Exhibit 99.2

August 2022 SAFEHOLD AND ISTAR A TRANSFORMATIVE TRANSACTION

2 Forward - Looking Statements and Other Matters Forward - Looking Statements Certain matters discussed in this document may be forward - looking statements within the meaning of the Private Securities Litiga tion Reform Act of 1995. We have tried, whenever possible, to identify these statements by using words like “future,” “anticipate,” “intend,” “plan,” “estimate,” “believe,” “expect,” “pro jec t,” “forecast,” “could,” “would,” “should,” “will,” “may,” and similar expressions of future intent or the negative of such terms. These statements are subject to a number of risks and uncertainti es that could cause results to differ materially from those anticipated as of the date of this release. Actual results may differ materially as a result of (1) the ability to consummate the announced tra nsactions on the expected terms and within the anticipated time periods, or at all, which is dependent on the parties’ ability to satisfy certain closing conditions, including the approval of SAFE’s an d STAR’s stockholders, completion of the Spin - Off, sales of assets and other factors; (2) any delay or inability of New Safehold and/or SpinCo to realize the expected benefits of the transactions; (3) c han ges in tax laws, regulations, rates, policies or interpretations; (4) the value of New Safehold shares to be issued in the transaction; (5) the value of SpinCo's shares and liquidity in SpinCo's shares; (6 ) t he risk of unexpected significant transaction costs and/or unknown liabilities; (7) potential litigation relating to the proposed transactions; (8) the impact of actions taken by significant s toc kholders; (9) the potential disruption to STAR’s or SAFE’s respective businesses of diverted management attention, and the unanticipated loss of key members of senior management or other employees, in each cas e as a result of the announced transactions; and (10) general economic and business conditions that could affect New Safehold and SpinCo following the transactions. Risks that could cause ac tual risks to differ from those anticipated as of the date hereof include those discussed herein, those set forth in the securities filings of STAR, including its most recently filed Annual R epo rt on Form 10 - K, and those set forth in the securities filings of SAFE, including its most recently filed Annual Report on Form 10 - K. Each of STAR and SAFE also cautions the reader that undue reliance should not be placed on any forward - looking statements, which speak only as of the date of this document. Neither STAR nor SAFE undertakes any duty or responsibility to update any of these forward - looking statements to reflect events or circumstances after the date of this report or to reflect actual outcomes. Additional Information and Where You Can Find It In connection with the proposed transactions, STAR will file with the SEC a registration statement on Form S - 4 that will include a joint proxy statement of STAR and SAFE and that also will constitute a prospectus for the shares of STAR Common Stock being issued to SAFE’s stockholders in the proposed Merger. In addition, Spin Co will file with the SEC a Form 10 registration statement that will register its common shares. STAR, SAFE and SpinCo also may file other documents with the SEC regarding the proposed transact ion s. This document is not a substitute for the joint proxy statement/prospectus or Form 10 registration statement or any other document which STAR, SAFE and SpinCo may file with the SE C. INVESTORS AND SECURITY HOLDERS OF STAR AND SAFE, AS APPLICABLE, ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS, THE FORM 10 REGISTRATION STATEMENT AND ANY OTHER RELEVANT DO CUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTA IN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and security holders may obtain free copies of the joint proxy st atement/prospectus and the Form 10 registration statement (when available) and other documents filed with the SEC by STAR, SAFE and SpinCo through the web site maintained by th e SEC at www.sec.gov or by contacting the investor relations departments of STAR or SAFE at the following: This document is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to bu y any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities l aws of any such jurisdiction. This document is not a substitute for the prospectus or any other document that STAR, SAFE or SpinCo may file with the SEC in connection with the proposed transactions . N o offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in the Solicitation STAR, SAFE and their respective directors and executive officers may be deemed to be participants in the solicitation of prox ies in respect of the proposed transactions. Information regarding STAR’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is co nta ined in STAR’s definitive proxy statement for its 2022 annual meeting, which is on file with the SEC. Information regarding SAFE’s directors and executive officers, including a description of their dire ct interests, by security holdings or otherwise, is contained in SAFE’s definitive proxy statement for its 2022 annual meeting, which is filed with the SEC. A more complete description will be included in the re gistration statement on Form S - 4, the joint proxy statement/prospectus and the Form 10 registration statement. iStar, Inc . 1114 Avenue of the Americas 39 th Floor New York, NY 10036 Attention : Investor Relations Safehold, Inc . 1114 Avenue of the Americas 39 th Floor New York, NY 10036 Attention : Investor Relations

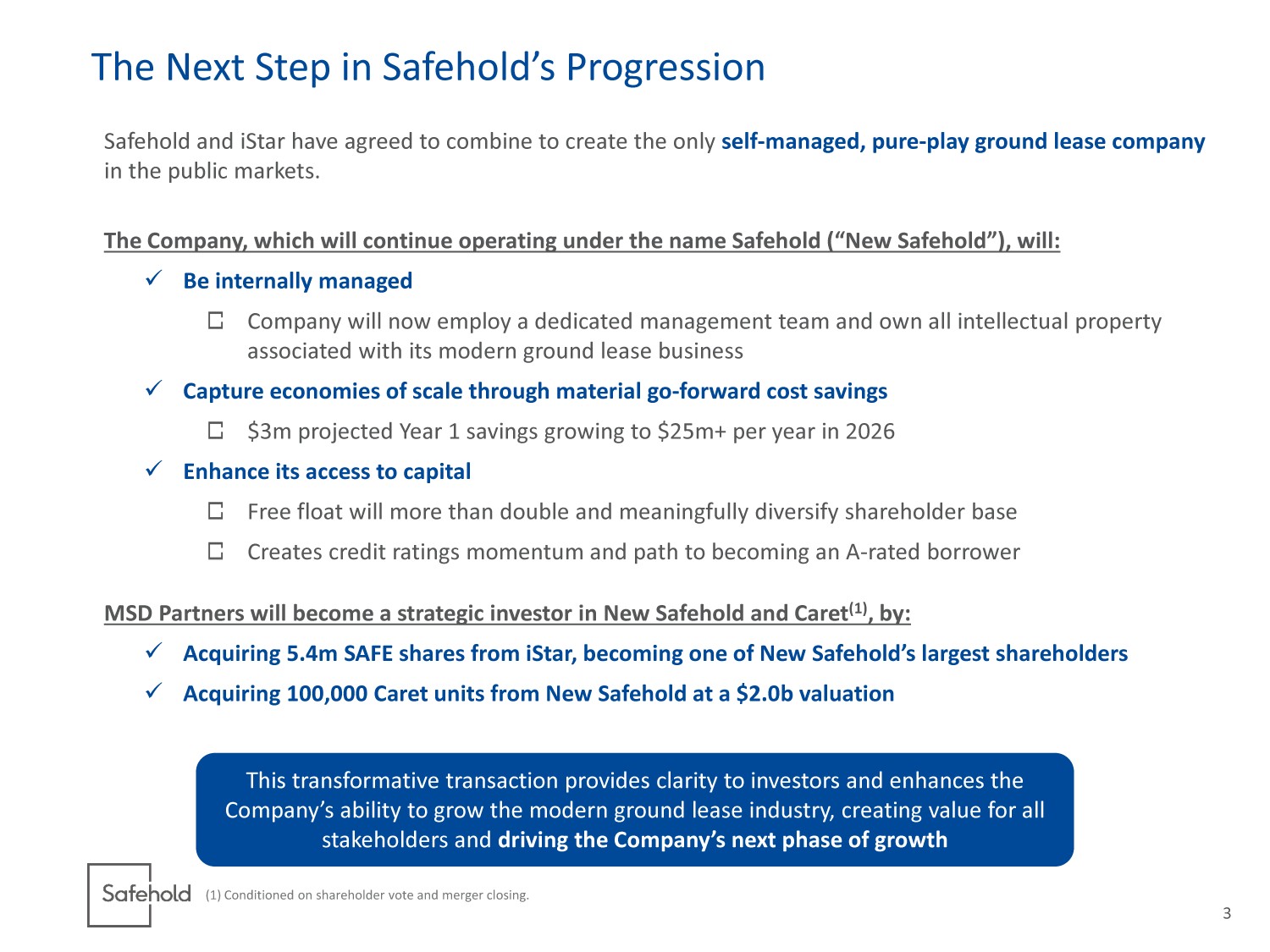

3 Safehold and iStar have agreed to combine to create the only self - managed, pure - play ground lease company in the public markets. The Company, which will continue operating under the name Safehold (“New Safehold”), will: x Be internally managed Company will now employ a dedicated management team and own all intellectual property associated with its modern ground lease business x Capture economies of scale through material go - forward cost savings $3m projected Year 1 savings growing to $25m+ per year in 2026 x Enhance its access to capital Free float will more than double and meaningfully diversify shareholder base Creates credit ratings momentum and path to becoming an A - rated borrower MSD Partners will become a strategic investor in New Safehold and Caret (1) , by: x Acquiring 5.4m SAFE shares from iStar, becoming one of New Safehold’s largest shareholders x Acquiring 100,000 Caret units from New Safehold at a $2.0b valuation The Next Step in Safehold’s Progression This transformative transaction provides clarity to investors and enhances the Company’s ability to grow the modern ground lease industry, creating value for all stakeholders and driving the Company’s next phase of growth (1) Conditioned on shareholder vote and merger closing.

