UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One) |

| |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2020

OR

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to ____________

Commission File No.: 001-38033

|

| |

| DXC TECHNOLOGY COMPANY |

| (Exact name of registrant as specified in its charter) |

|

| | | | | | |

| Nevada | | 61-1800317 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | |

| 1775 Tysons Boulevard | | | | |

| Tysons | , | Virginia | | 22102 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | |

Registrant's telephone number, including area code: (703) 245-9675

|

| | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | DXC | New York Stock Exchange |

| 2.750% Senior Notes Due 2025 | DXC 25 | New York Stock Exchange |

| 1.750% Senior Notes Due 2026 | DXC 26 | New York Stock Exchange |

| | | | | | | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

| Large Accelerated Filer | x | | | Accelerated Filer | o | | | |

| | | | | | | | | |

| Non-accelerated Filer | o | | | Smaller reporting company | ☐ | |

| | | | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes x No

254,194,590 shares of common stock, par value $0.01 per share, were outstanding on July 31, 2020.

TABLE OF CONTENTS

|

| | | |

| Item | | | Page |

| | | | |

| | | | |

| 1. | | | |

| 2. | | | |

| 3. | | | |

| 4. | | | |

| | | | |

| | | | |

| | | | |

| 1. | | | |

| 1A. | | | |

| 2. | | | |

| 3. | | | |

| 4. | | | |

| 5. | | | |

| 6. | | | |

PART I

ITEM 1. FINANCIAL STATEMENTS

Index to Condensed Consolidated Financial Statements

DXC TECHNOLOGY COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

|

| | | | | | | | |

| | | Three Months Ended |

| (in millions, except per-share amounts) | | June 30, 2020 | | June 30, 2019 |

| | | | | |

| Revenues | | $ | 4,502 |

| | $ | 4,890 |

|

| | | | | |

| Costs of services (excludes depreciation and amortization and restructuring costs) | | 3,629 |

| | 3,622 |

|

| Selling, general, and administrative (excludes depreciation and amortization and restructuring costs) | | 539 |

| | 507 |

|

| Depreciation and amortization | | 492 |

| | 470 |

|

| Restructuring costs | | 72 |

| | 142 |

|

| Interest expense | | 106 |

| | 91 |

|

| Interest income | | (23 | ) | | (30 | ) |

| Other income, net | | (88 | ) | | (118 | ) |

| Total costs and expenses | | 4,727 |

| | 4,684 |

|

| | | | | |

| (Loss) income before income taxes | | (225 | ) | | 206 |

|

| Income tax (benefit) expense | | (26 | ) | | 38 |

|

| Net (loss) income | | (199 | ) | | 168 |

|

| Less: net income attributable to non-controlling interest, net of tax | | 6 |

| | 5 |

|

| Net (loss) income attributable to DXC common stockholders | | $ | (205 | ) | | $ | 163 |

|

| | | | | |

| (Loss) income per common share: | | | | |

| Basic | | $ | (0.81 | ) | | $ | 0.61 |

|

| Diluted | | $ | (0.81 | ) | | $ | 0.61 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

DXC TECHNOLOGY COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (unaudited)

|

| | | | | | | | | | |

| | | | | Three Months Ended |

| (in millions) | | June 30, 2020 | | June 30, 2019 |

| | | | | | | |

| Net (loss) income | | $ | (199 | ) | | $ | 168 |

|

| Other comprehensive income (loss), net of taxes: | | | | |

| | Foreign currency translation adjustments, net of tax benefit of $7 and $12 | | (3 | ) | | (135 | ) |

| | Cash flow hedges adjustments, net of tax expense of $3 and $0 | | 11 |

| | 4 |

|

| | Available-for-sale securities, net of tax expense of $0 and $1 | | 4 |

| | 1 |

|

| | Pension and other post-retirement benefit plans, net of tax: | | | | |

| | | Amortization of prior service cost, net of tax benefit of $1 and $0 | | (9 | ) | | (1 | ) |

| | Pension and other post-retirement benefit plans, net of tax | | (9 | ) | | (1 | ) |

| Other comprehensive income (loss), net of taxes | | 3 |

| | (131 | ) |

| Comprehensive (loss) income | | (196 | ) | | 37 |

|

| | Less: comprehensive income (loss) attributable to non-controlling interest | | 5 |

| | (19 | ) |

| Comprehensive (loss) income attributable to DXC common stockholders | | $ | (201 | ) | | $ | 56 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

DXC TECHNOLOGY COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited) |

| | | | | | | | |

| | | As of |

| (in millions, except per-share and share amounts) | | June 30, 2020 | | March 31, 2020 |

| ASSETS | | | |

|

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 5,509 |

| | $ | 3,679 |

|

| Receivables and contract assets, net of allowance of $104 and $74 | | 4,271 |

| | 4,392 |

|

| Prepaid expenses | | 667 |

| | 646 |

|

| Other current assets | | 261 |

| | 270 |

|

| Total current assets | | 10,708 |

| | 8,987 |

|

| | | | | |

| Intangible assets, net of accumulated amortization of $4,627 and $4,347 | | 5,540 |

| | 5,731 |

|

| Operating right-of-use assets, net | | 1,602 |

| | 1,428 |

|

| Goodwill | | 2,057 |

| | 2,017 |

|

| Deferred income taxes, net | | 285 |

| | 265 |

|

| Property and equipment, net of accumulated depreciation of $4,072 and $3,818 | | 3,503 |

| | 3,547 |

|

| Other assets | | 4,199 |

| | 4,031 |

|

| Total Assets | | $ | 27,894 |

| | $ | 26,006 |

|

| | | | | |

| LIABILITIES and EQUITY | | | | |

| Current liabilities: | | | | |

| Short-term debt and current maturities of long-term debt | | 1,682 |

| | 1,276 |

|

| Accounts payable | | 1,522 |

| | 1,598 |

|

| Accrued payroll and related costs | | 766 |

| | 630 |

|

| Current operating lease liabilities | | 488 |

| | 482 |

|

| Accrued expenses and other current liabilities | | 2,756 |

| | 2,801 |

|

| Deferred revenue and advance contract payments | | 1,030 |

| | 1,021 |

|

| Income taxes payable | | 81 |

| | 87 |

|

| Total current liabilities | | 8,325 |

| | 7,895 |

|

| | | | | |

| Long-term debt, net of current maturities | | 10,334 |

| | 8,672 |

|

| Non-current deferred revenue | | 733 |

| | 735 |

|

| Non-current operating lease liabilities | | 1,208 |

| | 1,063 |

|

| Non-current income tax liabilities and deferred tax liabilities | | 1,075 |

| | 1,157 |

|

| Other long-term liabilities | | 1,277 |

| | 1,355 |

|

| Total Liabilities | | 22,952 |

| | 20,877 |

|

| | | | | |

| Commitments and contingencies | |

|

| |

|

|

| | | | | |

| DXC stockholders’ equity: | | | | |

| Preferred stock, par value $.01 per share, 1,000,000 shares authorized, none issued as of June 30, 2020 and March 31, 2020 | | — |

| | — |

|

| Common stock, par value $.01 per share, 750,000,000 shares authorized, 256,382,532 issued as of June 30, 2020 and 255,674,040 issued as of March 31, 2020 | | 3 |

| | 3 |

|

| Additional paid-in capital | | 10,729 |

| | 10,714 |

|

| Accumulated deficit | | (5,386 | ) | | (5,177 | ) |

| Accumulated other comprehensive loss | | (599 | ) | | (603 | ) |

| Treasury stock, at cost, 2,291,790 and 2,148,708 shares as of June 30, 2020 and March 31, 2020 | | (154 | ) | | (152 | ) |

| Total DXC stockholders’ equity | | 4,593 |

| | 4,785 |

|

| Non-controlling interest in subsidiaries | | 349 |

| | 344 |

|

| Total Equity | | 4,942 |

| | 5,129 |

|

| Total Liabilities and Equity | | $ | 27,894 |

| | $ | 26,006 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

DXC TECHNOLOGY COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited) |

| | | | | | | | |

| | | Three Months Ended |

| (in millions) | | June 30, 2020 | | June 30, 2019 |

| Cash flows from operating activities: | | | | |

| Net (loss) income | | $ | (199 | ) | | $ | 168 |

|

| Adjustments to reconcile net (loss) income to net cash provided by (used in) operating activities: | | | | |

