Bank of America Merrill Lynch Global Real Estate Conference September 10, 2019 Together with you, we make a house a home.

Disclaimer This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which include, but are not limited to, statements related to the Company’s expectations regarding the anticipated benefits of the merger with Starwood Waypoint Homes, the performance of the Company’s business, its financial results, its liquidity and capital resources, and other non-historical statements. In some cases, you can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "could," "seeks," "projects," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including, among others, risks associated with achieving expected revenue synergies or cost savings from the merger, risks inherent to the single-family rental industry sector and the Company’s business model, macroeconomic factors beyond the Company’s control, competition in identifying and acquiring the Company’s properties, competition in the leasing market for quality residents, increasing property taxes, homeowners' association fees and insurance costs, the Company’s dependence on third parties for key services, risks related to evaluation of properties, poor resident selection and defaults and non-renewals by the Company’s residents, performance of the Company’s information technology systems, and risks related to the Company’s indebtedness. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Additional factors that could cause the Company’s results to differ materially from those described in the forward-looking statements can be found under the section entitled "Part I. Item 1A. Risk Factors," of the Annual Report on Form 10-K for the fiscal year ended December 31, 2018, filed with the Securities and Exchange Commission (the "SEC"), as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at http://www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the Company’s filings with the SEC. The forward- looking statements speak only as of the date of this presentation, and we expressly disclaim any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except to the extent otherwise required by law. 2

Southern California I. INVITATION HOMES INVESTMENT HIGHLIGHTS 3

Invitation Homes Investment Highlights Leading investor and operator of over 80k homes in a sector with outsized growth prospects • Strong household formation and low supply growth; Millennials reaching age where needs align with single-family housing Outsized Growth • Resident turnover rates have improved year-over-year for the past 6 consecutive quarters Fundamentals • Carrying high occupancy out of peak leasing season, with rental rate growth continuing to outpace prior year Competitive • High-growth market footprint (70% of revenue from Western U.S. and Florida), with household growth >2x the US average Advantages in • Scale and market density drives efficiency, with over 4,700 homes per market on average (difficult to replicate today) Unique Portfolio and Platform • Proactive “ProCare” approach to resident service, leveraging combination of local in-house expertise and centralized tools • Opportunity for platform and process refinements to further increase efficiency Long Runway for Further Value • Developing initiatives to offer expanded ancillary services and upgraded renovation options to residents Creation • Recycling capital to enhance portfolio, while simultaneously progressing toward investment grade balance sheet • Stickiness of residents and affordability versus homeownership enhance stability of demand throughout economic cycles Attractive SFR • Granular nature of portfolio diversifies risk and allows for investment management on a unit-by-unit basis Risk Profile • Highly liquid transaction market; Flexibility to sell to investors or owner-occupants mitigates risk and enhances value • Part of the housing affordability solution, helping families live in great neighborhoods without the cost of homeownership Serving our • ~$2B invested in renovation to enhance residents’ experience, revitalize communities, and support local vendors Communities • Smart Home technology reduces energy consumption at the same time it enhances residents’ experience ________________________________________________ (1) Source: John Burns Real Estate Consulting (JBREC). 4

