Q2 2023 Investor Presentation July 24, 2023

2 Important Notices and Disclaimers Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws, which reflect our current expectations and beliefs with respect to, among other things, future events and our financial performance. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. This may be especially true given recent events and trends in the banking industry and the inflationary environment. Although we believe that the expectations reflected in such forward-looking statements are reasonable as of the dates made, we cannot give any assurance that such expectations will prove correct and actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and in other SEC filings under the sections entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors”. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. These statements are often, but not always, made through the use of words or phrases such as “may,” “can,” “should,” “could,” “to be,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “likely,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “target,” “project,” “would” and “outlook,” or the negative version of those words or other similar words or phrases of a future or forward-looking nature. Forward-looking statements appear in a number of places in this presentation and may include statements about business strategy and prospects for growth, operations, ability to pay dividends, competition, regulation and general economic conditions. Non-GAAP Financial Measures In addition to reporting GAAP results, the Company reports non-GAAP financial measures in this presentation and other disclosures. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our performance. While we believe that these non- GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. For a reconciliation of the non-GAAP measures we use to the most comparable GAAP measures, see the Appendix to this presentation.

3 Branches (13) Legend Huntsville Birmingham Montgomery Columbus Atlanta Alabama Georgia 65 85 75 Anniston Auburn 20 85 75 85 65 65 59 Tuscaloosa LPOs (2) Quarterly Deposit Net Loans / Deposits: 89.22% Overview of Southern States Bancshares, Inc. Q2 ‘23 Financial Highlights Quarterly Asset Growth(2): 26.7%Assets ($B): $2.3 NPLs / Loans: 0.06% Quarterly Loan Growth(2): 17.4%Gross Loans ($B): $1.7 ACL / Loans: 1.25% Quarterly Deposit Growth(3): 30.1%Deposits ($B): $1.9 YTD NCOs / Avg. Loans: 0.03% TCE / TA(1): 7.94% Core Net Income(1)($M): $7.1 Core ROAA(1): 1.29% NIM: 3.73% Core Efficiency Ratio(1): 49.96% Mobile Savannah Macon Valdosta Augusta Southern States Bancshares (Nasdaq: SSBK) was founded in August 2007 and priced its IPO on August 11, 2021 Management team with 200 years of collective experience in the banking industry and deep ties to local markets History of solid growth, top-tier profitability and a strong credit culture Bifurcated growth strategy through organic growth and disciplined M&A Focused on being a dominant bank in our smaller markets and a competitive player in the larger metropolitan areas Diversified loan portfolio complemented by low-cost, core funding base Source: Company Documents; financial data as of the three months ended 6/30/23 unless otherwise noted (1) Please refer to non-U.S. GAAP reconciliation in the appendix (2) Annualized (3) Annualized; includes a $49.1 million increase in brokered deposits 20.7%of Brokered Growth(2):

