- JBGS Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

JBG SMITH Properties (JBGS) 8-KRegulation FD Disclosure

Filed: 4 Jun 18, 12:00am

I N V E S T O R P R E S E N T A T I O N J U N E 2 0 1 8 CEB Tower at Central Place Lobby

D I S C L O S U R E S Forward-Looking Statements Certain statements contained herein may constitute “forward-looking statements” as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not guarantees of performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Consequently, t he future results of JBG SMITH Properties (“JBG SMITH” or the “Company”) may differ materially from those expressed in these for ward-looking statements. You can find many of these statements by looking for words such as “approximate”, “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans”, “would”, “may” or similar expressions in this document. We also note the following forward-looking statements: annualized net operating income; our expected NOI growth in the case of our construction and near-term development assets, estimated square feet, estimated number of units, the estimated completion date, estimated stabili zation date, estimated incremental investment, estimated total investment, projected net operating income yield and estimated stabilized net operating income; and in the case of our future development assets, estimated potential development density, and estimated total investment. Many of the factors that will de termine the outcome of these and our other forward-looking statements are beyond our ability to control or predict. These factors include, among others: adverse economic conditions in the Washington, DC metropolitan area, the timing of and costs associated with development and property improvements, financing co mmitments, and general competitive factors. For further discussion of factors that could materially affect the outcome of our fo rward-looking statements and other risks and uncertainties, see “Risk Factors” and the Cautionary Statement Concerning Forward-Looking Statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2017. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances occurring after the issuance of the Company’s Annual Report of Form 10-K or Quarterly Report on Form 10-Q, as applicable, and this investor presentation. Organization and Basis of Presentation JBG SMITH was formed by Vornado Realty Trust (“Vornado”) for the purpose of receiving via the spin-off on July 17, 2017, substantially all of the assets and liabilities of Vornado’s Washington, DC segment, which operated as Vornado / Charles E. Smith, ( the “Vornado Included Assets”). On July 18, 2017, JBG SMITH acquired the management business and certain assets (the “JBG Assets”) of The JBG Companies (“JBG”). The spin-off from Vornado and combination with JBG are collectively referred to as the "Formation Transaction." The Vornado Included Assets are considered the ac counting predecessor. As a result, the financial results of the JBG Assets are only included in the combined company’s financial statements from July 18, 2017 forward and are not reflected in the combined company’s historical financial statements for any prior period. Consequently, our results for the periods before and after the Formation Transaction are not directly comparable. We believe, however, that presenting certain supplemental adjusted financial and operational information at the property-level that is "adjusted" to include the results of the JBG Assets for periods prior to the acquisition date may be useful to investo rs. No other adjustments have been made to this supplemental adjusted information, which is purely informational and does not purport to be indicative of what would have happened had the acquisit ion of the JBG Assets occurred at the beginning of the periods presented. The information contained in this investor presentation does not purport to disclose all items required by the accounting pri nciples generally accepted in the United States of America (“GAAP”) and is unaudited information, unless otherwise indicated. Pro Rata Information We present certain financial information and metrics in this Investor Report “at JBG SMITH Share,” which refers to our owners hip percentage of consolidated and unconsolidated assets in real estate ventures (collectively, “real estate ventures”) as applie d to these financial measures and metrics. Financial information “at JBG SMITH Share” is calculated on an asset-by-asset basis by applying our percentage economic interest to each applicable line item of that asset’s financial information. “At JBG SMITH Share” information, which we also refer to as being “at share,” “our pro rata share” or “our share,” is not, and is not intended to be, a presentation in accordance with GAAP. Given that a substantial portion of our assets are held through real estate ventures, w e believe this form of presentation, which presents our economic interests in the partially owned entities, provides investors valuable information regarding a significant component of our portfolio, its composition, performance and capitalization. We do not control the unconsolidated real estate ventures and do not have a legal claim to our co -venturers’ share of assets, liabilities, revenue and expenses. The operating agreements of the unconsolidated real estate ventures gener ally allow each co-venturer to receive cash distributions to the extent there is available cash from operations. The amount of cash each investor receives is based upon specific provisions of each operating agreement and varies depending on certain factors including the amount of capital contributed by each investor and whether any investors are entitled to preferential distributions. With respect to any such third-party arrangement, we would not be in a position to exercise sole decision-making authority regarding the property, real estate venture or other entity, and may, under certain circumstances, be exposed to economic risks no t present were a third-party not involved. We and our respective co-venturers may each have the right to trigger a buy-sell or forced sale arrangement, which could cause us to sell our interest, or acquire our co-venturers’ interests, or to sell the underlying asset, either on unfavorable terms or at a time when we otherwise would not have initiat ed such a transaction. Our real estate ventures may be subject to debt, and the repayment or refinancing of such debt may require equity capital calls. To the extent our co -venturers do not meet their obligations to us or our real estate ventures or they act inconsistent with the interests of the real estate venture, we may be adversely affected. Because of these limitations, the non-GAAP “at JBG SMITH Share” financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP. Market Data Market data and industry forecasts are used in this Investor Report, including data obtained from publicly available sources. These sources generally state that the information they provide has been obtained from sources believed to be the reliable, but the accuracy and completeness of the information is not assured. The Company has not independently verified any such information. Not an Offer This document is not an offer to sell or solicitation of an offer to buy any securities. Any offers to sell or solicitations to buy securities shall be made by means of a prospectus approved for that purpose. All information shown as of March 31, 2018 and all data shown at JBG SMITH share, unless otherwise noted.

J B G S M I T H : C O M P A N Y H I G H L I G H T S Weighted Average Lease Term Net Debt/Annualized Adjusted 4747 Bethesda Avenue (Rendering) 1 6.9x EBITDA 33.7% Net Debt/Total Enterprise Value $7.0B Total Enterprise Value $371M Annualized Q1 2018 NOI 86 Walk Score Over 98% Metro Served 5.6 Years 5.6M Commercial SF + 12.3M Multifamily SF Future Development Pipeline 1.1M Commercial SF + 1,568 Multifamily Units Under Construction 12.2M Commercial SF + 4,232 Multifamily Units Operating Portfolio

J B G S M I T H : I N V E S T M E N T R A T I O N A L E Aerial View of Washington, DC A PROVEN VALUE LIQUIDITY AND UNRIVALED OF HIGH-QUALITY THE DC MARKET DIFFERENTIATED STRENGTH TO PROFILE BEST URBAN GROWTH 2 CONCENTRATION SIGNIFICANT CREATOR WITH A IS POISED FOR ASSETS IN GROWTH FINANCIAL STRATEGY SUBMARKETS SUPPORT GROWTH MARKET PORTFOLIO BALANCE SHEET GROWTH PLATFORM

J B G S M I T H : P L A T F O R M D I F F E R E N T I A T E S S T R A T E G Y THROUGH INVESTMENT CONCENTRATION 3 JBG SMITH’S EXPERTISE IN ALL 3 URBAN PRODUCT TYPES MAXIMIZES VALUE AND MIXED-USE PLACEMAKING R E T A I L M U L T I F A M I LY O F F I C E •Track record of recognizing and capitalizing on mixed-use opportunities that others with a single focus cannot •Strong bench of mixed-use real estate expertise across office, multifamily, and retail •Vertically integrated platform with track record of value creation across market cycles •Size and scale to drive efficiencies •Placemaking expertise maximizes value of high-density, Metro-served real estate •Reputation for speed, certainty, creativity, and fair dealing leads to favorable economics