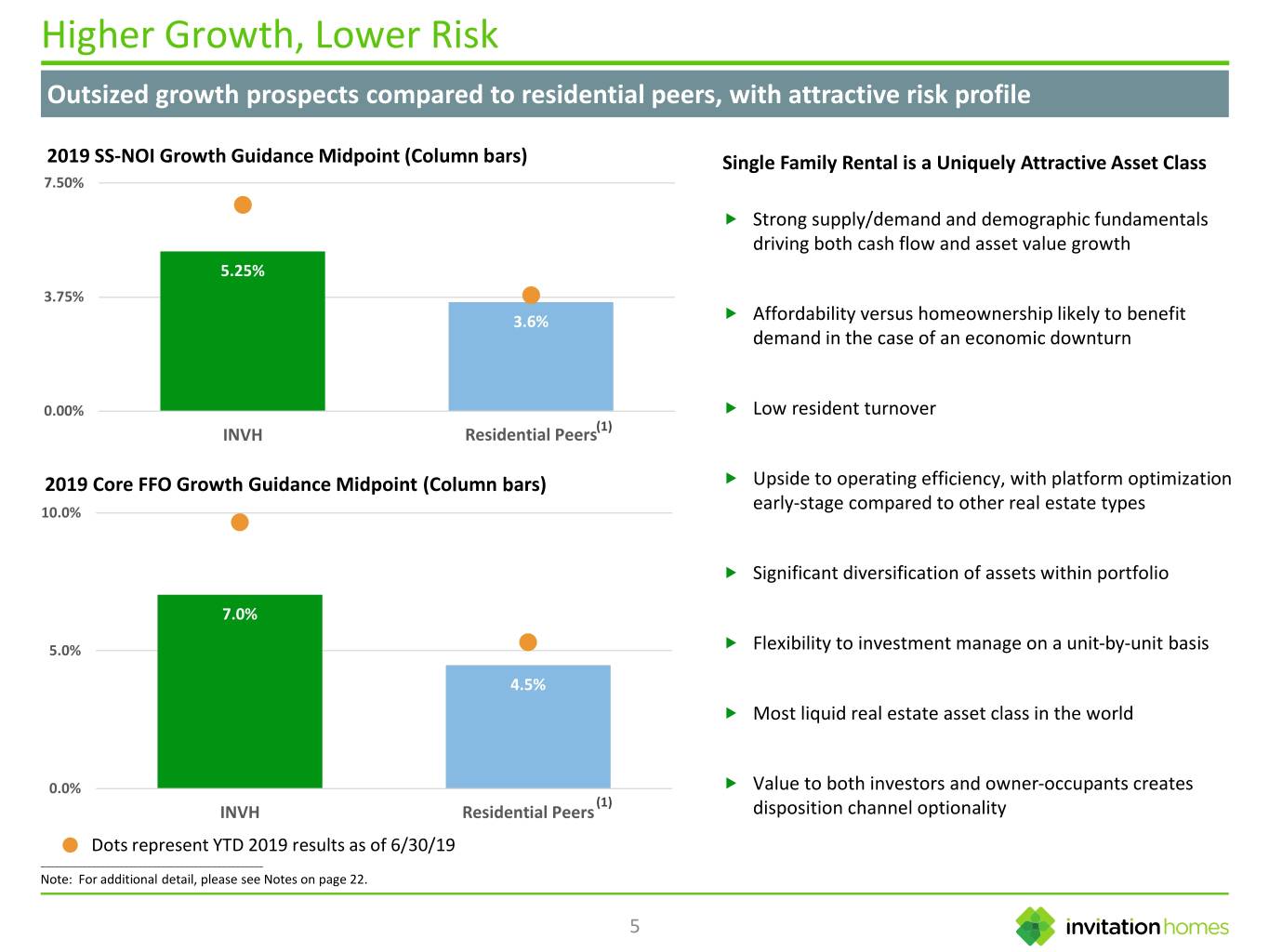

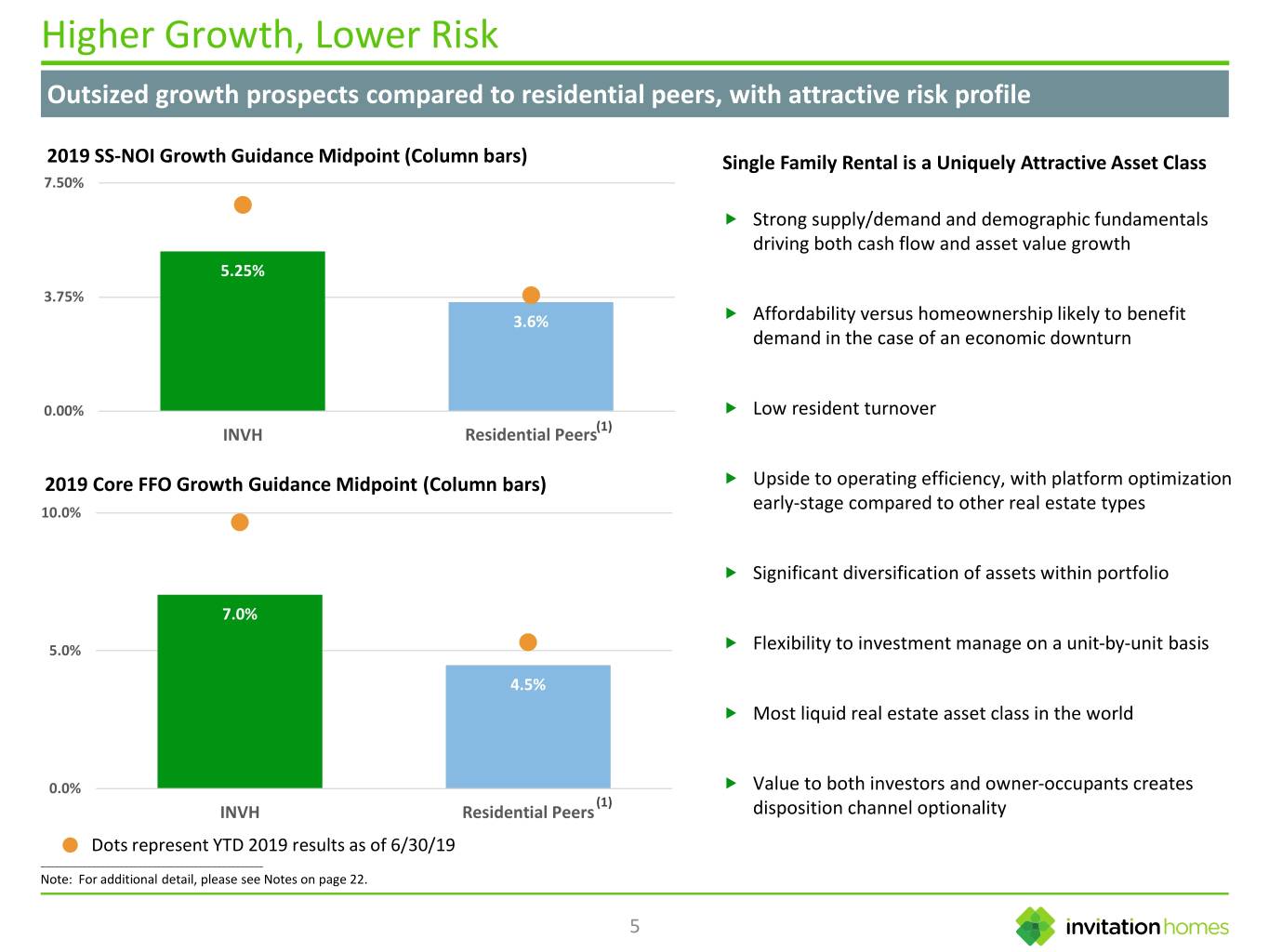

Higher Growth, Lower Risk Outsized growth prospects compared to residential peers, with attractive risk profile 2019 SS-NOI Growth Guidance Midpoint (Column bars) Single Family Rental is a Uniquely Attractive Asset Class 7.50% Strong supply/demand and demographic fundamentals driving both cash flow and asset value growth 5.25% 3.75% 3.6% Affordability versus homeownership likely to benefit demand in the case of an economic downturn 0.00% Low resident turnover INVH Residential Peers(1) 2019 Core FFO Growth Guidance Midpoint (Column bars) Upside to operating efficiency, with platform optimization 10.0% early-stage compared to other real estate types Significant diversification of assets within portfolio 7.0% 5.0% Flexibility to investment manage on a unit-by-unit basis 4.5% Most liquid real estate asset class in the world 0.0% Value to both investors and owner-occupants creates (1) INVH Residential Peers disposition channel optionality Dots represent YTD 2019 results as of 6/30/19 ________________________________________________ Note: For additional detail, please see Notes on page 22. 5

