Denver Investor Presentation March 2025 Together with you, we make a house a home.

Key Takeaways And Updates We are the nation’s premier single-family home leasing and management company Our preliminary January-February QTD 2025 Same Store results (1): • Renewal lease rate growth of 5.5% vs. 4.2% in Q4 2024 • New lease rate growth of (0.8%) vs. (2.2%) in Q4 2024, with February positive • Blended lease rate growth of 3.6% vs. 2.3% in Q4 2024 • Average occupancy of 97.1% vs. 96.7% in Q4 2024 We believe we remain well-positioned to deliver attractive growth through our accretive homebuilder partnerships, our high-margin third-party management business, and our strategic approach to offering a best-in-class resident experience focused on choice, flexibility, and convenience Orlando >300 bps Acceleration In new lease rate growth from December 2024 to February 2025 (1) 2 ~$1,100 / Month Affordability gap (2) ________________________________________________ (1) February 2025 Same Store results are preliminary. (2) According to John Burns Research & Consulting, the average cost of home ownership in excess of the cost of leasing, as weighted by our markets as of December 2024.

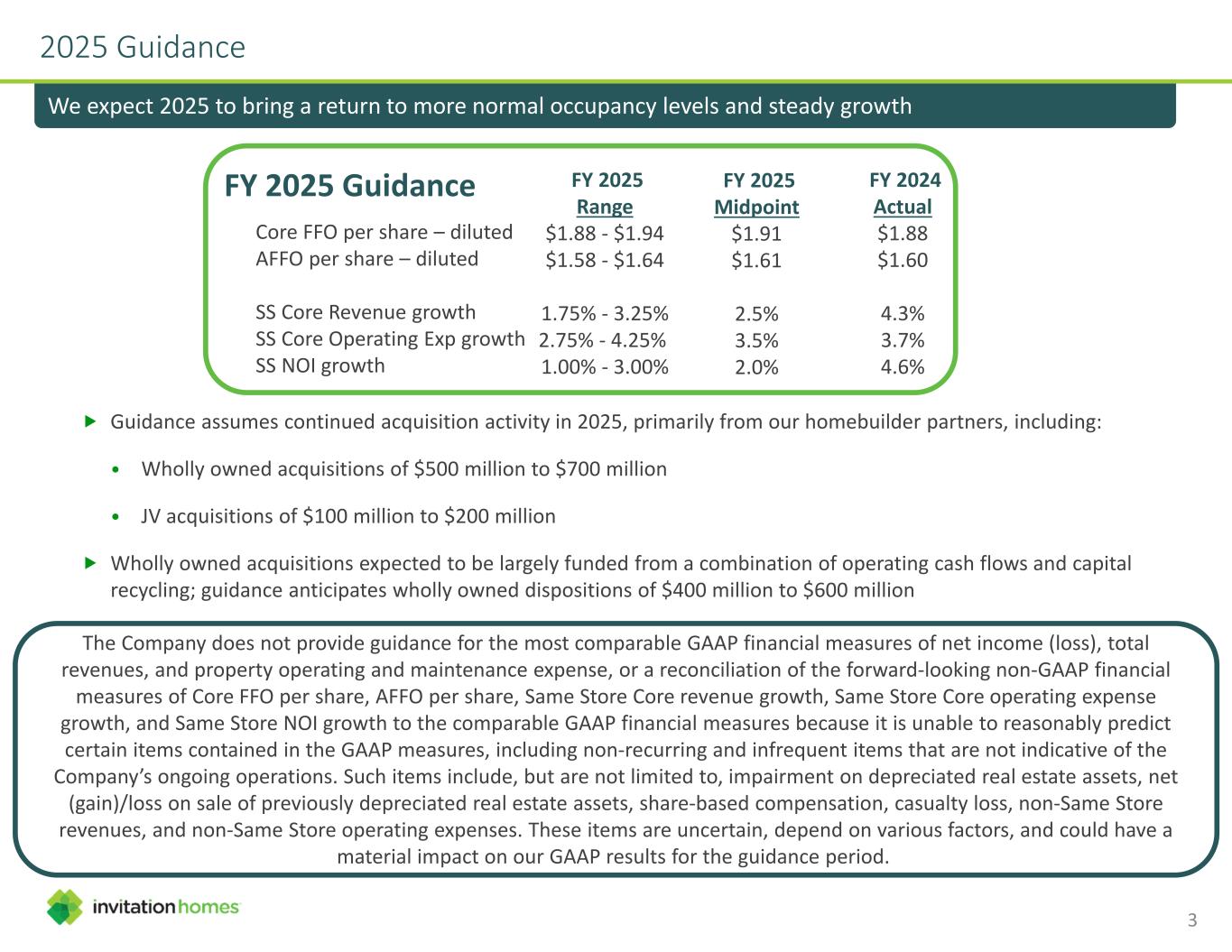

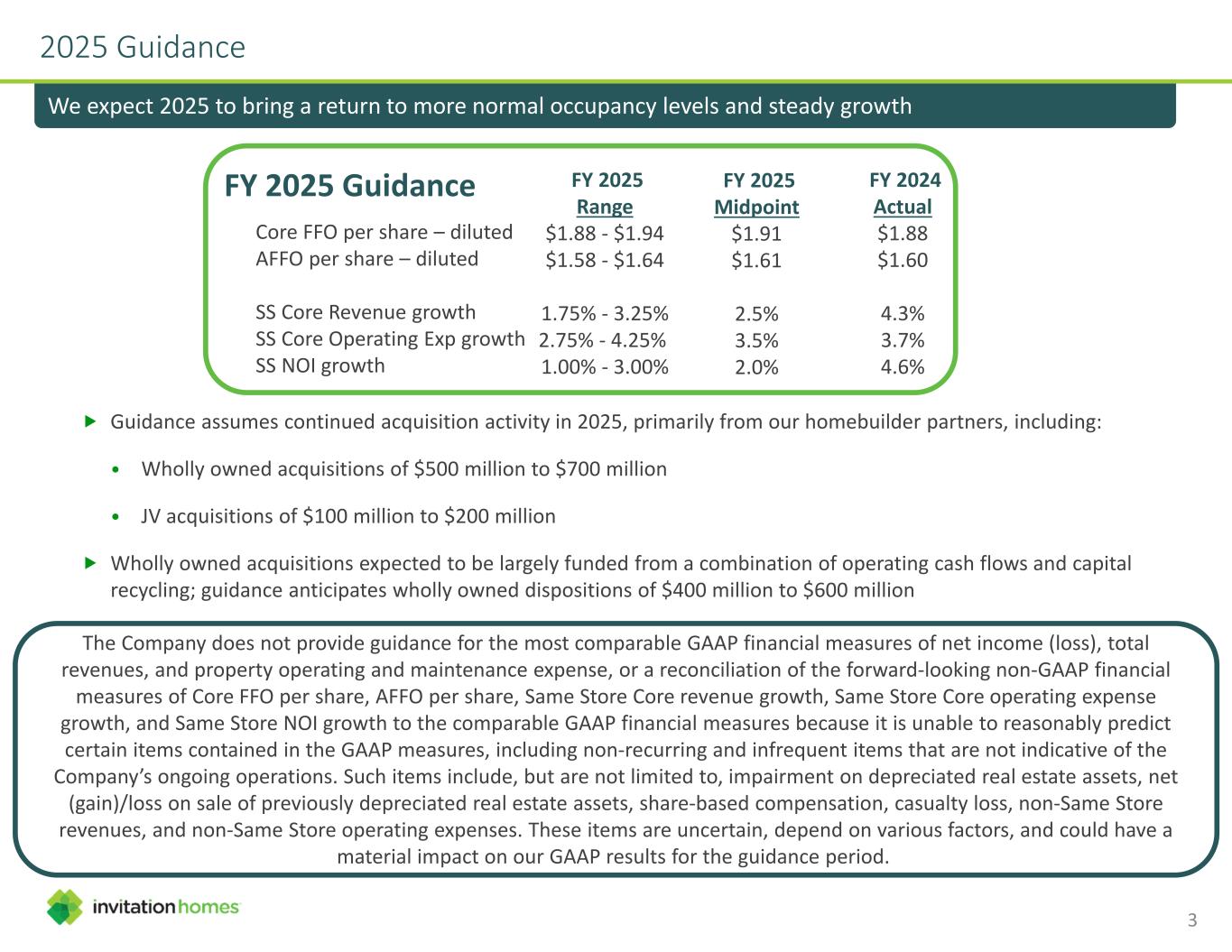

2025 Guidance We expect 2025 to bring a return to more normal occupancy levels and steady growth 3 FY 2025 Guidance FY 2025 Range $1.88 - $1.94 $1.58 - $1.64 1.75% - 3.25% 2.75% - 4.25% 1.00% - 3.00% Core FFO per share – diluted AFFO per share – diluted SS Core Revenue growth SS Core Operating Exp growth SS NOI growth FY 2024 Actual $1.88 $1.60 4.3% 3.7% 4.6% FY 2025 Midpoint $1.91 $1.61 2.5% 3.5% 2.0% The Company does not provide guidance for the most comparable GAAP financial measures of net income (loss), total revenues, and property operating and maintenance expense, or a reconciliation of the forward-looking non-GAAP financial measures of Core FFO per share, AFFO per share, Same Store Core revenue growth, Same Store Core operating expense growth, and Same Store NOI growth to the comparable GAAP financial measures because it is unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company’s ongoing operations. Such items include, but are not limited to, impairment on depreciated real estate assets, net (gain)/loss on sale of previously depreciated real estate assets, share-based compensation, casualty loss, non-Same Store revenues, and non-Same Store operating expenses. These items are uncertain, depend on various factors, and could have a material impact on our GAAP results for the guidance period. Guidance assumes continued acquisition activity in 2025, primarily from our homebuilder partners, including: • Wholly owned acquisitions of $500 million to $700 million • JV acquisitions of $100 million to $200 million Wholly owned acquisitions expected to be largely funded from a combination of operating cash flows and capital recycling; guidance anticipates wholly owned dispositions of $400 million to $600 million

