UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

PART I

NOTIFICATION

This Form 1-K is to provide an [X] Annual Report OR [ ] Special Financial Report

for the fiscal year endedDecember 31, 2017

NANO STONE INC.

Exact name of issuer as specified in the issuer’s charter

Delware | | 81-2632123 |

Jurisdiction of

incorporation/organization | | I.R.S. Employer

Identification Number |

2125 Center Ave, Suite 414, Fort Lee,

New Jersey 07024

Address of principal executive offices

+1 (201) 592-0317

Telephone number

Up to 3,676,470 Shares of Common Stock

Minimum purchase: 200 Shares $6.80 per share ($1,360)

securities issued pursuant to Regulation A

Summary Information Regarding Prior Offerings and Proceeds

The following information must be provided for any Regulation A offering that has terminated or completed prior to the filing of this Form 1-K, unless such information has been previously reported in a manner permissible under Rule 257. If such information has been previously reported, check this box [ ] and leave the rest of Part I blank.

Not applicable

1

PART II

INFORMATION TO BE INCLUDED IN REPORT

Item 1. Business

Forward-Looking Statements

This annual report contains forward-looking statements. The Securities and Exchange Commission (the “Commission”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This annual report and other written and oral statements that we make from time to time may contain forward-looking statements that set out anticipated results based on management’s plans and assumptions regarding future events or performance. We have tried, wherever possible, to identify such statements by using words such as “anticipate”, “estimate”, “expect”, “project”, “intend”, “plan”, “believe”, “will” and similar expressions in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance or results of current and anticipated sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

The factors described herein and other factors could cause our actual results of operations and financial condition to differ materially from those expressed in any forward-looking statements we make and investors should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible for us to predict all such factors. Further, we cannot assess the impact of each factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Description of Business

Nano Stone is an innovative building materials company and a pioneer in the development of unique granite and marble finished products with its disruptive Nano Stone Technology that provides eco-friendly & durable attributes to natural stones. The company’s Nano Stone Technology chemically impregnates natural stones e.g. granite, marble, etc. with anti-bacterial, anti-stain, anti-etching and anti-radon properties, an increase of up to 30% additional strength, near-permanent uniform coloring from a wide selection of shades and an infusion of many different varieties of long lasting fragrance, all with superior quality shine and finishes that distinguishes the Company from other natural stone distributors around the world. This unique technology that the Company acquired was developed through years of research and historical investments by the predecessor company that helped achieve this level of perfection. The resulting product is a cost-effective game changing disruptive innovation ready for the broader market for upgradation in building materials for interior and exterior building design, new construction and home remodeling projects. Nano Stone’s premium quality stone is easier to maintain, eco-friendly and optimizes the use of scarce natural resources by allowing for thinner tiles with reduced breakage during transport, installation, and general use. With dedication and detailed planning, our products have the potential to be the new industry standard and set the bar for other manufacturers and distributors to meet the expectations of customers worldwide.

2

The Company is a headed by a visionary team with a focus on the mass commercialization of its disruptive Nano Stone Technology treated enhanced stone products for the building and construction industry. Sanjay Mody and his associates acquired the assets of a Korean entity and brought on some of the former entity’s key personnel to form Nano Stone Inc. with the objective to grow the Company as a global supplier of its unique Nano Stone Technology treated enhanced natural stone products as well as other innovative building materials. To protect against patent infringement and the challenges for a growing company associated with enforcing patents on a worldwide basis, to retain its long-term value proposition for its investors and its brand as it develops and grows its business, the Company made a strategic and conscious decision of keeping its technology for the formulation of its proprietary Nano Stone chemical and Nano Stone Treatment process trade secrets.

Since inception, the Company has expanded its marketing operations in the US, South Korea, India, Hong Kong, Egypt, China, and Japan and continues to further expand its relationships with distributors, end user-groups, and suppliers of natural stone worldwide. Nano Stone has a dedicated and experienced team with decades of experience in R&D, marketing, sales, management and finance. The Company continues to optimize its supply chain at important global centers to provide cost competitive, high quality products in a large selection of color, designs, and sizes to meet the needs and continued satisfaction of our most discerning customers. The Company has forged exclusive global and regional relationships with some of the highest quality stone quarries in Egypt, the Middle East, and India and continues to expand its product lineup to provide the highest quality materials that are both Nano Stone Technology treated and untreated at competitive prices including blocks, slabs, and cut to size stones. The Company’s future plans for an expanded presence in Brazil, Italy, India, and other parts of Asia for procurement and processing of natural stone will facilitate the scalability of the company’s product offerings through its supply chain and allow for distribution and reach in all of its target markets.

The Company now has the following subsidiaries:

Nano Stone Korea Co. Limited.

oNano Stone Korea Co. Limited is a wholly-owned South Korean entity and was formed on September 27, 2016 in the Republic of Korea.

Nano Stone (HK) Limited.

oNano Stone (HK) Limited is a wholly-owned Hong Kong entity and was formed on March 30, 2017.

NextGen Nano Stone Trading Private Limited.

oNextGen Nano Stone Trading Private Limited is a 99% owned Indian entity and was formed on September 15, 2017.

There are a few important pillars that will drive the success of our business:

Technology: Since Nano Stone has proven and certified technology, we believe our technology risk is low.

3

Management: We believe the management has an impeccable record of honesty, integrity and hard work and has a substantial financial stake aligned with our stake holders. The Company is debt free as of the date of this offering and we plan to operate with precision and planning keeping its costs and expenses low and operating efficiently for the benefit of our investors.

Market: The markets for natural stone e.g. Marble, Granite, Onyx, Sandstone, Limestone, etc. are well known and widely documented with market sales of approximately $50 billion in the building industry. The element of market factors is reduced with such long track records. We believe, Nano Stone has a good chance of wide success and adoption as the consumers worldwide are adopting and accepting to new technology savvy products that improves their lifestyle, ambiance and recognition for early adoption of new products.

Execution: The most important and saddled with element of risk is the execution of new product and technology. The management is taking every important steps and protective planning for a seamless execution of Nano Stone Technology for manufacturing, marketing, pricing and distribution strategy. It is mindful of maintaining and prioritizing our proprietary trade secrets and keeping them safe. Procurement of high quality stone products directly from quality quarries are the cornerstone of its competitive process. We go into details for all supply chain and logistic costs to stay competitive and profitable without sacrificing quality and schedule. With all this and our professional approach, and global networking capabilities, we hope to smoothen the execution risk and deliver the best results to all of our stake holders.

4

Nano Stone Product Overview

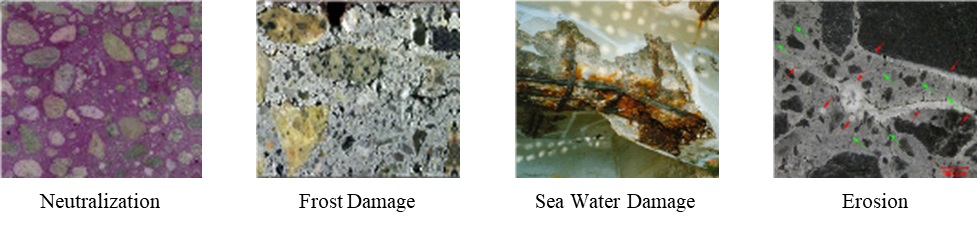

Problem

Natural stones such as marble and granite have naturally occurring porosity. These pores can house harmful radon gas (which is the case for many varieties of granite), can breed bacterial growth, are the cause of softness and fragility of the material (as is the case in many varieties of marble), and can be susceptible to permanent etching, staining, and discoloration if not quickly cleaned (as is the case with residuals such as red wine, turmeric, soy sauce, etc.). These harmful effects on the stones can permanently damage the look and destroy the value of the stone.

For decades, the natural stone industry has had very few innovations in optimizing the use of natural stones. There is an increased demand for eco-friendly, health protective and home freshening building materials that reduce maintenance and meets the need of modern construction and remodeling requirements. The industry suffers from providing color consistency across projects due to the inconsistent color availability of many natural stone types, making it difficult for procuring new natural stones for large premium projects especially when it comes to repairs and maintenance that match the originals and in remodeling of older properties or areas. Additionally, the industry has been plagued with logistic issued including breakage losses resulting in increased freight and insurance costs. Innovation has lagged behind in upgrading technology to provide solutions for some of these major shortcomings in the natural stone industry.

