Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12 | |

Keane Group, Inc.

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

Notice of 2018 Annual Meeting

Keane Group, Inc. Proxy Statement

ANNUAL MEETING

Thursday, May 24, 2018

10:00 A.M. Central Standard Time

The Woodlands Resort

2301 North Millbend Drive

The Woodlands, Texas 77380

MEETING HOURS

Registration 9:30 A.M.

Meeting 10:00 A.M.

Whether or not you plan to participate in the Annual Meeting in person, please promptly vote your shares by using the Internet or telephone, or if the accompanying proxy statement was mailed to you, by completing, signing, dating and returning your proxy card as soon as possible in the enclosed postage prepaid envelope.

Table of Contents

Table of Contents

James C. Stewart

Chairman and Chief Executive Officer

2121 Sage Road, Suite 370

Houston, TX 77056

April 13, 2018

Dear Keane Group, Inc. Stockholder,

Your board of directors and management cordially invite you to attend our 2018 Annual Meeting of Stockholders, to be held at The Woodlands Resort, located at 2301 North Millbend Drive, The Woodlands, Texas, 77380 on Thursday, May 24, 2018 at 10:00 a.m. Central Time.

Last year marked our first year as a public company, but also one of the most successful years in Keane’s history. Our initial public offering, which was completed in January 2017, set the stage for high public interest in the company and strong financial performance throughout the year. I am immensely proud of our team’s achievement of this critical milestone, and more importantly, our path ahead for continued growth and success benefitting our stockholders, customers, and employees.

Since completing our IPO, we have furthered our position as a leading provider of completions services in the United States. Our success has been underpinned by robust industry demand, our strategic partnerships with high-quality customers under a dedicated service model and our thoughtful approach toward growth. We have progressed optimization of our existing asset portfolio by deploying all of our previously idled hydraulic fracturing assets and by pruning our portfolio ofnon-core service lines as we grew via third party merger and acquisition activity. Upon delivery of three additional hydraulic fracturing fleets by the end of the third quarter of 2018, we will operate 1.35 million hydraulic horsepower in leading shale basins, including the Permian and Marcellus/Utica.

Beyond our growth and strategy, Keane’s success is driven by our highly dedicated personnel, and their focus on health, safety and environment (HSE) and executing on behalf of our customers. The deep relationships we build with our long-standing customers require proof of operating proficiency and fundamental trust, which I’m proud to say we earn daily. Keane is a leader in well site HSE and operational execution, built on our commitment to utilizing leading-edge HSE systems and comprehensively maintained high-quality equipment.

Our field execution has driven positive financial results, enabling continued investment in our business, while also initiating the return of value to shareholders through an announced share repurchase program. Throughout the year, we maintained and improved a healthy balance sheet, characterized by responsible leverage, sufficient liquidity and dynamic flexibility, and we are committed to maintaining a strong financial position going forward.

As we navigate the ever-changing U.S. completions services market, Keane remains ideally positioned with a strong outlook for continued growth and returns. We expect further growth in demand for high-quality completions services, combined with increasing service intensity, and Keane is excited to be part of that activity—meeting customer needs, delivering results, and driving value for our stockholders.

Your vote is important to us. Whether or not you plan to participate in the Annual Meeting in person, we urge you to promptly vote your shares by using the Internet or telephone, or if the accompanying proxy statement was mailed to you, by completing, signing, dating and returning your proxy card as soon as possible in the enclosed postage prepaid envelope. Thank you for your continued support and interest in our company.

Sincerely,

James C. Stewart

Chairman and Chief Executive Officer

2018 Proxy Statement | i

Table of Contents

Notice of 2018 Annual Meeting of Stockholders

May 24, 2018

10:00 A.M. Central Standard Time

The Woodlands Resort

2301 North Millbend Drive

The Woodlands, Texas 77380

Dear Stockholders,

You are cordially invited to attend the 2018 Annual Meeting of Stockholders (the “Annual Meeting”) of Keane Group, Inc. (the “Company”). At the Annual Meeting, our stockholders will be asked to vote on the following proposals:

| 1. | To elect the eleven individuals named in this Proxy Statement as directors of the Company until the 2019 annual meeting of stockholders of the Company (the “2019 Annual Meeting”) or, in each case, until his or her earlier death, retirement, resignation or removal from the position of director; |

| 2. | To ratify the appointment of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm and auditor for the financial year ending December 31, 2018 and to authorize the board of directors of the Company, acting through the Audit and Risk Committee, to determine the auditors’ remuneration; |

| 3. | To approve, in an advisory vote, the compensation of our named executive officers; and |

| 4. | To recommend the frequency of advisory votes on named executive officer compensation. |

The board of directors recommends that you vote “FOR” Proposals 1, 2 and 3 and vote “ONE YEAR” on Proposal 4. The foregoing items, including the votes required in respect of each, are set forth and more fully described in the accompanying Proxy Statement.

Stockholders of record at the close of business on March 29, 2018 are entitled to vote at the meeting or any adjournment. If you plan to attend the meeting, you will need to show proof of your stock ownership, such as a recent account statement, letter or proxy from your broker or other intermediary, along with photo identification. Admission to the meeting will be on a first-come, first-served basis. Registration will begin at 9:30 A.M., and seating will begin at 9:45 A.M.

Your vote is important to us. Whether or not you plan to participate in the Annual Meeting in person, we urge you to promptly vote your shares by using the Internet or telephone, or if the accompanying proxy statement was mailed to you, by completing, signing, dating and returning your proxy card as soon as possible in the enclosed postage prepaid envelope.

By order of the board of directors

Kevin M. McDonald

Executive Vice President,

General Counsel & Corporate Secretary

Houston, Texas

April 13, 2018

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 24, 2018:This notice, the Proxy Statement, the proxy card and our Annual Report on Form10-K for the fiscal year ended December 31, 2017 (the “2017 10-K”) are available on our website at www.keanegrp.com.

ii | Keane Group, Inc.

Table of Contents

2018 Proxy Statement | iii

Table of Contents

In this Proxy Statement, “Keane,” the “Company,” “we,” “us” and “our” refer to Keane Group, Inc., a Delaware corporation.

This Proxy Statement and proxy card are being made available on behalf of our board of directors, or our “Board,” to all stockholders beginning on or about April 13, 2018.

Meeting and Voting Information

Annual Meeting:May 24, 2018 at 10:00 A.M. Central Standard Time, The Woodlands Resort, 2301 North Millbend Drive, The Woodlands, Texas 77380.

Agenda

Proposal

| Required Approval

|

Board

| ||||

1. |

Election of Directors. To elect each of the eleven individuals named in this Proxy Statement until the 2019 Annual Meeting or, in each case, until his or her earlier death, retirement, resignation or removal from the position of director.

|

Majority of Votes |

FOR each | |||

2. |

Ratify Appointment of Independent Auditors. To ratify the appointment of KPMG as our independent auditor for the fiscal year ending December 31, 2018 and to authorize the Board of Directors, acting through the Audit and Risk Committee, to determine the auditors’ remuneration.

|

Majority of Votes |

FOR | |||

3. |

Approve Executive Compensation. To approve, in an advisory vote, the compensation of our named executive officers.

|

Majority of Votes

|

FOR | |||

4. |

Frequency Vote. To recommend the frequency of advisory votes on named executive officer compensation.

|

Majority of Votes

|

ONE YEAR |

Who Can Vote

All registered stockholders at the close of business on March 29, 2018 (the “Record Date”) have the right to notice of, and to vote, in person or by proxy, at the Annual Meeting. Each share of common stock is entitled to one vote. As of the Record Date, there were 112,243,769 shares of Keane common stock outstanding and entitled to vote.