Tampa Carolinas I. Strategic Approach To Growth

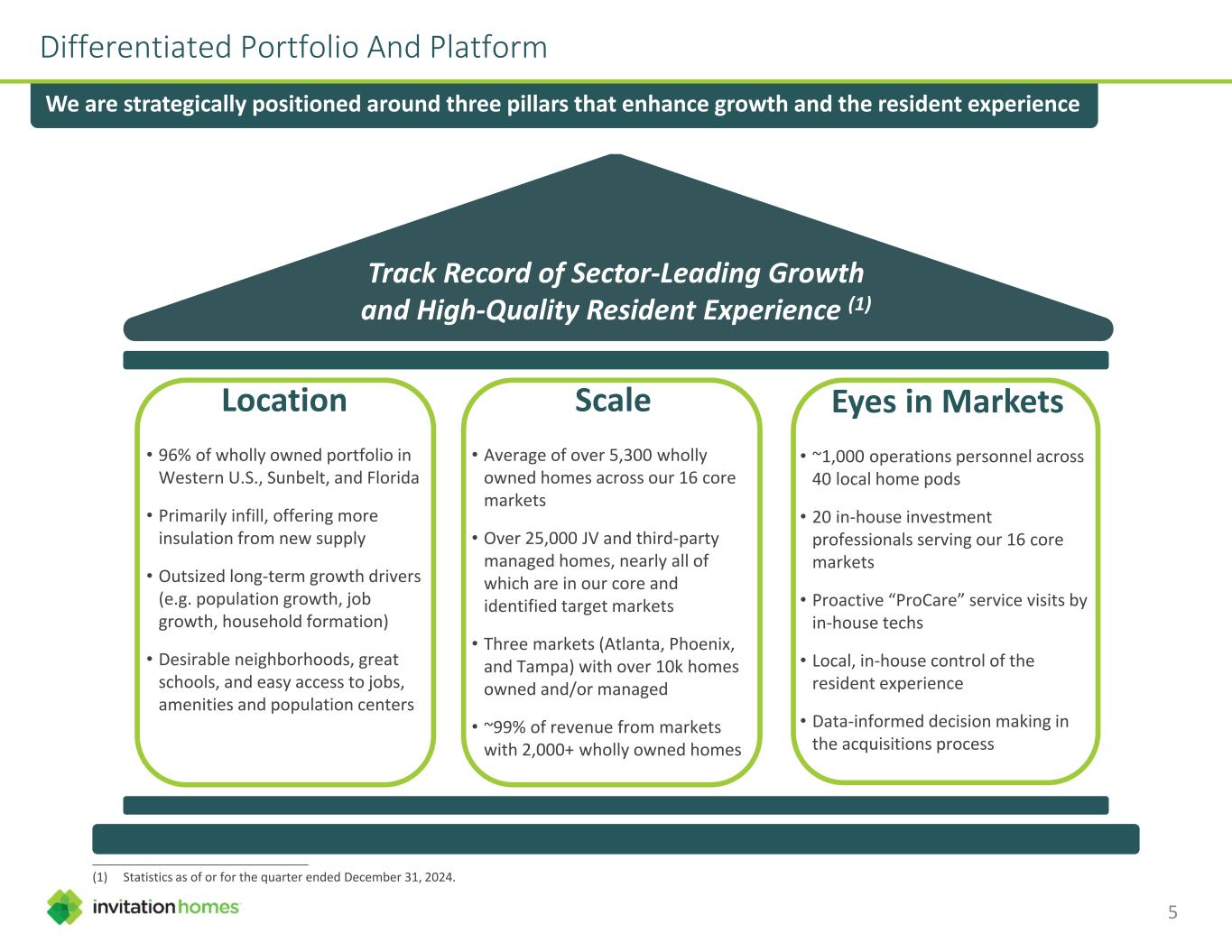

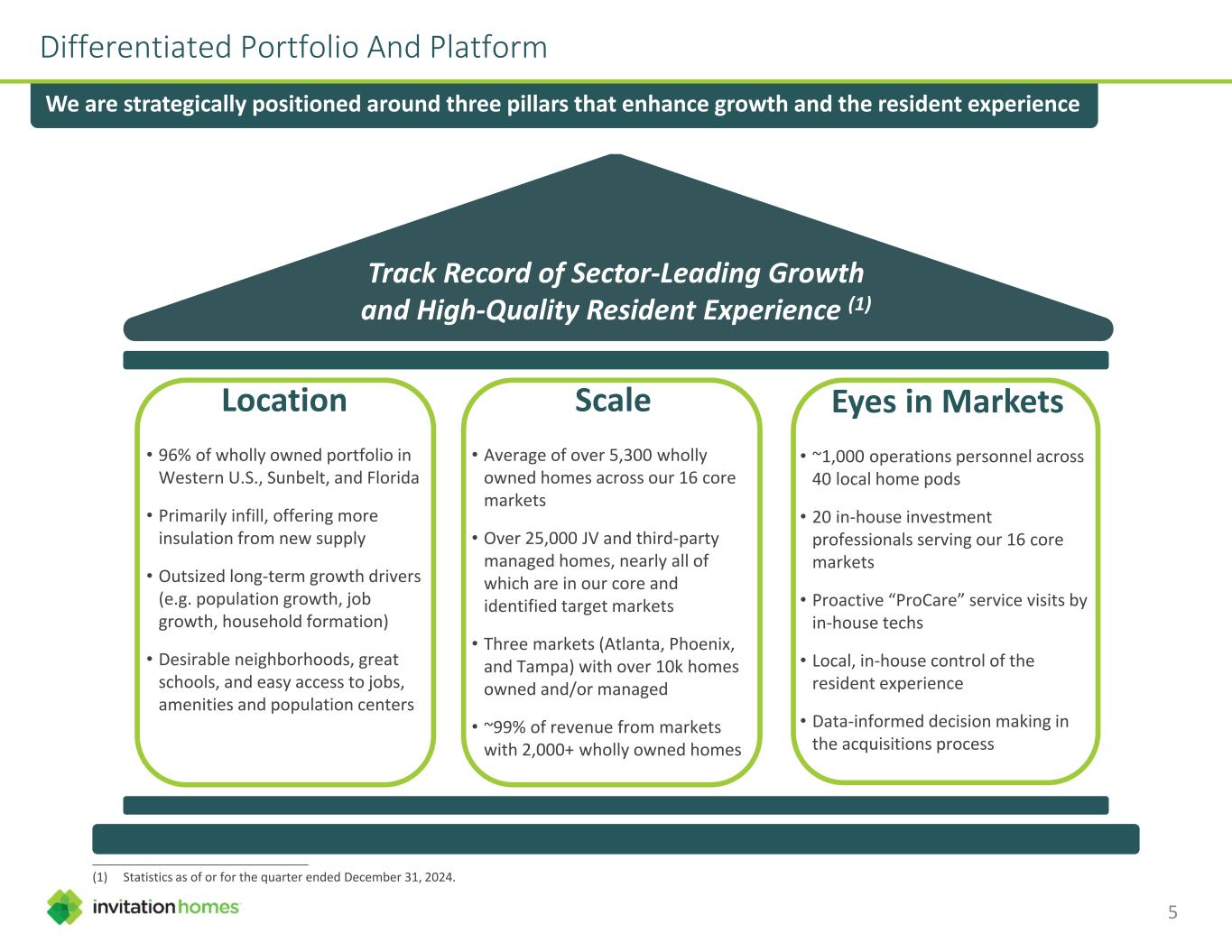

Eyes in Markets • ~1,000 operations personnel across 40 local home pods • 20 in-house investment professionals serving our 16 core markets • Proactive “ProCare” service visits by in-house techs • Local, in-house control of the resident experience • Data-informed decision making in the acquisitions process Location • 96% of wholly owned portfolio in Western U.S., Sunbelt, and Florida • Primarily infill, offering more insulation from new supply • Outsized long-term growth drivers (e.g. population growth, job growth, household formation) • Desirable neighborhoods, great schools, and easy access to jobs, amenities and population centers Differentiated Portfolio And Platform We are strategically positioned around three pillars that enhance growth and the resident experience Track Record of Sector-Leading Growth and High-Quality Resident Experience (1) Scale • Average of over 5,300 wholly owned homes across our 16 core markets • Over 25,000 JV and third-party managed homes, nearly all of which are in our core and identified target markets • Three markets (Atlanta, Phoenix, and Tampa) with over 10k homes owned and/or managed • ~99% of revenue from markets with 2,000+ wholly owned homes 5 ________________________________________________ (1) Statistics as of or for the quarter ended December 31, 2024.

