UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23210

STIRA ALCENTRA GLOBAL CREDIT FUND

(Exact name of registrant as specified in charter)

18100 Von Karman Avenue, Suite 500

Irvine, CA 92612

(Address of principal executive offices) (Zip code)

Christopher Hilbert

Chief Executive Officer

Stira Alcentra Global Credit Fund

18100 Von Karman Avenue, Suite 500

Irvine, CA 92612

(Name and address of agent for service)

Copies to:

Heath D. Linsky, Esq.

Lauren B. Prevost, Esq.

Owen J. Pinkerton, Esq.

Morris, Manning & Martin, LLP

1600 Atlanta Financial Center

3343 Peachtree Road, N.E.

Atlanta, Georgia 30326-1044

(404) 233-7000

Registrant’s telephone number, including area code: (877) 567-7264

Date of fiscal year end: December 31

Date of reporting period: June 30, 2018

| Item 1. | Reports to Shareholders. |

Stira Alcentra Global Credit Fund

Semi-Annual Report

June 30, 2018

Stira Alcentra Global Credit Fund

Dear Shareholders,

On behalf of everyone at Stira Alcentra Global Credit Fund (the “Fund”), please accept our appreciation for your investment. Effectively operating a fund requires coordination by numerous valued parties, but nobody is as important to us as our shareholders.

For our young fund, the first half of 2018 was almost as eventful as 2017. In January the SEC approved our fifth share class (class “C”), and in March granted exemptive relief to allow the Fund to co-invest with affiliated funds. In April we saw the departure of a Trustee to join the State Department, ultimately replaced by a veteran of the credit industry. And in June we filed our new “ticker symbols” with the SEC, which will allow advisers at certain firms to process investment orders electronically.

As we anticipated in our last letter, the spring of 2018 also brought milestone changes to the portfolio composition. Specifically, we invested in the first of many direct loans with a large pet-nutrition company called Manna Pro.

In the first six months of this year, our assets under management grew from approximately $10 million to $28 million. Growth of assets is critical to our overall success, and with more firms joining our selling group every week, we look forward to a robust capital raise in the future.

If you have any questions about your investment account, please do not hesitate to contact us at 1-877-567-7264.

Warmest regards,

| |  |

| | | |

| Christopher Hilbert | | Jack Yang, Board Member |

| CEO and Chairman of the Board | | Global Head of Business Development, Alcentra |

| | | |

| |  |

Past performance is not a guarantee of future results. The Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Diversification does not assure a profit or protect against loss in a declining market. Stira Capital Markets Group, LLC is the dealer manager of the Fund. Investing in the Fund involves risk; principal loss is possible. The Fund offers the following share classes: Class A, Class T, Class D, Class I, and Class C. For more information on the differences in share classes, refer to the Fund’s prospectus, which can be found at: www.StiraALLternatives.com.

Stira Alcentra Global Credit Fund

Fund Profile and Financial Data

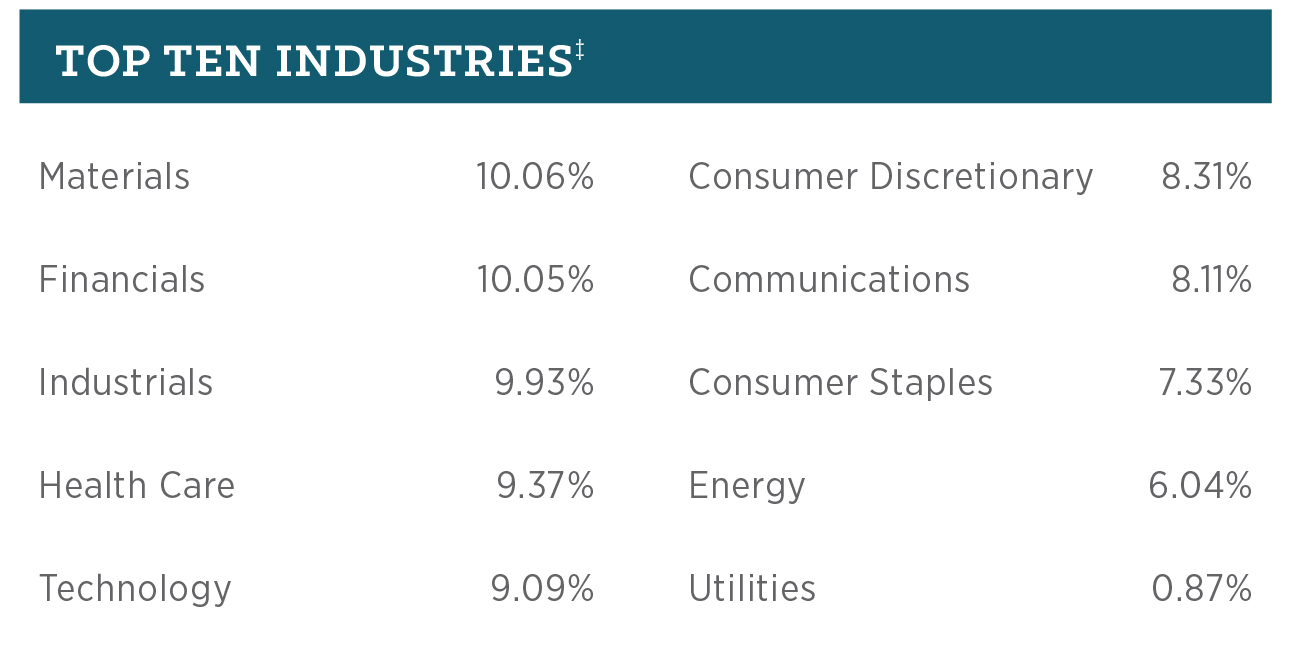

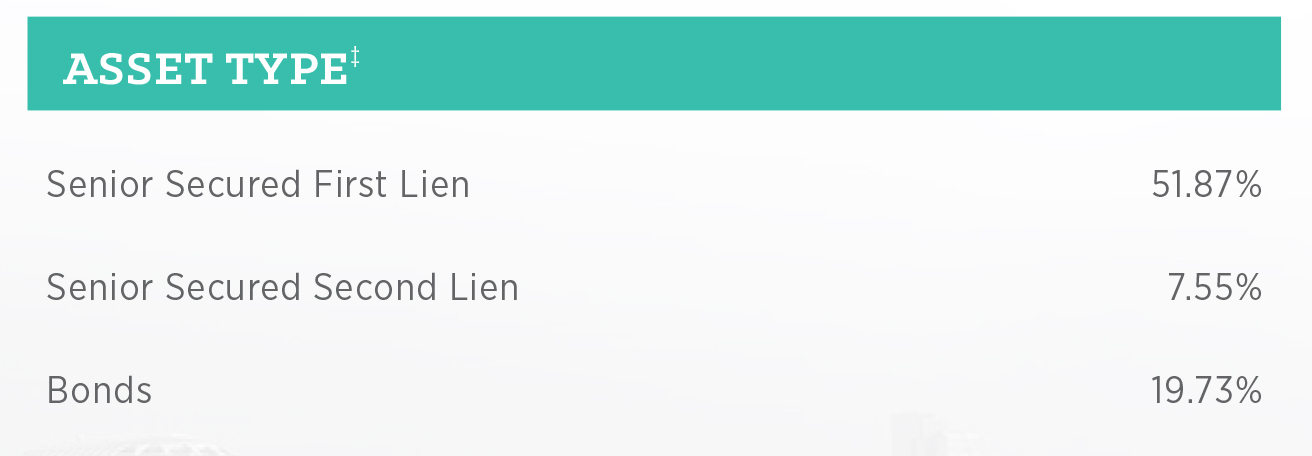

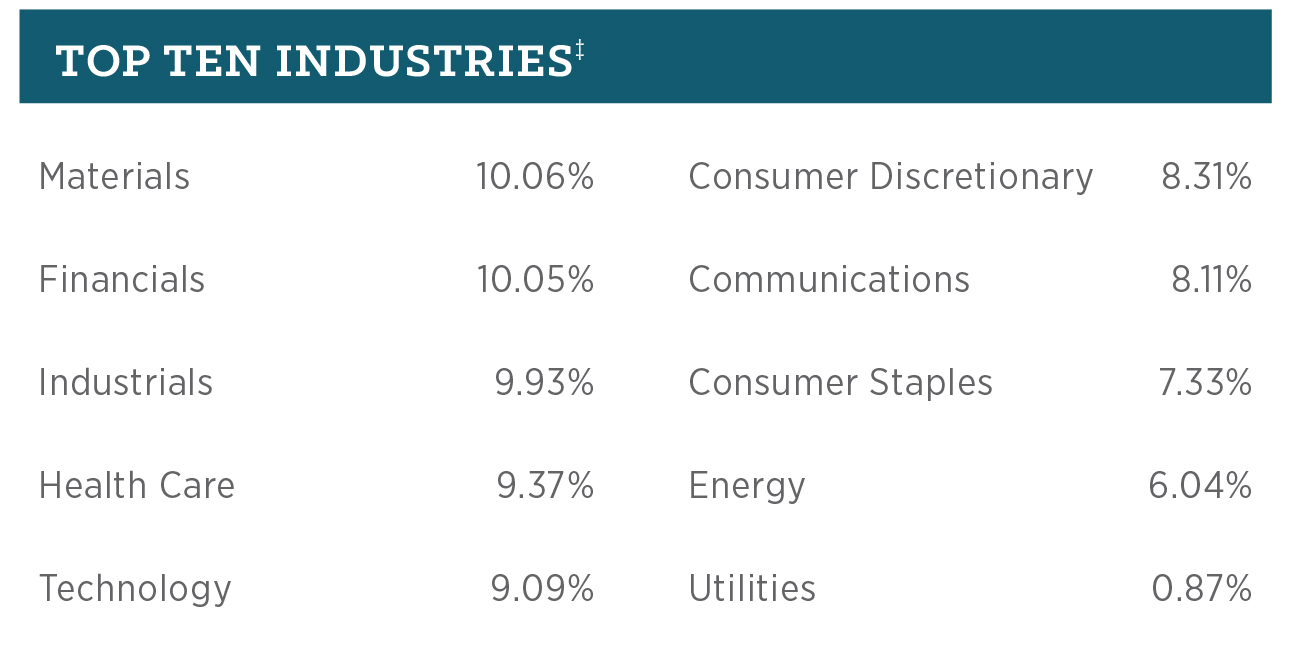

As of June 30, 2018, the Fund had invested approximately $21.9 million in 82 portfolio companies. The weighted average yield of the investment portfolio based upon original cost, as of June 30, 2018, was 6.60% with an average duration of 1.02 years. The following graphics illustrate the Fund’s investment portfolio as of June 30, 2018, by industry, geography, asset type, floating/fixed rate breakdown and investment structure:

| ‡ | As a percentage of net assets. |

Stira Alcentra Global Credit Fund

‡ As a percentage of net assets.