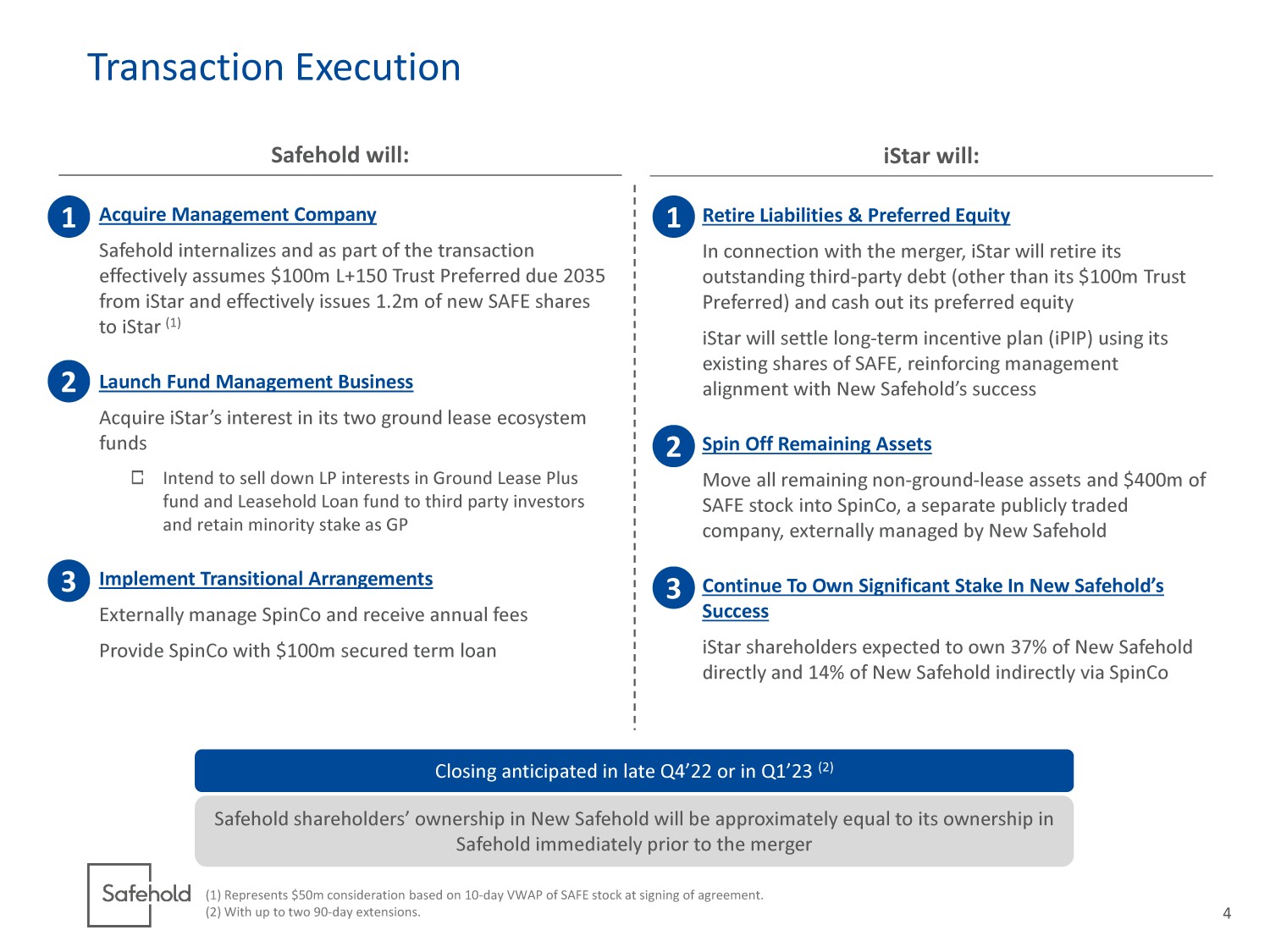

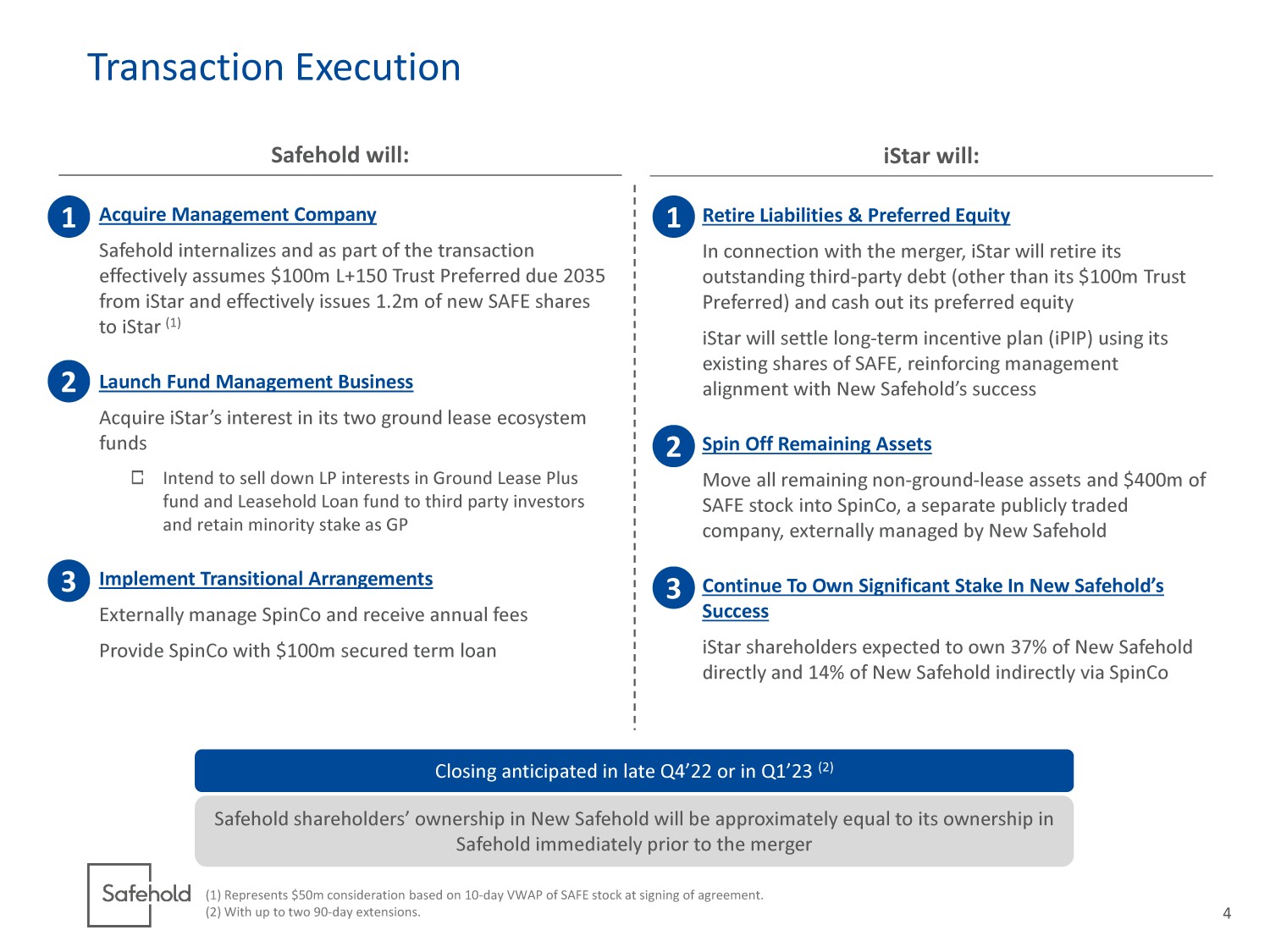

4 Transaction Execution Safehold will: Acquire Management Company Safehold internalizes and as part of the transaction effectively assumes $100m L+150 Trust Preferred due 2035 from iStar and effectively issues 1.2m of new SAFE shares to iStar (1) Launch Fund Management Business Acquire iStar’s interest in its two ground lease ecosystem funds Intend to sell down LP interests in Ground Lease Plus fund and Leasehold Loan fund to third party investors and retain minority stake as GP Implement Transitional Arrangements Externally manage SpinCo and receive annual fees Provide SpinCo with $100m secured term loan 1 Closing anticipated in late Q4’22 or in Q1’23 (2) iStar will: Retire Liabilities & Preferred Equity In connection with the merger, iStar will retire its outstanding third - party debt (other than its $100m Trust Preferred) and cash out its preferred equity iStar will settle long - term incentive plan ( iPIP ) using its existing shares of SAFE, reinforcing management alignment with New Safehold’s success Spin Off Remaining Assets Move all remaining non - ground - lease assets and $400m of SAFE stock into SpinCo, a separate publicly traded company, externally managed by New Safehold Continue To Own Significant Stake In New Safehold’s Success iStar shareholders expected to own 37% of New Safehold directly and 14% of New Safehold indirectly via SpinCo 2 3 1 2 3 (1) Represents $50m consideration based on 10 - day VWAP of SAFE stock at signing of agreement. (2) With up to two 90 - day extensions. Safehold shareholders’ ownership in New Safehold will be approximately equal to its ownership in Safehold immediately prior to the merger

