| | Filed by Stira Alcentra Global Credit Fund pursuant to Rule 425 under the Securities Act of 1933 and deemed filed under Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Stira Alcentra Global Credit Fund Commission File No. 333-214405 |

January 31, 2019

3744 - 7 © Priority Senior Secured Income Management, LLC. Destra Capital Investments 444 West Lake Street, Suite 1700 Chicago, IL 60606 877.855.3434 www.destracapital.com member FINRA/SIPC Priority Income Fund

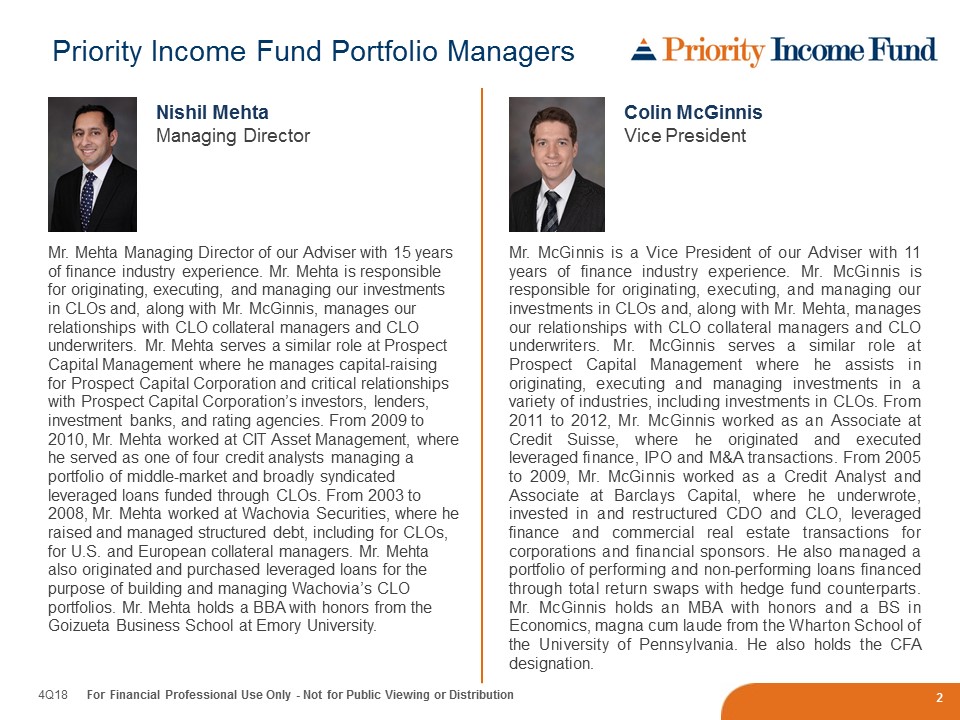

2 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution Priority Income Fund Portfolio Managers Mr. Mehta Managing Director of our Adviser with 15 years of finance industry experience. Mr. Mehta is responsible for originating, executing, and managing our investments in CLOs and, along with Mr. McGinnis, manages our relationships with CLO collateral managers and CLO underwriters. Mr. Mehta serves a similar role at Prospect Capital Management where he manages capital - raising for Prospect Capital Corporation and critical relationships with Prospect Capital Corporation’s investors, lenders, investment banks, and rating agencies. From 2009 to 2010, Mr. Mehta worked at CIT Asset Management, where he served as one of four credit analysts managing a portfolio of middle - market and broadly syndicated leveraged loans funded through CLOs. From 2003 to 2008, Mr. Mehta worked at Wachovia Securities, where he raised and managed structured debt, including for CLOs, for U.S. and European collateral managers. Mr. Mehta also originated and purchased leveraged loans for the purpose of building and managing Wachovia’s CLO portfolios. Mr. Mehta holds a BBA with honors from the Goizueta Business School at Emory University. Mr . McGinnis is a Vice President of our Adviser with 11 years of finance industry experience . Mr . McGinnis is responsible for originating, executing, and managing our investments in CLOs and, along with Mr . Mehta, manages our relationships with CLO collateral managers and CLO underwriters . Mr . McGinnis serves a similar role at Prospect Capital Management where he assists in originating, executing and managing investments in a variety of industries, including investments in CLOs . From 2011 to 2012 , Mr . McGinnis worked as an Associate at Credit Suisse, where he originated and executed leveraged finance, IPO and M&A transactions . From 2005 to 2009 , Mr . McGinnis worked as a Credit Analyst and Associate at Barclays Capital, where he underwrote, invested in and restructured CDO and CLO, leveraged finance and commercial real estate transactions for corporations and financial sponsors . He also managed a portfolio of performing and non - performing loans financed through total return swaps with hedge fund counterparts . Mr . McGinnis holds an MBA with honors and a BS in Economics, magna cum laude from the Wharton School of the University of Pennsylvania . He also holds the CFA designation . Nishil Mehta Managing Director Colin McGinnis Vice President