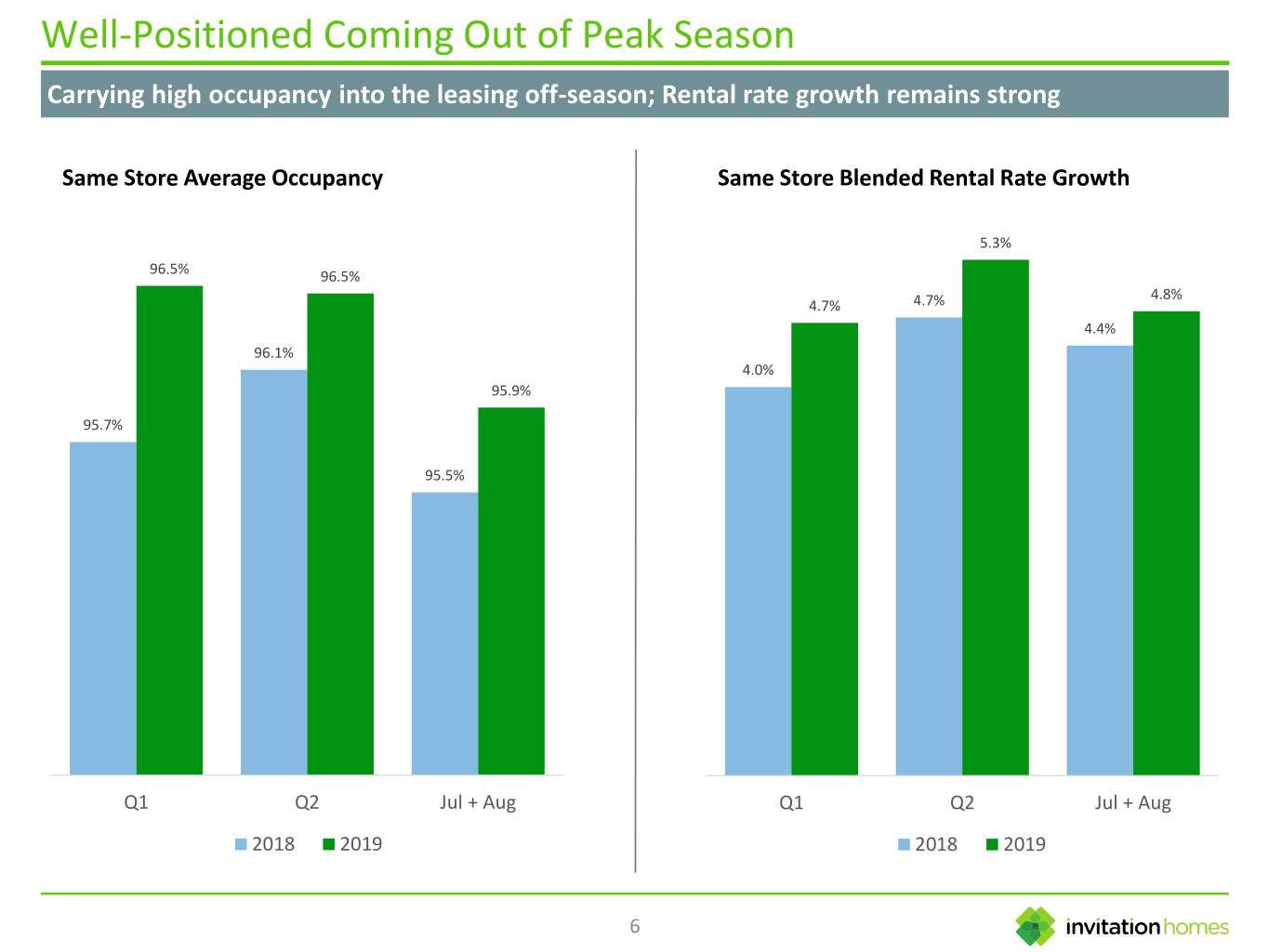

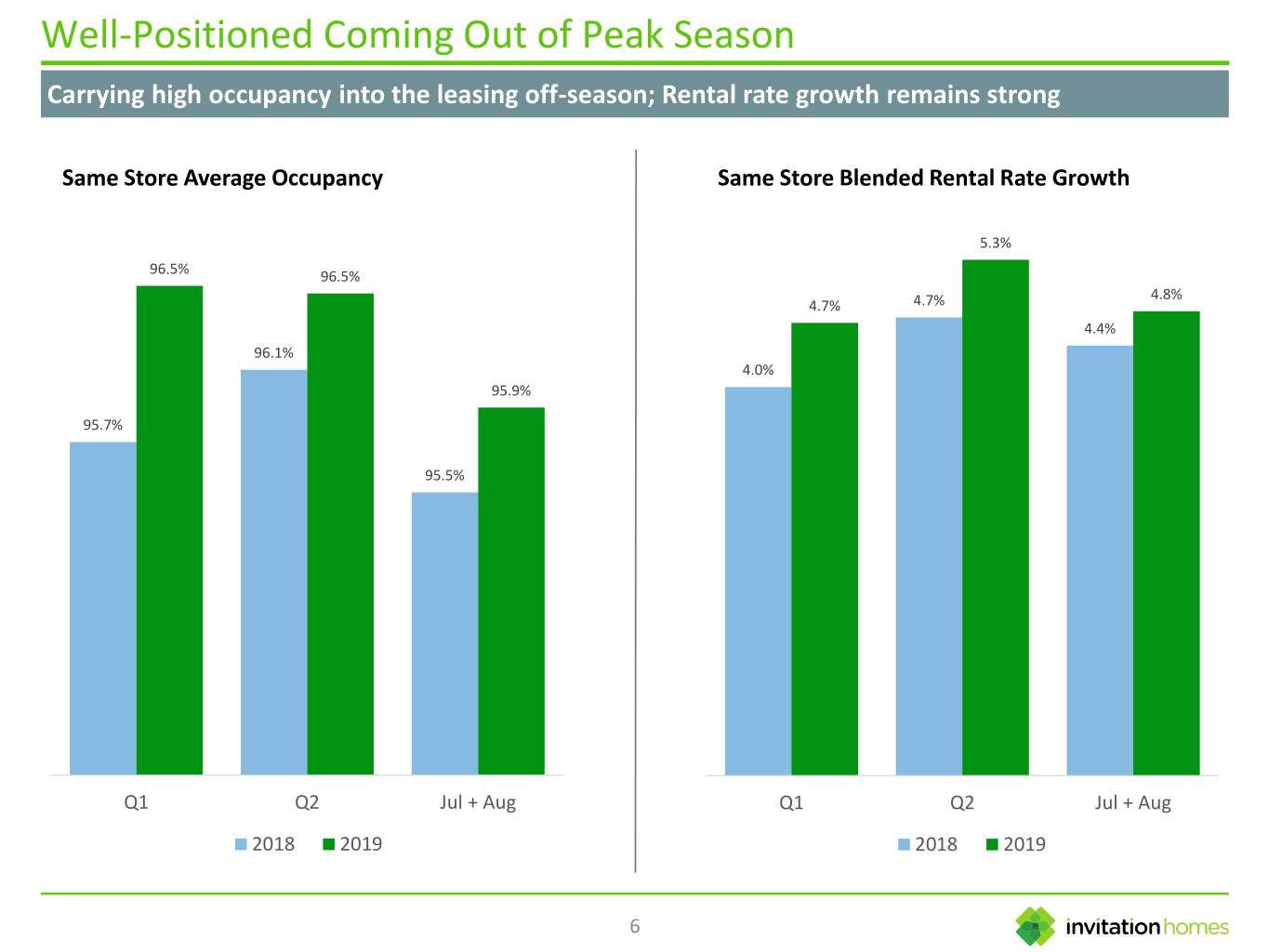

Well-Positioned Coming Out of Peak Season LeadingCarrying investor high occupancy and operator into the of overleasing 80k off homes-season; in aRental sector rate with growth outsized remains growth strong prospects Same Store Average Occupancy Same Store Blended Rental Rate Growth 5.3% 96.5% 96.5% 4.8% 4.7% 4.7% 4.4% 96.1% 4.0% 95.9% 95.7% 95.5% Q1 Q2 Jul + Aug Q1 Q2 Jul + Aug 2018 2019 2018 2019 6

Strong Leasing Results Continue Blended rent growth outpacing prior year Same Store Renewal Rental Rate Growth Same Store New Lease Rental Rate Growth 5.2% 5.4% 5.2% 4.8% 4.7% 4.9% 4.8% 4.8% 4.7% 3.8% 3.6% 2.5% Q1 Q2 Jul + Aug Q1 Q2 Jul + Aug 2018 2019 2018 2019 7

Premier Single-Family Portfolio Unmatched scale and density in high-growth locations; Recycling capital to enhance portfolio The IH Way: “Channel Agnostic, Location Specific” 70% of Revenue Generated Seattle in Western U.S. and 5% Florida Regions Minne- apolis >4,700 2% Northern Chicago Homes per Market California 4% 7% Denver on Average 3% Las Vegas Southern 3% Nashville Carolinas California 1% 5% 13% Phoenix >95% 7% Atlanta Dallas Jacksonville of Revenue from Markets 3% 13% 2% with >2,000 Homes Orlando Houston 7% 2% Tampa 10% South Florida 4.5% 13% Increase in YTD 2019 Percent of 2Q19 Core revenues Same Store Core Revenues 8

West is Best – Blended Rental Rate Growth by Market Western US and Florida footprint is a differentiating growth driver for Invitation Homes Seattle 8.4% Minne apolis 4.7% Northern Chicago California 2.6% 8.4% Denver 5.7% Las Southern Vegas 6.9% California Carolinas 7.6% Nashville 3.1% Phoenix 3.2% 8.2% Atlanta Dallas 5.4% 4.3% Jacksonville 4.1% Orlando Houston 5.7% 3.2% Tampa 3.9% South Florida 2.8% Figures represent 2Q19 Same Store blended rental rate growth Blended rental rate growth greater than 5.0% Blended rental rate growth between 3.0% and 5.0% Blended rental rate growth less than 3.0% Note: Circle sizes represent sizes of markets (percent of 2Q19 Core revenues) 9 Confidential

West is Best – Average Occupancy by Market Strong occupancy across all markets Seattle 96.9% Minne apolis 97.2% Northern Chicago California 97.9% 97.4% Denver 96.6% Las Southern Vegas 97.8% California Carolinas 96.3% Nashville 96.3% Phoenix 95.2% 97.3% Atlanta Dallas 96.1% 95.4% Jacksonville 96.1% Orlando Houston 96.6% 97.3% Tampa 96.2% South Florida 95.5% Figures represent 2Q19 Same Store average occupancy Average occupancy greater than 96.0% Average occupancy between 95.5% and 96.0% Average occupancy less than 95.5% Note: Circle sizes represent sizes of markets (percent of 2Q19 Core revenues) 10 Confidential

Best-in-Class Operating & Asset Management Platform Innovative ProCare Service Platform drives resident loyalty and operating efficiency The IH Way: “Eyes on Assets” • Proactive approach to resident care and maintenance • Local resident service, leasing, and asset/investment management, with centralized oversight and tools • Collaboration between Operations and Investment Teams to identify opportunities and drive consistency • Enhancing efficiency through better technology, in- house technician utilization, and route optimization Trailing Twelve Months Turnover Rate (Same Store) 34.5% 33.8% 32.4% 31.0% 30.1% 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 11

