Q4 2024 Investor Presentation January 2025

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws, which reflect our current expectations and beliefs with respect to, among other things, future events and our financial performance. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. This may be especially true given recent events and trends in the banking industry. Although we believe that the expectations reflected in such forward-looking statements are reasonable as of the dates made, we cannot give any assurance that such expectations will prove correct and actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in other SEC filings under the sections entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors”. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. These statements are often, but not always, made through the use of words or phrases such as “may,” “can,” “should,” “could,” “to be,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “likely,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “target,” “project,” “would” and “outlook,” or the negative version of those words or other similar words or phrases of a future or forward-looking nature. Forward-looking statements appear in a number of places in this presentation and may include statements about business strategy and prospects for growth, operations, ability to pay dividends, competition, regulation and general economic conditions. Important Notices and Disclaimers Non-GAAP Financial Measures In addition to reporting GAAP results, the Company reports non-GAAP financial measures in this presentation and other disclosures. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. For a reconciliation of the non-GAAP measures we use to the most comparable GAAP measures, see the Appendix to this presentation. 2 |

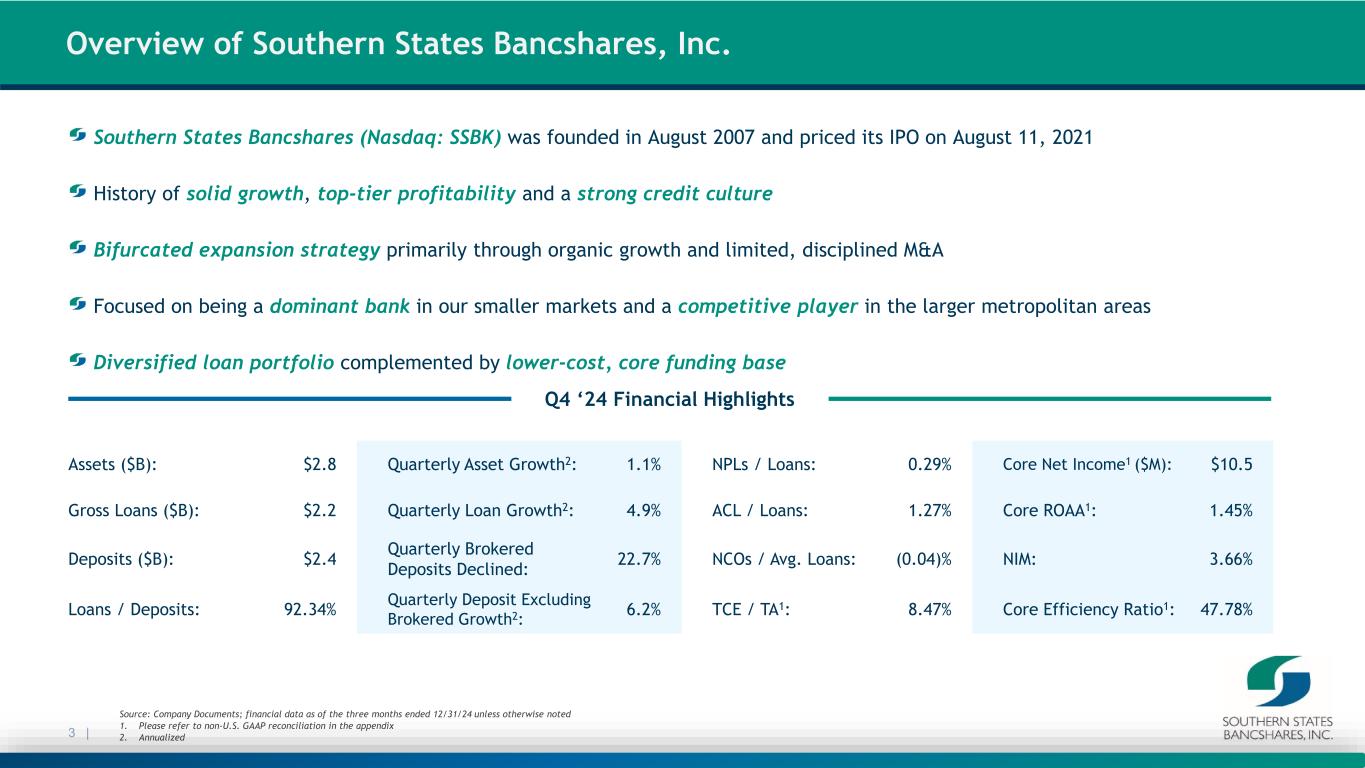

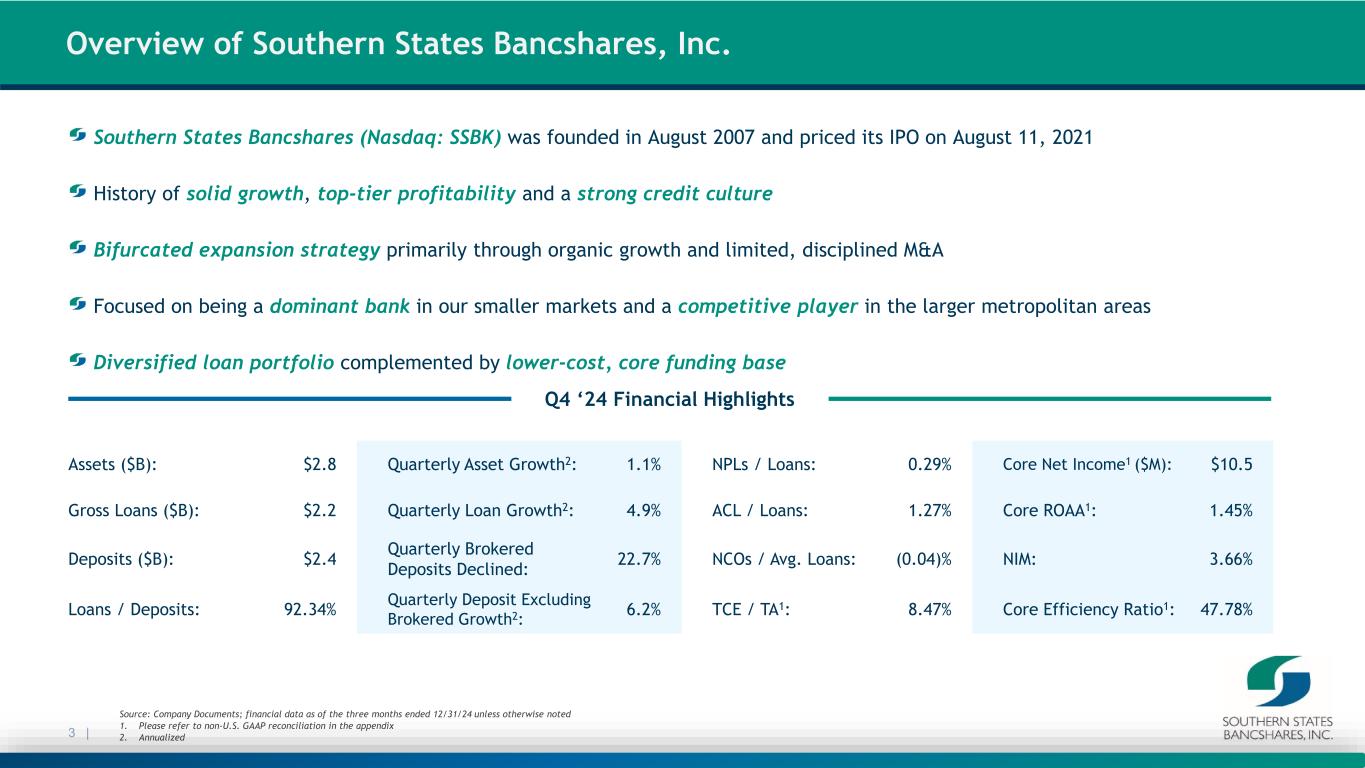

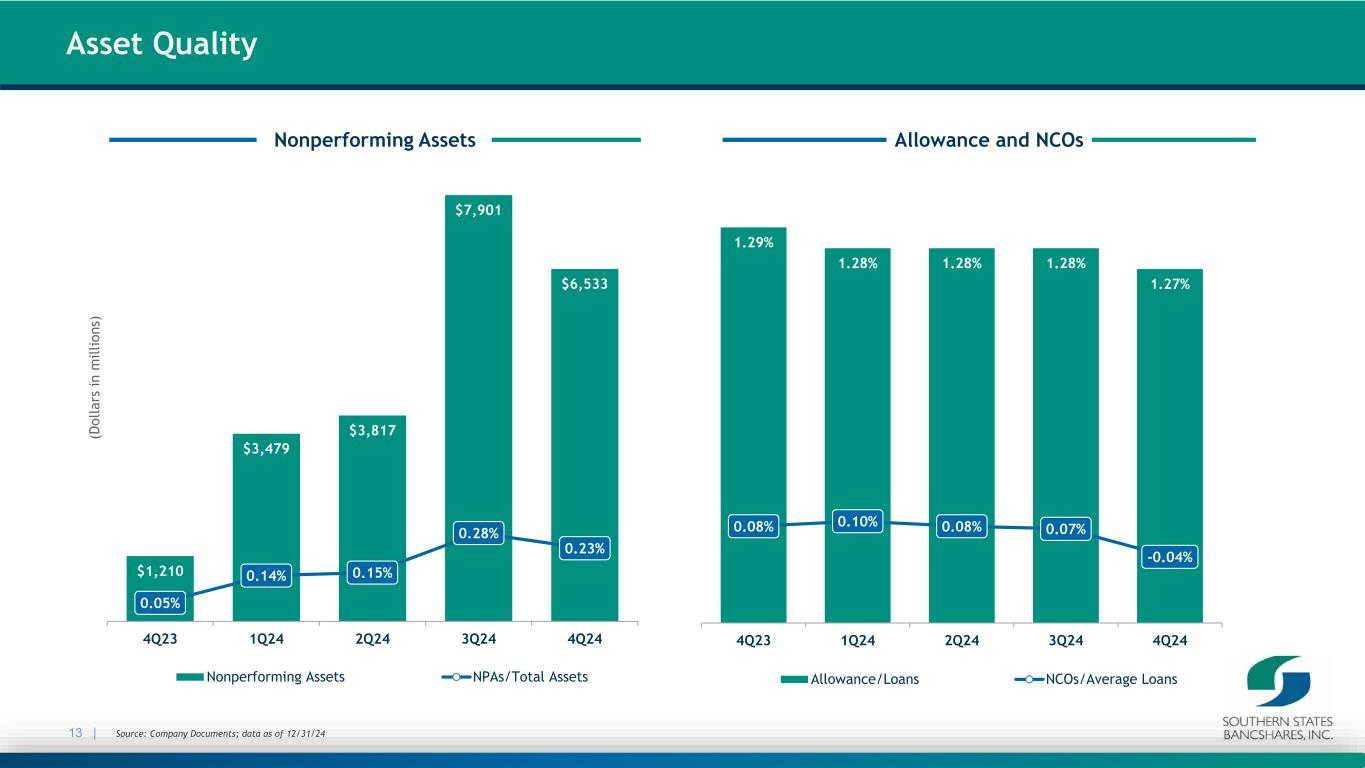

3 | Source: Company Documents; financial data as of the three months ended 12/31/24 unless otherwise noted 1. Please refer to non-U.S. GAAP reconciliation in the appendix 2. Annualized Q4 ‘24 Financial Highlights Southern States Bancshares (Nasdaq: SSBK) was founded in August 2007 and priced its IPO on August 11, 2021 History of solid growth, top-tier profitability and a strong credit culture Bifurcated expansion strategy primarily through organic growth and limited, disciplined M&A Focused on being a dominant bank in our smaller markets and a competitive player in the larger metropolitan areas Diversified loan portfolio complemented by lower-cost, core funding base Assets ($B): $2.8 Quarterly Asset Growth2: 1.1% NPLs / Loans: 0.29% Core Net Income1 ($M): $10.5 Gross Loans ($B): $2.2 Quarterly Loan Growth2: 4.9% ACL / Loans: 1.27% Core ROAA1: 1.45% Deposits ($B): $2.4 Quarterly Brokered Deposits Declined: 22.7% NCOs / Avg. Loans: (0.04)% NIM: 3.66% Loans / Deposits: 92.34% Quarterly Deposit Excluding Brokered Growth2: 6.2% TCE / TA1: 8.47% Core Efficiency Ratio1: 47.78% Overview of Southern States Bancshares, Inc.

