SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN A PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934, as amended

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a 6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a 12 |

BRINKER CAPITAL DESTINATIONS TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a 6(i)(1) and 0 11. |

| 1) | Title of each class of securities to which transaction applies: |

| | | |

| 2) | Aggregate number of securities to which transaction applies: |

| | | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| 4) | Proposed maximum aggregate value of transaction: |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| | | |

| 2) | Form, Schedule or Registration Statement No.: |

| | | |

BRINKER CAPITAL DESTINATIONS TRUST

1055 Westlakes Drive, Suite 250

Berwyn, PA 19312

Dear Shareholder:

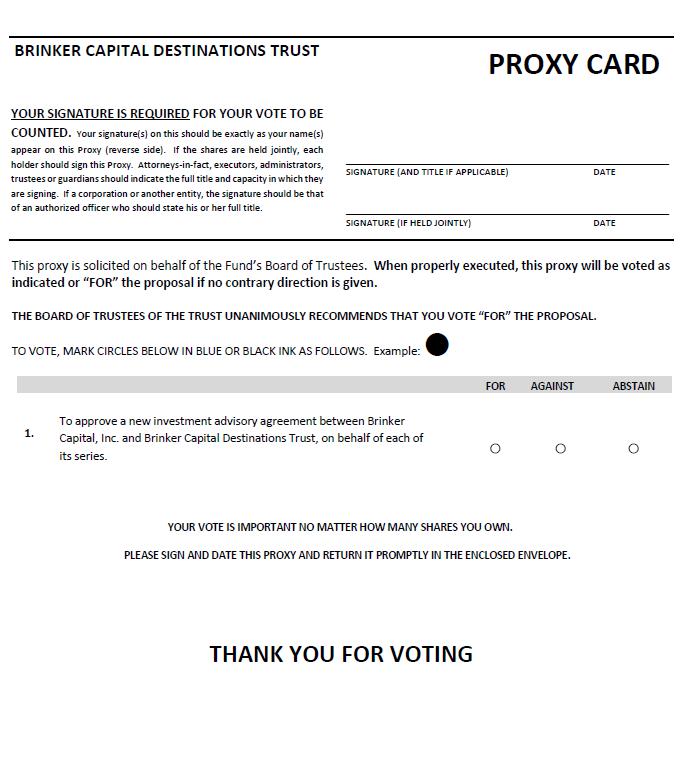

Enclosed is a notice, proxy statement and proxy card for a Special Meeting of Shareholders (the “Meeting”) of the Destinations Large Cap Equity Fund, Destinations Small-Mid Cap Equity Fund, Destinations International Equity Fund, Destinations Equity Income Fund, Destinations Real Assets Fund, Destinations Core Fixed Income Fund, Destinations Low Duration Fixed Income Fund, Destinations Global Fixed Income Opportunities Fund, Destinations Municipal Fixed Income Fund and Destinations Multi Strategy Alternatives Fund (each, a “Fund,” and together, the “Funds”), each a series of Brinker Capital Destinations Trust (the “Trust”). The Meeting is scheduled for [11] a.m., Eastern Time, on Thursday, September [24], 2020. Due to current circumstances, and in accordance with the Trust’s governing documents and applicable laws, the Special Meeting of Shareholders will be a virtual meeting and will be conducted exclusively online via live webcast. If you are a shareholder of record of a Fund as of the close of business on Friday, July [24], 2020, you are entitled to vote at the Meeting, and any adjournment of the Meeting.

Brinker Capital, Inc. (“Brinker Capital”) currently serves as investment adviser to each Fund. At the Meeting, shareholders of each Fund will be asked to approve a new investment advisory agreement (the “New Agreement”) between the Trust, on behalf of each Fund, and Brinker Capital (the “Proposal”). The New Agreement has the same advisory fee as, and otherwise does not materially differ from, the current investment advisory agreement (the “Current Agreement”) between the Trust, on behalf of the Funds, and Brinker Capital. As discussed in more detail in the accompanying materials, you are being asked to approve the Proposal because the Current Agreement will be deemed to terminate as a result of an upcoming transaction involving a change in the ownership of Brinker Capital Holdings, Inc., Brinker Capital’s parent company.

The Board of Trustees of Brinker Capital Destinations Trust has unanimously approved the Proposal and recommends that you vote “FOR” the Proposal as described in the proxy statement.

Your vote is important to us. Although you may join us at the virtual meeting, most shareholders cast their votes by proxy. Whether or not you plan to attend the Meeting, we need your vote. Your failure to vote will increase costs of the solicitation, as Brinker Capital may be required to retain proxy solicitors to contact shareholders in an effort to obtain a quorum for the Meeting. Please take a few minutes to review this proxy statement and vote your shares today. Please refer to the enclosed proxy card for details on how to vote by telephone or on the Internet. Shareholders are receiving hard copies of these proxy materials and who are unable to vote by telephone or on the Internet, may also mark, sign, and date the enclosed proxy card and return it promptly in the enclosed postage-paid envelope.

If we do not receive your vote promptly, you may be contacted by a representative of the Fund(s), who will remind you to vote your shares.

Thank you for your attention and consideration of this important Proposal and for your investment in the Fund(s). If you need additional information, please call shareholder services at [1-877-771-7979].

Sincerely,

| /s/ Jason B. Moore | |

| | |

| Jason B. Moore | |

| President | |

BRINKER CAPITAL DESTINATIONS TRUST

1055 Westlakes Drive, Suite 250

Berwyn, PA 19312

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON September [24], 2020

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of the Destinations Large Cap Equity Fund, Destinations Small-Mid Cap Equity Fund, Destinations International Equity Fund, Destinations Equity Income Fund, Destinations Real Assets Fund, Destinations Core Fixed Income Fund, Destinations Low Duration Fixed Income Fund, Destinations Global Fixed Income Opportunities Fund, Destinations Municipal Fixed Income Fund and Destinations Multi Strategy Alternatives Fund (each, a “Fund,” and together, the “Funds”), each a series of Brinker Capital Destinations Trust (the “Trust”), will be held on September [24], 2020, at [11] a.m., Eastern Time, at [website for virtual meeting].

At the Meeting, shareholders of record of each Fund at the close of business on Friday, July 24, 2020 (“Shareholders”) will be asked to approve a new investment advisory agreement (the “New Agreement”) between the Trust, on behalf of each Fund, and Brinker Capital, Inc., and to transact such other business, if any, as may properly come before the Meeting.

Please mark, sign and date the enclosed proxy card and return it promptly in the enclosed, postage-paid envelope (or vote by touch-tone telephone or through the Internet) to ensure that the Meeting may be held and a maximum number of shares may be voted. Your vote is important no matter how many shares you own. You may change your vote even though a proxy has already been returned by providing written notice to the Trust, by submitting a subsequent proxy using the mail, by Internet, by telephone or by attending the Meeting virtually and voting your shares during the Meeting.

Shareholders of record of each Fund at the close of business on July [24], 2020 are entitled to notice of and to vote at the Meeting or any adjournment thereof.

| | By Order of the Board of Trustees |

| | |

| | /s/ Jason B. Moore |

| | |

| | Jason B. Moore |

| | President |

It is important that proxies be returned promptly. Shareholders are urged to make, date and sign and return the proxy in the enclosed prepaid envelope or vote by TOUCH-tone telephone or through the Internet.

IMPORTANT NEWS FOR SHAREHOLDERS

Although we encourage you to read the full text of the enclosed proxy statement, for your convenience here is a brief overview of the matter that requires your vote as a shareholder of one or more of the Funds.