Stira Alcentra Global Credit Fund

Schedule of Investments

As of June 30, 2018

| Description | | Spread

Above Index | | | Base Rate

Floor

(%) | | | Interest

Rate

(%) | | | Maturity

Date | | Principal

Amount | | | Cost(1) ($) | | | Fair Value

($) | | | % of Net

Assets | |

| Investments in Non-Controlled, Non-Affiliated Portfolio Companies — 79.15% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Bonds — 19.73% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Communications — 2.85% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cincinnati Bell, Inc. (2)(3) | | | | | | | | | 7.000 | | | 7/15/2024 | | $ | 150,000 | | | $ | 151,852 | | | $ | 136,875 | | | | 0.49 | % |

| Radiate Holdco LLC/Radiate Finance, Inc. (2)(3) | | | | | | | | | 6.625 | | | 2/15/2025 | | | 150,000 | | | | 148,203 | | | | 137,250 | | | | 0.50 | % |

| Altice Finco S.A. (2)(3) | | | | | | | | | 7.625 | | | 2/15/2025 | | | 225,000 | | | | 236,826 | | | | 200,812 | | | | 0.73 | % |

| Sprint Corp. | | | | | | | | | 7.250 | | | 9/15/2021 | | | 300,000 | | | | 317,224 | | | | 312,000 | | | | 1.13 | % |

| Total Communications | | | | | | | | | | | | | | | | | | | 854,105 | | | | 786,937 | | | | 2.85 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 0.36% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Scientific Games International, Inc. (3) | | | | | | | | | 6.625 | | | 5/15/2021 | | | 100,000 | | | | 102,935 | | | | 101,250 | | | | 0.36 | % |

| Total Consumer Discretionary | | | | | | | | | | | | | | | | | | | 102,935 | | | | 101,250 | | | | 0.36 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer Staples — 0.32% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kronos Acquisition Holdings, Inc. (2)(3) | | | | | | | | | 9.000 | | | 8/15/2023 | | | 100,000 | | | | 100,442 | | | | 90,000 | | | | 0.32 | % |

| Total Consumer Staples | | | | | | | | | | | | | | | | | | | 100,442 | | | | 90,000 | | | | 0.32 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Energy — 4.97% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Enviva Partners L.P./Enviva Partners Finance Corp. (3) | | | | | | | | | 8.500 | | | 11/1/2021 | | | 200,000 | | | | 210,972 | | | | 208,000 | | | | 0.75 | % |

| Oasis Petroleum, Inc. (3) | | | | | | | | | 6.875 | | | 3/15/2022 | | | 95,000 | | | | 93,800 | | | | 96,635 | | | | 0.35 | % |

| Unit Corp. (3) | | | | | | | | | 6.625 | | | 5/15/2021 | | | 245,000 | | | | 245,044 | | | | 244,388 | | | | 0.89 | % |

| Genesis Energy L.P./Genesis Energy Finance Corp. (3) | | | | | | | | | 6.500 | | | 10/1/2025 | | | 300,000 | | | | 304,241 | | | | 288,000 | | | | 1.04 | % |

| Sanchez Energy Corp. (3) | | | | | | | | | 6.125 | | | 1/15/2023 | | | 130,000 | | | | 112,161 | | | | 88,075 | | | | 0.32 | % |

| SemGroup Corp. (3) | | | | | | | | | 6.375 | | | 3/15/2025 | | | 200,000 | | | | 194,687 | | | | 190,000 | | | | 0.69 | % |

| Whiting Petroleum Corp. (3)(2) | | | | | | | | | 6.625 | | | 1/15/2026 | | | 250,000 | | | | 259,864 | | | | 257,812 | | | | 0.93 | % |

| Total Energy | | | | | | | | | | | | | | | | | | | 1,420,769 | | | | 1,372,910 | | | | 4.97 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financials — 0.70% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AssuredPartners, Inc. (2)(3) | | | | | | | | | 7.000 | | | 8/15/2025 | | | 200,000 | | | | 202,645 | | | | 192,500 | | | | 0.70 | % |

| Total Financials | | | | | | | | | | | | | | | | | | | 202,645 | | | | 192,500 | | | | 0.70 | % |

Stira Alcentra Global Credit Fund

Schedule of Investments

As of June 30, 2018

| Description | | Spread

Above Index | | Base Rate

Floor

(%) | | | Interest

Rate

(%) | | | Maturity

Date | | Principal

Amount | | | Cost(1)

($) | | | Fair Value

($) | | | % of Net

Assets | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Health Care — 2.83% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tenet Healthcare Corp. | | | | | | | | | 6.750 | | | 6/15/2023 | | $ | 300,000 | | | $ | 296,424 | | | $ | 298,500 | | | | 1.08 | % |

| Valeant Pharmaceuticals International, Inc. (2)(3) | | | | | | | | | 5.875 | | | 5/15/2023 | | | 175,000 | | | | 156,101 | | | | 164,391 | | | | 0.60 | % |

| NVA Holdings, Inc. (2)(3) | | | | | | | | | 6.875 | | | 4/1/2026 | | | 165,000 | | | | 165,000 | | | | 163,969 | | | | 0.59 | % |

| Polaris Intermediate Corp. (2)(3) | | | | | | | | | 8.500 | | | 12/1/2022 | | | 150,000 | | | | 155,250 | | | | 154,687 | | | | 0.56 | % |

| Total Health Care | | | | | | | | | | | | | | | | | | | 772,775 | | | | 781,547 | | | | 2.83 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Industrials — 1.90% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bombardier, Inc. (2)(3) | | | | | | | | | 7.500 | | | 3/15/2025 | | | 150,000 | | | | 157,879 | | | | 156,187 | | | | 0.56 | % |

| Brand Energy & Infrastructure Services, Inc. (2)(3) | | | | | | | | | 8.500 | | | 7/15/2025 | | | 150,000 | | | | 159,269 | | | | 151,875 | | | | 0.55 | % |

| Covanta Holding Corp. (3) | | | | | | | | | 5.875 | | | 7/1/2025 | | | 125,000 | | | | 124,003 | | | | 120,625 | | | | 0.44 | % |

| Hillman Group, Inc. (The) (2)(3) | | | | | | | | | 6.375 | | | 7/15/2022 | | | 100,000 | | | | 98,309 | | | | 95,750 | | | | 0.35 | % |

| Total Industrials | | | | | | | | | | | | | | | | | | | 539,460 | | | | 524,437 | | | | 1.90 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Materials — 4.43% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Energy Finance S.A. (2)(3) | | | | | | | | | 6.875 | | | 6/15/2025 | | | 100,000 | | | | 103,643 | | | | 102,625 | | | | 0.37 | % |

| CVR Partners L.P./CVR Nitrogen Finance Corp. (2)(3) | | | | | | | | | 9.250 | | | 6/15/2023 | | | 200,000 | | | | 208,138 | | | | 206,000 | | | | 0.75 | % |

| First Quantum Minerals Ltd. (2)(3) | | | | | | | | | 7.250 | | | 4/1/2023 | | | 200,000 | | | | 200,868 | | | | 200,000 | | | | 0.72 | % |

| ARD Finance S.A. (3) | | | | | | | | | 7.125 | | | 9/15/2023 | | | 300,000 | | | | 313,591 | | | | 300,750 | | | | 1.09 | % |

| BWAY Holding Co. (2)(3) | | | | | | | | | 7.250 | | | 4/15/2025 | | | 275,000 | | | | 281,201 | | | | 268,125 | | | | 0.97 | % |

| Platform Specialty Products Corp. (2)(3) | | | | | | | | | 5.875 | | | 12/1/2025 | | | 150,000 | | | | 151,414 | | | | 146,625 | | | | 0.53 | % |

| Total Materials | | | | | | | | | | | | | | | | | | | 1,258,855 | | | | 1,224,125 | | | | 4.43 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Technology — 0.50% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Genesys Telecommunications Laboratories, Inc./Greeneden Lux 3 Sarl/Greeneden U.S. Holdings (2)(3) | | | | | | | | | 10.000 | | | 11/30/2024 | | | 125,000 | | | | 140,472 | | | | 139,516 | | | | 0.50 | % |

| Total Technology | | | | | | | | | | | | | | | | | | | 140,472 | | | | 139,516 | | | | 0.50 | % |

Stira Alcentra Global Credit Fund

Schedule of Investments

As of June 30, 2018

| Description | | Spread

Above Index | | Base Rate

Floor

(%) | | | Interest

Rate

(%) | | | Maturity

Date | | Principal

Amount | | | Cost(1)