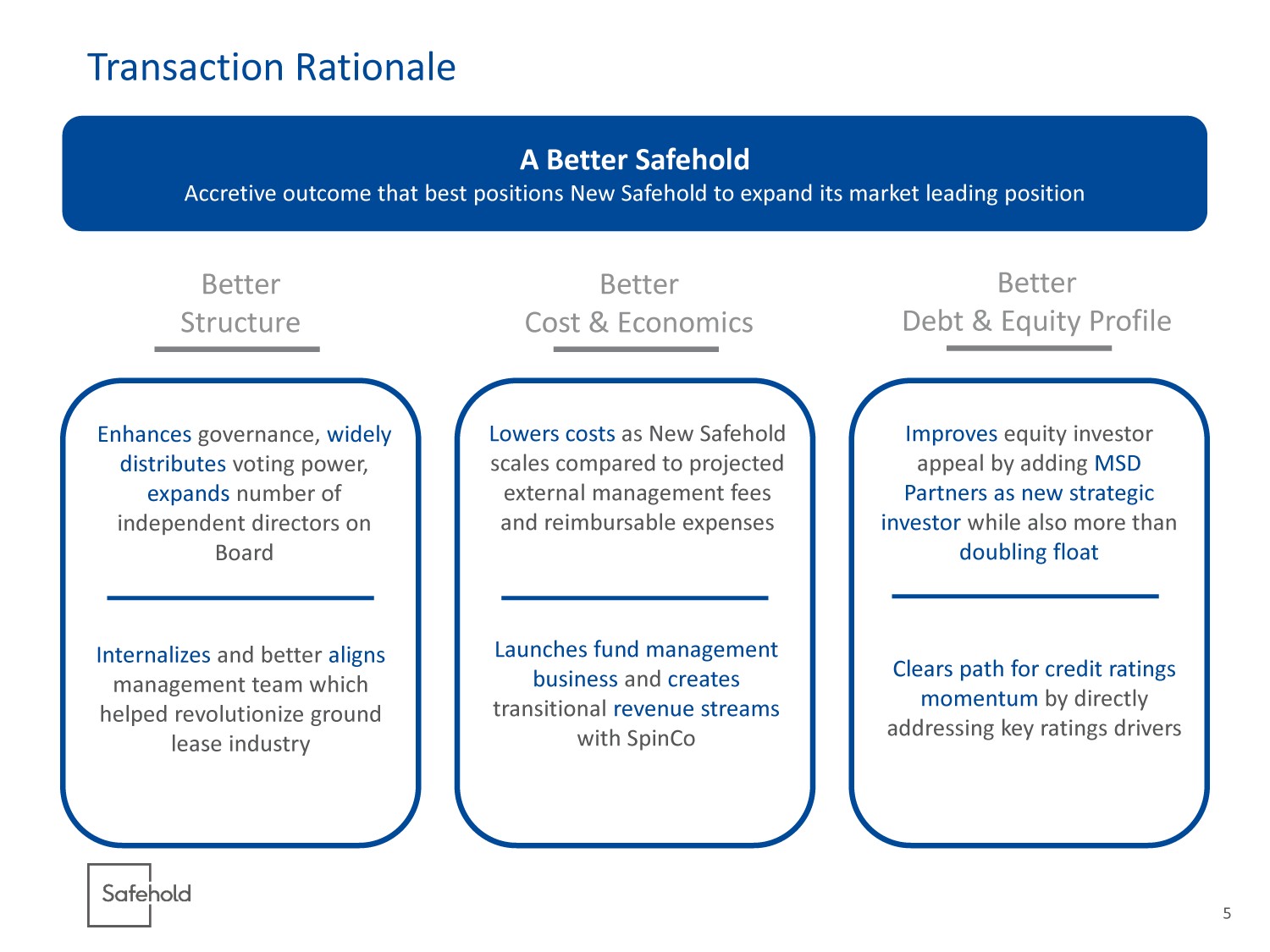

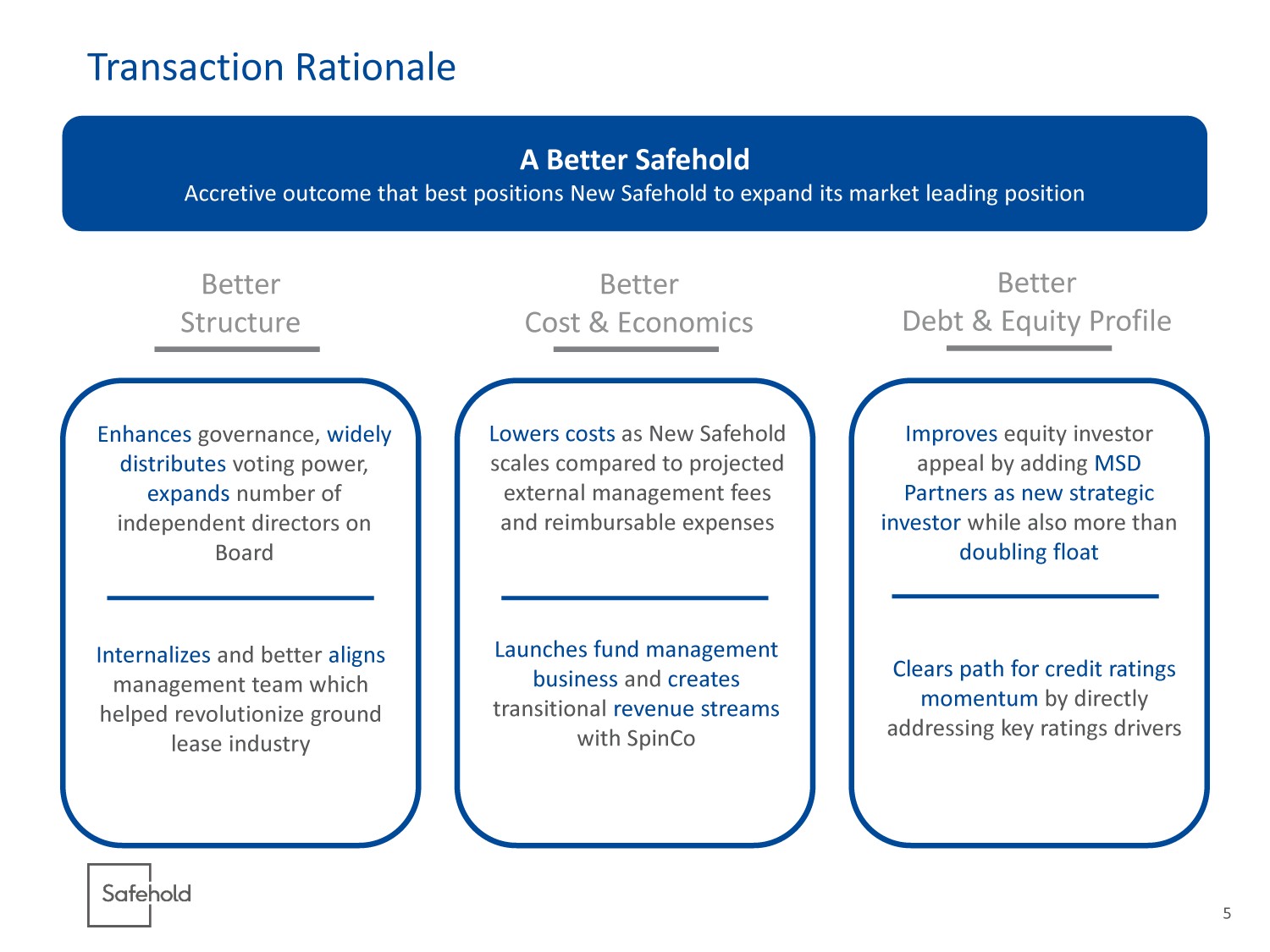

5 Transaction Rationale A Better Safehold Accretive outcome that best positions New Safehold to expand its market leading position Internalizes and better aligns management team which helped revolutionize ground lease industry Enhances governance, widely distributes voting power, expands number of independent directors on Board Lowers costs as New Safehold scales compared to projected external management fees and reimbursable expenses Launches fund management business and creates transitional revenue streams with SpinCo Improves equity investor appeal by adding MSD Partners as new strategic investor while also more than doubling float Clears path for credit ratings momentum by directly addressing key ratings drivers Better Structure Better Debt & Equity Profile Better Cost & Economics