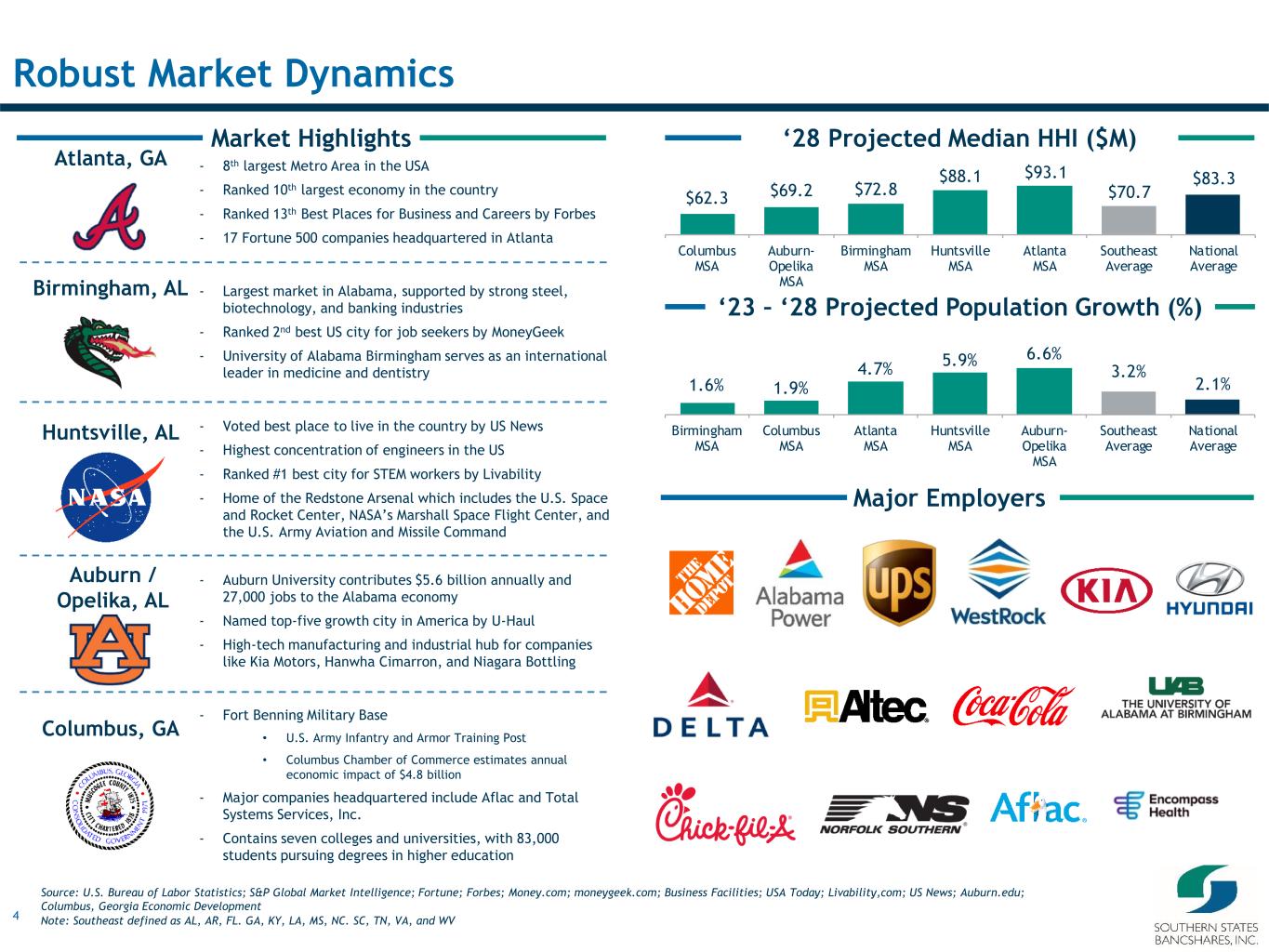

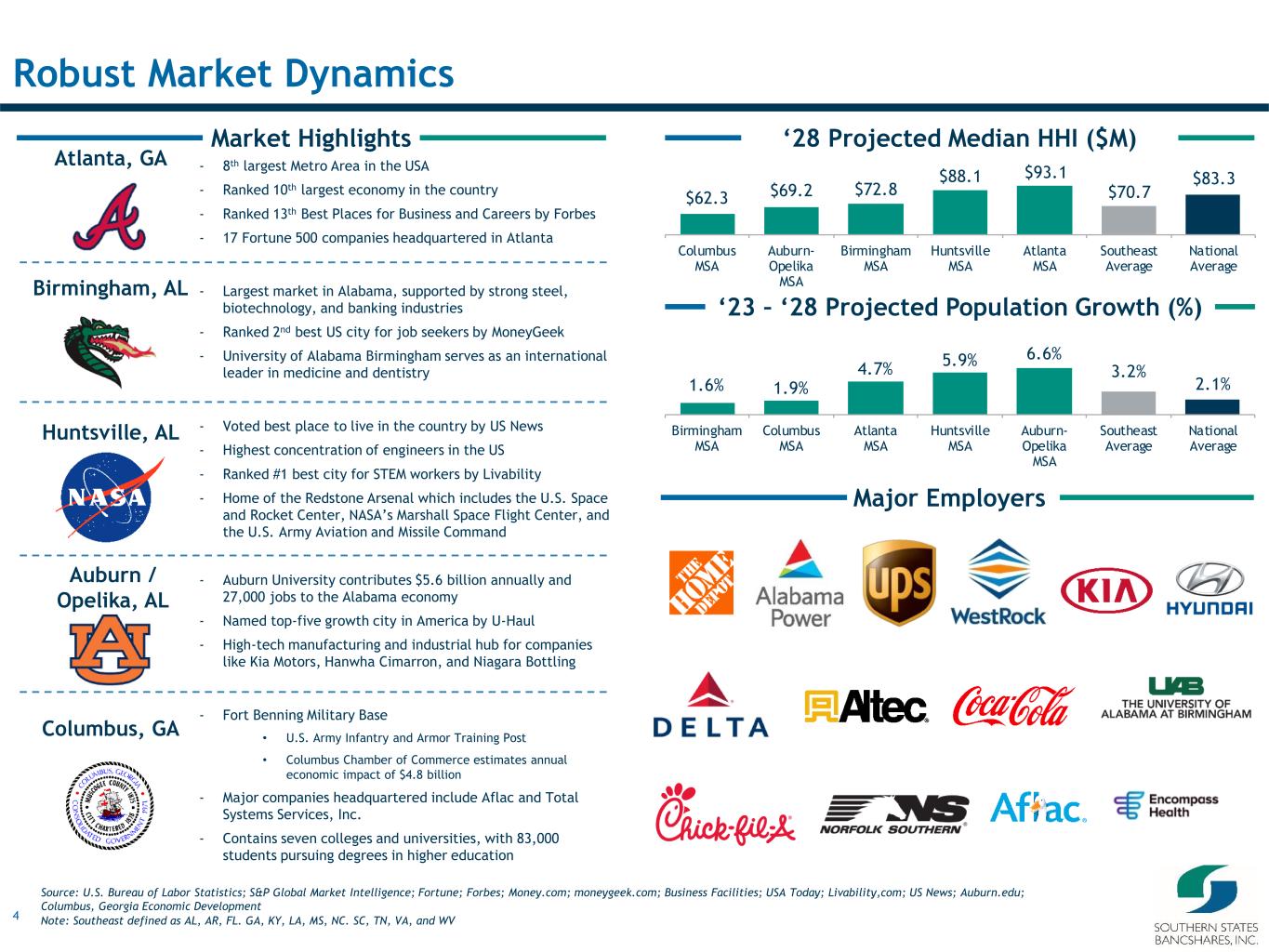

4 $62.3 $69.2 $72.8 $88.1 $93.1 $70.7 $83.3 Columbus MSA Auburn- Opelika MSA Birmingham MSA Huntsville MSA Atlanta MSA Southeast Average National Average 1.6% 1.9% 4.7% 5.9% 6.6% 3.2% 2.1% Birmingham MSA Columbus MSA Atlanta MSA Huntsville MSA Auburn- Opelika MSA Southeast Average National Average Columbus, GA Major Employers Market Highlights Robust Market Dynamics Source: U.S. Bureau of Labor Statistics; S&P Global Market Intelligence; Fortune; Forbes; Money.com; moneygeek.com; Business Facilities; USA Today; Livability,com; US News; Auburn.edu; Columbus, Georgia Economic Development Note: Southeast defined as AL, AR, FL. GA, KY, LA, MS, NC. SC, TN, VA, and WV - 8th largest Metro Area in the USA - Ranked 10th largest economy in the country - Ranked 13th Best Places for Business and Careers by Forbes - 17 Fortune 500 companies headquartered in Atlanta - Largest market in Alabama, supported by strong steel, biotechnology, and banking industries - Ranked 2nd best US city for job seekers by MoneyGeek - University of Alabama Birmingham serves as an international leader in medicine and dentistry - Voted best place to live in the country by US News - Highest concentration of engineers in the US - Ranked #1 best city for STEM workers by Livability - Home of the Redstone Arsenal which includes the U.S. Space and Rocket Center, NASA’s Marshall Space Flight Center, and the U.S. Army Aviation and Missile Command - Auburn University contributes $5.6 billion annually and 27,000 jobs to the Alabama economy - Named top-five growth city in America by U-Haul - High-tech manufacturing and industrial hub for companies like Kia Motors, Hanwha Cimarron, and Niagara Bottling - Fort Benning Military Base • U.S. Army Infantry and Armor Training Post • Columbus Chamber of Commerce estimates annual economic impact of $4.8 billion - Major companies headquartered include Aflac and Total Systems Services, Inc. - Contains seven colleges and universities, with 83,000 students pursuing degrees in higher education Huntsville, AL Birmingham, AL Atlanta, GA ‘28 Projected Median HHI ($M) ‘23 – ‘28 Projected Population Growth (%) Auburn / Opelika, AL

5 Proven, Veteran Management Team Lynn Joyce SEVP & Chief Financial Officer Greg Smith SEVP & Chief Risk and Credit Officer Jack Swift SEVP & Chief Operating Officer Our senior management team, on average, has more than 25 years of banking experience Mark Chambers President and CEO • 2007-2019 SEVP & President Southeast Region Southern States Bank • 2004-2007 Market President Wachovia Bank • 1998-2004 Commercial Lender Aliant Bank • 1992-2013 EVP & CFO First Financial Bank, a NASDAQ listed Financial Institution • 1986-1992 Arthur Andersen & Co • 2006-2019 SEVP & CCO Southern States Bank • 1986-2006 Credit Admin, Commercial Loan Officer and Market President Regions Bank • 2006-2019 SEVP & President Central Region Southern States Bank • 1996-2006 Senior Vice President Colonial Bank • 1992-1996 Vice President SouthTrust Bank