($) | | | Fair Value

($) | | | % of Net

Assets | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Utilities — 0.87% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NRG Energy, Inc. (3) | | | | | | | | | 7.250 | | | 5/15/2026 | | $ | 225,000 | | | $ | 242,993 | | | $ | 239,625 | | | | 0.87 | % |

| Total Utilities | | | | | | | | | | | | | | | | | | | 242,993 | | | | 239,625 | | | | 0.87 | % |

| Total Corporate Bonds | | | | | | | | | | | | | | | | | | | 5,635,451 | | | | 5,452,847 | | | | 19.73 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior Secured - First Lien — 51.87%(4)(5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Communications — 4.48% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ABG Intermediate Holdings 2, LLC | | 1M LIBOR + 3.500% Cash | | | 2.094 | | | | 5.594 | | | 9/26/2024 | | | 146,721 | | | | 146,721 | | | | 146,507 | | | | 0.53 | % |

| ABG Intermediate Holdings 2, LLC (6) | | | | | | | | | — | | | 9/29/2025 | | | 52,909 | | | | 52,909 | | | | 53,041 | | | | 0.19 | % |

| Meredith Corp. | | 1M LIBOR + 3.000% Cash | | | 2.094 | | | | 5.094 | | | 1/31/2025 | | | 340,646 | | | | 342,366 | | | | 340,992 | | | | 1.23 | % |

| Red Ventures, LLC | | 1M LIBOR + 4.000% Cash | | | 2.094 | | | | 6.094 | | | 11/8/2024 | | | 347,874 | | | | 348,797 | | | | 350,121 | | | | 1.27 | % |

| West Corp. | | 1M LIBOR + 4.000% Cash | | | 2.094 | | | | 6.094 | | | 10/10/2024 | | | 248,750 | | | | 248,750 | | | | 248,221 | | | | 0.90 | % |

| West Corp. | | 1M LIBOR + 3.500% Cash | | | 2.094 | | | | 5.594 | | | 10/10/2024 | | | 100,000 | | | | 99,879 | | | | 99,365 | | | | 0.36 | % |

| Total Communications | | | | | | | | | | | | | | | | | | | 1,239,422 | | | | 1,238,247 | | | | 4.48 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 7.94% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Constellis Holdings, LLC | | 3M LIBOR + 5.000% Cash | | | 2.334 | | | | 7.334 | | | 4/21/2024 | | | 248,744 | | | | 251,651 | | | | 250,091 | | | | 0.90 | % |

| Employbridge, LLC | | 3M LIBOR + 5.000% Cash | | | 2.503 | | | | 7.503 | | | 4/10/2025 | | | 287,832 | | | | 291,674 | | | | 290,951 | | | | 1.05 | % |

| FPC Holdings, Inc. | | 1M LIBOR + 4.500% Cash | | | 2.094 | | | | 6.594 | | | 11/19/2022 | | | 219,714 | | | | 213,400 | | | | 221,499 | | | | 0.80 | % |

| Innovative Xcessories & Services, LLC | | 1M LIBOR + 4.750% Cash | | | 2.090 | | | | 6.840 | | | 11/29/2022 | | | 242,270 | | | | 245,308 | | | | 242,573 | | | | 0.88 | % |

| Pre-Paid Legal Services, Inc. | | 1M LIBOR + 3.250% Cash | | | 1.982 | | | | 5.232 | | | 5/1/2025 | | | 249,451 | | | | 250,515 | | | | 251,010 | | | | 0.91 | % |

| SRS Distribution, Inc. | | 3M LIBOR + 3.250% Cash | | | 2.330 | | | | 5.580 | | | 5/23/2025 | | | 250,000 | | | | 249,375 | | | | 246,667 | | | | 0.89 | % |

| Staples, Inc. | | 3M LIBOR + 4.000% Cash | | | 2.358 | | | | 6.358 | | | 9/12/2024 | | | 248,750 | | | | 234,652 | | | | 245,836 | | | | 0.89 | % |

| Weight Watchers International, Inc. | | 1M LIBOR + 4.750% Cash | | | 2.010 | | | | 6.760 | | | 11/29/2024 | | | 441,218 | | | | 448,345 | | | | 447,148 | | | | 1.62 | % |

| Total Consumer Discretionary | | | | | | | | | | | | | | | | | | | 2,184,920 | | | | 2,195,775 | | | | 7.94 | % |

Stira Alcentra Global Credit Fund

Schedule of Investments

As of June 30, 2018

| Description | | Spread

Above Index | | Base Rate

Floor

(%) | | | Interest

Rate

(%) | | | Maturity

Date | | Principal

Amount | | | Cost(1)

($) | | | Fair Value

($) | | | % of Net

Assets | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Consumer Staples — 7.78% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Albertsons, LLC | | 3M LIBOR + 3.000% Cash | | | 2.337 | | | | 5.337 | | | 12/21/2022 | | $ | 397,742 | | | $ | 391,488 | | | $ | 394,702 | | | | 1.43 | % |

| Albertsons, LLC (6) | | | | | | | | | — | | | 5/2/2023 | | | 180,000 | | | | 179,100 | | | | 180,001 | | | | 0.65 | % |

| Manna Pro Products, LLC | | 1M LIBOR + 6.000% Cash | | | 2.046 | | | | 8.046 | | | 12/8/2023 | | | 1,309,354 | | | | 1,301,612 | | | | 1,312,674 | | | | 4.75 | % |

| Manna Pro Products, LLC (7) | | 1M LIBOR + 6.000% Cash | | | 2.091 | | | | 8.091 | | | 12/8/2023 | | | 263,187 | | | | 263,187 | | | | 263,187 | | | | 0.95 | % |

| Total Consumer Staples | | | | | | | | | | | | | | | | | | | 2,135,387 | | | | 2,150,564 | | | | 7.78 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Energy — 0.52% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Keane Group Holdings, LLC | | 1M LIBOR + 3.750% Cash | | | 2.000 | | | | 5.750 | | | 5/25/2025 | | | 97,500 | | | | 97,015 | | | | 97,500 | | | | 0.35 | % |

| Murray Energy Corp. | | 1M LIBOR + 7.250% Cash | | | 2.094 | | | | 9.344 | | | 4/16/2020 | | | 48,409 | | | | 47,670 | | | | 45,774 | | | | 0.17 | % |

| Total Energy | | | | | | | | | | | | | | | | | | | 144,685 | | | | 143,274 | | | | 0.52 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financials — 4.72% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DTZ U.S. Borrower, LLC | | 3M LIBOR + 3.250% Cash | | | 2.359 | | | | 5.609 | | | 11/4/2021 | | | 348,461 | | | | 347,643 | | | | 348,499 | | | | 1.26 | % |

| Hub International Ltd. | | 2M LIBOR + 3.000% Cash | | | 2.360 | | | | 5.360 | | | 4/25/2025 | | | 300,000 | | | | 299,267 | | | | 298,533 | | | | 1.08 | % |

| Mayfield Agency Borrower, Inc. | | 1M LIBOR + 4.500% Cash | | | 2.094 | | | | 6.594 | | | 2/28/2025 | | | 221,000 | | | | 221,652 | | | | 221,552 | | | | 0.80 | % |

| USI, Inc. | | 3M LIBOR + 3.000% Cash | | | 2.334 | | | | 5.334 | | | 5/16/2024 | | | 381,091 | | | | 383,116 | | | | 379,329 | | | | 1.37 | % |

| LSF9 Atlantis Holdings, LLC | | 1M LIBOR + 6.000% Cash | | | 2.001 | | | | 8.001 | | | 5/1/2023 | | | 56,907 | | | | 57,509 | | | | 56,445 | | | | 0.21 | % |

| Total Financials | | | | | | | | | | | | | | | | | | | 1,309,187 | | | | 1,304,358 | | | | 4.72 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Health Care — 4.90% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Air Methods Corp. | | 3M LIBOR + 3.500% Cash | | | 2.334 | | | | 5.834 | | | 4/21/2024 | | | 300,000 | | | | 301,620 | | | | 288,469 | | | | 1.04 | % |

| CVS Holdings I L.P. | | 1M LIBOR + 3.000% Cash | | | 2.100 | | | | 5.100 | | | 2/6/2025 | | | 349,125 | | | | 348,457 | | | | 346,507 | | | | 1.26 | % |

| Pearl Intermediate Parent, LLC | | 1M LIBOR + 2.750% Cash | | | 2.085 | | | | 4.835 | | | 2/14/2025 | | | 68,000 | | | | 67,836 | | | | 66,810 | | | | 0.24 | % |

| Pearl Intermediate Parent, LLC | | 3M LIBOR + 2.750% Cash | | | 2.335 | | | | 5.085 | | | 2/14/2025 | | | 20,000 | | | | 19,952 | | | | 19,650 | | | | 0.07 | % |

| PharMerica Corp. | | 1M LIBOR + 3.500% Cash | | | 2.046 | | | | 5.546 | | | 12/6/2024 | | | 99,750 | | | | 100,571 | | | | 99,797 | | | | 0.36 | % |

| Team Health Holdings, Inc. | | 1M LIBOR + 2.750% Cash | | | 2.094 | | | | 4.844 | | | 2/6/2024 | | | 398,362 | | | | 390,159 | | | | 383,921 | | | | 1.39 | % |

| Valeant Pharmaceuticals International, Inc. | | 1M LIBOR + 3.000% Cash | | | 1.982 | | | | 4.982 | | | 6/2/2025 | | | 150,000 | | | | 151,875 | | | | 149,688 | | | | 0.54 | % |

| Total Health Care | | | | | | | | | | | | | | | | | | | 1,380,470 | | | | 1,354,842 | | | | 4.90 | % |

Stira Alcentra Global Credit Fund

Schedule of Investments

As of June 30, 2018

| Description | | Spread

Above Index | | Base Rate

Floor

(%) | | | Interest

Rate

(%) | | | Maturity

Date | | Principal

Amount | | | Cost(1)