Meeting Attendance

If you plan to attend the Annual Meeting in person, you will need to show proof of your stock ownership, such as a recent account statement, letter or proxy from your broker or other intermediary, along with photo identification. Admission to the meeting will be on a first-come, first-served basis. Registration will begin at 9:30 A.M., and seating will begin at 9:45 A.M.

How to Vote

To ensure your representation at the Annual Meeting, we request that you grant your proxy to vote on each of the proposals in this Proxy Statement and any other matters that may properly come before the meeting to the persons

2018 Proxy Statement | 1

Table of Contents

named in the proxy card by voting in one of the ways described herein no later than the Voting Deadline (defined below) whether or not you plan to attend.

Voting Deadline: 11:59 P.M. Eastern Standard Time on May 23, 2018.

Most of our stockholders hold their shares through a broker, bank, trustee or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company LLC, you are considered, with respect to those shares, the stockholder of record, and we are sending these proxy materials directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to us or to a third party, or to vote in person at the Annual Meeting. If you received a printed set of proxy materials by mail, we have enclosed a proxy card for you to use to vote your shares.

Beneficial Owner

If your shares are held in a brokerage account or by a bank, trustee or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you on behalf of your broker, bank, trustee or other nominee. As the beneficial owner, you have the right to direct your broker, bank, trustee or other nominee how to vote and you also are invited to attend the Annual Meeting of Stockholders. If you received a printed set of proxy materials, your broker, bank, trustee or other nominee has enclosed a voting instruction form for you to use in directing the broker, bank, trustee or other nominee how to vote your shares.

Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a legal proxy from the broker, bank, trustee or other nominee that holds your shares giving you the right to vote the shares at the Annual Meeting.

See“Quorum and Voting” as to the effect ofbroker non-votes.

Quorum and Voting

A majority of the outstanding shares of our common stock present in person or represented by proxy at the Annual Meeting will constitute a quorum for the transaction of business. Abstentions and brokernon-votes will be included in determining whether a quorum is present at the Annual Meeting. A“broker non-vote” occurs when a nominee (such as a broker) holding shares for a beneficial owner abstains from voting on a particular proposal because the nominee does not have discretionary voting power for that proposal and has not received instructions from the beneficial owner on how to vote those shares.

If you are a beneficial owner and your broker or other nominee holds your shares in its name (in “street name”), the broker generally has discretion to vote your shares with respect to “routine” proposals. The only “routine” proposal in this Proxy Statement is Proposal 2. Proposals 1, 3 and 4 are“non-routine” and your broker may not vote your shares. Accordingly, if you hold your shares in “street name,” your broker will not be able to vote your shares on these matters unless your broker receives voting instructions from you.

Approval of each proposal will be decided by a simple majority of the votes cast “FOR” or “AGAINST,” in person or by proxy, provided a quorum is present. Abstentions andbroker “non-votes” will not affect the voting results.

The election of each director nominee will be considered and voted upon as a separate proposal. There is no cumulative voting in the election of directors. If the proposal for the election of a director nominee does not receive the required majority of the votes cast, then the director will not be elected and the position on the Board that would have been filled by the director nominee will become vacant. The Board has the ability to fill the vacancy

2 | Keane Group, Inc.

Table of Contents

upon the recommendation of its Nominating and Corporate Governance Committee, subjectto re-election by the Company’s stockholders at the 2019 Annual Meeting. Abstentions andbroker “non-votes” will not affect the voting results.

The chart below summarizes the voting requirements and effects ofbroker non-votes and abstentions on the outcome of the vote for the proposals at the Annual Meeting.

Proposal

| Required Approval

|

Broker Discretionary Voting Allowed

| Broker Non-Votes

| Abstentions

| ||||

1. Election of Directors

|

Majority of Votes Cast

|

No

|

No effect

|

No effect

| ||||

2. Ratify Appointment of Independent Auditors

|

Majority of Votes Cast

|

Yes

|

N/A

|

No effect

| ||||

3. Approve Executive Compensation

|

Majority of Votes Cast

|

No

|

No effect

|

No effect

| ||||

4. Frequency Vote

|

Majority of Votes Cast

|

No

|

No effect

|

No effect

|

Proxies

A copy of the Proxy Materials and proxy card are being sent to each stockholder registered in our share register as of the Record Date. Stockholders not registered in our share register as of the Record Date will not be entitled to attend, vote or grant proxies to vote at the Annual Meeting. Your vote and proxy are being solicited by our board of directors in favor of Kevin M. McDonald or, failing him, James C. Stewart (the “Proxy Holders”), for use at the Annual Meeting.

We request that you grant your proxy to vote on each of the proposals in this notice and any other matters that may properly come before the meeting to the Proxy Holders by completing, signing, dating and returning the proxy card in accordance with the instructions thereon, for receipt by us no later than the Voting Deadline, whether or not you plan to attend.

If you are a registered holder and you properly complete and submit your proxy card in a timely manner, you will be legally designating the individual or individuals named by you in the proxy card, or if you do not name your proxy or proxies, the Proxy Holders, to vote your shares in accordance with your instructions indicated on the card. If you are a registered stockholder and properly complete and submit your proxy card in a timely manner without naming your proxy or proxies and you do not indicate how your shares are to be voted, then the Proxy Holders will vote as the board of directors recommends on each proposal and if other matters properly come before the Annual General Meeting, the Proxy Holders will have your authority to vote your shares in their discretion on such matters.

Revoking Your Proxy

If you are a registered stockholder, you may revoke your proxy by:

| • | writing to the Corporate Secretary at 2121 Sage Road, Suite 370, Houston, Texas 77056, such that the revocation is received no later than the Voting Deadline; or |

| • | submitting a later dated proxy via mail, to the address specified in the proxy materials, for receipt by us no later than the Voting Deadline. |

If you have revoked your proxy as described above, you may attend and vote in person at the Annual Meeting.

If you are not a registered holder, but you hold your shares through a broker or other nominee, you must follow the instructions provided by your broker or other nominee if you wish to revoke a previously granted proxy, since attending the Annual Meeting alone will not revoke any proxy.

2018 Proxy Statement | 3

Table of Contents

Multiple Proxy Cards

If you receive multiple proxy cards, this indicates that your shares are held in more than one account, such as two brokerage accounts and are registered in different names. You should complete and return each of the proxy cards to ensure that all of your shares are voted.

Cost of Proxy Solicitation

We have retained D.F. King & Co., Inc. to solicit proxies from our stockholders at an estimated fee of $8,500, plus expenses. Some of our directors, officers and employees may solicit proxies personally, without any additional compensation, electronically, by telephone or by mail. Proxy materials also will be furnished without cost to brokers and other nominees to forward to the beneficial owners of shares held in their names. All costs of proxy solicitation will be borne by the Company.

Questions

You may call or contact our proxy solicitor, D.F. King & Co., Inc., at (800)628-8528 or keane@dfking.com, or contact us care of the Corporate Secretary at 2121 Sage Road, Suite 370, Houston, TX 77056 or via telephone at (713) 960-0381 if you have any questions or need directions to be able to attend the meeting and vote in person.

Please Vote. Your Vote is Important to Us.

4 | Keane Group, Inc.

Table of Contents

Proposal 1 Election of Directors

The Board of Directors recommends that you vote“FOR” each nominee for director.

Upon the recommendation of the Nominating and Corporate Governance Committee, the board of directors of the Company has nominated each of the following eleven nominees to be elected at the Annual Meeting: Lucas Batzer, Dale Dusterhoft, Marc G.R. Edwards, Christian A. Garcia, Lisa A. Gray, Gary M. Halverson, Shawn Keane, Elmer D. Reed, James C. Stewart, Lenard B. Tessler and Scott Wille.