J B G S M I T H : D I S C I P L I N E D A N D E X P E R I E N C E D L E A D E R S H I P T E A M CEB Tower at Central Place Rosslyn, VA INTERESTS ASSOCIATED WITH LONG-EQUITY COMPENSATION 4 SEASONED TEAM WITH LONG HISTORY TOGETHER 100% OF SVPs AND ABOVE HAVE PERFORMANCE-BASED GOALS AND INCENTIVES TERM VALUE CREATION MEANINGFUL ALIGNMENT WITH SHAREHOLDER Name and Title Age Years with JBGS Matt Kelly Chief Executive Officer and Trustee 45 13 Rob Stewart Executive Vice Chairman and Trustee 56 30 Dave Paul President & Chief Operating Officer 55 10 Steve Theriot Chief Financial Officer 58 5 James Iker Chief Investment Officer 45 15 Brian Coulter Co-Chief Development Officer 58 30 Kai Reynolds Co-Chief Development Officer 48 14 Patrick Tyrrell Chief Administrative Officer 57 15 Steve Museles Chief Legal Officer 55 1 Angie Valdes Chief Accounting Officer 49 1 MANAGEMENT AND BOARD OF TRUSTEES OWN OR REPRESENT OVER 10% OF THE EQUITY OF JBGS STRONG COLLABORATIVE CORPORATE CULTURE

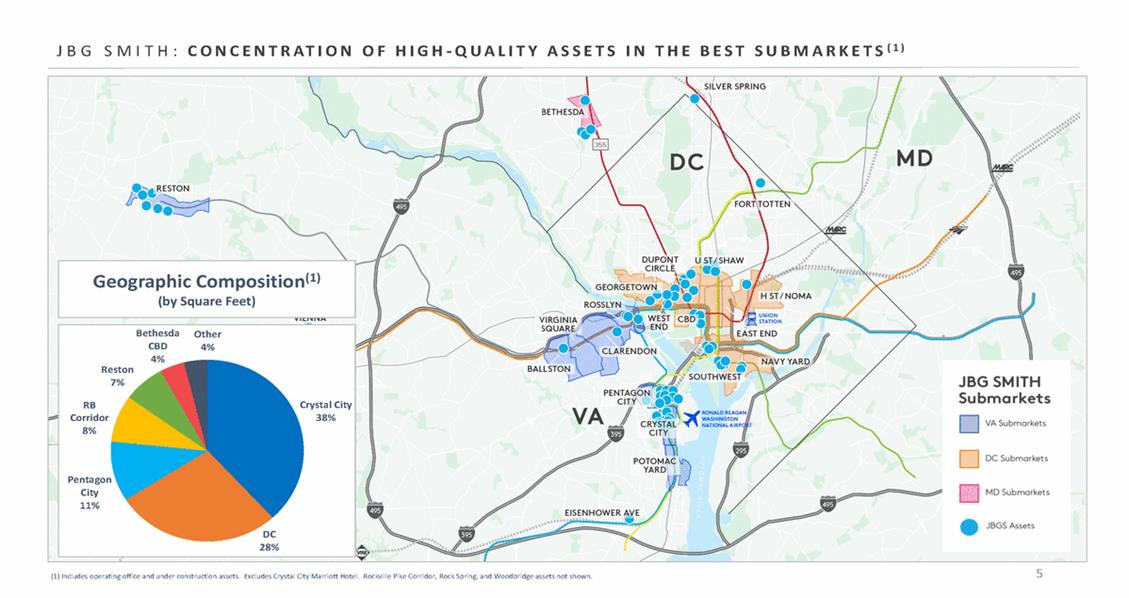

S U B M A R K E T S (1) J B G S M I T H : C O N C E N T R A T I O N O F H I G H - Q U A L I T Y A S S E T S I N T H E B E S T 5 (1) Includes operating office and under construction assets. Excludes Crystal City Marriott Hotel. Rockville Pike Corridor, Rock Spring, and Woodbridge assets not shown. BethesdaOther CBD4% 4% Reston 7% RBCrystal City Corridor38% 8% Pentagon City 11% DC 28% Geographic Composition(1) (by Square Feet)

Portfolio Composition (18.1M SF Total) by Rentable Square Footage OPERATINGDEVELOPMENT Operating Other 2% Under Construction 13% Operating Office 50 Assets 11.8M SF Under Construction Assets 10 Assets 1.1M SF / 1,568 Units Operating Multifamily 20% Operating Multifamily 14 Assets 4,232 Units Near-Term Development Pipeline 0 Assets + 17.9M SF Future Development Pipeline Operating Office 65% Operating Other(1) 4 Assets 348K SF Future Development Pipeline 43 Assets 17.9M SF Estimated Potential Development Density 6

J B G S M I T H : I N V E S T O R U P D A T E 7 The Foundry Washington, DC FIRST QUARTER RESULTS FUTURE GROWTH CAPITAL ALLOCATION VIEW OF THE MARKET

M A R K E T : E X E C U T I V E S U M M A R Y O F F I C E S P E N D I N G 8 F E D E R A L R E B O U N D W A L K A B I L I T Y M A T T E R S A M E N I T Y R I C H S U B M A R K E T S O U T P E R F O R M P O C K E T SO F O P P O R T U N I T Y D E C L I N I N G M U L T I F A M I L Y S U P P L Y P I P E L I N E C O N T I N U E D S T R O N G J O B G R O W T H T H E R E A R E S I X K E Y T R E N D S B E H I N D O U R V I E W O F T H E M A R K E T

M A R K E T : T H I R D C O N S E C U T I V E Y E A R O F S T R O N G J O B G R O W T H Source: Bureau of Labor Statistics (“BLS”), JLL Research 9 JOB GROWTH (THOUSANDS) AVERAGE ANNUAL JOB GROWTH 100 80 60 40 20 0 -20 -40 -60 -80 200720082009201020112012201320142015201620172018 YTD 20-YEAR (1999-2018) AVERAGE: 42,700 74.5 55.6 41.1 10-YEAR (2009-2018) AVERAGE: 28,400 44.1 39.2 35.7 37.3 26.5 24.3 14.1 10.7 -68.8

DC MARKET IS MORE INSULATED FROM RECESSIONS RAPID RECOVERY AFTER HEADWINDS SUBSIDE 0.0% DC Metro AreaMajor Market Average (not including DC Metro Area) 1990 RecessionTech CrashGreat Recession 4.0% Major Market Average (not including DC Metro Area)DC Metro Area -1.0% -0.3% 3.0% 2.0% -2.0% % EMPLOYMENT CHANGE -4.0% -3.5% -3.4% -2.6% % EMPLOYMENT CHANGE 0.0% -1.0% -5.0% -4.6% -2.0% -6.0% -3.0% -7.0% -8.0% -6.7% -4.0% -5.0% MARKET HEADWINDS 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Source: JLL Research, BLS, Major Markets include: Dallas, Houston, Atlanta, Chicago, Miami, Seattle, Los Angeles, San Francisco, Phoenix, Boston, NYC, Philadelphia 10

