TRILOGY INTERNATIONAL PARTNERS INC.

Annual Information Form

For the Year Ended December 31, 2016

Dated March 27, 2017

ANNUAL INFORMATION FORM

TRILOGY INTERNATIONAL PARTNERS INC.

TABLE OF CONTENTS

ANNUAL INFORMATION FORM

TRILOGY INTERNATIONAL PARTNERS INC.

GENERAL MATTERS

Information Contained in this Annual Information Form

Unless the context otherwise indicates, references to “TIP Inc.” in this Annual Information Form (“AIF”) mean Trilogy International Partners Inc. and its consolidated subsidiaries following the completion of the Arrangement (as defined under the heading “Corporate Structure”). References to “Trilogy” mean Trilogy International Partners LLC, which became a subsidiary of TIP Inc. upon completion of the Arrangement.

Unless otherwise indicated, all information in this AIF is presented as at March 27, 2017, and references to specific years are references to the fiscal years of Trilogy ended December 31.

On February 7, 2017, Trilogy and Alignvest Acquisition Corporation (“Alignvest”) completed the Arrangement, as a result of which Alignvest changed its name to “Trilogy International Partners Inc.” and adopted the financial year-end of Trilogy, being December 31. See “Corporate Structure – The Arrangement”. This AIF should be read in conjunction with Trilogy’s 2016 audited consolidated financial statements and notes and Trilogy’s 2016 Management’s Discussion and Analysis (the “2016 MD&A”). These documents are not, however, incorporated by reference herein. Trilogy’s 2016 audited consolidated financial statements and the 2016 MD&A were filed by TIP Inc. pursuant to Section 4.10 of National Instrument 51-102 –Continuous Disclosure Obligations and are available on TIP Inc.’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com.

Presentation of Financial Information

TIP Inc. has prepared Trilogy's consolidated financial statements in accordance with accounting principles generally accepted in the U.S. (“U.S. GAAP”). Shareholders of TIP Inc. who are resident in Canada should be aware that U.S. GAAP is different from International Financial Reporting Standards generally applicable to Canadian-incorporated companies.

This AIF makes reference to certain measures and wireless telecommunication industry metrics that are not recognized measures under U.S. GAAP and do not have a standardized meaning prescribed by U.S. GAAP. They are, therefore, unlikely to be comparable to similar measures presented by other companies. Rather, these non U.S. GAAP measures complement U.S. GAAP measures by providing further understanding of TIP Inc.’s results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of TIP Inc.’s financial information reported under U.S. GAAP. Non-U.S. GAAP measures used to analyze the performance of TIP Inc. include “Adjusted EBITDA” and “Adjusted EBITDA margin”.

This AIF also makes reference to “data revenue”, “wireless service revenues”, “subscriber count”, “monthly average revenue per wireless user” or “ARPU”, “churn”, “cost of acquisition”, “equipment subsidy per gross addition”, and “capital intensity”, which are commonly used operating metrics in the wireless telecommunications industry, but may be calculated differently compared to other wireless telecommunication providers.

For a description of why non-U.S. GAAP measures are presented and a definition and reconciliation of each measure to their most directly comparable measures calculated in accordance with U.S. GAAP, see the heading “Definitions and Reconciliations of Non-GAAP Measures” in the 2016 MD&A.

Currency

Unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “$” or “U.S.$” are to United States dollars. References to “C$” are to Canadian dollars and references to “NZD$” are to New Zealand dollars.

- 2 -

The following table sets forth, for the periods indicated, the high, low, average and period-end noon spot rates of exchange for the U.S. dollar, expressed in Canadian dollars, published by the Bank of Canada.

| | Year Ended December 31 |

| | 2016 | 2015 | 2014 |

| | | | |

| Noon rate at end of period | C$1.3427 | C$1.3840 | C$1.1601 |

| | | | |

| Average noon rate during period | C$1.3248 | C$1.2787 | C$1.1045 |

| | | | |

| High noon rate for period | C$1.4589 | C$1.3990 | C$1.1643 |

| | | | |

| Low noon rate for period | C$1.2544 | C$1.1728 | C$1.0614 |

The following table sets forth, for the periods indicated, the high, low, average and period-end spot rates of exchange for the New Zealand dollar, expressed in U.S. dollars, published by Oanda (www.oanda.com).

| | Year Ended December 31 |

| | 2016 | 2015 | 2014 |

| | | | |

| Rate at end of period | U.S.$0.6918 | U.S.$0.6844 | U.S.$0.7823 |

| | | | |

| Average rate during period | U.S.$0.6969 | U.S.$0.6999 | U.S.$0.8300 |

| | | | |

| High rate for period | U.S.$0.7442 | U.S.$0.7825 | U.S.$0.8815 |

| | | | |

| Low rate for period | U.S.$0.6386 | U.S.$0.6265 | U.S.$0.7659 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in this AIF are not based on historical facts and constitute forward-looking statements or forward-looking information within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Canadian securities laws (“forward-looking statements”), including TIP Inc.’s business outlook for the short and longer term and statements regarding TIP Inc.’s strategy, plans and future operating performance. Forward-looking statements are provided to help you understand TIP Inc.’s views of its short and longer term plans, expectations and prospects. TIP Inc. cautions you that forward-looking statements may not be appropriate for other purposes.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential”, “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are not promises or guarantees of future performance, they represent TIP Inc.’s current views and may change significantly. Forward-looking statements are based on a number of material assumptions, including, but not limited to, those listed below, which could prove to be significantly incorrect:

- the absence of unforeseen changes in the legislative and operating frameworks for TIP Inc.;

- TIP Inc. meeting its future objectives and priorities;

- TIP Inc. having access to adequate capital to fund its future projects and plans;

- TIP Inc.’s future projects and plans proceeding as anticipated;

- taxes payable;

- subscriber growth, pricing, usage and churn rates;

- technology deployment;

- data based on good faith estimates that are derived from management’s knowledge of the industry and other independent sources;

- assumptions concerning general economic and industry growth rates; and

- 3 -

- commodity prices, currency exchange and interest rates and competitive intensity.

Forward-looking statements are statements about the future and are inherently uncertain, and TIP Inc.’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of known and unknown risks, uncertainties and other factors, including, without limitation, those referred to below under “Risk Factors” and those referred to in TIP Inc.’s other regulatory filings with the U.S. Securities and Exchange Commission (the “SEC”) in the United States and the provincial securities commissions in Canada. These risks, uncertainties and other factors that could cause actual events or results to differ significantly from those expressed or implied in TIP Inc.’s forward-looking statements include, without limitation:

- Trilogy has incurred losses in the past and TIP Inc. may incur losses in the future;

- TIP Inc.’s ability to refinance its indebtedness;

- TIP Inc.’s and Trilogy’s status as holding companies;

- TIP Inc.’s significant level of indebtedness and the refinancing, default and other risks, as well as the limits, restrictive covenants and restrictions resulting therefrom;

- TIP Inc.’s ability to incur additional debt despite its indebtedness level;

- the risk that TIP Inc.’s credit ratings could be downgraded;

- TIP Inc. having insufficient financial resources to achieve its objectives;

- risks associated with any potential acquisition, investment or merger;

- the significant political, social, economic and legal risks of operating in Bolivia;

- the regulated nature of the industry in which TIP Inc. participates;

- TIP Inc.’s operations being in markets with substantial tax risks and inadequate protection of shareholder rights;

- the need for spectrum access;

- the use of “conflict minerals” and the effect thereof on manufacturing of certain products, including handsets;

- anti-corruption compliance;

- intense competition;

- lack of control over network termination, roaming and international long distance revenues;

- rapid technological change and associated costs;

- reliance on equipment suppliers;

- subscriber “churn” risks, including those associated with prepaid accounts;

- the need to maintain distributor relationships;

- TIP Inc.’s future growth being dependent on innovation and development of new products;

- security threats and other material disruptions to TIP Inc.’s wireless network;

- the ability of TIP Inc. to protect subscriber information;

- health risks associated with handsets;

- litigation, including class actions and regulatory matters;

- fraud, including device financing, customer credit card, subscription and dealer fraud;

- reliance on management;

- risks associated with the minority shareholders of TIP Inc.’s subsidiaries;

- general economic risks;

- natural disasters including earthquakes;

- foreign exchange and interest rate changes;

- currency controls;

- interest rate risk;

- Trilogy’s ability to utilize carried forward tax losses;

- TIP Inc.’s payment of dividends;

- tax related risks;

- TIP Inc.’s dependence on Trilogy to pay taxes and other expenses;

- Trilogy may be required to make distributions to TIP Inc. and the other owners of Trilogy;

- differing interests among TIP Inc.’s and Trilogy’s equity owners;

- volatility of the Common Share (as defined below under “Corporate Structure- The Arrangement”) price;

- 4 -

- dilution of the Common Shares;

- market coverage;

- TIP Inc.’s internal controls over financial reporting;

- new laws and regulations; and

- risks as a publicly traded company, including, but not limited to, compliance and costs associated with the U.S.Sarbanes-Oxley Act of 2002(“SOX”) (to the extent applicable).

