UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | Filed by a Party other than the Registrant [ ] |

Check the appropriate box:

| [ ] | | Preliminary Proxy Statement |

| | |

| [ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| [X] | | Definitive Proxy Statement |

| | |

| [ ] | | Definitive Additional Materials |

| | |

| [ ] | | Soliciting Material under §240.14a-12 |

Frankly Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

NOTICE AND SUPPLEMENT TO MANAGEMENT INFORMATION CIRCULAR

FOR THE ANNUAL GENERAL AND SPECIAL MEETING OF

SHAREHOLDERS OF FRANKLY INC.

To be held at:

The office of Ellenoff Grossman & Schole LLP at 1345 6thAve. New York, NY 10105

at 11 AM (EDT)

on October 20, 2017

This document (the “Notice and Supplement”) supplements the Management Information Circular of Frankly Inc. (the “Corporation”) dated August 25, 2017 (the “Circular”) issued in connection with the annual general and special meeting (the “Meeting”) of the holders of shares (“Shareholders”) of the Corporation originally called for September 29, 2017. This Notice and Supplement also provides notice that the Meeting has been postponed until October 20, 2017. References hereinafter to the “Meeting” are to the annual general and special meeting of the Corporation to be held on October 20, 2017, or any adjournment or postponement thereof. Capitalized terms used herein are used with the same meanings ascribed to them in the Circular.

The Meeting has been postponed in order to provide Shareholders of the Corporation with certain information required to be provided in connection with a shareholders’ meeting under United States securities law. There has been no change to the matters to be considered at the Meeting; therefore, the purposes of the Meeting are as they were stated in the Circular, namely:

| (a) | to table before the Shareholders the consolidated financial statements of the Corporation for the year ended December 31, 2016, including the auditors’ report thereon; |

| | |

| (b) | to elect the directors of the Corporation who will serve until the end of the next annual meeting of Shareholders or until their successors are elected or appointed, as more fully described in the Circular; |

| | |

| (c) | to appoint Baker Tilly Virchow Krause LLP as the independent auditor of the Corporation for the fiscal year ending December 31, 2017; |

| | |

| (d) | for disinterested Shareholders to consider, and if thought fit, to pass, with or without variation, an ordinary resolution approving the amended and restated equity incentive plan of the Corporation (attached as Appendix “A” to the Circular); and |

| | |

| (e) | to transact such further and other business as may properly come before the Meeting or any adjournment or postponement thereof. |

Additional information on the above matters can be found in the Circular under the heading “Business of the Meeting.”

The Record Date for the determination of Shareholders entitled to notice of the Meeting or any adjournment or postponement thereof and to vote at the Meeting has not changed. The Record Date is the close of business on August 23, 2017.

This Notice and Supplement is being mailed to Shareholders of record and beneficial shareholders as at the Record Date and is available, along with the Circular, under the Corporation’s profile on the System for Electronic Document Analysis and Retrieval, online at www.sedar.com.

As there has been no change to the matters to be considered at the meeting, the form of proxy previously sent to you also has not changed and you can continue to use such form. If you do not expect to attend the Meeting in person, please promptly complete and sign such form of proxy and return it for receipt by no later than October 18, 2017, or 48 hours prior to any adjournment or postponement of the Meeting. If you have received more than one proxy form because you own shares of the Corporation registered in different names or addresses, each proxy form should be completed and returned.

If you are a Non-Registered Shareholder (as defined in the Circular under the heading “Non-Registered Shareholders”), you would have received with the original notice of meeting a voting instruction form for your use. If you received these materials through your broker or another intermediary, please complete and sign the materials in accordance with the instructions provided to you by such broker or other intermediary.

If you have already returned your form of proxy or voting information form, as applicable, per the instructions in the Circular, and you do not wish to change your vote, you are not required to re-submit your form of proxy or voting information form. If you wish to revoke documentation previously submitted, please follow the instructions set out at page 4 of the Circular, under the heading “Revocation”.

Dated as of this 26th day of September, 2017.

| | BY ORDER OF THE BOARD OF DIRECTORS OF FRANKLY INC. |

| | |

| | By: | /s/ Steve Chung |

| | Name: | Steve Chung |

| | Title: | Chief Executive Officer |

Note Regarding Management Information Circular Supplement

In previous years, the Corporation prepared its management information circular in compliance with Canadian disclosure requirements. The Corporation is no longer a foreign private issuer pursuant to applicable U.S. securities laws. Accordingly, this supplement (the “Supplement”) to the Management Information Circular dated August 25, 2017 (the “Circular”) has been prepared to comply with the disclosure requirements under the rules of the U.S. Securities and Exchange Commission (the “SEC”) applicable to U.S. domestic issuers. This Supplement includes additional information and supplements the Circular. This Supplement may also update or supersede information in the Circular. In the case of inconsistencies, this Supplement will apply. You should review the information in this Supplement together with the Circular for further information on the Meeting and the Corporation. Terms used but not defined in this Supplement have the meanings indicated in the Circular. All dollar amounts set forth in this Supplement are in United States (“U.S.”) dollars, except where otherwise indicated.

Forward-Looking Information

The Management Information Circular and this Supplement contain certain forward-looking information and forward-looking statements (collectively, “forward-looking information”) within the meaning of applicable securities laws relating, but not limited, statements with respect to the nature of the usage of the Corporation’s software-as-a-service platform, the Corporation’s strategy and capabilities, changing audience and advertising demand for local news and media, needs for new technology from local news and media industry, the vertical and regional expansion of the Corporation’s market and business opportunities, the expansion of the Corporation’s product offering, and the estimated number of smart device users, local news and media businesses and digital advertisers in the future. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict or are beyond the Corporation’s control. A number of important factors could cause actual outcomes and results to differ materially from those expressed in these forward looking statements. Consequently, readers should not place undue reliance on such forward-looking statements. In addition, these forward-looking statements relate to the date on which they are made.

These forward-looking statements include, but are not limited to: the Corporation’s ability to implement the Corporation’s business strategy; the Corporation’s ability to successfully integrate any acquired businesses; the Corporation’s overall ability to effectively respond to technology changes affecting the industry and increasing competition from other technology providers; the Corporation’s ability to retain existing content management system (“CMS”) platform customers or add new ones; the Corporation’s ability to generate new customers for the Corporation’s mobile technology products; the availability of advertising inventory and the market demand and prices of such inventory; the Corporation’s ability to introduce changes to the Corporation’s existing products or develop and introduce new and unproven products and the Corporation’s customers’ or the market’s; the Corporation’s ability to manage the Corporation’s growth effectively; the recent consolidation and vertical integration within the local news broadcasting industry acceptance of such products; the business conditions of the Corporation’s customers particularly in the local news broadcasting and adjacent industries; the adoption of ASTC 3.0 and its implications on the Corporation’s customers; the Corporation’s ability to expand the Corporation’s customer base to global markets; the Corporation’s ability to protect its intellectual property; and the Corporation’s ability to access capital markets.

These and other factors are detailed from time to time in reports filed by Frankly with securities regulators in Canada and with the SEC in the United States. Reference should be made to “Item 1A – Risk Factors” and “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Forward-Looking Information” in Frankly’s annual and interim reports on Form 10-K and 10-Q.

Forward-looking information is based on current expectations, estimates and projections and it is possible that predictions, forecasts, projections, and other forms of forward-looking information will not be achieved by Frankly. Except as required by law, Frankly undertakes no obligation to update publicly or otherwise revise any forward-looking information, whether as a result of new information, future events or otherwise.

Availability of Documents

Copies of the following documents are available free of charge on written request to the Office of the Corporate Secretary, 27-01 Queens Plaza N Suite 502, Long Island City, NY 11101 or online at www.sedar.com and www.sec.gov: the Articles and by-laws of the Company, Terms of Reference of the Board and each of the committees of the Board, the interim financial statements on Form 8-K for periods subsequent to the Supplement.