| Depreciation and amortization | | 496 |

| | 474 |

|

| Operating right-of-use expense | | 156 |

| | 176 |

|

| Pension & other post-employment benefits, actuarial & settlement losses | | 2 |

| | — |

|

| Share-based compensation | | 16 |

| | 18 |

|

| Loss (gain) on dispositions | | 4 |

| | (8 | ) |

| Provision for losses on accounts receivable | | 35 |

| | (4 | ) |

| Unrealized foreign currency exchange gain | | (11 | ) | | (14 | ) |

| Other non-cash charges, net | | 7 |

| | (1 | ) |

| Changes in assets and liabilities, net of effects of acquisitions and dispositions: | | | | |

| Increase in assets | | (100 | ) | | (335 | ) |

| Decrease in operating lease liability | | (156 | ) | | (174 | ) |

| Decrease in other liabilities | | (131 | ) | | (366 | ) |

| Net cash provided by (used in) operating activities | | 119 |

| | (66 | ) |

| | | | | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment | | (95 | ) | | (105 | ) |

| Payments for transition and transformation contract costs | | (82 | ) | | (72 | ) |

| Software purchased and developed | | (48 | ) | | (63 | ) |

| Payments for acquisitions, net of cash acquired | | (10 | ) | | (1,911 | ) |

| Cash collections related to deferred purchase price receivable | | 159 |

| | 371 |

|

| Proceeds from sale of assets | | 6 |

| | 21 |

|

| Short-term investing | | — |

| | (75 | ) |

| Other investing activities, net | | 9 |

| | 12 |

|

| Net cash used in investing activities | | (61 | ) | | (1,822 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Borrowings of commercial paper | | 748 |

| | 1,401 |

|

| Repayments of commercial paper | | (317 | ) | | (1,401 | ) |

| Borrowings under lines of credit | | 2,500 |

| | — |

|

| Repayment of borrowings under lines of credit | | (750 | ) | | — |

|

| Borrowings on long-term debt, net of discount | | 993 |

| | 2,198 |

|

| Principal payments on long-term debt | | (1,084 | ) | | (509 | ) |

| Payments on finance leases and borrowings for asset financing | | (245 | ) | | (210 | ) |

| Proceeds from stock options and other common stock transactions | | — |

| | 7 |

|

| Taxes paid related to net share settlements of share-based compensation awards | | (3 | ) | | (12 | ) |

| Repurchase of common stock and advance payment for accelerated share repurchase | | — |

| | (500 | ) |

| Dividend payments | | (53 | ) | | (51 | ) |

| Other financing activities, net | | (3 | ) | | (36 | ) |

| Net cash provided by financing activities | | 1,786 |

| | 887 |

|

| Effect of exchange rate changes on cash and cash equivalents | | (14 | ) | | (30 | ) |

| Net increase (decrease) in cash and cash equivalents | | 1,830 |

| | (1,031 | ) |

| Cash and cash equivalents at beginning of year | | 3,679 |

| | 2,899 |

|

| Cash and cash equivalents at end of period | | $ | 5,509 |

| | $ | 1,868 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

DXC TECHNOLOGY COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2020 |

| (in millions, except shares in thousands) | Common Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Loss | Treasury Stock (1) | Total DXC Equity | Non- Controlling Interest | Total Equity |

| Shares | | Amount |

| Balance at March 31, 2020 | 255,674 |

| | $ | 3 |

| $ | 10,714 |

| $ | (5,177 | ) | $ | (603 | ) | $ | (152 | ) | $ | 4,785 |

| $ | 344 |

| $ | 5,129 |

|

| Cumulative effect of adopting ASU 2016-13 | | | | | (4 | ) | | | (4 | ) | | (4 | ) |

| Net loss | | | | | (205 | ) | | | (205 | ) | 6 |

| (199 | ) |

| Other comprehensive income | | | | | | 4 |

| | 4 |

| (1 | ) | 3 |

|

| Share-based compensation expense | | | | 15 |

| | | | 15 |

| | 15 |

|

| Acquisition of treasury stock | | | | | | | (2 | ) | (2 | ) | | (2 | ) |

| Stock option exercises and other common stock transactions | 709 |

| | |

|

| | | | — |

| | — |

|

| Balance at June 30, 2020 | 256,383 |

| | $ | 3 |

| $ | 10,729 |

| $ | (5,386 | ) | $ | (599 | ) | $ | (154 | ) | $ | 4,593 |

| $ | 349 |

| $ | 4,942 |

|

| | | | | | | | | | | |

| | Three Months Ended June 30, 2019 |

| (in millions, except shares in thousands) | Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Treasury Stock | Total DXC Equity | Non- Controlling Interest | Total Equity |

| Shares | | Amount |

| Balance at March 31, 2019 | 270,214 |

| | $ | 3 |

| $ | 11,301 |

| $ | 478 |

| $ | (244 | ) | $ | (136 | ) | $ | 11,402 |

| $ | 323 |

| $ | 11,725 |

|

| Net income | | | | | 163 |

| | | 163 |

| 5 |

| 168 |

|

| Other comprehensive loss | | | | | | (107 | ) | | (107 | ) | (24 | ) | (131 | ) |

| Share-based compensation expense | | | | 18 |

| | | | 18 |

| | 18 |

|

| Acquisition of treasury stock | | | | | | | (13 | ) | (13 | ) | | (13 | ) |

| Share repurchase program | (7,360 | ) | | | (410 | ) | (90 | ) | | | (500 | ) | | (500 | ) |

| Stock option exercises and other common stock transactions | 855 |

| | | 7 |

| | | | 7 |

| | 7 |

|

| Dividends declared ($0.21 per share) | | | | | (57 | ) | | | (57 | ) | | (57 | ) |

| Balance at June 30, 2019 | 263,709 |

| | $ | 3 |

| $ | 10,916 |

| $ | 494 |

| $ | (351 | ) | $ | (149 | ) | $ | 10,913 |

| $ | 304 |

| $ | 11,217 |

|

(1) 2,291,790 treasury shares as of June 30, 2020.

The accompanying notes are an integral part of these condensed consolidated financial statements.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Note 1 - Summary of Significant Accounting Policies

Business

DXC Technology Company ("DXC," the "Company," "we," "us," or "our") helps global companies run their mission critical systems and operations while modernizing IT, optimizing data architectures, and ensuring security and scalability across public, private and hybrid clouds. With decades of driving innovation, the world’s largest companies trust DXC to deploy its enterprise technology stack to deliver new levels of performance, competitiveness and customer experiences.

HHS Sale

On March 9, 2020, DXC entered into a definitive agreement to sell (the “HHS Sale”) its U.S. State and Local Health and Human Services business (the “HHS Business”) to Veritas Capital Fund Management, L.L.C. for $5.0 billion in cash. The HHS Business is an end-to-end provider of technology-enabled, mission critical solutions that are fundamental to the administration and operations of health programs throughout the United States. The transaction is expected to close by September 2020, but no later than December 2020, subject to the satisfaction of certain closing conditions. Following the transaction close, DXC will retain its remaining healthcare practice, servicing customers across the healthcare continuum, including payers, providers and life sciences firms.

Luxoft Acquisition

On June 14, 2019, DXC completed its acquisition of Luxoft Holding, Inc. ("Luxoft"), a global digital strategy and software engineering firm (the "Luxoft Acquisition"). The acquisition builds on DXC’s unique value proposition as an end-to-end, mainstream IT and digital services market leader, and strengthens the Company’s ability to design and deploy transformative digital solutions for clients at scale. See Note 3 - "Acquisitions" for further information.

Basis of Presentation

In order to make this report easier to read, DXC refers throughout to (i) the interim unaudited Condensed Consolidated Financial Statements as the “financial statements,” (ii) the Condensed Consolidated Statements of Operations as the “statements of operations,” (iii) the Condensed Consolidated Statements of Comprehensive (Loss) Income as the "statements of comprehensive income," (iv) the Condensed Consolidated Balance Sheets as the “balance sheets,” and (v) the Condensed Consolidated Statements of Cash Flows as the “statements of cash flows.” In addition, references throughout to numbered “Notes” refer to the numbered Notes in these Notes to Condensed Consolidated Financial Statements, unless otherwise noted.