This list is not exhaustive of the factors that may affect any of TIP Inc.’s forward-looking statements.

TIP Inc.’s forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made, and TIP Inc. does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by applicable law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

MARKET AND INDUSTRY DATA

This AIF relies on and refers to information regarding various companies and certain market and industry data. TIP Inc. has obtained this information and industry data from independent market research reports and information made publicly available by such companies. Such reports generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed. Although TIP Inc. believes the market research and publicly available information is reliable, TIP Inc. has not independently verified and cannot guarantee the accuracy or completeness of that information and investors should use caution in placing reliance on such information.

CORPORATE STRUCTURE

Incorporation

TIP Inc. was incorporated under the name “Alignvest Acquisition Corporation” under theBusiness Corporations Act (Ontario) (“OBCA”) on May 11, 2015. Alignvest was a special purpose acquisition corporation, or “SPAC”, formed for the purpose of effecting an acquisition of one or more businesses or assets, by way of a merger, share exchange, asset acquisition, share purchase, reorganization, or any other similar business combination involving Alignvest, referred to as its “qualifying acquisition”.

The Arrangement

On November 1, 2016, Alignvest and Trilogy entered into an arrangement agreement (as amended December 20, 2016, the “Arrangement Agreement”). On February 7, 2017, pursuant to the terms of the Arrangement Agreement, Alignvest completed its qualifying acquisition under which it effected a business combination with Trilogy by way of a court approved plan of arrangement (the “Arrangement”).

Under the Arrangement, Alignvest acquired, directly or indirectly, all of the voting interest, and a significant economic equity interest, in Trilogy. As consideration, Trilogy received payments from Alignvest totaling approximately $199.3million (net of $3.0 million in cash retained by TIP Inc.), representing the proceeds of Alignvest’s initial public offering and private placements that closed concurrently with the Arrangement, less redemptions from such proceeds of a portion of Alignvest’s then outstanding class A restricted voting shares (the “Alignvest Class A Restricted Voting Shares”) and certain expenses.

At the effective time of the Arrangement, Alignvest’s name was changed to “Trilogy International Partners Inc.” and Alignvest’s authorized capital was amended to create one special voting share (the “Special Voting Share”) and an unlimited number of common shares (the “Common Shares”). In addition, the existing share purchase warrants of Alignvest (the “Alignvest Warrants”) were deemed to be amended to be share purchase warrants (the “TIP Inc. Warrants”) to acquire Common Shares following 30 days after the effective date of the Arrangement, at an exercise price of C$11.50 per share, but otherwise unamended. The TIP Inc. Warrants are governed by the terms of a warrant agreement dated June 24, 2015 (as amended February 7, 2017, the “Warrant Agreement”) between TIP Inc. and TSX Trust Company (the “Warrant Agent”).

- 5 -

Immediately following the effective time of the Arrangement, TIP Inc. continued out of the jurisdiction of Ontario under the OBCA and into the jurisdiction of British Columbia under theBusiness Corporations Act(British Columbia) (“BCBCA”). As a result of this continuation, TIP Inc. adopted new Articles that included an advance notice policy, as well as certain ownership and voting restrictions that were implemented in order for TIP Inc. to comply with theOverseas Investment Act 2005of New Zealand. See “Description of Capital Structure”.

For more information on the Arrangement, see the management information circular of Alignvest dated December 22, 2016 (including the prospectus set out at Appendix “F” thereto), as amended January 12, 2017, which is available on TIP Inc.’s SEDAR profile atwww.sedar.com.

TIP Inc.

The head office of TIP Inc. is located at Suite 400, 155 108th Avenue NE, Bellevue, Washington, 98004 and the registered and records office of TIP Inc. is located at Suite 2600, 595 Burrard Street, P.O. Box 49314, Three Bentall Centre, Vancouver, British Columbia, V7X 1L3.

Inter-corporate Relationships

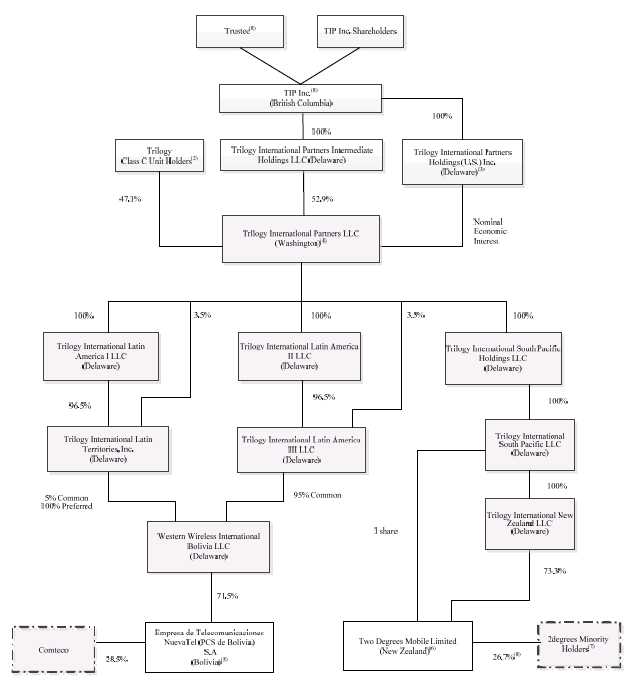

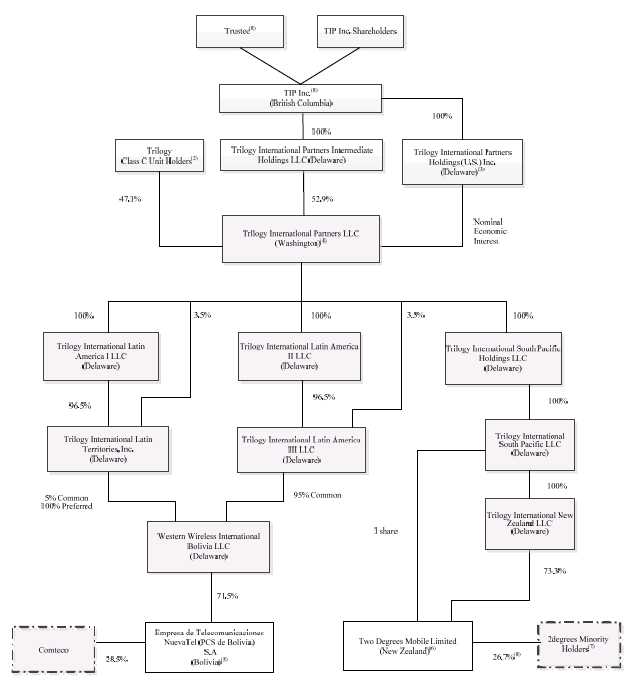

The organizational chart below indicates the inter-corporate relationships of TIP Inc. and its material subsidiaries, including their jurisdiction of incorporation in parentheses, as of the date hereof.

- 6 -

Notes:

| | (1) | TIP Inc. indirectly holds the class B units of Trilogy (the “Trilogy Class B Units”) through its wholly-owned subsidiary, Trilogy International Partners Intermediate Holdings LLC (“Trilogy Intermediate Holdings”). The Trilogy Class B Units provide TIP Inc. with an indirect 52.9% economic interest in Trilogy under the Trilogy LLC Agreement (as defined below under the heading “Corporate Structure – Trilogy LLC Agreement”). Holders of Trilogy Class C Units hold the balance of the economic interest in Trilogy. See note (2) below for a description of the voting rights of holders of Trilogy Class C Units. Except under limited circumstances, only Trilogy International Partners Holdings (U.S.) Inc. (“Trilogy Holdings”), as the Managing Member (as defined below under the heading “Corporate Structure – Trilogy LLC Agreement”) holding Class A units of Trilogy (the “Trilogy Class A Units”), has any voting rights under the Trilogy LLC Agreement. See “Corporate Structure – Trilogy LLC Agreement – Management”. |

| | (2) | Holders of Trilogy Class C Units (the “Trilogy Class C Units”) are entitled to exercise voting rights in TIP Inc. through the Special Voting Share held by TSX Trust Company (the “Trustee”) on the basis of one vote per Trilogy Class C Unit held, under the terms of a voting trust agreement among TIP Inc., Trilogy and the Trustee dated February 7, 2017 (the “Voting Trust Agreement”). See “Description of Capital Structure-Special Voting Share of TIP Inc.” and “Description of Capital Structure-Voting Trust Agreement”. At such time as there are no Trilogy Class C Units outstanding, the Special Voting Share shall automatically be redeemed and cancelled for C$1.00 to be paid to the holder thereof. |