QUESTIONS AND ANSWERS

| Q. | Why am I being asked to vote on a new advisory agreement for the Funds? |

| A. | Brinker Capital, Inc. (“Brinker Capital”), a subsidiary of Brinker Capital Holdings, Inc. (“Brinker Holdings”) serves as investment adviser to each Fund. On June 26, 2020, Brinker Holdings entered into an agreement, pursuant to which GT Polaris, Inc. (“GT Polaris”), a newly formed entity, will acquire, through various subsidiaries, 100% of the issued and outstanding equity interests of Brinker Holdings (the “Transaction”). GT Polaris will be indirectly owned and controlled by investment funds affiliated with Genstar Capital Partners LLC and investment funds affiliated with TA Associates Management, L.P. Certain other persons are also expected to have an ownership interest in GT Polaris. Consummation of the Transaction is conditioned upon the contemporaneous acquisition of Orion Advisor Solutions, LLC and certain of its affiliates (collectively, “Orion”) by GT Polaris. Following consummation of the Transaction, Brinker Capital’s business will be integrated with the businesses of Orion. Orion currently is indirectly, majority-owned and controlled by investment funds affiliated with TA Associates Management, L.P. The business of an investment adviser within the Orion companies, CLS Investments, LLC, will be combined with Brinker Capital and Ms. Noreen Beaman, the current Chief Executive Officer of Brinker Capital, will be appointed as President of the combined investment adviser, which will operate as “Brinker Capital Investments.” Brinker Capital is entering into the Transaction because it believes the Transaction will provide Brinker Capital with access to personnel, resources and investment capital that will allow it to continue to grow its investment advisory business and continue to provide excellent services to its advisory clients, including the Funds. The Transaction is expected to close on or about September [30], 2020 (the “Closing”), pending satisfaction of all closing conditions. |

| | You are being asked to approve a new investment advisory agreement for your Fund(s) (the “New Agreement”) because the Transaction will be considered to result in a change of control of Brinker Capital under the Investment Company Act of 1940, as amended, and accordingly will result in the assignment and automatic termination of the investment advisory agreement pursuant to which Brinker Capital currently provides investment advisory services to each Fund (the “Current Agreement”). Shareholder approval of the New Agreement will enable Brinker Capital to continue to serve as an investment adviser to each Fund following the closing of the Transaction. Shareholders are not being asked to approve the Transaction. |

| Q. | How will the Transaction affect me as a shareholder of the Funds? |

| A. | The Transaction will not result in any changes to the organization or structure of the Funds and is not expected to result in any change or interruption to the services provided to the Funds by Brinker Capital or any of the Funds other service providers. You will still own the same shares in the same Funds after the close of the Transaction. If the New Agreement is approved, Brinker Capital will continue to provide advisory services to each Fund on the same terms, and at the same advisory fee rate, as Brinker Capital provides such services under the Current Agreement, and the portfolio managers of the Funds will not change. |

| Q. | How does the New Agreement differ from the Current Agreement? |

| A. | The terms of the New Agreement are identical to the terms of the Current Agreement, except with respect to the date, certain technical corrections and updates, and to reflect that the New Agreement will be permitted to be renewed by the Board telephonically if permitted by law. |

| Q. | How do the Trustees suggest that I vote? |

| A. | After careful consideration, the Board of Trustees of the Trust (the “Board”) unanimously approved the New Agreement at a meeting held on July 13, 2020 (the “Board Meeting”), and recommend that you vote “FOR” the approval of the New Agreement. Please see “Board Considerations in Approving the New Agreement” in the enclosed proxy statement for more information. |

| Q. | What happens if the New Agreement is not approved? |

| A. | If the New Agreement is not approved by shareholders, Brinker Capital will continue to provide services to each Fund under the Current Agreement until its term expires or is otherwise terminated, and the Board will consider what further action is in the best interests of each Fund and its shareholders, including resubmitting the New Agreement to shareholders for approval. |

| Q. | Will my vote make a difference? |

| A. | Yes. Every vote is important and we encourage all shareholders to participate in the governance of the Funds. Additionally, your immediate response on the enclosed proxy card or by telephone or Internet may help save the costs of further solicitations. |

| Q. | I am a separately managed account client of Brinker Capital through its Destinations advisory program, and Brinker Capital has proxy voting discretion with respect to the Fund shares I own. How will Brinker Capital vote my proxy with respect to the Proposal? |

| A. | Currently, approximately [●]% of each Fund’s shares are owned by separately managed account clients of Brinker Capital; in many cases, Brinker Capital has proxy voting discretion with respect to Fund shares held in such accounts. Brinker Capital intends to “echo vote” its clients’ shares of each Fund with respect to the Proposal in cases where Brinker Capital has proxy voting discretion. This means Brinker Capital will vote any Fund shares held by such separately managed account clients, for which it does not receive voting instructions, in the same proportion as the vote of its other separately managed account clients that do provide voting instructions. |

| Q. | How do I place my vote? |

| A. | You may vote your shares by any of the following methods: |

(1) Telephone: Call the telephone number provided on the proxy card attached to the enclosed Proxy Statement;

(2) Internet: Log on to the Internet as directed on the proxy card attached to the enclosed Proxy Statement and vote electronically;

| | (3) Regular Mail: If you are unable to vote by telephone or on the Internet, you can fill out the proxy card attached to the enclosed Proxy Statement and return it to us as directed on the proxy card; or |

| | (4) Shareholder Meeting: Although we would prefer that you place your vote by telephone or on the Internet, you also have the option to attend the virtual Special Meeting on Thursday, September 24, 2020 and vote at that time. We will be hosting the Special Meeting live via audio webcast. There is no physical location for the Special Meeting. Any shareholder eligible to vote can attend the Special Meeting live online by accessing [website]. You will need to obtain your own Internet access if you choose to virtually attend the Special Meeting. A summary of the information that you need to attend the webcast is provided below: |

| • | Instructions on how to attend and participate are posted at [website]. |

| • | Assistance with questions regarding how to attend and participate will be provided at [website] on the day of the meeting. |

| • | Webcast starts at 11:00 A.M., Eastern Time. |

| • | You will need your 16-Digit Control Number to enter the Special Meeting. |

| • | Shareholders may submit questions while attending the Special Meeting via the Internet. |

| Q. | Why hold a virtual meeting? |

| A: | In light of the concerns regarding novel coronavirus (COVID-19), we believe that hosting a virtual meeting is in the best interest of the Trust and its shareholders. |

We would prefer that you vote by telephone or on the Internet, if possible, because that enables a quicker processing of proxy votes and reduces the cost of the Special Meeting. Please refer to the proxy card attached to this Proxy Statement for further instructions on how to vote. Should you require additional information regarding the proxy or replacement proxy cards, please call shareholder services at [1-877-771-7979].

| Q. | Whom do I call if I have questions? |

| A. | If you need additional voting information, please call shareholder services at [1-877-771-7979] Monday through Friday [9:00 a.m. to 10:00 p.m. Eastern Time]. |

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. FOR SHAREHOLDERS RECEIVING HARD COPIES OF THESE PROXY MATERIALS, A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE, SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

BRINKER CAPITAL DESTINATIONS TRUST

1055 Westlakes Drive, Suite 250

Berwyn, PA 19312

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON September [24], 2020

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Trustees of Brinker Capital Destinations Trust (the “Trust”) for use at the Special Meeting of Shareholders of the Destinations Large Cap Equity Fund, Destinations Small-Mid Cap Equity Fund, Destinations International Equity Fund, Destinations Equity Income Fund, Destinations Real Assets Fund, Destinations Core Fixed Income Fund, Destinations Low Duration Fixed Income Fund, Destinations Global Fixed Income Opportunities Fund, Destinations Municipal Fixed Income Fund and Destinations Multi Strategy Alternatives Fund (each, a “Fund,” and together, the “Funds”) to be held virtually at [website] on September [24], 2020 at [11] a.m., Eastern time, and at any adjourned session thereof (such special meeting and any adjournment thereof are hereinafter referred to as the “Meeting”). Shareholders of record of each Fund at the close of business on July [24], 2020 (the “Record Date” and such shareholders, “Shareholders”) are entitled to vote at the Meeting. The proxy card and this proxy statement, as well as the accompanying notice of special meeting, are being electronically or physically mailed to Shareholders (depending on each Shareholder’s current setup for receiving information from the Trust) during the period from August [5] until August [10], 2020, or thereabouts.

