- CP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

10-K/A Filing

Canadian Pacific Railway Limited (CP) 10-K/A2019 FY Annual report (amended)

Filed: 29 Apr 20, 8:02am

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Canada | 98-0355078 | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

7550 Ogden Dale Road S.E. , Calgary , Alberta , Canada | T2C 4X9 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered | ||

| Common Shares, without par value, of Canadian Pacific Railway Limited | CP | New York Stock Exchange | ||

| Toronto Stock Exchange | ||||

| Perpetual 4% Consolidated Debenture Stock of Canadian Pacific Railway Company | CP/40 | New York Stock Exchange | ||

| BC87 | London Stock Exchange |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

PART III | ||||||

Item 10 | 1 | |||||

Item 11 | 7 | |||||

Item 12 | 58 | |||||

Item 13 | 59 | |||||

Item 14 | 59 | |||||

PART IV | ||||||

Item 15 | 61 | |||||

Item 16 | 61 | |||||

| 62 | ||||||

Director profiles All 11 nominated directors are qualified and experienced, and have agreed to serve on our Board. All directors are CP shareholders and must meet our director share ownership requirements within five years of joining the Board. Share ownership listed here is as at February 28, 2020, and includes shares that directors beneficially own or control, or hold directly or indirectly. Share ownership includes holdings under the Directors’ Deferred Share Unit (“DDSU”) plan. |

Isabelle Courville Chair | ||

| Independent Age: 57Director since: May 1, 2013 Residence: Rosemère, Québec, Canada2019 voting results: 99.26% for | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, accounting & financial expertise, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, sales & marketing, and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

| Meeting Attendance | ||||||

| Board | 7 of 7 | 100% | ||||

| Audit and Finance | 4 of 4 | 100% | ||||

| Governance | 5 of 5 | 100% | ||||

| Compensation | 5 of 5 | 100% | ||||

| Risk and Sustainability | 2 of 2 | 100% | ||||

| • | President of Hydro-Québec Distribution andHydro-Québec TransÉnergie (2007 to 2013) |

| • | 20 years of experience in the Canadian telecommunications industry, including President of Bell Canada’s Enterprise Group (2003 to 2006) and President and Chief Executive Officer of Bell Nordiq Group (2002 to 2003) |

| • | SNC-Lavalin Group Inc. (2017 to present) (Chair of Human Resources Committee and member of Governance and Ethics Committee) |

| • | Veolia Environment S.A. (2015 to present) (member of Accounts and Audit Committee, Nominating Committee and the Research, Innovation and Sustainable Development Committee) |

| • | Laurentian Bank of Canada (2007 to 2019) (Chair of the Board and member of Human Resources and Corporate Governance Committee) |

| • | Gecina S.A. (2016 to April 2017) (member of Audit Committee) |

| • | TVA Group (2013 to 2016) (member of Human Resources Committee) |

| • | Institute for Governance of Private and Public Organizations (IGOPP) (2016 to present) (member of Human Resources Committee) |

| • | Institute of Corporate Directors (ICD) (2013 to 2017) |

| • | Bachelor’s degree in Engineering Physics, École Polytechnique de Montréal |

| • | Bachelor’s degree in Civil Law, McGill University Doctorate Honoris Causa, University of Montréal |

The Hon. John Baird, P.C. | ||

| Independent 50Age: Director since: May 14, 2015 Residence: Toronto,Ontario, Canada . 2019 voting results: 99.43% for | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, transportation industry knowledge, governance, government & regulatory affairs and legal, risk management and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

| Meeting Attendance | ||||||

| Board | 7 of 7 | 100% | ||||

| Governance | 5 of 5 | 100% | ||||

| Compensation | 2 of 2 | 100% | ||||

| Risk and Sustainability | 2 of 2 | 100% | ||||

| • | Senior Advisor at the law firm of Bennett Jones LLP, Hatch Ltd. (an engineering firm) and Eurasia Group (a geopolitical risk consultancy) (2015 to present) |

| • | Member of the International Advisory Board, Barrick Gold Corporation (2015 to present) |

| • | President of Grantham Finchley Consulting Inc. (2015 to present) |

| • | Canfor / Canfor Pulp (CPPI) (2016 to present) (member of Environmental, Health and Safety Committee; Capital Expenditure Committee and Corporate Governance Committee) |

| • | FWD Group Ltd./FWD Ltd. (2015 to present) (member of Audit Committee and Risk Management and Actuarial Committee) |

| • | PineBridge Investments (2015 to present) |

| • | Friends of Israel Initiative (2015 to present) (member of the Board) |

| • | Served as Canadian Foreign Minister, Minister of Transport and Infrastructure, Minister of the Environment, and President of the Treasury Board during his three terms as a Member of the Canadian Parliament (2006 to 2015) |

| • | Appointed to the Privy Council in 2006 |

| • | Former Minister of Community and Social Services and Minister of Energy in Ontario provincial legislature |

| • | Senior Advisor to Community Living Ontario, an organization that supports individuals with developmental disabilities |

| • | Advisory Board member to Prince’s Charities Canada, the charitable office of His Royal Highness The Prince of Wales |

| • | Honours Bachelor of Arts (Political Studies), Queen’s University |

Keith E. Creel | ||

| Not Independent Age: 51Director since: May 14, 2015 Residence: Wellington,Florida, U.S.A. 2019 voting results: 99.82% for | |

DIRECTOR SKILLS AND QUALIFICATIONS President and Chief Executive Officer of CP since January 31, 2017. Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, sales & marketing and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

| Meeting Attendance | ||||||

| Board | 7 of 7 | 100% | ||||

| • | President and Chief Executive Officer of CP (2017 to present) |

| • | President and Chief Operating Officer of CP (February 2013 to January 2017) |

| • | Named “Railroad Innovator” for 2014 by Progressive Railroading in recognition of his leadership at CP |

| • | Executive Vice-President and Chief Operating Officer of Canadian National Railway Company (CN) (2010 to 2013) |

| • | Other positions at CN included Executive Vice- President, Operations, Senior Vice-President Eastern Region, Senior Vice-President Western Region, and Vice-President of CN’s Prairie division (2002 to 2010) |

| • | Trainmaster and director of corridor operations at Illinois Central Railway prior to its merger with CN in 1999 |

| • | Superintendent and general manager at Grand Trunk Western Railroad (1999 to 2002) |

| • | Began his railroad career in 1992 as an intermodal ramp manager at Burlington Northern Railway in Birmingham, Alabama |

| • | Member of the Board of TTX Company (a private company) (2014 to present) |

| • | Representative on American Association of Railroads |

| • | Commissioned officer in the U.S. Army and served in the Persian Gulf War in Saudi Arabia |

| • | Bachelor of Science in Marketing, Jacksonville State University |

| • | Advanced Management Program, Harvard Business School |

Gillian (Jill) H. Denham | ||

| Independent Age: 59Director since: September 6, 2016 Residence: Toronto, Ontario, Canada2019 voting results: 98.46% for | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, executive compensation/human resources, investment management, governance, government/regulatory affairs and legal, risk management, sales & marketing and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

| Meeting Attendance | ||||||

| Board | 7 of 7 | 100% | ||||

| Audit and Finance | 4 of 4 | 100% | ||||

| Audit | 4 of 4 | 100% | ||||

| Finance | 2 of 2 | 100% | ||||

| Risk and Sustainability | 2 of 2 | 100% | ||||

| • | President, Authentum Partners Ltd., a company that invests in and advises technology related businesses (2018 to present) |

| • | Vice Chair Retail Markets for Canadian Imperial Bank of Commerce (“CIBC”) (2001 to 2005) |

| • | Previously held senior positions at CIBC Wood Gundy and CIBC, including: Managing Director Head of Commercial Banking and E-Commerce |

| • | President of Merchant Banking/Private Equity and Managing Director Head responsible for CIBC’s European Operations |

| • | Morneau Shepell Inc. (2008 to present) (Chair of the Board) |

| • | National Bank of Canada (2010 to present) (member of Human Resources Committee) |

| • | Kinaxis Inc. (2016 to present) (Chair of the Compensation Committee and member of the Audit Committee and Nominating and Governance Committee) |

| • | IHS Markit Ltd. (2014 to 2016) |

| • | Penn West Petroleum Ltd. (2012 to 2016) |

| • | Calloway Real Estate Investment Trust (2011 to 2012) |

| • | Munich Reinsurance Company of Canada (Chair) (2012 to present) |

| • | Temple Insurance Company (Chair) (2012 to present) |

| • | Centre for Addiction and Mental Health (CAMH) (2015 to 2019) |

| • | Honours Business Administration (HBA) degree, Ivey Business School, Western University |

| • | MBA, Harvard Business School |

Edward R. Hamberger | ||

| Independent Age: 69Director since: July 15, 2019 Residence: Delray Beach, Florida, U.S.A. 2019 voting results: N/A | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, sales & marketing and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

| Meeting Attendance | ||||||

| Board | 5 of 5 | 100% | ||||

| Audit and Finance | 4 of 4 | 100% | ||||

| Risk and Sustainability | 2 of 2 | 100% | ||||

| • | President and Chief Executive Officer Association of American Railroads (1998 to 2019) |

| • | Served as Assistant Secretary for governmental affairs at the U.S. Department of Transportation (1987 to 1989) |

