Q1 2022 Investor Presentation April 25, 2022

2 Important Notices and Disclaimers Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws, which reflect our current expectations and beliefs with respect to, among other things, future events and our financial performance. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. This may be especially true given the current COVID-19 pandemic and uncertainty about its continuation. Although we believe that the expectations reflected in such forward-looking statements are reasonable as of the dates made, we cannot give any assurance that such expectations will prove correct and actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements are set forth in the Company’s Annual Report Form 10K for the year ended December 31, 2021 under the sections entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors”. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. These statements are often, but not always, made through the use of words or phrases such as “may,” “can,” “should,” “could,” “to be,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “likely,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “target,” “project,” “would” and “outlook,” or the negative version of those words or other similar words or phrases of a future or forward-looking nature. Forward-looking statements appear in a number of places in this presentation and may include statements about business strategy and prospects for growth, operations, ability to pay dividends, competition, regulation and general economic conditions. Non-GAAP Financial Measures In addition to reporting GAAP results, the Company reports non-GAAP financial measures in this presentation and other disclosures. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our performance. While we believe that these non- GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. For a reconciliation of the non-GAAP measures we use to the most comparable GAAP measures, see the Appendix to this presentation.

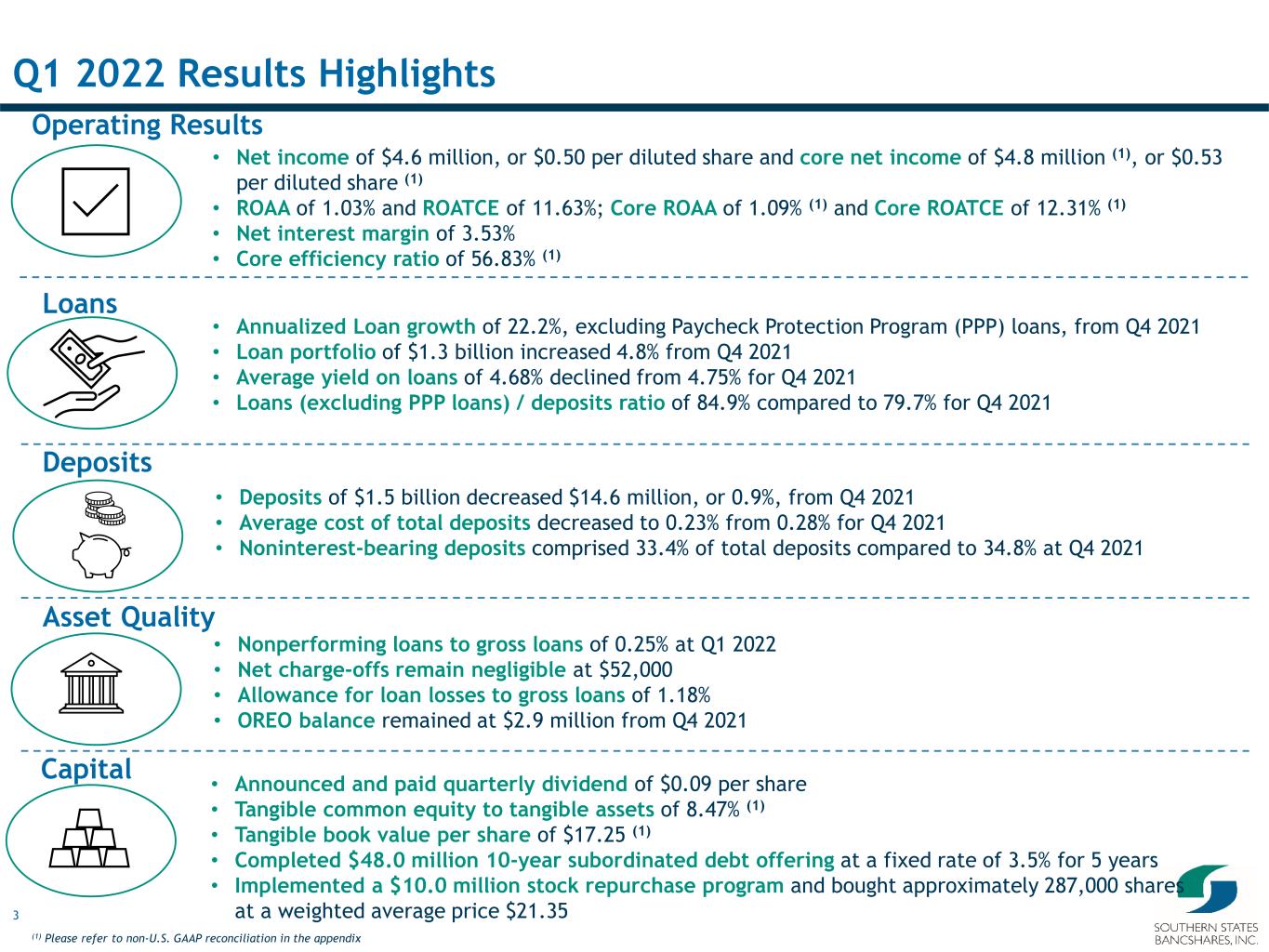

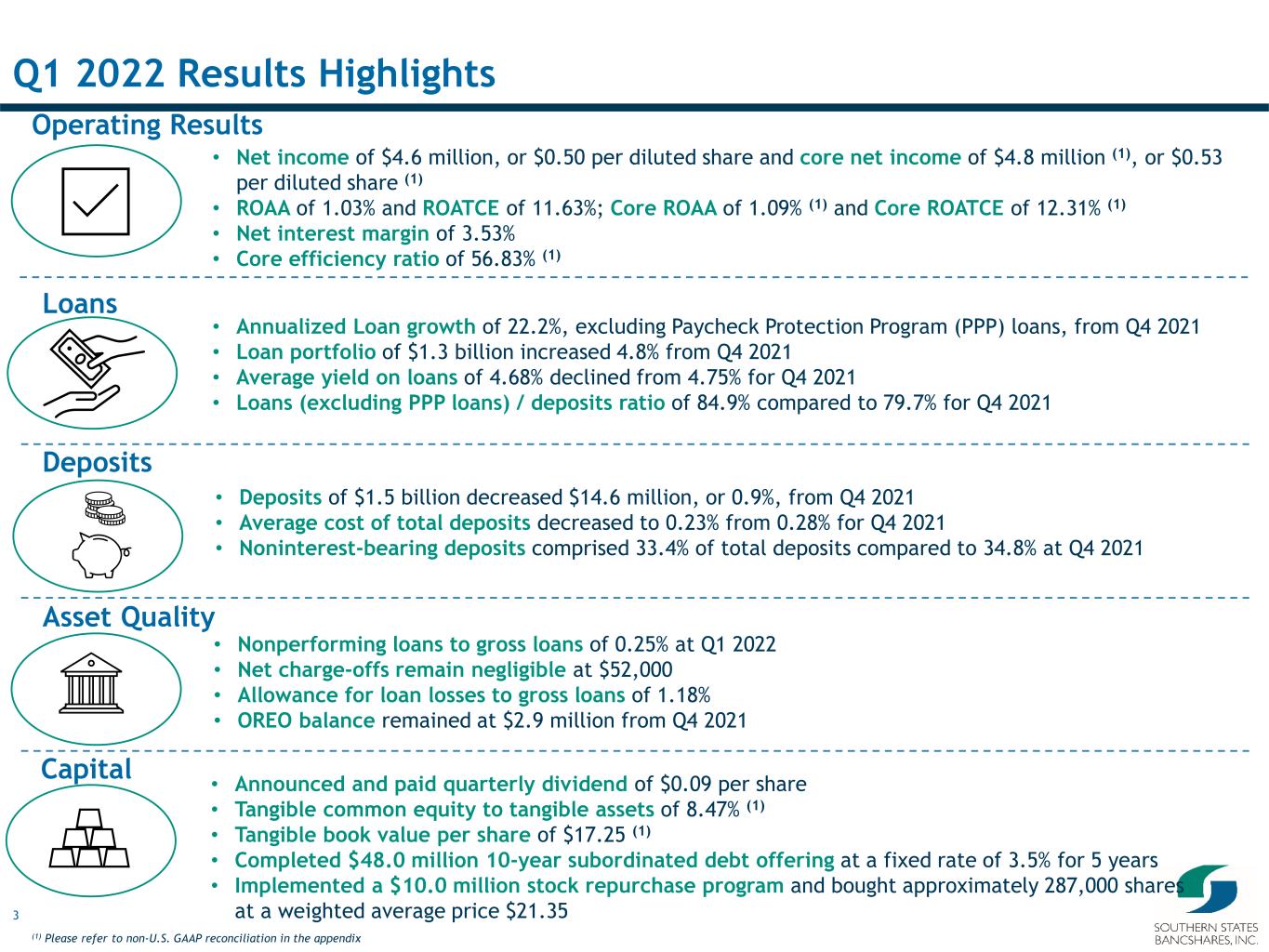

3 Q1 2022 Results Highlights (1) Please refer to non-U.S. GAAP reconciliation in the appendix Operating Results Loans Deposits Capital Asset Quality • Net income of $4.6 million, or $0.50 per diluted share and core net income of $4.8 million (1), or $0.53 per diluted share (1) • ROAA of 1.03% and ROATCE of 11.63%; Core ROAA of 1.09% (1) and Core ROATCE of 12.31% (1) • Net interest margin of 3.53% • Core efficiency ratio of 56.83% (1) • Annualized Loan growth of 22.2%, excluding Paycheck Protection Program (PPP) loans, from Q4 2021 • Loan portfolio of $1.3 billion increased 4.8% from Q4 2021 • Average yield on loans of 4.68% declined from 4.75% for Q4 2021 • Loans (excluding PPP loans) / deposits ratio of 84.9% compared to 79.7% for Q4 2021 • Deposits of $1.5 billion decreased $14.6 million, or 0.9%, from Q4 2021 • Average cost of total deposits decreased to 0.23% from 0.28% for Q4 2021 • Noninterest-bearing deposits comprised 33.4% of total deposits compared to 34.8% at Q4 2021 • Nonperforming loans to gross loans of 0.25% at Q1 2022 • Net charge-offs remain negligible at $52,000 • Allowance for loan losses to gross loans of 1.18% • OREO balance remained at $2.9 million from Q4 2021 • Announced and paid quarterly dividend of $0.09 per share • Tangible common equity to tangible assets of 8.47% (1) • Tangible book value per share of $17.25 (1) • Completed $48.0 million 10-year subordinated debt offering at a fixed rate of 3.5% for 5 years • Implemented a $10.0 million stock repurchase program and bought approximately 287,000 shares at a weighted average price $21.35