Refining Portfolio and Pursuing Investment Grade Balance Sheet Maintaining an opportunistic eye toward acquisitions and dispositions while continuing to delever Capital Recycling to Enhance Portfolio Making Progress Towards Investment Grade Compelling market opportunity to prune portfolio and re-deploy Safe balance sheet today capital in homes with higher expected long-term total return • No debt maturing prior to 2022 • $273M of acquisitions and $360M of dispositions YTD • Over 90% of debt fixed or swapped to fixed rate through through June 2019 2031 • Portfolio scale enables more selective asset management • ~50% of assets unencumbered decisions Continuing to open new financing channels, with first loan from • Leveraging combination of local in-house investment teams life insurance company in 2Q19 and centralized technology to source accretive acquisitions Prioritizing excess cash for debt repayment Opportunistic and disciplined approach to bulk transactions 6/30/19 6/30/18 Pro Forma(1) • Abundant private capital and small-to-midsized institutional portfolios create opportunity for selective bulk transactions 9.3x to supplement one-off acquisition and disposition activity 8.4x Net Debt to Adjusted EBITDAre • 2H18 and 1Q19 bulk sales: – $248M of dispositions across multiple bulk transactions – Average rents ~20% below portfolio average • 1H19 bulk acquisition: 5.6 5.4 – $115M acquisition from mid-sized institutional operator Weighted Average Maturity (Yrs) – Attractive upside to in-place rents and NOI margins 12

Seattle II. COMPELLING INDUSTRY FUNDAMENTALS 13

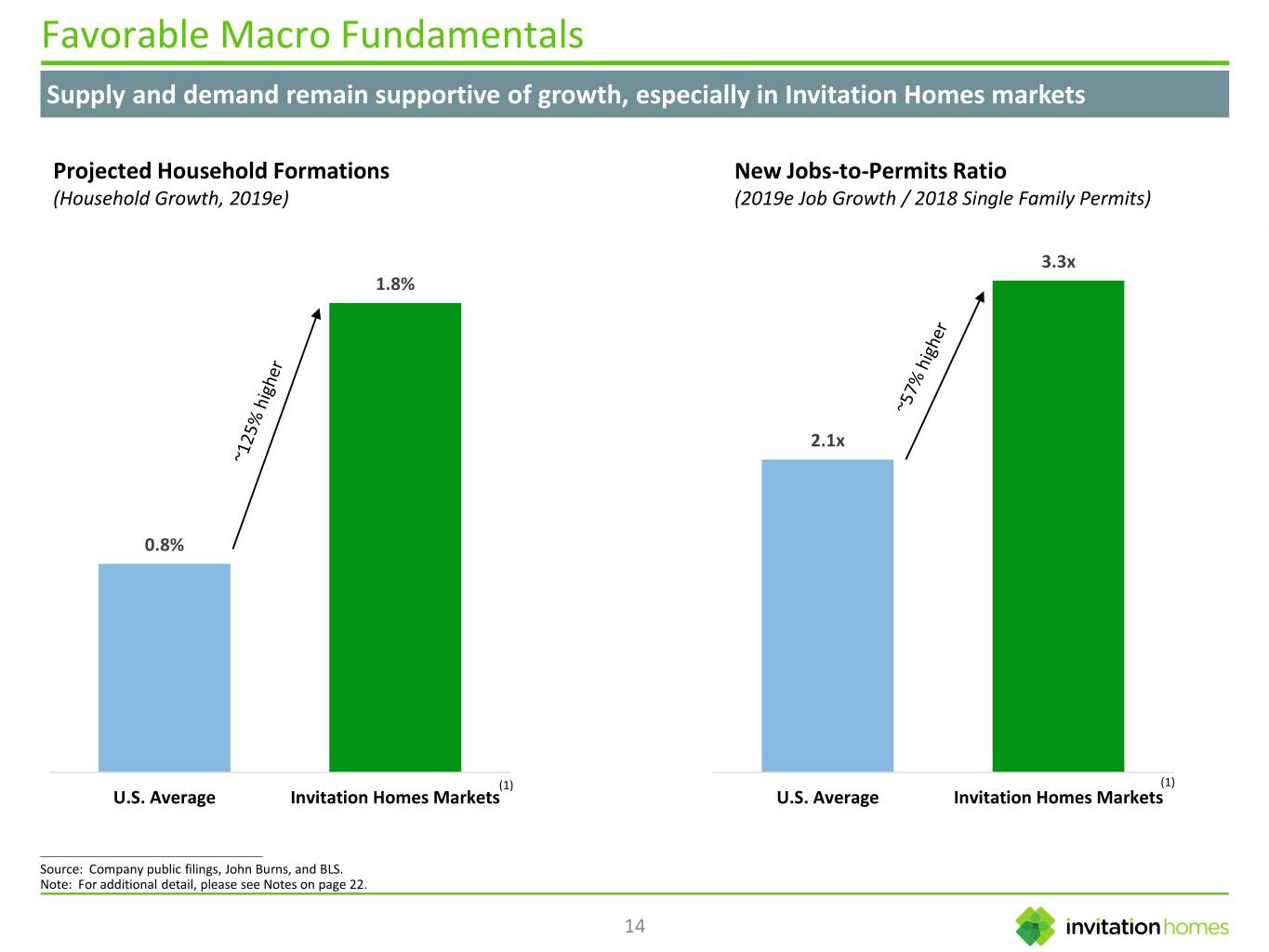

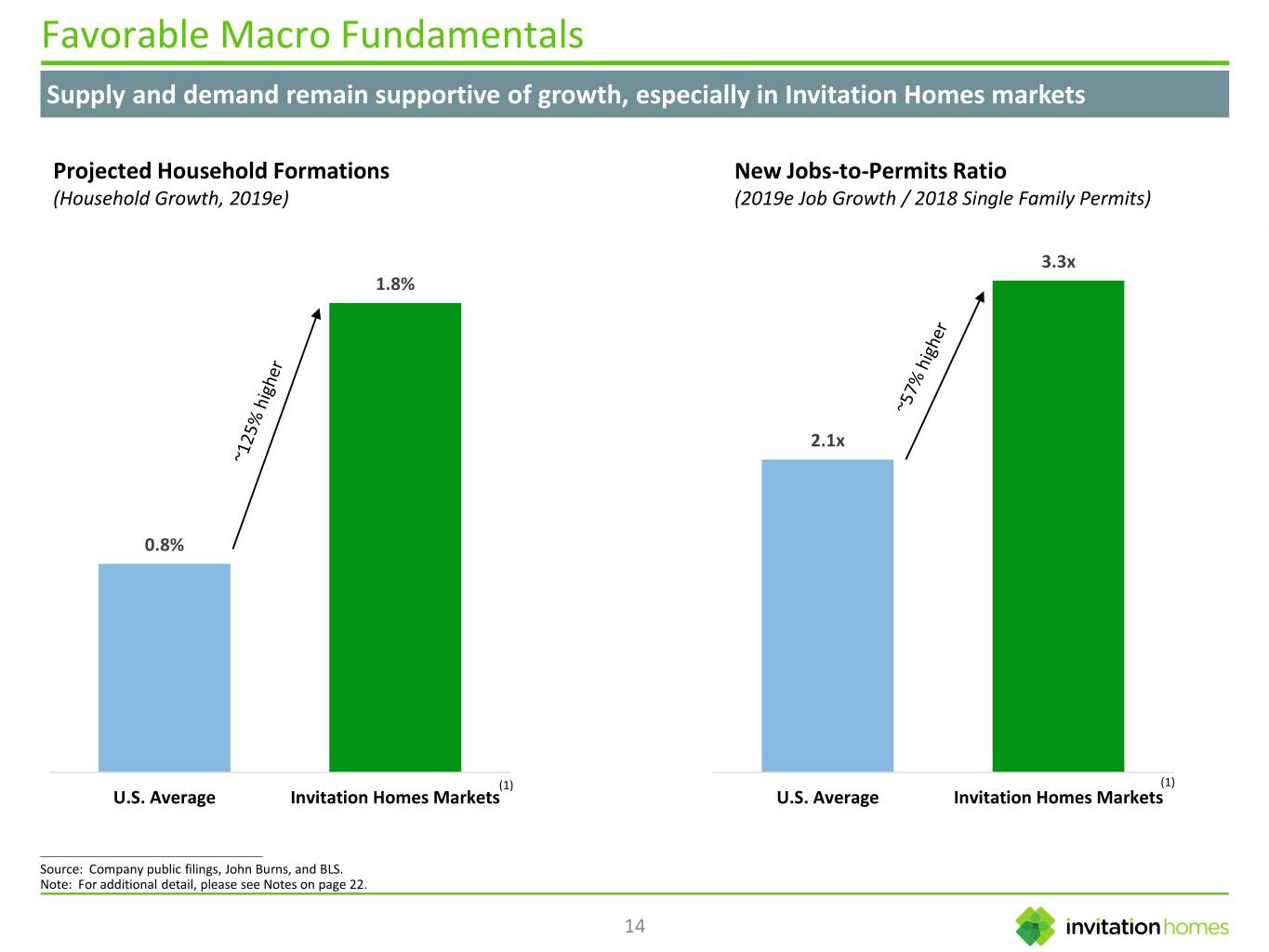

Favorable Macro Fundamentals Supply and demand remain supportive of growth, especially in Invitation Homes markets Projected Household Formations New Jobs-to-Permits Ratio (Household Growth, 2019e) (2019e Job Growth / 2018 Single Family Permits) 3.3x 1.8% 2.1x 0.8% (1) (1) U.S. Average Invitation Homes Markets U.S. Average Invitation Homes Markets ________________________________________________ Source: Company public filings, John Burns, and BLS. Note: For additional detail, please see Notes on page 22. 14