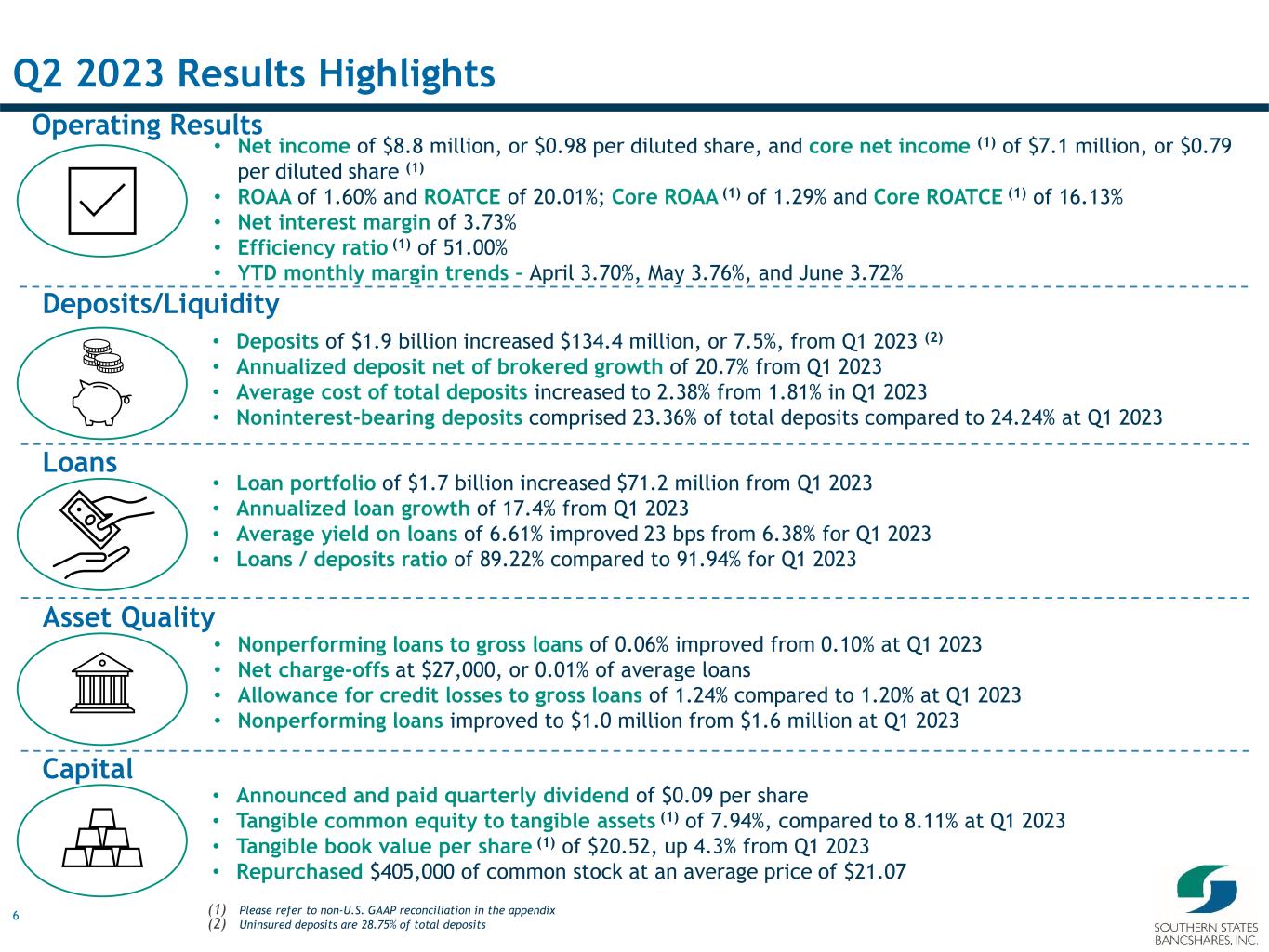

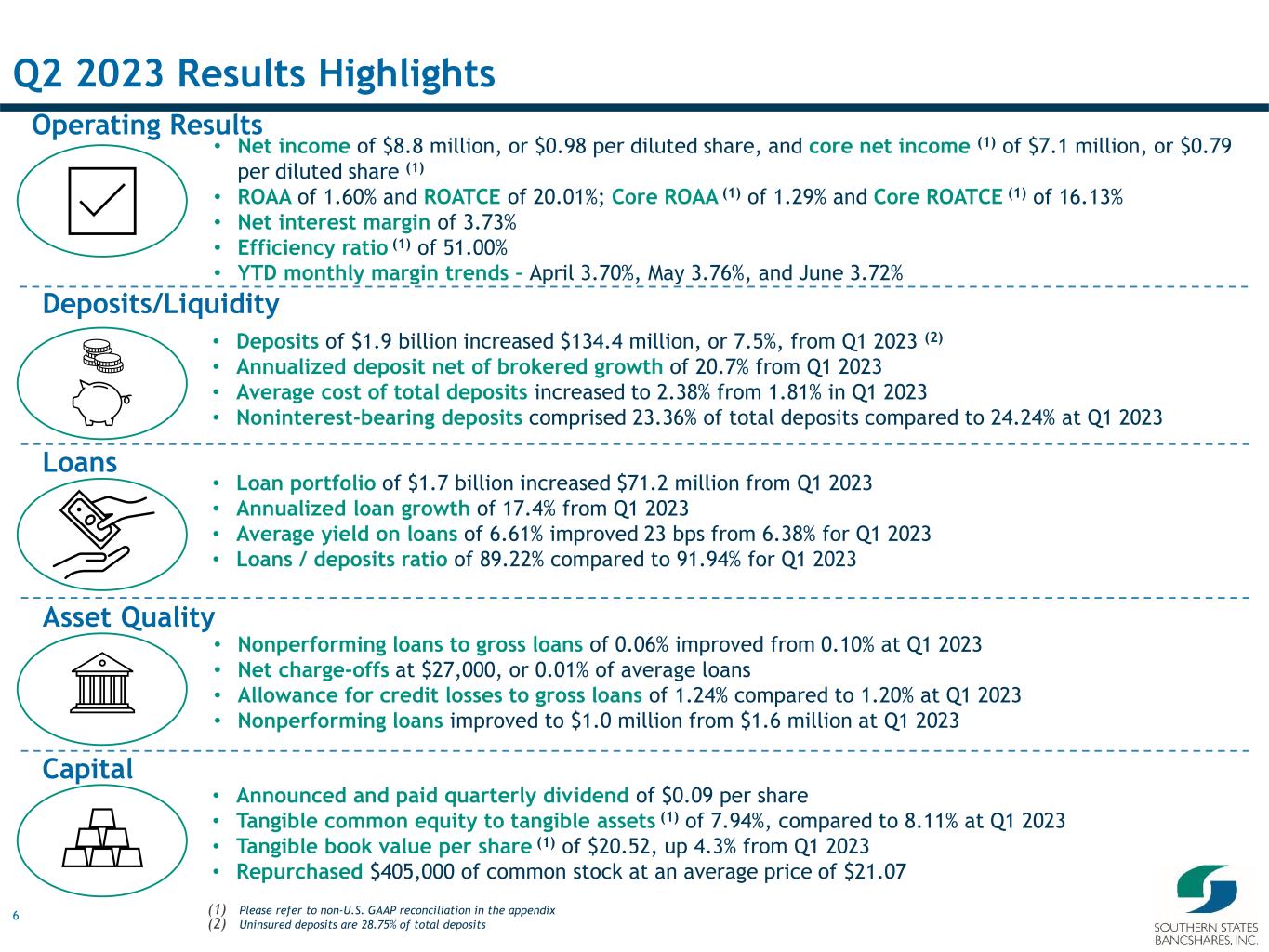

6 Q2 2023 Results Highlights (1) Please refer to non-U.S. GAAP reconciliation in the appendix (2) Uninsured deposits are 28.75% of total deposits Operating Results Deposits/Liquidity Loans Capital Asset Quality • Net income of $8.8 million, or $0.98 per diluted share, and core net income (1) of $7.1 million, or $0.79 per diluted share (1) • ROAA of 1.60% and ROATCE of 20.01%; Core ROAA (1) of 1.29% and Core ROATCE (1) of 16.13% • Net interest margin of 3.73% • Efficiency ratio (1) of 51.00% • YTD monthly margin trends – April 3.70%, May 3.76%, and June 3.72% • Loan portfolio of $1.7 billion increased $71.2 million from Q1 2023 • Annualized loan growth of 17.4% from Q1 2023 • Average yield on loans of 6.61% improved 23 bps from 6.38% for Q1 2023 • Loans / deposits ratio of 89.22% compared to 91.94% for Q1 2023 • Deposits of $1.9 billion increased $134.4 million, or 7.5%, from Q1 2023 (2) • Annualized deposit net of brokered growth of 20.7% from Q1 2023 • Average cost of total deposits increased to 2.38% from 1.81% in Q1 2023 • Noninterest-bearing deposits comprised 23.36% of total deposits compared to 24.24% at Q1 2023 • Nonperforming loans to gross loans of 0.06% improved from 0.10% at Q1 2023 • Net charge-offs at $27,000, or 0.01% of average loans • Allowance for credit losses to gross loans of 1.24% compared to 1.20% at Q1 2023 • Nonperforming loans improved to $1.0 million from $1.6 million at Q1 2023 • Announced and paid quarterly dividend of $0.09 per share • Tangible common equity to tangible assets (1) of 7.94%, compared to 8.11% at Q1 2023 • Tangible book value per share (1) of $20.52, up 4.3% from Q1 2023 • Repurchased $405,000 of common stock at an average price of $21.07