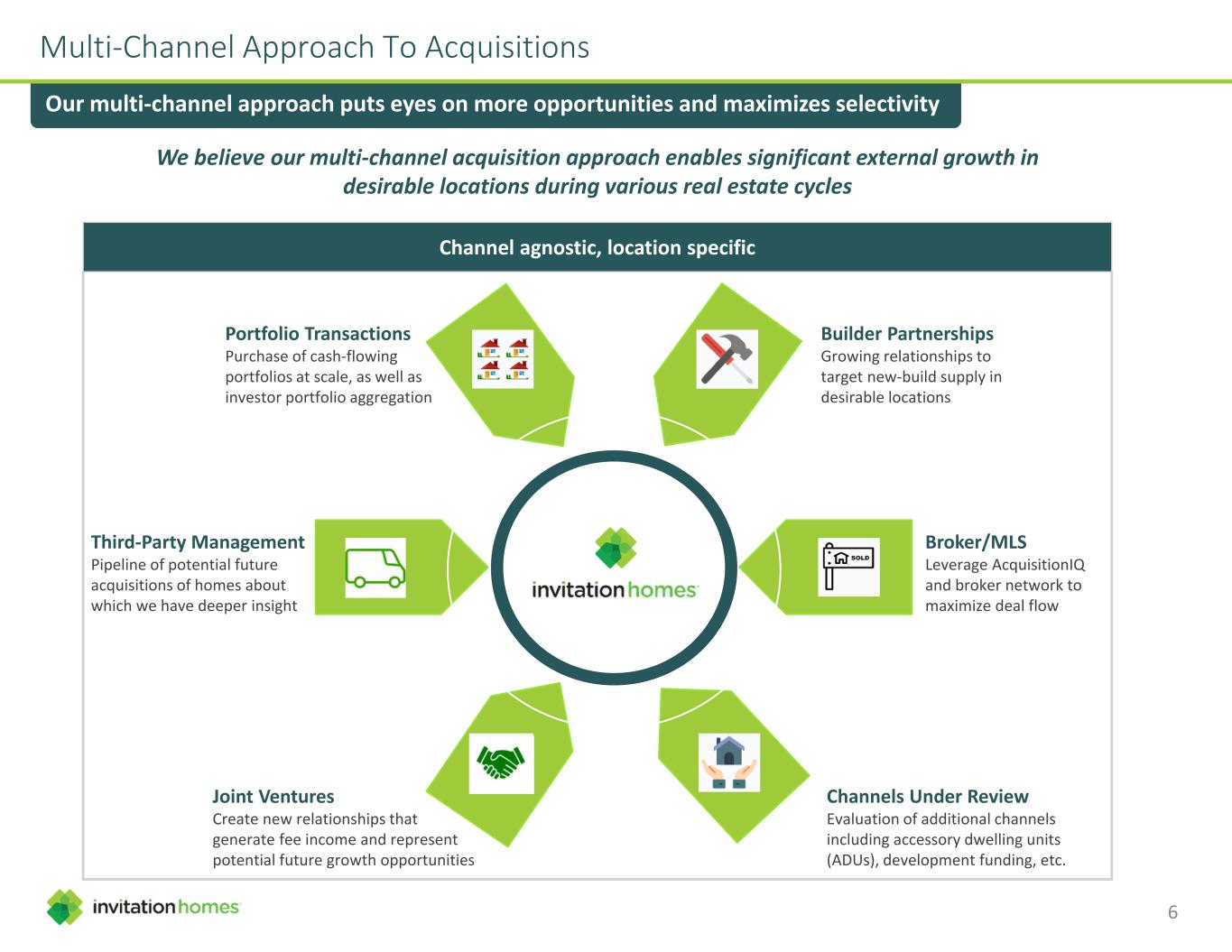

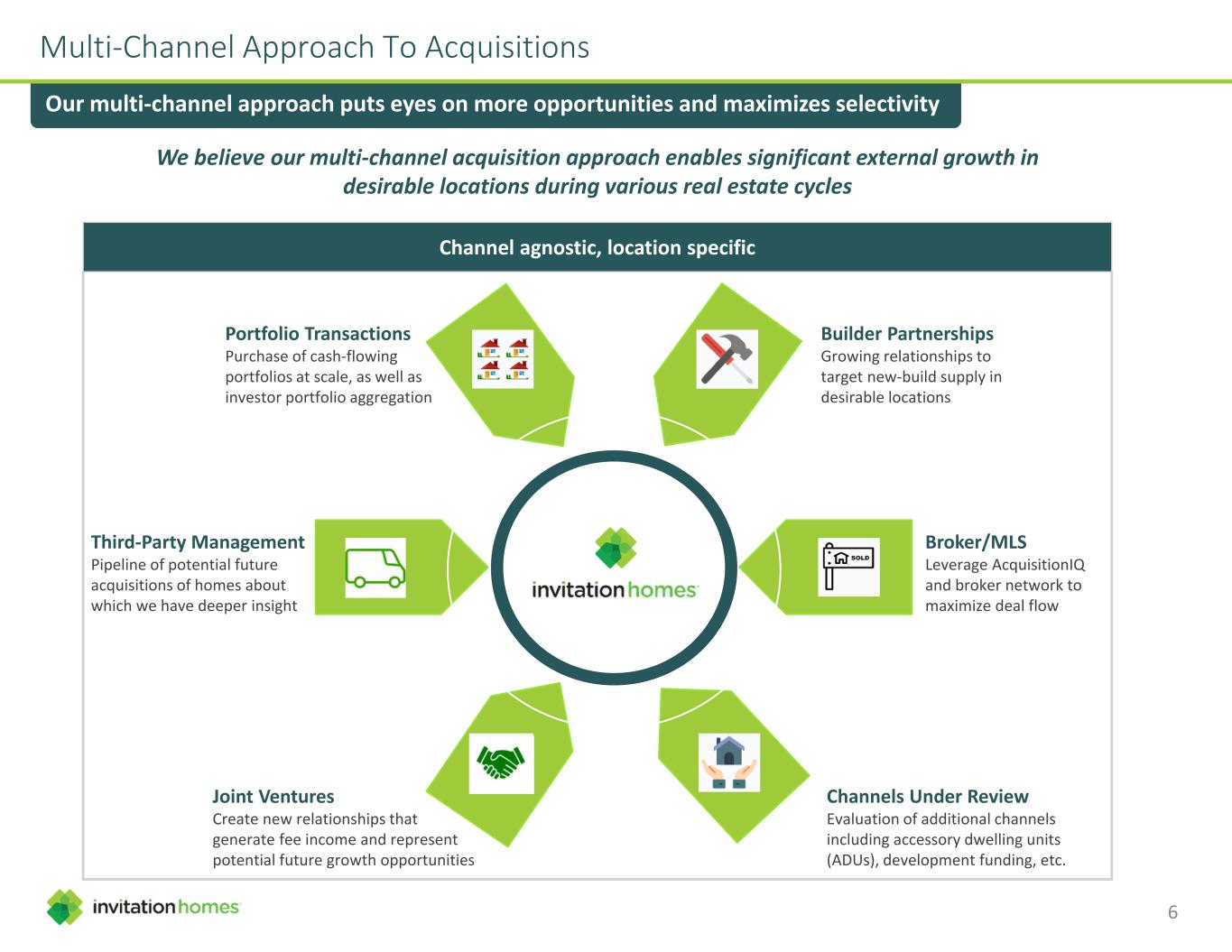

Channel agnostic, location specific Multi-Channel Approach To Acquisitions Our multi-channel approach puts eyes on more opportunities and maximizes selectivity Broker/MLS Leverage AcquisitionIQ and broker network to maximize deal flow Builder Partnerships Growing relationships to target new-build supply in desirable locations Third-Party Management Pipeline of potential future acquisitions of homes about which we have deeper insight Portfolio Transactions Purchase of cash-flowing portfolios at scale, as well as investor portfolio aggregation Joint Ventures Create new relationships that generate fee income and represent potential future growth opportunities Channels Under Review Evaluation of additional channels including accessory dwelling units (ADUs), development funding, etc. We believe our multi-channel acquisition approach enables significant external growth in desirable locations during various real estate cycles 6

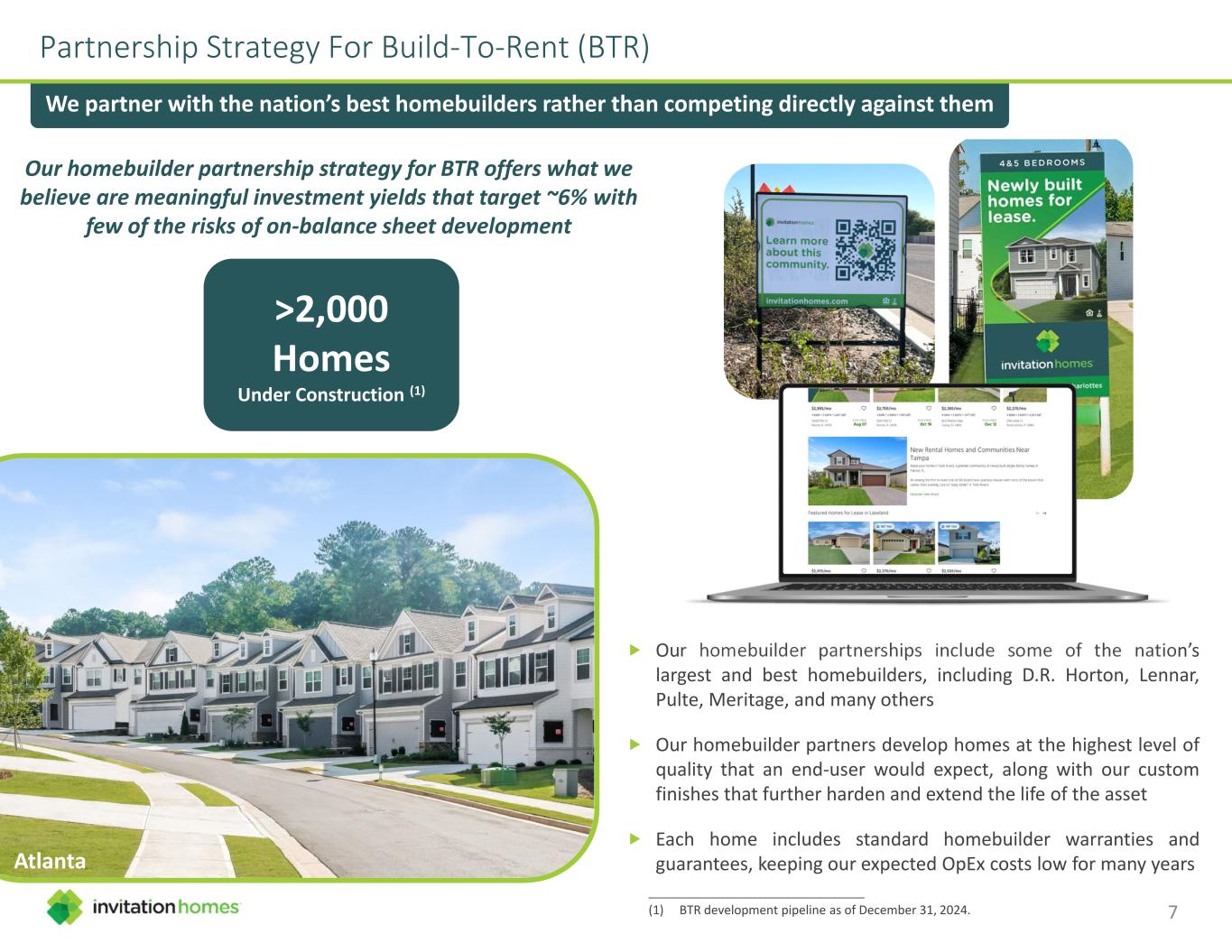

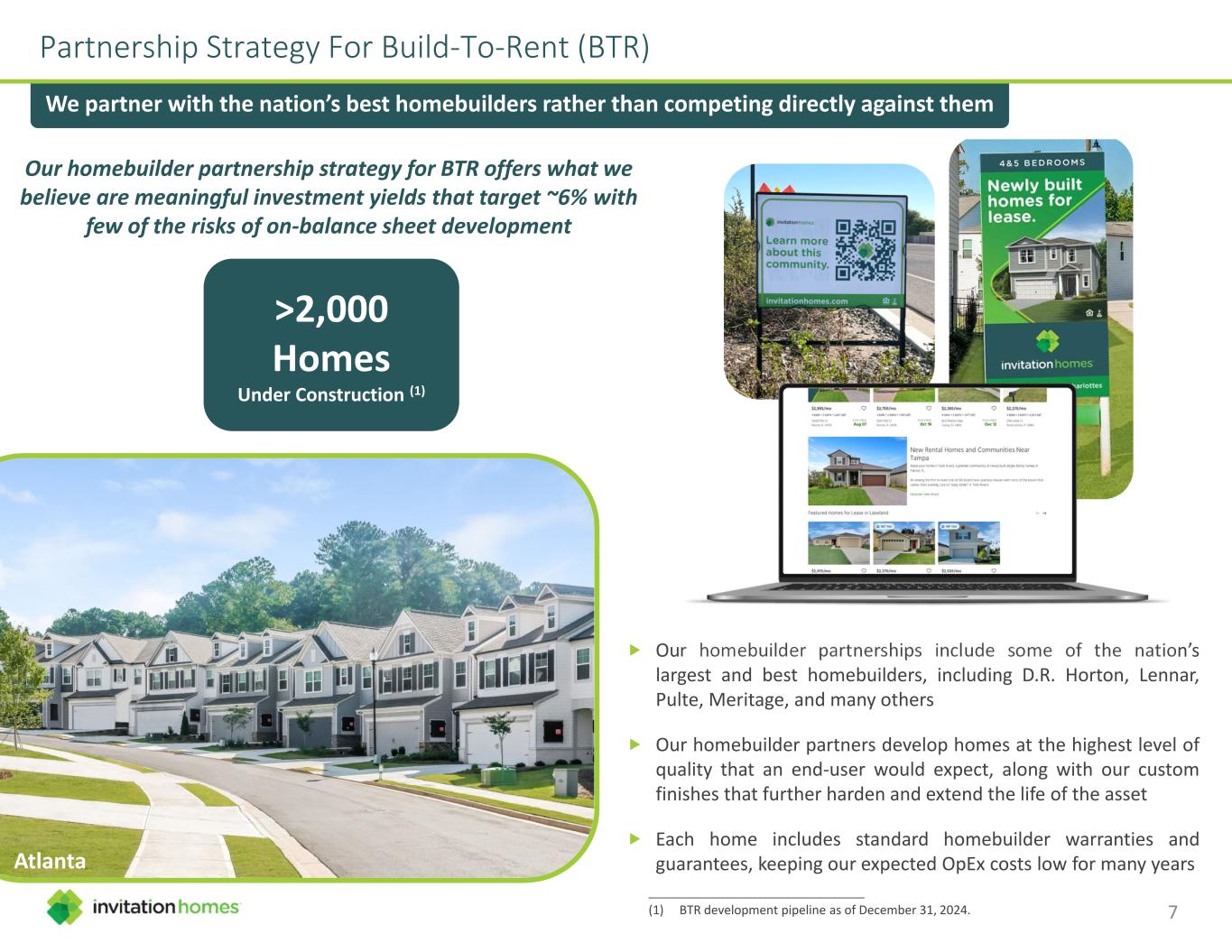

Partnership Strategy For Build-To-Rent (BTR) We partner with the nation’s best homebuilders rather than competing directly against them Our homebuilder partnership strategy for BTR offers what we believe are meaningful investment yields that target ~6% with few of the risks of on-balance sheet development Our homebuilder partnerships include some of the nation’s largest and best homebuilders, including D.R. Horton, Lennar, Pulte, Meritage, and many others Our homebuilder partners develop homes at the highest level of quality that an end-user would expect, along with our custom finishes that further harden and extend the life of the asset Each home includes standard homebuilder warranties and guarantees, keeping our expected OpEx costs low for many years Orlando Orlando 7 Atlanta >2,000 Homes Under Construction (1) ________________________________________________ (1) BTR development pipeline as of December 31, 2024.