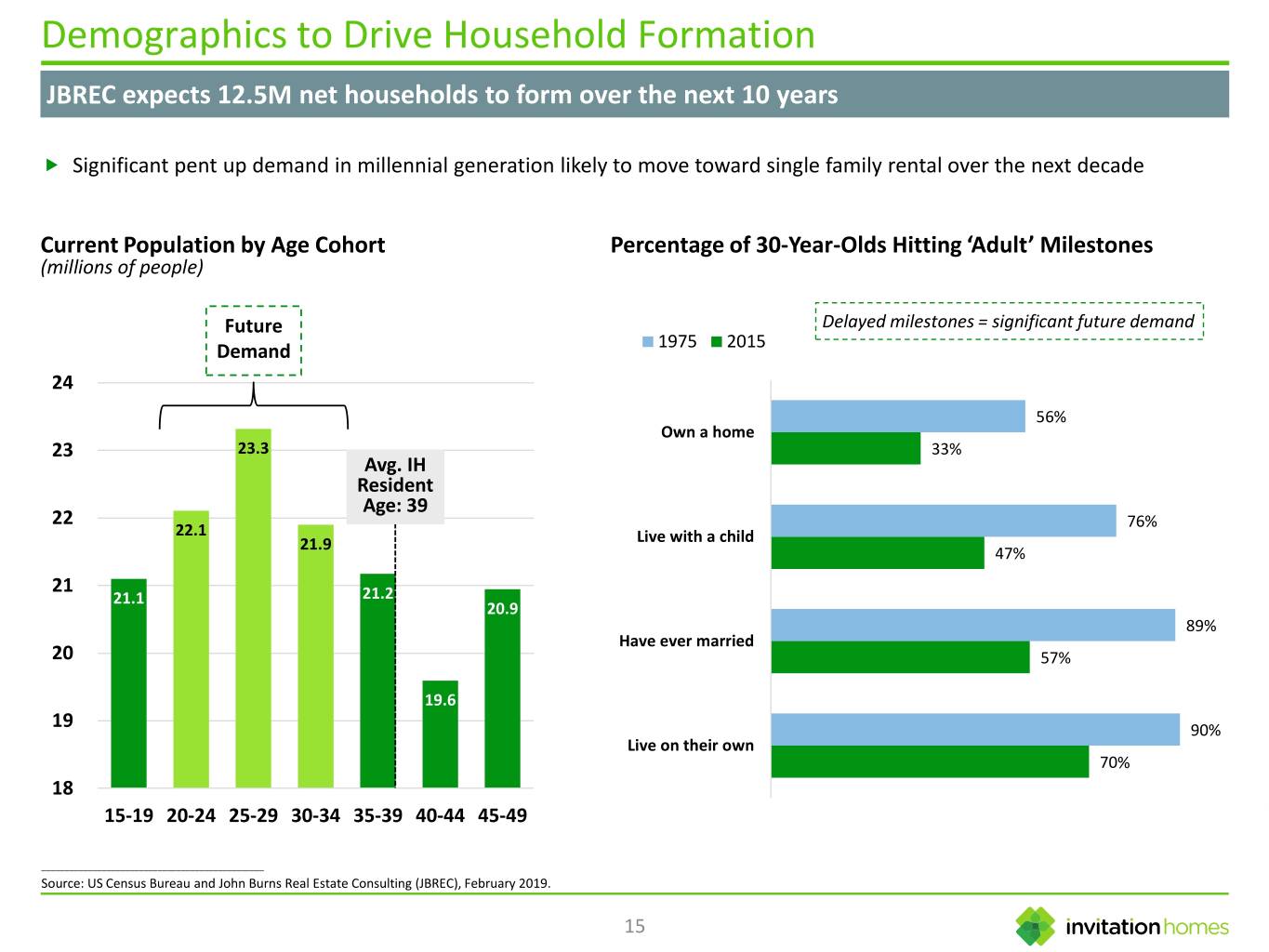

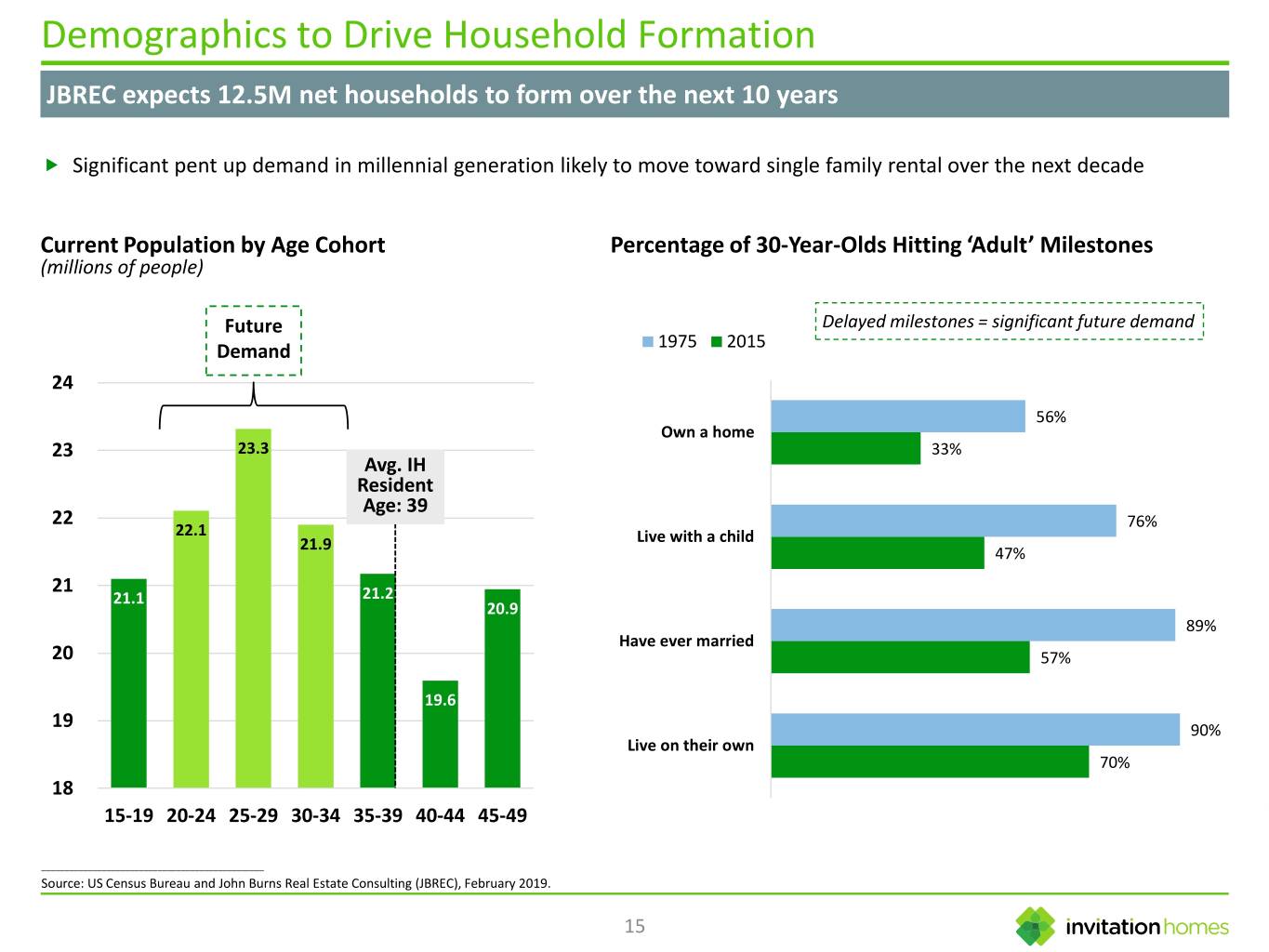

Demographics to Drive Household Formation JBREC expects 12.5M net households to form over the next 10 years Significant pent up demand in millennial generation likely to move toward single family rental over the next decade Current Population by Age Cohort Percentage of 30-Year-Olds Hitting ‘Adult’ Milestones (millions of people) Future Delayed milestones = significant future demand Demand 1975 2015 24 56% Own a home 23 23.3 33% Avg. IH Resident Age: 39 22 76% 22.1 21.9 Live with a child 47% 21 21.1 21.2 20.9 89% Have ever married 20 57% 19.6 19 90% Live on their own 70% 18 15-19 20-24 25-29 30-34 35-39 40-44 45-49 ________________________________________________ Source: US Census Bureau and John Burns Real Estate Consulting (JBREC), February 2019. 15