| • | Transportation Institute, University of Denver (2002 to present) |

| • | Business Advisory Committee, Kellogg School of Management, Northwestern University (2000 to 2019) |

| • | TTCI (Chair of the Board) (1998 to 2019) |

| • | Railinc Corporation (1998 to 2019) |

| • | Mineta Transportation Institute, San Jose State University (2005 to 2019) |

| • | Juris Doctor Georgetown University |

| • | Master of Science, Foreign Service, Georgetown University |

| • | Bachelor of Science, Foreign Service, Georgetown University |

Rebecca MacDonald | ||

| Independent Age: 66Director since: May 17, 2012 Residence: North York, Ontario, Canada2019 voting results: 99.35% for | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, executive compensation/human resources, investment management, governance, risk management, sales & marketing and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

| Meeting Attendance | ||||||

| Board | 7 of 7 | 100% | ||||

| Audit | 4 of 4 | 100% | ||||

| Compensation | 3 of 3 | 100% | ||||

| Governance (Chair) | 5 of 5 | 100% | ||||

| • | Founder and current Executive Chair of Just Energy Group Inc., a Toronto-based independent marketer of deregulated gas and electricity |

| • | President and Chief Executive Officer of Just Energy (2001 to 2007) |

| • | Founded Energy Savings Income Fund in 1997, another company which aggregated customers in the deregulation of the U.K. natural gas industry |

| • | Founded Energy Marketing Inc. in 1989 |

| • | Just Energy Group Inc. (2001 to present) (Executive Chair since 2007) |

| • | Horatio Alger Association in both Canada and the United States |

| • | Founded the Rebecca MacDonald Centre for Arthritis and Autoimmune Disease at Mount Sinai Hospital in Toronto |

| • | Previously Vice-Chair of the Board of Directors of Mount Sinai Hospital |

| • | Previously a member of the Board of Governors of the Royal Ontario Museum |

| • | Honorary LLD degree, University of Victoria |

Edward L. Monser | ||

| Independent Age: 69Director since: December 17, 2018 Residence: St. Louis, Missouri, U.S.A.2019 voting results: 99.82% for | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, accounting & financial expertise, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, risk management, sales & marketing and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

Meeting Attendance | ||||||

Board | 7 of 7 | 100% | ||||

Audit and Finance | 4 of 4 | 100% | ||||

Audit | 3 of 4 | 75% | ||||

Compensation | 5 of 5 | 100% | ||||

| • | President (2010-2018) and Chief Operating Officer (2001-2015) of Emerson Electric Co. |

| • | President (1996-2001) and Executive Vice President (1991-1996) of Rosemount Inc. |

| • | Member of the Advisory Economic Development Board for China’s Guangdong Province |

| • | Member and current Vice-Chairman of the U.S.-India Strategic Partnership Forum |

| • | Air Products & Chemicals Corporation (2013 to present) (Chair of Management Development and Compensation Committee and member of Audit Committee) |

| • | Seyer Industries (2019 to present) |

| • | Vertiv Company (2016 to present) |

| • | Ranken Technical College |

| • | Past board member and past vice-chairman of the U.S.-China Business Council |

| • | Bachelor’s degree, Engineering, Illinois Institute of Technology |

| • | Bachelor’s degree, Education, Eastern Michigan University |

| • | Executive MBA, Stanford University Graduate School of Business |

Matthew H. Paull | ||

| Independent Age: 68Director since: January 26, 2016 Residence: Willmette, Illinois, U.S.A.2019 voting results: 99.79% for | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, executive compensation/human resources, investment management, governance, government/regulatory affairs and legal, risk management and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

Meeting Attendance | ||||||

Board | 7 of 7 | 100% | ||||

Compensation (Chair) | 5 of 5 | 100% | ||||

Finance | 2 of 2 | 100% | ||||

Risk and Sustainability | 2 of 2 | 100% | ||||

| • | Senior Executive Vice-President and Chief Financial Officer of McDonald’s Corporation (2001 until his retirement in 2008) |

| • | Before joining McDonald’s in 1993, was a partner at Ernst & Young where he managed a variety of financial practices during his 18-year career and consulted with many leading multinationalcorporations |

| • | Air Products & Chemicals Corporation (2013 to present) (Chair of Audit and Finance Committee and member of Corporate Governance and Nominating Committee and Executive Committee) |

| • | Chipotle Mexican Grill Inc. (2016 to 2020) (member of Compensation Committee)* |

| • | Best Buy Co. (2003 to 2013) (lead independent director and chair of Finance Committee) |

| • | WMS Industries Inc. (2012 to 2013) |

| • | KapStone Paper and Packaging Corporation (2010 to 2018) |

| • | Pershing Square Capital Management, L.P. (2008 to present) (member of Advisory Board) |

| • | Master’s degree in Accounting, University of Illinois |

| • | Bachelor’s degree, University of Illinois |

| * | As previously announced by Chipotle Mexican Grill Inc. on March 6, 2020, Mr. Paull will not stand for re-election to the Board of Chipotle Mexican Grill Inc. at its 2020 annual meeting of shareholders. |

Jane L. Peverett | ||

| Independent Age: 61Director since: December 13, 2016 Residence: West Vancouver, British Columbia, Canada2019 voting results: 99.23% for | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, accounting & financial expertise, environment, health & safety, executive compensation/human resources, governance, government/regulatory affairs and legal, risk management and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

Meeting Attendance | ||||||

Board | 7 of 7 | 100% | ||||

Audit and Finance (Chair) | 4 of 4 | 100% | ||||

Audit | 4 of 4 | 100% | ||||

Finance | 2 of 2 | 100% | ||||

Governance | 3 of 3 | 100% | ||||

| • | President & Chief Executive Officer of BC Transmission Corporation (electrical transmission) (2005 to 2009) |

| • | Vice-President, Corporate Services and Chief Financial Officer of BC Transmission Corporation (2003 to 2005) |

| • | President of Union Gas Limited (a natural gas storage, transmission and distribution company) (2002 to 2003) |

| • | Other positions at Union Gas Limited: President & Chief Executive Officer (2001 to 2002); Senior Vice-President Sales & Marketing (2000 to 2001) and Chief Financial Officer (1999 to 2000) |

| • | CIBC (2009 to present) (Chair of Audit Committee) |

| • | Northwest Natural Gas Company (2007 to present) (member of Organization and Executive Compensation Committee and Public Affairs and Environmental Policy Committee) |

| • | Capital Power Corporation (2019 to present) (Member of Corporate Governance, Compensation and Nominating Committee and Health, Safety and Environment Committee) |

| • | Encana Corp. (2003 to 2017) |

| • | Postmedia Network Canada Corp. (2013 to 2016) |

| • | HydroOne Limited (2015 to 2018) |

| • | CSA Group (2019 to present) (Chair of the Board) |

| • | British Columbia Institute of Corporate Directors Executive Committee |

| • | Bachelor of Commerce degree, McMaster University |

| • | Master of Business Administration degree, Queen’s University |

| • | Certified Management Accountant |

| • | A Fellow of the Society of Management Accountants |

| • | Holds the ICD.D designation from the Institute of Corporate Directors |

Andrea Robertson | ||

| Independent Age: 56Director since: July 15, 2019 Residence: Calgary, Alberta, Canada2019 voting results: N/A | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

Meeting Attendance | ||||||

Board | 5 of 5 | 100% | ||||

Governance | 3 of 3 | 100% | ||||

Compensation | 3 of 3 | 100% | ||||

| • | President & Chief Executive Officer, Shock Trauma Air Rescue Service (STARS) (2012 to present) |

| • | President & Chief Operating Officer, Shock Trauma Air Rescue Service (STARS) (2011 to 2012) |

| • | The Calgary Airport Authority (2017 to present) |

| • | Bow Valley College (2015 to 2018) |

| • | United Way (2007 to 2013) |

| • | Alberta Children’s Hospital Foundation (2008 to 2009) |

| • | Foothills Development Council (2008 to 2009) |

| • | Libin Cardiovascular Institute (2008 to 2009) |

| • | Executive Leadership, Harvard University |

| • | ICD.D Rotman School of Business |

| • | Masters in Science of Health Administration, Central Michigan University |

| • | Baccalaureate of Nursing - University of Calgary |

| • | Executive Fellowship - Wharton University |

Gordon T. Trafton | ||

| Independent Age: 66Director since: January 1, 2017 Residence: Naperville, Illinois, U.S.A.2019 voting results: 99.51% for | |

DIRECTOR SKILLS AND QUALIFICATIONS Brings expertise in the following areas: senior executive leadership, accounting & financial literacy, environment, health & safety, executive compensation/human resources, transportation industry knowledge, governance, government/regulatory affairs and legal, risk management, sales & marketing and strategic oversight. |