4 | Branches (15) Legend Huntsville Birmingham Montgomery Columbus Atlanta Alabama Georgia 65 85 75 Anniston Auburn 20 85 75 85 65 65 59 Tuscaloosa LPOs (2) Mobile Savannah Macon Valdosta Augusta Dominant Bank in Small Market; Competitive Player in Large Metropolitan Areas

$62.3 $69.2 $72.8 $88.1 $93.1 $70.7 $83.3 Columbus MSA Auburn- Opelika MSA Birmingham MSA Huntsville MSA Atlanta MSA Southeast Average National Average 1.6% 1.9% 4.7% 5.9% 6.6% 3.2% 2.1% Birmingham MSA Columbus MSA Atlanta MSA Huntsville MSA Auburn- Opelika MSA Southeast Average National Average Columbus, GA Major Employers Market Highlights 5 | Robust Market Dynamics - 8th largest Metro Area in the USA - Ranked 10th largest economy in the country - Ranked 13th Best Places for Business and Careers by Forbes - 17 Fortune 500 companies headquartered in Atlanta - Largest market in Alabama, supported by strong steel, biotechnology, and banking industries - Ranked 2nd best US city for job seekers by MoneyGeek - University of Alabama Birmingham serves as an international leader in medicine and dentistry - Voted best place to live in the country by US News - Highest concentration of engineers in the US - Ranked #1 best city for STEM workers by Livability - Home of the Redstone Arsenal which includes the U.S. Space and Rocket Center, NASA’s Marshall Space Flight Center, and the U.S. Army Aviation and Missile Command - Auburn University contributes $5.6 billion annually and 27,000 jobs to the Alabama economy - Named top-five growth city in America by U-Haul - High-tech manufacturing and industrial hub for companies like Kia Motors, Hanwha Cimarron, and Niagara Bottling - Fort Benning Military Base • U.S. Army Infantry and Armor Training Post • Columbus Chamber of Commerce estimates annual economic impact of $4.8 billion - Major companies headquartered include Aflac and Total Systems Services, Inc. - Contains seven colleges and universities, with 83,000 students pursuing degrees in higher education Huntsville, AL Birmingham, AL Atlanta, GA ‘28 Projected Median HHI ($M) ‘23 – ‘28 Projected Population Growth (%) Auburn / Opelika, AL Source: U.S. Bureau of Labor Statistics; S&P Global Market Intelligence; Fortune; Forbes; Money.com; moneygeek.com; Business Facilities; USA Today; Livability,com; US News; Auburn.edu; Columbus, Georgia Economic Development Note: Southeast defined as AL, AR, FL. GA, KY, LA, MS, NC. SC, TN, VA, and WV