M A R K E T : M U L T I F A M I L Y K E Y T H E M E S year volume and activity remained concentrated in more Source: JBGS market research estimates based on JLL historical and CoStar future projection data augmented with published pipelines from local media for core DC area counties (DC, Montgomery, Prince George’s, Arlington, Alexandria, Fairfax, Fairfax City, Falls Church, and Loudoun); 2020 total represents current construction, but may increase if 2019 deliveries are delayed or impending construction starts. Rent growth is sourced from JLL Research for JBGS submarkets. Investment sales data sourced from CoStar. 11 MARKET NOTES: • Delivery pipeline falling off in DC from peak in 2017 but unlikely to see rent growth in 2018 given lease-up of 2017 deliveries • 2019 pipeline has grown slightly with some new starts expected to deliver in late 2019 • Rent growth remains strong and rebounded through 2018 with 5.1% growth from 2017 to 2018 YTD – a pickup from flat performance in the beginning of the • Rents in non-JBGS submarkets were essentially flat from 2017-2018, reflecting how commodity markets react more negatively to an influx of new supply • Annualized investment sales in multifamily dropped off through the first quarter from 2017 levels • Class B sales remained approximately 40% of the suburban assets DELIVERIES 2008-2020 16,000$3.00 14,000 $2.50 12,000 $2.00 10,000 8,000$1.50 6,000 $1.00 4,000 $0.50 2,000 0$0.00 JBGS SUBMARKETSNON-JBGS SUBMARKETSJBGS Markets Rent Growth 2008200920102011201220132014201520162017 201820192020 10-YEAR AVERAGE: 8,889 UNITS

M A R K E T : O F F I C E K E Y T R E N D S $35 Source: JLL class-cut historical data for Washington, DC and Arlington submarkets 12 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 DC Class BArlington B $55 $50 $50 $45 $40 $39 $30 $25 TrophyClass AClass B $95 $83 $85 $75 $65 $65 $55 $45$50 $35 $25 TrophyClass AClass B 25% 20% 16.3% 15% 10%7.5% 5%7.2% 0% ARLINGTON CLASS B RENTS POISED FOR GROWTH AS SPREAD WITH DC CLASS B REACHES 20-YEAR HIGH WIDENING SPREAD BETWEEN CLASS A AND CLASS B RENTAL RATES CREATES ROOM FOR CLASS B GROWTH DC CLASS B VACANCIES ARE TRENDING DOWNWARD AS MANY BUILDINGS ARE REDEVELOPED

UNDER CONSTRUCTION OFFICE ASSETS ARE 69% PRELEASED WITH 67% OF REMAINING VACANCY IN THE TOP HALF OF BUILDINGS View from CEB Tower at Central Place 61% DC MARKET TROPHY VACANCY IN BOTTOM OF BUIDINGS View from L’Enfant Plaza Office - Southeast CEB TOWER AT CENTRAL PLACE L’ENFANT PLAZA OFFICE - SOUTHEAST View from 4747 Bethesda Avenue 33% JBGS TROPHY VACANCY IN BOTTOM OF BUILDINGS View from 1900 N Street 1900 N STREET4747 BETHESDA AVENUE(1) LeasedVacant Source: JLL Research; Refers to Under Development; Bottom Floors (1-6) Upper Floors (7+)13 (1) Includes JBG SMITH lease for approximately 80,200 square feet on floors 2-5.

M A R K E T : J B G S M I T H S U B M A R K E T S O U T P E R F O R M 85% 5% 0% -5% 84% 81% 30% 25% 20% 15% 10% 15% 15% 10% Source: JLL Research 14 MULTIFAMILY 2018 ASKING RENTS RELATIVE TO MARKET10-YEAR ASKING RENT GROWTH10-YEAR NET ABSORPTION AS % OF STARTING 30%45%INVENTORY 25%40%45% 20%35%40% 35% 30% 10%25% 5%20% 0% -5%5%5% -10%0%0% JBGS SubmarketsNon-JBGS SubmarketsJBGS SubmarketsNon-JBGS SubmarketsJBGS SubmarketsNon-JBGS Submarkets 39.0% 29.1% 24.2% -3.5% 45.7% 14.0% OFFICE 2018 ASKING RENTS RELATIVE TO MARKET10-YEAR ASKING RENT GROWTH10-YEAR AVERAGE OCCUPANCY 25%16%87% 20%14%86% 15%12% 10%10% 8% 6%83% -10%4%82% -15%2% -20%0% -25%-2%-0.3%80% JBGS SubmarketsNon-JBGS SubmarketsJBGS SubmarketsNon-JBGS SubmarketsJBGS SubmarketsNon-JBGS Submarkets 12.5% 17.0% -20.5% 86.2% 82.5%

M A R K E T : W A L K A B L E A M E N I T I E S D R I V E O U T P E R F O R M A N C E 8.0% $2.00 4.0% $0.50 Walker's Paradise (90-Very Walkable (70-Somewhat Walkable Car-Dependent (0-49) Source: Walk Score, JLL Research 15 DC Metro Multifamily Submarkets: Walkscore vs. Rent RentVacancy $3.5010.0% 9.0% $3.00 $2.507.0% 6.0% 5.0% $1.50 $1.003.0% 2.0% 1.0% $0.000.0% 100)89)(50-69) DC Metro Office Submarkets: Walkscore vs. Rent RentVacancy $60.0030.0% $50.0025.0% $40.0020.0% $30.0015.0% $20.0010.0% $10.005.0% $0.000.0% Walker's ParadiseVery WalkableSomewhat WalkableCar-Dependent (90-100)(70-89)(50-69)(0-49) 88 JBG SMITH MULTIFAMILY PORTFOLIO WALK SCORE 85 JBG SMITH OFFICE PORTFOLIO WALK SCORE WALK SCORE IS A THIRD-PARTY MEASURE OF AMENITIES WITHIN WALKING DISTANCE. COMPARING THESE SCORES WITH RENTS SHOWS THAT MORE WALKABLE, AMENITY-RICH MARKETS OUTPERFORM THEIR LESS WALKABLE COUNTERPARTS.

M A R K E T : 2 0 1 8 B I P A R T I S A N B U D G E T A C T S H O U L D B E N E F I T D C R E G I O N SPENDING CAPS BY NEARLY $300B OVER 2018 AND 2019 3% $1,279 priorities have a presence in of likely contractors for the Source: Congressional Budget Office, Department Of Defense , Center for Strategic and International Studies 16 SF (Thousands) 74% of likely contractors for the Pentagon’s FY2019 investment Crystal City 50% Pentagon’s FY2019 investment priorities are headquartered in the DC area Federal Discretionary Spending Authority Growth $1,400$1,313 $1,200$300B $1,000 $800 $600 $400 $200 $0 2016201720182019 Defense CapNon-Defense CapAdjustments2018 Budget Growth = $1,1888% $1,149 + JBGS Government Leases Expiring During Current Budget Cycle 200 180 160 140 120 100 80 60 40 20 0 Budget Priority Not Budget Priority THE 2018 BIPARTISAN BUDGET ACT RAISED THE WHICH SHOULD DRIVE DEMAND IN DC ONLY 2% OF JBG SMITH’S OFFICE LEASES THAT EXPIRE BETWEEN NOW AND SEPTEMBER 2019 ARE EXPOSED TO LOWER BUDGET PRIORITIES $165B IN ADDITIONAL DEFENSE SPENDINGS SHOULD BENEFIT NORTHERN VA

Q 1 2 0 1 8 U P D A T E : T E N A N T C O N C E N T R A T I O N A N D I N D U S T R Y D I V E R S I F I C A T I O N ANNUALIZED RENT(2) Educational Other (GSA) 22% (1) (2) (3) (4) Chart based on Operating Office and Retail annualized rent as of March 31, 2018. Percentages based on Operating Portfolio annualized rent as of March 31, 2018. Paul Hastings is a tenant at Bowen Building, which was sold in May 2018. Private Sector includes Business Services, Communications, Food and Beverage, Real Estate and Legal Services. 17 TOP 10 TENANTS % OF OFFICE AND RETAIL ANNUALIZED RENT(1) % OF TOTAL PORTFOLIO 1 U.S. Government (GSA) 22.4% 18.4% 2 Family Health International 3.5% 2.8% 3 Lockheed Martin Corporation 2.8% 2.3% 4 Arlington County 2.5% 2.1% 5 Paul Hastings LLP(3) 2.1% 1.7% 6 Greenberg Traurig LLP 1.9% 1.6% 7 Baker Botts 1.5% 1.2% 8 Public Broadcasting Service 1.3% 1.0% 9 Accenture LLP 1.2% 1.0% 10 WeWork 1.2% 1.0% Other Health and10% Services 6%Private Sector(4) 31% Associations 10% Government Contractors 17% US. Government Government 4% Industry Diversification(1) Tenant Concentration