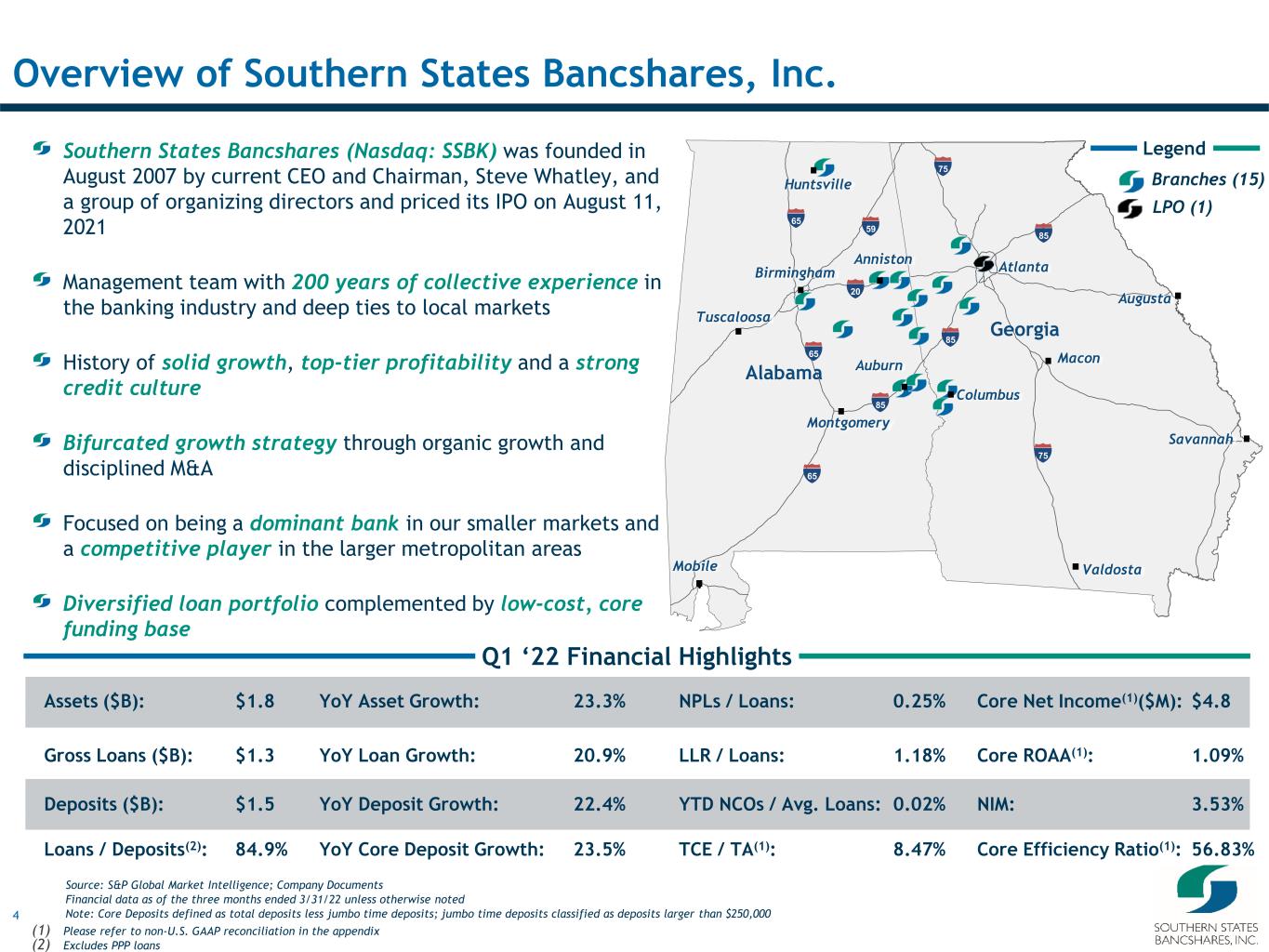

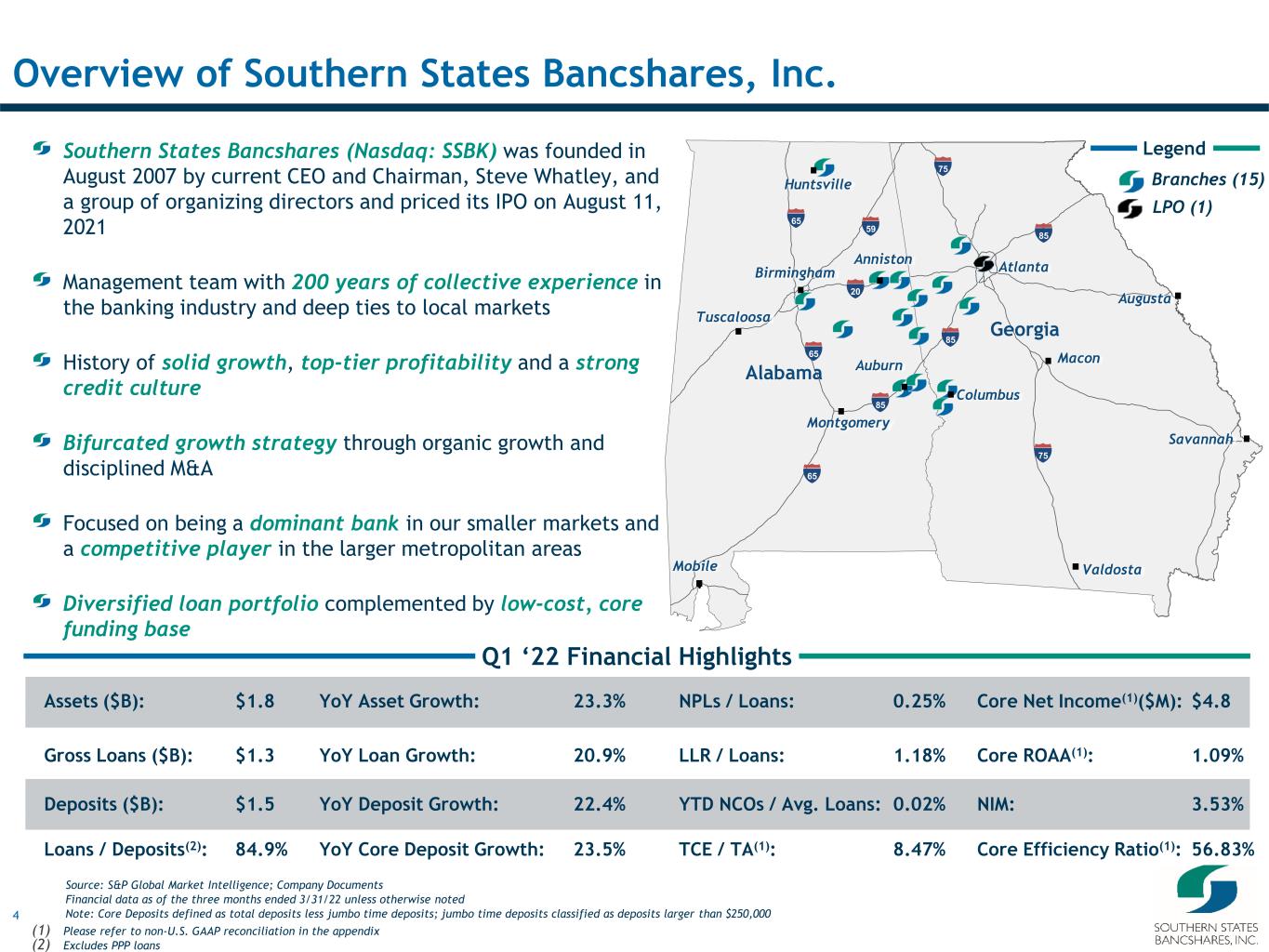

4 Branches (15) Legend Huntsville Birmingham Montgomery Columbus Atlanta Alabama Georgia 65 85 75 Anniston Auburn 20 85 75 85 65 65 59 Tuscaloosa LPO (1) YoY Core Deposit Growth: 23.5%Loans / Deposits(2): 84.9% Overview of Southern States Bancshares, Inc. Q1 ‘22 Financial Highlights YoY Asset Growth: 23.3%Assets ($B): $1.8 NPLs / Loans: 0.25% YoY Loan Growth: 20.9%Gross Loans ($B): $1.3 LLR / Loans: 1.18% YoY Deposit Growth: 22.4%Deposits ($B): $1.5 YTD NCOs / Avg. Loans: 0.02% TCE / TA(1): 8.47% Core Net Income(1)($M): $4.8 Core ROAA(1): 1.09% NIM: 3.53% Core Efficiency Ratio(1): 56.83% Mobile Savannah Macon Valdosta Augusta Southern States Bancshares (Nasdaq: SSBK) was founded in August 2007 by current CEO and Chairman, Steve Whatley, and a group of organizing directors and priced its IPO on August 11, 2021 Management team with 200 years of collective experience in the banking industry and deep ties to local markets History of solid growth, top-tier profitability and a strong credit culture Bifurcated growth strategy through organic growth and disciplined M&A Focused on being a dominant bank in our smaller markets and a competitive player in the larger metropolitan areas Diversified loan portfolio complemented by low-cost, core funding base Source: S&P Global Market Intelligence; Company Documents Financial data as of the three months ended 3/31/22 unless otherwise noted Note: Core Deposits defined as total deposits less jumbo time deposits; jumbo time deposits classified as deposits larger than $250,000 (1) Please refer to non-U.S. GAAP reconciliation in the appendix (2) Excludes PPP loans