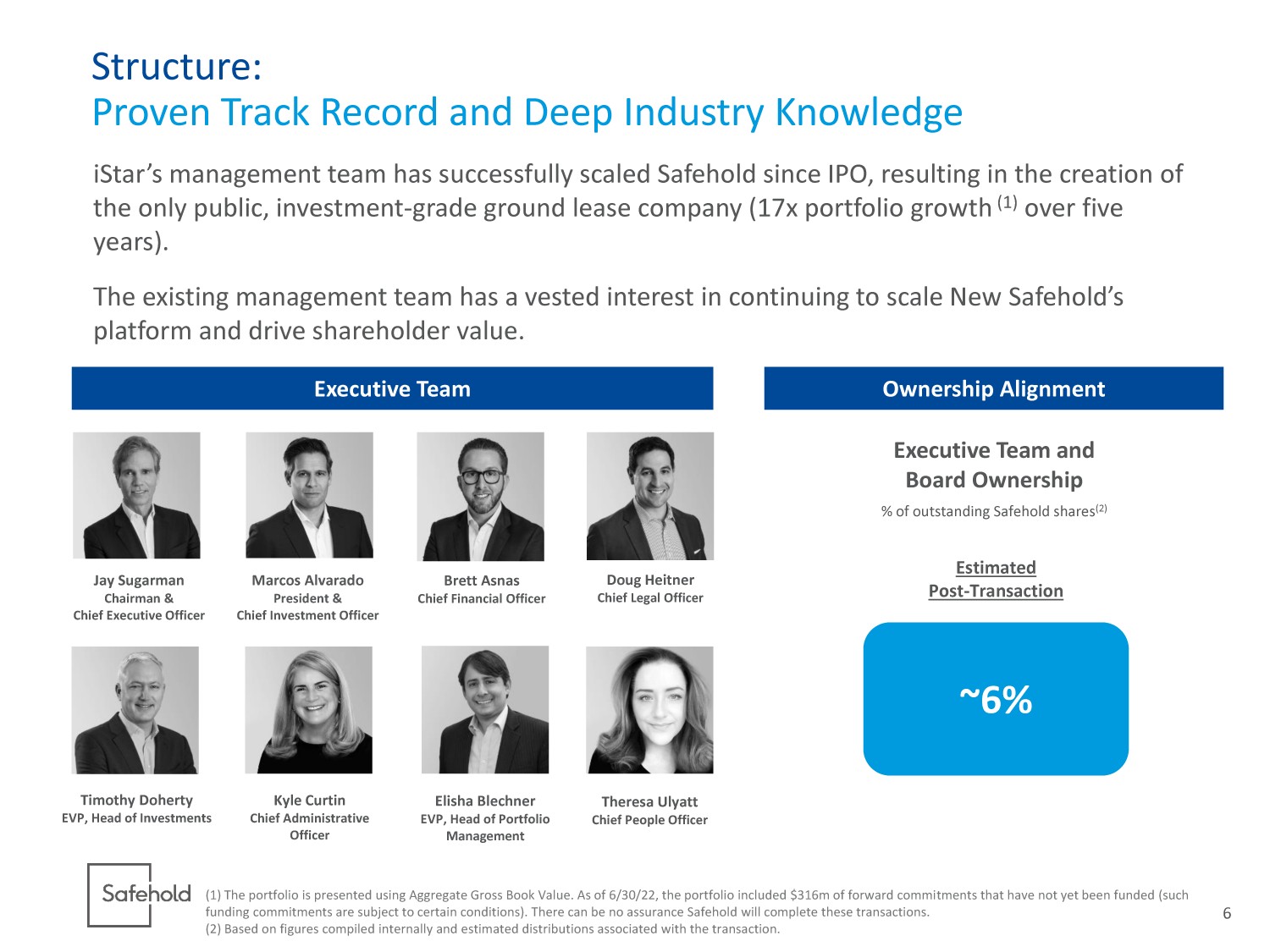

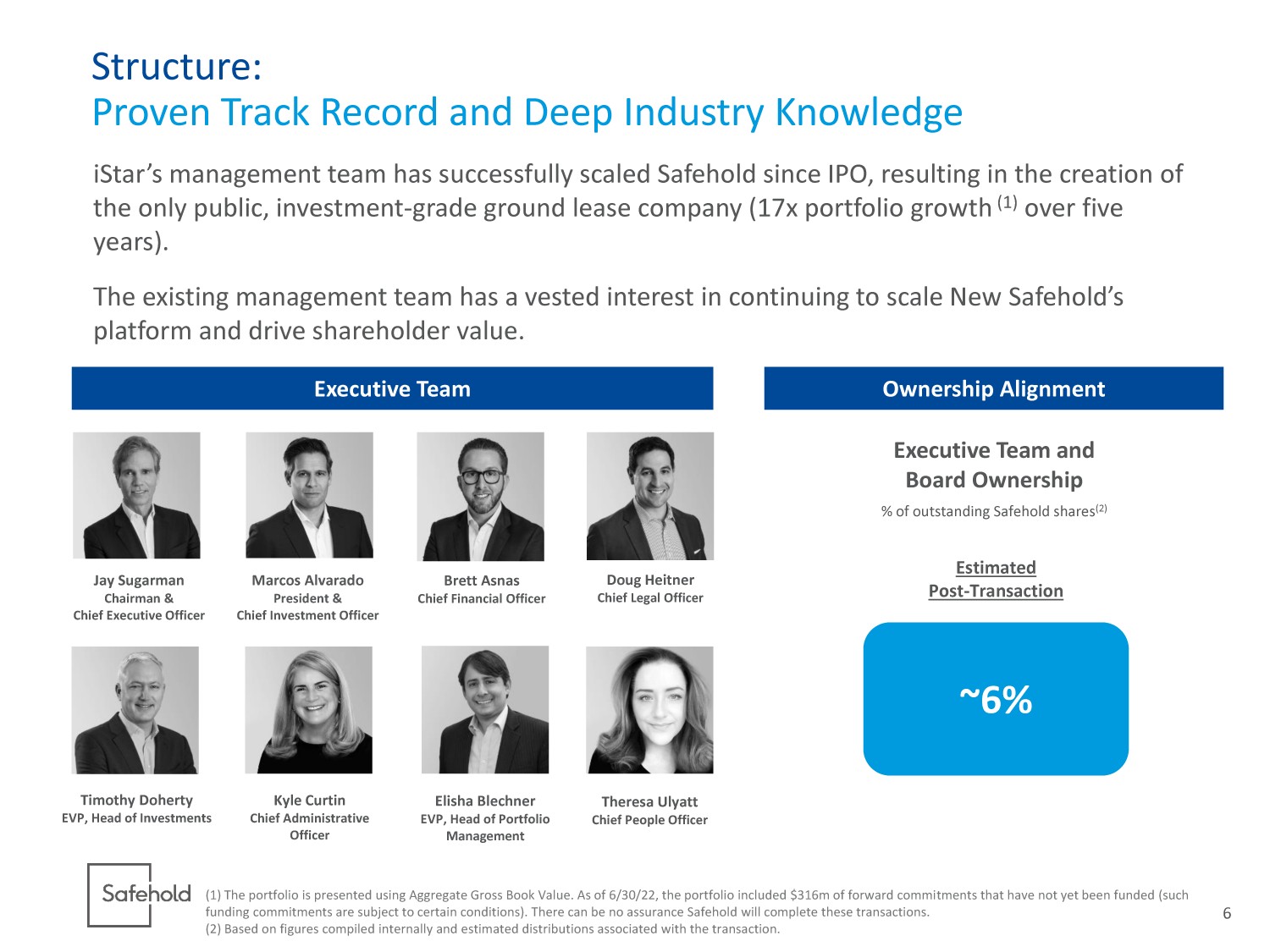

6 Structure: Proven Track Record and Deep Industry Knowledge iStar’s management team has successfully scaled Safehold since IPO, resulting in the creation of the only public, investment - grade ground lease company (17x portfolio growth (1) over five years). The existing management team has a vested interest in continuing to scale New Safehold’s platform and drive shareholder value. Jay Sugarman Chairman & Chief Executive Officer Marcos Alvarado President & Chief Investment Officer Doug Heitner Chief Legal Officer Timothy Doherty EVP, Head of Investments Brett Asnas Chief Financial Officer Elisha Blechner EVP, Head of Portfolio Management Executive Team Ownership Alignment Estimated Post - Transaction Executive Team and Board Ownership % of outstanding Safehold shares (2) ~6% (1) The portfolio is presented using Aggregate Gross Book Value. As of 6/30/22, the portfolio included $316m of forward commi tme nts that have not yet been funded (such funding commitments are subject to certain conditions). There can be no assurance Safehold will complete these transactions. (2) Based on figures compiled internally and estimated distributions associated with the transaction. Theresa Ulyatt Chief People Officer Kyle Curtin Chief Administrative Officer