The accompanying financial statements include the accounts of DXC, its consolidated subsidiaries, and those business entities in which DXC maintains a controlling interest. Investments in business entities in which the Company does not have control, but has the ability to exercise significant influence over operating and financial policies, are accounted for by the equity method. Other investments are accounted for by the cost method. Non-controlling interests are presented as a separate component within equity in the balance sheets. Net earnings attributable to the non-controlling interests are presented separately in the statements of operations and comprehensive income attributable to non-controlling interests are presented separately in the statements of comprehensive income. All intercompany transactions and balances have been eliminated.

The financial statements of the Company have been prepared in accordance with the rules and regulations of the U.S. Securities and Exchange Commission for quarterly reports and accounting principles generally accepted in the United States ("GAAP"). Certain disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules. These financial statements should therefore be read in conjunction with the audited consolidated financial statements and accompanying notes included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2020 ("fiscal 2020").

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Use of Estimates

The preparation of financial statements in conformity with GAAP, requires the Company's management to make estimates and assumptions that affect amounts reported in the financial statements. The Company bases its estimates on assumptions regarding historical experience, currently available information and anticipated developments that it believes are reasonable and appropriate. However, because the use of estimates involves an inherent degree of uncertainty, actual results could differ from those estimates. The severity, magnitude and duration, as well as the economic consequences of the coronavirus disease 2019 ("COVID-19") pandemic, are uncertain, rapidly changing and difficult to predict. Therefore, accounting estimates and assumptions may change over time in response to COVID-19 and may change materially in future periods. In the opinion of the Company's management, the accompanying financial statements of DXC contain all adjustments, including normal recurring adjustments, necessary to present fairly the Company's financial statements. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full fiscal year.

Allowance for Credit Losses

Effective April 1, 2020, the Company adopted ASU 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” using the modified retrospective method. Refer to Note 2 - "Recent Accounting Pronouncements" and Note 5 - "Receivables" for further discussion of the impact of adoption and other required disclosures. The amendments in this update changed the guidance for credit losses to an expected loss model rather than an incurred loss model. Financial assets subject to impairment under an expected credit loss model include billed and unbilled receivables, other receivables, and contract assets. Certain off-balance sheet arrangements, such as financial guarantees associated with receivables securitization facilities, are also subject to the guidance of ASU 2016-13.

Under an expected credit loss model, the Company immediately recognizes an estimate of credit losses expected to occur over the remaining life of financial assets that are in the scope of ASU 2016-13. DXC considers all available relevant information when estimating expected credit losses, including past events, current market conditions and forecasts and their implications for expected credit losses.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 2 - Recent Accounting Pronouncements

During the three months ended June 30, 2020, DXC adopted the following Accounting Standards Updates ("ASU") issued by the Financial Accounting Standards Board:

|

| | | |

| Date Issued and ASU | Date Adopted and Method | Description | Impact |

June 2016

ASU 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” | April 1, 2020 Modified Retrospective | This update requires the measurement and recognition of expected credit losses using the current expected credit loss model for financial assets held at amortized cost, which includes the Company’s trade accounts receivable, certain financial instruments and contract assets. It replaces the existing incurred loss impairment model with an expected loss methodology. The recorded credit losses are adjusted each period for changes in expected lifetime credit losses. The standard requires a cumulative effect adjustment to the statement of financial position as of the beginning of the first reporting period in which the guidance is effective.

| The Company adopted this standard using the modified retrospective approach and recorded an immaterial cumulative effect adjustment in retained earnings as of April 1, 2020.

|

August 2018

ASU 2018-15, "Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract"

| April 1, 2020 Prospective

| This update helps entities evaluate the accounting for fees paid by a customer in a cloud computing arrangement (hosting arrangement) by providing guidance for determining when the arrangement includes a software license. Entities have the option to apply this standard prospectively to all implementation costs incurred after the date of adoption or retrospectively.

| The Company adopted this standard using the prospective method and determined that the adoption of ASU 2018-15 had no material impact to its condensed consolidated financial statements.

|

The following ASUs were recently issued but have not yet been adopted by DXC:

|

| | | |

| Date Issued and ASU | DXC Effective Date | Description | Impact |

December 2019

ASU 2019-12, "Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes" | Fiscal 2022 | This update is intended to simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740. The amendments also improve consistent application of and simplify GAAP for other areas of Topic 740 by clarifying and amending existing guidance. Early adoption of this update is permitted. | The Company is currently evaluating the potential impact this standard may have on its financial statements in future reporting periods. |

Other recently issued ASUs effective after June 30, 2020 are not expected to have a material effect on DXC's consolidated financial statements.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 3 - Acquisitions

Fiscal 2020 Acquisitions

Luxoft Acquisition

On June 14, 2019, DXC completed the acquisition of Luxoft, a digital service provider whose offerings encompass strategic consulting, custom software development services, and digital solution engineering for total consideration of $2.0 billion. The acquisition will combine Luxoft’s digital engineering capabilities with DXC’s expertise in IT modernization and integration. The purchase agreement (“Merger Agreement”) was entered into by DXC and Luxoft on January 6, 2019 and the transaction was closed on June 14, 2019 (the "acquisition date.")

The transaction between DXC and Luxoft is an acquisition, with DXC as the acquirer and Luxoft as the acquiree, based on the fact that DXC acquired 100% of the equity interests and voting rights in Luxoft, and that DXC is the entity that transferred the cash consideration.

The Company's allocation of the purchase price to the assets acquired and liabilities assumed as of the Luxoft acquisition date is as follows:

|

| | | | |

| (in millions) | | Fair Value |

| Cash and cash equivalents | | $ | 113 |

|

| Accounts receivable | | 233 |

|

| Other current assets | | 15 |

|

| Total current assets | | 361 |

|

| Property and equipment | | 31 |

|

| Intangible assets | | 577 |

|

| Other assets | | 99 |

|

| Total assets acquired | | 1,068 |

|

| Accounts payable, accrued payroll, accrued expenses, and other current liabilities | | (121 | ) |

| Deferred revenue | | (8 | ) |

| Long-term deferred tax liabilities and income tax payable | | (106 | ) |

| Other liabilities | | (72 | ) |

| Total liabilities assumed | | (307 | ) |

| Net identifiable assets acquired | | 761 |

|

| Goodwill | | 1,262 |

|

| Total consideration transferred | | $ | 2,023 |

|

Goodwill represents the excess of the purchase price over the fair value of identifiable assets acquired and liabilities assumed at the acquisition date. The goodwill recognized with the acquisition was attributable to the synergies expected to be achieved by combining the businesses of DXC and Luxoft, expected future contracts and the acquired workforce. The cost-saving opportunities are expected to include improved operating efficiencies and asset optimization. The total goodwill arising from the acquisition was allocated to Global Business Services ("GBS") and is not deductible for tax purposes. See Note 10 - "Goodwill."

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

The Company valued current assets and liabilities using existing carrying values as an estimate of the approximate fair value of those items at the acquisition date except for certain contract receivables for which the Company determined fair value based on a cost plus margin approach. The Company valued acquired property and equipment using predominately the direct capitalization method of the income approach and in certain specific cases, the Company determined that the net book value represents the fair value. The Company valued customer relationships using the multi-period excess earnings method under the income approach and valued trade names and developed technology using a relief from royalty method under the income approach. The Company determined that the net book value of the purchased software represents the fair value.

Below are the estimated useful lives of the acquired intangibles:

|

| | |

| | | Estimated Useful Lives (Years) |

| Customer related intangibles | | 10 |

| Trade names | | 20 |

| Developed technology | | 3 |

| Third-party purchased software | | 3 |

The Company valued deferred tax liabilities based on statutory tax rates in the jurisdictions of the legal entities where the acquired non-current assets and liabilities are taxed.