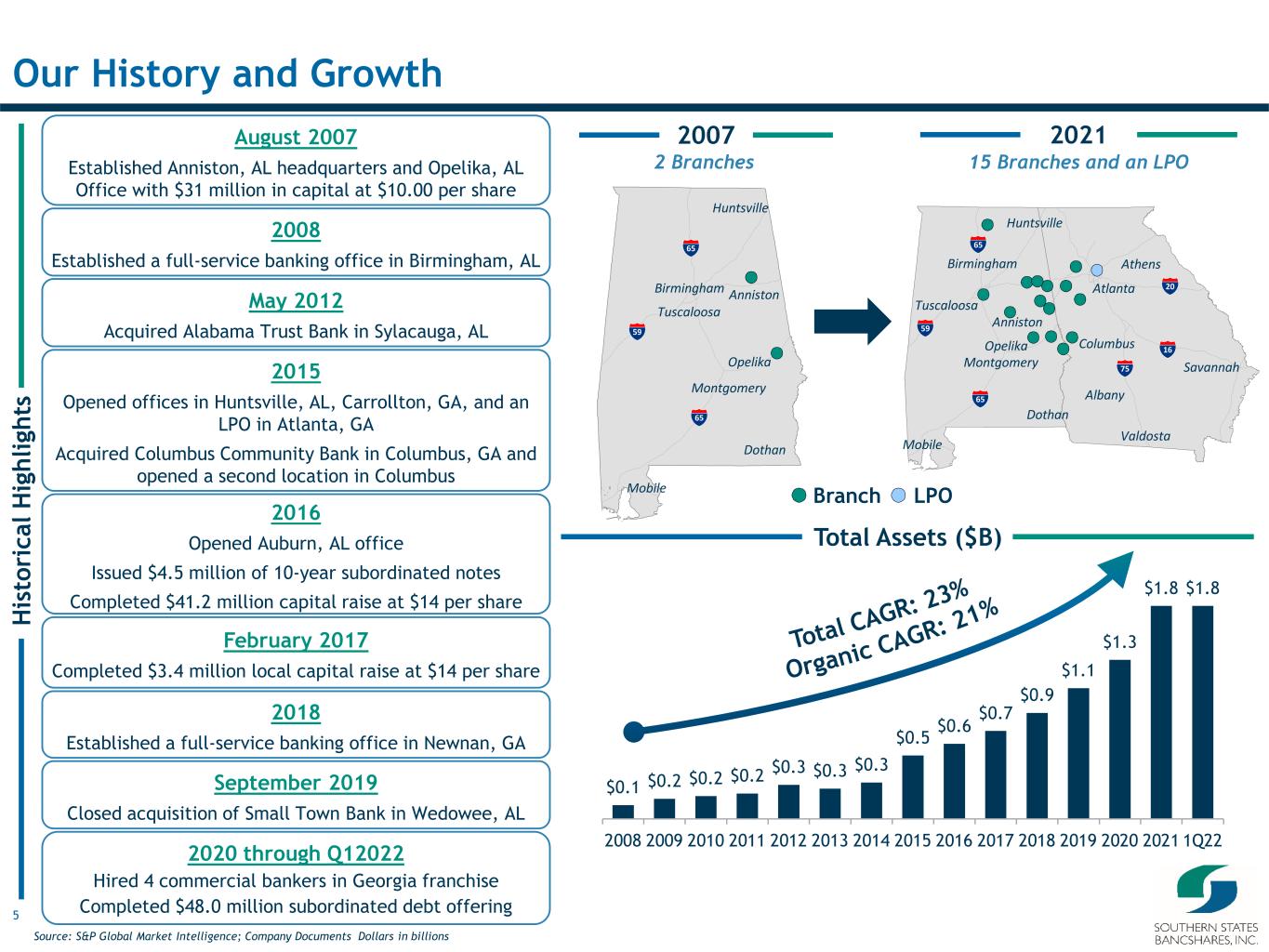

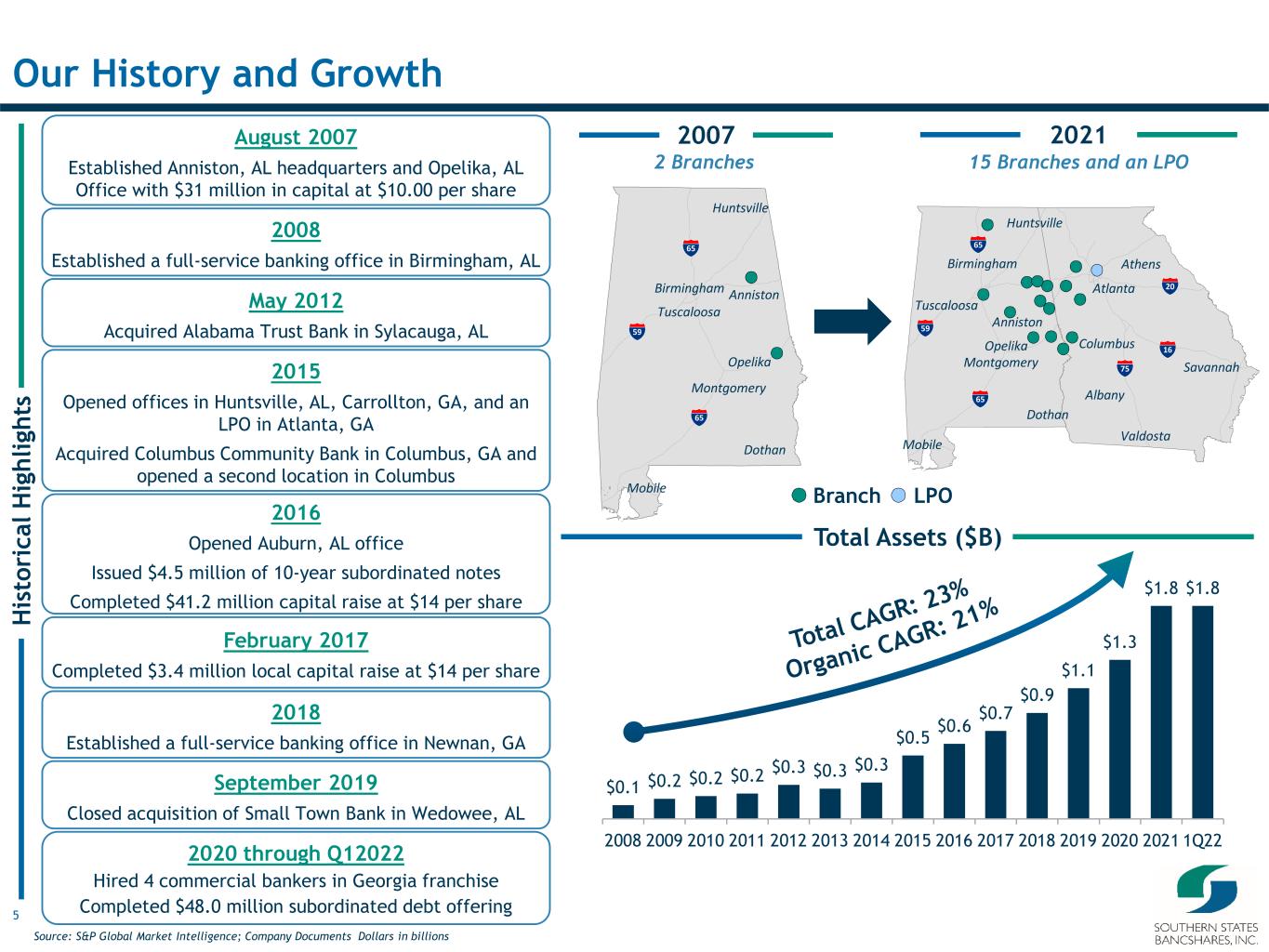

5 2007 Our History and Growth Source: S&P Global Market Intelligence; Company Documents Dollars in billions H is to ri ca l H ig hl ig ht s August 2007 Established Anniston, AL headquarters and Opelika, AL Office with $31 million in capital at $10.00 per share May 2012 Acquired Alabama Trust Bank in Sylacauga, AL 2015 Opened offices in Huntsville, AL, Carrollton, GA, and an LPO in Atlanta, GA Acquired Columbus Community Bank in Columbus, GA and opened a second location in Columbus February 2017 Completed $3.4 million local capital raise at $14 per share 2018 Established a full-service banking office in Newnan, GA 2020 through Q12022 Hired 4 commercial bankers in Georgia franchise Completed $48.0 million subordinated debt offering Anniston Opelika Anniston Mobile Huntsville Tuscaloosa Dothan Savannah Columbus Birmingham Huntsville Montgomery Mobile Athens Tuscaloosa Albany Dothan Valdosta Montgomery Birmingham 16 20 75 65 65 59 65 65 59 Opelika Anniston Atlanta Total Assets ($B) September 2019 Closed acquisition of Small Town Bank in Wedowee, AL 2016 Opened Auburn, AL office Issued $4.5 million of 10-year subordinated notes Completed $41.2 million capital raise at $14 per share 2021 2 Branches 15 Branches and an LPO Branch LPO 2008 Established a full-service banking office in Birmingham, AL $0.1 $0.2 $0.2 $0.2 $0.3 $0.3 $0.3 $0.5 $0.6 $0.7 $0.9 $1.1 $1.3 $1.8 $1.8 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 1Q22