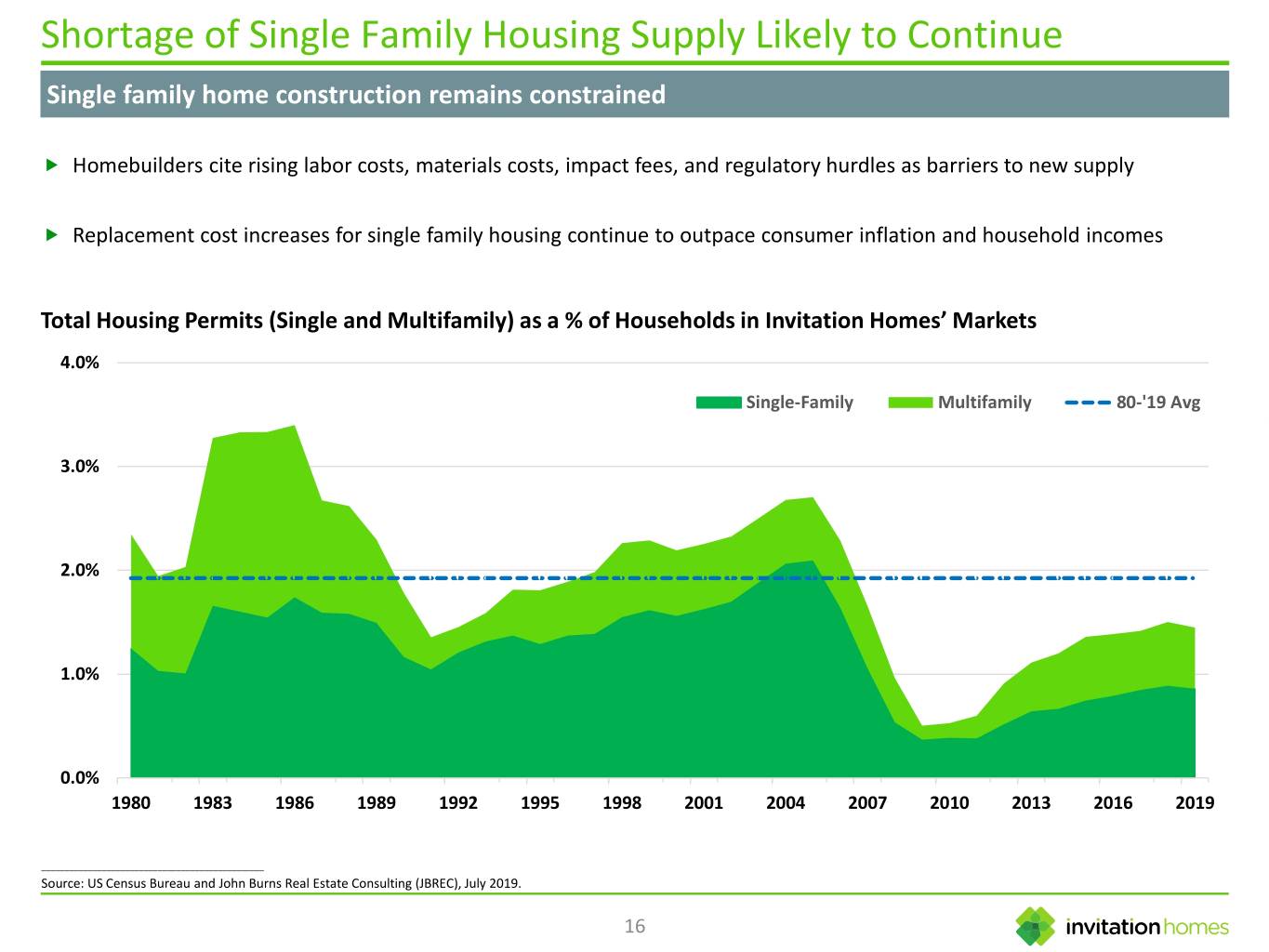

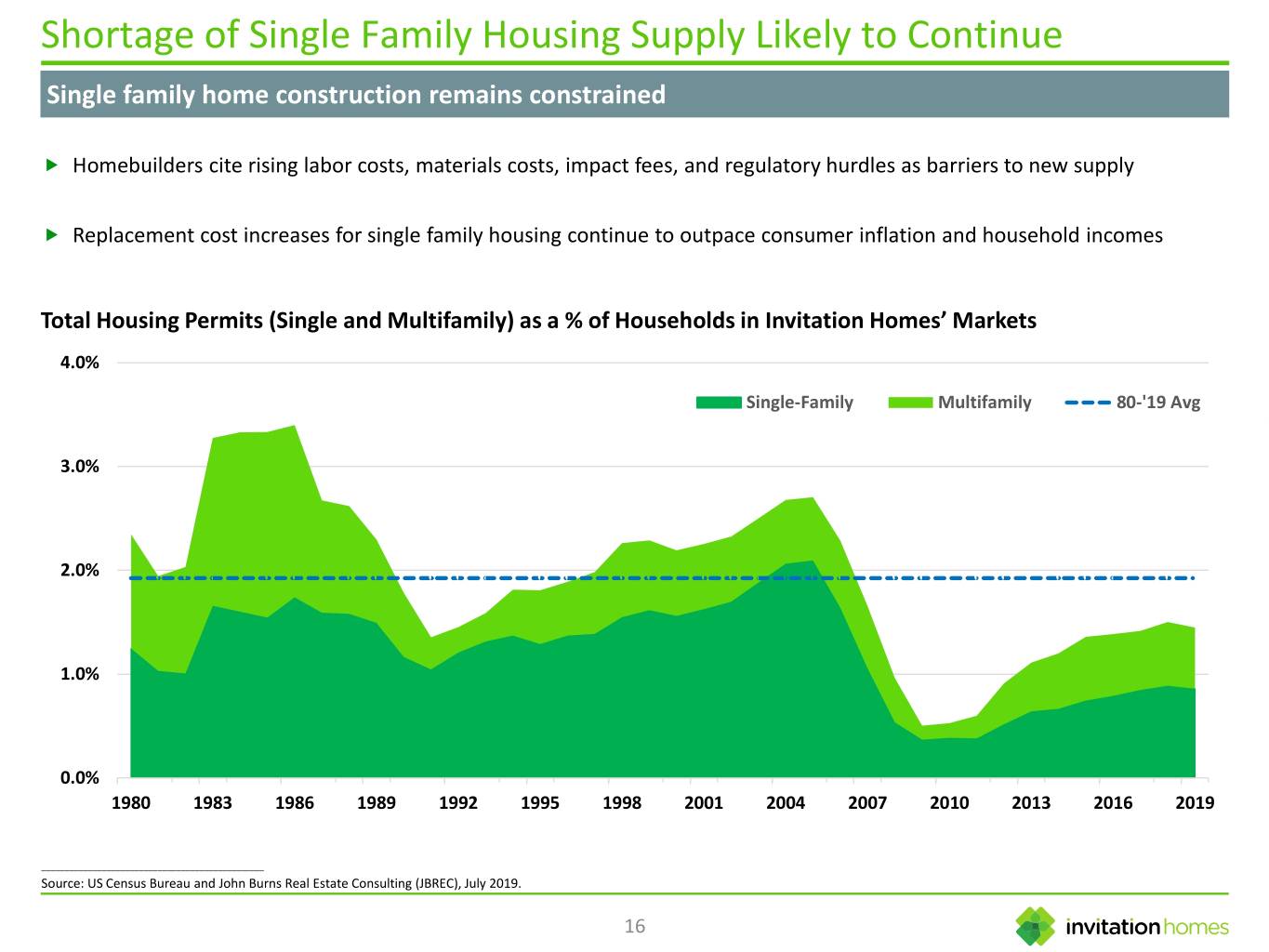

Shortage of Single Family Housing Supply Likely to Continue Single family home construction remains constrained Homebuilders cite rising labor costs, materials costs, impact fees, and regulatory hurdles as barriers to new supply Replacement cost increases for single family housing continue to outpace consumer inflation and household incomes Total Housing Permits (Single and Multifamily) as a % of Households in Invitation Homes’ Markets 4.0% Single-Family Multifamily 80-'19 Avg 3.0% 2.0% 1.0% 0.0% 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 2016 2019 ________________________________________________ Source: US Census Bureau and John Burns Real Estate Consulting (JBREC), July 2019. 16