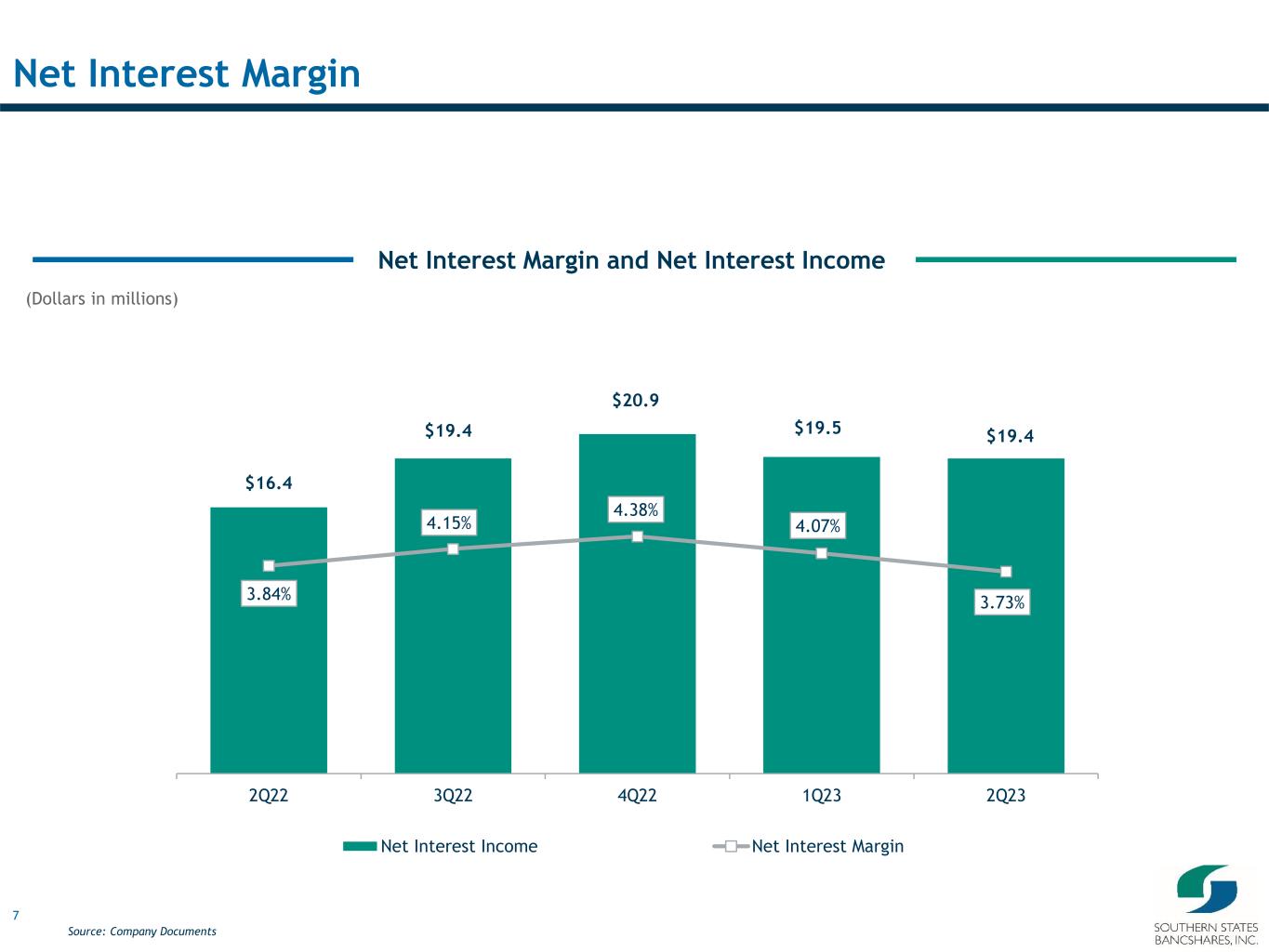

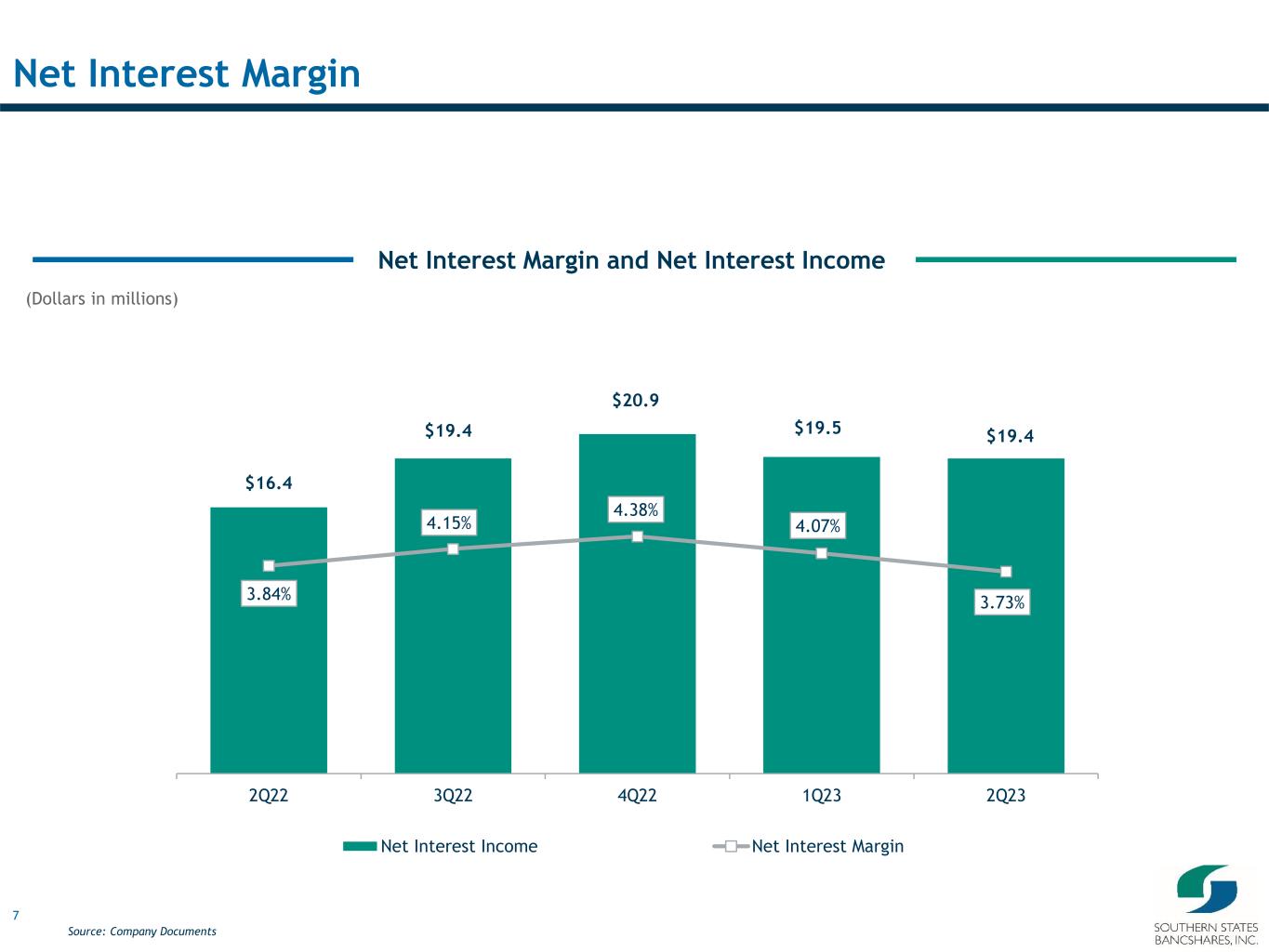

7 $16.4 $19.4 $20.9 $19.5 $19.4 3.84% 4.15% 4.38% 4.07% 3.73% $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 2Q22 3Q22 4Q22 1Q23 2Q23 Net Interest Income Net Interest Margin Net Interest Margin and Net Interest Income Net Interest Margin Source: Company Documents (Dollars in millions)

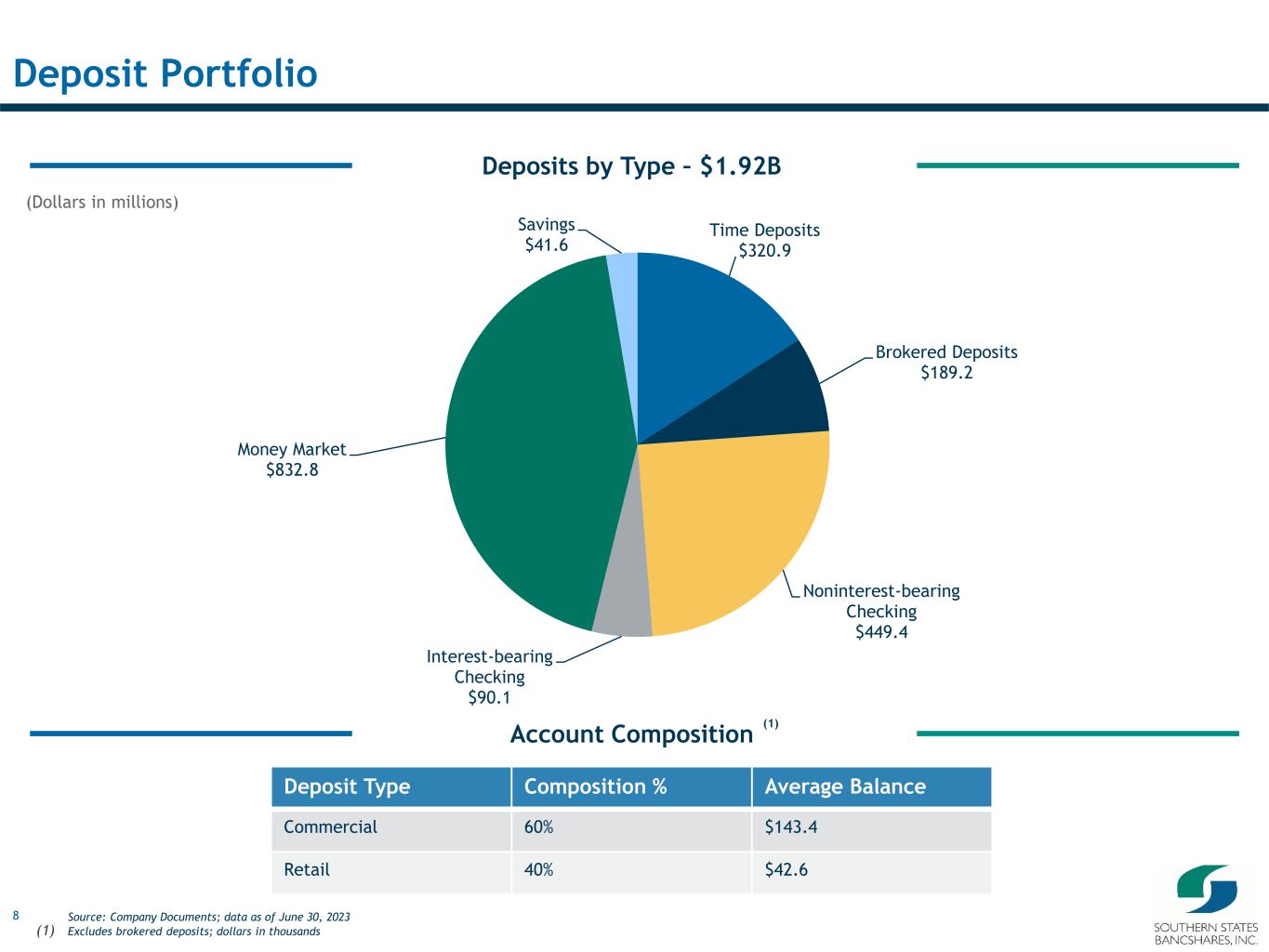

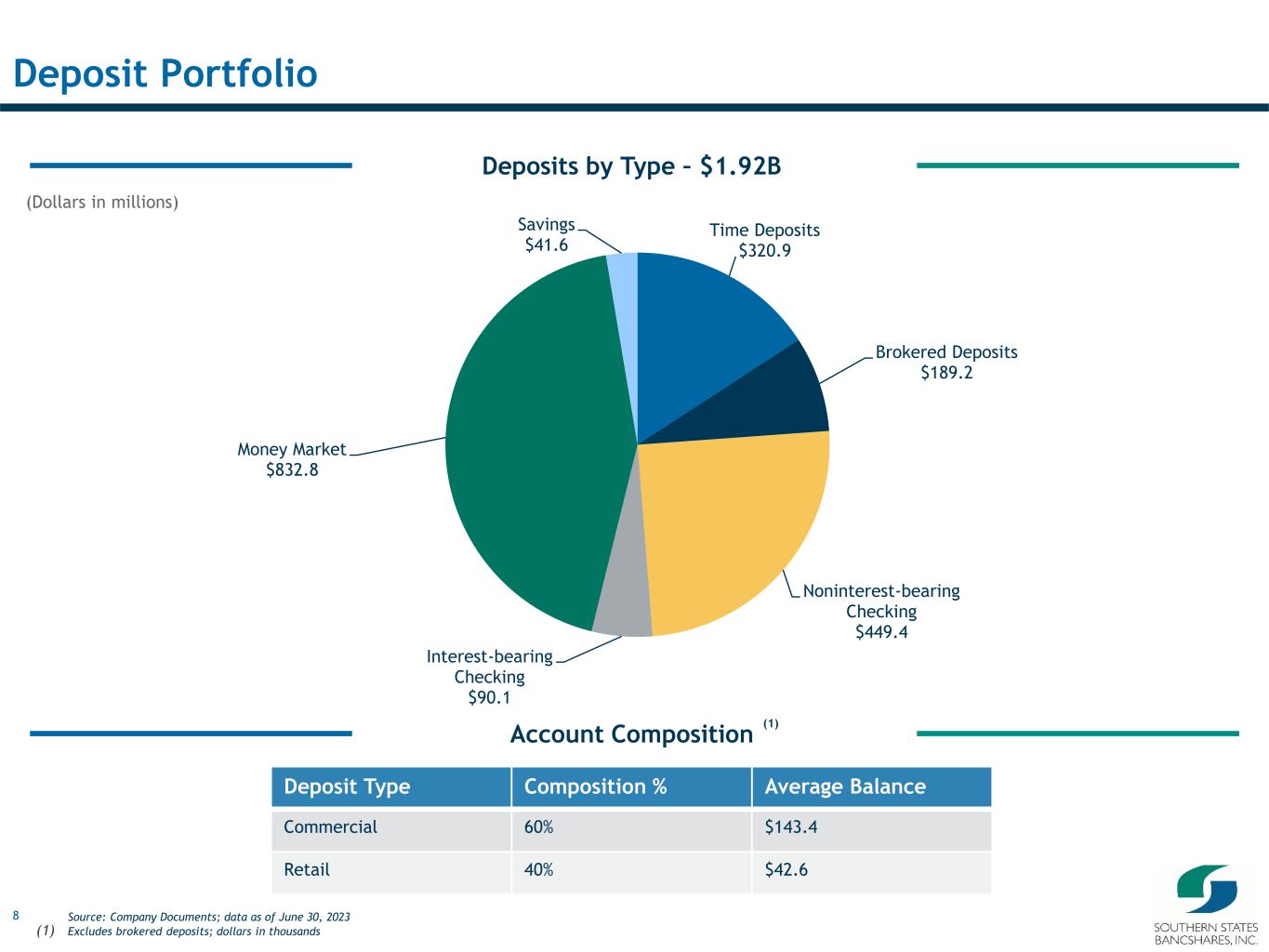

8 Time Deposits $320.9 Brokered Deposits $189.2 Noninterest-bearing Checking $449.4 Interest-bearing Checking $90.1 Money Market $832.8 Savings $41.6 Deposits by Type – $1.92B Deposit Portfolio Source: Company Documents; data as of June 30, 2023 (1) Excludes brokered deposits; dollars in thousands Deposit Type Composition % Average Balance Commercial 60% $143.4 Retail 40% $42.6 Account Composition (1) (Dollars in millions)