- 7 -

| | (3) | Trilogy Holdings holds the Trilogy Class A Units and is the Managing Member of Trilogy. See “Corporate Structure – Trilogy LLC Agreement – Management”. The Managing Member has full and complete authority, power and discretion to manage and control the business, affairs and properties of Trilogy, subject to applicable law and the restrictions on Trilogy described under the heading “Corporate Structure – Trilogy LLC Agreement”. The Trilogy Class A Units have nominal economic value and no rights to participate in the appreciation of the economic value of Trilogy. |

| | (4) | The Trilogy LLC Agreement governs, among other things, the business and affairs of Trilogy. See “Corporate Structure – Trilogy LLC Agreement”. |

| | (5) | Certain matters relating to TIP Inc.’s ownership, transfer and sale of shares (the “NuevaTel Shares”) of Empresa de Telecomunicaciones NuevaTel (PCS de Bolivia) S.A (“NuevaTel”) are subject to the NuevaTel Shareholders Agreement (as defined below). See “Description of the Business of TIP Inc. – Bolivia (NuevaTel) – NuevaTel Shareholders Agreement”. |

| | (6) | Certain matters relating to TIP Inc.’s ownership, transfer and sale of shares (the “2degrees Shares”) of Two Degrees Mobile Limited (“2degrees”) as well as the governance of 2degrees are subject to the 2degrees Shareholders Agreement (as defined below). See “Description of the Business of TIP Inc. – New Zealand (2degrees) – 2degrees Shareholders Agreement”. |

| | (7) | The minority holders of 2degrees consist of Tesbrit B.V. (“Tesbrit”) and NZ Communications Trustee Limited. Certain individuals also hold options to purchase 2degrees Shares. |

| | (8) | 2degrees had three separate loans from Trilogy totaling approximately $37.5 million as of December 31, 2016. Loans in the aggregate amount of $13.9 million are convertible into 2degrees shares at a per share price of $1.27 (the “Fixed Rate Loan”) and loans in the aggregate amount of $23.7 million are convertible at fair market value at the time of conversion (the “Floating Rate Loan”). In January 2017, Trilogy converted the outstanding balance of the Fixed Rate Loan into ordinary shares of 2degrees. 10,920,280 2degrees Shares were issued to Trilogy in full repayment of the Fixed Rate Loan. Further, in connection with the completion of the Arrangement on February 7, 2017, TIP Inc. indirectly acquired the interests of the 2degrees Participating Minority Shareholders (as defined below). In March 2017, Trilogy, on behalf of TIRS, paid the government of New Zealand the deferred installment of the 2degrees license obligation, increasing the Floating Rate Loan by $7.3 million. If all conversion rights under such indebtedness were exercised at December 31, 2016 and adjusted for: (i) the conversion of the Fixed Rate Loan; (ii) the transfer of shares from the 2degress Participating Minority Shareholders to TIP Inc., and; (iii) the payment to the New Zealand government, the impact would be an increase in TIP Inc.’s current 73.3% ownership interest in 2degrees by approximately 1.3%, subject to certain pre-emptive rights held by Tesbrit under the 2degrees Shareholder Agreement (see “Description of the Business of TIP Inc. – New Zealand (2degrees) – 2degrees Shareholders Agreement”). |

The assets and revenues of each of the unnamed subsidiaries of TIP Inc. did not exceed 10% of Trilogy’s assets or have revenues exceeding 10% of the total consolidated revenues attributable to Trilogy’s assets of and for the year ended December 31, 2016. In the aggregate, such subsidiaries did not account for 20% of Trilogy’s assets or total consolidated revenues attributable to Trilogy’s assets as of and for the year ended December 31, 2016.

Trilogy LLC Agreement

At the effective time of the Arrangement, Trilogy, TIP Inc. and all of the Trilogy Members (as defined below), other than Trilogy Intermediate Holdings, entered into the Sixth Amended and Restated Limited Liability Company Agreement. Immediately after the effective time of the Arrangement, Trilogy, TIP Inc., Trilogy Holdings and Trilogy Intermediate Holdings entered into the Seventh Amended and Restated Limited Liability Company Agreement (the “Trilogy LLC Agreement”) to effect the transfer of Trilogy Class B Units from TIP Inc. to Trilogy Intermediate Holdings.

The following is a summary of the Trilogy LLC Agreement, which is binding on all Trilogy Members. This summary is qualified in its entirety by reference to that agreement, which is available on TIP Inc.’s SEDAR profile at www.SEDAR.com.

Description of Units

The interests in Trilogy are divided into and represented by an unlimited number of each of three classes of units (the “Trilogy Units”) as follows: (i) Trilogy Class A Units, all of which are held by (and only by) the Managing Member (as defined below), (ii) Trilogy Class B Units, all of which are held by Trilogy Intermediate Holdings, a 100% owned subsidiary of TIP Inc., and (iii) Trilogy Class C Units, all of which are held by the other Trilogy members (all of whom were members of Trilogy as of immediately prior to consummation of the Arrangement) (collectively, with Trilogy Intermediate Holdings and the Managing Member, the “Trilogy Members”).

As of February 7, 2017, the effective date of the Arrangement, there were 157,339,668 Trilogy Class A Units, 44,177,149 Trilogy Class B Units and 39,334,917 Trilogy Class C Units outstanding. The Trilogy Class C Units are subdivided into Class C-1 Units, Class C-2 Units, and Class C-3 Units.

- 8 -

The economic interests of the Trilogy Class C Units are pro rata to those of the Trilogy Class B Units, which are held by TIP Inc. through its 100% owned subsidiary, Trilogy Intermediate Holdings. The number of Trilogy Class B Units is equal, and at all times will be equal, to the number of Common Shares.

Except under limited circumstances, only Trilogy Members holding Trilogy Class A Units (currently, Trilogy Holdings) have any voting rights under the Trilogy LLC Agreement. Except for the nominal economic rights possessed by the holders of Trilogy Class A Units, only Trilogy Members holding Trilogy Class B Units or Trilogy Class C Units have economic rights under the Trilogy LLC Agreement.

Reciprocal Changes

TIP Inc. may not issue or distribute additional Common Shares, or issue or distribute rights, options or warrants to acquire additional Common Shares, or issue or distribute any cash or property to holders of all or substantially all Common Shares (on a ratable basis), unless a corresponding issuance or distribution is made on an economically equivalent basis to all holders of Trilogy Class C Units. TIP Inc. also may not subdivide, reduce, combine, consolidate, reclassify or otherwise change Common Shares, unless a corresponding change is made with respect to the Trilogy Class C Units.

No action in respect of the Trilogy Class C Units contemplated by the preceding paragraph shall be made without the corresponding action having been made in respect of Common Shares.

If TIP Inc. issues or redeems Common Shares, Trilogy is obligated to issue or redeem a corresponding number of Trilogy Class B Units to or from Trilogy Intermediate Holdings, such that the number of issued and outstanding Trilogy Class B Units at any time will correspond and be equivalent to the then number of issued and outstanding Common Shares.

Income Allocations; Distributions

Income shall be allocated among the Trilogy Members in proportion to the number of Trilogy Class B Units and Trilogy Class C Units held by such members, except that, under Section 704(c) of theU.S. Internal Revenue Code (the “Code”), gain or loss realized from the disposition of NuevaTel or 2degrees shall be allocated taking into account the “built-in gain” associated with such assets as of February 7, 2017, the effective date of the Arrangement, first allocating such built-in gain to the holders of Trilogy Class C Units, and then, unless otherwise determined by the Independent Directors (as defined in the Trilogy LLC Agreement), allocating gain in excess of such built-in gain, and loss, pro rata among the Trilogy Members in proportion to the number of Trilogy Class B Units and Trilogy Class C Units held by such members. Distributions (except in liquidation) shall be made at the times and in the amounts determined by the Managing Member, except that Trilogy is required to make, on a periodic basis, tax distributions to the Trilogy Members in proportion to the number of Trilogy Class B Units and Trilogy Class C Units held by such members, based on an assumed forty percent (40%) tax rate multiplied by Trilogy’s positive taxable income (if any) for the period. All distributions of cash flow from operations shall be made among the Trilogy Members in proportion to the number of Trilogy Class B Units and Trilogy Class C Units held by such members.