C A P I T A L A L L O C A T I O N : S T R O N G O F F I C E S A L E S V O L U M E A N D P R I C I N G $1,200 $1 Source: JLL Research 18 Sales Volume ($Billions) A N N U A L I Z E D $ 8 . 3 B Price/SF OFFICE INVESTMENT SALES >$50M, EXCLUDING LAND SALES Sales VolumeMax Price/SFWtd Avg. Price/SF $8$1,400 $7 $6 $1,000 $5 $800 $4 $600 $3 $400 $2 $200 $0$0 2008200920102011201220132014201520162017Q1 2018

C A P I T A L A L L O C A T I O N : P H I L O S O P H Y (1)Includes only investments and dispositions of JBG prior to the spin-off. 19 $ THOUSANDS I N V E S T M E N T S / D I S P O S I T I O N S ( 1 ) 2000 - 20062007 - 20082009 - 20122013 - 2016 InvestmentsDispositions $1,245,622 $1,203,916 $1,057,077 $445,413 ($624,106) ($1,418,543) ($437,049) ($1,224,825) •Take advantage of market conditions to recycle or recapitalize assets where JBG SMITH can achieve or exceed our estimated net asset value pricing •Several criteria should be met to sell: •Market pricing exceeds replacement cost •Implied go-forward rates of return are too low to justify holding relative to other internal investment opportunities •Limited JBG SMITH concentration in surrounding area •Use the proceeds from capital recycling to deleverage and/or invest in higher-yielding opportunities •Acquisition activity focused on: •Assets with redevelopment potential in emerging growth submarkets •Where JBG SMITH has concentrated holdings •Combination of sites adds unique value

C A P I T A L A L L O C A T I O N : D I S P O S I T I O N S U P D A T E 1900 N Street (Rendering) Bowen Building Summit I and II (1)Summit I and II, which were sold in April 2018 contributed $5.0 million of annualized NOI in Q1 2018. (2)Bowen Building, which was sold in May 2018, contributed $8.3 million of annualized NOI in Q1 2018. 20 •Year-to-date we have executed over $335 million of asset sales and recapitalizations: •1900 N Street •Summit I and II(1) •Bowen Building (2) •$700 million represents an achievable subset of a larger basket of assets which we expect to be: •Income producing Operating assets •Non-income producing Under Construction assets or land currently held in our Future Development Pipeline •Use 1031 exchanges for low basis assets where we can: •Improve risk-adjusted returns •Achieve strategic goals by upgrading asset quality, location or use type IDENTIFIED OPPORTUNITIES TO GENERATE $700M THROUGH POTENTIAL ASSET SALES AND RECAPITALIZATIONS BY YEAR-END

F U T U R E G R O W T H : U N D E R C O N S T R U C T I O N A S S E T S 55% 23% 21 MD 13% DC 87% Estimated Total Investment – Multifamily MD 22% RB Corridor DC PROPERTY TYPE OFFICE MULTIFAMILY OTHER 4 5 1 1,071,899 NA 4,105 ASSETS ESTIMATED SQUARE FEET % PRE-LEASED 69.0% NA 100% WEIGHTED AVERAGE PRE-LEASE RENT PSF $61.17 NA $32.40 MULTIFAMILY UNITS NA 1,568 NA ESTIMATED TOTAL INVESTMENT $735M $737M $2M ESTIMATED INCREMENTAL INVESTMENT $200M $409M $1M WEIGHTED AVERAGE PROJECTED NOI YIELD ON ESTIMATED TOTAL PROJECT COST 7.1% WEIGHTED AVERAGE PROJECTED NOI YIELD ON ESTIMATED INCREMENTAL INVESTMENT 15.7% ESTIMATED STABILIZED NOI $96M WEIGHTED AVERAGE COMPLETION DATE Q3 2019 WEIGHTED AVERAGE STABILIZATION DATE Q4 2020 Composition Estimated Total Investment – Office and Other

F U T U R E G R O W T H : C O N C E N T R A T E N E W O F F I C E A S S E T S I N A M E N I T Y - R I C H C O R E M A R K E T S 4747 Bethesda Avenue 271,433 SF 287,183 SF Estimated Total Investment: $124M Washington, DC Arlington, VA 74.3% Preleased 74.6% Preleased Note: All figures shown at 100% except Estimated Total Investment, which is shown at JBG SMITH share. 22 1900 N Street Washington, DC Bethesda, MD29.6% Preleased 77.4% Preleased Estimated Total Investment: $163M CEB Tower at Central PlaceL’Enfant Plaza Office - Southeast 529,997215,185 SF Estimated Total Investment: $401MEstimated Total Investment: $48M

F U T U R E G R O W T H : C O N C E N T R A T E N E W M U L T I F A M I L Y A S S E T S I N P A T H O F G R O W T H S U B M A R K E T S Washington, DC Bethesda, MD Estimated Total Investment: $155M Estimated Total Investment: $94M Washington, DC Washington, DC Estimated Total Investment: $218M Estimated Total Investment: $117M Note: All figures shown at 100% except Estimated Total Investment, which is shown at JBG SMITH share. 23 7900 Wisconsin AvenueAtlantic Plumbing C 322 Units256 Units 965 Florida Avenue Washington, DC 433 Units Estimated Total Investment: $153M 1221 Van StreetWest Half 291 Units465 Units

F U T U R E G R O W T H : U N D E R C O N S T R U C T I O N A S S E T S C O M P L E T I O N T I M E L I N E Q1 2020 Q4 2020 Q2 2020 Q3 2020 Office Multifamily Estimated Total Estimated Total Office - Southeast Avenue Multifamily $401M $117M 215,185 SF 287,183 SF $2.5M UNDER BUDGET Multifamily Office Multifamily Multifamily Note: Under Construction assets square feet and units shown at 100%. 24 (1)Stonebridge at Potomac Town Center – Phase II is not shown. (2)Refers to multifamily portion of building as of May 2018. 2 0 1 8D E L I V E R I E S Q1 2018Q1 2018 2 0 1 9D E L I V E R I E S Q3 2019Q4 2019Q4 2019 CEB Tower at1221 Van2 0 2 0D E L I V E R I E S Central PlaceStreet 529,997 SF291 Units 74.6% Leased54% Leased(2) L’Enfant Plaza4747 BethesdaAtlantic Plumbing C InvestmentInvestmentOfficeOffice256 Units West Half1900 N Street 7900 Wisconsin Ave. 965 Florida Avenue 1 QUARTER AHEAD OF SCHEDULE465 Units271,433 SF322 Units433 Units 4 OFFICE ASSETS / 5 MULTIFAMILY ASSETS / 1 OTHER ASSET(1) 1.1M SQUARE FEET / 1,568 UNITS