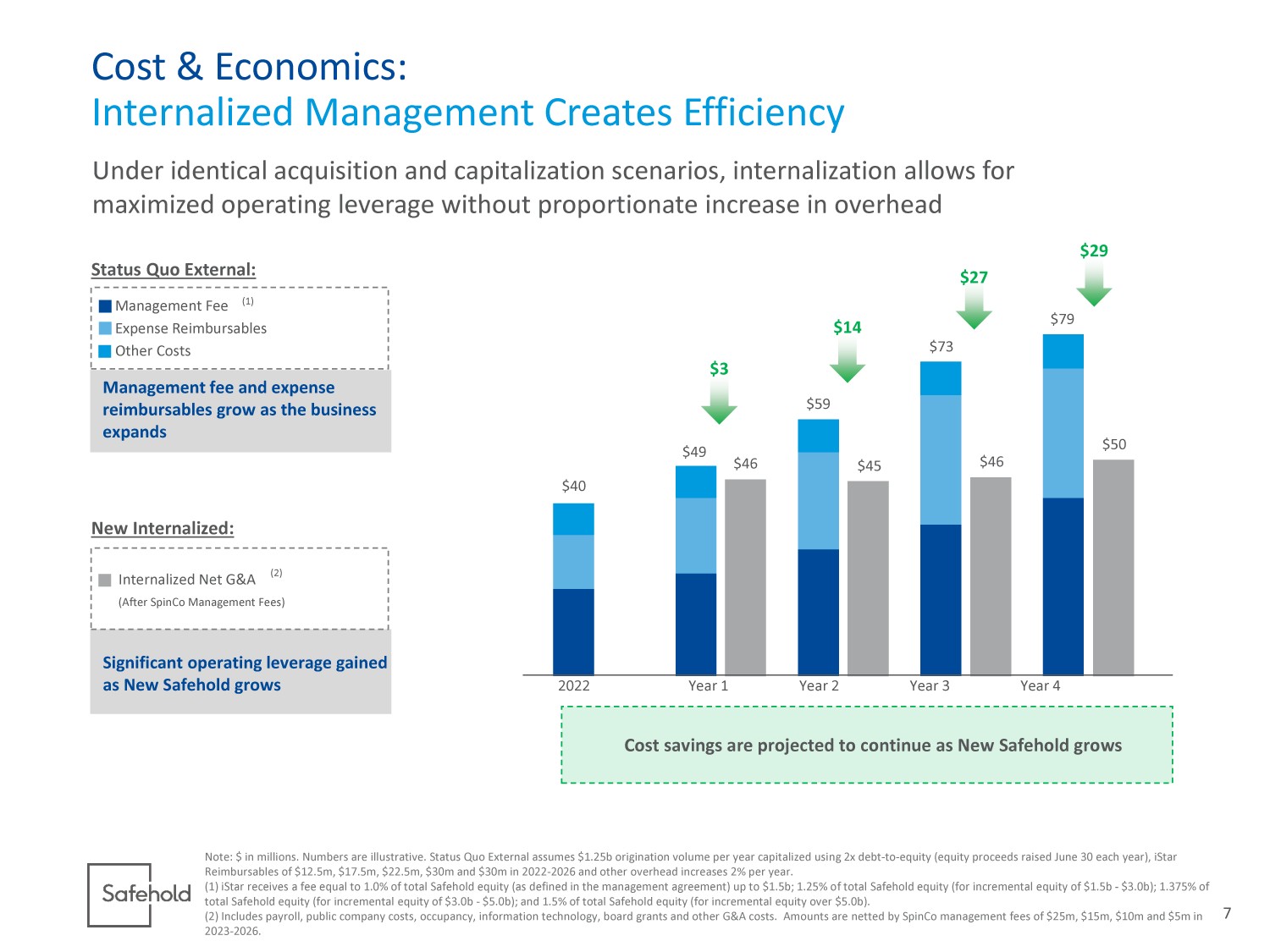

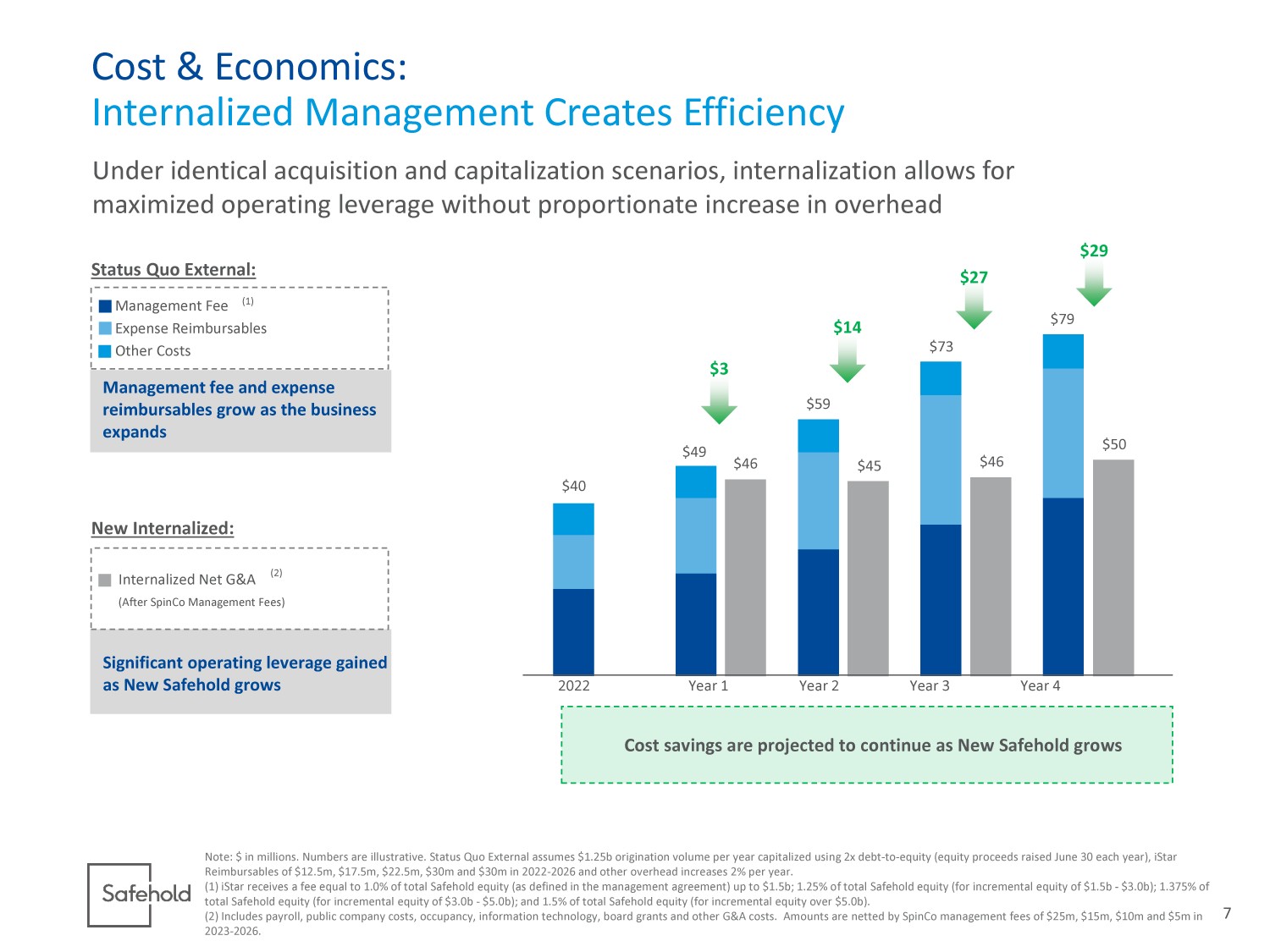

7 Under identical acquisition and capitalization scenarios, internalization allows for maximized operating leverage without proportionate increase in overhead Cost & Economics: Internalized Management Creates Efficiency Note: $ in millions. Numbers are illustrative. Status Quo External assumes $1.25b origination volume per year capitalized usi ng 2x debt - to - equity (equity proceeds raised June 30 each year), iStar Reimbursables of $12.5m, $17.5m, $22.5m, $30m and $30m in 2022 - 2026 and other overhead increases 2% per year. (1) iStar receives a fee equal to 1.0% of total Safehold equity (as defined in the management agreement) up to $1.5b; 1.25% o f t otal Safehold equity (for incremental equity of $1.5b - $3.0b); 1.375% of total Safehold equity (for incremental equity of $3.0b - $5.0b); and 1.5% of total Safehold equity (for incremental equity over $5.0b). (2) Includes payroll, public company costs, occupancy, information technology, board grants and other G&A costs. Amounts are ne tted by SpinCo management fees of $25m, $15m, $10m and $5m in 2023 - 2026. Management Fee Expense Reimbursables Other Costs New Internalized: $46 $45 $46 $50 $40 $49 $59 $73 $79 $3 $14 $27 $29 Management fee and expense reimbursables grow as the business expands Significant operating leverage gained as New Safehold grows Internalized Net G&A Cost savings are projected to continue as New Safehold grows Status Quo External: (After SpinCo Management Fees) (1) (2) 2022 Year 1 Year 2 Year 3 Year 4

8 2023 2024 2025 2026 Net G&A SpinCo Management Fees Cost & Economics: Transitional Arrangements with SpinCo Note: $ in millions. (1) SpinCo may borrow an additional $25m from New Safehold under certain conditions. (2) Based on SAFE shares, real estate book value and cash. $25 $15 $10 $5 $71 Gross $55 Gross $46 Net $50 Net SpinCo will pay a management fee to New Safehold to manage SpinCo and support transition to a normalized cost structure $45 Net $46 Net $60 Gross $56 Gross New Safehold will make a senior secured loan to SpinCo with significant over - collateralization. The loan terms are accretive to earnings and cash flow metrics Amount (1) $100m LTV (2) <20% Term 4 years Interest Rate 8.0% cash pay Collateral ~$400m of SAFE shares (separately encumbered with up to $140m of secured debt), ~$350m book value of real estate assets (no additional debt permitted) and $50m of cash Amortization Cash sweep above $50m cash and reserves held at SpinCo Key Terms