The Trust currently offers two classes of shares of beneficial interest of each Fund (“Shares”): Class I Shares and Class Z Shares. Each full Share will be entitled to one vote at the Meeting and each fraction of a Share will be entitled to the fraction of a vote equal to the proportion of a full Share represented by the fractional Share. As of the Record Date, the Funds had the following Shares issued and outstanding:

| Fund | Share Class | Shares Issued and

Outstanding |

| Destinations Large Cap Equity Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations Small-Mid Cap Equity Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations International Equity Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations Equity Income Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations Real Assets Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations Core Fixed Income Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations Low Duration Fixed Income Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations Global Fixed Income Opportunities Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations Municipal Fixed Income Fund | Institutional Class | [•] |

| Class I | [•] |

| Destinations Multi Strategy Alternatives Fund | Institutional Class | [•] |

| Class I | [•] |

As used in this proxy statement, the Trust’s Board of Trustees is referred to as the “Board,” and the term “Trustee” includes each trustee of the Trust. A Trustee who is not an “interested person” of the Trust, as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), is referred to in this proxy statement as an “Independent Trustee.”

PROPOSAL – APPROVAL OF THE NEW INVESTMENT ADVISORY AGREEMENT

The Change in Control of Brinker Capital, Inc.

Brinker Capital, Inc. (“Brinker Capital”), a subsidiary of Brinker Capital Holdings, Inc. (“Brinker Holdings”) serves as investment adviser to each Fund. On June 26, 2020, Brinker Holdings entered into an agreement, pursuant to which GT Polaris, Inc. (“GT Polaris”), a newly formed entity, will acquire 100% of the issued and outstanding equity interests of Brinker Holdings (the “Transaction”). GT Polaris will be indirectly owned and controlled by investment funds affiliated with Genstar Capital Partners LLC and investment funds affiliated with TA Associates Management, L.P. Certain other persons are also expected to have an ownership interest in GT Polaris. Consummation of the Transaction is conditioned upon the contemporaneous acquisition of Orion Advisor Solutions, LLC and certain of its affiliates (collectively, “Orion”) by GT Polaris. Following consummation of the Transaction, Brinker Capital’s business will be integrated with the businesses of Orion. Orion currently is indirectly, majority-owned and controlled by investment funds affiliated with TA Associates Management, L.P. The business of an investment adviser within the Orion companies, CLS Investments, LLC, will be combined with Brinker Capital and Ms. Noreen Beaman, the current Chief Executive Officer of Brinker Capital, will be appointed as President of the combined investment adviser, which will operate as “Brinker Capital Investments.” Brinker Capital is entering into the Transaction because it believes the Transaction will provide Brinker Capital with access to personnel, resources and investment capital that will allow it to continue to grow its investment advisory business and continue to provide excellent services to its advisory clients, including the Funds. The Transaction is expected to close on or about September [30], 2020 (the “Closing”), pending satisfaction of all closing condition.

Brinker Capital believes the Transaction benefits Shareholders in the following respects, among others:

| · | The Transaction will provide Brinker Capital and the Funds with access to advanced technologies used for investment, operational, accounting and administrative purposes, which will allow Brinker Capital to grow its businesses to better meet the demands of an evolving marketplace of investors, continue to provide excellent service to its clients, including the Funds, and better compete in the marketplace. |

| · | The parties’ reputation, expertise and standing will offer the potential to, among other things, increase assets invested in the Funds, which will help the Funds to achieve economies of scale that can be passed onto Fund shareholders. As Brinker Capital and the Funds grow, the Funds may also benefit from being able to attract additional sub-advisers and being able to negotiate more favorable terms with service providers. |

| · | The Transaction may also benefit the Funds by introducing them to new distribution partners or distribution channels, which could have the effect of increasing the Fund’s assets and reputation in the marketplace. |

| · | The parties have a deep understanding-of and belief-in Brinker Capital's approach, particularly in relation to Brinker Capital’s investment teams and clients. Brinker Capital is of the view that the parties will support the autonomy offered to Brinker Capital’s investment personnel, which will lead to better outcomes for the Funds. |

| · | The Funds’ portfolio managers will not change in connection with the Transaction, which will allow Shareholders to experience continuity of management of the Funds. |

| · | The Transaction will create a long term capital base and support for Brinker Capital’s approach and structure that can provide long term stability for the business, which, in turn, enhances Brinker Capital’s ability to consistently and effectively service the Funds. |

The Transaction will be deemed to result in a change of control of Brinker Capital under the Investment Company Act of 1940, as amended (the “1940 Act”), resulting in the assignment, and automatic termination, of the advisory agreement between the Trust, on behalf of each Fund, and Brinker Capital (the “Current Agreement”). Section 15(a)(4) of the 1940 Act requires the automatic termination of an advisory contract when it is assigned. As a result, Shareholders of each Fund are being asked to approve a new advisory agreement between the Trust, on behalf of each Fund, and Brinker Capital (the “New Agreement”) so that Brinker Capital’s management of the Fund may continue without any interruption. Shareholders are not being asked to approve the Transaction.

As discussed in greater detail below, at a meeting held on July 13, 2020 (the “Board Meeting”), the Board approved the New Agreement, to become effective upon Shareholder approval. In addition, the Board, including all of the Independent Trustees, unanimously recommended the approval of the New Agreement to each Fund’s Shareholders.

The Transaction will not result in any changes to the organization or structure of the Funds and is not expected to result in any change or interruption to the services provided to the Funds by Brinker Capital or any of the Funds other service providers. You will still own the same shares in the same Funds after the close of the Transaction. If the New Agreement is approved, Brinker Capital will continue to serve as the Funds’ investment adviser, and none of the Funds’ other service providers are expected to change in connection with the Transaction. Under the New Agreement, Brinker Capital will provide the same advisory services to the Funds on the same terms as Brinker Capital provides such services under the Current Agreement. The advisory fee rate paid by the Funds to Brinker Capital under the Current Agreement will remain unchanged under the New Agreement.

If the New Agreement is not approved by Shareholders, the Board will consider such further action as it deems in the best interests of Shareholders, which may include resubmitting the New Agreement to Shareholders for approval.

Required Vote

Shareholders of each Fund will vote on the Proposal. In general, the 1940 Act requires all new investment advisory agreements to be approved by the vote of a “majority of the outstanding voting securities” (as defined in the 1940 Act) of a registered investment company. Under the 1940 Act, the vote of a “majority of the outstanding voting securities” of a Fund means the affirmative vote of the lesser of: (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy; or (b) more than 50% of the outstanding voting securities (a “1940 Act Majority”). Approval of the Proposal with respect to a Fund requires the affirmative vote of a 1940 Act Majority of the Fund’s shares. Accordingly, the purpose of this Proxy Statement is to submit the New Agreement to a vote of each Fund’s Shareholders pursuant to the requirements of the 1940 Act described above. Approval of the Proposal by Shareholders of one Fund is not contingent upon the approval of the Proposal by Shareholders of another Fund. If Shareholders of only one Fund or some of the Funds approve the Proposal, the Board will consider such further action as it deems in the best interests of Shareholders, which may include resubmitting the New Agreement to Shareholders of the applicable Fund(s) for approval.