Redemption Rights of Holders of Trilogy Class C Units

From and after the expiration of the Lock-Up Period (as defined below) applicable to any Trilogy Class C Units, a holder of such Trilogy Class C Units shall have the right to require Trilogy to repurchase any or all of such Trilogy Class C Units held by such holder for either (i) a number of Common Shares equal to the number of Trilogy Class C Units to be repurchased or (ii) a cash amount equal to the fair market value of such Common Shares at such time (based on the weighted average market price of a Common Share during the preceding twenty (20) consecutive trading days), the form of consideration to be determined by Trilogy. The repurchase shall occur on the date specified in the notice provided by the holder notifying Trilogy of its exercise of such redemption right, which shall be no less than fifteen (15) business days from the date of such notice. In addition, Trilogy is required to cause a mandatory redemption of all outstanding Trilogy Class C Units for the consideration described above upon the earliest to occur of (A) the seven-year anniversary of consummation of the Arrangement, (B) there remaining outstanding fewer than five percent (5%) of the issued and outstanding Trilogy Class C Units immediately after consummation of the Arrangement, (C) a change in control of TIP Inc. or of Trilogy Holdings and Trilogy Intermediate Holdings, or (D) the failure of the holders of Trilogy Class C Units to approve any transaction required to maintain the economic equivalence of a Trilogy Class C Unit and a Common Share.

- 9 -

Transfer Restrictions

No holder of Trilogy Class C Units may transfer Trilogy Units comprising any series of Trilogy Class C Units during the following periods, measured from the date of consummation of the Arrangement, being February 7, 2017 (each, a “Lock-Up Period”):

| | (i) | Class C-1 Units: 24 months; |

| | | |

| | (ii) | Class C-2 Units: 12 months; and |

| | | |

| | (iii) | Class C-3 Units: 180 days. |

The foregoing restrictions do not apply to transfers by a holder of Trilogy Class C Units to an Affiliate (as defined in the Trilogy LLC Agreement), so long as such transferee remains an Affiliate. In the case of any such transfer to an Affiliate, such Affiliate will be bound by the foregoing transfer restrictions.

From and after the expiration of the Lock-Up Period applicable to any Trilogy Class C Units, the holder of such Trilogy Class C Units may freely transfer its Trilogy Class C Units after giving fifteen (15) business days prior written notice to Trilogy of its intention to do so; provided that if Trilogy receives from any holder of Trilogy Class C Units any such notice (“Proposed Transfer Notice”), then upon notice to such holder within five (5) business days of receipt of such Proposed Transfer Notice, Trilogy is required to, unless otherwise determined by all of the Independent Directors (as defined in the Trilogy LLC Agreement), cause a mandatory redemption of all of the outstanding Trilogy Class C Units of such holder proposed to be transferred in accordance with the procedures set forth under the heading “Redemption Rights of Holders of Trilogy Class C Units” above.

In addition to the foregoing, the Common Shares issuable on redemption of the Trilogy Class C Units held by a Locked-Up Shareholder (as defined below) are also be subject to restrictions on transfer following the consummation of the Arrangement. See “Escrowed Securities andSecurities Subject to Contractual Restriction on Transfer”.

None of TIP Inc., Trilogy Holdings or Trilogy Intermediate Holdings is permitted to transfer their Trilogy Units, other than (i) pursuant to a change of control transaction involving TIP Inc. or involving Trilogy Holdings and Trilogy Intermediate Holdings, (ii) pursuant to a Drag-Along Sale (as defined below), or (iii) to any 100% owned direct or indirect subsidiary of TIP Inc.

Canadian securities regulatory authorities may intervene in the public interest (either on application by an interested party or by staff of a Canadian securities regulatory authority) to prevent an offer to holders of Trilogy Class C Units being made or completed where such offer is abusive of the holders of Common Shares who are not subject to that offer.

TIP Inc. is required to advise the Ontario Securities Commission in the event a holder of Trilogy Class C Units proposes to transfer to a third party, Trilogy Class C Units representing greater than 10% of the combined issued and outstanding Common Shares and Trilogy Class C Units for a price that is greater than 115% of the market price (as such term is defined in s.1.11 of National Instrument 62-104 –Take-Over Bids and Issuer Bids).

Change of Control; Drag-Along; Required Approvals for Sale Transactions

TIP Inc. may not, and may not permit Trilogy Holdings and Trilogy Intermediate Holdings or Trilogy to, consummate a change of control transaction, unless the consideration payable in respect of such transaction is comprised of cash or marketable securities having value sufficient to enable the recipient thereof to pay all tax liabilities arising under, or related to, such transaction (assuming the consideration payable to each recipient would be taxable at a forty percent (40%) tax rate).

- 10 -

If TIP Inc., Trilogy Holdings and Trilogy Intermediate Holdings determine to transfer in one or a series of related bona fide arm’s-length transactions all, but not less than all, of the Trilogy Class A Units and Trilogy Class B Units held by them (whether in connection with a merger, acquisition or similar transaction) and the consideration payable in respect of such transaction meets the consideration requirements described above, TIP Inc., Trilogy Holdings and Trilogy Intermediate Holdings are required to “drag-along” all other Trilogy Members as to all of their respective Trilogy Units, on the same terms and conditions (a “Drag-Along Sale”).

Under the Articles of TIP Inc., if any Trilogy Class C Units (as constituted on the close of business on the effective date of the Arrangement, being February 7, 2017) would be issued and outstanding on the effective date of any proposed Sale Transaction (as defined below in “Description of Capital Structure - Rights and Restrictions in Connection with a Proposed Sale Transaction”), such proposed Sale Transaction would, unless approved by all of the Independent Directors of TIP Inc. (as defined in the Articles of TIP Inc.), be subject to the approval of the holders of Common Shares and the holder of the Special Voting Share, each voting as a separate class and each by a simple majority of votes cast.

Management

The management of the business and affairs of Trilogy is vested in the Trilogy Member designated by the holders of Trilogy Class A Units as the “Managing Member”. The initial Managing Member is Trilogy Holdings. The Managing Member can only be changed by the holders of a majority of the Trilogy Class A Units (i.e., the Managing Member acting through its TIP Inc.-appointed directors). Subject to applicable law and the restrictions on Trilogy described in this section of the AIF, the Managing Member generally has complete authority, power and discretion to manage and control the business, affairs and properties of Trilogy.

Restrictions on Activities of TIP Inc.

TIP Inc. and its wholly-owned subsidiaries are not permitted to, among other things, incur indebtedness (except as provided below), make acquisitions or investments, or engage in any trade or business, except through Trilogy and its subsidiaries (subject to limited exceptions).

If TIP Inc. issues any additional equity interests, the net proceeds of such issuance are required to be paid to Trilogy, in consideration of the issuance to Trilogy Intermediate Holdings of a corresponding amount of Trilogy Class B Units or other applicable additional equity in Trilogy. If TIP Inc. incurs any indebtedness, the net proceeds of such incurrence must be advanced to Trilogy as a loan, on terms corresponding to those governing the indebtedness incurred by TIP Inc.

Notwithstanding the foregoing, as more fully described below, a portion of the net proceeds of any such equity issuance or debt issuance may be used by TIP Inc. to pay obligations that are to be funded by Trilogy, but that Trilogy is unable to fund because of restrictions under the Existing Notes Indenture (as defined below in “Material Contracts – Existing Notes Indenture”) or other agreements by which Trilogy is bound.

TIP Inc. and Managing Member Expenses

Trilogy is required to make payments to TIP Inc. and Trilogy Holdings (and any 100% owned subsidiary of TIP Inc.) as required for each of them to pay expenses, costs, disbursements, fees and other obligations (other than income tax obligations, except for income tax obligations arising in respect of payments made by Trilogy to TIP Inc., Trilogy Holdings or any 100% owned subsidiary of TIP Inc. to pay expenses and other obligations) incurred in respect of any of their business or affairs related to their investment in Trilogy, in all cases to the extent that TIP Inc., Trilogy Holdings or such subsidiary does not have not have cash on hand to pay such amounts. Trilogy may be restricted under the Existing Notes Indenture or other agreements by which Trilogy is or may in the future be bound from making such payments as required, in which case, to the extent Trilogy is so restricted, TIP Inc. shall be permitted to issue equity, and TIP Inc., Trilogy Holdings or any 100% owned subsidiary of TIP Inc. shall be permitted to incur indebtedness, to finance the payment of such obligations.