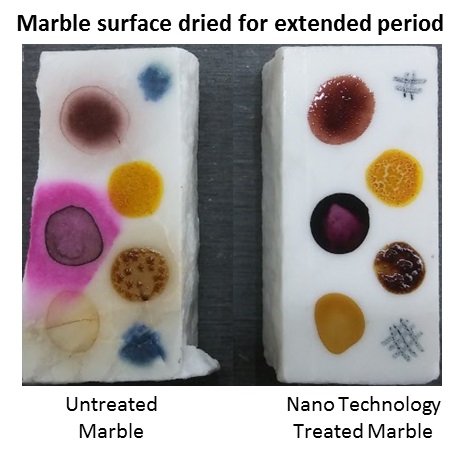

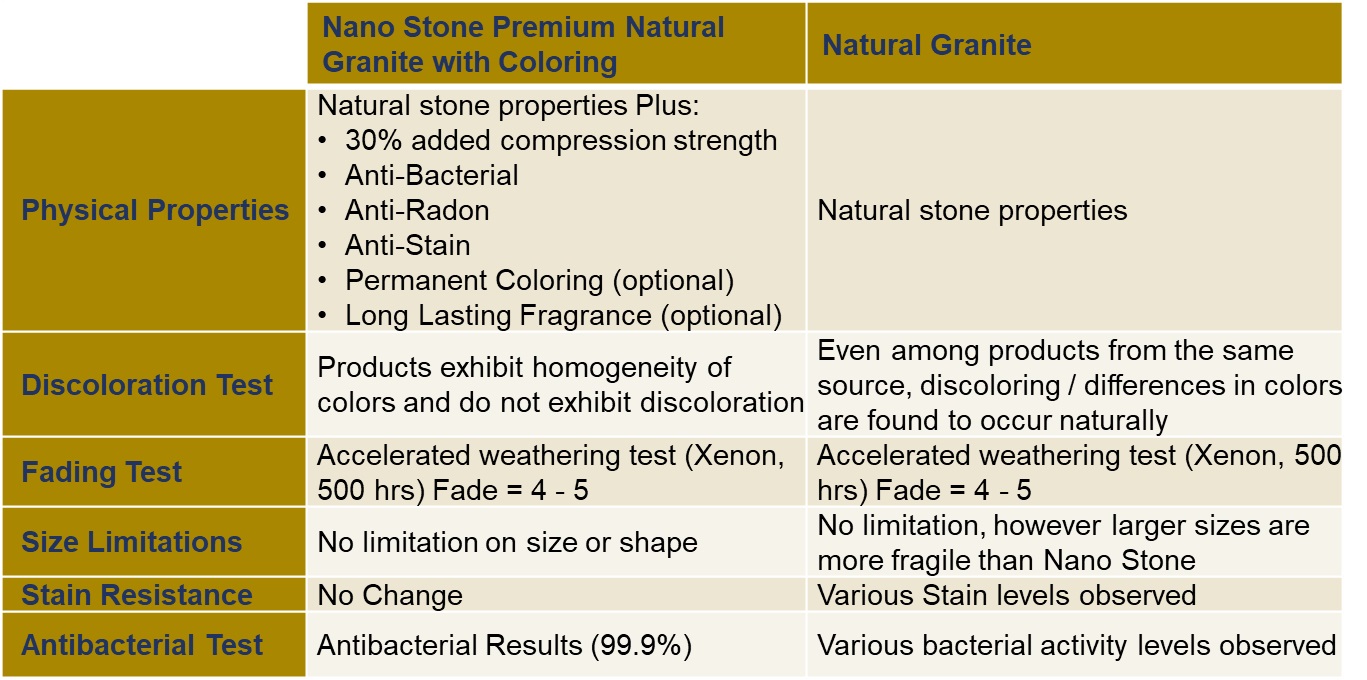

Product Solution: Next Generation Stone Enhancements

The company’s eco-friendly cost effective Nano Stone Technology chemically impregnates natural stones e.g. granite, marble, etc. through the use of proprietary chemicals and specialized proprietary impregnation to fill the pores and enhance the stones with distinguishing features such as anti-bacterial, anti-stain, anti-etching and anti-radon properties; and increase of up to 30% additional compression strength; permanent coloring from one of many thousands of shades; and/or an infusion of many different varieties of long lasting fragrance, all with superior quality shine and finishes that distinguishes the Company from other natural stone distributors around the world.

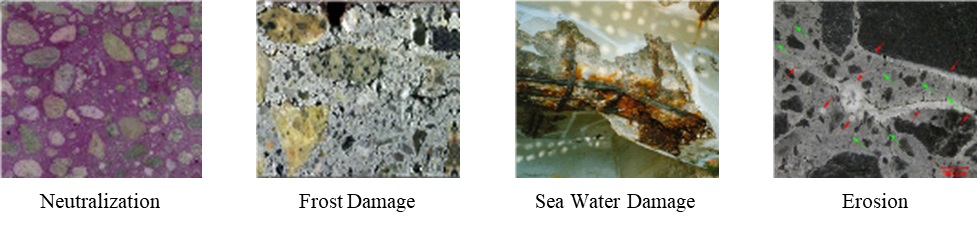

Our Nano Stone Technology treated stones feature added strength and pollution deflection properties that can prolong the life of the product for interior and exterior settings and minimize wear and tear.

Our revolutionary Nano Stone Technology impregnates the stones and fills open pores to give all Nano Stones the following unique properties:

Superior Strength- Our technology adds up to 30% compression strength to natural granite and marble. The additional strength reduces breakage during transportation/installation and increases the longevity of the stone in its various applications

Anti-Bacteria- Unlike natural stones, our Nano Stone Technology fills the open pores that traditionally are breeding grounds for harmful bacteria

Anti-Radon - Natural stones inherently carry traces of radium within their pores. Our Nano Stone Technology fills the stone’s pores preventing unhealthy radon exposure.

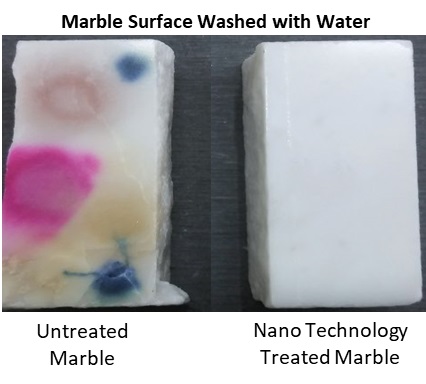

Anti-Stain- Natural stones are porous by nature and will stain if exposed to many different mediums. Our treated stones repel penetration from mediums such as wine, oil and greasy materials making them stain free and preserving their natural look and beauty.

Anti-Etching – Certain stones are fairly soft and prone to etching (marking) which is caused by acid reaction with calcium carbonate. Our Nano Stone Technology treated stones are resistant to various acid, alkali substances and chemicals. Since Nano Stone Product is resilient, they can be used in various chemical plants and food processing plants.

Superior Polish- Our Nano Stone Technology treated stones allow for a higher level of shine and refractive gloss from their untreated counterparts providing for premium quality finishes to the end user.

5

Optional Add-on Attributes:

Permanent Coloring -An optional add on to our revolutionary technology permanently impregnates our premium stones with a wide selection of vibrant uniform colors that provides consistency for developers engaged in premium quality buildings, for residential, commercial or public use. The coloring options also provides consistency for rehab of older buildings and Public places marked historical or heritage.

Long Lasting Fragrance -Another unique optional add on to our revolutionary technology is permanently infusing a wide selection of long lasting fragrances into our stones (i.e. Rose, Lavender, Jasmine, Orange, Lilac, etc.). Compared to any perfume that we buy today for use in our daily lives, our Nano Stone Technology treated stones can have long lasting fragrance that improves the ambiance in hospitality and commercial places. We have the ability to prepare complex modern perfume grade fragrances that can be made available for consumer stone products as well as tiles, counter tops and home decoratives.

Salient Features

Nano Stones exhibit unique attributes that are attractive to end users:

Resistive to color change from ultraviolet exposure

Resistive to pollution permeation in stone caused by CO2, Chemical Corrosion, Freeze/Thaw

Quality uniformity in all our stones

Enhanced compressive strength

Expanded use of materials in construction

Opportunities to replace building materials in various uses

Eco-Friendly Nano chemical treatment is harmless to humans

Resistive to deterioration in both color, finish, and strength

Flexibility of shapes, colors, and patterns including matching looks from different installations

Minimized defects, lower wastage and reduced cost for cost and quality efficiency

Longer lasting stone life reduces replacement/maintenance costs over the life of the building

Enhanced strength compression allows for users to use slimmer profile stones.

6

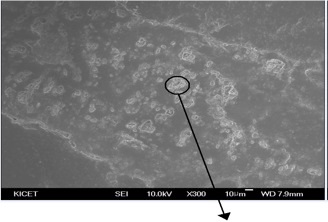

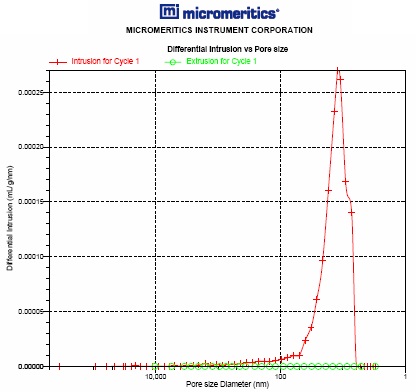

Nano Stone Technology

Pore are inherent in all-natural stones. Our proprietary Nano Stone Technology process impregnates the stone’s pores with proprietary Nano chemicals that provide the stones our unique attributes. The penetration is uniform throughout the stone up to a thickness of - 300mm.