Voting Authority of Brinker Capital

Because of the structure of Brinker Capital’s investment advisory programs, whereby the Funds are used to implement model-driven investment advice based on the particular financial circumstances and risk tolerance of the underlying investor (with whom Brinker Capital typically also has an adviser-client relationship), Brinker Capital often will have proxy voting discretion on behalf of a Fund shareholder. Currently, approximately [●]% of each Fund’s shares are owned by separately managed account clients of Brinker Capital and Brinker Capital has the authority to vote approximately [45]% of each Fund’s outstanding shares as of the Record Date. Brinker Capital intends to “echo vote” its clients’ shares of each Fund with respect to the Proposal in cases where Brinker Capital has proxy voting discretion. This means Brinker Capital will vote any Fund shares held by such separately managed account clients, for which it does not receive voting instructions, in the same proportion as the vote of its other separately managed account clients that do provide voting instructions. This will allow Brinker Capital, on behalf of those shareholders for whom no timely instructions are received, to follow the desired outcome of the Proposal as voiced by those shareholders who vote. The effect of this proportional voting is that a relatively small number of shareholders may determine the outcome of the vote.

Description of the Material Terms of the Current Agreement and the New Agreement

| · | Material Terms of the Current Agreement and the New Agreement |

The Current Agreement, dated January 18, 2017, was initially approved by the Funds’ initial shareholder. The New Agreement will become effective for each Fund upon the closing of the Transaction, subject to the approval by each Fund’s Shareholders. The terms of the New Agreement are identical to the terms of the Current Agreement, except with respect to the date, certain technical corrections and updates, and to reflect that the New Agreement will be permitted to be renewed by the Board telephonically if permitted by law. The change to permit telephonic renewal is in response to the present remote working environment, which currently is of uncertain duration, and for which the U.S. Securities and Exchange Commission has provided certain time-limited exemptive relief. Set forth below is a summary of material terms of the New Agreement. The form of the New Agreement is included as Appendix A. Although the summary of material terms of the New Agreement below is qualified in its entirety by reference to the form of New Agreement included as Appendix A, Shareholders should still read the summary below carefully.

The advisory fee rate under the Current Agreement and the New Agreement is the same. The annualized advisory fee rate paid to Brinker Capital by the Trust will remain at 0.75% of the Destinations Large Cap Equity Fund’s average daily net assets, 0.90% of the Destinations Small-Mid Cap Equity Fund’s average daily net assets, 1.00% of the Destinations International Equity Fund’s average daily net assets, 0.80% of the Destinations Equity Income Fund’s average daily net assets, 1.00% of the Destinations Real Assets Fund’s average daily net assets, 0.65% of the Destinations Core Fixed Income Fund’s average daily net assets, 0.70% of the Destinations Low Duration Fixed Income Fund’s average daily net assets, 0.85% of the Destinations Global Fixed Income Opportunities Fund’s average daily net assets, 0.70% of the Destinations Municipal Fixed Income Fund’s average daily net assets, and 1.35% of the Destinations Multi Strategy Alternatives Fund’s average daily net assets. In addition, the Funds’ operating expenses are not expected to increase as a percentage of Fund assets as a result of the Transaction or entering into the New Agreement.

The New Agreement would require Brinker Capital to provide the same services as Brinker Capital provided under the Current Agreement. Brinker Capital shall, subject to the supervision of the Board, regularly provide the Funds with investment research, advice and supervision and shall furnish continuously an investment program for each Fund’s assets consistent with the investment objectives and policies of each Fund.

The New Agreement has the same duration and termination provisions as the Current Agreement. The New Agreement will have an initial term of two years from its effective date and will continue from year to year so long as its renewal is specifically approved by (a) a majority of the Trustees who are not parties to the New Agreement and who are not “interested persons” (as defined in the 1940 Act) of any party to the New Agreement, at a meeting called for the purpose of voting on such approval and a majority vote of the Trustees or (b) by vote of a majority of the voting securities of each Fund. It may be terminated by the Trust, without the payment of any penalty, by a vote of the Board or with respect to a Fund, upon the affirmative vote of a majority of the outstanding voting securities of the Fund. It may also be terminated at any time upon not more than 60 days’ nor less than 30 days’ written notice by Brinker Capital, without the payment of any penalty, and shall automatically terminate in the event of its assignment.

The New Agreement requires that Brinker Capital provide the Funds with the same standard of care subjects Brinker Capital to the same degree of potential liability as the Current Agreement.

| · | Information on Investment Advisory Fees Paid |

For the fiscal year ended February 29, 2020, the following table shows: (i) the aggregate amount of fees paid to the sub-advisers by Brinker Capital; (ii) the fees waived by Brinker Capital; and (iii) the contractual advisory fee that Brinker Capital is entitled to receive from each Fund:

| | | Total Contractual

Advisory Fee | | | Portion of Advisory

Fee Waived by

Brinker Capital | | | Aggregate Sub-

advisory Fee Paid

by Brinker Capital | |

| Destinations Large Cap Equity Fund | | $ | 28,938,783 | | | $ | 5,140,568 | | | $ | 8,750,067 | |

| Destinations Small-Mid Cap Equity Fund | | $ | 8,968,662 | | | $ | 363,761 | | | $ | 4,716,866 | |

| Destinations International Equity Fund | | $ | 18,552,554 | | | $ | 1,478,368 | | | $ | 9.838,690 | |

| Destinations Equity Income Fund | | $ | 3,701,154 | | | $ | 673,076 | | | $ | 1,223,765 | |

| Destinations Real Assets Fund | | $ | 1,052,292 | | | $ | 133,775 | | | $ | 542,992 | |

| Destinations Core Fixed Income Fund | | $ | 12,308,093 | | | $ | 1,489,218 | | | $ | 3,434,012 | |

| Destinations Low Duration Fixed Income Fund | | $ | 2,702,168 | | | $ | 57,401 | | | $ | 1,139,269 | |

| Destinations Global Fixed Income Opportunities Fund | | $ | 6,761,808 | | | $ | 876,917 | | | $ | 2,782,409 | |

| Destinations Municipal Fixed Income Fund | | $ | 6,211,004 | | | $ | 1,355,495 | | | $ | 1,398,836 | |

| Destinations Multi Strategy Alternatives Fund | | $ | 12,511,065 | | | $ | 3,637,206 | | | $ | 5,259,548 | |

Brinker Capital’s current contractual fee waiver arrangements will remain in effect until June 30, 2021 and Brinker Capital currently expects to annually renew them on a going-forward basis, as it has since the launch of the Funds.

Information about Brinker Capital

Brinker Capital, a Delaware corporation with its principal place of business at 1055 Westlakes Drive, Suite 250, Berwyn, PA 19312, is an investment adviser registered under the Investment Advisers Act of 1940, as amended. Brinker Capital is wholly-owned by Brinker Capital Holdings, Inc. As of June 30, 2020, Brinker Capital had approximately $[25.3] billion in assets under management or administration.

Listed below are the names and titles of each current principal executive officer and director of Brinker Capital. The principal business address of each principal executive officer and director is 1055 Westlakes Drive, Suite 250, Berwyn, PA 19312.

| Name | Position Held With Brinker Capital |

| I. Charles Widger | Executive Chairman |

| Noreen D. Beaman | Chief Executive Officer |

| Philip F. Green Jr. | Chief Financial Officer |

| Brian M. Ferko | Chief Compliance Officer |

| Jason B. Moore | Chief Solutions Officer |

| Donna M. Marley | Senior Vice President of Funds |

Section 15(f) of the 1940 Act

Brinker Capital intends for the Transaction to come within the safe harbor provided by Section 15(f) of the 1940 Act, which permits an investment adviser of a registered investment company (or any affiliated persons of the investment adviser) to receive any amount or benefit in connection with a sale of an interest in the investment adviser that results in an assignment of an investment advisory contract, provided that the following two conditions are satisfied.