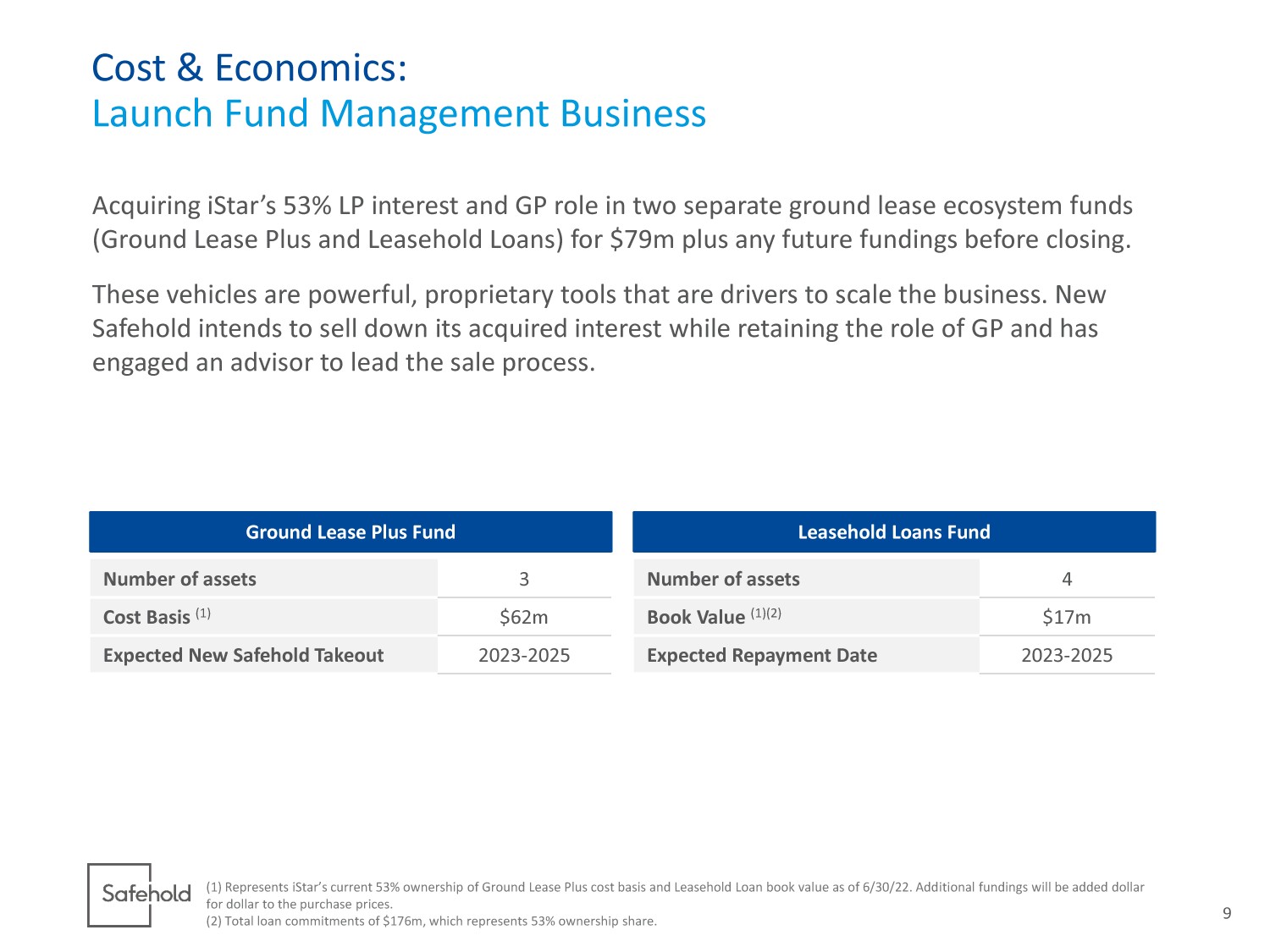

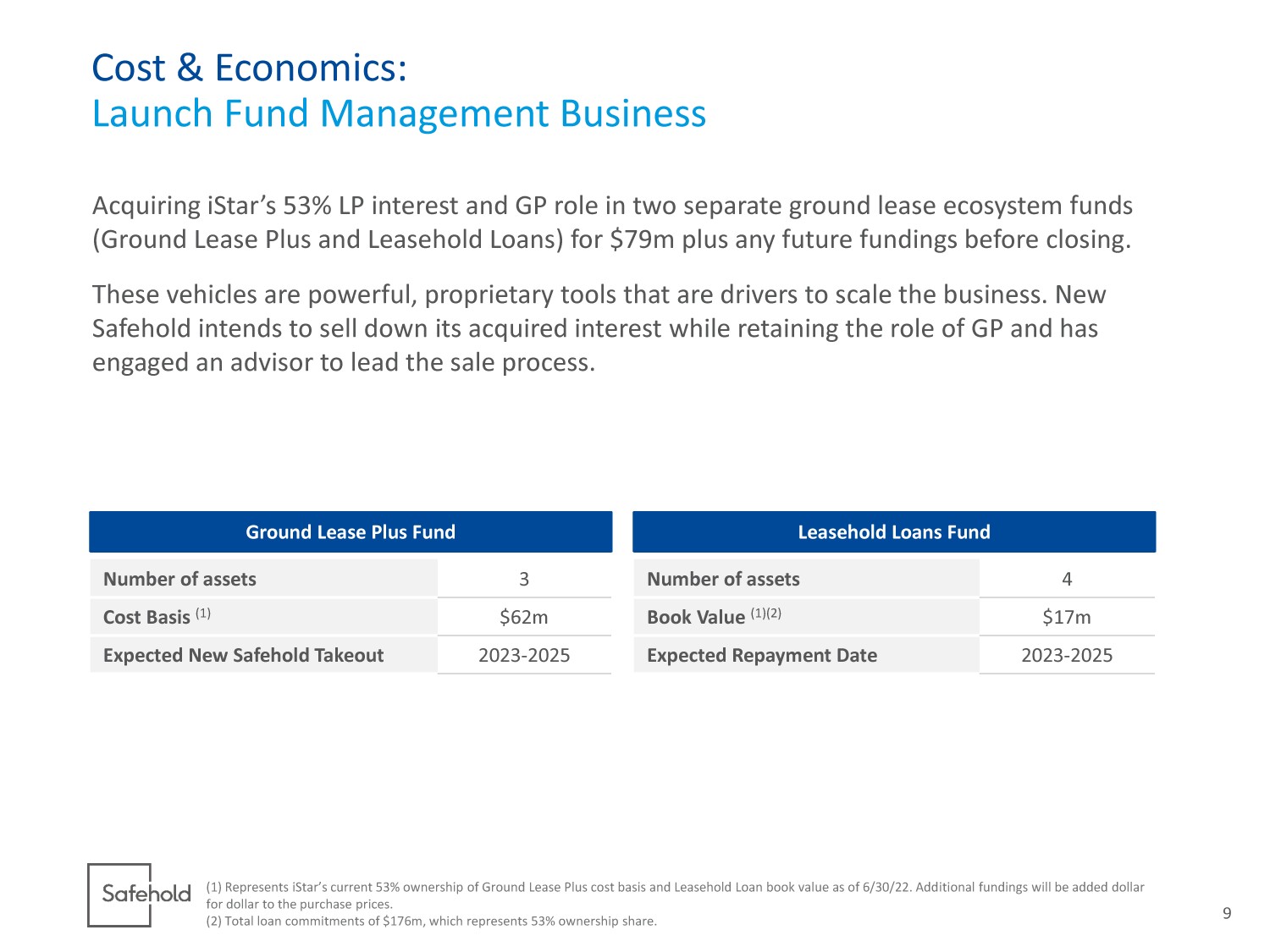

9 Cost & Economics: Launch Fund Management Business Acquiring iStar’s 53% LP interest and GP role in two separate ground lease ecosystem funds (Ground Lease Plus and Leasehold Loans) for $79m plus any future fundings before closing. These vehicles are powerful, proprietary tools that are drivers to scale the business. New Safehold intends to sell down its acquired interest while retaining the role of GP and has engaged an advisor to lead the sale process. Ground Lease Plus Fund Leasehold Loans Fund Number of assets 3 Cost Basis (1) $62m Expected New Safehold Takeout 2023 - 2025 Number of assets 4 Book Value (1)(2) $17m Expected Repayment Date 2023 - 2025 (1) Represents iStar’s current 53% ownership of Ground Lease Plus cost basis and Leasehold Loan book value as of 6/30/22. Add iti onal fundings will be added dollar for dollar to the purchase prices. (2) Total loan commitments of $176m, which represents 53% ownership share.

10 MSD Partners will buy 100,000 units of Caret from Safehold for $200 per unit (1) , implying a Caret valuation of $2.0b o New Safehold will use the $20m of proceeds to invest in more ground leases and for general corporate purposes o Valuation represents premium to prior Caret sale and does not include redemption option MSD Partners will buy 5.4m shares of SAFE in a direct sale from iStar o $200m investment represents $37 per share o Non - dilutive to Safehold shareholders Debt & Equity Profile: MSD Partners to Become One Of New Safehold’s Largest Shareholders and Caret’s Largest Third - Party Investor MSD Partners will make strategic investments in both New Safehold and Caret concurrent with the closing (1) Subject to Safehold shareholder consent of certain Caret modifications. MSD Partners is a leading investment firm that deploys capital on behalf of Dell Technologies founder and CEO Michael Dell and his family, as well as other like - minded, long - term - oriented investors

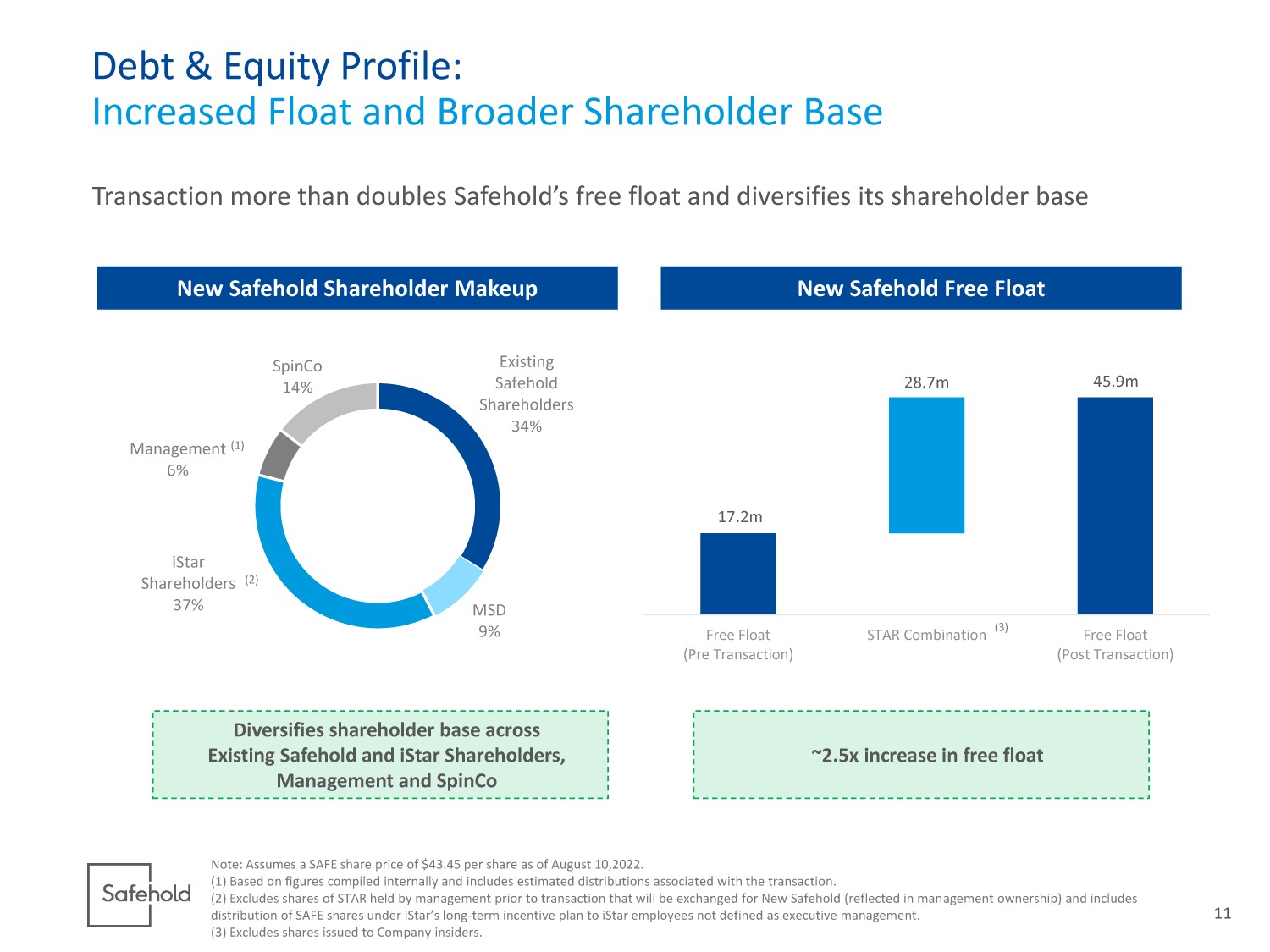

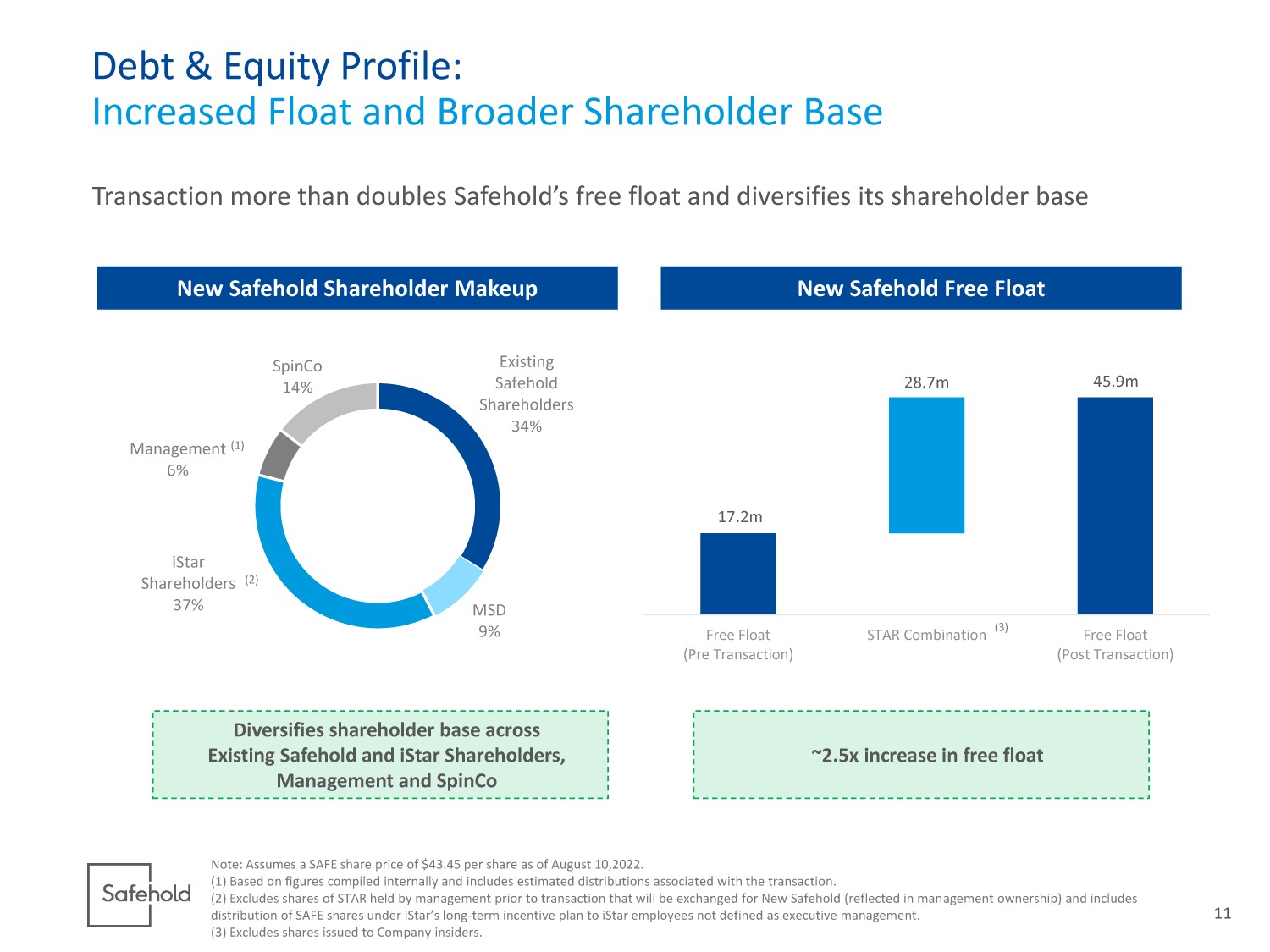

11 Existing Safehold Shareholders 34% MSD 9% iStar Shareholders 37% Management 6% SpinCo 14% Debt & Equity Profile: Increased Float and Broader Shareholder Base Transaction more than doubles Safehold’s free float and diversifies its shareholder base New Safehold Shareholder Makeup New Safehold Free Float Free Float (Pre Transaction) STAR Combination Free Float (Post Transaction) 17.2m 28.7m 45.9m Note: Assumes a SAFE share price of $43.45 per share as of August 10,2022. (1) Based on figures compiled internally and includes estimated distributions associated with the transaction. (2) Excludes shares of STAR held by management prior to transaction that will be exchanged for New Safehold (reflected in man age ment ownership) and includes distribution of SAFE shares under iStar’s long - term incentive plan to iStar employees not defined as executive management. (3) Excludes shares issued to Company insiders. (1) (3) Diversifies shareholder base across Existing Safehold and iStar Shareholders, Management and SpinCo ~2.5x increase in free float (2)