OVERALL 2019 ATTENDANCE | 100% | |||||

Meeting Attendance | ||||||

Board | 7 of 7 | 100% | ||||

Audit | 4 of 4 | 100% | ||||

Governance | 5 of 5 | 100% | ||||

Risk and Sustainability (Chair) | 2 of 2 | 100% | ||||

| • | Consultant, Brigadier Consulting (2013) |

| • | Consultant, CP (2013) |

| • | Special Advisor to the Canadian National Railway leadership team (2009 to his retirement in 2010) |

| • | Senior Vice-President Strategic Acquisitions and Integration, CN (2009 to 2010) |

| • | Senior Vice-President, Southern Region, CN (2003 to 2009) |

| • | Held a number of leadership positions with Illinois Central Railroad and Burlington Northern Railroad |

| • | Leeds School of Business Advisory Board, University of Colorado Boulder (2012 to present) |

| • | Bachelor of Science, Transportation Management from the Leeds School of Business, University of Colorado Boulder |

| (a) | a director, chief executive officer or chief financial officer of a company that: |

| • | was subject to a cease trade or similar order or an order that denied the issuer access to any exemptions under securities legislation for over 30 consecutive days, that was issued while the proposed director was acting in that capacity, or |

| • | was subject to a cease trade or similar order or an order that denied the issuer access to an exemption under securities legislation for over 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in that capacity |

| (b) | a director or executive officer of a company that, while that proposed director was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, |

| (c) | become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold their assets, or |

| (d) | subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities commission. |

Our code of business ethics (the “Code”) sets out our expectations for conduct. It covers confidentiality, protecting our assets, avoiding conflicts of interest, fair dealing with third parties, compliance with the laws, rules and regulations, as well as reporting any illegal or unethical behaviour, among other things. The Code applies to everyone at CP and our subsidiaries: directors, officers, employees (unionized and non-unionized) and contractors who do work for us.Directors, officers and non-union employees must sign an acknowledgment every year that they have read, understood and agree to comply with the Code. Unionized employees are provided with a copy of the Code every three years. In 2019, unionized employees were mailed a copy of the Code. Directors must also confirm annually that they have complied with the Code. The Code is part of the terms and conditions of employmentfor non-union employees, and contractors must agree to follow principles of standards of business conduct consistent with those set out in our Code as part of the terms of engagement. | Monitoring compliance and updating the Code The Governance Committee is responsible for monitoring compliance with the Code, reviewing it periodically and recommending changes as appropriate, and promptly disclosing any aspects of the Code that have been waived. The Audit and Finance Committee ensures compliance with the Code. 100% of non-union employees have completed their annual certification of compliance with the Code. |

| • | Keith E. Creel, President and Chief Executive Officer |

| • | Nadeem S. Velani, Executive Vice-President and Chief Financial Officer |

| • | John K. Brooks, Executive Vice-President and Chief Marketing Officer |

| • | Laird J. Pitz, Senior Vice-President and Chief Risk Officer |

| • | Mark A. Redd, Executive Vice-President Operations |

| • | Robert A. Johnson, Retired Executive Vice-President Operations |

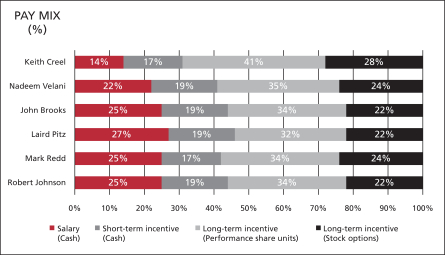

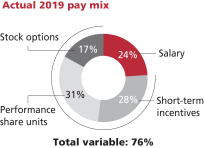

At-risk pay | |||||||||||||||||||||||||||||||||||

| ($ thousands) | Long-term incentive awards | ||||||||||||||||||||||||||||||||||

| Base salary | Short-term incentive | Performance share units | Stock options | Total direct compensation | % at risk | ||||||||||||||||||||||||||||||

Keith E. Creel President and Chief Executive Officer | 1,538 | 2,979 | 5,870 | 3,642 | 14,029 | 89 | % | ||||||||||||||||||||||||||||

Nadeem S. Velani Executive Vice-President and Chief Financial Officer | 751 | 1,096 | 1,552 | 979 | 4,378 | 83 | % | ||||||||||||||||||||||||||||

John K. Brooks Executive Vice-President and Chief Marketing Officer | 670 | 829 | 1,197 | 697 | 3,393 | 81 | % | ||||||||||||||||||||||||||||

Laird J. Pitz Senior Vice-President and Chief Risk Officer | 529 | 571 | 811 | 503 | 2,414 | 78 | % | ||||||||||||||||||||||||||||

Mark A. Redd Executive Vice-President Operations | 491 | 593 | 605 | 355 | 2,044 | 76 | % | ||||||||||||||||||||||||||||

Robert A. Johnson (1) Retired Executive Vice-President Operations | 478 | 524 | 1,015 | 629 | 2,646 | 82 | % | ||||||||||||||||||||||||||||

| (1) | Mr. Johnson retired from the Company effective September 30, 2019. |

| 1. | Provide customers with industry-leading rail service |

| 2. | Control costs |

| 3. | Optimize our assets |

| 4. | Remain a leader in rail safety |

| 5. | Develop our people |

| BNSF Railway Company | BCE Inc. | |

| Canadian National Railway Company | Fortis Inc. | |

| CSX Corporation | TC Energy Corporation | |

| Kansas City Southern | TELUS Corporation | |

| Norfolk Southern Corporation | Rogers Communications Inc. | |

| Union Pacific Corporation | Barrick Gold Corporation | |

| Cenovus Energy Inc. | Kinross Gold Corporation | |

| Enbridge Inc. | Suncor Energy Inc. | |

| Imperial Oil Limited |

Ownership requirement (as a multiple of base salary) | ||||

CEO | 6x | |||

Executive Vice-President | 3x | |||

Senior Vice-President | 2x | |||

Vice-President | 1.5 to 2x | |||

Senior management | 1x | |||

Human Resources/ compensation/ succession planning | CEO/senior management | Governance and policy development | Transportation industry | Risk management | Engagement (shareholders and others) | |||||||

Matthew Paull (Committee Chair) | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

Isabelle Courville (Chair of the Board) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||

Rebecca MacDonald | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

Ed Monser | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||

Andrea Robertson | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| • | direct responsibility for executive compensation matters |

| • | membership on other human resources committees |

| • | compensation plan design and administration, compensation decision-making and understanding the Board’s role in the oversight of these practices |

| • | understanding the principles and practices related to leadership development, talent management, succession planning and employment contracts |

| • | engagement with investors on compensation issues |

| • | oversight of financial analysis related to compensation plan design and practices |

| • | oversight of labour matters and a unionized workforce |

| • | pension benefit oversight |

| • | recruitment of senior executives |

| Committee advisor | Management advisor | |

• the Compensation Committee retained Kingsdale Advisors (Kingsdale) in 2018 and 2019 to act as an independent compensation advisor • the Compensation Committee approves all compensation related fees and work performed by the independent compensation advisor | • management engages Willis Towers Watson to provide market survey data and advice relating to executive compensation |

| 2019 | 2018 | |||||||||||||||||||

| Kingsdale | Willis Towers Watson | Kingsdale | Willis Towers Watson | |||||||||||||||||

Executive compensation-related fees | $ 90,000 | $ 74,785 | $ 78,750 | $ 233,309 | ||||||||||||||||

Other fees | $112,821 | $2,598,193 | $111,254 | $2,150,258 | ||||||||||||||||

Total fees | $202,821 | $2,672,978 | $190,004 | $2,383,567 | ||||||||||||||||

| • | the targets for the STIP and PSU plan, anticipated payout levels and the risks associated with achieving targeted performance; |

| • | the design of the long-term incentive awards, which reward sustainable financial and operating performance; and |

| • | the compensation program, policies and practices to ensure alignment with our enterprise risk management practices. |

| 1. Plan design | • we use a mix of fixed and variable (at-risk) compensation and a significant proportion isat-risk pay• short and long-term incentive plans have specific performance measures that are closely aligned with the achievement of our business strategy and performance required to achieve results in accordance with guidance provided to the market • the payout curve for the STIP is designed asymmetrically to reflect the significant stretch in target performance • the payout under the STIP is capped and not guaranteed, and the compensation committee has discretion to reduce the awards • the long-term incentive plan has overlapping vesting periods to address longer-term risks and maintain executives’ exposure to the risks of their decision-making through unvested share based awards | |

| 2. Policies | • we promote an ethical culture and everyone is subject to a code of business ethics • we have share ownership requirements for executives and senior management so they have a stake in our future success • we have a disclosure and insider trading/reporting policy to protect our interests and ensure high business standards and appropriate conduct • our anti-hedging policy prohibits directors, officers and employees from hedging our shares and share-based awards • our anti-pledging policy prohibits directors and senior officers from holding our shares in a margin account or otherwise pledging them as security • we also have a policy that prohibits employees from forward selling shares that may be delivered on the future exercise of stock options, or otherwise monetizing their option awards, other than through exercising the options and subsequently selling the shares through a public venue or the company’s cashless exercise option • our clawback policy allows us to recoup incentive pay from current and former senior executives as appropriate (see page 16 for more information about clawbacks) • DSUs held by the CEO and executives are not settled for cash until at least six months after leaving the Company • our whistleblower policy applies to all employees and prohibits retaliation against anyone who makes a complaint acting in good faith | |