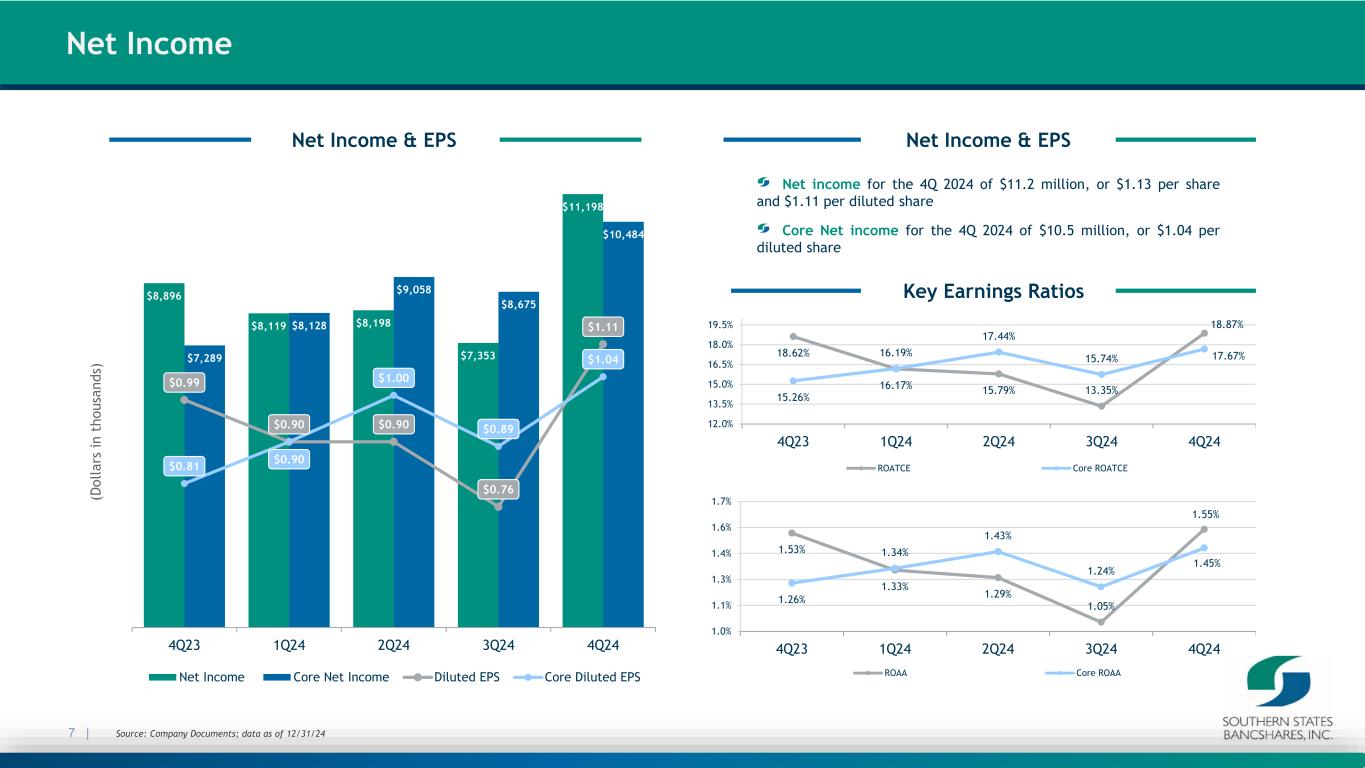

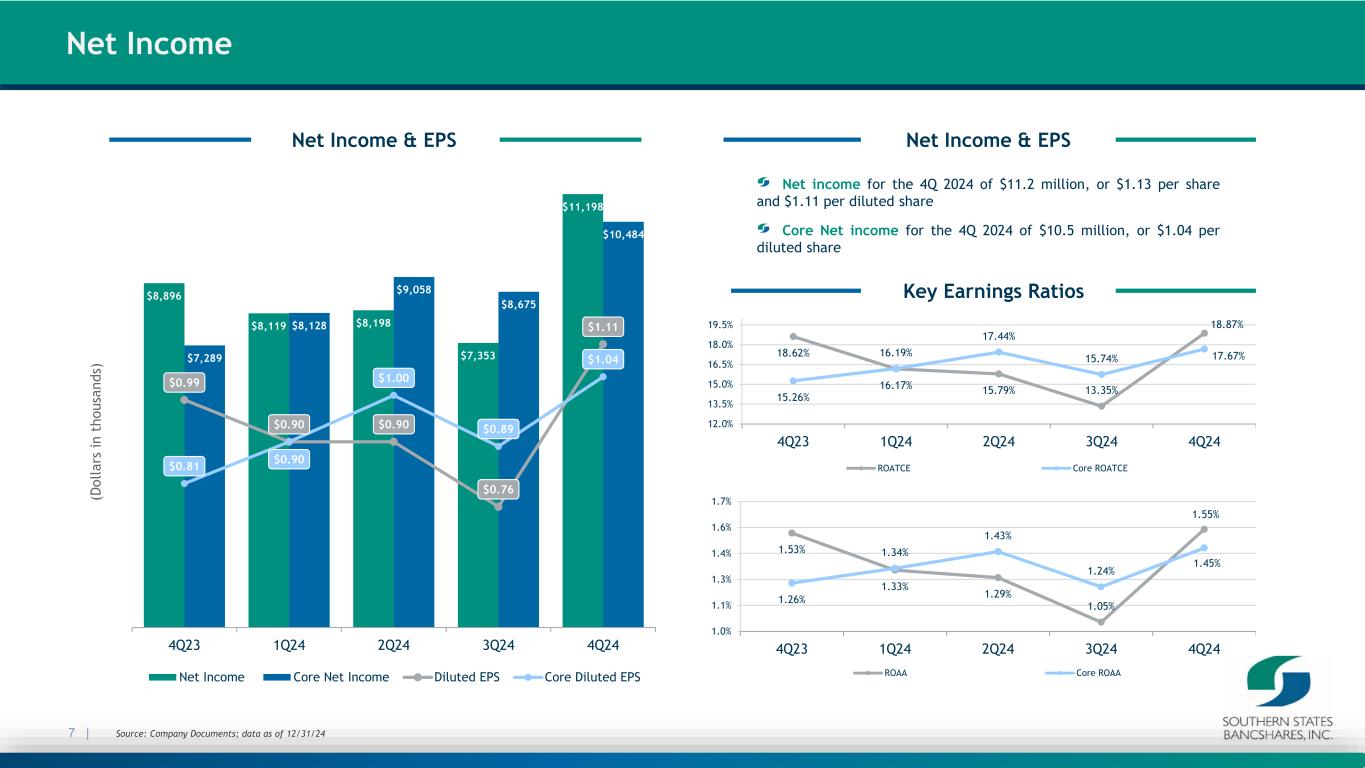

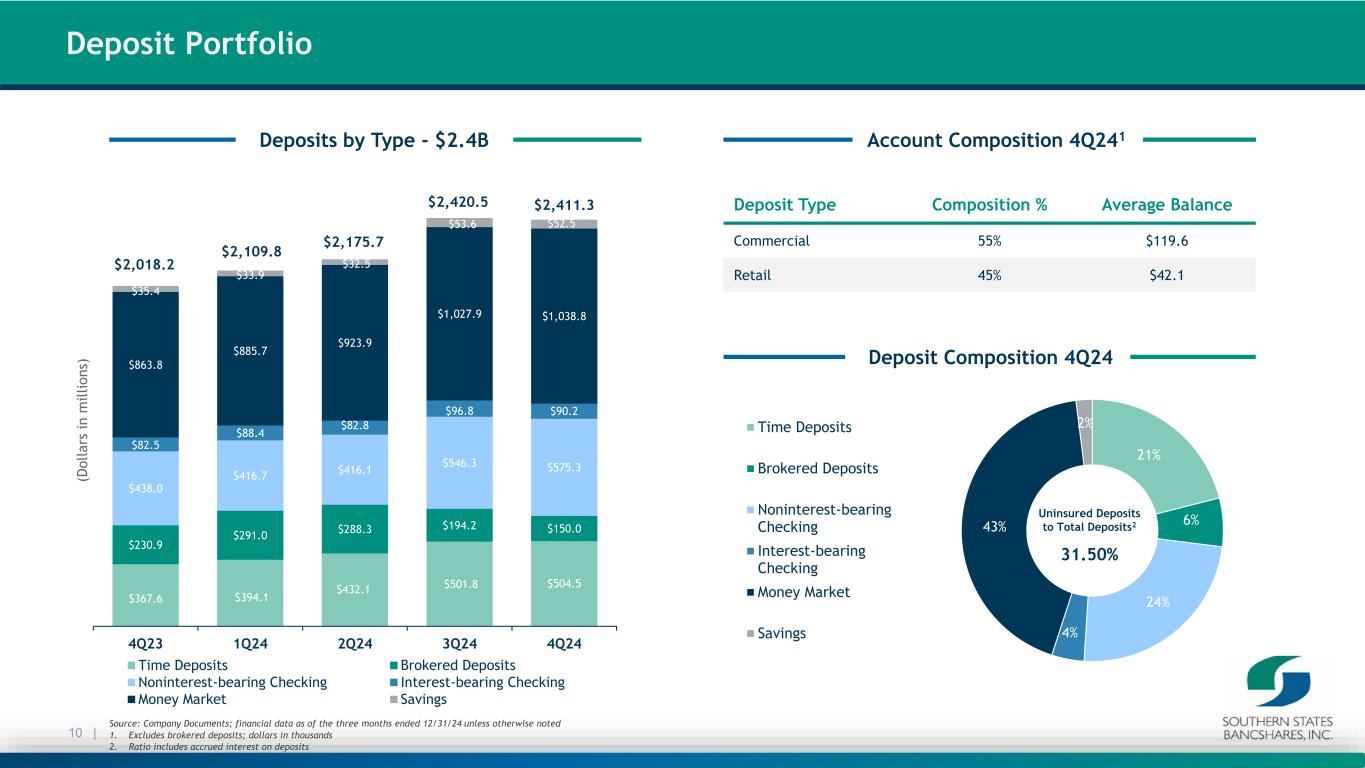

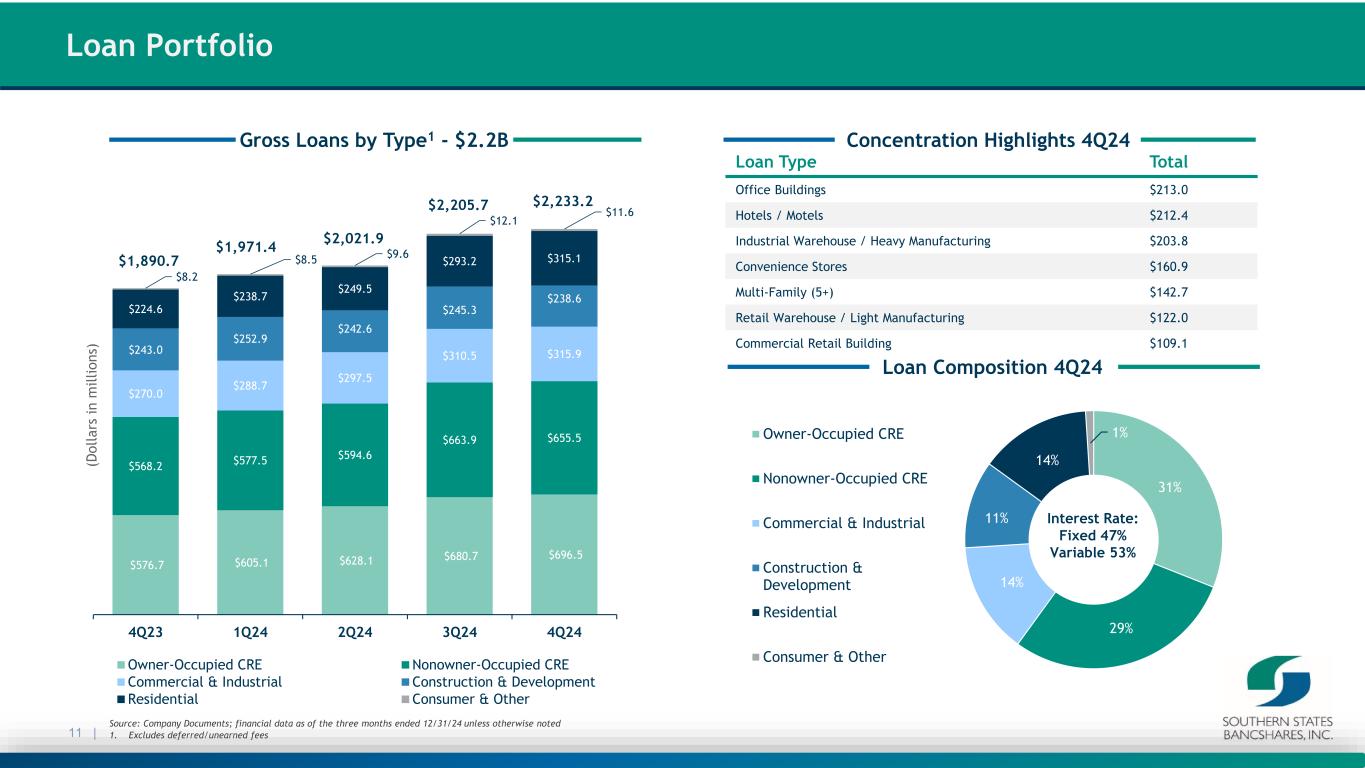

Profitability1 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Net Income $8,896 $8,119 $8,198 $7,353 $11,198 Core Net Income $7,289 $8,128 $9,058 $8,675 $10,484 ROAA 1.53% 1.33% 1.29% 1.05% 1.55% Core ROAA 1.26% 1.34% 1.43% 1.24% 1.45% ROAE 17.02% 14.87% 14.55% 11.89% 16.13% ROATCE 18.62% 16.17% 15.79% 13.35% 18.87% Core ROATCE 15.26% 16.19% 17.44% 15.74% 17.67% Net Interest Margin 3.69% 3.59% 3.56% 3.65% 3.66% Net Interest Margin - FTE 3.71% 3.60% 3.57% 3.66% 3.67% Efficiency Ratio 41.48% 46.90% 49.78% 52.79% 46.67% Core Efficiency Ratio 45.78% 46.90% 44.75% 46.96% 47.78% Per Share Data1 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Share Price $29.28 $25.92 $27.14 $30.73 $33.31 Tangible Book Value $22.30 $23.07 $23.91 $23.38 $24.04 Price / Tangible Book Value 1.3x 1.1x 1.1x 1.3x 1.4x Cash Dividend per Common Share $0.09 $0.09 $0.09 $0.09 $0.09 Basic EPS $1.00 $0.91 $0.91 $0.76 $1.13 Diluted EPS $0.99 $0.90 $0.90 $0.76 $1.11 Core Diluted EPS $0.81 $0.90 $1.00 $0.89 $1.04 Balance Sheet Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Total Assets $2,446,663 $2,510,975 $2,572,011 $2,841,440 $2,849,264 Total Loans $1,884,508 $1,965,149 $2,015,434 $2,199,211 $2,226,569 Total Deposits $2,018,189 $2,109,798 $2,175,678 $2,420,546 $2,411,297 Loans / Deposits 93.38% 93.14% 92.63% 90.86% 92.34% TCE / Tangible Assets 8.12% 8.23% 8.34% 8.25% 8.47% Avg. Cost of Deposits 2.86% 3.12% 3.27% 3.19% 2.96% Annualized Loan Growth 24.7% 17.2% 10.3% 36.3% 4.9% Avg. Yield on Loans 6.91% 7.06% 7.17% 7.21% 7.03% NPL / Gross Loans 0.06% 0.17% 0.19% 0.36% 0.29% NCOs / Avg. Loans 0.08% 0.10% 0.08% 0.07% (0.04)% Loss Provision / Avg. Loans 0.56% 0.26% 0.22% 0.48% 0.01% Quarterly Financial Highlights 6 | Source: Company Documents; data as of 12/31/24 1. Please refer to non-U.S. GAAP reconciliation in the appendix