Each director elected will serve until the 2019 Annual Meeting or, in each case, until his or her earlier death, retirement, resignation or removal from the position of director. All of our nominees have consented to serve as directors and our board of directors has no reason to believe that any of the nominees will be unable to act as a director.

A director nominee will bere-elected if approved by a simple majority of the votes cast. If you properly submit a proxy card, but do not indicate how you wish to vote, the Proxy Holders will vote for all of the listed director nominees.

|

Age: 55

|

| James C. Stewart, Chairman and Chief Executive Officer.

Mr. Stewart became the Chairman and Chief Executive Officer of Keane in March 2011. Prior to joining Keane, from 2007 to 2009, he served as the President and Chief Executive Officer of a privately held international drilling company. From 2006 to 2007, Mr. Stewart served as Vice President of Integrated Drilling Services for Weatherford International plc, based in London and Dubai, where he created and managed a global business unit that included a50-rig international land contract drilling group and a global project management team. Mr. Stewart began his career with Schlumberger Limited, where he held senior leadership positions across the globe over the span of 22 years. Mr. Stewart’s qualifications to serve as Chairman and Chief Executive Officer include his broad leadership experience with oilfield services, as well as his long tenure and successes in the oil and natural gas market. | |

|

Age: 57

|

| Marc G. R. Edwards, Lead Director.

Mr. Edwards has served as a member of Keane’s board of directors since September 2016. Mr. Edwards has served as President and Chief Executive Officer and as a member of the board of directors of Diamond Offshore Drilling, Inc., a deepwater water drilling contractor, since 2014. He previously spent 30 years at Halliburton Company, where he worked in various roles, most recently as Senior Vice President of the Completion and Production Division. Mr. Edwards developed an extensive background in the global energy industry during his tenure at Halliburton, which enables him to provide important contributions and a new perspective to our board of directors. Hisday-to-day leadership experience gives him invaluable insight regarding the operations of an oilfield services company. | |

2018 Proxy Statement | 5

Table of Contents

|

Age: 34

|

| Lucas N. Batzer, Director.

Mr. Batzer has served as a member of Keane’s board of directors since March 2016. He currently serves as a Managing Director of Private Equity at Cerberus Capital Management, L.P. (“Cerberus”), which he joined in August 2009. Prior to joining Cerberus, Mr. Batzer worked as an analyst at The Blackstone Group from 2007 to 2009. He has served on the boards of directors of ABC Group and Reydel Automotive, two automotive component suppliers, since June 2016 and November 2014, respectively. Mr. Batzer’s experience in the private equity industry, board experience and comprehensive knowledge of our business and operational strategy, positions him as an important resource on our board of directors. |

|

Age: 57

|

| Dale M. Dusterhoft, Director.

Mr. Dusterhoft has served as a member of Keane’s board of directors since March 2016 and currently serves as Chief Executive Officer and as a director of Trican Well Service L.P. (“Trican”), which he joined at its inception in 1996. He has served on the board of directors of Trican since August 2009. Prior to becoming Chief Executive Officer of Trican, Mr. Dusterhoft was the Company’s Senior Vice President of Technical Services. Before joining Trican, Mr. Dusterhoft worked for 12 years with a major Canadian pressure pumping company, where he held management positions in Operations, Sales and Engineering. Mr. Dusterhoft serves on the board of the Alberta Children’s Hospital Foundation and the Calgary Petroleum Club. In addition, Mr. Dusterhoft is a past President of the Canadian | |

| | Association of Drilling Engineers, the Canadian Section of the Society of Petroleum Engineers and a past member of the Industry Advisory Board of the Schulich School of Engineering at the University of Calgary. Mr. Dusterhoft’s years of leadership and operational experience in large, successful enterprises in the oil industry is valuable to our board of directors’ understanding of the industry. | |||

|

Age: 54

|

| Christian A. Garcia, Director.

Mr. Garcia has served as a member of Keane’s board of directors since May 2017. Mr. Garcia currently serves as Executive Vice President and Chief Financial Officer of Visteon Corporation, a role he has held since October 2016. Previously, Mr. Garcia served in various executive and leadership roles at Halliburton Company, including as Senior Vice President and Acting Chief Financial Officer. Mr. Garcia has a Bachelor of Science in Business Economics from the University of the Philippines and a Master of Science in Management in Finance from Purdue University, and brings extensive financial and oilfield services experience to the Company. |

|

Age: 62

|

| Lisa A. Gray, Director.

Ms. Gray has served as a member of Keane’s board of directors since March 2011. Ms. Gray has served as Vice Chairman of Cerberus Operations and Advisory Company, LLC (“COAC”) since May 2015, as General Counsel from 2004 to 2017 and currently serves as Senior Legal Officer. Prior to joining Cerberus, she served as Chief Operating Executive and General Counsel for WAM!NET Inc. from 1996 to 2004. Prior to that, she was a partner at the law firm of Larkin, Hoffman, Daly & Lindgren, Ltd from 1990 to 1996. Prior to that, she was active in severalnon-profit corporations. Ms. Gray has over 25 years of experience in the areas of mergers and acquisitions, corporate debt restructuring and corporate governance. Ms. Gray serves as Vice Chairman and General Counsel of COAC, an affiliate of our largest beneficial owner, and has extensive experience and familiarity with us. In addition, Ms. Gray has | |

| extensive legal and corporate governance skills, which broaden the scope of our board of directors’ experience. | ||||

6 | Keane Group, Inc.

Table of Contents

|

Age: 59

|

| Gary M. Halverson, Director.

Mr. Halverson has served as a member of Keane’s board of directors since September 2016. In 2016, Mr. Halverson became a Senior Advisor at First Reserve, a private equity firm that focuses on energy investments, and a Partner at 360 Development Partners, a commercial real estate firm. Mr. Halverson was formerly Group President of Drilling and Production Systems and Senior Vice President at Cameron International Corporation from 2014 to 2016 prior to its sale to Schlumberger in 2016. He has over 38 years of industry experience with Cameron, where he worked in various roles across the U.S., Latin America and Asia, including President of Surface Systems between 2005 and 2014, Vice President and General Manager for Western Hemisphere between 2002 and 2006, General Manager of Latin | |

|

| America between 2001 and 2002 and Director of Sales and Marketing for Asia/Pacific/Middle East between 1993 and 2001. Mr. Halverson formerly served as Chairman of the Board of Directors of the Petroleum Equipment Suppliers Association, as a director on the board of the General Committee of Special Programs of the American Petroleum Institute, as a director on the board of the Well Control Institute and was the U.S. delegate to the World Petroleum Congress. Mr. Halverson’s extensive involvement in the oilfield service industry brings a valuable perspective to our Board.

| |||

|

Age: 52

|

| Shawn Keane, Director.

Mr. Keane has served as a member of Keane’s board of directors since March 2011. Mr. Keane served as President of Keane from 2008 to 2011 and helped transition the company into the hydraulic fracturing industry in the Marcellus/Utica Shale. Previously, he served as Keane’s Vice President between 2000 and 2008, and in various management positions from 1983 to 2000, when he began his employment with Keane & Sons Drilling, Inc., a predecessor entity of Keane. Mr. Keane’s knowledge of our company’s operational history and experience in the oilfield services industry is valuable to our board of directors’ understanding of our business and financial performance. |

|

Age: 69

|

| Elmer D. Reed, Director.