SUMMARY

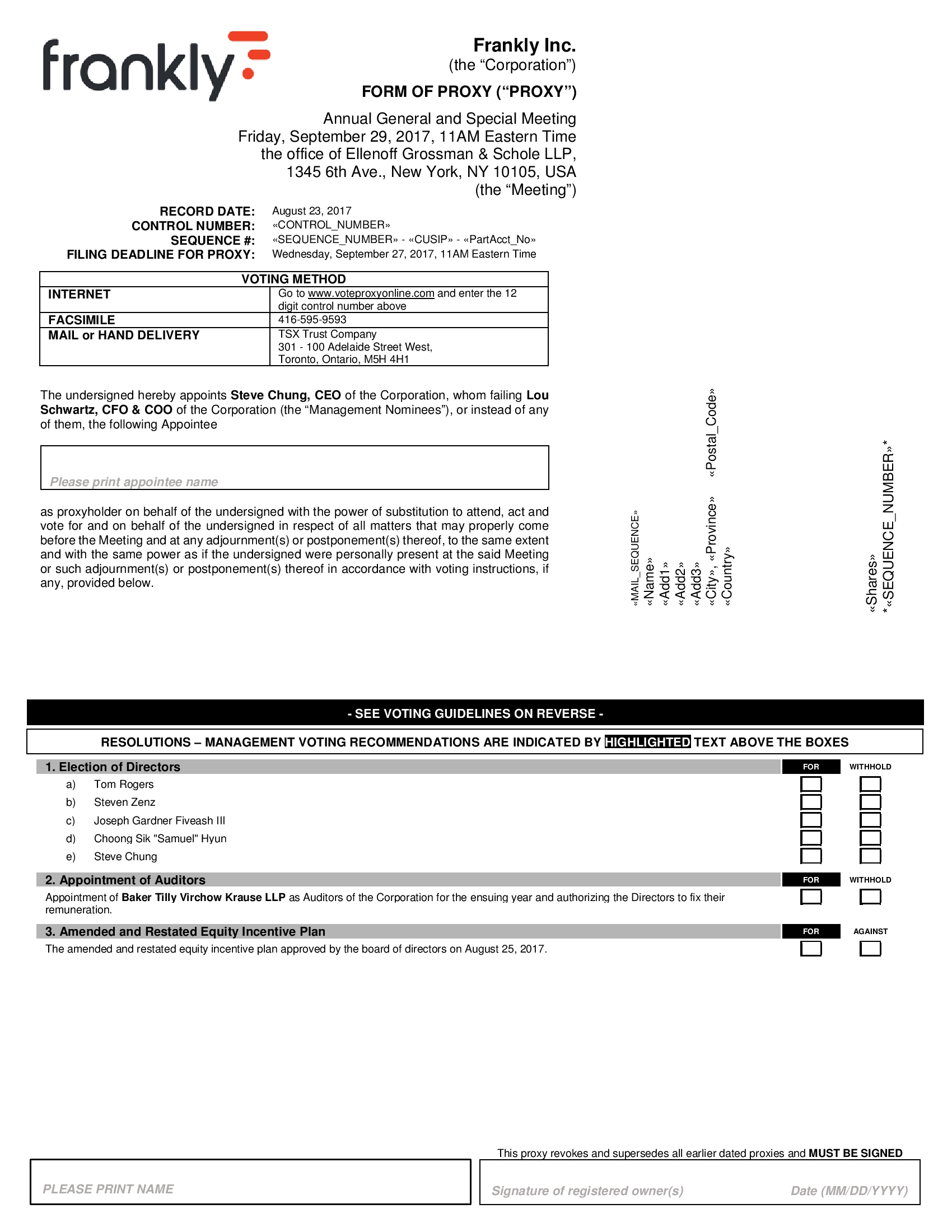

| | | | | | | | |

| About the meeting | | | | What the meeting will cover | | | |

When October 20, 2017 11:00 a.m. EDT Where Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas 11th Floor New York, New York 10105 Record date August 23, 2017 Meeting materials were mailed to shareholders on or about August 25, 2017 and this Supplement is being mailed to shareholders on or about September 28, 2017 | | | | 1. Receive the audited consolidated financial statements for the year ended December 31, 2016 | | | |

| | | 2. Elect the Directors | | The Board recommends you vote for each nominee | |

| | | 3. Appoint Baker Tilly Virchow Krause LLP as auditor | | The Board recommends you vote for this resolution | |

| | | 4. Approve the Amended & Restated Equity Incentive Plan | | The Board recommends you vote for this resolution | |

| | |

Nominated Directors

You will elect 5 directors to the Board this year. Each nominee must receive a simple majority of the votes cast at the Meeting either in person or by proxy to be elected. The Board met 6 times during 2016. Each director attended 75% or more of the total Board and Board committee meetings on which the director served in 2016. None of the nominees serves on another public company board other than Steven Zenz.

| Name | | Age | | | Director since | | Position | | Independent | | | Committee

memberships |

| Steve Chung | | | 38 | | | February 2013 | | Chief Executive Officer and Director | | | No | | | |

| Tom Rogers | | | 62 | | | October 2016 | | Chairman of the Board | | | Yes | | | Audit, Nominating, Compensation (Chair) |

| Choong Sik (Samuel) Hyun | | | 46 | | | April 2016 | | Director | | | Yes | | | Audit, Nominating (Chair), Compensation |

| Joseph Gardner Fiveash III(1)(2) | | | 55 | | | August 2015 | | Director | | | No | | | |

| Steven Zenz | | | 63 | | | October 2016 | | Director | | | Yes | | | Audit (Chair), Nominating, Compensation |

| | (1) | Upon the appointment of Mr. Zenz and Mr. Rogers on September 28, 2016, Mr. Fiveash was removed from the Audit Committee. |

| | | |

| | (2) | Upon the appointment of Mr. Zenz and Mr. Rogers on September 28, 2016, Mr. Fiveash was removed from the Compensation Committee. |

Meeting Information

We are sending you this Supplement in connection with the Circular sent on August 25, 2017 to solicit proxies by the management of the Corporation to be used at Meeting to be held on October 20, 2017.

Location of the Meeting

The Meeting will be held at:

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas 11th Floor

New York, New York 10105

at 11:00 a.m. (Eastern Daylight Time)

on Friday, October 20, 2017

Business of the Meeting

At the Meeting, you will be asked to vote on the following matters:

| ● | the election of directors; |

| | |

| ● | the appointment of Baker Tilly Virchow Krause LLP as the Corporation’s auditor; and |

| | |

| ● | the amended and restated equity incentive plan; |

Voting Recommendations

The Board recommends that you voteFOR each of the Nominees, FOR the appointment of Baker Tilly Virchow Krause LLP as the Corporation’s auditor; andFOR the amended and restated equity incentive plan.

Information Regarding Outstanding Shares and Principal Shareholders

As of August 1, 2017, there were 2,139,392 common shares issued and outstanding. Each Share carries one vote on each matter voted upon at the Meeting.

For information regarding the ownership of certain individuals, including directors and officer of the Corporation, see “Security Ownership of Certain Beneficial Owners and Management”.

Solicitation of Proxies

The solicitation of proxies by this Supplement is being made by or on behalf of the management of the Corporation and the total cost of the solicitation will be borne by the Corporation. The Corporation has engaged Broadridge Investor Communication Solutions, Inc. and TSX Trust to assist in the solicitation of proxies and provide related advice and informational support for a services fee and the reimbursement of customary disbursements that are not expected to exceed $3,750.

Appointment of Auditors

At the Meeting, the Shareholders will be asked to appoint Baker Tilly as the independent auditor of the Corporation, to hold office until the close of the next annual meeting of Shareholders. The audit committee of the Corporation (the “Audit Committee”) and the Board have approved the appointment of Baker Tilly as independent auditor.

Representatives of Baker Tilly are not expected to be present at the Annual General Meeting. Accordingly, representatives of Baker Tilly will not have the opportunity to make a statement or be available to respond to questions at the Meeting.