9 OO-CRE 30.0% NOO-CRE 28.7% C&I 15.0% C & D 13.3% Residential 12.5% Consumer & Other 0.5% Loans by Type $1.72B Loan Portfolio Source: Company Documents; data as of June 30, 2023 Loan Type Composition % Fixed 54.3% Variable 45.7% Loan Composition Loan Type Total Office Buildings $183.2 Industrial Warehouse / Heavy Manufacturing $146.0 Convenience Stores $145.8 Retail Warehouse / Light Manufacturing $117.6 Hotels / Motels $92.2 Multi-Family (5+) $88.3 Commercial Retail Building $82.3 Concentration Highlights(Dollars in millions)

10 <$1M 146 $1-5M 38 $5-10M 5 >$10M 3 Office Building Loans $183.2M Loan Portfolio – Office Building Source: Company Documents; data as of June 30, 2023 Location Composition % Georgia 66% Alabama 25% Other 9% Loan Composition # of Stories Total Six Stories 2 Five stories 1 Four stories 6 Three stories 5 One & two stories 178 Office Building Type

11 $0.5 $3.9 $13.4 $3.4 $2.0 $2.2 - $1.0 $2.1 $1.8 $3.0 $1.8 $2.0 $2.1 - $2.0 $0.5 $0.6 $4.2 $10.2 $2.9 $2.9 $2.9 0.2% 0.6% 2.5% 1.3% 0.4% 0.3% 0.2%$0.0 $5.0 $10.0 $15.0 $20.0 $25.0 2017 2018 2019 2020 2021 2022 2Q23 Nonaccruals ($mm) TDRs ($mm) OREO ($mm) NPAs / Loans + OREO $20.6 Nonperforming Assets by Type Asset Quality Source: Company Documents Dollars in millions (1) TDRs reflect COVID-19 relief under the CARES Act and bank regulatory COVID-19 relief in 2020 and 2021 Reserves / Loans NCOs / Avg. Loans $5.9 $3.1 $6.3 $15.4 (0.10%) 0.02% 0.57% 0.07% 0.00% $6.9 0.02% Comprehensive and conservative underwriting process Highly experienced bankers incentivized with equity ownership Commitment to a diverse loan portfolio while maintaining strong asset quality metrics Proactively manage loan concentrations with all collateral types capped at approximately 50% of risk- based capital Proactive approach to resolving problem credits 1.02% 1.11% 1.11% 1.22% 1.19% 1.27% 1.25% 2017 2018 2019 2020 2021 2022 2Q23 0.01% $7.2 (1)

12 $567 $704 $840 $1,030 $963 $1,241 $1,717 $67 $9 2017 2018 2019 2020 2021 2022 2Q23 $1,587 $1,250 $622 $776 $951 $1,140 $1,556 $1,721 $1,924 2017 2018 2019 2020 2021 2022 2Q23 $736 $888 $1,095 $1,333 $1,774 $1,266 $2,278 $67 $9 2017 2018 2019 2020 2021 2022 2Q23 $2,045 Loans / DepositsTotal Deposits ($M) Total Assets ($M) Total Loans ($M) Balance Sheet Growth Source: Company Documents PPP Loans PPP Loans $1,783 90.2% 90.0% 88.1% 90.4% 80.3% 92.2% 89.2% 2017 2018 2019 2020 2021 2022 2Q23

13 Building Shareholder Value Our Strategic Focus Maintain focus on strong, profitable organic growth without compromising our credit quality Further grow our core deposit franchise Expand into new markets by hiring commercial bankers Focus on high growth markets and further expanding our Atlanta franchise Evaluate strategic acquisition opportunities Continue implementing technology to optimize customer service and provide efficient opportunities to scale the business Prudently manage capital between balance sheet growth and return to shareholders

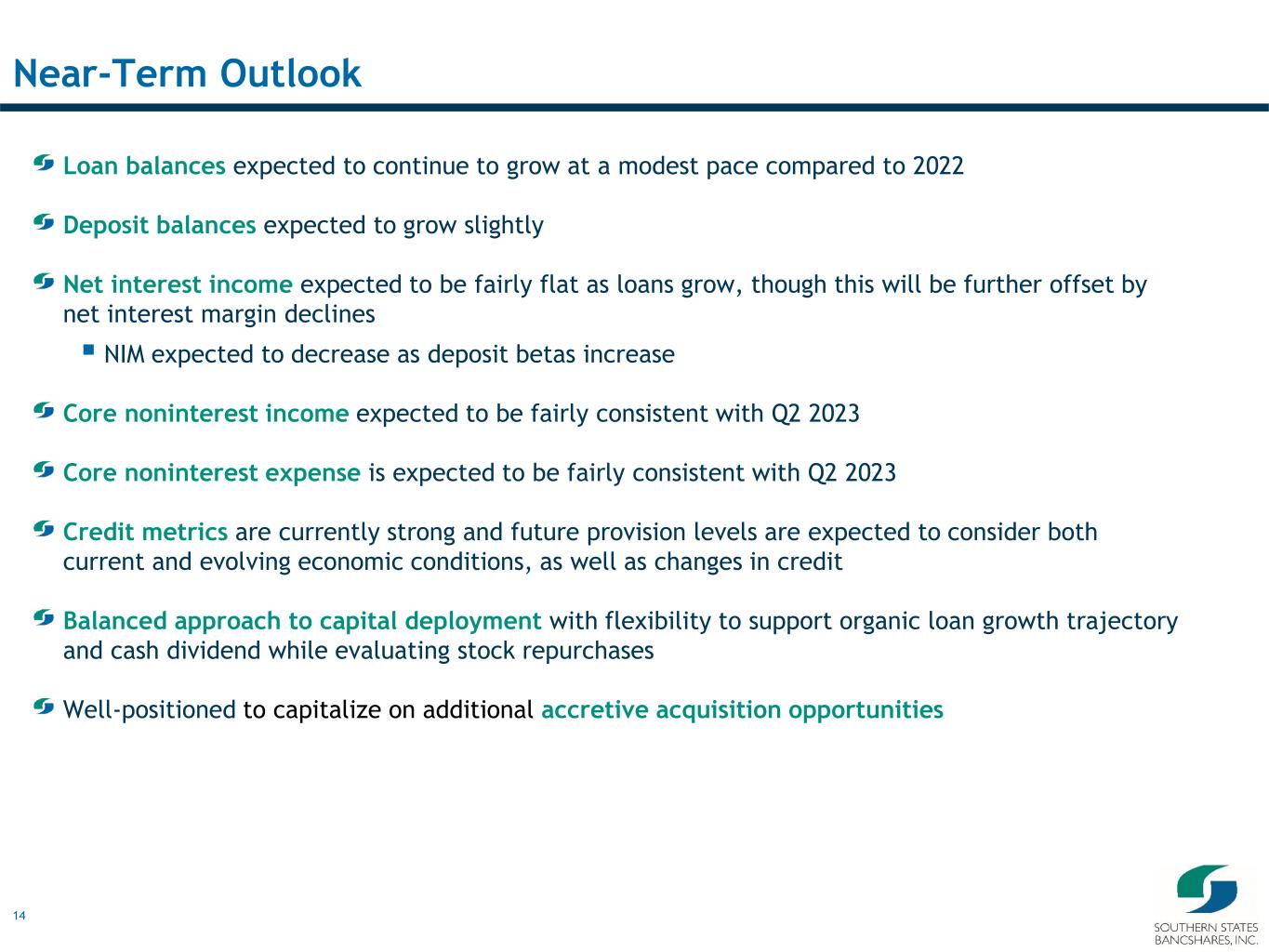

14 Near-Term Outlook Loan balances expected to continue to grow at a modest pace compared to 2022 Deposit balances expected to grow slightly Net interest income expected to be fairly flat as loans grow, though this will be further offset by net interest margin declines ▪ NIM expected to decrease as deposit betas increase Core noninterest income expected to be fairly consistent with Q2 2023 Core noninterest expense is expected to be fairly consistent with Q2 2023 Credit metrics are currently strong and future provision levels are expected to consider both current and evolving economic conditions, as well as changes in credit Balanced approach to capital deployment with flexibility to support organic loan growth trajectory and cash dividend while evaluating stock repurchases Well-positioned to capitalize on additional accretive acquisition opportunities

