UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

[Check one]

o |

| REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

OR | ||

|

|

|

x |

| ANNUAL REPORT PURSUANT TO SECTION 13(a) or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2011 Commission File Number: 1-6702

NEXEN INC.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English (if applicable))

Canada

(Province or other jurisdiction of incorporation or organization)

1311

(Primary Standard Industrial

Classification Code Number (if applicable))

98-600202

(I.R.S. Employer

Identification Number (if applicable))

801 - 7th Avenue S.W.

Calgary, Alberta, Canada T2P 3P7

(403) 699-4000

Website: www.nexeninc.com

(Address and telephone number of Registrant’s principal executive offices)

Nexen Petroleum U.S.A. Inc.

5601 Granite Parkway

Suite 1400

Plano, Texas 75024

(972) 450-4600

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

| Name of each exchange on which registered |

|

|

|

Common shares, no par value |

| The New York Stock Exchange |

|

|

|

Subordinated Securities, due 2043 |

| The New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

For Annual Reports indicate by check mark the information filed with this Form:

x Annual information form x Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

527,892,635

Indicate by check mark whether the Registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

Yes o No o

The Annual Report on Form 40-F shall be incorporated by reference into or as an exhibit to, as applicable, each of the Registrant’s Registration Statements under the Securities Act of 1933: Form S-8 (File No.’s 333-119276, 333-118019 and 333-13574), Form F-3 (File No.’s 333- 172612, 333-142670, 333-142652 and 333-84786) and Form F-10 (File No. 333-174753).

Principal Documents

The following documents have been filed as part of this Annual Report on Form 40-F, beginning on the following page:

(a) | Annual Information Form of Nexen Inc. for the fiscal year ended December 31, 2011. |

|

|

(b) | Management’s Discussion and Analysis of Nexen Inc. for the fiscal year ended December 31, 2011. |

|

|

(c) | Consolidated Financial Statements of Nexen Inc. as at December 31, 2011. |

NEXEN INC.

ANNUAL INFORMATION FORM

For the Year Ended December 31, 2011

February 15, 2012

| 1 | |

| 4 | |

| 4 | |

| 6 | |

| 7 | |

| 8 | |

| 14 | |

| 18 | |

| 20 | |

| 20 | |

| 40 | |

| 43 | |

| 44 | |

| 51 | |

| 53 | |

| 55 | |

| 57 | |

| 58 | |

| 59 | |

| 60 | |

| 62 | |

APPENDIX B—Reserves Estimates and Supplementary Data Under SEC Requirements |

| 67 |

APPENDIX C—Form 51-101F2 Report on Reserves Data by Internal Qualified Reserves Evaluator |

| 82 |

APPENDIX D—Form 51-101F3 Report of Management and Directors on NI 51-101 Oil and Gas Disclosure |

| 83 |

ANNUAL INFORMATION FORM (AIF)

Below is a list of terms specific to the oil and gas industry. They are used throughout this AIF.

/d |

| = per day |

| boe |

| = barrel of oil equivalent on the basis of 1 bbl to 6 mcf of natural gas |

bbl |

| = barrel |

| mboe |

| = thousand barrels of oil equivalent |

mbbls |

| = thousand barrels |

| mmboe |

| = million barrels of oil equivalent |

mmbbls |

| = million barrels |

| mcf |

| = thousand cubic feet |

mmbtu |

| = million British thermal units |

| mmcf |

| = million cubic feet |

km |

| = kilometre |

| bcf |

| = billion cubic feet |

MW |

| = megawatt |

| WTI |

| = WestTexas Intermediate |

GWh |

| = gigawatt hours |

| Brent |

| = Dated Brent |

GJ |

| = gigajoules |

| NGL |

| = natural gas liquid |

PSCTM |

| = Premium Synthetic CrudeTM |

| NYMEX |

| = NewYork Mercantile Exchange |

AECO |

| = natural gas storage facility located in Alberta |

| $000s or $M |

| = thousands of dollars |

$MM |

| = millions of dollars |

| US$ |

| = United States dollars |

In this Annual Information Form (AIF), references to “we”, “our”, “us”, “Nexen” or the “Company” mean Nexen Inc., our subsidiaries and partnerships.

Unless we indicate otherwise, all dollar amounts ($) are in Canadian dollars, and oil and gas volumes, reserves and related performance measures are presented on a working interest before-royalties basis. Where appropriate, information on an after-royalties basis is provided. The information contained in this AIF is dated December 31, 2011, unless otherwise indicated. The date of this discussion is February 15, 2012.

Conversions of gas volumes to boe in this AIF were made on the basis of 1 boe to 6 mcf of natural gas. A boe conversion ratio of 6 mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Disclosure provided herein in respect of boes may be misleading, particularly if used in isolation. Using the forecast prices applied to our reserves estimates, the boe conversion ratio based on wellhead value is approximately 30 mcf:1 bbl.

Accounting Matters

In February 2008, the Canadian Institute of Chartered Accountants announced that publicly accountable enterprises must adopt International Financial Reporting Standards (IFRS) by January 1, 2011. Accordingly, our consolidated balance sheet as at January 1, 2010 and the results of operations for the years ended December 31, 2011 and 2010 have been prepared in accordance with IFRS. The financial information presented in the 2011 AIF, Management’s Discussion & Analysis (MD&A) and Consolidated Financial Statements has been prepared in accordance with IFRS as issued by the International Accounting Standards Board (IASB). In accordance with the Canadian IFRS transition rules, financial information before 2010 has not been restated. A description of the transition from previous Canadian generally accepted accounting principles (GAAP) to IFRS is included in Note 26 of our Consolidated Financial Statements.

Non-GAAP Measures

Certain financial measures referred to in this AIF, namely “cash flow from operations” and “net debt” do not have a standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by others. These non-GAAP measures are included to assist investors in analyzing Nexen’s operating performance, leverage and liquidity. Reconciliations of these non-GAAP measures to their nearest GAAP equivalent are included in our MD&A.

Foreign Exchange

The noon-day Canadian to US dollar exchange rates for Cdn$1.00, as reported by the Bank of Canada, were:

(US$) |

| December 31 |

| Average |

| High |

| Low |

|

2007 |

| 1.0120 |

| 0.9304 |

| 1.0905 |

| 0.8437 |

|

2008 |

| 0.8166 |

| 0.9381 |

| 1.0289 |

| 0.7711 |

|

2009 |

| 0.9555 |

| 0.8757 |

| 0.9716 |

| 0.7692 |

|

2010 |

| 1.0054 |

| 0.9709 |

| 1.0054 |

| 0.9278 |

|

2011 |

| 0.9833 |

| 1.0117 |

| 1.0583 |

| 0.9430 |

|

On January 31, 2012, the noon-day exchange rate was US$0.9948 for Cdn$1.00.

FORWARD-LOOKING STATEMENTS

Certain statements in this AIF constitute “forward-looking statements” (within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended) or “forward-looking information” (within the meaning of applicable Canadian securities legislation). Such statements or information (together “forward-looking statements”) are generally identifiable by the forward-looking terminology used such as “anticipate”, “believe”, “intend”, “plan”, “expect”, “estimate”, “budget”, “outlook”, “forecast” or other similar words and include statements relating to, or associated with, individual wells, regions or projects. Any statements as to possible future crude oil or natural gas prices; future production levels; future royalties and tax levels; future capital expenditures, their timing and their allocation to exploration and development activities; future earnings; future asset acquisitions or dispositions; future sources of funding for our capital program; future debt levels; availability of committed credit facilities; possible commerciality of our projects; development plans or capacity expansions; the expectation that we have the ability to substantially grow production at our oil sands facilities through controlled expansions; the expectation of achieving the production design rates from our oil sands facilities; the expectation that our oil sands production facilities continue to develop better and more sustainable practices; the expectation of cheaper and more technologically advanced operations; the expected design size of our facilities; the expected timing and associated production impact of facility turnarounds and maintenance; the expectation that we can continue to operate our offshore exploration, development and production facilities safely and profitably; future ability to execute dispositions of assets or businesses; future sources of liquidity, cash flows and their uses; future drilling of new wells; ultimate recoverability of current and long-term assets; ultimate recoverability of reserves or resources; expected finding and development costs; expected operating costs; the expectation of our ability to comply with the new safety and environmental rules at a minimal incremental cost, and of receiving necessary drilling permits for our US offshore operations; estimates on a per share basis; future foreign currency exchange rates; future expenditures and future allowances relating to environmental matters and our ability to comply therewith; dates by which certain areas will be developed, come on-stream or reach expected operating capacity; and changes in any of the foregoing are forward-looking statements.