Key benefits for Invitation Homes: Drive meaningful AFFO/sh growth and margin expansion with value-add platform & minimal capital investment High margin revenue stream in a high-barrier sector where efficient third-party managers are scarce Add value to the core business by increasing scale in markets where we own homes Create a pipeline of future acquisition opportunities of homes about which we have an information advantage Provide a pathway to more easily scale into new markets that we find attractive Our Third-Party Management Business Capital-light opportunity to meaningfully grow AFFO/share with owners of large SFR portfolios Key benefits for portfolio owners: Access to our unmatched scale and platform, including our people and systems Engage our coast-to-coast expertise in managing diverse and geographically dispersed assets Key benefits for residents: Receive our trademark services, including ProCare and 24/7 emergency maintenance Realize potential savings and convenience through our scale and value-added services such as Smart Home, internet bundle, and free Esusu credit reporting (where available) Experience the flexibility, convenience, and choice of leasing a home using the INVH platform 8

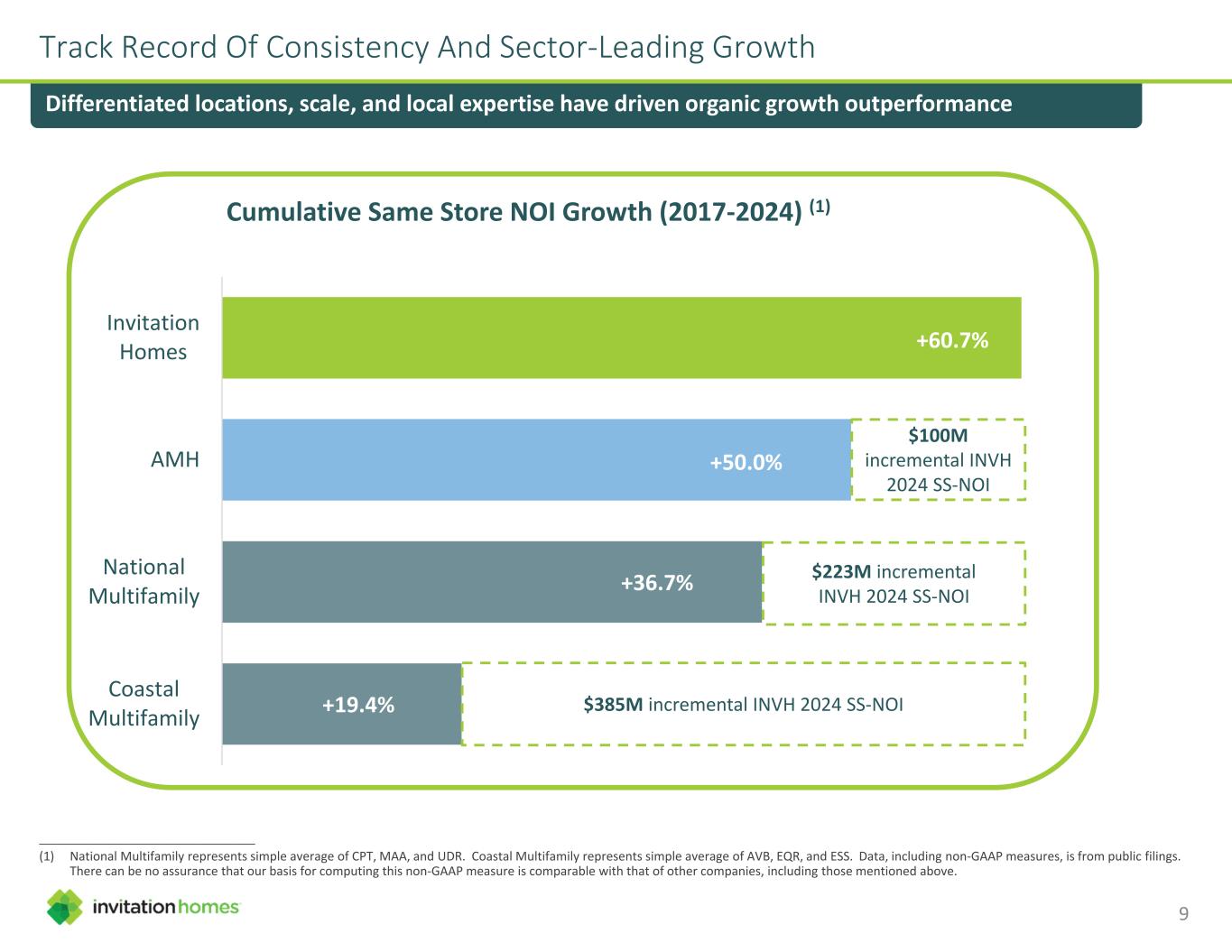

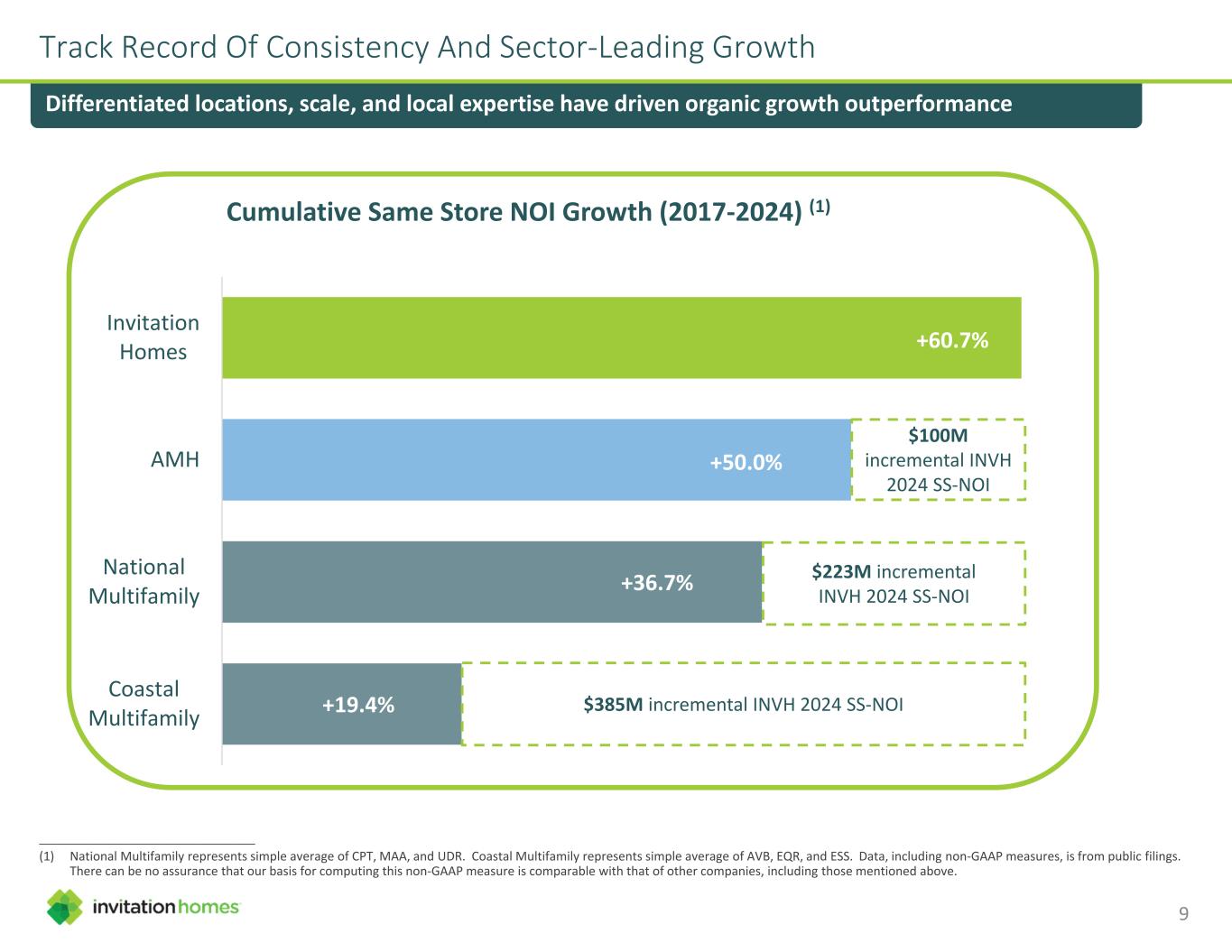

+60.7% +50.0% +36.7% +19.4% Invitation Homes AMH National Multifamily Coastal Multifamily Cumulative Same Store NOI Growth (2017-2024) (1) Track Record Of Consistency And Sector-Leading Growth $100M incremental INVH 2024 SS-NOI $223M incremental INVH 2024 SS-NOI $385M incremental INVH 2024 SS-NOI Differentiated locations, scale, and local expertise have driven organic growth outperformance ________________________________________________ (1) National Multifamily represents simple average of CPT, MAA, and UDR. Coastal Multifamily represents simple average of AVB, EQR, and ESS. Data, including non-GAAP measures, is from public filings. There can be no assurance that our basis for computing this non-GAAP measure is comparable with that of other companies, including those mentioned above. 9