Mr. Reed has served as a member of Keane’s board of directors since April 2011. Prior to joining our board of directors, Mr. Reed served as Vice President, Executive Sales for Select Energy Services from 2010 to 2015 and in various management positions for BJ Services Company from 2003 to 2010, Newpark Drilling Fluids from 2001 to 2003 and Halliburton Energy Services from 1971 to 1999. Mr. Reed has over 45 years of oilfield service and operational experience. He served as a member of the board of directors of Circle Star Energy, an E&P company, in 2012. Mr. Reed has been active in the Independent Petroleum Association of America and is a lifetime member of the Society of Petroleum Engineers. He is also a member of Houston Livestock Show and Rodeo and Houston Farm and Ranch, and | |

| | regularly assists with infrastructure development projects in South America. Mr. Reed strengthens our board of directors with decades of experience in the oilfield service industry. | |||

2018 Proxy Statement | 7

Table of Contents

|

Age: 65

|

| Lenard B. Tessler, Director.

Mr. Tessler has served as a member of Keane’s board of directors since October 2012. Mr. Tessler is currently Vice Chairman and Senior Managing Director of Cerberus, where he is a member of the Cerberus Capital Management Investment Committee. Prior to joining Cerberus in 2001, Mr. Tessler served as Managing Partner of TGV Partners from 1990 to 2001, a private equity firm which he founded. Earlier in his career, he was a founding partner of Levine, Tessler, Leichtman & Co., and a founder, Director and Executive Vice President of Walker Energy Partners. Mr. Tessler is currently Lead Director of Albertsons Companies, and a director of Avon Products, Inc. He is also a Trustee of the New York-Presbyterian Hospital where he is a member of the Investment Committee and | |

|

| the Budget and Finance Committee. Mr. Tessler’s leadership roles at our largest beneficial owner, his board service, his extensive experience in financing and private equity investments and his in-depth knowledge of our company and its acquisition strategy, provide critical skills for our board of directors to oversee our strategic planning and operations. �� | |||

|

Age: 37

|

| Scott Wille, Director.

Mr. Wille has served as a member of Keane’s board of directors since March 2011. Mr. Wille is currentlyCo-Head of North American Private Equity and Senior Managing Director at Cerberus, which he joined in 2006. Prior to joining Cerberus, Mr. Wille worked in the leveraged finance group at Deutsche Bank Securities Inc. from 2004 to 2006. Mr. Wille has served as a director of Remington Outdoor Company, Inc., a designer, manufacturer and marketer of firearms, ammunition and related products, since February 2014 and Albertsons Companies since 2015. Mr. Wille previously served as a director of Tower International, Inc., a manufacturer of engineered structural metal components and assemblies, from September 2010 to October 2012. Mr. Wille’s experience in the financial and private equity | |

| | industries, together with hisin-depth knowledge of our company and its acquisition strategy, are valuable to our board of directors’ understanding of our business and financial performance. | |||

Family Relationships

None of our officers or directors has any family relationship with any director or other officer. “Family relationship” for this purpose means any relationship by blood, marriage or adoption, not more remote than first cousin.

Board Composition

Our business and affairs are currently managed under the board of directors of Keane. Our board of directors has eleven members. Members of the board of directors will be elected at our annual meeting of stockholders to serve for a term of one year or until their successors have been elected and qualified, subject to prior death, resignation, retirement or removal from office.

Board Meetings

During 2017, the board of directors met seven times, the Audit and Risk Committee met four times, the Compensation Committee met seven times and the Nominating and Corporate Governance Committee met two times; all of the directors participated, in person or by telephone, in at least 75% of all board of directors and applicable committee meetings. It is our policy that directors are expected to attend each annual meeting of stockholders.

Director Independence

Our board of directors has affirmatively determined that Marc G. R. Edwards, Christian A. Garcia, Gary M. Halverson and Elmer D. Reed are independent directors under the applicable rules of the New York Stock Exchange (the “NYSE”) and as such term is defined in Rule10A-3(b)(1) under the Securities Exchange Act of 1934 (the “Exchange Act”).

8 | Keane Group, Inc.

Table of Contents

Director Nominations

In obtaining the names of possible director nominees, our Nominating and Corporate Governance Committee conducts its own inquiries and considers suggestions from other directors, management, stockholders and professional director search firms. The Nominating and Corporate Governance Committee’s process for evaluating nominees identified in unsolicited recommendations from stockholders is the same as its process for unsolicited recommendations from other sources.

The Nominating and Corporate Governance Committee believes that nominees should possess the highest personal and professional ethics, reputation, integrity and values and be committed to representing the long-term interests of our stockholders. Directors should have a record of accomplishment in their chosen professional field and demonstrate sound business judgment. Directors must be willing and able to devote sufficient time to carrying out their duties and responsibilities effectively, including attendance at and participation in board and committee meetings, and should be committed to serve on the board for an extended period of time. The Nominating and Corporate Governance Committee will consider independence, diversity of viewpoints, backgrounds and experience, including a consideration of gender, ethnicity, race, country of citizenship and age in determining whether a candidate will be an appropriate fit with, and an asset to, the board of directors. When considering existing directors, the Nominating and Corporate Governance Committee evaluates their history of attendance at board and committee meetings as well as contributions and effectiveness at such meetings.

In addition, pursuant to the terms of our bylaws and the Amended and Restated Stockholders’ Agreement, dated as of July 3, 2017, by and among the company, Keane Investor Holdings, LLC (“Keane Investor”), RockPile Energy Holdings, LLC (“RockPile Holdings”) and WDE RockPile Aggregate, LLC (the “White Deer Holder”), Keane Investor (or its permitted assignee or designee) has certain rights to designate members to our board of directors, subject to certain director qualifications, including the rights to:

| • | following the date on which we cease to be a “controlled company” under the NYSE rules but prior to the date on which Keane Investor (or its permitted assignee or designee) cease to own 35% of the then outstanding shares of our common stock, appoint a number of individuals equal to one director fewer than 50% of our board of directors (rounded up to the next whole number); |

| • | for so long as Keane Investor (or its permitted assignee or designee) has beneficial ownership of less than 35% but more than 20% of our then-outstanding common stock, appoint the greater of (i) three individuals or (ii) 25% of our board of directors (rounded up to the next whole number); |

| • | for so long as Keane Investor (or its permitted assignee or designee) has beneficial ownership of less than 20% but more than 15% of our then-outstanding common stock, appoint the greater of (i) two individuals or (ii) 15% of our board of directors (rounded up to the next whole number); and |

| • | for so long as Keane Investor (or its permitted assignee or designee) has beneficial ownership of less than 15% but more than 10% of our then-outstanding common stock, appoint one individual to our board of directors. |

For additional information, see“Other Information—Related Party Transactions” in this proxy statement.

Controlled Company

Keane Investor controls a majority of our outstanding common stock. As a result, we are a “controlled company” within the meaning of the NYSE corporate governance standards. Under NYSE rules, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain NYSE corporate governance requirements, including:

| • | the requirement that a majority of the board of directors consist of independent directors; |

2018 Proxy Statement | 9

Table of Contents

| • | the requirement that we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | the requirement that we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. |

We currently utilize, and intend to continue to utilize these exemptions. As a result, we will not have a majority of independent directors nor will our Nominating and Corporate Governance Committee and Compensation Committee consist entirely of independent directors. Accordingly, our stockholders will not have the same protections afforded to stockholders of companies that are subject to all of the NYSE corporate governance requirements.

In the event that we cease to be a controlled company within the meaning of these rules, we will be required to comply with these provisions after specified transition periods.

More specifically, if we cease to be a controlled company within the meaning of these rules, we will be required to (i) satisfy the majority independent board requirement within one year of our status change, and (ii) have (a) at least one independent member on each of our Nominating and Corporate Governance Committee and Compensation Committee by the date of our status change, (b) at least a majority of independent members on each committee within 90 days of the date of our status change and (c) fully independent committees within one year of the date of our status change.