- 11 -

Tax Matters Partner

For all taxable years of Trilogy ending before or including the effective date of the Arrangement, Theresa E. Gillespie or, if Theresa E. Gillespie is unable or declines to serve, another person selected by the holders of a majority of the Trilogy Class C Units, shall serve as the tax matters partner of Trilogy (the “Tax Matters Partner”); provided, however, that with respect to any matter to be acted upon or determined by such Tax Matters Partner (other than any act or determination as required by applicable law, or related to or arising out of any matter encompassed by the redemption rights of the holders of Trilogy Class C Units), the approval of all of the Independent Directors shall be required if the decision of the Tax Matters Partner would have a material or disproportionately adverse effect upon the holders of Trilogy Class B Units, in either case, as compared to the holders of Trilogy Class C Units. For all other taxable years of Trilogy, an individual selected by the Managing Member with the approval of a majority of the Independent Directors shall serve as the Tax Matters Partner.

Amendments

Amendments generally require approval by holders of Trilogy Units representing not less than fifty percent (50%) of each class of Trilogy Units, provided, that any amendment that materially adversely or disproportionately affects the economic benefits of any Trilogy Member requires the written consent of such member; provided, further, that any amendment that extends the duration of any Lock-Up Period of any series of Trilogy Class C Units requires approval by holders of Trilogy Class C Units representing not less than fifty percent (50%) of such series of Trilogy Class C Units.

DESCRIPTION OF THE BUSINESS OF TIP INC.

Following the Arrangement between Alignvest and Trilogy, TIP Inc. now holds a significant economic interest in Trilogy’s existing business of indirectly providing wireless communications services through its operating subsidiaries in New Zealand and Bolivia.

Overview

Trilogy Background

Trilogy, based in Bellevue, Washington, is an internationally focused privately held wireless telecommunications company. Trilogy was founded in 2005 by John W. Stanton, Bradley J. Horwitz, and Theresa E. Gillespie (collectively, the “Trilogy Founders”), who, together with a small group of other investors, bought assets including Bolivia (NuevaTel) from Western Wireless Corporation (“Western Wireless”), which had been founded by the Trilogy Founders and sold to Alltel Corporation for $6 billion in 2005.

Over the following 11 years, Trilogy completed a number of transactions that resulted in the portfolio of operations that are now owned by TIP Inc. In 2008, Trilogy acquired 26% of New Zealand Communications Limited, a greenfield mobile wireless operator in New Zealand, now known as 2degrees. Trilogy subsequently increased its stake in 2degrees and TIP Inc. now holds approximately 73.3% of 2degrees following the completion of the Arrangement. Focusing its efforts on growing 2degrees and NuevaTel, Trilogy sold its operating company in Haiti in 2012 and in the first quarter of 2016 it divested its ownership of a wireless system in the Dominican Republic (adjacent to Haiti), which it had acquired in 2007. Finally, in 2015 2degrees acquired Snap Limited (“Snap”), a New Zealand provider of fixed broadband communications services to enterprise and residential subscribers.

TIP Inc.

TIP Inc. owns and controls majority stakes in two operations that the Trilogy Founders grew from greenfield developments. 2degrees in New Zealand, with estimated wireless market share of approximately 23%, and NuevaTel in Bolivia, with estimated wireless market share of approximately 23%, provide communications services customized for each market, including local, international long distance, and roaming services for both customers and international visitors roaming on their networks. 2degrees also provides fixed voice and broadband services in New Zealand. Both companies provide mobile services on both a prepaid and postpaid basis.

- 12 -

2degrees and NuevaTel’s networks support several digital technologies including Global System for Mobile Communications (“GSM” or “2G”); Universal Mobile Telecommunication Service, a GSM-based third generation mobile service for mobile communications networks (“3G”); and Long Term Evolution, a widely deployed fourth generation service (“4G”). 3G and 4G networks are important because they enable customers to use smartphones which enable greater consumption of data. 4G networks are particularly important as data speeds of up to 10 times faster than 3G enable customers to use more data-intensive applications, driving higher revenue. Both 2degrees and NuevaTel benefit from ample spectrum licenses, and have recently invested significant amounts of capital in their network infrastructure in 3G and 4G to benefit from growth in additional data consumption.

A summary overview of TIP Inc.’s operating subsidiaries is presented below as at December 31, 2016 unless otherwise noted.

| | New Zealand (2degrees) | Bolivia (NuevaTel) |

| TIP Inc. Ownership Percentage | 73.3%(1) | 71.5% |

| Launch Date | August 2009 | November 2000 |

| Population (in millions)(2) | 4.5 | 11.0 |

| Wireless Penetration(3) | 139% | 86% |

| Wireless Subscribers (in thousands) | 1,439 | 2,217 |

| Market Share of Wireless Subscribers(3) | 23% | 23% |

| Notes: | | |

| | (1) | Approximate as of the date hereof. As of December 31, 2016, prior to the completion of the Arrangement, Trilogy held approximately 62.9% of 2degrees. |

| | (2) | Source: The U.S. Central Intelligence Agency’s World Factbook as of July 2016. |

| | (3) | Management estimates. |

New Zealand (2degrees)

Background to market entry

2degrees successfully entered the New Zealand market in 2009 as a disruptive competitor. Prior to 2degrees’ entry, the New Zealand wireless communications market was a duopoly, and the incumbent operators, Vodafone and Telecom New Zealand (now Spark New Zealand (“Spark”)), were able to set relatively high prices, which resulted in low wireless usage by consumers. Additionally, mobile revenue in New Zealand in 2009 was only 31% of total New Zealand telecommunications industry revenue, compared to 42% for the rest of its Organisation for Economic Co-operation and Development (OECD) peers. These two factors led Trilogy to believe that New Zealand presented a significant opportunity for a third competitor to enter the market successfully.

Consequently, 2degrees launched in the New Zealand wireless market in 2009 through innovative pricing, a customer-centric focus, and differentiated brand positioning. 2degrees introduced a novel, low-cost, pre-paid mobile product that cut the incumbents’ prices of prepaid voice calls and text messages in half. Since then, 2degrees has reinforced its reputation as the challenger brand by combining low-cost alternatives with excellent customer service. 2degrees rapidly gained market share: as of December 31, 2016, management estimates 2degrees’ wireless market subscriber share to be approximately 23%.

Additionally, with the acquisition of Snap on April 30, 2015, 2degrees began to provide fixed broadband communications services to new and existing subscribers.

As of December 31, 2016, Trilogy-controlled entities owned 62.9% of 2degrees, with the remaining interests owned primarily by Tesbrit (27.4%), a Dutch investment company, Hautaki Limited (7.2%), a Maori-owned entity (“Hautaki”), and KMCH Holdings Limited (2.5%), a New Zealand limited company (“KMHC” and together with Hautaki, the “2degrees Participating Minority Shareholders”). Upon completion of the Arrangement on February 7, 2017, TIP Inc.-controlled entities owned approximately 73.3% of 2degrees, with the remaining 26.7% interests owned primarily by Tesbrit. The majority of funding to the 2degrees business has been through equity contributions, totaling approximately $367 million through December 31, 2016, which were funded by Trilogy and the 2degrees minority partners.

- 13 -

Strategy

2degrees has grown rapidly since its launch in 2009. Since starting as a low-cost, prepaid-only challenger, 2degrees has transformed itself into a full-service provider. Management believes several key initiatives will enable 2degrees to continue its growth, including: (i) increasing market share in the consumer postpaid mobile market by providing 4G data services and optimizing video content delivery, (ii) capitalizing on the Snap acquisition to provide fixed broadband services and bundled product offerings, specifically to the previously underserved enterprise customers, (iii) cross-selling fixed solutions to the existing mobile consumer subscriber base, and (iv) continuing to invest in its network.

2degrees is in the process of transitioning its customer mix to add higher value, higher margin postpaid customers. Despite having an overall market share of all wireless customers of approximately 23%, 2degrees’ market share of higher-value postpaid customers was only approximately 26% as of December 31, 2016. As a result, management estimates that there is a significant opportunity to drive incremental Service Revenues and Adjusted EBITDA from both (i) converting prepaid customers into postpaid customers, and (ii) gaining greater market share in the postpaid space. The New Zealand Commerce Commission estimates that as of June 30, 2015, postpaid subscribers comprise approximately 40% of the nationwide wireless subscriber base, yet contribute over 70% of revenues. As 2degrees’ customer mix improves and it gains a greater share of the postpaid market, management anticipates that the blended ARPU will increase significantly. In the fourth quarter of 2016, 2degrees’ postpaid subscribers generated almost five times the ARPU of prepaid subscribers, at $36.95compared to prepaid ARPU of $7.85 Management believes that there continues to be opportunities to grow data revenues in the postpaid market due to, among other reasons, (i) proliferating smartphone usage in New Zealand, (ii) the development of new distribution channels, and (iii) the introduction of new devices and other technologies.