First, an “unfair burden” may not be imposed on the investment company as a result of the sale of the interest, or any express or implied terms, conditions or understandings applicable to the sale of the interest. The term “unfair burden,” as defined in the 1940 Act, includes any arrangement during the two-year period following the transaction whereby the investment adviser (or predecessor or successor adviser), or any “interested person” of the adviser (as defined in the 1940 Act), receives or is entitled to receive any compensation, directly or indirectly, from the investment company or its security holders (other than fees for bona fide investment advisory or other services), or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than ordinary fees for bona fide principal underwriting services). Brinker Capital has confirmed that the Transaction will not impose an unfair burden on the Funds within the meaning of Section 15(f) of the 1940 Act.

Second, during the three-year period following the Transaction, at least 75% of the members of the investment company's board of trustees cannot be “interested persons” (as defined in the 1940 Act) of Brinker Capital. At the present time, five out of six (or 83.3%) of the Trustees are classified as not “interested persons” with respect to Brinker Capital. Brinker Capital anticipates that for a period of three years following the closing of the Transaction, at least 75% of the members of the Board will not be interested persons of Brinker Capital.

[Board Considerations in Approving the New Agreement

In preparation for the Board Meeting, the Trustees requested that Brinker Capital furnish information necessary to evaluate the terms of the New Agreement. The Trustees used this information, as well as other information that other service providers of the Funds submitted to the Board in connection with the Board Meeting and other meetings held since the most recent renewal of the Current Agreement in December 2019, to help them decide whether to approve the New Agreement for an initial two-year term. In recognition of the fact that the Transaction was in progress and had not been closed at the time of the Board Meeting and that the Board was being asked to approve the New Agreement with Brinker Capital as it was expected to exist as of the close of the Transaction, the materials provided by Brinker Capital addressed both Brinker Capital as it existed at the time of the Board Meeting and Brinker Capital as it was expected to exist after the consummation of the Transaction.

Specifically, the Board requested and received written materials from Brinker Capital regarding, among other things: (i) the terms, conditions, and expected timing of the Transaction, and the reasons that Brinker Capital was undergoing the Transaction; (ii) the nature, extent and quality of the services to be provided by Brinker Capital under the New Agreement; (iii) Brinker Capital’s and the buyers’ operations and financial condition; (iv) the proposed advisory fee to be paid to Brinker Capital under the New Agreement; (v) Brinker Capital’s compliance program; and (vi) Brinker Capital’s investment management personnel.

At the Board Meeting, the Trustees, including all of the Independent Trustees, based on their evaluation of the information provided by Brinker Capital and other service providers of the Funds, approved the New Agreement. As part of their evaluation, the Independent Trustees received advice from independent counsel and met in executive session outside the presence of Fund management and Brinker Capital. In considering the approval of the New Agreement, the Board considered various factors that they determined were relevant, including: (i) the nature, extent and quality of the services to be provided by Brinker Capital; (ii) the investment performance of the Funds and Brinker Capital; and (iii) the fee to be paid to Brinker Capital under the New Agreement, as discussed in further detail below. In addition, the Board, in considering the New Agreement in the context of the Transaction, relied upon representations from Brinker Capital that: (i) the Transaction was not expected to result in any material changes to the nature, quality and extent of services provided to the Funds by Brinker Capital that are discussed below, and, in fact, was expected to result in greater access to resources, personnel and technologies that are expected to enhance the services provided to the Funds by Brinker Capital; (ii) Brinker Capital did not anticipate any material changes to its compliance program or Code of Ethics in connection with the Transaction; and (iii) the portfolio managers for the Funds were not expected to change in connection with the Transaction.

Nature, Extent and Quality of Services Provided by Brinker Capital

In considering the nature, extent and quality of the services to be provided by Brinker Capital, the Board reviewed the portfolio management services to be provided by Brinker Capital to the Funds, including the quality of the continuing portfolio management personnel, the resources expected to be made available to Brinker Capital after the consummation of the Transaction and Brinker Capital’s compliance history and compliance program. The Trustees reviewed the terms of the proposed New Agreement, and noted that the New Agreement has the same advisory fee as, and does not materially differ from, the Current Agreement. The Trustees also reviewed Brinker Capital’s investment and risk management approaches for the Funds. The Trustees also considered other services to be provided to the Funds by Brinker Capital such as monitoring adherence to each Fund’s investment restrictions and monitoring compliance with various Fund policies and procedures and with applicable securities laws and regulations. Based on the factors above, as well as those discussed below, the Board concluded, within the context of its full deliberations, that the nature, extent and quality of the services to be provided to each Fund by Brinker Capital under the New Agreement would be satisfactory.

Investment Performance of Brinker Capital

In connection with its most recent approval of the continuation of the Current Agreement and other meetings held during the course of the trailing 12-month period, the Board was provided with reports regarding each Fund’s performance over various time periods. As part of these meetings, Brinker Capital and its representatives provided information regarding and, as applicable, led discussions of factors impacting, Brinker Capital’s performance for the Funds, outlining current market conditions and explaining their expectations and strategies for the future. The Trustees determined that it was appropriate to take into account its consideration of Brinker Capital’s performance at meetings held prior to the Board Meeting. In doing so, the Trustees determined that Brinker Capital’s performance was satisfactory, or, where Brinker Capital’s performance was materially below a Fund’s benchmarks and or peer group, the Trustees were satisfied by the reasons for underperformance and/or the steps taken by Brinker Capital in an effort to improve performance. Based on this information and Brinker Capital’s representation that the portfolio managers for the Funds were not expected to change in connection with the Transaction, the Board concluded, within the context of its full deliberations, that the investment results that Brinker Capital had been able to achieve for each Fund were sufficient to support approval of the New Agreement.

Costs of Advisory Services, Profitability and Economies of Scale

With respect to the cost of advisory services, the Board considered that the investment advisory fee payable to Brinker Capital under the New Agreement is the same as the investment advisory fee payable to Brinker Capital under the Current Agreement. With respect to profitability and economies of scale, the Board considered Brinker Capital’s profitability and economies of scale from its management of the Funds when it most recently approved the continuation of the Current Agreement, but determined that such profitability and economies of scale may change as a result of the changes to Brinker Capital’s ownership structure and operations that will occur after the consummation of the Transaction. Accordingly, the Trustees did not make any conclusions regarding Brinker Capital’s profitability, or the extent to which economies of scale would be realized by Brinker Capital as the assets of the Funds grow, but will do so during future considerations of the New Agreement. The Board noted Brinker Capital’s expectation that if the Transaction is successful, the Funds likely will increase in size, which would result in economies of scale that could be passed onto the Funds’ shareholders.

Conclusion

Although formal Board action was not taken with respect to the conclusions discussed above, those conclusions formed, in part, the basis for the Board’s approval of the New Agreement at the Board Meeting. The Board concluded, in the exercise of its reasonable judgment, that the terms of the New Agreement, including the compensation to be paid thereunder, are reasonable in relation to the services expected to be provided by Brinker Capital to the Funds and that the appointment of Brinker Capital and the approval of the New Agreement would be in the best interest of the Funds and their Shareholders. Based on the Trustees’ deliberations and their evaluation of the information described above and other factors and information they believed relevant, the Board, including all of the Independent Trustees, unanimously approved (a) the appointment of Brinker Capital as investment adviser to the Funds, and (b) the New Agreement.

In evaluating the background and conclusions discussed above, Shareholders should consider:

| · | In reaching its determination regarding the approval of the New Agreement, the Board, including all of the Independent Trustees, considered the factors, conclusions and information they believed relevant in the exercise of their reasonable judgment, including, but not limited to, the factors, conclusions and information discussed above; and |

| · | In their deliberations, the Board members did not identify any particular factor (or conclusion with respect thereto) or information that was all important or controlling, and each Board member may have attributed different weights to the various factors (and conclusions with respect thereto) and information. |

THE TRUSTEES UNANIMOUSLY RECOMMEND THAT SHAREHOLDERS OF EACH FUND VOTE TO APPROVE THE PROPOSAL.]