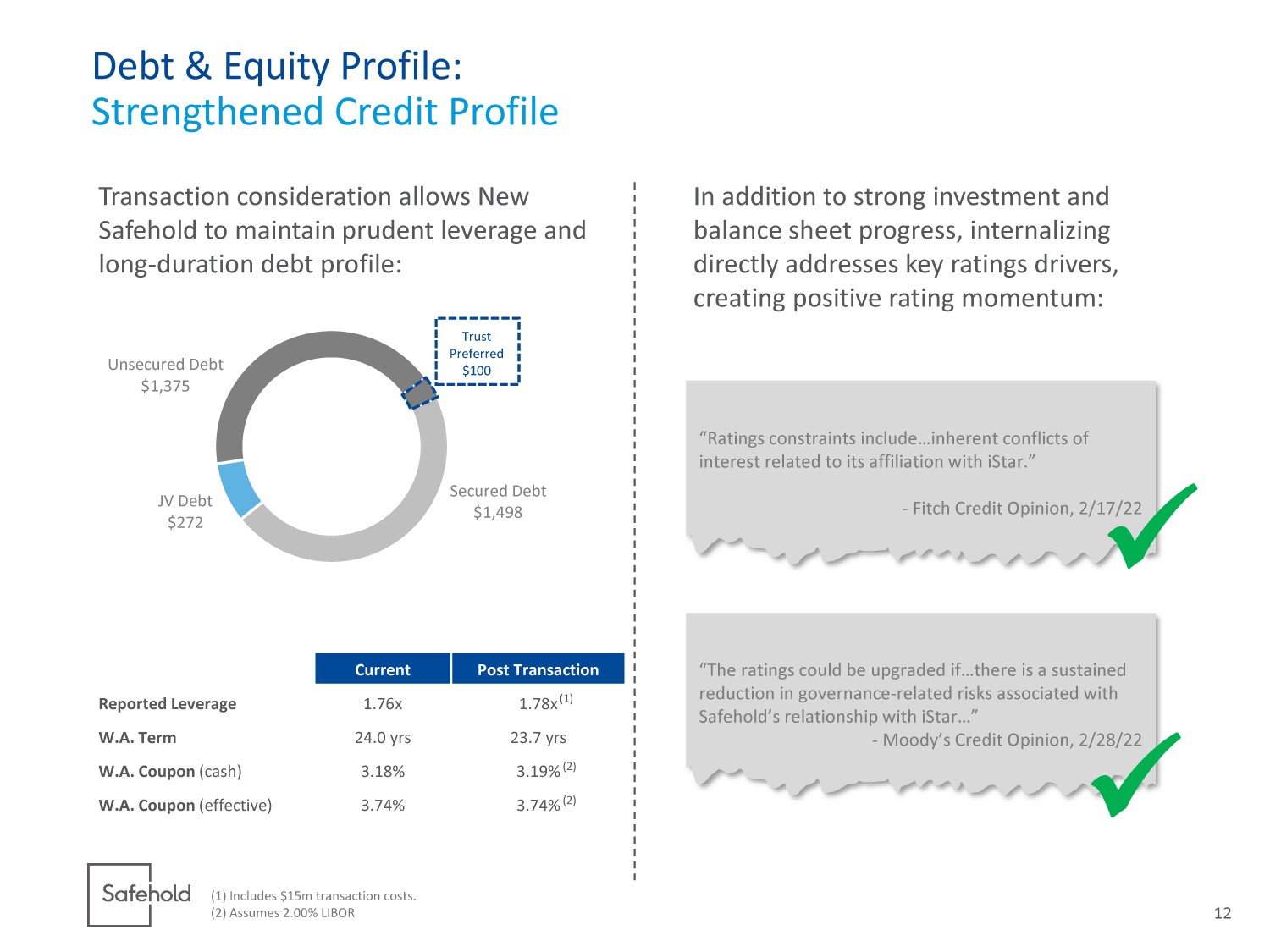

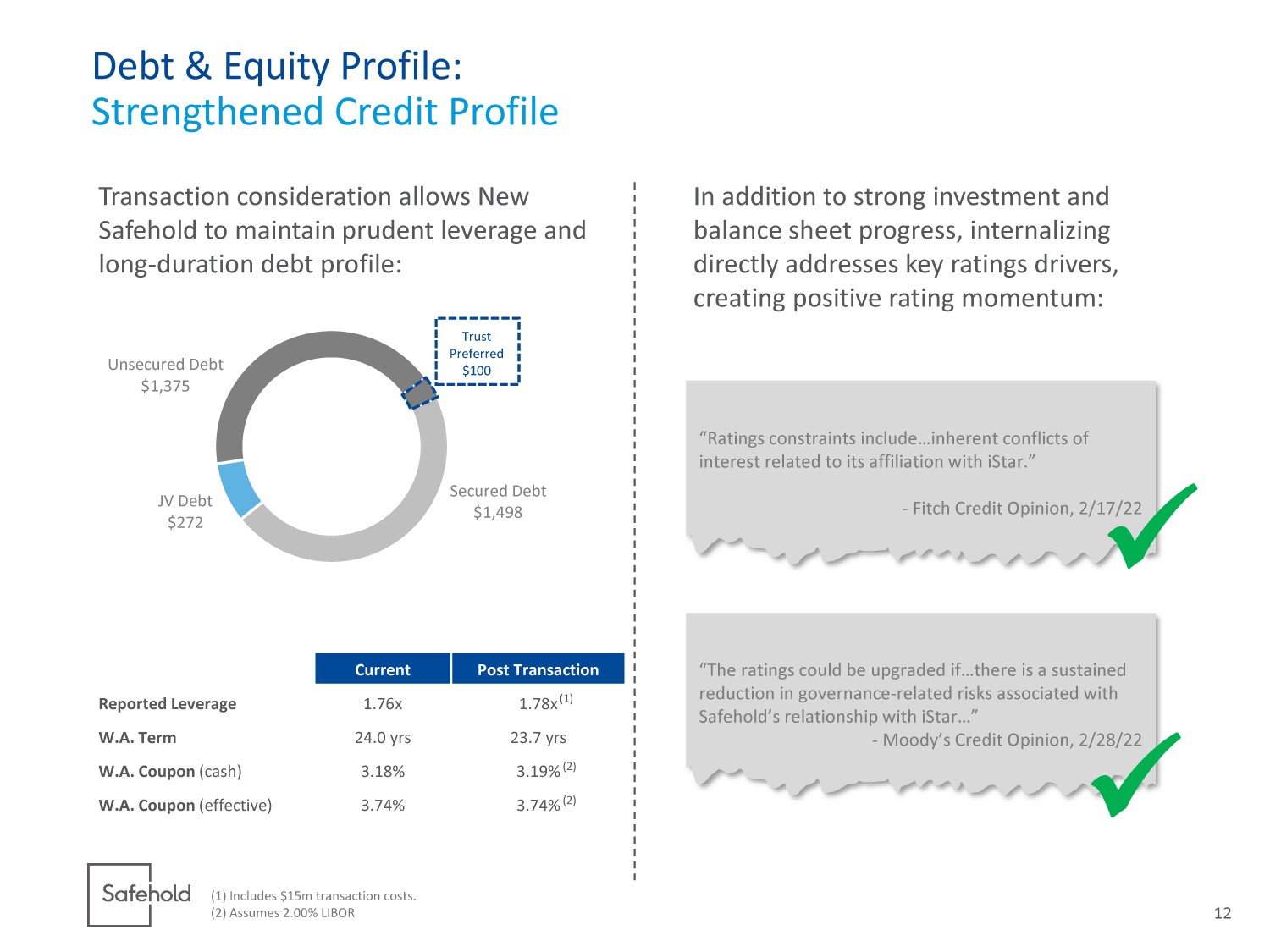

12 Secured Debt $1,498 JV Debt $272 Unsecured Debt $1,375 Trust Preferred $100 Debt & Equity Profile: Strengthened Credit Profile Current Post Transaction Reported Leverage 1.76x 1.78x W.A. Term 24.0 yrs 23.7 yrs W.A. Coupon (cash) 3.18% 3.19% W.A. Coupon (effective) 3.74% 3.74% In addition to strong investment and balance sheet progress, internalizing directly addresses key ratings drivers, creating positive rating momentum: (1) Includes $15m transaction costs. (2) Assumes 2.00% LIBOR “Ratings constraints include…inherent conflicts of interest related to its affiliation with iStar .” - Fitch Credit Opinion, 2/17/22 “The ratings could be upgraded if…there is a sustained reduction in governance - related risks associated with Safehold’s relationship with iStar…” - Moody’s Credit Opinion, 2/28/22 x x Transaction consideration allows New Safehold to maintain prudent leverage and long - duration debt profile: (1) (2) (2)

13 Conclusion The transaction positions New Safehold to drive the next phase of its growth x x x Better Cost & Economics Better Debt & Equity Profile Addresses related party concerns, improves governance with a more diversified shareholder base Experienced management team and intellectual property brought in - house x x Better Structure Broadens capital access, attracts new strategic investor, creates credit rating momentum and path to becoming an A - rated borrower Internalization, diversified ownership and increased free float expand potential shareholder universe Lower and more predictable G&A structure as New Safehold scales New revenue streams to facilitate transition x