Board Leadership Structure

Our board of directors does not have a formal policy on whether the roles of Chief Executive Officer and Chairman of the board of directors should be separate. However, James C. Stewart currently serves as both Chief Executive Officer and Chairman. Our board of directors has considered its leadership structure and believes at this time that our company and its stockholders are best served by having one person serve in both positions. Combining the roles fosters accountability, effective decision-making and alignment between interests of our board of directors and management. Mr. Stewart also is able to use thein-depth focus and perspective gained in his executive function to assist our board of directors in addressing both internal and external issues affecting the Company.

Our corporate governance guidelines provide for the election of one of our directors to serve as Lead Director when the Chairman of the board of directors is also the Chief Executive Officer. Marc G. R. Edwards currently serves as our Lead Director, and is responsible for serving as a liaison between the Chairman and thenon-management directors, approving meeting agendas and schedules for our board of directors and presiding at executive sessions of thenon-management directors and any other board meetings at which the Chairman is not present, among other responsibilities. Ournon-management directors meet regularly in executive sessions at which onlynon-management directors are present, and the Lead Director chairs those sessions.

Our board of directors expects to periodically review its leadership structure to ensure that it continues to meet the Company’s needs.

Role of Board in Risk Oversight

While the full board of directors has the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. In particular, our audit and risk committee oversees management of enterprise risks as well as financial risks. Our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements and the incentives created by the compensation awards it administers. Our Compliance Committee is responsible for overseeing the management of compliance and regulatory risks facing our company and risks associated with business conduct and ethics. Our Nominating and Corporate Governance Committee oversees risks associated with corporate governance. Pursuant to our board of directors’ instruction, management regularly reports on applicable risks to the relevant committee or the full board of directors, as appropriate, with additional review or reporting on risks conducted as needed or as requested by our board of directors and its committees.

10 | Keane Group, Inc.

Table of Contents

Communication with the Board and itsNon-Management Members

Persons may communicate with our board of directors by submitting such communication in writing to the attention of Kevin McDonald, Executive Vice President, in care of the Board of Directors, Keane Group, Inc., 2121 Sage Road, Suite 370, Houston, Texas 77056. Persons may communicate with thenon-management members of the board of directors by submitting such communication in writing to Kevin McDonald, Executive Vice President, in care of thenon-management members of the Board of Directors, Keane Group, Inc., 2121 Sage Road, Suite 370, Houston, Texas 77056.

Our board of directors has assigned certain of its responsibilities to permanent committees consisting of board members appointed by it. The charter for each committee of our board of directors is available on our website at www.keanegrp.com, by clicking on “Investors,” then “Corporate Governance,” then “Governance Documents,” then the name of the applicable committee charter.

| Name | Audit & Risk Committee | Compensation Committee | Compliance Committee | Nominating & Corporate Governance Committee | ||||

Christian A. Garcia | 🌑 | |||||||

Dale M. Dusterhoft | 🌑 | 🌑 | ||||||

Elmer D. Reed | 🌑 | |||||||

Gary M. Halverson | 🌑 | 🌑 | ||||||

Lisa A. Gray | 🌑 | 🌑 | ||||||

Lucas N. Batzer | 🌑 | |||||||

Marc G. R. Edwards | 🌑 | 🌑 | 🌑 | |||||

Scott Wille | 🌑 | |||||||

Shawn Keane | 🌑 | 🌑 |

🌑 = Chairperson

🌑 = Member

Audit and Risk Committee

Our Audit and Risk Committee consists of Marc G. R. Edwards, Christian A. Garcia and Gary M. Halverson, with Christian Garcia serving as chair of the committee. The committee assists the board in its oversight responsibilities relating to the integrity of our financial statements, our compliance with legal and regulatory requirements (to the extent not otherwise handled by our Compliance Committee), our independent auditor’s qualifications and independence, and the establishment and performance of our internal audit function and the performance of the independent auditor. Each of Messrs. Garcia, Edwards and Halverson qualify as independent directors under the corporate governance standards of the rules of the NYSE and the independence requirements ofRule 10A-3 of the Exchange Act. Our board of directors has determined that Mr. Garcia qualifies as an “audit committee financial expert” as such term is currently defined in Item 407(d)(5) ofRegulation S-K. Each member of the audit and risk committee is able to read and understand fundamental financial statements, including our balance sheet, statement of operations and cash flows statements.

Our board of directors has adopted a written charter under which the audit and risk committee operates. A copy of the audit and risk committee charter, which satisfies the applicable standards of the Securities and Exchange Commission (the “SEC”) and the NYSE, is available on our website.

2018 Proxy Statement | 11

Table of Contents

Compensation Committee

Our Compensation Committee consists of Dale M. Dusterhoft, Marc G. R. Edwards, Shawn Keane and Scott Wille, with Scott Wille serving as chair of the committee. The Compensation Committee is authorized to review our compensation and benefits plans to ensure they meet our corporate objectives, approve the compensation structure of our executive officers and evaluate our executive officers’ performance and advise on salary, bonus and other incentive and equity compensation. A copy of the Compensation Committee charter is available on our website.

Compliance Committee

Our Compliance Committee consists of Lucas N. Batzer, Lisa A. Gray, Shawn Keane and Elmer D. Reed, with Lisa A. Gray serving as chair of the committee. The purpose of the Compliance Committee is to assist the board in implementing and overseeing our compliance programs, policies and procedures that are designed to respond to the various compliance and regulatory risks facing our company, and monitor our performance with respect to such programs, policies and procedures. A copy of the charter for the Compliance Committee is available on our website.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Dale M. Dusterhoft, Marc G. R. Edwards, Lisa A. Gray and Gary M. Halverson, with Marc G. R. Edwards serving as chair of the committee. The Nominating and Corporate Governance Committee is primarily concerned with identifying individuals qualified to become members of our board of directors, selecting the director nominees for the next annual meeting of the stockholders, selecting director candidates to fill any vacancies on our board of directors and developing our corporate governance guidelines and principles. A copy of the Nominating and Corporate Governance Committee charter is available on our website.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics (“Code of Business Conduct and Ethics”) that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. In addition, our senior financial officers, including our principal executive officer and principal financial officer, are subject to a written code of ethics for senior financial officers. We have made a current copy of both codes available on our website, www.keanegrp.com and both are available in print and without charge to any person who sends a written request to our Corporate Secretary at 2121 Sage Road, Suite 370, Houston, TX 77056. In addition, we intend to post on our website all disclosures that are required by law or the NYSE listing standards concerning any amendments to, or waivers from, any provision of either code.

Stockholder Recommendation of Director Nominees

We do not have formal procedures in place by which stockholders may recommend nominees to our board of directors.

Corporate Governance Guidelines

We have adopted corporate governance guidelines in accordance with the corporate governance rules of the NYSE, as applicable, that serve as a flexible framework within which our board of directors and its committees operate. These guidelines cover a number of areas, including the size and composition of the board, board membership criteria and director qualifications, director responsibilities, board agenda, roles of the Chairman and Chief Executive Officer, executive sessions, standing board committees, board member access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning. A copy of our corporate governance guidelines are posted on our website.

12 | Keane Group, Inc.

Table of Contents

Allnon-employee members of our board of directors earned or received compensation for service on our board of directors during fiscal year 2017, as set forth in the table below and as described in the accompanying narrative.