7 | Net Income & EPS Source: Company Documents; data as of 12/31/24 Net Income (D ol la rs in t ho us an ds ) Net Income & EPS Net income for the 4Q 2024 of $11.2 million, or $1.13 per share and $1.11 per diluted share Key Earnings Ratios 18.62% 16.17% 15.79% 13.35% 18.87% 15.26% 16.19% 17.44% 15.74% 17.67% 12.0% 13.5% 15.0% 16.5% 18.0% 19.5% 4Q23 1Q24 2Q24 3Q24 4Q24 ROATCE Core ROATCE $8,896 $8,119 $8,198 $7,353 $11,198 $7,289 $8,128 $9,058 $8,675 $10,484 $0.99 $0.90 $0.90 $0.76 $1.11 $0.81 $0.90 $1.00 $0.89 $1.04 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 110.0% 120.0% 130.0% 140.0% 150.0% $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 4Q23 1Q24 2Q24 3Q24 4Q24 Net Income Core Net Income Diluted EPS Core Diluted EPS Core Net income for the 4Q 2024 of $10.5 million, or $1.04 per diluted share 1.53% 1.33% 1.29% 1.05% 1.55% 1.26% 1.34% 1.43% 1.24% 1.45% 1.0% 1.1% 1.3% 1.4% 1.6% 1.7% 4Q23 1Q24 2Q24 3Q24 4Q24 ROAA Core ROAA

$15.8 $17.9 $19.4 $20.8 $19.9 $36.2 $38.7 $41.0 $45.0 $45.0 4Q23 1Q24 2Q24 3Q24 4Q24 Interest Expense Interest Income 8 | Source: Company Documents; data as of 12/31/24 Net Interest Income and Net Interest Margin Net Interest Income Net Interest Margin (D ol la rs in m ill io ns ) $20.4 $20.8 $21.6 $24.2 3.69% 3.59% 3.56% 3.65% 3.66% 6.91% 7.06% 7.17% 7.21% 7.03% 3.03% 3.27% 3.41% 3.31% 3.09% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 3.60% 3.70% 3.80% 3.90% 4Q23 1Q24 2Q24 3Q24 4Q24 Net Interest Margin Yield on Loans Cost of Funds $25.1