($) | | | Fair Value

($) | | | % of Net

Assets | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Industrials — 8.03% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ATS Consolidated, Inc. | | 1M LIBOR + 3.750% Cash | | | 2.094 | | | | 5.844 | | | 2/28/2025 | | $ | 259,350 | | | $ | 259,914 | | | $ | 261,188 | | | | 0.94 | % |

| EnergySolutions, LLC | | 3M LIBOR + 3.750% Cash | | | 2.334 | | | | 6.084 | | | 5/9/2025 | | | 250,000 | | | | 248,762 | | | | 250,781 | | | | 0.91 | % |

| Filtration Group Corp. | | 3M LIBOR + 3.000% Cash | | | 2.094 | | | | 5.094 | | | 3/29/2025 | | | 291,174 | | | | 292,641 | | | | 291,574 | | | | 1.05 | % |

| Loparex Holding B.V. | | 3M LIBOR + 4.250% Cash | | | 2.334 | | | | 6.584 | | | 4/11/2025 | | | 500,000 | | | | 503,614 | | | | 503,125 | | | | 1.82 | % |

| Pike Corp. | | 1M LIBOR + 3.500% Cash | | | 2.100 | | | | 5.600 | | | 3/23/2025 | | | 252,436 | | | | 254,005 | | | | 253,567 | | | | 0.92 | % |

| Ply Gem Industries, Inc. | | 3M LIBOR + 3.750% Cash | | | 2.339 | | | | 6.089 | | | 4/12/2025 | | | 350,000 | | | | 350,206 | | | | 349,673 | | | | 1.27 | % |

| Titan Acquisition Ltd. | | 1M LIBOR + 3.000% Cash | | | 2.094 | | | | 5.094 | | | 3/28/2025 | | | 314,213 | | | | 313,999 | | | | 309,972 | | | | 1.12 | % |

| Total Industrials | | | | | | | | | | | | | | | | | | | 2,223,141 | | | | 2,219,880 | | | | 8.03 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Materials — 5.64% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AgroFresh, Inc. | | 3M LIBOR + 4.750% Cash | | | 2.359 | | | | 7.109 | | | 7/31/2021 | | | 248,721 | | | | 248,978 | | | | 247,478 | | | | 0.90 | % |

| Albea Beauty Holdings S.A. | | 3M LIBOR + 3.000% Cash | | | 2.445 | | | | 5.445 | | | 4/22/2024 | | | 337,908 | | | | 338,999 | | | | 336,640 | | | | 1.22 | % |

| Consolidated Energy Finance S.A. | | 1M LIBOR + 2.500% Cash | | | 2.025 | | | | 4.525 | | | 5/7/2025 | | | 240,000 | | | | 239,407 | | | | 238,800 | | | | 0.86 | % |

| Covia Holdings Corp. | | 3M LIBOR + 3.750% Cash | | | 2.300 | | | | 6.050 | | | 6/1/2025 | | | 300,000 | | | | 301,009 | | | | 300,423 | | | | 1.09 | % |

| Cyanco Intermediate Corp. | | 1M LIBOR + 3.500% Cash | | | 2.094 | | | | 5.594 | | | 2/15/2025 | | | 187,530 | | | | 188,263 | | | | 187,764 | | | | 0.68 | % |

| OCI Beaumont, LLC | | 3M LIBOR + 4.000% Cash | | | 2.334 | | | | 6.334 | | | 2/14/2025 | | | 244,388 | | | | 246,127 | | | | 246,794 | | | | 0.89 | % |

| Total Materials | | | | | | | | | | | | | | | | | | | 1,562,783 | | | | 1,557,899 | | | | 5.64 | % |

Stira Alcentra Global Credit Fund

Schedule of Investments

As of June 30, 2018

| Description | | Spread

Above Index | | Base Rate

Floor

(%) | | | Interest

Rate

(%) | | | Maturity

Date | | Principal

Amount | | | Cost(1)

($) | | | Fair Value

($) | | | % of Net

Assets | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Technology — 7.86% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bright Bidco B.V. | | 1M LIBOR + 3.500% Cash | | | 2.094 | | | | 5.594 | | | 6/30/2024 | | $ | 248,125 | | | $ | 250,142 | | | $ | 246,574 | | | | 0.89 | % |

| Capri Finance, LLC | | 3M LIBOR + 3.250% Cash | | | 2.359 | | | | 5.609 | | | 11/1/2024 | | | 299,250 | | | | 299,984 | | | | 297,194 | | | | 1.07 | % |

| Everi Payments, Inc. | | 1M LIBOR + 3.000% Cash | | | 2.094 | | | | 5.094 | | | 5/9/2024 | | | 547,988 | | | | 552,551 | | | | 548,558 | | | | 1.98 | % |

| Harland Clarke Holdings Corp. | | 3M LIBOR + 4.750% Cash | | | 2.334 | | | | 7.084 | | | 11/3/2023 | | | 208,404 | | | | 210,330 | | | | 203,542 | | | | 0.74 | % |

| McAfee, LLC | | 1M LIBOR + 4.500% Cash | | | 2.094 | | | | 6.594 | | | 9/30/2024 | | | 348,496 | | | | 352,544 | | | | 350,799 | | | | 1.27 | % |

| Mitchell International, Inc. (7) | | 1M LIBOR + 3.250% Cash | | | 2.094 | | | | 5.344 | | | 11/29/2024 | | | 3,722 | | | | 3,705 | | | | 3,707 | | | | 0.01 | % |

| Mitchell International, Inc. | | 1M LIBOR + 3.250% Cash | | | 2.094 | | | | 5.344 | | | 11/29/2024 | | | 46,153 | | | | 45,940 | | | | 45,961 | | | | 0.17 | % |

| Quest Software U.S. Holdings, Inc. | | 3M LIBOR + 4.250% Cash | | | 2.326 | | | | 6.576 | | | 5/16/2025 | | | 190,000 | | | | 189,680 | | | | 189,565 | | | | 0.69 | % |

| Riverbed Technology, Inc. | | 1M LIBOR + 3.250% Cash | | | 2.100 | | | | 5.350 | | | 4/24/2022 | | | 289,259 | | | | 288,900 | | | | 286,263 | | | | 1.04 | % |

| Total Technology | | | | | | | | | | | | | | | | | | | 2,193,776 | | | | 2,172,163 | | | | 7.86 | % |

| Total Senior Secured - First Lien | | | | | | | | | | | | | | | | | | | 14,373,771 | | | | 14,337,002 | | | | 51.87 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior Secured - Second Lien — 7.55%(4)(5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Energy — 0.55% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Granite Acquisition, Inc. | | 3M LIBOR + 7.250% Cash | | | 2.334 | | | | 9.584 | | | 12/19/2022 | | | 152,597 | | | | 154,205 | | | | 153,361 | | | | 0.55 | % |

| Total Energy | | | | | | | | | | | | | | | | | | | 154,205 | | | | 153,361 | | | | 0.55 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financials — 4.64% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Asurion, LLC | | 1M LIBOR + 6.000% Cash | | | 2.094 | | | | 8.094 | | | 8/4/2025 | | | 450,000 | | | | 461,870 | | | | 457,312 | | | | 1.66 | % |

| Capital Automotive L.P. | | 1M LIBOR + 6.000% Cash | | | 2.100 | | | | 8.100 | | | 3/24/2025 | | | 285,051 | | | | 292,255 | | | | 287,545 | | | | 1.04 | % |

| Mayfield Agency Borrower, Inc. | | 1M LIBOR + 8.500% Cash | | | 2.094 | | | | 10.594 | | | 1/30/2026 | | | 150,000 | | | | 151,087 | | | | 149,250 | | | | 0.54 | % |

| Sedgwick Claims Management Services, Inc. | | 3M LIBOR + 5.750% Cash | | | 2.307 | | | | 8.057 | | | 2/28/2022 | | | 385,000 | | | | 386,845 | | | | 387,649 | | | | 1.40 | % |

| Total Financials | | | | | | | | | | | | | | | | | | | 1,292,057 | | | | 1,281,756 | | | | 4.64 | % |

Stira Alcentra Global Credit Fund

Schedule of Investments

As of June 30, 2018

| Description | | Spread

Above Index | | Base Rate

Floor

(%) | | | Interest

Rate

(%) | | | Maturity

Date | | Principal

Amount | | | Cost(1)

($) | | | Fair Value

($) | | | % of Net

Assets | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Health Care — 1.64% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pearl Intermediate Parent, LLC | | 1M LIBOR + 6.250% Cash | | | 2.085 | | | | 8.335 | | | 2/13/2026 | | $ | 251,000 | | | $ | 253,851 | | | $ | 251,941 | | | | 0.91 | % |

| PharMerica Corp. | | 1M LIBOR + 7.750% Cash | | | 2.046 | | | | 9.796 | | | 12/7/2025 | | | 200,000 | | | | 203,786 | | | | 200,542 | | | | 0.73 | % |

| Total Health Care | | | | | | | | | | | | | | | | | | | 457,637 | | | | 452,483 | | | | 1.64 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Technology — 0.72% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mitchell International, Inc. | | 1M LIBOR + 7.250% Cash | | | 2.094 | | | | 9.344 | | | 11/20/2025 | | | 200,000 | | | | 199,060 | | | | 200,563 | | | | 0.72 | % |

| Total Technology | | | | | | | | | | | | | | | | | | | 199,060 | | | | 200,563 | | | | 0.72 | % |

| Total Senior Secured - Second Lien | | | | | | | | | | | | | | | | | | | 2,102,959 | | | | 2,088,163 | | | | 7.55 | % |

| Total Investments in Non-Controlled, Non-Affiliated Portfolio Companies | | | | | | | | | | | | | | | | | | | 22,112,181 | | | | 21,878,012 | | | | 79.15 | % |

| Total Investments | | | | | | | | | | | | | | | | | | | 22,112,181 | | | | 21,878,012 | | | | 79.15 | % |

| Unfunded Loan Commitments | | | | | | | | | | | | | | | | | | | (117,106 | ) | | | (117,106 | ) | | | (0.42 | )% |

| Net Investments | | | | | | | | | | | | | | | | | | | 21,995,075 | | | | 21,760,906 | | | | 78.73 | % |

| Assets In Excess Of Other Liabilities | | | | | | | | | | | | | | | | | | | | | | | 5,880,374 | | | | 21.27 | % |

| Net Assets | | | | | | | | | | | | | | | | | | | | | | $ | 27,641,280 | | | | 100.00 | % |

| (1) | The cost of debt securities is adjusted for accretion of discount/amortization of premium and interest paid-in-kind on such securities. |

| (2) | Exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be deemed liquid by Alcentra NY, LLC, the Fund’s investment sub-adviser, and may be resold, normally to qualified institutional buyers in transactions exempt from registration. Total market value of Rule 144A securities amounts to $2,965,000, which represents approximately 10.7% of the Fund’s net assets as of June 30, 2018. |

| (3) | Security with “Call” features with resetting interest rates. Maturity dates disclosed are the final maturity dates. |

| (4) | The principal balance outstanding for all floating rate loans is indexed to LIBOR or an alternate base rate (e.g., prime rate), which typically resets semi-annually, quarterly, or monthly at the borrower's option. The borrower may also elect to have multiple interest reset periods for each loan. For each of these loans, the Fund has provided the applicable margin over LIBOR based on each respective credit agreement. |

| (5) | Variable rate security. Interest rate disclosed is that which is in effect on June 30, 2018. |

| (6) | This loan settled after June 30, 2018, at which time the interest rate was determined. |

| (7) | Unfunded or partially unfunded loan commitments. The Fund may enter into certain credit agreements for which all or a portion may be unfunded. The Fund is obligated to fund these commitments at the borrower’s discretion. |