Nano Stone Technology in Action

7

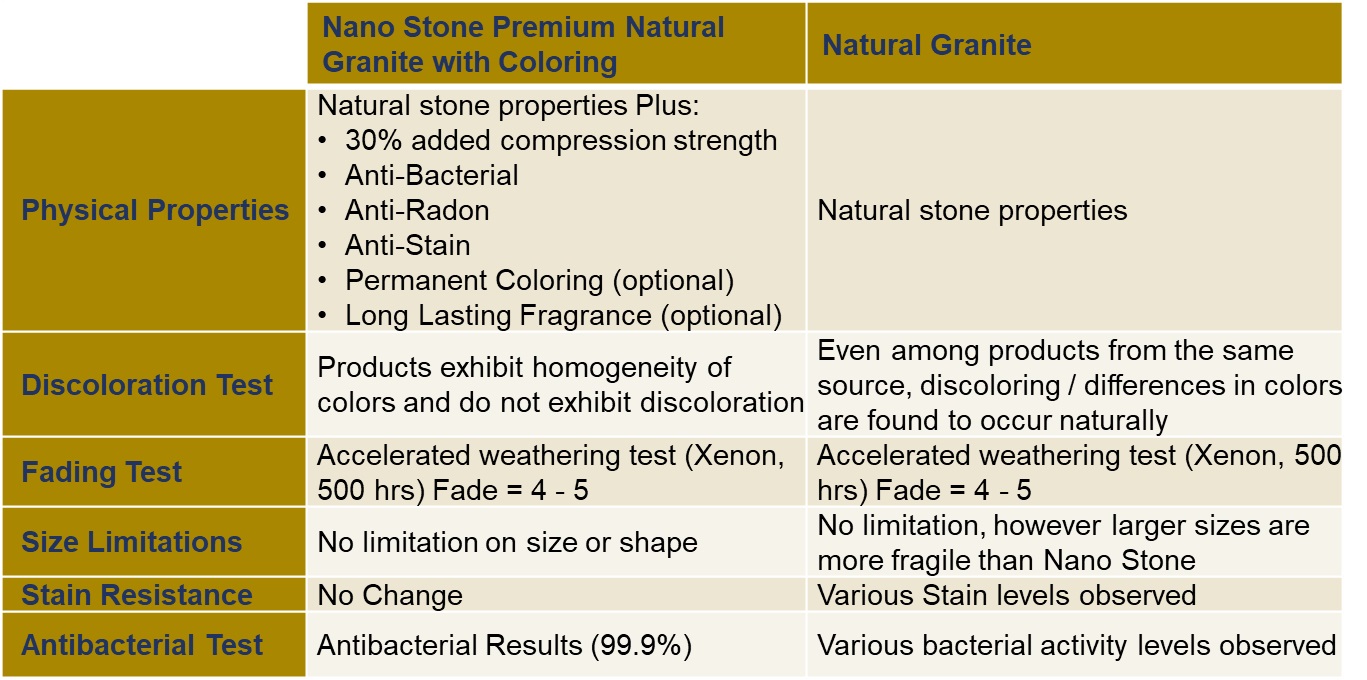

To prove the robust characteristics of the Nano Stones, we had them tested and the results were incredible:

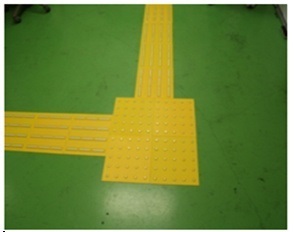

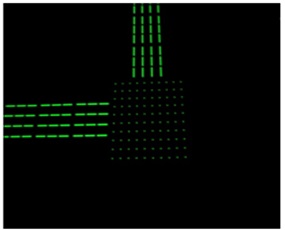

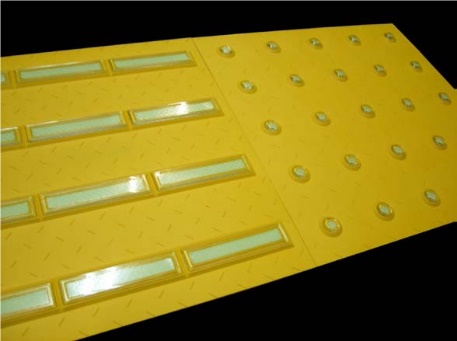

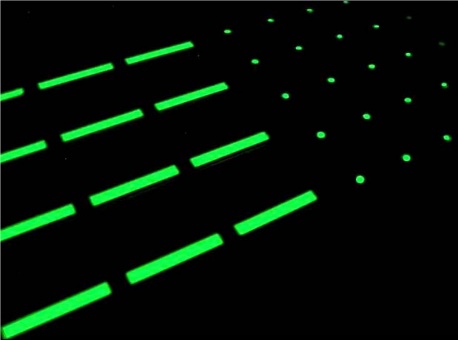

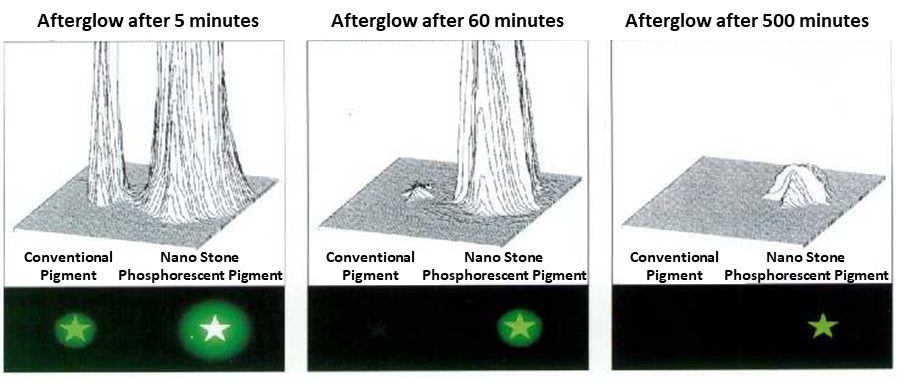

Nano Stone Phosphorescent Pigment

We have also developed in our ongoing R&D a Nano phosphorescent pigment that that can be painted onto indoor and outdoor surfaces and provide long lasting luminescence that can be helpful for safety and disaster prevention purposes. It has the potential to have wide applications including roadways and walkways, building signage, underground parking garages, consumer electronics, work safety clothing, and various other applications.

8

Business Strategy

Nano Stone Technology has historically been successfully tested, certified and installed by a predecessor company in both new construction and old remodeled developments. Nano Stone has ready infrastructure that it acquired but is currently idle that provides production capabilities in the near-term, allowing the Company to focus on sales and execution. Our extensive experience and market research helps us identify our priorities and target customers to grow our business. Nano Stone is accepted as a premium natural stone in several Asian markets where the predecessor company historically sold its products to be installed in both indoor and outdoor applications. The global market for natural stones is approximately $50 billion and projected to grow by 6% through 2020. North America, Europe, MENA, and the Far East markets are all growth markets with increased focus on infrastructure projects that provide a stable outlook for both sales and profitability. We are focusing on expanding new markets, increasing sales, marketing and standardizing production and treatment of stones in other new centers for processing of Nano Stones to meet customer needs. Our offerings of quality well-priced untreated blocks, slabs, and tiles through our relationships with quarries in various markets around the world also offer us an exclusive product advantage to our proposed con

We have a multi-fold marketing and growth strategy to increase our customer base, revenue and profits. We are adopting a four-point strategy to grow our business both in domestic and international markets.

The market could be segmented as follows:

1) Construction Projects: Work directly with various Project Developers and GC’s across markets;

2) Architects and Designers: Work to integrate Nano Stone as a specific product in scope of work;

3) Distributors for kitchen counter top markets, flooring & tiling external building walls for premium value.

4) Large Retailers: Distribution of fragrant stone products.

9

Our treated products have an inherent edge to other natural stones available in the market, as our technology process enables natural stones to exhibit attractive unique features:

Our Nano Stone Technology treated stones may have a positive effect with consumers valuing environmentally friendly multifunctional natural stones that also translate into premium value for the real estate in which it is installed

Nano Stone Technology treated stones retain their high aesthetic qualities for longer than traditional stones resulting in higher feasibility for faster growth and strong ROI for our distributors and the Company

Our Nano Stone Technology treats high quality abundantly available granite and marbles with colors that command premiums in the market place including exotics and specialties for specific projects resulting in higher margins and faster market penetration

Our basic Nano Stone Technology treated stones or color impregnated stones can also be infused with long lasting fragrance that can enhance the ambience, reduce daily maintenance costs post installation, and would be a premium differentiator for the end users

We are meeting project developers and distributors across markets and are positioning ourselves with a country centric approach to blend with local business practices through our partners where we have easy access to low hanging opportunities. We will invest our resources wisely and focus on ready projects that have the high potential to adopt our products for high quality, ambiance, low maintenance and long-lasting value. We will protect our trade secrets and control Nano chemical manufacturing to maintain quality control over our production here in the US. Our stone processing facilities are being consolidated and transitioned to an Indian Factory from Korea and China and we will be exploring additional facilities in Italy and Brazil besides our current processing centers. These distributed locations offer high quality cost efficient processing with lower operating and labor costs and offer wide selection and price competitive availability of granite and marble. Italy provides quality and premium technology/perception. These additions will make our global supply chain more efficient for distribution/direct access to end users, resulting in increased revenue, customer satisfaction and stronger profit margins.