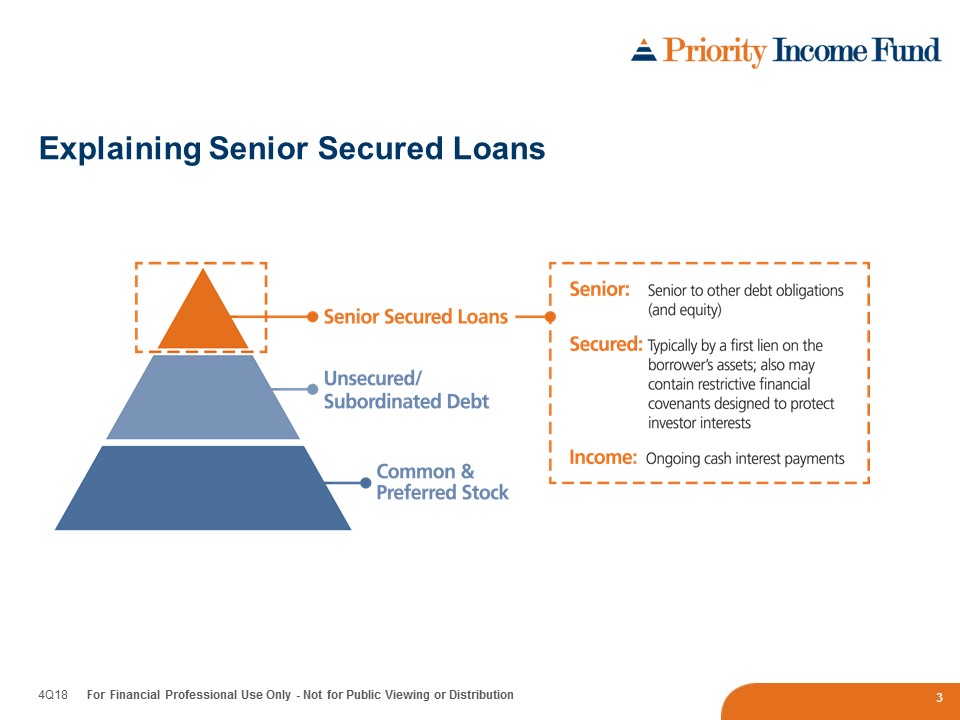

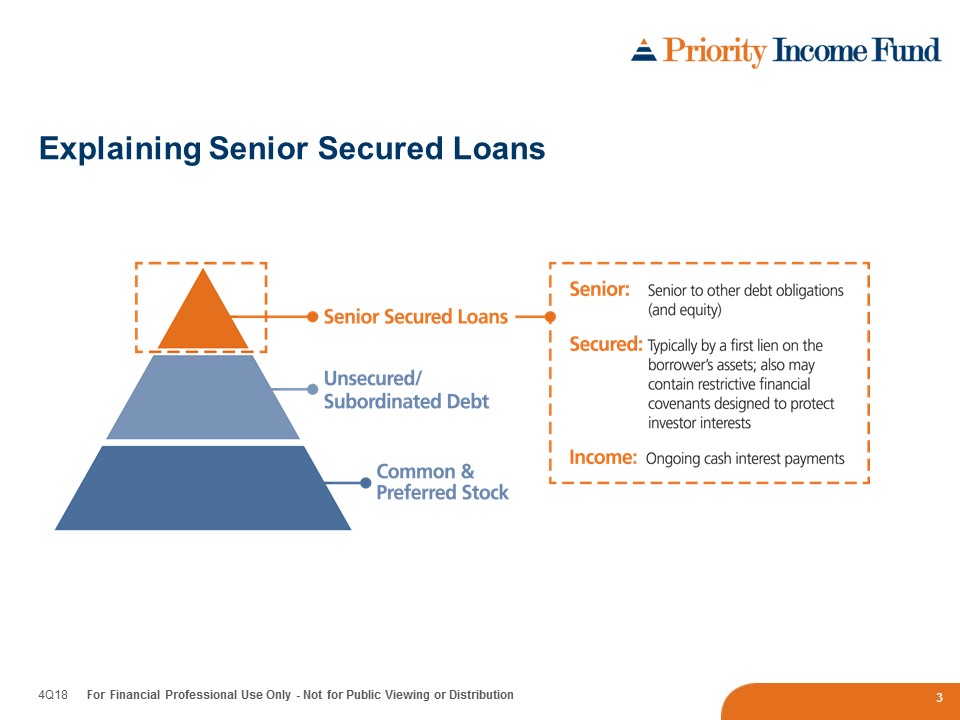

3 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution Explaining Senior Secured Loans

4 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution The Fund intends to invest in diversified pools of senior secured loans made to medium and large U.S. companies in industries such as: The Fund intends to generally limit exposure in the overall portfolio to approximately 2% in any one company and approximately 10% in any one industry. ▲ Business Equipment and Services ▲ Consumer Products and Services ▲ Energy and Power ▲ Financial Services ▲ Food and Beverage ▲ Healthcare ▲ Industrial and Manufacturing ▲ Media and Entertainment ▲ Retail ▲ Telecommunications Where the Fund Intends to Invest

5 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution † The equity owner, as the most subordinate position, receives remaining funds after liabilities are paid. Thus, should a decre ase in payments occur, it is typically the first position to be affected by the decrease. † Assets (senior secured loans) make interest payments 1 Interest payments are used first to pay liabilities 2 Once liabilities are paid, the interest that remains flows to the equity † 3 Fund’s Investment Goal: Generate Income Through a 3 - Step Process

