April 10, 2023

VIA EDGAR TRANSMISSION

Ms. Christina DiAngelo Fettig

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: FS Credit Income Fund (the “Fund” or “Registrant”)

(File Nos. 333-215074 and 811-23221)

Dear Ms. Fettig:

This letter is in response to the comments of the staff of the Securities and Exchange Commission (“SEC Staff”) that you provided by telephone on February 27, 2023 regarding the Fund’s October 31, 2022 annual report (the “Annual Report”), which was filed with the Securities and Exchange Commission (“SEC”) on Form N-CSR on December 27, 2022.

For your convenience, the Staff’s comments are summarized below and each comment is followed by the Registrant’s response.

| 1. | Comment: The Staff notes that the Fund had exposure to derivatives during the fiscal year ended October 31, 2022, but did not see any disclosure in management’s discussion of fund performance about how derivatives affected performance. Please confirm if the use of derivatives materially affected the Fund’s performance during the most recently completed fiscal year. |

Response: Derivatives did not materially affect the Fund’s performance during the fiscal year ended October 31, 2022. In the future, the Fund will disclose how derivatives affected performance in the management’s discussion of fund performance section to the extent derivatives materially affect the Fund’s performance.

| 2. | Comment: Page 3 of the Annual Report includes a line graph depiction of performance assuming a $10,000 initial investment in, among other things, Class I shares of the Fund since inception. The Staff notes the Fund’s prospectus indicates Class I shares of the Fund require a minimum initial investment of $1 million. Instruction 4.g.(2)(A)1.(d) to Item 24 of Form N-2 requires a fund to base the line graph on a fund’s required minimum initial investment if that amount exceeds $10,000. In future filings, please base the line graph on the Fund’s required minimum initial investment for Class I shares or explain why it does not apply. |

Response: The Fund confirms that, in future filings, it will base the line graph on the Fund’s $1,000,000 minimum initial investment for Class I shares.

Ms. Christina DiAngelo Fettig

April 10, 2023

Page 2

| 3. | Comment: Page 4 of the Annual Report includes a cumulative total return table. Instruction 4.g.(2)(B) to Item 24 of Form N-2 requires a fund to provide the fund’s average annual total returns. Please confirm if the relevant returns disclosed on Page 4 are actually average annual returns and consider changing the heading of the table. If the relevant returns do not represent average annual returns, please explain how the returns will be corrected. |

Response: The performance table on Page 4 correctly reflects average annual total returns. The Fund will revise the heading of the table accordingly in future shareholder reports.

| 4. | Comment: In the October 31, 2022 Schedule of Investments, the Staff notes there is an “Unfunded Loan Commitments” line on Page 7. Please explain the portfolio companies to which these commitments relate. |

Response: The Fund directs the staff to the senior secured loans—first lien investments that are denoted with footnote (g) as follows: Avalara $454; Hanger $181; Mercury Financial $4,108; Royal Caribbean $75; and Spirit RR Holdings $519, indicating that these investments are unfunded loan commitments, amounting to the $5,337 total unfunded loan commitments noted on Page 7.

| 5. | Comment: Footnote (g) to the October 31, 2022 Schedule of Investments on Page 36 appears to disclose individual portfolio company unfunded commitments. Please explain how this relates to the “Unfunded Loan Commitments” line on Page 7. Each unfunded loan commitment should be identified in the Schedule of Investments. |

Response: Please see the response to comment 4 above.

| 6. | Comment: On the Statement of Assets and Liabilities there is a “Commitments and Contingencies” line with an amount of ($2,586) (in thousands) which refers to Note 11. Please explain what the ($2,586) represents and how Note 11 is related to this amount. |

Response: The amount on the “Commitments and Contingencies” line on the Statement of Assets and Liabilities of $(2,586) represents the Fund’s commitment as of October 31, 2022 to FS Credit Income Advisor and its affiliates, as referred to in Note 11, Commitments and Contingencies. Note 11 directs shareholders to Note 4, Related Party Transactions, for a complete discussion of the Fund’s commitments to FS Credit Income Advisor, GoldenTree and their respective affiliates resulting from the expense limitation agreements. The total amount of ($2,586) represents the sum of expense reimbursements for the years ended October 31, 2020, 2021 and 2022 of ($767), ($1,033) and ($786), respectively.

Ms. Christina DiAngelo Fettig

April 10, 2023

Page 3

| 7. | Comment: In future filings, please disclose the value of futures contracts in the Schedule of Investments in accordance with Regulation S-X, Rule 12-13A. |

Response: The Fund confirms that it will disclose the value of futures contracts in the Schedule of Investments in future filings.

| 8. | Comment: Please confirm whether excise tax is included in the ratio of total expenses to average net assets in the Financial Highlights section of the Annual Report. |

Response: The Fund confirms excise tax expenses are included in the ratio of total expenses to average net assets in the Financial Highlights section of the Annual Report.

| 9. | Comment: Please explain how to reconcile the senior secured loans—first lien identified as Level 3 in the fair value hierarchy chart (the “Fair Value Chart”) on page 65 in Note 8 to the Fund’s financial statements with the total of the individual Level 3 investments identified in the Schedule of Investments. |

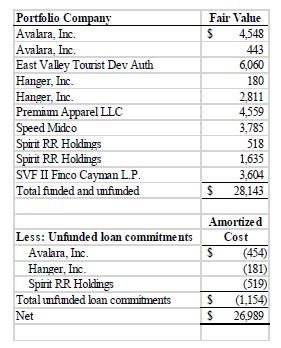

Response: Please see the below table, which reconciles the senior secured loans—first lien identified as Level 3 on pages 6 and 7 with the Fair Value Chart on page 65.