3. Mitigation measures | • senior executives have a significant portion of their compensation deferred • we must achieve a specific threshold of operating income, otherwise no short-term incentive awards are granted • financial performance is verified by our external auditor (completion of annual financial statement audit) before the Board makes any decisions about short-term incentives • the Compensation Committee adopted principles for adjusting payout under the STIP, and provides them to the Board as part of their review of the Compensation Committee’s recommendations and performance overall • environmental principles are fundamental to how we achieve our financial and operational objectives, and the Compensation Committee takes them into account when exercising discretion and determining the short-term incentive awards • all long-term incentive eligible employees are subject to two-year non-compete andnon-solicit covenants should they leave CP• safety is considered as part of individual performance under the short-term incentive for the President and CEO and executives in operations roles in addition to being a specific STIP measure • we regularly benchmark executive compensation against our comparator group of companies • different performance scenarios are stress-tested and back-tested to understand possible outcomes • we review and consider risks associated with retention-related compensation |

| • | the incentive compensation received was calculated based on financial results that were subsequently restated or corrected, in whole or in part; and/or |

| • | the senior executive engaged in gross negligence, fraud or intentional misconduct that caused or contributed to the need for the restatement or correction, as admitted by the senior executive or as reasonably determined by the Board |

| Element | Purpose | Risk mitigating features | Link to business and talent strategies | |||||

| Salary Cash (see page 18) | • competitive level of fixed pay • reviewed annually | • external advisor benchmarks against our comparator group to ensure appropriate levels and fairness | • attract and retain talent • no automatic or guaranteed increases to promote a performance culture | ||||

| Short-term incentive Cash bonus (see page 18) | • annual performance incentive to attract and retain highly qualified leaders • set target awards based on level of employee | • set target performance at the beginning of the year to assess actual performance at the end of the year • actual payouts are based on the achievement of pre-determined corporate and individual objectives• corporate performance has an operating income hurdle • payouts are capped • no guarantee of a minimum payout | • attract and retain highly qualified leaders • motivate high corporate and individual performance • use metrics that are based on the strategic plan and approved annually • align personal objectives with area of responsibility and role in achieving operating results | ||||

Deferred compensation Deferred share units (see page 52) | • encourages share ownership • executives can elect to receive the short-term incentive and their annual PSU grant in DSUs if they have not yet met their share ownership requirement • company provides a 25% match of the deferral amount in DSUs | • deferral limited to the amount needed to meet the executive’s share ownership guidelines • aligns management interests with growth in shareholder value • helps retain key talent • company contributions vest after three years | • sustained alignment of executive and shareholder interests because the value of DSUs is tied directly to our share price • cannot be redeemed for cash until a minimum of six months after the executive leaves CP | |||||

Long-term incentive (LTIP) (see page 21) | ||||||||

Performance share units (see page 23) | • equity-based incentive aligns with shareholder interests and focuses on three-year performance • accounts for 60% of an executive’s long-term incentive award | • use pre-defined market and financial metrics• the number of units that vest is based on a performance multiplier that is capped • no guarantee of a minimum payout | • focuses the leadership team on achieving challenging performance goals • ultimate value based on share price and company performance • attract and retain highly qualified leaders | |||||

Stock options (see page 24) | • accounts for 40% of an executive’s long-term incentive award • vests over four years, term is seven years | • focuses on appreciation in our share price, aligning with shareholder interests • only granted to executives | • focuses the leadership team on creating sustainable long-term value | |||||

| Pension Defined contribution and defined benefit pension plans (see page 51) | • pension benefit based on pay and service and competitive with the market • supplemental plan for executives and senior managers | • balances risk management of highly performance-focused pay package | • attract and retain highly qualified leaders | ||||

Perquisites Flexible spending account (see page 45) | • competitive with the market | • restrictions for the CEO | • attract and retain highly qualified leaders | |||||

| 2019 (in USD) | % change from 2018 | 2018 (in USD) | ||||||||||

Keith Creel | 1,158,750 | 3.0% | 1,125,000 | |||||||||

Nadeem Velani | 566,500 | 3.0% | 550,000 | |||||||||

John Brooks | 525,000 | 31.3% | 400,000 | |||||||||

Laird Pitz | 400,000 | 6.7% | 375,000 | |||||||||

Mark Redd | 425,000 | 24.4% | 341,700 | |||||||||

Robert Johnson | 458,350 | 3.0% | 445,000 | |||||||||

| Notes: |

| • | Mr. Brooks was promoted to the position of Executive Vice-President & Chief Marketing Officer effective February 14, 2019, with a corresponding increase in pay. |

| • | Mr. Redd was promoted to the position of Executive Vice-President Operations effective September 1, 2019, with a corresponding increase in pay. |

| What it is | • cash bonus for achieving pre-determined annual corporate and individual performance objectives that are tied directly to our strategy and operational requirements | |

| Payout | • corporate performance is assessed against financial, safety and operational measures • individual performance is assessed against individual performance objectives • no guarantee of a minimum payout | |

| Restrictions | • must meet minimum level of performance • must achieve corporate operating income hurdle for any payout on individual or corporate performance to occur • performance multiplier is capped for exceptional performance • actual award is capped as a percentage of base salary | |

| If the executive retires | • executive must give three months’ notice • award for the current year is pro-rated to the retirement date |

| • | As both Mr. Brooks and Mr. Redd received promotions in 2019, their short-term incentive plan (STIP) targets have been prorated accordingly. |

| • | Mr. Johnson retired from the Company effective September 30, 2019. His STIP is reflective of the portion of the year which he was employed. |

| Payout as a % of base salary | ||||||||||||||||

| Level | Below hurdle | Minimum | Target | Maximum | ||||||||||||

CEO | 0 | % | 62.5 | % | 125 | % | 250 | % | ||||||||

Other named executives | 0 | % | 34.2-45 | % | 68.3-90 | % | 136.7-180 | % | ||||||||

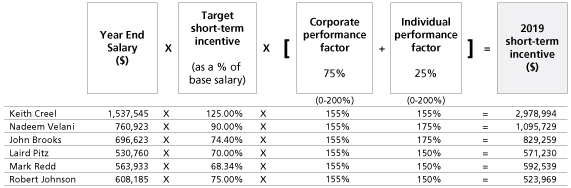

Performance measure | Why it is important | Threshold (50%) | Target (100%) | Exceptional (200%) | 2019 Reported Result | 2019 STIP Result | Weighting | Score | ||||||||||||||||||||||

Financial measures | ||||||||||||||||||||||||||||||

STIP Operating ratio Operating expenses divided by total revenues based on an assumed fuel price and foreign exchange rate | Continues our focus on driving down costs while focusing on growth strategy | 61.3% | 60.8% | 60.3% | 59.9% | 59.9 | % | 35% | 200% | |||||||||||||||||||||

STIP Operating income ($ millions) Total revenues less total operating expenses based on an assumed foreign exchange rate | Highlights the importance of revenue growth to our corporate strategy | 3,014 | 3,054 | 3,121 | 3,124 | 3,089 | 35% | 152% | ||||||||||||||||||||||

Safety measure | ||||||||||||||||||||||||||||||

FRA Train Accident Frequency Number of FRA reportable train accidents which meet FRA reporting thresholds per million train miles | CP has long been an industry leader in rail safety and we are more focused on it than ever, committed to protecting our people, our communities, our environment and our customers’ goods. As safety is our top priority, in 2019, we increased the weighting of our safety measure within the STIP targets to 20% from 10% | 1.12 | 1.08 | 0.99 | 1.06 | 1.06 | 20% | 122% | ||||||||||||||||||||||

Operating measure | ||||||||||||||||||||||||||||||

Trip Plan Compliance Calculated as the number of shipments completed on time (less than 12 hours late vs. baseline plan), divided by the total number of shipments completed | Trip plan compliance is a detailed schedule of performance and the core of CP’s product offering. It balances between customer needs and what we are capable of delivering It is critical to the service we provide customers and to our growth strategy. Trip plan compliance, as a stand-alone measure, is a relatively new measure at CP | 75% | 80% | 85% | 77.1% | 77.1 | % | 10% | 71% | |||||||||||||||||||||

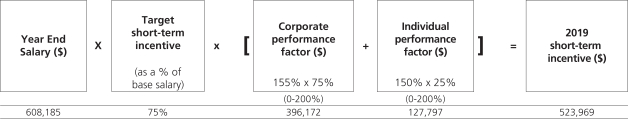

Corporate performance factor | 155% | |||||||||||||||||||||||||||||

2019 individual performance factor | The individual performance factor for the CEO has a cap, so his individual performance factor cannot exceed the corporate performance factor. This ensures the payout factor for the CEO aligns with the CEO’s overall responsibility for CP’s performance. | |||||||||||||

Keith Creel | 155 | % | ||||||||||||

Nadeem Velani | 175 | % | ||||||||||||

John Brooks | 175 | % | ||||||||||||

Laird Pitz | 150 | % | ||||||||||||

Mark Redd | | 150 | % | |||||||||||

Robert Johnson | 150 | % | ||||||||||||

The Compensation Committee sets the individual performance factor for the CEO. The CEO reviews the performance of his direct reports against their objectives, and recommends their individual performance factors to the Compensation Committee. | ||||||||||||||

| Performance share units (60%) | Stock options (40%) | |||

| What they are | • notional share units that vest at the end of three years based on absolute and relative performance and the price of our shares | • right to buy CP shares at a specified price in the future | ||

| Payout | • cliff vest at the end of three years based on performance against three pre-defined financial and market metrics• no guarantee of a minimum payout | • vest 25% every year beginning on the anniversary of the grant date • expire at the end of seven years • only have value if our share price increases above the exercise price |

| Performance share units (60%) | Stock options (40%) | |||

| Dividend equivalents | • earned quarterly and compound over the three-year period | • do not earn dividend equivalents | ||

| Restrictions | • must meet minimum level of performance • performance multiplier is capped for exceptional performance | • cannot be exercised during a blackout period | ||

| If the executive retires | • must give three months’ notice • award continues to vest and executive is entitled to receive the full value as long as they have worked for six months of the performance period, otherwise the award is forfeited | • must give three months’ notice • options continue to vest, but expire five years after the retirement date or on the normal expiry date, whichever is earlier |