Tampa Phoenix II. Location & Scale

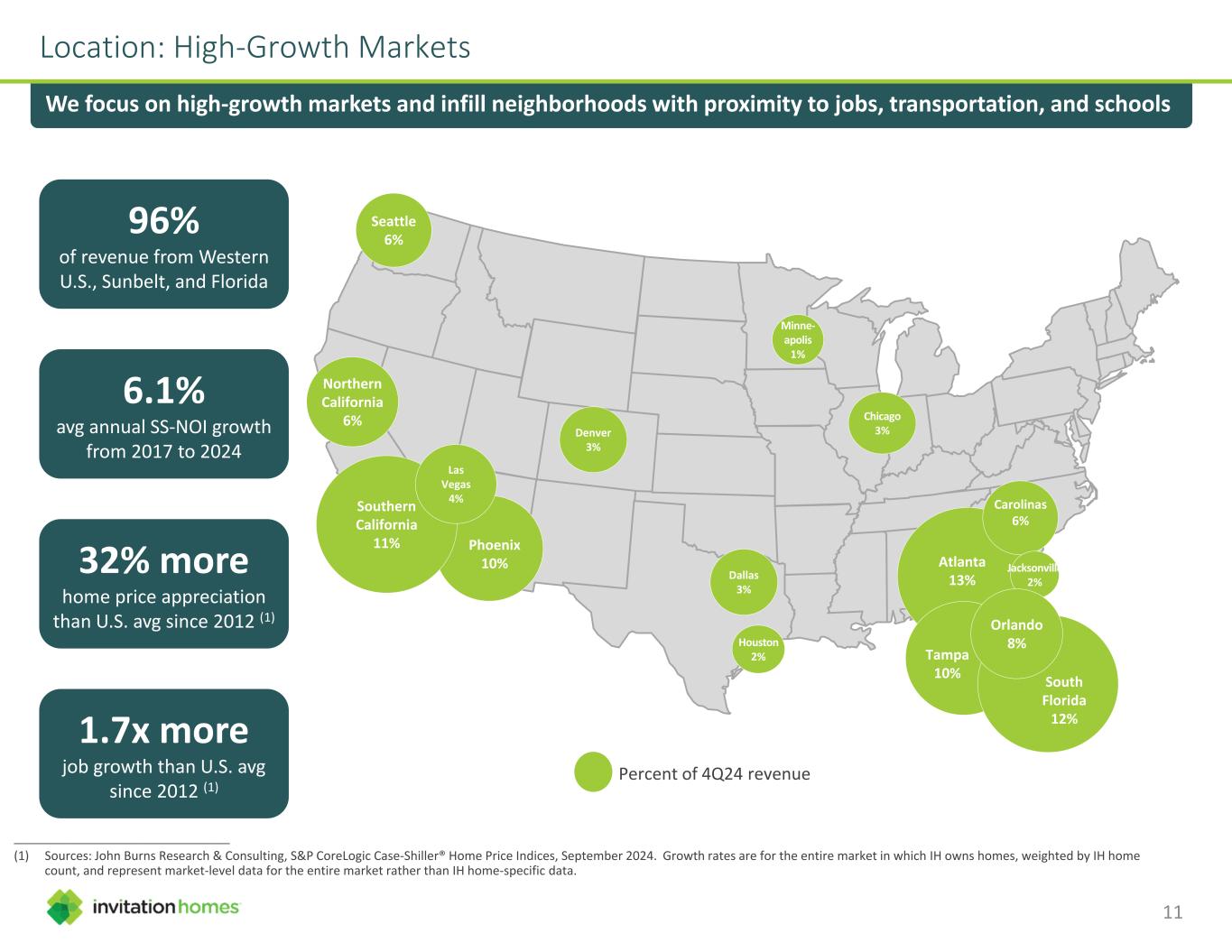

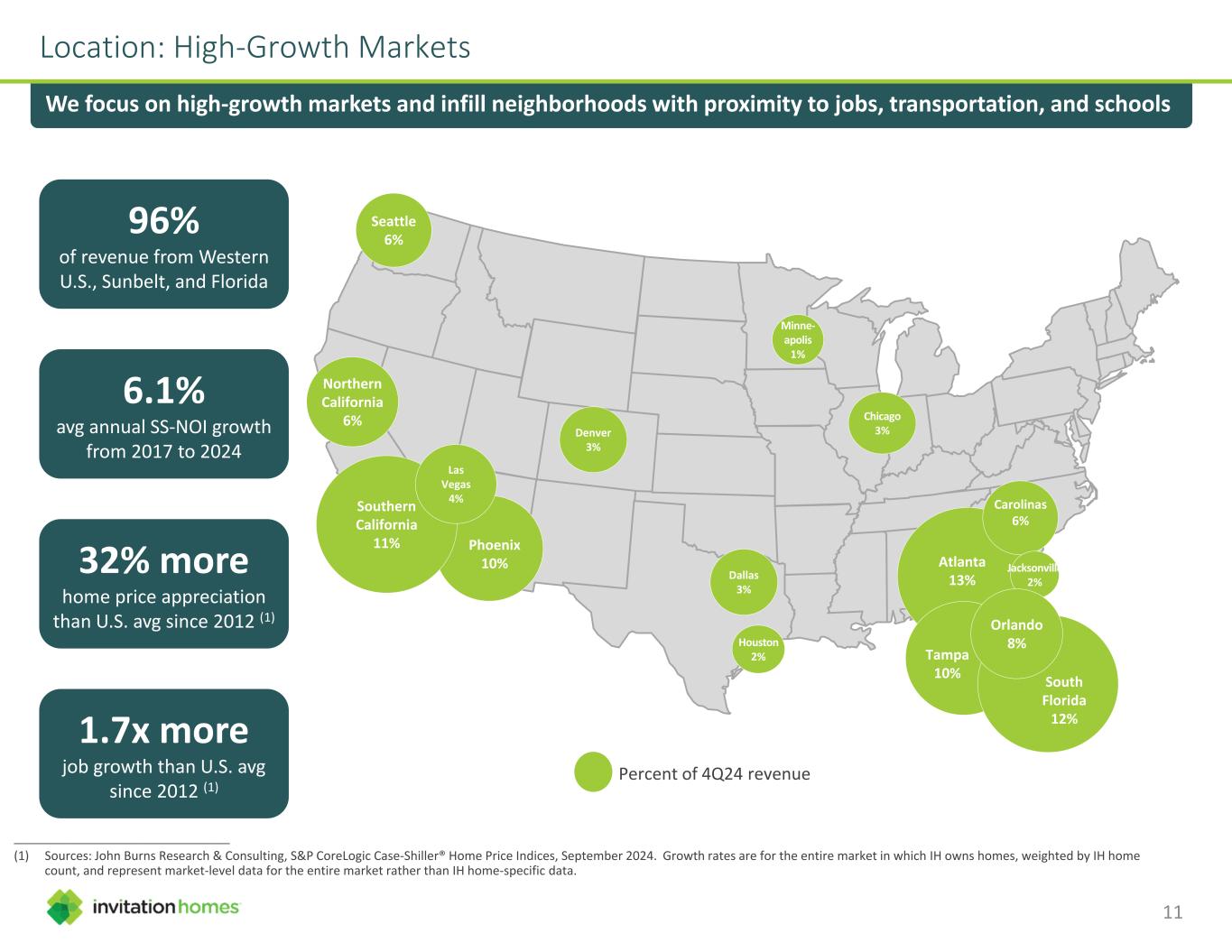

Location: High-Growth Markets We focus on high-growth markets and infill neighborhoods with proximity to jobs, transportation, and schools 96% of revenue from Western U.S., Sunbelt, and Florida 6.1% avg annual SS-NOI growth from 2017 to 2024 32% more home price appreciation than U.S. avg since 2012 (1) Percent of 4Q24 revenue Seattle 6% Minne- apolis 1% Denver 3% Dallas 3% Phoenix 10% Atlanta 13% Tampa 10% Southern California 11% Las Vegas 4% South Florida 12% Northern California 6% Carolinas 6% Jacksonville 2% Orlando 8%Houston 2% Chicago 3% ________________________________________________ (1) Sources: John Burns Research & Consulting, S&P CoreLogic Case-Shiller® Home Price Indices, September 2024. Growth rates are for the entire market in which IH owns homes, weighted by IH home count, and represent market-level data for the entire market rather than IH home-specific data. 1.7x more job growth than U.S. avg since 2012 (1) 11

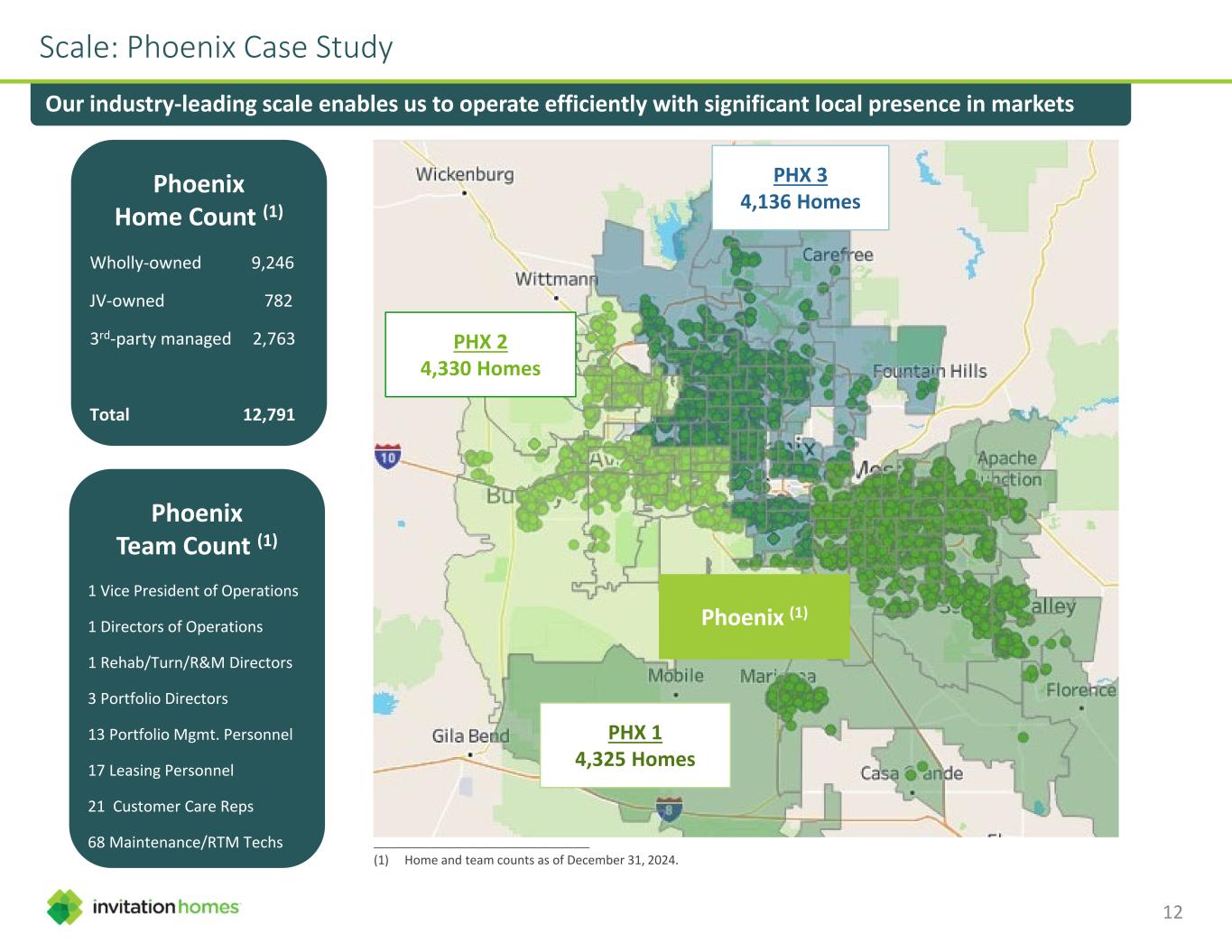

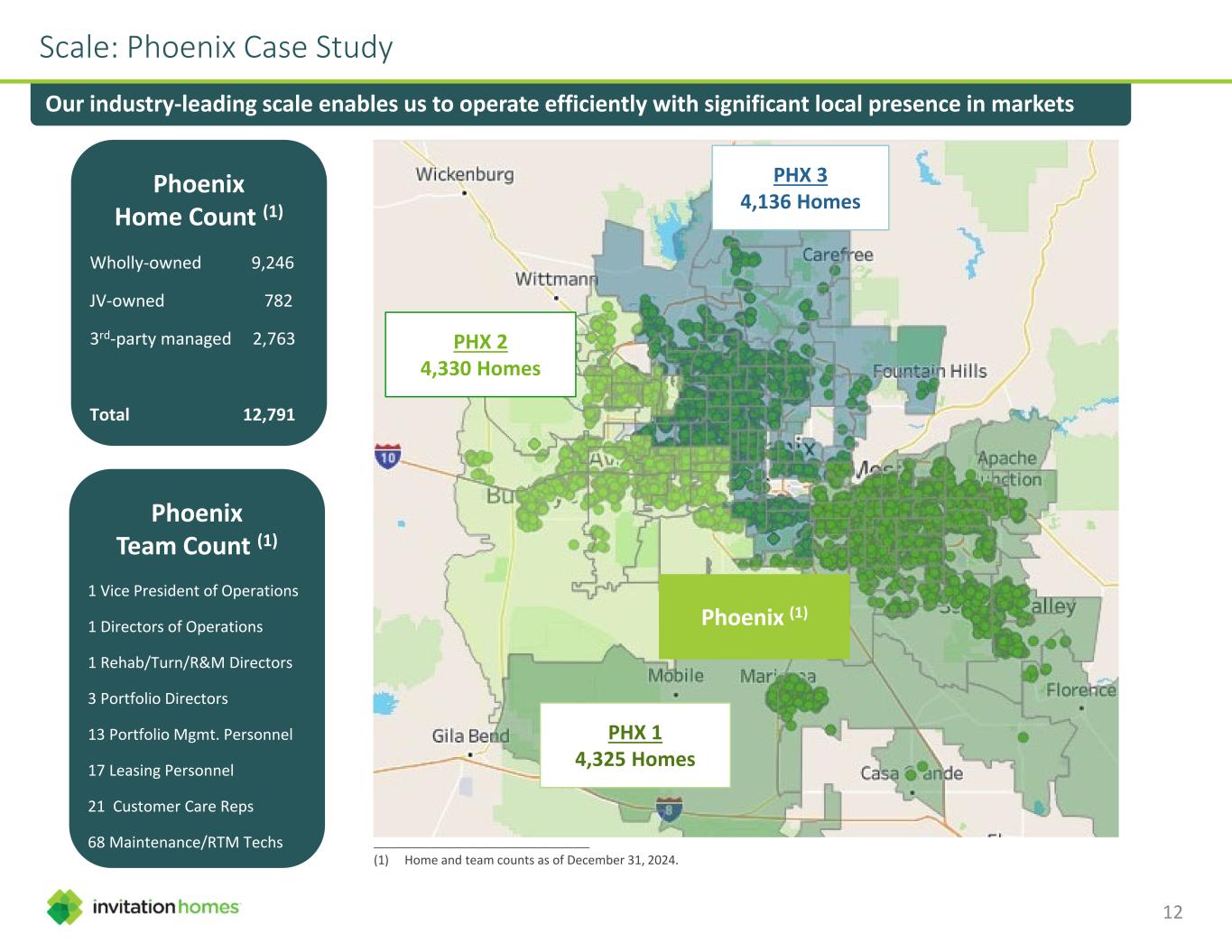

Scale: Phoenix Case Study Our industry-leading scale enables us to operate efficiently with significant local presence in markets Phoenix Home Count (1) Wholly-owned 9,246 JV-owned 782 3rd-party managed 2,763 Total 12,791 PHX 1 4,325 Homes PHX 2 4,330 Homes Phoenix (1) PHX 3 4,136 Homes Phoenix Team Count (1) 1 Vice President of Operations 1 Directors of Operations 1 Rehab/Turn/R&M Directors 3 Portfolio Directors 13 Portfolio Mgmt. Personnel 17 Leasing Personnel 21 Customer Care Reps 68 Maintenance/RTM Techs ________________________________________________ (1) Home and team counts as of December 31, 2024. 12