F U T U R E G R O W T H : N E A R - T E R M V A L U E C R E A T I O N ~ $96M OF NOI UNDER CONSTRUCTION ASSETS ~ $37M OF NOI STABILIZATION OF OPERATING PORTFOLIO Note: This is a hypothetical presentation of potential near-term NOI from the delivery and stabilization of our under construction assets and the stabilization of our operating portfolio and is dependent on numerous assumptions, which may not be accurate. Actual future NOI may differ materially from this hypothetical potential near-term NOI. Please see the forward-looking statements disclaimer in this presentation for a discussion of the risks that could cause actual results to differ materially from any projected or estimated results (1) Timeframe from 03/31/18 through 2023 intended to reflect the completion and stabilization of the Under Construction assets. Adjusted for our joint venture with CPPIB at 1900 N Street, as well as the sale of Summit I and II, which were sold in April 2018, and the Bowen Building, which was sold in May 2018. 25 54% Office / 46% Multifamily Office is 69% Pre-leased Weighted Average Estimated Stabilization Date is Q4 2020 Key Assumptions •Lease-up of office portfolio to 91.5% occupancy at current market rents •2.25% average contractual rent growth on non-GSA office leases with term beyond 2022 •-5.0% mark-to-market on office rents as leases roll •2.0% annual office market rent growth •2.75% annual multifamily market rent growth •Stabilization of Under Construction assets •NOI growth is back-end weighted •Adjusted for 2018 Year-to-Date sales activity THROUGH 2023 WE EXPECT TO DELIVER $133M OF NOI GROWTH(1)

F U T U R E G R O W T H : F U T U R E D E V E L O P M E N T P I P E L I N E Source: JLL Research land comparables for selected submarkets from 2010-2017 26 POTOMAC YARD JBGS Inv. JLL Comps Avg. $37/SF $50-$60/SF CRYSTAL/PENTAGON JBGS Inv. JLL Comps Avg. $43/SF $40-$50/SF RB CORRIDOR JBGS Inv. JLL Comps Avg. $40/SF $50-$60/SF RESTON TOWN CENTER JBGS Inv. JLL Comps Avg. $23/SF $75-$85/SF SUBURBAN RESTON JBGS Inv. JLL Comps Avg. $22/SF $30-$40/SF DC MATURE JBGS Inv. JLL Comps Avg. $188/SF $200-$300/SF DC EMERGING JBGS Inv. JLL Comps Avg. $60/SF $80-$90/SF SILVER SPRING JBGS Inv. JLL Comps Avg. $32/SF $40-$50/SF ESTIMATED POTENTIAL DEVELOPMENT DENSITY JBGS ESTIMATED TOTAL INVESTMENT PSF JLL MARKET VALUE COMPARABLE AVERAGE 17.9M $43 $75-$85/SF ROCKVILLE JBGS Inv. JLL Comps Avg. $32/SF $20-$30/SF JLL COMPARABLES REPRESENT DEAL-BY-DEAL SPOT PRICING JBGS INVESTMENTS ARE CONCENTRATED, MULTI-PHASED DEVELOPMENT OPPORTUNITIES

Tenant Concentration TOP 10 CRYSTAL CITY TENANTS % OF TOTAL PORTFOLIO ANNUALIZED RENT 1 U.S. Government (GSA) 14.8% 2 Lockheed Martin Corporation 2.3% 3 Public Broadcasting Service 1.0% 4 DRS Tech Inc dba Finmeccanica 0.8% 5 National Consumer Cooperative 0.7% 6 Conservation International Foundation 0.7% 7 The International Justice Mission 0.7% 8 Booz Allen Hamilton Inc 0.6% 9 American Diabetes Association 0.6% 10 Management Systems International, Inc 0.4% 6.2M SF OF OPERATING OFFICE 2.4M SF OF OPERATING MULTIFAMILY DOWNTOWN DC THE PENTAGON Industry Diversification(1) Portfolio Composition REAGAN NATIONAL AIRPORT Health and Educational Services 6% Association s 12% Governme nt Contractors 22% Other 8% Private Sector(2) 12% U.S. Government (GSA) 40% Operating Multifamily 28% Operating Office 72% BLUE = JBGS CONTROL (1)Pie chart based on annualized rent of office and retail. (2)Private Sector includes Business Services, Communications, Food and Beverage, Real Estate and Legal Services. 27

WASHINGTON, DC N F U T U R EG R O W T H : T R A N S F O R M A T I V E R E P O S I T I O N I N G O F C R Y S T A L C I T Y 28 FUTURE DEVELOPMENT OPERATING

F U T U R E G R O W T H : C R Y S T A L C I T Y P H A S E O N E R E T A I L 29 P H A S E O N E R E T A I L ( 1 3 0 , 0 0 0 S F ) RENDERING N E W M E T R O E N T R A N C ET H E A T R E A N C H O R ( 4 9 K S F )A M E N I T Y R E T A I L ( 6 7 K S F )I M P R O V E D S T R E E TG R O C E R Y A N C H O R ( 1 4 K S F ) SECOND METRO ENTRANCE PROGRAMMING AND ACTIVATION PUBLIC SPACE WITH HUMAN SCALE AMENITIES ATTRACTIVE TO OFFICE AND MULTIFAMILY TENANTS CREATION OF A RETAIL HEART

F U T U R E G R O W T H : C R Y S T A L C I T Y P H A S E Z E R O – C R E A T I N G A “ P L A C E ” N O W 30 PARKING AND WAYFINDING ENHANCEMENTS IN TEST GARAGE BRANDED IDENTIY THROUGHOUT SMALL AND LARGE SCALE ART IN PUBLIC SPACES ACTIVATE LOBBIES WITH SEATING, ART, AND COFFEE BARS •Immediately change the perception of Crystal City •Engage with tenants, prospective tenants, and brokers in the market PHASE ZERO INTENDED TO: FESTIVE LIGHTING, OUTDOOR SEATING AREAS

Q 1 2 0 1 8 U P D A T E : F I N A N C I A L A N D O P E R A T I N G R E S U L T S 4% 66% 1,300 10% 500 6% 2018 2019 2020 2021 2022 2023 2024 2025 2026 31 Office Square Feet 1,50018% 1,10014% 900 700 300 1002% DCMDVA Annual Average of 10% of SF through 2023 Lease Expiration Schedule MD DC 30% VA Operating Other Operating1% Multifamily 20% Operating Office 79% •Net loss attributable to common shareholders was $(4.2)M or $(0.04) per diluted share •Funds from Operations (“FFO”) of $41.2M or $0.35 per share •Core FFO of $52.2M or $0.44 per share •Annualized NOI of $371.3M compared to $363.3M in Q4 2017 •Same Store NOI increased 11.3% to $71.4M compared to $64.2M in Q1 2017 •Operating Portfolio Highlights: oOperating Office Portfolio was 87.8% leased and 87.0% occupied oOperating Multifamily Portfolio was 96.1% leased and 94.2% occupied oOperating Other Portfolio was 94.2% leased and 94.2% occupied (excluding Crystal City Marriott Hotel) •Executed approximately 322,000 square feet of office leases at our share, including: o134,000 square feet of new leases o188,000 square feet of second generation leases, which generated a 1.5% rental rate increase on a GAAP basis and an (3.9%) decrease on a cash basis. Annualized NOI Composition - $371.3M

Q 1 2 0 1 8 U P D A T E : S T R O N G B A L A N C E S H E E T T O F U N D F U T U R E G R O W T H 2% 3% 66% 18% Availability 73% 32 (1)Interest rate caps in place for 17% of debt Floating Rate Debt(1) 27% Fixed Rate Debt Cash 14% Term Loan AvailabilityRevolver 52% In-Place Construction Loan Availability 16% Debt Structure $1.7B of Liquidity Mortgages 29% Recourse EquityCorporate Debt 5% Company Recourse • Primarily utilize non-recourse, asset-level financing with a bias toward financing office over multifamily assets • Prudent leverage levels o 6.9x Net Debt/Annualized Adjusted EBITDA o 33.7% Net Debt/Total Enterprise Value o Identified opportunities to generate $700M of capital through potential asset sales and recapitalizations • If expected asset sales/recaps occur, expect to end 2018 with a Net Debt/Annualized Adjusted EBITDA between 7.0x and 7.5x and a Net Debt/TEV between 32% and 35% • Intend to file a universal shelf registration statement when eligible in Q3 2018 33.7% Net Debt / Total Enterprise Value Financing Strategy