Additionally, 2degrees is leveraging its acquisition of Snap, a broadband service provider, to improve its service offerings and gain a larger share of the overall NZD$5 billion telecommunications market. Given this addition to the service offerings, 2degrees started to bundle wireless and broadband product offerings to Small and Medium Enterprises (“SME”) customers to become a compelling and competitive option. SME is the market base with the single largest concentration of revenue in the New Zealand market and 2degrees estimates that it has only single-digit penetration of the SME market. To better enable 2degrees to target SME customers, the acquisition of Snap gives 2degrees the opportunity to develop SME specific plans and to cross-sell services to existing mobile and broadband subscribers. These initiatives are expected to drive meaningful increases in Service Revenues, Adjusted EBITDA and, importantly, cash flow, given that fixed-broadband offerings in New Zealand require minimal capital investment because of the fiber-to-the-premise infrastructure funded and supported by the government.

Lastly, 2degrees has invested over $400million in its spectrum, network and other capital expenditures since 2009. 2degrees has used these investments in building its network to provide national coverage (approximately 96% of New Zealand’s population), launching 4G services in 2014, and bringing its 4G capability to over 65% of its total cell sites. Initially, 2degrees launched service with a network only in major population centers and relied on roaming agreements to provide service outside these areas. Now that 2degrees has its own robust, nationwide network, it is able to provide better service, enhancing both customer attraction and retention, and has an improved cost structure with lower roaming fees paid to other network operators. Going forward, 2degrees expects to continue investing in its network infrastructure to continue offering competitive service offerings.

Services

Today, 2degrees continues to offer compelling plans for voice and data. The Prepay Plus plan has low standard calling and texting rates to anyone in New Zealand and can be easily complemented with bundled rate plans, or “Value Packs”. Furthermore, 2degrees also offers “Carryover Packs”, rate plans which let customers call and text Australia at no extra cost. The latter also includes an option that enables customers to carry-over unused minutes and data for up to a year. As 2degrees has increased scale, it has intensified its efforts to recruit postpaid subscribers 2degrees’ postpaid plans attract higher value subscribers through innovative offers such as the “Carryover” plans, in addition to the Equipment Installment Plan (“EIP”), which is a handset financing program. 2degrees also offers shared plans, “Freedom” plans (no-term contract), and the ability to call and text both New Zealand and Australia at no extra cost. 2degrees also offers a trade-up option on certain high value handsets whereby a subscriber can trade up to the latest smartphone every year under certain terms and conditions.

- 14 -

One of the key changes in the New Zealand market has been the introduction of the EIP, which are handset financing plans that allow customers to purchase the handsets they prefer, largely without regard to the service rate plans they select, and pay for their phones over time. The introduction of the EIP significantly reduces handset subsidies that 2degrees pays, thereby reducing subscriber acquisition costs, while allowing subscribers to purchase high-end handsets with the flexibility to choose the appropriate monthly plans without long-term contracts. This handset financing model enables subscribers to purchase data-centric handsets leading to increased data usage and total revenues, as well as generating overall customer satisfaction. Since 2degrees separated the repayment of the handset cost from the service charge, subscribers have upgraded more quickly to the latest handsets as evidenced by the fact that, as of December 31, 2016, over 80% of all postpaid subscribers are on a 4G handset.

2degrees entered the fixed-line internet service provider (“ISP”) business and began offering home broadband plans with the Snap acquisition in 2015. Consistent with the 2degrees values of simplicity and transparency, 2degrees offers just two plans to new residential customers: an uncapped internet plan and a plan with a traffic cap of 80 gigabytes per month. 2degrees offers customers equivalent pricing for both traditional copper broadband and entry-level ultra-fast fiber broadband. This equivalent pricing enables 2degrees to stand by its commitment to offer the best type of connection available at each address, and to upgrade customers as new technology becomes available.

Marketing Strategy

2degrees positions itself as customer friendly, standing for value, fairness, and simplicity, combining low-cost alternatives with excellent customer service. 2degrees leverages its outstanding customer service capabilities to differentiate itself from competitors and to foster a highly satisfied and loyal customer base as evidenced by 2degrees’ strong net promoter score. This customer-centric focus has resulted in 2degrees receiving numerous customer service awards from Canstar Blue and Roy Morgan Research, both of whom seek to identify and reward brands that exemplify product innovation and customer value.

Advertising

2degrees’ media strategy involves developing insight into consumer preferences and choices, followed by seeking to influence the consumers at each stage of their selection process. 2degrees aims to (i) reach consumers who are not actively in the market, (ii) win share from consumers who are seeking a communications product, and (iii) foster brand-loyalty and advocacy to its existing customers. With respect to its media strategy, 2degrees focuses on digital, television, online-video content, and outdoor advertising to market the 2degrees brand.

Distribution

As of December 31, 2016, 2degrees’ distribution network included approximately 19 company-owned retail stores, over 40 independent dedicated dealers and over 2,500 points of sale through national retail chains and grocery stores. 2degrees also offers services through its online self-service store.

Operations

Facilities

2degrees is headquartered in Auckland, with offices in Wellington and Christchurch.

- 15 -

Employees

2degrees has experienced rapid growth and has increased total employees from 381 as of December 31, 2010 to 1,035 employees as of December 31, 2016. 2degrees’ employees are distributed across its functional areas with 287 in sales and marketing, 209 in operations and engineering, 99 in information technology, 339 in customer operations, and 101 in finance and administration, corporate affairs and human resources.

Assets

Network

2degrees operates 2G, 3G and 4G networks. As of December 31, 2016, the 2degrees network consisted of 1,041 cell sites, of which approximately 697 provide 4G service (an increase of 129 4G sites from December 31, 2015). 2degrees provides nationwide coverage with 96% of New Zealand covered through its own network and an additional 2% covered through a national roaming agreement with Vodafone. During 2016, 2degrees built additional cell sites to improve data throughput and in-building coverage. Additionally, 2degrees initiated deployment of cell sites in areas of the country where its subscribers generate high levels of national roaming traffic in order to minimize consumer roaming costs; full benefits for this construction program are expected to be realized in 2017 after the project is completed in the first quarter of 2017.

2degrees Spectrum Holdings

Management believes 2degrees has ample spectrum to compete effectively against other New Zealand wireless operators and expects to renew its spectrum position once the applicable license expiration date is reached.

| Frequency Band | Spectrum | Spectrum License Expiration | Technology |

| 700 MHz | 10 MHz x 2 | 2031(1) | 4G |

| 900 MHz | 9.8 MHz x 2 | 2031(2) | 2G and 3G |

| 1800 MHz | 25 MHz x 2 | 2021 | 2G and 3G |

| 2100 MHz | 15 MHz x 2 | 2021 | 3G |

| Notes: | | |

| (1) | The 2031 expiration for the 700 MHz license is conditioned on payment of the spectrum license cost in installments by 2019. If the aforementioned criteria are not satisfied, the 700 MHz spectrum license expires in 2020. |

| | (2) | The 2031 expiration for the 900 MHz spectrum is conditioned on payment by May 2022 of the price of the spectrum license and satisfying certain New ZealandCommerce Actrequirements per the sale offer. If these criteria are not satisfied, the rights to use the 900 MHz spectrum expire except for 4 MHz that expires in 2031. |

Market Context

New Zealand is a developed, prosperous country with a population of 4.5 million and a wireless penetration rate of 139.0% .

Economy Overview

Over the past 30 years, New Zealand has transformed from an agrarian economy, dependent on concessionary British market access, to a more industrialized, developed, services-dependent nation, with a large and growing tourism industry and free market economy that competes globally. The country had steady GDP growth of over 2.5% per yearwith low, stable inflation rates. The country’s GDP per capita is on par with Western Europe.

The country has a well-developed legal framework and regulatory system. New Zealand was most recently rated AA+ by Standard & Poor’s (“S&P”) and Aaa by Moody’s based on the country’s high economic strength, very high institutional and government financial strength, and low susceptibility to event risk. The country has no history of debt default.

New Zealand operates under a floating currency regime where the Official Cash Rate (“OCR”) is used as a monetary policy lever. The OCR is the interest rate set by the Reserve Bank of New Zealand to meet the inflation target specified in its Policy Targets Agreement; the rate is reviewed eight times a year and may be adjusted following significant changes in global macroeconomics.

- 16 -

Telecom Overview

The size of the New Zealand telecommunications market reached NZD$5 billion in 2015 and total industry investment for 2015 was approximately NZD$1.77 billion, surpassing the previous high in 2014. This investment was underpinned by government-backed spending in the Ultra-Fast Broadband initiative, which brings fiber connectivity to homes, schools, businesses, and medical facilities; the Rural Broadband initiative, which brings fiber connection to rural areas; and the 4G mobile spectrum investment, which upgrades the infrastructure capability.