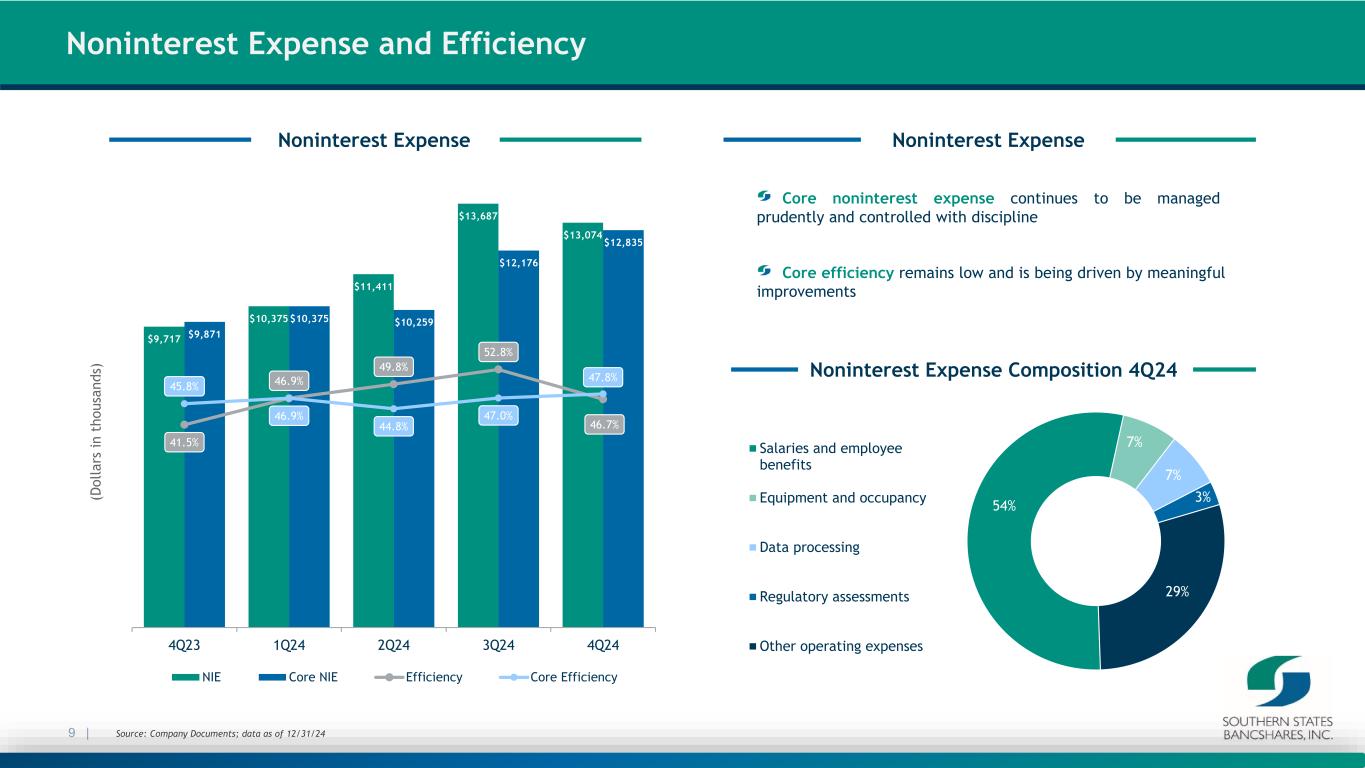

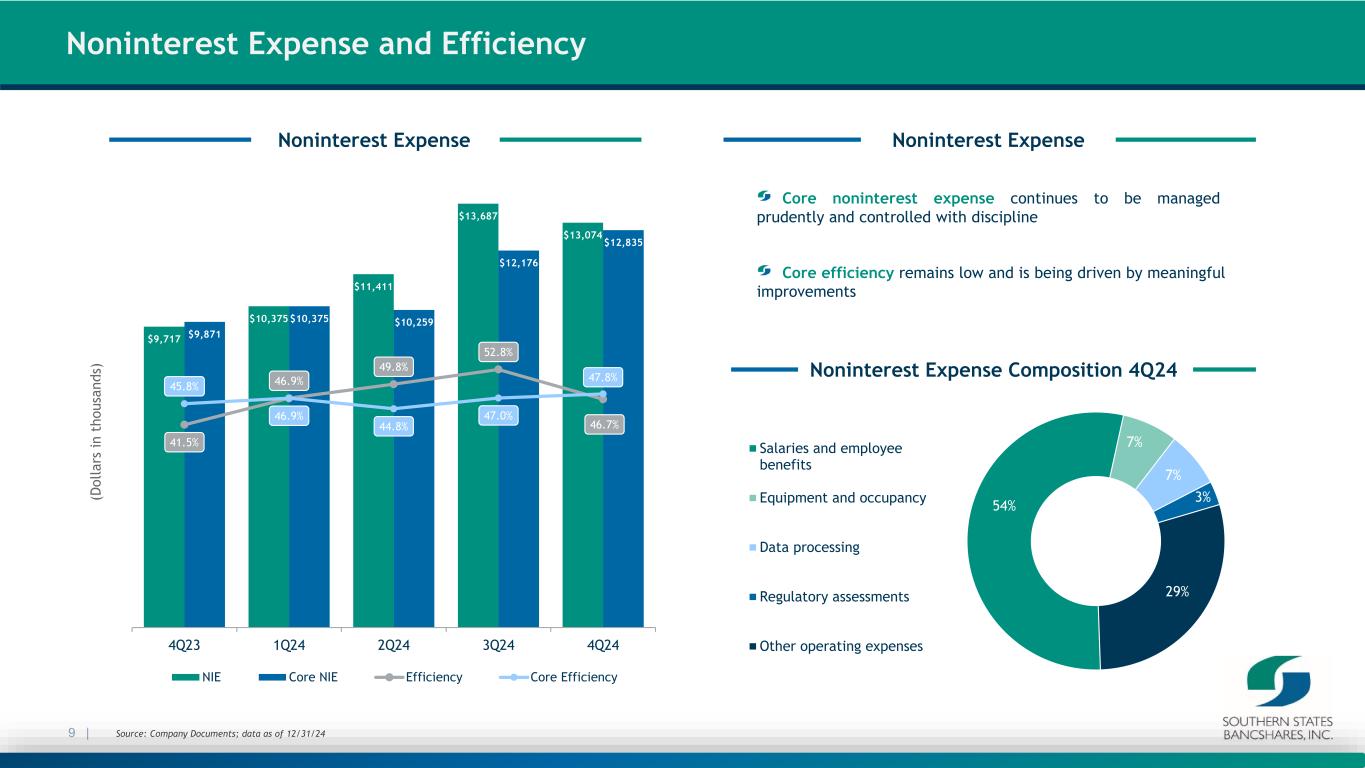

9 | Noninterest Expense Noninterest Expense and Efficiency (D ol la rs in t ho us an ds ) Noninterest Expense $9,717 $10,375 $11,411 $13,687 $13,074 $9,871 $10,375 $10,259 $12,176 $12,835 41.5% 46.9% 49.8% 52.8% 46.7% 45.8% 46.9% 44.8% 47.0% 47.8% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 4Q23 1Q24 2Q24 3Q24 4Q24 NIE Core NIE Efficiency Core Efficiency Core noninterest expense continues to be managed prudently and controlled with discipline Core efficiency remains low and is being driven by meaningful improvements Noninterest Expense Composition 4Q24 54% 7% 7% 3% 29% Salaries and employee benefits Equipment and occupancy Data processing Regulatory assessments Other operating expenses Source: Company Documents; data as of 12/31/24

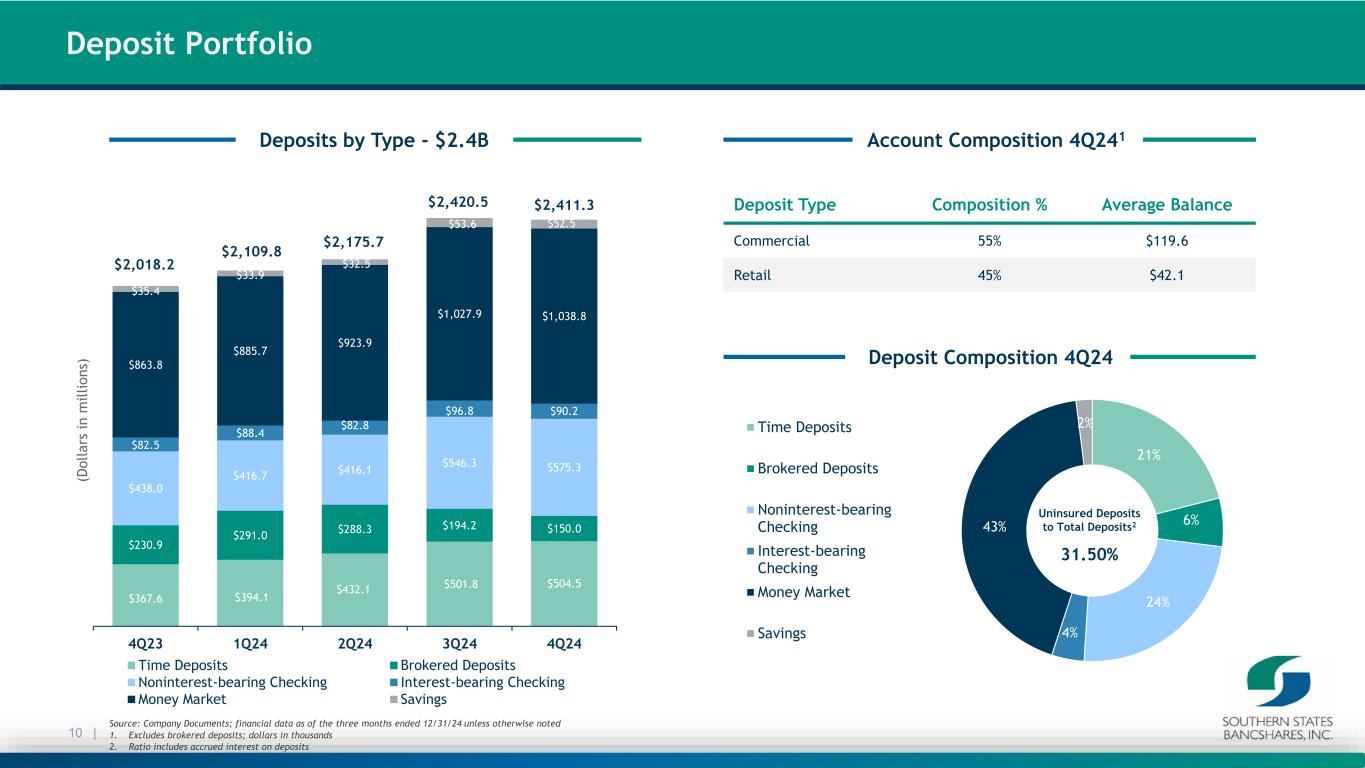

$367.6 $394.1 $432.1 $501.8 $504.5 $230.9 $291.0 $288.3 $194.2 $150.0 $438.0 $416.7 $416.1 $546.3 $575.3 $82.5 $88.4 $82.8 $96.8 $90.2 $863.8 $885.7 $923.9 $1,027.9 $1,038.8 $35.4 $33.9 $32.5 $53.6 $52.5 $2,018.2 $2,109.8 $2,175.7 $2,420.5 $2,411.3 4Q23 1Q24 2Q24 3Q24 4Q24 Time Deposits Brokered Deposits Noninterest-bearing Checking Interest-bearing Checking Money Market Savings (D ol la rs in m ill io ns ) 10 | Deposit Type Composition % Average Balance Commercial 55% $119.6 Retail 45% $42.1 Deposit Portfolio Deposits by Type - $2.4B Account Composition 4Q241 Deposit Composition 4Q24 21% 6% 24% 4% 43% 2%Time Deposits Brokered Deposits Noninterest-bearing Checking Interest-bearing Checking Money Market Savings Uninsured Deposits to Total Deposits2 31.50% Source: Company Documents; financial data as of the three months ended 12/31/24 unless otherwise noted 1. Excludes brokered deposits; dollars in thousands 2. Ratio includes accrued interest on deposits