ADDITIONAL INFORMATION

Other Service Providers

Brown Brothers Harriman & Co (“BBH”), located at 50 Post Office Square, Boston, Massachusetts, 02110, serves as the Funds’ administrator, fund accountant and custodian.

Foreside Fund Services, LLC (“Foreside”), located at Three Canal Plaza, Suite 100, Portland, Maine 04101, serves as the Funds’ distributor and principal underwriter.

UMB Fund Services, Inc. located at 235 W. Galena Street, Milwaukee, Wisconsin 53212, serves as a transfer agent and provides shareholder services to the Trust to render certain shareholder record keeping and accounting services.

Morgan, Lewis & Bockius LLP, located at 1701 Market Street, Philadelphia, PA 19103, serves as counsel to the Trust.

Tait, Weller & Baker LLP, located at Two Liberty Place, 50 South 16th Street, Suite 2900, Philadelphia, PA 19102, serves as the independent registered public accounting firm of the Trust.

Payment of Expenses

The various parties involved in the Transaction have contractually agreed to pay the expenses of the preparation, printing and mailing of this proxy statement and its enclosures and of all related solicitations. The Funds will not incur any of these expenses.

Commissions Paid to Affiliated Brokers

During the Funds’ most recently completed fiscal year ended February 29, 2020, the Funds did not pay any commissions to any affiliated brokers.

Beneficial Ownership of Shares

As of the Record Date, the following persons owned of record, or were known by the Trust to own beneficially, more than 5% of the shares of a class of a Fund. On that date, the Trustees and officers of such Fund, together as a group, beneficially owned less than 1% of the Fund’s outstanding shares.

| FUND NAME | | Share

Class | | Name & Address | | Form of

Ownership | | Percent of

Class Owned | |

| Destinations Large Cap Equity | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Large Cap Equity | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Large Cap Equity | | Class Z | | Matrix Financial Solution 717 17th St., Suite 1300, Denver, CO 80202 | | Record Owner | | | [●] | % |

| Destinations Small-Mid Cap Equity Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Small-Mid Cap Equity Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Small-Mid Cap Equity Fund | | Class Z | | Matrix Financial Solution 717 17th St., Suite 1300, Denver, CO 80202 | | Record Owner | | | [●] | % |

| Destinations International Equity Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations International Equity Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations International Equity Fund | | Class Z | | Matrix Financial Solution 717 17th St., Suite 1300, Denver, CO 80202 | | Record Owner | | | [●] | % |

| Destinations Equity Income Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Equity Income Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Equity Income Fund | | Class Z | | Matrix Financial Solution 717 17th St., Suite 1300, Denver, CO 80202 | | Record Owner | | | [●] | % |

| Destinations Equity Income Fund | | Class Z | | Apex Clearing Corporation

One Dallas Center, 350 N. Paul St.

Suite 1300, Dallas, TX 75201 | | Record Owner | | | [●] | % |

| Destinations Real Assets Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Real Assets Fund | | Class I | | Pershing LLC

One Pershing Plaza, Jersey City, NJ 07399 | | Record Owner | | | [●] | % |

| Destinations Real Assets Fund | | Class I | | LPL Financial LLC 75 State St., 22nd Floor, Boston, MA 02109 | | Record Owner | | | [●] | % |

| Destinations Real Assets Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Real Assets Fund | | Class Z | | Brinker Capital, Inc.

1055 Westlakes Dr., Suite 250

Berwyn, PA 19312 | | Record Owner | | | [●] | % |

| Destinations Core Fixed Income Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Core Fixed Income Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Core Fixed Income Fund | | Class Z | | Matrix Financial Solution 717 17th St., Suite 1300, Denver, CO 80202 | | Record Owner | | | [●] | % |

| Destinations Low Duration Fixed Income Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Low Duration Fixed Income Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Low Duration Fixed Income Fund | | Class Z | | Matrix Financial Solution 717 17th St., Suite 1300, Denver, CO 80202 | | Record Owner | | | [●] | % |

| Destinations Global Fixed Income Opportunities Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Global Fixed Income Opportunities Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Global Fixed Income Opportunities Fund | | Class Z | | Matrix Financial Solution 717 17th St., Suite 1300, Denver, CO 80202 | | Record Owner | | | [●] | % |

| Destinations Municipal Fixed Income Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Municipal Fixed Income Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Municipal Fixed Income Fund | | Class Z | | Apex Clearing Corporation

One Dallas Center, 350 N. Paul St.

Suite 1300, Dallas, TX 75201 | | Record Owner | | | [●] | % |

| Destinations Multi Strategy Alternatives Fund | | Class I | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Multi Strategy Alternatives Fund | | Class Z | | National Financial Services Corp.

200 Seaport Blvd., Boston, MA 02110 | | Record Owner | | | [●] | % |

| Destinations Multi Strategy Alternatives Fund | | Class Z | | Matrix Financial Solution 717 17th St., Suite 1300, Denver, CO 80202 | | Record Owner | | | [●] | % |

The information as to beneficial ownership is based on statements furnished to such Fund by the Trustees, and/or on the records of the Trust’s transfer agent.

Annual and Semi-Annual Report to Shareholders

For a free copy of the Funds’ annual report dated February 29, 2020, which covers the period from March 1, 2019 to February 29, 2020, or semi-annual report dated August 31, 2019, which covers the period from March 1, 2019 to August 31, 2019, Shareholders may call [(877) 771-7979] or write to the Fund at: Brinker Capital Destinations Funds, P.O. Box 2175, Milwaukee, WI 53201.

Submission of Shareholder Proposals

The Trust is organized as a statutory trust under the laws of the State of Delaware. As such, the Trust is not required to, and does not, hold annual meetings. Nonetheless, the Board may call a special meeting of shareholders for action by shareholder vote as may be required by the 1940 Act or as required or permitted by the Declaration of Trust and Amended and Restated By-Laws of the Trust. Shareholders of the Fund who wish to present a proposal for action at a future meeting, including a recommendation for nominations to fill vacancies on the Board, should submit a written proposal to the Trust for inclusion in a future proxy statement. Submission of a proposal does not necessarily mean that such proposal will be included in the Fund’s proxy statement because inclusion in the proxy statement is subject to compliance with certain federal regulations. Shareholders retain the right to request that a meeting of the shareholders be held for the purpose of considering matters requiring shareholder approval.

Voting and Other Matters

If you wish to participate in the Meeting, you may submit the proxy card included with this proxy statement or attend virtually. Your vote is important no matter how many shares you own. You can vote easily and quickly by mail, by Internet, by telephone or virtually. At any time before the Meeting, you may change your vote, even though a proxy has already been returned, by written notice to the Trust or by submitting a subsequent proxy, by mail, by Internet, by telephone or by voting virtually at the Meeting. Should shareholders require additional information regarding the proxy or replacement proxy cards, they may contact shareholder services at [1-877-771-7979].

The solicitation of proxies will be largely by mail, but may include telephonic, Internet or oral communication by officers and service providers of the Trust. The costs of the solicitation of proxies and the costs of holding the Meeting will be borne by the various parties involved in the Transaction, not the Funds. All proxy cards solicited that are properly executed and received in time to be voted at the Meeting will be voted at the Meeting or any adjournment thereof according to the instructions on the proxy card. If no specification is made on an executed proxy card, it will be voted FOR the matters specified on the proxy card.

If your shares are held of record by a broker-dealer and you wish to vote virtually at the Meeting, you should obtain a legal proxy from your broker of record and present it virtually to the Inspector of Elections at the Meeting. The presence in person or by proxy of shareholders of each Fund holding more than thirty-three and one-third percent (33 1/3%) of the total number of votes eligible to be cast by all shareholders of the Fund as of the Record Date constitutes a quorum for the transaction of most business at the Meeting. For purposes of determining the presence of a quorum, abstentions or broker non-votes will be counted as present; however, they will have the effect of a vote AGAINST the Proposal. Although business can be conducted with the above quorum requirement, the 1940 Act requires that all new investment advisory agreements be approved by the vote of a 1940 Act Majority. Accordingly, in order for the Proposal to pass, the lesser of: (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy; or (b) more than 50% of the total outstanding voting securities, on a fund-by-fund basis, will be required.