Stira Alcentra Global Credit Fund

Statement of Assets and Liabilities

| | | As of

June 30, 2018

(Unaudited) | |

| Assets | | | |

| Portfolio investments, at fair value | | | | |

| Non-controlled, non-affiliated investments, at fair value (cost of $21,995,075)(1) | | $ | 21,760,906 | |

| Total of portfolio investments, at fair value (cost $21,995,075) | | | 21,760,906 | |

| Cash and cash equivalents | | | 4,135,805 | |

| Receivable for fund shares sold | | | 2,199,601 | |

| Receivable for expense support due from Adviser | | | 232,778 | |

| Deferred offering costs | | | 162,274 | |

| Dividends and interest receivable | | | 143,280 | |

| Receivable for investments sold | | | 1,240 | |

| Prepaid expenses and other assets | | | 48,770 | |

| Total Assets | | $ | 28,684,654 | |

| | | | | |

| Liabilities | | | | |

| Payable for investments purchased | | | 689,517 | |

| Professional fees payable | | | 111,500 | |

| Shareholder distributions payable | | | 77,810 | |

| Accounting and administration fees payable | | | 66,000 | |

| Trustees’ fees payable | | | 55,750 | |

| Transfer agent fees payable | | | 4,028 | |

| Other accrued expenses and liabilities | | | 38,769 | |

| Total Liabilities | | $ | 1,043,374 | |

| Commitments and contingencies (Note 3) | | | | |

| | | | | |

| Net Assets | | | | |

| Common shares, par value $0.001 per share | | | 3,058 | |

| Paid-in capital | | | 27,909,136 | |

| Accumulated net realized loss | | | (36,745 | ) |

| Net unrealized appreciation (depreciation) on investments | | | (234,169 | ) |

| Total Net Assets | | | 27,641,280 | |

| Total Liabilities and Net Assets | | $ | 28,684,654 | |

| | | | | |

| Net Assets: | | | | |

| Class A | | | 6,974,011 | |

| Class C | | | 1,904,623 | |

| Class D | | | 305,202 | |

| Class I | | | 3,498,479 | |

| Class T | | | 14,958,965 | |

| Total Net Assets | | $ | 27,641,280 | |

| | | | | |

| Shares Outstanding $0.001 par value (unlimited number of shares authorized): | | | | |

| Class A | | | 771,482 | |

| Class C | | | 210,694 | |

| Class D | | | 33,762 | |

| Class I | | | 387,010 | |

| Class T | | | 1,654,796 | |

| Total Shares Outstanding | | | 3,057,744 | |

| | | | | |

| Net asset value per share: | | | | |

| Class A | | | 9.04 | |

| Class C | | | 9.04 | |

| Class D | | | 9.04 | |

| Class I | | | 9.04 | |

| Class T | | | 9.04 | |

| (1) | Net of unfunded loan commitments of $117,106 |

See notes to unaudited financial statements

Stira Alcentra Global Credit Fund

Statement of Operations

| | | For the six months

ended June 30, 2018

(Unaudited) | |

| Investment Income: | | | | |

| From non-controlled, non-affiliated investments: | | | | |

| Interest income from portfolio investments | | $ | 459,444 | |

| Other income from portfolio investments | | | 16,056 | |

| Total investment income | | $ | 475,500 | |

| | | | | |

| Expenses: | | | | |

| Administration and custodian fees | | | 195,662 | |

| Management fees | | | 172,546 | |

| Professional fees | | | 155,697 | |

| Trustees’ fees and expenses | | | 112,051 | |

| Administrative services expenses | | | 96,084 | |

| Amortization of offering costs | | | 42,133 | |

| Printing and mailing expenses | | | 34,468 | |

| Distribution and servicing fees - Class C | | | 2,969 | |

| Distribution and servicing fees - Class I | | | 2,990 | |

| Distribution and servicing fees - Class T | | | 17,666 | |

| Transfer agent fees | | | 9,119 | |

| Insurance expense | | | 6,919 | |

| Other expenses | | | 88,797 | |

| Total expenses | | $ | 937,101 | |

| Expense reimbursements | | | (1,086,425 | ) |

| Net expenses | | | (149,324 | ) |

| Net investment income | | $ | 624,824 | |

| | | | | |

| Realized Gain (Loss) and Net Change in Unrealized Appreciation (Depreciation) From Portfolio Investments | | | | |

| Net realized gain (loss) on: | | | | |

| Non-controlled, non-affiliated investments | | $ | (76,383 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Non-controlled, non-affiliated investments | | | (198,868 | ) |

| Non-controlled, affiliated investments | | | — | |

| Net realized gain (loss) and net change in unrealized appreciation (depreciation) from portfolio investments, payments from affiliate | | | (275,251 | ) |

| Net Increase in Net Assets Resulting from Operations | | $ | 349,573 | |

See notes to unaudited financial statements

Stira Alcentra Global Credit Fund

Statements of Changes in Net Assets

| | | For the six months

ended June 30, 2018

(Unaudited) | | | For the period from

August 8, 2017

(commencement of

operations) to

December 31, 2017 | |

| Increase (decrease) in net assets resulting from operations | | | | | | | | |

| Net investment income | | $ | 624,824 | | | $ | 143,405 | |

| Net realized gain (loss) on investments | | �� | (76,383 | ) | | | 50,009 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (198,868 | ) | | | (35,301 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 349,573 | | | | 158,113 | |

| | | | | | | | | |

| Capital transactions | | | | | | | | |

| Issuance of common stock: | | | | | | | | |

| Class A | | | 6,413,774 | | | | 935,344 | |

| Class C | | | 1,903,460 | | | | — | |

| Class D | | | 310,400 | | | | — | |

| Class I | | | 3,225,409 | | | | 275,000 | |

| Class T | | | 6,895,503 | | | | 8,329,179 | |

| Total issuance of common stock | | | 18,748,546 | | | | 9,539,523 | |

| | | | | | | | | |

| Commissions and fees on shares sold: | | | | | | | | |

| Class A(1) | | | (497,738 | ) | | | (70,328 | ) |

| Class C(2) | | | (6,208 | ) | | | — | |

| Class T(1) | | | (302,480 | ) | | | (68,381 | ) |

| Total commissions and fees on shares sold | | | (806,426 | ) | | | (138,709 | ) |

| | | | | | | | | |

| Reinvestment of distributions: | | | | | | | | |

| Class A | | | 44,046 | | | | 1,217 | |

| Class C | | | 10,170 | | | | — | |

| Class D | | | 1,897 | | | | — | |

| Class I | | | 31,507 | | | | 137 | |

| Class T | | | 203,356 | | | | 76,930 | |

| Total reinvestment of distributions | | | 290,976 | | | | 78,284 | |

| | | | | | | | | |

| Net increase in net assets resulting from capital transactions | | | 18,233,096 | | | | 9,479,098 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income: | | | | | | | | |

| Class A | | | (125,932 | ) | | | (9,907 | ) |

| Class C | | | (19,458 | ) | | | — | |

| Class D | | | (2,502 | ) | | | — | |

| Class I | | | (66,022 | ) | | | (137 | ) |

| Class T | | | (410,910 | ) | | | (143,732 | ) |

| | | | | | | | | |

| Total distributions to shareholders | | | (624,824 | ) | | | (153,776 | ) |

| | | | | | | | | |

| Total increase in net assets | | | 17,957,845 | | | | 9,483,435 | |

| | | | | | | | | |

| Net assets at beginning of period | | | 9,683,435 | | | | 200,000 | |

| Net assets at end of period | | $ | 27,641,280 | | | $ | 9,683,435 | |

| Undistributed net investment income | | $ | — | | | $ | — | |

| | | | | | | | | |

| Capital shares transactions | | | | | | | | |

| Issuance of common stock: | | | | | | | | |

| Class A | | | 650,385 | | | | 94,372 | |

| Class C | | | 209,572 | | | | — | |

| Class D | | | 33,553 | | | | — | |

| Class I | | | 353,539 | | | | 29,983 | |

| Class T | | | 724,072 | | | | 899,982 | |

| Total issuance of common stock | | | 1,971,121 | | | | 1,024,337 | |

| | | | | | | | | |

| Reinvestment of distributions: | | | | | | | | |

| Class A | | | 4,853 | | | | 133 | |

| Class C | | | 1,122 | | | | — | |

| Class D | | | 209 | | | | — | |

| Class I | | | 3,473 | | | | 15 | |

| Class T | | | 22,361 | | | | 8,382 | |

| Total reinvestment of distributions | | | 32,018 | | | | 8,530 | |

| | | | | | | | | |

| Net increase in shares resulting from capital transactions | | | 2,003,139 | | | | 1,032,867 | |

| (1) | The Fund began offering and selling Classes A and I shares on November 7, 2017. |

| (2) | The Fund began offering and selling Class C shares on February 5, 2018. |