Statements relating to “reserves” or “resources” are forward-looking statements, as they involve the implied assessment, based on estimates and assumptions that the reserves and resources described exist in the quantities predicted or estimated and can be profitably produced in the future.

All of the forward-looking statements in this AIF are qualified by the assumptions that are stated or inherent in such forward-looking statements. Although we believe that these assumptions are reasonable based on the information available to us on the date such assumptions were made, this list is not exhaustive of the factors that may affect any of the forward-looking statements and the reader should not place an undue reliance on these assumptions and such forward-looking statements. The key assumptions that have been made in connection with the forward-looking statements include the following: that we will conduct our operations and achieve results of operations as anticipated; that our development plans will achieve the expected results; the general continuance of current or, where applicable, assumed industry conditions; the continuation of assumed tax, royalty and regulatory regimes; the accuracy of the estimates of our reserve volumes; commodity price and cost assumptions; the continued availability of adequate cash flow and debt and/or equity financing to fund our capital and operating requirements as needed; and the extent of our liabilities. We believe the material factors, expectations and assumptions reflected in the forward-looking statements are reasonable, but no assurance can be given that these factors, expectations and assumptions will prove to be correct.

Forward-looking statements are subject to known and unknown risks and uncertainties and other factors, many of which are beyond our control and each of which contributes to the possibility that our forward-looking statements will not occur or that actual results, levels of activity and achievements may differ materially from those expressed or implied by such statements. Such factors include, but are not limited to: market prices for oil and gas; our ability to explore, develop, produce, upgrade and transport crude oil and natural gas to markets; ultimate effectiveness of design or design modifications to facilities; the results of exploration and development drilling and related activities; the cumulative impact of oil sands development on the environment; the impact of technology on operations and processes and how new complex technology may not perform as expected; the availability of pipeline and global refining capacity; risks inherent to the operations of any large, complex refinery units, especially the integration between production operations and an upgrader facility; availability of third-party bitumen for use in our oil sands production facilities; labour and material shortages; risks related to accidents, blowouts and spills in connection with our offshore exploration, development and production activities, particularly our deep-water activities; direct and indirect risks related to the imposition of moratoriums, suspensions or cancellations of our offshore exploration, development and production operations, particularly our deep-water activities; the impact of severe weather on our offshore exploration, development and production activities, particularly our deep-water activities; the effectiveness and reliability of our technology in harsh and unpredictable environments; risks related to the actions and financial circumstances of our agents, contractors, counterparties and joint-venture partners; volatility in energy trading markets; foreign currency exchange rates; economic conditions in the countries and regions in which we carry on business; governmental actions including changes to taxes or royalties, changes in environmental and other laws and regulations including without limitation, those related to our offshore exploration, development and production activities; renegotiations of contracts; results of litigation, arbitration or regulatory proceedings; political uncertainty, including actions by terrorists, insurgent or other groups, or other armed conflict, including conflict between states; and other factors, many of which are beyond our control. These risks, uncertainties and other factors and their possible impact are discussed more fully in the sections titled “Risk Factors” in this AIF and “Quantitative and Qualitative Disclosures About Market Risk” in our MD&A. The impact of any one risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty as these factors are interdependent, and management’s future course of action would depend on our assessment of all information at that time. Although we believe that the expectations conveyed by the forward-looking statements are reasonable based on information available to us on the date such forward-looking statements were made, no assurances can be given as to future results, levels of activity and achievements. Undue reliance should not be placed on the forward-looking statements contained herein, which are made as of the date hereof as the plans, intentions, assumptions or expectations upon which they are based might not occur or come to fruition. Except as required by applicable securities laws, Nexen undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Included herein is information that may be considered financial outlook and/or future-oriented financial information (FOFI). Its purpose is to indicate the potential results of our intentions and may not be appropriate for other purposes. The forward-looking statements contained herein are expressly qualified by this cautionary statement.

Nexen Inc. is incorporated under the Canada Business Corporations Act. Our registered and head office is located at 801 – 7th Avenue S.W., Calgary, Alberta, Canada T2P 3P7.

Our material operating subsidiaries owned directly or indirectly and their jurisdictions of incorporation as at December 31, 2011 are as follows:

|

| Jurisdiction of Incorporation/ |

Name of Subsidiary |

| Formation/Continuation |

Nexen Petroleum UK Limited |

| England & Wales |

Nexen Petroleum Nigeria Limited |

| Nigeria |

Nexen Petroleum Offshore USA Inc. |

| Delaware |

Nexen Marketing |

| Alberta |

Canadian Nexen PetroleumYemen |

| Yemen |

Nexen Oil Sands Partnership |

| Alberta |

All material operating subsidiaries are 100% beneficially owned, controlled or directed by us.

Nexen Inc. is an independent, Canadian-based, global energy company. We were formed in Canada in 1971 as Canadian Occidental Petroleum Ltd. when Occidental Petroleum Corporation combined their Canadian crude oil, natural gas, sulphur and chemical operations into one company.

Strategy

We create value by producing the energy resources that fuel people’s lives. Our strategy is to capture resource early, maintain a portfolio of opportunities and create competitive advantage through technology, talent and experience. We seek to build a sustainable energy company focused on delivering on execution and exploiting our three key growth areas: i) conventional oil and gas; ii) oil sands; and iii) shale gas.

CONVENTIONAL OIL AND GAS

Our conventional oil and gas assets are comprised of large acreage positions in select basins including the UK North Sea, deep-water Gulf of Mexico and offshore West Africa. Strategically, we focus on these basins due to: i) past successes; ii) existing infrastructure in place; iii) significant potential in remaining resource; and iv) attractive fiscal terms. We assess our global portfolio of opportunities to identify prospects that we believe will generate the highest value in our selected basins.

In the UK North Sea, we are a significant regional player with concentrated assets, infrastructure and exploration potential for future growth. In addition to other producing properties, we operate the Buzzard field and platform, which is the largest discovery in the UK North Sea in over a decade. Other recent discoveries at Golden Eagle, Telford TAC and Rochelle are under development and are expected to provide new sources of production in the short-term. We continue to actively explore the UK North Sea basin including relatively under-explored areas such as west of the Shetland Islands.

In the Gulf of Mexico, we hold deep-water and shelf producing assets as well as several undeveloped deep-water discoveries including Appomattox, Vicksburg and Knotty Head. We are a significant leaseholder in the Gulf with access to deep-water drilling rigs. The deep-water Gulf of Mexico is near infrastructure and continental US markets.

We have several significant discoveries offshore West Africa, including Usan, Usan West, Ukot and Owowo. Development of the Usan field is nearing completion and first oil is expected in the next month or two. We are actively exploring the basin with several follow up prospects to pursue.

OIL SANDS

Our oil sands investments include interests in the Long Lake project, the Syncrude joint venture and 656,000 undeveloped acres (gross) in the Athabasca oil sands in northern Alberta. Our oil sands strategy is to generate steady and predictable cash flow for decades. While the cost to produce from the Athabasca oil sands is higher relative to conventional oil deposits, the significant discovered resource base and stable fiscal jurisdiction make this a key source of future oil development.

We first entered the oil sands by acquiring an interest in the Syncrude joint venture. Syncrude produces synthetic crude oil from mined bitumen-saturated sands.