(in dollars) Name | Fees $ | Stock $(1) | Option $ | Non-Equity $ | Change in $ | All Other $ | Total | ||||||||||||||||||||||||||||

Gary M. Halverson | 75,000 | — | — | — | — | — | 75,000 | ||||||||||||||||||||||||||||

Elmer D. Reed | 75,000 | — | — | — | — | — | 75,000 | ||||||||||||||||||||||||||||

Marc G. R. Edwards | 100,000 | — | — | — | — | — | 100,000 | ||||||||||||||||||||||||||||

Christian A. Garcia(2) | 59,505 | 274,542 | — | — | — | — | 334,047 | ||||||||||||||||||||||||||||

Lucas N. Batzer | 75,000 | 75,000 | |||||||||||||||||||||||||||||||||

Dale M. Dusterhoft | 75,000 | 75,000 | |||||||||||||||||||||||||||||||||

James E. Geisler | 75,000 | 75,000 | |||||||||||||||||||||||||||||||||

Lisa A. Gray | 75,000 | 75,000 | |||||||||||||||||||||||||||||||||

Shawn Keane | 75,000 | 75,000 | |||||||||||||||||||||||||||||||||

Lenard B. Tessler | 75,000 | 75,000 | |||||||||||||||||||||||||||||||||

Scott Wille | 75,000 | 75,000 | |||||||||||||||||||||||||||||||||

| (1) | Reflects the grant date fair value calculated in accordance with ASC 718 (as defined below) of the restricted stock granted to Mr. Garcia in fiscal year 2017. See Note(12) Equity-Based Compensation in our consolidated and combined financial statements, included in our 201710-K, for a discussion of the assumptions used in the valuation of such awards. |

| (2) | Mr. Garcia joined our board of directors effective May 15, 2017. |

As of December 31, 2017, the aggregate number of shares of restricted stock held by eachnon-employee director was:

Name

| Number of Shares

| ||||

Gary M. Halverson | 20,833 | ||||

Elmer D. Reed | 20,833 | ||||

Marc G. R. Edwards | 34,722 | ||||

Christian A. Garcia | 18,947 | ||||

Director Services Agreements

We have entered into Director Services Agreements with each of Marc G. R. Edwards, Christian A. Garcia, Gary M. Halverson and Elmer D. Reed. The Director Services Agreements provide that each such director serve on anat-will basis until the earlier of disability, death, resignation or removal.

Pursuant to the Director Services Agreement with Mr. Edwards, he serves as our lead director and is entitled to receive an annual fee of $100,000 per year. The Director Services Agreements with Messrs. Halverson, Reed and Garcia provide that each director is entitled to receive an annual fee of $75,000 per year. Mr. Garcia receives an additional annual fee of $20,000 for his service as chair of the audit and risk committee.

2018 Proxy Statement | 13

Table of Contents

In connection with his appointment as a director, on May 15, 2017, we granted Mr. Garcia 18,947 shares of restricted stock under our Equity and Incentive Award Plan. Subject to Mr. Garcia’s continued service with the Company on each vesting date, his restricted stock will vest in three equal installments on each of May 15, 2018, May 15, 2019 and May 15, 2020, and will become fully vested upon a change in control. All unvested restricted stock will be forfeited upon a termination of service for any reason, except that upon a termination of service without cause, (i) all unvested restricted stock that would have vested on the next vesting date following the termination will vest upon such termination and (ii) the remaining unvested restricted stock will remain outstanding for a period of 90 days following the termination date and will vest if a change in control occurs during such90-day period.

Commencing in fiscal year 2017, each of the othernon-employee members of our board or directors became eligible to receive a director service fee in the amount of $75,000 per year.

14 | Keane Group, Inc.

Table of Contents

Proposal 2 Ratify Appointment of Independent Auditors and Authorize Auditors’ Remuneration

The Board of Directors recommends that you vote“FOR” this proposal.

The Audit and Risk Committee of the Board of Directors (the “Audit Committee”) of the Company has selected KPMG LLP, an independent registered public accounting firm, to audit the Company’s financial statements and the effectiveness of internal control over financial reporting for 2018. While the Audit Committee is responsible for appointing, compensating and overseeing the independent auditors’ work, we are requesting the ratification of the appointment of KPMG as our audit for 2018 as a matter of good corporate governance. KPMG served as our independent auditor for 2017 and the Audit Committee took a number of factors into consideration in determining whether to reappoint KPMG as the Company’s independent auditor, including KPMG’s historical and recent performance, capabilities and expertise, tenure as the Company’s independent auditor and familiarity with the Company’s business. We believe the appointment of KPMG is in the best interest of the Company and its stockholders.

Representatives of KPMG are to be present at the Annual Meeting with an opportunity to make a statement if they would like to do so and to be available to respond to appropriate questions from our stockholders.

The ratification of the appointment of KPMG as our independent auditor for 2018 requires the affirmative vote of a simple majority of the votes cast. If you properly submit a proxy card but do not indicate how you wish to vote, the Proxy Holders will vote for the proposal.

2018 Proxy Statement | 15

Table of Contents

The following table summarizes fees paid or accrued to our independent registered public accounting firm, KPMG, in connection with various services for the years ended December 31, 2017 and 2016 respectively:

(Thousands of Dollars)

| ||||||||

2017

|

2016

| |||||||

Audit Fees(1)

|

$

|

1,377

|

|

$

|

671

|

| ||

Audit –Related Fees(2)

|

|

983

|

|

|

1,832

|

| ||

Tax Fees(3)

|

|

690

|

|

|

231

|

| ||

All Other Fees(4)

|

|

264

|

|

|

45

|

| ||

Total

|

$

|

3,314

|

|

$

|

2,779

|

| ||

| (1) | Consists of fees for professional services rendered for the audits of our consolidated financial statements for fiscal years 2017, 2016 and 2015 included in our 2017 Form10-K |

| (2) | Consists of fees billed for assurance and related services, primarily related to our initial public offering and acquisition of RockPile Energy Services, LLC (“RockPile”). |

| (3) | Consists of fees for professional services rendered by our principal accountant for tax compliance, tax advice, and tax planning. |

| (4) | Consists of fees for products and services provided by our principal accountant, other than the services reported under “audit fees,” “audit-related fees,” and “tax fees.” |

Our Audit Committee has adopted a policy (the“Pre-Approval Policy”), that sets forth the procedures and conditions pursuant to which audit andnon-audit services proposed to be performed by the independent auditor may bepre-approved. ThePre-Approval Policy generally provides that we will not engage KPMG to render any audit, audit-related, tax or permissiblenon-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specificpre-approval”) or (ii) entered into pursuant to thepre-approval policies and procedures described in thePre-Approval Policy (“GeneralPre-Approval”). Unless a type of service to be provided by KPMG has received GeneralPre-Approval under thePre-Approval Policy, it requires specificpre-approval by the Audit Committee. Any proposed services exceedingpre-approved cost levels or budgeted amounts will also require specificpre-approval. On an annual basis, the Audit Committee reviews and generallypre-approves the services (and related fee levels or budgeted amounts) that may be provided by KPMG without first obtaining specificpre-approval from our Audit Committee. Our Audit Committee may revise the list of generalpre-approved services from time to time, based on subsequent determinations.

During 2017 and 2016, no services were provided to us by KPMG other than in accordance with thepre-approval policies and procedures described above.

16 | Keane Group, Inc.

Table of Contents

The Audit Committee represents and assists the board of directors in providing independent, objective oversight of the Company’s accounting functions and internal control over financial reporting. The Audit Committee acts under a charter which is available on the Company’s website at www.keanegrp.com under “Investors,” then “Corporate Governance,” then “Governance Documents,” then “Audit and Risk Committee Charter.” The board of directors has determined that each member of the Audit Committee satisfies the requirements of the NYSE as to independence, financial literacy and expertise.

Management is responsible for the Company’s financial statements and the reporting process, including the system of disclosure controls and procedures and internal control over financial reporting.

KPMG, the Company’s independent registered public accounting firm, is responsible for expressing an opinion on the conformity of our financial statements with accounting principles generally accepted in the United States and on the effectiveness of the Company’s internal control over financial reporting.