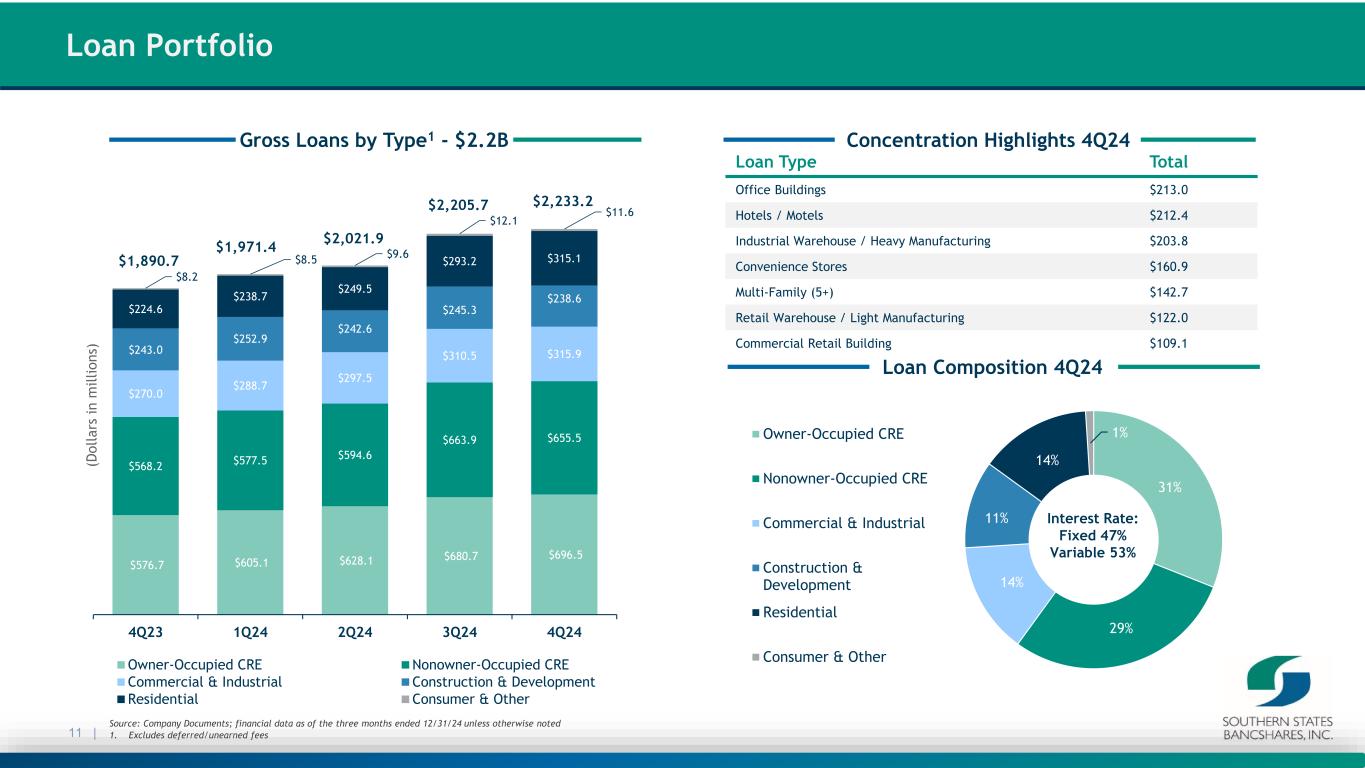

11 | Loan Portfolio Gross Loans by Type1 - $2.2B 31% 29% 14% 11% 14% 1%Owner-Occupied CRE Nonowner-Occupied CRE Commercial & Industrial Construction & Development Residential Consumer & Other Interest Rate: Fixed 47% Variable 53% Loan Composition 4Q24 Concentration Highlights 4Q24 $576.7 $605.1 $628.1 $680.7 $696.5 $568.2 $577.5 $594.6 $663.9 $655.5 $270.0 $288.7 $297.5 $310.5 $315.9$243.0 $252.9 $242.6 $245.3 $238.6 $224.6 $238.7 $249.5 $293.2 $315.1 $8.2 $8.5 $9.6 $12.1 $11.6 $1,890.7 $1,971.4 $2,021.9 $2,205.7 $2,233.2 4Q23 1Q24 2Q24 3Q24 4Q24 Owner-Occupied CRE Nonowner-Occupied CRE Commercial & Industrial Construction & Development Residential Consumer & Other (D ol la rs in m ill io ns ) Loan Type Total Office Buildings $213.0 Hotels / Motels $212.4 Industrial Warehouse / Heavy Manufacturing $203.8 Convenience Stores $160.9 Multi-Family (5+) $142.7 Retail Warehouse / Light Manufacturing $122.0 Commercial Retail Building $109.1 Source: Company Documents; financial data as of the three months ended 12/31/24 unless otherwise noted 1. Excludes deferred/unearned fees

12 | Office Building Loan Portfolio Office Building Loans $213.0M $74.1 $80.7 $82.7 $88.8 $92.3 $104.0 $112.3 $113.9 $120.8 $115.2 $13.7 $5.2 $8.1 $6.3 $5.5 0 50 100 150 200 4Q23 1Q24 2Q24 3Q24 4Q24 Owner-Occupied CRE Nonowner-Occupied CRE Construction & Development $191.8 $204.7 $215.9 $198.2 $213.0 Office Building Type 4Q24 # of Stories Total Six Stories 2 Five stories 1 Four stories 5 Three stories 7 One & two stories 240 (D ol la rs in m ill io ns ) 207 38 8 2 <$1 Million $1-$5 Million $5-$10 Million >$10 Million Geographic Comp: Alabama 72% Georgia 24% Other States 4% Office Building Loans 4Q24 Source: Company Documents; data as of 12/31/24