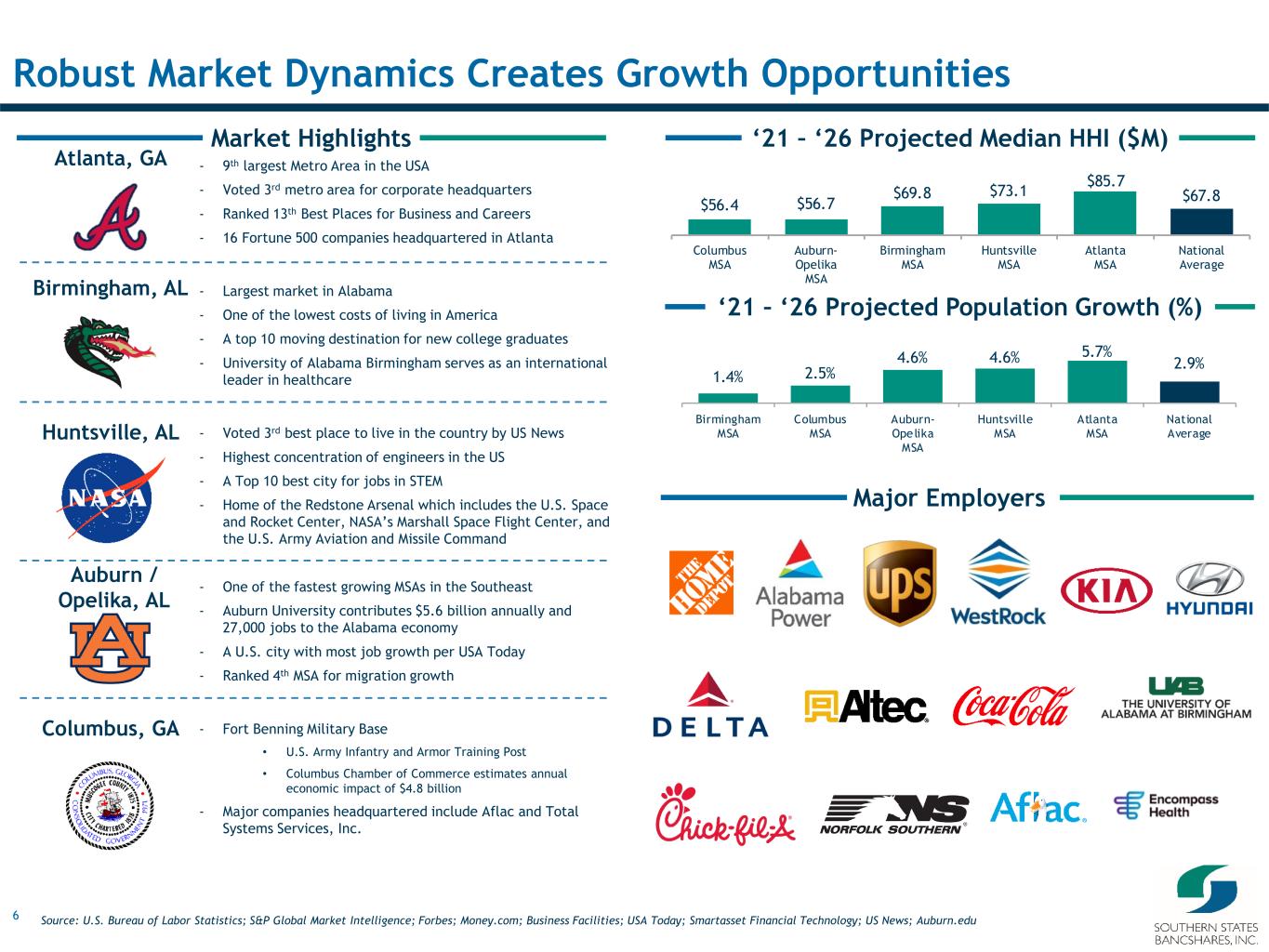

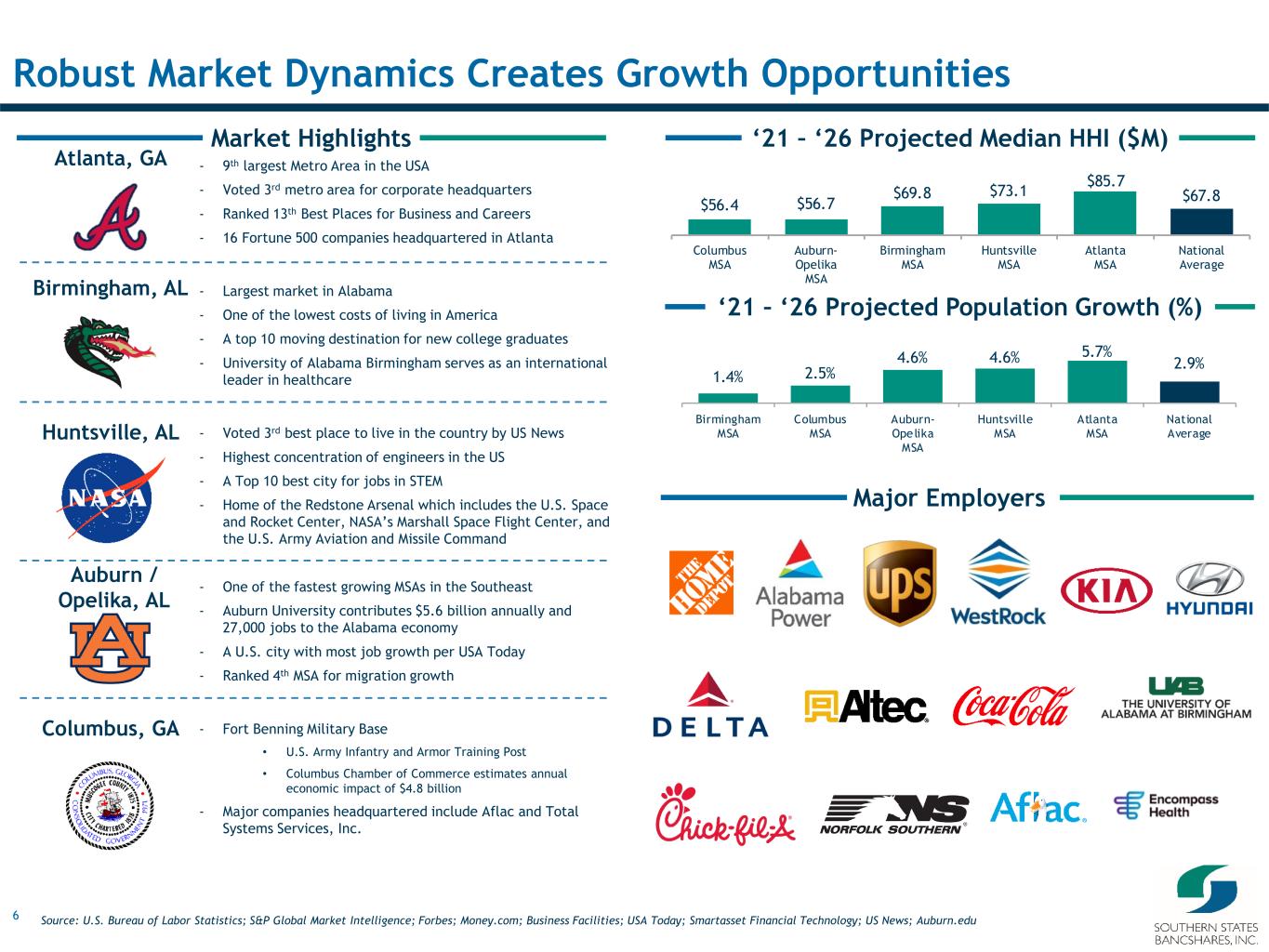

6 Columbus, GA $56.4 $56.7 $69.8 $73.1 $85.7 $67.8 Columbus MSA Auburn- Opelika MSA Birmingham MSA Huntsville MSA Atlanta MSA National Average 1.4% 2.5% 4.6% 4.6% 5.7% 2.9% Birmingham MSA Columbus MSA Auburn- Opelika MSA Huntsville MSA Atlanta MSA National Average Major Employers Market Highlights Robust Market Dynamics Creates Growth Opportunities Source: U.S. Bureau of Labor Statistics; S&P Global Market Intelligence; Forbes; Money.com; Business Facilities; USA Today; Smartasset Financial Technology; US News; Auburn.edu - 9th largest Metro Area in the USA - Voted 3rd metro area for corporate headquarters - Ranked 13th Best Places for Business and Careers - 16 Fortune 500 companies headquartered in Atlanta - Largest market in Alabama - One of the lowest costs of living in America - A top 10 moving destination for new college graduates - University of Alabama Birmingham serves as an international leader in healthcare - Voted 3rd best place to live in the country by US News - Highest concentration of engineers in the US - A Top 10 best city for jobs in STEM - Home of the Redstone Arsenal which includes the U.S. Space and Rocket Center, NASA’s Marshall Space Flight Center, and the U.S. Army Aviation and Missile Command - One of the fastest growing MSAs in the Southeast - Auburn University contributes $5.6 billion annually and 27,000 jobs to the Alabama economy - A U.S. city with most job growth per USA Today - Ranked 4th MSA for migration growth - Fort Benning Military Base • U.S. Army Infantry and Armor Training Post • Columbus Chamber of Commerce estimates annual economic impact of $4.8 billion - Major companies headquartered include Aflac and Total Systems Services, Inc. Huntsville, AL Birmingham, AL Atlanta, GA ‘21 – ‘26 Projected Median HHI ($M) ‘21 – ‘26 Projected Population Growth (%) Auburn / Opelika, AL

7 Loans / Deposits(1)Total Deposits ($M) Total Loans ($M)Total Assets ($M) Balance Sheet Growth Source: S&P Global Market Intelligence; Company Documents (1) Excludes PPP loans PPP Loans PPP Loans $629 $736 $888 $1,095 $1,266 $1,774 $1,799 $67 $9 $1 2016 2017 2018 2019 2020 2021 1Q22 $1,783 $1,798 $1,333 $520 $622 $776 $951 $1,140 $1,556 $1,542 2016 2017 2018 2019 2020 2021 1Q22 $503 $567 $704 $840 $964 $1,241 $1,310 $67 $9 $1 2016 2017 2018 2019 2020 2021 1Q22 $1,250 $1,030 $1,309 95.5% 90.2% 90.0% 88.1% 85.0% 79.7% 85.1% 2016 2017 2018 2019 2020 2021 1Q22