Nano Stone Technology processed granite and marble products infused with fragrance have an untapped opportunity for hospitality, commercial and residential markets. High-end and Premium hotels worldwide will seek this unique product for their lobby areas, bathrooms, and other common areas that can enhance the ambiance and reduce maintenance costs post installation. Commercial buildings have high foot traffic and high-quality granite with impeccable finishes and infused fragrance would be a welcome addition and a premium differentiator.

Additionally, our research has identified a sizable market potential for long lasting fragrance on natural stones for use as mementos, paper weights in offices, and attractive air fresheners in bathrooms, storages, cars, and kitchens. The Company is working on introducing miniature marble and granite chip products with a variety of fragrances for the residential market that can replace traditional air fresheners in bathrooms, kitchens, and lobbies with attractive stone and stone chip replacements presented as a jar of stones for kitchens and bathrooms, small netted bags for bathrooms and cars, etc. to remove odors and provide a fragrant ambience to the user.

We are working on introducing and launching consumer focused miniature marble and granite home goods products with a variety of long lasting infused fragrances for the residential market that would be positioned as luxurious alternatives for traditional air fresheners and provide fragrant ambience in bathrooms, kitchens, and lobbies with attractive stone designs, complex fragrances, and awe-inspiring colors. our retail small bag packaged hand polished natural stones with fragrance in granite and marble with various colors and shapes. Our retail prices would be attractive for our consumers and retail channels to profit and provide incentives for retailers to stock our product. The prices would vary based on different natural stones, natural colors, shapes and other considerations for maintaining premium value and brand recognition. This premium gift item packaged for the rapid acceptance by most consumers would find a ready appeal with distributions in stores such as Bed Bath & Beyond, Ikea, Home Depot, Lowes, and other such distribution centers.

10

Our unique products would provide fragrant solutions that would not only look attractive but would provide long lasting fragrance that would enhance the ambiance of the room in which it sits. Our technology’s versatility will continue to drive Nano Stone’s development of many other product applications.

Market Overview

Large and Growing Global Opportunity for all types of Stone Products

Global granite and marble trade continues to increase year over year since 2010 and is now estimated to be over $55 billion with over $20 billion in just Brazil, India and China

Demand for natural stones in a few developing markets is growing at an annual rate of 10% and US demand is projected to grow at 7% until 2020 for residential, commercial, hospitality and refurbishing projects

Different regions of the world have varied preferences in colors, designs and qualities of stones

Regions with hot climates prefer marble while countries with temperate climates are more inclined towards granite

With increased prosperity over the decades, upgrading homes for better living and improving resale value for homes continues to propel markets for granite and marble

Low Barriers to Entry with the Right Product and Relationships

The global market is unorganized and highly fragmented with a majority being small mom & pop operations

A large portion of the granite and marble sales in most markets are driven by architects, developers and infrastructure project developers

The sector on the whole is unorganized and non-standardized.

Most current vendors are traditional and have not experienced any disruptive new technology in their product offering.

Strong Demand for Cutting Edge Products

Construction activities in many developing markets are demanding eco-friendly building materials with low maintenance and premium resale value

Developers worldwide are searching to differentiate their projects with long term value propositions and are open to adopt newer technologies that command premiums to end users

Surveys have found that an overwhelming majority of respondents prefer granite countertops to any other countertop surface for their "dream kitchen," and they believe that granite countertops and high-end marble kitchen countertops increase the resale value of a home.

Consumers seeking consistency in color and design inevitably settle for engineered stones that are full of chemicals and may have adverse health effects.

Nano Stone Technology treated marble with higher compression strength and several unique attributes including our Anti-etching properties would become the premium consumer choice across markets.

11

Sales & Marketing Strategy

Go-to Market Strategy

Nano Stone has researched and had discussions with customers in the following market segments to determine our initial customer type for our Go-to-Market strategy.

oMulti-site retail outlet stores

oBus and Railway Stations

oAirports

oArchitects and Designers

oDevelopers for residential and commercial buildings

oHotels Chains

oHome improvement Chain Stores

oHospitals

oMilitary & Defense sector

oGov. Organizations (Fed/State/Local)

oMulti-tenant/floor office Buildings

oResidential developments

oRehab work for residential and public projects

Nano Stone continues to partner with successful and experienced wholesale operations across various regions in US and globally that will showcase our products and source and sell our branded Nano Stone products with our unique attributes in a variety of colors, designs and fragrances that will differentiate them from other natural stone product vendors.

Build brand equity through targeted promotions and focused high impact advertisements that will educate the consumer about Nano Stone’s unique features and provide vanity value to developers.

Offer attractive incentives to dealers for meeting or exceeding sales targets.

Develop a broad base of architects & developers that will promote Nano Stone products in their projects by inviting decision makers to small group format seminars to introduce our Nano Stone Technology treated premium products for their projects.

Nano Stone = Price Competitive and Product Reliability

Continue our focus on reducing procurement cost, maintaining and improving quality, color and design for a steady supply

Improve our semi-automated production line to ensure quality production, cost control, homogenization of products and process stability to retain the hallmark of quality

Develop an efficient global supply chain to reduce lead time for product delivery

Adopt regional needs for size, design, color and quality

Maintain a healthy stock of products in logistics centers to enable just in time delivery as required by project developers and partner distributors

Maintain competitive pricing with premium quality

Brand each slab and stones with logo to enhance customer confidence in buying Nano Stone products for quality and warranty

Utilize sturdy fiberglass mesh packaging to minimize breakage and transit losses

Incentivize strategic warehouse operators interested in higher margins with exclusive territories

Provide homogenous suggested retail pricing to benefit both distributors and customers

Co-op advertising to support distributors

12

Customer Benefits & Customer Acquisition

Our Nano Stone Technology can impregnate natural stones with permanent coloring from one of many thousands of shades that provides color consistency and enormous flexibility to architects to design projects and create long lasting buildings with the strength, coloring, health hygiene, fragrance for projects that have large flow of people such as Government buildings, museums, public infrastructure, multi-family apartment buildings, office building and shopping complexes, premium quality personal homes, etc. Currently there are no known products that could claim long lasting color consistency capability in the natural stone offerings.

Our marketing strategy is to appoint one or two master distributors in each country depending on the size and assisting them with marketing and planning supplies to large chains and sizeable retailers for quicker access to the end users. We expect large business in the US and many other parts of the world where we have held discussions for tie-ups for distribution and market penetration. Our growth would only be impeded due to resource constrains rather than consumer demand as any new technology and processes is expected to encounter a surge once it rolls out a new anticipated product successfully in the market place.

Channel partners working through distributors and resellers are constantly seeking newer products to offer customers as product acceptance in alignment with existing stone manufacturers and trends in the market. We are confident that our product appeal would experience strong traction through these channels. In the first year, we will invest resources for developing these channels and expand the channel business as we grow our distribution network and work in tandem. We expect 60% of growth through project sales, 25% through retail chains, and 15% through distributors/resellers.

The average Cost of Customer Acquisition (COCA) may not be high as we have ongoing sales and installed base in Korea, Japan and continue to work with developers in existing markets in Korea, Japan and expand in Hong-Kong, US, India, MENA, UK and EU. Considering the innovating product and its wide appeal retailers will help spread the word through their networks, this will develop considerable residual sales to drive the COCA down over time.

The unique attributes of the natural stone have shown high excitement from architects and project developers in the US, India and MENA markets as the increased strength and unique Nano Stone features are a strong differentiator from any stone product they are currently deploying. The pricing for the product will be classified with other premium quality comparable colors and origin of stones and the branding element of “Nano Stone” would provide a unique identity as a marketing tool for residential and commercial upscale and premium developments.

Competition

We have a unique product with trade secret technology protection that helps limit any competition in this space in the near future. Since our technology and process are a trade secret it will provide a strong lead in expanding our market share and the branded Nano Stone will be more recognized before any new competition arrives on the horizon.

While some players may cut prices on their natural stones to protect their market share, our technology is agnostic to the pricing from stone quarries and those benefits could be calibrated to our advantage. Our technology and processing cost marginally adds to our final cost but our procurement techniques and premium placement in the market with several quality attributes mentioned above would identify our product as their final choice. Nano Stone would soon become the product of choice by consumers and that would bring change in the outlook of the industry.