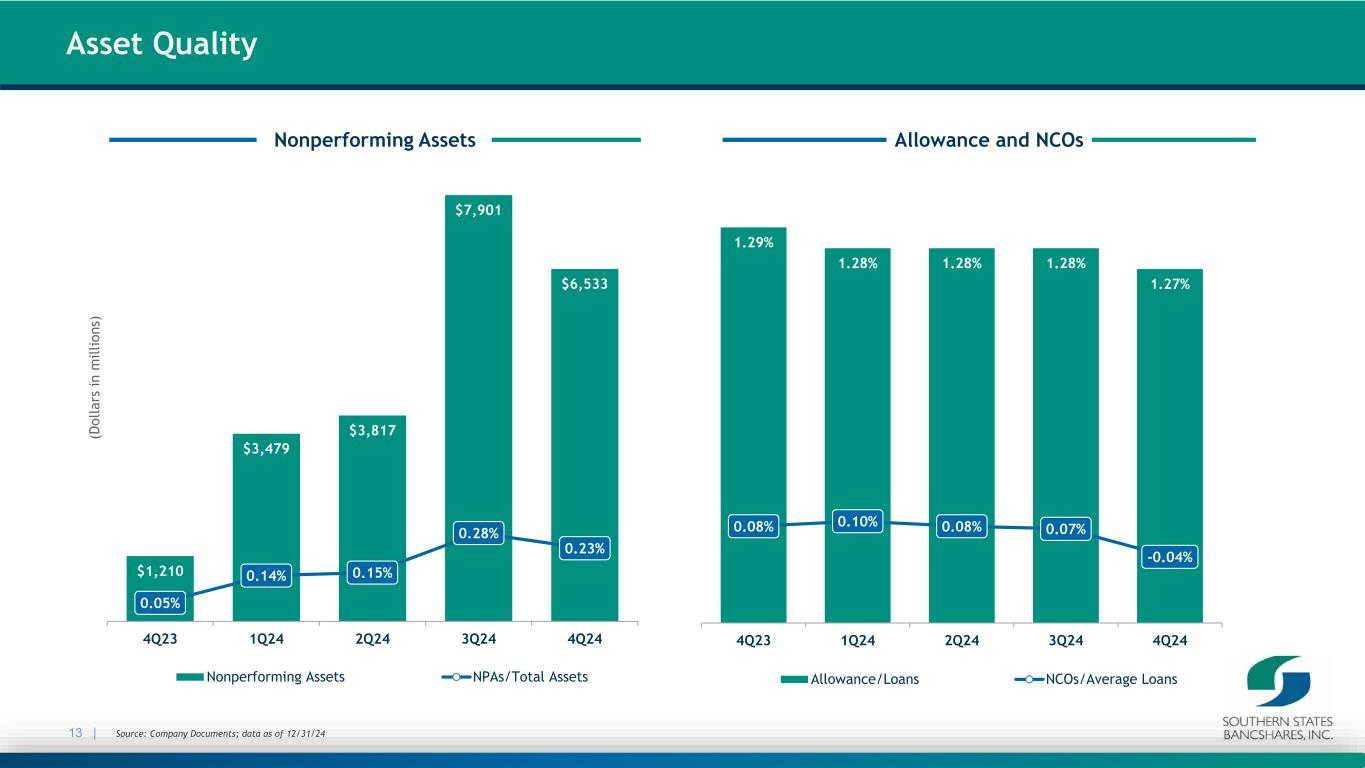

$1,210 $3,479 $3,817 $7,901 $6,533 0.05% 0.14% 0.15% 0.28% 0.23% -0.10% 0.10% 0.30% 0.50% 0.70% 0.90% 1.10% 1.30% 1.50% -$500 $500 $1,500 $2,500 $3,500 $4,500 $5,500 $6,500 $7,500 $8,500 4Q23 1Q24 2Q24 3Q24 4Q24 Nonperforming Assets NPAs/Total Assets (D ol la rs in m ill io ns ) 13 | Allowance and NCOs Asset Quality Nonperforming Assets 1.29% 1.28% 1.28% 1.28% 1.27% 0.08% 0.10% 0.08% 0.07% -0.04% -0.30% -0.10% 0.10% 0.30% 0.50% 0.70% 0.90% 1.10% 1.30% 1.50% 1.10% 1.15% 1.20% 1.25% 1.30% 4Q23 1Q24 2Q24 3Q24 4Q24 Allowance/Loans NCOs/Average Loans Source: Company Documents; data as of 12/31/24

14 | Risk-Based Capital & Leverage Ratios Capital Tangible Book Value & Stock Price $29.28 $25.92 $27.14 $30.73 $33.31 $22.30 $23.07 $23.91 $23.38 $24.04 0.00 6.00 12.00 18.00 24.00 30.00 36.00 0.00 5.00 10.00 15.00 20.00 25.00 30.00 35.00 4Q23 1Q24 2Q24 3Q24 4Q24 Stock price Tangible Book Value 1.3X 1.1X 1.1X 1.3X 1.4X 9.20% 9.39% 9.54% 9.36% 9.84% 14.29% 14.42% 14.50% 14.18% 14.73% 8.99% 8.79% 8.72% 8.64% 8.67% 7.0% 9.0% 11.0% 13.0% 15.0% 4Q23 1Q24 2Q24 3Q24 4Q24 CET1/Tier 1 Capital Total Capital Leverage Other Capital Ratios Q423 Q124 Q224 Q324 Q424 Total Equity to Total Assets 8.79% 8.88% 8.97% 9.55% 9.82% Tangible Common Equity to Tangible Assets 8.12% 8.23% 8.34% 8.25% 8.47% Cash Dividend per Common Share $0.09 $0.09 $0.09 $0.09 $0.09 Source: Company Documents; data as of 12/31/24

$704 $840 $1,030 $1,250 $1,587 $1,885 $2,227 2018 2019 2020 2021 2022 2023 2024 $776 $951 $1,140 $1,556 $1,721 $2,018 $2,411 2018 2019 2020 2021 2022 2023 2024 $888 $1,095 $1,333 $1,783 $2,045 $2,447 $2,849 2018 2019 2020 2021 2022 2023 2024 Total Deposits ($M) Total Loans ($M) $7.7 $5.6 $12.1 $18.6 $27.1 $32.0 $34.9 $0.81 $1.18 $1.56 $2.23 $3.02 $3.53 $3.67 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 2018 2019 2020 2021 2022 2023 2024 Net Income Diluted EPS 15 | Growth History Total Assets ($M) Net Income ($M) Source: Company Documents; data as of 12/31/24

16 | Building Shareholder Value Maintain focus on strong, profitable organic growth without compromising our credit quality Further develop and grow our core deposit franchise Expand into new markets by hiring commercial bankers Focus on high growth markets and further expand our Atlanta franchise Evaluate strategic acquisition opportunities Prudently manage capital between balance sheet growth and return to shareholders Our Strategic Focus

Appendix 17 |

18 | Non-GAAP Financial Measures Reconciliations Three Months Ended Twelve Months Ended December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Net income $ 11,198 $ 7,353 $ 8,896 $ 34,868 $ 31,952 Add: One-time retirement related expenses — — — — 1,571 Add: Professional fees related to ERC 236 — — 236 — Add: Wire fraud loss — — — 1,155 — Add: Merger-related expenses — 1,511 — 1,511 — Add: Net OREO loss (gain) 3 — (154) — (156) Less: Employee retention credit 1,154 — — 1,162 — Less: Fee received on early loan payoff — — 1,863 — 1,863 Less: Net gain on securities 25 75 98 108 555 Less: Tax effect (226) 114 (508) 161 (241) Core net income $ 10,484 $ 8,675 $ 7,289 $ 36,339 $ 31,190 Average assets $ 2,875,981 $ 2,777,215 $ 2,303,398 $ 2,664,353 $ 2,211,742 Core return on average assets 1.45 % 1.24 % 1.26 % 1.36 % 1.41 %

19 | Non-GAAP Financial Measures Reconciliations Three Months Ended Twelve Months Ended December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Net income $ 11,198 $ 7,353 $ 8,896 $ 34,868 $ 31,952 Add: One-time retirement related expenses — — — — 1,571 Add: Professional fees related to ERC 236 — — 236 — Add: Wire fraud loss — — — 1,155 — Add: Merger-related expenses — 1,511 — 1,511 — Add: Net OREO loss (gain) 3 — (154) — (156) Add: Provision 72 2,583 2,579 4,957 6,090 Less: Employee retention credit 1,154 — — 1,162 — Less: Fee received on early loan payoff — — 1,863 — 1,863 Less: Net gain on securities 25 75 98 108 555 Add: Income taxes 3,696 2,380 2,330 10,724 9,068 Pretax pre-provision core net income $ 14,026 $ 13,752 $ 11,690 $ 52,181 $ 46,107 Average assets $ 2,875,981 $ 2,777,215 $ 2,303,398 $ 2,664,353 $ 2,211,742 Pretax pre-provision core return on average assets 1.94 % 1.97 % 2.01 % 1.96 % 2.08 %

20 | Non-GAAP Financial Measures Reconciliations 1. Assumes a 24.0% tax rate Three Months Ended Twelve Months Ended December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Net interest income $ 25,050 $ 24,246 $ 20,404 $ 91,707 $ 80,112 Add: Fully-taxable equivalent adjustments(1) 66 75 99 288 312 Net interest income - FTE $ 25,116 $ 24,321 $ 20,503 $ 91,995 $ 80,424 Net interest margin 3.66 % 3.65 % 3.69 % 3.61 % 3.81 % Effect of fully-taxable equivalent adjustments(1) 0.01 % 0.01 % 0.02 % 0.02 % 0.01 % Net interest margin - FTE 3.67 % 3.66 % 3.71 % 3.63 % 3.82 % Total stockholders' equity $ 279,889 $ 271,370 $ 214,964 $ 279,889 $ 214,964 Less: Intangible assets 42,115 40,318 17,761 42,115 17,761 Tangible common equity $ 237,774 $ 231,052 $ 197,203 $ 237,774 $ 197,203