Equity Compensation Plan Information

The following table provides information, as of December 31, 2016, with respect to all compensation arrangements maintained by the Company, including individual compensation arrangements, under which shares are authorized for issuance. The chart below does not include RSUs.

| Plan Category (a) | | | Number of

Securities to be

issued upon

exercise of

outstanding options

and

rights (b) | | | | Weighted-

average exercise

price of

outstanding

options and

rights (c) | | | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in columns (a) and

(c)) | |

| | | | | | | | | | | | | |

| Equity compensation plans approved by shareholders under the Incentive Stock Option Plan | | | 245,762 | (1) | | $ | 19.55 | (2) | | | 8,390 | (3) |

| | | | | | | | | | | | | |

| Equity compensation plans not approved by shareholders | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Total | | | 245,762 | (1) | | $ | 19.55 | (2) | | | 8,390 | (3) |

| (1) | Excludes options that were issued, cancelled or replaced after December 31, 2016. At August 1, 2017, this number is 191,307. |

| | |

| (2) | Excludes options that were issued, cancelled or replaced after December 31, 2016. At August 1, 2017, the weighted average exercise price is $5.25. |

| | |

| (3) | Excludes options that were issued, cancelled or replaced after December 31, 2016. At August 1, 2017, this number was 17,005. |

Certain Relationships and Related Transactions, and Director Independence

The following is a summary of transactions and series of similar transactions, since the Corporation’s inception, to which the Corporation was a party or will be a party, in which:

| ● | the amount involved exceeded or will exceed $120,000; and |

| | |

| ● | a director, executive officer, holder of more than 5% of the Corporation’s capital stock or any member of their immediate family had or will have a direct or indirect material interest. |

The Corporation also describes below certain other transactions with the Corporation’s directors, executive officers and stockholders. Pursuant to the Corporation’s Code of Ethical Conduct, all related party transactions must be approved by vote of a majority of the Corporation’s disinterested and independent directors.

Raycom Transactions and Agreements

Raycom is a holder of more than 5% of the Corporation’s capital stock. In addition, one of directors of the Corporation’s Board of Directors, Mr. Fiveash, is the Senior Vice President of Digital Media and Strategy of Raycom and is one of Raycom’s Board designees.

Website Software and Services Agreement and Local Sales Products Agreement

Frankly Media LLC (“Frankly Media”) entered into a Website Software and Services Agreement with Raycom (the “Raycom Service Agreement”), dated October 1, 2011 and amended on October 1, 2014 and August 25, 2015. Pursuant to the Service Agreement, Frankly Media provides website software, platform and advertising services to Raycom. The Service Agreement expires on December 31, 2017 unless terminated earlier upon written notice. Frankly Media also entered into a local sales products agreement, dated August 1, 2015 (the “LSP Agreement”) with Raycom, pursuant to which Frankly Media provides targeted display and video advertising services. The LSP Agreement will expire on August 1, 2017. During the fiscal year of 2016, the Corporation recognized revenue of $5,021,343 under the Service Agreement and LSP Agreement and for the three months ended March 31, 2017, the Corporation recognized revenue of $1,361,884.

Pursuant to the Advance Agreement, as amended on March 30, 2017 and May 25, 2017, Raycom pre-paid an aggregate of $5 million of future fees for services to be provided by the Company pursuant to the Raycom Services Agreement. If the Corporation completes an equity raise of at least $5 million before June 30, 2017, then the Corporation can either (i) refund the prepayment to Raycom within 30 days of the completion of the equity raise along with an additional $30,000 for fees in connection with the prepayment by Raycom, or (ii) apply the prepayment to services provided by us for the year ending December 31, 2017 in which case Raycom will receive the Discount for the services to be provided by us. If the Corporation does not complete an equity raise of at least $5 million by June 30, 2017, then the prepayment will be applied to the services to be provided for the period commencing July 1, 2017 and Raycom will receive the discounted services to be provided by us for the year ending December 31, 2017.

Unit Purchase Agreement and Original Raycom Note

On July 28, 2015, the Corporation entered into a Unit Purchase Agreement pursuant to which the Corporation issued the Original Raycom Note in the aggregate principal amount of $4 million. The Original Raycom Note accrued simple interest at a 5% annual rate and was payable on August 31, 2016. The Corporation incurred interest expense under the Original Raycom Note due to Raycom during the year ended December 31, 2016 and the three months ended March 31, 2017 of $133,333 and $0, respectively. On August 31, 2016, in connection with the Raycom SPA and the Credit Agreement with Raycom, each as described below under the heading “—Raycom Loan”, the Corporation fully paid $3 million of the Original Raycom Note and converted $1 million of the Original Raycom Note into 150,200 common shares.

Raycom Loan

On August 31, 2016, the Corporation entered into the Raycom SPA, as amended on December 20, 2016 and March 30, 2016, and the Credit Agreement with Raycom, amended on December 20, 2016, March 30, 2016 and June 26, 2017 as described more fully below.

Securities Purchase Agreement. Pursuant to the Raycom SPA, Raycom agreed to accept an aggregate of 150,200 common shares and 871,160 warrants to purchase one common shares per warrant at a price per common shares equal to CDN$8.50 ($6.63 based on the exchange rate at August 18, 2016) for a purchase price of CDN$1,276,700 (or $1 million based on the exchange rate at August 18, 2016) in settlement of $1 million of the Original Raycom Loan.

Credit Agreement.Pursuant to a Credit Agreement, the Corporation entered into a Credit Facility with Raycom in the principal amount of $14.5 million and issued to Raycom 5-year warrants (the “Raycom Warrants”) to purchase 871,160 common shares at a price per share of CDN $8.50 ($6.63 based on the exchange rate at August 18, 2016). The Credit Facility terminates on August 31, 2021. The Raycom Warrants have a 5-year term but upon a repayment of principal under the Credit Agreement, a pro-rata portion thereof will expire on the date which is later of (a) August 31, 2017 or (b) 30 days from the date of each principal repayment. Upon each payment of principal, the number of Raycom Warrants that will expire will equal the product of the (i) then outstanding number of Raycom Warrants and (ii) the principal repayment divided by the then outstanding principal balance of the loan. The exercise price and the number of shares underlying the Raycom Warrants will be subject to adjustment as set forth in the Credit Agreement. The Corporation incurred interest expense under the Credit Facility during the year ended December 31, 2016 and the three months ended March 31, 2017 of $673,353 and $510,080, respectively.

Subject to approval of Raycom, at its sole discretion, the Corporation may require further loans for working capital or general operating requirements from time to time upon written notice by minimum increments of $500,000 up to an aggregate amount of $1.5 million. The Corporation will pay interest on each loan outstanding at any time at a rate per annum of 10%. Interest will accrue and be calculated, but not compounded, daily on the principal amount of each loan on the basis of the actual number of days each loan is outstanding and will be compounded and payable monthly in arrears on each interest payment date. To the maximum extent permitted by applicable law, the Corporation will pay interest on all overdue amounts, including any overdue interest payments, from the date each of those amounts is due until the date each of those amounts is paid in full. That interest will be calculated daily, compounded monthly and payable on demand of Raycom at a rate per annum of 12%. The Corporation will have the option to repay all or a portion of loans outstanding under the Credit Facility without premium, penalty or bonus upon prior notice to Raycom and repayment of all interest, fees and other amounts accrued and unpaid under the Credit Facility.

The Corporation must also make certain mandatory repayments, are required to maintain certain leverage and interest coverage ratios and subject to certain restrictions, including but not limited to indebtedness, change of control and distributions. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—The August Refinancing–Credit Agreement” on the Corporation’s Form 10-Q.

Upon an event of default, Raycom may by written notice terminate the facility immediately and declare all obligations under the Credit Agreement and the related loan documents, whether matured or not, to be immediately due and payable. Raycom may also as and by way of collateral security, deposit and retain in an interest bearing account, amounts received by Raycom from us under the Credit Agreement and the related loan documents and realize upon the Security Interest Agreements, Guaranty Agreements and Pledge Agreement as described below. If the Corporation fails to perform any of the Corporation’s obligations under the Credit Agreement and the related loan documents, Raycom may upon 10 days’ notice, perform such covenant or agreement if capable. Any amount paid by Raycom under such covenant or agreement will be repaid by us on demand and will bear interest at 12% per annum.

On June 26, 2017, the Corporation further amended the Credit Agreement as more fully described below.