Non-Compete andNon-Solicitation | ||

CP is mindful that the demand for experienced and talented railroaders is high, particularly those with backgrounds in precision scheduled railroading. To manage near-term retention risk, the company’s long-term incentive award agreements contain non-compete, non-solicitation and other restrictive clauses, includingnon-disclosure restrictions.Non-compete andnon-solicitation provisions will apply if a recipient fails to comply with certain commitments for atwo-year period following the end of employment. |

Target as a % of base salary | ||||

Keith Creel | | 500% | | |

Nadeem Velani | | 275% | | |

John Brooks | | 225% | | |

Laird Pitz | | 200% | | |

Mark Redd | | 225% | | |

Robert Johnson | | 225% | | |

2019 long-term | ||||||||||||||||||||||||||||

| incentive | Allocation | |||||||||||||||||||||||||||

| award | Performance share units | Stock options | ||||||||||||||||||||||||||

| (grant value) ($) | ($) | (#) | ($) | (#) | ||||||||||||||||||||||||

Keith Creel | | 9,512,269 | | | 5,870,208 | | | 21,901 | | | 3,642,061 | | | 54,202 | | |||||||||||||

Nadeem Velani | | 2,531,053 | | | 1,552,110 | | | 5,788 | | | 978,943 | | | 16,313 | | |||||||||||||

John Brooks | | 1,893,801 | | | 1,196,771 | | | 4,465 | | | 697,030 | | | 10,453 | | |||||||||||||

Laird Pitz | | 1,313,416 | | | 810,534 | | | 3,024 | | | 502,882 | | | 7,484 | | |||||||||||||

Mark Redd | | 959,877 | | 604,824 | 2,167 | | 355,053 | | | 5,293 | | |||||||||||||||||

Robert Johnson | | 1,643,916 | | | 1,014,508 | | | 3,785 | | | 629,408 | | | 9,367 | | |||||||||||||

| • | See the summary compensation table on page 43 for details about how we calculated the grant date fair values of the PSUs and stock options. Both were calculated in accordance with FASB ASC Topic 718. |

| • | The grant value of the awards based on the NYSE trading price has been converted to Canadian dollars using a 2019 average exchange rate of $1.3269. |

| • | On February 14, 2019, additional stock options were granted to Mr. Brooks as a result of his promotion to Executive Vice-President. |

| • | On September 3, 2019, additional PSUs and stock options were granted to Mr. Redd as a result of his promotion to Executive Vice-President. |

2019 PSU performance measures | Why the measure is important | Threshold (50%) | Target (100%) | Exceptional (200%) | Weighting | |||||||||||||

PSU three-year average return on invested capital (ROIC) Net operating profit after tax divided by average invested capital | Focuses executives on the effective use of capital as we grow Ensures shareholders’ capital is employed in a value-accretive manner | 15.3% | 16% | 16.4% | 70% | |||||||||||||

Total shareholder return Measured over three years. The percentile ranking of CP’s TSX Compound Annual Growth Rate (CAGR) relative to the companies that make up the S&P/TSX 60 | Compares our TSR on the TSX to the broader S&P/TSX60 to reflect our progress relative to the Canadian market Aligns long-term incentive compensation with long-term shareholder interests | 25th percentile | | 50th percentile | | 75th percentile | | 15% | ||||||||||

Total shareholder return Measured over three years. The ordinal ranking of CP’s NYSE CAGR relative to the Class 1 Railroads | Compares our TSR on the NYSE to the publicly traded Class 1 Railroads to ensure we are competitive against our primary competitors. Aligns long-term incentive compensation with long-term shareholder interests | 4th | 3rd | 1st | 15% | |||||||||||||

Grant value ($) | # of PSUs | Grant price | ||||||||||

Keith Creel | | 5,870,208 | | | 21,901 | | | US$202.00 (NYSE) | | |||

Nadeem Velani | | 1,552,110 | | | 5,788 | | | $268.16 (TSX) | | |||

John Brooks | | 1,196,771 | | | 4,465 | | | US$202.00 (NYSE) | | |||

Laird Pitz | | 810,534 | | | 3,024 | | | US$202.00 (NYSE) | | |||

Mark Redd | 432,874 171,950 | 1,615 552 | US$202.00 (NYSE) US$234.76 (NYSE) | |||||||||

Robert Johnson | | 1,014,508 | | | 3,785 | | | US$202.00 (NYSE) | | |||

Grant value ($) | # of options | Grant price | ||||||||||

Keith Creel | | 3,642,061 | | | 54,202 | | | US$205.31 (NYSE) | | |||

Nadeem Velani | | 978,943 | | | 16,313 | | | $271.50 (TSX) | | |||

John Brooks | 502,881 194,149 | 7,484 2,969 | US$205.31 (NYSE) US$202.00 (NYSE) | |||||||||

Laird Pitz | | 502,882 | | | 7,484 | | | US$205.31 (NYSE) | | |||

Mark Redd | 268,508 86,545 | 3,996 1,297 | US$205.31 (NYSE) US$234.76 (NYSE) | |||||||||

Robert Johnson | | 629,408 | | | 9,367 | | | US$205.31 (NYSE) | | |||

| • | On February 14, 2019, additional stock options were granted to Mr. Brooks as a result of his promotion to Executive Vice-President. |

| • | On September 3, 2019, additional options were granted to Mr. Redd as a result of his promotion to Executive Vice-President. |

As a % of the number of shares outstanding | ||

Maximum number of shares that may be reserved for issuance to insiders as options | 10% | |

Maximum number of options that may be granted to insiders in a one-year period | 10% | |

Maximum number of options that may be granted to any insider in a one-year period | 5% | |

As a % of the number of shares outstanding at the time the shares were reserved | ||

Maximum number of options that may be granted to any person | 5% |

(as at December 31) | 2017 | 2018 | 2019 | |||||||||

Number of options granted | | 369,980 | | | 282,125 | | | 224,730 | | |||

Weighted number of shares outstanding | | 145,863,318 | | | 142,885,817 | | | 138,771,939 | | |||

Burn rate | | 0.25% | | | 0.20% | | | 0.16% | | |||

Number of options/shares | Percentage of outstanding shares | |||||||

Options outstanding (as at December 31, 2019) | | 1,416,346 | | | 1.03 | % | ||

Options available to grant (as at December 31, 2019) | | 1,098,707 | | | 0.80 | % | ||

Shares issued on exercise of options in 2019 | | 260,267 | | | 0.19 | % | ||

Options granted in 2019 | | 224,730 | | | 0.16 | % | ||

| • | changes to clarify information or to correct an error or omission |

| • | changes of an administrative or a housekeeping nature |

| • | changes to eligibility to participate in the stock option plan |

| • | terms, conditions and mechanics of granting stock option awards |

| • | changes to vesting, exercise, early expiry or cancellation |

| • | amendments that are designed to comply with the law or regulatory requirements |

| • | an increase to the maximum number of shares that may be issued under the plan |

| • | a decrease in the exercise price |

| • | a grant of options in exchange for, or related to, options being cancelled or surrendered |

| • | on February 28, 2012, the stock option plan was amended so that a change of control would not trigger accelerated vesting of options held by a participant, unless the person is terminated without cause or constructively dismissed; and |

| • | on November 19, 2015, the stock option plan was amended to provide net stock settlement as a method of exercise, which allows an option holder to exercise options without the need for us to sell the securities on the open market, resulting in less dilution. |

PSU measures | Threshold (50%) | Target (100%) | Maximum (200%) | PSU result | Weighting | PSU performance factor | ||||||||||||||||||

3 Year Average Adjusted Return on Invested Capital (1) | 14.5% | 15% | 15.5% | 15.9% | 60% | 200% | ||||||||||||||||||

TSR to S&P/TSX Capped Industrial Index | | 25th percentile | | | 50th percentile | | | 75th percentile | | | 80th percentile | | | 20% | | | 200% | | ||||||

TSR to S&P 1500 Road and Rail Index | | 25th percentile | | | 50th percentile | | | 75th percentile | | | 66.7th percentile | | | 20% | | | 167% | | ||||||

PSU performance factor | | 193% | | |||||||||||||||||||||

| (1) | Adjusted Return on Invested Capital is a non-GAAP measure. Non-GAAP measures are defined and reconciled on pages 54-62 of CP’s Annual Report on Form 10-K for the year ended December 31, 2019. |

| Mr. Creel was appointed as President and Chief Executive Officer (CEO) on January 31, 2017, a planned transition that had been in place since he was recruited to CP in February 2013 as President and Chief Operating Officer (COO). Prior to joining CP, Mr. Creel had a very successful operating career that began in 1992 at Burlington Northern as a management trainee in operations and eventually led to his becoming the EVP and COO at CN in 2010. Mr. Creel obtained a Bachelor of Science in marketing from Jacksonville State University and has completed the Advanced Management Program at the Harvard Business School. He served as a commissioned officer in the U.S. Army during which time he served in the Persian Gulf War. The end of 2019 marked Mr. Creel’s third year as our President and CEO. This past year, Mr. Creel was focused on developing people, driving safety improvements and pursuing continued sustainable, profitable growth. Mr. Creel was recognized by Institutional Investor as a member of the 2020All-Canada Executive Team and was ranked as the top CEO in the Capital Goods/Industrials sector. |

| Compensation (in CAD $‘000) | 2019 | ||||

Fixed | ||||||

Base earnings | | 1,538 | | |||

Variable | ||||||

Short-term incentive | | 2,979 | | |||

Long-term incentive | ||||||

- PSUs | | 5,870 | | |||

- Stock options | | 3,642 | | |||

Total direct compensation | | 14,029 | | |||

Total target direct compensation | | 11,147 | | |||

Notes: Salary is the actual amount received in the year. Payments made in U.S. dollars have been converted to Canadian dollars using an average exchange rate for the year of $1.3269. | ||||||