Our in situ oil sands project at Long Lake produces and upgrades bitumen in the Athabasca oil sands. Steam-assisted-gravity-drainage (SAGD) bitumen production began in 2008 and production of PSCTM from the upgrader began in 2009. Our near-term plans include development of the Kinosis lease, a source of in situ bitumen to provide additional feedstock for the Long Lake upgrader.

SHALE GAS

We have over 300,000 acres of shale gas lands in the Horn River, Cordova and Liard basins in northeast British Columbia. Our shale gas strategy is currently focused primarily on the Horn River basin. The Horn River basin is a significant shale gas play with high resource density and strong well productivity. In November 2011, we signed an agreement to farm-out a 40% working interest in our shale gas lands in northeast British Columbia to a consortium led by INPEX Corporation. The sale is expected to close in the second quarter of 2012. In 2011, we expanded our shale gas portfolio by acquiring a non-operated interest in Poland and by beginning to test shale gas opportunities in Colombia.

Shale gas balances our corporate portfolio, which consists predominantly of large-scale, capital-intensive and long cycle-time projects. It provides natural gas exposure and short cycle-time projects where we control the scale and pace of development depending on the current price environment.

Three–Year Overview

20091 |

| · | Generated cash flow from operations of $2.2 billion and net income of $536 million |

|

| · | Discovered the Hobby field in the UK North Sea, the first discovery of our Golden Eagle area |

|

| · | Acquired an additional 15% working interest in the Long Lake project and completed first major turnaround to address steam reliability issues |

|

| · | Produced first PSCTM from Long Lake |

|

| · | Issued $1 billion of 10-year and 30-year senior notes |

|

| · | Discovered Owowo field, offshore West Africa |

|

|

|

|

2010 |

| · | Generated cash flow from operations of $2.2 billion and net income of $1.1 billion |

|

| · | Discovered the Appomattox field in the deep-water Gulf of Mexico |

|

| · | Disposed of non–core, heavy oil properties in Western Canada for $939 million |

|

| · | Divested of non–core marketing businesses including North American natural gas marketing |

|

| · | Doubled bitumen production at Long Lake with improved steam reliability |

|

| · | More than doubled our British Columbia shale gas acreage, adding lands in the Cordova and Liard basins |

|

|

|

|

2011 |

| · | Generated cash flow from operations of $2.4 billion and net income of $697 million |

|

| · | Completed a non-core asset disposition program with the sale of our interest in Canexus for $458 million |

|

| · | Repaid approximately $800 million of long-term debt |

|

| · | Moored the Usan floating production and storage offloading vessel (FPSO) at site in offshore West Africa with final commissioning underway |

|

| · | Developed action plans to increase production at Long Lake and fill the upgrader; ramped-up pad 11, drilled pads 12 and 13 and progressed regulatory process for pads 14, 15 and Kinosis K1A |

|

| · | Commissioned the Buzzard fourth platform to handle higher levels of H2 S from the field |

|

| · | Achieved first oil at our Blackbird field in the UK North Sea |

|

| · | Received government approval and sanctioned the Golden Eagle development in the UK |

|

| · | Brought a nine-well pad on-stream and began drilling an 18-well pad at Horn River |

|

| · | Entered into an agreement to farm-out a 40% working interest in our northeast British Columbia shale gas operations for $700 million |

1 Financial amounts for 2009 and earlier were prepared under previous Canadian Generally Accepted Accounting Principles and have not been restated for IFRS. Amounts for 2010 and 2011 were prepared under IFRS.

In 2012, we expect the following changes to our businesses:

· UK North Sea—progress development of our Golden Eagle discovery, bring tie-backs at Telford TAC and Rochelle on-stream and continue to explore the UK North Sea basin with seven exploration and appraisal wells planned.

· Gulf of Mexico—complete the Kakuna exploration well, continue appraisal of the Appomattox discovery and test other identified deep-water Gulf of Mexico opportunities with six exploration and appraisal wells planned.

· Offshore West Africa—complete commissioning of the Usan FPSO with first oil production in the next month or two and continue exploration of our acreage.

· Long Lake—progress towards filling the upgrader to capacity by optimizing bitumen production from additional Long Lake well pads and accelerating development of the Kinosis bitumen resource.

· Shale Gas—close the sale of the 40% working interest in our northeast British Columbia shale gas operations, bring the first 18-well pad on stream and expand field processing capacity at Horn River and continue exploration activities in Poland and Colombia.

In this AIF, we provide estimates of remaining quantities of proved and probable crude oil, synthetic oil, bitumen, coal bed methane (CBM), shale gas and natural gas reserves (oil and gas reserves) for our various properties as at December 31, 2011. These reserves estimates and related disclosures have been prepared in accordance with National Instrument 51-101—Standards of Disclosure for Oil and Gas Activities (NI 51-101). We have also prepared reserves estimates and disclosures in accordance with SEC requirements, which are included in Appendix B of this AIF. Reserves estimates and disclosures prepared in accordance with NI 51-101 requirements differ from reserves estimates prepared in accordance with SEC requirements. Significant qualitative differences between NI 51-101 and SEC reserves estimates and disclosures are described in the section entitled “Special Note to Investors” on page 40.

Our proved and probable reserve estimates have been internally prepared. For our reserves estimates prepared in accordance with NI 51-101 requirements, we had 96% of our proved reserves assessed (either evaluated or audited as described on pages 37 to 38) by independent reserves consultants. Their assessment of the proved reserves is performed at varying levels of property aggregation, and we work with them to reconcile any difference on the portfolio of properties to within 10% in the aggregate. Estimates pertaining to individual properties within the portfolio may differ by more than 10% either positively or negatively, however, we believe such differences are not material relative to our total proved reserves.

We also had 98% of our NI 51-101 proved plus probable oil and gas reserves estimates assessed by independent reserves consultants. By definition, proved reserves must be determined together with probable reserves (see definition on page 39). As such, the independent reserves consultants’ assessments are prepared on a combined proved plus probable basis. Like proved reserves, their assessment of the proved plus probable reserves is performed at varying levels of property aggregation, and we work with them to reconcile any difference on the portfolio of properties to within 10% in the aggregate. Estimates pertaining to individual properties within the portfolio may differ by more than 10% either positively or negatively, however, we believe such differences are not material relative to our total proved plus probable reserves.

Refer to the section on Basis of Reserves Estimates on pages 21 to 22 for a description of our internal reserves process and the nature and scope of the independent assessments performed on our proved and probable reserves estimates and the results thereof.

UNDERSTANDING THE OIL AND GAS INDUSTRY

The oil and gas industry is highly competitive. With strong global demand for energy and limited exploration opportunities, there is intense competition to find and develop new sources of supply. Yet, barrels from different reservoirs around the world do not have equal value. Their value depends on the costs to find, develop and produce the oil or gas, the fiscal terms of the host regime and the price that products attract based on quality, location and marketing efforts. We captured an inventory of opportunities in our core growth areas, and our goal is to extract the maximum value from each barrel of oil equivalent so that every dollar of capital we invest generates an attractive return.

Numerous factors can affect this. Changes in crude oil and natural gas prices can significantly affect our net income and cash flow generated from operations. Consequently, these prices may also affect the carrying value of our oil and gas properties and how much we invest in oil and gas exploration and development. We attempt to reduce these impacts by investing in projects we believe will generate positive returns at relatively low commodity prices, and we maintain liquidity that provides us with the ability to sustain capital investment in high-quality projects during periods of low commodity prices.

The prices we receive for our oil and gas products are determined by global crude oil and regional natural gas markets, all of which can be volatile. With many alternative customers, the loss of any one customer is not expected to have a materially adverse effect on the price of our products or revenues. Oil and gas producing operations are generally not seasonal. However, demand for some of our products such as natural gas can fluctuate season to season, which impacts price. We manage our operations on a country-by-country basis, reflecting differences in the regulatory regime, competitive environments and risk factors associated with each country.

