we seek to drive positive change and create value for our stakeholders.

Our Mission, Vision and Values Our Associates Our Vendors Corporate Governance and Ethics Environment Our Communities and Residents

Our mission statement “Together with you, we make a house a home” reflects our commitment to a resident-centric business philosophy. The way we carry out that mission on a daily basis is reflected in our company’s core values: Unshakable Integrity; Genuine Care; Continuous Excellence; and Standout Citizenship. Our vision is to be the premier choice in home leasing by continuously enhancing our residents’ living experiences and communities.

Our logo represents four pillars: home; neighborhood; community; and Invitation Homes.

home neighborhood community invitation homes

We believe in doing business with a purpose. Since our inception, we have operated to benefit our residents, our associates and our communities by deeply embedding our values, ethics and integrity into all that we do. The way we think, act, partner and execute is guided by our values. Our Code of Conduct explains how we integrate our purpose, mission and values into our daily decisions. It demonstrates our commitment to our stakeholders to be a responsible corporate citizen and a good business partner.

| 19 | 2019 Proxy Statement |

The Board of Directors and Certain Governance Matters(continued)

|

Our Communities and Residents

We recognize that the vitality of our business is directly linked to the vitality of the communities in which we operate. As of December 31, 2018, we and our predecessors have invested approximately $2.2 billion in the upfront renovation of homes in our portfolio. During the year ended December 31, 2018, we invested approximately $35,000 per home in the upfront renovation of homes. We believe that the investments we make and the high standards to which we renovate and maintain our homes benefit our communities, creating jobs and improving the overall quality of life for our residents and their neighbors. We believe such investments improve our relationships with local communities and home owners associations and enhance our brand recognition and loyalty. By offering quality homes in attractive neighborhoods, we believe we give residents the choice to lease a home in a community that may not have otherwise been attainable.

Invitation Homes puts residents first with ourbest-in-class ProCare Service property management platform. From welcoming residents with anin-person home orientation atmove-in, to making residents’ lives easier with our Smart Home technology offering, to providingmid-lease customer care visits and 24/7 maintenance service, we strive to provide our residents with a worry-free leasing lifestyle.

We also take pride in giving back to our communities through philanthropic initiatives, such as our “There’s No Place Like Home” scholarship contest. In addition, Invitation Homes associates receive 20 hours of paid time off to volunteer in their communities each year. They have used this time to build homes and shelters, contribute and package food and school supplies and provide other needed support in their communities.

We take pride in consistently providing residents with friendly and professional service. That is why we ask our residents for their feedback after every interaction. Our associates’ compensation is linked to the quality of resident care they provide, and we recognize standout resident service with quarterly Genuine Care awards.

Our Associates

Our associates are our most precious resource. From our focus on health and safety to our support for a diverse and inclusive culture, we treat each other fairly and act with honesty, integrity and respect. We are committed to the professional development and career advancement of our associates. All associates can take advantage ofin-house training courses and other programs administered by our dedicated Learning and Development team that helps prepare associates to be successful in their current positions as well as in their broader careers.

We believe passionately that diverse and inclusive companies make for more innovative, engaged and happy teams. Our organization makes it a priority to celebrate diversity and cultivate a culture of inclusion. Invitation Homes is proud to be an equal opportunity workplace dedicated to pursuing and hiring a diverse workforce.

Our company’s workplace wellness initiatives, such as wellness challenges and onsite health and wellness services (e.g., flu shots, massages, yoga classes) promote healthy habits and demonstrate managerial support for associates’ physical and emotional well-being. Invitation Homes is committed to employee health and welfare by providing a competitive benefits package, including health, dental, vision, term life and disability insurance.

Corporate Governance and Ethics

We believe it is critically important to maintain a corporate culture that demands integrity and reflects ethical values. Our Code of Conduct is a tool to help guide us as we collaborate to accomplish our goals together, while holding ourselves individually responsible for our work and accountable for our actions. Every Invitation Homes associate, regardless of location or position in the Company, has an obligation to follow the Code of Conduct every day, without exception. See “The Board of Directors and Certain Governance Matters—Code of Business Conduct and Ethics” for more information about our Code of Conduct.

Invitation Homes is committed to sound corporate governance practices and adherence to the highest ethical standards. We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Our commitment to good corporate governance is reflected in our Corporate Governance Guidelines, which describe the views and policies of our Board. See “The Board of Directors and Certain Governance Matters—Our Corporate Governance” for more information about our corporate governance practices.