Appendix

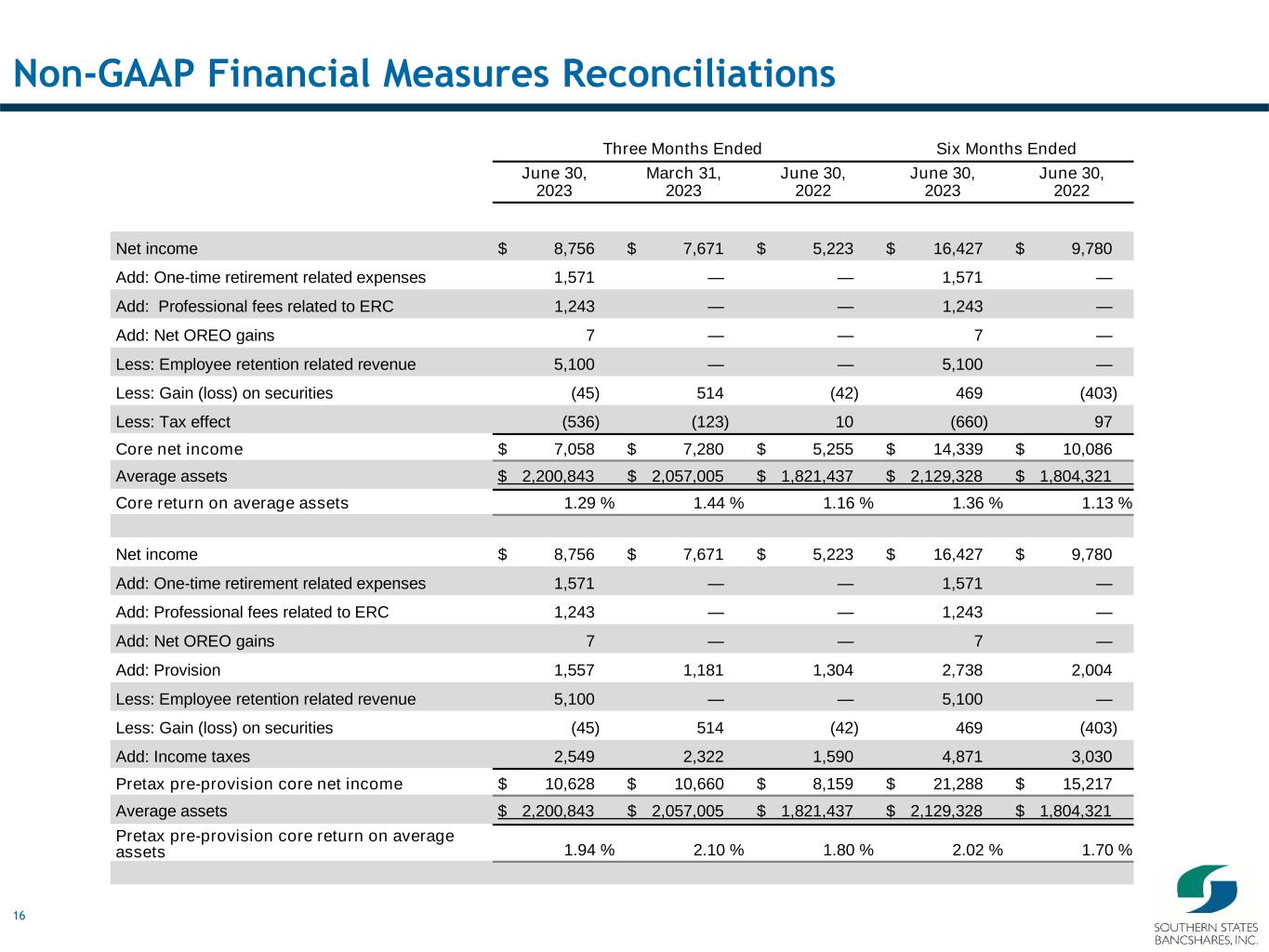

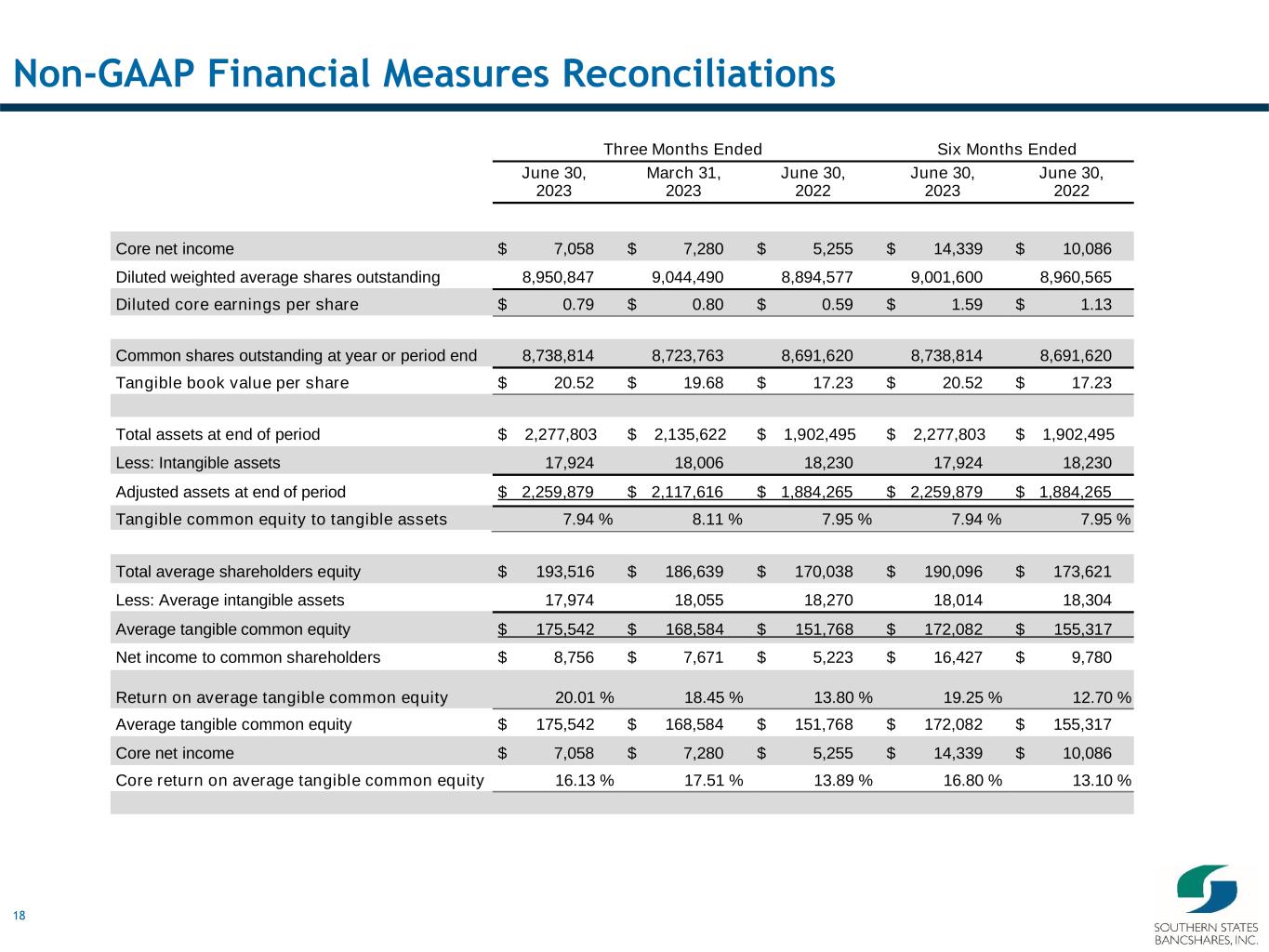

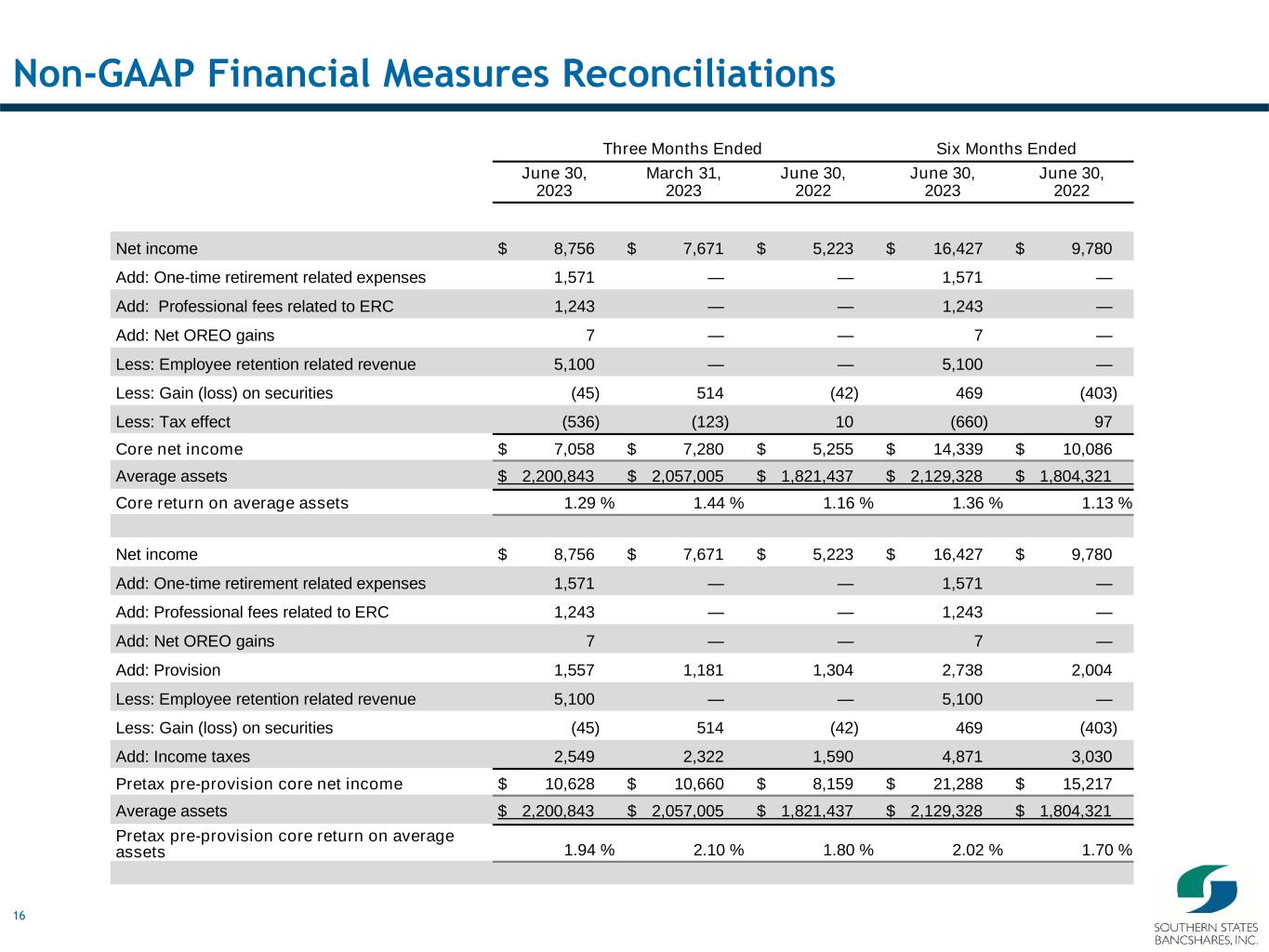

16 Non-GAAP Financial Measures Reconciliations Three Months Ended Six Months Ended June 30, 2023 March 31, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Net income $ 8,756 $ 7,671 $ 5,223 $ 16,427 $ 9,780 Add: One-time retirement related expenses 1,571 — — 1,571 — Add: Professional fees related to ERC 1,243 — — 1,243 — Add: Net OREO gains 7 — — 7 — Less: Employee retention related revenue 5,100 — — 5,100 — Less: Gain (loss) on securities (45) 514 (42) 469 (403) Less: Tax effect (536) (123) 10 (660) 97 Core net income $ 7,058 $ 7,280 $ 5,255 $ 14,339 $ 10,086 Average assets $ 2,200,843 $ 2,057,005 $ 1,821,437 $ 2,129,328 $ 1,804,321 Core return on average assets 1.29 % 1.44 % 1.16 % 1.36 % 1.13 % Net income $ 8,756 $ 7,671 $ 5,223 $ 16,427 $ 9,780 Add: One-time retirement related expenses 1,571 — — 1,571 — Add: Professional fees related to ERC 1,243 — — 1,243 — Add: Net OREO gains 7 — — 7 — Add: Provision 1,557 1,181 1,304 2,738 2,004 Less: Employee retention related revenue 5,100 — — 5,100 — Less: Gain (loss) on securities (45) 514 (42) 469 (403) Add: Income taxes 2,549 2,322 1,590 4,871 3,030 Pretax pre-provision core net income $ 10,628 $ 10,660 $ 8,159 $ 21,288 $ 15,217 Average assets $ 2,200,843 $ 2,057,005 $ 1,821,437 $ 2,129,328 $ 1,804,321 Pretax pre-provision core return on average assets 1.94 % 2.10 % 1.80 % 2.02 % 1.70 %