Presentation of our oil and gas operations is separated between conventional oil and gas activities, and oil sands activities. Our conventional operations include our oil and gas operations in the UK North Sea, North America (excluding oil sands) and other countries (Yemen, offshore West Africa, Colombia and other). Our oil sands activities are segregated between in situ oil sands operations (primarily at Long Lake) and our interest in Syncrude. Our shale gas results are included in the North America segment until they become significant.

Production, revenues, net income, capital expenditures and identifiable assets for these segments appear in Note 25 to the Consolidated Financial Statements and in our MD&A.

|

|

|

United Kingdom (UK) – North Sea

· We are the second largest oil producer in the UK North Sea.

· We are developing our Golden Eagle discovery, with first oil expected in late 2014.

· We continue to actively explore the North Sea, with seven exploration and appraisal wells planned for 2012.

|

|

|

The UK North Sea is a key producing area for Nexen. Our primary assets, which we operate, include a 43.2% interest in the Buzzard field and facilities, a 41.9% interest in the Scott field and production platform, an 80.4% interest in the Telford field, a 79.7% interest in the Ettrick field and a 90.6% interest in the Blackbird field, along with interests in several undeveloped discoveries and approximately 971,000 net undeveloped exploration acres. We are a significant regional player with concentrated assets, infrastructure and exploration potential for future growth. Our UK North Sea operations complement our global portfolio with significant cash flow generation and the opportunity for short cycle-time production growth.

Our UK strategy is to grow our existing North Sea production and identify new sources of production. To do this, we identify exploration and exploitation opportunities near existing infrastructure that can be tied-in economically in a short time period. We also seek to establish new core areas through exploration in relatively unexplored areas of the basin (e.g. west of Shetlands, the Central Graben and the northern North Sea). We target oil-focused assets that are early life and generate strong cash margins.

BUZZARD

The Buzzard field is located about 60 miles northeast of Aberdeen in the Outer Moray Firth, central North Sea, in 317 feet of water. Buzzard is the largest discovery in the UK North Sea in over a decade. It was discovered in 2001 and came on stream in early 2007. The Buzzard development was initially comprised of three platforms capable of processing at least 200,000 bbls/d of oil and 60 mmcf/d of gas. A fourth platform with production-sweetening facilities to handle higher levels of hydrogen sulphide was completed in 2011. Oil from Buzzard is exported via the Forties pipeline to the Kinneil Terminal in Scotland. Gas is exported via the Frigg system to the St. Fergus Gas Terminal in northeast Scotland.

We expect to produce the Buzzard field through 36 production wells and maintain reservoir pressure with an active water-flood program. We have drilled 30 of these wells to date. Our share of production in 2011 was 62,400 boe/d. In 2012, we expect to drill five additional production wells and one appraisal well in the Buzzard field.

SCOTT/TELFORD

The Scott field began producing in 1993, while Telford was tied back to the Scott platform and came on stream in 1996. Most of our oil and gas from these fields is produced through subsea wells tied back to the Scott platform. Oil is delivered to the third-party Kinneil Terminal in Scotland via the Forties pipeline, while gas is exported via the SAGE pipeline to the St. Fergus Gas Terminal in northeast Scotland. Recently, successful extension drilling of the Telford field exceeded expectations and extended the field’s proved reserves. The TAC and TAE Telford development wells are expected to be on stream in 2012 and 2013, respectively. The nearby Rochelle gas field is planned to be tied back to the Scott platform in 2012. Scott/Telford produced 13,000 boe/d (net to us) in 2011. We plan to drill two additional development wells in 2012 at Telford.

ETTRICK/BLACKBIRD

Ettrick is a producing field originally discovered in 1981 and brought on stream in 2009. Oil and gas is produced from the fields through seven subsea wells tied back to a leased FPSO. The FPSO is designed to handle 30,000 bbls/d of oil and 35 mmcf/d of gas and to re-inject 55,000 bbls/d of water. The produced oil is offloaded from the FPSO onto tankers and typically delivered to ports in the North Sea. Production from the nearby Blackbird field came on stream late in 2011 and is produced through the Ettrick FPSO. Our share of production from Ettrick/Blackbird in 2011 was 14,000 boe/d. We expect to drill two development wells in 2012, one in each field.

GOLDEN EAGLE

In 2007, we made a discovery at Golden Eagle, followed by Peregrine (formerly Pink) in 2008 and Hobby in 2009. We refer to these three discoveries as the Golden Eagle area and hold a 36.5% operated interest. Since the original discovery, we successfully completed a comprehensive appraisal program, which included drilling nine appraisal wells, two drill-stem tests and one injection test. In 2011, we completed the appraisal work, explored additional acreage, sanctioned the development plan and received government approval. The Golden Eagle development will include a two-platform stand-alone facility with production capacity of about 70,000 boe/d (26,000 boe/d net to us) at full rates. In 2012, we expect to advance the development of the Golden Eagle area and begin to fabricate the platforms and facilities. Development drilling in the field is expected to start in 2013 and first oil is expected in late 2014. Our net investment is expected to be $1.2 billion over the next three years.

EXPLORATION

We hold approximately 68 blocks in the UK North Sea. We continue to actively explore the basin and hold several undeveloped discoveries on operated blocks near the Golden Eagle, Scott and Buzzard facilities as follows:

Field |

| Interest (%) |

| Operator Status |

| Comments |

Blackhorse |

| 50 |

| operated |

| discovery near Scott, evaluating development alternatives |

Bright |

| 80 |

| operated |

| discovery near Buzzard, evaluating development alternatives |

Bugle |

| 100 |

| operated |

| discovery near Scott, evaluating development alternatives |

Kildare |

| 50 |

| operated |

| discovery near Scott; evaluating development alternatives |

Marten |

| 40 |

| operated |

| discovery near Buzzard, evaluating development alternatives |

Polecat |

| 100 |

| operated |

| discovery near Buzzard; evaluating development alternatives |

Samedi |

| 100 |

| operated |

| discovery near Golden Eagle, evaluating development alternatives |

In the UK North Sea, we plan to drill a total of four exploration wells and three appraisal wells in 2012.

United States (US) — Gulf of Mexico

· We are a significant leaseholder in the deep-water Gulf of Mexico.

· We are appraising our Appomattox discovery in the emerging Norphlet play.

|

|

|

The deep-water Gulf of Mexico is an integral part of our growth strategy. Existing production infrastructure, the potential for material discoveries and attractive fiscal terms make the deep-water Gulf of Mexico one of the world’s most prospective basins for oil and gas. While costs of deep-water exploration are typically higher, prospects generally have multiple sands and higher production rates—factors that can enhance economics. The deep-water Gulf is near infrastructure and continental US markets, so discoveries can be brought on stream in reasonable time frames relative to less developed or more remote areas of the world. We currently focus our exploration program on Miocene sub-salt plays and Norphlet targets in the central Gulf of Mexico.

Over the past few years, we have built our resources and capabilities to explore in the deep water by accumulating a large inventory of high-quality acreage and gained access to two new-build deep-water drilling rigs.

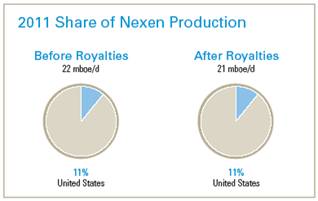

Our existing Gulf of Mexico production and reserves are primarily concentrated in six deep—water and four shallow—water (shelf) areas. Our oil and natural gas production is transported to the continental US for sale via third-party pipelines and infrastructure. Our share of production from the Gulf of Mexico in 2011 was 22,600 boe/d (20,400 boe/d after royalties).

DEEP WATER

Most of our deep-water production comes from our 25% non-operated Longhorn field, our 100% operated Aspen field, our 50% non-operated Wrigley field, and our 30% non-operated Gunnison field. Our share of 2011 deep-water production before royalties was 16,400 boe/d (15,300 boe/d after royalties).

Our Longhorn property is on Mississippi Canyon Blocks 502 and 546 in 2,400 feet of water. The project is a non-operated four-well subsea tie-back to the Corral platform located 19 miles north of the field. Longhorn came on stream in late 2009 and produced 7,900 boe/d (net to us) in 2011.