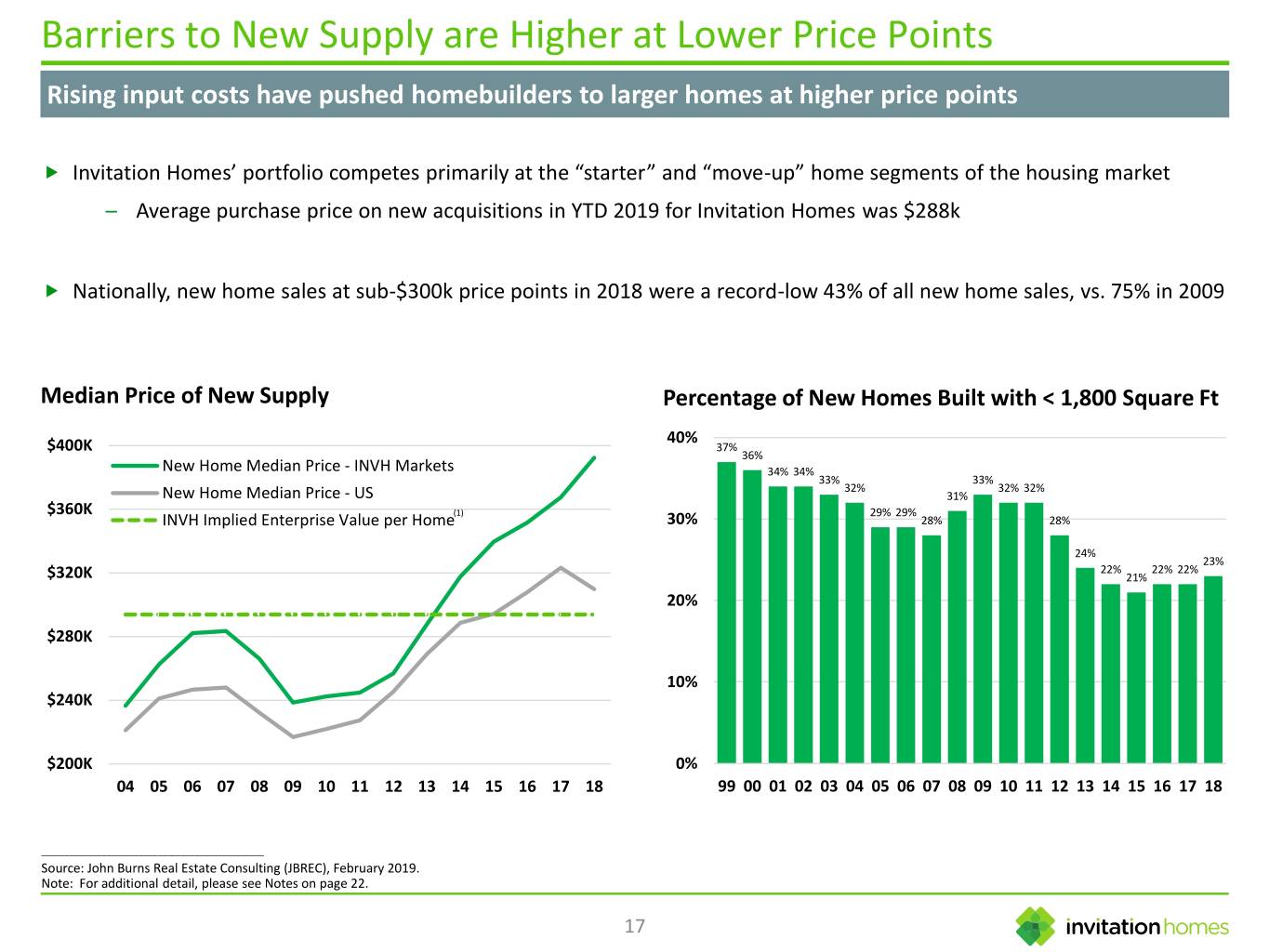

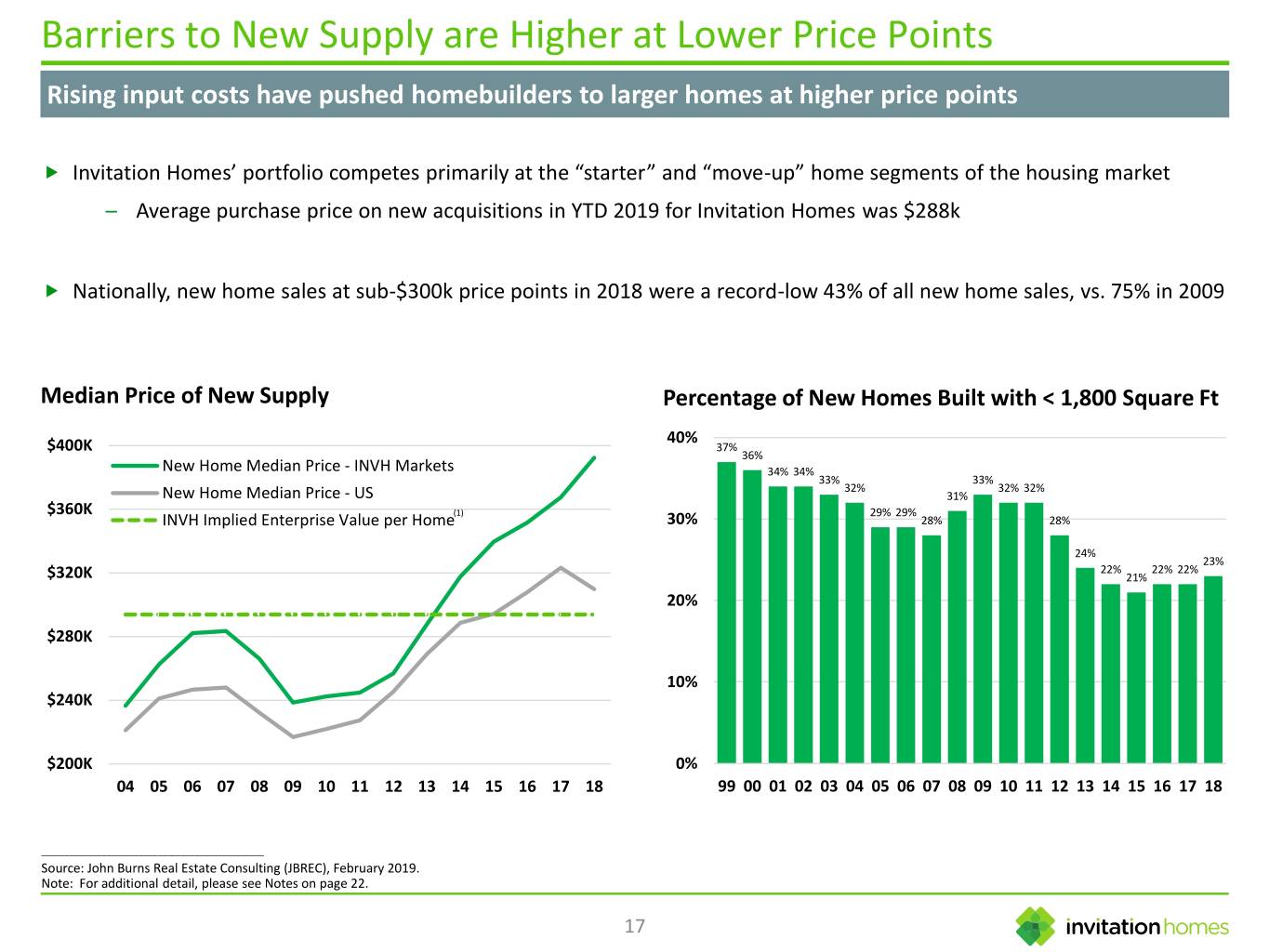

Barriers to New Supply are Higher at Lower Price Points Rising input costs have pushed homebuilders to larger homes at higher price points Invitation Homes’ portfolio competes primarily at the “starter” and “move-up” home segments of the housing market – Average purchase price on new acquisitions in YTD 2019 for Invitation Homes was $288k Nationally, new home sales at sub-$300k price points in 2018 were a record-low 43% of all new home sales, vs. 75% in 2009 Median Price of New Supply Percentage of New Homes Built with < 1,800 Square Ft 40% $400K 37% 36% New Home Median Price - INVH Markets 34% 34% 33% 33% 32% 32% 32% New Home Median Price - US 31% $360K (1) 29% 29% INVH Implied Enterprise Value per Home 30% 28% 28% 24% 23% 22% 22% 22% $320K 21% 20% $280K 10% $240K $200K 0% 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 ________________________________________________ Source: John Burns Real Estate Consulting (JBREC), February 2019. Note: For additional detail, please see Notes on page 22. 17

Denver III. THE INVITATION HOMES WAY – LEVERAGING OUR RESOURCES TO SERVE COMMUNITIES 18

Our Mission, Vision, and Values Mission Together with you, we make a house a home. Vision Values Unshakeable Integrity Continuous Excellence We hold ourselves accountable We always find a way to Be the premier choice in home leasing by to act with honesty, trust and innovate and deliver. continuously enhancing our residents’ respect. Standout Citizenship living experience. Genuine Care We strive to benefit our We serve with heart. neighbors and our communities. 19

Positive Impact on Residents and Communities Providing a high quality leasing experience for families and improving communities Resident Experience Community Investment “ProCare” professional resident services provided by in- ~$2 billion investment rehabilitating homes to date house local management and service teams $289 million local taxes supporting communities in 2018 24/7 resident service hotline $256 million to maintain homes for residents in 2018 Resident First Look program for home sales Technology-enhanced resident experience $31 million paid to homeowner associations in 2018 High quality homes in desirable neighborhoods Hundreds of local vendors supported 20

Glossary Adjusted EBITDAre We define EBITDA as net income or loss computed in accordance with accounting principles generally accepted in the United States (“GAAP”) before the following items: interest expense; income tax expense; and depreciation and amortization. National Association of Real Estate Investment Trusts ("Nareit") recommends as a best practice that REITs operating as real estate companies which report an EBITDA performance measure also report EBITDAre in all financial reports for periods beginning after December 31, 2017. We define EBITDAre, consistent with the Nareit definition, as EBITDA, further adjusted for gain on sale of property, net of tax and impairment on depreciated real estate investments. Adjusted EBITDAre is defined as EBITDAre before the following items: sharebased compensation expense; IPO related expenses; merger and transaction-related expenses; severance; casualty losses, net; acquisition costs; and interest income and other miscellaneous income and expenses. EBITDA, EBITDAre and Adjusted EBITDAre are used as supplemental financial performance measures by management and by external users of our financial statements, such as investors and commercial banks. Set forth below is additional detail on how management uses EBITDA, EBITDAre and Adjusted EBITDAre as measures of performance. The GAAP measure most directly comparable to EBITDA, EBITDAre and Adjusted EBITDAre is net income or loss. EBITDA, EBITDAre and Adjusted EBITDAre are