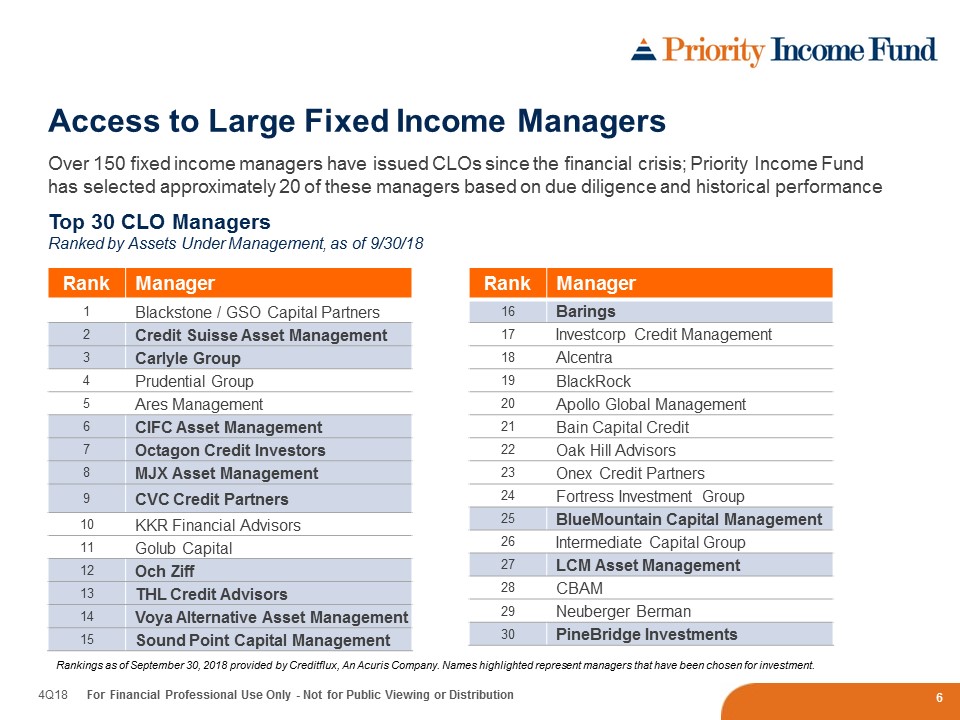

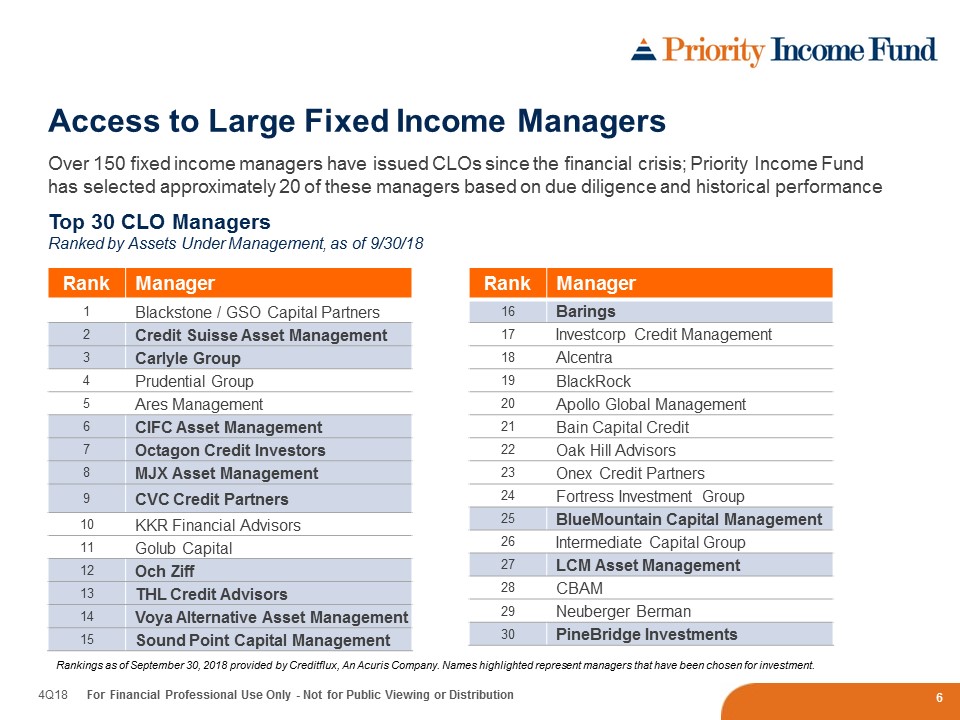

6 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution Access to Large Fixed Income Managers Top 30 CLO Managers Ranked by Assets Under Management, as of 9/30/18 Rank Manager 1 Blackstone / GSO Capital Partners 2 Credit Suisse Asset Management 3 Carlyle Group 4 Prudential Group 5 Ares Management 6 CIFC Asset Management 7 Octagon Credit Investors 8 MJX Asset Management 9 CVC Credit Partners 10 KKR Financial Advisors 11 Golub Capital 12 Och Ziff 13 THL Credit Advisors 14 Voya Alternative Asset Management 15 Sound Point Capital Management Rankings as of September 30, 2018 provided by Creditflux, An Acuris Company. Names highlighted represent managers that have been chosen for investment . Rank Manager 16 Barings 17 Investcorp Credit Management 18 Alcentra 19 BlackRock 20 Apollo Global Management 21 Bain Capital Credit 22 Oak Hill Advisors 23 Onex Credit Partners 24 Fortress Investment Group 25 BlueMountain Capital Management 26 Intermediate Capital Group 27 LCM Asset Management 28 CBAM 29 Neuberger Berman 30 PineBridge Investments Over 150 fixed income managers have issued CLOs since the financial crisis; Priority Income Fund has selected approximately 20 of these managers based on due diligence and historical performance