In discharging its oversight role, the Audit Committee has:

| • | reviewed and discussed with management the audited financial statements of Keane Group, Inc. as of and for the year ended December 31, 2017; and |

| • | discussed with KPMG the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as amended, as adopted by the Public Company Accounting Oversight Board. In addition, the Audit Committee has received the written disclosures and the letter from KPMG required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee concerning independence, and has discussed with KPMG their independence. |

The Audit Committee and the Board of Directors believe that, due to KPMG’s knowledge of the Company and the industry in which the Company operates, it is in the best interest of the Company and its stockholders to continue the retention of KPMG to serve as the Company’s independent registered public accounting firm. Although the Audit Committee has the sole authority to appoint the independent registered public accounting firm, the Audit Committee recommends that the board of directors ask the stockholders to ratify the appointment of the independent registered public accounting firm at the 2018 Annual General Meeting.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements referred to above be included in the Annual Report onForm 10-K of Keane Group, Inc. for the year ended December 31, 2017.

The Audit and Risk Committee

Christian A. Garcia, Chair

Marc G.R. Edwards

Gary M. Halverson

2018 Proxy Statement | 17

Table of Contents

Proposal 3 Advisory Approval of Executive Compensation

The Board of Directors recommends that you vote“FOR” this proposal.

We are asking our stockholders to approve, on an advisory basis, the compensation of our named executive officers (“NEOs”) as disclosed pursuant to Item 402 of RegulationS-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion. While this vote is not binding on our Company, the results of the vote on this proposal will be carefully considered by the board of directors and the Compensation Committee when making future executive compensation decisions.

The text of the resolution in respect of Proposal 3 is as follows:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in this Proxy Statement pursuant to the rules of the SEC, including the Compensation Discussion and Analysis, compensation tables and any related narrative discussion is hereby APPROVED.”

We urge you to carefully review the Compensation Discussion and Analysis, or “CD&A,” section in this Proxy Statement, as well as the 2017 Summary Compensation Table, other compensation tables and related narrative discussion, for more information regarding the compensation of our NEOs. We believe the information in this Proxy Statement demonstrates the successful design and implementation of a compensation program that aligns stockholders’ and management’s interests.

A simple majority of the votes cast is required to approve this proposal. If you properly give a proxy but do not indicate how you wish to vote, the persons named on the proxy card, or if you do not name your proxy or proxies, the Proxy Holders, will vote for the proposal.

18 | Keane Group, Inc.

Table of Contents

Proposal 4 Advisory Vote on the Frequency of Say on Executive Pay

The Board of Directors recommends that you vote“ONE YEAR” with respect to the frequency of advisory votes on named executive officer compensation.

We are asking our stockholders to recommend, on an advisory basis, whether a vote to approve the compensation of our named executive officers should occur every one, two or three years, commonly referred to assay-on-frequency. While this vote is not binding on our Company, the results of the vote on this proposal will be carefully considered by the board of directors and the Compensation Committee when determining how often we submit a resolution to our stockholders regarding our compensation decisions for our named executive officers.

The Board has determined that an advisory vote to approve executive compensation that occurs once every year is appropriate for the Company and its stockholders. In reaching this recommendation, the Board determined that holding an annual advisory vote to approve executive compensation enhances transparency and allows stockholders to provide direct annual feedback to the Company regarding the Company’s compensation philosophy, policies and practices, and is consistent with the Company’s policy of ongoing engagement and communication with stockholders.

A simple majority of the votes cast is required to approve this proposal. If you properly give a proxy but do not indicate how you wish to vote, the persons named on the proxy card, or if you do not name your proxy or proxies, the Proxy Holders, will vote for the proposal.

Set forth below is certain information regarding our executive officers, other than the biography of our Chairman and Chief Executive Officer, which appears under“Proposal 1—Election of Directors—Director Information.”

Name

|

Age†

|

Position

| ||

James C. Stewart

|

55

|

Chairman and Chief Executive Officer

| ||

Gregory L. Powell

|

43

|

President and Chief Financial Officer

| ||

M. Paul DeBonis Jr.

|

58

|

Chief Operating Officer

| ||

Kevin M. McDonald

|

51

|

Executive Vice President, General Counsel & Secretary

| ||

Ian J. Henkes

|

46

|

Vice President & General Manager, South Region and National Wireline

|

| † | As of December 31, 2017 |

2018 Proxy Statement | 19

Table of Contents

Gregory L. Powell, President and Chief Financial Officer. Mr. Powell has served as Chief Financial Officer of Keane since March 2011. He previously held the title of Vice President between March 2011 and July 2015, when he became President. Prior to joining Keane, Mr. Powell served as an Operations Executive for Cerberus from 2006 to March 2011. During his tenure at Cerberus, he was responsible for evaluating new investments and partnering with portfolio companies to maximize value creation. Mr. Powell previously served on the board of directors and audit committee of Tower International, Inc., a manufacturer of engineered structural metal components and assemblies. Prior to joining Cerberus, Mr. Powell spent ten years with General Electric, starting with global leadership training and growing into various leadership roles in Finance and Mergers and Acquisitions, with his last role being Chief Financial Officer for GE Aviation—Military Systems.

M. Paul DeBonis Jr.,Chief Operating Officer. Mr. DeBonis has served as Chief Operating Officer of Keane since May 2011. Prior to joining Keane, he served as President of Big Country Energy Services USA LP from May 2010 to May 2011 and as President of Pure Energy Services (USA), Inc. from June 2005 to May 2010. He previously served as Oilfield Services Marketing Manager at Schlumberger Limited. Mr. DeBonis started his oil and gas career with Dowell Services in the fracturing and cementing departments. He has worked in several basins throughout the United States and Canada. Mr. DeBonis was a Schlumberger Field Engineer Graduate in 1985. Mr. DeBonis has authored and published two papers related to hydraulic fracturing for the Society of Petroleum Engineers.

Kevin M. McDonald, Executive Vice President, General Counsel & Secretary. Mr. McDonald has served as Keane’s Executive Vice President, General Counsel & Secretary since November 2016. Prior to joining Keane, he served in leadership roles at Marathon Oil Corporation from 2012 to 2016, including as Deputy General Counsel of Corporate Legal Services and Government Relations, Deputy General Counsel of Governance, Compliance & Corporate Services and Assistant General Counsel. He practiced as a partner at the international law firm Fulbright & Jaworski LLP (now Norton Rose Fulbright LLP) in 2012. Mr. McDonald previously held various counsel positions, including President & Chief Executive Officer and acting General Counsel at Arms of Hope, anon-profit organization, from 2008 to 2012, Senior Vice President, General Counsel & Chief Compliance Officer at Cooper Industries between from 2006 to 2008, Associate General Counsel at Anadarko Petroleum from 2006 to 2008 and Managing Counsel (Litigation) at Valero Energy from 2002 to 2004. Mr. McDonald began his career as an associate at Norton Rose Fulbright LLP between 1992 and 2001.

Ian J. Henkes,Vice President & General Manager, South Region and National Wireline. Mr. Henkes joined Keane as Vice President for Human Resources in February 2016 and was promoted to his current position in July 2017. Prior to joining Keane, he served as Human Resources Manager for Schlumberger’s Drilling & Measurements global businesses from August 2014 to February 2016, as Vice President for North America at Pathfinder Energy Services from January 2013 to September 2014 and as Personnel Manager at Pathfinder Energy Services from September 2012 to December 2012. Prior to joining Pathfinder Energy Services, Mr. Henkes served in various roles at Schlumberger from 1994 to 2012.

The Compensation Committee has reviewed and discussed this CD&A with the Company’s management. Based on the review and discussions, the Compensation Committee has recommended to our board of directors that this CD&A be included in this Proxy Statement.