Note 4 - Earnings (Loss) per Share

Basic earnings (loss) per share ("EPS") is computed using the weighted average number of shares of common stock outstanding during the period. Diluted EPS reflects the incremental shares issuable upon the assumed exercise of stock options and equity awards. The following table reflects the calculation of basic and diluted EPS: |

| | | | | | | | |

|

| Three Months Ended |

| (in millions, except per-share amounts) |

| June 30, 2020 | | June 30, 2019 |

| Net (loss) income attributable to DXC common shareholders: | | $ | (205 | ) | | $ | 163 |

|

| | | | | |

| Common share information: | | | | |

| Weighted average common shares outstanding for basic EPS | | 253.63 |

| | 267.00 |

|

| Dilutive effect of stock options and equity awards | | — |

| | 1.97 |

|

| Weighted average common shares outstanding for diluted EPS | | 253.63 |

| | 268.97 |

|

| | | | | |

| (Loss) Earnings per share: | | | | |

| Basic | | $ | (0.81 | ) | | $ | 0.61 |

|

| Diluted | | $ | (0.81 | ) | | $ | 0.61 |

|

Certain share-based equity awards were excluded from the computation of dilutive EPS because inclusion of these awards would have had an anti-dilutive effect. The number of awards excluded were as follows:

|

| | | | | | |

| | | Three Months Ended |

| | | June 30, 2020(1) | | June 30, 2019 |

| Stock Options | | 1,749,189 |

| | 4,824 |

|

| Restricted Stock Units | | 3,149,436 |

| | 589,569 |

|

| Performance Stock Units | | 233,762 |

| | — |

|

(1) Due to the Company's net loss for the three months ended June 30, 2020, stock options, restricted stock units and performance stock units were excluded from the computation of dilutive EPS because they would have had an anti-dilutive effect.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 5 - Receivables

Receivables Facility

The Company has an accounts receivable sales facility (as amended, restated, supplemented or otherwise modified as of June 30, 2020, the "Receivables Facility") with certain unaffiliated financial institutions (the "Purchasers") for the sale of commercial accounts receivable in the United States. Under the Receivables Facility, certain of the Company's subsidiaries (the "Sellers") sell accounts receivable to DXC Receivables LLC ("Receivables SPV"), a wholly owned bankruptcy-remote entity, in a true sale. Receivables SPV subsequently sells certain of the receivables in their entirety to the Purchasers pursuant to a receivables purchase agreement. The financial obligations of Receivables SPV to the Purchasers under the Receivables Facility are limited to the assets it owns and non-recourse to the Company. Sales of receivables by Receivables SPV occur continuously and are settled on a monthly basis. During the first quarter of fiscal 2021, Receivables SPV amended the Receivables Facility (the "Amendment") to decrease the facility limit from $750 million to $600 million and extend the termination date to August 19, 2020. Under the terms of the Receivables Facility, there is no longer any deferred purchase price ("DPP") for receivables as the entire purchase price is paid in cash when the receivables are sold to the Purchasers. Prior to the Amendment, DPPs were realized by Receivables SPV upon the ultimate collection of the underlying receivables sold to the Purchasers. Cash receipts on the DPP were classified as cash flows from investing activities.

The amount available under the Receivables Facility fluctuates over time based on the total amount of eligible receivables generated during the normal course of business after deducting excess concentrations. As of June 30, 2020, the total availability under the Receivables Facility was $324 million, and the amount sold to the Purchasers was $403 million, which was derecognized from the Company's balance sheet. As of June 30, 2020, the Company recorded a $79 million liability within accounts payable because the amount of cash proceeds received by the Company under the Receivables Facility was more than the total availability. The Receivables Facility is scheduled to terminate on August 19, 2020, but provides for 1 or more optional one-year extensions, if agreed to by the Purchasers. The Company uses the proceeds from the sale of receivables under the Receivables Facility for general corporate purposes.

The fair value of the sold receivables approximated book value due to the short-term nature, and as a result, 0 gain or loss on sale of receivables was recorded.

While the Company guarantees certain non-financial performance obligations of the Sellers, the Purchasers bear customer credit risk associated with the receivables sold under the Receivables Facility and have recourse in the event of credit-related customer non-payment solely to the assets of the Receivables SPV.

The following table is a reconciliation of the beginning and ending balance of the DPP:

|

| | | | |

| (in millions) | | As of and for the Three Months Ended |

| | | June 30, 2019 |

| Beginning balance | | $ | 574 |

|

| Transfers of receivables | | 1,214 |

|

| Collections | | (1,265 | ) |

| Change in funding availability | | 2 |

|

| Ending balance | | $ | 525 |

|

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Milano Receivables Facility

On June 5, 2020, the Company entered into an accounts receivable securitization facility (the "Milano Facility") with certain unaffiliated financial institutions (the "Milano Purchasers") for the sale of commercial accounts receivable related to Medicaid Management Information Systems ("MMiS") contracts in the United States. The Milano Facility is scheduled to terminate on June 4, 2021, but provides for 1 or more optional one-year extensions, if agreed to by the Purchasers. The Milano Facility has a facility limit of $275 million. Under the Milano Facility, certain of the Company's subsidiaries (the "Milano Sellers") sell MMiS accounts receivable to Milano Receivables Funding LLC ("Milano Receivables SPV"), a wholly owned bankruptcy-remote entity, in a true sale. Milano Receivables SPV subsequently sells the receivables in their entirety to the Milano Purchasers pursuant to a receivables purchase agreement. The financial obligations of Milano Receivables SPV to the Milano Purchasers under the Milano Facility are limited to the assets it owns and non-recourse to the Company. Sales of MMiS receivables by Milano Receivables SPV occur continuously and are settled on a monthly basis.

The amount available under the Milano Facility fluctuates over time based on the total amount of eligible receivables generated during the normal course of business after deducting excess concentrations. As of June 30, 2020, the total availability under the Milano Facility was approximately $251 million, and the amount sold to the Milano Purchasers was $263 million, which was derecognized from the Company's balance sheet. As of June 30, 2020, the Company recorded a $12 million liability within accounts payable because the amount of cash proceeds received by the Company under the Milano Facility was more than the total availability. The Company uses the proceeds from the sale of receivables under the Milano Facility for general corporate purposes.

The fair value of the sold receivables approximated book value due to the short-term nature, and as a result, 0 gain or loss on sale of receivables was recorded.

While the Company guarantees certain non-financial performance obligations of the Milano Sellers, the Milano Purchasers bear customer credit risk associated with the receivables sold under the Milano Facility and have recourse in the event of credit-related customer non-payment solely to the assets of the Milano Receivables SPV.

German Receivables Facility

On October 1, 2019, the Company executed an accounts receivable securitization facility (as amended, restated, supplemented or otherwise modified as of June 30, 2020, the "DE Receivables Facility") with certain unaffiliated financial institutions (the "DE Purchasers") for the sale of commercial accounts receivable in Germany. The DE Receivables Facility has a facility limit of €200 million (approximately $225 million as of June 30, 2020). Under the DE Receivables Facility, certain subsidiaries of the Company organized in Germany (the "DE Sellers") sell accounts receivable to DXC ARFacility Designated Activity Company ("DE Receivables SPV"), a trust-owned bankruptcy-remote entity, in a true sale. Pursuant to a receivables purchase agreement, DE Receivables SPV subsequently sells the receivables to the DE Purchasers in return for payments of capital. Sales of receivables by DE Receivables SPV occur continuously and are settled on a monthly basis. During the first quarter of fiscal 2021, DE Receivables SPV amended the DE Receivables Facility. Under the terms of the DE Receivables Facility, there is no longer any DPP for receivables as the entire purchase price is paid in cash when the receivables are sold to the DE Purchasers. Prior to the Amendment, DPPs were realized by DE Receivables SPV upon the ultimate collection of the underlying receivables sold to the DE Purchasers. Cash receipts on the DPPs were classified as cash flows from investing activities. The DPP balance was $102 million before the Amendment was executed. Upon execution of the Amendment, the Purchasers extinguished the DPP balance and returned title to the applicable underlying receivables to DE Receivables SPV. The DPP extinguishment was classified as a non-cash investing activity, please refer to Note 18 - "Cash Flows."

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

The amount available under the DE Receivables Facility fluctuates over time based on the total amount of eligible receivables generated during the normal course of business after deducting excess concentrations. As of June 30, 2020, the total availability under the DE Receivables Facility was approximately $116 million, and the amount sold to the DE Purchasers was $123 million, which was derecognized from the Company's balance sheet. As of June 30, 2020, the Company recorded a $7 million liability within accounts payable because the amount of cash proceeds received by the Company under the DE Receivables Facility was more than the total availability. The DE Receivables Facility is scheduled to terminate on September 30, 2020, but provides for 1 or more optional one-year extensions, if agreed to by the DE Purchasers. The Company uses the proceeds from DE Receivables SPV's sale of receivables under the DE Receivables Facility for general corporate purposes.