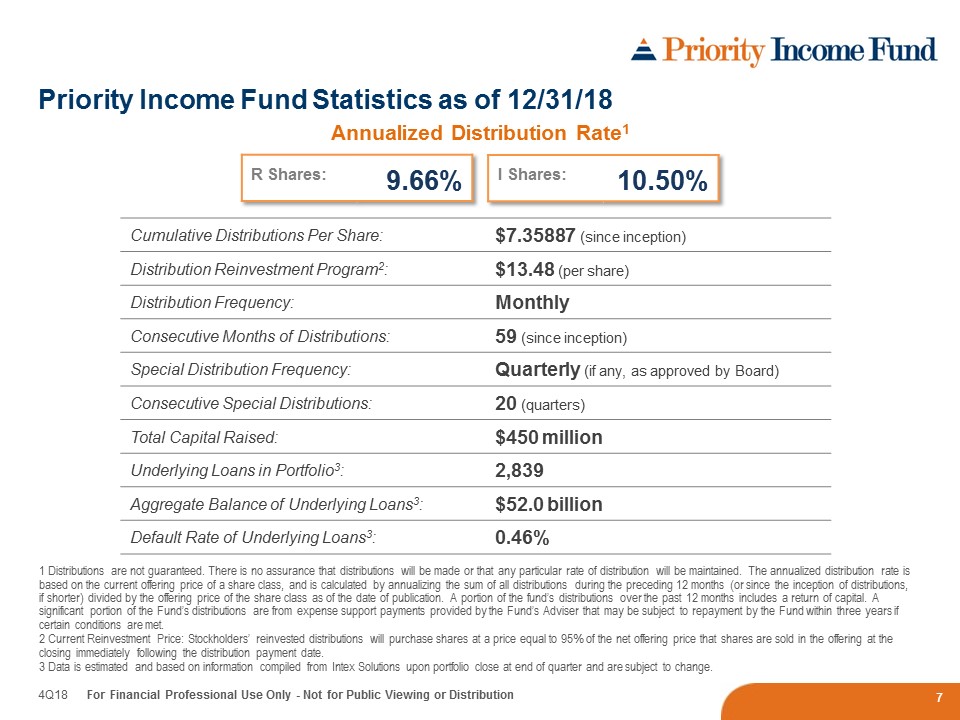

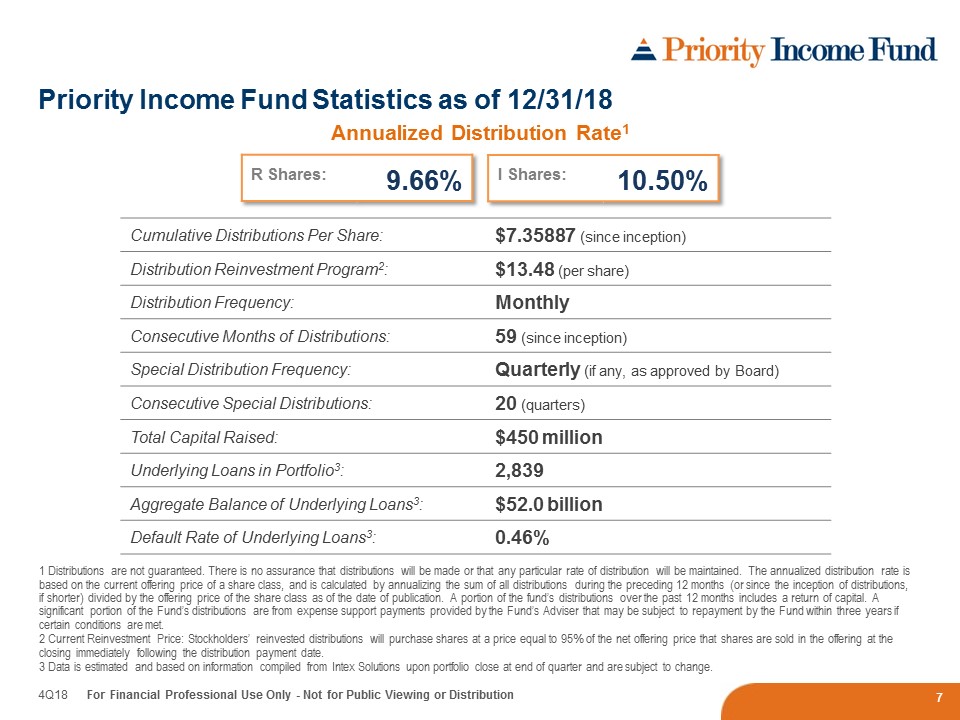

7 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution Priority Income Fund Statistics as of 12/31/18 Cumulative Distributions Per Share: $7.35887 (since inception) Distribution Reinvestment Program 2 : $13.48 (per share) Distribution Frequency: Monthly Consecutive Months of Distributions: 59 (since inception) Special Distribution Frequency: Quarterly (if any, as approved by Board) Consecutive Special Distributions: 20 (quarters) Total Capital Raised: $450 million Underlying Loans in Portfolio 3 : 2,839 Aggregate Balance of Underlying Loans 3 : $52.0 billion Default Rate of Underlying Loans 3 : 0.46% Annualized Distribution Rate 1 R Shares: 9.66% I Shares: 10.50% 1 Distributions are not guaranteed. There is no assurance that distributions will be made or that any particular rate of dist rib ution will be maintained. The annualized distribution rate is based on the current offering price of a share class, and is calculated by annualizing the sum of all distributions during th e p receding 12 months (or since the inception of distributions, if shorter) divided by the offering price of the share class as of the date of publication. A portion of the fund’s distribut ion s over the past 12 months includes a return of capital. A significant portion of the Fund’s distributions are from expense support payments provided by the Fund’s Adviser that may be sub ject to repayment by the Fund within three years if certain conditions are met. 2 Current Reinvestment Price: Stockholders’ reinvested distributions will purchase shares at a price equal to 95% of the net off ering price that shares are sold in the offering at the closing immediately following the distribution payment date. 3 Data is estimated and based on information compiled from Intex Solutions upon portfolio close at end of quarter and are sub jec t to change.