See notes to unaudited financial statements

Stira Alcentra Global Credit Fund

Statement of Cash Flows

| | | For the six months

ended June 30, 2018

(Unaudited) | |

| Cash Flows from Operating Activities | | | | |

| Net increase in net assets resulting from operations | | $ | 349,573 | |

| | | | | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by (used in) operating activities: | | | | |

| Net realized loss from portfolio investments | | | 76,383 | |

| Net change in unrealized (appreciation) depreciation of portfolio investments | | | 198,868 | |

| Accretion of discount on debt securities | | | 4,794 | |

| Purchases of portfolio investments | | | (16,046,791 | ) |

| Net proceeds from sales/return of capital of portfolio investments | | | 2,907,788 | |

| Amortization of deferred offering costs | | | 42,133 | |

| (Increase) decrease in operating assets: | | | | |

| Dividends and interest receivable | | | (58,194 | ) |

| Receivable for investments sold | | | (599 | ) |

| Receivable for expense support due from Adviser | | | 190,835 | |

| Prepaid expenses and other assets | | | (48,770 | ) |

| Increase (decrease) in operating liabilities: | | | | |

| Payable for investments purchased | | | (1,148,484 | ) |

| Trustees' fees payable | | | (30,000 | ) |

| Professional fees payable | | | (67,550 | ) |

| Transfer agent fee payable | | | 3,228 | |

| Accounting and administration fees payable | | | (48,553 | ) |

| Other accrued expenses and liabilities | | | 23,308 | |

| Net cash used in operating activities | | | (13,652,031 | ) |

| | | | | |

| Cash Flows from Financing Activities | | | | |

| Issuance of common stock | | | 17,277,820 | |

| Payment of commissions on sale of common stock and related dealer manager fee | | | (806,426 | ) |

| Payment of deferred offering costs | | | (187,485 | ) |

| Distributions paid to shareholders | | | (274,164 | ) |

| Net cash provided by financing activities | | | 16,009,745 | |

| Increase in cash | | | 2,357,714 | |

| Cash at beginning of period | | | 1,778,091 | |

| Cash and Cash Equivalents at End of Period | | $ | 4,135,805 | |

| | | | | |

| Supplemental and non-cash financing activities: | | | | |

| Distributions paid to common stockholders through common stock issuances pursuant to the distribution reinvestment plan | | $ | 290,976 | |

| Increase in distributions payable | | | 53,280 | |

| Increase in amounts receivable from transfer agent – Class A | | | 474,217 | |

| Increase in amounts receivable from transfer agent – Class C | | | 290,000 | |

| Increase in amounts receivable from transfer agent – Class D | | | 107,212 | |

| Decrease in amounts receivable from transfer agent – Class I | | | (50,350 | ) |

| Increase in amounts receivable from transfer agent – Class T | | | 649,647 | |

| Increase in distribution and shareholder servicing fees payable | | | 6,404 | |

See notes to unaudited financial statements

Stira Alcentra Global Credit Fund

Financial Highlights

| | | For the six months ended

June 30, 2018

(Unaudited) | | | For the period from

August 8, 2017

(commencement of

operations) to December

31, 2017 | |

| Class A Shares | | | | | | | | |

| Per share data(1) | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.18 | | | $ | 9.15 | |

| | | | | | | | | |

| Net investment income (loss) | | | 0.38 | | | | 0.23 | |

| Net realized and unrealized gains (losses) | | | (0.17 | ) | | | 0.04 | |

| Net increase (decrease) in net assets resulting from operations | | | 0.21 | | | | 0.27 | |

| | | | | | | | | |

| Distributions to shareholders:(2) | | | | | | | | |

| From net investment income | | | (0.35 | ) | | | (0.24 | ) |

| Total dividend distributions declared | | | (0.35 | ) | | | (0.24 | ) |

| | | | | | | | | |

| Net asset value, end of period | | $ | 9.04 | | | $ | 9.18 | |

| Market value per share, end of period | | $ | 9.84 | | | $ | 9.98 | |

| | | | | | | | | |

| Total return based on net asset value(3)(4) | | | 2.52 | % | | | 1.16 | % |

| Total return based on market value(3)(4) | | | 2.21 | % | | | 1.15 | % |

| | | | | | | | | |

| Shares outstanding at end of period | | | 771,482 | | | | 116,244 | |

| | | | | | | | | |

| Ratio/Supplemental Data: | | | | | | | | |

| Net assets, at end of period | | $ | 6,974,011 | | | $ | 1,067,355 | |

| Ratio of total expenses before waiver to average net assets(5) | | | 11.89 | % | | | 111.84 | % |

| Ratio of net expenses to average net assets(5) | | | (2.27 | )% | | | — | % |

| Ratio of net investment income (loss) before waiver to average net assets(5) | | | (5.81 | )% | | | (94.67 | )% |

| Ratio of net investment income (loss) after waiver to average net assets(5) | | | 8.34 | % | | | 17.17 | % |

| | | | | | | | | |

| Portfolio turnover rate(3) | | | 19.00 | % | | | 0.04 | % |

| (1) | The per share data was derived by using the average shares outstanding during the period. |

| (2) | The per share data for distributions is the actual amount of distributions paid or payable per share of common stock outstanding during the entire period. |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

See notes to unaudited financial statements

Stira Alcentra Global Credit Fund

Financial Highlights

| | | For the six months ended | |

| | | June 30, 2018 | |

| | | (Unaudited) | |

| Class C Shares | | | | |

| Per share data(1) | | | | |

| Net asset value, beginning of period | | $ | 9.12 | |

| | | | | |

| Net investment income (loss) | | | 0.20 | |

| Net realized and unrealized gains (losses) | | | 0.02 | |

| Net increase (decrease) in net assets resulting from operations | | | 0.22 | |

| | | | | |

| Distributions to shareholders:(2) | | | | |

| From net investment income | | | (0.30 | ) |

| Total dividend distributions declared | | | (0.30 | ) |

| | | | | |

| Net asset value, end of period | | $ | 9.04 | |

| Market value per share, end of period | | $ | 9.05 | |

| | | | | |

| Total return based on net asset value(3)(4) | | | 1.48 | % |

| Total return based on market value(3)(4) | | | 1.48 | % |

| | | | | |

| Shares outstanding at end of period | | | 210,694 | |

| | | | | |

| Ratio/Supplemental Data: | | | | |

| Net assets, at end of period | | $ | 1,904,623 | |

| Ratio of total expenses before waiver to average net assets(5) | | | 24.43 | % |

| Ratio of net expenses to average net assets(5) | | | (3.10 | )% |

| Ratio of net investment income (loss) before waiver to average net assets(5) | | | (12.39 | )% |

| Ratio of net investment income (loss) after waiver to average net assets(5) | | | 15.15 | % |

| | | | | |

| Portfolio turnover rate(3) | | | 19.00 | % |

| (1) | The per share data was derived by using the average shares outstanding during the period. |

| (2) | The per share data for distributions is the actual amount of distributions paid or payable per share of common stock outstanding during the entire period. |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (5) | Annualized, except for consulting fees. |

See notes to unaudited financial statements

Stira Alcentra Global Credit Fund

Financial Highlights

| | | For the six months ended | |

| | | June 30, 2018 | |

| | | (Unaudited) | |

| Class D Shares | | | | |

| Per share data(1) | | | | |

| Net asset value, beginning of period | | $ | 9.07 | |

| | | | | |

| Net investment income (loss) | | | 0.18 | |

| Net realized and unrealized gains (losses) | | | 0.14 | |

| Net increase (decrease) in net assets resulting from operations | | | 0.32 | |

| | | | | |

| Distributions to shareholders:(2) | | | | |

| From net investment income | | | (0.35 | ) |

| Total dividend distributions declared | | | (0.35 | ) |

| | | | | |

| Net asset value, end of period | | $ | 9.04 | |

| Market value per share, end of period | | $ | 9.23 | |

| | | | | |

| Total return based on net asset value(3)(4) | | | 2.52 | % |

| Total return based on market value(3)(4) | | | 2.35 | % |

| | | | | |

| Shares outstanding at end of period | | | 33,762 | |

| | | | | |

| Ratio/Supplemental Data: | | | | |

| Net assets, at end of period | | $ | 305,202 | |

| Ratio of total expenses before waiver to average net assets(5) | | | 19.75 | % |

| Ratio of net expenses to average net assets(5) | | | (4.59 | )% |

| Ratio of net investment income (loss) before waiver to average net assets(5) | | | (8.83 | )% |

| Ratio of net investment income (loss) after waiver to average net assets(5) | | | 15.51 | % |

| | | | | |

| Portfolio turnover rate(3) | | | 19.00 | % |

| (1) | The per share data was derived by using the average shares outstanding during the period. |

| (2) | The per share data for distributions is the actual amount of distributions paid or payable per share of common stock outstanding during the entire period. |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (5) | Annualized, except for consulting fees. |

See notes to unaudited financial statements

Stira Alcentra Global Credit Fund

Financial Highlights

| | | For the six months ended

June 30, 2018

(Unaudited) | | | For the period from

August 8, 2017

(commencement of

operations) to December

31, 2017 | |

| Class I Shares | | | | | | | | |

| Per share data(1) | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.18 | | | $ | 9.15 | |

| | | | | | | | | |

| Net investment income (loss) | | | 0.35 | | | | 0.04 | |

| Net realized and unrealized gains (losses) | | | (0.17 | ) | | | 0.04 | |

| Net increase (decrease) in net assets resulting from operations | | | 0.18 | | | | 0.08 | |

| | | | | | | | | |

| Distributions to shareholders:(2) | | | | | | | | |

| From net investment income | | | (0.32 | ) | | | (0.05 | ) |

| Total dividend distributions declared | | | (0.32 | ) | | | (0.05 | ) |

| | | | | | | | | |

| Net asset value, end of period | | $ | 9.04 | | | $ | 9.18 | |

| Market value per share, end of period | | $ | 9.05 | | | $ | 9.18 | |

| | | | | | | | | |

| Total return based on net asset value(3)(4) | | | 2.26 | % | | | 0.83 | % |

| Total return based on market value(3)(4) | | | 2.26 | % | | | 0.83 | % |

| | | | | | | | | |

| Shares outstanding at end of period | | | 387,010 | | | | 29,998 | |

| | | | | | | | | |

| Ratio/Supplemental Data: | | | | | | | | |

| Net assets, at end of period | | $ | 3,498,479 | | | $ | 275,443 | |

| Ratio of total expenses before waiver to average net assets(5) | | | 12.25 | % | | | 15.93 | % |

| Ratio of net expenses to average net assets | | | (1.88 | )% | | | — | % |

| Ratio of net investment income (loss) before waiver to average net assets(5) | | | (6.27 | )% | | | (12.67 | )% |

| Ratio of net investment income (loss) after waiver to average net assets(5) | | | 7.85 | % | | | 3.26 | % |

| | | | | | | | | |

| Portfolio turnover rate(3) | | | 19.00 | % | | | 0.04 | % |

| (1) | The per share data was derived by using the average shares outstanding during the period. |

| (2) | The per share data for distributions is the actual amount of distributions paid or payable per share of common stock outstanding during the entire period. |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