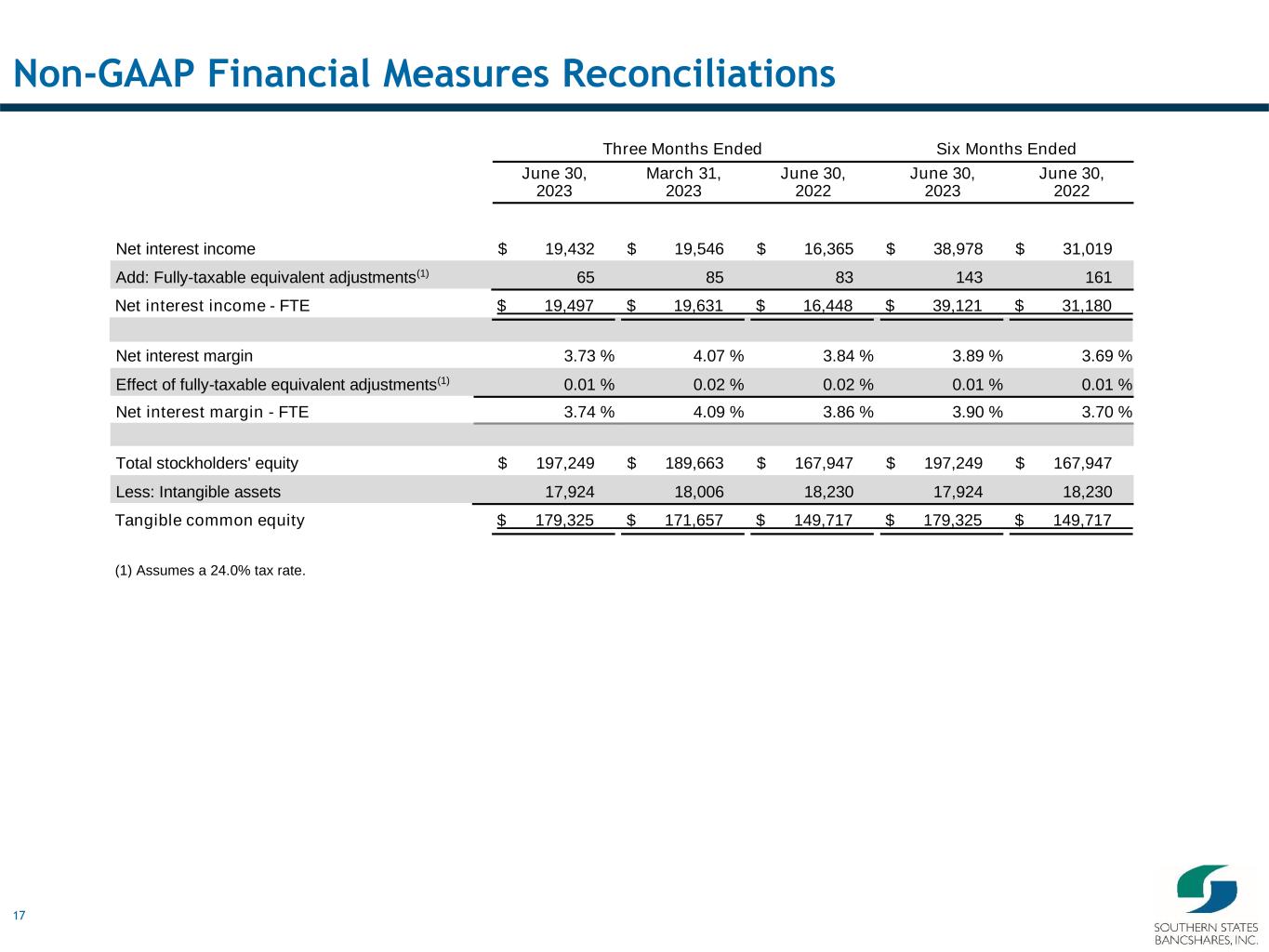

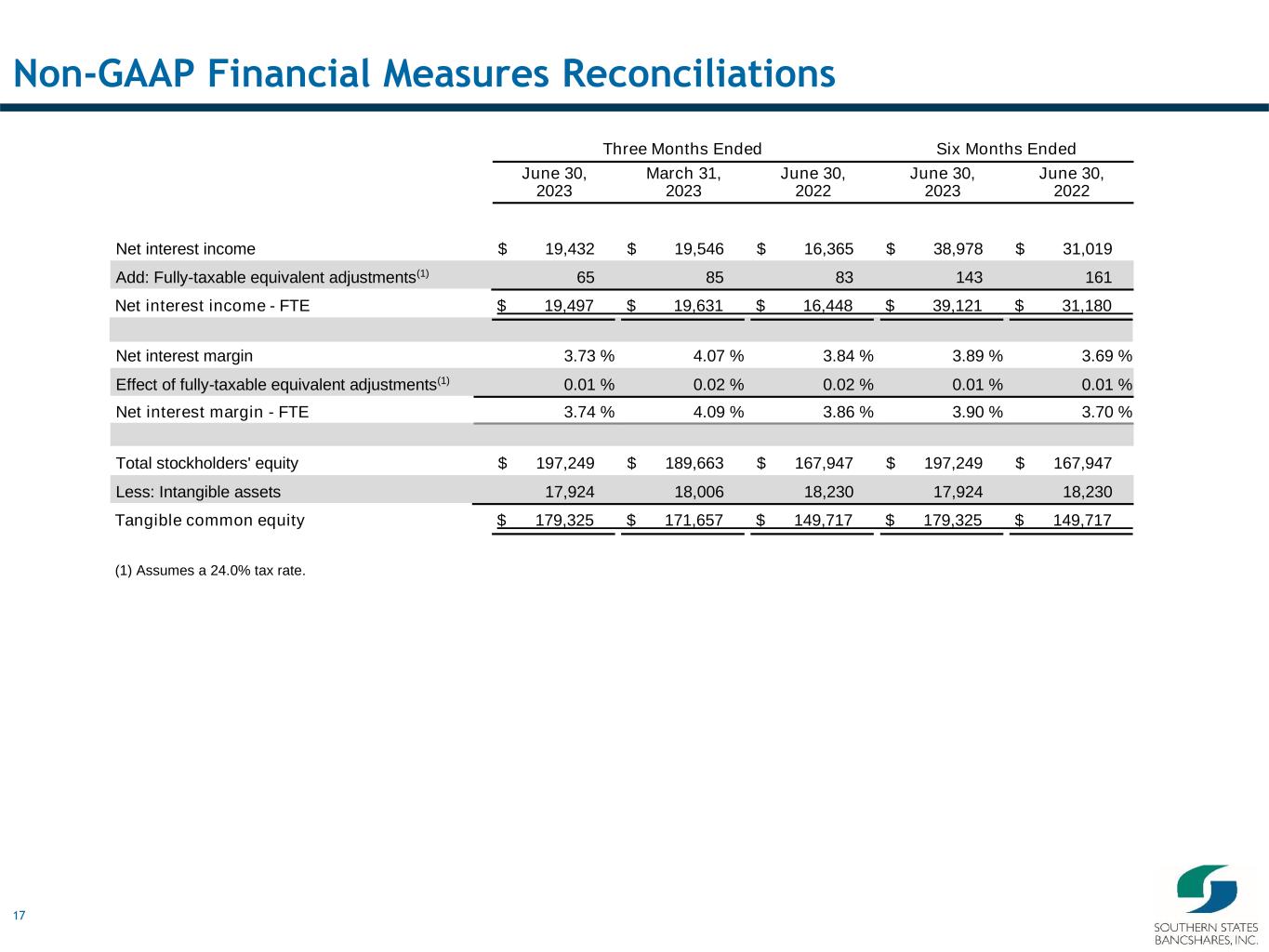

17 Non-GAAP Financial Measures Reconciliations Three Months Ended Six Months Ended June 30, 2023 March 31, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Net interest income $ 19,432 $ 19,546 $ 16,365 $ 38,978 $ 31,019 Add: Fully-taxable equivalent adjustments(1) 65 85 83 143 161 Net interest income - FTE $ 19,497 $ 19,631 $ 16,448 $ 39,121 $ 31,180 Net interest margin 3.73 % 4.07 % 3.84 % 3.89 % 3.69 % Effect of fully-taxable equivalent adjustments(1) 0.01 % 0.02 % 0.02 % 0.01 % 0.01 % Net interest margin - FTE 3.74 % 4.09 % 3.86 % 3.90 % 3.70 % Total stockholders' equity $ 197,249 $ 189,663 $ 167,947 $ 197,249 $ 167,947 Less: Intangible assets 17,924 18,006 18,230 17,924 18,230 Tangible common equity $ 179,325 $ 171,657 $ 149,717 $ 179,325 $ 149,717 (1) Assumes a 24.0% tax rate.

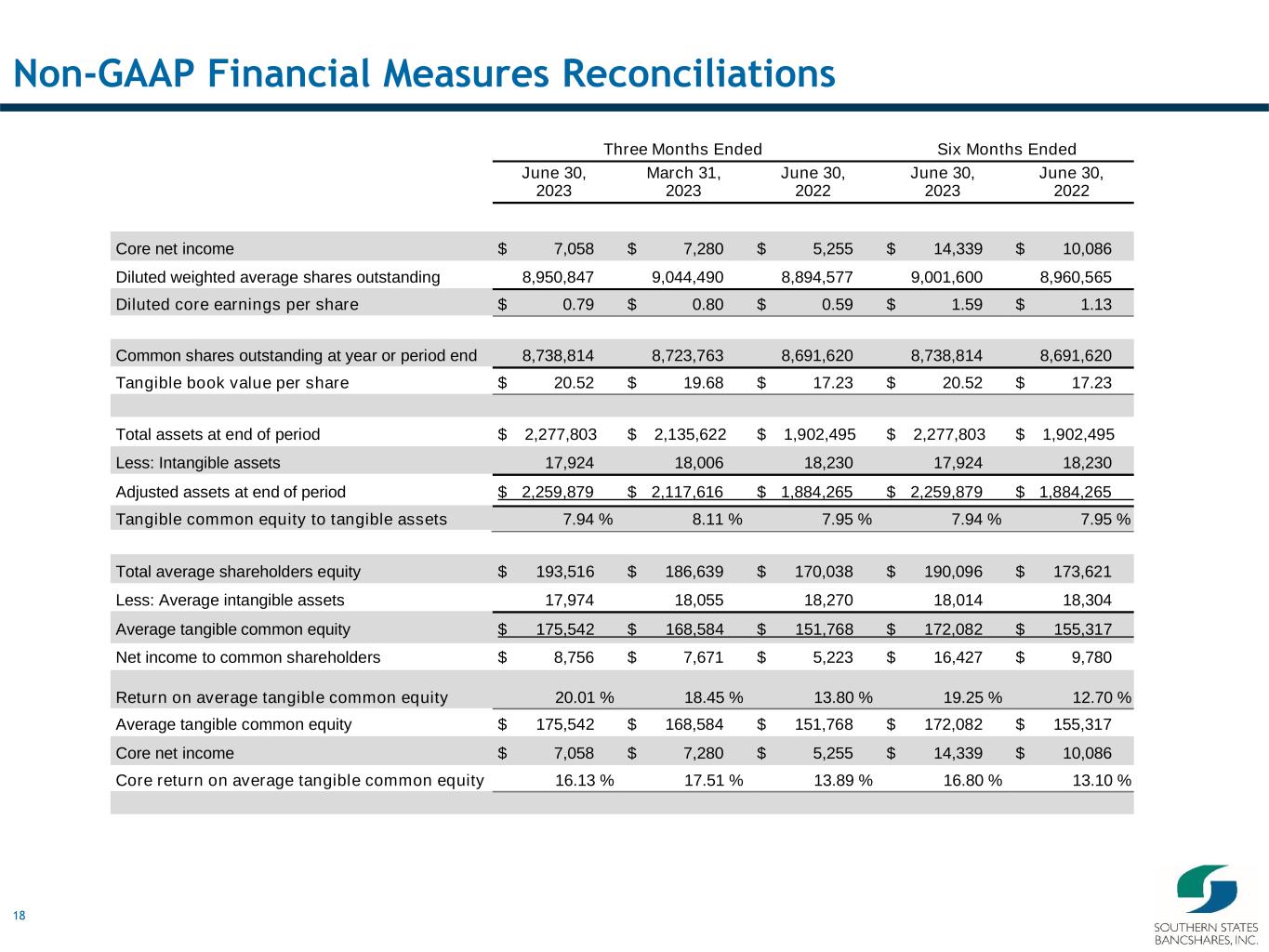

18 Non-GAAP Financial Measures Reconciliations Three Months Ended Six Months Ended June 30, 2023 March 31, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Core net income $ 7,058 $ 7,280 $ 5,255 $ 14,339 $ 10,086 Diluted weighted average shares outstanding 8,950,847 9,044,490 8,894,577 9,001,600 8,960,565 Diluted core earnings per share $ 0.79 $ 0.80 $ 0.59 $ 1.59 $ 1.13 Common shares outstanding at year or period end 8,738,814 8,723,763 8,691,620 8,738,814 8,691,620 Tangible book value per share $ 20.52 $ 19.68 $ 17.23 $ 20.52 $ 17.23 Total assets at end of period $ 2,277,803 $ 2,135,622 $ 1,902,495 $ 2,277,803 $ 1,902,495 Less: Intangible assets 17,924 18,006 18,230 17,924 18,230 Adjusted assets at end of period $ 2,259,879 $ 2,117,616 $ 1,884,265 $ 2,259,879 $ 1,884,265 Tangible common equity to tangible assets 7.94 % 8.11 % 7.95 % 7.94 % 7.95 % Total average shareholders equity $ 193,516 $ 186,639 $ 170,038 $ 190,096 $ 173,621 Less: Average intangible assets 17,974 18,055 18,270 18,014 18,304 Average tangible common equity $ 175,542 $ 168,584 $ 151,768 $ 172,082 $ 155,317 Net income to common shareholders $ 8,756 $ 7,671 $ 5,223 $ 16,427 $ 9,780 Return on average tangible common equity 20.01 % 18.45 % 13.80 % 19.25 % 12.70 % Average tangible common equity $ 175,542 $ 168,584 $ 151,768 $ 172,082 $ 155,317 Core net income $ 7,058 $ 7,280 $ 5,255 $ 14,339 $ 10,086 Core return on average tangible common equity 16.13 % 17.51 % 13.89 % 16.80 % 13.10 %

19 Non-GAAP Financial Measures Reconciliations Three Months Ended Six Months Ended June 30, 2023 March 31, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Net interest income $ 19,432 $ 19,546 $ 16,365 $ 38,978 $ 31,019 Add: Noninterest income 6,862 1,786 1,404 8,648 2,737 Less: Employee retention related revenue 5,100 — — 5,100 — Less: Gain (loss) on securities (45) 514 (42) 469 (403) Operating revenue $ 21,239 $ 20,818 $ 17,811 $ 42,057 $ 34,159 Expenses: Total noninterest expense $ 13,432 $ 10,158 $ 9,652 $ 23,590 $ 18,942 Less: One-time retirement related expenses 1,571 — — 1,571 — Less: Professional fees related to ERC 1,243 — — 1,243 — Less: Net OREO gains 7 — — 7 — Adjusted noninterest expenses $ 10,611 $ 10,158 $ 9,652 $ 20,769 $ 18,942 Core efficiency ratio 49.96 % 48.79 % 54.19 % 49.38 % 55.45 %