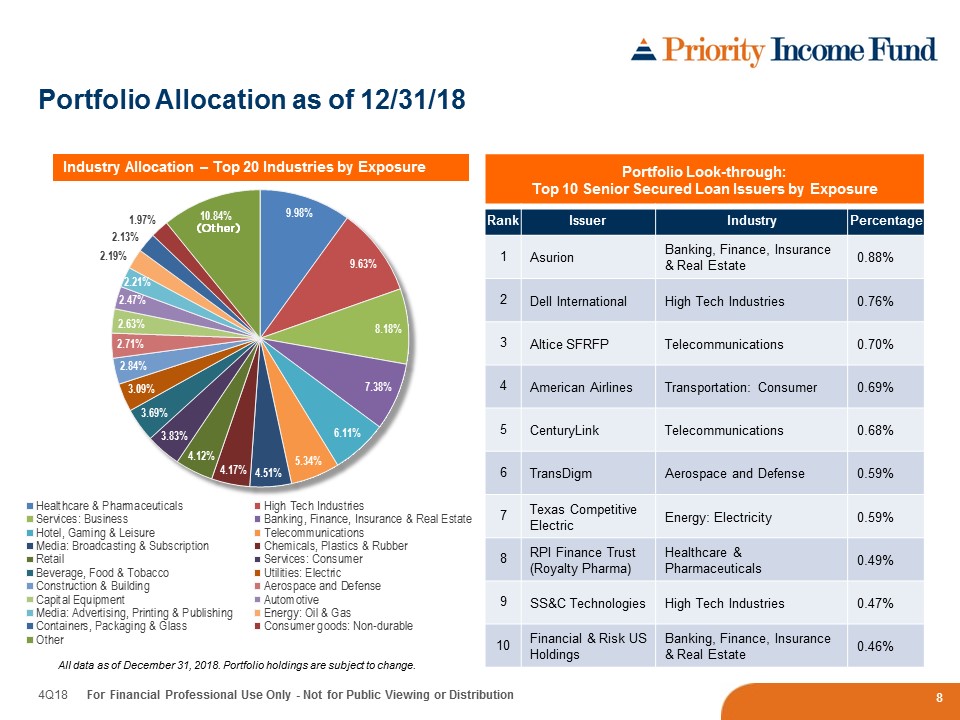

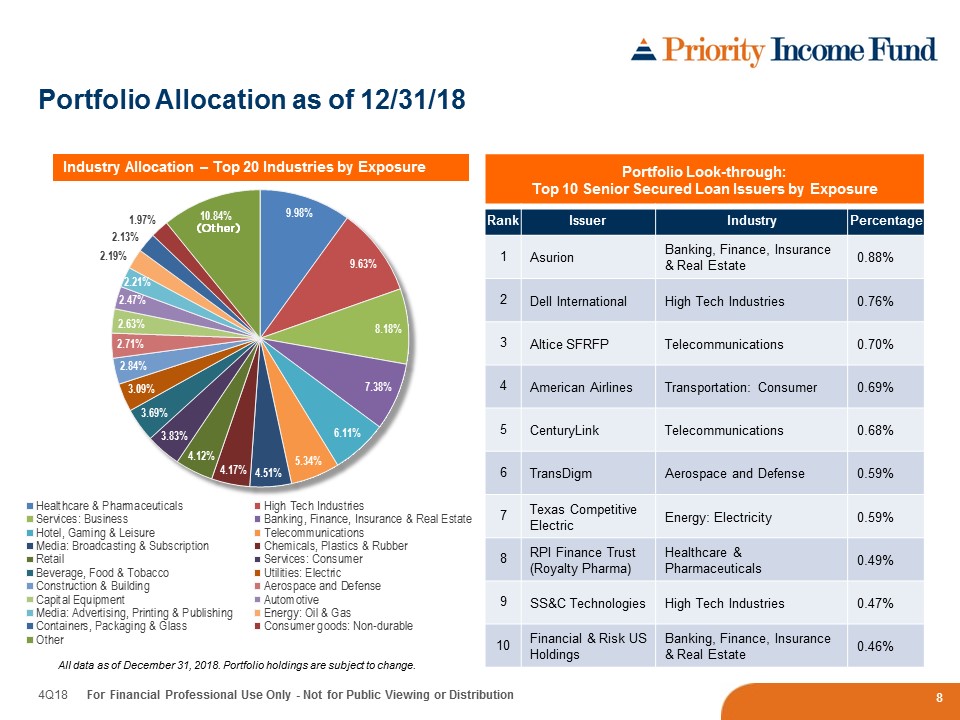

8 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution All data as of December 31, 2018. Portfolio holdings are subject to change. Portfolio Look - through: Top 10 Senior Secured Loan Issuers by Exposure Rank Issuer Industry Percentage 1 Asurion Banking, Finance, Insurance & Real Estate 0.88% 2 Dell International High Tech Industries 0.76% 3 Altice SFRFP Telecommunications 0.70% 4 American Airlines Transportation: Consumer 0.69% 5 CenturyLink Telecommunications 0.68% 6 TransDigm Aerospace and Defense 0.59% 7 Texas Competitive Electric Energy: Electricity 0.59% 8 RPI Finance Trust (Royalty Pharma) Healthcare & Pharmaceuticals 0.49% 9 SS&C Technologies High Tech Industries 0.47% 10 Financial & Risk US Holdings Banking, Finance, Insurance & Real Estate 0.46% Industry Allocation – Top 20 Industries by Exposure Portfolio Allocation as of 12/31/18 9.98% 9.63% 8.18% 7.38% 6.11% 5.34% 4.51% 4.17% 4.12% 3.83% 3.69% 3.09% 2.84% 2.71% 2.63% 2.47% 2.21% 2.19% 2.13% 1.97% 10.84% Healthcare & Pharmaceuticals High Tech Industries Services: Business Banking, Finance, Insurance & Real Estate Hotel, Gaming & Leisure Telecommunications Media: Broadcasting & Subscription Chemicals, Plastics & Rubber Retail Services: Consumer Beverage, Food & Tobacco Utilities: Electric Construction & Building Aerospace and Defense Capital Equipment Automotive Media: Advertising, Printing & Publishing Energy: Oil & Gas Containers, Packaging & Glass Consumer goods: Non-durable Other (Other)