Q 1 2 0 1 8 U P D A T E : T H I R D - P A R T Y A S S E T M A N A G E M E N T & R E A L E S T A T E S E R V I C E S B U S I N E S S 7% Property Management Fees Development Fees 33 •Third-Party Management business is stable and relatively sticky •Subject to market conditions, anticipate the decline in revenues from the Legacy JBG Funds to be fairly linear over the 4-7 year wind down period •Expect a corresponding decline in G&A related to the Legacy JBG Funds over the same time period Other Service Revenue Construction Management Fees 3% 40% 12% Leasing Fees 12% Asset Management Fees 26% JBG SMITH JV Partners 23% Legacy JBG Funds 43% Third-Party Management 34% Q1 2018 Revenue Breakdown by Service Type Q1 2018 Revenue Breakdown by Source

Q 1 2 0 1 8 U P D A T E : S T R O N G C O R P O R A T E G O V E R N A N C E 34 ALLOW A MAJORITY OF SHAREHOLDERS TO CALL A SPECIAL MEETING ALLOW A MAJORITY OF SHAREHOLDERS TO AMEND OUR BYLAWS OPTED OUT OF MUTA LONG-TERM COMMITMENT TO DIVERSITY AND 50:50 MEN AND WOMEN ON BOARD BOARD OF TRUSTEES AND MANAGEMENT RECENTLY MADE A SERIES OF PROACTIVE, SHAREHOLDER-ALIGNED CHANGES Competency/Attribute Scott Estes Alan Forman Michael Glosserman Charles Haldeman Matt Kelly Carol Melton William Mulrow Steven Roth Mitchell Schear Ellen Shuman Robert Stewart John Wood Operating Public company experience Real estate expertise Financial literacy Experience over several business cycles Executive Leadership Investment/capital allocation expertise Accounting expertise Government/business conduct/legal BOARD OF TRUSTEES WITH DEEP PUBLIC MARKETS EXPERIENCE AND STRONG CAPITAL ALLOCATION CREDENTIALS

E S G : E N V I R O N M E N T A L S T R A T E G Y disclosure of and Social through GRESB (1)LEED, Energy Star or both certified square feet in Operating Office portfolio shown at JBG SMITH share. (2)Average annual improvement of 3.4% per year since 2014. 35 Public Environmental performance 10.8M SF(1) of Green Certified Assets Board of Trustees oversight on Environmental and Social matters Commitment to diversity and gender balance on the Board and in the workplace 10%(2) Reduction in Energy Use Intensity across Operating Office portfolio since 2014 Our Environmental Strategy encourages continual improvement and shareholder engagement around the following topics: ResourceCarbonDesignClimateHealth and ConservationReductionsStandardsAdaptationWellness WE HAVE A COMMITMENT TO ACCOUNTABLE BUSINESS PRACTICES, SMART GROWTH, AND SOCIAL RESPONSIBILITY THAT ALIGNS WITH OUR CORE BUSINESS OBJECTIVES AND CORPORATE STRATEGY

E S G : W A S H I N G T O N H O U S I N G I N I T I A T I V E 36 •JBG SMITH and the Federal City Council will establish a non-profit (Washington Housing Conservancy) to acquire or build between 2,000 and 3,000 units of affordable workforce housing over the next 10 years •Organize and manage third-party mezzanine capital to bridge the gap between charitable contributions and traditional mortgage financing •Make use of our size and scale to manage the Initiative’s assets and drive housing equity •Dramatically strengthen our relationships with local jurisdictions throughout the region •Invest $10M in the Impact Pool •Hired dedicated resource to focus on social impact investments •Initiative is expected to be G&A neutral over time INNOVATIVE, COLLABORATIVE APPROACH TO PRODUCE AFFORDABLE WORKFORCE HOUSING IN HIGH-IMPACT LOCATIONS

D E F I N I T I O N S Non-GAAP Measures This investor presentation includes non-GAAP measures. For these measures, we have provided an explanation of how these non-GAAP measures are calculated and why JBG SMITH’s management believes that the presentation of these measures provides useful information to investors regarding JBG SMITH’s financial condition and results of operations. Reconciliations of certain non-GAAP measures to the most directly comparable GAAP financial measure are included in this investor presentation. Our presentation of non-GAAP financial measures may not be comparable to similar non-GAAP measures used by other companies. In addition to "at share" financial information, the following non-GAAP measures are included in this investor presentation: Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), Adjusted EBITDA, and Annualized Adjusted EBITDA Management uses EBITDA and EBITDAre, non-GAAP financial measures, as a supplemental operating performance measures and believes they help investors and lenders meaningfully evaluate and compare our operating performance from period-to-period by removing from our operating results the impact of our capital structure (primarily interest charges from our consolidated outstanding debt and the impact of our interest rate swaps) and certain non-cash expenses (primarily depreciation and amortization on our assets). EBITDAre is computed in accordance with the definition established by the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines EBITDAre as GAAP net income (loss) adjusted to exclude interest expense, income taxes, depreciation and amortization expenses, gains on sales of depreciated real estate and impairment losses of depreciable real estate, including our share of such adjustments of unconsolidated real estate ventures. These supplemental measures may help investors and lenders understand our ability to incur and service debt and to make capital expenditures. EBITDA and EBITDAre are not substitutes for net income (loss) (computed in accordance with GAAP) and may not be comparable to similarly titled measures used by other companies. “Adjusted EBITDA,” a non-GAAP financial measure, represents EBITDAre adjusted for items we believe are not representative of ongoing operating results, such as non-recurring transaction and other costs, gain (loss) on the extinguishment of debt, gain on the bargain purchase of a business and share-based compensation expense related to the Formation Transaction. We believe that adjusting such items not considered part of our comparable operations, provides a meaningful measure to evaluate and compare our performance from period-to-period. “Annualized Adjusted EBITDA” , a non-GAAP financial measure, represents Adjusted EBITDA for the three months ended March 31, 2018 multiplied by four. Because EBITDA, EBITDAre and Adjusted EBITDA have limitations as analytical tools, we use EBITDA, EBITDAre and Adjusted EBITDA to supplement GAAP financial measures. Additionally, we believe that users of these measures should consider EBITDA, EBITDAre and Adjusted EBITDA in conjunction with net income (loss) and other GAAP measures in understanding our operating results. Estimated Potential Development Density “Estimated potential development density” reflects management’s estimate of developable gross square feet based on our current business plans with respect to real estate owned or controlled as of. March 31, 2018. Given timing, zoning requirements and other factors, we make no assurance that estimated potential development density amounts will become actual density to the extent we complete development of assets for which we have made such estimates. Free Rent ‘‘Free rent’’ means the amount of base rent and tenant reimbursements that are abated according to the applicable lease agreement(s). Funds from Operations ("FFO") and Core FFO FFO is a non-GAAP financial measure computed in accordance with the definition established by NAREIT. NAREIT defines FFO as “net income (computed in accordance with GAAP), excluding gains (or losses) from sales of, or impairment charges related to, depreciable operating properties, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures.” "Core FFO" represents FFO adjusted to exclude items (net of tax) which we believe are not representative of ongoing operating results, such as transaction and other costs, gains (or losses) on extinguishment of debt, gain on the bargain purchase of a business, gains (or losses) on the disposal of non-depreciable assets, share-based compensation expense related to the Formation Transaction, amortization of the management contracts intangible and the mark-to-market of interest rate swaps. "FAD" is a non-GAAP financial measure and represents FFO less cash basis recurring tenant improvements, leasing commissions and other capital expenditures, net deferred rent activity, recurring share-based compensation expense, accretion of acquired below-market leases, net of amortization of acquired above-market leases, amortization of debt issuance costs and other non-cash income and charges. FAD is presented solely as a supplemental disclosure that management believes provides useful information as it relates to our ability to fund dividends. We believe FFO, Core FFO and FAD are meaningful non-GAAP financial measures useful in comparing our levered operating performance from period-to-period and as compared to similar real estate companies because these non-GAAP measures exclude real estate depreciation and amortization expense and other non-comparable income and expenses, which implicitly assumes that the value of real estate diminishes predictably over time rather than fluctuating based on market conditions. FFO, Core FFO and FAD do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements and should not be considered as an alternative to net income (loss) as a performance measure or cash flow as a liquidity measure. FFO, Core FFO and FAD may not be comparable to similarly titled measures used by other companies. Future Development “Future development” refers to assets that are development opportunities on which we do not intend to commence construction within 18 months of March 31, 2018 where we (i) own land or control the land through a ground lease or (ii) are under a long-term conditional contract to purchase, or enter into a leasehold interest with respect to land.