Guaranty Agreements, Security Interest Agreements and Pledge Agreement.In connection with the Credit Agreement, the Corporation’s subsidiaries Frankly Co. and Frankly Media have entered into Guaranty Agreements whereby Frankly Co. and Frankly Media have guaranteed the Corporation’s obligations under the Credit Agreement. In addition, each of Frankly Inc., Frankly Co. and Frankly Media have entered into Security Interest Agreements pursuant to which Raycom has first priority security interests in substantially all of the Corporation’s assets. Frankly Media has also entered into an Intellectual Property Pledge Agreement pursuant to which it has granted a security interest in all of its intellectual property to Raycom. The Corporation has also (i) deposited the Corporation’s intellectual property in escrow accounts for the benefit of Raycom, (ii) in furtherance of the security interest granted to Raycom in the Corporation’s equity interest in Frankly Media LLC, entered into a pledge agreement and a control agreement pursuant to which the Corporation granted Raycom control of the equity interest of Frankly Media and (iii) entered into an insurance transfer and consent assigning the Corporation’s rights and payments under insurance policies covering the Corporation’s operations and business naming Raycom as mortgagee, first loss payee and additional named insured. In addition, the Corporation has entered into a Pledge Agreement pursuant to which the Corporation granted Raycom a security interest on substantially all of the assets of the Corporation’s current and future subsidiaries.

Raycom may transfer or assign, syndicate, grant a participation interest in or grant a security interest in, all or any part of its rights, remedies and obligations under the Credit Agreement and the related loan documents, without notice or the Corporation’s consent.

Raycom Conversion.The Corporation entered into a Securities Purchase Agreement with Raycom (the “Raycom Agreement”) dated June 26, 2017, pursuant to which the Corporation agreed to issue to Raycom common shares and warrants in exchange for a US$7,000,000 reduction in the principal amount of indebtedness due to Raycom pursuant to the Credit Agreement and the associated promissory note. Upon the consummation of the transactions contemplated by the Raycom Agreement, the principal amount due to Raycom will be reduced from US$14,500,000 to US$7,500,000. The issuance of the common shares and warrants pursuant to the Raycom Agreement will be subject to approval by the Corporation’s shareholders (other than Raycom, which will not be permitted to vote on the matter). The Corporation has agreed to seek such shareholder approval as promptly as may be practicable. Pursuant to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (“MI 61-101”), the transactions with Raycom Media, Inc. will be “related-party transactions.” Unless there is an exemption available under applicable securities law, the Company will need to obtain a formal valuation for the transaction.

Pursuant to the Raycom Agreement, Raycom will receive (i) such number of the Corporation’s common shares as is equal to the Canadian dollar equivalent of US$7,000,000 as of the date of the Raycom Agreement, divided by the greater of (A) 85% of the last closing price of the Corporation’s common shares on the TSX-V on the last trading day completed prior to the issuance of the news release announcing the execution of the Raycom Agreement, which closing price was CDN$4.89 ($3.69 based on the exchange rate on June 26, 2017), and (B) 85% of the Canadian dollar equivalent of the initial combined public offering price of common shares and warrants sold in the Corporation’s U.S. initial public offering, and (ii) warrants to purchase up to 675,900 common shares. The warrants will have an exercise price per share equal to the greater of (A) the U.S. dollar equivalent of the last closing price of the Corporation’s common shares on the TSX-V on the last trading day completed prior to the issuance of the news release announcing the execution of the Raycom Agreement (being $3.69), or (B) 120% of the initial combined public offering price of the common shares and warrants to purchase common shares to be sold in the Corporation’s U.S. initial public offering, and will expire on August 31, 2021. Upon the approval of the Raycom Conversion, warrants to purchase 675,900 common shares would be issuable to Raycom and based on an assumed combined initial public offering price of $5.25 per common share and a warrant to purchase a common share (the midpoint of the price range set forth on the cover page of the preliminary prospectus included in the Form S-1, as amended, that the Corporation has filed with the SEC for the Corporation’s U.S. initial public offering), 1,567,952 common would be issuable to Raycom.

In addition, the Raycom Agreement amends the Credit Agreement to provide that, (i) commencing with the closing date thereunder, the interest rate payable under the Credit Agreement and the associated promissory note will increase from 10% to 15.75% per annum. The 5.75% additional interest will accrue and be calculated daily and be payable quarterly. Such amount will be payable in the Corporation’s discretion either in cash or an equivalent amount of the Corporation’s common shares, based on the last closing price of the common shares on the TSX-V on the last trading day before the end of the applicable quarter (or, if the Corporation’s common shares are not trading on the TSX-V, on such other exchange on which the common shares may then be traded). If the common shares are not traded on a public exchange, the additional interest will be paid in cash.

In addition, the Raycom Agreement provides that, commencing with the closing date thereunder, the amount of each mandatory repayment due under the Credit Agreement will be reduced from US$687,500 to US$355,600, reflecting the proportionate reduction in the principal amount outstanding.

The Raycom Agreement also provides that (i) the Corporation will increase the size of the Corporation’s Board of Directors from five to seven on or before September 30, 2017, subject to shareholder approval, (ii) so long as Raycom owns common shares representing not less than 20% of the issued and outstanding common shares calculated on a fully-diluted basis, (A) a total of two individuals, neither of whom need be independent of the Corporation’s company, designated by Raycom will be named as part of management’s nominees for election as directors in the Corporation’s annual proxy circular (subject to compliance with certain TSX-V requirements) and (B) Raycom will have the right to approve one of management’s other nominees, who shall be independent of the Corporation’s company, for election as director in such proxy circular. Raycom will also be entitled to certain redesignation rights should any of its director nominees die, resign, or be disqualified or removed. If the Corporation is not successful in obtaining shareholder approval to increase the number of directors on the Board to seven by September 30, 2017, the Corporation will, by December 31, 2017, call a special shareholders’ meeting for the purpose of enlarging the Board to seven directors, subject to TSX-V Personal Information Form clearance and shareholder approval.

Pursuant to TSX-V rules, if the transactions contemplated by the Raycom Agreement are completed, the expiration date for warrants to purchase 420,560 common shares previously issued to Raycom in connection with the Credit Agreement will be accelerated from August 31, 2021 to August 31, 2017. All other terms of such warrants will remain unchanged. The remaining warrants to purchase 450,600 common shares will continue to be exercisable until August 31, 2021.

The Raycom Conversion is subject to completion of the Corporation’s U.S. initial public offering with gross proceeds to us of at least US$11,000,000 by October 31, 2017 and the listing of the Corporation’s common shares on NASDAQ.

Management Services Agreement with Schwartz & Associates, PC

On April 1, 2015, Gannaway Web Holdings, LLC (now Frankly Media) entered into a Management Services Agreement (the “Management Services Agreement”) with Schwartz and Associates, PC (“Schwartz & Associates”), a Georgia professional corporation for which Mr. Schwartz, the Corporation’s Chief Financial Officer and Chief Operating Officer is the managing partner. Pursuant to the Management Services Agreement, Gannaway Web Holdings, LLC (the “Company”) engaged Schwartz & Associates to provide management series and Mr. Schwartz was appointed Chief Strategy Officer of Gannaway Web Holdings, LLC. Under the Management Services Agreement, Schwartz & Associates received for their services a base compensation of $12,500 per month, paid semi-monthly. The Management Services Agreement also provided for special incentive compensation in the following:

| | ● | In a sale to a third party of the Company or substantially all of the Company’s assets, Mr. Schwartz was entitled to receive (i) if the transaction was originated by Mr. Schwartz, $500,000 or 2.5% of the total consideration of the transaction, or (ii) if the transaction was originated by a third party, $250,000 and 2% of the total amounts received in such transaction in excess of $50 million. |

| | | |

| | ● | In a sale to an existing Company investor, Mr. Schwartz was entitled to receive (i) if the transaction was originated by Mr. Schwartz, $250,000 or 2.5% of the total Company valuation in excess of $40 million, or (ii) if the transaction was originated by a third party, $250,000 and 5% of total the amounts received in excess of $22,500,000. |

| | | |

| | ● | In a third party investment in the Company, Mr. Schwartz was entitled to receive (i) if the transaction was originated by Mr. Schwartz, 2.5% of the total amount invested, or (ii) if the transaction was originated by a third party, 2.5% of the total amount invested. |

Mr. Schwartz was also entitled to participate in any employee benefit programs, plans and practices on the same terms as other salaried employees on a basis consistent with other senior executives. Upon termination for any reason, the Corporation was required to pay Mr. Schwartz all accrued and unpaid fees through the terminated date. Upon termination without cause or resignation for good reason, Mr. Schwartz was also entitled to a separation fee equal to the balance of the months remaining under the term of the agreement. On August 1, 2015, the Management Services Agreement was amended to extend the term of the agreement to December 31, 2015. On December 31, 2015, the Management Services Agreement expired and was not renewed. However, the terms of Mr. Schwartz’ s compensation currently reflect the terms of his compensation pursuant to the Management Services Agreement. The Corporation intends to enter into an employment agreement with Mr. Schwartz shortly after the closing of the Corporation’s U.S. initial public offering.