See notes to unaudited financial statements

Stira Alcentra Global Credit Fund

Financial Highlights

| | | For the six months ended

June 30, 2018

(Unaudited) | | | For the period from

August 8, 2017

(commencement of

operations) to December

31, 2017 | |

| Class T Shares | | | | | | | | |

| Per share data(1) | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.18 | | | $ | 9.20 | |

| | | | | | | | | |

| Net investment income (loss) | | | 0.35 | | | | 0.22 | |

| Net realized and unrealized gains (losses) | | | 0.16 | | | | (0.04 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 0.51 | | | | 0.18 | |

| | | | | | | | | |

| Distributions to shareholders:(2) | | | | | | | | |

| From net investment income | | | (0.65 | ) | | | (0.20 | ) |

| Total dividend distributions declared | | | (0.65 | ) | | | (0.20 | ) |

| | | | | | | | | |

| Net asset value, end of period | | $ | 9.04 | | | $ | 9.18 | |

| Market value per share, end of period | | $ | 9.53 | | | $ | 9.66 | |

| | | | | | | | | |

| Total return based on net asset value(4)(3)(5) | | | 2.01 | % | | | 2.24 | % |

| Total return based on market value(3)(4)(5) | | | 1.91 | % | | | 2.24 | % |

| | | | | | | | | |

| Shares outstanding at end of period | | | 1,654,797 | | | | 908,364 | |

| | | | | | | | | |

| Ratio/Supplemental Data: | | | | | | | | |

| Net assets, at end of period | | $ | 14,958,965 | | | $ | 8,340,637 | |

| Ratio of total expenses before waiver to average net assets(6) | | | 11.54 | % | | | 23.35 | % |

| Ratio of net expenses to average net assets | | | (1.77 | )% | | | — | % |

| Ratio of net investment income (loss) before waiver to average net assets(6) | | | (5.64 | )% | | | (19.62 | )% |

| Ratio of net investment income (loss) after waiver to average net assets(6) | | | 7.67 | % | | | 3.73 | % |

| | | | | | | | | |

| Portfolio turnover rate(3) | | | 19.00 | % | | | 0.04 | % |

| (1) | The per share data was derived by using the average shares outstanding during the period. |

| (2) | The per share data for distributions is the actual amount of distributions paid or payable per share of common stock outstanding during the entire period. |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (5) | Total return reflects a one-time payment from affiliate. If such payment was not included, the returns would have been 1.33% for the period from August 8, 2017 to December 31, 2017. |

See notes to unaudited financial statements

STIRA ALCENTRA GLOBAL CREDIT FUND

NOTES TO UNAUDITED FINANCIAL STATEMENTS

June 30, 2018

Note 1. Principal Business and Organization

Stira Alcentra Global Credit Fund (formerly Steadfast Alcentra Global Credit Fund) (the “Fund”) was formed as a Delaware statutory trust on October 24, 2016, and is an externally managed, non-diversified closed-end management investment company that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund intends to elect to be treated for federal income tax purposes, and intends to qualify annually thereafter, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

The Fund’s investment adviser is Stira Investment Adviser, LLC (formerly Steadfast Investment Adviser, LLC) (the “Adviser”), a registered investment adviser with the U.S. Securities and Exchange Commission (the “SEC”) pursuant to the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Adviser oversees the management of the Fund’s activities. The Adviser has engaged Alcentra NY, LLC (the “Sub-Adviser”), a registered investment adviser with the SEC pursuant to the Advisers Act, to act as the Fund’s investment sub-adviser. The Sub-Adviser is the U.S. subsidiary of Alcentra Group, a subsidiary of BNY Mellon, and is responsible for identifying investment opportunities, making investment decisions for the Fund and executing on its trading strategies, subject to oversight by the Adviser. The Fund's administrator is State Street Bank and Trust Company (“State Street”). State Street provides various accounting and administrative services, including preparing preliminary financial information for review by the Adviser, preparing and monitoring expense budgets, maintaining accounting books and records, processing trade information for the Fund and performing certain portfolio compliance testing.

The Fund’s investment objective is to provide current income, and capital preservation with the potential for capital appreciation. The Fund intends to pursue its investment objective by providing customized financing solutions to lower middle-market and middle-market companies in the form of floating and fixed rate senior secured loans, second lien loans and subordinated debt.

On May 8, 2017, the Fund commenced its continuous public offering pursuant to a registration statement on Form N-2 to offer a minimum of $3,000,000 (the “Minimum Offering Requirement”) and up to $3,000,000,000 in five classes of shares of beneficial interest of the Fund (the “Shares”): Class A, Class T, Class D, Class I and Class C Shares (the “Offering”). Shares were initially offered at $10.00 per Class A Share, $9.68 per Class T Share, $9.39 per Class D Share, $9.20 per Class I Share and $9.18 per Class C Share (with discounts available for certain categories of purchasers). Prior to satisfying the Minimum Offering Requirement, subscriptions were held in an escrow account with UMB Bank, N.A. On August 8, 2017, the Fund raised the Minimum Offering Requirement and the offering proceeds held in escrow were released to the Fund. Subsequent to satisfying the Minimum Offering Requirement, Shares are offered through Stira Capital Markets Group, LLC (formerly Steadfast Capital Markets Group, LLC) (the “Dealer Manager”) at an offering price equal to the Fund’s then current net asset value (“NAV”) per Share, plus selling commissions and dealer manager fees, if applicable. Upon satisfying the Minimum Offering Requirement, the Fund only offered and sold Class T Shares. On November 7, 2017, the Fund received exemptive relief from the SEC to offer multiple share classes. Following the receipt of such exemptive relief, the Fund began offering and selling Class A, Class D and Class I Shares. On February 5, 2018, the Fund registered and began offering and selling Class C Shares. The Fund is offering to sell any combination of Shares, with an aggregate number of Shares up to the maximum offering amount.

The Fund is currently accepting purchases of Shares on a semi-monthly basis, although the Fund may determine to conduct more frequent closings. The Fund does not issue Shares purchased (and an investor does not become a shareholder with respect to such Shares) until the applicable closing. Consequently, purchase proceeds do not represent capital of the Fund, and do not become assets of the Fund, until such date.

STIRA ALCENTRA GLOBAL CREDIT FUND

NOTES TO UNAUDITED FINANCIAL STATEMENTS (continued)

June 30, 2018

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying financial statements of the Fund have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (“GAAP”) and pursuant to the requirements for reporting in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. In the opinion of management, the financial results included herein contain all adjustments and reclassifications considered necessary for the fair presentation of financial statements for the period included herein. The accounting records of the Fund are maintained in United States dollars, the functional currency of the Fund.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements. Actual results could differ from those estimates and such differences could be material.

Cash

The Fund deposits its cash in a financial institution which, at times, may be in excess of the Federal Deposit Insurance Corporation insurance limits. Cash at June 30, 2018 is on deposit at State Street Bank. There are no restrictions on cash.

Investments

Investment security transactions are accounted for on a trade date basis. Cost of portfolio investments represents the actual purchase price of the securities acquired including capitalized legal, brokerage and other fees as well as the value of interest and dividends received in-kind and the accretion of original issue discounts. Fees may be charged to the issuer by the Fund in connection with the origination of a debt security financing. Such fees are reflected as a discount to the cost of the portfolio security and the discount is accreted into income over the life of the related debt security

Portfolio Investment Classification

The Company classifies its investments in accordance with the requirements of the 1940 Act. Under the 1940 Act, “Control Investments” are defined as investments in which the Company owns more than 25% of the voting securities or has rights to maintain greater than 50% of the board representation. Under the 1940 Act, “Affiliate Investments” are defined as investments in which the Company owns between 5% and 25% of the voting securities and does not have rights to maintain greater than 50% of the board representation. “Non-controlled, non-affiliate investments” are defined as investments that are neither Control Investments nor Affiliate Investments.

Valuation of Portfolio Investments

Portfolio investments are carried at fair value as determined by the Fund’s Board of Trustees (the “Board”). The methodologies used in determining these valuations include:

Debt

The yield to maturity analysis is used to estimate the fair value of debt, including any unitranche facilities, which are a combination of senior and subordinated debt in one debt instrument. The calculation of yield to maturity takes into account the current market price, par value, coupon interest rate and time to maturity.

Valuation techniques are applied consistently from period to period, except when circumstances warrant a change to a different valuation technique that will provide a better estimate of fair value.

Organizational Expenses

When recognized, organizational expenses, including reimbursement payments to the Adviser, are expensed on the Fund’s Statement of Operations. These expenses consist principally of legal and accounting fees incurred in connection with the organization of the Fund and are expensed as incurred, subject to recoupment as described in Note 7.

STIRA ALCENTRA GLOBAL CREDIT FUND

NOTES TO UNAUDITED FINANCIAL STATEMENTS (continued)

June 30, 2018

Offering Costs

Offering costs incurred prior to the satisfaction of the Minimum Offering Requirement were deferred. Upon satisfaction of the Minimum Offering Requirement and thereafter, offering costs, including any deferred offering costs, are capitalized on the Fund’s Statement of Assets and Liabilities, subject to the 1.0% limitation described in Note 7, and are amortized over 12 months on a straight-line basis, subject to recoupment as described in Note 7. These costs include, among other things, legal, accounting, printing and other expenses pertaining to the Offering.

Net Asset Value per Share

Net asset value per share is calculated using the number of shares outstanding as of the end of the period.