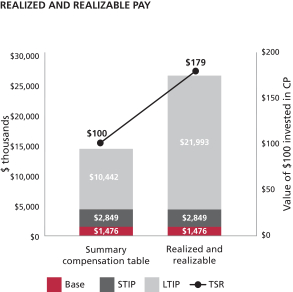

| • | the value of vested 2017 PSUs paid in February 2020 was calculated using the 30-day average trading price of our shares prior to December 31, 2019 of US$245.01 on the NYSE with a performance multiplier of 1.93 and includes dividends earned up to the payment date. |

| • | the value of unvested 2018 and 2019 PSUs are based on the closing price of our shares on December 31, 2019 of US$254.95 on the NYSE with a performance multiplier of 1.0. PSUs include reinvestment of additional units received as dividend equivalents |

| • | the value of unvested/unexercised stock options is based on the closing price of our shares on December 31, 2019 of US$254.95 on the NYSE |

| • | the compensation figures for salary earned and actual bonus received have been converted to Canadian dollars using the following average exchange rates: $1.3269 for 2019, $1.2957 for 2018 and $1.2986 for 2017. |

| • | the value of any realized and realizable PSUs and Stock Options have been converted into Canadian dollars using the 2019 year-end exchange rate of $1.2988 |

| • | The up-front performance stock options grant received in 2017 is included in realizable pay |

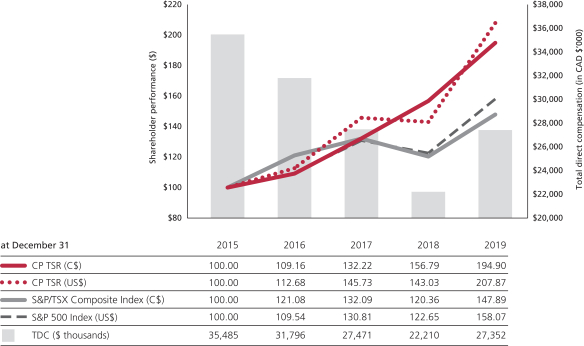

| (in CAD $‘000) | Value of $100 | |||||||||||||||||||

Compensation awarded ($) | Realized and realizable value of compensation as at December 31, 2019 ($) | Period | Keith Creel ($) | Shareholder ($) | ||||||||||||||||

2017 | 18,780,304 | 48,994,522 | Jan 1, 2017 to Dec 31, 2019 | 260.88 | 178.55 | |||||||||||||||

2018 | 11,491,066 | 14,640,604 | Jan 1, 2018 to Dec 31, 2019 | 127.41 | 147.41 | |||||||||||||||

2019 | 14,029,129 | 15,318,711 | Jan 1, 2019 to Dec 31, 2019 | 109.19 | 138.38 | |||||||||||||||

Requirement (as a multiple of salary) | Minimum ownership value ($) | Shares ($) | Deferred share units ($) | Total ownership value ($) | Total ownership (as a multiple of salary) | |||||||||

6x | 9,616,608 | 1,166,073 | 10,666,164 | 11,832,237 | 7.38x | |||||||||

| (1) | Adjusted diluted EPS is a non-GAAP measure.Non-GAAP measures are defined and reconciled on pages 54-62 of CP’s Annual Report on Form10-K for the year ended December 31, 2019. |

| Mr. Velani was appointed Vice-President and Chief Financial Officer (CFO) on October 18, 2016 and was appointed Executive Vice-President and Chief Financial Officer on October 17, 2017. Mr. Velani is a key member of the senior management team responsible for the long-term strategic direction of the Company. Other responsibilities include financial planning, reporting and accounting systems, as well as pension, treasury, investor relations and tax functions. Mr. Velani joined CP in March 2013 and most recently served as Vice-President Investor Relations. Prior to CP, Mr. Velani spent approximately 15 years at CN where he worked in a variety of positions in financial planning, sales and marketing, investor relations and the Office of the President and CEO. |

| Compensation (in CAD $‘000) | 2019 | ||||

Fixed | ||||||

Base earnings | | 751 | | |||

Variable | ||||||

Short-term incentive | | 1,096 | | |||

Long-term incentive | ||||||

- PSUs | | 1,552 | | |||

- Stock options | | 979 | | |||

Total direct compensation | | 4,378 | | |||

Total target direct compensation | | 3,538 | | |||

Requirement (as a multiple of salary) | Minimum ownership value ($) | Shares ($) | Deferred share units ($) | Total ownership value ($) | Total ownership (as a multiple of salary) | |||||||||||||||

3x | 2,363,511 | 204,541 | 2,373,218 | 2,577,759 | 3.27x | |||||||||||||||

| Mr. Brooks was appointed Executive Vice-President and Chief Marketing Officer (CMO) on February 14, 2019. During the financial year ended December 31, 2018, Mr. Brooks was CP’s Senior Vice-President and Chief Marketing Officer. During Mr. Brooks’ sales and marketing career he has held senior responsibilities in all lines of business, including coal, chemicals, merchandise products, grain and intermodal. He began his railroading career with Union Pacific and later helped start I&M Rail Link, LLC, which was purchased by the Dakota, Minnesota and Eastern Railroad (DM&E) in 2002. Mr Brooks was Vice-President of Marketing at the DM&E prior to it being acquired by CP in 2007. In the role of CMO, Mr. Brooks is responsible for CP’s business units and leading a group of highly capable sales and marketing professionals across North America. In addition, Mr. Brooks is responsible for strengthening partnerships with existing customers, generating new opportunities for growth, enhancing the value of the company’s service offerings and developing strategies to optimize CP’s book of business. |

| Compensation (in CAD $‘000) | 2019 | ||||

Fixed | ||||||

Base earnings | | 670 | | |||

Variable | ||||||

Short-term incentive | | 829 | | |||

Long-term incentive | ||||||

- PSUs | | 1,197 | | |||

- Stock options | | 697 | | |||

Total direct compensation | | 3,393 | | |||

Total target direct compensation | | 2,782 | | |||

Notes: Salary is the actual amount received that year. Payments made in U.S. dollars have been converted to Canadian dollars using an average exchange rate for the year of $1.3269. | ||||||

Requirement (as a multiple of salary) | Minimum ownership value ($) | Shares ($) | Deferred share units ($) | Total ownership value ($) | Total ownership (as a multiple of salary) | |||||||||||||||

3x | 2,220,821 | 692,832 | 615,076 | 1,307,908 | 1.77x | |||||||||||||||

| Mr. Pitz was promoted to Senior Vice-President and Chief Risk Officer in October of 2017. This was part of the overall realignment of the risk and insurance functions for succession purposes, and to retain Mr. Pitz for the necessary development of the succession candidates. He is responsible for all aspects of risk-management in Canada and the U.S., including police services, casualty and general claims, environmental risk, field safety and systems, operational regulatory affairs and training, disability management and forensic audit investigations. Mr. Pitz joined CP on April 2, 2014, as Vice-President of Security and Risk Management. Mr. Pitz, a Vietnam War veteran and former FBI special agent, is a 40-year career professional who has directed strategic and operational risk-mitigation, security and crisis-management functions for companies operating in a wide range of fields including defense, logistics and transportation. |

| Compensation (in CAD $‘000) | 2019 | ||||

Fixed | ||||||

Base earnings | | 529 | | |||

Variable | ||||||

Short-term incentive | | 571 | | |||

Long-term incentive | ||||||

- PSUs | | 811 | | |||

- Stock options | | 503 | | |||

Total direct compensation | | 2,414 | | |||

Total target direct compensation | | 1,964 | | |||

Notes: Salary is the actual amount received that year. Payments made in U.S. dollars have been converted to Canadian dollars using an average exchange rate for the year of $1.3269. | ||||||

Requirement (as a multiple of salary) | Minimum ownership value ($) | Shares ($) | Deferred share units ($) | Total ownership value ($) | Total ownership (as a multiple of salary) | |||||||||||||||