Leadership Structure and Risk Oversight

The Corporation’s board of directors is currently led by its chairman, Tom Rogers. The Corporation’s board of directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the Company continues to grow. The Corporation separates the roles of chief executive officer and chairman of the board in recognition of the differences between the two roles. The chief executive officer is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the chairman of the board of directors provides guidance to the chief executive officer and presides over meetings of the full board of directors. The Corporation believes that this separation of responsibilities provides a balanced approach to managing the board of directors and overseeing the Company.

The Board is actively involved in overseeing the Corporation’s risk management processes. The Board focuses on the Corporation’s general risk management strategy and ensures that appropriate risk mitigation strategies are implemented by management. Further, operational and strategic presentations by management to the Board include consideration of the challenges and risks of the Corporation’s businesses, and the Board and management actively engage in discussion on these topics. In addition, each of the Board’s committees considers risk within its area of responsibility. For example, the Audit Committee provides oversight to legal and compliance matters and assesses the adequacy of the Corporation’s risk-related internal controls. The Compensation Committee considers risk and structures the Corporation’s executive compensation programs to provide incentives to reward appropriately executives for growth without undue risk taking.

Independence of Directors

The Board has determined that Messrs. Zenz, Rogers and Hyun are “independent” as defined in Rule 5605(a)(2) of the Nasdaq Stock Market Rules. The Corporation’s board currently consists of 3 independent directors and 2 non-independent directors.

Audit Committee

Under National Instrument 52-110 -Audit Committees (“NI 52-110”), the Corporation is required to include in this disclosure required under Form 52-110F2 with respect to the Audit Committee, including the composition of the Audit Committee, the text of the Audit Committee charter (attached to the Circular as Appendix “C”), and the fees paid to the external auditor.

The Directors of the Corporation have established an Audit Committee comprised of three Directors. The Audit Committee members are Tom Rogers, Steven Zenz, and Choong Sik Hyun. The relevant education and experience of each member of the Audit Committee is provided above, under the heading “Director Nominees of Frankly Inc” in the Circular. Two of the Audit Committee members (Messrs. Rogers and Zenz) are independent, as the term is defined in NI 52-110, and each member is financially literate in that each has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Corporation’s financial statements. Mr. Zenz satisfies the requirements for being designated an audit committee financial expert as defined in SEC regulations because of his financial and accounting expertise. Upon the appointment of Mr. Zenz and Mr. Rogers on September 28, 2016, Mr. Fiveash was removed from the Audit Committee. The Audit Committee met 4 times during the fiscal year ended December 31, 2016.

As set out in the Audit Committee charter, the principal responsibilities of the Audit Committee include: (i) overseeing the quality and integrity of the internal controls and accounting procedures of the Corporation, including reviewing the Corporation’s procedures for internal control with the Corporation’s auditor and Chief Financial Officer; (ii) reviewing and assessing the quality and integrity of the Corporation’s annual and quarterly financial statements and related management discussion and analysis, as well as all other material continuous disclosure documents, such as the Corporation’s annual information form (if applicable); (iii) monitoring compliance with legal and regulatory requirements related to financial reporting; (iv) reviewing and approving the engagement of the auditor of the Corporation and independent audit fees; (v) reviewing the qualifications, performance and independence of the auditor of the Corporation, considering the auditor’s recommendations and managing the relationship with the auditor, including meeting with the auditor as required in connection with the audit services provided to the Corporation; (vi) assessing the Corporation’s financial and accounting personnel; (viii) reviewing the Corporation’s risk management procedures; (ix) reviewing any significant transactions outside the Corporation’s ordinary course of business and any pending litigation involving the Corporation; and (x) examining improprieties or suspected improprieties with respect to accounting and other matters that affect financial reporting.

At no time since the commencement of the Corporation’s most recently completed financial period was a recommendation of the Audit Committee to nominate or compensate an external auditor not adopted by the Board. At no time since the commencement of the Corporation’s most recently completed financial period has the Corporation relied on an exemption under NI 52-110, including the exemption in Section 2.4 of NI 52-110 (De Minimis Non-audit Services), or an exemption from NI 52-110, in whole or in part, granted under Part 8 of NI 52-110.

Audit and Non-Audit Fees and Services – 2016 & 2015

In accordance with applicable laws and the requirements of stock exchanges and securities regulatory authorities, the Audit Committee must pre-approve all audit and non-audit services to be provided by the independent auditor.The aggregate fees billed by the Corporation’s external auditors for the Corporation’s fiscal years ending December 31, 2016 and December 31, 2015 are approximately as follows:

| Fiscal Year | | | Audit Fees(1) | | | Audit-Related Fees | | | Tax Fees(2) | | | All Other Fees | | | Total | |

| | 2016 | | | | 667,207 | | | | - | | | | - | | | | - | | | | 667,207 | |

| | 2015 | | | | 206,747 | | | | - | | | | 29,014 | | | | - | | | | 235,761 | |

Notes

| (1) | Audit fees consisted principally of U.S. and Canadian audits and statutory audits. |

| | |

| (2) | Tax fees were for professional services related to tax compliance in the United States and Canada. These services primarily consisted of the preparation of tax returns. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures

On September 30, 2014, the Corporation entered into a letter of intent with TicToc Planet, Inc., a Delaware Corporation (“TicToc”) incorporated in September 2012. On December 8, 2014, the Corporation entered into a merger agreement with the Corporation’s then wholly-owned subsidiary, WB III Subco Inc., and TicToc, pursuant to which the Corporation agreed to complete a qualifying transaction with TicToc by way of a “reverse triangular merger” (the “Qualifying Transaction”). On December 22, 2014, pursuant to articles of amendment, the Corporation changed the Corporation’s name to “Frankly Inc.” On December 23, 2014, the Corporation completed the Qualifying Transaction, which resulted in a reverse takeover of Frankly Inc. by the shareholders of TicToc, whereby WB III Subco Inc. merged with and into TicToc, TicToc changed its name to Frankly Co. and the security holders of Frankly Co. received securities of Frankly Inc. in exchange for their securities of Frankly Co.

Prior to the Qualifying Transaction, Collins Barrow Toronto LLP was engaged as WB III Acquisition Corp.’s (“WB III”) independent accountants with the recommendation and approval of WB III’s audit committee. Upon consummation of the Qualifying Transaction, Collins Barrow Toronto LLP resigned as the Corporation’s independent accountants on February 17, 2015 and the Corporation engaged KPMG LLP, the Canadian member firm of KPMG International, (“KPMG Canada”) as the Corporation’s independent registered public accounting firm on February 17, 2015 to audit the Corporation’s financial statements as of December 31, 2014 and the year ended December 31, 2014.

On May 1, 2015, the Corporation dismissed KPMG Canada as the Corporation’s independent accountants with the recommendation and approval of the Corporation’s audit committee and the Corporation engaged Collins Barrow Toronto LLP as the Corporation’s independent registered public accounting firm on December 16, 2015 to audit the Corporation’s financial statements as of December 31, 2015 and for the year then ended. On June 21, 2016 the Corporation engaged Baker Tilly Virchow Krause LLP to audit the Corporation’s consolidated financial statements as of and for the year ended December 31, 2014, which had been previously audited by KPMG Canada. On December 1, 2016, with the recommendation and approval of the Corporation’s audit committee, and in connection with the Corporation’s U.S. initial public offering, the Corporation advised Collins Barrow Toronto LLP that, subject to receipt of necessary approvals, the Corporation intended to engage Baker Tilly Virchow Krause LLP as the Corporation’s independent registered public accounting firm to audit the Corporation’s financial statements as of and for the year ended December 31, 2016. Although Collins Barrow Toronto LLP was advised of its dismissal in December 1, 2016, the final termination letter was not issued until April 17, 2017.

The reports of Collins Barrow Toronto LLP as independent accountants to WB III prior to the Qualifying Transaction on WB III’s consolidated financial statements did not contain any adverse opinion or disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope, or accounting principles. The report of Collins Barrow Toronto LLP on the Corporation’s consolidated financial statements did not contain any adverse opinion or disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope, or accounting principles.