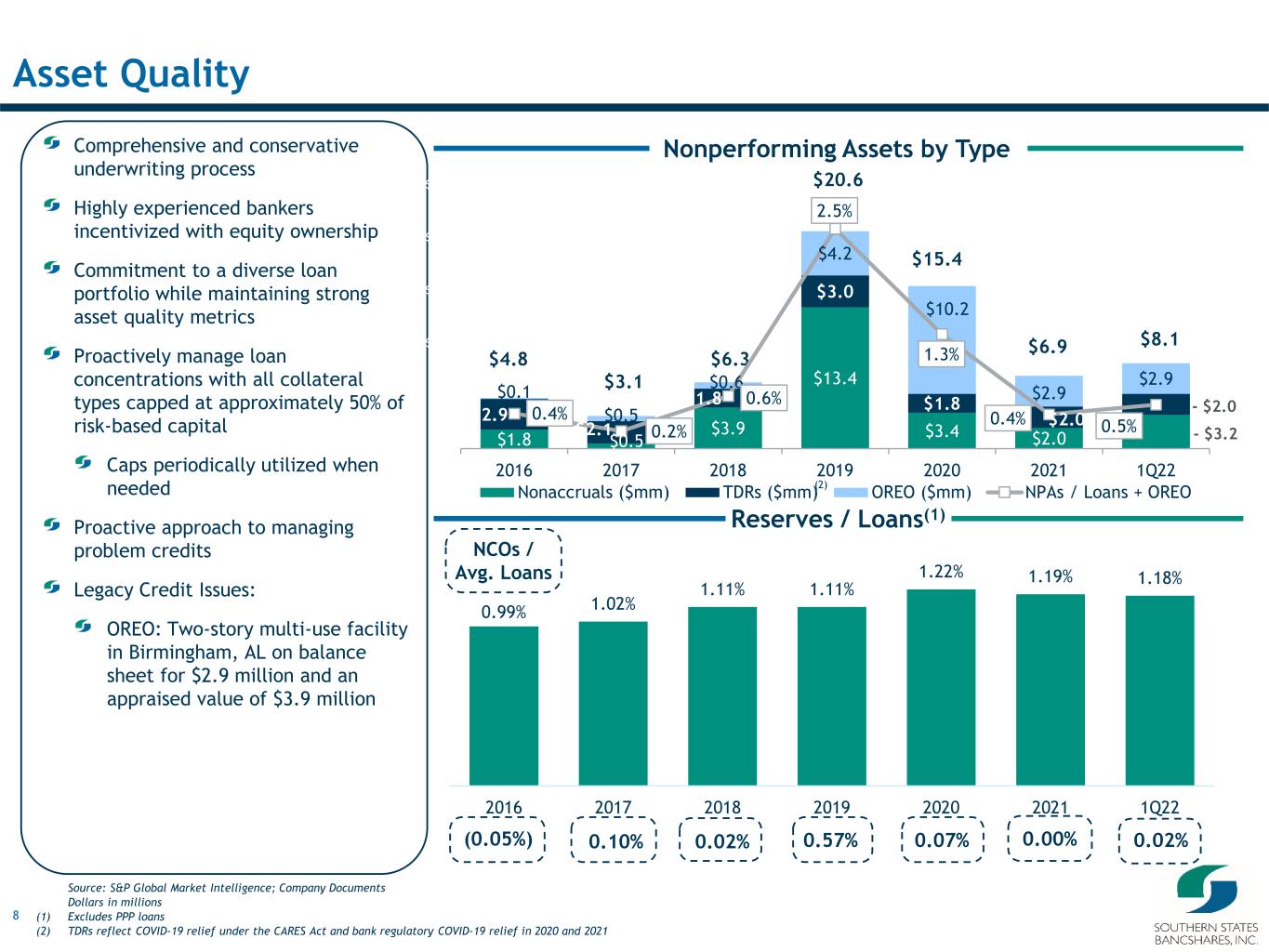

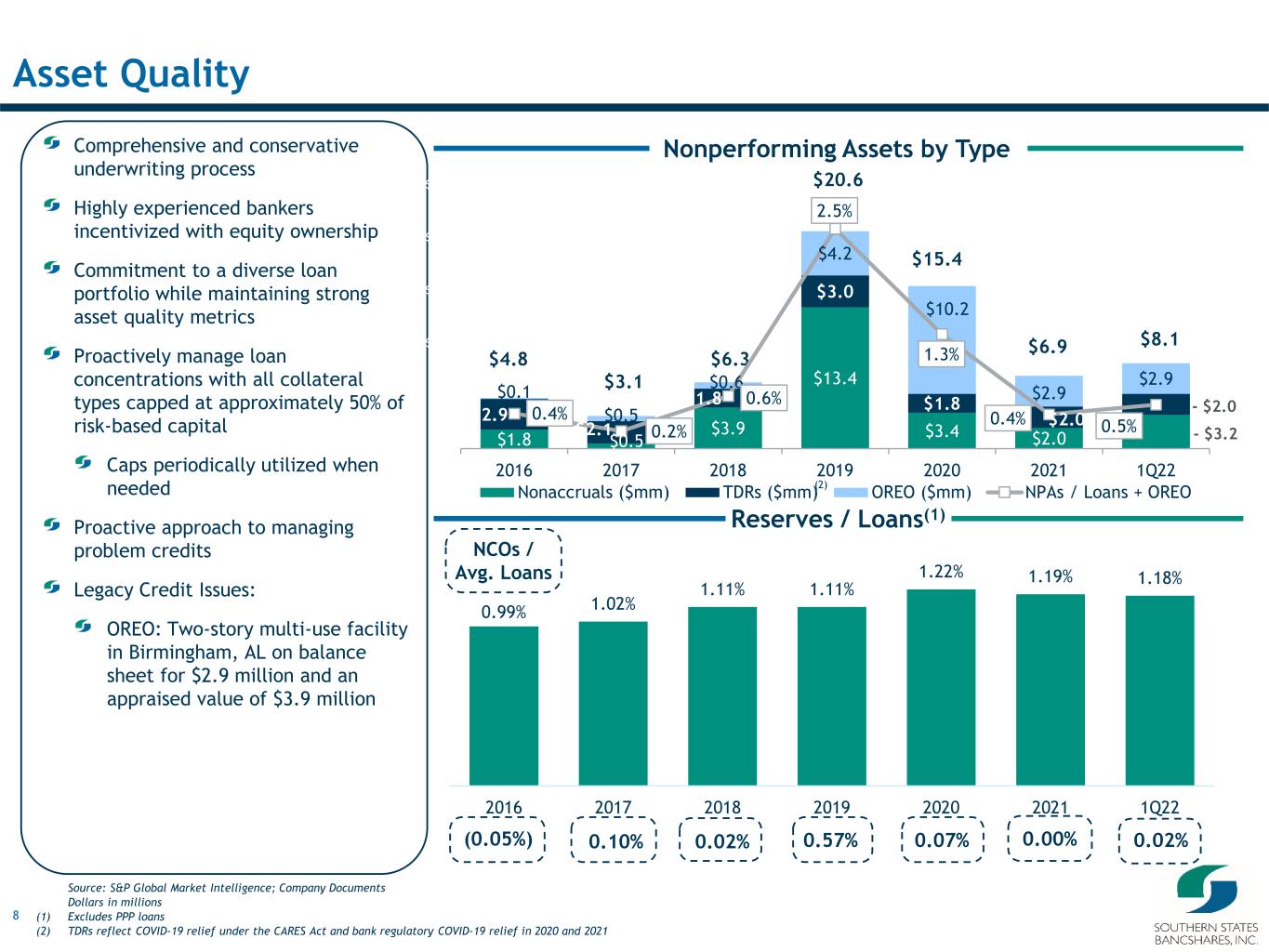

8 Nonperforming Assets by Type Asset Quality Source: S&P Global Market Intelligence; Company Documents Dollars in millions (1) Excludes PPP loans (2) TDRs reflect COVID-19 relief under the CARES Act and bank regulatory COVID-19 relief in 2020 and 2021 Reserves / Loans(1) NCOs / Avg. Loans $4.8 $3.1 $6.3 $15.4 (0.05%) 0.10% 0.02% 0.57% 0.07% $6.9 0.00% Comprehensive and conservative underwriting process Highly experienced bankers incentivized with equity ownership Commitment to a diverse loan portfolio while maintaining strong asset quality metrics Proactively manage loan concentrations with all collateral types capped at approximately 50% of risk-based capital Caps periodically utilized when needed Proactive approach to managing problem credits Legacy Credit Issues: OREO: Two-story multi-use facility in Birmingham, AL on balance sheet for $2.9 million and an appraised value of $3.9 million (2) $1.8 $0.5 $3.9 $13.4 $3.4 $2.0 - $3.2 $2.9 $2.1 $1.8 $3.0 $1.8 $2.0 - $2.0 $0.1 $0.5 $0.6 $4.2 $10.2 $2.9 $2.9 0.4% 0.2% 0.6% 2.5% 1.3% 0.4% 0.5% $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 2016 2017 2018 2019 2020 2021 1Q22 Nonaccruals ($mm) TDRs ($mm) OREO ($mm) NPAs / Loans + OREO $20.6 0.99% 1.02% 1.11% 1.11% 1.22% 1.19% 1.18% 2016 2017 2018 2019 2020 2021 1Q22 0.02% $8.1

9 Building Shareholder Value Our Strategic Focus Maintain focus on strong, profitable organic growth without compromising our credit quality Expand into new markets by hiring commercial bankers Focus on high growth markets and further scaling our Atlanta franchise Evaluate strategic acquisition opportunities Further grow our core deposit franchise Continue implementing technology to optimize customer service and provide efficient opportunities to scale the business Prudently manage capital between balance sheet growth and return to shareholders

10 Near-Term Outlook Loan balances expected to continue growing at a healthy pace supported by a robust pipeline Loan growth aided by prior year opportunistic commercial banker hires driven by talent dislocation from bank consolidation in our markets Deposit balances expected to increase modestly Net interest income expected to increase incrementally from loan growth and rate increases Net interest margin expected to increase modestly as rates rise Core noninterest income expected to be fairly consistent with Q1 2022 as swaps decline and mortgage income moderates Quarterly adjusted noninterest expense is expected to increase modestly from Q1 2022 based on salary increases, effective April 1, plus new compliance and support personnel additions Continued strong credit metrics are expected to allow for modest provision levels, but we are monitoring for credit issues as rates rise Balanced approach to capital deployment with flexibility to support strong organic loan growth trajectory and cash dividend Well-positioned to capitalize on additional accretive acquisition opportunities