As used above, “broker non-votes” relate to shares that are held of record by a broker-dealer for a beneficial owner who has not given instructions to such broker-dealer. Pursuant to certain rules promulgated by the New York Stock Exchange LLC that govern the voting by such broker-dealers, a broker-dealer holding shares of record for a beneficial owner may not exercise discretionary voting power with respect to certain non-routine matters, including the approval of a new investment management agreement as contemplated by the Proposal.

If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve the Proposal are not received, or if other matters arise requiring shareholder attention, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Except when a quorum is not present at the Meeting, any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. Abstentions and “broker non-votes” will not be counted for or against any such proposal to adjourn. The persons named as proxies will vote those proxies that they are entitled to vote FOR such Proposal in favor of such an adjournment, and will vote those proxies required to be voted AGAINST such Proposal, against such an adjournment. The various parties involved in the Transaction will bear the costs of any additional solicitation or any adjourned sessions, not the Funds. No business other than the matter described above is expected to come before the Meeting, but should any matter incident to the conduct of the Meeting or any question as to an adjournment of the Meeting arise, the persons named in the enclosed proxy will vote thereon according to their best judgment in the interest of the Funds.

SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING VIRTUALLY AND WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO VOTE BY MAIL, BY TELEPHONE OR INTERNET AS EXPLAINED ON THE PROXY CARD.

Appendix A - FORM OF INVESTMENT ADVISORY AGREEMENT

BRINKER CAPITAL DESTINATIONS TRUST

INVESTMENT ADVISORY AGREEMENT

THIS INVESTMENT ADVISORY AGREEMENT (“Agreement) is made as of the [30th] day of [September], 2020, by and between Brinker Capital Destinations Trust, a Delaware statutory trust (the “Trust”), on behalf of the series of the Trust indicated on Schedule A (each, a “Fund” and collectively, the “Funds”), which may be amended from time to time by written instrument executed by the parties to add additional Funds and Brinker Capital, Inc., a Delaware corporation (the “Adviser”).

WHEREAS, the Trust is registered with the U.S. Securities and Exchange Commission (“SEC”) as an open-end investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, each Fund is a series of the Trust having its own investment objective or objectives, policies, limitations and separate assets and liabilities; and

WHEREAS, the Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and engages in the business of providing investment management services; and

WHEREAS, the Trust, on behalf of each Fund, desires to retain the Adviser to render advice and services to each Fund pursuant to the terms and provisions of this Agreement, and the Adviser desires to furnish said advice and services; and

WHEREAS, the Adviser agrees to serve as the investment adviser for each Fund on the terms and conditions set forth herein; and

WHEREAS, the Adviser may retain one or more sub-advisers (the “Sub-Advisers”) to render portfolio management services to the Funds pursuant to investment sub-advisory agreements between the Adviser and each such Sub-Adviser (each, a “Sub-Advisory Agreement”).

NOW, THEREFORE, in consideration of the covenants and the mutual promises hereinafter set forth, the parties to this Agreement, intending to be legally bound hereby, mutually agree as follows:

1. APPOINTMENT OF ADVISER. The Trust hereby appoints the Adviser and the Adviser hereby accepts such appointment, to render investment advisory and related services to each Fund for the period and on the terms set forth in this Agreement, subject to the supervision and direction of the Trust’s Board of Trustees (the “Board”).

2. DUTIES OF ADVISER.

(a) GENERAL DUTIES. Subject to the supervision of the Board, the Adviser shall act as investment adviser to each Fund and shall supervise investments of each Fund in accordance with the investment objectives, policies and restrictions of each Fund as provided in each Fund’s prospectus and statement of additional information, as currently in effect and as amended or supplemented from time to time (the “Registration Statement”), and in compliance with the requirements applicable to registered investment companies under applicable laws, including, but not limited to, the 1940 Act, the Commodity Exchange Act and the rules of the National Futures Association, and those requirements applicable to regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended (“Code”). It is understood and agreed that the Adviser shall have no obligation to initiate litigation on behalf of each Fund.

Without limiting the generality of the foregoing, the Adviser shall: (i) furnish each Fund with advice and recommendations with respect to the investment of each Fund’s assets and the purchase and sale of portfolio securities and other investments for each Fund, including the taking of such steps as may be necessary to implement such advice and recommendations (i.e., placing the orders); (ii) manage and oversee the investments of each Fund, subject to the ultimate supervision and direction of the Board; (iii) vote proxies for each Fund (or delegate such responsibility to vote proxies), and file beneficial ownership reports required by Sections 13(f) and 13(g) of the Securities Exchange Act of 1934 (the “1934 Act”) for the Fund; (iv) maintain records relating to the advisory services provided by the Adviser hereunder required to be prepared and maintained by the Adviser or each Fund pursuant to applicable law; (v) furnish reports, statements and other data on securities, valuations of Fund assets, economic conditions and other matters related to the investment of each Fund’s assets which the officers of the Trust may reasonably request; and (vi) render to the Board such periodic and special reports with respect to each Fund’s investment activities as the Board may reasonably request; and (vii) have full authority to retain Sub-Advisers to provide certain investment advisory services to each Fund, subject to the approval of the Board and the requirements of the 1940 Act. In accordance with clause (vii), the Adviser may delegate certain of its duties under this Agreement with respect to a Fund to a Sub-Adviser or Sub-Advisers (including the rights and obligations set forth in Section 2(b) below) by entering into Sub-Advisory Agreements with one or more Sub-Advisers and, except as otherwise permitted under the terms of any exemptive relief granted to the Trust and Adviser by the SEC, or by rule or regulation, the Adviser may only enter into Sub-Advisory Agreements or materially amend Sub-Advisory Agreements with the approval of the Board and the approval of the shareholders of the affected Fund. The Adviser shall be responsible for overseeing the performance of the Sub-Advisers and recommending changes in Sub-Advisers as appropriate. The Adviser may pay the Sub-Adviser a portion of the compensation received by the Adviser hereunder; provided, however, that the Adviser shall remain fully liable for all of its obligations under this Agreement.

(b) BROKERAGE. In connection with the investment and reinvestment of the assets of each Fund, the Adviser is authorized (and can delegate to Sub-Advisers) to select the brokers, dealers or futures commission merchants that will execute purchase and sale transactions for each Fund’s portfolio (the “Portfolio”), to execute for each Fund as its agent and attorney-in-fact standard customer agreements and other documentation in connection with opening trading accounts with such brokers, dealers or futures commission merchants, including, but not limited to, ISDA agreements, and to use all reasonable efforts to obtain the best available price and most favorable execution (“best execution”) with respect to all such purchases and sales of portfolio securities for said Portfolio. The Adviser may take into consideration, among other things, the best net price available; the reliability, integrity and financial condition of the broker-dealer; the size of and difficulty in executing the order; and the value of the expected contribution of the broker-dealer to the investment performance of each Fund on a continuing basis. The price charged to a Fund in any transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of the portfolio execution services offered. The Adviser shall maintain records adequate to demonstrate compliance with the requirements of this section. Such records shall be made available to the Trust upon request.