With a high wireless penetration rate of 139% and the availability of the latest in-demand devices, data consumption in New Zealand continues to grow. Mobile data consumption has nearly doubled in 2015; consumers utilized approximately 390 megabytes per subscriber in 2015, up from 229 megabytes in 2014, suggesting strong growth in data consumption for the foreseeable future. This growth in consumption is largely due to an increased share of smartphone owners utilizing data. In 2016, smartphone device shipments have taken a 92% share of overall device shipments in the market. Additionally, New Zealand smartphone adoption has risen to 82% through June 30, 2016, up from 77% in 2015 and 68% in 2014.

Competition

2degrees competes with two wireless providers in New Zealand: Vodafone, with 39% of the wireless subscriber market, and Spark with 38% of the market, in each case based on management estimates as of December 31, 2016. Vodafone operates a 2G, 3G and 4G network. Spark operates a 3G and 4G network. Spark and Vodafone offer services across both the fixed and mobile markets.

In the broadband market, 2degrees, with 3% of the broadband subscriber market, competes with a handful of broadband providers in New Zealand: Spark with 42% of the broadband subscriber market, Vodafone with 27% of the market, Vocus with 14% of the market, Trust Power with 5% of the market, and remaining players accounting for 9%, as of December 31, 2016.

Governmental Regulation

New Zealand has a dedicated Minister for Communications, supported by the Ministry of Business Innovation and Employment (“MBIE”), which advises on policy for telecommunications and spectrum issues. The Ministry of Business Innovation and Employment administers the allocation of radio frequency licenses. 2degrees offers service pursuant to licenses in the 700 MHz band, the 900 MHz band, the 1800 MHz band and the 2100 MHz band. 2degrees’ 900 MHz and 700 MHz spectrum licenses expire in, or can be renewed to, 2031; other spectrum licenses expire in 2021. The MBIE has indicated that it may not offer renewals to 2degrees and its wireless competitors for all of the spectrum they currently use in the 1800 and 2100 MHz bands, but may hold a portion of the spectrum for auction. The MBIE has not made a final decision on the matter.

The politically independent Commerce Commission of New Zealand is responsible for implementation of New Zealand’sTelecommunications Act 2001. Pursuant to theTelecommunications Act 2001, the Commerce Commission includes a dedicated Telecommunications Commissioner, who oversees a team that enforces, monitors, and provides reports on the telecommunications sector. The Commerce Commission is responsible for identifying which telecommunications services warrant regulation, price and/or non-price terms for regulated services, market monitoring and for establishing enforcement arrangements applicable to regulated services.

2degrees believes that it has benefited from this policy and regulatory framework. It has gained access to tower sharing sites, has benefited from regulated number portability and regulated rates for mobile termination, and has the ability to secure regulated rates for national roaming if commercial negotiations fail. In addition, theTelecommunications Act 2001 provides for wholesale regulation of fixed access services that 2degrees offers, including unbundled bitstream access. Both policy and implementation issues related to spectrum are carried out by the MBIE.

- 17 -

The New Zealand government is currently undertaking a statutory review of theRadiocommunications Act. This review primarily addresses interference management and does not address spectrum allocation or competition issues. The New Zealand government is also reviewing theTelecommunications Act 2001. In the context of this review, it has announced that the regulatory framework for fiber services will be regulated using a ‘utility style’ building blocks approach post-2020 (representing a shift from the current Total Service Long Run Incremental Cost (TSLRIC) pricing approach applied to copper services). Copper services are proposed to be deregulated in areas where fiber services are available. Access to fiber unbundling will be required, but is not price-regulated. There are no major changes to the regulation of mobile services proposed at this stage but various genericTelecommunications Act 2001 processes may be streamlined. Implementation details are still being determined.

The New Zealand government has taken an active role in funding fiber (the Ultra-fast Broadband Initiative) and wireless infrastructure (the Rural Broadband Initiative) to enhance citizens’ access to higher speed broadband services. In March 2015 the Government announced the expansion of the Ultra-fast Broadband Initiative from 75% to 80% of premises passed, at a projected cost of between NZD$152 million and NZD$210 million. In addition, it announced an extension of the Rural Broadband Initiative and a Mobile Black Spots Fund, allocating NZD$150 million of funding for these purposes. Competitive tenders for these initiatives are due in the first half of 2017.

New Zealand’s Overseas Investment Office (“OIO”) screens foreign investments that would result in the acquisition of 25% or more ownership of, or a controlling interest in, “significant business assets” (significant business assets are defined as assets valued at more than NZD$100 million). For those investments that require screening, the investor must demonstrate the necessary business experience and acumen to manage the investment, demonstrate financial commitment to the investment, be of good character, and not be a person who would be ineligible for a permit under New Zealand immigration law.

In accordance with the terms of the Arrangement Agreement, Alignvest and Trilogy submitted an application under theOverseas Investment Act 2005 and theOverseas Investment Regulations 2005 for consent to the transactions contemplated under the Arrangement. The OIO provided such consent on December 22, 2016.

The OIO also monitors foreign investments after approval. All consents are granted with reporting conditions, which are generally standard in nature. Investors must report regularly on their compliance with the terms of the consent. It is an offence to intentionally or recklessly make false or misleading statements, or any material omission, in any information provided to the OIO. If the High Court is satisfied that an offense has been committed, the High Court can order the disposal of the investor’s New Zealand holdings.

Political Climate

New Zealand is a constitutional monarchy with a stable parliamentary system of government closely patterned on that of the United Kingdom. The Labor Party and the more conservative National Party dominate New Zealand politics, governing in coalition with smaller parties, which has resulted in a stable legislative environment.

New Zealand is renowned for its efforts to ensure a transparent, competitive, and corruption-free government procurement system. Stiff penalties against bribery of government officials as well as those accepting bribes are strictly enforced. New Zealand consistently achieves top ratings in the Transparency International’s Corruption Perception Index (“CPI”). In the 2016 CPI, Transparency International ranked New Zealand number one in the world, along with Denmark (out of 176 countries and territories), with a rating of 90 out of 100.

Intangible Properties

2degrees has a unique and strong local brand with marketing and operating strategies tailored to fit its market and the potential return on investment. 2degrees’ intellectual property enables it to be known and recognized in the New Zealand marketplace through its brand style, trade dress, domain names and trademarks. For example, the 2degrees brand plays a key role in product positioning and its reputation.

2degrees aims to maximize the value of its intangible assets by ensuring that they are adequately used, protected and valued. In order to protect its intellectual property assets, 2degrees relies on a combination of legal protections afforded under copyright, trade-mark, patent and other intellectual property laws as well as contractual provisions under licensing arrangements.

- 18 -

2degrees’ intangible properties also include wireless spectrum licenses as further discussed above under “2degrees Spectrum Holdings”.

2degrees Shareholders Agreement

The governance of 2degrees is addressed in its company constitution, which sets forth conventional terms relating to the rights and obligations of shareholders and the board of directors, and by the 2degrees Third Amended and Restated Shareholders Agreement, dated November 22, 2012 (the “2degrees Shareholder Agreement”). Trilogy International South Pacific LLC and TINZ (both subsidiaries of TIP Inc.), as well as the principal minority shareholder of 2degrees, Tesbrit, are parties to this agreement. Its amendment requires each of their consent. The 2degrees Shareholder Agreement limits the business of 2degrees to providing telecommunications services in New Zealand, requires shareholders to exercise best efforts to refer business opportunities to 2degrees, and requires shareholders to refrain from activities that are competitive with 2degrees.

TIP Inc. has strategic and operational control of 2degrees, subject to significant protections for Tesbrit, as set forth in the 2degrees Shareholder Agreement. Tesbrit holds two positions on the 2degrees board of directors and certain extraordinary decisions will require the approval of one of the directors appointed by Tesbrit. These decisions include (among other things) changes to the constitution, the nature of 2degrees’ business, transactions outside of the ordinary course of business, and affiliated party transactions. A proposal to sell more than half of 2degrees’ assets requires TINZ and Tesbrit’s approval.

The 2degrees Shareholder Agreement provides all shareholder parties with pre-emptive rights in respect of issues of 2degrees Shares and indebtedness, except with respect to securities issued to employees pursuant to an approved equity compensation program.

All transfers of 2degrees Shares (other than for internal shareholder group re-organisations) are subject to rights of first offer in favor of TIP Inc. and Tesbrit pro rata. Transfers of 2degrees Shares by TIP Inc. or Tesbrit to any party besides each other are also subject to rights of second offer in favor of other shareholder parties. All shareholder parties have tag along rights in the case of a sale of 2degrees Shares by TIP Inc. or Tesbrit to a third party. If TIP Inc. and Tesbrit seek to transfer all of their 2degrees Shares to a third party in excess of a threshold price, they can drag all other shareholder parties in the transaction.