Sales Model

Goals:

The Company’s product offering is divided in segments based on different natural stones, level of treatment, colors and fragrance. The new construction project segment is the segment for generating strong volume business. Our focus area of growth is for Architecture and Developer projects supported and supplemented by wide distribution

13

arrangements to make our product accessible for segments such as home remodeling, bath and kitchen upgrades and new installs, and the specialty fragrant stones market.

The company’s Nano Stone Technology treated products are unique as no other products in the market offer the features that Nano Stone offers, however, as we market our products as premium quality natural stones with prices that may be higher than comparative untreated stones currently being sold in the market and compete in similar markets, we can compare our anticipated margins with some listed entities worldwide for comparison. The rationale behind our anticipated higher gross margin vs. industry standards is based on historical performance of the predecessor company in comparison to the industry standards.

A few reference companies and data points from Yahoo Finance for comparison purposes are as follows:

Caesarstone Ltd. – Ticker: CSTE – ~34% Gross Margins for latest FY

Madhav Marbles – Ticker: MADHAV.NS – ~48% Gross Margins for latest FY

We aim to be profitable in the near term pending execution of our business strategy from our order backlogs with our projected funding with gross margins that we anticipate will be higher than industry standards based on historical performance of the predecessor company. We anticipate growth in our business and aim to provide good returns to our shareholders.

Sales Pricing:

Nano Stone has a wide variety of natural stones from different regions for different applications. The price of the product will be determined by the details of process, color, quantity and application of the end user. The internal objective is to maintain a balanced approach of upper end pricing and in some case as premium pricing for some rare stones with colors and added attributes to remain profitable and competitive in the market place. The pricing of each product varies from time to time and our model of low inventory and market lead time for delivery facilitates us to optimize pricing and margins based on volume and product classification in each country. In standard cases of popular colors and design we will maintain a standard transfer price keeping taxes and duties in account. Some flexibility for our channel partners helps them enhance their profitability and attract them towards marketing and stocking Nano Stone in their inventory.

The wide application of our Nano Stone Technology offers a wide horizon of product offering that would make Nano Stone branded product a success in the market place with generating brand value and profiting all stake holders

Sales Methods:

All markets have different marketing standards/methods and we will adopt local customs when we enter markets. Currently, we are working on projects with developers and architects that have projects set up underway and therefore have smaller lead times to cater to their customized needs for both internal and external stone products in their design stage. In each of the local markets, we plan to utilize an experienced sales force with a deep knowledge of the market, industry and region to provide correct information and visibility to plan ahead of trends and business activities. Our product portfolio will grow based on feedback we receive from Wholesalers and distributors to meet the needs and aspirations of the consumers. We will participate in major trade shows and regional shows to promote our products with unique attributes. Our selection of wholesalers and distributors will filter low end traders so we can focus on working with only the high-end wholesalers and distributors in the markets we choose to enter. Our focus is to market and promote all treated natural stones as branded “Nano Stone” products and not by their origin, which is the current custom in the market place.

We plan to co-locate a Nano Stone boutique in warehouses and showrooms in the US to house various Nano Stone designs and colors with minimal inventory stocking requirements and attractive margins for the wholesalers and warehouses to promote Nano Stone premium natural stones. We are working on tie-up with large existing distributors

14

to stock our goods and act as wholesalers and distributors for our products and limit our overheads in the market until we gain sufficient traction to build out and operate our own warehousing.

Our offerings of exclusive Onyx from our exclusive tie-up with an Egyptian quarry with warm colors and translucent properties for premium application for affluent market adds to our premium offerings with Nano Stone.

We intend to use all social media and other cost-effective technologies to reach out to potential customers for offering Nano Stone products as viable alternative for their projects for new construction or re-models. Nano Stone plans to use Salesforce.com as it’s principle CRM tool after funding. The platform is excellent for multi-person access and review of any account so customer information can be accessed easily from anywhere.

Emerging Growth Company Status

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For as long as we are an emerging growth company, we may take advantage of specified exemptions from reporting and other regulatory requirements that are otherwise applicable generally to other public companies. These exemptions include:

An exemption from providing an auditor’s attestation report on management’s assessment of the effectiveness of our systems of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002;

An exemption from complying with any new requirements adopted by the Public Accounting Oversight Board (“PCAOB”), requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer;

Eligibility to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act;

No requirement to obtain an auditor attestation on our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

An exemption from compliance with any other new auditing standards adopted by the PCAOB after April 5, 2012, unless the Commission determines otherwise; and

Reduced disclosure of executive compensation.

We will cease to be an “emerging growth company” upon the earlier of (i) the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more, (ii) the last day of the fiscal year following the fifth anniversary of our initial public offering, if any (iii) the date on which we have, during the previous three-year period, issued more than $1 billion of non-convertible debt, or (iv) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months. The value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

Government Regulation

Our business is subject to certain laws and governmental regulations. Changes in these laws and regulations, or their interpretation by agencies and courts, occur frequently. We may be susceptible to changes in and reinterpretations of compliance policies of government agencies with regards to import/export of raw materials as well as processing of certain of our products using our proprietary technologies.

15

Employees:

The company currently has 15 personnel working on behalf of the company. However, to conduct its operations to date, Nano Stone has engaged a team of experienced engineering consulting companies and contractors with extensive knowledge and experience in the natural stone industry to assist with development and marketing of the its technology and to assist its marketing activities. The company anticipates that it will hire a number of key personnel as employees after completion of the Offering.

Bankruptcy, Receivership or Similar Proceedings

None.

Legal Proceedings

We know of no existing or pending legal proceedings against us, nor are we involved as a plaintiff in any proceeding or pending litigation. There are no proceedings in which any of our directors, officers or any of their respective affiliates, or any beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

For the year ended December 31, 2017 and December 31, 2016, the Company has generated revenue of $39,424, and $0, respectively. Our operating expenses during the period ending December 31, 2017 (excluding non-cash stock-based compensation of $200,000 and depreciation of $1,303,073) was $654,972 vs. $245,197 of operating expenses (excluding non-cash stock-based compensation of $107 and depreciation of $618,640) for the period ending December 31, 2016, which related to organizing the company, business planning, research and development, recruiting management and staff, transitioning production infrastructure, and raising capital including previously completed offerings and this offering.

As a result, our net losses on a consolidated basis for the years ending December 31, 2017 and December 31, 2016, were $2,166,794 and $864,862, respectively.

Liquidity and Capital Resources

Liquidity is the ability of an enterprise to generate adequate amounts of cash to meet its needs for cash requirements. As of December 31, 2017, we had $383 in cash and assets of $182,688,current and total liabilities of $181,440, and a total liability and shareholders’ equity of $182,688.

During the year ended December 31, 2017, we spent $358,800 in net cash on operating activities, substantially all of our spending during the year ended December 31, 2017 was attributable to our operation.

16

On a consolidated basis, as of December 31, 2017, the Company had $931,530 in cash, total liabilities of $468,477 and a working capital surplus of $1,179,366 vs. $832,459 in cash, total liabilities of $302,062, and a working capital surplus of $1,283,691 as of December 31, 2016.

In management’s opinion, the Company’s cash position is insufficient to maintain its operations at the current level for the next 12 months. We are attempting to raise funds to proceed with our plan of operation. As of December 31, 2017, we funded our operations primarily through cash and assets contributed through the Company’s acquisition of assets from the founder and his associates, a working capital surplus, a $55,000 initial loan from our founder, a $140,000 convertible note issued in November 2016 and converted into shares in December 2017, and $1,465,879 raised from private placement proceeds from the sale and issuance of 452,606 shares of our common stock.

The proceeds from the private offerings are as follows: (1) In November 2016, the Company raised $140,000 through a private placement convertible note (“Note”) incurring interest at a rate of 6.00% per annum on the principal amount payable at maturity which was due June 30, 2017 with a strike price of $2.50; the Note was subsequently extended to be due December 31, 2017. On December 4, 2017, the Note including accrued and unpaid interest which amounted to $148,950 was converted into 59,580 shares of our common stock at the conversion rate of $2.50 per share. (2) From December 1, 2016 to December 31, 2016, the Company raised $760,000 of proceeds from the sale and issuance of 304,000 shares of common stock at $2.50 through a private Reg S offering. (3) From January 1, 2017 to December 31, 2017, the Company sold and issued a total of 148,606 shares of our common stock at $4.75 for proceeds of $705,879 through a private Reg D offering which ended August 28, 2017.

To meet our need for cash we are attempting to raise $24,999,000 in its current Offering. The maximum aggregate amount of our offering will be required to fully implement our business plan. If we are unable to successfully generate revenue we may quickly use up the proceeds from this offering and will need to find alternative sources. If we need additional cash and cannot raise it, we may either have to suspend operations until we do raise the cash, or cease operations entirely.