Aspen is on Green Canyon Block 243 in 3,150 feet of water. The project was developed using four subsea oil wells tied back to the third-party operated Bullwinkle platform 16 miles away and began producing in late 2002.

Wrigley is on Mississippi Canyon Block 506 in 3,300 feet of water. The project began gas production in 2007 and consists of a single subsea well tied back to the Shell-operated Cognac platform 17 miles away.

Gunnison is in 3,100 feet of water and includes Garden Banks Blocks 667, 668 and 669. Gunnison began production in late 2003 through a truss SPAR platform that can handle 40,000 bbls/d of oil and 200 mmcf/d of gas.

Green Canyon 6/137 is in water depths of 650 feet. Production from this field is currently suspended as the third-party platform that processed our oil and gas was destroyed by Hurricane Ike in September 2008. A tie-back to existing third-party facilities to restore production is under construction and production is expected to resume in 2012.

SHELF

Our shelf producing assets are offshore Louisiana, primarily in four 100%-owned field areas: Eugene Island 255/257/258/259, Eugene Island 295, Vermilion 76 and West Delta. Given the mature nature of these assets, our 2012 capital investment on these assets is expected to be minimal.

EXPLORATION

We hold approximately 205 blocks in the Gulf of Mexico and expect this acreage and future exploration opportunities to position us for growth. Our undeveloped deep-water discoveries include:

Well |

| Interest (%) |

| Operator Status |

| Comments |

Appomattox |

| 20 |

| non-operated |

| discovery; appraisal underway |

Knotty Head |

| 25 |

| non-operated |

| discovery; currently evaluating development options |

Vicksburg |

| 25 |

| non-operated |

| discovery; further appraisal required |

In 2010, we completed a successful exploration well and sidetrack at Appomattox, approximately six miles west of our Vicksburg discovery. Results of these activities indicated a significant oil discovery with the potential to extend the discovery. In 2011, appraisal drilling recommenced at Appomattox following the end of the US Government drilling moratorium. In early 2012, a successful well on the northeast fault block encountered oil play and we are completing an evaluation to determine the size of the discovery. Additional wells are planned in 2012 to further delineate these discoveries. During 2011, we progressed development studies at Knotty Head and began drilling operations at Kakuna, a 52.5% operated deep-water exploration well targetting the Miocene sub-salt play. Results from this well are expected in 2012. In 2011, we received a drilling permit from the US Government to drill the deep-water Angel Fire prospect, which we expect to spud during 2012.

In 2012, we plan to drill up to six exploration and appraisal wells in the deep-water Gulf of Mexico, focusing on the Miocene sub-salt play and following up on the success in the Norphlet play.

Other International

· Our entry into Yemen kicked off our international expansion in the early 1990s, which provided us with other international opportunities.

· Development of the Usan field, offshore Nigeria is nearing completion and first oil production is expected in the next month or two.

· In Nigeria, we have several discoveries and additional exploration prospects beyond Usan.

NIGERIA

Offshore West Africa is a core area with several discoveries that offer relatively low risk exploration for prolific reservoirs supported by 3D seismic data. Our strategy here is to complete development of the Usan discovery and continue to explore our existing portfolio of multiple prospects in this oil-rich region to provide medium to long-term growth.

In 1998, we acquired a 20% non-operated interest in Block OPL-222, which covers 448,000 acres approximately 80 km offshore in water depths ranging from 200 to 1,200 metres. In 1998, we discovered the Ukot field comprised of three oil-bearing intervals and in 2002, the Usan field was discovered, with seven successful wells confirming the presence of significant hydrocarbon accumulations. In 2007, OPL-222 was converted to two Oil Mining Leases, OML-138 and 139. The Usan development is within OML-138.

Development of the Usan field is progressing and expected to come on stream in the next month or two, with peak facility capacity of 180,000 bbls/d (36,000 bbls/d, net to us). The FPSO and initial subsea facilities were completed and installed in the field during 2011. The FPSO, capable of storing up to two million barrels of oil, is undergoing final hook-up and commissioning. Oil will be offloaded onto tankers for delivery to customers.

In 2008, we acquired an 18% non-operated interest in Block OPL-223, covering 230,000 acres, which provides us with significant exploration potential contiguous with our other licenses. In 2009, we drilled the Owowo South B-1 exploration well in the southern portion of Block OPL-223, in 670 metres of water, 20 km east of the Usan field. Under the Production Sharing Contract governing OPL-223, the Nigerian National Petroleum Corporation is the concessionaire of the license. All of our licenses in Nigeria are operated by Total Exploration & Production Nigeria Ltd. We are planning a multi-well exploration and appraisal drilling program in 2012 to test and delineate our Nigeria portfolio.

As is typical in many jurisdictions, the Nigerian government is reviewing its existing petroleum fiscal terms, including those applicable to our interests, the impact of which could negatively affect the economics of our projects.

YEMEN

Yemen was a significant international region for us since we first began production at Masila on Block 14 in 1993. We operated Masila, the country’s largest oil project, for 18 years and developed strong relationships with the government and local communities. On December 17, 2011, the Masila production sharing agreement (PSA) expired and production, operations, central processing facility, main oil pipeline and export facilities were transferred to the Yemen Government. We continue to operate the East Al Hajr facility (Block 51) and our strategy is to maximize the remaining value of the block.

Production from Yemen in 2011 was 32,900 bbls/d (18,100 bbls/d after royalties).

East Al Hajr Block (Block 51)

The first successful exploratory well was drilled in 2003 and development of the block began in 2004, which included a central processing facility (CPF), gathering system and a 22 km tie-back to an export oil pipeline. Production commenced in late 2004 and approximately 69 wells are currently on stream. Oil is delivered to customers via tankers in the Gulf of Aden.

We operate Block 51, which is governed by the Block 51 PSA between the Government of Yemen and the East Al Hajr partners (EAH Partners); The Yemen Company (TYCO) (12.5% carried working interest) and Nexen (87.5% working interest). Under the PSA, TYCO has no obligation to fund capital or operating expenditures and, therefore, our effective interest is 100% and, for purposes of accounting and reserves recognition, we treat TYCO’s 12.5% participating interest as a royalty interest. The PSA expires in 2023.

COLOMBIA

In 2000, we made a discovery at Guando on our 20% non-operated Boqueron Block, and production from the Guando field began in 2001. Boqueron is in the Upper Magdalena Basin of central Colombia, approximately 100 km southwest of Bogota. Under terms of our licence, our working interest in Guando decreased from 20 to 10% during the second quarter of 2009, as cumulative oil production from the field reached 60 million barrels. Our share of production in Colombia in 2011 was 1,700 bbls/d (1,600 bbls/d after royalties).

We currently hold interests in six exploration and production blocks in the Upper Magdalena Basin and the Eastern Cordillera area. In the Upper Magdalena Basin, we hold a 10% interest in the Boqueron block and a 50% non-operating interest in the Villarrica Norte Block. In the Eastern Cordillera area, we hold a 100% interest in the Chiquinquira, Sueva, Barbosa and Garagoa exploration and production blocks.

· We operate the Long Lake project, an integrated SAGD and upgrader process.

· Syncrude has been operating for over 30 years and provides steady predictable cash flows.

· We have significant undeveloped acreage in the Athabasca oil sands, totaling over 656,000 acres (gross).

The Athabasca oil sands deposit in northeast Alberta is a key growth area for us. Our strategy is to economically develop our bitumen resource in phases to provide low-risk, stable, future growth. Our operated project at Long Lake involves integrating SAGD bitumen production with field-upgrading technology to produce PSCTM for sale, and synthetic gas, which significantly reduces our need to purchase natural gas for operations. We have a 7.23% investment in the Syncrude oil sands mining and upgrading operation, as well as significant undeveloped acreage.