The fair value of the sold receivables approximated book value due to the short-term nature, and as a result, no gain or loss on sale of receivables was recorded.

Certain obligations of DE Sellers under the DE Receivables Facility and certain DXC subsidiaries located in Germany, as initial servicers, are guaranteed by the Company under a performance guaranty, made in favor of an administrative agent on behalf of the DE Purchasers. However, the performance guaranty does not cover DE Receivables SPV’s obligations to pay yield, fees or invested amounts to the administrative agent or any of the DE Purchasers.

The following table is a reconciliation of the beginning and ending balances of the DPP:

|

| | | | |

| (in millions) | | As of June 30, 2020 |

| Beginning balance | | $ | 103 |

|

| Transfers of receivables | | 417 |

|

| Collections | | (420 | ) |

| Change in funding availability | | 2 |

|

| Facility amendments | | (102 | ) |

| Ending balance | | $ | — |

|

Allowance for Doubtful Accounts

The Company calculates expected credit losses for trade accounts receivable based on historical credit loss rates for each aging category as adjusted for the current market conditions and forecasts about future economic conditions. The following table presents the activity in the allowance for doubtful accounts for trade accounts receivable:

|

| | | | |

| (in millions) | | As of and for the Three Months Ended |

| | | June 30, 2020 |

| Beginning balance | | $ | 74 |

|

| Impact of adoption of the Credit Loss Standard | | 4 |

|

| Provisions for expected credit losses | | 35 |

|

| Write-offs charged against the allowance | | (9 | ) |

| Ending balance | | $ | 104 |

|

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 6 - Leases

The Company has operating and finance leases for data centers, corporate offices, retail stores and certain equipment. Its leases have remaining lease terms of 1 to 13 years, some of which include options to extend the leases for up to 10 years, and some of which include options to terminate the leases within 1 to 3 years.

The components of lease expense were as follows:

|

| | | | | | | | |

| (in millions) | | Three Months Ended June 30, 2020 | | Three Months Ended June 30, 2019 |

| Operating lease cost | | $ | 156 |

| | $ | 176 |

|

| Short-term lease cost | | 15 |

| | 10 |

|

| Variable lease cost | | 8 |

| | 15 |

|

| Sublease income | | (12 | ) | | (9 | ) |

| Total operating costs | | $ | 167 |

| | $ | 192 |

|

| | | | | |

| Finance lease cost: | | | | |

| Amortization of right-of-use assets | | $ | 116 |

| | $ | 109 |

|

| Interest on lease liabilities | | 14 |

| | 17 |

|

| Total finance lease cost | | $ | 130 |

| | $ | 126 |

|

Cash payments made from variable lease costs and short-term leases are not included in the measurement of operating and finance lease liabilities, and as such, are excluded from the supplemental cash flow information stated below. In addition, for the supplemental non-cash information on operating and finance leases, please refer to Note 18 - "Cash Flows."

Supplemental Cash Flow information related to leases was as follows:

|

| | | | | | | | |

| (in millions) | | Three Months Ended June 30, 2020 | | Three Months Ended June 30, 2019 |

| Cash paid for amounts included in the measurement of: | | | | |

| Operating cash flows from operating leases | | $ | 156 |

| | $ | 174 |

|

| Operating cash flows from finance leases | | $ | 14 |

| | $ | 17 |

|

| Financing cash flows from finance leases | | $ | 138 |

| | $ | 145 |

|

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Supplemental Balance Sheet information related to leases was as follows:

|

| | | | | | | | | | |

| | | | | As of |

| (in millions) | | Balance Sheet Line Item | | June 30, 2020 | | March 31, 2020 |

| Assets: | | | | | | |

| ROU operating lease assets | | Operating right-of-use assets, net | | $ | 1,602 |

| | $ | 1,428 |

|

| ROU finance lease assets | | Property and Equipment, net | | 1,137 |

| | 1,220 |

|

| Total | | | | $ | 2,739 |

| | $ | 2,648 |

|

| | | | | | | |

| Liabilities: | | | | | | |

| Current | | | | | | |

| Operating lease | | Current operating lease liabilities | | $ | 488 |

| | $ | 482 |

|

| Finance lease | | Short-term debt and current maturities of long-term debt | | 432 |

| | 444 |

|

| Total | | | | $ | 920 |

| | $ | 926 |

|

| | | | | | | |

| Non-current | | | | | | |

| Operating lease | | Non-current operating lease liabilities | | $ | 1,208 |

| | $ | 1,063 |

|

| Finance lease | | Long-term debt, net of current maturities | | 583 |

| | 602 |

|

| Total | | | | $ | 1,791 |

| | $ | 1,665 |

|

The following table provides information on the weighted average remaining lease term and weighted average discount rate for operating and finance leases:

|

| | | | | | |

| | | As of |

| | | June 30, 2020 | | March 31, 2020 |

| Weighted Average remaining lease term: | | Years |

| Operating leases | | 4.9 |

| | 4.8 |

|

| Finance leases | | 2.7 |

| | 2.7 |

|

| | | | | |

| Weighted average remaining discount rate: | | Rate |

| Operating leases | | 4.1 | % | | 4.0 | % |

| Finance leases | | 4.2 | % | | 6.4 | % |

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

The following maturity analysis presents expected undiscounted cash payments for operating and finance leases on an annual basis as of June 30, 2020:

|

| | | | | | | | | | | | |

| Fiscal year | | Operating Leases | | |

| (in millions) | | Real Estate | | Equipment | | Finance Leases |

| Remainder of 2021 | | $ | 356 |

| | $ | 51 |

| | $ | 345 |

|

| 2022 | | 403 |

| | 38 |

| | 370 |

|

| 2023 | | 321 |

| | 18 |

| | 223 |

|

| 2024 | | 248 |

| | 10 |

| | 99 |

|

| 2025 | | 168 |

| | 5 |

| | 23 |

|

| Thereafter | | 261 |

| | 3 |

| | 1 |

|

| Total lease payments | | 1,757 |

| | 125 |

| | 1,061 |

|

| Less: imputed interest | | (181 | ) | | (5 | ) | | (46 | ) |

| Total payments | | $ | 1,576 |

| | $ | 120 |

| | $ | 1,015 |

|

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 7 - Fair Value

Fair Value Measurements on a Recurring Basis

The following table presents the Company’s assets and liabilities that are measured at fair value on a recurring basis, excluding pension assets and derivative assets and liabilities. See Note 8 - "Derivative and Hedging Activities" for information about the fair value of the Company's derivative assets and liabilities. There were no transfers between any of the levels during the periods presented.

|

| | | | | | | | | | | | | | | | |

| | | Fair Value Hierarchy |

| (in millions) | | June 30, 2020 |

| Assets: | | Fair Value | | Level 1 | | Level 2 | | Level 3 |

| Money market funds and money market deposit accounts | | $ | 706 |

| | $ | 706 |

| | $ | — |

| | $ | — |

|

U.S. treasury bills(1) | | 500 |

| | 500 |

| | — |

| | — |

|

Time deposits(1) | | 305 |

| | 305 |

| | — |

| | — |

|

Other debt securities(2) | | 56 |

| | — |

| | 53 |

| | 3 |

|

| Total assets | | $ | 1,567 |

| | $ | 1,511 |

| | $ | 53 |

| | $ | 3 |

|

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Contingent consideration | | $ | 48 |

| | $ | — |

| | $ | — |

| | $ | 48 |

|

| Total liabilities | | $ | 48 |

| | $ | — |

| | $ | — |

| | $ | 48 |

|

|

| | | | | | | | | | | | | | | | |

| | | March 31, 2020 |

| Assets: | | Fair Value | | Level 1 | | Level 2 | | Level 3 |

| Money market funds and money market deposit accounts | | $ | 156 |

| | $ | 156 |

| | $ | — |

| | $ | — |

|

Time deposits(1) | | 595 |

| | 595 |

| | — |

| | — |

|

Other debt securities(2) | | 51 |

| | — |

| | 48 |

| | 3 |

|

| Deferred purchase price receivable | | 103 |

| | — |

| | — |

| | 103 |

|

| Total assets | | $ | 905 |

| | $ | 751 |

| | $ | 48 |

| | $ | 106 |

|

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Contingent consideration | | $ | 46 |

| | $ | — |

| | $ | — |

| | $ | 46 |

|

| Total liabilities | | $ | 46 |

| | $ | — |

| | $ | — |

| | $ | 46 |

|

(1) Cost basis approximated fair value due to the short period of time to maturity.