Although we intend on developing our marketing and growth strategy with our proceeds, there is no guarantee that we will be able to execute such a plan within our target time. Developing the project will depend highly on our funds, the availability of those funds, and the size of the fund raised. The Company plans to pursue its strategy of the business. There can be no assurance of the Company's ability to do so or that additional capital will be available to the Company. If so, the Company's investment objective of developing the business will be adversely affected and the Company may not be able to pursue its project opportunity if it is unable to finance such buildup. The Company currently has no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources. Since the Company has no such arrangements or plans currently in effect, its inability to raise funds for the above purposes will have a severe negative impact on its ability to remain a viable company. There can be no assurance that additional capital will be available to the Company.

Going Concern

The accompanying financial statements have been prepared in conformity with generally accepted accounting

principles, which contemplate the continuation of the Company as a going concern.

The Company reported revenue of $39,424, and comprehensive losses of $2,222,761 on a consolidated basis for the year ending December 31, 2017 vs. $0 in revenue and $871336 of comprehensive losses for the year ending December 31, 2016.

In view of the matters described, there is doubt as to the Company's ability to continue as a going

concern without a significant infusion of capital. To meet our need for cash we are attempting to raise $24,999,000 in its current Offering. The maximum aggregate amount of our offering will be required to fully implement our business plan. If we are unable to successfully generate revenue we may quickly use up the proceeds from this offering and will need to find alternative sources. If we need additional cash and cannot raise it, we may either have to suspend operations until we do raise the cash, or cease operations entirely. Any future financing may involve substantial dilution to existing investors.

17

Item 3. Directors and Officers

Directors, Executive Officers and Significant Employees

Nano Stone has assembled an experienced management team including experts and executives in our industry and professionals with decades of experience in the stone industry.

The table below lists our directors and global executive officers, their ages as of December 31, 2017, and the date of their first appointment to such positions. Each position is currently held with an indefinite term of office.

Name | Position | Age | Date of First |

| | | Appointment |

Executive Officers | | | |

| | | |

Sanjay Mody (1) (3) | Chairman and President | 60 | May, 2016 |

Dr. Gyung-young Kim, | CTO | 67 | July, 2016 |

Dong Ho (James) Lee | President (Nano Stone Korea Co. Ltd.) | 55 | July, 2016 |

Hon Shik Chung | Vice President Sales (Asia) | 52 | July, 2016 |

| | | |

Directors | | | |

Sanjay Mody (1) | Chairman of Board | 60 | May, 2016 |

Sanin Mody (1) | Director | 33 | May, 2016 |

Thomas Mabey (1) (2) | Director | 70 | Dec, 2016 |

| | | |

(1)Board Member

(2)Independent director

(3)Board Chairman

Executive Officersand Directors

Executive Officers

Nano Stone has a core team of highly experienced management and technology staff to execute on its business strategy.

Sanjay Mody - Founder, Chairman and President

Sanjay is the Founder, Chairman and President of Nano Stone Inc., a Co-Founder and Director at Ojas Capital, and brings with him over 30 years of international marketing, finance, management, banking, principal investing, resource management, restructuring, consulting and operations. He gained wide experience through his roles in asset management at Morgan Stanley Dean Witter, as an executive at Laidlaw Global, as a board member on Caprius Inc. a publicly traded pharmaceutical company, as a board member of Rockland Technimed, Ltd., a Theranostics company with a disruptive Nano-tech MRI medium that seeks to set the new Gold standard of metabolic imaging. He has mining experience managing operations in Russia, electronic factories in India and China and through various other executive roles at institutions across the world. His wide network of global domain relationships provides him wide reach into markets for fund raising, marketing & regulatory processing and developing the company’s strategic growth initiatives as well as oversight over business execution. He studied commerce from Bombay University. Sanjay Mody is the father of our director Sanin Mody.

18

Thomas C. Mabey – Director

Thomas brings to Nano Stone over thirty years of operations, construction, civil engineering, sales and marketing, brand building, and corporate development experience through his years of building world class institutions engaged in construction, civil engineering, and technology. Thomas formerly served as the Chairman of the Board of Sahara LLC after the sale of his company Sahara, Inc. and currently serves as the Chairman of EMM Technology, LLC. He founded Sahara, Inc. more than 30 years ago, and has completed numerous landmark projects including $1.2 billion in projects with Larry Miller, numerous mixed-use projects, stadiums, senior housing developments, and numerous other projects throughout the Company’s history. Thomas has been responsible for launching and cultivating several flourishing companies, establishing successful philanthropic ventures, developing public and private funding sources, and dealing with local, state, and federal municipalities, environment agencies, and government institutions. At Nano Stone, he is responsible for providing guidance and leadership on organization development, strategic initiatives, domestic sales development, capital development, and corporate governance. Thomas received a Bachelor of Science in Civil Engineering from the University of Utah.

Dr. Gyung-young Kim - CTO

Dr. Gyung-young Kim is the chief inventor of the Nano Stone technology using Marble and Granite to evolve unique attributes and coloring technology with proprietary Nano ecofriendly processes. He has pioneered the technology and process to impregnate natural stones e.g. granite, marble, etc. through a process and enhance the stones with distinguishing features such as anti-bacterial, anti-stain, anti-etching, and anti-radon properties, 30% additional strength, permanent coloring from one of many thousands of shades, and to infuse the stone with one of many different varieties of long lasting fragrance, all with superior quality shine and finishes. He was formerly employed with S.G. Technology Ltd. and has served as a professor at one of Korea’s most recognized university, Korea University, after leaving his post as Chief Researcher at KIST (Korea Institute of Science and Technology). His accomplishments include having over 150 patents and Trade Secrets across technologies including Nano Stone technology, dielectric composition, RFID, ceramic antenna and building materials. He received his Ph.D. from North Carolina State University in Material Science and Engineering and completed his Post-Doctorate at the University of Florida State.

Sanin Mody – Director

Sanin Mody is a Director at Nano Stone Inc., an experienced investment and management professional as co-founder of Ojas Capital, LP, and brings with him a breadth of finance and operations experience. Prior to Ojas, Sanin was the Healthcare Acquisitions Manager at Virtus Real Estate Capital where he his responsibilities included originating, structuring, presenting to investment committee, executing and managing over $200 million of senior housing real estate investments. Previously, he advised public Health Care REITs and Real Estate opportunity funds on financial and strategic alternatives related to buy and sell-side mergers and acquisitions, recapitalizations, portfolio acquisitions/dispositions, and equity and debt financings as a member of Barclays’ Global Real Estate Investment Banking Group in New York. He has also spent time working with OMERS Private Equity in New York where he evaluated investments and structured LBOs for the $6.80 billion fund, and at Morgan Stanley in their New York headquarters as an Investment Banker helping raise capital and executing M&A transactions for technology, media, and telecom companies. Sanin received his MBA with a concentration in Finance, Real Estate, and Operations from Columbia Business School and holds a degree in Operations Research and Industrial Engineering from Cornell University. Sanin Mody is the son of our chairman Sanjay Mody.

Dong Ho (James) Lee - President (Nano Stone Korea Co. Ltd.)

James brings to Nano Stone over twenty-five years of sales and marketing experience with an emphasis on new product and market development for premium construction materials, computational cameras, and other technology devices. Prior to Nano Stone, he was a Partner and Sales Director for Korea’s leading professional photo papers and microporous coating Specialty Company. He worked for 5 years in one of Korea’s largest cable television suppliers C&M and served as the chief marketing officer for KCC for launching new construction materials in the Korean, US, European and MENA market where he gained proficiencies in management while leading his respective territories

19

and developing/implementing sales and marketing plans that exceeded sales targets year over year. James has been responsible for launching new products, in organizing exhibitions as well as seminars, and in generating result oriented regional contacts and expert at building local channel partners to promote new products and achieve sales target. At Nano Stone, he is responsible for providing guidance and leadership to sales, marketing and production in his territories and lead regional and international sales and marketing efforts for the company. He is widely traveled throughout Europe, North Africa, Asia, the Middle East, U.S. and India and has lived and been educated in both Canada and Korea. James holds an MBA from KAIST, Business School in Seoul, Korea.

Hon Shik Chung – Vice President Sales (Asia)

Hon Shik brings to Nano Stone over twenty-five years of sales and marketing experience having worked in some of the most prestigious corporations in Korea. Prior to Nano Stone, he was the Chief Global Strategy Officer and Executive Director for New Business Development for CJ E&M, a company listed on the KOSDAQ exchange with revenues of over $1.4 billion. Prior to that he was the Chief Marketing Officer and Sales Director for C&M where he helped the company grow its revenue to over $300 million in 8 years with over 40% EBITDA margins. He has also had extended experiences working with Prudential Life Insurance and Daewoo Corporation where he was responsible for sales and marketing of a variety of products and services across their portfolio. Hon Shik has been responsible for positioning companies, products, and services, generating result oriented partner contacts and achieve sales targets in each of his previous roles. At Nano Stone, he is responsible for generating tangible sales for the Company’s products, marketing and positioning the product across our target markets/territories, and managing sales and marketing efforts for the company. Hon Shik holds a Bachelor of Business Administration degree from Yonsei University in Seoul, Korea.