2x | 1,106,550 | 25,724 | 1,485,075 | 1,510,799 | 2.73x | |||||||||||||||

| Mr. Redd was appointed Executive Vice-President Operations effective September 1, 2019. Mr. Redd oversees the 24/7 operations of CP’s network including those teams responsible for network transportation, operations, mechanical, engineering, procurement and labour relations. Mr. Redd brings to his role considerable leadership experience in rail operations and safety excellence. Mr. Redd joined CP in October 2013. In April 2016, he was appointed Vice-President Operations Western Region, and was promoted to Senior Vice-President Operations Western Region in February 2017. Prior to these roles, he was General Manager Operations U.S. West and General Manager Operations Central Division. He was named CP’s 2016 Railroader of the Year. Mr. Redd began his railroading career at Midsouth Rail in Jackson, Mississippi, as a brakeman and conductor, before moving to Kansas City Southern (KCS) as an engineer. Throughout his over 20 years at KCS, Mr. Redd held a variety of leadership positions in network and field operations, including Vice-President Transportation where he oversaw key operating functions in the U.S. and Mexico. During this time, he also served as the Chairman of the operating board for the Port Terminal Railroad Association in Houston, Texas. |

| Compensation (in CAD $‘000) | 2019 | ||||

Fixed | ||||||

Base earnings | | 491 | | |||

Variable | ||||||

Short-term incentive | | 593 | | |||

Long-term incentive | ||||||

- PSUs | | 605 | | |||

- Stock options | | 355 | | |||

Total direct compensation | | 2,044 | | |||

Total target direct compensation | | 2,218 | | |||

Notes: Salary is the actual amount received that year. Payments made in U.S. dollars have been converted to Canadian dollars using an average exchange rate for the year of $1.3269. | ||||||

Requirement (as a multiple of salary) | Minimum ownership value ($) | Shares ($) | Deferred share units ($) | Total ownership value ($) | Total ownership (as a multiple of salary) | |||||||||||||||

3x | 1,797,807 | 291,791 | 721,813 | 1,013,604 | 1.69x | |||||||||||||||

| On September 30, 2019, Mr. Johnson retired from CP after an impressive railroading career that spanned more than three decades. Mr. Johnson was appointed as Executive Vice-President Operations in April 2016. In this role, Mr. Johnson had overall operational responsibility for CP’s rail network, including aspects of operational safety, service, engineering and mechanical services in both Canada and the U.S. with a focus on train performance and overall fluidity of the network. Prior to this appointment, Robert was CP’s Senior Vice-President Operations, Southern Region. Mr. Johnson’s railroad career spans over 37 years. He spent 32 of those years with BNSF where he held successively more responsible roles in operations, transportation, engineering and service excellence. His most recent position at BNSF was General Manager, Northwest Division, overseeing day-to-day |

| Compensation (in CAD $‘000) | 2019 | ||||

Fixed | ||||||

Base earnings | | 478 | | |||

Variable | ||||||

Short-term incentive | | 524 | | |||

Long-term incentive | ||||||

- PSUs | | 1,015 | | |||

- Stock options | | 629 | | |||

Total direct compensation | | 2,646 | | |||

Total target direct compensation | | 2,433 | | |||

Notes: Salary is the actual amount received that year. Payments made in U.S. dollars have been converted to Canadian dollars using an average exchange rate for the year of $1.3269. | ||||||

| • | Total direct compensation is the total compensation awarded to the NEOs, as reported in the summary compensation table in prior years. |

| • | In years where there weremore than five NEOs, we used the following to calculate total direct compensation in the table above: |

| • | 2019: Keith Creel, Nadeem Velani, John Brooks, Laird Pitz and Mark Redd |

| • | 2018: Keith Creel, Nadeem Velani, Robert Johnson, Laird Pitz and John Brooks |

| • | 2017: Keith Creel, Nadeem Velani, Robert Johnson, Laird Pitz and Jeffrey Ellis |

| • | 2016: Hunter Harrison, Nadeem Velani, Keith Creel, Robert Johnson and Laird Pitz |

| • | 2015: Hunter Harrison, Mark Erceg, Keith Creel, Laird Pitz and Mark Wallace |

| • | Mr. Harrison, Mr. Creel, Mr. Brooks, Mr. Pitz, Mr. Redd and Mr. Johnson, were paid in U.S. dollars and their amounts have been converted using the following average exchange rates: $1.3269 for 2019, $1.2957 for 2018, $1.2986 for 2017, $1.3248 for 2016 and $1.2787 for 2015 |

Non-equity Incentive plan compensation ($) | ||||||||||||||||||||||||||||||||||||

Name and principal position | Year | Salary ($) | Share-based awards ($) | Option-based awards ($) | Annual incentive plans | Long-term incentive plans | Pension values ($) | All other compensation ($) | Total compensation ($) | |||||||||||||||||||||||||||

Keith E. Creel | 2019 | 1,537,866 | 5,870,208 | 3,642,061 | 2,978,994 | - | 566,343 | 554,930 | 15,150,402 | |||||||||||||||||||||||||||

President and Chief | 2018 | 1,453,595 | 4,369,757 | 2,519,163 | 3,148,551 | - | 452,209 | 543,332 | 12,486,607 | |||||||||||||||||||||||||||

Executive Officer | | 2017 | | | 1,436,594 | | | 4,407,788 | | | 10,516,630 | | | 2,419,292 | | | - | | | 398,894 | | | 926,402 | | | 20,105,600 | | |||||||||

Nadeem S. Velani | 2019 | 751,099 | 1,623,980 | 978,943 | 1,095,729 | - | 214,043 | 59,250 | 4,723,044 | |||||||||||||||||||||||||||

Executive Vice-President | 2018 | 666,946 | 1,199,385 | 688,327 | 1,032,596 | - | 138,925 | 57,680 | 3,783,859 | |||||||||||||||||||||||||||

and Chief Financial Officer | | 2017 | | | 451,355 | | | 806,073 | | | 202,650 | | | 490,763 | | | - | | | 101,027 | | | 49,523 | | | 2,101,391 | | |||||||||

John K. Brooks | 2019 | 670,235 | 1,240,804 | 697,030 | 829,259 | - | 254,186 | 66,651 | 3,758,165 | |||||||||||||||||||||||||||

Executive Vice-President | 2018 | 499,384 | 424,798 | 244,922 | 602,177 | - | 166,898 | 61,456 | 1,999,635 | |||||||||||||||||||||||||||

and Chief Marketing Officer | | 2017 | | | 436,359 | | | 428,442 | | | 125,582 | | | 420,251 | | | - | | | 144,378 | | | 59,567 | | | 1,614,579 | | |||||||||

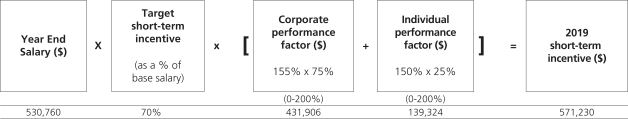

Laird J. Pitz | 2019 | 529,378 | 810,534 | 502,882 | 571,230 | - | 104,830 | 45,606 | 2,564,460 | |||||||||||||||||||||||||||

Senior Vice-President | 2018 | 482,486 | 444,139 | 256,132 | 560,593 | - | 87,126 | 42,346 | 1,872,822 | |||||||||||||||||||||||||||

and Chief Risk Officer | | 2017 | | | 457,901 | | | 394,237 | | | 228,694 | | | 435,601 | | | - | | | 82,361 | | | 41,137 | | | 1,639,931 | | |||||||||

Mark A. Redd | 2019 | 491,307 | 642,177 | 355,053 | 592,539 | - | 96,231 | 214,626 | 2,391,933 | |||||||||||||||||||||||||||

Executive Vice-President | 2018 | 440,209 | 832,824 | 562,059 | 510,812 | - | 78,942 | 283,124 | 2,707,970 | |||||||||||||||||||||||||||

Operations | | 2017 | | | 415,321 | | | 367,349 | | | 179,664 | | | 391,637 | | | - | | | 69,989 | | | 66,582 | | | 1,490,542 | | |||||||||

Robert A. Johnson | 2019 | 478,386 | 1,014,508 | 629,408 | 523,969 | - | 121,175 | 79,573 | 2,847,019 | |||||||||||||||||||||||||||

Retired Executive Vice- | 2018 | 572,808 | 950,363 | 547,936 | 778,392 | - | 105,825 | 63,858 | 3,019,182 | |||||||||||||||||||||||||||

President Operations | | 2017 | | | 564,891 | | | 958,705 | | | 556,073 | | | 597,372 | | | - | | | 114,037 | | | 54,819 | | | 2,845,897 | | |||||||||

Assumptions | Willis Towers Watson expected life binomial valuation | |

TSX / NYSE | ||

Term | 3 years | |

Vesting Schedule | 3 year cliff | |

Payout Range % (threshold-target-max) | 50-100-200 | |

Risk of Forfeiture | 5% | |

PSU Value (as a % of grant price) | 81% |

| Assumptions | Willis Towers Watson expected life binomial valuation | |||||||||

| NYSE | TSX | |||||||||

Option Term | 7 years | 7 years | ||||||||

Vesting Schedule | 4 year pro-rated | 4 year pro-rated | ||||||||

Expected Life | 4.75 years | 4.75 years | ||||||||

Dividend Yield (1-year historical) | 1.00% | 0.99% | ||||||||

Volatility (3-year daily) | 24.0% | 21.7% | ||||||||

Risk-free Rate (yield curve) | 2.5 - 3.1% | 2.0 - 2.5% | ||||||||

Risk of Forfeiture | 5% | 5% | ||||||||

Stock Option Value (as a % of grant price) | 23% | 20% | ||||||||

| Perquisites | Other compensation | |||||||||||||||||||||||||||||||||||||||

| Name | Personal use of company aircraft ($) | Auto benefits ($) | Housing allowance ($) | Financial and tax planning ($) | Additional medical ($) | Club benefits ($) | 401K match ($) | Employer share purchase plan match ($) | Tax Assistance ($) | Total ($) | ||||||||||||||||||||||||||||||