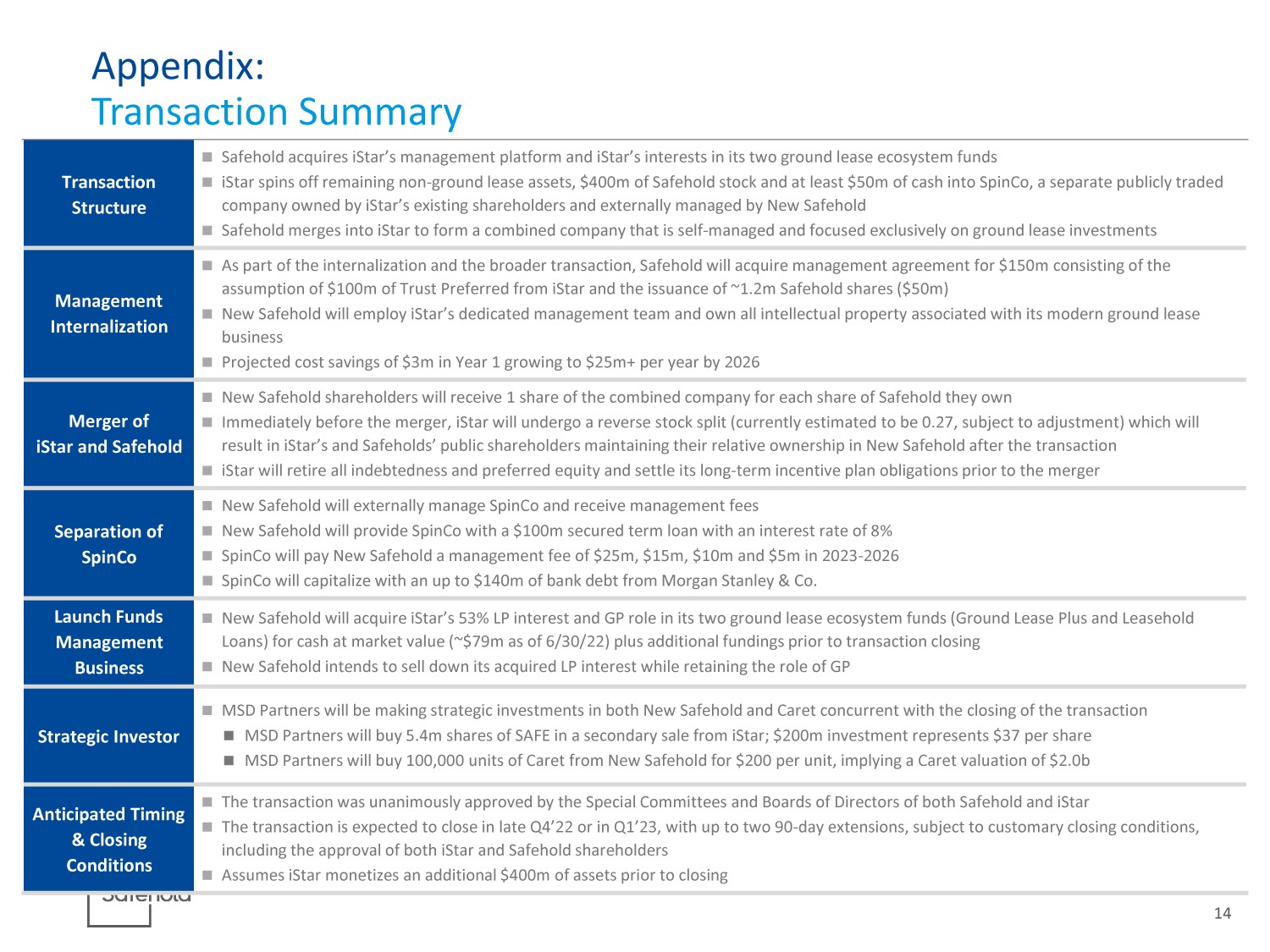

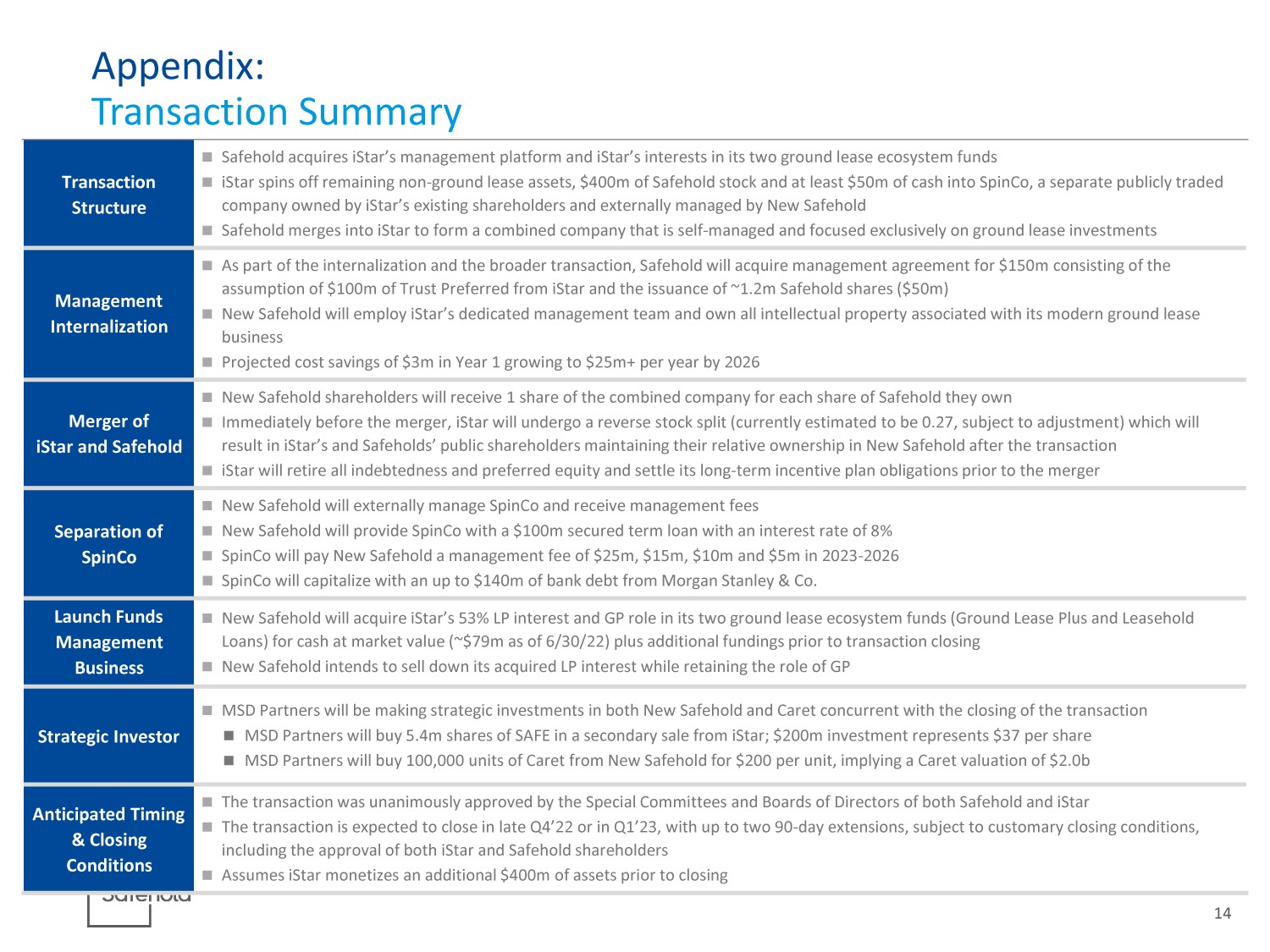

14 Appendix: Transaction Summary Transaction Structure Safehold acquires iStar’s management platform and iStar’s interests in its two ground lease ecosystem funds iStar spins off remaining non - ground lease assets, $400m of Safehold stock and at least $50m of cash into SpinCo, a separate pub licly traded company owned by iStar’s existing shareholders and externally managed by New Safehold Safehold merges into iStar to form a combined company that is self - managed and focused exclusively on ground lease investments Management Internalization As part of the internalization and the broader transaction, Safehold will acquire management agreement for $150m consisting o f t he assumption of $100m of Trust Preferred from iStar and the issuance of ~1.2m Safehold shares ($50m) New Safehold will employ iStar’s dedicated management team and own all intellectual property associated with its modern groun d l ease business Projected cost savings of $3m in Year 1 growing to $25m+ per year by 2026 Merger of iStar and Safehold New Safehold shareholders will receive 1 share of the combined company for each share of Safehold they own Immediately before the merger, iStar will undergo a reverse stock split (currently estimated to be 0.27, subject to adjustmen t) which will result in iStar’s and Safeholds’ public shareholders maintaining their relative ownership in New Safehold after the transacti on iStar will retire all indebtedness and preferred equity and settle its long - term incentive plan obligations prior to the merger Separation of SpinCo New Safehold will externally manage SpinCo and receive management fees New Safehold will provide SpinCo with a $100m secured term loan with an interest rate of 8% SpinCo will pay New Safehold a management fee of $25m, $15m, $10m and $5m in 2023 - 2026 SpinCo will capitalize with an up to $140m of bank debt from Morgan Stanley & Co. Launch Funds Management Business New Safehold will acquire iStar’s 53% LP interest and GP role in its two ground lease ecosystem funds (Ground Lease Plus and Lea sehold Loans) for cash at market value (~$79m as of 6/30/22) plus additional fundings prior to transaction closing New Safehold intends to sell down its acquired LP interest while retaining the role of GP Strategic Investor MSD Partners will be making strategic investments in both New Safehold and Caret concurrent with the closing of the transacti on MSD Partners will buy 5.4m shares of SAFE in a secondary sale from iStar; $200m investment represents $37 per share MSD Partners will buy 100,000 units of Caret from New Safehold for $200 per unit, implying a Caret valuation of $2.0b Anticipated Timing & Closing Conditions The transaction was unanimously approved by the Special Committees and Boards of Directors of both Safehold and iStar The transaction is expected to close in late Q4’22 or in Q1’23, with up to two 90 - day extensions, subject to customary closing c onditions, including the approval of both iStar and Safehold shareholders Assumes iStar monetizes an additional $400m of assets prior to closing