The 2degrees Shareholder Agreement terminates upon mutual consent or upon the dissolution or public listing of 2degrees.

Trilogy and the parent of Tesbrit also executed a separate agreement dated May 15, 2008, setting forth similar transfer restrictions and rights concerning transfers of equity interests in TINZ and Tesbrit.

Bolivia (NuevaTel)

The Trilogy Founders launched NuevaTel in 2000 while they managed Western Wireless. Trilogy subsequently acquired a majority stake in the business in 2006 and TIP Inc. currently owns 71.5% of NuevaTel, with the remaining 28.5% owned by Comteco, a large cooperatively owned fixed line telephone provider in Bolivia.

Overview

NuevaTel, which operates under the brand name “Viva” in Bolivia, provides wireless, long distance, public telephony and wireless broadband communication services. NuevaTel provides competitively priced and technologically advanced service offerings characterized by innovative solutions to expand market share and superior subscriber care. NuevaTel focuses its customer targeting efforts on millennials and differentiates itself through simplicity, transparency, a strong national brand, and loyalty programs. As of December 31, 2016, NuevaTel had approximately 2.2 million wireless subscribers representing approximately an estimated 23% subscriber market share.

- 19 -

Strategy

NuevaTel has been a significant player in the Bolivian wireless industry since its launch in 2000. Over the past 16 years, NuevaTel has grown substantially. Since 2008, NuevaTel has distributed cumulative gross dividends of $254million to its shareholders. In 2015 and 2016, NuevaTel increased its network investment in Bolivia. This investment resulted in a return to sequential growth for NuevaTel’s Adjusted EBITDA in the second, third and fourth quarters of 2016. Capitalizing upon this renewed momentum, NuevaTel’s key growth initiatives in the coming years will focus on (i) driving 4G adoption, (ii) increasing data usage among the existing subscriber base, and (iii) continuing its 4G overlay expansion.

Management believes that future growth in the Bolivian wireless business will be driven through expanded 4G adoption that will enable greater data consumption. NuevaTel has started migrating and upgrading its existing high-value customers to 4G devices, and has seen their level of data consumption and associated data revenues more than offset the secular decline in traditional voice and text revenues. As such, NuevaTel will continue to incentivize upgrading to 4G with creative promotions and targeted subsidies.

To increase data consumption further, NuevaTel is participating with the social networking services company Facebook in its Internet.org initiative (the partnership between Facebook and global telecommunication companies to help bring affordable access to Internet services in less developed countries) and NuevaTel is currently pursuing compelling content to bundle with its wireless service offerings in 2017.

To broaden the overall availability of 4G services, NuevaTel will continue to invest capital in expanding its 4G footprint. Management expects to build over two hundred additional sites in each of 2017 and 2018 bringing its 4G network footprint to over 80% of its network. Management believes these investments will drive steady growth in Service Revenues and Adjusted EBITDA and provide a continued stream of dividends to fund additional growth opportunities.

Services

NuevaTel offers wireless voice and high-speed data communications services through both prepaid and postpaid payment plans, with prepaid subscribers representing approximately 82% of the subscriber base as of December 31, 2016. Postpaid plans are sold using five distinct offerings based on tariff and usage. Prepaid customers have the option of purchasing prepaid cards ranging from 10 Bolivianos up to 80 Bolivianos. Additionally, prepaid customers are eligible to receive voice and data service bonuses at the time of recharge based on a customer’s tenure and historical purchase trends, which improves customer loyalty and reduces churn. NuevaTel offers a full range of smartphone devices, including iPhones and Samsung Galaxy devices; however, the majority of its handset sales are more affordable smartphones from manufacturers such as Huawei. The recent availability of 4G-enabled smartphones at prices affordable to Bolivian customers is a key factor enabling 4G adoption. With the increasing penetration of 4G/LTE smartphones in the customer base, there is a significant opportunity for continued growth in data adoption as NuevaTel’s 4G/LTE network continues to expand.

Additionally, NuevaTel has a number of ancillary, noncore businesses including public telephony (pay phone) services with approximately 59 thousand units installed nationally and WiMax, a fixed broadband product offering. Both of these businesses will continue to decline in the coming years as NuevaTel focuses on its core business of postpaid and prepaid wireless services. Public telephone and WiMAX products combined contributed less than 6% of service revenues in 2016.

Marketing Strategy

NuevaTel has positioned itself as the young and dynamic challenger brand in the Bolivian telecommunications market under the brand “Viva”. NuevaTel’s emphasis is on higher-value customers in both the prepaid and postpaid wireless services and on urban areas with higher population density and relatively strong socio-economic factors.

- 20 -

Specifically, NuevaTel caters to millennials, and has developed a community for its customers centered on music, concerts, and Bolivian brands to increase loyalty. Additionally, NuevaTel offers a unique loyalty program known as “Fidepuntos”, a customer-rewards program that grants points for service consumption and tenure, designed to: increase loyalty, develop stronger relationships between customers and NuevaTel and reduce churn which leads to a higher customer lifetime value – a key marketing measure of customer profitability.

Distribution

NuevaTel distributes its products through company-owned “Viva” branded stores that are designed and staffed to promote customer interaction with new devices and advanced wireless data technologies. NuevaTel also utilizes outsourced dealers and stores, which help implement NuevaTel’s handset distribution strategy to increase 4G device proliferation and data adoption. As of December 31, 2016, NuevaTel’s distribution network included approximately 17 stores, over 170 dealers and over 9,980 other dealer points of presence.

Advertising

NuevaTel uses many different forms of advertising to communicate and connect with its customers. Institutional brand awareness is built using television and billboard advertising; while newspaper, radio, and digital channels are typically used to drive promotional campaigns.

Operations

Facilities

NuevaTel’s headquarters is located in the capital city of La Paz. Additional operational offices are located in Santa Cruz and Cochabamba, with sales support offices located throughout the country.

Employees

As of December 31, 2016, NuevaTel had approximately 711 employees. The 711 employees are distributed across its functional areas with 295 in sales and marketing, 115 in operations and engineering, 81 in information technology, 78 in customer operations, and 142 in finance and administration, corporate affairs and human resources.

Assets

Network

NuevaTel has a robust spectrum position and network infrastructure. NuevaTel currently provides 2G and 3G mobile communications in the 1900 MHz band, 4G services in the 1700/2100 MHz bands and WiMAX services in several cities in the 3500 MHz band. NuevaTel’s mobile network consisted of approximately 1,075 cell sites at December 31, 2016. NuevaTel launched a significant number of new and overlay 4G sites in 2015, ending 2016 with approximately 577 4G sites.

NuevaTel launched major network expansions in 2015 and 2016 to enable 4G and expand 3G services. NuevaTel invested a total of $103million over those years in network infrastructure to boost in-city coverage, both in terms of speed and capacity. Total cell site count increased by 18% in 2016, while 4G sites as a percentage of the total sites increased 10% from 2015.

NuevaTel maintains international roaming agreements with over 200 operators in over 90 countries as of December 31, 2016.

- 21 -

NuevaTel Spectrum Holdings

| Frequency Band | Spectrum | Spectrum License Expiration | Technology |

| 1900 MHz | 25 MHz x 2 | 2019-2028(1) | 2G and 3G |

| 3500 MHz | 25 MHz x 2 | 2024-2027 | WiMax |

| 1700/2100 MHz | 15 MHz x 2 | 2029 | 4G |

| Notes: | | |

| | (1) | 30MHz (15MHz x 2) expires in November 2019 and 20MHz (10MHz x 2) expires in April 2028. |

TIP Inc. estimates that NuevaTel had a 67% population coverage as of December 31, 2016.

Market Context

Economic Overview

Bolivia, officially known as the Plurinational State of Bolivia, is a presidential republic located in western-central South America, bordered to the north and east by Brazil, to the southeast by Paraguay, to the south by Argentina, to the southwest by Chile, and to the northwest by Peru. The currency used in Bolivia, the Boliviano, is tied to the value of the U.S. Dollar. Since the introduction of the pegged regime, the Bolivian exchange rate has remained stable. While there has been speculation as to breaking the peg with the U.S. Dollar, TIP Inc. does not expect the impact, if any, to be material in the short or medium term. In May 2016, S&P issued a rating of BB and in August 2016, Moody’s issued a rating of Ba3 for Bolivia’s sovereign bonds, which reflect the country’s strong external balance sheet, low debt burden, and favorable debt profile.