Tampa Denver III. Eyes In Markets

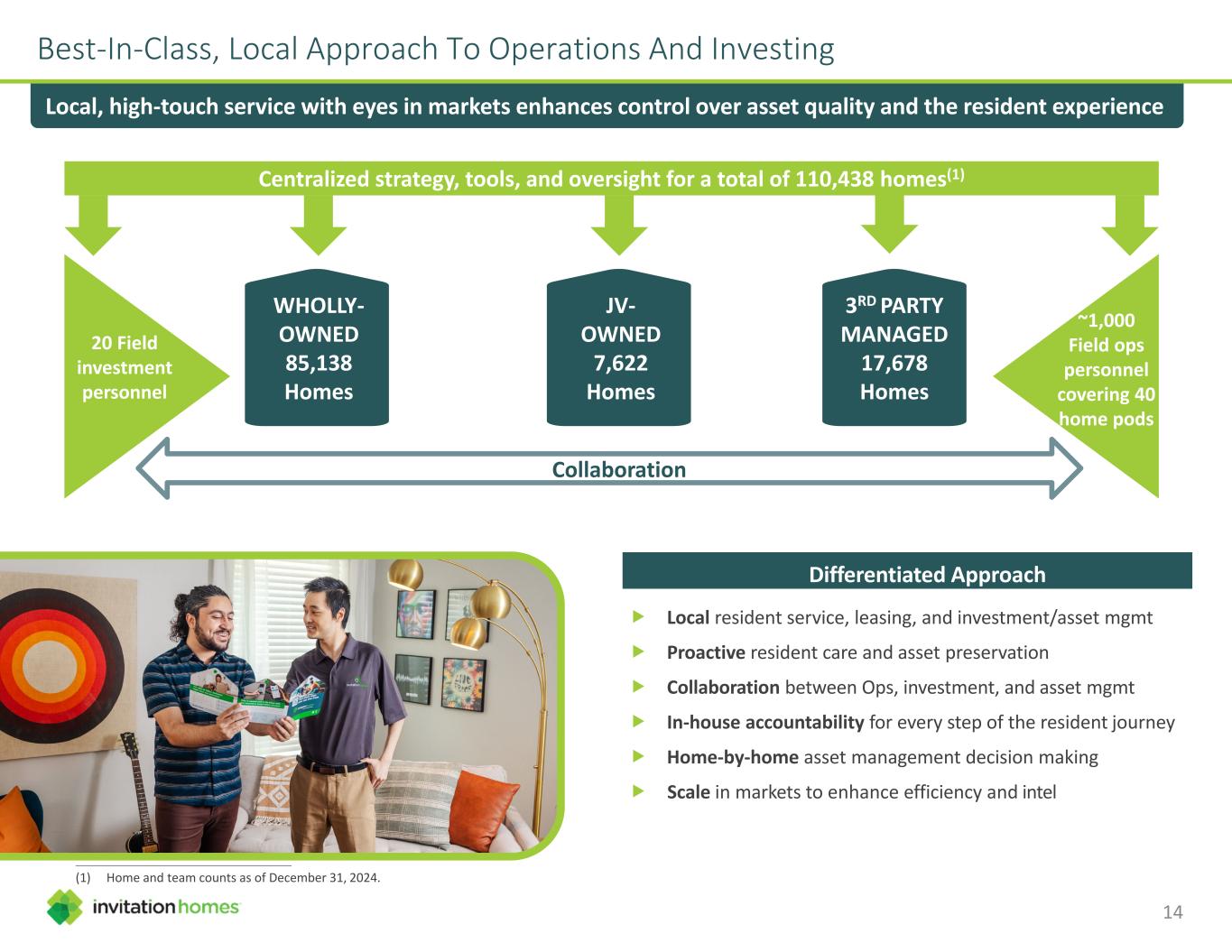

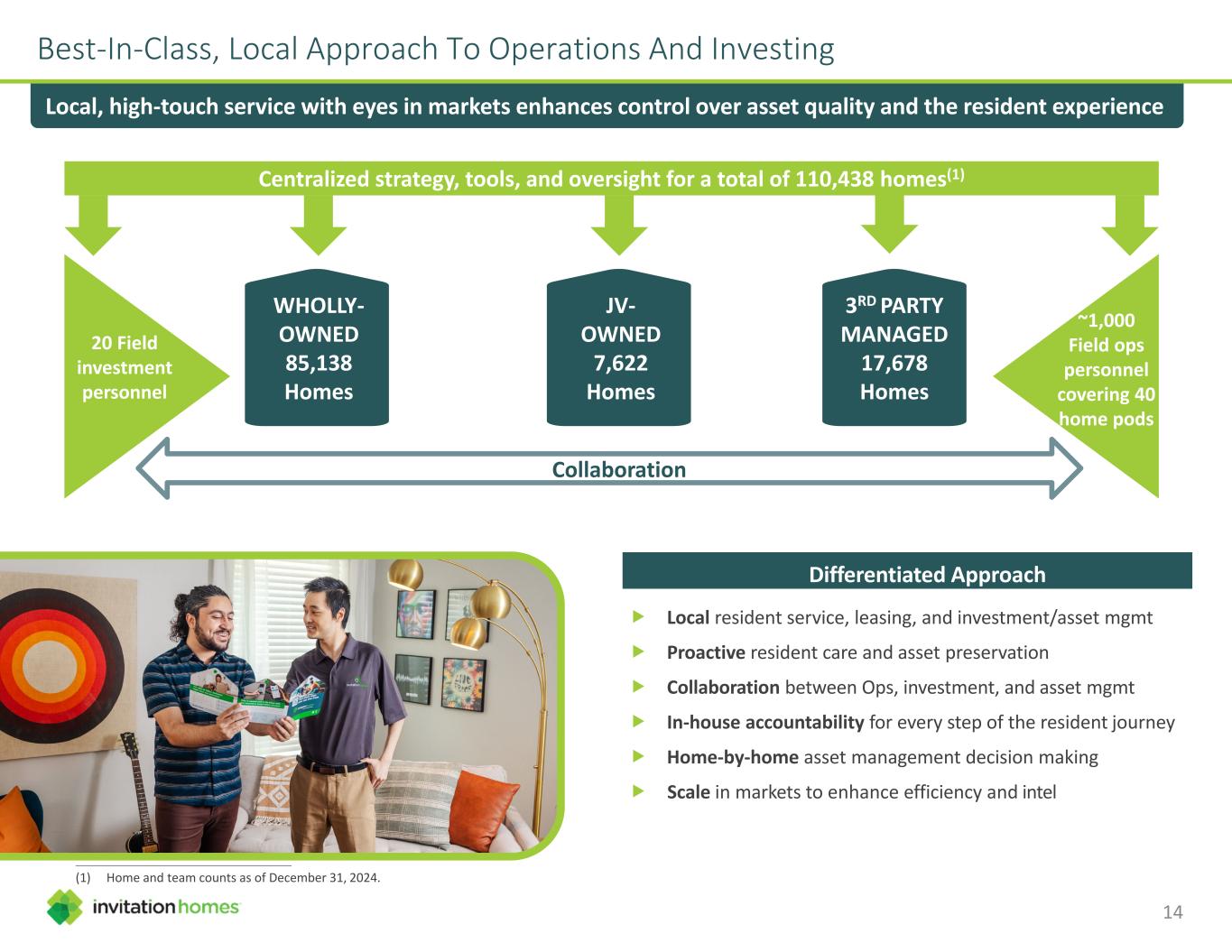

Best-In-Class, Local Approach To Operations And Investing Local, high-touch service with eyes in markets enhances control over asset quality and the resident experience Differentiated Approach Local resident service, leasing, and investment/asset mgmt Proactive resident care and asset preservation Collaboration between Ops, investment, and asset mgmt In-house accountability for every step of the resident journey Home-by-home asset management decision making Scale in markets to enhance efficiency and intel ________________________________________________ (1) Home and team counts as of December 31, 2024. WHOLLY- OWNED 85,138 Homes 20 Field investment personnel ~1,000 Field ops personnel covering 40 home pods Centralized strategy, tools, and oversight for a total of 110,438 homes(1) Collaboration JV- OWNED 7,622 Homes 3RD PARTY MANAGED 17,678 Homes 14

Proactive Resident Service And Asset Management ProCare proactive maintenance program designed to optimize each touch point with our residents and homes Initial Showing / Leasing Interaction ProCare Resident Orientation (RO) ProCare 45-Day Maintenance Visit Work Order General Property Condition Assessment Program ProCare Pre-Move Out Visit (PMOV) Move Out Inspection / Budget Creation Move-in Move-out Educate Residents Make Repairs Check Home Condition ProCare is our differentiated approach to service that leverages proactive engagement with residents and homes to maximize resident satisfaction and the quality and efficiency of asset preservation In-house personnel own every step of the resident journey Proactive resident education and “eyes on assets” are critical to homes’ condition and cost to maintain Emergency repairs are addressed immediately, while minor repairs can be bundled into ProCare visits for efficiency Our mobile maintenance app, launched in 2021, allows residents to make camera-enabled maintenance requests on their own terms, and allows us to diagnose the problem before we arrive and reduce the number of return trips 15