Environment

At Invitation Homes, we strive to create a better way to live and be a force for positive change, and we are committed to efforts that make us more innovative and sustainable. Protecting the environment is critically important to us, and our

| 2019 Proxy Statement | 20 |

The Board of Directors and Certain Governance Matters(continued)

|

sustainability initiatives help limit the carbon footprints and overall environmental impact of our homes. Those initiatives include: Smart Home technology that enables maintenance technicians and residents to control thermostats remotely and reduce energy consumption; standards of performance that require the use of energy-efficient lighting and appliances; and supply chain management that focuses on our vendors’ sustainability practices and procedures. We believe that we can respond to local and global environmental challenges by combining our strengths in sustainability, innovation and partnership.

Our Vendors

Everyone who works at or with Invitation Homes should feel confident about our high ethical standards, our honesty, and our integrity. Our Vendor Code of Conduct is an extension of our values to Company vendors and serves to highlight our commitment to ethical business practices and regulatory compliance. The Vendor Code of Conduct is posted on our website www.invitationhomes.com under “About Us”—“Corporate Citizenship.”

Corporate social responsibility is vitally important to who we are as a company. We support social and environmental initiatives, particularly in our operations and communities. Our Corporate Social Responsibility Policy is posted on our website www.invitationhomes.com under “About Us”—“Corporate Citizenship” and applies to all activities undertaken by or on behalf of Invitation Homes anywhere we operate. This policy encompasses areas of community and associate engagement, human rights, corporate governance and ethics, and environmental initiatives, that reflect existing and emerging standards of corporate social responsibility.

The Nominating and Corporate Governance Committee is responsible for recommending to the Board nominees for election as director, and the Board is responsible for selecting nominees for election. This nomination process occurs as part of the nomination of the slate of directors for election at our annual meeting of stockholders and at times when there is a vacancy on the Board or other need to add a director to the Board.

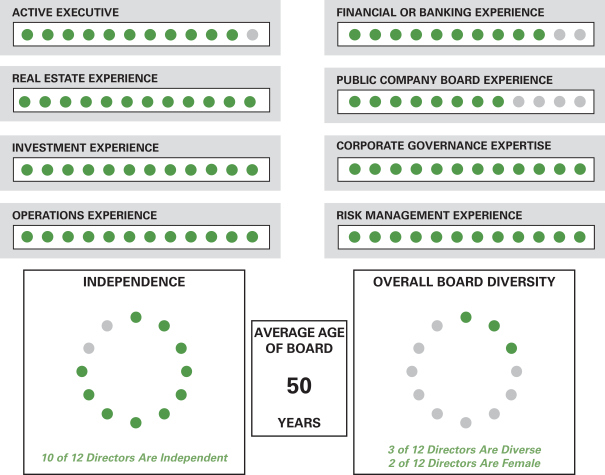

As part of this nomination process, the Nominating and Corporate Governance Committee weighs the characteristics, experience, independence and skills of potential candidates for election to the Board and, in considering such candidates, also assesses the size, composition and combined expertise of the Board and the extent to which the candidate would fill a present need on the Board. As the application of these factors involves the exercise of judgment, the Nominating and Corporate Governance Committee does not have a standard set of fixed qualifications that is applicable to all director candidates, but rather takes into account all factors it considers appropriate such as the individual’s relevant career experience, strength of character, judgment, familiarity with the Company’s business and industry, independence of thought, an ability to work collegially, diversity of background, existing commitments to other businesses, potential conflicts of interest with other pursuits, legal considerations, corporate governance background, financial and accounting background, executive compensation background, relevant industry experience and technical skills and the size, composition and combined expertise of the existing Board. Although in identifying prospective director candidates, our Nominating and Corporate Governance Committee and the Board consider diversity of viewpoints, background and experiences, the Board does not have a formal diversity policy.

The Nominating and Corporate Governance Committee may seek referrals and/or receive recommendations from other members of the Board, management, stockholders and other sources, including third party recommendations. The Nominating and Corporate Governance Committee may also, but need not, retain a search firm to assist it in identifying candidates to serve as directors of the Company. The Nominating and Corporate Governance Committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation. When considering director candidates, the Nominating and Corporate Governance Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance the Board’s effectiveness.

In connection with its annual recommendation of a slate of nominees for election at the annual meeting, the Nominating and Corporate Governance Committee also may assess the contributions of those directors recommended forre-election in the context of the Board evaluation process and other perceived needs of the Board. When considering whether the directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of our business and structure, the Board focused primarily on the information discussed in each of the board member’s biographical information set forth above. In connection with its recommendation of a slate of nominees for election at the Annual Meeting, our Nominating and Corporate Governance Committee and the Board also considered and determined that Mr. Sternlicht’s service on more

| 21 | 2019 Proxy Statement |

The Board of Directors and Certain Governance Matters(continued)

|

than two public company boards of directors, in addition to the board of directors of Starwood Property Trust, Inc., where he serves as the Chief Executive Officer, does not impair his ability to effectively serve on our Board.