By way of explanation, the amount of Level 3 senior secured loans—first lien on page 65 is the net amount of the fair value of Level 3 funded and unfunded loans less the amortized cost amount of Level 3 unfunded loans. On pages 6 and 7, the Level 3 securities are denoted with footnote (f) and unfunded loan commitments are denoted with footnote (g). There is a $1 rounding difference between the amount in the table below and the amount in the Fair Value Chart on page 65. The Fund confirms that it will reconcile any rounding differences in future reports.

Ms. Christina DiAngelo Fettig

April 10, 2023

Page 4

| 10. | Comment: Please explain why the Fair Value Chart identifies cross currency swaps as Level 3 but cross currency swaps do not appear to be identified as Level 3 on the Schedule of Investments per Footnote 6 of Regulation S-X, Article 12-13C. |

Response: The Fund confirms that, in future shareholder reports, it will footnote any cross-currency swaps as Level 3 on the Schedule of Investments that identify as Level 3 in the Fair Value Chart. Typically, the Fund’s cross currency swaps are Level 2 as they are priced by a pricing service.

| 11. | Comment: With respect to the fair value reconciliation disclosure chart on page 66 of the Annual Report, there are two line items: net transfers into Level 3 and net transfers out of Level 3. Please disclose and discuss transfers into Level 3 separately and apart from transfers out of Level 3 or confirm there were only transfers into Level 3 for the year ended October 31, 2022. |

Response: The Fund confirms that there were only transfers into Level 3 for the year ended October 31, 2022.

| 12. | Comment: With respect to the fair value reconciliation disclosure chart on page 66 of the Annual Report, footnote 1 discloses general reasons for transferring into and out of Level 3. In future filings, please provide more specificity as to the reasons for the transfers. |

Response: In future filings, the Fund confirms that it will provide more specificity as to the reason for the transfers into and transfers out of Level 3 in the fair value reconciliation disclosure.

Ms. Christina DiAngelo Fettig

April 10, 2023

Page 5

| 13. | Comment: In Note 4 to the Fund’s financial statements, the Fund discloses the amount it accrued during the year ended October 31, 2022 for expense reimbursements from the adviser that FS Investments has agreed to pay pursuant to the Fund’s expense limitation agreement. In future filings, please disclose the amount subject to potential recoupment by year in an aging chart instead of limiting disclosure to current year. |

Response: The Fund confirms that it will disclose the amount subject to potential recoupment by year in an ageing chart in future filings.

| 14. | Comment: FASB ASC 946-235-50-02 requires disclosure of the method used to allocate income, expenses, and realized and unrealized capital gains and losses to each class of shares in the financial statements. Please disclose the method in future filings. |

Response: The Fund confirms that, in future filings, it will disclose in the financial statements the method used to allocate income, expenses, and realized and unrealized capital gains and losses to each class of shares.

| 15. | Comment: Item 2(c) of the Fund’s Form N-CSR indicates the Fund’s board of trustees adopted an amended code of ethics. Please briefly describe the nature of the amendment and represent that you will describe the nature of any amendments in future filings. |

Response: On September 14, 2022, the Fund’s board of trustees approved the amended Code of Ethics, which was amended to make certain conforming changes resulting from changes made to the Codes of Ethics of other investment advisers affiliated with the Fund’s adviser, FS Credit Income Advisor, LLC. The material changes included (i) revisions to the gifts and entertainment limits, (ii) enhancements to internal compliance training, (iii) new verbiage which indicates that the approval of personal trading pre-clearance requests expires after two business days, (iv) modifications to the definition of and quarterly and annual reporting requirements of access persons, and (v) recommended sanctions for certain non-material and material violations of the Code of Ethics. The Fund confirms that, in future filings, it will briefly describe the nature of any amendments to the code of ethics as required by Item 2(c) of Form N-CSR.

Ms. Christina DiAngelo Fettig

April 10, 2023

Page 6

Comment: The Staff notes Item 8(a)(3) of the Fund’s Form N-CSR includes disclosure of certain information on the compensation of each portfolio manager. Pursuant to Instruction 1 of Item 8(a)(3), the information shall be provided as of the registrant’s most recently completed fiscal year, except that, in the case of any newly identified portfolio manager, information must be provided as of the most recent practicable date. In future filings, please disclose the date as of which this information is provided.

Response: The Fund confirms that, in future filings, it will disclose in Item 8(a)(3) of the Fund’s Form N-CSR the date as of which the portfolio management compensation information has been disclosed.

| 16. | Comment: The Registrant is identified as non-diversified. The Staff notes, however, that it appears the Registrant has been operating as diversified. Please confirm whether the Fund has been operating as diversified for more than three years and, if so, that the Fund will obtain shareholder approval prior to changing its operating status back to non-diversified. |

Response: The Registrant confirms that the Fund has been operating as diversified for a continuous three-year period, and as a result, the classification status of the Fund has been changed to diversified. Therefore, the Registrant will reflect that fact in future shareholder reports and registration statements. The Registrant further confirms that the Fund would seek shareholder approval prior to changing its operating status back to non-diversified.

* * * * *

We trust that the foregoing is responsive to your comments. Questions and comments concerning this filing may be directed to the undersigned at (215) 220-4531.

| Very truly yours, | |

| /s/ Edward T. Gallivan, Jr. | |

| Edward T. Gallivan, Jr. | |

| Chief Financial Officer | |

| FS Credit Income Fund |