Compensation of Directors and Executive Officers

The following table sets forth information about the annual compensation of each of our four highest-paid persons who were directors or executive officers during our last twelve months as of December 31, 2017.

| | USD Equivalent | Other | Total |

| Capacities in which | compensation | compensation | compensation |

Name | compensation was received | ($) | ($) | ($) |

Sanjay Mody | President/Chairman | -0- | -0- | -0- |

Dr. Gyung-young Kim | CTO | 36,000 | $75,000 (in Stock) | 92,500 |

Sanin Mody | Director | -0- | -0- | -0- |

Dong Ho (James) Lee | President (Nano Stone Korea Co. Ltd.) | ~48,000 | $125,000 (in Stock) | 173,000 |

Sanjay Mody, Dr. Gyung-young Kim, Sanin Mody, and James Lee received stock grants for the contribution of assets into the Company and as founders: Mr. Sanjay Mody received 6,000,000 shares of the Company’s common stock, Dr. Gyung-young Kim received 60,000 shares of the Company’s common stock, Sanin Mody received 1,000,000 shares of the Company’s common stock, and James Lee received 150,000 shares of the Company’s common stock. Additionally, under the Incentive Plan (as defined in the Description of Common Stock Securities), James Lee was granted 200,000 shares that vest equally over 4 years at year end of every year of completed services with the Company beginning in 2017, Dr. Gyung-young Kim was granted 120,000 shares that vest equally over 4 years at calendar year end of every year of completed services with the Company beginning in 2017, and upon joining the Board of Directors,Thomas Mabey purchased 10,000 shares of the Company stock at $2.50 in December 2016 and was granted 81,000 options with a strike price of $4.75 that vest equally over 3 years at the anniversary of every year of completed services as a Director.

Compensation of Directors

We do not currently compensate our directors for attendance at meetings. We reimburse our officers and directors for reasonable expenses incurred during the course of their performance. In December 2016, the Company established the Incentive Plan (seeSecurities Being Offered). We reserve the right to amend it at any time in the future.

20

Executive Compensation Philosophy

We believe that Nano Stone is at the beginning of its journey and that for us to be successful we must hire and retain people who can continue to develop our strategy, quickly innovate and develop new business opportunities by leveraging the unique technology we have in hand, and constantly enhancing our business model. To achieve these objectives, we need a highly talented team. We expect our executive team to possess and demonstrate strong leadership and management capabilities. Compensation paid to the four individuals listed in the table above is expected to continue at the same rate going forward. In December 2016, we established the Incentive Plan which put in place a program to incentivize employees going forward. Apart from the grants disclosed herein, no additional plans or arrangements are currently in place, however, the Company reserves the right to introduce new arrangements and amend existing arrangements with any of its Directors, its Executives, and its Senior/Junior Employees at any time in the future.

Item 4. Security Ownership of Management and Certain Securityholders

Set forth below is information regarding the beneficial ownership of our common stock, our only outstanding class of capital stock, as of December 31, 2017 by (i) each person whom we know owned, beneficially, more than 10% of the outstanding shares of our common stock, and (ii) all of the current officers and directors as a group. We believe that, except as noted below, each named beneficial owner has sole voting and investment power with respect to the shares listed. Unless otherwise indicated herein, beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and includes voting or investment power with respect to shares beneficially owned.

| | | | | Amount and | | | | |

| | Amount and | | | nature of | | | | |

| | nature of | | | beneficial | | | Percent | |

| | beneficial | | | ownership | | | of class | |

Name and address of beneficialowner (1) | | ownership (2) | | | acquirable(3) | | | (3) | |

Sanjay Mody | | 6,000,000 | | | -0- | | | 61.52% | |

Sanin Mody | | 1,000,000 | | | -0- | | | 10.25% | |

James Lee | | 200,000 | | | 150,000 | | | 3.59% | |

Dr. Gyung-young Kim | | 90,000 | | | 90,000 | | | 1.85% | |

Thomas Mabey (4) | | 10,000 | | | 81,000 | | | 0.93% | |

| | | | | | | | | |

All directors and officers as a group (5 persons) | | 7,300,000 | | | 321,000 | | | 78.14% | |

| | | | | | | | | |

| (1) | The address of those listed is c/o Nano Stone Inc., 2125 Center Ave, Suite 414, Fort Lee, NJ 07024. |

| (2) | Unless otherwise indicated, all shares are owned directly by the beneficial owner. |

| (3) | Based on 9,753,186 fully diluted shares (including unexercised and unvested stocks and options) as December 31, 2017. |

| (4) | Thomas Mabey’s shares are beneficially owned through his family’s trust. |

| | |

Summary of Prior Issuances and Offerings

In June of 2016, the Company issued 8,800,000 shares of our common stock to the founders and associates for non-cash consideration for assets contributed to the Company.

In November of 2016, the Company issued a Convertible Promissory Note in the principal amount of $140,000 to an existing minority shareholder. The convertible note incurs interest at 6% per annum on the principal amount payable at maturity and converts at a share price of $2.50 if exercised.

From December 1, 2016 to December 31, 2016, the Company sold and issued a total of 304,000 shares of common stock for proceeds of $760,000 to one of the Company’s directors and through a Regulation S offering that ended December 31, 2016.

21

In December 2016, the Company established the Incentive Plan (see Securities Being Offered) and in December granted 81,000 options with a strike price of $4.75 to one of its Directors that vests equally over 3 years; in January 2017 the Company awarded 320,000 shares to certain directors and employees as disclosed in this Offering that vest over 4 years.

From January 1, 2017 to August 28, 2017, the Company sold and issued a total of 148,606 shares of common stock for proceeds of $705,879 through a Regulation D offering that ended August 28, 2017

In August of 2017, the Company issued an additional 40,000 options from the Incentive Plan to an employee with a strike price of $4.75 that vest equally over 4 years through our Incentive Plan.

On December 4, 2017, the Note including accrued and unpaid interest which amounted to $148,950 was converted into 59,580 shares of our common stock at the conversion rate of $2.50 per share.

Item 5. Interest of Management and Others in Certain Transactions

During this fiscal year, there have been no transactions, or proposed transactions, which have materially affected or will materially affect us in which any director, executive officer or beneficial holder of more than 5% of the outstanding common, or any of their respective relatives, spouses, associates or affiliates, has had or will have any direct or material indirect interest. We have no policy regarding entering into transactions with affiliated parties.

Conflicts of Interest and Corporate Opportunities

The officers and directors have acknowledged that under Delaware Corporate law that they must present to the Company any business opportunity presented to them as an individual that met the Delaware's standard for a corporate opportunity: (1) the corporation is financially able to exploit the opportunity; (2) the opportunity is within the corporation's line of business; (3) the corporation has an interest or expectancy in the opportunity; and (4) by taking the opportunity for his own, the corporate fiduciary will thereby be placed in a position inimical to their duties to the corporation. This is enforceable and binding upon the officers and directors as it is part of the Code of Ethics that every officer and director is required to execute. However, the Company has not adopted formal written policies or procedures regarding the process for how these corporate opportunities are to be presented to the Board. It is the Company’s intention to adopt such policies and procedures in the future.

INDEMNIFICATION PROVISIONS FOR OFFICERS AND DIRECTORS

Our Certificate of Incorporation permits us to indemnify our officers and directors to the fullest extent authorized or permitted by law in connection with any proceeding arising by reason of the fact any person is or was an officer or director of the Company. Furthermore, our Certificate of Incorporation provides that no director of the Company shall be personally liable to it, its debt holders, or its shareholders for monetary damages for any breach of fiduciary duty by such director acting as a director. Notwithstanding this indemnity, a director shall be liable to the extent provided by law for any breach of the director's duty of loyalty to the Company, its debt holders, or its shareholders, for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law, or for any transaction from which a director derived an improper personal benefit. Our Certificate of Incorporation permits us to purchase and maintain insurance on behalf of directors, officers, employees or agents of the Company or to create a trust fund, grant a security interest and/or use other means to provide indemnification.

Delaware law also provides that indemnification permitted under the law shall not be deemed exclusive of any other rights to which the directors and officers may be entitled under the corporation’s bylaws, any agreement, a vote of stockholders or otherwise. Our Bylaws permit us to indemnify our officers and directors to the full extent authorized or permitted by law.

Item 6. Other Information

None

22

Item 7. Financial Statements

23

|

|

NANO STONE INC. |

Consolidated Financial Statements and Independent Auditor’s Report December 31, 2017 |

|

24

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

September 6, 2018

To:Board of Directors and Stockholders of Nano Stone Inc.