Investment Income and Investment Transactions

Investment income includes interest income and dividend income, net of any foreign withholding taxes. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized on the ex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to the ex-dividend date. Investment transactions are reflected on the trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily NAV calculations. Investment income is recorded net of any foreign withholding taxes. The Fund may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any foreign capital gains tax is accrued daily based upon net unrealized gains, and is payable upon the sale of such investments.

Foreign Currency Translations

The accounting records and reporting currency of the Fund is maintained in U.S. dollars. Assets and liabilities denominated in foreign currencies are translated into U.S. dollars using the current exchange rates at the close of each business day. The effect of changes in foreign currency exchange rates on investments is included within net realized and unrealized gain (loss) on investments. Changes in the value of other assets and liabilities as a result of fluctuations in foreign exchange rates are included in the Statements of Operations within net change in unrealized gain (loss) on foreign currency translations. Transactions denominated in foreign currencies are translated into U.S. dollars on the date the transaction occurred, the effects of which are included within net realized gain (loss) on foreign currency transactions.

Income Taxes

The Fund intends to elect to be treated for U.S. federal income tax purposes as a RIC under Subchapter M of the Code, and to operate in a manner so as to qualify for the tax treatment applicable to RICs. To obtain and maintain qualification for taxation as a RIC, the Fund must, among other things, meet certain source-of-income and asset diversification requirements. In addition, the Fund must distribute to its stockholders, for each taxable year, at least 90% of its “investment company taxable income,” which is generally net ordinary taxable income plus the excess of realized net short-term capital gains over realized net long-term capital losses (the “Annual Distribution Requirement”). As a RIC, the Fund generally will not pay corporate-level U.S. federal income taxes on any ordinary income or capital gains that are timely distributed to shareholders as dividends.

The Fund accounts for income taxes in conformity with ASC Topic 740, Income Taxes (“ASC 740”). ASC 740 provides guidelines for how uncertain tax positions should be recognized, measured, presented, and disclosed in financial statements. ASC 740 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions deemed to meet a “more-likely-than-not” threshold would be recorded as a tax benefit or expense in the current period. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Fund’s Statement of Operations. There were no material uncertain income tax positions, interest, or penalties as of June 30, 2018.

The Fund evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax benefits or liabilities in the Fund’s financial statements. Recognition of a tax benefit or liability with respect to an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Fund will recognize interest and penalties, if any, related to unrecognized tax liabilities as income tax expense on its Statement of Operations. During the period ended June 30, 2018, the Fund did not incur any interest or penalties.

STIRA ALCENTRA GLOBAL CREDIT FUND

NOTES TO UNAUDITED FINANCIAL STATEMENTS (continued)

June 30, 2018

Distributions

Distributions to the Fund’s shareholders are recorded as of the record date. Subject to the discretion of the Board, and applicable legal restrictions, the Fund intends to authorize and declare ordinary cash distributions on a daily basis and to pay such distributions on a monthly basis. Such ordinary cash distributions are expected to be paid from investment income, net of any Fund operating expenses. At least annually, the Fund intends to authorize and declare special cash distributions of net realized long-term capital gains, if any, and any other income, gains and dividends and other distributions not previously distributed. Such special cash distributions are expected to be paid using special cash distributions received from the Fund.

Note 3. Commitments and Contingencies

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. In addition, the Fund has agreed to indemnify its officers, trustees, employees, agents or any person who serves on behalf of the Fund from any loss, claim, damage, or liability which such person incurs by reason of his performance of activities of the Fund, provided they acted in good faith. The Fund expects the risk of loss related to its indemnifications to be remote.

The Fund’s investment portfolio may contain debt investments that are in the form of lines of credit and unfunded delayed draw commitments, which require the Fund to provide funding when requested by portfolio companies in accordance with the terms of the underlying loan agreements. As of June 30, 2018, the Fund’s unfunded commitments under loan and financing agreements are presented below:

| | | June 30, 2018 | |

| | | Total Commitment | | | Unfunded Commitment | |

| Pearl Intermediate Parent LLC | | $ | 20,000 | | | $ | 14,463 | |

| Manna Pro Products, LLC | | | 263,187 | | | | 102,643 | |

| | | $ | 283,187 | | | $ | 117,106 | |

Note 4. Investment Portfolio

As of June 30, 2018, the Fund had invested approximately $21.9 million in 82 portfolio companies. The weighted average yield of the investment portfolio based upon original cost, as of June 30, 2018, was 6.60% with an average duration of 1.02 years. The following graphics illustrate the Fund’s investment portfolio as of June 30, 2018 by industry, geography, asset type, floating/fixed rate breakdown and investment structure:

| Top 10 Holdings | | % of Fair Value | | | % of Net

Assets | |

| Manna Pro Products, LLC | | | 6.00 | % | | | 4.75 | % |

| Everi Payments, Inc. | | | 2.51 | % | | | 1.98 | % |

| Loparex Holding B.V. | | | 2.30 | % | | | 1.82 | % |

| Asurion, LLC | | | 2.09 | % | | | 1.66 | % |

| Weight Watchers International, Inc. | | | 2.04 | % | | | 1.62 | % |

| Albertsons, LLC | | | 1.81 | % | | | 1.43 | % |

| Sedgwick Claims Management Services, Inc. | | | 1.77 | % | | | 1.40 | % |

| Team Health Holdings, Inc. | | | 1.76 | % | | | 1.39 | % |

| USI, Inc. | | | 1.73 | % | | | 1.37 | % |

| McAfee, LLC | | | 1.60 | % | | | 1.27 | % |

| | | | 23.61 | % | | | 18.69 | % |

STIRA ALCENTRA GLOBAL CREDIT FUND

NOTES TO UNAUDITED FINANCIAL STATEMENTS (continued)

June 30, 2018

| Industry Concentration | | % of Fair Value | | | % of Net

Assets | |

| Materials | | | 12.72 | % | | | 10.06 | % |

| Financials | | | 12.70 | % | | | 10.05 | % |

| Industrials | | | 12.54 | % | | | 9.93 | % |

| Health Care | | | 11.83 | % | | | 9.37 | % |

| Technology | | | 11.48 | % | | | 9.09 | % |

| Consumer Discretionary | | | 10.50 | % | | | 8.31 | % |

| Communications | | | 10.24 | % | | | 8.11 | % |

| Consumer Staples | | | 9.26 | % | | | 7.33 | % |

| Energy | | | 7.63 | % | | | 6.04 | % |

| Utilities | | | 1.10 | % | | | 0.87 | % |

| Assets in excess of other liabilities (net of unfunded loans commitments) | | | — | | | | 20.85 | % |

| | | | 100.00 | % | | | 100.00 | % |

| Asset Type | | % of Fair Value | | | % of

Net Assets | |

| Senior Secured - First Lien | | | 65.5 | % | | | 51.87 | % |

| Corporate Bonds | | | 24.9 | % | | | 19.73 | % |

| Senior Secured - Second Lien | | | 9.6 | % | | | 7.55 | % |

| Assets in excess of other liabilities (net of unfunded loans commitments) | | | — | | | | 20.85 | % |

| | | | 100.0 | % | | | 100.00 | % |

| Geographic Concentration | | % of Fair Value | | | % of Net

Assets | |

| United States | | | 84.39 | % | | | 66.74 | % |

| Western Europe | | | 12.54 | % | | | 9.91 | % |

| Other | | | 3.07 | % | | | 2.42 | % |

| Assets in excess of other liabilities | | | — | | | | 20.93 | % |

| | | | 100.00 | % | | | 100.00 | % |

| Floating/Fixed Rate Breakdown | | % of Fair Value | | | % of Net

Assets | |

| Floating | | | 75.05 | % | | | 59.34 | % |

| Fixed | | | 24.95 | % | | | 19.73 | % |

| Assets in excess of other liabilities | | | — | | | | 20.93 | % |

| | | | 100.00 | % | | | 100.00 | % |

| Investment Structure | | % of Fair Value | | | % of Net

Assets | |

| Originated | | | 7.21 | % | | | 5.70 | % |

| Syndicated | | | 92.79 | % | | | 73.36 | % |

| Assets in excess of other liabilities | | | — | | | | 20.94 | % |

| | | | 100.00 | % | | | 100.00 | % |

STIRA ALCENTRA GLOBAL CREDIT FUND

NOTES TO UNAUDITED FINANCIAL STATEMENTS (continued)

June 30, 2018

Note 5. Fair Value of Financial Instruments

The Fund accounts for its investments in accordance with FASB ASC Topic 820 (“ASC 820”), Fair Value Measurements and Disclosures, which defines fair value and establishes a framework for measuring fair value. ASC 820 defines fair value as the price that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also establishes a fair value hierarchy which prioritizes and ranks the level of market price observability used in measuring investments at fair value.

Market price observability is impacted by a number of factors, including the type of investment, the characteristics specific to the investment, and the state of the marketplace (including the existence and transparency of transactions between market participants). Investments with readily-available actively quoted prices or for which fair value can be measured from actively-quoted prices in an orderly market will generally have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments measured and reported at fair value are classified and disclosed in one of the following categories (from highest to lowest) based on inputs:

Level 1 — Quoted prices (unadjusted) are available in active markets for identical investments that the Fund has the ability to access as of the reporting date. The type of investments which would generally be included in Level 1 includes listed equity securities and listed derivatives. As required by ASC 820, the Fund, to the extent that it holds such investments, does not adjust the quoted price for these investments, even in situations where the Fund holds a large position and a sale could reasonably impact the quoted price.

Level 2 — Other significant observable inputs, including but not limited to, quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) at the measurement date. This category includes quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in non-active markets including actionable bids from third parties for privately held assets or liabilities, and observable inputs other than quoted prices such as yield curves and forward currency rates that are entered directly into valuation models to determine the value of derivatives or other assets or liabilities.

Level 3 — Pricing inputs are unobservable for the investment and include situations where there is little, if any, market activity for the investment. The inputs into the determination of fair value require significant judgment or estimation by the Fund. The types of investments which would generally be included in this category include debt and equity securities issued by private entities.