D E F I N I T I O N S Historical Cost, Estimated Incremental Investment, Estimated Total Investment and Estimated Total Project Cost “Historical cost” is a non-GAAP measure which includes the total historical cost incurred by JBG SMITH, on a cash basis, with respect to the development of an asset, including any acquisition costs, hard costs, soft costs, tenant improvements, leasing costs and other similar costs, but excluding any financing costs, ground rent expenses and capitalized payroll costs incurred as of March 31, 2018. “Estimated incremental investment” means management’s estimate of the remaining cost to be incurred in connection with the development of an asset as of March 31, 2018, including all remaining acquisition costs, hard costs, soft costs, tenant improvements, leasing costs and other similar costs to develop and stabilize the asset but excluding any financing costs, ground rent expenses and capitalized payroll costs. “Estimated total investment” means, with respect to the development of an asset, the sum of the historical cost in such asset and the estimated incremental investment for such asset. "Estimated total project cost" is estimated total investment excluding purchase price allocation adjustments recognized as a result of the Formation Transaction. Actual incremental investment, actual total investment and actual total project cost may differ substantially from our estimates due to numerous factors, including unanticipated expenses, delays in the estimated start and/or completion date, changes in design and other contingencies. In Service ‘‘In service’’ refers to office, multifamily or other assets that are at or above 90% leased or have been in service collecting rent for more than 12 months as of March 31, 2018. Metro-Served “Metro-served” means locations, submarkets or assets that are generally nearby and within walking distance of a Metro station, defined as being within 0.5 miles of an existing or planned Metro station. Near-Term Development ‘‘Near-term development’’ refers to assets that have substantially completed the entitlement process and on which we intend to commence construction within 18 months following March 31, 2018, subject to market conditions. Net Operating Income ("NOI"), Annualized NOI, Estimated Stabilized NOI and Projected NOI Yield “NOI” is a non-GAAP financial measure management uses to measure the operating performance of our assets and consists of property-related revenue (which includes base rent, tenant reimbursements and other operating revenue, net of free rent and payments associated with assumed lease liabilities) less operating expenses and ground rent, if applicable. NOI also excludes deferred rent, related party management fees, interest expense, and certain other non-cash adjustments, including the accretion of acquired below-market leases and amortization of acquired above-market leases and below-market ground lease intangibles. Annualized NOI represents NOI for the three months ended March 31, 2018 multiplied by four. Management believes Annualized NOI provides useful information in understanding JBG SMITH’s financial performance over a 12-month period, however, investors and other users are cautioned against attributing undue certainty to our calculation of Annualized NOI. Actual NOI for any 12-month period will depend on a number of factors beyond our ability to control or predict, including general capital markets and economic conditions, any bankruptcy, insolvency, default or other failure to pay rent by one or more of our tenants and the destruction of one or more of our assets due to terrorist attack, natural disaster or other casualty, among others. We do not undertake any obligation to update our calculation to reflect events or circumstances occurring after the date of this Investor Report. There can be no assurance that the annualized NOI shown will reflect JBG SMITH’s actual results of operations over any 12-month period. We also report adjusted annualized NOI which includes signed but not yet commenced leases and incremental revenue from recently delivered assets assuming stabilization. While we believe adjusted annualized NOI provides useful information regarding potential future NOI from our assets, it does not account for any decrease in NOI for lease terminations, defaults or other negative events that could affect NOI and therefore, should not be relied upon as indicative of future NOI. This investor presentation also contains management’s estimate of stabilized NOI and projections of NOI yield for under construction and near-term development assets, which are based on management’s estimates of property-related revenue and operating expenses for each asset. These estimates are inherently uncertain and represent management’s plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. The property-related revenues and operating expenses for our assets may differ materially from the estimates included in this Investor Report. Management’s projections of NOI yield are not projections of JBG SMITH’s overall financial performance or cash flow, and there can be no assurance that the projected NOI yield set forth in this Investor Report will be achieved. “Projected NOI yield” means our estimated stabilized NOI reported as a percentage of 1) estimated total project costs, 2) estimated total investment and 3) estimated incremental investment. Actual initial full year stabilized NOI yield may vary from the projected NOI yield based on the actual incremental investment to complete the asset and its actual initial full year stabilized NOI, and there can be no assurance that we will achieve the projected NOI yields described in this Investor Report. The Company does not provide reconciliations for non-GAAP estimates on a future basis, including adjusted annualized NOI and estimated stabilized NOI because it is unable to provide a meaningful or accurate calculation or estimate of reconciling items and the information is not available without unreasonable effort. This inability is due to the inherent difficulty of forecasting the timing and/or amounts of various items that would impact net income. Additionally, no reconciliation of projected NOI yield to the most directly comparable GAAP measure is included in this Investor Report because we are unable to quantify certain amounts that would be required to be included in the comparable GAAP financial measures without unreasonable efforts because such data is not currently available or cannot be currently estimated with confidence. Accordingly, we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. Management uses each of these measures as supplemental performance measures for its assets and believes they provide useful information to investors because they reflect only those revenue and expense items that are incurred at the asset level, excluding non-cash items. In addition, NOI is considered by many in the real estate industry to be a useful starting point for determining the value of a real estate asset or group of assets. However, because NOI excludes depreciation and amortization and captures neither the changes in the value of our assets that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our assets, all of which have real economic effect and could materially impact the financial performance of our assets, the utility of this measure of the operating performance of our assets is limited. Moreover, our method of calculating NOI may differ from other real estate companies and, accordingly, may not be comparable. NOI should be considered only as a supplement to net operating income (loss) (computed in accordance with GAAP) as a measure of the operating performance of our assets. Recently Delivered “Recently delivered” refers to assets that have been delivered within the 12 months ended March 31, 2018.