The Compensation Committee

Scott Wille, Chair

Dale M. Dusterhoft

Marc G.R. Edwards

Shawn Keane

20 | Keane Group, Inc.

Table of Contents

Compensation Discussion & Analysis

This Compensation Discussion & Analysis (“CD&A”) explains our executive compensation program for our named executive officers (“NEOs”) listed below. This CD&A also describes the Compensation Committee’s process for making pay decisions, as well as its rationale for specific decisions related to the fiscal year ended December 31, 2017 (“fiscal year 2017”).

| NEO | Title | |

James C. Stewart | Chairman and Chief Executive Officer (“CEO”) | |

Gregory L. Powell | President and Chief Financial Officer (“CFO”) | |

M. Paul DeBonis Jr. | Chief Operating Officer | |

Kevin M. McDonald | Executive Vice President, General Counsel & Secretary | |

Ian J. Henkes | Vice President & General Manager, South Region and National Wireline(1) | |

R. Curt Dacar | Former Chief Commercial Officer(2) |

| (1) | Mr. Henkes served in the position of Vice President of Human Resources through June 30, 2017. Effective as of July 1, 2017, he was promoted to the position of Vice President & General Manager, South Region and National Wireline. |

| (2) | Mr. Dacar separated from service with the Company on September 1, 2017. |

Executive Summary

Compensation Practices & Policies

The following practices and policies in our program promote sound compensation governance and are in the best interests of our stockholders and executives:

| • | We link a significant portion of compensation to our annual financial performance or long-term stock price performance |

| • | We use an independent compensation consultant |

| • | We have a clawback policy covering cash and equity compensation |

| • | We have a prohibition on option repricing without stockholder approval |

| • | We have a prohibition on hedging of Company securities by our executive officers |

| • | We provide no single-triggerchange-of-control cash severance payments |

| • | We provide no excise taxgross-ups |

2017 Compensation ActionsAt-A-Glance

The Compensation Committee took the following compensation-related actions for fiscal year 2017:

| • | Compensation Adjustments: |

| ¡ | Starting on March 4, 2015, each of Messrs. Stewart, Powell and DeBonis participated in a cost reduction program that included a 20% reduction to each such NEO’s base salary. Due to the Company’s improved economic conditions and financial performance, effective July 1, 2017, the Compensation Committee |

2018 Proxy Statement | 21

Table of Contents

approved the restoration of the base salaries of each of Messrs. Stewart, Powell and DeBonis to the level provided for in the NEO’s Executive Employment Agreement (as discussed below). |

| ¡ | In connection with our IPO, the Compensation Committee approved an increase in Mr. Henkes’ severance entitlement from six months to twelve months of his base salary. Further, due to his increased responsibilities in connection with his promotion from Vice President of Human Resources to Vice President & General Manager, South Region and National Wireline, effective as of July 2017, the Compensation Committee approved an increase of Mr. Henkes’ annual base salary from $245,000 to $300,000, and of his target annual bonus from 75% to 100% of base salary. |

| ¡ | In connection with the annual review of Mr. McDonald’s compensation, taking into account his achievements, his future potential contributions, the scope of his responsibilities and experiences and following a review of the compensation paid to the chief legal officers in our peer group, effective as of December 1, 2017, the Compensation Committee approved an increase of Mr. McDonald’s annual base salary from $335,000 to $400,000, and his target annual bonus from 75% to 100% of base salary. |

| • | Retention Bonuses/ Deferred Stock Awards: In 2016, in connection with our IPO, the Compensation Committee approved cash retention bonuses to each of Messrs. Stewart, Powell, DeBonis and Henkes to incentivize successful completion of the IPO and their continued service with the Company. To further align the interests of our senior management team with our stockholders, on March 16, 2017, the Compensation Committee and each of Messrs. Stewart, Powell and DeBonis agreed that in lieu of cash retention payments, such NEOs would be granted Deferred Stock Awards as further described below. |

| • | Annual Incentives: The Compensation Committee adopted an annual bonus program for fiscal year 2017, based on the achievement of specific Company performance objectives. Based on our level of achievement, our Compensation Committee has determined that each of our currently employed NEOs is eligible to receive an amount under the 2017 Executive Bonus Program equal to 200% of the NEO’s target bonus. |

| • | Long-Term Incentives: A significant amount of the compensation delivered to the NEOs is in the form of equity. In addition to the Deferred Stock Awards granted to Messrs. Stewart, Powell and DeBonis, the NEOs were awarded long-term incentives consisting of a mixture of restricted stock unit awards and stock options. The Compensation Committee believes the use of these equity vehicles creates strong alignment with the Company’s stockholders by linking NEO compensation closely to stock performance. For the stock options granted to the NEOs in fiscal year 2017, the exercise price was set at $19.00 per share, our IPO price. This resulted in a premium of approximately 30% above the closing price of our common stock on the grant date with respect to the stock options granted to the NEOs other than Mr. Dacar, and a premium of approximately 17% above the closing price of our common stock on the grant date with respect to the stock options granted to Mr. Dacar. |

What Guides Our Program

Our Compensation Philosophy

Our compensation philosophy is driven by the following guiding principles:

| • | A significant portion of an executive’s total compensation should be variable(“at-risk”) and linked to the achievement of specific short- and long-term performance objectives. |

| • | Executives should be compensated through pay elements (base salaries, short and long-term incentives) designed to enhance stockholder value by incentivizing our executives to work towards goals that drive a suitable rate of return on stockholder investment. |

| • | Target compensation should be competitive with that being offered to individuals in comparable roles at other companies with which we compete for talent to ensure we employ the best people to lead the |

22 | Keane Group, Inc.

Table of Contents

successful implementation of our business plans and to attract the caliber of executive we need to support the long-term growth of our enterprise. |

| • | Decisions about compensation should be guided by best-practice governance standards and rigorous processes that encourage prudent decision-making. |

The Principal Elements of Pay

Our compensation philosophy is supported by the following principal elements of pay:

| Pay Element | How it’s Paid | Purpose | ||

Base Salary | Cash (Fixed) | Provide a competitive base salary rate relative to similar positions in the market and enable the Company to attract and retain critical executive talent | ||

Annual Incentives | Cash (Variable) | Reward executives for delivering on annual financial and strategic objectives that contribute to stockholder value creation | ||

Long-Term Incentives | Equity (Variable) | Provide incentives for executives to execute on longer-term financial and strategic goals that drive stockholder value creation and support the Company’s retention strategy | ||

Retention Rewards | Cash or Equity (Fixed) | Provide incentive for executives to remain employed with the Company following our IPO to continue to drive stockholder value creation and support the Company’s retention strategy |

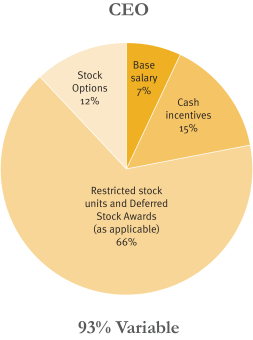

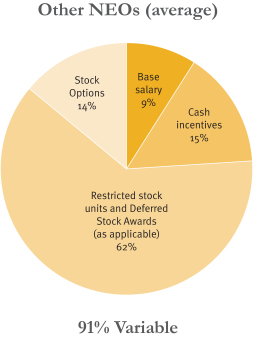

Pay Mix

A majority of NEO total direct compensation for fiscal year 2017 was variable, at approximately 93% for our CEO, and approximately 91% for our other NEOs (excluding Mr. Dacar). The following charts illustrate the total direct compensation mix for our CEO and our other NEOs for fiscal year 2017:

|  |

2018 Proxy Statement | 23

Table of Contents

Our Decision-Making Process

The Role of the Compensation Committee