(2) Other debt securities include available-for-sale investments with Level 2 inputs that have a cost basis of $38 million and $37 million, and unrealized gains of $15 million and $11 million, as of June 30, 2020 and March 31, 2020, respectively.

The fair value of money market funds, money market deposit accounts, U.S. Treasury bills with less than three months maturity and time deposits, included in cash and cash equivalents, are based on quoted market prices. The fair value of other debt securities, included in other long-term assets, is based on actual market prices. The fair value of the DPPs, included in receivables, net, is determined by calculating the expected amount of cash to be received and is principally based on unobservable inputs consisting primarily of the face amount of the receivables adjusted for anticipated credit losses. The fair value of contingent consideration, included in other liabilities, is based on contractually defined targets of financial performance and other considerations.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Other Fair Value Disclosures

The carrying amounts of the Company’s financial instruments with short-term maturities, primarily accounts receivable, accounts payable, short-term debt, and financial liabilities included in other accrued liabilities, are deemed to approximate their market values due to their short-term nature. If measured at fair value, these financial instruments would be classified as Level 2 or Level 3 within the fair value hierarchy.

The Company estimates the fair value of its long-term debt, primarily by using quoted prices obtained from third-party providers such as Bloomberg, and by using an expected present value technique that is based on observable market inputs for instruments with similar terms currently available to the Company. The estimated fair value of the Company's long-term debt, excluding finance lease liabilities, was $10.2 billion and $8.2 billion as of June 30, 2020 and March 31, 2020, respectively, as compared with carrying value of $10.0 billion and $8.4 billion as of June 30, 2020 and March 31, 2020, respectively. If measured at fair value, long-term debt, excluding finance lease liabilities would be classified as Level 1 or Level 2 within the fair value hierarchy.

Non-financial assets such as goodwill, tangible assets, intangible assets and other contract related long-lived assets are recorded at fair value in the period they are initially recognized, and such fair value may be adjusted in subsequent periods if an event occurs or circumstances change that indicate that the asset may be impaired. The fair value measurements, in such instances, would be classified as Level 3 within the fair value hierarchy. There were 0 significant impairments recorded during the fiscal period covered by this report.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 8 - Derivative and Hedging Activities

In the normal course of business, the Company is exposed to interest rate and foreign exchange rate fluctuations. As part of its risk management strategy, the Company uses derivative instruments, primarily foreign currency forward contracts and interest rate swaps, to hedge certain foreign currency and interest rate exposures. The Company’s objective is to reduce earnings volatility by offsetting gains and losses resulting from these exposures with losses and gains on the derivative contracts used to hedge them. The Company does not use derivative instruments for trading or any speculative purposes.

Derivatives Designated for Hedge Accounting

Cash flow hedges

The Company has designated certain foreign currency forward contracts as cash flow hedges to reduce foreign currency risk related to certain Indian Rupee-denominated intercompany obligations and forecasted transactions. The notional amounts of foreign currency forward contracts designated as cash flow hedges as of June 30, 2020 and March 31, 2020 were $450 million and $455 million, respectively. As of June 30, 2020, the related forecasted transactions extend through September 2022.

For the three months ended June 30, 2020 and June 30, 2019, respectively, the Company performed an assessment at the inception of the cash flow hedge transactions and determined that all critical terms of the hedging instruments and hedged items matched. The Company performs an assessment of critical terms on an on-going basis throughout the hedging period. During the three months ended June 30, 2020 and June 30, 2019, respectively, the Company had no cash flow hedges for which it was probable that the hedged transaction would not occur. As of June 30, 2020, $6 million of the existing amount of loss related to the cash flow hedge reported in accumulated other comprehensive loss is expected to be reclassified into earnings within the next 12 months.

Net investment hedges

During the fiscal year ended March 31, 2019, the Company designated certain foreign currency forward contracts as net investment hedges to protect its investment in certain foreign operations against adverse changes in exchange rates between the Euro and the U.S. dollar. These contracts were de-designated and settled during the fiscal year ended March 31, 2020, and as of June 30, 2020, there were 0ne outstanding.

During the three months ended June 30, 2020, the pre-tax gain (loss) on derivatives designated for hedge accounting recognized in other comprehensive income (loss) was $11 million and in loss from operations was $(4) million.

Derivatives Not Designated for Hedge Accounting

The derivative instruments not designated as hedges for purposes of hedge accounting include certain short-term foreign currency forward contracts. Derivatives that are not designated as hedging instruments are adjusted to fair value through earnings in the financial statement line item to which the derivative relates to.

Foreign currency forward contracts

The Company manages the exposure to fluctuations in foreign currencies by using short-term foreign currency forward contracts to hedge certain foreign currency denominated assets and liabilities, including intercompany accounts and forecasted transactions. The notional amounts of the foreign currency forward contracts outstanding as of June 30, 2020 and March 31, 2020 were $2.1 billion and $2.2 billion, respectively.

The following table presents the pretax amounts impacting income related to designated and non-designated foreign currency forward contracts:

|

| | | | | | | | | | |

| | | | | For the Three Months Ended |

| (in millions) | | Statement of Operations Line Item | | June 30, 2020 | | June 30, 2019 |

| Foreign currency forward contracts | | Other expense (income), net | | $ | 25 |

| | $ | 19 |

|

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Fair Value of Derivative Instruments

All derivative instruments are recorded at fair value. The Company’s accounting treatment for these derivative instruments is based on its hedge designation. The following tables present the fair values of derivative instruments included in the balance sheets:

|

| | | | | | | | | | |

| | | Derivative Assets |

| | | | | As of |

| (in millions) | | Balance Sheet Line Item | | June 30, 2020 | | March 31, 2020 |

| | | | | | | |

| Derivatives designated for hedge accounting: | | |

| Foreign currency forward contracts | | Other current assets | | $ | 2 |

| | $ | — |

|

| Total fair value of derivatives designated for hedge accounting | | $ | 2 |

| | $ | — |

|

| | | |

| Derivatives not designated for hedge accounting: | | |

| Foreign currency forward contracts | | Other current assets | | $ | 3 |

| | $ | 16 |

|

| Total fair value of derivatives not designated for hedge accounting | | $ | 3 |

| | $ | 16 |

|

|

| | | | | | | | | | |

| | | Derivative Liabilities |

| | | | | As of |

| (in millions) | | Balance Sheet Line Item | | June 30, 2020 | | March 31, 2020 |

| | | | | | | |

| Derivatives designated for hedge accounting: | | | | |

| Foreign currency forward contracts | | Accrued expenses and other current liabilities | | $ | 8 |

| | $ | 20 |

|

| Total fair value of derivatives designated for hedge accounting: | | $ | 8 |

| | $ | 20 |

|

| | | | | | |

| Derivatives not designated for hedge accounting: | | | | |

| Foreign currency forward contracts | | Accrued expenses and other current liabilities | | $ | 5 |

| | $ | 12 |

|

| Total fair value of derivatives not designated for hedge accounting | | $ | 5 |

| | $ | 12 |

|

The fair value of foreign currency forward contracts represents the estimated amount required to settle the contracts using current market exchange rates and is based on the period-end foreign currency exchange rates and forward points which are classified as Level 2 inputs.

Other Risks for Derivative Instruments

The Company is exposed to the risk of losses in the event of non-performance by the counterparties to its derivative contracts. The amount subject to credit risk related to derivative instruments is generally limited to the amount, if any, by which a counterparty's obligations exceed the obligations of the Company with that counterparty. To mitigate counterparty credit risk, the Company regularly reviews its credit exposure and the creditworthiness of the counterparties. With respect to its foreign currency derivatives, as of June 30, 2020, there were 0 counterparties with concentration of credit risk.