In Situ Oil Sands

In 2001, we formed a joint venture with OPTI Canada Inc. (OPTI) to develop the Long Lake lease using SAGD for in situ bitumen production and proprietary OrCrudeTM technology for the first stage of upgrading the bitumen to PSCTM. OPTI has the exclusive Canadian licence for the OrCrudeTM technology. We acquired the exclusive right to use this technology with OPTI within approximately 160 km of Long Lake, and the right to use the technology elsewhere in Canada and the rest of the world (excluding Israel) subject to certain rights of OPTI to participate.

SAGD bitumen operations at Long Lake started mid-2008 and we began producing PSCTM from the upgrader in 2009. Early in 2009, we acquired an additional 15% interest in the Long Lake project and the joint venture lands from OPTI, increasing our ownership level to 65%. Following the acquisition, we are responsible for operating the entire project.

In 2011, Chinese National Offshore Oil Company acquired OPTI, which included the 35% non-operated interest in the Long Lake project and joint venture lands.

|

|

|

SAGD AND UPGRADER INTEGRATION

The SAGD process involves drilling two parallel horizontal wells about 16 feet apart, with horizontal portions generally between 2,300 and 3,300 feet long. Steam is injected into the shallower well, where it heats the bitumen that then flows by gravity to the deeper producing well. The OrCrudeTM technology, using conventional distillation, solvent de-asphalting and thermal cracking, separates the produced bitumen into partially upgraded sour crude oil and liquid asphaltenes. By coupling the OrCrudeTM process with commercially available hydrocracking and gasification technologies, sour crude oil is upgraded to light (39° API) PSCTM , and the asphaltenes are converted to a low-energy, synthetic fuel gas. This gas is available as a low-cost fuel for generating steam and as a source of hydrogen for the hydrocracking process. The gas is also consumed in a dual 85 MW unit cogeneration plant to produce electricity for on-site use and sale to the provincial electricity grid. The energy conversion efficiency for our Long Lake upgrader is about 90%, compared to 75% for a typical bitumen-fed coker based plant.

LONG LAKE AND KINOSIS PROJECTS

The Long Lake project is located approximately 40 km southeast of Fort McMurray, Alberta and operations include steam generation and water treatment facilities, cogeneration plant, SAGD operations and an onsite upgrader. Bitumen is produced from the McMurray reservoir through 90 well pairs located on 11 pads. Steam generation capacity is 228,000 bbls/d from six once-through steam boilers (46% of total capacity) and two cogeneration units (54% of total capacity).

The first several months of steam injection into a well pair largely involve heating the reservoir, followed by a ramp-up of bitumen production to peak rates over 12 to 24 months. At the start of production, steam-to-oil ratios (SORs) are high but are expected to decline as bitumen production ramps up to our target rates. We expect the SOR to be in the range of three to four over the long term.

We completed drilling 10 wells on pad 11 during 2011 with first production from the initial wells mid year. We currently produce 4,500 bbls/d (gross) from this pad and expect to produce 4,000 to 8,000 bbls/d (gross) at maturity. We expect to begin steaming the 18 well pairs on pads 12 and 13 in the spring and fall of 2012, respectively, with first oil expected three months later, thereafter ramping up over 12 to 18 months. We expect production from these two pads will contribute 11,000 to 17,000 bbls/d (gross) at maturity.

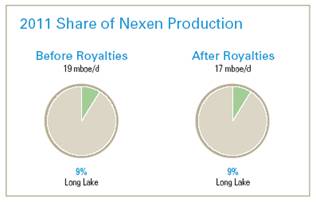

SAGD bitumen production in 2011 averaged 28,600 bbls/d gross (18,600 bbls/d net to us) and we are currently producing approximately 35,000 bbls/d gross (22,800 bbls/d net to us).

Initially, we expected to fill the upgrader from the first 11 pads that are now on-stream; however, we underestimated the impact lean zones and shales would have on production rates and steam-oil ratio (SOR). We better understand the correlation between reservoir characteristics, production and SOR, based on the range of well performance we experienced in the initial wells. This understanding allows us to target the best quality resource for development that is analogous to the wells in our initial set that are exhibiting good performance. It also confirms that our oil sands lands, including undeveloped areas on the Long Lake lease, contain attractive resource. We expect production from pads 1 to 11 to continue to increase over time from additional steam, heating through the lean zones, the ramp-up of wells as they mature, and well work-over activities.

In 2011, we adjusted our oil sands resource development strategy to accelerate increasing bitumen production for filling the upgrader. Our strategy for filling the upgrader includes:

· maintain production from the initial 10 pads;

· ramp-up of pad 11;

· start-up of pads 12 and 13, where steaming is expected in 2012;

· drilling of pads 14 and 15, which are expected to commence drilling in 2012, with first steam in 2013;

· acceleration of development of high quality resource from Kinosis (K1A);

· drilling additional core holes to identify future drilling locations on the Long Lake and Kinosis leases; and

· processing third-party sourced bitumen in the interim to enhance returns.

We are working through the engineering and regulatory processes to develop 25 to 30 well pairs on the Kinosis lease, which is located along the southern border of Long Lake (known as K1A). These wells will be drilled in bitumen resource where our extensive core hole analysis and reservoir understanding indicates that the geological characteristics, including minimal lean zones and shale barriers, are similar to our higher producing areas. Assuming regulatory approval, drilling is expected in 2012 or 2013, with first steam injection in early 2014. We expect production from these wells will contribute 15,000 to 25,000 bbls/d (gross).

To further evaluate our Long Lake and Kinosis leases for future development, a 200 well core-hole drilling program is expected to be completed this winter. This program supports our sustaining development activities to keep the Long Lake upgrader full and to begin developing the remainder of the Kinosis lease.

We expect to maintain bitumen production over the project’s life, estimated in excess of 50 years, by periodically drilling additional SAGD well pairs.

Initial production of PSCTM oil from the upgrader began in 2009. The upgrader consists of the OrCrudeTM unit, air separation unit, hydro-cracker, sulphur recovery facilities and gasifier. Production design capacity for the Long Lake upgrader is approximately 60,000 bbls/d (39,000 bbls/d net to us) of PSCTM. We are progressing projects that will increase the operating independence between our SAGD facilities and upgrader while maintaining the benefits of integration. The facilities are able to import between 10,000 and 15,000 bbls/d of third party bitumen to process into PSCTM through the upgrader.

In 2011, we processed about 31,500 bbls/d gross (20,500 bbls/d net to us) of proprietary and third-party bitumen through the upgrader, producing 22,800 bbls/d gross (14,800 bbls/d net to us) of PSCTM. Our operations include storage capacity of 430,000 bbls on site. PSCTM is transported via the Athabasca Pipeline to Hardisty and sold to customers in Canada and the US.

Combined SAGD, cogeneration and upgrading operating costs are expected to average about $35/bbl once we reach design capacities. We expect ongoing capital costs to average approximately $10/bbl depending on well spacing, well length and recovery factor. The full-cycle capital costs of producing and upgrading bitumen using this technology are comparable to those for surface mining and coking upgrading on a barrel-of-daily production basis.

OTHER PROJECTS

Engineering and regulatory work is underway on the non-operated SAGD project at Hangingstone. We have a 25% interest in this project. Project sanctioning is expected in 2012 with first steam in 2016. Our share of production at full rates is expected to be 6,000 bbls/d.

Syncrude

We hold a 7.23% participating interest in the Syncrude joint venture. This joint venture was established in 1975 to mine shallow oil sand deposits using open-pit mining methods, extract the bitumen and upgrade it to a high-quality, light (32° API), sweet, synthetic crude oil. Syncrude’s operating strategy is to develop this resource, focusing on safe, reliable and profitable operations.

|

|

|

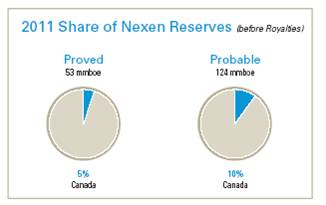

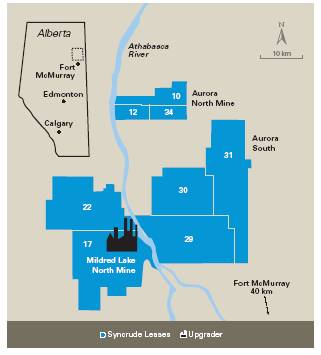

Syncrude exploits a portion of the Athabasca oil sands that contains bitumen in the unconsolidated sands of the McMurray formation. Ore bodies are buried beneath 50 to 150 feet of over-burden, have bitumen grades ranging from 4 to 14% by weight and ore-bearing sand thickness of 100 to 160 feet. Syncrude’s operations are on eight leases (10, 12, 17, 22, 29, 30, 31 and 34) covering 248,300 acres, 40 km north of Fort McMurray in northeast Alberta. Syncrude currently mines oil sands at two mines: Mildred Lake North and Aurora North. Trucks and shovels are used to collect the oil sands in the open-pit mines. The oil sands are transferred for processing using a hydro-transport system.