We have audited the accompanying consolidated balance sheets of Nano Stone Inc. (the "Company") and subsidiaries as of December 31, 2017 and 2016, and the related consolidated statements of operations, comprehensive income, statement of changes in stockholders' equity, and cash flows for each of the years in the two-year period ended December 31, 2017 and the related notes to the consolidated statements. Nano Stone's management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We did not audit the financial statements of Nano Stone Korea Co. LTD, Nano Stone (HK) Limited, wholly-owned subsidiaries, and Nextgen Nano Stone Trading Private Limited an Indian Subsidiary, which statements reflect total assets and revenues constituting 5 percent and 100 percent, respectively, of the related consolidated totals. Those statements were audited by other auditors whose report has been furnished to us, and our opinion, insofar as it relates to the amounts included for Nano Stone Korea Co. Ltd, Nextgen Nano Stone Trading Private Limited an Indian subsidiary and Nano Stone (HK) Limited, is based solely on the report of the other auditors.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Nano Stone Inc. as of December 31, 2017 and 2016, and the results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

/s/ Ram Associates

Ram Associates

Hamilton, NJ

25

Nano Stone Inc.

Audited Condensed Consolidated Balance Sheet

December 31, 2017 and December 31, 2016

| December 31, 2017 | | December 31, 2016 |

ASSETS | | | | | |

Current Assets | | | | | |

Cash and Cash Equivalent | $ | 931,530 | | $ | 832,459 |

Inventories | | 630,593 | | | 611,000 |

Non-trade accounts receivable | | 6,488 | | | - |

Deposits | | 52,418 | | | - |

Other current assets | | 26,814 | | | 1,373 |

Total Current Assets | | 1,647,843 | | | 1,444,832 |

| | | | | |

Property and equipment, net | | 7,221,729 | | | 8,472,001 |

Intangibles, net | | 7,204,746 | | | 7,204,746 |

Other assets | | 47,907 | | | - |

TOTAL ASSETS | $ | 16,122,225 | | $ | 17,121,579 |

| | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

Current Liabilities | | | | | |

Accounts payable and accrued expenses | $ | 401,570 | | $ | 157,828 |

Convertible Notes | | - | | | 140,921 |

Other current liabilities | | 66,907 | | | 3,313 |

Total Current Liabilities | | 468,477 | | | 302,062 |

TOTAL LIABILITIES | | 468,477 | | | 302,062 |

| | | | | |

STOCKHOLDERS' EQUITY | | | | | |

Common stock, $ 0.0001 par value, 15,000,000 shares authorized; 9,632,186 shares issued and outstanding. | | 963 | | | 910 |

Additional paid-in capital | | 18,745,312 | | | 17,689,943 |

Non-controlling interest | | 1,332 | | | - |

Accumulated other comprehensive income / (loss) | | (62,203) | | | (6,474) |

Accumulated deficit | | (3,031,656) | | | (864,862) |

TOTAL STOCKHOLDERS' EQUITY | | 15,653,748 | | | 16,819,517 |

| | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 16,122,225 | | $ | 17,121,579 |

-The accompanying notes are an integral part of these consolidated financial statements -

26

Nano Stone Inc.

Audited Condensed Consolidated Statements of Comprehensive Income (Loss)

| Year Ended | | Year Ended |

| December 31, 2017 | | December 31, 2016 |

Sales | $ | 39,424 | | $ | - |

Cost of goods sold | | (22,539) | | | - |

Gross profit | | 16,885 | | | - |

| | | | | |

Operating expenses | | | | | |

Selling, general and administrative expenses | | (654,972) | | | (245,197) |

Stock based compensation | | (200,000) | | | (107) |

Depreciation | | (1,303,073) | | | (618,640) |

Total operating expenses | | (2,158,045) | | | (863,944) |

| | | | | |

Profit (Loss) from operations | | (2,141,160) | | | (863,944) |

| | | | | |

Interest Income | | 608 | | | 3 |

Interest Expense | | (10,650) | | | (921) |

Other income (expenses) | | (10,042) | | | (918) |

| | | | | |

Net Loss before income taxes | $ | (2,151,202) | | $ | (864,862) |

| | | | | |

Taxes – state and other | | (15,592) | | | - |

| | | | | |

Net loss | $ | (2,166,794) | | | (864,862) |

Net Loss attributable to non-controlling interest | | (239) | | | - |

Foreign currency translation adjustments | | (55,728) | | | (6,474) |

| | | | | |

Comprehensive loss | $ | (2,222,761) | | $ | (871,336) |

| | | | | - |

Basic income (loss) per share | $ | (0.17) | | $ | (0.10) |

Basic weighted average number of shares | | 9,632,186 | | | 9,104,000 |

-The accompanying notes are an integral part of these consolidated financial statements -

27

Nano Stone Inc.

Audited Condensed Consolidated Statements of Cash Flows

| Year Ended | | Year Ended |

| December 31, 2017 | | December 31, 2016 |

Cash Flows from Operating Activities | | | | | |

Net loss | $ | (2,166,794) | | $ | (868,862) |

Adjustments to reconcile net loss to net cash used in operating activities | | | | | |

Depreciation | | 1,303,073 | | | 618,640 |

Interest accrued on convertible notes | | - | | | 921 |

Stock based compensation | | 200,000 | | | 107 |

| | | | | |

Changes in Assets and Liabilities: | | | | | |

Increase in non-trade accounts receivable | | (6,488) | | | - |

Increase in Inventories | | (19,593) | | | - |

Increase in Other current assets | | (77,859) | | | - |

Increase in Other assets | | (47,907) | | | (1,373) |

Decrease in Accounts payable and accrued expenses | | 243,742 | | | 157,828 |

Increase in Other Current Liabilities | | 63,594 | | | 3,313 |

Net cash used in operating activities | | (508,232) | | | (85,426) |

| | | | | |

Cash Flows from Investing Activities | | | | | |

Purchases of property and equipment | | (52,801) | | | (20,641) |

Net cash used in investing activities | | (52,801) | | | (20,641) |

| | | | | |

Cash Flows from Financing Activities | | | | | |

Issuance of Common stock | | 53 | | | 910 |

Increase in additional paid-in capital | | 855,369 | | | 804,090 |

Decrease in convertible Notes | | (140,921) | | | 140,000 |

Non-controlling interest | | 1,332 | | | - |

Net cash provided by financing activities | | 715,833 | | | 945,000 |

| | | | | |

Effect of exchange rate changes on cash | | (55,729) | | | (6,474) |

| | | | | |

Net increase (decrease) in cash | | 99,071 | | | 832,459 |

| | | | | |

Cash beginning of period | | 832,459 | | | - |

Cash end of period | $ | 931,530 | | $ | 832,459 |

| | | | | |

Supplementary disclosure of cash flows information | | | | | |

Cash paid during the period for | | | | | |

Interest | $ | 10,650 | | $ | - |

Taxes – state and other | $ | 15,592 | | $ | - |

| | | | | |

Supplementary disclosure of Non-cash Operating activities | | | | | |

Current assets purchased by issue of Common Stock | $ | - | | $ | 611,000 |

| | | | | |

Supplementary disclosure of Non-cash Investing and Financing activities | | | | | |

Fixed and Intangible assets purchased by issue of Common Stock | $ | - | | $ | 16,274,746 |

-The accompanying notes are an integral part of these consolidated financial statements -

28

Nano Stone Inc.

Audited Consolidated Statements of Changes in Stockholders' Equity

| | | | | | Accumulated | | | | | | |

| | | | | | Other | | | | | | |

| Common Stock | Additional Paid | Comprehensive | Accumulated | Minority | Total Stockholder’s |

| Shares | | Amount | in Capital | Loss | Deficit | Interest | Equity |

Balance, May 04, 2016 | | | | | | | | | | | | | |

Issuance of Shares | 9,104,000 | $ | 910 | $ | 17,689,836 | | | | | | | $ | 17,690,746 |

Stock based compensation | | | | | 107 | | | | | | | | 107 |

Net loss | | | | | | | | | (864,862) | | | | (864,862) |

Accumulated Other Comprehensive Income / (loss) | | | | | | | (6,474) | | | | | | (6,474) |

| | | | | | | | | | | | | |

Balance, December 31, 2016 | 9,104,000 | $ | 910 | $ | 17,689,943 | $ | (6,474) | $ | (864,862) | $ | - | $ | 16,819,517 |

Issuance of Shares | 528,186 | | 53 | | 855,369 | | | | | | 1,332 | | 856,754 |

Stock based compensation | | | | | 200,000 | | | | | | | | 200,000 |

Net income/(loss) | | | | | | | | | (2,166,794) | | | | (2,166,794) |

Foreign currency translation adjustments | | | | | | | (55,729) | | | | | | (55,729) |

Balance, December 31, 2017 | 9,632,186 | $ | 963 | $ | 18,745,312 | $ | (62,203) | $ | (3,031,656) | $ | 1,332 | $ | 15,653,748 |

-The accompanying notes are an integral part of these consolidated financial statements -

29

NOTE 1 –ORGANIZATION

History, Organization and Description of the Business