In evaluating the ability of a broker-dealer to provide best execution with respect to a particular transaction, the Adviser may also consider the brokerage and research services provided (as those terms are defined in Section 28(e) of the 1934 Act). Consistent with any guidelines established by the Board and Section 28(e) of the 1934 Act, the Adviser is authorized to pay to a broker or dealer who provides such brokerage and research services a commission for executing a portfolio transaction for a Fund that is in excess of the amount of commission another broker or dealer would have charged for effecting that transaction if, but only if, the Adviser determines in good faith that such commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer -- viewed in terms of that particular transaction or in terms of the overall responsibilities of the Adviser to its discretionary clients, including the Fund. In addition, the Adviser is authorized to allocate purchase and sale orders for securities to brokers or dealers (including brokers and dealers that are affiliated with the Adviser, any Sub-Adviser or the Trust's principal underwriter) if the Adviser believes that the quality of the transaction and the commission are comparable to what they would be with other qualified firms. In no instance, however, will a Fund’s assets be purchased from or sold to the Adviser, any Sub-Adviser, the Trust's principal underwriter, or any affiliated person of either the Trust, Adviser, any Sub-Adviser or the principal underwriter, acting as principal in the transaction, except to the extent permitted by the SEC and the 1940 Act.

When the Adviser deems the purchase or sale of a security to be in the best interest of a Fund as well as of other clients, the Adviser, to the extent permitted by applicable laws and regulations and consistent with the Adviser’s duty to seek best execution, may aggregate orders of the Fund and of those other clients for the purchase or sale of the security. In such event, allocation of the securities so purchased or sold, as well as the expenses incurred in the transaction, will be made by the Adviser in the manner it considers to be equitable and consistent with its fiduciary obligations to the Fund and to such other clients.

The Trust authorizes and empowers the Adviser to open and maintain trading accounts in the name of each Fund and to execute for each Fund as its agent and attorney-in-fact customer agreements with such broker or brokers as the Adviser shall select as provided herein. The Adviser shall cause all securities and other property purchased or sold for a Fund to be settled at the place of business of the custodian or as the custodian shall direct. All securities and other property of a Fund shall remain in the direct or indirect custody of the custodian except as otherwise authorized by the Board.

The Adviser further shall have the authority to instruct the custodian to pay cash for securities and other property delivered to the custodian for a Fund and deliver securities and other property against payment for a Fund, and such other authority granted by the Trust from time to time. The Adviser shall not have authority to cause the custodian to deliver securities and other property or pay cash to the Adviser except as expressly provided herein.

3. REPRESENTATIONS OF THE ADVISER. The Adviser represents, warrants and agrees that it:

(a) has all requisite power and authority to enter into and perform its obligations under this Agreement;

(b) has taken all necessary actions to authorize its execution, delivery and performance of this Agreement;

(c) is registered as an adviser under the Advisers Act; and

(d) has furnished to the Trust the Adviser’s most recent registration statement on Form ADV.

4. REPRESENTATIONS OF THE TRUST. The Trust represents, warrants and agrees that it:

(a) has all requisite power and authority to enter into and perform its obligations under this Agreement;

(b) has taken all necessary actions to authorize its execution, delivery and performance of this Agreement; and

(c) has furnished to the Adviser copies of each of the following documents: (i) the Agreement and Declaration of Trust of the Trust; (ii) the Amended and Restated By-Laws of the Trust; (iii) the resolutions of the Board approving the engagement of the Adviser as investment adviser of the Funds and approving the form of this Agreement; and (iv) current copies of a Fund’s Registration Statement. The Trust shall furnish the Adviser from time to time with copies of all material amendments of or material supplements to the foregoing, if any.

5. COVENANTS OF THE ADVISER. The Adviser covenants that it shall:

(a) maintain all licenses and registrations necessary to perform its duties hereunder in good order; and

(b) maintain insurance in the types and in an amount at least equal to that disclosed to the Board in connection with their approval of this Agreement and shall provide prompt notice to the Trust (i) of any material changes in its insurance policies or insurance coverage; or (ii) if any material claims are reasonably expected to be made on its insurance policies. Furthermore, the Adviser shall, upon reasonable request, provide the Trust with any information it may reasonably require concerning the amount of or scope of such insurance.

6. INDEPENDENT CONTRACTOR. The Adviser shall, for all purposes herein, be deemed to be an independent contractor, and shall, unless otherwise expressly provided and authorized to do so in this Agreement or another writing by the Trust to the Adviser, have no authority to act for or represent the Trust or any Fund in any way, or in any way be deemed an agent for the Trust or for any Fund. It is expressly understood and agreed that the services to be rendered by the Adviser to the Fund under the provisions of this Agreement are not to be deemed exclusive, and that the Adviser may give advice and take action with respect to other clients, including affiliates of the Adviser, that may be similar or different from that given to any Fund.

7. ADVISER’S PERSONNEL. The Adviser shall, at its own expense, maintain such staff and employ or retain such personnel and consult with such other persons as it shall from time to time determine to be necessary to the performance of its obligations under this Agreement.

8. EXPENSES.

(a) With respect to the operation of each Fund, the Adviser shall be responsible for (i) providing the personnel, office space and equipment reasonably necessary to perform its obligations hereunder; and (ii) the costs of any special Board meetings or shareholder meetings convened for the primary benefit of the Adviser.

(b) The Adviser and the Trust, on behalf of a Fund, may, but are not obligated to, enter into a separate agreement pursuant to which the Adviser agrees to waive its management fee and/or reimburse Fund expenses in order to limit the total annual operating expenses of the Fund at a level set forth in such agreement.

(c) Each Fund is responsible for and has assumed the obligation for payment of all of its expenses, other than as stated in Section 8(a) above, including but not limited to: fees and expenses incurred in connection with the issuance, registration and transfer of its shares; brokerage and commission expenses; all expenses of transfer, receipt, safekeeping, servicing and accounting for the cash, securities and other property of the Trust for the benefit of the Fund including all fees and expenses of its custodian, shareholder services agent and accounting services agent; interest charges on any borrowings; costs and expenses of pricing and calculating its daily net asset value (including, without limitation, any equipment or services obtained for the purpose of pricing shares or valuing a Fund’s assets) and of maintaining its books of account required under the 1940 Act; taxes, if any; expenditures in connection with meetings of the Fund’s shareholders and the Board that are properly payable by the Fund; salaries and expenses of officers of the Trust, including without limitation the Trust’s Chief Compliance Officer, fees of members of the Board or members of any advisory board or committee, and expenses of members of the Board or members of any advisory board or committee; insurance premiums on property or personnel of the Fund that inure to its benefit, including liability and fidelity bond insurance; the cost of preparing, printing and mailing reports, proxy statements and Registration Statement of the Fund or other communications for distribution to prospective and existing shareholders; legal, auditing and accounting fees; all or any portion of trade association dues or educational program expenses determined appropriate by the Board; fees and expenses (including legal fees) of registering and maintaining registration of its shares for sale under applicable securities laws; all expenses of maintaining and servicing shareholder accounts, including all charges for transfer, shareholder recordkeeping, dividend disbursing, redemption, and other agents for the benefit of the Fund, if any; and all other charges and costs of its operation plus any extraordinary and non-recurring expenses, except as herein otherwise prescribed.

(d) Nothing herein shall prohibit the Trustees from approving the payment by the Trust of additional compensation to others for consulting services, supplemental research and security and economic analysis.

9. INVESTMENT ADVISORY AND MANAGEMENT FEE.

(a) The applicable Fund shall pay to the Adviser, and the Adviser agrees to accept, as full compensation for all services furnished or provided to such Fund pursuant to this Agreement, an annual management fee at the rate set forth in Schedule A to this Agreement.

(b) The management fee shall be accrued daily by each Fund and paid to the Adviser on the first business day of the succeeding month.

(c) The initial fee under this Agreement shall be payable on the first business day of the first month following the effective date of this Agreement and shall be prorated as set forth below. If this Agreement is terminated prior to the end of any month, the fee to the Adviser shall be prorated for the portion of any month in which this Agreement is in effect which is not a complete month according to the proportion which the number of calendar days in the month during which the Agreement is in effect bears to the number of calendar days in the month, and shall be payable within 10 days after the date of termination.