The extraction facilities, which separate bitumen from oil sands, are capable of processing more than 310 million tons of oil sands per year and between 140 and 160 million barrels of bitumen per year depending on the average bitumen ore grade. To extract bitumen, the oil sands are mixed with water to form a slurry. Air and chemicals are added to separate bitumen from the sand grains. The process at the Mildred Lake North Mine uses hot water, steam and caustic soda to create a slurry, while at the Aurora North Mine, the oil sands are mixed with warm water. Close to 90% of the water used in operations is recycled from the upgrader and mine sites. Incremental water is drawn from the Athabasca River in accordance with existing licences.

The extracted bitumen is fed into a vacuum distillation tower and three cokers for primary upgrading, which ultimately become light, sweet, synthetic crude oil. Sulphur and coke, which are by-products of the process, are stockpiled for possible future sale.

The high quality of Syncrude’s synthetic crude oil allows it to be sold at prices approximating WTI. In 2011, about 45% of the synthetic crude oil was sold to refineries in Eastern Canada, 40% to those in the mid-western United States and the remaining 15% was sold to refineries in the Edmonton area. Electricity is provided to Syncrude from two generating plants on site: a 270 MW plant and an 80 MW plant.

Since operations started in 1978, Syncrude has shipped more than two billion barrels of synthetic crude oil to Edmonton by Alberta Oil Sands Pipeline Ltd. The pipeline was expanded in 2004 and 2009 to accommodate increased Syncrude production.

In 1999, the Alberta Energy and Utilities Board (AEUB) extended Syncrude’s operating licence for the eight oil sands leases through to 2035. The licence permits Syncrude to mine oil sands and produce synthetic crude oil from approved development areas on the oil sands leases. The leases are automatically renewable as long as oil sands operations are ongoing or the leases are part of an approved development plan. All eight leases are included in a development plan approved by the AEUB. There were no known commercial operations on these leases prior to the start-up of operations in 1978.

In 1999, the AEUB approved an increase in Syncrude’s production capacity to 465,700 bbls/d. At the end of 2001, Syncrude increased its synthetic crude oil capacity to 246,500 bbls/d with the development of the Aurora North Mine, which involved extending mining operations to a new location about 40 km north of the main Syncrude site. The next expansion of Syncrude came on stream in 2006, increasing capacity to 360,000 bbls/d with the completion of the Stage 3 project.

Syncrude pays royalties to the Alberta government. Effective January 1, 2009, and consistent with other oil sands producers, Syncrude began paying royalties based on bitumen, rather than paying royalties calculated on fully upgraded synthetic crude oil. As a part of this conversion, the Alberta government will recapture royalties related to upgrader capital expenses of about $5 billion (gross) that were deducted against prior royalties from future production over a 25-year period. In connection with the transition to the revised Alberta royalty framework, Syncrude will continue to pay base royalty rates (being the greater of 25% of net bitumen-based revenues, or 1% of gross bitumen-based revenues) plus an incremental royalty of up to $975 million (our share $70.5 million) until December 31, 2015. The incremental royalty is subject to certain minimum bitumen production thresholds and is to be paid in six annual payments. This agreement is in lieu of the Syncrude owners converting to the Province of Alberta’s new royalty framework that became effective January 1, 2009. After January 1, 2016, the rates under the new Alberta royalty framework will apply to the Syncrude project.

· We reached a joint venture agreement for our northeast British Columbia shale gas play to accelerate value realization.

· We brought on stream a nine—well pad in the Horn River basin during the year.

· We expanded our shale gas exploration portfolio by acquiring a non-operated exploration interest in Poland and by testing shale gas opportunities in Colombia.

|

|

|

As part of our growth strategy in unconventional Canadian resource plays, we have accumulated over 300,000 acres of prospective shale gas lands in northeast British Columbia. Shale gas is natural gas produced from reservoirs composed of organic shale. The gas is stored in pore spaces and fractures, or absorbed into organic matter. Recent advances in drilling and completion technology have allowed companies to access this considerable potential resource.

Our shale gas resource allows us to take advantage of emerging markets such as growing oil sands demand and potential liquid natural gas (LNG) export opportunities off the west coast. Shale gas complements our corporate oil and gas portfolio with natural gas exposure and relatively short cycle-time projects where we control the scale and pace of development of the resource. We can match the pace of drilling and field development to forecasted economic conditions.

Our Canadian production (excluding the Athabasca oil sands) is comprised of unconventional shale gas assets in northeast British Columbia and conventional producing natural gas and CBM assets in Alberta and Saskatchewan. Prior to the sale of our heavy oil assets in July 2010, Canadian production included heavy oil volumes from east-central Alberta and west-central Saskatchewan. Proceeds from the sale were $939 million and the properties were producing approximately 15,000 boe/d.

In addition to our development of the Athabasca oil sands, our strategy for Canada is three-fold: i) significantly expand our shale gas reserves and production; ii) generate new material resource play opportunities; and iii) continue to optimize value from our conventional and CBM producing assets.

NORTHEAST BRITISH COLUMBIA

We hold approximately 300,000 acres in the Horn River, Cordova and Liard basins in northeast British Columbia. Approximately 50 to 55 mmcf/d of natural gas is generated from our shale gas properties in the Horn River. This basin is a significant shale gas play with high resource density and excellent well productivity.

In 2011, we invested $398 million progressing development of our shale gas assets at Horn River. In addition to our eight-well pad completed in 2010, we drilled and completed a nine-well pad which was brought on stream in late 2011. We began drilling an 18-well pad during the year with start-up scheduled for late 2012 and associated peak volumes expected in early 2013. Our current field processing capacity is approximately 50 to 55 mmcf/d and production from our Horn River assets is limited by this constraint. We are expanding this capacity to 175 mmcf/d in 2012 in order to process additional volumes from development of the field. Current operations are produced from 23 horizontal wells via pad developments, which minimize surface disturbances. Natural gas is compressed and dehydrated with infield facilities before export to final treating facilities via producer-owned and third-party pipelines. We hold long-term take or pay capacity on the third party pipelines and facilities.

During the year, we entered into a joint venture agreement to farm-out a 40% non-operated interest in our northeast British Columbia shale gas lands for proceeds of $700 million. The sale is expected to close in the second quarter of 2012 and Nexen will remain as operator under the joint venture.

Primary tenure in the Horn River Basin is four years and drilling activity and extensions can increase this up to 18 years. Our drilling activity to date has secured tenure for 10 years on all of our Horn River lands with extensions available of up to another three years. With the tenure secured, we are able to control the pace of field development during periods of low gas prices.

Limited gas pipeline infrastructure and processing capacity in the Horn River Basin could potentially constrain early development of the play. To ensure sufficient gathering, processing and transportation capacity for our development programs, we contracted gas pipeline capacity and associated treating capacity at the Spectra-operated Fort Nelson plant. We also entered into additional agreements that allow us to participate in regional infrastructure expansion projects.

OTHER CANADA

Conventional natural gas properties in Alberta and Saskatchewan account for 40% of our 2011 Canadian natural gas production. This production is primarily generated from our Medicine Hat/Hatton conventional fields with over 2,200 shallow gas wells on production. These properties are mature but have low decline rates and numerous infill drilling opportunities. Our future investment here is limited as a result of low natural gas prices.