The Company also enters into enforceable master netting arrangements with some of its counterparties. However, for financial reporting purposes, it is the Company's policy not to offset derivative assets and liabilities despite the existence of enforceable master netting arrangements. The potential effect of such netting arrangements on the Company's balance sheets is not material for the periods presented.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Non-Derivative Financial Instruments Designated for Hedge Accounting

The Company applies hedge accounting for foreign currency-denominated debt used to manage foreign currency exposures on its net investments in certain non-U.S. operations. To qualify for hedge accounting, the hedging instrument must be highly effective at reducing the risk from the exposure being hedged.

Net Investment Hedges

DXC seeks to reduce the impact of fluctuations in foreign exchange rates on its net investments in certain non-U.S. operations with foreign currency-denominated debt. For foreign currency-denominated debt designated as a hedge, the effectiveness of the hedge is assessed based on changes in spot rates. For qualifying net investment hedges, all gains or losses on the hedging instruments are included in currency translation. Gains or losses on individual net investments in non-U.S. operations are reclassified to earnings from accumulated other comprehensive loss when such net investments are sold or substantially liquidated.

As of June 30, 2020, DXC had $1.4 billion of foreign currency-denominated debt designated as hedges of net investments in non-U.S. subsidiaries. For the three months ended June 30, 2020, the pre-tax impact of loss on foreign currency-denominated debt designated for hedge accounting recognized in other comprehensive loss was $27 million. As of March 31, 2020, DXC had $1.9 billion of foreign currency-denominated debt designated as hedges of net investments in non-U.S. subsidiaries.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 9 - Intangible Assets

Intangible assets consisted of the following:

|

| | | | | | | | | | | | |

| | | As of June 30, 2020 |

| (in millions) | | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value |

| Software | | $ | 4,086 |

| | $ | 2,729 |

| | $ | 1,357 |

|

| Customer related intangible assets | | 5,843 |

| | 1,859 |

| | 3,984 |

|

| Other intangible assets | | 238 |

| | 39 |

| | 199 |

|

| Total intangible assets | | $ | 10,167 |

| | $ | 4,627 |

| | $ | 5,540 |

|

|

| | | | | | | | | | | | |

| | | As of March 31, 2020 |

| (in millions) | | Gross Carrying Value | | Accumulated Amortization | | Net Carrying Value |

| Software | | $ | 4,048 |

| | $ | 2,614 |

| | $ | 1,434 |

|

| Customer related intangible assets | | 5,795 |

| | 1,697 |

| | 4,098 |

|

| Other intangible assets | | 235 |

| | 36 |

| | 199 |

|

| Total intangible assets | | $ | 10,078 |

| | $ | 4,347 |

| | $ | 5,731 |

|

The components of amortization expense were as follows:

|

| | | | | | | | |

| | | Three Months Ended |

| (in millions) | | June 30, 2020 | | June 30, 2019 |

| Intangible asset amortization | | $ | 253 |

| | $ | 236 |

|

Transition and transformation contract cost amortization(1) | | 61 |

| | 67 |

|

| Total amortization expense | | $ | 314 |

| | $ | 303 |

|

| |

(1) | Transaction and transformation contract costs are included within other assets on the balance sheet. |

Estimated future amortization related to intangible assets as of June 30, 2020 is as follows:

|

| | | | |

| Fiscal Year | | (in millions) |

|

| Remainder of 2021 | | $ | 743 |

|

| 2022 | | $ | 940 |

|

| 2023 | | $ | 860 |

|

| 2024 | | $ | 753 |

|

| 2025 | | $ | 668 |

|

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 10 - Goodwill

The following table summarizes the changes in the carrying amount of goodwill, by segment, as of June 30, 2020.

|

| | | | | | | | | | | | |

| (in millions) | | GBS | | GIS | | Total |

| Goodwill, gross | | $ | 6,507 |

| | $ | 5,066 |

| | $ | 11,573 |

|

| Accumulated impairment losses | | (4,490 | ) | | (5,066 | ) | | (9,556 | ) |

| Balance as of March 31, 2020, net | | $ | 2,017 |

| | $ | — |

| | $ | 2,017 |

|

| | | | | | |

| Acquisitions | | 16 |

| | — |

| | 16 |

|

| Foreign currency translation | | 24 |

| | — |

| | 24 |

|

| | | | | | | |

| Goodwill, gross | | 6,547 |

| | 5,066 |

| | 11,613 |

|

| Accumulated impairment losses | | (4,490 | ) | | (5,066 | ) | | (9,556 | ) |

| Balance as of June 30, 2020, net | | $ | 2,057 |

| | $ | — |

| | $ | 2,057 |

|

The addition to goodwill was due to an insignificant acquisition. The foreign currency translation amount reflects the impact of currency movements on non-U.S. dollar-denominated goodwill balances.

Goodwill Impairment Analyses

The Company tests goodwill for impairment on an annual basis, as of the first day of the second fiscal quarter, and between annual tests if circumstances change, or if an event occurs that would more likely than not reduce the fair value of a reporting unit below its carrying amount. As of June 30, 2020, the Company assessed whether there were events or changes in circumstances that would more likely than not reduce the fair value of any of its reporting units below its carrying amount and require goodwill to be tested for impairment. The Company determined that there have been no such indicators and therefore, it was unnecessary to perform an interim goodwill impairment test as of June 30, 2020.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 11 - Debt

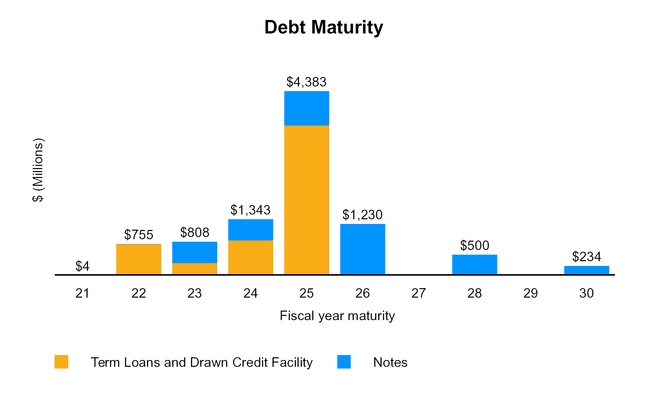

The following is a summary of the Company's debt:

|

| | | | | | | | | | | | |

| (in millions) | | Interest Rates | | Fiscal Year Maturities | | June 30, 2020 | | March 31, 2020 |

| Short-term debt and current maturities of long-term debt | | | | | | | | |

Commercial paper(1) | | (0.22)% - 0.44% | | 2021 - 2022 | | $ | 967 |

| | $ | 542 |

|

| Current maturities of long-term debt | | Various | | 2021 - 2022 | | 283 |

| | 290 |

|

| Current maturities of finance lease liabilities | | 0.62% - 18.47% | | 2021 | | 432 |

| | 444 |

|

| Short-term debt and current maturities of long-term debt | | | | | | $ | 1,682 |

| | $ | 1,276 |

|

| | | | | | | | | |

| Long-term debt, net of current maturities | | | | | | | | |

| AUD term loan | | 0.94% - 0.96%(2) | | 2022 | | 344 |

| | 489 |

|

| GBP term loan | | 1.46%(3) | | 2022 | | 369 |

| | 556 |

|

| EUR term loan | | 0.65%(4) | | 2022 - 2023 | | 280 |

| | 822 |

|

| EUR term loan | | 0.80%(5) | | 2023 - 2024 | | 839 |

| | 821 |

|

| USD term loan | | 1.42% - 2.24%(6) | | 2025 | | 379 |

| | 480 |

|

| $274 million Senior notes | | 4.45% | | 2023 | | 276 |

| | 276 |

|

| $171 million Senior notes | | 4.45% | | 2023 | | 172 |

| | 172 |

|

| $500 million Senior notes | | 4.25% | | 2025 | | 505 |

| | 505 |

|

| $500 million Senior notes | | 4.00% | | 2024 | | 497 |

| | — |

|

| $500 million Senior notes | | 4.13% | | 2026 | | 496 |

| | — |

|

| £250 million Senior notes | | 2.75% | | 2025 | | 306 |

| | 307 |

|

| €650 million Senior notes | | 1.75% | | 2026 | | 726 |

| | 709 |

|

| $500 million Senior notes | | 4.75% | | 2028 | | 507 |

| | 507 |

|

| $234 million Senior notes | | 7.45% | | 2030 | | 271 |

| | 271 |

|

| Revolving credit facility | | 1.27% - 2.08% | | 2024 - 2025 | | 3,250 |

| | 1,500 |

|

| Lease credit facility | | 1.17% - 1.99% | | 2021 - 2023 | | 8 |

| | 11 |

|

| Finance lease liabilities | | 0.62% - 18.47% | | 2021 - 2027 | | 1,015 |

| | 1,046 |

|

| Borrowings for assets acquired under long-term financing | | 0.48% - 6.39% | | 2021 - 2028 | | 740 |

| | 802 |

|

| Mandatorily redeemable preferred stock outstanding | | 6.00% | | 2023 | | 62 |

| | 62 |

|

| Other borrowings | | Various | | 2021 - 2022 | | 7 |

| | 70 |

|

| Long-term debt | | | | | | 11,049 |

| | 9,406 |

|

| Less: current maturities | | | | | | 715 |

| | 734 |

|

| Long-term debt, net of current maturities | | | | | | $ | 10,334 |

| | $ | 8,672 |

|

| |

(1) | At DXC's option, DXC can borrow up to a maximum of €1 billion or its equivalent in €, £, and $. Under this existing €1.0 billion commercial paper program, the Company issued £600 million via direct sale to the Bank of England. |