Appendix

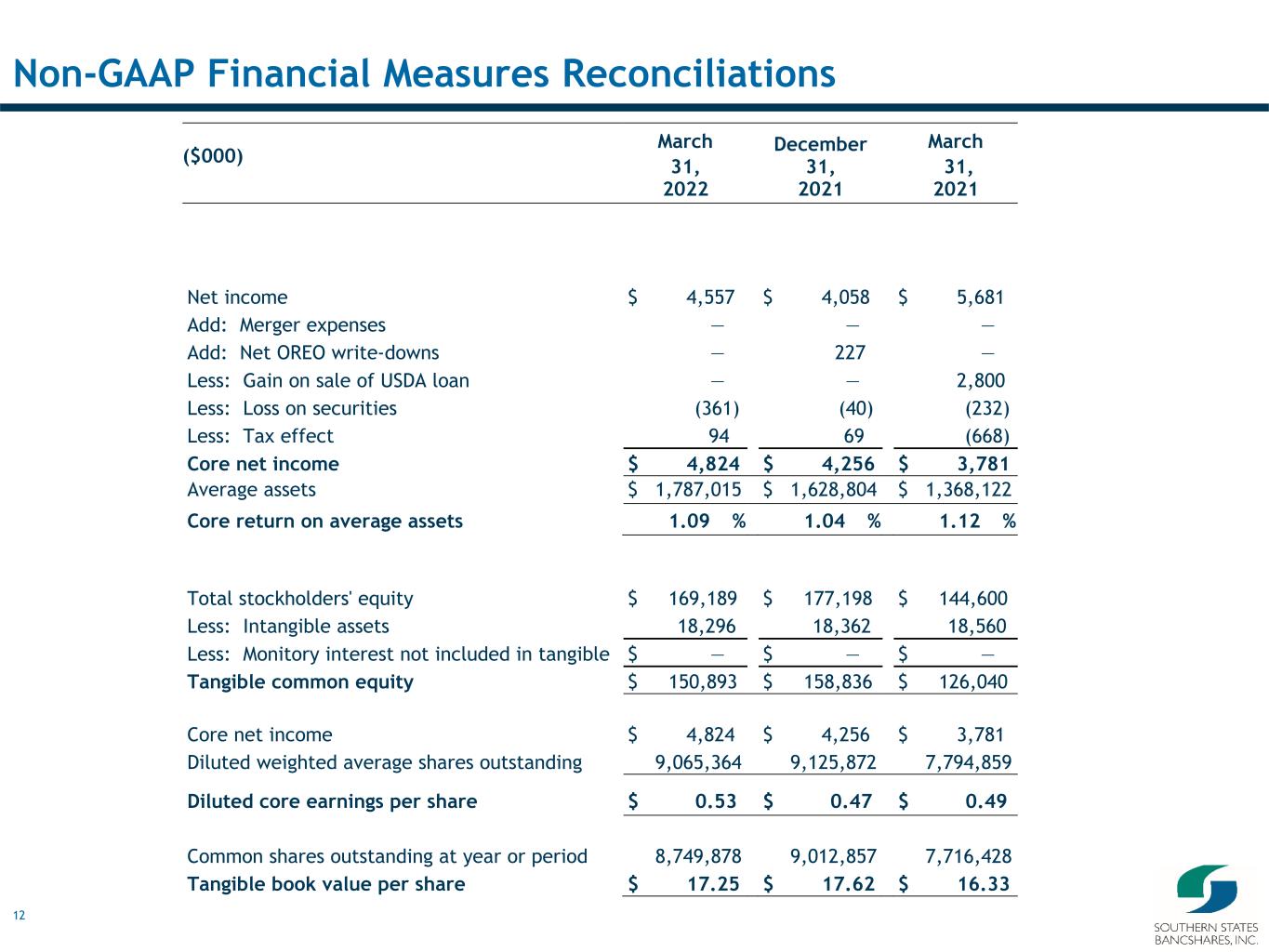

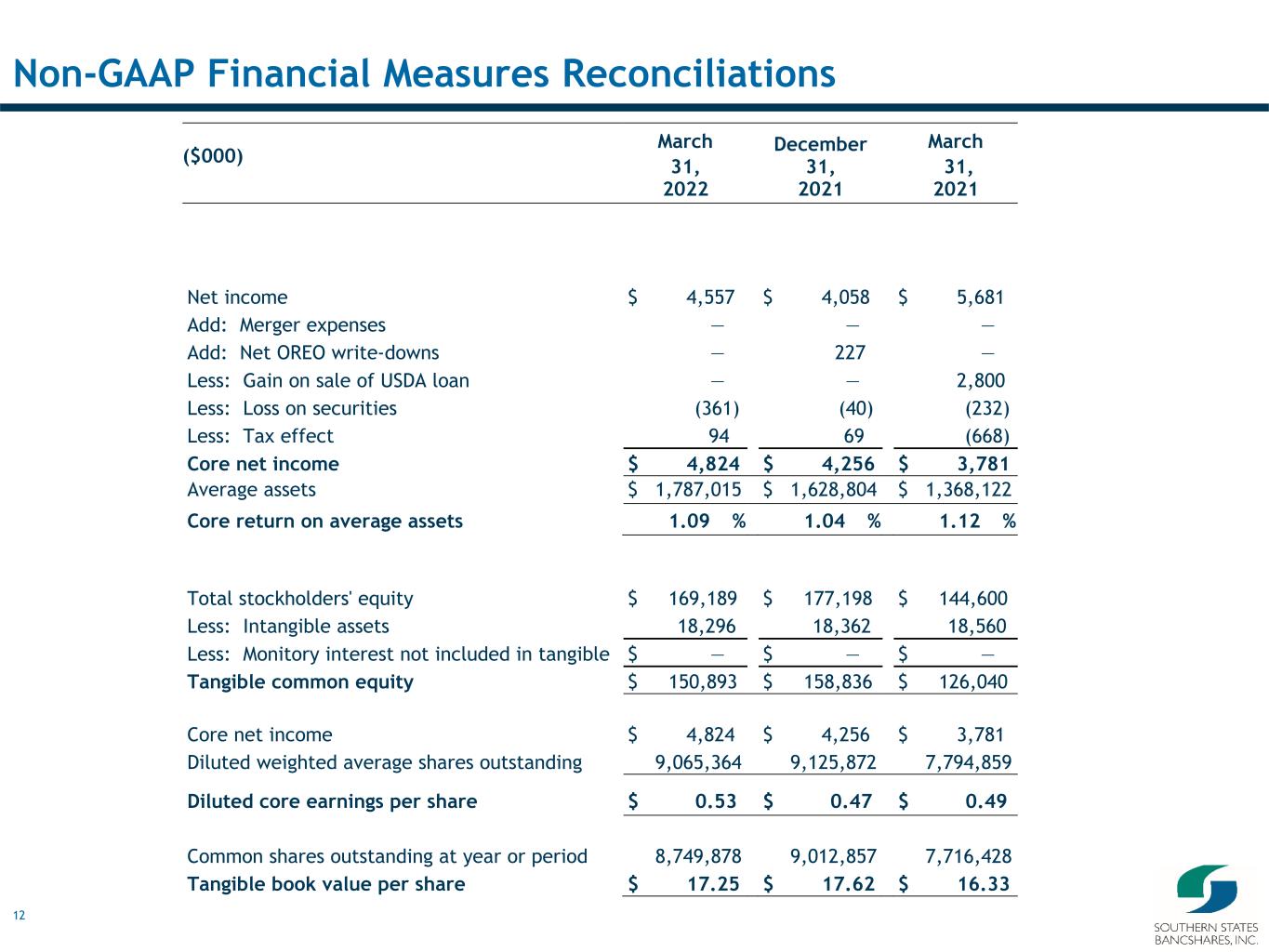

12 Non-GAAP Financial Measures Reconciliations March 31, 2022 December 31, 2021 March 31, 2021 Net income $ 4,557 $ 4,058 $ 5,681 Add: Merger expenses — — — Add: Net OREO write-downs — 227 — Less: Gain on sale of USDA loan — — 2,800 Less: Loss on securities (361) (40) (232) Less: Tax effect 94 69 (668) Core net income $ 4,824 $ 4,256 $ 3,781 Average assets $ 1,787,015 $ 1,628,804 $ 1,368,122 Core return on average assets 1.09 % 1.04 % 1.12 % Total stockholders' equity $ 169,189 $ 177,198 $ 144,600 Less: Intangible assets 18,296 18,362 18,560 Less: Monitory interest not included in tangible $ — $ — $ — Tangible common equity $ 150,893 $ 158,836 $ 126,040 Core net income $ 4,824 $ 4,256 $ 3,781 Diluted weighted average shares outstanding 9,065,364 9,125,872 7,794,859 Diluted core earnings per share $ 0.53 $ 0.47 $ 0.49 Common shares outstanding at year or period 8,749,878 9,012,857 7,716,428 Tangible book value per share $ 17.25 $ 17.62 $ 16.33 ($000)