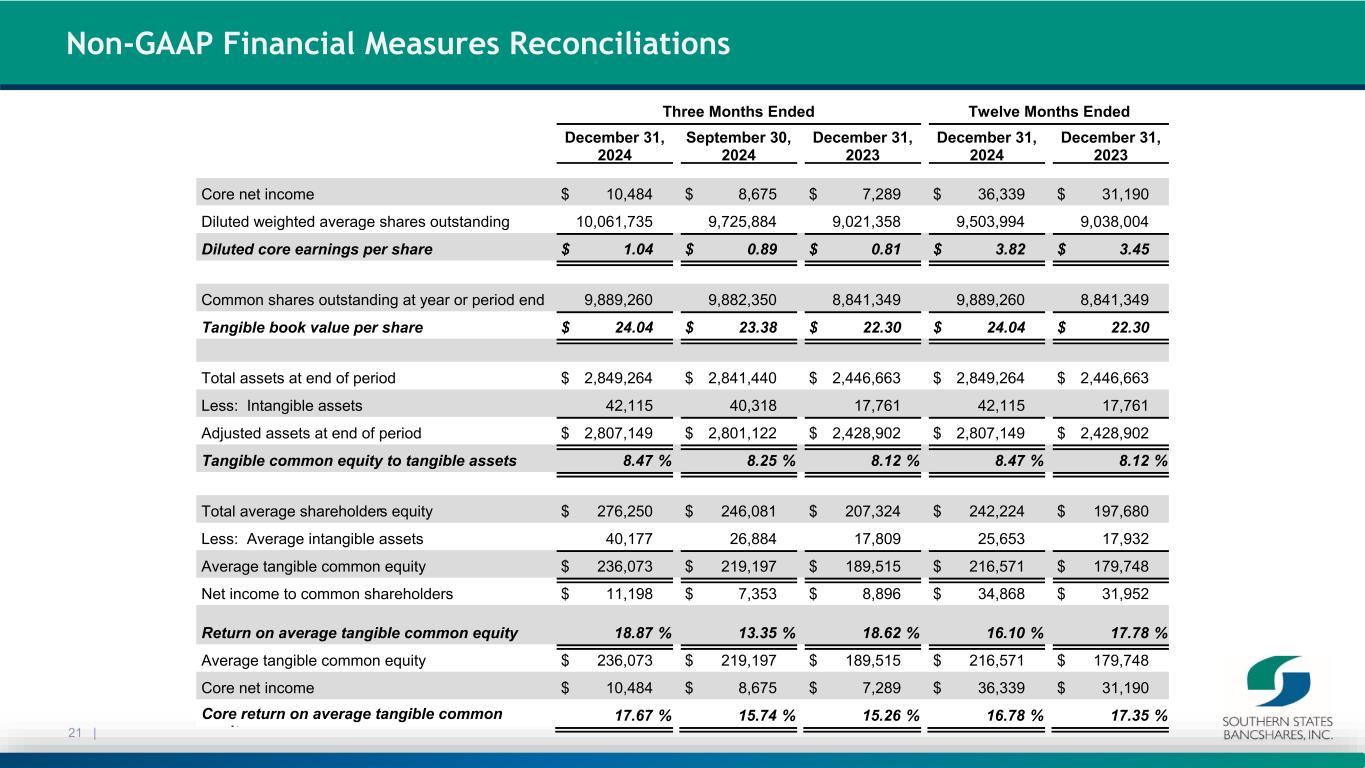

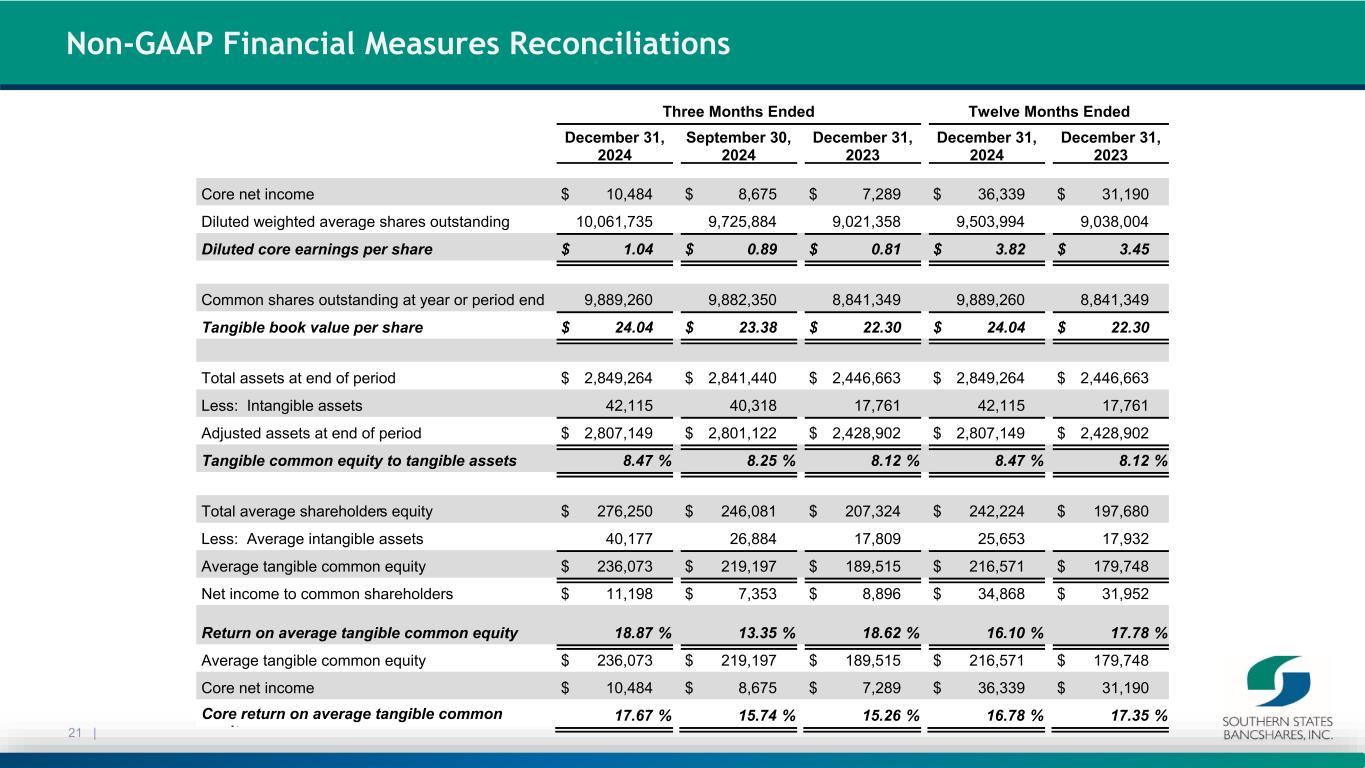

21 | Non-GAAP Financial Measures Reconciliations Three Months Ended Twelve Months Ended December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Core net income $ 10,484 $ 8,675 $ 7,289 $ 36,339 $ 31,190 Diluted weighted average shares outstanding 10,061,735 9,725,884 9,021,358 9,503,994 9,038,004 Diluted core earnings per share $ 1.04 $ 0.89 $ 0.81 $ 3.82 $ 3.45 Common shares outstanding at year or period end 9,889,260 9,882,350 8,841,349 9,889,260 8,841,349 Tangible book value per share $ 24.04 $ 23.38 $ 22.30 $ 24.04 $ 22.30 Total assets at end of period $ 2,849,264 $ 2,841,440 $ 2,446,663 $ 2,849,264 $ 2,446,663 Less: Intangible assets 42,115 40,318 17,761 42,115 17,761 Adjusted assets at end of period $ 2,807,149 $ 2,801,122 $ 2,428,902 $ 2,807,149 $ 2,428,902 Tangible common equity to tangible assets 8.47 % 8.25 % 8.12 % 8.47 % 8.12 % Total average shareholders equity $ 276,250 $ 246,081 $ 207,324 $ 242,224 $ 197,680 Less: Average intangible assets 40,177 26,884 17,809 25,653 17,932 Average tangible common equity $ 236,073 $ 219,197 $ 189,515 $ 216,571 $ 179,748 Net income to common shareholders $ 11,198 $ 7,353 $ 8,896 $ 34,868 $ 31,952 Return on average tangible common equity 18.87 % 13.35 % 18.62 % 16.10 % 17.78 % Average tangible common equity $ 236,073 $ 219,197 $ 189,515 $ 216,571 $ 179,748 Core net income $ 10,484 $ 8,675 $ 7,289 $ 36,339 $ 31,190 Core return on average tangible common it 17.67 % 15.74 % 15.26 % 16.78 % 17.35 %

22 | Non-GAAP Financial Measures Reconciliations Three Months Ended Twelve Months Ended December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 December 31, 2023 Net interest income $ 25,050 $ 24,246 $ 20,404 $ 91,707 $ 80,112 Add: Noninterest income 2,990 1,757 3,118 7,390 8,874 Less: Employee retention credit 1,154 — — 1,162 — Less: Fee received on early loan payoff — — 1,863 — 1,863 Less: Net gain on securities 25 75 98 108 555 Operating revenue $ 26,861 $ 25,928 $ 21,561 $ 97,827 $ 86,568 Expenses: Total noninterest expense $ 13,074 $ 13,687 $ 9,717 $ 48,548 $ 41,876 Less: One-time retirement related expenses — — — — 1,571 Less: Professional fees related to ERC 236 — — 236 — Less: Wire fraud loss — — — 1,155 — Less: Merger-related expenses — 1,511 — 1,511 — Less: Net OREO loss (gain) 3 — (154) — (156) Less: Loss on sale of branches — — — — — Adjusted noninterest expenses $ 12,835 $ 12,176 $ 9,871 $ 45,646 $ 40,461 Core efficiency ratio 47.78 % 46.96 % 45.78 % 46.66 % 46.74 %