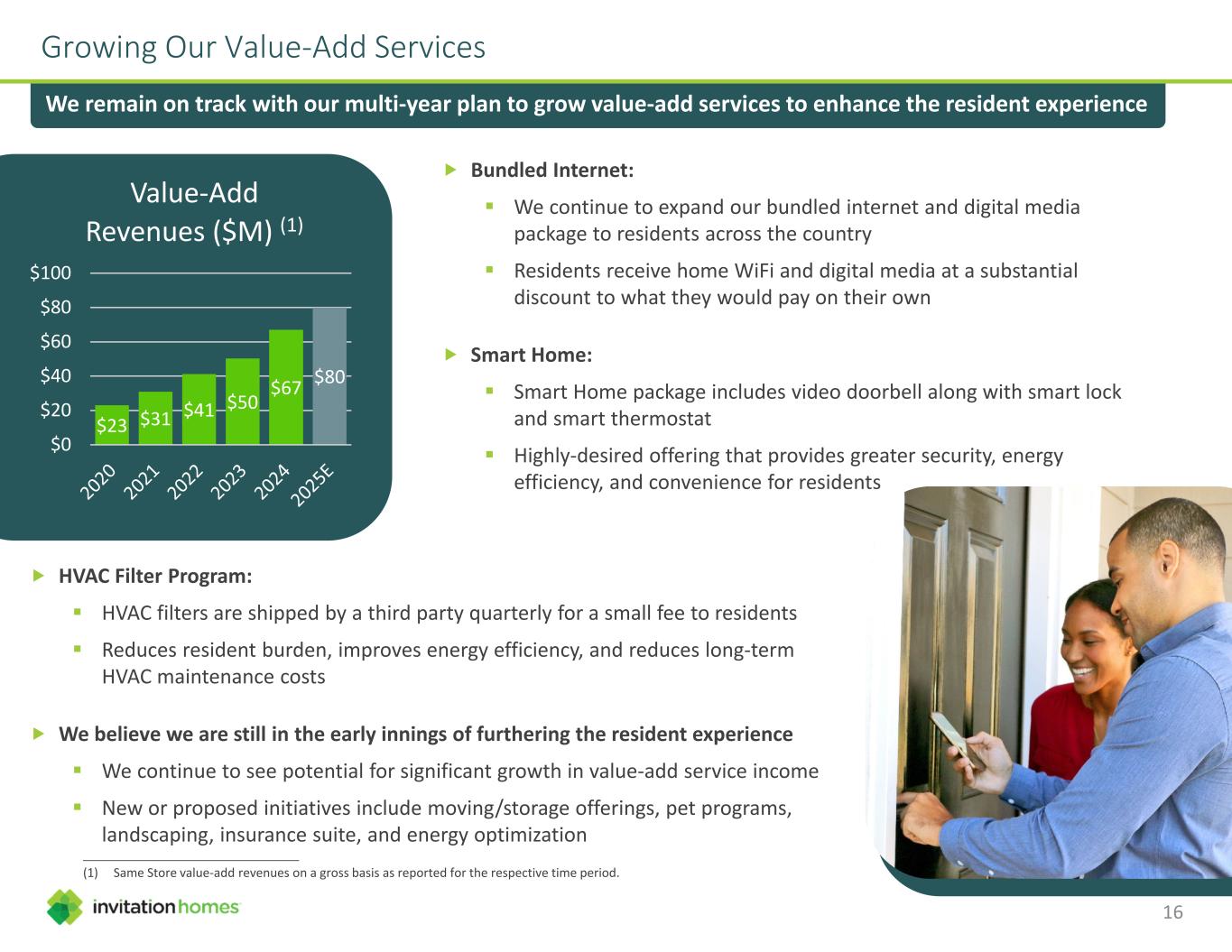

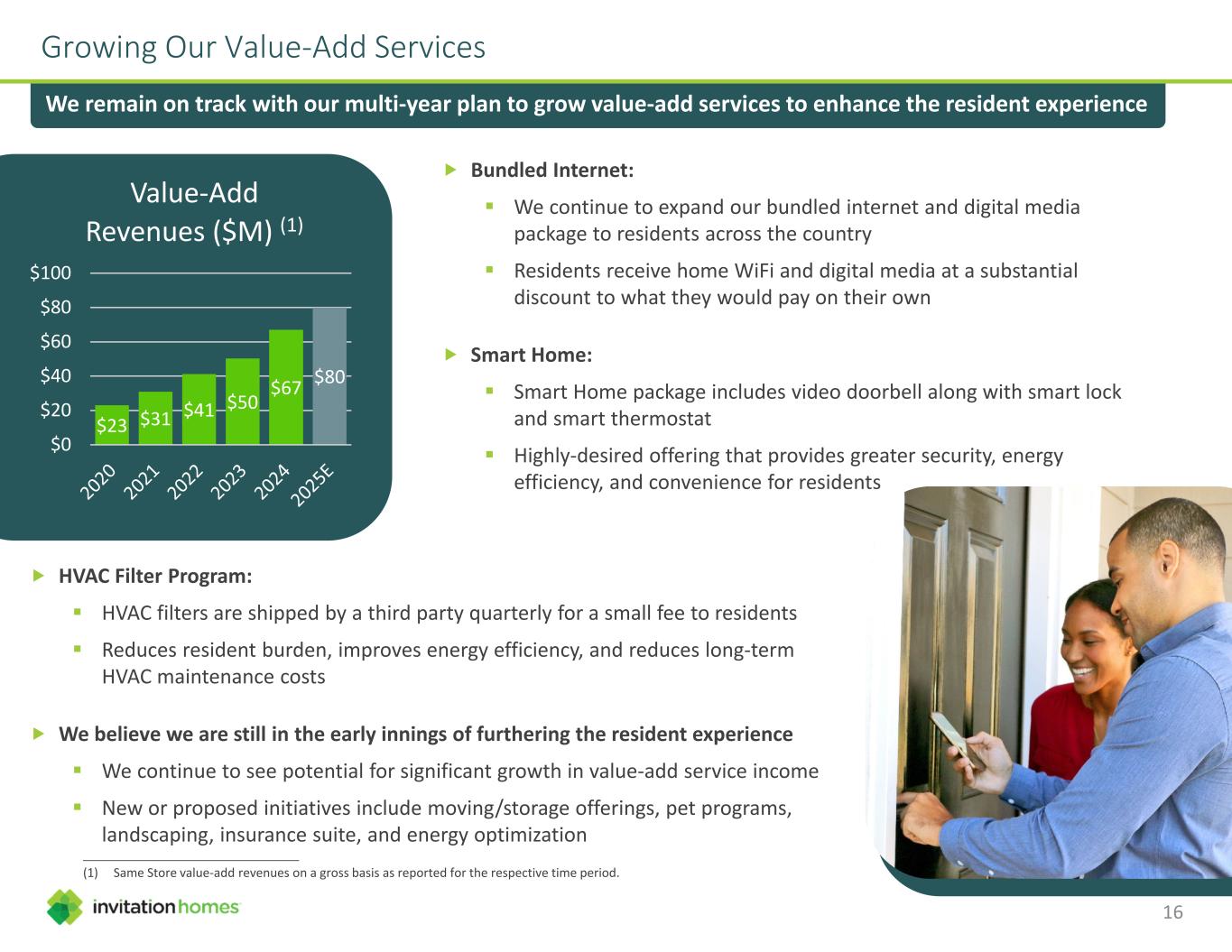

Growing Our Value-Add Services We remain on track with our multi-year plan to grow value-add services to enhance the resident experience Bundled Internet: We continue to expand our bundled internet and digital media package to residents across the country Residents receive home WiFi and digital media at a substantial discount to what they would pay on their own Smart Home: Smart Home package includes video doorbell along with smart lock and smart thermostat Highly-desired offering that provides greater security, energy efficiency, and convenience for residents HVAC Filter Program: HVAC filters are shipped by a third party quarterly for a small fee to residents Reduces resident burden, improves energy efficiency, and reduces long-term HVAC maintenance costs We believe we are still in the early innings of furthering the resident experience We continue to see potential for significant growth in value-add service income New or proposed initiatives include moving/storage offerings, pet programs, landscaping, insurance suite, and energy optimization 16 $23 $31 $41 $50 $67 $80 $0 $20 $40 $60 $80 $100 Value-Add Revenues ($M) (1) ________________________________________________ (1) Same Store value-add revenues on a gross basis as reported for the respective time period.

Southern California IV. Industry Fundamentals

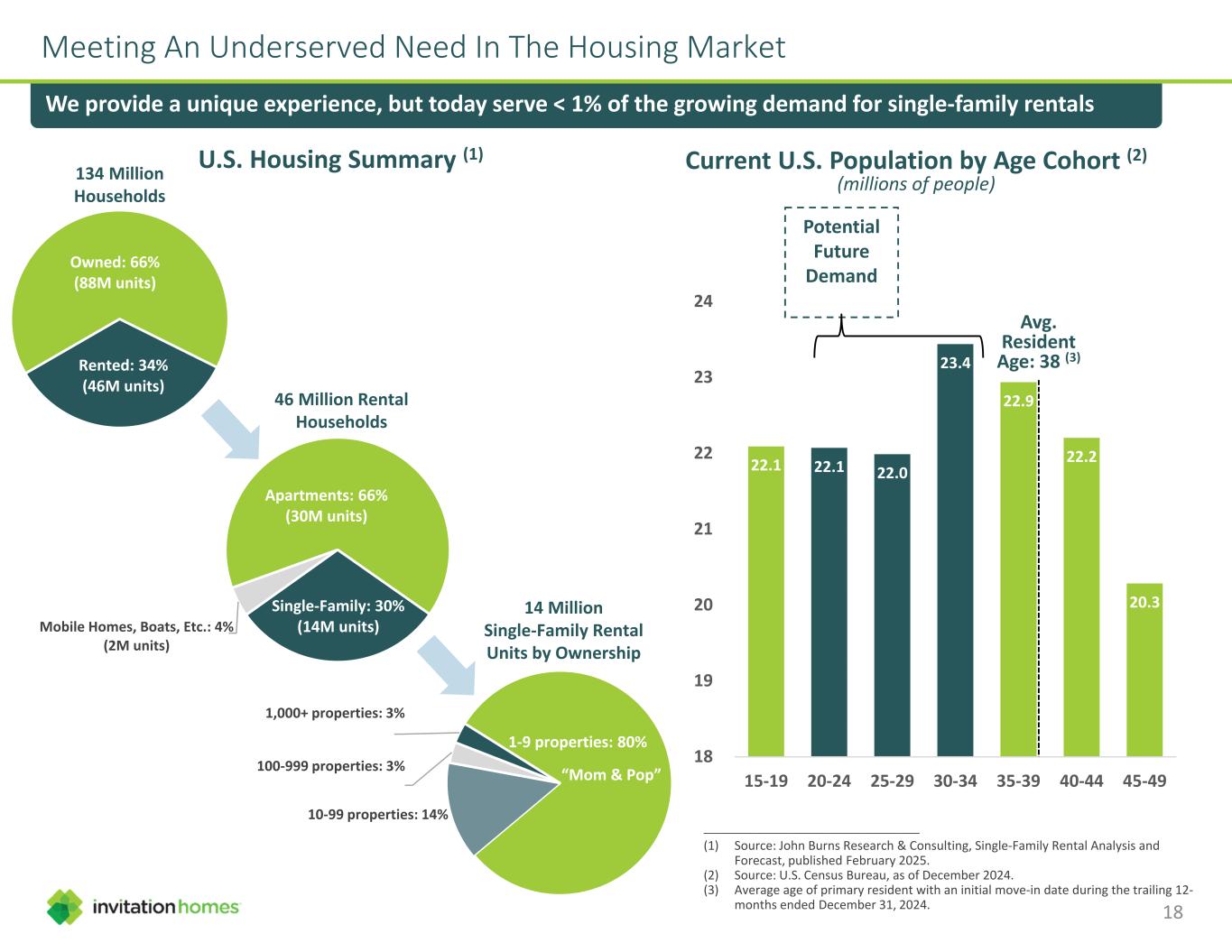

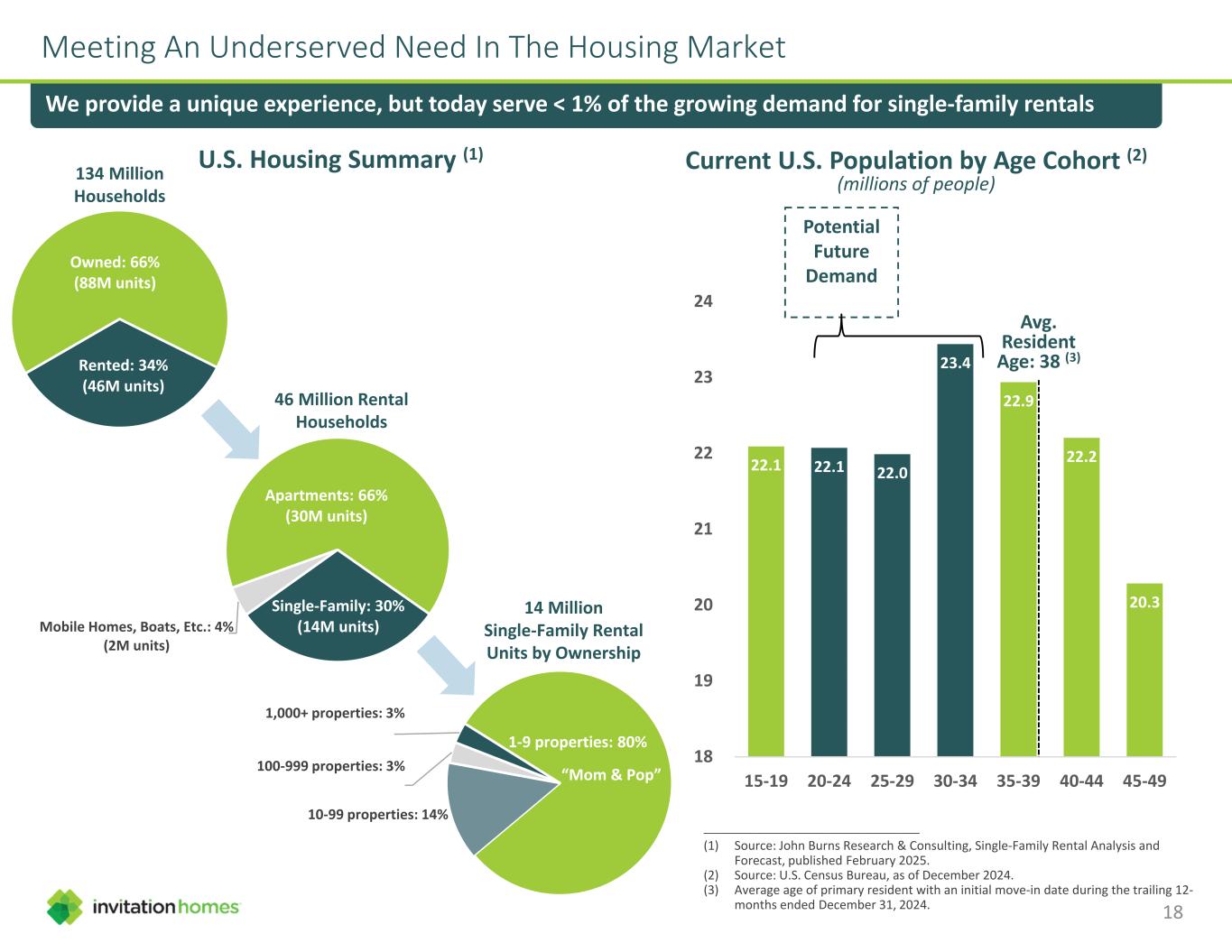

1-9 properties: 80% 10-99 properties: 14% 100-999 properties: 3% 1,000+ properties: 3% Single-Family: 30% (14M units)Mobile Homes, Boats, Etc.: 4% (2M units) Apartments: 66% (30M units) Meeting An Underserved Need In The Housing Market We provide a unique experience, but today serve < 1% of the growing demand for single-family rentals 14 Million Single-Family Rental Units by Ownership Current U.S. Population by Age Cohort (2) (millions of people) 22.1 22.1 22.0 23.4 22.9 22.2 20.3 18 19 20 21 22 23 24 15-19 20-24 25-29 30-34 35-39 40-44 45-49 Avg. Resident Age: 38 (3) Potential Future Demand Owned: 66% (88M units) Rented: 34% (46M units) U.S. Housing Summary (1) 134 Million Households 46 Million Rental Households 18 ________________________________________________ (1) Source: John Burns Research & Consulting, Single-Family Rental Analysis and Forecast, published February 2025. (2) Source: U.S. Census Bureau, as of December 2024. (3) Average age of primary resident with an initial move-in date during the trailing 12- months ended December 31, 2024. “Mom & Pop”