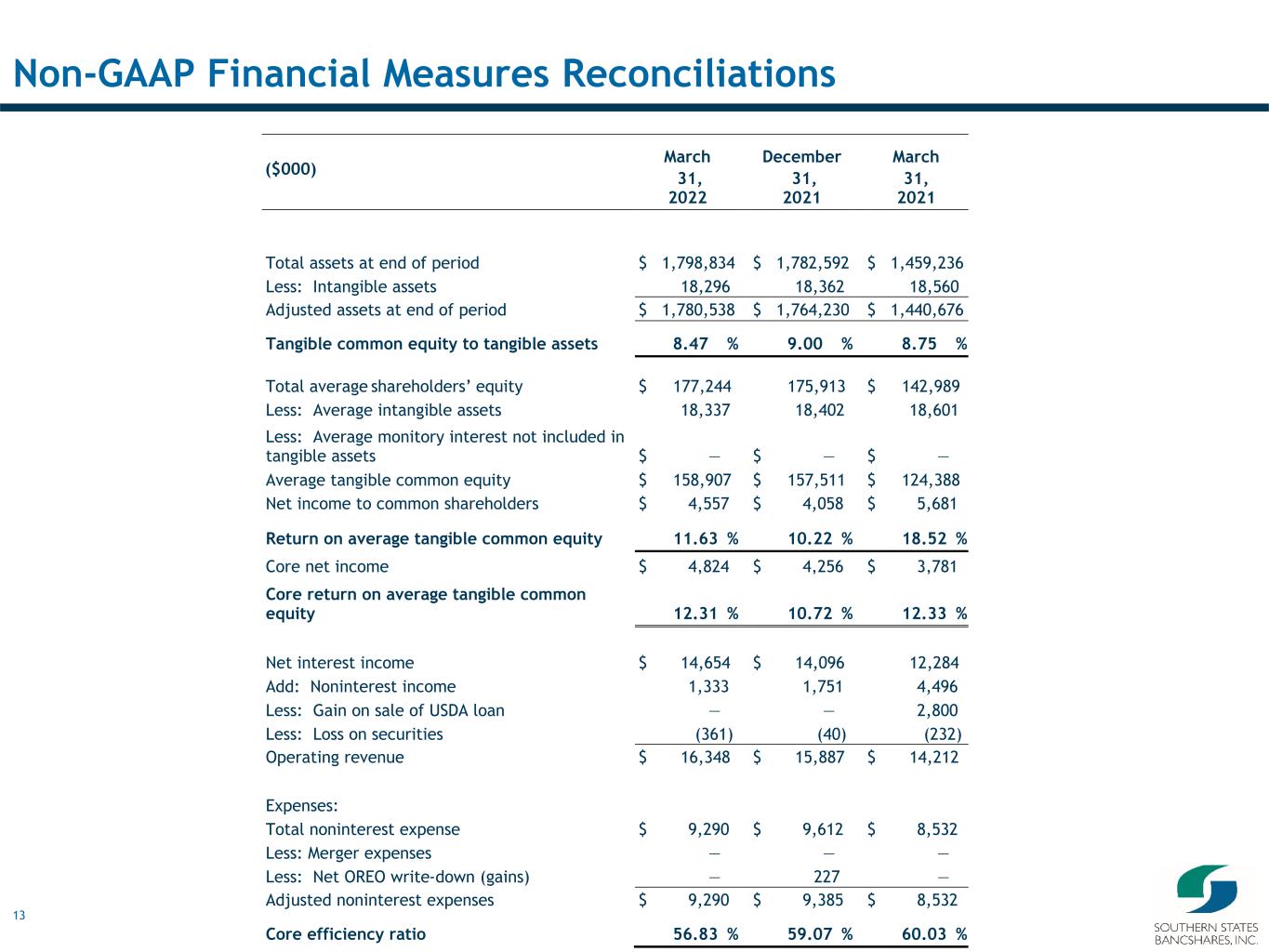

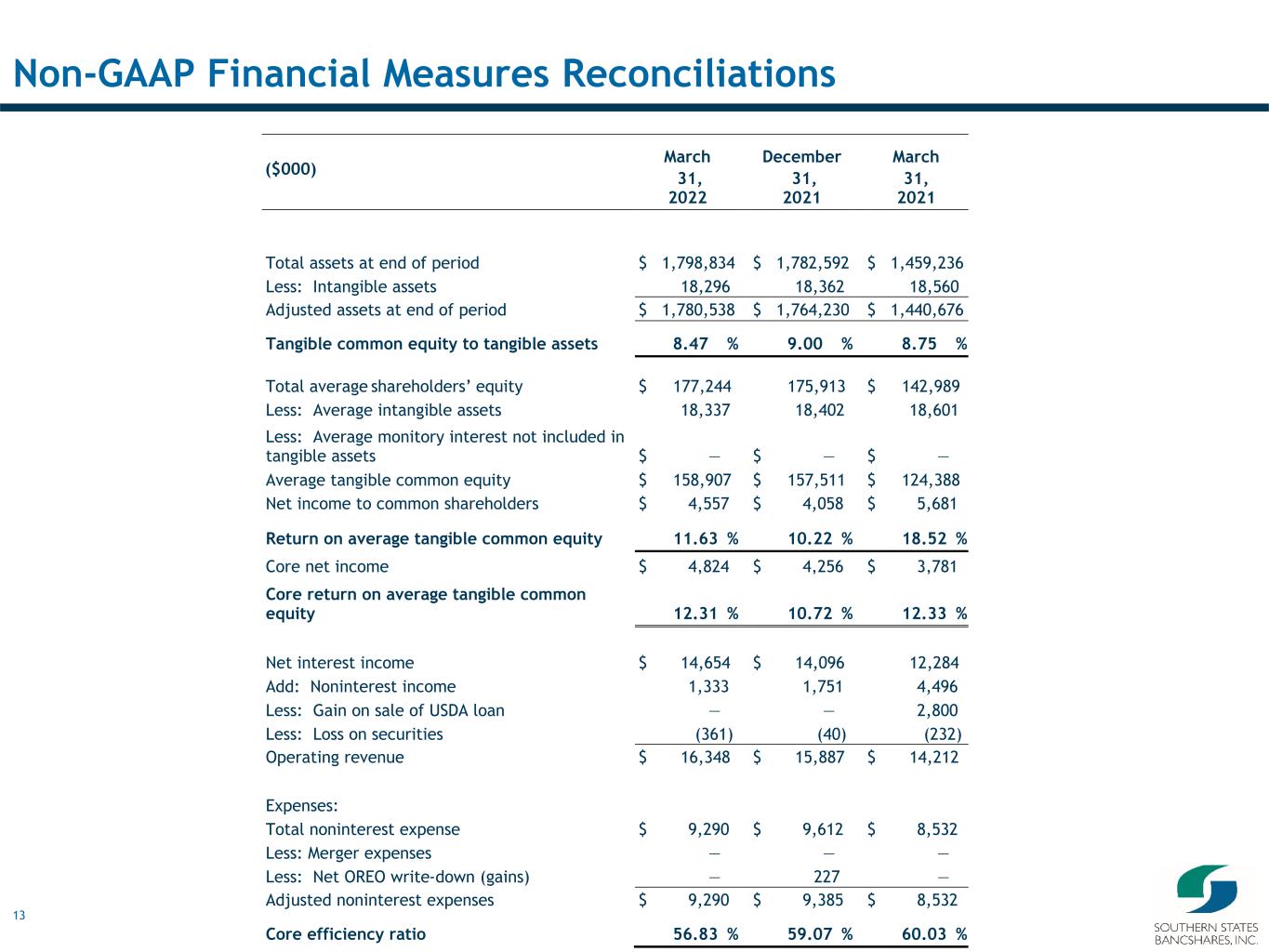

13 Non-GAAP Financial Measures Reconciliations March 31, 2022 December 31, 2021 March 31, 2021 Total assets at end of period $ 1,798,834 $ 1,782,592 $ 1,459,236 Less: Intangible assets 18,296 18,362 18,560 Adjusted assets at end of period $ 1,780,538 $ 1,764,230 $ 1,440,676 Tangible common equity to tangible assets 8.47 % 9.00 % 8.75 % Total average shareholders’ equity $ 177,244 175,913 $ 142,989 Less: Average intangible assets 18,337 18,402 18,601 Less: Average monitory interest not included in tangible assets $ — $ — $ — Average tangible common equity $ 158,907 $ 157,511 $ 124,388 Net income to common shareholders $ 4,557 $ 4,058 $ 5,681 Return on average tangible common equity 11.63 % 10.22 % 18.52 % Core net income $ 4,824 $ 4,256 $ 3,781 Core return on average tangible common equity 12.31 % 10.72 % 12.33 % Net interest income $ 14,654 $ 14,096 12,284 Add: Noninterest income 1,333 1,751 4,496 Less: Gain on sale of USDA loan — — 2,800 Less: Loss on securities (361) (40) (232) Operating revenue $ 16,348 $ 15,887 $ 14,212 Expenses: Total noninterest expense $ 9,290 $ 9,612 $ 8,532 Less: Merger expenses — — — Less: Net OREO write-down (gains) — 227 — Adjusted noninterest expenses $ 9,290 $ 9,385 $ 8,532 Core efficiency ratio 56.83 % 59.07 % 60.03 % ($000)