9 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution With nearly three decades of experience in managing credit and alternative investments, Prospect Capital Management, LLC (“Prospect”) controls the day - to - day management of the investment portfolio: − Origination of investments − Servicing and management of investments An established asset management firm and registered investment advisor − Senior management team has worked together approximately 15 years through multiple economic cycles − More than 100 professionals across all functions Manage more than $6.3 billion of capital under management 1 Portfolio Manager Past performance is neither indicative nor a guarantee of future results. Prospect Capital Management data as of June 30, 2018, except as noted otherwise. 1 Capital under management includes equity, outstanding indebtedness and undrawn credit facilities as of June 30, 2018.

10 4Q18 For Financial Professional Use Only - Not for Public Viewing or Distribution Seasoned investment professionals − Senior team members’ experience averages over 20 years − Significant experience in originating, evaluating, structuring, and investing in senior secured loans and CLOs − Investment expertise across all levels of the corporate capital structure Focus on safety and capital preservation − Disciplined credit analysis and a highly systematic investment process − Employs a conservative investment approach focused on current cash income and long - term investment performance Broad multi - channel investment origination network − Team utilizes market knowledge, experience, and industry relationships to identify attractive investment opportunities Track Record Focus on credit investments including senior secured loans, pools of senior secured loans, unsecured debt and credit - focused energy investments Portfolio of $4.8 billion of senior secured loans and CLOs Past performance is neither indicative nor a guarantee of future results. Prospect Capital Management data as of December 31, 2018, except as noted otherwise. Portfolio Manager

3744 - 7 © Priority Senior Secured Income Management, LLC. Destra Capital Investments 444 West Lake Street, Suite 1700 Chicago, IL 60606 877.855.3434 www.destracapital.com member FINRA/SIPC Priority Income Fund Investors should consider the investment objective and policies, risk considerations, charges and ongoing expenses of an investment carefully before investing. The prospectus and summary prospectus contains this and other information relevant to an investment in the fund. Please read the prospectus or summary prospectus carefully before you invest or send money. To obtain a prospectus, please contact your investment representative or Destra Capital Investments LLC at 877.855.3434 or access our website at destracapital.com.

Additional Information and Where to Find It

In connection with the proposed merger of Stira Alcentra Global Credit Fund (“SAGC”) with and into Priority Income Fund Inc. (“Priority”), Priority and SAGC have filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form N-14 that includes a prospectus and a proxy statement on Schedule 14A (collectively, the “Joint Proxy Statement/Prospectus”) that will be mailed to shareholders of SAGC following effectiveness of the Registration Statement on Form N-14. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT PRIORITY, SAGC, THE PROPOSED MERGER AND RELATED MATTERS. Investors and security holders are able to obtain the Joint Proxy Statement/Prospectus and other documents filed with the SEC, free of charge, from the SEC’s website (www.sec.gov) and from SAGC’s website (www.stiraALLternatives.com). Investors and security holders may also obtain free copies of the Joint Proxy Statement/Prospectus and other documents filed with the SEC by contacting SAGC at (877) 567-7264.

Participants in the Solicitation

SAGC and Priority and their respective trustees/directors, executive officers, other members of their management, employees and other persons may be deemed to be participants in the anticipated solicitation of proxies in connection with the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of SAGC shareholders in connection with the proposed merger is set forth in the Joint Proxy Statement/Prospectus filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the Joint Proxy Statement/Prospectus and in other relevant materials that may be to be filed with the SEC. These documents may be obtained free of charge from the sources indicated above.

No Offer or Solicitation

The information in this communication is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.