Keith Creel | | 413,422 | | | 28,704 | | | 17,056 | | | 33,173 | | | 1,353 | | | 23,647 | | | 7,165 | | | 30,410 | | | - | | | 554,930 | | ||||||||||

Nadeem Velani | | - | | | 33,177 | | | - | | | - | | | - | | | 11,200 | | | - | | | 14,872 | | | - | | | 59,249 | | ||||||||||

John Brooks | | - | | | 26,251 | | | - | | | - | | | 2,610 | | | 14,861 | | | 9,658 | | | 13,271 | | | - | | | 66,651 | | ||||||||||

Laird Pitz | | - | | | 22,543 | | | - | | | - | | | - | | | 14,861 | | | 8,203 | | | - | | | - | | | 45,607 | | ||||||||||

Mark Redd | | - | | | 36,594 | | | - | | | - | | | 2,510 | | | 14,861 | | | 7,626 | | | 9,728 | | | 143,305 | | | 214,624 | | ||||||||||

Robert Johnson | | - | | | 53,148 | | | - | | | - | | | - | | | 14,861 | | | 9,616 | | | 1,949 | | | - | | | 79,574 | | ||||||||||

| Use of company aircraft | The value is calculated by multiplying the variable cost per air hour by the number of hours used for travel and includes costs for fuel, maintenance, landing fees and other miscellaneous costs. As an executive of a Calgary-based company, enabling the CEO to visit his family in the United States is an important retention tool. Non-corporate use of the corporate jet has been limited to family visits and limited to the CEO only. | |

| Auto benefits | Includes a company-leased vehicle and reimbursement of related operating costs as well as taxable reimbursement of auto benefits for eligible vehicles. Upon retirement on September 30, 2019, Mr. Johnson received his vehicle as a gift from CP. His auto benefits include the value of the vehicle and the lease payments for the time he was employed in 2019. | |

Housing allowance | The incremental cost to provide reasonable accommodation for Mr. Creel in Calgary. | |

Financial and tax planning | For Mr. Creel, financial and tax planning services according to his current employment contract. | |

Additional medical | CP encourages executives to participate in the executive medical program. Under the U.S. medical benefits plan, available to all U.S. employees, the majority of the cost of a medical examination is covered by the plan. Only additional services for the executive medical are paid for by CP. In Canada, executive medicals are not covered under any general benefit plan. | |

Club memberships | Included in the perquisites program available to all senior executives. | |

| 401K plan | Mr. Creel, Mr. Brooks, Mr. Pitz, Mr. Redd and Mr. Johnson also receive matching contributions to the 401k plan. | |

| ESPP match | Includes company contributions to the employee share purchase plan (ESPP). The NEOs participate in the ESPP on the same terms and using the same formulas as other participants. See page 50 to read more about the ESPP. | |

| Tax assistance | As a U.S. employee relocating to CP’s head office in Canada, Mr. Redd was provided with tax assistance to minimize the tax implications of his cross-border employment on his base salary and any STIP payment up to target. All other income was taxed at full Canadian tax rates. Mr. Redd’s tax assistance is an estimate for 2019. Effective with his promotion to Executive Vice President, Mr. Redd is no longer eligible for tax assistance. |

| • | reasonable living accommodation in Calgary |

| • | use of the corporate jet for business commuting and family visits within North America |

| • | non-disclosure, non-solicitation covenants |

| • | severance provisions as described on page 54 |

| • | reimbursement for club memberships of up to US$25,000 annually |

| • | reimbursement for financial services of up to US$25,000 annually |

| Option-based awards | Share-based awards | |||||||||||||||||||||||||||||||||

| Name | Grant date | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options ($) | Grant type | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) | Market or payout value of vested share-based awards not paid out or distributed ($) | |||||||||||||||||||||||||

Keith Creel | 31-Jan-2014 | 39,900 | 168.84 | 31-Jan-2024 | 6,471,381 | |||||||||||||||||||||||||||||

24-Jul-2014 | 47,940 | 210.32 | 24-Jul-2024 | 5,786,837 | ||||||||||||||||||||||||||||||

23-Jan-2015 | 33,910 | 175.92 | 23-Jan-2025 | 3,480,664 | ||||||||||||||||||||||||||||||

22-Jan-2016 | 55,250 | 116.80 | 22-Jan-2026 | 9,913,464 | ||||||||||||||||||||||||||||||

20-Jan-2017 | 33,884 | 150.99 | 20-Jan-2024 | 4,575,128 | ||||||||||||||||||||||||||||||

1-Feb-2017 | 18,762 | 151.14 | 1-Feb-2024 | 2,529,651 | ||||||||||||||||||||||||||||||

1-Feb-2017 | 177,225 | 151.14 | 1-Feb-2024 | 23,894,968 | ||||||||||||||||||||||||||||||

22-Jan-2018 | 43,148 | 185.85 | 22-Jan-2025 | 3,872,407 | ||||||||||||||||||||||||||||||

25-Jan-2019 | 54,202 | 205.31 | 25-Jan-2026 | 3,494,535 | ||||||||||||||||||||||||||||||

6-Feb-2013 | DSU | 10,546,127 | ||||||||||||||||||||||||||||||||

21-Feb-2017 | PSU | 14,138,889 | ||||||||||||||||||||||||||||||||

15-Feb-2018 | PSU | 18,621 | 6,166,051 | |||||||||||||||||||||||||||||||

14-Feb-2019 | PSU | 22,068 | 7,307,316 | |||||||||||||||||||||||||||||||

Total | 504,221 | 64,019,035 | 40,689 | 13,473,367 | 24,685,016 | |||||||||||||||||||||||||||||

Nadeem Velani | 2-Apr-2013 | 2,310 | 126.34 | 2-Apr-2023 | 472,834 | |||||||||||||||||||||||||||||

31-Jan-2014 | 1,820 | 168.84 | 31-Jan-2024 | 295,186 | ||||||||||||||||||||||||||||||

23-Jan-2015 | 1,539 | 218.78 | 23-Jan-2025 | 172,753 | ||||||||||||||||||||||||||||||

22-Jan-2016 | 2,927 | 165.74 | 22-Jan-2026 | 483,804 | ||||||||||||||||||||||||||||||

20-Jan-2017 | 4,644 | 201.49 | 20-Jan-2024 | 601,584 | ||||||||||||||||||||||||||||||

22-Jan-2018 | 13,260 | 231.66 | 22-Jan-2025 | 1,317,646 | ||||||||||||||||||||||||||||||

25-Jan-2019 | 16,313 | 271.50 | 25-Jan-2026 | 971,113 | ||||||||||||||||||||||||||||||

26-Feb-2014 | DSU | 223,781 | ||||||||||||||||||||||||||||||||

19-Feb-2015 | DSU | 113,220 | ||||||||||||||||||||||||||||||||

24-Feb-2017 | DSU | 124 | 41,083 | 164,332 | ||||||||||||||||||||||||||||||

22-Feb-2019 | DSU | 270 | 89,402 | 357,609 | ||||||||||||||||||||||||||||||

21-Feb-2017 | PSU | 2,517,052 | ||||||||||||||||||||||||||||||||

15-Feb-2018 | PSU | 5,304 | 1,755,752 | |||||||||||||||||||||||||||||||

14-Feb-2019 | PSU | 5,832 | 1,930,622 | |||||||||||||||||||||||||||||||

Total | 42,813 | 4,314,920 | 11,530 | 3,816,859 | 3,375,994 | |||||||||||||||||||||||||||||

John Brooks | 1-Apr-2012 | 2,850 | 75.71 | 1-Apr-2022 | 727,662 | |||||||||||||||||||||||||||||

7-Dec-2012 | 2,345 | 97.70 | 7-Dec-2022 | 547,159 | ||||||||||||||||||||||||||||||

22-Feb-2013 | 1,900 | 119.18 | 22-Feb-2023 | 402,515 | ||||||||||||||||||||||||||||||

31-Jan-2014 | 1,440 | 168.84 | 31-Jan-2024 | 233,554 | ||||||||||||||||||||||||||||||

23-Jan-2015 | 2,506 | 175.92 | 23-Jan-2025 | 257,226 | ||||||||||||||||||||||||||||||

22-Jan-2016 | 4,340 | 116.80 | 22-Jan-2026 | 778,723 | ||||||||||||||||||||||||||||||

20-Jan-2017 | 2,610 | 150.99 | 20-Jan-2024 | 352,411 | ||||||||||||||||||||||||||||||

22-Jan-2018 | 4,195 | 185.85 | 22-Jan-2025 | 376,489 | ||||||||||||||||||||||||||||||

25-Jan-2019 | 7,484 | 205.31 | 25-Jan-2026 | 482,512 | ||||||||||||||||||||||||||||||

14-Feb-2019 | 2,969 | 202.00 | 14-Feb-2026 | 204,182 | ||||||||||||||||||||||||||||||

6-Sep-2012 | DSU | 334,073 | ||||||||||||||||||||||||||||||||

22-Feb-2019 | DSU | 166 | 54,816 | 219,265 | ||||||||||||||||||||||||||||||

21-Feb-2017 | PSU | 1,374,360 | ||||||||||||||||||||||||||||||||

15-Feb-2018 | PSU | 1,810 | 599,421 | |||||||||||||||||||||||||||||||