During the period beginning June 7, 2013 to December 23, 2014 (the date of the Qualifying Transaction) and for the years ended December 31, 2015 and 2016, Collins Barrow Toronto LLP did not have any disagreement with WB III or us, respectively, on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of Collins Barrow Toronto LLP, would have caused it to make reference to the subject matter of the disagreement in connection with its report on the Corporation’s financial statements.

The report of KPMG Canada on the Corporation’s consolidated financial statements did not contain any adverse opinion or disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope, or accounting principles.

During the year ended December 31, 2014, KPMG Canada did not have any disagreement with us on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of KPMG Canada, would have caused it to make reference to the subject matter of the disagreement in connection with its report on the Corporation’s financial statements.

The Corporation delivered a copy of this disclosure to Collins Barrow Toronto LLP and KPMG Canada and requested that they furnish us a letter addressed to the SEC stating whether they agree with the above statements. In their respective letters to the SEC, dated November 10, 2016 filed as Exhibit 16.1, and November 10, 2016 and May 11, 2017, filed as Exhibits 16.2 and 16.3, respectively, to the Corporation’s Form 10 dated August 7, 2017, Collins Barrow Toronto LLP and KPMG Canada state that they agree with the statements above concerning their respective firm.

As required pursuant to National Instrument 51-102 - Continuous Disclosure Obligations (“NI 51-102”), a copy of the complete reporting package, including the Corporation’s Notice of Change of Auditor dated April 17, 2017 and letters of acknowledgement from each of Collins Barrow and Baker Tilly, was filed on SEDAR and is attached to this Supplement as Schedule A. There have been no “reportable events” between the Corporation and Collins Barrow and no qualified opinion or denial of opinion by Collins Barrow within the meaning of NI 51-102.

Compensation Committee

The Compensation Committee oversees the remuneration policies and practices of the Corporation. In particular, the principal responsibilities and purpose of the Compensation Committee is to assist the Board in fulfilling its oversight responsibilities in relation to: (i) the evaluation and compensation of the Chief Executive Officer, the Chief Financial Officer, the Chief Technology Officer and other members of the Corporation’s senior management; (ii) the compensation of the Board; and (iii) any additional matters delegated to the Compensation Committee by the Board. The Compensation Committee shall report to the Board on a regular basis. The Committee shall also oversee the preparation of and make recommendations in respect of the Corporation’s executive compensation disclosure, as required by applicable legislation, regulatory requirements and policies of the Canadian Securities Administrators, as applicable.

The Compensation Committee will meet as frequently as is appropriate to fulfill its responsibilities, which will not be less than once a year. In discharging its mandate, the Compensation Committee shall have the authority to retain (and authorize the payment by the Corporation of) and receive advice from special legal or other advisers as the Compensation Committee determines to be necessary to permit it to carry out its duties.

The Compensation Committee is currently comprised of three Directors: Tom Rogers, Steven Zenz, and Choong Sik Hyun. Messrs Rogers and Zenz are independent for the purposes of National Instrument 58-101 -Corporate Governance. The relevant education and experience of each member of the Compensation Committee is provided in the Circular, under the heading“Director Nominees of Frankly Inc.”. Upon the appointment of Mr. Zenz and Mr. Rogers on September 28, 2016, Mr. Fiveash was removed from the Compensation Committee. The Compensation Committee met 2 times during the fiscal year ended December 31, 2016.

The Compensation Committee Charter, dated December 23, 2014 and passed on January 29, 2015 by a Board resolution, contemplates that the appointment of members to the Compensation Committee shall take place annually at the first meeting of the Board after a meeting of Shareholders at which the Directors are elected. The Board may appoint a member to fill a vacancy that occurs between the annual election of Directors.

Nominating and Corporate Governance Committee

The Corporation’s nominating and corporate governance committee consists of Choong Sik (Samuel) Hyun (Chairperson), Steven Zenz and Tom Rogers. The Corporation’s board of directors has adopted a Nominating and Corporate Governance Committee charter, which defines the nominating and corporate governance committee’s primary duties, including:

| | ● | identifying individuals qualified to become members of the Corporation’s board of directors and recommending director candidates for election or re-election to the Corporation’s board of directors; |

| | | |

| | ● | maintaining oversight of the Corporation’s board of directors and the Corporation’s governance functions and effectiveness; |

| | | |

| | ● | considering and making recommendations to the Corporation’s board of directors regarding board size and composition, committee composition and structure and procedures affecting directors, and each director’s independence; |

| | | |

| | ● | establishing standards for service on the Corporation’s board of directors; and |

| | | |

| | ● | advising the board of directors on candidates for the Corporation’s executive offices, and conducting appropriate investigation of such candidates. |

The Nominating and Corporate Governance Committee met once during the fiscal year ended December 31, 2016.

Compensation Committee Interlocks and Insider Participation

None of the members of the Corporation’s Compensation Committee is or has been an officer or employee of the Corporation. None of the Corporation’s executive officers currently serves, or in the past year has served, as a member of the Board or Compensation Committee (or other Board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on the Corporation’s Board or Compensation Committee.

Code of Business Conduct and Ethics and Insider Trading Policy

In January 2017, the Corporation’s board of directors adopted a Code of Ethical Conduct Policy and in January 2017 the board of directors adopted a revised Disclosure, Securities Trading and Confidentiality Policy.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of August 1, 2017, the total number of common shares owned beneficially by (i) each of the Corporation’s named executive officers, (ii) each of the Corporation’s directors, (iii) all of the Corporation’s current directors and officers as a group and (iv) each person who beneficially owns 5% or more of the Corporation’s outstanding common shares. For purposes of calculating beneficial ownership, the applicable percentage of ownership is based upon 2,139,392 common shares outstanding as of August 1, 2017, which excludes (i) 191,307 options issued and outstanding under the Corporation’s Equity Plan, and (ii) 121,653 RSUs issued and outstanding under the Corporation’s Equity Plan. Shares issuable pursuant to options or warrants exercisable within 60 days after August 7, 2017 are deemed outstanding for purposes of computing the percentage ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage of ownership for any other person. Unless otherwise indicated in the footnotes to this table, beneficial ownership of the Corporation’s common shares represents sole voting and investment power with respect to those shares.

| Name | | Number of

common

shares | | | % of

common

shares | |

| Directors and Named Executive Officers: | | | | | | | | |

| Steve Chung(1) | | | 43,964 | | | | 2.0 | % |

| Louis Schwartz(2) | | | 35,402 | | | | 1.6 | % |

| Omar Karim(3) | | | 4,597 | | | | * | |

| Choong Sik Hyun | | | - | | | | - | |

| Joseph Gardner Fiveash III | | | - | | | | - | |

| Steven Zenz(4) | | | 4,704 | | | | * | |

| Tom Rogers(5) | | | 4,704 | | | | * | |

| All directors and executive officers as a group (7 persons) | | | 93,371 | | | | 4.2 | % |

| | | | | | | | | |

| 5% Owners (not included above): | | | | | | | | |

| Raycom Media, Inc.(6)(7) | | | 1,418,485 | | | | 47.1 | % |

| SKP America, LLC(8) | | | 545,289 | | | | 25.5 | % |

| Gannaway Entertainment, Inc.(9) | | | 177,710 | | | | 8.3 | % |

* Less than one percent.

| (1) | Includes options to purchase 36,415 common shares and 7,549 RSUs that will vest by September 30, 2017. Excludes options to purchase 42,216 common shares and 15,539 RSUs that will vest after September 30, 2017. |

| | |

| (2) | Includes options to purchase 7,454 common shares and 16,451 RSUs that will vest by September 30, 2017. Excludes options to purchase 20,720 common shares and 14,579 RSUs that will vest after September 30, 2017. |

| | |

| (3) | Includes options to purchase 438 common shares and 1,509 RSUs that will vest by September 30, 2017. Excludes options to purchase 4,472 common shares and 10,910 RSUs that will vest after September 30, 2017. |

| | |

| (4) | Excludes 5,883 RSUs that will vest after September 30, 2017. |

| | |

| (5) | Excludes 5,883 RSUs that will vest after September 30, 2017. |

| | |

| (6) | The business address for Raycom Media, Inc. is 201 Monroe Street, RSA Tower, 20th Floor. Warren Spector, Raycom’s Chief Financial Officer, holds the voting power and dispositive power with respect to such shares. |

| | |

| (7) | Includes 871,160 warrants to purchase one common share per warrant at a price per common share equal to CDN$8.50 ($6.63 based on the exchange rate at August 18, 2016). Excludes warrants to purchase 675,900 common shares and, based on an assumed initial combined public offering price of $5.25 per common share and related warrant to purchase a common share (the midpoint of the price range set forth on the cover page of the preliminary prospectus included in the Form S-1, as amended, that the Corporation has filed with the SEC for the Corporation’s U.S. initial public offering), 1,567,952 common shares that would be issuable to Raycom pursuant to the Raycom Conversion. |

| | |

| (8) | The business address for SKP America, LLC is 900 Middlefield Road, Redwood City, California 94063. Mr. Sang Won Kim, Head of Growth Office (Corporate Development) holds the voting power and dispositive power with respect to such shares. |

| | |

| (9) | The business address for Gannaway Entertainment, Inc. is 767 3rd Avenue, New York, NY 10017. Gary Gannaway, Chief Executive Officer, holds the voting power and dispositive power with respect to such shares. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Corporation’s beneficial owners were not subject to the reporting requirements of Section 16(a) of the Exchange Act during the fiscal year ended December 31, 2016.