Approximately 30% of our current Canadian natural gas is produced from our CBM developments in the Fort Assiniboine area of central Alberta. We began commercial operations in the Upper Mannville coals in 2005 and progressively developed opportunities on our land base with horizontal well technology. We have limited activity planned here currently as a result of lower natural gas prices.

OTHER INTERNATIONAL

During 2011, we entered into a joint venture agreement to explore 10 concessions in Poland’s Paleozoic shale play. We acquired a 40% non-operated working interest in the concessions, which encompass more than two million acres. Total capital investment by Nexen for exploration activities is estimated to be approximately $100 million over the next two years. The opportunity provides shale gas exposure to growing European gas demand where prices are significantly higher than in North America. The initial exploration well was spudded in late 2011 and results are expected in 2012.

In 2011, we commenced a drilling program for four shale gas wells on two Colombian blocks (totaling 1.5 million acres). One well was drilled in late 2011 with a total depth of 5,800 feet and we expect the remainder to be spudded during 2012. We are in the early stages of shale gas exploration here and are one of the first companies to test shale gas opportunities in Colombia.

Our energy marketing group’s primary focus is to market Nexen’s proprietary crude oil and natural gas production. We also engage in market optimization activities including the purchase and sale of third-party production which provides us with additional market intelligence and opportunities in order to obtain competitive pricing for our proprietary volumes. Our team leverages regional knowledge and holds capacity on key North American infrastructure. In addition to physical marketing, we take advantage of quality, time and location spreads to generate returns. We also use financial contracts, including futures, forwards, swaps and options to manage our business. Results of these activities are included in Corporate and Other.

RESERVES, PRODUCTION AND RELATED INFORMATION

Nexen prepares and discloses reserves estimates and other information in accordance with National Instrument 51-101—Standards of Disclosure for Oil and Gas Activities (NI 51-101) and with SEC requirements. Prior to 2010, Nexen and many of our Canadian peer companies relied upon a discretionary exemption from certain requirements of NI 51-101 granted by Canadian securities regulators which permitted disclosure of reserves information in accordance with SEC requirements only. In order to maintain comparability with Canadian peer companies who began disclosing their reserves under NI 51-101, we have presented our NI 51-101 reserves and related information in this AIF. As our reserves estimates were prepared only in accordance with SEC requirements prior to 2010, our NI 51-101 reserves information is limited to 2010 and 2011.

In order to provide comparability to non-Canadian oil and gas companies, we have also prepared reserves estimates and related information in accordance with SEC requirements, which are included in Appendix B of this AIF. Refer to the Special Note to Investors on page 40 for an explanation of differences between reserves estimates prepared under NI 51-101 and SEC requirements.

Nexen has not filed with nor included in reports to any Canadian or United States federal authority or agency with any estimates of its total proved oil or gas reserves since the beginning of 2011.

Basis of Reserves Estimates

The process of estimating reserves requires complex judgments and decision-making based on available geological, geophysical, engineering and economic data. To estimate the economically recoverable oil and gas reserves and related future net cash flows, we consider many factors and make various assumptions including:

· expected reservoir characteristics based on geological, geophysical and engineering assessments;

· future production rates based on historical performance and expected future operating and investment activities;

· future oil and gas prices and quality differentials;

· assumed effects of regulation by governmental agencies; and

· future development and operating costs.

We believe these factors and assumptions are reasonable based on the information available to us at the time we prepared our estimates. However, there is no guarantee that the estimated reserves will be recovered and these estimates may change substantially as additional data from ongoing development activities and production performance becomes available, and as economic conditions impacting oil and gas prices and costs change. For more information as to the risks involved in the recovery of oil and gas, see “Risk Factors” on pages 44 to 51 of this AIF.

Our estimates of reserves and future net revenue are based on internal evaluations. Reserves estimates for each property are prepared at least annually by the property’s reservoir engineer and geoscientists, and by divisional management familiar with the property. Our internal reserves evaluation staff consists of over 180 individuals in multifunctional teams with relevant experience in reserves evaluation, engineering and geoscience, and over 140 of these individuals are qualified reserves evaluators for the purposes of NI 51-101. These individuals are dedicated to the development and operations of the properties evaluated and have a thorough knowledge of them. We support the technical staff with up-to-date tools for geological mapping, seismic interpretation, reservoir simulation and other technical analysis. Our reserves processes are designed to use all available information to provide accurate estimates for internal business needs and external reporting requirements. Due to the extent and expertise of our internal reserves evaluation resources, our staff”s familiarity with our properties, and the controls applied to the evaluation process, we believe the reliability of our internally generated estimates of reserves and future net revenue are not materially less than would be generated by an independent qualified reserves evaluator.

Our internal qualified reserves evaluator (IQRE) is responsible for the reserves data and related disclosures. This position, required under NI 51-101, was appointed by the board in December 2003. The IQRE is a professional engineer and meets all professional and statutory requirements in regards to experience, education and professional membership associated with the role. With over 29 years of experience, the IQRE has an in-depth knowledge of reserves estimation techniques and professional guidelines, and with Canadian and SEC reserves regulations and related reporting requirements. The IQRE’s primary duty includes assessing whether the reserves estimates and related disclosures have been prepared in accordance with applicable regulatory requirements.

Although we have received an exemption from the NI 51-101 requirements to have our reserves estimates independently assessed, our policy is to have at least 80% of our NI 51-101 reserves estimates either evaluated or audited annually by independent qualified reserves consultants. The section entitled “Independent Reserves Evaluation” on pages 37 to 38 of the AIF describes the nature and scope of the work performed by the independent consultants and their opinions from performing this work.

An Executive Reserves Committee, including our CEO, CFO and IQRE, meet with divisional reserves personnel to review the estimates and any changes from previous estimates. The board of directors has a Reserves Review Committee (Reserves Committee) to assist the board and the Audit and Conduct Review Committee to oversee the annual review of our oil and gas reserves and related disclosures. The Reserves Committee is comprised of three or more directors, the majority of whom are independent and familiar with estimating oil and gas reserves and disclosure requirements. The Reserves Committee meets with management periodically to review the reserves process, the portfolio of properties selected by management for independent assessment, results and related disclosures. The Reserves Committee appoints and meets with the IQRE and independent qualified reserves consultants to review the scope of their work, whether they have had access to sufficient information, the nature and satisfactory resolution of any material differences of opinion, and in the case of the independent qualified reserves consultants, their independence. In the event of a proposed change to the areas of responsibility of either an independent qualified reserves consultant or the IQRE, the Reserves Committee inquires whether there have been disputes between the respective party and management.

The Reserves Committee has reviewed our procedures for preparing the reserves estimates and related disclosures, and the properties selected by management for independent assessment. The Committee reviewed the information with management and met with the IQRE and the independent qualified reserves consultants. As a result, the Reserves Committee is satisfied that the internally generated reserves estimates are reliable and free of material misstatement. Based on the recommendation of the Reserves Committee, the board has approved the reserves estimates and related disclosures in this AIF.

We have adopted a corporate policy that prescribes the procedures and standards to be followed in the evaluation of our reserves. This policy is reviewed and amended annually as required to conform to changes in law or industry accepted evaluation practices. A copy can be found on our corporate website at www.nexeninc.com.

Reserves Estimates

The reserves data set forth on the following pages summarizes our crude oil and natural gas reserves and the net present value of the future net revenue for the reserves using forecast prices and costs. The information has been prepared in accordance with the requirements of NI 51-101. The estimates and other information has an effective date of December 31, 2011 and was prepared on February 15, 2012.

Readers should review the definitions and information contained in the “Definitions” section on pages 38 to 39 in conjunction with the following tables and notes.

Figures in this statement have been rounded to the nearest 1 mmbbls or 1 bcf. As a result, some columns may not add due to rounding.

SUMMARY OF OIL AND GAS RESERVES AS AT DECEMBER 31, 2011

Forecast prices and Costs

|

| Total |