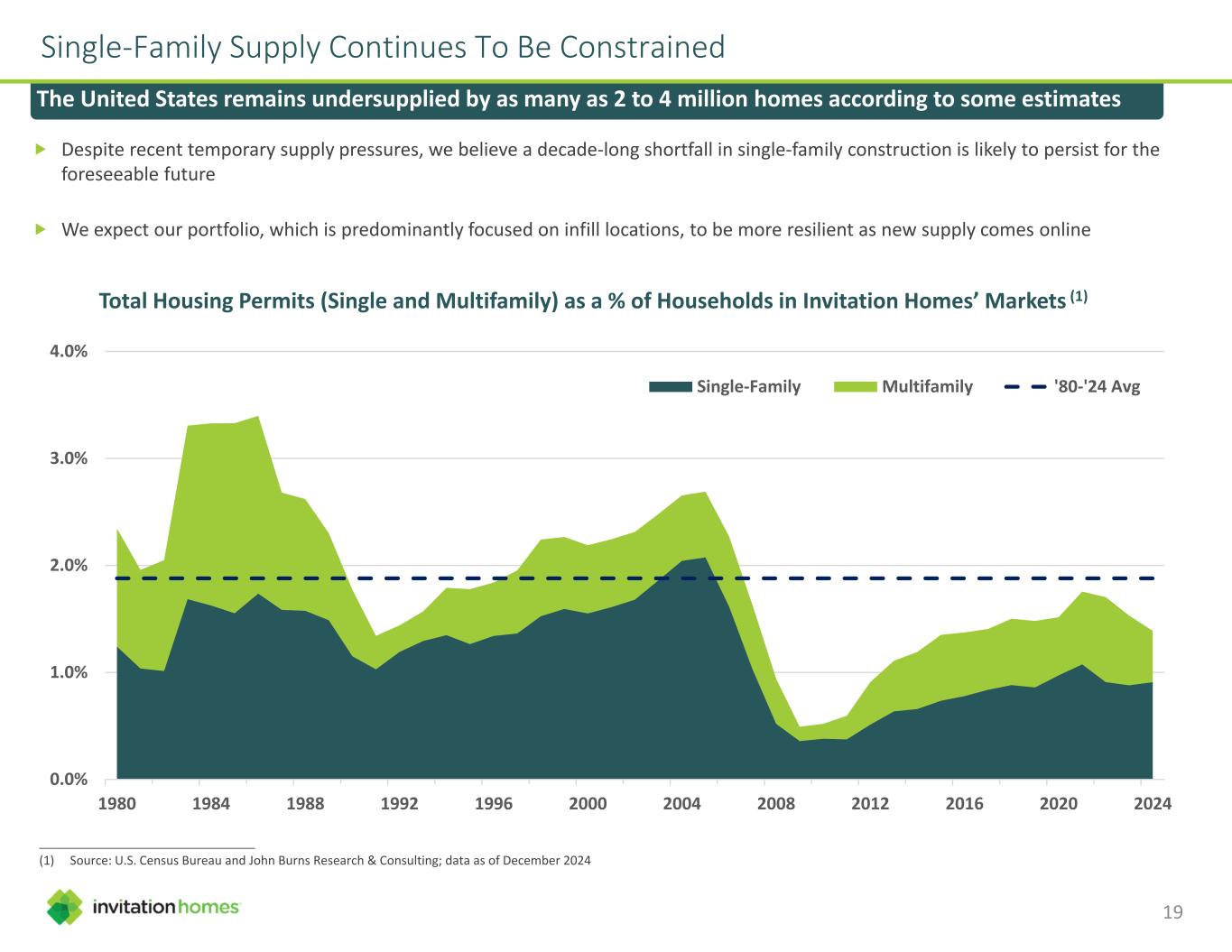

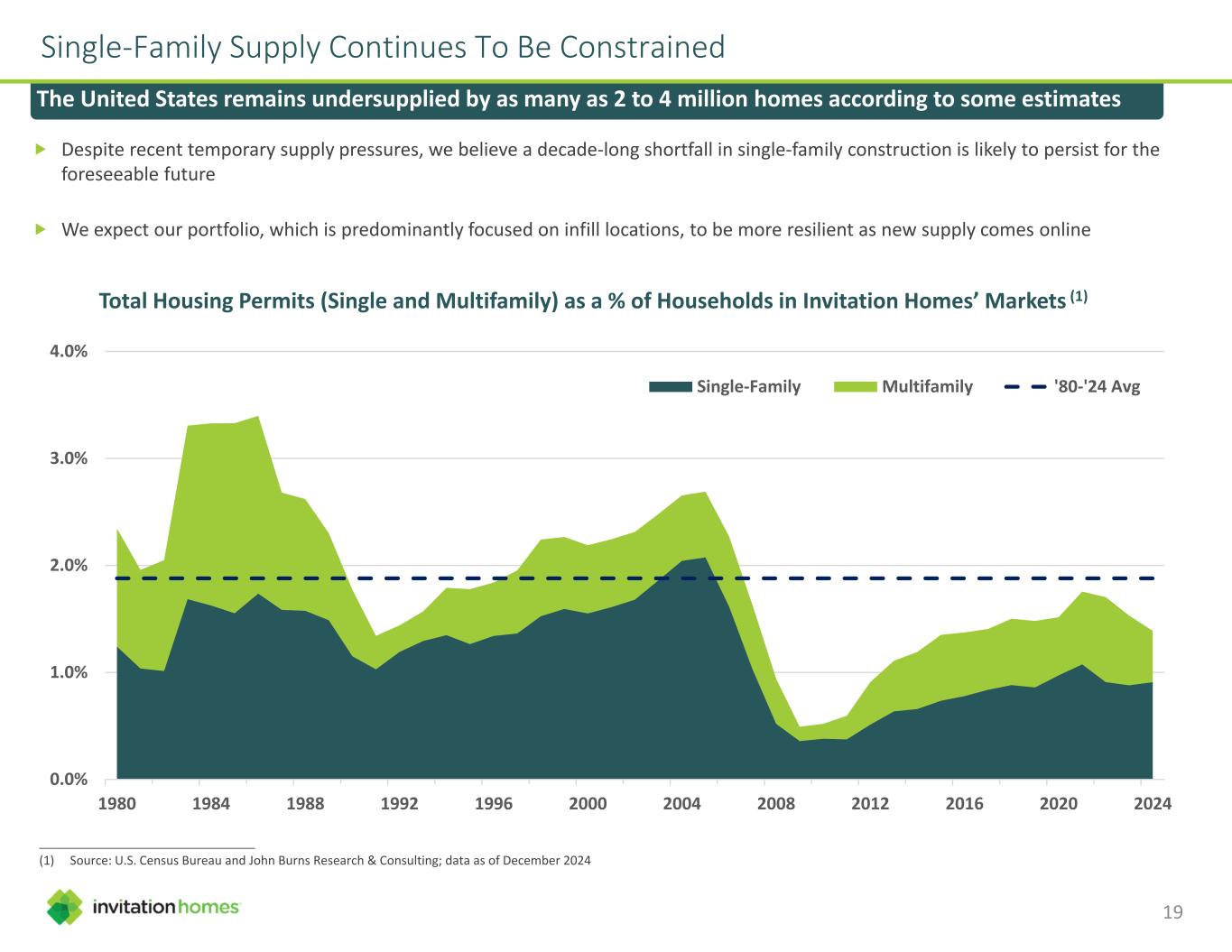

Single-Family Supply Continues To Be Constrained The United States remains undersupplied by as many as 2 to 4 million homes according to some estimates Total Housing Permits (Single and Multifamily) as a % of Households in Invitation Homes’ Markets (1) 0.0% 1.0% 2.0% 3.0% 4.0% 1980 1984 1988 1992 1996 2000 2004 2008 2012 2016 2020 2024 Single-Family Multifamily '80-'24 Avg ________________________________________________ (1) Source: U.S. Census Bureau and John Burns Research & Consulting; data as of December 2024 19 Despite recent temporary supply pressures, we believe a decade-long shortfall in single-family construction is likely to persist for the foreseeable future We expect our portfolio, which is predominantly focused on infill locations, to be more resilient as new supply comes online

Our Commitment To Corporate Stewardship Top-ranked REIT corporate governance (2) 91% of directors are independent Executive and Board involvement in sustainability initiatives Robust risk management Opted out of MUTA Genuine Care commitment to our residents Associates’ goals linked to resident service and sustainability Employee Resource Groups and regular training Coordinated philanthropy and volunteer efforts Free rent payment credit reporting through our partnership with Esusu Read our Sustainability Report online at www.InvitationHomes.com/Sustainability ________________________________________________ (1) Available where feasible. (2) Achieved top score among all REITs in Green Street Advisors’ corporate governance rankings, dated June 20, 2024. Resident education on energy efficiency ENERGY STAR® certified appliances and durable, energy-efficient materials (1) Smart Home technology and HVAC filter delivery program (1) Water-saving landscape designs (1) Anchor investment in Fifth Wall Climate Tech Fund ENVIRONMENTAL GOVERNANCE SOCIAL 20

Disclaimer IR@InvitationHomes.com S&P 500 www.invh.com This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which include, but are not limited to, statements related to the Company’s expectations regarding the performance of the Company’s business, its financial results, its liquidity and capital resources, and other non-historical statements. In some cases, you can identify these forward-looking statements forward-looking words such as “outlook,” “guidance,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including, among others, risks inherent to the single-family rental industry and the Company’s business model, macroeconomic factors beyond the Company’s control, competition in identifying and acquiring properties, competition in the leasing market for quality residents, increasing property taxes, homeowners’ association and insurance costs, poor resident selection and defaults and non-renewals by the Company’s residents, the Company’s dependence on third parties for key services, risks related to the evaluation of properties, performance of the Company’s information technology systems, development and use of artificial intelligence, risks related to the Company’s indebtedness, and risks related to the potential negative impact of fluctuating global and United States economic conditions (including inflation), uncertainty in financial markets (including as a result of events affecting financial institutions), geopolitical tensions, natural disasters, climate change, and public health crises, on the Company’s financial condition, results of operations, cash flows, business, associates, and residents. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The Company believes these factors include, but are not limited to, those described under Part I. Item 1A. “Risk Factors” of its Annual Report on Form 10-K for the year ended December 31, 2024 (the “Annual Report”), as such factors may be updated from time to time in the Company’s periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release, in the Annual Report, and in the Company’s other periodic filings. The forward-looking statements speak only as of the date of this presentation, and the Company expressly disclaims any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except to the extent otherwise required by law.