SHAREHOLDER PROPOSALS

In 2016, Frankly did not receive any shareholder proposals to be included in its Circular.

The Company is subject to both the rules of the SEC under the Exchange Act and the provisions of the British Columbia Business Corporations Act (“BCBCA”) with respect to shareholder proposals. As clearly indicated under the BCBCA and in the rules of the SEC under the Exchange Act, simply submitting a shareholder proposal does not guarantee its inclusion in the proxy materials.

Shareholder proposals submitted pursuant to the rules of the SEC under the Exchange Act for inclusion in the Company’s proxy materials for its annual meeting of shareholders to be held in 2018 (the “2018 Meeting”), must be received no later than July 20, 2018. Such proposals must also comply with all applicable provisions of Exchange Act Rule 14a-8.

Proposals submitted pursuant to the applicable provisions of the BCBCA that a shareholder intends to present at the 2018 Meeting and wishes to be considered for inclusion in Frankly’s Circular and form of proxy relating to the 2018 annual meeting of shareholders must be received no later than July 20, 2018. Such proposals must also comply with all applicable provisions of the BCBCA and the regulations thereunder.

All shareholder proposals must be delivered to the Office of the Corporate Secretary by mail 27-01 Queens Plaza N Suite 502, Long Island City, NY 11101.

DIRECTORS’ APPROVAL

The contents of this Supplement and its distribution have been approved by the Directors of the Corporation.

| /s/ Steve Chung | |

| Steve Chung | |

| Chief Executive Officer | |

| September 26, 2017 | |

AUDIT COMMITTEE REPORT

The Audit Committee represents and assists the Board of Directors in its oversight of the integrity of Frankly’s financial reporting and compliance programs. In particular, the Audit Committee’s responsibilities include fulfilling public company audit committee obligations and assisting the Board of Directors in fulfilling its oversight responsibilities in relation to the disclosure of financial statements and information derived from financial statements, including the review of the annual and interim financial statements of Frankly, the integrity and quality of Frankly’s financial reporting and internal controls, Frankly’s legal and regulatory requirements, and the qualifications, independence, engagement, compensation and performance of Frankly’s external auditor. As of the date of this report, the current members of the Audit Committee are: Steven Zenz (Chairperson), Choong Sik (Samuel) Hyun and Tom Rogers. Mr. Zenz satisfies the requirements for being designated an audit committee financial expert as defined in SEC regulations because of his financial and accounting expertise. Upon the appointment of Mr. Zenz and Mr. Rogers on September 28, 2016, Mr. Fiveash was removed from the Audit Committee. The Audit Committee met 4 times during the fiscal year ended December 31, 2016.

Frankly’s management is responsible for preparing Frankly’s financial statements and the overall reporting process, including Frankly’s system of internal controls. The Audit Committee is directly responsible for the compensation, appointment and oversight of Frankly’s independent registered public accounting firm, Baker Tilly Virchow Krause LLP (“Baker Tilly”). That firm reports directly to the Audit Committee. The independent registered public accounting firm is responsible for auditing the financial statements and expressing an opinion on the conformity of the audited financial statements with generally accepted accounting principles in the United States (“U.S. GAAP”).

The Audit Committee also meets privately in separate executive sessions periodically with management, compliance and representatives from Frankly’s independent registered public accounting firm. In this context, the Audit Committee has held discussions with management and Baker Tilly. Management represented to the Audit Committee that Frankly’s consolidated financial statements were prepared in accordance with U.S. GAAP, and the Audit Committee has reviewed and discussed the audited financial statements with management and Baker Tilly.

Baker Tilly has informed the Audit Committee that, in its opinion, the consolidated statements of operations and comprehensive loss, shareholders’ equity, and cash flows that comprise Frankly’s 2016 Financial Statements present fairly, in all material respects, the financial position of Frankly and its subsidiaries as of December 31, 2016 and the results of their operations and their cash flows for the year then ended, in conformity with U.S. GAAP.

The Audit Committee also has discussed with Baker Tilly the matters required to be discussed by Auditing Standard No. 1301 (Communications With Audit Committees), as amended, and requested any other relevant input from Baker Tilly. Baker Tilly provided to the Audit Committee, and the Audit Committee received, the written disclosures and letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Baker Tilly’s communications with the audit committee concerning independence, and the Audit Committee discussed with Baker Tilly their independence.

Based on the considerations above, the Audit Committee recommended to the Board of Directors, and the Board has approved, the 2016 Financial Statements. The Audit Committee has recommended Baker Tilly as Frankly’s independent registered public accounting firm for Fiscal Year 2017 and recommended that the Board of Directors submit this appointment to the Company’s shareholders for ratification at the Annual General Meeting. The Audit Committee pre-approved any audit and permitted non-audit services provided to Frankly by Baker Tilly.

AUDIT COMMITTEE (as of September 26, 2017):

| Steven Zenz | |

| Choong Sik (Samuel) Hyun | |

| Tom Rogers | |

FRANKLY INC.

NOTICE OF CHANGE OF AUDITORS PURSUANT TO

NATIONAL INSTRUMENT 51-102 (Section 4.11)

British Columbia Securities Commission

Alberta Securities Commission

Ontario Securities Commission

Dear Sirs/Mesdames:

Re: Notice Regarding Proposed Change of Auditor Pursuant to National Instrument 51-102

Notice is hereby given that on April 17, 2017, the Audit Committee of Frankly Inc. (the “Company” or “Frankly”) determined:

| | 1. | to accept the resignation dated April 17, 2017, of Collins Barrow Toronto LLP (the “Former Auditor”), as auditor of Frankly at the request of the Company; and |

| | | |

| | 2. | to engage Baker Tilly Virchow Krause LLP, as auditor of Frankly, effective April 17, 2017. |

There have been no reservations in the Former Auditor’s Report on any of the Company’s financial statements commencing at the beginning of the two most recently completed fiscal years and ending on December 31, 2016, or for any period subsequent to the last completed fiscal year for which an audit report was issued up to April 17, 2017.

In the opinion of the Company, prior to the resignation, and as at the date hereof, there were no reportable events, including disagreements, consultations, or unresolved issues as defined in National Instrument 51-102 -Continuous Disclosure Obligationsbetween the Former Auditor and the Company.

The contents of this Notice and the attached letters from Collins Barrow Toronto LLP and Baker Tilly Virchow Krause LLP have been reviewed by the Audit Committee of Frankly.

Dated this 17th day of April, 2017

FRANKLY INC.

| By: | /s/“Louis Schwartz” | |

| | Louis Schwartz | |

| | Chief Financial Officer | |

| Collins Barrow Toronto Collins Barrow Place 11 King Street West Suite 700, PO BOX 27 Toronto, Ontario M5H 4C7 Canada T: 416.480.0160 F: 416.480.2646 toronto.collinsbarrow.com |

April 17, 2017

British Columbia Securities Commission

Alberta Securities Commission

Ontario Securities Commission

| Re: | Frankly Inc. |

| | Notice Regarding Proposed Change of Auditor Pursuant to National Instrument 51-102 |

Dear Sirs/Mesdames:

Pursuant to National Instrument 51-102 (Part 4.11), we have read the above-noted Change of Auditor Notice dated April 17, 2017, and confirm our agreement with the information contained in the Notice pertaining to our firm.