(2) Variable interest rate equal to the bank bill swap bid rate for a one-, two-, three- or six-month interest period plus 0.60% to 0.95% based on the published credit ratings of DXC.

(3) Three-month LIBOR rate plus 0.80%.

(4) At DXC's option, the EUR term loan bears interest at the Eurocurrency Rate for a one-, two-, three-, or six-month interest period, plus a margin between 0.40% and 0.9%, based on published credit ratings of DXC.

(5) At DXC's option, the EUR term loan bears interest at the Eurocurrency Rate for a one-, two-, three-, or six-month interest period, plus a margin between 0.55% and 1.05%, based on published credit ratings of DXC.

(6) At DXC's option, the USD term loan bears interest at the Eurocurrency Rate for a one-, two-, three-, or six-month interest period, plus a margin between 1.00% and 1.50%, based on published credit ratings of DXC or the Base Rate plus a margin between 0.00% and 0.50%, based on published credit ratings of DXC.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Senior Notes and Term Loans

During the first quarter of fiscal 2021, the Company issued two senior notes with an aggregate principal of $1.0 billion, consisting of (i) $500 million of 4.00% Senior Notes due fiscal 2024, and (ii) $500 million of 4.13% Senior Notes due fiscal 2026. The proceeds from these notes were applied towards the early prepayment of our term loan facilities, including prepayment of €500 million of Euro Term Loan due fiscal 2023, £150 million of GBP Term Loan due fiscal 2022, A$300 million of AUD Term Loan due fiscal 2022, and $100 million of USD Term Loan due fiscal 2025.

Interest on the Company's term loans is payable monthly or quarterly in arrears at the election of the borrowers. The Company fully and unconditionally guarantees term loans issued by its 100% owned subsidiaries. The interest on the Company's senior notes is payable semi-annually in arrears, except for interest on the £250 million Senior Notes due 2025 and the €650 million Senior Notes due 2026, which are payable annually in arrears. Generally, the Company's notes are redeemable at the Company's discretion at the then-applicable redemption premium plus accrued interest.

Revolving Credit Facility

During the first quarter of fiscal 2021, the Company borrowed the remaining $2.5 billion under the $4.0 billion credit facility agreement ("Credit Agreement") as a precautionary measure to increase its cash position and increase financial flexibility in light of continuing uncertainty in the global economy and financial capital markets resulting from the COVID-19 pandemic. During the quarter, the Company repaid $750 million, which became available under the revolving credit facility for redraw at the request of the Company.

The Company expects to use the proceeds from the borrowings under the Credit Agreement for working capital, general corporate purposes or other purposes permitted under the Credit Agreement. Borrowings under the Credit Agreement will bear interest at a variable rate based on LIBOR or on a base rate, plus an individual margin based on DXC’s long-term debt rating.

Note 12 - Revenue

Revenue Recognition

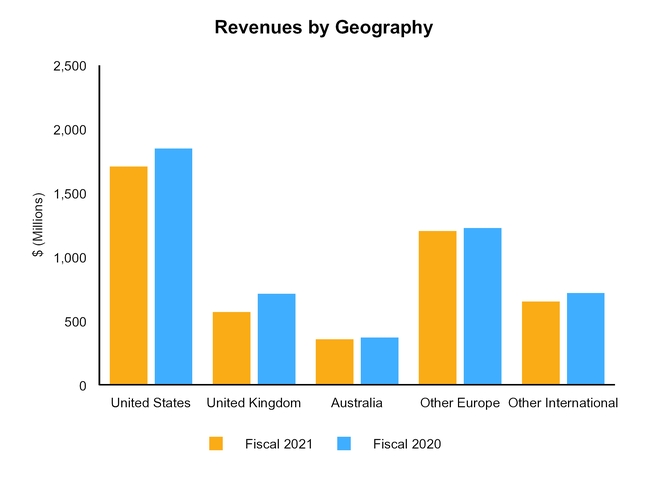

The following table presents DXC's revenues disaggregated by geography, based on the location of incorporation of the DXC entity providing the related goods or services:

|

| | | | | | | | |

| | | Three Months Ended |

| (in millions) | | June 30, 2020 | | June 30, 2019 |

| United States | | $ | 1,709 |

| | $ | 1,851 |

|

| United Kingdom | | 573 |

| | 715 |

|

| Australia | | 361 |

| | 373 |

|

| Other Europe | | 1,205 |

| | 1,230 |

|

| Other International | | 654 |

| | 721 |

|

| Total Revenues | | $ | 4,502 |

| | $ | 4,890 |

|

The revenue by geography pertains to both of the Company’s reportable segments. Refer to Note 19 - "Segment Information" for the Company’s segment disclosures.

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Remaining Performance Obligations

Remaining performance obligations represent the aggregate amount of the transaction price in contracts allocated to performance obligations not delivered, or partially undelivered, as of the end of the reporting period. Remaining performance obligation estimates are subject to change and are affected by several factors, including terminations, changes in the scope of contracts, periodic revalidations, adjustments for revenue that has not materialized and adjustments for currency. As of June 30, 2020, approximately $23 billion of revenue is expected to be recognized from remaining performance obligations. We expect to recognize revenue on approximately 35% of these remaining performance obligations in fiscal 2021, with the remainder of the balance recognized thereafter.

Contract Balances

The following table provides information about the balances of the Company's trade receivables and contract assets and contract liabilities:

|

| | | | | | | | |

| | | As of |

| (in millions) | | June 30, 2020 | | March 31, 2020 |

| Trade receivables, net | | $ | 2,986 |

| | $ | 3,059 |

|

| Contract assets | | $ | 442 |

| | $ | 454 |

|

| Contract liabilities | | $ | 1,763 |

| | $ | 1,756 |

|

Change in contract liabilities were as follows: |

| | | | | | | | |

| | | Three Months Ended |

| (in millions) | | June 30, 2020 | | June 30, 2019 |

| Balance, beginning of period | | $ | 1,756 |

| | $ | 1,886 |

|

| Deferred revenue | | 698 |

| | 770 |

|

| Recognition of deferred revenue | | (719 | ) | | (717 | ) |

| Currency translation adjustment | | 30 |

| | (5 | ) |

| Other | | (2 | ) | | (16 | ) |

| Balance, end of period | | $ | 1,763 |

| | $ | 1,918 |

|

DXC TECHNOLOGY COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) - continued

Note 13 - Restructuring Costs

The Company recorded restructuring costs of $72 million and $142 million, net of reversals, for the three months ended June 30, 2020 and June 30, 2019, respectively. The costs recorded during the three months ended June 30, 2020 were largely a result of the Fiscal 2021 Plan (defined below).

The composition of restructuring liabilities by financial statement line item is as follows: |

| | | | |

| | �� | As of |

| (in millions) | | June 30, 2020 |

| Accrued expenses and other current liabilities | | $ | 165 |

|

| Other long-term liabilities | | 33 |

|

| Total | | $ | 198 |

|

Summary of Restructuring Plans

Fiscal 2021 Plan

During fiscal 2021, management approved global cost savings initiatives designed to better align the Company's workforce and facility structures (the "Fiscal 2021 Plan").

Fiscal 2020 Plan