not used as measures of our liquidity and should not be considered alternatives to net income or loss or any other measure of financial performance presented in accordance with GAAP. Our EBITDA, EBITDAre and Adjusted EBITDAre may not be comparable to the EBITDA, EBITDAre and Adjusted EBITDAre of other companies due to the fact that not all companies use the same definitions of EBITDA, EBITDAre and Adjusted EBITDAre. Accordingly, there can be no assurance that our basis for computing these non-GAAP measures is comparable with that of other companies. Average Occupancy Average occupancy for an identified population of homes represents (i) the total number of days that the homes in such population were occupied during the measurement period, divided by (ii) the total number of days that the homes in such population were owned during the measurement period. Core Revenues Core revenues for an identified population of homes reflects total revenues, net of any resident recoveries and/or bad debt attributable to such population. Rental Rate Growth Rental rate growth for any home represents the percentage difference between the monthly rent from an expiring lease and the monthly rent from the next lease, and, in each case, reflects the impact of any amortized non-service rent concessions and contractual rent increases. Leases are either renewal leases, where our current resident chooses to stay for a subsequent lease term, or a new lease, where our previous resident moves out and a new resident signs a lease to occupy the same home. Same Store / Same Store Portfolio Same Store or Same Store portfolio includes, for a given reporting period, homes that have been stabilized and seasoned (whether under Invitation Homes ownership or Starwood Waypoint Homes ownership), excluding homes that have been sold, homes that have been identified for sale to an owner occupant and have become vacant, homes that have been deemed inoperable or significantly impaired by casualty loss events or force majeure, and homes acquired in portfolio transactions that are deemed not to have undergone renovations of sufficiently similar quality and characteristics as the existing Invitation Homes Same Store portfolio. Homes are considered stabilized if they have (i) completed an initial renovation and (ii) entered into at least one post-initial renovation lease. An acquired portfolio that is both leased and deemed to be of sufficiently similar quality and characteristics as the existing Invitation Homes Same Store portfolio may be considered stabilized at the time of acquisition. Homes are considered to be seasoned once they have been stabilized for at least 15 months prior to January 1st of the year in which the Same Store portfolio was established. We believe presenting information about the portion of our portfolio that has been fully operational for the entirety of a given reporting period and its prior year comparison period provides investors with meaningful information about the performance of our comparable homes across periods and about trends in our organic business. Total Homes / Total Portfolio Total homes or total portfolio refers to the total number of homes we own, whether or not stabilized, and excludes any properties previously acquired in purchases that have been subsequently rescinded or vacated. Turnover Rate Turnover rate represents the number of instances that homes in an identified population become unoccupied in a given period, divided by the number of homes in such population. 21

Notes Page 5 1) Residential Peers include AIV, AMH, AVB, CPT, EQR, ESS, MAA and UDR Page 14 1) Weighted by total homes in each Invitation Homes market, as of June 30, 2019. Page 17 1) INVH implied enterprise value per home based on August 30, 2019 closing stock price of $28.76 per share. 22