D E F I N I T O N S Same Store “Same store” refers to the pool of assets that were in service for the entirety of both periods being compared, except for assets for which significant redevelopment, renovation, or repositioning occurred during either of the periods being compared. No JBG Assets are included in the same store pool. Second Generation Lease “Second generation lease” is a lease on space that had been vacant for less than nine months. Signed But Not Yet Commenced Leases “Signed but not yet commenced leases” means leases for assets in JBG SMITH’s portfolio that, as of March 31, 2018, have been executed but for which the contractual lease term had not yet begun, and no rental payments had yet been charged to the tenant. Square Feet ‘‘Square feet’’ or ‘‘SF’’ refers to the area that can be rented to tenants, defined as (i) for office and other assets, rentable square footage defined in the current lease and for vacant space the rentable square footage defined in the previous lease for that space, (ii) for multifamily assets, management’s estimate of approximate rentable square feet, (iii) for the assets under construction and the near term development assets, management’s estimate of approximate rentable square feet based on current design plans as of March 31, 2018, or (iv) for future development assets, management’s estimate of developable gross square feet based on its current business plans with respect to real estate owned or controlled as of March 31, 2018. Total Enterprise Value “Total Enterprise Value” means our total market capitalization plus our total consolidated and unconsolidated indebtedness less cash and cash equivalents. Under Construction ‘‘Under construction’’ refers to assets that were under construction during the three months ended March 31, 2018.

E B I T D A , E B I T D A r e A N D A D J U S T E D E B I T D A R E C O N C I L I A T I O N ( N O N - G A A P ) Three Months Ended March 31, 2018 dollars in thousands Net loss $ (4,786) Depreciation and amortization expense 49,160 Interest expense (1) Income tax benefit 19,257 (908) Unconsolidated real estate ventures allocated share of above adjustments 10,175 EBITDA and EBITDAre $ 72,898 Gain on sale of land (455) Transaction and other costs 4,221 Share-based compensation related to Formation Transaction 9,428 Unconsolidated real estate ventures allocated share of above adjustments 30 Adjusted EBITDA $ 86,122 Net Debt to Adjusted EBITDA (2) 6.9x March 31, 2018 Net Debt (at JBG SMITH Share) Consolidated indebtedness (3) $ 2,185,461 Unconsolidated indebtedness 419,476 Total consolidated and unconsolidated indebtedness 2,604,937 Less: cash and cash equivalents 238,519 Net Debt (at JBG SMITH Share) $ 2,366,418 $ (0.24) (1) Interest expense includes the amortization of deferred financing costs and the mark-to-market of interest rate swaps and caps, net of capitalized interest costs. (2) Adjusted EBITDA for the three months ended March 31, 2018 is annualized by multiplying by four. (3) Includes mortgage loan related to assets held for sale. EBITDA, EBITDAre and Adjusted EBITDA

F F O , C O R E F F O A N D F A D R E C O N C I L I A T I O N ( N O N - G A A P ) in thousands, except per share data Three Months Ended March 31, 2018 Net loss attributable to common shareholders $ (4,190) Net loss attributable to redeemable noncontrolling interests (594) Net loss attributable to noncontrolling interests (2) Net loss (4,786) Real estate depreciation and amortization 46,639 Pro rata share of real estate depreciation and amortization from unconsolidated real estate ventures 6,436 FFO Attributable to Operating Partnership Common Units $ 48,289 FFO attributable to redeemable noncontrolling interests (7,127) FFO attributable to common shareholders $ 41,162 FFO attributable to the operating partnership common units $ 48,289 Gain on sale of land (455) Transaction and other costs, net of tax 4,136 Mark-to-market on derivative instruments (1,119) Share of gain from mark-to-market on derivative instruments held by unconsolidated real estate ventures (342) Share-based compensation related to Formation Transaction 9,428 Amortization of management contracts intangible, net of tax 1,286 Core FFO Attributable to Operating Partnership Common Units $ 61,223 Core FFO attributable to redeemable noncontrolling interests (9,037) Core FFO attributable to common shareholders $ 52,186 FFO per diluted common share $ 0.35 Core FFO per diluted common share $ 0.44 Weighted average diluted shares 117,955 FFO and Core FFO

F F O , C O R E F F O A N D F A D R E C O N C I L I A T I O N ( N O N - G A A P ) Three Months Ended March 31, 2018 in thousands, except per share data Core FFO attributable to the operating partnership common units Recurring capital expenditures and second generation tenant improvements and leasing commissions Straight-line and other rent adjustments (1) Share of straight-line rent from unconsolidated real estate ventures Third-party lease liability assumption payments Share of third party lease liability assumption payments for unconsolidated real estate ventures Share-based compensation expense Amortization of debt issuance costs Share of debt issuance costs from unconsolidated real estate ventures $ 61,223 (6,097) (1,075) 159 (472) (50) 4,276 1,164 69 Non-real estate depreciation and amortization 749 FAD available to the Operating Partnership Common Units (A) $ 59,946 Distributions to common shareholders and unitholders (2) (B) FAD Payout Ratio (B÷A) (3) $ 31,423 52.4 % Maintenance and recurring capital expenditures Share of maintenance capital and recurring expenditures from unconsolidated real estate ventures Second generation tenant improvements and leasing commissions Share of second generation tenant improvements and leasing commissions from unconsolidated real estate ventures Recurring capital expenditures and second generation tenant improvements and leasing commissions First generation tenant improvements and leasing commissions Share of first generation tenant improvements and leasing commissions from unconsolidated real estate ventures Non-recurring capital expenditures Share of non-recurring capital expenditures from unconsolidated joint ventures $ 2,683 1,149 1,893 372 6,097 4,185 995 3,366 620 Non-recurring capital expenditures 9,166 Total JBG SMITH Share of Capital Expenditures $ 15,263 (1) Includes straight-line rent, above/below market lease amortization and lease incentive amortization. (2) In May 2018, our Board of Trustees declared a dividend of $0.225 per share, payable on May 25, 2018. (3) The FAD payout ratio on a quarterly basis is not necessarily indicative of an amount for the full year due to fluctuation in timing of capital expenditures, the commencement of new leases and the seasonality of our operations. The FAD payout ratio for the three and six months ended December 31, 2017 was 84.9% and 73.8%. Capital Expenditures FAD

N O I R E C O N C I L I A T I O N dollars in thousands ( N O N - G A A P ) Three Months Ended March 31, 2018 2018 2017 Net income (loss) attributable to common shareholders Add: Depreciation and amortization expense General and administrative expense: Corporate and other Third-party real estate services Share-based compensation related to Formation Transaction Transaction and other costs Interest expense Income tax expense (benefit) Less: Third-party real estate services, including reimbursements $ (4,190) $ 6,318 49,160 33,782 12,711 22,609 9,428 4,221 19,257 (908) 13,392 4,698 — 5,841 13,918 354 24,330 1,116 (1,902) 573 455 594 2 7,125 1,582 209 775 — — — Other income Income (loss) from unconsolidated real estate ventures Interest and other income, net Gain on sale of real estate Net loss attributable to redeemable noncontrolling interests Net loss attributable to noncontrolling interests Consolidated NOI NOI attributable to consolidated JBG Assets (1) Proportionate NOI attributable to unconsolidated JBG Assets (1) Proportionate NOI attributable to unconsolidated real estate ventures Non-cash rent adjustments (2) Other adjustments (3) 87,120 — — 9,207 (1,096) 68,612 11,050 3,715 2,201 (4,017 (2,408) 1,079 Total adjustments 5,703 14,028 NOI $ 92,823 $ 82,640 Non-same store NOI 21,419 18,461 Same store NOI $ 71,404 $ 64,179 Number of properties in same store pool 36 36 (1) Includes financial information for the JBG Assets as if the July 18, 2017 acquisition of the JBG Assets had been completed as of the beginning of the period presented. (2) Adjustment to exclude straight-line rent, above/below market lease amortization and lease incentive amortization. (3) Adjustment to include other income and payments associated with assumed lease liabilities related to operating properties, and exclude incidental income generated by development assets and commercial lease termination revenue.

[LOGO]