Yours Sincerely,

Collins Barrow Toronto LLP

Chartered Professional Accountants

cc: Audit Committee, Frankly Inc.

April 17, 2017

British Columbia Securities Commission

Alberta Securities Commission

Ontario Securities Commission

| | Re: | Frankly Inc. |

| | | Notice Regarding Proposed Change of Auditor Pursuant to National Instrument 51-102 |

Dear Sirs/Mesdames:

Pursuant to National Instrument 51-102 (Part 4.11), we have read the above-noted Change of Auditor Notice dated April 17, 2017, and confirm our agreement with the information contained in the Notice pertaining to our firm.

Yours Sincerely,

Baker Tilly Virchow Krause LLP

Chartered Professional Accountants

cc: Audit Committee, Frankly Inc.

NOTICE OF MEETING AND

MANAGEMENT INFORMATION CIRCULAR

FOR THE ANNUAL GENERAL AND SPECIAL MEETING OF

SHAREHOLDERS OF FRANKLY INC.

THIS MANAGEMENT INFORMATION CIRCULAR IS FURNISHED IN CONNECTION WITH THE SOLICITATION BY THE MANAGEMENT OF FRANKLY INC. OF PROXIES TO BE VOTED AT THE ANNUAL GENERAL AND SPECIAL MEETING OF ALL SHAREHOLDERS.

To be held at:

The office of Ellenoff Grossman & Schole LLP at 1345 6thAve. New York, NY 10105

at 11 AM (EDT)

on September 29, 2017

| These materials are important and require your immediate attention. They require Shareholders to make important decisions. If you are in doubt as to how to deal with these materials or the matters they describe, please contact your financial, legal, tax or other professional advisors. |

August 25, 2017

Dear Fellow Shareholders,

On behalf of Frankly Inc., we invite you to attend our annual general and special meeting of shareholders to be held at the office of Ellenoff Grossman & Schole LLP at 1345 6th Ave. New York, NY 10105 at 11 AM (EDT) on September 29, 2017. Your participation at this meeting is very important and we encourage you to review the information circular accompanying this letter, which includes important information for the holders of Frankly Inc. shares. We encourage you to vote on the matters set out in the circular by following the proxy instructions set out therein and returning your proxy or voting instruction form (as applicable) by the applicable deadline.

We have had some exciting developments at Frankly in the past year that included the launch of new products, important customers and innovative partners. We witnessed the launch of our Next Generation web platform, our continued success in rolling out our mobile apps and releasing new OTT platforms including AppleTV, RokuTV and FireTV. In addition, we were able to attract new industry leading customers such as News12, a former Cablevision property that has now spun off to Altice. Also, we onboarded new strategic partners such as Vendasta with whom we co-launched the well-received Frankly Local product. Finally, we began an aggressive push into data through our Frankly Data product, which we believe is a very unique offering provided to our customers leveraging data.

All of the above have been enabled by our dedicated staff and your support of Frankly Inc. and we are sincerely grateful to each of you for having chosen to accompany us on this journey. We look forward to building on our past accomplishments with your continued support.

Yours truly,

| | <Signed>“Steve Chung” |

| | Steve Chung Chief Executive Officer Frankly Inc. |

FRANKLY INC.

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

to be held on September 29, 2017.

NOTICE IS HEREBY GIVEN that the Annual General and Special Meeting (the “Meeting”) of the holders of shares (“Shareholders”) of Frankly Inc. (the “Corporation”) will be held at the office of Ellenoff Grossman & Schole LLP at 1345 6th Ave. New York, NY 10105 at 11 AM (EDT) on September 29, 2017. The Meeting is being held for the following purposes:

| (a) | to table before the Shareholders the consolidated financial statements of the Corporation for the year ended December 31, 2016, including the auditors’ report thereon (the “Financial Statements”); |

| | |

| (b) | to elect the directors of the Corporation (the “Directors”) who will serve until the end of the next annual meeting of Shareholders or until their successors are elected or appointed, as more fully described in the management information circular dated August 25, 2017 (the “Circular”) accompanying this notice of Meeting (the “Notice”); |

| | |

| (c) | to appoint Baker Tilly Virchow Krause LLP as the independent auditor of the Corporation for the fiscal year ending December 31, 2017; |

| | |

| (d) | for disinterested Shareholders to consider, and if thought fit, to pass, with or without variation, an ordinary resolution approving the amended and restated equity incentive plan of the Corporation (attached as Appendix “A” to the Circular); and |

| | |

| (e) | to transact such further and other business as may properly come before the Meeting or any adjournment or postponement thereof. |

Additional information on the above matters can be found in the Circular under the heading “Business of the Meeting.”

The board of Directors has fixed the close of business on August 23, 2017 as the record date (the “Record Date”) for the determination of Shareholders entitled to notice of the Meeting or any adjournment or postponement thereof and to vote at the Meeting.

The Circular, this Notice, the forms of proxy and the voting instruction form are being mailed to Shareholders of record and beneficial shareholders as at the Record Date and are available under the Corporation’s profile on the System for Electronic Document Analysis and Retrieval, online at www.sedar.com. Shareholders are reminded to review the meeting materials before voting.

If you do not expect to attend the Meeting in person, please promptly complete and sign the enclosed applicable form of proxy and return it for receipt by no later than 48 hours prior to the Meeting. If you receive more than one proxy form because you own shares of the Corporation registered in different names or addresses, each proxy form should be completed and returned.

If you are a Non-Registered Shareholder (as defined in the Circular under the heading “Non-Registered Shareholders”), accompanying this Notice is a voting instruction form for your use. If you receive these materials through your broker or another intermediary, please complete and sign the materials in accordance with the instructions provided to you by such broker or other intermediary.

Dated as of this 25th day of August, 2017.

| | BY ORDER OF THE BOARD OF DIRECTORS OF FRANKLY INC. |

| | |

| | By: | <Signed> Steve Chung |

| | Name: | Steve Chung |

| | Title: | Chief Executive Officer |

TABLE OF CONTENTS

MANAGEMENT INFORMATION CIRCULAR

Introduction

This management information circular (this “Circular”) is being furnished to holders (the “Shareholders”) of common shares (“Common Shares”) in the capital of Frankly Inc. (the “Corporation” or “Frankly”) in connection with the solicitation of proxies by and on behalf of the management of the Corporation for the Annual General and Special Meeting (the “Meeting”) of the Shareholders to be held at the office of Ellenoff Grossman & Schole LLP at 1345 6th Ave. New York, NY 10105 at 11 AM (EDT) on September 29, 2017.

This Circular, the accompanying notice of the Meeting (the “Notice”) and the form of proxy and the voting instructions form (collectively, the “Meeting Materials”) are being mailed to Shareholders of record of the Corporation as at the close of business on August 23, 2017 (the “Record Date”). The Corporation will bear all costs associated with the preparation and mailing of the Meeting Materials, as well as the cost of the solicitation of proxies. The solicitation will be primarily by mail; however, officers and regular employees of the Corporation may also directly solicit proxies (but not for additional compensation) personally, by telephone, by facsimile or by other means of electronic transmission. Banks, brokerage houses and other custodians and nominees or fiduciaries will be requested to forward proxy solicitation material to their principals and to obtain authorizations for the execution of proxies and will be reimbursed for their reasonable expenses in doing so.

All information contained in this Circular is given as of August 25, 2017 unless otherwise specifically stated.

Currency

All dollar amounts set forth in this Circular are in United States (“U.S.”) dollars, except where otherwise indicated.

GENERAL PROXY MATTERS

Voting in Person at the Meeting

A registered holder of Common Shares (“Registered Shareholder”), or a beneficial owner who has appointed themselves to represent them at the Meeting, will appear on a list of Shareholders prepared by TSX Trust Company, the registrar and transfer agent for purposes of the Meeting (the “Registrar”). To vote in person at the Meeting, each Registered Shareholder or appointee will be required to register by identifying themselves at the Meeting registration desk. Non-Registered Shareholders (as defined in this Circular under the heading “Non-Registered Shareholders”) must appoint themselves as a proxyholder to vote in person at the Meeting.

Solicitation of Proxies